What happened to the real estate cycle?

Back in 2018, the mortgage stress test was introduced. Nearly overnight it knocked about 20% of the buyers out of a pretty hot market and stopped price gains from continuing. After prices had jumped 40% in two years, the stress test and gradually rising rates put the market on a pretty steady cooling pace for a solid 18 months. I puzzled somewhat about why the hot market had only lasted 2 years when it usually goes for longer, but I thought the stress test had changed the game and we were likely on track to keep cooling down for a few more years. That was clearly wrong. And while it’s tempting to ascribe the missed forecast to the pandemic and associated firehose of stimulus, the reality is that prices would have risen substantially even without it. That was clear two years ago, after interest rates had dropped and market conditions were pointing to hefty price gains before anyone had heard of COVID. The pandemic with its increases in out of town buyers and rock bottom rates turbocharged a trend that was already in place.

Two years on though, what happened to the real estate cycle? Will it ever cool down, or will we be stuck in a hot market forever as the amount of in-migration perpetually overwhelms our willingness to build homes?

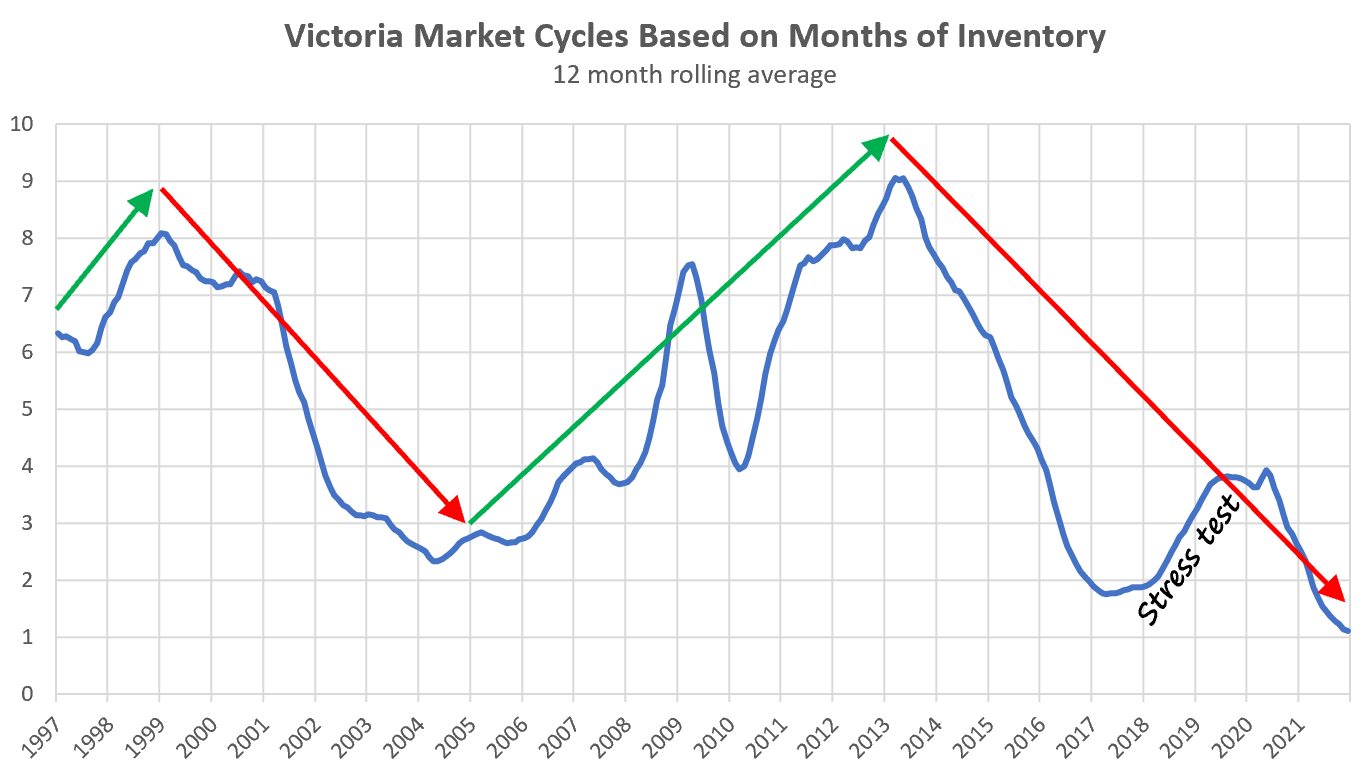

Well let’s see what the picture is looking like today. First, let’s look at cycles based on months of inventory, which is probably our best measure of actual market conditions. The problem is we only have 25 years of data, which isn’t even enough for two cycles.

If you consider the 2 years of cooling market after the introduction of the stress test a regulatory blip, then this heating cycle is getting extremely long in the tooth at nearly 9 years long. The last one only lasted 6 years, but of course it didn’t get quite this nutty either. Alternately you could say that the cooling cycle started in 2017, and the current conditions are just an epic “wiggle” in the same way that the Great Financial Crisis was a large wiggle in the cooling cycle of the 2000s.

