1981: Anatomy of Victoria’s Housing Crash

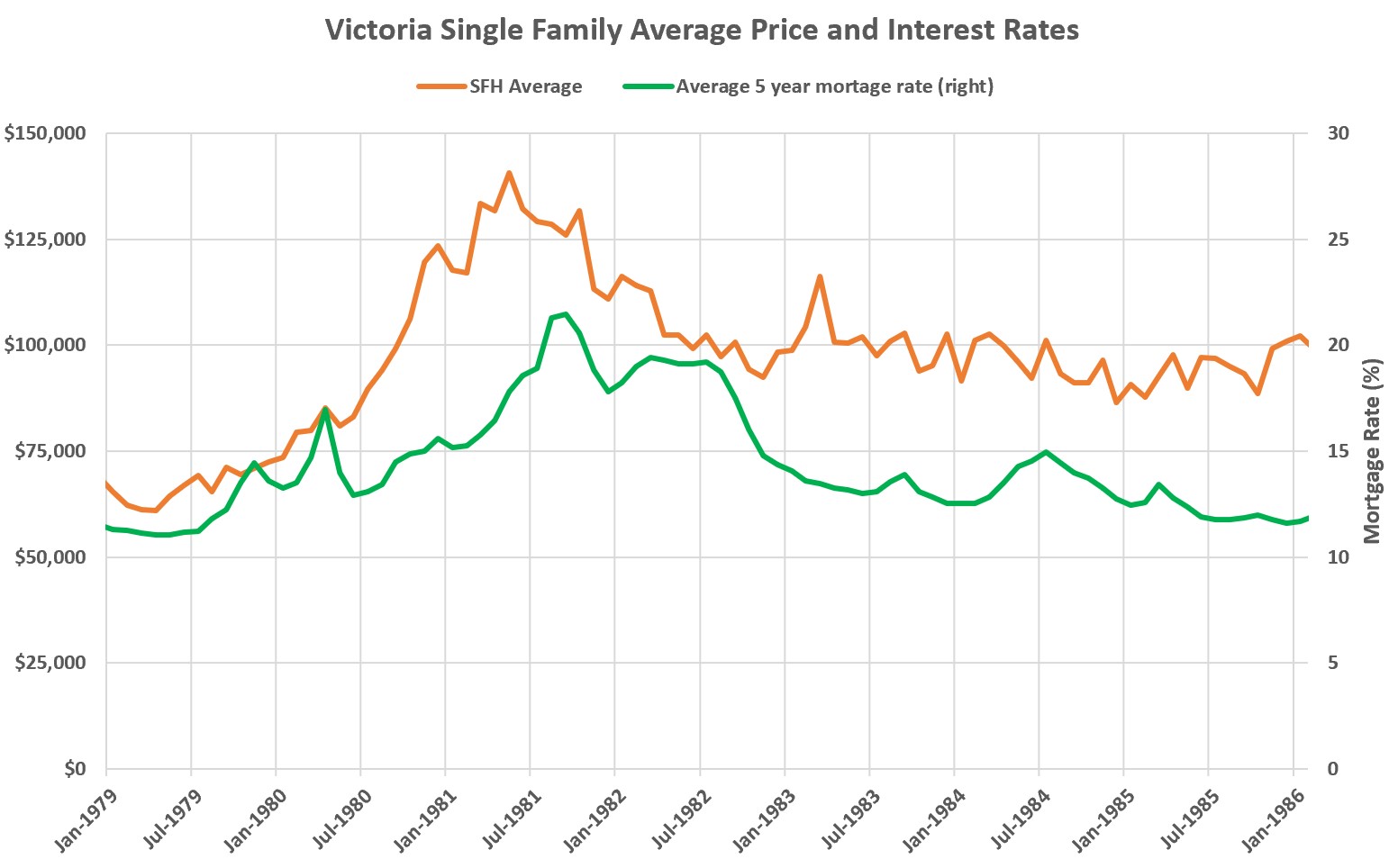

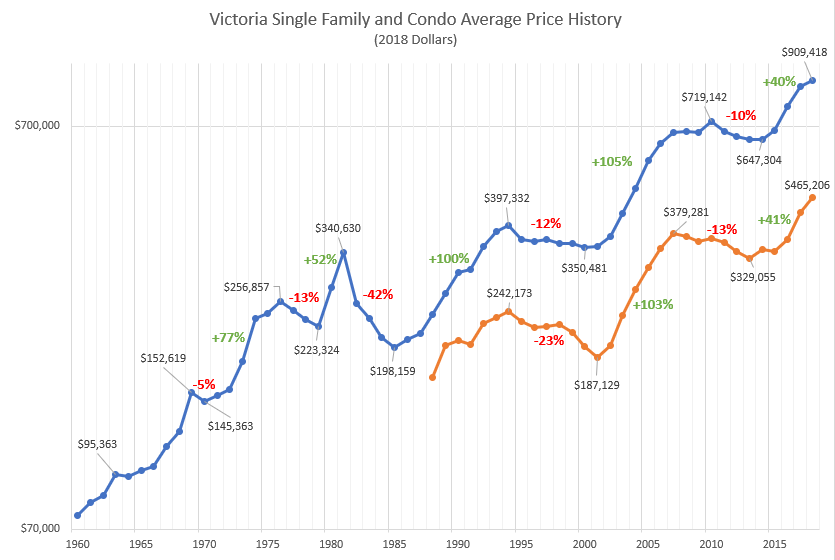

If we look at the history of house prices in Victoria, one thing that stands out is that we haven’t seen a lot of big declines in the last 60 years. Taking into account inflation, in the 2010s single family lost 10% of their value after gaining 105% the previous decade. In the 90s they lost 12% after doubling in value, and from 1960 to 1976 there was hardly a down year at all. The one period that stands out is 1981 to 1985, when the average house price plummeted by 42% inflation adjusted.

What happened back then? Well up until recently, we only had annual price data for that period, so it was hard to tell exactly how that runup happened, and what market activity was like then. I had monthly data back to 1990, but no further back. However in November’s VREB press release there was a mention that this November’s 795 sales were not (as I first thought) the highest on record, but in fact second to the 892 that sold in November 1989. Of course if there’s data out there on the Victoria market I must have it, so I’ve received those older sales records back to 1978 and transcribed them from the original scans.

