Bubble watch: has anything changed?

Though he has moved on to the pensions field, the old boss of CMHC was making news again this week on the topic of housing. In an interview with CTV, Evan Siddall said “I really don’t think we’re in a bubble. If demand is going up and supply is not, prices will go up, that’s not a bubble.” Is he right? Well he doesn’t have the greatest track record as a prognosticator of housing, but it’s a worthy topic of discussion especially if you’re wondering about whether it still makes sense to jump in to the market now or if it’s primed for a big dip.

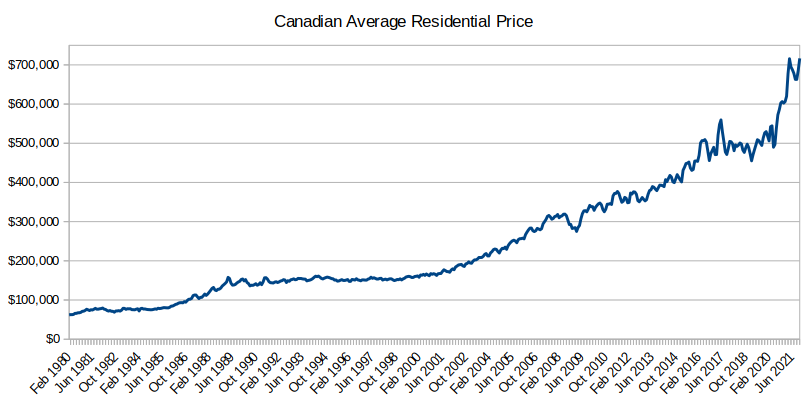

In some ways, a bubble can’t be positively identified until it has popped. I’d say we’d need to see at least a 20% drop in prices to say that what came before was a bubble. We’ve heard the Canadian housing market be called a bubble hundreds of times for decades, and despite going in radically different directions from the US market especially after 2008, so far there’s been no crash. Even if today’s prices are a bubble, those calls were clearly incorrect. A 20% drop in national prices would only bring us back to July 2020.

Clearly house prices cannot continue to outpace incomes forever, but it’s anyone’s guess when the trend falls apart. Most owners today – certainly in BC – have never experienced a protracted fall in house prices and that recency (or not so recency) bias is a powerful psychological force that has convinced most Canadians real estate is the invulnernable investment with zero risk. No wonder that the rate of investor buyers has been increasing. Many of these “investors” are just parents buying for their kids, hoping to get ahead of a market that is rising faster than anyone’s income could possible keep up.

Back to Evan’s prediction that this is no bubble though. Although I’m acutely aware of the extreme supply shortage in Victoria (and across most of Canada) and am diverting a lot of my energy to change the system that causes it, I’m under no illusion that the chronic supply shortage is the main cause behind our post-pandemic price jump. That was clearly more to do with an explosion of demand caused by ultra-low rates, combined with spending redirected to real estate hitting an already pretty tight market, along with a migration of people that put intense pressure on small to medium markets like Victoria. In that sense I don’t agree that just because there’s a housing shortage we can’t possibly have a price bubble. Housing demand can definitely swing between the rental and resale markets faster than supply can keep up, and that can cause price spikes and drops.

That said I also don’t think we’re in for a 20% drop in national prices and therefore agree that I wouldn’t call this a national bubble by that definition. I think our high prices are a serious problem for the country that will drag on growth and stifle the economy, but I still think that the more likely scenario is an extended stagnation in national house prices which will be a very painful shift for those banking on never-ending growth.

But national prices are of secondary importance for buyers in Victoria. In 1981, Victoria prices collapsed by 40% while national prices increased. Overall, national prices are an aggregate of many different markets that aren’t necessarily synchronized, so they have less volatility than prices in any individual city.

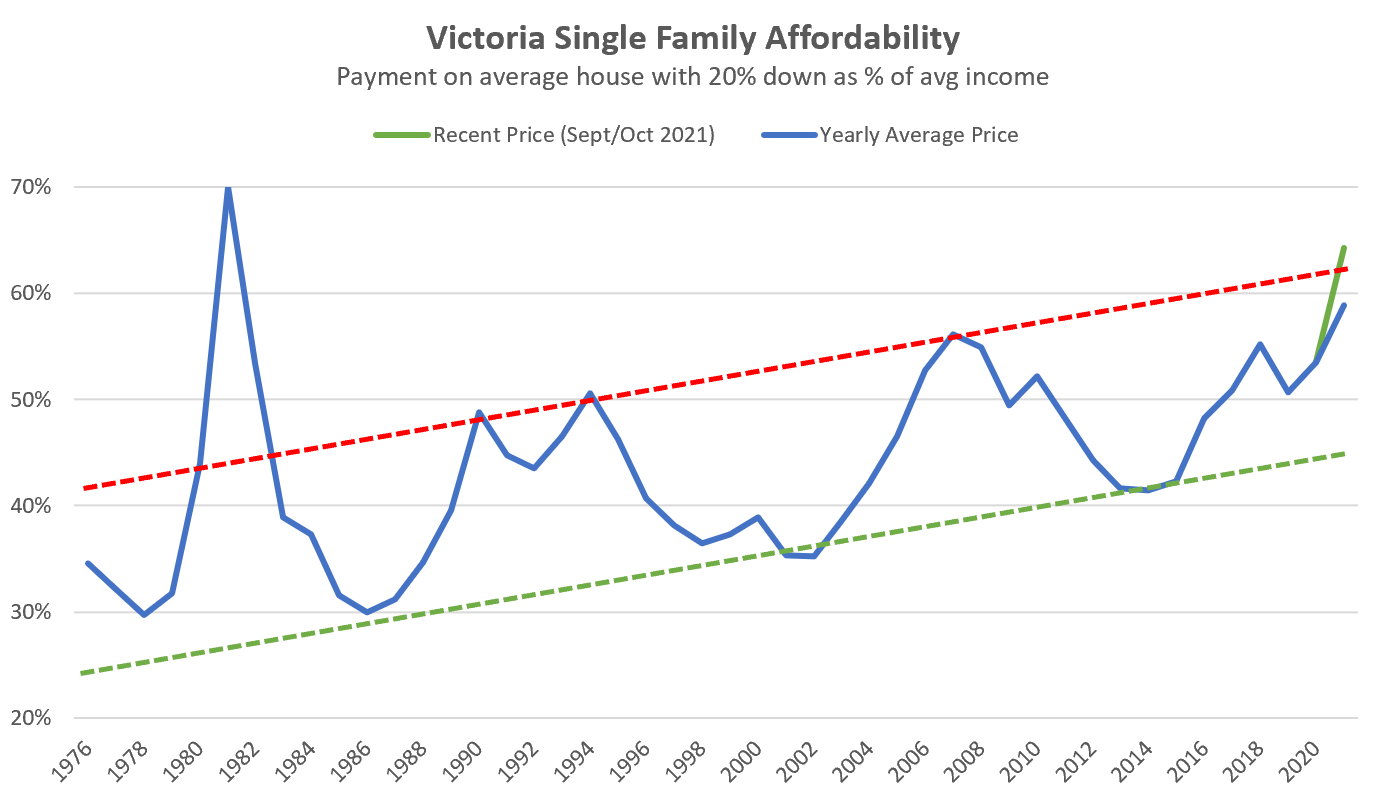

Back in February after prices had made their first big jump upwards, I examined the question of whether this was a bubble and concluded that it wasn’t. Now that prices have jumped again for both single family and condos, let’s revisit that analysis and see if the conclusion has changed, starting with single family homes. As we know, in a densifying city, we should expect single family homes to become consistently less affordable to local incomes over the long run, as they become an ever smaller part of the total housing stock.

Back then we were seeing properties selling 25% above their recent valuations, and after that initial jump early in the year, single family prices took a bit of a pause. That kept the yearly average ($1.21M) at less than the level tested back then and within the historical range. However with recent prices going up again to over $1.3 million, we are heading into concerning territory despite continued low rates. Is it a bubble? Not like it was in 1981 where affordability spiked way above the historical range, but it’s getting up there. In the short term though, market conditions still are pointing up, even though we are now at levels of affordability where we’ve seen a turnaround and plateau or moderate price decline in the past. Remember these charts are using yearly average prices, and a lot of volatility can happen within a year that averages out.

