More on Victoria comings and goings

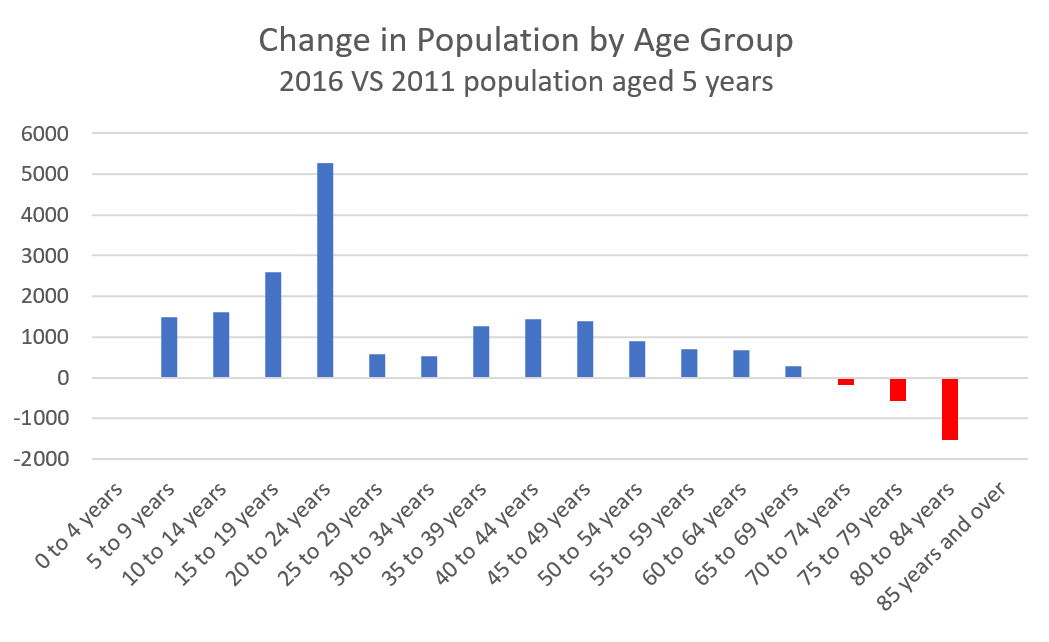

When the 2016 census data came out, I wrote an article dispelling the myth that Victoria was just attracting an army of retirees. By looking at the change in the demographics between 2011 and 2016, I showed that the biggest increases came from young people and the middle aged between 35 and 50. Most of the people coming were within prime working ages.

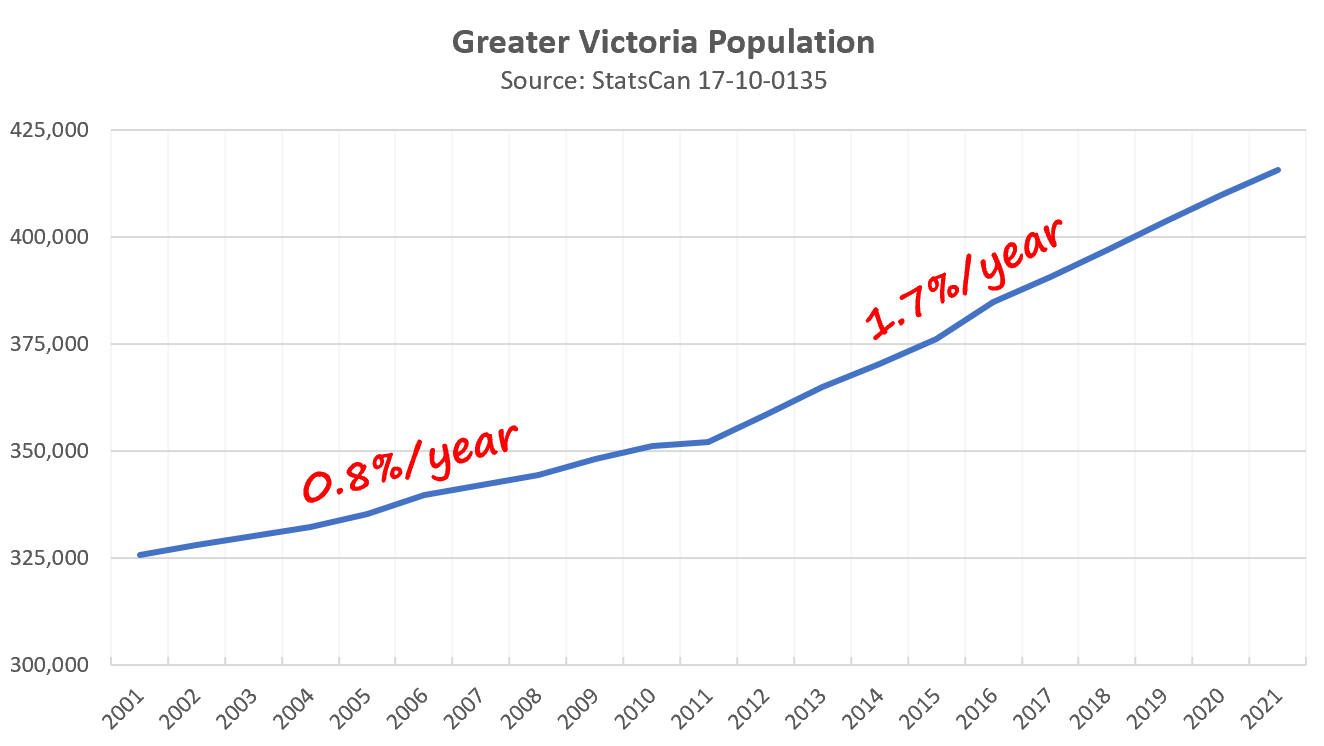

Well the 2021 census results aren’t released yet, but with the new population estimates from last week we can take a look at how things have changed since then. We saw a sharp uptick in population growth after 2011, and that shows no sign of slowing down with the latest data.

Perhaps more interestingly is that we also have detailed estimates about migration and deaths by age group in table 17-10-0136 which I don’t believe I’ve looked at before (or I have and I’ve forgotten which is quite possible after writing some 750 posts over the last decade).

Jens Von Bergmann took a look at these data for several Canadian cities, including creating a nifty animation of changes since 2001.

That gives us a way to look into what really changed from before 2011 when growth averaged 2600 people per year versus after 2011 when it average 6300 per year. Where did those extra 3700 people come from? Let’s compare each segment in the period 2001 – 2011 and 2012 onwards to see what changed our growth trajectory so suddenly.

Was it an explosion in births? No. We get about 2900 of those every year.

Victorians suddenly just refusing to die? No. In fact deaths have ramped up recently from an average of about 3100 pre-2013 to 3900 in 2020. As I’ve discussed before, we should expect the rate and number of deaths to increase for the forseeable future.

A surge in non-permanent residents (aka mostly students)? Not really. They are highly volatile from year to year, but average out to about 450 pre and post 2011. That said the effect of returning international students as schools returned to in-person instruction isn’t captured here which may be throwing a wrench in those figures.

More direction immigration? That’s part of the story. Before 2012 we only had about 400 net direct immigrants per year, while the average after is just over 1000. That accounts for an extra 600 a year.

More migration from elsewhere in BC? Again a part of it. We went from an average of 700 arrivals per year to 1900 coming to Victoria from elsewhere in BC, an increase of 1200/year.

More migration from other provinces? Also a big change here. We went from an average of 1800 a year to 3100, an increase of 1300/year. In the most recent year (2020/2021) it was an astonishing 5235 arrivals from other provinces.

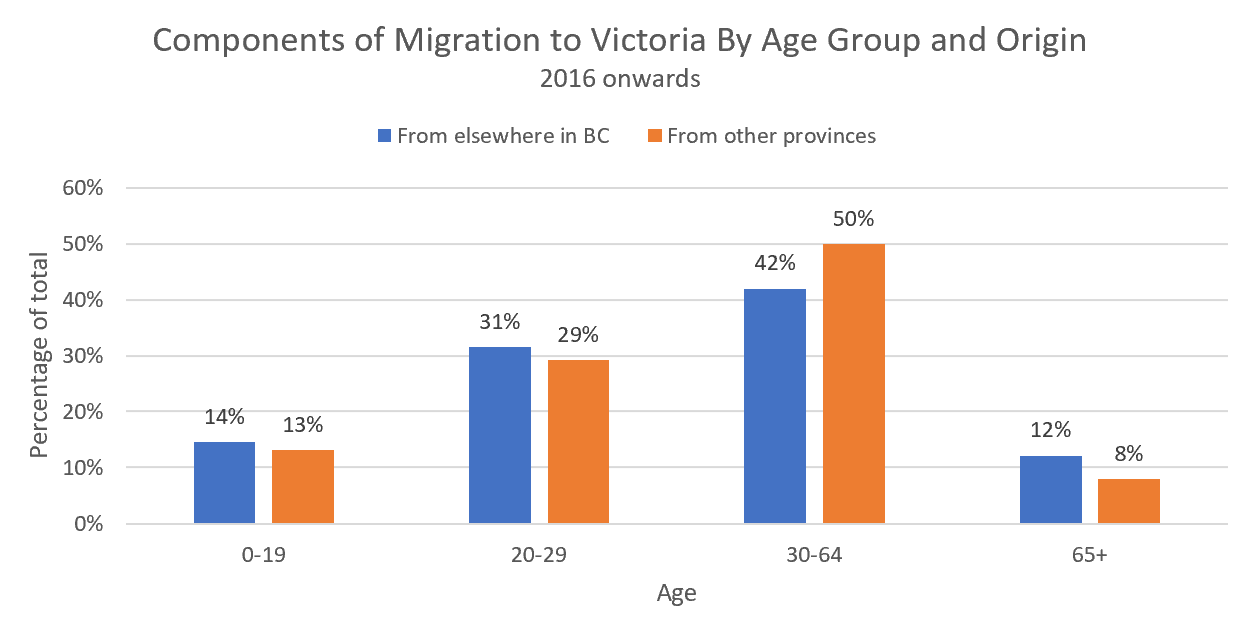

So it’s clear that an increase in within-Canada migration is the primary driver in our increased population growth. Is it a continuation of the trend from 2011 to 2016 where working age folks made up most of the increases? Or is it a wave of retirees?

