Flippin’ Victoria

BC has a Speculation & Vacancy Tax, the results of which I’ve discussed several times. It’s a pretty good vacancy tax, but it’s debatable how well it targets speculation. That’s partially because in my mind speculation is hard to define, with every owner being part speculator. How many people would be buying right now if they were convinced prices would fall?

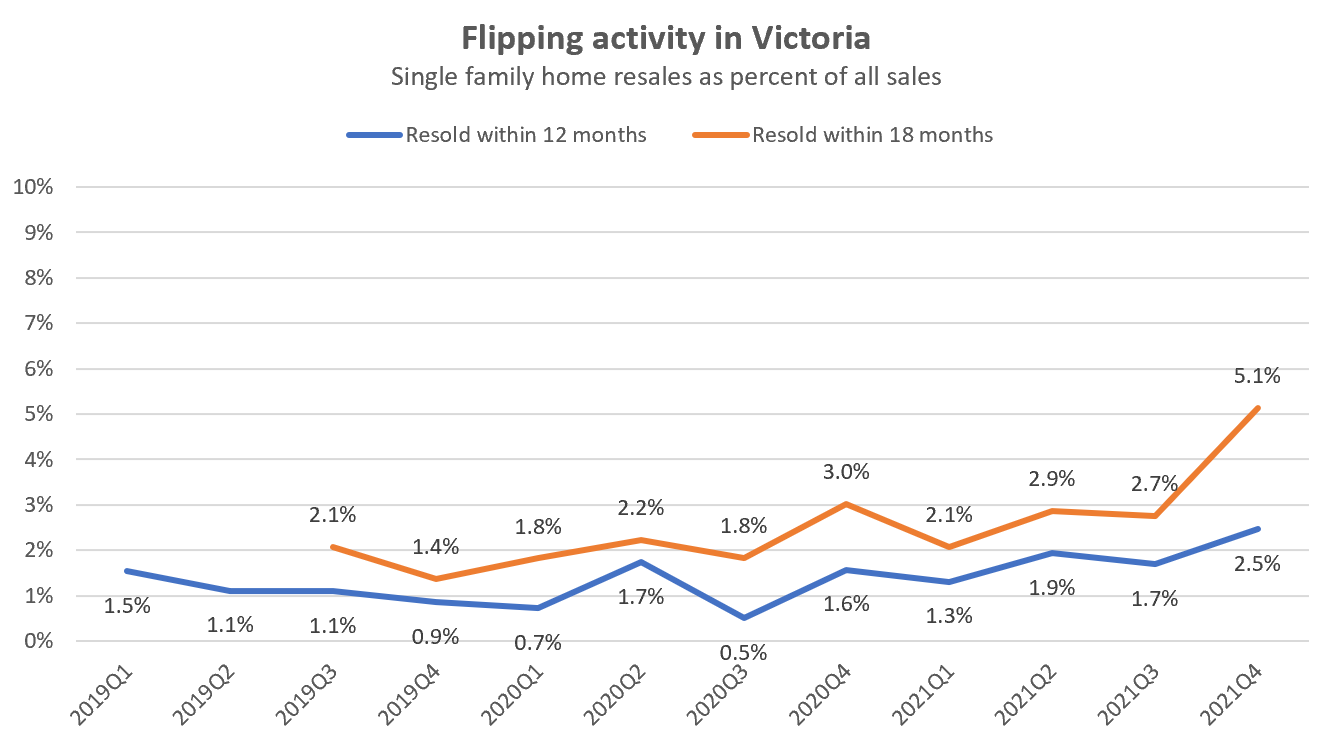

However many people believe that flippers – those owners that buy only to sell shortly afterwards – should be specifically targetted by a speculation tax. How many of those flippers are there? It’s a more difficult question to answer than it should be since it requires the history of all property sales, but I’ve extracted the last few years of data for detached homes to see what order of magnitude we are talking about. There’s no set definition for flipping, but I’ve charted sales pairs that happened within 12 months, and those that happened within 18 months.

Are flippers a substantial factor in the market?

Generally flipping activity is low in Victoria, with an average of 1.4% of houses sold in the last 3 years having been flipped within 12 months. That rises to 2.5% when you extend the holding period to 18 months. Either way, it’s not a large part of the market. Worth remembering is that while some or most of these are probably deliberate flips, there are other reasons a place may need to be resold unexpectedly in a short time because of sudden job or health changes. Getting to zero will never be possible even with a dedicated effort from some level of government to crack down on flipping.

What’s interesting though is a noticeable rise in flips just in the current quarter (to date), jumping to 5.1% of sold properties that had been sold less than 18 months prior. A blip, or are people cashing in on the huge price gains that we’ve seen post-pandemic? Just like investors that are attracted to rising prices, it’s not surprising that flippers may be the same. Note that the flip is measured when the property is sold, so in some ways an increase in flippers cashing out could help with our supply problem as long as they stay out of the market and don’t just buy in again.

It’s worth keeping an eye on this figure to see if it trends up further, but overall I don’t think flippers have much influence on the market at these levels. They’re the highly visible beneficiaries of large price gains in the market and thus attract negative attention, but it’s worth remembering that every owner in the market has made similar gains. The only difference is that the flippers realized the gain, while for the rest it remains unrealized and thus flies under the radar.

Also weekly numbers courtesy of the VREB.

| Dec 2021 |

Dec

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 77 | 190 | 631 | ||

| New Listings | 102 | 236 | 456 | ||

| Active Listings | 889 | 876 | 1279 | ||

| Sales to New Listings | 75% | 81% | 138% | ||

| Sales YoY Change | -28% | -32% | |||

| Months of Inventory | 2.0 | ||||

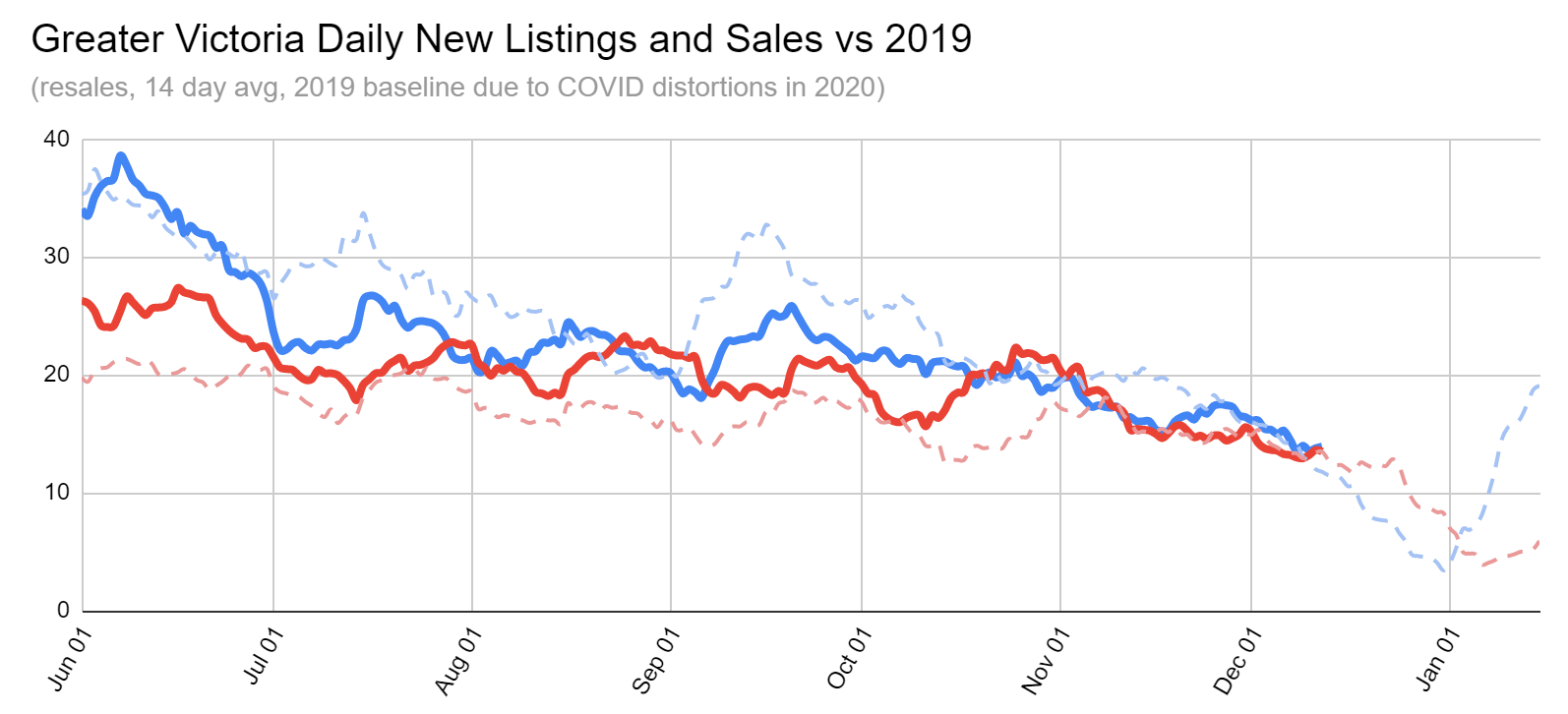

Sales and new listings have been pretty steady on a similar pace to 2019 for the last couple weeks. That’s a substantial sales drop from the pace of a year ago, but of course this is pretty meaningless until we get more inventory on the market. Currently there are 60% fewer listings on the market than the same week in 2019. The next two weeks will be quiet just because listings will drop sharply. They generally pick up starting in January, so if nothing else expect some more options to arrive in the new year.