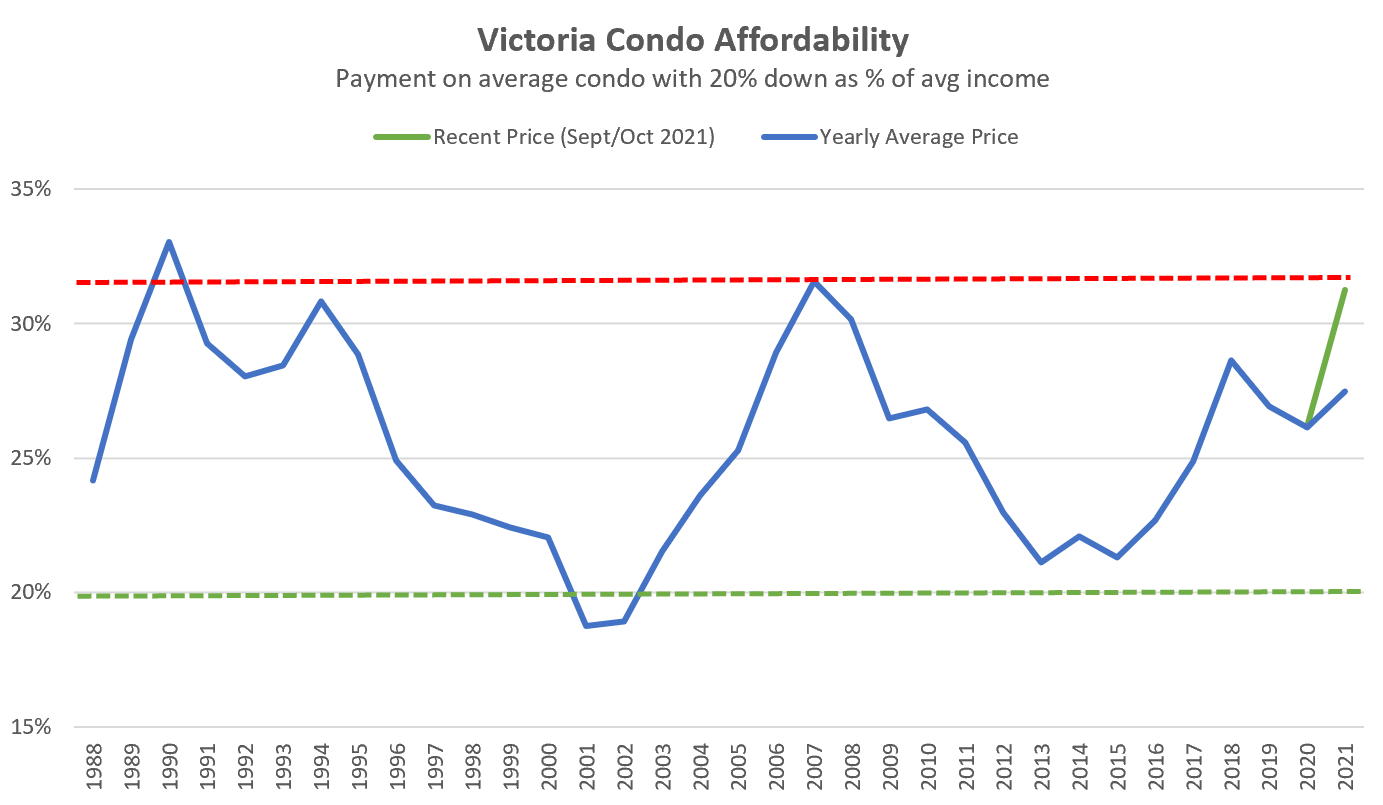

What about condos? Well last time those were in an entirely unconcerning range in the middle of the affordability spectrum, and if you look at the year to date average price that is still the case. But prices have jumped in recent months, and with that affordability has deteriorated significantly. Still not as stretched as the detached market though and despite those recent price gains I still think there is more to come before the market slows. What seems to be clear is that the stress test has completely stopped working.

As a caution, it’s worth revisiting the list of provisos from the last article to go with this data. Interest rates are broad market averages, incomes are a couple years out of date, long term trends are eyeballed, and there’s no guarantee the future will be like the past. These aren’t precise forecasts, just rough guidelines on where we might be on the affordability front.

In conclusion then, despite even more price gains I still don’t see any clear evidence of a bubble that would lead to a 20%+ price drop. Affordability measures are getting concerning especially in the detached market, and of course all this is built on people getting ever larger down payments together, partially funded by extracting past equity gains from parents. It’s also worth remembering that affordability recovered in past cycles via dropping interest rates, not dropping prices. That might still be possible (rates could drop further), but it doesn’t seem overly likely. What will happen when consumer sentiment sours on real estate and there’s no Bank of Canada easing to compensate? Will there be enough out of town demand to keep prices stable or are we in for something new?

@Mt. Tolmie Foothills

Tramatizing is the wrong word….what you’re looking for is pathetic or laughable. Everytime I see a 70s or 80s house listed at market rates i just laugh at the mediocrity. And then someone snaps up the home in 2 hours lol

Now we are talking! I am always up for some cli-fi!

I spent some time reading through the materials and here is my take on what they state:

People with money in developed countries will be much better positioned to do okay.

In terms of what this means for you or your children, I would think that local agricultural will rise in importance eventually as traditional sources literally dry up. Having land will probably be more important and more difficult to obtain.

I don’t know what else or how likely any of these predictions are, but they don’t seem ludicrous to me. Access to enough water is going to be huge in the future. Just not certain given that technology may offer solutions and possibly some countries will move faster than expected to address climate change.

A few happy thoughts for your evening. And check the flood, fire, tsunami and liquefaction maps before you buy.

Totoro, the sight of that 1970’s kitchen is traumatizing to millennials.

This doesn’t inspire confidence:

I clicked “2022 Canada Predictions” and the third bullet point is:

Alberta government to cut corporate tax rate to 8 per cent, the lowest in Canada.

Well, Alberta’s corporate tax rate is already at 8% and has been since July 1, 2020.

https://www.alberta.ca/taxes-levies-overview.aspx

current council meeting https://colwood.civicweb.net/Portal/Video.aspx

Some good NIMBYism taking place….neighbours

“We might be too focused on providing housing.”

“It is not up to Colwood to fix the housing problem….”

Yes. There is a lot of information on the site.

Maybe read the climate wars series starting with Canada, which is less bleak than the US, which is less bleak than Mexico, which is about as bleak as a lot of South America: https://www.quantumrun.com/prediction/canada-and-australia-deal-gone-bad-wwiii-climate-wars-p4

Am I missing something? Their environment predictions seem to be kind of no-brainers. Like:

“Major Canadian cities will see temperatures rise by 2050.”

No kidding! BTW I don’t disagree with you that Victoria will be a better location than many in a changing climate. Few flood prone areas. Not so susceptible to many forms of severe weather. Drought manageable. In general the models show us warming up a bit slower than the global average thanks to the ocean’s moderating influence. I do expect wildfire to become a bigger deal on the island than it has been.

For those interested in the next 20-30 years and climate change predictions this site is interesting: https://www.quantumrun.com/country-predictions/canada

Victoria is probably going to be a good place to be earthquakes aside. Other places not so much. And house insurance for natural disasters is going to be expensive or unobtainable.

They wouldn’t if the math doesn’t work. Seems like it does not.

Prices are what they are and we each have a credit limit. You have to start somewhere and savings are not going to get you a SFH in the core at median incomes for the most part.

The options now in the core for a SFH at median income are:

– property ladder over time

– co-ownership

-co-signor and a suite for affordability

-change your idea about what is suitable

https://www.realtor.ca/real-estate/23885790/8-1701-mckenzie-ave-saanich-mt-tolmie

https://www.realtor.ca/real-estate/23879131/16-1705-feltham-rd-saanich-gordon-head

It would be great if houses were dirt cheap, and every family got a nice house in the neighborhood they wanted. This just seems impossible now, when the population grows by 5,000 people per year, and we’ve stopped building many new SFH. I know young people in the same position as you, and I know it’s tough.

Anyway, I do hope you find the house you’re looking for. Thanks for the discussion.

Ah, right. Because why would a Victoria family with median income and decent savings think they could ever buy suitable housing anywhere other than Langford? How entitled! Victoria is full! And at this trajectory soon even Langford won’t be affordable either. Then I suppose they should all buy out in Sooke to start on the property ladder? When does it end Patrick?

Most people would include Westshore as part of Victoria. You aren’t insisting on living in the City of Victoria are you? I’m talking about the first, and lowest rung on the housing ladder for a family with $100K income. And that means a $700K townhouse in Langford, and sorry, but there’s nothing wrong with that.

*Assuming they have no debt and a sizable downpayment. Until then they have to somehow amass the downpayment while paying an average of $2103/mo in rent for a 2 BR unit, all while prices appreciate far faster than they can save.

And so to be clear, you’re also saying there’s no affordable, fit for purpose family housing for median income earners with decent savings in Victoria? Because that is kind of the whole point I’ve been trying to make…

My God you’re insensitive. Shame on you.

Regarding your cartoon…. Yes, the terrible housing situation facing people under 30 shown in your cartoon. Imagine having to choose between your stock portolio, and owning a house in your preferred neighbourhood. Surely the government can intervene, so these young people can get both of these at the same time, before they turn 30. If not rectified, these young millennials would be the first generation in history that would be expected to sacrifice something for the benefit of their young family.