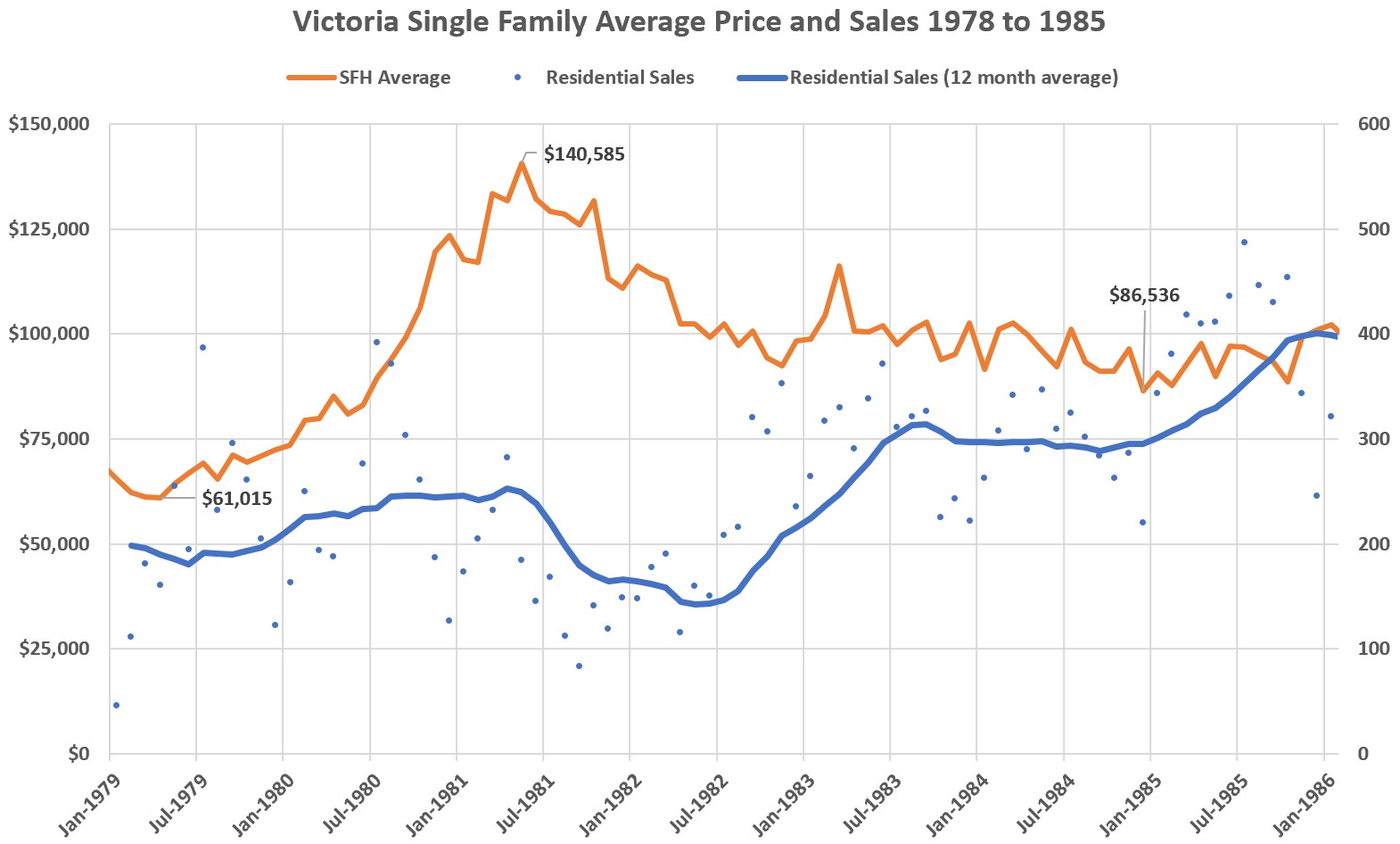

With monthly data, we can take a closer look at the crash of 1981 and how it actually played out. Below is the single family average price, as well as residential sales volume in that period.

A few things stand out to me now that we have a higher resolution picture of that time:

- Both the crash and the runup in prices happened extremely quickly. The entire price escalation leading up the crash happened in about 2 years when prices more than doubled, but the majority of the gains came from May 1980 to May 1981, when prices increased an astonishing 74% in just one year.

- The crash happened very quickly as well. Although the bottom was not reached until 1985, average prices from peak dropped 35% in only 18 months, going from about $140,000 to $92,000. After that, prices stayed roughly flat for another 3 years while inflation ate away at them before the market truly bottomed and started rising again.

- Nominal prices didn’t fully recover the 1981 peak until 8 years later. Inflation adjusted it took until 1992.

- After collapsing in spring 1981, sales stayed low for about a year until record interest rates started declining again. With both interest rates and prices down substantially by 1983, sales recovered as buyers snapped up distressed properties. It wasn’t enough to entirely halt sliding prices, but quite a few Victorians seem to have recognized a good deal at the time and bought in at what would be essentially the bottom.

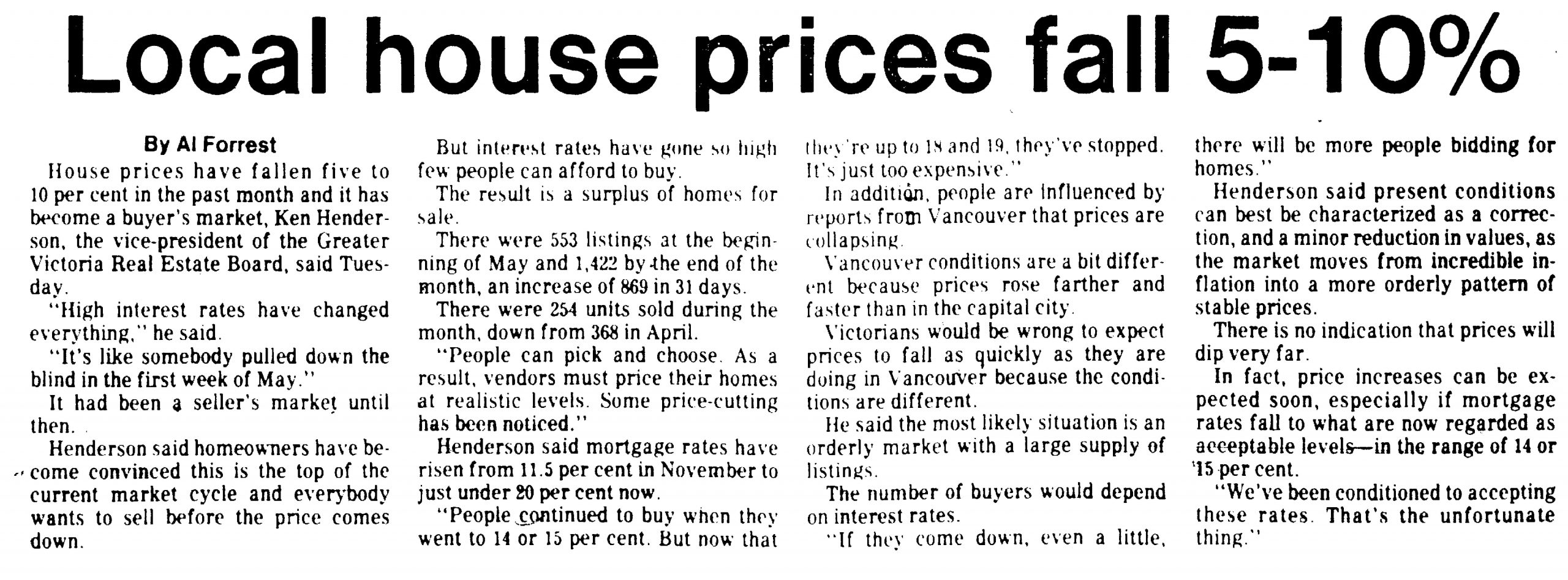

Below is how the news characterized the market right at the peak when sales had already turned down. It’s clear how radical the shift in the market was, with months of inventory jumping from 1.5 in April to 5.6 in May 1981. Buyers piling into real estate as a hedge against high inflation were finally stopped when interest rates hit 20% and climbing. Even then, the industry was optimistic though, predicting stable prices and “no indication that prices will dip very far”. They fell 38% over the next 3.5 years.

None of the municipalities were immune to the decline, although the high priced core in Victoria and Oak Bay seemed to decline a bit more than cheaper areas such as the westshore and townhouses/condos.

Are there any similarities to today?

With prices at record high levels, it’s natural to ask whether we are currently at risk of a similar crash. I would say no, since there are some big differences between then and now.