That seems to depend somewhat on whether we are talking about within province or out of province movers. Retirees are more likely to come from within the province, which makes a certain amount of sense as moving accross the country and away from family is a lot more daunting than moving a ferry ride away.

Retiree arrivals certainly did increase after 2011, but they still make up only about a tenth of all people moving to Victoria. It will be interesting to see if the trend of increasing in-migration and the resulting faster population growth continues, or if our high prices, high rents, and extremely limited inventory will start slowing this trend down again.

What we can say is that our municipalities will have to grapple with our new reality of faster population growth when all the planning forecasts and growth strategies are based on a much lower rate of about 1%.

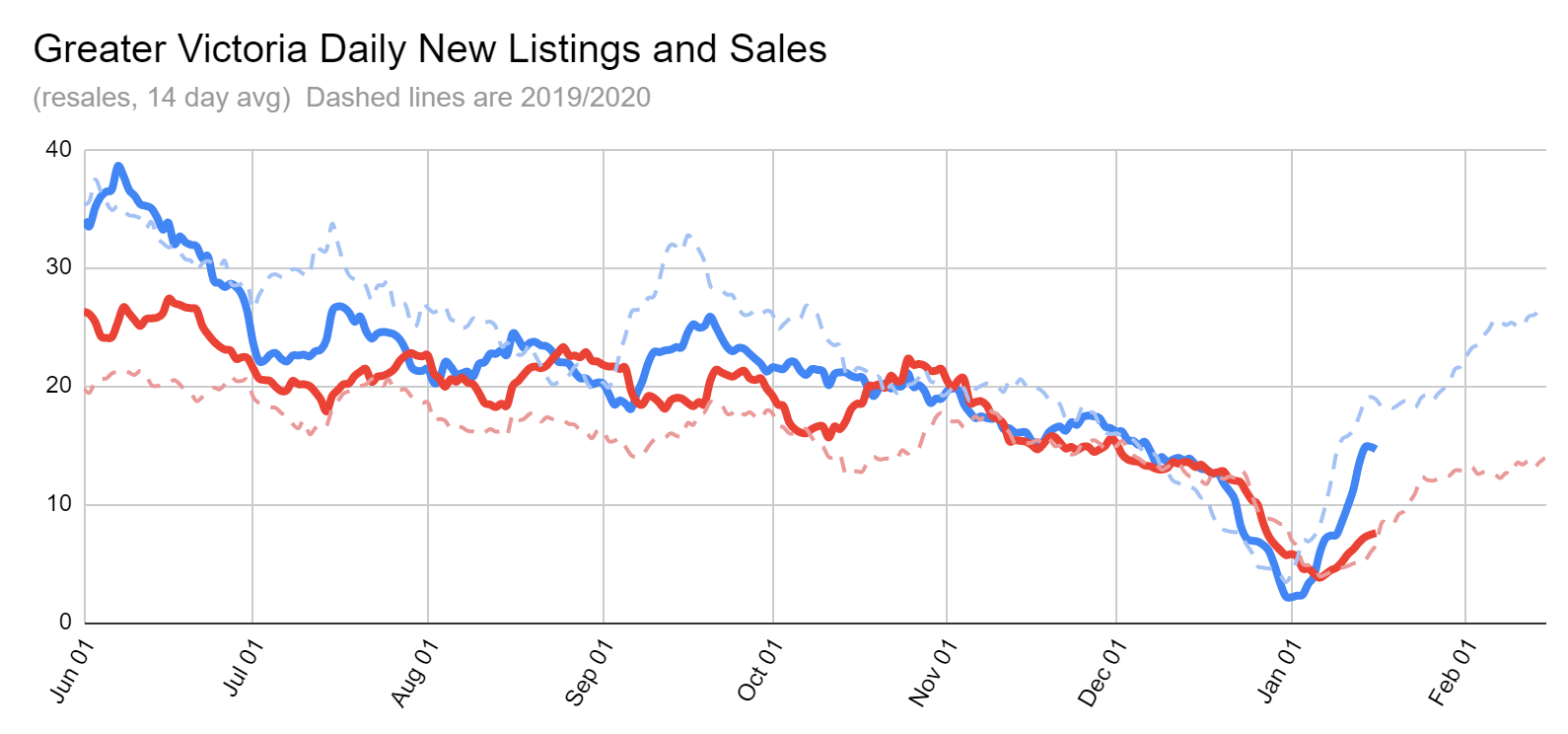

Also a quick update on the market. Inventory is down 47% from this week last year, which is seriously constraining sales. The sales rate is 32% lower than last January, although pretty much the same as a more normal January in 2020. That’s pretty impressive with some 60% less inventory on the market now compared to 2 years ago. New listings rate is roughly normal for this time of year. We will see a slow build in inventory from now until about June, but don’t expect too much until the market cools off substantially.

As I’ve mentioned before, the first signs of a slowdown will come not in reduced sales, but in reduced bidding war activity. So far in January, 58% of properties sold above the asking price, similar to the 55% that did in December. No sign of a decrease there. Our measure of sale price to assessed value is going to be unreliable in January as some sales are reported relative to their 2020 assessments and others are updated with the new ones. However we know these market conditions will continue to put upward pressure on prices in every category. Unfortunately for house hunters, the new year did not bring any sign of relief in the market yet.

New post: https://househuntvictoria.ca/2022/01/24/what-happened-to-the-real-estate-cycle

Demand is based on the price, so as prices increase demand decreases. So demand is quantified by the amount of listings sold.

Market demand are all the people looking to buy a house (including those that won’t /cannot buy at current prices.

If more homes are sold than demand has increased, seems unlikely prices would rise. Market demand should remain the same.

However, you are right that real estate is different than a market were goods are interchangeable, since each home is unique and are not necessarily interchangeable for buyers, so individual listings may have outliers

I don’t really understand this logic. If you cannot pay back the loan you used to buy the stock, the lender will go after your house.

The mortgage debt will usually have lower interest. I would pay off my higher interest debt first.

It’s an absolutely weird market. Lots of feeding frenzy as the sharks are trying to bite the few listings available before the rates increase.

But it’s also the way markets crash. Too fast of a rise pushes buyers out of the market. Home owners now have high expectations and are are not willing to lower their prices. Then you have to wait to see who breaks first. Buyers either have to move up to the new prices or the market stagnates and goes soft.

The idiom “the straw that breaks the camel’s back” comes to mind. Or how serial killers lose it at the end and finally get caught as they are no longer cautious in what they are doing. Or how sharks bite at anything when there is blood in the water.

We just have to see what happens in the next few months. This is what happened back in January of 2016 when the oil fields started to close down and the oil workers had big savings and severance checks to spend. Prices jumped by a hundred grand in just two weeks.

This is just a horrible market to be a buyer in. I doubt if any real estate agent enjoys this kind of market. Hard to get listings and buyers are stressed. Not a happy place.

Market price refers to “the market,” and unless you are limiting the definition of the market to be similar homes on Edgemont , you’d need to wait for more home sales to see if the “Victoria market” price has changed or not.

My hunch is that it’s not up that much from the Dec 31, 2021 vreb.org report which has SFH up 15% since June 30, 2021 assessment date (that 15% is halfway between the median rise and the average price rise). And 15% is still a huge rise since the last assessment

http://Www.vreb.org

G. Victoria SFH Average 1220k June 30/2021. 1325k Dec 31, 2021 = +9% average

G. Victoria SFH Median 1015k June 30/2021 , 1225k Dec 31, 2021 = +20% median

You can quantify supply. It’s the number of listings. But how can you quantify demand? Sure there is anecdotal evidence of demand as the number of offers presented but that only represents one property and not the marketplace for all types of housing in all types of price ranges. How do you plot demand on a graph then?

Real estate isn’t like widgets in an economics class. Supply has an effect on demand in real estate. They are not completely separate functions. The best you can do is measure demand indirectly with months of inventory, days-on-market, sales to new listings ratios, etc. But that’s like measuring a black hole in space that you can’t see. You can see the effects around a black hole, but you can’t define it.

For example if you doubled or tripled the number of listings would prices decline? The answer is we don’t know. It’s a possibility that increased supply could increase demand as more people would want to buy as there are more choices available and prices could increase. At least over the short term.

Real Estate isn’t a science and it isn’t an art. It’s a god damn mystery.