A family with $100k income can get a 3bdr townhouse for $700k in west shore. That’s fit for purpose for a family. I know that’s not good enough for you, which is fine, you seem to have higher requirements than most, but we are talking about what is affordable/attainable for average incomes, not what is desirable for the higher income crowd.

$100k family income could be two dishwashers, getting jobs like the $50k/year dishawasher jobs in Kits https://www.google.ca/amp/s/www.cbc.ca/amp/1.6221645

Ah come now Patrick! Why the hyperbole of the uplands? And TVs? It’s about what is fit for purpose here and you know it.

Could a big family crowd around a 7″ tablet to watch TV? Sure but this is not fit for purpose. And if the 7″ tablet is all that family can afford that doesn’t mean “TVs are affordable”. If the fit for purpose TV is $400 and the median family only has $300 then yes, TVs are not affordable would be an accurate general statement.

I would be very surprised if the majority of buyers now would be happy with the home they bought given the price they paid, unless they are moving from a more expensive market.

The image was from a housing forum for Ontario but still relevant to our situation here.

OK, that was just a figure of speech, describing comments people make when they’ve just bought a home. But feel free to replace that phrase with a “home that they’re happy with’, as it wasn’t part of my point.

Huge EV uptake in China.

https://twitter.com/NatBullard/status/1470514187705384960

“Right. “It” being a home. And most people have enough money to buy “a” home. Not a house in the Uplands. But one of the 50% of homes that sell BELOW average price.”

I feel like you are conflating “home” and “single family home.”

“with an unexpected announcement that they’ve found the home of their dreams and have bought after all.”

Come on man, I realize you are on a crusade to convince nonbelievers that homeownership is the way, but I don’t think I’ve met anyone who actually owns the home of their dreams. I’ve bought two homes now and both times I was hit with instant buyer’s remorse on taking possession. It eventually wore off.

I definitely prefer homeownership to renting, but it’s not all rainbows and unicorns either.

Actually, over 50% of homes sell below average price. Sorry, couldn’t resist. But that still doesn’t mean that “most” people who don’t already own are able to buy a property.

Right. “It” being a home. And most people have enough money to buy “a” home. Not a house in the Uplands. But one of the 50% of homes that sell BELOW average price.

The average TV might be $400, but you can also get one for $99. If I have $300, does that make TV’s unaffordable to me?

Affordable in the context of housing doesn’t mean that most people can buy it or that it is not expensive. Leo has set out a definition based on rates/income. I do note that the dictionary definition has a number of meanings, most commonly the vague “that can be afforded; believed to be within one’s financial means”.

Fatigued buyer,

There have been a few posters like you here over the years. They’ve decided prices are headed down, and they want to encourage others not to buy as well. That’s all fair enough. However, most of these “bears” end up “shocking” the HH forum here with an unexpected announcement that they’ve found the home of their dreams and have bought after all.

As I recall, they’re all instantly delighted with their purchase. And they forget about all their amateur economist positions about where interest rates are headed, or what the inversion of the yield curve means. They just enjoy their new house, and get on with family life.

But can we agree on the definition of the word affordable? Because you keep using it as though if someone can scrape together the funds to buy something, it’s affordable. That’s not the right usage of that word.

Collins dictionary: If something is affordable, most people have enough money to buy it.

Cambridge dictionary: not expensive

Merriam Webster (afford): to manage to bear without serious detriment

Housing in Victoria, and many places in Canada now, doesn’t fit those definitions. Maybe ‘possible’ is a better word? Housing is possible in Victoria now, and was more possible before? But please stop using the word affordable to describe something that is unequivocally not affordable.

That all said, you’re right! Housing is possible for me! If only I was clever enough to put my family in financial peril by completely emptying our savings to get in!

Thanks for the explanation. I’ll take your advice and ignore the values on the Y axis. And we can agree to disagree on whether or not homes are “unaffordable” (the typical HHV view) or “still affordable” (as I see it)

Yes, that’s a reasonable position that you’ve taken. As I recall, you’re renting a house, even though you could afford to buy one. But you’re not prepared to sell your other investments to make that happen. And you don’t want to over leverage yourself.

As I said, that’s an entirely reasonable position. You do have to live with the reality that there are plenty of people in a similar position to you, that are prepared to empty their stock and bank accounts to buy the houses that you’re passing up. Those people are clever enough to realize that 75% of their mortgage payments are forced savings, so they don’t need to rely on stocks and GICs as much as you want to.

Time will tell who is right, and maybe your “wait and see” will be prove to be right. You’re the one that lives with monthly down the drain rental payments and getting jerked around by your landlord from time to time. But that’s what you’ve chosen for yourself, your family and your pets

For the record I’ve always though that homes are affordable and this includes now. To me, the oscillations on Leo’s graph range from “super affordable” to “still affordable”, yet some people label that as “un-affordable”, which I disagree with. The mere fact that we are at record high home ownership, record low mortgage delinquency and multiple bids for homes for sale makes it pretty clear that homes are affordable at current prices

Leo, have you seen this video on the ID4? https://www.youtube.com/watch?v=EotuxCptcM4

And that comment is accurate. I really don’t understand how to explain it to you any better than I already have Patrick. I can’t tell if you are willfully misunderstanding just for the argument or actually not getting it.

You seem to have this idea that the chart represents what the average holder of mortgages is paying every month. It doesn’t and it was never intended to. The whole point of the chart is to be a measure of the affordability of current prices for the incomes of people who are needed to sustain the housing market. It doesn’t measure what existing owners are paying because 99% of those owners have no influence on the market so that would be irrelevant. Ideally we would have the full data series of exactly what first time buyers are spending, what their incomes are, their debt level, and the rates they are securing, but we don’t have that information so we use a proxy.

The reason I say ignore the values on the Y axis in favour of the current reading in the historical context is that we could make any number of different assumptions that would shift the chart up or down. I could use average individual income instead of household. I could assume 10% down, or 25%. I could subtract 1% from my rate series to get to roughly discounted rates. None of that changes anything meaningful about the chart. I’m all ears for how to make it clearer, but it seems most people do understand how to interpret the chart.

Banks stocks pay excellent dividends. I use to dislike banks and their fees and profits. Make sure your portfolio has lots of bank stocks!

The prospect of increasing interest rates appears inevitable given the inflation we are experiencing in practically every consumable. A no- brainer, right? Interest rates have never been lower, yet bank profits have never been higher. It seems counterintuitive, but banks love the negligible rates they can borrow at and lend out at exorbitant rates to credit cards, loans and mortgages. Not everyone gets 2% or less. I think it makes a smaller part of their business than we think. Also, the low rates are critical to our government’s love of spending money, and inability to produce a balanced budget. Our current one trillion dollar debt will cripple our country if interest rates go up significantly. Therefore, even though the banks and government supposedly do not determine interest rates, I’m sure they have more influence than we think. So maybe we should expect interest rate to remain artificially low and prices to escalate. This probably won’t end well but in the mean time institutions will rake in huge profits.

While we’re digging up old comments:

Rates are expected to rise multiple times in 2022 and beyond. 10 year terms are already over 3%. Median family income of 100k, even with a whopping 200k down payment, isn’t even getting a townhome outside the core anymore with a 10 year fixed mortgage. Unless the family is comfortable/happy in what they were able to afford for the next 10 years, this is pretty bad advice.

I think there’s already going to be a lot of buyers remorse and regret in the next few years. Don’t let your emotions cloud your good judgement people.

Patrick man, you’ve got to give Leo a break. The guy is spending a lot of his time trying to make sense of the markets and publishes a lot of interesting opinion pieces and statistics.

If you have all the answers or have better data to share, why not start your own blog?

I would certainly feel for any “poor souls” who take your advice and over leverage themselves into a rising-rate market that you still claim is affordable.

Well if you want to be transparent about the data on the chart, why not include in the footnotes to the chart, the same comment you make in forum discussion . I’m referring to this comment of yours . “ The values are irrelevant. Forget the values completely…The only thing that matters is the current reading in relation to the historical range”

As it is, of course people pay attention to the values (?why wouldn’t they), and they say “OMG, people are paying 60% of their incomes to buy a house. This isn’t sustainable. So I’ll wait instead for this to correct before buying a house”. And the poor souls who do that miss out, because they didn’t know that the “values are irrelevant”

Here are some values that ARE relevant. Household income of $100k per year buying a VREB SFH benchmark home (nov 2021 $1.12m), with a 2% mortgage rate, 20% down, will pay 45% of their income on a mortgage. (Compare this to 60% displayed in your chart, which is 33% higher). However, for today’s buyer, only 10% of their income (on average over 25 years) will be down the drain mortgage interest. The rest (75%) of the mortgage payment is forced savings building equity. Moreover, first time buyers aren’t buying average homes, they’re buying the near 50% of homes that are below average. The average new mortgage in Victoria is $400K, consuming less than 20% of average income. Those are the facts that explain why our home ownership is at record high levels, and mortgage delinquencies are at record lows.