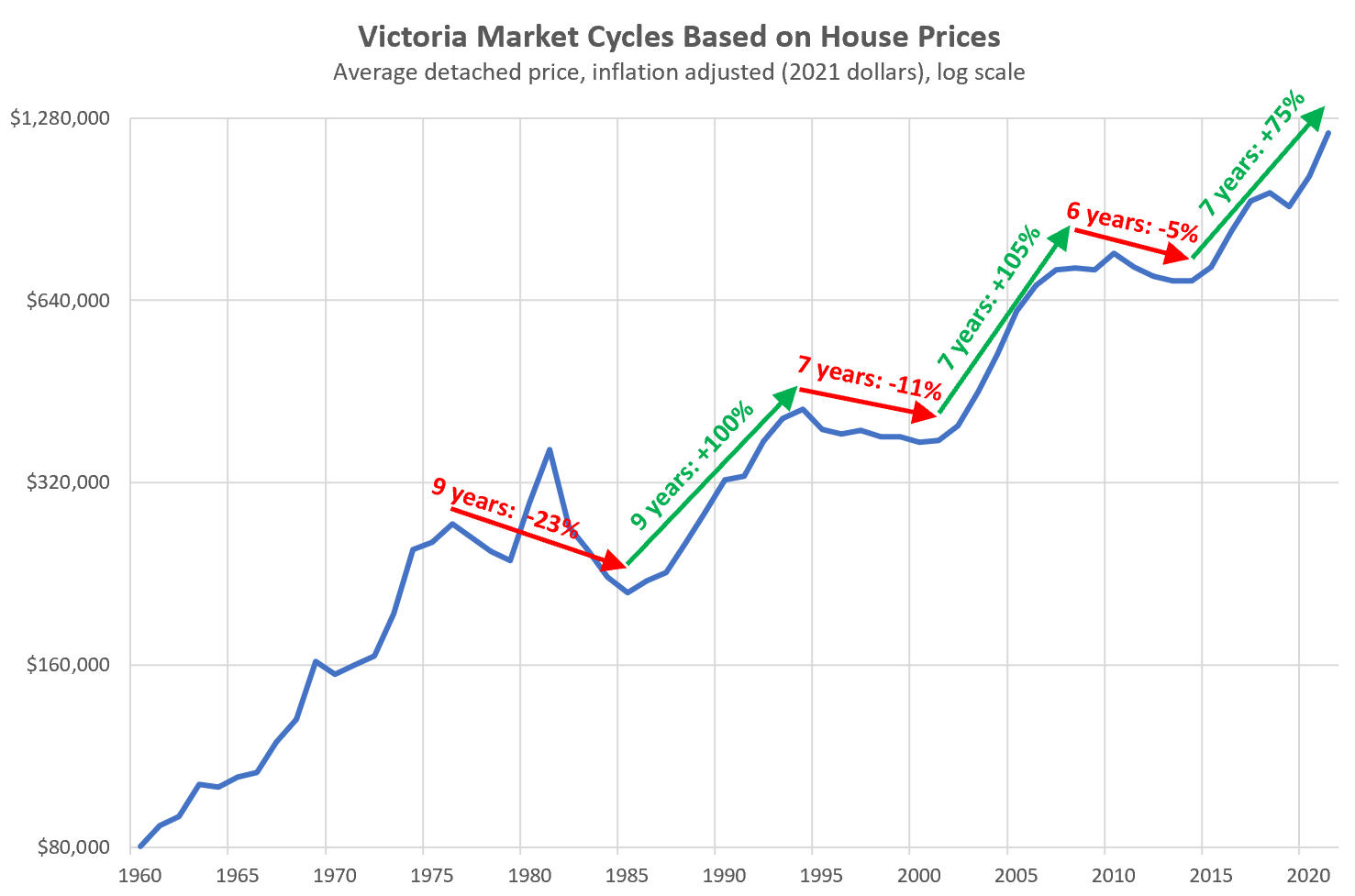

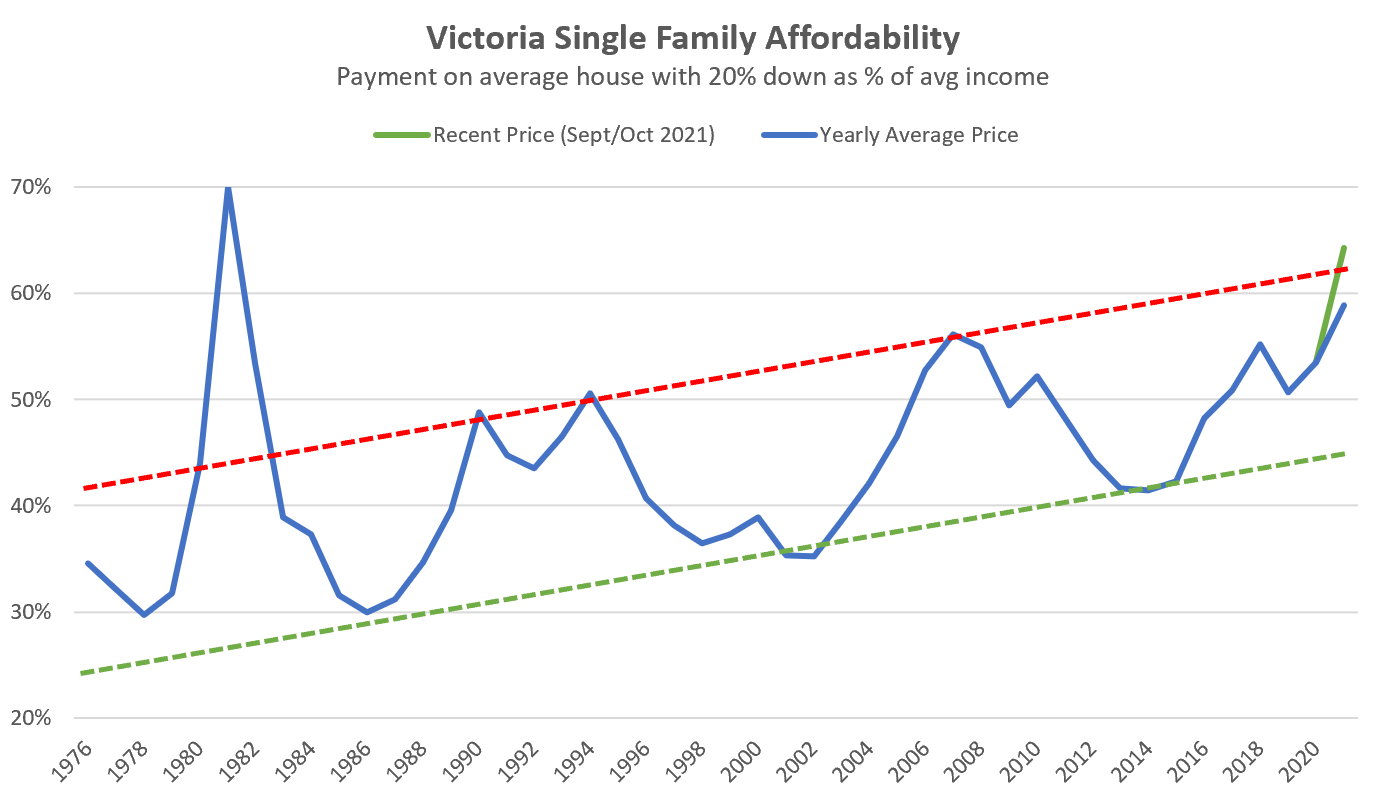

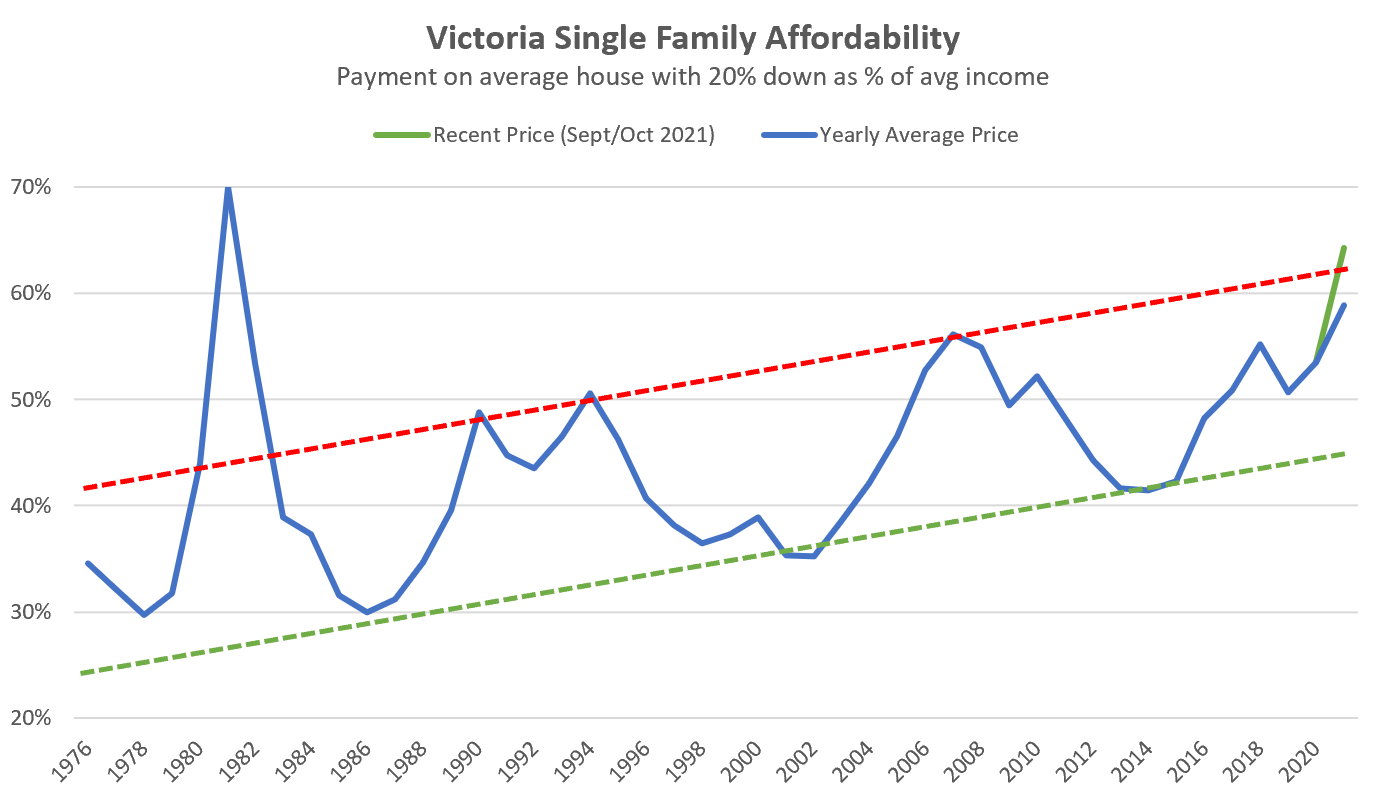

Market conditions are reflected in prices, so if we go look at price movements, we can go much further back. Those data start at 1960, but there’s not much of a discernable pattern from 1960 to 1976, where we saw a nearly uninterrupted rise in prices. I wonder what the housing discourse was like in the 70s? After a mostly flat 60 years it must have been quite a shock to see large real price increases for 15 years.

After that (and ploughing through our 1980s bubble), we can eyeball in some of the half cycles, which have lasted 6-9 years each.

Even those 45 years only encompasses 3 cycles, so we shouldn’t get too carried away trying to generalize this pattern to the future. Also worth mentioning is that though the full year 2021 average of $1.2M only represents a 75% increase from the most recent trough, recent average prices bump that to +96%, giving a similar rise as previous upswings.

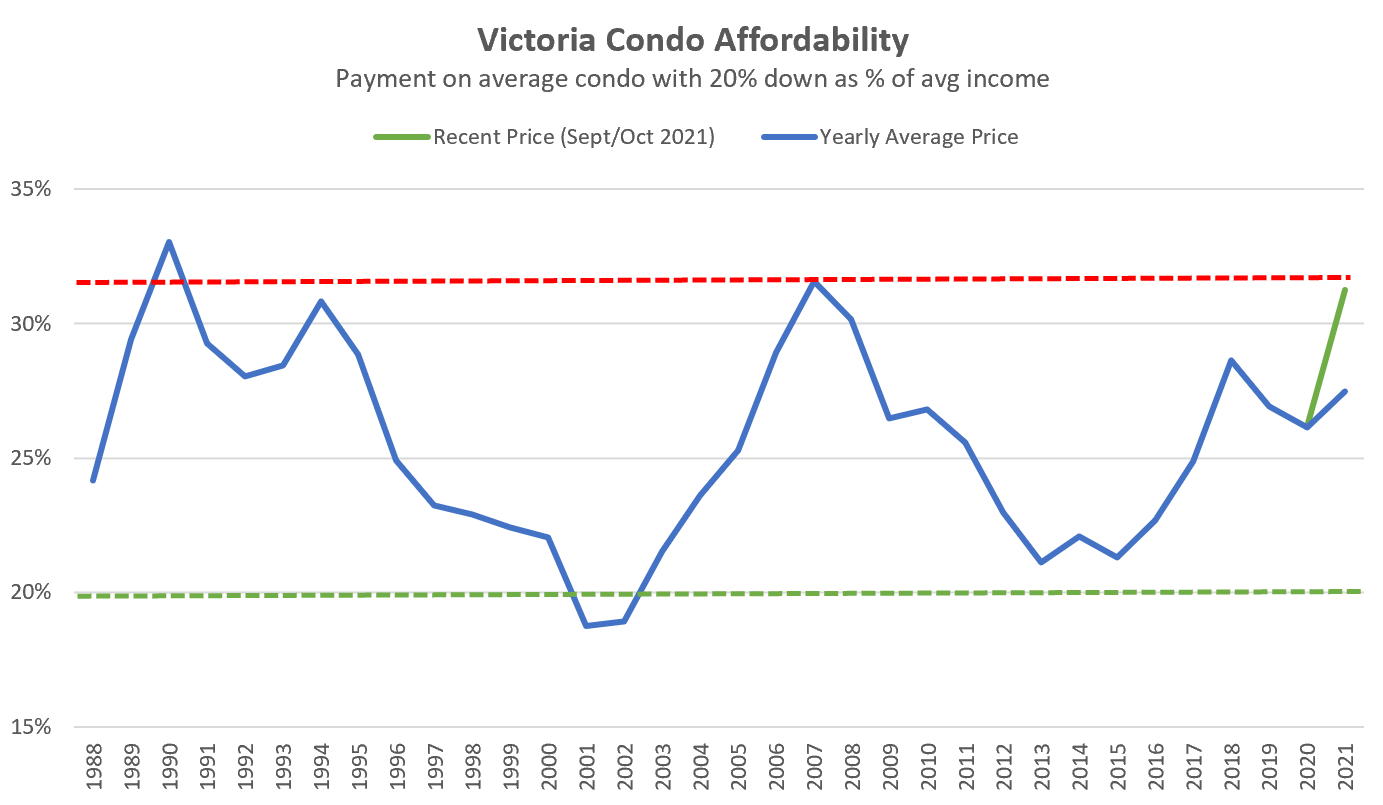

That and the affordability data all point to this being the 9th inning for the market. However we remain stuck with the problem that market conditions remain red hot, and those lead to further price gains. If 2022 is to mark the top, then we would have to see some rapid cooling in conditions, and soon.

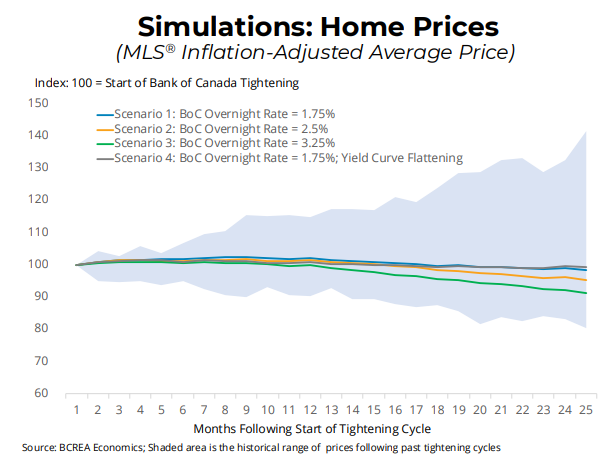

That is surely on the minds of the Bank of Canada as they approach the next interest rate decision on Wednesday. When national prices are up a record 26% in one year and conditions remain hotter than ever, in my opinion it calls for a shot across the bow without delay.