A real estate agent and an appraiser are looking at the marketplace differently. An agent is pricing for the future assuming a reasonable exposure time into the future. They may use the last sale in a complex and add a bit more for what they think the market has increased.

An appraiser looks to the recent past for evidence of transactions along with the preponderance of evidence available. For an appraiser, one sale doesn’t make a market.

When the market is moving quickly the sales lag and agent’s deals start to collapse because of financing.

Sure but when a lot hinges on those prices holding up in an environment with higher liquidity…

That house now becomes a comp for the neighbourhood. It’s used for appraisals, lending, equity calculations, etc. These sales, regardless of the means of how they came to be, have a ripple effect. It all just feels like a giant house of cards that will be seriously tested if there’s ever a significant bump in inventory. I get that’s how supply and demand works but these conditions seem ripe for serious movements in both directions.

Strictly speaking, I agree with you.

All I’m saying is, this is an historically weird market, and historically weird markets produce historically weird transactions (e.g. the sale on Edgemont).

The market is supply and demand, not some abstract entity that somehow exists independently of the former. Market price is the price at which supply meets demand. If supply is just a handful of houses, that’s just the way it is.

Yup, that’s a point I was trying to get at yesterday:

…with so few listings/sales, properties aren’t being properly tested by the market.

Bought in mid 2019 for 1.04M. Even if some updates were done (not clear if it was after 2019), that’s quite the pay day in just over 2 years (likely tax free).

You have to wonder if this is truly representative of value. It seems like anything “nice” on the market these days has over 20 bids and surprises alot of folks with the final sale price. That sale removes just one party from a large list of others looking for the exact same thing who are getting more desperate to get it.

If 20 homes went up for sale at the same time similar to Ascot in the same area, would they all be snatched up at 1.5M? Tough to say but the lack of supply has got to be seriously skewing prices of the nicer single family homes that do come up.

Maybe you are buying too much housing if you have zero safety net? My first place was $198,900 and at that time I had $40k in RRSPs (that I didn’t use for the down payment). Even thought I could have swung 350-400k I didn’t want to liquidate my investment, so I bought a unit with no parking, no window in the bedroom, etc. If you want to get ahead in life you must take some risk and make some sacrifices.

You have extremely stable companies that did not cut their dividend in 2008/2009 or 2020. You can’t live your entire life in fear. Like when do things actually look good? Did it look like it was a good time to buy in 2012/2013 when you had 500 sales per month and 5000 inventory? Does it look like a good time to buy anything now whether it be real estate or stocks when literally everything is a bubble?

I personally have leaned heavily towards real estate vs stock market but I am not going to give up 5-6k a year in dividends tax free in my TSFA. It is a like a no brainer to me. That is equivalent to 10k before tax income for doing nothing.

Stroller- from personal experience, lots (most?) of local supermarkets/bakeries/food distributors/local farms already donate their food that’s close to it’s expiry dates to local organizations/community kitchens/etc. They just don’t do it using an app. Victoria has a pretty amazing network of food-based non-profits.

Right, but your a 1%er. If your investments and your house values crater, you’re still in great shape. The same doesn’t apply to a regular Joe who loses their job, with a big mortgage to payoff, and can’t just sell off a few rental properties to clear things up.

Everything in life is a risk. I personally don’t see a huge risk in placing $100k into your TSFA, for example, in some bulletproof dividend companies at 5% and leaving your variable mortgage at 1.3%. Whether the shares go up or down every year you can transfer $3,700 against the mortage.

Plus, don’t underestimate principal repayment at these interest rates.

Is buying a home a risky investment?

One of the ways one can measure risk is liquidity. That would be the days-on-market. Currently housing is almost as liquid as stocks to sell. You can also sell your home and have a long closing date. In that way you can short the real estate market if you feel house prices will be coming down when you have a long closing date of 3 or 4 months.

The market is heavily in favor of buyers. Buyers are in the driver’s seat and set the terms and conditions. Purchasers are in the trunk. It is a horrible time to be a buyer.

Thanks DRAZ.

I’m going to introduce some thread drift here, based only on the observation that many people who post here appear to have strong moral convictions about waste, the environment, and aiding the disadvantaged.

Have a look a this: https://toogoodtogo.ca/en-ca/

They have hundreds of businesses signed up in Vancouver but none at all here on the island. If anyone can suggest a way of kicking that off I would be very pleased to be involved.

A family member uses it in London UK and raves about it constantly.

Yes. The “Fed Put.”

The fed have been doing this since 1987. It was first referred to as the “Greenspan Put”. Alan Greenspan became Fed chair in August 1987. Two months later the market crashed (“Black Monday”, Oct 19, 1987). The next day, Greenspan made an extraordinary one line statement “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system”. The market took that as the fed will do “whatever it takes” to prop up stock prices, and the phrase “Greenspan Put” was born.

They’ve intervened in every downturn since then. Hurting savers, helping stockholders. Including trying to prevent a future downturn prior to Y2K, which was a non-event anyway. Now it’s just called the Fed Put.

https://en.wikipedia.org/wiki/Greenspan_put

Until they can’t. Stay tuned.

Market has been risk free since about 2013 because any time it went down the fed stepped in with more liquidity.

3769 Ascot Drive – $1.52M

Would some kind soul please report the sales of price of 3769 Ascot Drive?

Thank-you

I look at the debt owing on a house much more importantly than other debt like a stock margin loan.

For example, let’s say you buy a $1m house and have a $600k mortgage debt. That $600k is money that you owe for sure, if you want to keep your house. Mortgage payments need to be made despite your future illness, job loss, interest rate increases or whatever other sh*t happens. Your family is depending on you to make those mortgage payments!

Now compare that to you with a stock margin account. And you borrow $50K to invest is more stock, because you’ve found some high dividend stocks that will likely make this profitable. That kind of debt isn’t as important, because losing the money in the stock account isn’t as disastrous to your family as losing your house would be.

So to me, it should be a priority to first payoff your mortgage, so you won’t leave your family without their house if you can’t pay off the loan in future.

Once that’s done, you can play risky games with a stock margin account, borrowing/leverage investments. Losing that just impacts your future retirement plans – which is important , but not as important as your kids getting to grow up in their family house.

There’s a difference between risking your investment portfolio (which affects your future retirement) and risking your family’s house (which affects your kids). Payoff your mortgage!

The stock market is taking a worse pounding now. Two years ago 8% of the stocks in the NASDAQ were down 50% or more. As of Friday, 53% were down 50% or more. It’s worse today.

It sure did, but it only took 9 months for it to climb back to its previous high. And today it’s much higher than that.

That drop was a blip and didn’t teach anybody anything, IMO.

Yes. Other than minimizing the amount borrowed initially, paying off the mortgage debt early is the best idea.

The stock market took a pounding less than two years ago. No stock market investor, except the total novice and uninformed, believes that the market is risk free.

For now. If someone is buying a house expecting it to be a retirement asset, a drop in long term appreciation of that magnitude means a lot. That doesn’t mean buyers will realize it in the short term though.

2050 I believe

How long is the term on the lease?

Quite eerie how few listings there are these days.

Looking to buy a place in Gordon Head? Here are your 8 choices:

Also, not a single house for sale in the Lambrick Park area of GH. Can’t ever remember seeing a sub-area of GH with zero listings.

It hasn’t been a gamble for so long that people forget that it is. Same with the stock market.

People are banking on never paying it back because they’ll sell the place for $2.5M when they want to upgrade.

And who knows they might be right, but it seems like a heck of a gamble.

The Westshore is now focus on densification.

Development-focused Langford is still seeing prices rise and supply remains low — https://tinyurl.com/yejkjv4w

I don’t care what your household income is — that is a shit-tonne of money to pay back. Ask me how I know.

Ditto.

I guess people are completely ignoring risk, at this point.

What is surprising to me is some of the continued increases in the Colwood and Langford area for SFHs. I can see that the land in town is constrained and might cause prices to rise, but I had thought that Colwood and Langford had more room to grow.

I’m feeling unsettled by the pace of the increases. No way you can keep up based on income. Some fairly average places seem to be going up 3-4% every month.

30 year old mobile home on leased land

2016: $118k

2018: $249k

2022: $360k

A tripling in price.

Forget oak bay the hottest real estate was the one you don’t even own

Oh, I didn’t know that.

And with a variable rate, when the rate goes up, your payment stays the same but the percentage of payment going towards interest increases, I think. That ratio is already so depressing for borrowers at the beginning of a mortgage!

I wouldn’t discount the pain of a 20% or even 10% nominal decline, or even an extended stagnation like Calgary had seen.. I’m always struck by how many people are just “alright” in their older years despite having benefitted from strong real estate appreciation all their lives. It’s easy to say they should have made better choices, but we’re all fallible.

I often wonder what happens when instead of starting with a $100k mortgage like back then, people are now starting with a $500k-$1M mortgage. It’s not that they can’t pay the mortgage now, it’s that shit happens in life, and there’s just a heck of a lot less buffer there than there was for previous generations.

Completely agree. I wouldn’t write an article about it because I think we’re lacking enough evidence at this point. As I wrote just a few weeks back, I don’t think the end of year prices are in bubble territory, but were definitely stretching affordability. This is all very imprecise so I also think another 5-10% on top of that is within the margin of error (+ when you move them into 2022 you get some income gains that help).