Well when someone like me points out that with current interest rates, an average income buying an average SFH would pay much lower % of their income on mortgage payments than shown on your affordability chart, you tell them that the values on your affordability chart are irrelevant. Here’s an example of that . For example, in sept 2021, In reply, you told me….

https://househuntvictoria.ca/2021/09/13/a-different-way-to-look-at-affordability/#comment-82216

Leos: “You’re missing the point of the [affordability] chart. It’s not meant to reflect any given buyer. The values are irrelevant. Forget the values completely…The only thing that matters is the current reading in relation to the historical range.”

====.

No, it’s the average rate paid for 5 yr terms as provided by CMHC (not posted rates). That’s not the same as the current discount rate. See the previous article for source.

As you say, the data series is consistent throughout the entire time period. So whatever offset it has from deep discounted rates is roughly consistent over time. Data for discount rates is only publicly available since 2013 so it’s not a usable time series.

I recall having this discussion before and we didn’t end up at a satisfactory conclusion though I don’t understand why. The definition of the chart is on the image and sources are linked in the articles. Mortgage payment for an average house with 20% down using the rate specified in 027-0015 divided by the average household income from 206-0011.

That’s it. You are trying to say it doesn’t reflect what any given person or the average homeowner is paying relative to their income, and that is true, because that’s not what I’m charting. This is a definition of home affordability, there are others. What this one has going for it is that it has a pattern that correlates with price movements, which to me indicates that affordablility is important, and this measure is a usable one.

https://youtu.be/ecnS1Ygf0o0

Doesn’t your affordability chart already use rates much higher than people are paying, so that you’ve told people here to ignore the Y axis and just look at the shape? I recall that you’re using posted mortgage rates (5%) instead of the discount rate ( 2%) that most people are paying ( rates are here https://www.ratehub.ca/5-year-fixed-mortgage-rate-history ).

If so, discount rates would need to rise 3% to reflect the numbers shown on your affordability graph. If I’m wrong, could you please tell us what % you are using for mortgage rate? It seems posters like interstellar might not have been to here to catch the caveats you’ve posted about that affordability chart, and are assuming this is what people are paying.

No interstellar, mortgage payments wouldn’t be anything near 70% of people’s income if rates rise 2%. Hopefully leoS can explain what the Y axis of the affordability chart refers to.

Brace for impact: Rate hikes are coming

This sort of answers your previous questions. Governments allow RE prices to balloon because it makes most people (i.e. homeowners) feel richer.

Yes.

Sono motors is trying to design a mostly-solar powered EV: https://insideevs.com/news/537836/sono-sion-solar-powered-fullychargedshow/

Cybertruck is supposed to come with an option for solar on the cargo cover: https://electrek.co/2021/05/27/tesla-cybertruck-retractable-solar-bed-cover-revealed-patent/

Toyota has been experimenting with some panels on the Prius Prime.

Overall it makes little sense because most cars are not parked in solar optimized locations. You’re far better off putting solar on your house and using that to charge the car.

More or less what I did in this article: https://househuntvictoria.ca/2021/10/25/how-sensitive-are-we-to-rising-rates/

Note in that case I was using the year to date average which gave some headroom on rates, but with current prices that headroom is essentially used up.

Definitely. However I think from the perspective of “bubblyness” it still wouldn’t be the same. Back then the top of the eyeballed “range” is around 45%, so a jump to 70% was way outside of normal. Today the top of the range is around 63%, so a similarly out of range reading would likely be more like 85-90%.

Tend to agree with you there.

Are there any EV manufacturers that are looking into installing a thin, flexible solar collector on the top surface of a car? This would make sense to me, while sitting outside during the day the car can charge itself. I remember when having to find an available hitching post to tether my horse to was a real pain.

Leo, can you model the same affordability chart with rates up >=2% ? I would bet that your chart will quickly increase above the 70% experienced in the 80s. Are we really betting that this will not ever happen or that salary growth will outpace that?

On another note – seeing how the government steps in to restrict people from buying gas in times of extreme shortage (floods etc). How come this doesn’t happen with real estate? How about we don’t allow second homes for investment purposes for a few years until the market balances itself?

Canada is heading for decades of subpar growth due to this real estate fiasco, boomer retirement / health care and higher taxation to pay for COVID debts. It’s counterintuitive but as a nation we are quickly getting poorer not richer.

Backup heat source is a must with a heatpump, and we all know what happen to water when it freeze. As a precaution, you might ant to check with your house insurance policy on water source heatpump with no backup system.

Give your tenant two nights a week to park in driveway? Average EV user does not need to charge every night. Market forces will easily sort this out.

As far as apartments/condos I had a client recently purchase a unit at Esquimalt Town Square and every single stall has a dedicated charger. This will be the norm in the near future and older buildings will slowly get onboard. It isn’t rocket science.

Finally, if I didn’t have a charger in my condo stall and if I didn’t have a charger at my office I would just go to Walmart or Wholefoods x2 per week and supercharge. Tesla is ahead of the curve but soon there will be superchargers all over the place and you’ll be able to charge 500km in less time than it takes to buy groceries, if you don’t have charging at home. Vast majority of people will charge at home as it will be a lot cheaper than supercharging fees so I don’t think you’ll see lineups at superchargers.

It’s okay the budget will balance itself.

Except that homes in many areas are not built for this and realistically there may only be space for charging one vehicle at a time and charging at home is an overnight affair. If there is a suite and/or second vehicle then the cars are on the road. We have sidewalks between this type of parking and access to home charging. An extension cord and three prong charger is way too slow to be practical.

And more people are working from home or don’t have dedicated parking at work.

It should be offered at home (or work). Imho, level 3 charging is really for longer journeys.

1) 100% EV ownership won’t happen anytime soon

2) EV usage requires less power than most people think:

350,000 EVs would require 1,050 GWh of electricity or 1.8% of all electricity sold by BC Hydro in 2017.

https://www.theglobeandmail.com/drive/mobility/article-are-our-power-grids-ready-for-an-electric-vehicle-surge/

Currently, B.C. has around 62,000 EVs on the road.

https://www.timescolonist.com/local-news/electric-vehicle-purchase-spike-expected-as-malahat-closure-squeezes-off-gasoline-4775180

I have now. Would agree with the results, although Sanden has now moved on 2 generations and ~20% more efficient (and skip the heat tape). One thing I didn’t see mentioned was the lifespan of the Rheem unit. It appears to be a typical tank with anode rod, so I’d expect the stainless Sanden to far outlast it. I would expect the Sanden to be more future-proof as well being a fully split system.

After spending a lot of time looking into it yesterday I echo the opinion on go full EV rather than hybrid. The range on newer vehicles is good enough for us and there are fast charge stations you can access if you want to go further afield. I have no problem installing charge station at home – going to be a normal thing in ten years.

And now, sort of on topic, if you are buying or have a house with a rental suite or multiple vehicles you should be thinking about how charging is going to work. Is this going to be offered at home and, if so, how? Is everyone going to need to charge at a public fast charge station? And what about all the apartment buildings?

This seems very well thought out.

https://www.hyundai.com/worldwide/en/eco/ioniq5/highlights

Nope.

Canada looks to overhaul EV rebate program to include more expensive SUVs, pickups

https://docdro.id/rpVoQ8X

https://www.theglobeandmail.com/canada/article-canada-looks-to-overhaul-ev-rebate-program-to-include-more-expensive/

Good plan. I think new gas vehicle sales in western countries will drop much faster than most anticipate as people make the same decision (either buy an EV now or just keep their cars longer to wait for EVs to become more affordable/available).

We kinda timed the bottom of the EV market with our Leaf. In 2016 there were tons of cheap lease returns from the US flooding in.

Agree. It’s only going to feed inflation to pour more demand onto something no one can produce enough of.

Better to put that money into building out charging infrastructure both fast charging and for those without home charging.

Government needs to scrap rebates immediately imo. Why are there rebates on cars people are waiting a year to get their hands on?

I know someone who has a deposit in on 4 different new EVs, just to see what will come in first. If you want an EV in a year, need to plan ahead now.

I think you’re right that the backorders will continue. The pace of the transition to EVs now depends 100% on how fast they can produce them, because there is a lot more demand than supply and that will likely continue for a couple years (probably 5 years for things like EV trucks, the F150 lighting is already sold out 3 years into the future).

We also considered going the hybrid route but arrived at the same conclusion as Marko: why go only halfway towards electric and still have to deal with all the maintenance headaches and costs of an ICE vehicle?