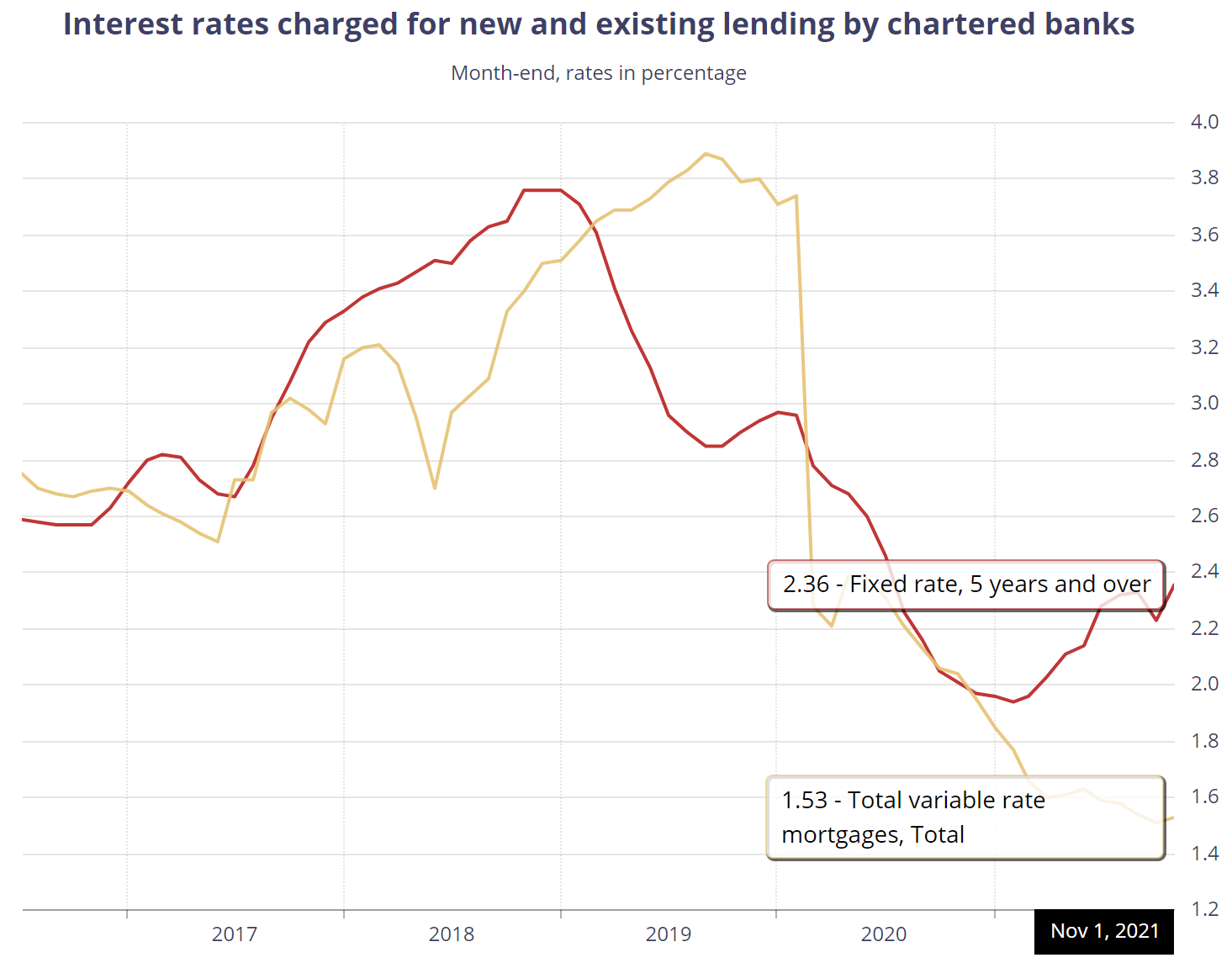

We know that fixed rates have been on the rise since early last year, but that has had almost no impact on the market because variable rates stayed at rock bottom levels.

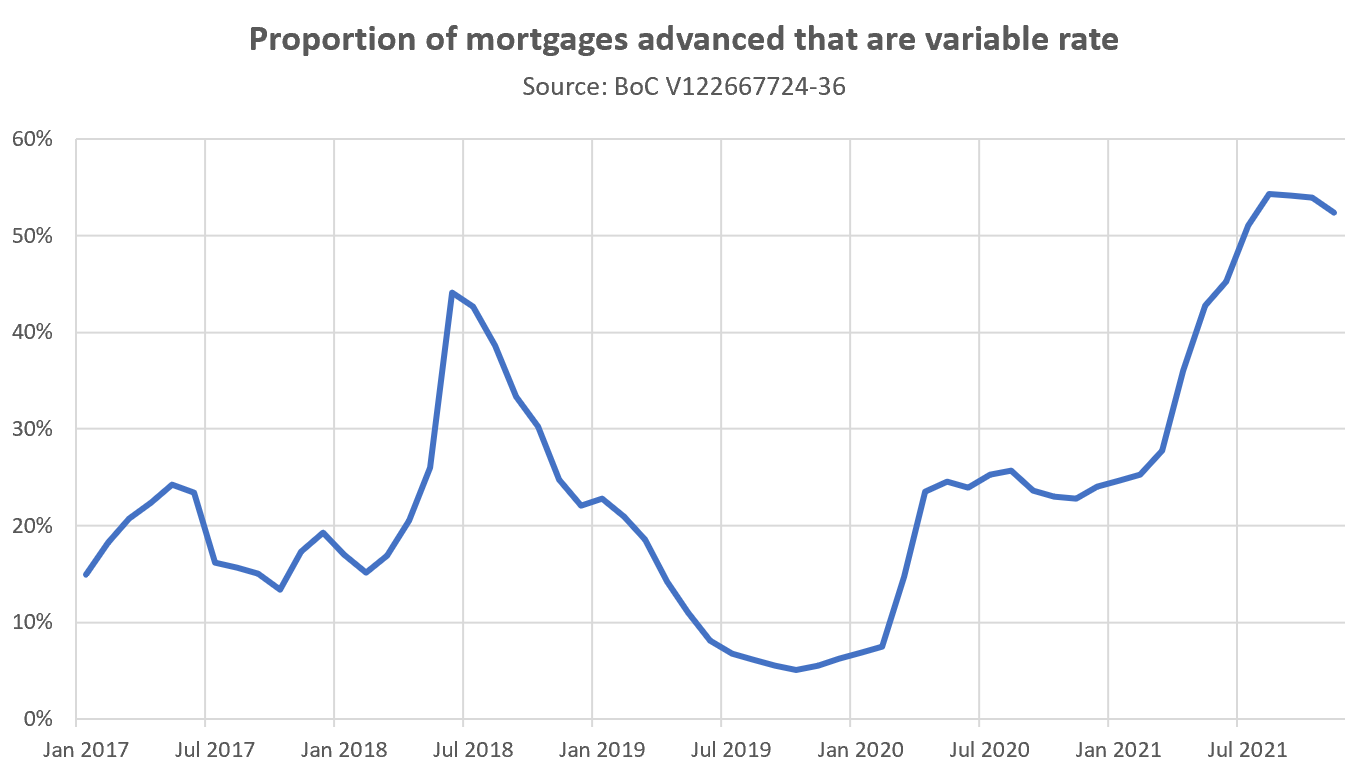

If variable and fixed rates are similar, about a quarter of borrowers chose to go for variable rates. However to no great surprise, borrowers took advantage of the current rate gap by flooding into variable rates, pushing up the proportion of variable mortgages to over 50% in recent months. Whether that move is a rational one to take advantage of savings or one made under pressure to afford increasingly large payments, the fact remains that it magnifies the impact of any rate increase from the central bank. Increasing rates means the 27% of mortgages outstanding that are variable will be paying higher interest rates immediately.

The move on Wednesday if it happens at all will be small, and thus isn’t likely to have a big impact. However it might be enough of a warning to calm some of the irrational exuberance we seem to be getting into. There have been some pretty astonishing sales recently as discussed in the comments section, and in fact the median sale of a detached house in January has come in at 25% over the assessed value from last July. So the assessments that caused such a stir in the media just a few weeks ago are already 25% less than market value. Condos are selling 20% higher than their most recent assessment.

As recently as 6 weeks ago I said prices were still supportable and not yet in bubble territory if things started to top out soon and we didn’t have any big shocks. Well if anything the mania has intensified while the risk of shocks has increased. We know that there will be some rates hikes coming this year, we know that government will introduce regulatory change of some type to calm real estate, and other markets have been selling off recently.

Just because we have 40 years of recency bias does not mean there is no risk in real estate. I’d say it’s higher than it has been in decades. Tread carefully.

https://househuntvictoria.ca/2022/01/24/what-happened-to-the-real-estate-cycle/#comment-84849

Kristan, we are in a similar-ish boat (34 & 36, moved to Victoria from AB 3 years ago with our $170,000 of saved equity and our house listed so we could take the money and buy something here). We now have 2 kids with a 3rd on the way. We decided to keep our AB house because rented out, it pays the mortgage with a 15yr amortization. We’ve got less than 10 yrs to go until we own it. It just didn’t feel worth it for us to give up that investment to get into the housing market here. We love other cultures, so we take in exchange students and rent a 4 bed + den half duplex in Esquimalt. It’s an older house with small living areas & smaller hot water tank, but we get a fenced back yard, my spouse can bike to work in 10 minutes, so we don’t need a second vehicle, our kids get to grow up experiencing different cultures, & we’re growing equity in a house – it’s just not the one we live in. We miss our bigger AB house, but live 4 minutes from parents who help with the kids, so all in all we still have decent quality of life 🙂

You can build your duplex anywhere you want.

-Just not on my street.

New post: https://househuntvictoria.ca/2022/02/01/january-to-the-moon/

Cadborosaurus, what was the size of the duplex you thought/proposed? If it is only 20% to 30% more than a SFH size allowed on the lot with enough space for parking, there would be more agreeable neighbours.

Also suite in duplex was forbidden in BC until December 12, 2019. See

https://www2.gov.bc.ca/assets/gov/farming-natural-resources-and-industry/construction-industry/building-codes-and-standards/bulletins/b19-04_info_lgs_secondary_suite_code_changes_2019_12_13.pdf

Added: we did support one neighbour who built a duplex on a corner lot, but were against a neighbour who wanted 5000+ sqft duplex on a very narrow front (no front street parking space, no garage/carport, and one car width driveway shared by both duplex) lot that allow 2600 sqft SFH. But we would re-consider and likely support if they wanted total 3400 sqft duplex with enough on site parking and a wider driveway.

I think the province has removed rule of “no suite in duplexes” a few years back, and they are allowed now in Vancouver (depending on lot size). So our cities here should allow them (depending on lot size) when/if they change the duplex regulation as stated in my earlier post, but put limit on suite size. Say allow up to 400 sqft suite in a 1500 sqft duplex. The family can rent it out (non-short-term) when they don’t need it, and use for family/themsleves when they do. The builder could even put rough-in for that now, as it will likely happen in so too far future due to our land limit and housing demand.

We tried to build a duplex with a lower suite on each side with friends years ago in Saanich and also looked at Victoria. 0 experience, but had the will and the want to get in and do some of the work ourselves. We had the plans, support of a lender and went to the city with 9 or so potential lots to discuss.