But if we’re talking another 20-30% on top of those prices running into what seems like the near-certainty of a few interest rate hikes this year? I gotta think even adding a “Victoria always surprises to the upside” fudge factor that is unsupportable.

There’s been a big shift from fixed rates into variable rates. Two ways to interpret that.

It’s a bit of both of course, but rising variable rates are going to test this

Never going to happen.

In general detached prices will be very sticky. But if there’s a sudden big spike up from the end of 2021 prices I think those increases are in jeopardy beyond the usual stagnation/slow decline scenario.

I think long long run the end of the 40 year trend of dropping rates could shave about half of the long term appreciation rate off our real estate and could mean the down cycles lead to actual price declines, not just plateaus (or maybe plateaus but smaller runups?). But that is such a long time frame that it doesn’t have a lot of meaning for any individual person’s buying decision.

I’d be way less inclined to think bubble on 100s on Edgemont like transactions, Introvert. Thinking ‘logically’ or maybe conventionally if that even applies in today’s environment, I would find it increasingly sketchy when you have very high prices on such a thin transaction volume. If there ever was a supply increase in response to a demand shock I’d suggest trouble is afoot. But I guess the other side of that coin is where will you get such a demand shock? Will interest rates alone do it? I’m skeptical. We bought in April last year and both the wife and me were prepared for a 10% pull back in prices. Thought we were at the top. Bought for 27% over 2020 assessed and didn’t see how it could go any higher. It like the new name should be Unreal-estate. I can’t believe this.

“I think we are getting into bubble territory now.”

There are so many misinformed and unknowledgeable people out there talking about “the bubble” that it’s hard to get a true understanding about what that actually means for Greater Victoria. As one of the most reliable people on the topic of GV real estate, can you give us your take Leo? No pressure and no one will hold you to your thoughts/predictions, but I feel like some out there think a GV real estate bubble popping is going to bring back $600k SFHs and people walking away from their properties with the key in the front door much like the 2008 housing crash in the US, so just looking for some perspective. Prices/values plateauing and staying constant or even declining 10-20% over the next few years still seems manageable to most home owners that live in the home they own, but wouldn’t mind your take on a “bubble pop” in GV.

Although, perhaps, with so few listings/sales, properties aren’t being properly tested by the market.

Wouldn’t we need to see hundreds of Edgemont-like crazy sales before we started talking about a bubble?

“Canada and Germany spend about the same amount of money on universal health care, yet Germany’s public system serves about 75 million people and is one of the top ranked systems in the world, while Canada’s public system serves half as many people (about 38 million) ”

According to the source below Germany spends 11.7% of GDP and Canada spends 10.8%. It appears that whoever wrote the quote above doesn’t understand what % of GDP means.

https://www.cihi.ca/en/how-does-canadas-health-spending-compare

Germans may exercise more and be more health conscious.

I think we are getting into bubble territory now. Still can’t get over $1.6M for Edgemont.

According to the source below Germany spends 11.7% of GDP and Canada spends 10.8%. It appears that whoever wrote the quote above doesn’t understand what % of GDP means.

https://www.cihi.ca/en/how-does-canadas-health-spending-compare

So between 4450 greentree and 1410 Simon we have sales from 36% – 38% over July 2021 assessments. Holy cow. For the realtors on the blog do you feel this is the expectation for the market this year? I’m a bit floored at this.

Corbella: Canada’s health care system overrun by administrators and lacks doctors — https://tinyurl.com/2p8eupfs

There you have it folks, Canada is a country of “paper pushers” instead of doers.

Ask $1.58M

Sold $1.55M

$1.445M

Are you aware that the BoC has been Justin Trudeau ATM?

Hi Leo,

Can you please post the sale price of 1410 Simon Rd when you have a moment?

Thank you

Are you guys aware that the Bank of Canada makes rate decisions, not the government?

Thanks, Leo. That was interesting.

The combined vote for PC, BQ, and Reform in 1993 was 48%, actually better than Mulroney got in 1988. If the PC’s had hung onto all of it they would have won. The gain in votes for the Liberals came at the expense of the NDP.

Of course unpopular policies mentioned below contributed to this split. You can also add the failed Meech Lake and Charlottetown Accords, which led to the formation of the BQ and the emergence of Reform as a contender in the first place.

Anyone have eyes on the sale price of 4450 Greentree Ter? Ask was close to 1.6 I think. Thanks!

Perhaps a revisit to history as how Mulroney government stacked the deck to pushed through the much hated GST, Libs false promised, and Mulroney recession/unemployment fighting.

Jean Chretien and Paul Martin also increased income tax rates, and as well as CPP rates (pseudo income tax).

However, the people that comes after Mulroney and Chretien did nothing to balance the budget.

Mulroney (and Kim) were also getting the boot for bringing in the GST, and the Liberals promised to get rid of it, but they never did which was actually a good thing. Helped balance the books and restore some fiscal order in Canada. Frankly, it should come up back to 7%. That would pull in around another 20 billion in the revenues. We should also eliminate the PST and restore the HST in BC but that’s not going to happen anytime soon.

There’s an obvious flaw in that ESG investment theory, at least as it applies to stocks. Because shunning the stocks of bad companies actually helps them if the bad company is buying back stock anyway.

As I understand it, the idea is that as people sell (or don’t buy) the stock of the “wicked companies” (eg. BP oil/gas), it will be harder for BadCo to raise money by selling stock, and they’ll sell their stock at a lower price. That sounds fine and I agree with that.

But lots of companies don’t sell stock. They buy back their stock. In this case, the reverse of the theory above occurs. Their “shunned” stock will be cheaper for BadCo to buy back. For example, this year BP is buying back about 50 million shares, and they’ll pay less for those shares because their stock is shunned by the ESG investors.

At the same time, these BadCo’s are raising money by selling bonds, so avoiding buying their bonds makes sense. But avoiding buying their stock helps many BadCo companies that are buying back their stock anyway.

That had a lot more to do with the newly formed BQ and Reform parties taking votes from the PC’s. Not to mention it was Kim Campbell who led the PC’s with her inept campaign in the election.

Also the Bank of Canada is very limited in its options once the Fed starts raising rates. If they don’t follow a collapse of the CAD would be likely.

I agree that a rise in interest rates may take a couple of years to result in prices falling.

It may very well be.

QT, are you suggesting that the Liberals will just punt the obvious need to raise interest rates to the next Conservative government to deal with inflation?

I don’t think the current government are going to let interest rates rise quickly to quell inflation, because it could lead to the fall of the PM as what happened to Brian Mulroney 1993 when he fought the recession.

And, IMO it would take at least a few years of rate increase and housing price increase, before we see a decline in real estate.

How is it that stranded oil is going to die, when electric and renewable are produce/grown by fossil fuel?

And, how can one call it ESG when billions of people are living in poverty and the ivory tower duellers are tuning food into fuel that emit just as much carbon as fossil fuel and perhaps more?

Canada’s largest renewable diesel plant will turn canola oil into fuel — https://tinyurl.com/yckp97m5

Pretty interesting discussion on ESG that may interest you in the latest rational reminder podcast Introvert:

https://rationalreminder.ca/podcast/184

“I think in the more short term, what the investment industry needs to grapple with is that I fear that in their pursuit is sell something for a slightly higher fee they have contorted themselves into pretending that virtue can come without any cost or might even be rewarding that they say that, “Well, yes, if you invest in forward-thinking electric companies and renewables, this is where the world is heading, stranded oil is going to die.”

And right now it kind of flows begetting performance begetting flows. So it becomes true, but we know this doesn’t always last. So, I worry that a lot of pension plans, asset managers, financial advisors have maybe kidded themselves or missold to investors the idea that they can do this without some ultimate financial cost, because at some point I think virtue sometimes has to be its own reward. And if we want to do the right thing, we have to do that without expecting that we’re also going to reap a above market gain from that. In fact, the only reason why divestment campaigns and such that can actually function is if they actually do the opposite. They lower returns by raising the cost of capital for dirty companies. And therefore we get less of that activity, but right now, and we can see some asset managers are being embroiled in some scandals already where people point out the gap between the rhetoric and the reality. I think that is going to be a live wire issue over the next few years.

I totally agree. I think theoretically, if you want to feel good about your ESG investment, you have to expect lower returns. It’s a requirement.

Yeah. If I had an ESG investment, it was doing really well. I’d go to my broker and say, “What the hell’s going on?” You can do it as a tactical trade as we discussed, like timing markets, getting these things right is really difficult. Yeah, you would’ve done really well with just Tesla, but I suspected one of the reason why ESG has looked like a really hot thing for the past decade is because if you look at how various ESG screens function and the ESG data is an absolute, sorry to say *** show it is just awful. It’s so messy and it’s so… People don’t agree on things, but technology tends to screen well on ESG measures and banks and energy for example do not. And lo and behold, the past decade has been unusually favorable for tech companies, has been really bad for energy companies. So, therefore it looks like ESG is a factor that screens well, does well. That could hold for another 10 years, it could hold for another 50 years, but I wouldn’t bet on it personally that way.”

Want a clear definition of the problem? Housing is too expensive.

We don’t get real solutions because there are too many parties (including current homeowners of course) who don’t want prices to go down.

I think we need agreement on what problem we are trying to solve, before you can come up with a solution.