Used EV prices are insane right now. On autotrader asking prices for used base Model 3s in BC are higher than original purchase price (factoring in rebates). Only thing is how long until prices normalize? If certain models are a 1 year wait it could be a while.

I had a friendly recently sell his 2015 Model S for 64% of new purchase price. Imagine trying to get 64% for a higher end 7 year old mercedes/audi/bmw, be lucky to get 30% which would have evaporated in out of warranty repair costs.

We have driven an electric car for several years now.

Which one anyone chooses will depend on your own driving habits and needs.

We love our Bolt. Amazing range and costs pennies to operate. We drive a lot.

Having said that, our next vehicle will be a Tesla. (Multiple advantages such as software updates etc.)

I can’t afford to buy a gas car.

I would never buy a hybrid unless I regularly went on long drives into the BC interior. Even then it could be done. (One of the best savings advantages in going electric is the lack of maintenance.)

We are installing solar panels. (grants available)

I would not buy a condo that does not provide electric charging stations to all parking spaces. ( Installing a few charging stations would be like installing a few stoves that everyone can share.)

On the other hand……one fair arguement for buying a condo without charging stations for every parking spot is that it will not be that long before the cars will drive themselves….and so it could trundle off by itself to the nearest station and charge up. But the stations will be charging a high fee for the electricity and so best to fill up using your own power from one’s solar panels:)

Instal a level two charging station in your house. (Grants available.)

Buy an electric car now ……while generous government grants are still available. These will be withdrawn as people see the light and make the switch and government will realize that they don;t have to support it anymore.I believe we are at that point now.

A while back, we were seriously considering selling our (one) gas car and buying a used older Leaf, but we couldn’t pull the trigger. We wanted more range than an older Leaf can provide (for trips to Calgary and such), but we didn’t want to up our budget. So we decided to stick with our trusty old Toyota for a few more years. I decided to start changing the oil myself (something I’ve always wanted to do), which saves a bit of money — but, of course, nothing beats an EV in terms of cost of operation.

The plan now is to vanquish the mortgage (<2.5 years) then save up for an EV that meets all our needs.

I would definitely buy a straight up ICE before a hybrid, why have two systems that can potentially fail/need service? And no they don’t pratically charge themselves.

$5 +/- and it will take 20 yrs to approach 100% EV ownership so plenty of time to address any grid issues.

Thank you Leo. That makes a lot of sense. The Bolt is one that I was looking at because of the battery recall. It will be replaced in the models I was considering, so essentially a new battery to start. And the range is great. But the price for used EVs is so high right now.

I find it ironic that the same day Jeff Bezos wastes millions of dollars and enormous amounts of energy on a 10 minute “space” flight for the ultra rich, Mother Nature takes out one of his distribution centers. Tragically,

hundreds of people were injured, some killed, and the rest put out of work.

I would opt for a hybrid vehicle over an EV. I’m big into backup. I believe they practically charge themselves while city driving. On the highway you probably have greater range. I do know that the energy required to heat a vehicle in extreme cold greatly reduces range. I have no idea what it costs to recharge a vehicle at home every night but I don’t think our power grid can handle 100% EV ownership.

Ah ok didn’t watch right to the end. Jason makes good videos.

Rough time to buy an EV right now unfortunately. We paid $16k for our 2013 Nissan Leaf 5 years ago. Today they are selling for $14k. Hardly depreciated in 5 years. Today if you want a 3 year old leaf you’re almost looking at $30k.

A year ago I was seeing Chevy Bolts nearing $20k, today nothing under $30k.

Put my name down on an ID4 as mentioned I think they’re the best value right now, but 12-16 months backordered so it’ll be a while (which is fine, nothing wrong with the Leaf just looking at something a bit bigger at some point). The cool thing about the VW too is that it will support vehicle to grid, so you can use the car to power the house.

I think the battery replacement shouldn’t be an issue on any modern EV that has liquid cooling just like the Teslas. The battery will outlast the car if it has typical usage patterns. Where it doesn’t make sense is in a car that gets very little use as the battery does have some degradation by time as well as cycling. So a 30 year old battery probably won’t be doing great even if it didn’t get driven much. Monitoring our Leaf’s battery (first gen, not liquid cooled) I’m at about 83% after 8.5 years old, and I’d say today it has about twice the range that would be required before it’s no longer a usable commuter car. So I suspect even many Leafs won’t get their batteries replaced, they will just be used as cheap second vehicles until they’re old enough it’s not worth fixing. Interestingly enough you can drop in a 40kWh battery very easily, but currently this isn’t really economical.

Honestly I would hold off until the used market normalizes. I wouldn’t personally spend $30k on a Leaf. The platform is end of life and the fast charging standard (CHADEMO) will get phased out over the coming years.

He addresses that in the video – basically stating that happens and you can adjust the graph to compensate for your scenario.

I always wondered about the math and was concerned about the inputs and battery recycling for EVs so it was good to get some information on this.

I have a Mazda 3 which I bought used – so no production environmental cost. I drive so little (3-5k a year) it still has under 100k on it. My take after watching the video was that buying a used EV is a good move for environmental reasons, but buying a new EV might not be for longer than my ownership period given the environmental impact of production and how little I drive.

The other part is money. My gas car is worth maybe 12,000 now, but I could drive it for another five years easily. To buy a 2018 Leaf is going to be 30k plus. I would save maybe $5000 a year on fuel and maintenance with an EV – probably less . It would take me about four years to make up the difference in price plus LOC. Maybe with less depreciation on the EV – not sure.

For me the desire to switch to an EV makes sense for environmental reasons, but I can see others doing the math on the payback period and being concerned about replacing batteries in EVs (Teslas aside) and how that plays into the equation.

Good video but even that comparison isn’t really accurate. It assumes the old car will be crushed but of course it won’t be. It will be resold and someone else will buy it and use it up instead of buying a new car.

Switching to electric makes sense from day 1.

Just did the math on a $45k electric ID4. Over 8 years it costs nearly $10k less than the base RAV4

Excellent video comparing the environmental impact of keeping your gas car to switching to electric: https://www.youtube.com/watch?v=L2IKCdnzl5k

Thanks Marko. You are probably right re. Tesla, but not sure it will continue that way and I don’t change cars frequently so I’ll likely have it for long enough that depreciation will be an issue. Plus the next ten years are going to have a radical shift in electric car take up I’d think. If I buy a 2018 Leaf or Tesla today not sure it won’t be quickly outdated and there is more depreciation potential with a Tesla that cost 30-40k more to purchase.

Specifically Tesla thought. Tesla liquid cools their batteries (as do a few other brands…Jag, Ford Focus Electric, etc.) and the range is so large to start a bit of degradation doesn’t impact the usability of the car. My battery went from 383 km @ new to 350 km by the time I hit 200,000 km. A drive a ton, but I still don’t drive >200 km per day so car is just as functional as it was 6 years ago.

If you buy a new Mazda MX30 with 160km range and it drops down to 145km after a few years that kind of sucks.

I was shopping for car in Croatia this summer (rental prices were insane) and I had it down to used Nissan Leaf 40 kWh and used BMW i3 94ah REX (range extender ) but in the end bought a brand new ICE Mazda3 hatchback.

Everything else electric is either very expensive or doesn’t have reliable 200km worth of range.

I haven’t crunched the numbers but I would bet someone who bought a Model 3 last year is better off on the cost efficiency front versus buying a cheaper EV last year. Tesla demand plus inflation = insane re-sale. That boat has sailed, but just saying cost efficient might not be the cheapest.

Re: used electric car. Thanks for posing the question. I have similar thoughts. I Would never entertain paying 50k+ for any kind of vehicle. Always buy used. And could care less what it looks like.

Biggest concern is battery life and replacement. Is there any commonality in battery packs? Is there a danger you could end up with a car with a beta rather than a VHS? (Ask your parents)

I recall Marko suggesting that battery degradation is not a concern. I hope so. I have dim views on everything else (rechargeable) battery powered that I have ever owned – from phones to tools. Power level drops off alarmingly and replacement is expensive to impossible

Only other requirement is that it be a hatchback. I can’t imagine being a home owner and not have the ability to haul (small amounts of) stuff – lumber, bags of leaves, and loot from my favourite shop “restore”

I wonder if there is a big difference between a dedicated designed electric car (like a leaf) vs a converted ICE (like a VW egolf)?

I think I would go with a leaf.

Off topic but I’ve decided to buy an electric vehicle. My budget is flexible, but I tend to look for the most cost efficient option and buy used because I rarely use a vehicle and I don’t really care about impressing anyone with it. Doesn’t need to transport large items. Limited range is ok, but would hope to get at least 200km driving distance with a charge. Currently considering a Nissan Leaf 2018 and above, any other recommendations?

It does seems high, but perhaps it is an honest quote, because straight swapping out a boiler for a heatpump isn’t a straight forward process. There are many things to consider to maximize efficiency.