I remember the clerk at the Saanich office laughed us out of the building. She picked through every single lot we had a print out for, and told us things like: this one has a panhandle so you don’t stand a chance at building here. These 6, the neighbours will show up in droves to NIMBY you off the block they dont want density. This one is sort of near a creek and there are these little frogs and ya, it’s not going to get approved either. It was the end of our attempt to build, it would have cost us 475k per family for each half and created 4 new homes.

City of Victoria using more development revenues, when a land agreement was settled back in 2006 with a $32m payment from the federal government. City of Victoria can’t seem to stay in their own lane always jumping into provincial and federal issues.

https://www.timescolonist.com/local-news/victoria-to-provide-200000-reconciliation-grant-to-songhees-and-esquimalt-nations-5014175

The reason you don’t see many new duplexes has absolutely nothing to do with market demand. How is there market demand for townhomes then?

This is why you don’t see many new duplexes

A better way of looking at this is can anyone provide an example of a SFH having been built in the last few years on a R2 lot that is ready to go for a duplex without rezoning or variances? I haven’t seen it. If the lot is zoned duplex and the economics make sense with a SFH what will get built 95% of the time is a duplex, because the economics make sense even more.

I own two homes side x side in Vic West that meet the requirements for duplexes without rezoning. Duplexes have been allowed for a while on lots greater than 7000 sqft. Duplexes a lot of times just don’t make sense financially. Purchase the house for a million. 2-duplexes at 1650 sqft could be a 700 to 800k cost due to two kitchens, firewalls and city service upgrades. Then you throw on boulevard upgrades by COV and your about 1.8m to plus to build. No suites so I figure in the neighborhood I am in there worth about million a side. Now if they allowed suites in these duplexes without rezoning I would be interested or allowing 4 to 6 units without rezoning even more interested. If not ill just keep renting the single homes out till it makes sense or they upzone the properties higher duplexes. I dont see any duplexes being built anywhere at the moment on lots that allow them.

What percentage of houses are duplexes? It’s not very high, I would guess less than 10%. Why? People generally do not get along and to share a yard could create all sorts of problems. People want their own space. Most duplexes I know of are owner occupied and the tenant of the other unit are renters and supplement the owner. That’s why there are mostly single family homes, it’s called market demand. We are territorial creatures.

Taxes Galore – the Singapore Model

1/ how to dampen prices…ouch

https://www.mas.gov.sg/news/media-releases/2021/measures-to-cool-the-property-market

a/ citizen 0%/17%/25% Tax on 1st/2nd/3rd properties

b/ PR 5%/25%/30% Tax on 1st/2nd/3rd properties

c/ Foreigner 30%/30%/30% Tax on 1st/2nd/3rd properties

d/ Companies 35% flat , but can be remitted if you are a qualified developer?

you would really have to love Singapore to pay a 25% to 35% premium to market. Also the developing game is left to billionaires only, as the even millionaire developers would be priced out.

2/ also after 1st property, downpayment increases to like 30% to 60%

3/ also most people live in public flats/government controlled, where if you look, anyone can be a homeowner

https://www.singsaver.com.sg/blog/costs-of-bto-flat-resale-flat-ec-and-condo-in-singapore

something for Canada to consider, but works nicely for them.

Very good. The size increase from SFH to duplexes could also depend on lot size, big ( >7500 sqft) lots can be 30% more, smaller lots can be 20% or 25% more, and 1500 sqft 3 bed/2bath (each duplex side) is still a good size for a family.

So permitting duplexes (with one title each) on SFH lots would be one way to address housing issue, to add the missing middle, increase density and avoid urban sprawl. But the cities have to update the duplex regulation first and to limit their total size max 20% to 30% more than SFH size limit on the same lot, thus much less impact to the land and the neighbourhood (than current double sized duplexes), so we could/may move away from current rezoning process except special type lots e.g. corner lots that could allow larger size duplexes.

Given your example, I would think 95% would be duplexes? You can build 800 sqft more and the 3300 sqft finished you would sell for substantially more per foot than than the 2500 sqft. Like if a SFH is 1.8 you are getting 1.3 per duplex side so that’s 2.6 total.

Say once duplexes are permitted on all/most SFD lots, if there is one lot that is allowed to build either a 2500 sqft SDF or a 1650 sqft/each duplexes (total 3300 sqft), you think most (non-upland/oak bay) people/builder would build the SDF rather than the duplexes?

As far as I know, he is still a family doctor there with same style setup. He even offered to take a few patients who had severe health issues with him (as his patients in the new office), if them couldn’t get a family doctor and didn’t mind to see him in Mill Bay. Unfortunately (or should I say fortunately) we are not part of those few.

Well freedom, the problem could be re-zoning then. To rezone from single family to two-family (duplex) requires public input from the neighbors. They can just say no. It also costs more money as it creates a new strata lot that has to be surveyed and registered. The lot would also have to be large enough and have the proper set backs. And of course that means more development charges payable to the city.

I don’t know if it would be worth the hassle and costs.

That may have been part of it, but when breaking the news to his patients, he might have left out the part about his new job offering him “more money and easier work.”

Just turn Uplands or Victoria golf course into executive 9s. Plenty of land available resulting in a much higher tax revenue (I’m assuming).

FYI: Our family doctor moved away to practice in Mill Bay about 3 years ago due to high housing cost in Victoria.

That makes sense. What also makes sense is that the allowed total size (of both duplexes) is not that much bigger than allowed size of a SFD on the same lot, to limit land value escalation,

While in Saanich, when someone applies a duplex rezoning on a SFD lot, the result can be a monster house that doubles the floor space. That may be okay for a big long or a corner lot, but has to change and be limited to similar of Vancouver duplex regulation in size, if we allow duplex on all or most SFD lots.

OK, so there isn’t a Victoria shortage of doctors (GPs), but instead it is a shortage of office based family doctors providing ongoing (longitudinal) care vs walk-in/telemedicine doctors (GP). I agree with that, and have been saying that.

There are relevant implications in this for the Victoria housing market. A narrative presented here is that the “doctor shortage” is worsened by wonderful Victoria family doctors not being able to afford housing here, and so they are moving away (or not coming in the first place). We are told that we better sort out this high house price problem fast, or we will lose our doctors. And then we find the reality is that doctors aren’t moving away after all. They’re staying in Victoria, just switching to more lucrative and easier practices in tele-medicine and walk-in clinics. The doctors buying houses here are likely using their higher income from these clinic/telemed jobs to drive up our house prices even farther

We’ve got more than our share of total Canadian doctors in Victoria. We just need more of them doing office-based longitudinal care. That’s one for the governing bodies to sort out (College Physicans and BC Health)

The City of Vancouver document that I linked says expressly that they can be strata titled.

Please refer to my comments below. There is most definitely a shortage of family physicians attached to patients in Victoria. I did not comment on this shortage as a GP shortage and my main issue with your comments was stating that the current state of affairs was acceptable care. The shortage, I believe, is due to systemic issues that make practicing as a family physician in a clinic less attractive.

My idea of what might work would be a bricks and mortar clinic offering patient attachment with NPs who are less expensive than GPs and provide great longitudinal care, along with telemedicine for visits that don’t require in person exams. Each area should have a NP clinic and eligibility should be based on residence in the area. In many countries your doctor is assigned to you based on where you live.

Maybe more NP clinics will happen, but we’d have to graduate a lot more NPs and in my conversations with a doctor who was part of a research group for the government on this topic I learned there has historically been reluctance on the part of GPs to support this. Maybe this has changed now due to advances in telemedicine giving them an alternative.

And, BTW, it is pretty easy for Canadian physicians to get licensed in the US if they have a job offer. I would expect that telemedicine employers from the US will be looking at this if it is not already a source of competition. https://www.wheel.com/blog/practicing-telemedicine-while-living-abroad/

Stanford study finds most gas stoves leak methane when not in use and during cooking. (Gas hot water tanks also leak.)

https://www.nationalobserver.com/2022/01/31/news/gas-stove-bad-health-and-warming-planet-cooking

Please clarify. Are you saying you agree with the statement “There is no shortage of doctors (GP’s) in Victoria”

No you haven’t. You’ve been challenged on a few points, but not that one. The main one being your statements that having to wait 11 days for a telemedicine appointment and another week or more for something that needs to be seen in person is adequate when there is no way to get into a walk-in clinic. It’s not an okay wait time for a lot of things – like infections. There is also no care continuity and no way to be physically examined.

There is no doubt that family doctors are moving into telemedicine. And nothing wrong with that. I’d do it too given the system and covid. The problem is there a shortage of family gps attached to patients and in-person options because of this shift, the clinic closures including walk-ins, and because we do not have enough NPs.

Telemedicine will expand and that is a good thing, but it needs to be accompanied by in-person care when needed and consistent follow-up and a legal responsibility to follow up- which is not currently the case for the hundreds of thousands who cannot get a family doctor and are left with ad-hoc options.

I would be more than happy to be in an interdisciplinary practice and see a NP as a primary caregiver. In fact, a NP would be my preference with referrals to specialists if needed. None are accepting patients – I’ve tried everywhere.

So I the 100,000 other Greater Victoria residents are left with an “attachment gap” and a revolving doctor through telemedicine, or ER with no family doctor to review the report, and not getting the care I believe is necessary to prevent health problems – only to treat urgent matters that have not been caught early.

So if everyone is yelling for more supply is the reasoning being that houses will be more affordable The reality is building materials are going up probably north of 10 percent yearly and there’s a push on labour costs it’s pretty tough to buy a new build in oak bay for less than 3 mil right now and no relief in sight

https://www.anthropocenemagazine.org/2021/11/aim-low-when-designing-climate-friendly-city-future/

“There is no shortage of doctors (GP’s) in Victoria”

I’ve been “tarred and feathered” for saying the same thing here. But notice the quotes on the statement above, because it comes from Dr. Vanessa Young, chairwoman of the South Island Division of Family Practice.

And she’s right. What has happened is that, unfortunately the family practice office model is a “dying business model”. There has been exponential growth in the episodic care model (walk-in, telemedicine). And Victoria family doctors are leaving their offices in big numbers, to work in these new models that provide normal working hours and higher pay.

So we are left with the sad and serious reality that it is indeed hard if not impossible to find an office based family doctor – because this is a dying business model, and the doctors are leaving it in favor of walk in clinics

Anyway, the solution is “teams” of additional people supporting doctors, like nurse practitioners. This will allow people who need a prescription renewed to get it from a nurse, freeing up someone truly sick to be seen by a doctor. And so the next time you click on an iPad to see a doctor in telemedicine over some trivial issue like poison ivy, be aware that you are part of the “exponential increase in demand” problem. And hopefully your issue will be dealt with by a nurse in the future.

=== -====

The rest of this post is from the TC article that has quotes from 5 Victoria doctors (and Adrian Dix) saying the same things I’ve been saying here https://www.timescolonist.com/islander/why-cant-you-find-a-doctor-4673777

“Dr. Rita McCracken, a family physician and researcher at the University of B.C., said 40-50 per cent of medical students are choosing family practice for residency, but only 15 per cent of those who finish the residency choose to work in the traditional family practice model.”

“Dr. Greg Rideout says primary care has “collapsed” in the region. A family physician who moved to Victoria from St. John’s in late 2016, Rideout said he was astounded by the number of walk-in clinics in Victoria, the cost of living and the overhead required to operate a family practice.”