- Prices have spiked, but not nearly as fast as back then. In 1981 prices jumped 74% in one year. In the last year our average price is up 16%, and to get up 74% we would need to go back exactly 5 years. We’ve seen rapid price gains, but 1981 was a whole other level.

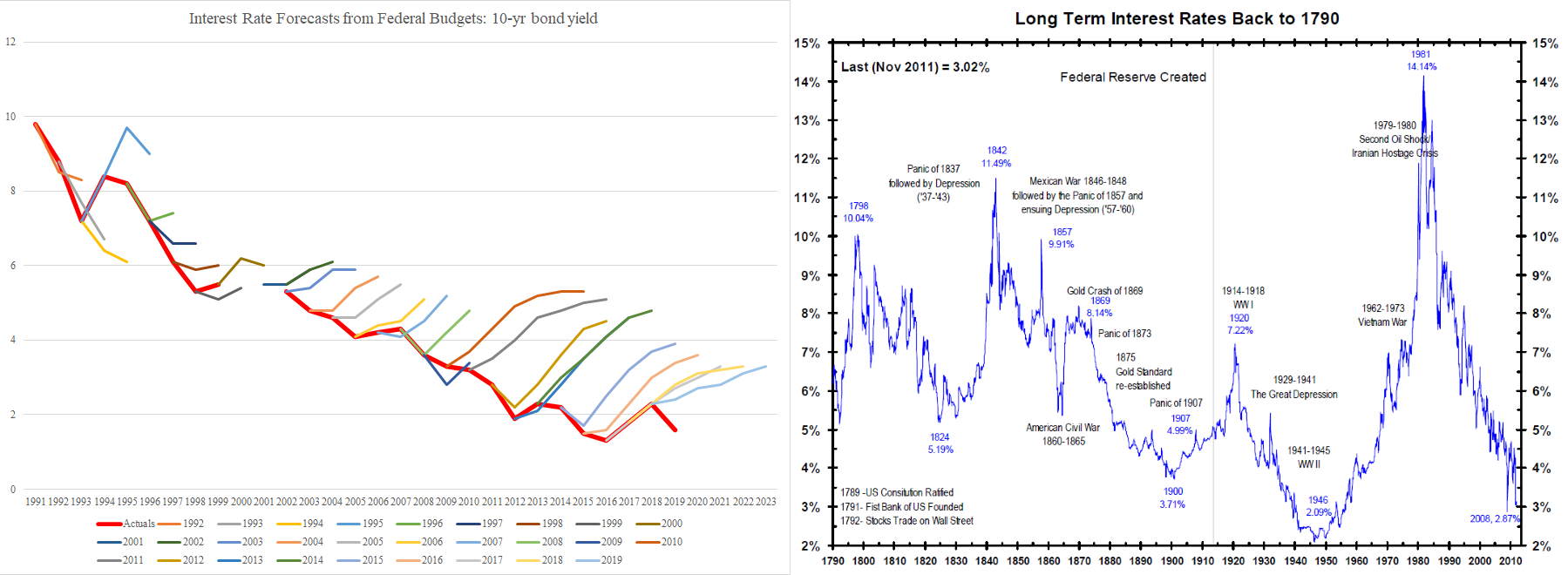

- Interest rates spiked. Interest rates hit a peak of over 20% in late summer of ’81 and that simply squeezed out a lot of buyers. That is not dissimilar to the US real estate crash, when borrowers also were squeezed out by rapidly rising adjustable rates on their loans. Now we have record low rates, and the central banks essentially promising us low rates for another 2 to 3 years even if inflation acts up a little more than usual. Of course things don’t always go as the central bank plans.

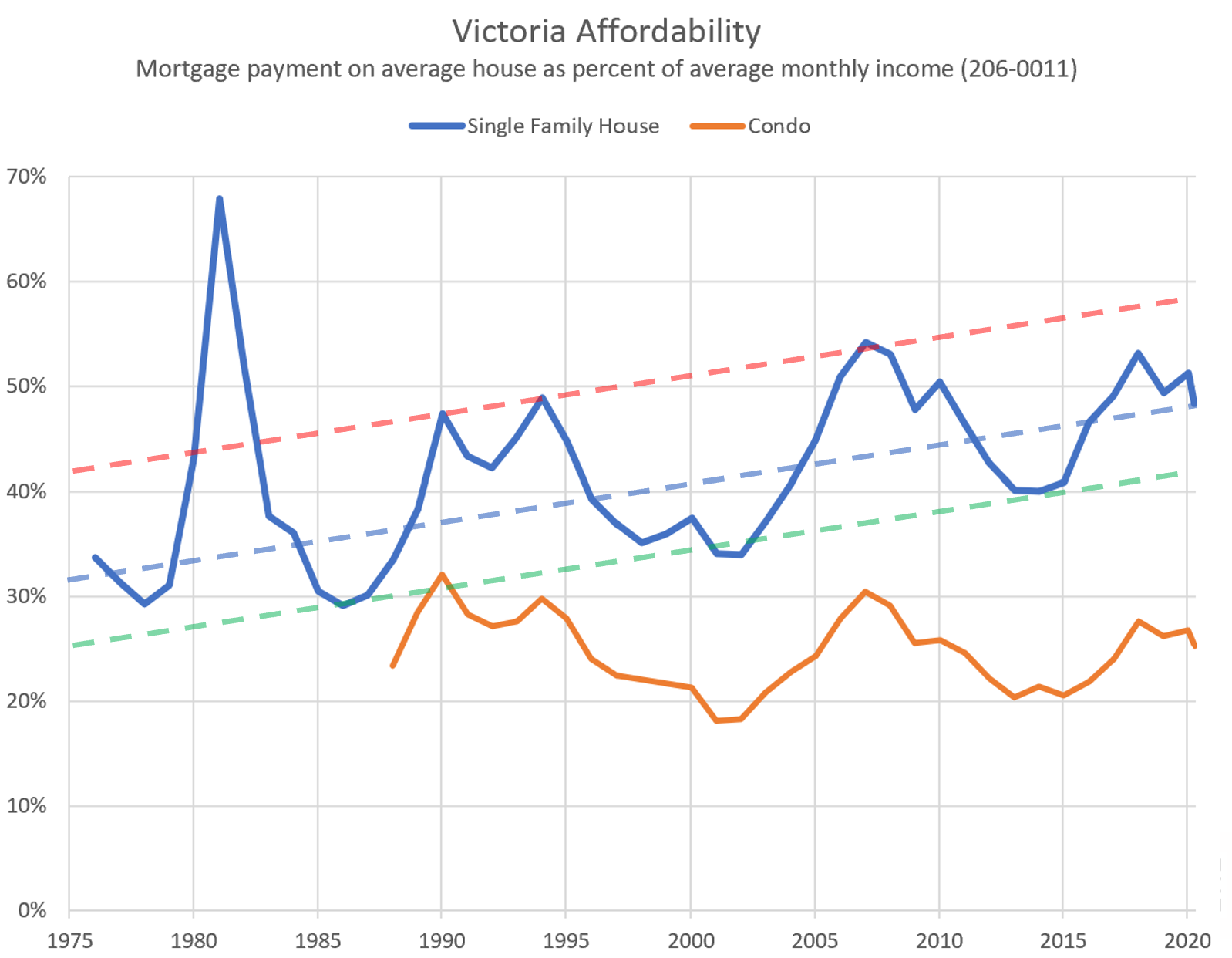

- Affordability was far worse. Affordability in 1980 was already strained, and that spike in interest rates blew it completely out of all historical norms. The payment on the average mortgage hit nearly 70% of the average household income, versus less than 50% now.