I don’t agree with you Frank. A drive out to Langford would change your attitude. It’s a vibrant community of young families from different parts of Canada. Victoria city proper is a bit different in that there are more international buyers , investors and single people that share accommodation for economic reasons. I don’t see any large impact of seniors moving to Victoria as much as a I did a few years back. Probably because starter homes in the City are close to a million dollars now as land costs are quite high. A single family infill city lot in an average blue collar neighborhood is going to cost close to $800,000. A lot closer to the waterfront is in the 1.2 to 1.4 million dollar range. That’s tremendously different than Winnipeg.

Lots of people have moved to Winnipeg from Victoria for decades, they knew they could never afford a house. Since they didn’t own a house, they couldn’t improve the housing inventory. Unfortunately, more people move to Victoria and the demand increases, we all know this.

Also, there are lots of unfilled jobs across the prairies and construction is booming. Victoria isn’t the only place with increased economic activity. I don’t understand your rationale. There is huge demand across North America and prices aren’t that much cheaper than Victoria, unless you want to move to Detroit. I can guarantee you there is no mass migration of young people to Victoria, mostly wealthy seniors.

new post: https://househuntvictoria.ca/2021/12/20/december-20-market-update/

I think you missed the point Frank, I wasn’t trying to sell you ten houses in Winnipeg. Here I’ll restate if for you.

“You could try moving to say Saskatchewan or Manitoba where you can still buy a starter house for $100,000. Or even Edmonton where prices are half to a third of the costs here, but the jobs aren’t there. That’s why so many young people are moving here and these areas are de-populating. So as long as the construction boom lasts in cities like Victoria and Vancouver prices are going to continue to rise.”

The point is that the increased economic activity caused by construction brings in new buyers and drives housing costs up. Increasing supply alone isn’t going to solve the housing problem.

It doesn’t matter if starter homes in Manitoba and Saskatchewan are double what I wrote. It doesn’t change the premise or conclusion. Most people are not going to sell in Victoria and move there.

“There are SO many simple things the government could do it is not even funny.”

Marko, how about you run for the premier? Let’s replace the “let’s-only-talk-about-solutions” clowns who are currently in charge. You’d definitely have my vote. 😉

Starter homes in Manitoba for $100,000? I’ll take ten of them. Maybe in remote small towns, but are you ever misinformed. A flooded out small house in a below average neighbourhood in Winnipeg just sold for $220,000 and it was uninhabitable. Prices in Winnipeg are about half the prices in Victoria for something you can move into. You’re talking about Turtleford Sask. or Pickeral Point, in the middle of nowhere. Most decent homes in good areas of Winnipeg are $500,000- one million.

That’s the way to do it Marko. Look at the re-sales and consider a premium over those prices. Don’t look at other pre-construction complexes that could mislead you. 5 or 10 percent, depending on how prices are rising, is a good rule of thumb.

Victoria is pretty bad for getting approvals. But holy crap, is Langford being built out fast. I was out at Bear Mountain the other day looking around and wondering where the heck are all these people coming from! Langford is going to eclipse Victoria proper in population if it hasn’t already. It’s all houses, cars and tons of shopping. The streets are all tree lined and everything is frigging NEW! Then I come back to my home in Victoria, dodge the pot holes and look at my neighborhood and I see what Langford looked like 20 years ago. It’s like night and day.

Pre-sale development purchases are pretty simple imo. What I do is I estimate the value of the completed unit in the current market based on <5 yr old comparables in the area. If the pre-sale is 5 to 10% discount, I buy.

I had not bought a pre-sale since Ironworks as there were no discounts but in October the re-sale condo market shot up so quickly it made some pre-sales that were at market 5 to 10% below market and that is when I pulled the trigger.

I would also add, that if you want to get into the pre-construction game you should know your values. The ordinary guy or gal is going to pay a premium for them because they have little bargaining power with the developer. If you want to buy into that specific complex, you are going to have to pay the developer’s price. Most of the time that premium isn’t that unreasonable but sometimes the novice investor can really get raked over the coals. Especially if the complex is in developing area with no comparable resales nearby. Once the complex is completed, then the pre-construction buyers begin selling their units and your ability to negotiate a better deal improves. There are a few, not many, projects in Victoria, that despite prices increasing their suite has not appreciated. Getting someone like Marko to give his thoughts on a pre-construction project wouldn’t be a bad idea. You’ll need someone knowledgeable, that you can trust, who doesn’t have any skin in the game.

If government got out of way and we had adequate inventory investors wouldn’t be an issue. You think as many amateur investors would pile in if vacancy was reasonable and they didn’t have 30 applications on a re-rent and had to maintain properties to a reasonable standard to keep their tenants?

Add in reasonable interest rates and problem is solved. Right now amateur landlords borrowing at 1.3%, increasing rent on on each re-rent, and can pick and choose their tenants.

Not to mention appreciation, as a result of poor monetary policy, is through the roof.

There are SO many simple things the government could do it is not even funny. For example, fine tune the “missing middle” like get rid of step code 5, and have a special program if the developer is willing to sign a 20 year rental covenant (at market rate) that rezoning/building permit will be turned around for any 3 bed townhome complex application within 12 months. Great stable alternative to renting a crap SFH from an amateur investor.

Reality is you’ll fight NIYMBs for years. City staff beauracy will burry you for a few more years, have to protect those 100k/year jobs. Then after years you make it to a hearing and you are at the political mercy of Ben Islitt. Then we wonder why there is an inventory problem.

The problem with Victoria City is that even the worst rat holes are getting high rents in the $2 to $3 per square foot range. People are desperate just to put a roof over their heads. Forget moving to Victoria if you have a family or single and don’t work in construction as most of your pay cheque will be gobbled up in rent and you’ll have difficulty saving for a down payment. As most non related construction work still pays much lower wages which includes most provincial government jobs, hospital workers and the military. Even doctors and those with high seniority in their jobs have problems renting or buying into this market.

If you need a three-bedroom family home then anywhere between $30,000 to $40,000 of your take home pay is going to rent. That makes things difficult for families where there are two people with non construction jobs to move here. But they still keep coming for those high paying construction jobs because we keep building more and more.

And it is not going to end soon as the lead economist for BC still considers housing to be affordable as his figures show wages in BC are rising, inflation is low, and interest rates are not going to change significantly over the next two years.

You could try moving to say Saskatchewan or Manitoba where you can still buy a starter house for $100,000. Or even Edmonton where prices are half to a third of the costs here, but the jobs aren’t there. That’s why so many young people are moving here and these areas are de-populating. So as long as the construction boom lasts in cities like Victoria and Vancouver prices are going to continue to rise.

And this is just ****ed up imo. I’ve made more money on personal pre-sale condo transactions literally doing shit all than building homes, how sad is that. That’s how messed up system is. I know everyone likes to shit on “greedy” developers but I’ve bought into many pre-sales where the contract holders as a whole have made more money on the uplift than the developer profit who actually built something instead of just flipping paper.

We should reward production not paper flipping.

That being said not without its risks in terms of the market dropping (people have short memory, condo market dropped 10 to 15% in Victoria from 2007 to 2014). I bought a one bedroom pre-sale condo (completion late 2024) in October and I think if it was finished today it would be worth 10-12% more. Worse case scenario market drops 30-40% and I just rent it out. Even if there is a huge supply of rental inventory, which there won’t be due to NIMBYs/beauracy/politics, I just drop the rent a bit. To end up in trouble market would have to tank, rental vacancy would have to skyrocket and interest rates would have to go up substantially.

On the other hand given monetary policy/inflation plenty of upside in three years and odds are rent will be higher than what it is today.

“Calm down, it wasn’t personal.”

I wasn’t worked up about anything or taking anything personally. Trust me there are way larger groups and forums than the one here where landlords are vilified and I don’t take any of it personally. I was simply sharing that your frat boy example isn’t necessarily true. Also, yes, both families love it and both are long-term tenants with no intensions of going anywhere.