Politicians are announcing “solutions” all the time without a clear understanding of the problem.

They have “solved” the problem of foreign buyers distorting the market with the solution of a foreigner buyers tax. They have solved the problem of vacant homes by adding a spec tax.

However, these solutions have not solved the problem of homes being so expensive.

Without a clear definition of what problem needs to be solved, “focussing on solutions” will just end up with more solutions like the first time buyers incentive that is solving a problem that barely exists.

Even on this forum there is no consensus on what the actual problem is.

Too many investors in the market.

First time buyers cannot afford a house without help from family.

Median income family cannot afford a SFH.

Not enough housing supply.

The issue is that politicians don’t actually want to solve the problem of prices being too high (or at least don’t want to spell out they plan to lower house prices) since lowering house prices might cause a downturn in the economy and/or lose them votes with home owners.

You’re not including Germany’s borrowing to finance the war itself, which was huge. The reparations were just the icing on the cake.

And what is the real GDP of Canada today compared to Germany in 1918? You have to factor that in after the inflation adjustment.

Which brings us to the real issue – ability to pay. Germany was a basket case in 1918. About 3 million people had been killed, the country had lost a good deal of territory, including the industrial heartlands of Rhineland (occupied) and Silesia (to Poland), and the government was facing continuing uprisings and was barely functional. All they could do was print money. Despite all this they were able to turn the economy around by 1924.

https://en.wikipedia.org/wiki/Weimar_Republic

The Chrétien PM / Martin FM era was one of the best for fiscal responsibility.

“This was a grotesque economic over-reaction, and we need to cut back asap. Let’s see if your socialist friends are up to the task.”

You might be right about that. Hopefully there is a Jean Chrétien waiting in the wings.

It’s good to hear you point out the huge German WW1 reparations debt (Treaty of Versailles) as a big factor of the hyperinflation. On that we can agree. And yes, the treaty of Versailles reparations were huge. But, adjusting to current dollars, they weren’t nearly as big as what Canada faces due to our $500 billion Covid deficit borrowing.

Canada has run up a bigger debt in the Covid years (2020-21) than the famous war reparations faced by Germany in the Treaty of Versailles.

Germany’s reparations debt was (in today’s dollars) $269 billion USD = $336 billion CAD.

Canada has borrowed $500 billion CAD, which is 500/336 = 1.5X the Treaty of Versailles debts that Germany faced. This is inflation adjusted to todays dollars of course.

https://www.history.com/news/germany-world-war-i-debt-treaty-versailles

“The Treaty of Versailles didn’t just blame Germany for the war—it demanded financial restitution for the whole thing, to the tune of 132 billion gold marks, or about $269 US billion today (2019)”

You may have missed the point that with the response to Covid, Canada is also “Financing a war entirely with borrowed money.’

Currently $500 billion in deficit borrowing in 2020-21. Given our 3 million total Covid cases, that works out to $166,000 BORROWED per case of Covid. This was a grotesque economic over-reaction, and we need to cut back asap. Let’s see if your socialist friends are up to the task.

“We should remember the cautionary tale of the famous “Weimar republic” hyper-inflation in Germany from 1920-23 with “wheelbarrows of cash” with trillions of marks needed to buy food, which occurred during a socialist government in Germany”

Right. It didn’t have anything to do with:

A. Financing a war entirely with borrowed money, and

B. Losing the war and reparations being imposed by the victors.

Let’s just put on our ideological blinders and blame socialism instead.

“ why aren’t they working with an agent (could be savvy, but could also be crazy), etc.”

Hired two realtors. First one was completely useless only push me to buy “anything”, second one even worse, the seller accepted an offer before my offer sent in and this idiot asked me to buy his own listing.

I know there are many fantastic realtors, bur after some “unique” experiences, I decided to be an unrepresentative buyer. I am not sure if I saved money on commissions but I got exactly what I wanted.

Agreed.

We should remember the cautionary tale of the famous “Weimar republic” hyper-inflation in Germany from 1920-23 with “wheelbarrows of cash” with trillions of marks needed to buy food, which occurred during a socialist government in Germany that continued wild spending and generous social programs throughout, funded by exponential money printing.

We get you don’t like unrepresented showings. The question is, absent instructions from the seller, is it ethical to refuse them on your own initiative?

By the way I was unrepresented when I viewed my present house, and the listing agent didn’t have a problem with it. I engaged a cash-back buyer’s agent when I decided to make an offer.

It is really a complete non-issue. As I said 90% of the requests for a viewings don’t return the forms.

Last year the handful of showings I did to unrepresented parties ended up being disasters and zero successful unrepresented transactions for 2021. For example, last spring woman contacts me to view a listing and has to be 9 am on a Sunday…ok, I send her the forms, she sends the forms back signed. Sunday 9 am I show her the house. She sends an email asking for the property disclosure statement, I send it to her and let her know we are reviewing offers Monday at 5 pm.

Emails me Monday at 4 pm stating she is the neighbor (in fact she is but didn’t disclose to me at time of booking or showing) and that the seller has lied on the PDS and that I need to make all agents writing offers aware and all this other non-sense. After consulting with the seller and my own due diligence turns out there is no basis to her claim. Had zero intention of buying the home, but created a mess for us at the offer deadline.

Personally if I am a seller I don’t know how I would feel about a complete random sending an email through realtor.ca asking to book a showing. You don’t know who they are, if they are qualified to purchase, why aren’t they working with an agent (could be savvy, but could also be crazy), etc.

They are not fiduciaries in general but they legally have fiduciary duties to clients and are subject to the fiduciary standard of care in respect of these – and they can and have been sued for breach of fiduciary duty.

They should, but must they, i.e. are they legally fiduciaries? As the bard said, that is the question.

I don’t receive these emails, but a review of the BC Financial Services site (which is quite good) contains no prohibition on dealing with unrepresented parties, only a disclosure of risks requirement. I’m not sure what the content of the emails states, but if it states anything other than make sure the forms are signed, recommend representation, and the parameters of the limitation on information sharing with unrepresented parties then this is outside the scope of the legislation and regulations. I don’t see how an agent has the authority to refuse to show to an unrepresented party unless this is part of the listing agreement or a direction from a client on this has been given as they must all times act in the best interest of the client within the limits of the legislation.

The two that set themselves a part from the others as the best to deal with were Proline and Duttons during my recent foray back into the rental market.

No.

“Inflation is a decline in the value of money”

The value of money is how much of something you can buy with a given amount. If you can’t buy as much of something with the same amount of money, that means its price has gone up.

I generally enjoy Mr. Coyne’s columns but he lost me with this one.

“Inflation is a decline in the value of money”

Which, if caused by unhinged, unprincipled and irresponsible deficit spending is essentially theft from the electorate. As usual, Saint Margaret had it right. If you are expecting any true leadership in solving the problem:

“Can we expect the socialists to do this even if they think it to be necessary? No! In the first place, for them, economic policy is a perpetual popularity contest. Promise today, disappoint tomorrow, and then blame industry, finance, the banks, anyone but their own exaggerated promises and spendthrift policies. Electioneering breeds inflationeering.”

https://www.margaretthatcher.org/document/110607

A pandemic-fed urge to ramble sending B.C. real estate prices soaring

https://docdro.id/b8pYX1J

https://www.theglobeandmail.com/real-estate/vancouver/article-a-pandemic-fed-urge-to-ramble-sending-bc-real-estate-prices-soaring/

Inflation is about a lot more than just the rising cost of living

https://docdro.id/NJkCxaS

https://www.theglobeandmail.com/opinion/article-what-inflation-is-and-what-it-is-not-what-its-causes-are-and-its-costs/

Agreed.

I personally think all data should be made public so agents actually have to show value beyond providing comparable sales, etc.

Reddit is smoking hot with housing affordability topics right now and yea 98% of the focus is on the problem, not solutions.

No one is like why has a tree prevented 18 townhomes from being built at 902 Foul Bay Rd? These should have already been built and 18 families could be living there right now, but no the neighbors printed off hundreds of “save the trees” signs, because you know printing hundreds of signs is environmentally friendly.

It is getting worse by the day…..opposition to a 235 unit rental building sitting ON THE HIGHWAY -> https://www.peninsulanewsreview.com/news/decision-delayed-on-phase-2-of-marigold-project-in-central-saanich/

No one rushes to Reddit and asks….hmmm why is a 235 unit rental on the highway not being rubber stamped so construction can start asap.

i/ Your argument was that financial incentive made it more lucrative for agents to show buyers without a realtor their listing when dual agency was around. This is false, as you still collect both sides of the commission with an unrepresented party unless otherwise agreed upon with seller.

ii/ Dual agency carried more risk in terms of things going sideways versus unrepresented party. Unrepresented party asks you for any sort of advice you just reply with “sorry, can’t help you, representing the seller.”

iii/ The flakiness of individuals trying to book showings without an agent hasn’t changed since dual agency was scrapped. You had flaky realtor.ca inquiries back then and you have flaky realtor.ca inquires now.

So why does Josh say agents won’t even talk to an unrepresented party? It is because we are strongly discouraged from regulators (now government) in engaging in unrepresented party transactions. Leo is licenced and should be getting all the emails from BC Financial Services Authority, etc., he can correct me if his opinion is different on why agents are reluctant to work with unrepresented buyers.