There’s always uncertainty in economics though, and at no time more so than in this grand COVID experiment. If long term cycles in real estate are slow, then cycles in interest rates are glacial. We’ve got nearly 40 years of dropping rates in the rearview mirror, and that has been confounding the forecasts of economists who have been calling a bottom for about as long (below left). It also means that most people have never known anything but steadily declining rates. Trends in rates can go on for decades, and we may well see them stay at rock bottom levels for another 10 years like they did in 1940. But eventually this cycle will end, and if we switch to flat or rising rates for several decades the next 40 years in Victoria real estate may look very different than the last 40. More on that in a future post.

Also the weekly numbers, courtesy of the VREB:

| Dec 2020 |

Dec

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 142 | 402 | |||

| New Listings | 142 | 394 | |||

| Active Listings | 1775 | 1952 | |||

| Sales to New Listings | 100% | 102% | |||

| Sales YoY Change | +71% | ||||

| Months of Inventory | 4.9 | ||||

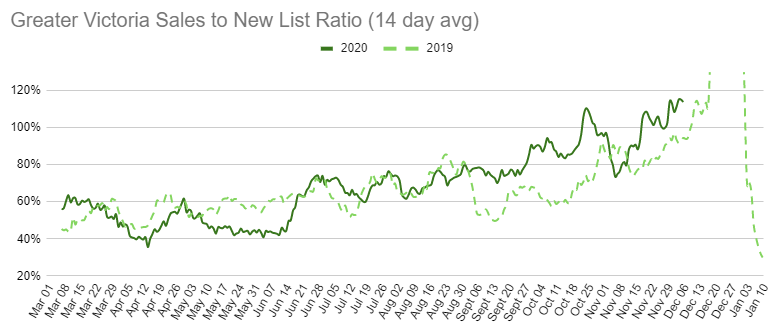

We usually get above a 100% sales to new list ratio in December, but in this case we’ve been above 100% for a couple weeks now. The market is running substantially hotter than it was last year and it looks very likely that we’ll hit another all time sales record for the month.

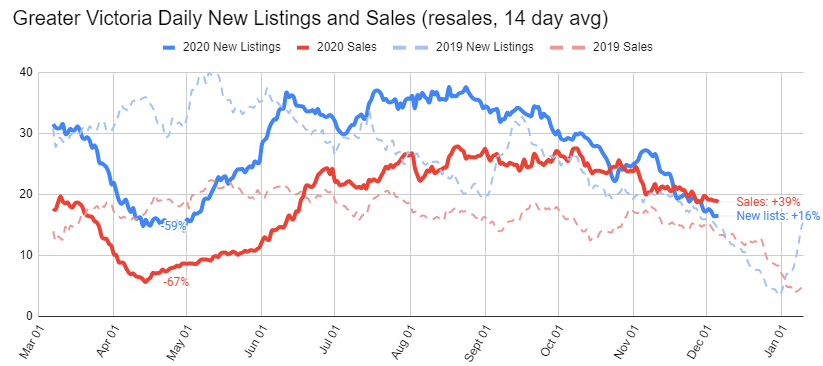

The biggest impediment to that will likely be available inventory. On the detached side there are currently 373 active listings in Greater Victoria, and only 130 are under the million dollar mark. There’s more condos available than this time last year, but overall there are 21% fewer properties on the market than the same time last year. Substantial new listings don’t normally start appearing until February, so that’s not likely to change for some months.

How did the crash affect Victoria renters? Any data on that point?

Monday post: https://househuntvictoria.ca/2020/12/14/dec-14-market-update/

I realize that the site C dam conversation is off topic somewhat, but the power to our homes is important:)

I came across this interesting bit of news.

“The first large-scale offshore wind farm is coming to the US and it could be the most powerful in the world.

Vineyard Wind recently announced it will be placing more than 60 of General Electric’s 856-foot Haliade-X turbines some 15 miles off the coast of Martha’s Vineyard, a popular island destination in Massachusetts.

When activated in 2023, the towers will generate enough energy to power 400,000 houses in New England, the company said.

I believe that the site C dam will produce about the same amount of power for the same amount of houses.

This wind turbine project costs around $3billion.

Of course they don’t run all the time. (Less than 50% of the time) But wind turbines…with battery storage ….could play a big part of our energy needs.

Same with Dams when done right.

Back to people having to drive to testing centers 🙂

Yup, governemnt gives a shit about covid but you have to go to a testing center to write a 100% useless exam….makes sense.

5 years into this still no evidence as to why exam was introduced and no evidence as how it has benefited anyone. Of the thousands of study guides I’ve sent out it’s been 99.9% negative feedback. Literally not one person has ever said anything alone the lines of “I learned something that will help me build a home.”

Umm..really? – I must be missing something. With a new build you generally file everything at once and then just wait for approval. Once you get that, there is normally no further permitting and the only thing that holds you up is inspections. Plumbing and Electrical can be filed separately but they’re easy/short applications.

As far as I’m aware, permitting a reno is the same, although if you’re not changing the footprint / height / floor area then you can skip the zoning review. Either way, you’re not starting until you’ve pulled the permit. In the CoV you need to have your abatement letter submitted prior to any permits being issued, so either way you need to have the existing structure tested.

And if you’ve got a network of Red Seal trades at your disposal, then you have a major advantage!

The owner/builder exam is stupid, but last I heard they open booked it and you can write it from home. IIRC, the owner builder stuff can even apply for major renovations.

I’m sure Marko will chime in if I’m way out to lunch here.

As I’ve said, it is essentially meaningless to talk about the probability of a price decline, because the current set of parameters which can affect the housing market have not been seen before.

On the one hand, it’s not good to be stressed out and house-poor.

On the other hand, the probability that RE prices will be lower in five or 10 years (compared to today) is very low; so you’ll probably have an even harder time buying in the future, unless your income and/or savings outpaces RE-price gains proportionally.

Some are and some are not. As well, if they are that livable, it’s really not that much of a teardown. However, permitting drives the scheduling for everything else and I can’t let a two year project turn into a five one or get into renew permits and etc.. because of delays… The time is the big cost part.

This is more to do with abatement letters and hazmat certifications. With renos, this tends not to delay permitting as it does for the teardown. For example, you might have a teardown that is without a hazmat issue, but you still have to go through the process of inspection and certification. With the reno, if there is no hazmat present just file your permit and carry on. (Of course if there is hazmat, complete the proper abatement, which up costs in either case)

In my case, I don’t need a general contractor to manage a reno. I have a well established network of Red Seal trades that can bring all needed items up to code. As well, the ability to pull home owner permits allows for greater flexibility especially for timings and managing the work and the trades in and out (big cost savings even on major reno projects). Ideally, I would be dealing with something close to it’s original state and not the standard Victoria hack job that saw some sort of mistaken modification in each decade of it’s 70 years. Coordinating the new build you are either at whim of the high priced general contractor or dealing with the inane and onerous owner-builder program which municipalities still make more of a headache with their patchwork policies.

Are these places you simply cannot live in while permitting? Seems like there are a lot of what I would consider tear-downs which are occupied.

Generally the same for major reno and tear-down. Maybe you can leave some asbestos tile in the kitchen for a reno.

I would disagree with this, except for the financing part. Major reno can easily be more expensive and more time consuming because you have to bring everything up to code / work around a bunch of existing stuff.

Agree with you there. Prices pushing past $400/sq. ft. for custom builds.