Does this sound familiar to anyone?

https://apnews.com/article/coronavirus-pandemic-sports-business-health-lifestyle-538efc664e9da0d2f0831f3f3ed9a4d7

I didn’t read it that way. It’s up to you whether to duct or not. The unit itself will have higher efficiency unducted, but of course you are sucking heat out of the space that then needs to be made up somehow. Not as critical in our climate but would be pretty tough to do all the calcs to determine which is optimal. Mine would be in a semi conditioned space so I’d probably not bother or only duct the outlet and insulate the interior walls between the laundry room and rest of the house

“Have you read this test? https://energy350.com/wp-content/uploads/2018/11/FortisBC-Heat-Pump-Water-Heater-Presentation-Slides-7.18.2018.pdf”

Thanks Leo- the write up on the Rheem makes me think I might consider that as my existing HW heater is way past its expected life. Didn’t realize they needed ducting in semi-conditioned spaces though.

The largest Arctic heat pump is only $7500 (60,000 Btu/Hr) so $30,000 seems like an excessive amount of labour. I tend to DIY this sort of project along with most repairs so I don’t have a good feel for labour costs. Perhaps a second opinion? The total cost would be affected by things like whether or not you currently run antifreeze in your system and whether or not things like circulation pumps and zoning valves would have to be changed but $22,500 still seems like a generous allowance for labour and extras. As my sig suggests, obviously I am out of touch with costs. It seems like materials are cheaper than they have ever been and labour the opposite.

thanks – it’s clear once again that many on this forum have a depth of knowledge. The Arctic one has indeed been recommended. I am admittedly on the fence about the whole decision for the very reason mentioned by totoro (if only staying in the house 10 years, payoff might be sort of a break-even type of proposition, and it’s a big upfront outlay for sure…)

Have you read this test? https://energy350.com/wp-content/uploads/2018/11/FortisBC-Heat-Pump-Water-Heater-Presentation-Slides-7.18.2018.pdf

What isn’t addressed in there really was why the two Sanden units on vancouver island had wildly different aCOPs. 1.98 vs 3.52??

Which Rheem you looking at? Hopefully it has a ducted supply/exhaust option.

True – only in combi systems with low heat load requirements

And just another comment on the radiant heat issue. No technical information to offer, but I do question the math. $27,500 is a lot to make up over ten years – 2500 is a relatively cheap fix. I’d figure out what savings to expect from the change first and then determine whether the math makes sense. Doubt the switch would add to resale value in ten years.

Re air to water heat pump

I have a Sanden hot water heater heat pump and am very happy with it. They produce plenty of domestic HW at a high temperature so you do not need an auxiliary heater to get it up to domestic hw temperatures. The outdoor unit is very quiet and it knocked my power bill well back into step one. They are NOT suitable for your application as you are restricted to about 8000 btu per hour heating with the Sanden. It is not conventional Freon phase change technology and efficiency suffers drastically if you return warm water to the input of the heat pump. They depend on cold supply water to run efficiently. I use an XPump heat exchanger and siphon off a small amount of hot water for a heated bathroom floor and the hit on efficiency is noticeable.

You should probably check out Arctic Heat pumps for your application. They are available in much larger units and will supply lots of water at the appropriate temperature for radiant floor heating. Both the Sanden and the Arctic heat pumps are self contained monoblock units and can be installed by a plumber (or DIY) without need for a HVAC installer.

A few years ago, a group of builders in Winnipeg frustrated by delays in inspections, hired a private investigator to follow these inspectors and taped their activities. A majority of them were found to be working at less than half capacity, wasting time on their own personal activities. They went to the media and it resulted in several dismissals and the city refunded the $18,000 they paid the private investigator. I wonder what happened to the individual managing the inspectors, probably was part of the problem. It’s easy with today’s technology to keep track of worker’s activities, if you want to run an efficient business, evidently the city didn’t.

Newish factor in BC is going to be provincial climate change migration. We sold our house in the Okanagan two years ago largely because of health concerns about smoke. I’d be willing to bet that there a number of people now thinking about doing the same and that many will look at the island as a possible relocation point. This year was probably a decision point for some of them, particularly those with underlying health conditions like asthma, diabetes and heart conditions.

It is a big trend in California.

https://www.cnbc.com/2021/09/16/homeowners-relocating-because-of-climate-change-wildfires-flooding.html

https://www.theguardian.com/world/2020/sep/04/what-is-californias-wildfire-smoke-doing-to-our-health-scientists-paint-a-bleak-picture

6.8% inflation in the US. Wonder how that will impact the market if it’s not knocked down quickly. You gotta think they are under immense pressure to raise rates down there.

https://www.victoria.ca/EN/main/city/city-budget-2022/statement-of-financial-information.html

Go down to page 43 and take a look at all the jobs and the numbers they are pulling in…”Tree Preservation Coordinator 92,062.28″ this individual delayed our building permit 4 months over a small item that could have been resolved in 10 minutes via email or phone. Then this same individual delayed us two months in having hydro hooked over a tree branch that could have been resolved in 10 minutes via email or phone with BC Hydro….if you have one of these 100k +/- jobs at the COV/other municipality obviously you aren’t going to be efficient, because if you are your job security is at stake.

How many government officials does it take. This is classic. How many government and municipal jobs were created to build a home? at what cost and to who?

https://www.youtube.com/watch?v=ZbiOAqZaKDQ

Was looking at that one vs Rheem. I think I’ll go for the Rheem at that price though.

They’re out there. My in-laws have been running one for the last 10 years worry-free. I’ve been running one for 3 years worry-free. Personally, I wouldn’t worry about built-in backup since it just adds complexity (backup would just be another electric boiler). I’d pick up some portable electric plug-in heaters and just bring them out if needed.

No idea on that one. The Sanden unit I use is 5K, but you’d need multiple units based on your heating requirements. They’re also fairly easy to install if you’re comfortable with basic plumbing.

at the risk of annoying everyone, let me once again ask an HVAC follow up question…(c’mon admit it you miss these topics!!)

Area to be heated is about 2,500 square feet on one floor, slab on grade, currently heated with radiant (hydronic) heat powered by electric boiler. The boiler and control system are acting up and need about $2,500 of repairs if I want to keep them.

I’m looking at doing a heat pump instead. As I want to keep the radiant heat, this would be an air-to-water heat pump tied into the existing hydronic system, not mini-splits or anything like that. And natural gas is not an option for us at all in our area.

My questions:

I’m also wondering if it’s “worth it”. I’ve had two quotes, hovering around $30k – yes I know it seems excessive, but what can you do. These are both from reputable contractors that have also been previously recommended on this forum. Now, current electricity bills with the electric boiler are running about $700 a month November/December. In the shoulder seasons the electric bills are maybe $400 a month, and maybe $300 in the summer (we also have a hot tub). Say we stay in the house for 10 years.

I really, really appreciate the input, thank you.

What may be odd is thinking that demand is caused by a single factor and trying to discredit information based on logical fallacies and false equivalents.

For example, thinking that the demand in Edmonton and Calgary must be climate related in some way because the demand in Victoria likely is. Makes you wonder whether it could possibly be related to economic opportunities in oil and gas and spin off, which has recently declined as has their market.

The coastline is pretty amazing (from pictures – I haven’t been). How much is development (and prices in general) driven by tourism and demand for second homes by folks from elsewhere in Europe?

The low prestige of doing most jobs that actually involves using your hands for something other than typing lead directly to the situation Marko described where there are:

In my social and work circles I meet many parents that would consider it a family crisis if their offspring skipped university to learn a trade instead. It’s still true that on average university graduates make more money than non graduates. But a well chosen trade can make better money than many degrees. Personally I think many of the trades are a good bet now for a smart hardworking kid starting out his/her working life. Lower educational expenses, your job is hard to outsource or automate, lots of flexibility where you work….

Lots of remote work (strong IT sector) but people still want to be close to the action for the social/amenity aspect. If all you friends you drink coffee with 4 hrs a day move from small town to big city drinking coffee alone for 4 hrs a day become boring.

No remote work in Croatia?

Trades/labour shortage is part of it, but a big part of the barriers are self imposed obstacles as well.

Croatian population has been declining for 30 years (down from 4.5 million in 2000 to around 4 million now) and somehow there are cranes everywhere, developers complaining they can’t find labour, and prices up 40-50% in last four years. Quality pre-sale buildings sell out before completion at 30-40x average income.

My personal observation is everyone is leaving the countryside and wants to live in the Croatian equivalent of Toronto/Vancouver/Victoria so while you can buy a nice house for 5x average income in the countryside a nice condo in an attractive city is 40x average income depsite the population declining every year.