The need to step up and force municipalities to build more housing means more workers have to be found and they have to move to the city. Thereby Increasing demand for rentals and homes when there is already a short supply of listings. There is only one sure way to cure high prices and that’s a recession. And that’s not likely to happen until interest rates increase which is unlikely for at least another two years.

Right now the best way to make money in real estate is to purchase one or more pre-construction strata properties that won’t be completed for at least a year. Then just sit back and enjoy the appreciation. After a year you can then sell or rent out the properties and enjoy another year or two of appreciation. That’s the trend I’m seeing in real estate.

The downside is that you are putting all of your eggs in one basket. If the market dips you’re going to have to come up with lots of cash or start fire selling the properties. But that’s unlikely to happen unless there is some external shock/black swan event.

If you have lots of equity in your home go out and buy a couple of pre-construction condos. The more people that do this will cause a shorter supply and drive prices even higher. Then developers will have to build more condos and entice more out of province workers to move here and rents will increase.

Temporarily, until their finances improve and the great day arrives when they can evict their tenant. Those lousy rentals are a big difference from a landlord owned property (e.g. see up-and-coming’s post) that wants tenant/families there forever.

Lower income families deserve more SFH homes to rent. Not just condos. I thought you joined an advocacy group just for that? Now you’re not sure??

The BOC should raise interest rates, but I don’t think they’ll raise them much. Their first master is the government, which has piled on so much debt, the only way out of it is inflation and low interest rates.

This won’t be like the 80s where inflation was fought with high interest rates. Because now the problem is huge government debt. This same thing (high govt debt and inflation) happened in WWI and WWII, and the govt just kept rates low so inflation took care of the debts. Expect low rates and inflation to continue.

Tons of owner occupiers have suites.

Investors buying up a house and renting it out is very different than a developer buying the same place and replacing it with a 12plex or something else substantially higher density than the single family house that was there. I’m in favour of the latter, not convinced we should have a high investor ownership rate of regular single family houses.

Eby wants to blow it all up, but it’s a delicate political dance. More voters still likely opposed to this today but every day prices increase and there are more people not comfortably housed that would support major reform. No more ability to enforce single family only zoning within 5 years is possible.

“The current situation is largely the result of government interference.”

Exactly – the government MUST act in EXTREME situations only – like now. In all other situations it should just stay out of the way and remove all unnecessary obstacles for developers.

Right, and dwellings is different then properties, so the 123k figure was likely correct, though the calculation from owners was probably not. Will have to recheck CHSP stats

The current situation is largely the result of government interference.

“This is a terrible take. I have a SFH as a rental with 3/2 up and 2/1 down, not a stacked duplex as you claim.”

Calm down, it wasn’t personal. The up/down duplexes I’ve rented have been noisy (especially the lower unit) due to age and construction and shared ductwork. Maybe your up/down duplex is nicely soundproofed, or the families aren’t bothered by it. That’s great for them.

“And you see a reply from a typical homeowner (“dad”) expressing horror at the idea, declaring that doubling the density to two families wouldn’t be family housing, and would be more like a frat house.”

Horror!

100% agree – the government needs to step up here and override the municipalities to accommodate significantly more development. No more property tax deferment as well. This “create a little tax here and there” incompetent approach that they were able to come up with is absolutely useless.

The provincial government, not the feds.

Supply sucks for buyers and renters and all types of properties. There both getting squeezed by supply. My grandparents can’t downsize as there are no suitable condos. They live on a 5 acre farm. My neice from Nelson a uvic student slept on a friend’s couch for two months while waiting for a bedroom in a rooming house. My other cousing in his late 30s and his wife and him just moved to North Ontario. The fact is there is so much red tape nothing will happen. There are more and more NIMBys. They actually just recently moved into a new home and dont want the new townhome development in there backyard.

I get it change is tough for all. I also thought in my early 20 owning a Let’s try our best to save trees, provide parking, please neighbors and the staff. But unless the feds override the municipalities on all the red tape it will be the same old.

Patrick – prices in Port Alberni jumped 50% or so last year if I remember correctly. That’s not some TOP desirable Canadian RE market. What does that have to do with helping POOR people buy properties? I really don’t follow your line of thought there. FED / BOC = government exists to maintain the stability of the financial markets. When you reach extreme conditions that’s when the central bank steps in or you end up with what happened in 1929 and the depression that followed. We have a situation where BOC / FED zeroed interest rates to accommodate extreme conditions in the financial markets due to COVID but created another extreme in the housing market which they have no tools to deal with. It’s fascinating that the financial markets have institution dedicated to stability but nothing like that exists for housing.

Yes, government should intervene , but to help POOR people. Not to help you with first world problems of buying a SFH in one of the most expensive RE markets in Canada. If you’re asking the government to stop investor/landlords, you’re trying to gentrify Victoria. So the lower income rental tenants just get evicted and go away, and you can move in.

We have to face it, many Victoria SFH are now being priced for their “highest and best use”, which is a multi-family dwelling. https://en.wikipedia.org/wiki/Highest_and_best_use

No, not merely “supply transporters”. Landlord/investors also increase the density of the properties they own, more so than owner occupiers. For example, look at upandcoming’s post below. He’s a landlord who has got two families living in SFH, doubling the density. And you see a reply from a typical homeowner (“dad”) expressing horror at the idea, declaring that doubling the density to two families wouldn’t be family housing, and would be more like a frat house.

I’m surprised you’re on the fence here. I thought you were a big advocate of increased density. How do you expect it to happen, without SFH turning into multi family dwellings, and aren’t investors the ones that make that happen? When an investor buys a SFH, don’t you think many of them have plans to increase the density?

There it goes the FREE MARKET argument. You really don’t get it Patrick. Government MUST interfere when you extreme conditions – why do you think FED exists?

Leo, you could allow SFH investment when the inventory increases above certain threshold. That would resolve the whole supply issue. Also the government should support building of rental townhouses and condos through tax incentives for the developers. This packing of renting families into moldy basements doesn’t make any sense to me. SFH stands for Single Family Housing – not Multiple family housing. Creating rental stock this way is just a lazy way out for our government which is refusing to step up and deal with the problem.

Sorry, but about 35% of households in Victoria rent, and they are the ones needing affordable housing. So we aren’t about to turn off the ability for landlords to purchase homes to maintain or add to the rental stock. We NEED more rentals just as much as we NEED more owner occupied homes. Many landlords buy the house and rent it out to two or more families. This is why they can pay more than someone like a FTB that is planning to buy the house for one family only.

This is the free market at work, helping to solve the problem by increasing density. So no, I don’t accept your pleas for government intervention.

A property can have more than own owner. Rather common, actually.

Investors are supply transporters. They move properties from the resale market to the rental market.

That adds price pressure to the resale market (prices up) and reduces price pressure from the rental market (vacancy rates up, prices down VS the counterfactual).

What % of investor ownership is optimal? A difficult policy question. If it’s 0% then there are no houses to rent. Then we are saying if you don’t own you effectively can’t live in a house. If it’s too high then we are forcing large numbers of people into renting even if they might otherwise be able to buy. I don’t know what the answer is.

Good catch. I’ll have to look back at the CHSP data to figure out where I got that 123,365 number from, but you’re right it makes absolutely no sense. For now I’ve dropped in the dwellings number from the census (172,559)

“I think many of these SFHs are rented out as stacked duplexes, with piss poor soundproofing between floors. I don’t have a problem with investors buying up houses and renting them out in this manner – it creates additional rental units and frat boys need somewhere to live too – but I wouldn’t characterize it as “family” housing.”

This is a terrible take. I have a SFH as a rental with 3/2 up and 2/1 down, not a stacked duplex as you claim. Both spaces have families in them that love having a front yard, lots of off-street parking, a garage and a fully fenced backyard for pets and lots of room for trampolines and kids to play soccer. They treat the property like it’s their own, with a garden and art projects using driftwood from the beach. I would never rent to frat boys as they don’t tend to care about things like mowing the lawn or general upkeep, but by all means, keep imagining that’s the way it is out there if it fits your narrative.

“If people are advocates of affordable housing, and want to see more affordable SFH available, they should advocate more investor (landlord) ownership, not less.”

I think many of these SFHs are rented out as stacked duplexes, with piss poor soundproofing between floors. I don’t have a problem with investors buying up houses and renting them out in this manner – it creates additional rental units and frat boys need somewhere to live too – but I wouldn’t characterize it as “family” housing.