$100M for new anti money laundering units in several provinces including BC. To be operational by March. They can spend some time sifting through the new registry

https://globalnews.ca/news/7517509/new-federal-anti-money-laundering-units/

I have been going through the considerations on several of these and the cost of the delay on the teardown, abatements, permit delays and the upward for of construction costs are big factors for it. I have only really considered the teardown on houses that are legitimately past the usable lifespan and are undersized for the property they sit on. These are properties that cannot support adding additional floor and would not make any sense with a foundation lift either. A reno, no matter how extensive tends to be easier with permits, financing and more cost effective than the majority of teardown and build. However, to find any value position is extremely difficult with the lack of inventory and the current price expectations of sellers. As said above, the economics of it are really difficult and don’t make sense to undertake. The need to live and work while undertaking a project really throw a wrench into things..lol..

Separately, I am always amused by folks in my social cohort that have purchased properties in Victoria almost express hostility at me for not buying. They almost view my refusal to take on the financial strain and the stress as offensive. I get the question even without bringing RE up to discuss: “why haven’t you bought?” and my answer of “I can’t afford it” elicits the response “yes you can, you just choose not too” and “you are the person that is supposed to buy”. Then they seem to become even more irritated when I explain that I refuse to ever allow money to be a stressor in my life and with that I can’t justify I purchase from my standpoint. Unfortunately, they seem to take that as a judgement on their circumstance, when it is not since I can only judge and speak to my own circumstance and not that of others. With that said, my circumstance, will very likely keep me out of this market because I just can’t “suck it up and take on the stress and join the rest of us”.

Yes, the exemption from PTT to the transfer of shares is really meant for this – to facilitate commercial transactions and business.

Yes fair enough for residential. I was thinking more commercial real estate where I’ve seen a lot of apartment buildings be sold via share sale in the last little while.

Pretty sure the beneficial ownership registry kills this loophole

Sure, but your pool of buyers are limited to those purchasing through a holdco. Rare to match that up with residential real estate held in a holdco. My uninformed guess is that the transfer of shares in residential real estate to and from a holdco may end up subject to PTT in the future now that the government has this information.

Can’t you just sell shares of the Holdco to avoid PTT?

Thanks for the link. Way back when I spent some time living right behind it on Hampshire Rd. That house is still there. Never thought I’d see the Lodge go.

Definitely. There is a big difference between deliberately laundering money through off-book transactions facilitated by Chinese gangs using BC casinos and filling out permanent ownership forms for property ownership, including:

I sorta get it, but really this is counter to their climate goals.

North Van banning nat. gas for new SFH starting next year: https://www.nsnews.com/local-news/city-of-north-van-steps-towards-climate-goals-with-new-building-regulations-3149068

Why do we often see displacement in new projects? Because it’s damn near impossible to rezone for multi family on most of the land in the city, so of course developers will gravitate to sites with existing multi family zoning that isn’t currently at the highest and best use.

Direct consequence is that many new developments displace existing affordable rentals. The solution is clear, but it’s not clamping down on one of the few kinds of development still happening

Cook St. Village development was a no-go, but this 258-apartment project is a go:

Victoria council approves redevelopment of Wellburn’s Market site

https://www.timescolonist.com/real-estate/victoria-council-approves-redevelopment-of-wellburn-s-market-site-1.24254085

Unlike money laundering?

How to buy a house in Victoria or Vancouver.

Step 1: Buy $41,000 of AAPL 20 year ago.

Step 2: Profit.

–

They should think about selling sooner then later as capital gains tax will most likely go up, as of now they would pay close to 900k in taxes and could be another 450K if rate goes up to 75 % or another 900k for a total of almost 1.8MM if capital if rates go to 100%, this would also apply to investment real estate

Yes, two different things.

The transfer of interest declaration and report are pretty simple forms though and the notary or lawyer has to add to their conveyancing checklist now.

The report is so long because it has to cover situations of multiple corporate owners, partnerships and that of trustees buying real property.

For as corporation with a single shareholder the additional information beyond the regular conveyancing information required is the incorporation number, social insurance number and date you became the shareholder and records office address. That timing was unfortunate though!

I haven’t seen these forms before. It looks to me that the government will have all the information they need to trace ownership and to apply taxation rules properly. I don’t think you will find people willing to lie on the ownership forms easily. This is a criminal offence.

How to buy a house in Victoria or Vancouver.

Step 1: Buy $41,000 of AAPL 20 year ago.

Step 2: Profit.

https://financialpost.com/personal-finance/family-finance/this-couple-made-a-fortune-in-apple-shares-now-they-have-to-turn-it-into-a-stable-retirement

I think we are…this is what I was referring to

“When registering an interest in land on or after November 30, 2020, the Land Owner Transparency Act (LOTA) will require corporations, trusts and partnerships to which the legislation applies to file a transparency declaration and a transparency report with the LOTA administrator to disclose beneficial ownership.”

What odd is that people who contributes absolutely nothing to society tend to complaints the loudest, and pay practically zero in taxes, consume the most frome social services. They and their ofsprings produces magnitude more carbon emissions than a hard working employer who provides employment for their peers that collectively pay much more taxes than said person can ever imagine.

Thanks for the info, totoro. Much appreciated.

I apologize, Marko. You may not be doing quite as well tax-wise as I had thought.

The principle of tax integration applies and he’ll likely pay virtually the same whether he pays himself with dividends or income and at the same personal tax rate overall as applies to a salaried worker like you. The difference is how many years you spread the pay outs over to reduce the personal tax rate – again, without a pension this is there for good reason for this and the business has already paid corporate taxes on the proceeds.

The transparency register deadline was October 1, 2020. We had to complete one too and the forms were released well in advance of this date – we accessed ours on September 23.

Perhaps you are talking about something else?

I complained about it, but I adapted. 50% marginal tax rate was the breaking point for me, personally. At that point I set up the companies, started taking a lot of time off (2-3 months per year), stopped doing mere postings (I am not driving out to Sooke to do a mere posting for $899 (($350 worth of expenses)) and then get taxed on that), etc. I would have stayed course if it was approx 45% as it was so much less paperwork and work not having the companies.

My concern was also with my medical specialist adapting and taking 2-3 months off per year and me not having access to him or her 🙂

That being said even with all the accounting I still pay the highest marginal rate in BC on my personal taxes, so not to worry.

What about when Marko retires from being a real estate agent and dissolves his corporation? What rate will he be taxed at when he withdraws (for personal use) all the money he’s been stockpiling in there?

The government released the forms at 12:01 am on November 30th and my completion was on November 30th. My lawyer only found out half way through the day…I had to go back to his office in the afternoon after signing everything else in the am.

You could have easily have done this yourself. It ends up as a one-page transparency register which simply lists the beneficial owners. Simple DIY instructions here: https://www2.gov.bc.ca/gov/content/employment-business/business/bc-companies/bearer-share-certificate-transparency-register/transparency-register

Untrue.

Why do people use corporations?

Because then ex. Marko, can keep his commission income in the corporation where it is potentially taxed at 9% but this capital will degrade in value unless reinvested and he cannot use it for personal reasons – so:

https://www.taxtips.ca/smallbusiness/investment-income-taxation.htm#:~:text=However%2C%20see%20our%20article%20on,a%20capital%20gain%20is%20taxable

if this income is paid out to Marko he will pay tax on it at his highest marginal tax rate.

Retained earnings kept in a holdco are the source of much of the investment capital in Canada. They do offer some control over tax planning, as they should for many reasons including the fact that most people who are entrepreneurs have no pension, but they are not a tax dodge and do not give Marko any extra personal funds at the same tax rate as his office assistant.