.

…

https://www.theglobeandmail.com/business/article-bank-of-canada-poised-to-start-rate-hike-cycle-next-week/

Housing Crisis, No Easy Solutions , Stanford Social Innovation Review

https://ssir.org/articles/entry/innovative_solutions_for_the_housing_crisis

Same poop, different pile

Note: “grassroots level”, it will have to happen at the local level if change needs to happen.

Key points:

Focus on the Solutions, Not the Problem

There are no simple nationwide solutions to housing affordability, but it’s a mistake to spend all our time talking about the problems. With the focus on solutions and innovation, it is possible to identify marvelous creativity at the “grassroots level” which is already underway throughout the country.

Taxing Principle Residences, interesting conversation.

Both sides:

https://www.reddit.com/r/canadahousing/comments/nufexv/should_we_end_the_primary_residence_capital_gains/

and from across the pond, an another take on QE

https://mpbondblog.wordpress.com/2022/01/21/the-qe-scam/

The answer is simple. The wealth which QE has passed to asset-holders has come, first of all, directly out of workers’ wages. By effectively devaluing the currency, QE has reduced the buying power of money, leading to an actual decrease in real wages, which, in the UK, still remain below their pre-QE levels. The money taken out of workers’ wages therefore forms the major part of that £250,000 + unearned dividend. In truth, the story that QE was about encouraging investment and boosting employment and growth was always a disingenuous fiction designed to disguise what was really going on – a massive transfer of wealth from the working class to the rich.

From the Globe: A pandemic-fed urge to ramble sending B.C. real estate prices soaring

I feel like whoever penned this piece is trying really hard not to shout “Bubble!”

Just out of curiosity. How much are you willing to gift your kids for a down payment when prices are so high now?

Panic buys ahead of the BoC announcement on January 26th. And, I can see an absolute mad house in the preceding 30 days if the BoC even hint at rates increase.

It seems like prices in the Westshore have jumped by $75,000 in the last ten days!!!!!!

No surprise here!

Mental and substance use disorders in Canada — https://www150.statcan.gc.ca/n1/pub/82-624-x/2013001/article/11855-eng.htm

“Approximately 21.6% of Canadians (about 6 million people) met the criteria for a substance use disorder during their lifetime (Table 1). Alcohol was the most common substance for which people met the criteria for abuse or dependence at 18.1%. More Canadians had symptoms of cannabis abuse or dependence in their lifetime (6.8%) compared with other drugs (4.0%). This is the first time a national rate of cannabis abuse or dependence has been assessed.”

Characteristics of frequent emergency department users in British Columbia, Canada: a retrospective analysis — https://www.cmajopen.ca/content/9/1/E134

“Results: Over the study period, 13.8%–15.3% of patients seen in emergency departments were frequent users. We identified 205 136 frequent users among 1 196 353 emergency department visitors. Frequent users made 40.3% of total visits in 2015/16. From 2012/13 to 2015/16, their visit rates per 100 000 BC population showed a relative increase of 21.8%, versus 13.1% among all emergency department patients.”

Ummm..really. Would you share which property managers you best liked working to find your rental? Friends of mine have just signed up with one property mgt company, and would certainly value a recommendation for someone who has just completed the process. Thanks!

Not sure why you would as a rule – although it may be an incentive for a listing realtor in a market such as right now to present the offer which would be an advantage to the buyer. Our lawyer asks for the buyer’s agent commission equivalent as a discount. Seems only reasonable.

You still double end the commission with an unrepresented party thought….

And I’m sick and tired of hearing such incredibly ignorant and insulting rhetoric like the kind you just spewed.

The forms deal with risk and the reluctance of RE agents is not about risk imo – if it is it is misplaced and any refusal to show is unethical and likely a breach of the listing agreement and code of conduct unless there is buyer direction not to show to unrepresented buyers.

The reason agents don’t want to deal with unrepresented parties is probably more what you have already identified – flakiness of a lot of of them (time waste which can be dealt with by requiring the forms in advance), plus the fact that they then have to do the showing. The risk to realtors was actually way higher when they were acting as dual agents, but the double commission meant that this was a sought after thing – no talk about risk back then.

My take is agents have a vested interest in keeping the industry to themselves where at all possible and when the dual representation was prohibited they instead developed within brokerage arrangements so the firm still gets the double commission. There is every incentive within the industry to minimize DIY transactions.

You can see this play out in lack of access to stats and MLS listing services that ended up in the the abuse of dominance case that the board lost all the way up to the Supreme Court of Canada.

https://www.canada.ca/en/competition-bureau/news/2018/08/backgrounder-abuse-of-dominance-by-the-toronto-real-estate-board.html

🙂

Just buy and hold for a really long time. That’s another way to avoid paying exorbitant sums to realtors, lawyers, and the provincial government (PTT).

Right, they just made it so agents don’t want anything to do with unrepresented parties.

Seeing different docs (with access to your history, charts and labs) isn’t necessarily a bad thing. It doesn’t hurt to get a second opinion. As you’ve described, a regular family doctor can just quit on you, and you’re back to square one. The Telus service does exactly what you want (triage), but the wait times are too long. They’re working on it.

It may turn out that your beloved family doctor that quit on you turns out to be working for a service like Telus medical. Because they can offer her flexible hours, working from home doing televisits, no on-call and no office expenses. What doctor wouldn’t prefer that to working at an office where they get to pay expenses and deal with staffing issues?

In particular, not indicative of a specific government desire for the buyer to be represented by a real estate agent.

So if a buyer has engaged a lawyer, for example, what excuse does the listing agent have for refusing to deal with a potential buyer?

Yes. This is a standard part of any legal form when dealing with unrepresented parties. Normal to be included and not indicative of a specific government desire to prohibit self-representation.

I think you have mixed quotes from Josh and I together. I did not say that it takes several weeks to get a Telus appointment. I said I can’t find a family doctor.

When I had one it still took time to get an appointment, but they triage – in my history of having a family doctor a truly urgent matter would be prioritized and doctors offices kept several slots open for this. When you don’t have a family doctor it is a walk-in clinic which does not triage and you can’t get in same day usually, so you end up in emergency, which is way more expensive for the system and extremely inefficient and time consuming.

I’m not sure about this process, but I would say that it is acceptable to not always see the same doctor. Waiting 11 days to speak to a doctor is not great and another three weeks for an in-person appointment is a long time. This may be manageable in some cases and not in others. If you have complex care needs it is much preferable to have a single doctor coordinating your referrals and compiling the results and following up.

Anyway, this is off topic. I’m ready to pay for better service, but it turns out there is a wait list for that too. If I had more complex needs I’d also be prepared to buy a home in a town where I could get a GP and live there part time.

Is that why on the the forms there are disclaimers such as “We (BC Financial Services Authority aka government) recommend that you seek independent representation in this real estate transaction” ?

Follow by “Be cautious”

and a number of other warnings. The forms are designed to be read to scare the buyer and have him or her go get their own representation.

Telus medical (Victoria) current wait time is 11 days (Feb 1 televisit if you book today). And if the doc thinks you need an office visit, they send you to the Telus clinic on superior st Victoria (likely wait 3 weeks for that). There is no charge, all is covered under Medicare. You don’t see the same doctor, but they all have your charts and lab results. For more information, you can phone them and a human will answer and describe the medical physician services they offer 1-855-577-8838.

I agree that this isn’t as good as finding “Marcus Welby, M.D.” to look after you and your family. But in the absence of that, why is this Telus “televisit and office visits with different doctors” service unacceptable? Are you expecting to find a family doctor that will see you sooner than 11 days? For routine care, 11 days is about average wait for appt for family doctors

Well, that is another story and one that does not reflect well on the profession which did not do a good job regulating itself – particularly in relation to dual representation. I’ll be clearer, the government has no vested interested in the public not being self-represented or they would have prohibited this. They do have an interest in protecting the public from unethical and unscrupulous real estate conduct and the profession is set up to enforce legal limits on realtor conduct and protect realtors against legal risks, like being sued by an unrepresented or represented client.

A nurse is very different than a nurse practitioner. An 811 nurse is not at all helpful to me if I need a prescription renewal or other medical care. 811 is a helpful service but not in any way a substitute for a nurse practitioner or doctor who can diagnose, refer and prescribe.

No, BC Financial Services Authority (formally BC Real Estate Council) brought these rules in after the Christy Clark government ended our right to self regulate in 2016.

OK. You were the one who said “ I wish we had way more nurse practitioners.” So that’s odd to then hear you say that a nurse available 24/7 free on the BC govt 811 phone is “not helpful”.

I actually think the 811 government phone line is very helpful to a lot of people, especially as it includes nurse, dietician and pharmacist. Most people don’t even know that a nurse is available 24/7 free by phoning 811

If you talk to anyone in the medical field or spent a single day in a doctors office you’d be quickly relieved of the idea that everyone seeing the doctor needed to see them instead of a nurse.

No, the CREA is concerned about legal liability for realtors when dealing with unrepresented folks as there is a lot of room for unfair dealings in that relationship. The forms deal with this in my opinion and realtors are careful in what they say when showing to an unrepresented buyer.

I agree that most people are going to want a realtor and there is value in this.

For me, I don’t use one for buying or selling and have saved the commission, which is quite significant.