“Instead of opening a family practice and providing continuing care to patients in the community, they might work a couple of shifts as a hospitalist, two or three half-days in a health authority owned-and-operated care clinic and a few shifts at a walk-in clinic, McCracken said.”

“B.C. Health Minister Adrian Dix has embraced the team-based approach as part of a three-pronged strategy to open urgent primary care centres, develop primary care networks and expand community health centres”

“Dr. Eric Cadesky, says the “shortage” is less about absolute numbers than a failure to use the doctors we have more efficiently by supporting them with teams of other professionals who can share the workload. “What could have been done by one doctor years ago may take two or three or more doctors to be able to keep up that same level of work today, because the demands have increased exponentially,” he said.”

“family physician Dr. Jennifer Lush, 44, says primary care is on the brink of collapse in Greater Victoria.”

Some realtors and VREB are also the part of housing problem – 954 Linkleas Ave is listed way underpriced. Some realtors call it’s “sales strategy”, I call it’s scam.

I doubt that we will see laneway houses built by developers along with a new house on a residential site. It just isn’t economically viable. It’s more viable to just put in a basement suite.

A site may be appropriately zoned and large enough of a site to construct a laneway. But if the laneway isn’t economically viable to build along with a new main dwelling then all of the political lip service doled out to the public will not have any significant effect on increasing housing.

When you say duplex home on a single family site. That sounds to me that the two units are not individually strata titled. Then it would be the same as building a laneway home. The duplexes wouldn’t be economically viable to build. All the political rhetoric about duplexes and laneway homes won’t do anything to solve the housing crisis.

City council could re-zone the bigger lots in Rockland to multi-family but then the character homes that they want to preserve are going to be demolished. After two decades of condominium construction the City of Victoria just doesn’t have the land base anymore to keep multi-family construction going into the future. We have or about to, run out of land.

There are large tracts of land in Esquimalt, but there happens to be a Navy base and military married quarters on it. This is what happens when you live on the tip of an island. There is a limited supply of land and most of it is occupied by people that don’t want character homes demolished or the Navy base booted out. And it’s that lack of land that will slow down construction and increase lay offs.

Don’t hold your breath waiting for the government to fix the housing problem or creating more affordable housing. Manitoba’s recently crowned Premiere, Heather Stefanson’s family own massive real estate holdings. Large apartment buildings, storage facilities, and who knows what, tens maybe hundreds of millions of dollars of real estate. I doubt she has any motivation to institute any policies that would decrease rents or the value property. That’s not why she went into politics in the first place. I wonder what real estate holdings the Trudeau’s own that we don’t know about.

Haven’t noticed the huge price increases in small towns across Canada lately? They seem to be attractive enough as they are.

Most already have hospitals and such by the way.

Vancouver had already allowed suites and laneway houses on most SFH zoned properties so the new duplex zoning does not add as much new buildability as might first appear.

It does however allow for strata titling of duplexes.

https://bylaws.vancouver.ca/bulletin/outright-duplex-how-to-guide.pdf

After a few years, we managed to buy a house, which needs work, hence the low bids!

I had a question….we were hoping to do a patio in the garden to be able to spend some time outside in the summer.

I was hoping for some recommendations of landscapers or someone who does patios for outdoors…someone who is reasonable and does great work :))

Thanks for all you do on this site Leo, this site has helped us a lot in navigating the housing crisis!

Improving services in smaller centres could be an effective approach for governments to take.

A lot of small towns would be more attractive if they had hospitals and such.

You could put a moratorium on construction and watch the economy collapse, unemployment skyrocket and vacancy rates hit double digits. That would definitely bring home prices down in Victoria as construction workers leave for better opportunities.

Not really an option that I would recommend. Better to continue what we are doing and wait for the next recession to hit BC.

If Russia invades, then oil prices will skyrocket as the US stock piles fuel and Alberta is going to need a lot more workers in the tar sands, Calgary and Edmonton. The average house costs $400,000 in Fort McMurray and there is a selection to chose from. Which makes it a lot more appealing with higher wages, lower taxes, and lower housing costs. It can get a bit chilly though. But that’s why they have heaters in trucks.

Pretty sure we could just stop backstopping mortgages and things would change overnight.

Garden Suitor, think of how much easier it would be for you today to look at all the homes for sale in Victoria City. You could do it in one day.

Fits with our experience that it’s been non-investors buying SFHs. In our search for a ~median SFH in the inner core (<4km of downtown) from Jan-Jul 2016 we looked at 100-120 places, and we ran into friends/acquaintances more weekends than not.

No it’s an analysis of the potential impacts of the broad upzoning that New Zealand approved recently. You can read it here https://househuntvictoria.ca/wp-content/uploads/2022/01/Cost-benefit-analysis_proposed-MDRS.pdf

There are no quick fixes to a problem that has been building for decades. The idea there is some magic regulation we can just fix and everything will be ok tomorrow or next year is pure fantasy. That remains true even if we end up having a significant cooling of the market and pullback in prices

Yeah they allowed duplexes but restrictions on building footprint and some other things have limited how many are actually buildable. Not sure how many exactly were started since

City of Vancouver upzoned all single-family neighbourhoods in 2018. What has happened since? I seem to recall reading somewhere that, since the change, uptake on building multifamily has been pretty low. But I can’t find much info on this.

This is someone’s model/predictions about doing something about housing that even they admit won’t be noticeable for a decade? Househunters need help now. Maybe you could interest some high school kids with this housing upzoning “model” idea that might be “noticeable within a decade.”

I know how I would solve the problem with adding transient construction workers and not increase the demand for housing significantly or have investors swarming all over the place. But it would require the co-operation of the different municipalities and Native Indian bands. Which would be a major cluster F*&K dealing with all these Empire building mayors and councils with their different agendas and addiction on the revenue coming from development permits.

I suspect we’re roughly at capacity for construction so it’s true that broad upzoning won’t radically increase our rate of building from this level, but:

How about instead we preserve our public greenspaces and upzone to 6 floors around them (around Cedar Hill Golf Course is a prime example). Then open up the park for all uses, not just golfers. Central Park model

Leo S, where are you going to get all those workers to build all these units? They have to come from somewhere and they have to live here to work.

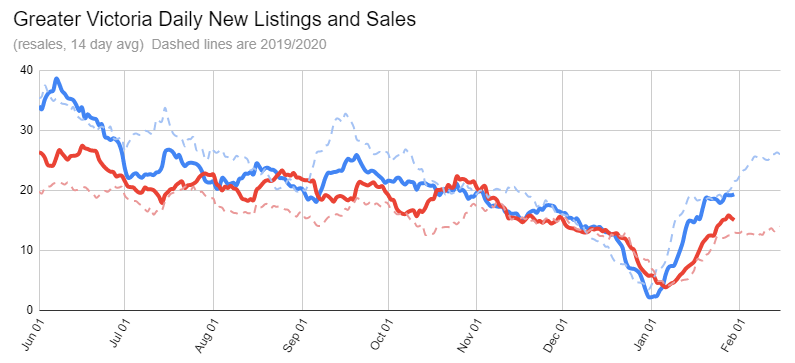

Pretty much “normal” new listings level (similar to January 2020), but somewhat higher sales despite the fact we have 60% fewer properties on the market.

Haha….you forced my hand Gosic Mus:)

Oh God forgive me… but I now have to mention that “Moncton” property prices had one of the highest percentage point increases in Canada in 2021 and another super year ahead predicted because it is still the least expensive place in Canada.

People from Toronto and Quebec are moving in.

All good. I promise not to mention Moncton again!

And you’re not going to find condo developers bidding on individual properties. It’s your job Marko to find and get 3 or 4 properties owners together and bring that to the developers.

That’s not going to be easy when developers only want to pay $135 to $150 a square foot for land. Otherwise the developer has to sit on these properties for years until condo prices increase. Leaving the land vacant, like the property on Miller, for the last three years.

We certainly won’t fix this overnight. That said I think the combo of rising rates, blind bidding ban, cooling off period, and whatever the feds are doing to restrict investors will knock some sense into the market this year.

As for rezoning and the long term fixes, I like the economic analysis that was done on the New Zealand upzoning. Their paper concluded that the changes over 20 years would lead to 213,000 more homes, much slower home price appreciation, and avoiding $200B in transfers from renters to owners.

And my favourite section of the paper, the authors conclude that the broad up-zoning is “likely to lead to more affordable and equitable urban living than what would happen in its absence. The difference will be small at first, noticeable within a decade, and enormous for the next generation”

Back from the mid-island, always lovely up there…

$1,152,000.

Not actually true. Majority of homes are not purchased by investors. We shouldn’t be surprised that investors are buying though. From 1991 to 2020 we added 2062 purpose built rentals while population increased by 113,000 people. In other words, about 108,000 people were dependent on individual investors for their homes. Not a great situation, but if we don’t want to build rentals, the investors will buy up existing units to fill the gap. It’s our choice (hint: municipal elections this year).

We have been building, but clearly not nearly enough. If we were, we’d have enough inventory on the market and sufficient vacancy rate. But we don’t. Can’t argue with the results.

Now if you believe that we can build our way out of this crisis, then here is a novel idea that would solve the housing crisis and the homeless living in the parks.

The City could sell Beacon Hill park to developers. Developers could build another West End just like in Vancouver. Think about all the bike lanes we could have then?

For the most part what I see is families outbidding families. Not seeing many builders or investors in the marketplace for SFHs.

Just last Wednesday showing a place and sure enough the buyers run into the next showing who is a friend. Happens at least once a month.

Only if the land is vacant. If you have to assemble land then you have to buy improved lots and assemble them. That’s expensive. You have to pay more than someone wanting a house to live in. I don’t see any vacant lots in Victoria big enough to build a condominium complex on. If you pay too much, then you have to hold these properties for years until it becomes economically feasible to build. That costs money too.

You’re not competing with developers that can only pay so much and still build with a profit.

I think you are hinting that if the land costs $500k, construction costs $500k, and the finished product is currently $1.1 million (10% profit), if the finished producted dropped to $900k the land would drop to 200k (assuming construction costs are the same).

Problem is this doesn’t really work in reality. Often the “teardowns” are rental properties so they have other utility, the builders have to outbid individuals wanting to do fixer uppers, and some land owners will hang on as they won’t be interested in selling at X lower price, and you have buyers that will pay more than a builder for a custom build where the numbers necessarily don’t have to work.

Same with construction costs. If construction goes up 100k, finished product remains the same, I don’t think that correlates to a direct 100k drop in the land to make the numbers work.

New lot development on the other hand is extremely expensive in terms of infrastructure/bureaucracy and the raw land makes up a smaller % of the overall budget; therefore, even big drops in the raw unserviced land may not make projects feasible.

You are making the assumption that land costs are somehow independent of what finished housing can sell for. In fact land costs are almost entirely dependent on what the finished housing can sell for. If the price of the latter goes down, so does the former. Because it’s endogenously priced – i.e. what it sells for is determined by what builders are willing to pay.