Root cause is obvious – fountain of money coming out of Ottawa and ultra low interest rates. Household buying power up in the face of the worst economic downturn in decades. Couple that with what ks112 said.

Funny that we never hear Marko complaining about all the paper shuffling and accountant invoices associated with setting up multiple Holdcos and PRECs, so that he can earn in the top 2% but be taxed at the same rate as his office assistant.

Marko, the root cause is that most people think real estate is a great investment (regardless if it is your principal residence or a rental property) and one that you can’t lose money on. That is the simple reason why prices are increasing.

1000x this.

I had to complete on a property the day it was introduced….nice and simple 27 page document to note that Juras Holdings Ltd. is owned by Marko Juras 🙂 Waiting for the additional invoice from the lawyer.

The one thing I am happy about is we get one more item crossed off that is driving up prices. Foreign buyer tax in place, spec tax in place, now this place….yet prices still continue to increase. At some point we will actually have to look at the root causes.

Long overdue:

https://twitter.com/richardzussman/status/1337443697449832449

Looks like Oak Bay escaped the threat of poor people moving into the neighbourhood:

Plans call for demolition of Oak Bay Lodge

https://www.timescolonist.com/news/local/plans-call-for-demolition-of-oak-bay-lodge-1.24253582

Here’s a CD Howe report calling it flawed but fixable.

https://www.cdhowe.org/sites/default/files/attachments/research_papers/mixed/Commentary_583.pdf

I’ve seen an article from a law firm saying that there is no ID verification so people can just make up beneficial owners (under threat of stiff penalties of course) and the $5 access fee will prevent media from effectively rummaging through it for their investigations.

I wish the article would say how BCs new registry is bad rather then just saying it’s bad. Also introvert for what it’s worth I’m more worried about our Province is wasting billions on compared to what it spends on you, if anything.

Some people say the beneficial ownership registry is game over for money launderers in BC real estate, some say it’s a joke and easily bypassed. Hard to know who is right

https://financialpost.com/diane-francis/diane-francis-the-u-s-is-finally-doing-something-about-the-global-money-laundering-scourge-will-we

On top of the other concerns, do we need the power from Site C?

What if EV uptake really takes off?

If we had 350,000 EVs in B.C. by 2030 (today we have around 30,000), the additional power required would be 1,050 GWh per year, or 1.8% of total power used in B.C. in 2017.

https://www.theglobeandmail.com/drive/mobility/article-are-our-power-grids-ready-for-an-electric-vehicle-surge/

https://in-sights.ca/2019/03/03/demand-forecasting-falsehood-or-foolishness/

“Taylor Swift video features shot of Victoria street”

Really scraping the bottom of the barrel with this one…

Introvert has a job?

Introvert, as a tax payer I am more concerned about our tax dollars being used to pay your wages so you can post on househuntvictoria.ca all day every day compared to the issues at Site C. Judging by the assortment of links you constantly post it is obvious this isn’t the only website you visit on a daily basis and I am sure you are not the only public sector worker that does.

Generally, operational emissions tend to be much much higher than embodied emissions, if the new building is ‘high-efficiency’*. Since there are solutions for the construction of high-efficiency buildings (PH, step 4/5 etc.), the focus has moved on to embodied carbon. Hopefully within the next 5 years we’ll see widespread availability of more environmentally friendly building materials. Mass timber, wood-fiber insulation, foam glass, etc.

*Exceptions would be structures which are not primarily wood (ICF, for example).

Taylor Swift video features shot of Victoria street

https://vancouverisland.ctvnews.ca/taylor-swift-video-features-shot-of-victoria-street-1.5225939#_gus&_gucid=&_gup=twitter&_gsc=UsTl1bD

What people don’t get, though, is that one of the possible outcomes for Site C, as planned, is that it never reaches functional and safe completion, irrespective of cost, due to “lack of solid ground on which to anchor the dam structure, powerhouse and spillways.”

The fact that it’s even a possibility that BC could spend 6, 10, 15 billion dollars on a project that we might literally have to abandon because of insurmountable geotechnical issues should be deeply worrisome.

https://thenarwhal.ca/site-c-dam-geotechnical-problems-bc-government-foi-docs/

I am a supporter of hydro power. I know…there are serious issues, pros and cons around the idea but I still believe they are amazing when you consider the enormous, generally clean amount of power they can produce.

Having said that, I would have preferred Hydro to have kept all the existing turbines running…. instead of shutting them down until more power was needed… and then storing that extra power in massive batteries. (I believe that one of the main reasons dams often look to expand power is to build another dam downstream. As you probably know, they need to do that to take care of excessive peak power needs….which are real needs.)

Now I know that dams need to shut down their turbines from time to time to do maintenance on the turbines. I also know that they often keep some turbines running during off peak periods with the idea of pumping water back up into the lake behind the dam…in a sense it works like a battery because the stored water then becomes potential new power.

But what I would like to see them do is ditch all that and make the leap to including massive battery storage and keep turbines running during the off peak period. I’m told they aren’t in a rush to do that because switching to that kind of system would entail a huge change of “all the system” across the entire network.

But it seems like we might as well start that process and be leaders in making those kinds of changes. It is inevitable anyway. So…. as much as I am in favor of dams when done right, I changed my view on BC’s site C dam and was against it in the end.

(Site C in BC was much too far along anyway to put a stop to it anyway and I think that Horgan had no other choice but to continue.)

Few of the protesters against site C in BC ever caught onto the idea of pushing for batteries to fill the gap of the peak power issue. They simply pulled out all the usual, often inaccurate, “stop this dam” bandwagon bullshit.

We need new thinking. I’d like to see us becoming leaders in power generation and bring BC’s power grid into the modern world and make more plans for wind farms, solar, geothermal etc. etc…. all feeding into a battery backup system to handle peak demand.

People will not cut back on power. Look around you right now. Tens of thousands of inflatable Santa’s and Grinches etc on peoples lawns powered by fans from China. No one really cares. “Oh…..I’m just using a tiny bit of power for those fans.”

The same people are likely out there at rallies with signs saying “stop the oil pipeline”, “stop the site C dam”……”protect the environment”.

Ha Ha……We are all fucked in the head when it comes right down to it.

Me included:)

Signed: “The Grinch at Christmas”

Exactly. Without approving new developments where the builds are way more energy efficient and allow people to live walkable lives, all the houses will be slowly replaced with energy sucking mega mansions over time.

Wonder if the people that enjoy living in diverse single family neighbourhoods with families from all walks of life will like it as much when the houses are all maxed out mansions occupied only by the top few percent of wealthy people. Change is inevitable. Gradual densification with missing middle housing will retain more neighbourhood character over time than trying to stop all change.

So wouldn’t it make sense to tear down a couple of house and replace with 50+ units versus having people tear down houses and replace them with houses?

The Bayview had a lot of sales in the last 90 days so the prime corner layouts sold. As far as luxury Bayview is all solid core doors, heat pump (you have no A/C at Swallows Landing), the kitchens and bathrooms are better imo (they didn’t bother to take the cabinets to the ceiling at Swallows), what is with the hot water tank inside the unit at Swallows? etc.

Not to mention the lobby/amenities are Bayview are top notch (for example, super well lit large car wash station, etc.); however, not a huge strata fee burden as no pool etc. How many buildings have a nice designated car wash station? That all being said Bayview doesn’t seem to sell any better per square foot than any other average run of the mill concrete building so I guess it is all a matter of opinion.

I do like the patio doors on the Swallows unit!