Patrick you are missing the forest for the trees. When you have extreme shortage you need to create immediate supply. There is really no need for “investors” in the current extremely constrained market where first time buyers are struggling to secure properties and competing with people who are using their house equity to secure more debt which creates a very dangerous feedback loop in the RE market where rapid price increases feed more prices increases. I am not against investing in RE in general and there is some argument for your rental point of view (you could allow RE “investment” when the inventory is above 7-9 months.). But if “investors” buy out existing stock – be it disinfectants or toilet paper due to supply constraints you need to institute limits on speculative demand (long-term or short-term) or you will have a huge problem on your hands. This is where Canada is standing right now – refusing to face the truth. Politicians frozen – too scared to do anything meaningful. The economic pain down the road will be much bigger than the cost of acting now.

Leo- If 128,790 people own one property, how can there be a total of 123,365 properties ,as stated, in the region. The math in that article makes absolutely no sense to me. I’m not even including the 16,345 people who own 2 properties which is an additional 32,690 properties. I don’t know where the 123,365 number of total properties comes from. I can see the 27,170 number, but the total number should be higher. I think the total number should be around 170,000. Am I missing something?

From Leo’s previous article…

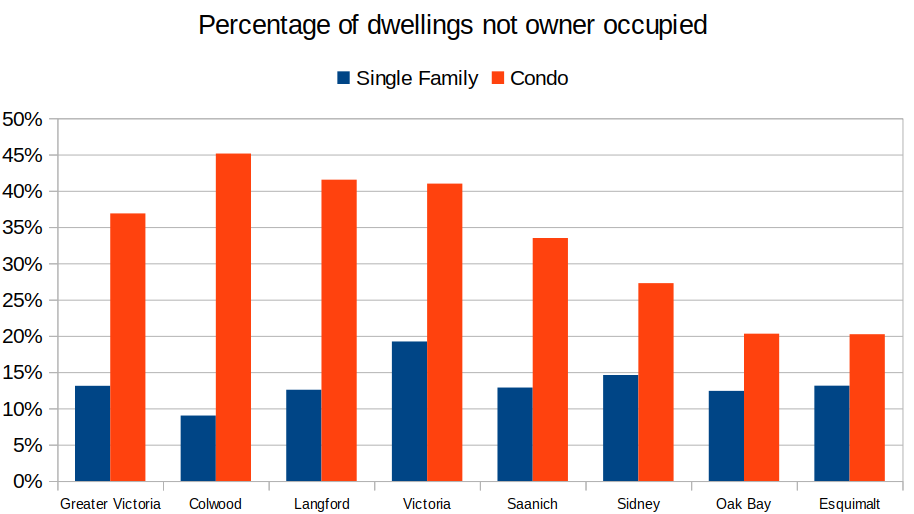

“That matches up well to the data on non-owner occupied properties, where data shows that in Greater Victoria 13% of detached homes and 37% of condos are not owner occupied. “

That would mean that in Greater Victoria, 87% of detached homes are owner occupied.

So only about 13% of detached homes are rented out. About 7,000 rental houses total. That is our sole supply of affordable detached house rentals in Victoria, affordable to many families in need of a house to rent. A rental house is a very important “rung” on the housing ladder, that many people benefit from at some point in life. And that category should always be available, so “thank you” to the landlords that make them available.

If people are advocates of affordable housing, and want to see more affordable SFH available, they should advocate more investor (landlord) ownership, not less. Otherwise, renting a detached house in Victoria will become the “good ole days” , and the only affordable rental housing options going forward will be the government’s idea of affordable housing – namely small condos in big buildings.

Guess they didn’t like it.

1563 Mt. Newton Cross

Sold Aug 2020: 4.3M

Sold Dec 2021: 4.9M

Sales: 323 (down 25% from last year)

New listings: 352 (down 5%)

Inventory: 823 (down 48%)

New post tonight.

Leo, can we expect a new post today?

From my previous article:

“The Canada Housing Statistics Program has that data from 2018 as I’ve covered before. At that point 128,790 people owned one property in Victoria, 16,345 people owned two properties, 3,230 people owned three properties, and 1,455 people owned four or more properties. That means (assuming the investors lived in one of their properties), at least 27,170 properties in Victoria were owned by investors, out of 123,365 total properties in the region.”

https://househuntvictoria.ca/2021/03/15/are-investors-driving-the-market/

$1,133,000

I’d like to know what percentage of the population are landlords/real estate investors. Not including people who own multiple properties such as cottages and winter vacation homes.

May I ask what 4265 springridge cres sold for? Thank you

Some are boomers that delayed selling because of pandemic, a few already own condos in addition to their SFD. They mostly say the maintenance and work is taking too much out of them if they do the work themselves and they pay way too much for others to come and do the maintenance poorly. So, they just want to downsize. The ones without condos already, plan to buy a condo, patio home or townhouse. The others selling are mid-thirties that bought property ladder homes but they can’t win an offer with their sale condition, so they are wanting to take profit and rent until they can action their next house.

You may be unaware, but New Zealand doesn’t have a capital gains tax. Their previous system was very generous, that a RE investor could deduct interest and also pay NO cap gains or other taxes at time of sale for personal or investment properties.

Under New Zealand’s new system, it is still generous….

– If the investment property is held more than 10 years, and they bought it intending to keep it long term, when they sell it they still pay NO taxes on the gains when sold (and get no interest deductions)

– If they hold the investment property less than 10 years, they DO pay full income taxes on the gains, but do get to deduct all the years of interest expenses to change their cost base at time of sale.

–

So that means, under the New Zealand new system (which you are “coming around to”), a RE investor who holds for 10 years or longer, at time of sale will be treated like a Canadian homeowner with a principle residence exemption (namely no taxes on gains, but no interest deductibility during time of ownership).

So…. Are you still “coming around to” Canada adopting New Zealand’s system?

https://www.interest.co.nz/property/112496/government-avoids-over-taxing-property-investors-allowing-interest-deductions

I am going to be building some duplexes soon as Rentals. I will putting in Illegal suites even though the bc building code allows suites in duplexes. I am only doing this as I will be keeping them as rental properties. If I was building them to sell I wouldn’t be putting in the suites. The extra headaches of suites with the fireproofing, parking and extra kitchens and appliances is just an extra headache. As well as the inspector accepting that its just a bar for now. So in theory 2 more rentals units vs selling per full duplex. Its the investors who pick up multiple presales and try to the flip them. Its a 1%er move as they have deep pockets and are trying to buy a commodity to dump on the market for profit causing increase in prices for the end user or investor. A close friend just picked up 4 townhomes with 5% down to flip before completion. Don’t really ethically agree with that move in the current environment.

Investors or owner-occupiers? If the latter, where do they plan to move?

As I’ve said before, when an investor outbids a would-be owner-occupier for an existing property, that creates an additional renter as well as an additional rental property. The difference is that if an owner-occupier got the property they would have security of tenure rather than being a precarious renter.

Frankly I’m coming around to disallowing interest costs as a deduction for investors buying existing properties, as New Zealand has.

Spoke with a couple realtors about what listings were looking like in the new year. They said it was looking to be slim for listings in the next few months and didn’t imagine it getting much better for inventory for at least 8 to 9 months. Caveat: these were realtors, so they did have a vested interest in selling something right now and stating it is going to be the same or worse in the near term does suit their interest as rational self actors (better buy now if you think it’s your chance). However, it does makes sense for it to take a bit of time as stimulus winds down and interest rates grow for pressure to increase on the seller end of things. Seperately, I am aware of some folks that have been holding on to their properties and waiting for “the right time for them” planning to list in the summer. I do think some of them might be disappointed as they are expecting a peak price when there will be likely less buyers with the means to meet the price demands when they finally do look to sell.

These arguments fall apart when the evil-sounding term “investors” are described instead as “landlords” and the homes they own are called what they are… “rental properties”

Then, your argument becomes calling for the government to intervene in the market to reduce the number of rental properties available, so that someone like you can buy the home instead of it becoming a rental property.

There is a shortage of rental properties, especially family-sized rentals. That means we need more of them, which means more landlords and more “investor nonsense” as you put it.

Also, landlords maximize profit by increasing density of the property. That might mean creating three suites in one house. Whereas a homeowner might be buying the whole house just for himself. Most everyone agrees that Increased density (households per space) is part of the solution, and investor owned properties have higher density than homeowner properties.

For example, let’s say a househunter here decides to buy a house that is currently rented out as three suites, with the parking spaces all rented out as well. But our house hunter can afford the whole property for himself. He outbids an investor/landlord, so he buys it and evicts three households. Now who is evil?

Notice how almost every homeowner with a suite here on HHV dreams of the day when finances improve and they can evict their tenant and take over the whole property. That’s a different mindset than a landlord, who dreams of the day when they can create an additional suite.