Fact not theory. In the Vancouver high-end market slump of a few years ago, it was the lot value properties that took the biggest % declines, by far.

“ Anyone who has witnessed my past posts for the last number of years now, will know that I have been bullish on Victoria’s real estate.”

Keep the posts coming. Just as long as they don’t contain the word “Moncton”

Hey, hey, hey! Those consultants have families and homes too! Why you dissing on them?

Spread the wealth man!

Wow, that invoice is scary. No one should need to put up with that nonsense. Obviously the consultants are “feeding at the trough”, so there’ll be no complaints from them.

Corporations buying houses in Canada is not an issue. However, I believe they are buying up property in the U.S. If I owned any property down there I would be selling now. Snowbirds can then pay the taxes, get 25% on the exchange, and use the added proceeds to buy wherever they want. Wintering in Victoria can be broken up by a few weeks vacation to Hawaii, California or Mexico without the expense and hassle of maintaining a secondary residence. That’s what I would do.

“Vancouver prices have actually not gone up very much in the past couple of years. (That Vancouver bungalow I always talk about would be hard pressed to get $3million today…..even though my relatives were getting several developers offering 3 million …..four or five five years ago.)”

I think central Vancouver is actually an excellent deal right now. You are in the centre of a big metro with Stanley Park, shops, subway lines, symphony, art galleries, top restaurants, head offices, waterfront walkways at your doorstep. We’ve lived before in huge single family houses in Victoria – in places like Oak Bay and Ten Mile Point – but would not say our present Vancouver condo lifestyle is inferior at all. What we lost in space is made up for in many other important ways.

Prices are controlled and going up at a measured rate. Once immigration gets going again in a big way, it will go up much faster but now is the time to buy DT Vancouver and Vancouver West Side, in my opinion.

It’s not corporations buying up properties in Victoria. Mostly it’s builders looking for land and people buying properties to rent for the added income and appreciation. Some that have sold are not downsizing but are leaving Victoria for up island. They are taking their winnings and leaving. Going to places where prices are lower and they will have a fat bank account.

There aren’t enough voters experiencing the housing problem (i.e. non-owners) to elect governments. Any elected government needs the support of a substantial number of voters who already own.

And that’s the real problem.

Canada’s constitution expressly authorizes the provinces to establish municipalities. Of course, municipal governments already existed before 1867.

and nothing will change. I’ve been reading the 1000s of reddit/FB comments and it is 99% complaining about prices. Average person thinks big corporations are outbidding them on SFHs when in reality it is their friends/colleagues/etc. Therefore, they will vote in a government that will sell them non-sense on tackling the housing problem but, they will just add more bureaucracy (municipal level) and print more money (federal level), a perfect receipt for further price appreciation. Add a sprinkle of 400-500k immigrants per year.

Interest rate increases might subdue the market for a few years but then the next crisis will happen, they will drop the rates to 0%, and will have the same current housing crisis all over again.

Now that I am more involved in development/rezoning I am becoming more and more bullish on real estate. What is going on the muncipal level is alarming imo. It has become worse and worse over 15 years but I think it is hitting a threshold of insanity. 1,644 sq/ft SFH in the Oaklands area 5 years start of rezoning to finished producted. I wonder why there is no inventory.

Over 50k on a sidewalk that I kid you not literally goes to no where and replacing a perfectly functioning driveway/curbs/etc.. Now add like a pile of other non-sense. We are talkings 100s of thousands of nonsense on ONE SFH 1,644 sq/ft home.. Below is the type of invoice you receive from various consultants as a function of the muncipality being ridicolous. First site meeting had 7 people present (myself, engineer, arborist, contractor, three people from COV)….for a sidewalk, to no where on a dead end street. City mandated, but then they complain about the sidewalk (which they mandated) damaging the trees so you as the developer have to hire the arborist and pay him/her to write reports. You have to hang dig that area and all this other non-sense around a tree arborist says is only 30 years old and has no value. Obviously the COV tree person thinks otherwise.

Long term this gets passed on to the consumer one way or another (too long and expensive to build, less gets built, restricts supply, prices go up).

Civil – Dip. Tech.

09/14/21 2.00 “Plan Review – Contractor/Municipal Liaison

Site Inspection – Forms”

10/05/21 0.25 Contractor liaison

10/19/21 1.25 Site Inspection – Contractor Liaison

11/03/21 1.50 Site Inspection – Contractor Liaison RE Scheduling

12/02/21 1.50 Site Inspection – Contractor Liaison

12/09/21 0.25 Municipal/Contractor Liaison

12/10/21 2.00 “Site Inspection – Curbs

Municipal/Contractor Liaison – Design Review”

12/14/21 1.25 Inspection Reports – Municipal/Contractor Liaison

12/15/21 1.00 Site Inspection – Curb/Sidewalk

Civil – , P.Eng

04-23-21 1.5 Coordinate pre-con meeting, setup project/admin, reach out to

contractors

05-05-21 1.5 Meet onsite and follow up with contractors

06/14/21 0.50 Discuss with contractor

06/17/21 0.50 Coordinate with arborist and city for meeting

06/22/21 1.50 Pre-con meeting

06/24/21 1.50 revise and submit drawing

06/28/21 1.00 update drawing and resubmit

09/10/21 1.50 Coordinate with contractor and concrete foreman

10/04/21 1.50 Review pipe video, discuss options

12/10/21 0.75 Coordinate with contractor and owner re delays

Admin Fee – 10%

Having a second bathroom renovated, my property manager had to go to 7 hardware stores before he found one shower. Home Depot said it was a 3-4 month wait for one. Hard to build new homes without the parts. Same thing inhibiting new car manufacturing, hence used cars are crazy prices.

Construction isn’t a problem if the municipalities would responsibly manage the limited land base.

Our city managers have done nothing different from what happened in China. They became addicted to huge development costs and rising property taxes filling the coffers and found ridiculous ways of spending it.

And like China, we are now in a housing crisis while we live in a small city with big city problems like the homeless, drug addiction, urban sprawl, and traffic congestion. And there is no way out of it. They sold out for short term gains which they spent without regards for the future.

And in my opinion, the bill for this extravagance is going to come due. As the people that will have to pay when construction slows, and the development charges decline, are the home owners and businesses with higher property taxes.

Because of the shortage of vacant and available land in the city. Condominium builders have to buy and assemble properties with houses on them at ridiculous costs due to the rise in home prices for marginal tear down homes that are usually situated along busy streets. Well most of those types of assemblies are gone now. Even if more properties along the corridors were rezoned, that wouldn’t help the housing crisis. Land is too expensive.

It’s just basic math. Land and construction cost this much. But you can only sell a unit for this much. And land costs for development have gone up 30 to 40 percent in 12 months. It doesn’t matter how much land the city rezones from single family to multi-family, if the numbers don’t work, you don’t build. Then you lay off workers.

As active listings decline so do sales. That should make sense to most people as less selection results in fewer purchases.

Active listings most often follow the seasons as fewer people chose to list their properties over Christmas and school holidays and fewer people want to buy at this time too. This past winter season has been no different than previous years. Except in magnitude and direction.

Pre-Covid, the ratio of active listings to sales for homes in Victoria during December was 256 to 76. A very healthy selection for those wanting to buy

In December 2020 that fell to 198 to 115. Still respectable.

But this December the ratio inverted at 62 to 77 and that spiked home prices in Victoria – biggley. That’s all free money. A winning ticket in the lottery of life.

Covid brought more buyers into the market while home owners cocooned and bought pandemic dogs. And that is a typical action when people fear for the future. They buy real estate as fear and greed are primary motivators.

Maybe it’s time to cash in on that greed. I could sell and rent a pretty nice condo for $5,000 a month and not have to worry about outflows like property taxes, repairs and other maintenance issues for the rest of my life. I could work a day or two a week then and do more volunteer work. But the first thing I’d move into that condo would be a barrel of Johnnie Walker Green label and one bottle of water.

It works a lot better than most other countries in the world. Yes, it could function better, no government is perfect. But we get what we vote for and as long as we have voters that think construction is the problem, we will have governments that will try to limit construction.

I’m sorry “Umm Really”. …but we will have to dissagree.

I was posting at least way back in 2012 through 2016 about Victoria prices being cheap. ( In 2012 when we bought a house with a legal suite in Sooke for around $375,000.00. My son and daughter bought one each around that time as well because we were gobsmacked at how inexpensive they were.)

Keep in mind that Prices started to climb even before Covid. And yes… house price jumps have also been a National event because of covid and lots of cash available and a strong immigration policy.

But I still stand by my basic point that Vancouver sets the prices for Victoria.

Vancouver prices have actually not gone up very much in the past couple of years. (That Vancouver bungalow I always talk about would be hard pressed to get $3million today…..even though my relatives were getting several developers offering 3 million …..four or five five years ago.)

(By the way……Thank you Patrick:)

Hm. I would think that your particular description of those afflicted construction workers would be more applicable to how they would respond to an economic (hence construction) boom. Not to say there aren’t females in the construction industry, but I digress.

Construction workers are not the “boogeyman”. They are simply the ones that get hard in an economic downturn.

About 3 years ago people were complaining that houses were too expensive and nothing affordable was available. Deryk made a series of great posts, with specific listings of detached houses available for around $600,000. He detailed the reasoning why they were a good deal, and how they could be rented out and repaired as needed.

Most people didn’t want to hear about those houses. They told him they were “bulldozer bait” and they wouldn’t consider them.

To state the obvious, Deryk was right.

Nice to see how humble people can be. However, correlation is very seldom causation. A global phenomenon (this little thing called (COVID-19) that influenced a push out from major urban centres combined with an unparalleled push of liquidity into the housing market that brought purchases forward by might have had something to do it. Not to mention the push the pandemic gave to a large number of folks into early retirement. The market run up has been a national run up, especially in towns the size of Victoria (yes, Victoria is still more of a town, it just imports and adopts big city problems). It’s good to remember that Victoria isn’t really a business centre and it’s economic drivers are limited and that will likely not see it maintain what is seen in markets like Vancouver. However, the ups and downs that we likely be seen in other markets will likely be somewhat mitigated by our ample supply of overpaid and low productivity public employee types that make up the population here. But, there will be quite few when travel fully opens up again will quickly realize that Vancouver Island is not Palm Springs or Fort Lauderdale and might want their winter get away to be somewhere else.

The real boogeyman is the municipality, former landlord. A fake level of govt (constitution only grants powerd to provincial and fed govt) that makes building houses and communities increasingly difficult. We have the provincial govt to thank for this – they empower these municipalities to make life harder for british columbians. It really is backwards. It is explicitly obvious that the different levels of govt in this country do not work for the people.

Does our half ass socialist, half ass capitalist, half ass democracy with special interest lobbyists work for you? Im not sure it is working for me.

First the bogeyman was the foreign buyer, then it was the investor, now it is the construction worker?

Anyone who has witnessed my past posts for the last number of years now, will know that I have been bullish on Victoria’s real estate. ( Four or five years ago for example, I said they were cheap…with the usual snap back from some House Hunt Victoria members saying that Victoria was not cheap and that I was essentially full of shit:)

I don’t pretend to have special powers or know more than anyone else, I was simply looking at what houses were selling for in our backyard. (Vancouver) And thought….How can a house in Victoria be considered to have that much less value than the houses in my backyard.