Construction/demo waste is a pretty big % of what goes into our landfills. Would be interesting to see what is best overall for a longer timespan (say 50+ years). Renewables gaining more traction means less impact per watt over time (assuming electrical heating/hw/etc and not gas/oil).

Marko,

Here is a comp of 2 condos asking for the same price between Bayview and Swallows landing. In my opinion the Swallows landing one just has a more luxury and exclusive feel to it if one can over look the location.

https://www.realtor.ca/real-estate/22453617/709-100-saghalie-rd-victoria-songhees

https://www.realtor.ca/real-estate/22543625/706-847-dunsmuir-rd-esquimalt-old-esquimalt

From my observations this is only feasible in Fairfield or Oak Bay where it economically makes sense to tear down a livable house. Once you move outside of Fairfield/Oak Bay you can’t really buy a true teardown that is livable for a month let alone a year or two. You would need to buy above and beyond the market value of a teardown to live in something for one or two years and then the economics of it don’t make sense.

They literally don’t understand anything. Just think about how many local high-pay jobs a project like this would create in terms of consultants/tradespeople, etc.

Then the council also seems to talk about the environment a lot….so I am guessing replacing run down 100 year old housing stock with the latest in energy efficiency doesn’t make sense?

Typically, the best bang-for-the-buck in RE is to buy used, isn’t it?

For non-multimillionaires, building new in the core seems like a good recipe for bankruptcy and/or divorce.

Hah.

Buy the place, move in for a year or two while you figure out where the sun shines. Then pull the trigger.

Introvert this must be your spirit ancestor.

In response to a duplex being potentially approved in Gordon Head, 1980s: “the rezoning would be the thin edge of the wedge leading to the destruction of the neighbourhood”

I don’t know. A brand new condo building just went up adjacent Swallows Landing. You also have those public stairs/walkway that cuts through the Swallows Landing property which personally I use all the time; however, would not want if I lived there. As for size of unit/view it is a function of price. You can get size and views in the three bayview buildings if you are prepared to pay.

My favorite thing about the Bayview complex is it is a cul-de-sac so super quiet (you would be suprised how little car traffic and foot traffic 500+ units generate).

Secondly it is super convenient. Youn can grab groceries on foot at Save on Foods. Downtown short walk and it’s way better than James Bay for commuting.

Somehow I don’t think I am going to be walking on foot from Swallows Landing to grab anything especially at night.

Then again I am very Euro. The drive in drive out culture is weird to me.

So after the city approves your plan in 6 months +/- you need to give the tenant 4 months’ notice which doesn’t start until the next pay period. Then you need to deal with abatement…etc.

You get your plans approved prior to tearing down. Depending on the situation you may also be able to pre-fab a lot of the structure (which lets you stay in the existing building a little longer).

Geez, I was looking at one of my last possible options to get into something livable here and that was to buy a teardown and rent out while I pick up extra work and re-capitalise my position. Then teardown and build, but not being able to organize and plan because of bureaucracy is starting to shy me away from it. I just couldn’t sit for 6 months, a year or possibly 2 years hemorrhaging cash as building costs are escalating and trying to organize and schedule trades. Well plan A, B or C hasn’t worked out and the others in between…. I think it’s on to plan T now.

Oh god. Sorry, everyone, for being so long-winded. I shoulda just said Site C is dumb.

A glance at the findings of the recent public inquiry into the Muskrat Falls megaproject debacle (Newfoundland’s Site C) is instructive:

Commissioner Richard LeBlanc concluded the government failed its duty to residents by predetermining that the megaproject would proceed no matter what.

Recall Christy Clark’s decision not to have the independent BCUC review the merits and pitfalls of a proposed Site C and instead decide to proceed because it felt right.

LeBlanc concluded that the business case, which assumed the Muskrat Falls project was the lowest-cost power option, was “questionable.”

BC never looked at other power-generating options either, because that would be silly.

LeBlanc stated that Nalcor concealed information that could have undermined the business case for the project.

We, too, were only fed the positives of Site C. It was supposed to be the BCUC’s job to investigate the risks, negatives, and alternative power options, but Christy Clark decided to skip that part.

https://en.wikipedia.org/wiki/Lower_Churchill_Project

I don’t think that’s what people are doing. But people are rightly becoming suspicious about the project when stuff like this comes out:

When the utility identified a stability problem under the foundations for the giant earth fill dam last December it held off making the news public until a July 31 filing to the BCUC.

Even then it held back details about the exact nature of the problem, the potential impact on the budget and construction schedule, and solutions, if any.

https://vancouversun.com/opinion/columnists/vaughn-palmer-site-c-cash-burn-continues-as-horgan-awaits-review-to-decide-projects-fate

Site C is being built for the fossil fuel industry to liquefy natural gas and export it overseas.

The era of large-scale dam projects may be over.

https://e360.yale.edu/features/after-a-long-boom-an-uncertain-future-for-big-dam-projects

Moreover, they’re not that environmentally friendly.

https://tinyurl.com/yyftcsel

I know nothing about the state of the Site C dam and whether it is better to finish or cancel it. But it is disturbing to see people cheering on problems with it. We need clean energy and lots of it if we are to have any chance at hitting lower emissions which are required to address climate change. We’ve built 82 dams, most of them decades ago. If we are incapable of building a dam in 2020 that is terrible news for the province.

I think Swallows landing has a more exclusive feel to it and the units are much bigger with better water views. Bayview one is a little too busy as there are just too many developments in that area.

https://vancouversun.com/opinion/columnists/vaughn-palmer-site-c-cash-burn-continues-as-horgan-awaits-review-to-decide-projects-fate

Don’t know why that’d matter – would it not apply to all homes owned under those criteria? Would be kind of pointless to say, “everyone up to the 30th gets to continue to hide.”

Personally I hope they enforce that law and for people who are caught giving false or unverifiable details, have the homes undergo an automatic civil forfeiture procedure. Next to food and water, housing is among the most precious of our national resources. We can’t afford for some or all of it to turn into safety deposit boxes for criminals and other shady folks.

Foreign ownership registry a game changer in B.C. say real estate insiders

One of the things I am pushing for in Saanich is public data on development timelines. Without data there is no way to hold the city accountable on time. Broad support so hopefully this will be part of the final recommendations.

Problem with the cook street village development is councilors don’t understand that new housing helps affordability even if it is market housing. And new residents help city budgets even in the absence of DCC/CACs

The original Microsoft Basic, which Gates himself was involved in coding, was pretty good for its time. The turning point IMHO was when he bought someone else’s OS and resold it for the IBM PC. Decades of borrowed and half-baked ideas followed.

I am doing a small development on the Westshore and I am estimating approx. 100-120k in fees before it goes infront of council. Even before you hit council you need a ton of surveying, arborists, traffic/parking study, schematic drawings, etc. My jaw dropped when I opened the proposals from a few architects.

I am guessing the developer spent somewhere between 500k and 1 million before this was voted down.

Trying to build a super small home in the Oaklands area and we are now 4 months into trying to obtain a permit with no end in sight. I email the city of victoria once a week and this is the type of reply you get

“Parks staff have until Friday to complete their review based on our review timeline. I know they are behind on application reviews right now so I would anticipate they will take until Friday. If you do not hear by Friday mid-day, please feel free to email us back and we can follow up with them.

Thank you for your patience,”

Whatever, it prevents people from building which restricts supply and drives up prices of end product so it’s not the end of the world but wish someone would just admit that policies are put into place to create unaffordable housing for the top 5% and call it a day. Why even pretend the city tries to do anything positive?