So if you’re concerned about the housing crisis, you should be calling for more investor owned (rental) properties, not less! Because rentals make more efficient (higher density) use of the space.

My friends in Toronto are stilling looking for a home here but I have to agree that the pickings are rather slim. I know that they are being told to wait until the spring market when there is traditionally more inventory but part of me wonders if there will really be a big bump in inventory then or are we likely to see a trickle?

Hmmm, look at the data you can get on COVID-19 exposures in Nova Scotia. It would be nice to get the BC info like this..

https://www.cbc.ca/news/canada/nova-scotia/possible-covid-19-exposures-in-nova-scotia-1.5803594

Taxing down payment gifts would be a great start. Some would probably think twice about sprinkling down payments to their kids from HELOCs if the gift was taxable at the reciever end of it. Unfortunately, there only seems to be political will to further spike demand by injecting more liquity to push more people with higher debt loads into the market and sell that as tackling the real estate problem. I would also argue there isn’t enough home ownership alternatives. If we are looking at Federal or Provincial level solutions, a large scale move into Private Public Partnership investments in family size rentals (not targeted to any income group, just build all you can and have it privately managed) to allow for a rental market that gives an alternative other than feeling forced to buy because you fall so far behind because of excessive rents. Keep anything to do with social housing, low income housing in and below market housing away from it because we all know those all end in failure. Simply, new below market, low income and social housing does not make any sense, just let the old stock become that when the large scale new is built. If someone can still save while living in quality rental accomodations that fits their family needs, it may address part of the need out there and lessen ownership desire as they can build other sustainable investments when not crushed by housing costs.

RSF- I wasn’t implying anything, you’re making things up. I am referring to a skill set that is unique and under appreciated. As for lawyers, really?

The government needs to stop this RE “investor” nonsense ASAP. Either tax it so much it becomes unprofitable or disallow it completely (maybe on a temporary basis until the extreme shortage resolves). This “assetization” of the housing sector is the primary driver of the housing shortage. Increasing the stress test just takes away the buying power from the first time buyers who actually need it the most. Our incompetent government is completely useless to deal with this. Who in their right mind would start their career here? The best financial decision any young person can make is to move away from here (south of the border you have 30-50% higher salaries and 1/2 priced real estate). And you wonder why we have shortage of doctors? Pretty soon we will have shortage of all professionals if we keep heading heading down this road. In fact – we’re so far down that road that this is inevitable. It sounds like our government has a solution to fill the gap with cheaper immigrants – way to go!!

And as per the health care conversations – yeah let’s burry the last good thing that Canada has going for itself – our public health care system! Anyone thinking that the solution is a private clinic in Vancouver is plain nuts in my book.

How can you possibly imply that there are not nurses, lawyers, counsellors, accountants, and many others not doing the same thing?? I know therapists who are incredible at what they do and unbelievably passionate about healing others with super skill sets. I know lawyers like that too, and university professors for that matter. Honestly the separate and above standard you propose is really discrediting to them when you think about it. Of course, those who love their work and make a contribution do it anyway without the money. I’m sure many people reading this agree so let us move on.

Regarding our health system: Doctors seem to have a passion for their work and are driven by the results they accomplish. I had a torn retina (out of the clear blue sky) and had the privilege of seeing Manitoba’s highest paid Doctor at around 1.4 million a year (before expenses). This man worked relentlessly, there is no backlog of cases, you need the operation within one or two weeks to avoid going blind in that eye. If a new case comes in, he works that much longer, no questions asked. There are only a handful of specialists that are qualified to do this type of operation. I wouldn’t want his job for a million dollars a year, life is too short, he must make huge sacrifices in his life. I don’t think he is going to retire early to lie on a beach given the demand for his services. Sadly, he will probably never get to enjoy the fruits of his labor.

I’m strongly in favour of universal health care, but it really isn’t working right now.

I’ve been looking at all the options for a number of years. Canada does a pretty good job with emergency services imo, but the level of primary care has fallen drastically in my experience. Walk in clinics are a joke as a substitute.

I had already been looking at international options pre-covid for more comprehensive private pay annual check-ups – and Japan was a strong contender -but post-covid Patrick’s suggestion of Telus health makes more sense if you can afford to pay $5000/year per family member and travel to Vancouver – plus you get a primary care physician if you don’t have one and can’t find one.

I bet Telus Health’s LifePlus program will have a good uptake, unless it gets shut down for violating the Health Act.

Well, self employment should be paid more than salaried jobs because of the lack of benefits, insurance, and back up, whether doctor, lawyer, or financial planner. I don’t see why the net income for doctors would be on part with others when the gross is double. Not doubt the US market is far more lucrative with some doctors making millions a year in that private fee for service system. This does put Canadians in a terrible bind and contributes to what seems like inflated incomes. I don’t see how you could conclude doctors are working twice as hard as other professions — just ask an articling student working 100 hours a week for 50k. I honestly don’t know how you could prove or measure who works harder without actually trying them all out. I might concede that doctors face the most psychologically taxing of all work relentless working with the sick and dying for years on end.

The buffoons who run your life for you will (after gouging out income tax) happily allow you to spend your money on anything you like – casinos, 6/49, tobacco, mezcal or dope. What they will NOT permit you to spend your money on is the search for quality physician at an appropriate market price.

Remove that layer of intransigent socialist idiocy and the lack of an available doctor will be a distant memory.

RightSaysFred- Regarding Doctor “salaries”: a salaried employee does not incur overhead costs. Doctors do not make a salary, they are paid a fee for service. Salaried employees do not require malpractice insurance, have office overhead, etc… The “salaries” reported for doctors do not take this into consideration. Add to that generous pension and benefits doctors do not get, a $100,000 salaried position could be more lucrative. That’s why we have a doctor shortage, many of them leave for greener pastures in the U.S. If we graduate more MDs, we’ll just be feeding more to the U.S. medical system since our quality of education meets U.S. standards. Don’t think Canadian medical students aren’t aware of opportunities elsewhere. Plus medical doctors are working twice as hard for their $200,000 and doing far more difficult work than other professions.

My mistake, it was Motor Trend.

Back when I used to go to the library to read Consumer Reports, it contained no advertising, and according to sources I can see on the net, it still contains none.

Realistically there is no need for that degree in everyday nursing. It was just pushed basically and became mandatory. If an RN wanted to go into administration for example they would then go for the undergraduate degree. Also, for a couple of years, back in the 80’s, an accelerated programme was made available to qualified mature students. They were able to do the nursing programme in about 2-1/2 years, and after graduating were able to write the RN exam.

Maybe they should bring this back in. We NEED nurses. So many people are overqualified these days in the work they actually perform. For instance there is no reason why, usually a boy, could not finish up his academics after grade 9 and then have the choice of programmes in the school where they could study to be an electrician, carpenter, plumber etc. The same with clerical, secretarial and other forms of admin. Get back those business programmes in the schools and stop wasting time with higher maths, sciences and languages. Academic programmes are a waste of time for many kids. So many boys and girls (if it weren’t for their overly ambitious and pushy parents whom just want to brag to their friends about their kids education), would be able to graduate from school with a trade or other valuable skills. They would successfully graduate with self-esteem and a renewed confidence. They wouldn’t have the stress and pressure of of either they take post secondary training or McDonalds will be it for them. I really believe there would be a lot less depression and drug use in much of the youth today if they were given these choices. Of course some kids excel at academics and genuinely want to become a professional. These other programmes would free up more space at universities.

All respect to great doctors, but Nurses do all the woooork 🙂

That’s a good point. An analogy is iOS vs Android. Someone could rave about their iPhone, and then you read a review about a Samsung Android phone that tells you it’s better. I’m not about to answer that “Android vs iOS” or “Tesla vs non-Tesla” question, but would point out that you actually need to try it out before accepting someone else’s opinion. Because once you do, you’ll be certain of what you like, and won’t need to rely on someone else’s opinion. Oh hell…. I will answer it… Tesla is better 🙂

Hey anyone for a price on 1041 Clare in Fairfield looked like a good building lot cheers

It wasn’t until the late 80’s that graduate nursing students went immediately for their BSN. Right up until the mid 80’s a nursing student who graduated would write the BC Exam in order to receive their RN. Then they were required to work, I think at least one or two years as an RN before they could go for their BSN. This experience working in the field was essential. As a result, most RNs who were employed before the mid 80’s were content with their employment thus never went further than just getting their RN.

Realistically there is no need for that degree in everyday nursing. It was just pushed basically and became mandatory. If an RN wanted to go into administration for example they would then go for the undergraduate degree. Also, for a couple of years, back in the 80’s, an accelerated programme was made available to qualified mature students. They were able to do the nursing programme in about 2-1/2 years, and after graduating were able to write the RN exam.