It seemed obvious that Victoria was Cheap in comparison. (Again, I endured the usual snap back…. that “Victoria is not Vancouver:)

Anyone in Vancouver, (say 5 years ago) could sell a run down, post war bungalow on Vancouver’s west side for 3 million and buy a fairly nice house in a good area of Victoria for well under one million. (bicycling distance or walking distance to downtown)

Anyway, I currently feel that prices in Victoria are reaching a level where….when compared to Vancouver (inner core) they could be reaching a level where one can buy a house on the east or south side of Vancouver for not much more than a house in Victoria’s inner core. (Closer to more cultural events, Huge business center offering much more opportunities. )

That to me is a signal that , while prices could rise a bit more here in Victoria but not much more.

Recap: My point is that four or five years ago we were bending over backwards to position our family and kids into owning a house.

We would not have the same confidence to try and do that in these times.

Having said that, I would much rather live in the Victoria area than Vancouver.

Good luck everyone. Only time will tell where things are heading.

That cannot and does not work long term or even medium term. You cannot support an economy by building housing. No less a figure than Adam Smith understood that over two centuries ago. That’s the very lesson of the housing bubbles, busts and financial crisis early in this century.

What stimulates the economy short term during such bubbles is increasing debt, and that increase cannot go on forever. Particularly when interest rates go up.

Check out this info, it appears that Canadian’s interest in U.S. properties are rapidly declining from the highs after the 2008 financial crisis. Hundreds of thousands still own property and they have also benefited from 30% gains. Victoria is not the only city experiencing crazy prices, it’s world wide. Want cheap property, try the Ukraine.

Lots of people have given up looking with so little to choose from. They are also afraid to sell their property and try to find another place to buy in this market. Difficult to determine how many people are on the sidelines. I believe last years sales were near record levels, in such a tight market, that indicates plenty of buyers were out there driving up prices. We’ll find out in a couple months how many properties come on the market and how many buyers there really are. I’m sure covid is presently affecting housing activity.

The anticipation of rising interest rates would induce panic buying as people want to buy before the interest rates increase. But why should they panic if they can afford to pay a slightly higher rate? They panic because they have limited resources.

And if they are wealthy they are not going to downsize to live in a middle income neighborhood like Saanich. There is still 3 months of inventory for water front properties in Oak Bay, Saanich and Victoria. And as prices increase the MOI increases. There just isn’t an endless money train of wealthy people coming to Victoria. The massive demand you refer to is in a narrow band of properties which got a lot smaller in the last month.

Sure there are 15 people bidding on a house in Victoria. But there are only 19 houses for sale and only 8 are listed less than 1.4 million. Once the prices get over 1.8 million then they days-on-market shoot up to 75. 15 people chasing after 8 houses isn’t massive demand.

With a severe shortage of housing and massive demand, I can’t see why rising interest rates would cool off construction. If anything, rising rates will induce panic buying. The hellish winter the rest of the country is experiencing and the pandemic motivating more people to retire, expect a huge demand for up Island properties and Victoria condos. That’s my scenario.

They may have a pot of money from selling their homes, but I wouldn’t call them wealthy in their income.

You may live in a 3 million dollar home, but the banks are not going to finance 80 percent of your home’s value without the income to support the loan.

What we are likely seeing is that the few homes that are being purchased today are being bought with big down payments or from the top percentile of wage earners. When or if the supply increases, say in April, then we could see a dramatic increase in the months of inventory and days-on-market, before prices begin to soften. I don’t think it would take too much of an increase in supply to satiate demand for this small group of buyers at these atrociously high prices.

That’s something for those that are thinking about “gifting” their children a bag full of cash to buy a home. That gift today is going to have to be substantial as they probably don’t have the income to support a large mortgage and you might not have the income to pull that much cash from your home.

Leo has a poster pinned to his wall of David Eby, tongue out, dunking on NIMBYs.

Rising interests rates should cool off construction a bit. The so called soft landing.

Or the marketplace can do the same thing as rising prices have the same effect of increasing mortgage payments and reducing the number of potential buyers. In the last three weeks there has been a 15% jump in prices. In just three weeks!

It could also happen if there isn’t sufficient land to develop. Contractors unable to buy land, can’t build, and will lay off workers. Slowing down development will increase unemployment and vacancy rates will rise as the transient workers leave Victoria for jobs in other places. That will cause prices and rents to decline.

The remaining construction workers will then have to adjust to lower wages or face long term unemployment. And the contractors will not be building as many speculation homes and switch to building homes on a contract basis as well as reducing their profit margins.

In past recessions contractors were not making a profit, they were working for wages.

The oxymoron that I used previously, and won’t repeat, is appropriate.

“The process we are seeing with the current market is “gentrification” We are used to think of that as middle class people moving into places where poor people lived. Now we are seeing the same thing, but it is wealthy moving in where middle class people lived.”

That’s a fascinating insight! I can totally see it.

We have been building for almost two decades now and prices and rents continue to rise. You can not build affordable housing as the very act of building stimulates the economy and causes rents and prices to rise.

The only solution to the housing crisis in Victoria is a recession that halts construction and puts construction workers out of a job. Like what happened in 2008 in most parts of the world.

This is a poor comparison. The reason why so many investors want to buy here is because the vacancy rates are so low they can charge an arm and a leg for rent. On the onset of the pandemic when all the students left we started to see rent prices drop here. My friend owns a condo in the Hudson and he had someone move out when the students were away and he had to rent at a lower price than 6 months prior. He goes through a company that rents out many units in the building and they noted that the market was soft so he had to reduce his price. Marko also noted some rents dropping in a couple buildings downtown at the time. I’m certain my friend could get an extra $300-500 now as vacancy rates are so low with the students back.

Do you think investors are going to be snapping up places when they have to pay thousands out of there own pocket each month to cover an 800K mortgage because instead of charging 3500 for a 3 bdrm they can only get 2500? I’d say we’d see a heavy drop in investor activity if that were the case. instead of students leaving, if we built enough homes across the Province so vacancy rates were 4%+ (likely closer to where they were when the students left) then rents would be less volatile and prices would not be as easily pushed up.

Building is really the only way out if we assume the government is going to continue to want a population increase. Rates can go up along with taxes etc but if there are only 50 homes available to buy in the CRD then prices will go up regardless.

The only thing you said correctly is its going to take more than a year to build out of this. Its taken years to get into this mess so it will take years to get us out. But as MTF said, best time to start was yesterday, next best time to start is today.

The process we are seeing with the current market is “gentrification” We are used to thinking of that as middle class people moving into places where poor people lived. Now we are seeing the same thing, but it is wealthy moving in where middle class people lived. I realize that’s stark, and not something anyone wants to see, but it should be a wake up call to urge government to get moving fast on increasing supply.

Two years ago on this forum I was saying the same thing, for example, pointing out how pointless and irrelevant the money laundering investigations, spec/foreigner tax were to housing. But many here stuck to the idea that these bogeyman were causing the high prices. We have seen endless “looking for bogeyman” articles here. There are builders planning massive Victoria builds (1500+ units e.g. http://www.harrisgreen.ca )… have we seen even one HHV article with an interview with a builder that is planning 1,500 homes in Victoria, to find out what their issue are?.. No!

Now it seems most people realize that it is just regular (albeit wealthier) folks outbidding them on houses. And when the builders try to solve this problem, the municipal governments waste precious time catering to the NIMBYs that stop these new builds to save a tree.

This is true, but we need to start sometime.

Whateveryoucallyourself…….And “today” is not tomorrow or the next day….but you are quite correct on today, and i can easily concede probably continuing through the early-middle part of this year. However, things will change materially IF rates accelerate to the degree that is anticipated. These have not been normal times. Prices may not come down materially but I’m confident inventory will increase materially from what it is now. May be be long time before we ever see a buyers market, but not as long until properties for sale see an uptick.

Eby’s solutions are always zero sum or negative outcome results. There will be a large element of unfairness as what he did with ICBC. Whatever cure he comes up with will be worse than the disease. He is far from a believer in the free market which also means a worse problem in the end.

You can NOT build enough homes in a year to lower prices. Anything you build is going to be snapped up by investors and will not lower prices or rents.

And investors want to buy housing in Victoria because our rents are higher than Vancouver making it more profitable to buy here than over there.

Building to solve the housing crisis is like Fu&*ing for virginity.

Awesome. Listening to the “professors” has got us nowhere. Since Eby is convinced we need to build, I hope that means listening to the builders and investors to give them what they need to build the homes.

I just wanted to give people a taste of how bad it is to be a buyer today.

The District of Saanich has a population of some 115,000 and comprises approximately 50,000 detached and strata residences of which 65 are currently listed for sale and of these there are only 37 detached homes listed. Consequently most properties are now offered as blind auctions with multiple offers presented at a specific date and time. Prospective purchasers have little to none in negotiating power.

Basically buyers are F&*%ed.

For some popular cities, building more supply also increases demand, as more people move in to the city.

In the popular cities, the population increases are limited by the number of homes available. So we can’t look to previous years’ population increases as an indication of future demand. For example, Oak Bay is very popular, but has a tiny population increase. This is because of the lack of new home supply. If 10,000 units were added to Oak Bay, they would get filled up and the population would rise by about 40%. Lots of people are remote workers, so they would be arriving to Victoria and bringing their job with them.

The same applies to the City of Vancouver. As they add new units, people will move in from the suburbs, as lots of people want to live in the City of Vancouver. The same applies to much of Victoria core.

What did 2261 MARLENE DR sell for?

You can rezone and build more but it really won’t be affordable for a lot of folks I’m always a little blown away the price of new condos and townhouses not just in the core

Supply always equals demand at market pricing.

Not sure if I’ve got my numbers right, correct me if I’m wrong. Canada builds over 300,000 “homes” every year. I found a number that indicated 200,000-300,000 houses are demolished every year. Is there not a problem here? No wonder we have a supply problem, we’re barely replacing existing supply.

I had an exchange with Patrick when he claimed that supply was double demand in Vancouver, showing how out to lunch his claims are. You can read the thread here

https://twitter.com/pmcondon2/status/1382101507089125377?s=21

And what’s your take on this?

Do you have the data, Leo?

Andy Yan is another academic who loves to pretend we don’t have the data. Eby is done with his dithering

I asked Condon about this claim and crickets. Not true based on any data I’ve looked at.

Anyway we don’t need to bury the issue under academic obfuscation. Is a townhouse cheaper or more expensive to buy than a house? There’s your answer

Is this a real estate blog or a medical services blog?

B.C. Housing Minister eager to spur supply

https://docdro.id/RbhXJ6m

https://www.theglobeandmail.com/real-estate/vancouver/article-bc-housing-minister-eager-to-spur-supply/

“Leo, isn’t your organization here making the mistake, that you like to point out, of thinking that market-rate units don’t help the overall housing situation?”