Sorry, this is stupid. Edmonton and Calgary were increasing at a much greater clip 2 decades ago than Victoria. So clearly the climate must have been better in those areas then than Victoria right? Realtors in Edmonton, Calgary and Winnipeg have all sold more houses than those in Victoria. Demand is clearly greater there, they just have more willing sellers.

Likely they can’t actually afford it.

Why would you need new housing if you have no population growth?

Where do these people live? a shed out back?

Yes. Total immigrant population.

Victoria has a low rate of growth from immigration – lower than the rest of Canada. In the period between 1996-2001 the overall number of immigrants dropped by 200 people.

Base stats here:

https://www.canada.ca/en/immigration-refugees-citizenship/corporate/reports-statistics/research/recent-immigrants-metropolitan-areas-victoria-comparative-profile-based-on-2001-census.html

Looking at your source, that’s a categorization of all immigrants. It’s not indicating current immigration origins.

Quite obviously, Victoria did not receive 60,075 immigrants in 2011. That’s the total immigrant population in 2011.

One unfortunate circumstance of immigration is that many highly educated professionals from other countries cannot pursue their careers because their credentials are not recognized here. It takes years to bring their qualifications up to Canadian standards, something they cannot afford, therefore they are forced into menial labor.

Evidently we can’t accommodate the current population of our country. Look at the backlog in the health care system, even prior to covid. Not only do we require more hospital beds, but where are we going to get qualified professionals to work at these facilities. Massive shortages in nurses, doctors, etc… These professionals don’t grow on trees and a huge number of them are at retirement age. And where are we going to get the billions necessary to build this infrastructure, we’re broke.

Would it be discrimination if an affordable rental apartment building was built for immigrants or is this not inclusionary. We can reduce the 6hr wait at life labs or have a construction force to fix the aged infrastructure. The immigrants moving to Victoria won’t be construction labor when they have no where to live at an entry level wage. It will be nurses, tech and the wealthy. Construction labor jobs at 22 to 25 dollars are hard to fill with little no experience.

You have 5 people working in an office for every person holding a shovel so yes.

” countries are trying to get rid of their people, not import more.”

Can you explain why German and Japan want more foreign workers? China changing from single child to three-child policy?

This defeatism is just crazy to me. Really we can’t figure out how to build basic infrastructure for moderate growth like has been done for thousands of years all around the world? Did we all get incompetent?

“lack of government investment in purpose built rentals”

It is beyond hilarious that anyone would believe that more government involvement would aid any situation. The same people that have given you a medical system that has your toddler wait fourteen months to see an ENT specialist will now provide housing? The bones of an excellent stand-up routine are in there somewhere.

Countless posts by Marko with concrete examples of the worthlessness and entitlement of regulators at every level should be more than enough evidence that what is actually needed is for “government” to vacate the field entirely.

What politicians seem to be oblivious to is the infrastructure that is required to accommodate a million new Canadians. It’s not only houses, you need the land to build on, roads and services such as hydro, water(which is getting in short supply), natural gas(in most parts of Canada), sewer(and treatment plants), hospitals, schools, etc… This isn’t Legoland, this is the real world. Why not plow down the Amazon rain forest and build houses for a billion South Americans? One good reason- humanity would disappear in less than 100 years. Like I said, countries are trying to get rid of their people, not import more. Canada looks big on a map, but most of is nearly impossible to develop and live comfortably. Just take a trip to Churchill, or should I say, hell.

Barrister, you’re an intelligent poster and regarding your comments on population growth and immigration, some quick points to provoke some thought:

1/ if we had low/no population growth, what ‘ready’ labour are we going to have to build all that new housing on the supply end? It averages 25-30 trades with a crew from 2-4 people to make a SFH. That is 50-120 humans.

2/ as the demographics curve skews, what revenue can the government tap into to pay for everything on their wish list?

My own whimsical thoughts are that we should surge the workforce over the 5 years with new immigrants and foreign workers. Pay them a little more than what the Americans pay from people who come over the southern border. Imagine how many homes 1MM new workers could build? and imagine the free market forces in play to get building costs down?

Hey Leo, thoughts on doing an article on outliers over the past year? The properties sold way over asking/assessed sure get attention.

Right on. Yet so many millennials here refuse to believe that they are simply getting outbid by fellow millennials – the largest population demographic in history. We are told here that so few young people can afford homes, where in reality there are record numbers that can afford homes. So they sit in disbelief and wonder… “who, other than me, could afford these homes”??

Moose Jaw is not hell it is actually at Churchill.

Maybe not directly, but definitively indirectly. I know at least three young Croatian couples in Victoria that ended up in Saskatchewan (better immigrant nominee options) to get their papers. Two of the three literally quit their jobs (farming, etc.) days after obtaining permanent residency, packed their cars, and drove to Victoria. They said Moose Jaw was hell 🙂

Quite different settlement pattern than the rest of BC (ie. Vancouver) where top three groups overall are from China, India and the Phillipines:

https://canadaimmigrants.com/british-columbia-immigration-by-country/

Better off spreading newcomers out. Small island. Small city.

This property has to be capped at 75 showings (couldn’t get in with one of my clients). I end up at a lot of these showings with my clients (usually young couples/families). Before us young families, after us young families….and then people blame everything else on the problem. On a property like this most of the time it is young families trying to outbid young families.

And then in 5 years when you go sell the finished product you’ll be labelled as a greedy developer. We have over 200 NBA players making over $5 million per year, god forbid a developer make $1 million on a 5 year project.

The problem is government regulation and beaurcacy is near impossible to reverse. It just keeps getting worse year after year. Example, owner-builder exam introduced 6 yrs ago. Zero evidence to bring it in and zero evidence that it has improved quality of owner built homes in last 6 years but it is here to stay forever as it keeps a bunch of people employed.

COV will bring in hand deconstruct policy for teardowns and do you really think it will ever to back where you can deconstruct with an excacator? Nope.

The amount of crap piled on in last 15 yrs is just insane and only getting worse.

I am builder trying to make the leap to developer. Against advice from all the other builders I know, I bought a property in Vic West. It’s two corner lots that back onto each other. Its the perfect missing middle project for 8 to 10 townhomes. I expect this will take me 4 years if I am lucky.

6 to 8 months of working with consultants – Architect, Tree Study, Traffic Study

2 to 4 months of neighborhood consultation, changes to design

2 to 3 years to go through the rezoning process with no guarantee

6 to 8 months waiting for a building permit.

Tenants 4 months notice after the building permit is given and now I have to demolish the buildings by hand as per City of Victoria ( not sure how long this will take)

There are a lot of smaller builders who are not Arzye or Abstract that would love to build infill triplex, multiplexes and townhomes. But just don’t want the fight and battle that comes with dealing with city and pleasing the neighborhood. Will the missing middle up zone properties and allow this to meet some kind of demand? Or will it come with conditions of step code 5, 20% affordability, save all trees and nothing gets built.

Meh either way low supply will reduce my risk I figure..

https://storeys.com/british-columbia-housing-market-cooling-off-period-work/

Some very good points about the cooling off period. Governments needs stop sticking Band-Aids on a guising wound, This is a supply issue and government regulation and rules issue. Need to take municipalities out of the equation and have the provincial Government dictate rules over building. Need to get rid of agriculture land BS.

I think the cooling off period will kill engineered bidding wars.

anyone know the “current” % premium of median sell price vs assessed price is for a condo in Victoria?

i believe Leo had it at 122% on 04 oct post

will be putting in a bid shortly. thanks

Most recent stats I can find are here:

https://canadaimmigrants.com/immigrants-in-victoria/

Quite different settlement pattern than the rest of BC (ie. Vancouver) where top three groups overall are from China, India and the Phillipines:

https://canadaimmigrants.com/british-columbia-immigration-by-country/

“That, my friends, is demand.”

‘

‘

Not really, that house was priced for a bidding war, as it was listed at only about 10% over assessed value.

The blind bidding really has to stop, for example last year we had an accepted offer on our current home and had about a 16 day subject to period. We listed our house at stretch value right away and because it was xmas week it wasn’t as busy as we would have liked, anyways we had an offer within a week of listing at about 65K under ask, there was someone else who really wanted our place but they didn’t know what the other person had bid so that ended up bidding over ask and about 75K over the other bid, or certainly more then we expected at about 30% over assessed value. Now we are happy but does that seem like a fair system?

Totoro –

Interesting. Do you have a source for that? That’s the first time I’ve heard that suggestion.

That, my friends, is demand.

https://vancouversun.com/news/local-news/building-higher-dikes-may-be-a-losing-battle-experts-warn

31 offers on 3920 Winton. Sold ~$300k over ask

779 Menawood, sold $450k over ask.

Totoro,

That’s a great post. Thanks.

If supply shortage is a market driver, then Norway has the solution. I have been told you cannot buy a home in Oslo unless you are going to live in it. Investors, both domestic and foreign, with multiple empty homes are a blight.