Who is looking out for Victoria’s taxpayers?

https://www.timescolonist.com/opinion/op-ed/comment-who-is-looking-out-for-victoria-s-taxpayers-1.24252352

After reading the above, here’s my sure-to-be unpopular take for the purposes of discussion:

To what extent should municipalities have to tailor their budgets to their residents’ ability to pay?

Can we consider the possibility that those on a fixed income didn’t save enough for retirement, if they struggle to pay annual property tax? Plus, property tax can be deferred, so…

And if your municipality’s tax is too much for your finances, then move to a lower-tax municipality and let those with the means to pay the higher tax reside in the higher-tax municipalities.

Unbelievable. Hundreds of thousands of dollars down the drain. And people wonder why housing is expensive. This ain’t the only reason but it’s a big one. The funny thing is many of the people complaining about it being expensive are opposed to new developments (developers = evil)

After the motion to approve that big Cook St. Village four-story development failed, the developer penned an Op-Ed in today’s TC:

Victoria needs a balanced ecosystem of housing

https://www.timescolonist.com/opinion/op-ed/comment-victoria-needs-a-balanced-ecosystem-of-housing-1.24252350

Harbour authority plans shore power for cruise ships at Ogden Point

https://www.timescolonist.com/business/harbour-authority-plans-shore-power-for-cruise-ships-at-ogden-point-1.24252340

This is great news!

Won’t happen for a few years (due to funding and COVID), but that the Harbour Authority has approved it is a huge step.

GHG equivalent of taking 1,394 cars off the road per year. James Bay will rejoice.

I think that sometimes a buyer will overpay a bit, other times a seller could have gotten a little more, and most of the time the sale price ends up being very close to where it should be.

In other words, I don’t think red-hot deals exist in Victoria RE. There are just too many eyes watching the listings, too much competition for a scarce resource, and too many people looking to make a buck.

What about the Bayview One as an alternative to Shoal Point? The location is a lot better than Swallows Landing imo.

Fair point. As Leo notes, individual assessments aren’t necessarily that reliable.

But on the surface, at least, $137K over assessment is a pretty good outcome for the seller.

Here’s the current distribution for single family under $1.5M. That sale at 20% over assessment is above the median, but not outside the norm

What does a ‘healthy sale’ mean? Introvert you have been around long enough to know that simply taking an assessment and sale price and assuming anything is useless. That person could have overpaid by 50K or the seller could have received an extra 50K and you would have no way of knowing based on the assessment. Just because you pay below assessment doesn’t mean the buyer got a good deal and just because someone pays over assessment doesn’t mean they got ripped off.

KS112, Those condo’s have a nice build and have a great view. I have only been in a few unites and the interior finish doesn’t look as dated as some units on shoal point. It’s also a lot easier to get in and around town compared to James Bay, which is absolute hell to get out of. I expect Esquimalt / Vic west to continue to improve from the days when people rarely crossed the bridge unless it was to play lacrosse or hockey.

Assessed at $678K. Quite a healthy sale!

Thanks Leo, guess I have a bit of a homer bias thinking 100 k over.

Sold for $815,000

Hello knowledgeable people. Could someone with the technology relay the sale price of 4031Travis Place ? Asking price of 799k seemed underpriced by over 100,000. I live on the street and am a little nosey. Thanks for this blog I find it extremely educational. Cheers

Vacancy taxes won’t solve Canada’s housing problems, but they can make a real difference

He was also a terrible programmer.

He really only cared about getting rich.

Really I think we can all agree, in this instance, it’s the language that is wrong, not Leo & Kenny G.

Longtime lurker here.

Leo, thank you for the insightful analysis. That’s very helpful. I appreciate the long-term perspective.

Anyone know much about the condos at Swallows Landing? That complex looks like a nice alternative to Shoal Point if you can look past the Esquimalt part.

Finance minister says that, after you apply online, you should receive a direct deposit “within days.”

I definitely don’t treat time as a scarce resource — I’m on HHV!

Yup, and this could also be causing confusion: the past tense of “to read” is “read” (pronounced differently). English is a strange language.

‘

‘

You know who doesn’t care about correct grammar Bill Gates

https://www.cnbc.com/2019/02/22/bill-gates-response-to-a-strangers-email-reveals-a-hilarious-truth.html

But the more I thought about it, the more I understood. It’s not as if Gates doesn’t know how to spell. He simply doesn’t care. In fact, caring about the little things is essentially the opposite of what email is about for Gates. Instead, it’s all about efficiency, efficiency, efficiency.

Put another way, Gates doesn’t have time for things like going back and double-checking for spelling errors. It’s been widely known that while creating Microsoft, he took years away from listening to music or watching television. The topic of time itself often comes up in conversations with Gates. “Time is the scarce resource and I treat it that way,” he once told

Yup, and this could also be causing confusion: the past tense of “to read” is “read” (pronounced differently). English is a strange language.

The flip side of the previous is that the higher that interest rates went, the bigger the advantage that a large down payment gave you over other buyers. I was able to put 40% down on my first purchase, a SFH in Vancouver. I would not have qualified for an insured mortgage with a small down payment.

And the mortgage was floating rate, the credit union wasn’t offering anything else. But the rates started floating down pretty soon.

To put interest rates into perspective in the 80’s, I had an $80,000 mortgage at 20 1/4% with monthly payments of $1,499, I will never forget it. If you do the calculation you will see that of that payment $1,350 went towards interest leaving only $149 reduction against the principal. We used to kid one another by saying “yeah, I payed off a couple of doorknobs this month!”

Another fact many won’t know if they weren’t around then was as the interest rates rocketed up, literally 1/4 to 1/2% per week, the banks would only give a 6 month closed mortgage or open mortgage, nothing longer, so you were forced to follow it up. Fortunately you benefitted when the rates came down as you were only locked in for 6 months. My 20 1/4% mortgage had dropped to 16 1/4% when it came due 6 months later, crazy times.

In Alberta, the Provincial government stepped in and payed the difference of any principle residence that was over 12%, how crazy was that?!

Lead is pronounced the same as led. That’s probably the issue.

Just heard that Chuck Yeager died.

Inflation the pandemic and public trust. The difficulty with the perception of how inflation is occurring may start to reflect in reality. The public’s trust in the institutions that manage it may erode if the institutions are not keeping up with consumer habits and where the impacts on prices are being actually felt. Government and large institutions tend to be behind the curve and play catch up most of the time and it’s likely understanding where the inflation impacts are being felt is a part of that.

This is a dated article that makes some interesting assertions on the matter:

https://financialpost.com/news/economy/pandemic-widens-gap-between-perceived-measured-inflation-schembri-says

https://www.bankofcanada.ca/2020/08/gap-between-inflation-perception-reality/

The last time Canada had an annual inflation rate higher than 2.5% was 2002!

https://www.inflation.eu/en/inflation-rates/canada/historic-inflation/cpi-inflation-canada.aspx

Oh no. Now it’s Kenny G, too!

Thanks can you tell us what to buy so we make 500% returns in the next two years. 😉

I have a friend in Ontario who owns a mediums size furniture manufacturing and sales business and he said the wage subsidies has lead to record profits for his company and the funds go basically straight to his bottom line

Great post Leo!

Separately, on the money out there right now and it’s impact.

From: https://financialpost.com/investing/fp-investigation-as-cews-flowed-in-dividends-flowed-out

Oh well, I have been surprised on the returns and growth I have been getting on my preferred shares in my portfolio. I guess I just have accept that I am stealing my children’s future tax dollars for today’s profits.