Maybe they should bring this back in. We NEED nurses. So many people are overqualified these days in the work they actually perform. For instance there is no reason why, usually a boy, could not finish up his academics after grade 9 and then have the choice of programmes in the school where they could study to be an electrician, carpenter, plumber etc. The same with clerical, secretarial and other forms of admin. Get back those business programmes in the schools and stop wasting time with higher maths, sciences and languages. Academic programmes are a waste of time for many kids. So many boys and girls (if it weren’t for their overly ambitious and pushy parents whom just want to brag to their friends about their kids education), would be able to graduate from school with a trade or other valuable skills. They would successfully graduate with self-esteem and a renewed confidence. They wouldn’t have the stress and pressure of of either they take post secondary training or McDonalds will be it for them. I really believe there would be a lot less depression and drug use in much of the youth today if they were given these choices. Of course some kids excel at academics and genuinely want to become a professional. These other programmes would free up more space at universities.

CR’s definition of ‘unreliable’ includes all ‘defects’ – not just ones that would cause your vehicle to not run. I think any EV is going to be more reliable than equivalent ICE.

The Korean cars (EV6 and Ioniq5) are great.

If you want an objective review of EVs, I’d recommend searching youtube ‘Tesla Bjorn’.

Didn’t consumer reports have a scandal a bunch of yeare ago with the Ford Focus being their top rated vehicle? It basically ended with the discovery of whoever is consumer reports top ad buyer, gets the top rated vehicle. I guess with that, it works the same as all media, news, journalism and academic institutions nowadays.

“On the misery spectrum Consumer Reports has the Tesla as the second-most unreliable vehicle you can buy and Volkswagen stands proud at fifth most unreliable. The ID4 was included in the Volkswagen mashup but it scored less than 50 out of a 100.

Hyundai is at the other end as the fourth most reliable brand on the market.”

That’s because whatever innovative spirit Tesla had was an illusion propagated by Elon worshiping Tesla fanboys. Half the people that drive them are more obnoxious than Musk himself. Go with the Hyundai or if you want more of a luxury vehicle I was sent a quote from the Audi dealership to upgrade and the E-tron was $71,000, but obviously with a wait (and disclaimer this was a few months ago and prices do seem to have gone up).

I keep hearing that there has been a rush to get mortgage pre-approvals done. Here’s my question: is it possible to get the actual numbers pre-approvals broken down by region or community and the money value (or value range) of those approvals? Along with a breakdown of how many pre-approvals are high-ratio vs uninsured. That might actually help assess demand and where the market strain is going to be focused on an affordability scale. That data must be held somewhere, just curious at what it would take to get it public. I know mortgage origination stats come out regularly (national and provincial scales), but what about the more granular data that can really offer insights to exploit?

Dangerously close to derailing the entire site here but just one more…..

On the misery spectrum Consumer Reports has the Tesla as the second-most unreliable vehicle you can buy and Volkswagen stands proud at fifth most unreliable. The ID4 was included in the Volkswagen mashup but it scored less than 50 out of a 100.

Hyundai is at the other end as the fourth most reliable brand on the market.

Not a bad solution. Professional roles can be very rigid based on university degree. Top companies are purely competency based. I wouldn’t doubt that the nurse/doctor dichotomy too rigidly clings to the old 19th century class strata.

I think the ID4 is much better value. 82kWh and 4WD for the same price as the 58kWh Ioniq with RWD. Higher ride height, tow rated, vehicle to grid capability.

@ stroller

Looing for an Ev now for my wife. Just cant get over that it is a Hyundai. When you meet a tesla owner they sell it over and over like a paid salesman for the company. I haven’t met a Hyundai owner who has been motivated enough to do this. Also looking for something that has enough storage for a family to go camping. Really love the Rivian RS1 but the wait list is 2024 and its 100k. Though not much more then a Tesla Model Y. And if inflation keeps rising a 100k wont like too much soon.

To resurrect a conversation from a few days back this seems to be even better than the hype had indicated….

https://driving.ca/reviews/first-drive/first-drive-2022-hyundai-ioniq-5

Because they’ve chosen not to. Why do you think civil service has these pensions and doctors don’t? Because they’re not allowed?

Solution to the doctor shortage is having triage nurses that can diagnose anything that’s simple, and pass anything that isn’t along to the doctor.

No need for 4 years of school. No $200k salary. More throughput, and more time for doctors to see patients that actually need it.

Last 2 years have been one of the greatest volume of purchases at the very highest prices ever.

Since they’re paid a % I think they’re doing just fine, and if they aren’t, might be time for a different job.

While we all focus on prices I suspect that a lot of real estate agents are starving due to the lack of volume. I wonder for SFH in Victoria who is the top listing broker?

Right. As you pointed out, fiddling with it might do something, but isn’t the big fix that’s needed, the other ideas from Trudeau (foreign buyers tax, flipper tax) won’t do much either.

The CIBC bank CEO has got the right idea..build more houses, and fast. And improve the transportation infrastructure between new developments and city core.

https://www.bnnbloomberg.ca/homebuyers-dodge-tougher-stress-test-as-osfi-maintains-threshold-1.1697360

“The time is now. There’s really no time to wait on all of this,” said Canadian Imperial Bank of Commerce President and Chief Executive Victor Dodig in an interview that was taped on Thursday.

Dodig called on all levels of government – municipal, provincial, and federal – to collaborate on a solution amid a general consensus “that continued growth in immigration is going to drive demand for housing.”

Not to beat a dead horse here, but the fact is that ALL full-time GPs make OVER $200,000 while the AVERAGE salary for lawyers, accountants, financial advisors, counsellors, PhDs, and realtors is under $100,000. Of course you can find exceptions all day, but that’s not the point. Lawyers average salary in BC is $80,000-$98,000 depending on the source.

To avoid any misunderstandings and any misreadings, let me repeat: doctors make DOUBLE the salary of the other professionals.

So the solution to the doctor shortage is to build and expand medical schools since there will be no shortage of applicants.

In all likelihood there is little or no net rental income at the start. That may change going forward, provided mortgage rates don’t go up.

Makes sense, but that’s not joint tenancy.

This rumour turned out to be incorrect. No change to the stress test rate

My friend’s son has a PHD in the sciences, his first job was in the $150,000 range. If you have a PHD in literature or philosophy, you’re probably struggling. A PHD does not ensure there is any demand for your specialty, most people with a PHD are professional students. Lawyer fees are minimum $200-300 an hour, that’s around $1500 a day if you’re moderately busy. Teachers with a Masters degree are pulling around $100,000 with a strong union, fantastic benefits and a great pension, not bad for 200 days work a year. Not to mention the job security some public service employees have thanks to a strong union backing them.

The physician “pension” is nothing at all like a civil service pension. It’s a defined RRSP contribution type of thing between $4,000 and $9,000 year. Certainly, not gold plated where you get something like 2 X match (I think politicians get 3 or 4 X match of contribution if re-elected) plus defined guaranteed payments indexed for inflation. The doctor’s “pension” is nowhere near as good.

That said, most lawyers do not make huge amounts of money. Probably about 30-40%% make less than $100,000 a year. And that job takes a good eight years of school and training. And many years after that before you become good at that job. A government lawyer would get a civil service pension but in private practice you would not get any retirement benefit – at all and with plenty of risk given the fees (example: real estate conveyance fees).

I won’t speak for realtors as there are many on this board but I always thought the top 5% made obscene amounts of money in the seven figures but 70% were really struggling. I don’t know if that is true in this hot market.

My comment wasn’t thought out? How ironic.

Look up the average income for a lawyer in BC and Victoria.

I can think of several realtors with graduate degrees off the top of my head; the average income for a PhD in Canada is less than $100,000 by many sources including this one.

https://ca.talent.com/salary?job=phd

Lawyers and realtors can make ridiculous money. 10 years education for a realtor, what a joke. Your comment was not thought out.

Isn’t it true though that family doctors make $200,000-$250,000 a year in Victoria? Plus can pay into the physician’s pension?

PhDs, accountants, counsellors, lawyers, realtors, and financial advisors rarely if every make that kind of money and they can’t usually sell their businesses either. Some of them have 10 years of education as well.

Given the priority of money in today’s culture, I would think the solution to the doctor shortage lies more in increasing the number of medical school spots.

Mortgage stress test going up by 50bps tomorrow apparently

PM has told the minister of housing to investigate higher down payments for investors.

The latter could take some wind out of the market. Mortgage stress test should affect the market, but it seems to have lost all power since about the end of 2019.

Right. In BC, it’s a minimum of 4 years premed + 4 year’s med school + 2-6 years specializing.

All told that’s 10-14 years. Some people take longer than 4 years of pre med

Kenny G is right that it is very common in second marriages particularly when people have children from previous marriages.