When buying my offer includes a request for a discount equal to the buyer’s commission on the sale price. I’ve done this a number of times and been the successful offer.

I used this service and sold for full price to an unrepresented buyer: https://www.fsbo.ca/ I had a lock box on the house to allow access to realtors and did offer a commission.

Finally, I have had no problem seeing places as an unrepresented buyer. I’m happy to fill in the forms and this protects the realtor in my opinion. It is a bit of a hassle for the listing realtor as they normally don’t have to show their listing – the buyer’s realtor does using the lockbox.

I do believe that there is an ethical obligation to show a listing to an unrepresented buyer as this is in the best interests of the client – u

unless the seller has directed the realtor not to show to unrepresented buyers, which would be unusual.

Who is in doubt about when they need to see a doctor? It’s one of my least favourite things to do. I know when I need to see one. I expect most people are in my camp and 811 is not helpful.

i/ Government doesn’t want you being self-represented; therefore, as the listing agent there is a lot of liability and risk involved. BC Financial Services Authority is not going to show mercy on an agent that is involved in an unrepresented transaction that stems to a complaint.

ii/ 90% of unrepresented inquiries are complete flakes, 10% are serious. Sometimes difficult to differentiate. When I reply with, happy to setup an showing but I need the unrepresented buyer forms signed (requirement on my end) I don’t hear back from 90%. It is a lot better than the unrepresented buyer not showing up to the showing which was a very common occurrence when we had limited dual agency. If people sign the forms they usual show up to the showing. Issue is buyer gets annoyed with agents ignoring them, or constantly signing the same forms over and over again, and eventually obtains a buyer’s agent. Blame the government, it is how they want it.

As far as getting your real estate license there is more involved now like post exam courses, etc. On the sale you can’t save much versus doing a mere posting and on the buying end try to negotiate a cash back agreement.

When buyers/sellers send me a well thought-out logical email I am willing to play ball with my fees. This is an example from a few months ago. Person emails me with “My father has moved to a retirement residence, I have a POA for the sale, his townhome is now vacant and professionally cleaned. This is the address/unit number. The agent I’ve been working for 20 years is refusing to offer a discount and the last two units have sold above ask with multiple offers. Let me know what you can offer?”

I replied with I can do $6,500 (listing end)+1.5% cooperating commission. Got the listing. We put it up on a Thursday, got three offers on the Monday. Sold. Yes, still a ridiculous amount of money but the seller saved 5.5k with a three sentence email.

This is like a once a year type email; made it clear he had POA (I would not need to drive to see the elderly father to deal with offers), made is clear unit is vacant (I don’t have to arrange showings), made is clear the commission structure was going to be the primary deciding factor. Side factor is it was fall and in the fall (less busy) I am willing to be more flexible than spring (super busy).

Other 99/100 are like “what is your marketing plan to get the most amount of money for my property” and then I am like, well I have an amazing marketing plan. It includes an amazing video tour like this -> https://www.youtube.com/watch?v=oi8igbD6u-Y&t=25s

but the honest reality is only purpose of video is lead generation. I probably get 10 listings a year off the videos (seller randomly browsing realtor.ca, sees my videos, thinks this guy does a good job at marketing, calls me to sell.”

From experience some lawyers will do it for free (if using them for conveyancing) and some will charge a few hundred dollars. The contracts agents use are identical, you just need to scan for for a few terms (deposit, price, completion/possession, inclusions, conditions if any, and any extra clauses).

Having a lawyer review in a balanced market is super easy. Buyer has 8 business days of conditions and you as the seller add a 3 day condition for the benefit of the seller for lawyer review. However, in the current market you may receive multiple unconditional offers let’s say at 5 pm open until 9 pm leaving no time for a lawyer to review.

With doctors doing more virtual visits, there are less time for doctors doing office visits. A virtual consultation done entirely on an iPad speaking with a doctor talking about your various health problems – yah a lot of people are obsessed with their health issues and would do that often – “for fun”. Unless they had to pay a small amount for it (poor people and people with chronic/serious conditions would still pay nothing)

BC increased the number of doctors in the province by 18% in 5 years from 2014-2018. That’s far above population growth. But the demand for medical appointments has risen faster than that, as ease of access through walk in clinics and telemedicine has skyrocketed.

You can already speak for free anytime to a nurse (24/7), pharmacist (5pm-9am, 7 days) or dietician (9am-5pm weekdays) in BC by calling 811 They can advise you if your issue should be referred to a doctor. While this isn’t as good as seeing the same provider in an office, it is 24/7 with immediate access.

https://www.healthlinkbc.ca/more/about-healthlink-bc/about-8-1-1

Maggie- You’d be surprised how many people have a second occupation- going to doctors. Not to mention the hypochondriacs and germaphobes there are out there. Emergency rooms are filled with people who have minor ailments. When anything is free, there will inevitably be abuses. Lots of “poor” people somehow always have money for cigarettes, weed, and alcohol, that’s why they’re poor. I’m sick and tired of hearing about the “poor”, in this country being impoverished is a choice some people make. Our government seems to be busier facilitating poverty than encouraging productivity. The point of user fees is to charge people using the system instead of raising everyone’s taxes, most of which is squandered before reaching the health care system.

Yeah, there’s nothing I love more to do with my free time than to visit a doctor’s office just for fun. By all means, let’s put up one more barrier for poor people trying to access health care.

That sounds more my speed. I’d like to represent myself on the buying side too but last I checked into that there’s a lot of realtors that won’t even talk to you unless you’re a realtor.

I’ve heard this is a thing for some ski towns, Revelstoke in particular

That is how we were finally able to get a family doctor and that was 10 years ago. I don’t think it is a recent problem here and I don’t think they had telemedicine back then.

Although I was speaking to someone that moved from Ontario last year and he was able to get an invite from a family doctor through a game of golf at the golf club. So sounds like more ways than just through pregnancy…

What towns have a surplus?

It’s been interesting to hear how some small towns in the interior are actually finding themselves with a surplus of family doctors. Can’t blame young doctors for wanting to work a half day then head up to the ski hill.

Any idea what a lawyer charges for looking at “not too much”?

A lot of the offers are unconditional so not too much to look at.

Really? They charge in six minute intervals so it shouldn’t cost several grand to review an offer if it takes five minutes – more like fifty dollars. Have you had a lawyer do this and been charged thousands? A conveyance is way more complicated and should cost more. Meanwhile people are paying their realtor $30,000 without complaint.

Has anyone heard of a lawyer actually red-flagging something in an offer?

I feel like lawyers are making several grand for doing 5 minutes of work.

Fair enough. Let me rephrase that to the shortage of family doctors “isn’t quickly solvable by graduating more family doctors”. Because the demand for something free is limited only by the ease of access, and we’re making it easier to access primary care through telemedicine and walk in clinics. So demand is rising faster than population growth, which is not something the government was planning for.

That doesn’t mean she gave up practicing medicine. Are you sure she didn’t switch to something work-at-home like telemedicine which she described to you as more “family friendly”. Put yourself in her place, would you rather work in an office seeing patients, or from home on a screen, where the patients are also waiting at home instead of in your office? Your office costs drop to zero for a start. Then there’s no commuting time, and you have plenty of time-for-short-family breaks during the day. And when the appointment is over you press [END CALL] and ‘poof, they’re gone’.

OK, you’re saying it’s got worse since “late last year and today”. What’s that – one month? That delay sounds like due to omicron, and yes everything is backed up. Not just with health care, but everything involving help from a live human . I’m sure you’ve noticed everything from out of stock groceries to long wait-on-hold banking to finding a tradesman is a big waiting list.

Why would you do that? Expensive waste of time unless you want to be a realtor. You can already list on MLS for about $500 without being and represent yourself without being a realtor and they provide you the buy sell contracts. Just get a lawyer to look over the offer.

It is not overblown.

About 25% of Victorians don’t have a family doctor. I’m one of them. There are zero doctors accepting new patients – I’m registered to get one and probably never will – and to get a walk-in appointment is almost impossible re. Josh’s comment. Getting a same-day appointment through Telus Health is also no longer a thing. Even when I had a doctor the wait to get an appointment was more than a week and she finally gave up her practice January despite being only a few years into being a fully qualified doctor. Just was not a family friendly profession for her and the system did not support her well especially during covid.

I wish we had way more nurse practitioners.

“I’ve had that thought before. It’s gross to think about. I’m not cool with the commission. When it gets time to sell my place and buy another, I’m going to have a serious look into becoming a realtor and representing myself.”

I’ve heard a few people say this and I’m sure it would be well worth it in the long run, especially if you know you’ll be selling within a certain timeframe. What are the overall costs to becoming a realtor, even if just for a year? I imagine it’s the course (six weeks?), some licensing fees, registration of some sort (to MLS?) and of course your time, which should be factored in. Anything else?

Nope. I have had that experience in the past through the Telus app, but the experience late last year and today is you have to wait several weeks for an appointment to open up. Same goes for booking appointment at a walk-in. The only way to be seen within 1 week is to call the downtown clinic the moment they open on days that they’re doing walk ins and cross your fingers. They fill up within minutes. I tried calling 3 other clinics and all were experiencing short staffing and lack of doctors. Some are only open for walk-ins for 4 hours twice a week. The downtown clinic is the only one that’s properly staffed in terms of doctors. I haven’t read into your stats but man is that ever not the story according to me, anyone I know, my wife who works at the hospital, the staff of 3 clinics I talked to on the phone or telemedicine doctors.

