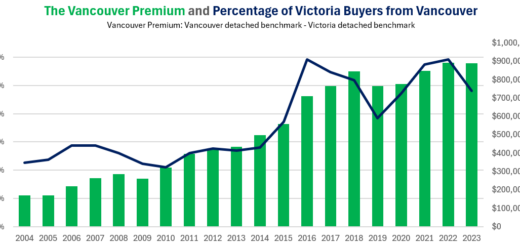

Vancouver premium fades, but it’s still a lot of money

After 6+ years of price stagnation following the Great Financial Crisis, two things turned the market around in 2014/15: the improvement of affordability from years of dropping rates and rising incomes, and the start of...