We wonder why we have a doctor shortage, when I went to university, you could apply for medicine after 2 years with the right courses. Now it’s 4 years and I’m not sure how long in medical school and residency. I’ve heard a total of 12 years. Who in their right mind would put their life on hold for that length of time to probe around people’s nether regions. There are much easier ways to make money if you are that intelligent.

Thanks Patrick. Don’t mind paying for it and travelling to Vancouver. Didn’t realize this was even legal!

If you want first class family doctor based primary care (e.g a 3 hour annual multi-disciplinary assessment instead of the usual 5-15 mins with a busy doc ) , and don’t mind paying for it, and travelling to Vancouver, there is the Copeman Clinic.

Copeman is their old name, they recently got bought out by Telus. https://www.telus.com/en/health/care-centres/locations/vancouver-nelson

<

blockquote>

The article you mentioned wasn’t counting “investors”, it was counting people that are listed as owners of more than one property. There are lots of reasons why a person like might not be an investor. It may be a cottage for part time use, a house for a family member, part of a divorce, temporarily owning two while you sell one etc.

Recall that 25% of land transfers in BC are among family members, who may be misidentified as “investors”, and not even taking part in a market transaction.

Let me know if you find data on the type of “actual” investors we are all taking about here.

Flow would be the net flow. Maybe there’s more investors selling than buying, which helps the market and lowers prices. Your source articles only looked at the buyer side.

“How common is JT w/o right of survival”

‘

‘

It’s very common for second marriages or marriage later in life to have home registered as tenants in common with a life interest in the home for the surviving spouse or a set time period for them to stay in the home.

Primary care physicians in private practice or employed by clinics/hospitals are not government employees. Vast majority are independent contractors.

I miss old school doctors. My new doctor only ever worked part time and lasted three years in practice and couldn’t find anyone to take her patients so here we are without a primary care physician as of next month. Anyone have any tips?

Yes, I too was an ER physician who worked until I was 68; the first 25 years in the hospital and the last 20 in an Urgent Care Clinic. Many of my colleagues worked well into their 60’s. Comments about no pension, high overhead etc. part of the reason. As is the scarcity of new doctors to take over from us. Also, unlike other types of “business” we cannot sell our practice’s to retire. I loved my work which made it much easier.

Re: Small Time Developers comment ….wow, what a privilege to buy a house for 1.4m to 1.6 m and have to have tenants living there to get your net out of pocket to ~3k. What about taxes on your net rental income off gross of 24k. Oh right, the government ees will decide f$ck that and hope they can fly under the radar of the taxman.

Anyway, the state of affairs for an any avg family needing tenant income to make things work can’t be ideal. But that is another cost in the equation and I suppose there is ample need of rental suites.

It’s part of the problem. But when you see an unprecedented rise in housing prices clear across the country, while population growth has dropped off, there has to be more to it.

Totoro posted a multi point list a few threads back which I thought was pretty much on the mark. The commoditization of housing is most definitely part of the problem and owner-occupiers are very much part of this. People simply would not be willing to pay today’s prices if they didn’t think they could sell for more.

Thanks for the clarification Barrister. How common is JT w/o right of survival?

“Nothing compares to the generous pension and benefit packages government employees get.”

It’s really not that great.

https://www.bnnbloomberg.ca/feds-eye-foreign-buyers-ban-on-non-recreational-residences-end-to-blind-bidding-1.1697008

This will have no material impact on supply. Government really does not understand what the problem is or is just being political. Dear NDP and Liberals availability of useable land and too many delays in getting approvals is the problem. How many years has the burn down building across from city hall been trying to get something approved.

Victoria could probable fill 100/ 100 to 150 residential buildinging in the next 5 years if they were built.

Patriotz, Since you do like to be picky, joint ownership transfer of an estate might be part of the estate transfer depending on whether the joint ownership is or is not by way of right of survival. Both would mean a change of title though.

“Regarding baby boomers not retiring: I have two old friends, one a psychiatrist, the other an emergency physician. Both are over 65 and have been working 40 years. I also know a surgeon who is in his 70’s and still working.”

‘

‘

‘

After working with clients for over 20 years I would have to say that Doctors probably have some of the worst money management skills and many are working by necessity rather then choice.

Far from it, none of them have a government pension. A common misconception, they also have no disability insurance or sick time. They are paid a fee and have zero benefits. I know, I was a Chiropractor for 16 years. You also have overhead and insurance to pay out of pocket. Nothing compares to the generous pension and benefit packages government employees get. Please get your facts straight.

“You realize that your buddy who’s an emergency physician and the other that’s a surgeon are government employees right?

No pensions for Doctors. Normally incorporated like any other business, as they an office and staff. Recently the government looked at taking away the corporation tax benefits for doctors. But that was shut down loudly.

You realize that your buddy who’s an emergency physician and the other that’s a surgeon are government employees right?

Regarding baby boomers not retiring: I have two old friends, one a psychiatrist, the other an emergency physician. Both are over 65 and have been working 40 years. I also know a surgeon who is in his 70’s and still working. I feel they are extremely dedicated to their profession and realize the importance of the work they do. They also realize the lack of people with their qualifications, making them almost irreplaceable at a time when there is a shortage. How many government employees work 40 years? Probably none thanks to the generous pensions they have bestowed themselves. I also know an intelligent young woman who opted not to pursue a career in medicine because she didn’t want to put her life on hold for 12 years. We have a serious problem here.

“Good or bad for society?”

Bad, crazy and entitled.

Investors now make up more than 25% of Ontario homebuyers, pushing prices higher, experts warn

Admittedly an Ontario story. And the homeownership rate, whatever it is (I think Victoria is actually lower than 68%), is not indicative of the present buyer mix. Stock versus flow.

So not downtown, not Sooke, let’s just ban development everywhere.

Where’s your data/evidence to support that statement? Home ownership is at or near all time high (68%). And the “investors” (landlords) are the ones that aren’t homeowners, implying that investors are at or near an all time LOW.

Thoughts when you see an article like this: https://www.sookenewsmirror.com/news/group-calls-for-moratorium-on-new-development-in-sooke/

Good or bad for society? Being a builder I am biased, but what’s the general consensus?

The data also show clearly that first time buyers are getting unprecedented levels of parental support. This is being enabled, of course, by rising RE prices and lower interest rates that enable parents to borrow large amounts of money against their own houses. The same factors are enabling investors to comprise a historically large % of purchases.

It may be obvious to you and me that millennials are the buyers supercharging this market runup, but it isn’t to many people here. We have been told for years that millennials are shut OUT of the market, meaning that they aren’t the ones buying homes. We are told that home prices are out of reach of the young. But it turns out that the data show clearly that this is wrong. They are in fact able to buy, and it is happening NOW. This is good news, and entirely normal, and expected. The point being, this is a demographic driven boom, and it is in the early stages, and will continue for many years. The bad news is that we haven’t prepared for this by constructing the needed homes .

”Flippers” are one of those invisible boogeymen that people here say “must be targeted. “, even though they have little or no role in the runup. We have an excellent HHV article on flipping (above ) concluding that “ I don’t think flippers have much influence on the market at these levels.”. And you say it is obvious that millennials are supercharging the market. Yet your recommendation is that we take action against flippers. Makes no sense to me.

What should we do? Government (and voters) should realize the demographics require construction of many more homes (of all kinds) , and fast. Make this a priority, and overrule the nimby city governments. And stop wasting time targeting marginal/irrelevant groups as a solution to the housing crisis.

I went for lunch with a mortgage broker yesterday. The mortgage broker has financed for a local credit union 150 million in loans last and this year pulling in a commission of over 700k each year over that time. His prediction was the market will go up another 10% in the next 6 months based on low interest rates and supply before flattening when rates start to trickle up. The newly built middle class home he says is the 1.4 million to 1.6 million dollars range. 1.25 million dollars of debt is 5k a month offset by a 2bedroom suite being rented for 2k a month. Leaves the cost to the family 3k a month mortgage. Which most two government worker families can afford. Rents are up helping offset borrowing. It will take a big jump in rates to soften pricing. Time will tell.

Bank of England surprises by hiking rates 15bps. Inflation scarier than Omicron to then

Good points Frank. I think the work at home boom is a big factor too. A young couple with no kids might now need a 3 bedroom place – that’s one master bedroom, and a home office room for each of them (to replace the office space they had at work).

Patrick i dont get your arguement. Of course millenials are supercharging the RE market….for most this is their first home, representing pure demand…..this group has been continually squeezed by the market. Is it any wonder when interest rates hit zero a bunch of younger buyers take the chance??

We should be expecting this to happen as time goes on. What our market doesnt have room for is the flippers/investors.