I’ve had that thought before. It’s gross to think about. I’m not cool with the commission. When it gets time to sell my place and buy another, I’m going to have a serious look into becoming a realtor and representing myself.

True, but nowadays you can see a doctor through telemedicine or a walk in clinic SAME DAY (ie today), within a couple of hours. In the old days everyone had to wait a few days for an office appointment, so there was less visits per patient per year.

Was that survey conduced in 1986? I’ve been looking for many years. The only way someone my age can get a family doctor is to get pregnant.

The family doc shortage on Vancouver island is overblown. A StatCan survey found only 3.5% of Vancouver Island people were looking for a doctor. And 89% have a regular doctor. But the reason for the shortage isn’t a shortage of doctors, since doctors per capita have been rising. It’s the improved access (telemedicine, walk-in clinics) leading to more patient visits per year

https://www.fraserinstitute.org/sites/default/files/supply-of-physicians-in-canada.pdf

“Hartnett (2016) (citing the Canadian Community Health Survey) reports that 11.1% of the population of Vancouver Island (in British Columbia) had no regular medical doctor in 2013/2014. Of those, the survey notes that 3.5% of the population was actively looking for a physician. The Survey does not indicate whether the remainder had given up their search or decided that they no longer needed a physician. The percentage without a regular doctor on southern Vancouver Island was reported as 15.9% with 5.1% actively looking. For British Columbia as a whole, 15.4% reported not having a regular doctor with 4.4% actively looking.”

While that study was done 6 years ago, statista reports that 85% of Canadians have a regular doctor and that number hasn’t changed 2003-2019 https://www.statista.com/statistics/434254/percentage-of-canadians-with-a-regular-medical-doctor/

fwiw, the supply of family doctors per capita has been rising steadily over time. The problem is that the number of doctor visits per year per patient has also been rising easier due to easier access through walk in clinics, telemedicine.

We could double the number of family docs, but if the average person sees the doctor twice as often (because of ease of access through telemedicine), we are still just as short. IMO, the solution is to charge patients a small fee for doctors visits, to discourage frivolous visits.

“Does a $10 plug tester tell you the type of wire which was used? (No). Does it tell you if there is an arc-fault? (Not the $10 one). Does it tell you if they’ve installed an AFCI breaker on that new bedroom plug? (No). Does it tell you if they pig-tailed the plugs or back-stabbed them? (No).”

Yeah, it’s not really all that useful. In my limited experience, an open ground is usually the result of an incorrectly wired outlet, or the home being older and the presence of original 2 wire romex. If the wire is in good condition, this can be addressed by GFCI protecting the circuit. If it’s in bad condition, probably be looking at a rewire in the near future.

Unfinished basements are handy because at least you can see some of the cable. If there are junction boxes present with so many splices they look like a spider, I always kind of take that as a red flag.

Does a $10 plug tester tell you the type of wire which was used? (No). Does it tell you if there is an arc-fault? (Not the $10 one). Does it tell you if they’ve installed an AFCI breaker on that new bedroom plug? (No). Does it tell you if they pig-tailed the plugs or back-stabbed them? (No).

Yup, that is fore sure. Just look at the new brokerages that have been very very successful and their marketing (see recent Reddit thread discussing one brokerage and an ad they recently ran). It is about selling a lifestyle and it works very well.

I think a large problem is 98% of people believe that a “101 point marketing plan” and a “large network of buyers” can get them more for their house than market value and that is where the lower fee structures fall apart. If you believe that Agent A can get you more money than Agent B than you are willing to pay a higher commission to Agent A and it is game over for Agent B. However, reality is if minimum level of requirements are met (professional photos, correct data input, etc.) on average a home will sell for market value.

We’re going to see this more and more in the near future:

https://thetyee.ca/News/2021/06/11/Vancouver-Council-Votes-Against-Delay-Climate-Emergency-Plan/

And yet…. 33 mere postings sold last year out of 10k MLS sales (imperfect search there may be more but it’s a small number).

Seems like people are happy to pay that commission.

Quite right. That was a move to make more mortgage money available to support the RE market. RE prices in Vancouver and Toronto had been declining for about six months previously and Harper’s strategy was to try to turn the market around. It worked – Canada was the only country where RE prices went up during the ensuing recession. I actually remember Harper on the radio saying that the rising RE prices indicated how well his government had managed the crisis.

Whoever- I know they would never assess the mechanicals of a house they were listing, but the buyer’s agent could guide their client to preform that simple task. I think that would increase the opinion of an agent’s performance, and create an informed buyer.

No “bailout” money, but $114 billion in “liquidity support”…

I was alluding to the U.S. government in that example.

Sure you can. That’s what Canada is doing to pay for the hundreds of billions spent on the pandemic: borrowing indefinitely.

Pretend there was no pandemic. The feds could have chosen to spend, in the form of health transfers to the provinces, several hundred billion over the next 20 years to greatly improve the healthcare system for Canadians.

Same amount of money. Same borrowing to pay for it.

“Real estate agents should be required to perform this test and report the results in the listing.”

NEVER, should a real estate agent hold themselves out as being an expert in a field that they have not been educated and trained. Doing this would void their Errors & Omissions insurance.

A real estate agent is capable and competent to render an opinion of value in assessing the value of your home. But ask them to perform an appraisal for a divorce or financing then their insurance would not cover them. Canadians are becoming more litigious and are more likely to sue for damages when they base their decisions on the opinions of others and subsequently suffer an economic loss.

As they should.

Much much higher road deaths per capita than Canada too, etc. Reality is people in the balkans are stupid continue to smoke, not get vaccinated, drive extremely risky; therefore, average life expectancy is three years shorter, but it means the health care system is solid given lifestyle choices.

Things is if I personally don’t smoke, exercise every day, get vaccinated, don’t overtake in opposite lane on blind corners the preventive medicine/education component doesn’t impact me much (other than some second hand smoke, etc.). At least I can go see a doctor and get quickly diagnosed, etc. Here in Canada, it’s great that no one smokes, people drive slow, etc., but personally doesn’t help me when I don’t have a GP, can’t see a specialist, and my elective surgery keeps getting postponed, etc.

I know a huge selling point for the Canadian Health Care system is it only consumes 11% of GDP and the US is 17% of GDP (50%public/50%private) but for me personally, it kind of sucks in the current state. If we are rich enough as a society where muncipalities have “tree advisors” to the tune of 6 figures how is it we cannot have a GP for everyone.

Haven’t you’ve been saying Vancouver RE prices have been in a bubble since 2001? Yet the predicted crash has never come. How is that “cyclical”?

Canada healthcare consistently rated higher than Croatia.

Canada #13 in world, Croatia #43. https://worldpopulationreview.com/country-rankings/best-healthcare-in-the-world

Not sure what there is to boast about… 1/300 people have died from COVID in Croatia

I’m in favour of user fees when it comes to accessing the medical system: $50 to go to emergency, $10-20 for blood tests, $20 for a doctor visit, etc.. Plumbers start at $100 to walk in your door. Given the millions of visits to hospitals or clinics, this would add up to hundreds of millions of dollars, maybe billions. I do think rare catastrophic health concerns should be covered. It’s the millions of frivolous visits that ruin our health care system and user fees are the most efficient way of addressing this. I just paid $360 for a filling, most Canadians can afford a nominal charge, those who can’t would receive care for free. I prefer this to increasing taxes.

Which just happened to be the biggest economic downturn in BC since the 1930’s. Improved affordability doesn’t get people buying again when there is 10%+ unemployment and abandoned construction sites everywhere. There has to be a change in outlook. That was also the case for the US bust circa 2006-10, and busts in general like the Toronto bust of the late 1980’s-early 90’s.

This is basically the reason why RE is cyclical. Many factors working together with feedback and time lags.

First, the Canadian government didn’t spend any money to bail out the financial industry in 2008. I know a lot of people think it did. They did spend money to bail out the auto industry although much of that money was recovered.

More generally, it’s one thing for the government to borrow money to respond to a crisis like 2008 or Covid, and another to fund improvements to an ongoing service like health care with an aging population . You can’t finance that by borrowing indefinitely. You’re going to need higher taxes (even with increased efficiencies IMHO) or radical reform or both, and that’s the sticking point.

“Do non structural updates require permits? Simple kitchen update, new floors, new bathrooms, etc? Would think simple cosmetic stuff doesn’t require anything?”

The work described would not require permits in a normal municipality. Oak Bay has a rule that any renovation exceeding $500 requires a building permit.

“Electrical/Wiring, wall removal/new walls I would expect should be permitted.”

Yes, electrical work usually requires a permit, even to change a light fixture, which nobody in the history of renovations has ever done.

“Where do you cross the line into permits?”

It’s a judgment call for the homeowner to make imo. Pretty much every house I’ve looked at has at least some unpermitted work. If I was doing major renovations involving changes to the structure of the building or major alterations to the electrical/plumbing systems, I’d be inclined to get permits. Throwing in some pot lights in a kitchen or living room, or boarding an unfinished wall in a basement, I probably wouldn’t bother. I think it’s best to avoid triggering the building code for minor renovations so that you don’t turn a $1,000 job into a $5,000 one.