Because Canada is a big country and housing markets are influenced by both local and national factors and buyers are not all the same.

We actually have to look at what is happening in various locations in Canada to determine cause/effect.

National factors like interest rates, the cultural value of home ownership, lack of government investment in purpose built rentals for decades, restrictive zoning, and the need for stable housing drive demand, but local factors like benchmark house prices are important too.

For example, a younger couple who are remote worker first-time buyers from TO might be more attracted to the affordability on the East Coast and view it as a good place to raise children. The ability to work remotely is a huge factor with this, and Victoria’s climate may be nice, but we are not affordable for a first-time buyer wanting to start a family and own a SFH. A different young couple from TO who cannot work remotely may instead drive until they can afford a home – adding to demand in areas like Hamilton, for example. As for Victoria, a Vancouver couple who are close to retirement might well be attracted to cashing out and moving here – especially if they are originally from here.

And house prices are not rising everywhere at the same rate or at all. Some markets are not as desirable for a variety of reasons. Places like Quebec City, Edmonton, Calgary and Winnipeg, for example. There are reasons prices increased only 3% YOY in some places despite interest rates and pandemic savings, and 35% in Parksville/Qualicum.

Why is it increasing all across the country then?

Who/what is to “blame” for house appreciation in Victoria? It is clearly not one thing . As far as I can tell it is a combination of:

The old targets of money laundering, empty homes and foreign ownership have, in my view, been discredited when it comes to Victoria as major contributors.

The new target of international immigration to Canada also seems off for Victoria. Most of our population growth is actually from migration from other parts of BC and Canada, not immigration. As an aside, the biggest group of immigrants to Victoria by far are from the UK. The second are US citizens. And immigrants make up a large portion of our service and health care workers. Victoria’s population is aging faster than average.

By the way getting actual net immigration numbers from the Feds is a bit of a challenge to say the least. One has to be careful since their reporting is not consistent year to year and at times will exclude categories such as spousal applications, Quebec investor programmers, business investor programs either run by various provinces or by the Feds. At times refugee numbers are reported separately.

One of my close friends is a leading immigration lawyer in Toronto and he says that the reported numbers are, to put it kindly, are a bit managed for better optics.

Not to state the obvious, there is likely to be a time lag for impact on the real estate market. My neighbour from Lebanon has been here three years but only bought a house a couple of years ago, He has also bought three more investment houses, two of which are in Sidney. My point is that just looking at this years increase in prices and then comparing immigration is not a rational comparison. Actually it rather feels like someone that is trying to pretend that increasing demand by 4k a year will not have a major effect on the market. Obviously not the only factor but certainly a main factor along with interest rates.

My concern here is that any discussion of immigration becomes a matter of either self interest or political dogma rather than a rational examination of economic drivers.

There was a falloff of population growth of 200,000, but only 100,000 of that was due to immigration (temporary + permanent). As mentioned, that’s because they closed the immigration offices and slowed the processing down, and now have a huge backlog. They’re speeding up the process but still falling behind. Despite that, statscan current estimate is that population growth is back to normal levels (362k per year as of today’s estimate fro pm their real time estimates – see below).

The other 100,000 falloff of population growth was due to non-immigration factors – 50,000 was Canadians rushing home at the start of Covid, and 25,000 was Covid deaths. They measure July to July, so the July 2021:comparison with July 2020 is skewed by the 50,000 Canadians who came home in early 2020.

So population growth in the year to July 2021 was 156K, instead of the typical 350k.

But statsCan has a “live model” where they estimate what the population growth is right now. And that is (for December 8, 2021) growing at a rate of 362,000 people per year, which is right back to normal growth levels.

Here’s statscan “live population clock” where you can see that https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2018005-eng.htm

You should remember that immigrant home buying demand isn’t coming from people who arrived yesterday, and more reflects people who arrived about 5 years ago. Leos immigration graph posted below shows this demand nicely – ignore the last year which is the (temporary) slowdown of processing, and notice the huge vertical immigration ramp up over the last 5 years – there’s the immigrant home buying demand that you were asking about

Note this chart is both immigration and net temporary residents

Well yes there is. How else do you explain the dropoff in Canada’s population growth over the last year and a half?

You talk about backlogs and potential for future immigration. I was talking about the actual dropoff in population growth at the very same time we saw an unprecedented Canada-wide rise in RE prices.

One more thing to keep in mind – international migration and immigration are two different things. International migration is someone changing their usual place of residence to Canada. Immigration is the issuing of permanent resident status to someone – even if they are already living in Canada. An unusually high number of new permanent residents over the last 18 months were already living in Canada.

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2019036-eng.htm

Countries around the world are holding the gate open to allow their indigenous people leave their native country, and they don’t want to see them again. They are trying to alleviate the overpopulation of their country. And Canada welcomes them with open arms. Take a look around Trudeau, we have enough poverty. Our hospitals, housing, basic infrastructure are already at a deficit, the country cannot handle a massive influx of immigrants, at least not for now. Half a million people a year is ludicrous.

No, there isn’t a “dramatic decrease in international migration”. The immigration numbers are merely reduced due to a backlog in processing. That’s not the same thing as less people coming to Canada, or less pressure on the housing market. The Canadian government are sitting on a big backlog of 1.8 million immigration applications – (since Victoria is 1% of Canada population, that would translate to about 18,000 immigration applications destined for Victoria – about 5% of Victoria’s population) . This backlog to 1.8 million has grown by 350K since July 2021, way faster than they can process them. These are HUGE numbers at every stage of the immigration process. Normally these applications take 6 months to process, but many immigration offices are still closed and it is taking 2 years and counting. Most of the delay is attributable to government inefficiency – for example they transitioned the workforce to home based and “struggled to find laptops” and this new system “crashes all the time”. The size of the backlog is described as STAGGERING, and if is cleared quickly, Canada’s immigration numbers would signifcantly exceed the 411K expected in 2022. Bottom line: expect more immigrants not less https://www.thestar.com/news/canada/2021/08/01/canada-faces-a-staggering-immigration-backlog-with-the-border-reopening-and-applicants-anxious-to-get-here-how-should-ottawa-prioritize.html

Take a look….

https://www.cbc.ca/news/canada/saskatoon/delays-across-immigration-streams-leave-many-in-limbo-in-canada-and-overseas-1.6275084

“According to data received from IRCC, Canada had a backlog of nearly 1.8 million immigration applications as of Oct. 27, including:

548,195 permanent residence applications, including 112,392 refugee applications.

775,741 temporary residence applications (study permits, work permits, temporary resident visas and visitor extensions).

468,000 Canadian citizenship applications.”

House-in-Calgary over ask. Mind-blowing.

$1,650,000 (450k over ask).

Can someone please look into what 779 Menawood Place went for? I’ve got a family member that is very interested!

Immigrants or net migration? Because this year we will clear 400k immigrants based on the last YTD numbers I saw.

Generally we get 450k a year since Trudeau came into power.

Is that really a big decrease? Will be close to last year. I am guessing 363k the previous year was for the entire year not July 1st.

So with the dramatic decrease in international migration, where is that increased demand coming from? Well a decrease in interest rates increases demand in itself, since it increases the amount that a given buyer is able to pay for the same property. And that leads to:

https://financialpost.com/real-estate/mortgages/investors-are-gobbling-up-homes-in-canadas-hot-housing-market

In the year till July 1 net international migration increased Canada’s population by 157,000. The year before it was 363,000. COVID looks like sticking around for a while so it will be interesting to see how these numbers recover over time.

landscaper- Their parents and grandparents are reaping the benefits and it trickles down in the form of down payments for overpriced houses. Most young people buying these days are getting some help from their family, unless they’re highly paid professionals with two incomes.

“I believe the primary contributing factor to the increase in housing prices is the incredible stock market gains that North America has experienced.”

but many middle class families or young/starter families don’t trade significant amount of stocks.

Leo: Excellent analysis , but you either skimmed over or actually ignored one of the primary divers for the market which is immigration levels of over 450k a year.

Not only is this totally new demand that is introduced into the market but at least a portion of this number represents people with substantial capital that in some cases can easily outbid local buyers. While most will not be moving to Victoria there will be many that will buy in Vancouver and allow migration of the seller to Victoria.

To build enough supply nationally to meet the instant demand of 450,000 is a real challenge ( a new city the size of Greater Victoria each and every year) should keep prices increasing. I find it curious that the real estate industry totally focuses on supply and virtually ignores that the demand side of the equation is almost completely driven by Ottawa’s immigration policy.

So are we in a bubble? In my opinion we are not as long as we keep the floodgates of immigration open. On the other hand if immigration is seriously reduced house prices within a few years should quickly reduce to a reasonable and very affordable price point.

Recent prices on charts should say Oct/Nov, not Oct/Sept, will correct.