Also, Frank hit the nail on the head for the second piece of the puzzle – life expectancy. This not only ruins the RE market but the better paying jobs become harder to get due to an increase in the average retirement age.

$1.105M

If anyone could provide the sale price of 994 tulip ave. it would be greatly appreciated. Cheers and Happy Holidays HHV.

Patrick- It’s not just millennials, it’s the overall demographics of today’s population. Baby boomers were once the predominant age group and many were home owners, as were their parents. Baby boomers are dying out slowly, but some will live well beyond life expectancy and remain in their homes. Some boomers still have parents living in their home as they have for decades. Now we have the final piece of the perfect real estate storm, children of the boomers coming of age and wanting their own home. This has probably not occurred before, 3 different generations occupying 3 different properties at one time. Lots of my friends are examples of this phenomenon. My grandfather died when I was 5, my mother and I lived with my grandparents. My mother stayed home to care for my blind grandmother. 60 years ago people had a much lower life expectancy and one home satisfied the needs of a family, today, one family needs 3 separate homes. I know lots of millennials still live at home but many of them are now in their 30’s, even 40’s and want to have a place of their own.. Maybe this explains the housing shortage.

As a counter to the bogeyman theory favoured by so many here, that various small invisible groups are responsible for the housing price run up, the most recent being “flippers” and “speculators.” And of course how we must “target them,” typically with new taxes, disclosures and “CRA crackdowns”.

Time for a dose of reality, courtesy of the Wall Street journal, with this article describing the reason behind the “supercharged” housing market…millennials! The largest cohort in history. They find that millennial buyers have now risen to an incredible 2/3 of first time mortgage applications. And are already 37% of repeat buyers.

Millennials Are Supercharging the Housing Market

https://www.wsj.com/articles/millennials-are-supercharging-the-housing-market-11639496815

“The generation’s growing appetite for homeownership is a major reason why many economists forecast home-buying demand is likely to remain strong for years to come.

But most housing analysts don’t expect a wave of sustained home price cuts for quite a while. They say the pandemic and the emergence of remote work accelerated millennial home-buying trends already under way. Young families living in apartments decided to buy houses in the suburbs or leave expensive cities for cheaper ones. Millennials who already owned homes traded up for more space.

The generation accounted for 67% of first-time home purchase mortgage applications and 37% of repeat-purchase applications in the first eight months of 2021, according to CoreLogic. And as the largest cohort of millennials turned 30 this year—below the median first-time buyer age of 33—those percentages could rise higher still.”

I see it a little differently. Out of town buyer comes and they buy up one home and it’s out of the inventory for the forseeable future.

Flipper buys with the intent of making some key renovations and putting it back on the market.

However I do agree that if flippers jump in en masse that it puts short term pressure on the market. We certainly don’t want them to make up 10% of the market. A crackdown from the CRA would help here, as I suspect most are coasting under the primary residence exemption. They should at least be taxed.

From: https://www.reuters.com/markets/us/fed-prepares-stiffen-inflation-response-post-transitory-world-2021-12-15/

Where the US goes on interest rates, Canada is sure to follow or be in front (Canada already tappered bond purchases), but I imagine the bond markets will be moving quickly ahead of the anoucements. Anyways, I am sure people haven’t over borrowed and have ample freeboard in their finances to absorb the increases to the cost of borrowing along with everything else that demands their cash.. lol..

A luxury condo project would generate millions and millions in revenue between the three levels of government (GST, PTT, DCC, Permits Fees, etc.) You take these millions and go where you will get best bang for buck for affordable units. For example, buy a building for affordable housing across from Costco in Langford (amenities close, transit to downtown not too bad, etc.). Not sure why politicians are always pushing affordable housing in the most expensive locations like waterfront downtown (Northern Junk for example).

Then you have hundreds of thousands of annual property taxes from that building and I highly doubt more than half of that would be cost for the city (a luxury building, i.e. higher tax asessment, can’t cost the city more in terms of expenses versus a lower end building). Would have one water main, one sewer main, would need limited fire fighting resources and I am guessing increase on policing resources other than investigating parkade break-ins would be minimal. You take this surplus of revenue and you invest in more affordable housing every year.

That’s the theory…..but reality is a new building comes online generating $500k/year in property tax COV will just hire more people and create more policies/bureaucracy to protect those new jobs. Instead of taking 6 months for a building permit they just push it to 9 months. Rezoning process take it from 3 to 4-5 years, no big deal.

BC Housing instead of diverting funds to affordable housing will open another branch to administer another baseless/useless exam.

Yeah. What good would that do.

Ah Marko, I value everything you post but …… “the retired person in the condo will be paying massive property taxes which can be used towards affordable housing’?

I would truly love to see you sketch out the cash flow from a confiscatory tax towards the blooming of housing that is “affordable” administered by “civil” “servants”.

After all, you have had opportunity to closely observe (as a businessman) the machinations of the entitled, faceless, worthless, grey blancmange responsible BC Homebuilders Exam. Is this (pace Dr. Johnson) the triumph of hope over experience?

So the government got all worked up about people selling disinfectants on Amazon for double the retail price at the beginning of COVID but when a 4k sq ft lot in Langford now selling for $600k (during critical shortage of housing) – nobody even mentions it? What did they call it back then – “price gauging”? What a laughable scam our RE has become!

Thanks for this Leo! I know you mentioned in previous posts that small percentage increases of out of town buyers can make a big impact. I’m guessing the same isn’t true for houses being bought and sold over the short term?

Come to think of it, didn’t you also “aimlessly” build a mansion on the Peninsula only to soon decide that it wasn’t your cup of tea? 🙂

Basement suites aren’t sitting vacant so where do those 300 displaced basement suite people go?

Personally, I just can’t wrap my head around the “we don’t have a supply problem” argument. Obviously 1.3% mortgage interest rates and the fed’s printing money doesn’t help the demand side of the equation but at the end of the day one way or another you need roofs over heads and the number of truly vacant properties is small.

In the basement of a SFH probably, or they would displace others in the rental market with lower incomes into those basements. Net effect would be SFH a bit cheaper due to less rental demand for those basements, but it wouldn’t affect the core demand for the SFH themselves.

I bought the condo out of boredom 5 years ago, lucky it is up 150,000 euros since then. From a big picture perspective completely, asshole move on my part as it makes real estate less affordable in Croatia and a family could be living in it while I keep it vacant 9 months of the year.

Travelling, also an asshole move on my part BUT in my defense I don’t pretend to care about the environment. I am part of the problem; it is what it is.

It isn’t a substitute by any means but if the downtown tower didn’t exist where would those 300 people physically live? (Once again the fed policy of mass immigration stands on its own so population goes up whether we build, or not).

My client I mentioned that works at the hospital and bought a pre-sale will move into the pre-sale and will vacate her basement suite which someone else will occupy, etc.

Also, the high-end building on Oak Bay Ave everyone is complaining about two million condos, but I don’t really see the problem. Someone retired will sell their $2 million SFH in Oak Bay to move into the $2 million condo. A well to do younger family will buy the $2 million-dollar SFH and sell their $1.4 SFH, etc., etc.

Not to mention the retired person in the condo will be paying massive property taxes which can be used towards affordable housing, etc., or just hiring more 6 figure useless municipal staff. The insane strata fees will support a janitor for the building, etc.

Inventory whatever it may be (condo, apartment, luxury, affordable, sfh, etc.), as long as not sitting vacant, is a plus in my opinion given the housing crisis. Spec tax has shown not much is sitting vacant. Finally, assuming we are concerned about the environment condo/apartment is a better way of housing vesus sfhs.

Personally I am totally fine with clearcutting on the Westshore, it would just appear the everyone is concerned about the environment so you would think they would not prefer that option?

“A tower downtown is 100-150 SFHs LESS on the Westshore. Less cars, less traffic, less population, less infrastructure required, less ongoing energy consumption.”

Aren’t most condo units studio or 1 BR? I don’t see how that would be a good substitute for an SFD.

A tower downtown is 100-150 SFHs LESS on the Westshore. Less cars, less traffic, less population, less infrastructure required, less ongoing energy consumption.

If towers were being built downtown and the units were sitting vacant then I could see an argument, but they aren’t. There are physical people actually living in these units that would have to live elsewhere otherwise.

As far as population growth, talk to the feds. If the policy is mass immigration a better way of dealing with it is density versus sprawl, imo.

Except that we are clearcutting Sooke.

Many folks, rightly, love to poke fun at certain goofball arguments NIMBYs throw out there. Well, this is a goofball argument of the YIMBYs: that by densifying the core, Sooke and Langford wouldn’t continue to get paved over.

In reality, both densification and clearcutting are inevitable given people’s desires and current levels of population growth, and to say that the former would prevent the latter is disingenuous.

oops