I think the point is that Victoria city council (and Together Victoria specifically) sure talks a big game when it comes to affordable housing, but in the end all they do is make housing more expensive through delays, over-analysis, drawn out council discussions and other half-wit antics that they seem to believe they should be paid more money to preside over. They even find ways to derail projects that conform with the OCP. It’s painful to watch.

Leo, isn’t your organization here making the mistake, that you like to point out, of thinking that market-rate units don’t help the overall housing situation?

https://twitter.com/HomesForLiving_/status/1487101950369751044

Tele-health isn’t a deterioration, it’s a huge improvement, here to stay, and most doctors are doing it. The sudden arrival of Telehealth with Covid was a “lightbulb” moment, that has transformed medical care forever. 60% of medical visits were virtual during the worst of Covid https://www.ctvnews.ca/health/coronavirus/new-normal-are-virtual-doctor-s-appointments-here-to-stay-1.4939255

94% of family doctors do some Telehealth, most in addition to their office practices. It’s fantastic to see a doc on an iPad for a routine problem that doesn’t require an office visit. Even better if it’s an evening appointment and you didn’t need to take time off work. That’s no different from phoning a lawyer instead of always traveling to their office. Or doing your banking online, instead of in person at your neighborhood branch, where everyone knows you.

The problem is, you need to find a doctor that does tele-health but also does some office work, and can provide longitudinal care. (Referrals, connected to hospital ).

Fwiw, pre Covid, one of the draws of the private pay clinics was that they include tele-health option. Now (post Covid) everyone has easy access to FREE tele-health, not just people paying $5K per year for private clinic care.

The Telus medical approach is a combination of telemedicine as the default, with office visits when needed. Great! The problems with it now are 1. Waiting times are getting longer because it is so popular 2. You see a different doctor each time. They are working on both of those issues.

The problem is that people can’t find a regular doctor that will provide full service (longitudinal) care

The solution can come from government and the doctors. Because it is within the power of the government (BC Health – fee schedules) and the Profession (the college of physicians of BC) to change regulations and fee schedules to insure that patients get what they need, which is “longitudinal care” – meaning clinics MUST provide a full service with office option etc. I’d expect them to work with these bigger clinics like Telus to make sure that’s available. Telus obviously knows about this, because their model does have an office component.

https://househuntvictoria.ca/2022/01/24/what-happened-to-the-real-estate-cycle/#comment-84945

And dentists charge a lot for care, especially non routine work. That works out if you have a job with good dental benefits or can coordinate benefits with a partner with a good plan. But otherwise dental care can be out of reach for often the people with the least money to afford it.

Throwing the word socialist around is a cheap way of trying to get leverage over people you disagree with. Plus all it takes is a basic level of empathy and thinking of others to realize that everyone in a wealthy society should have access to medical care regardless of their individual circumstances.

The solution to doctor shortages is simple and immediate.

Do you hear anyone moaning about their inability to find a good dentist? Their training is also long and arduous, the start-up costs are massive and the work is difficult but people continue to pile into the profession because they are unfettered and make or break themselves in the market based solely on their quality, reputation, and price-point.

Stop loading doctors with the patently unbearable load of being poster-persons for a failed socialist agenda and we will be patella-deep in quality physicians.

Francis, thank you for that information. Builder’s profit is higher in Victoria, but sales commission have to be deducted as well as other soft costs such as financing over the construction period out of that profit. Excluding land cost.

Hard costs which exclude builders’ profit and other soft costs such as financing and real estate commission. In other words, just the cost of materials and labor run about 75% of the total cost to build in Victoria. To make this a bit clearer. If the contractor is charging $250 a square foot for a standard home built on speculation for the builder to sell, then the contractor’s hard costs are about $185 a square foot. Not including land.

And, if a contractor building a house on speculation to sell, who bought the vacant lot 9 months ago then the contractor is getting a further bump in profit due to the rapid inflation of land prices during that time. Speculation builders are making very good profits these days on homes they started to build six months ago and are nearing completion today.

However today, contractors buying on speculation to sell, now have to buy land at much higher prices as well as higher soft costs.

Again just optics. If the health premium brings in $X, and health care spending is $Y, and X<Y, you can say that it goes to health care, but saying so doesn't make any difference. What matters is Y.

And yes I have to agree the GP situation appears to be worse in Victoria than in Ottawa. We use a community health clinic and we are on our third GP, but we don't have to worry if the doctor moves on or retires, they just give us another one.

Yes. But it is better structed than our old MSP. And the OHIP premium goes to health care. There was never an issue to get a family doctor in Ottawa during 20 years when we were there, still much and much easy now than in Victoria.

We seem to have have deteriorated from having your own GP who is familiar with you to having clinics which is less optimum to now going to telehealth which is definitely far from ideal. What amazes me is the number of party members that will run up and tell is that this is all perfectly fine, nothing to see move along. Somehow I very much doubt that our politicians are relying on telehealth and dont have a GP. And no this is not a new problem caused by Covid.

It’s income tax, plain and simple. Calling it a health premium is just optics. Similarly BC’s sales tax was called the Social Services Tax for a long time.

Umm,

That’s great to hear. Telus is expecting to expand the service, and expects to reduce the waiting times. It is a scalable business model, unlike solo practitioner GP’s. And has the digital component (tele-medicine) which is bound to improve with tech advancements. For example, maybe they’ll have specialists that they can bring into a call to answer some questions.

Just to weigh in on the ehealth debate: as someone who has not been able to find a GP in Victoria since 2006. The access through Babylon and now Telus MyCare has been awesome the last couple of years. Getting a prescription or a prescription renewal has been seemless. As well, I have used to get quick referrels for diagnostics and specialists. It’s amazing to actually have a doctor be on time for an appointment, let alone not having to sit in a walk-in clinic for hours on end. A few of the specialists have been irritated because they have to hold a file since there’s no primary care office to send it. The service has been fantastic and has saved me a ton of potentially lost productivity. People just need to stop being obsessed with trying to define and impose the service that is the best for them as being the best for everyone else. The more options the better, and doctors having the ability to do ehealth allows them to cut office overhead and see more patients instead of having to move out of province or out of country.

Although there is no fee like MSP, Ontatio has a health premium payment as part of provincial income tax. It is individual income based (and collected with other taxes) to fund Ontario’s health services. Payment amount increases with income level, those with income lower than $20K/yr don’t need to pay, and those who makes more than $200K/yr pay full amount ($900/yr).

I agree a small fee for service would be a good idea. Maybe for low income they could get something like a $200 cash rebate at the end of the year if they use less medical services to discourage overuse.

Looks like inflation is starting to become a bit more imbedded. In the last few days I have noticed my monthly golf dues up by 5% and my base salary adjusted by about 4% at year end.

Just look to Australia for what happens when a hybrid public/private system is introduced. It happened there 30+ years ago. The rationale at that time was that people were going to the doctor all the time and having to pay would make them go less. It’s all sunshine and roses at first and then patient costs increase substantially over time. My dad just had cancer treatment there and it cost him $30k out of pocket.

I don’t follow that logic. For example, does that mean Dr. Bonnie Henry can’t comment on what’s reasonable to do with covid, unless she’s had Covid herself?

I’m just telling you what’s going on with Doctors in Victoria. If you don’t like it, sorry and you can just ignore it.

IMO, this increased access to doctors via telemedicine is going to overwhelm the system, because “free” and “easier access” means more patient visits.

We need more private clinics, and user fees (means tested).

I am a proponent of a private medical care, which means the taxes currently paid support the current delivery model + willing to pay an premium not only to be able to see a GP faster, but also ensure that the economics of being a GP in BC and Canada are good enough that will not lead to an exodus to greener pastures for GPs. Perhaps a tiered system like a 1:5 ratio, for every private pay the GP sees, then they would have to see 5 MSP clients. Just throwing it out there, but there has to better way and the government needs to EXPERIMENT first being implemented system wide (e.g. one district in City)

Opinions on this is diverse. This article from a policy standpoint lays it it out (in more nerdy speak)

https://www.longwoods.com/content/26435/healthcare-policy/are-non-critical-medical-devices-potential-sources-of-infections-in-healthcare-facilities-

What I’m trying to say Patrick is not that I am surprised that you have instant access to a GP, but that you seem to think it is fine that others can’t get one and have to wait three weeks for telemedicine or go to the ER. Unless you have experienced this yourself then I would suggest you should not be telling others, or contradicting on-the-ground physician opinions, about what is fine for them when they are telling you that it is indeed not okay.

Why would you be surprised? I’ve been the one here on HHV telling people about these private clinics and how great they are, for example this post …

https://househuntvictoria.ca/2021/12/13/flippin-victoria/#comment-83795

Hopefully this private pay MD care will expend to Victoria soon as there will be more and more demands for it here – Our public medical system is totally broken and I have given up hope that it will be fixed any time soon.

I would also hope that 5K fee can be included as medical expenses credit at tax filling time, as it should.

The point is that you were telling us that 11 days for a telemedicine appointment and another two weeks for an in-person appointment with the only other option as ER was reasonable, while at the same time having almost instant access to a GP yourself. Unless you are in it yourself I wouldn’t be making these comments. Too much of a “let them eat cake” type vibe.

I’ve told you over and over that office based family doctors are disappearing, and why they are disappearing. Yes it’s sad, and unacceptable. But it’s a fact. They could hire 100 more doctors for Victoria, and they’ll work tele medicine and walkins. They aren’t going to be opening offices.

You may not believe me, but you’ll notice that the same time colonist article on the clinic closure said the very same thing today,

https://www.timescolonist.com/local-news/two-doctorsa-frustrations-a-sign-of-turmoil-in-health-care-3000-of-their-patients-displaced-4974364

“Mark my words, you are never going to see a new privately built family practice in Victoria again,”

Patrick, it is hard to fathom that you, who have had a private pay physician access 24/7 365 days a year for years with no wait times, feel entitled to comment on what should be good enough for the rest of us who can’t get a GP.

Well of course tele-medicine isn’t as good as a regular family doctor. No one here has said that.

I am just telling people what is going on. Which is that office based clinics are moving to tele-medicine, so the doctors can work from home. Of course that isn’t as good as “Marcus Welby, M.D” looking after you and your family.

Yes, there’s a shortage of office based doctors. Because they’re quitting and becoming tele medicine and walk-in doctors. And the shortage of office based doctors will worsen, even though the total number of doctors stays the same as they move to tele medicine.

Yes, I’ve been using one for years. Copeman Clinic in Vancouver (now called “Telus”). I highly recommend it. It’s exactly what you want in a family doctor based medical multi disciplinary office . I’ve heard there’s a waiting list for it now though . https://www.telus.com/en/health/care-centres/locations/vancouver-nelson

Yes. You have have to go to Vancouver currently for some services but they offer a lot of telemedicine and a primary care physician. It costs about $5000/year per person for the first year. It includes an in depth health assessment with recommendations and ongoing timely care.

https://www.telus.com/en/health/care-centres/personalized-care/member

https://twitter.com/fabulavancouver/status/1486851777068601345

Anyone that believes that telehealth is any sort of substitute for having a GP is either delusionally married to their politics or seriously ill informed.