When are high prices a bubble?

The market for single family homes is completely off the hook out there. 55% are selling for over the asking price, often for tens of thousands of dollars over. Many of those over-asks are going in unconditional offers to strengthen offers, with buyers struggling to do pre-inspections while COVID restrictions mean that many are committing a million dollars based on a half hour viewing, or even sight unseen. Compounding the situation is that these bidding wars are blind, with the winning bidders not knowing if they outbid the runner ups by $500 or $50,000. That means it’s impossible to tell if the sales prices reflect market value, since buyers don’t have sufficient information and the properties aren’t exposed to the market for enough time.

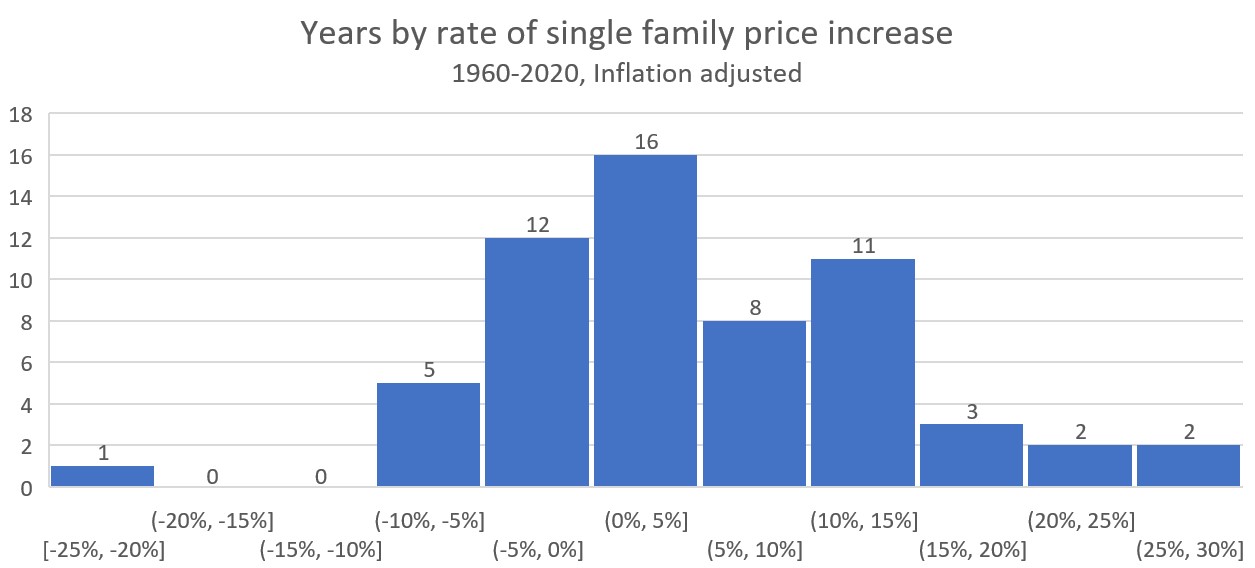

All that activity is driving up prices extremely rapidly, with the median single family home in the last 3 weeks selling for 25% over its assessed value from only 8 months ago. That’s a huge increase and certainly outside the norm, although not entirely unheard of in the Victoria market. It’s too early to extrapolate these prices to the full year, but looking back to 1960 we’ve seen prices rise more than 20% per year about once every 15 years, and over 25% only twice in 60 years.

However we need to separate price changes from price levels. Just because we’ve seen a price explosion doesn’t mean that the market is necessarily overvalued. For that we want to look at where price levels are relative to fundamentals. Can buyers actually afford to buy at these prices? For some buyers, that answer is an unqualified yes. A Vancouver buyer who just sold a $3M house doesn’t care one bit about affordability of a house half that price in Victoria and will buy regardless. But out of town buyers have made up around a quarter of the market while all-cash buyers are about a fifth. That’s a substantial driver of the market, but the reality is that most of the market is still fueled by debt taken on by ordinary people earning ordinary incomes in Victoria. And no market – no matter how hot – can survive three quarters of the buyers disappearing.

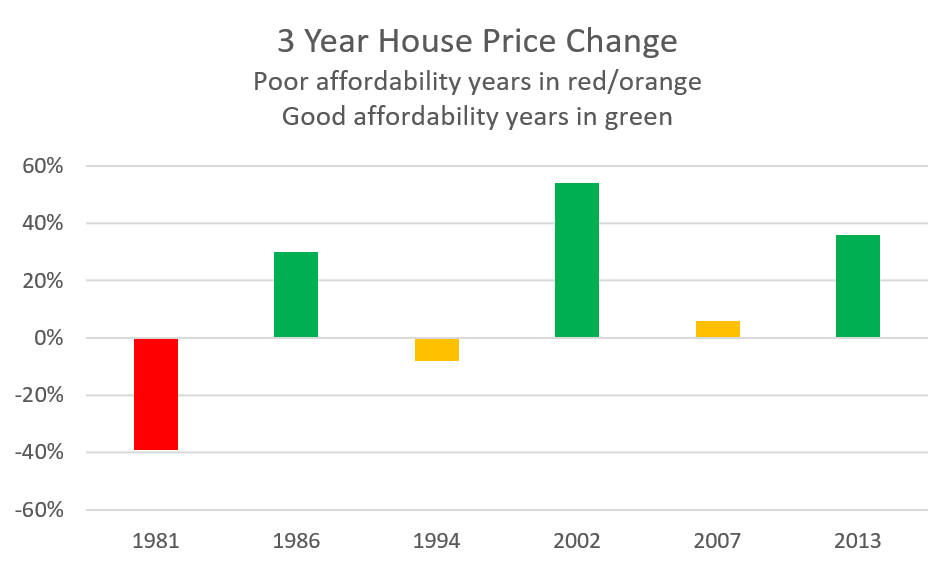

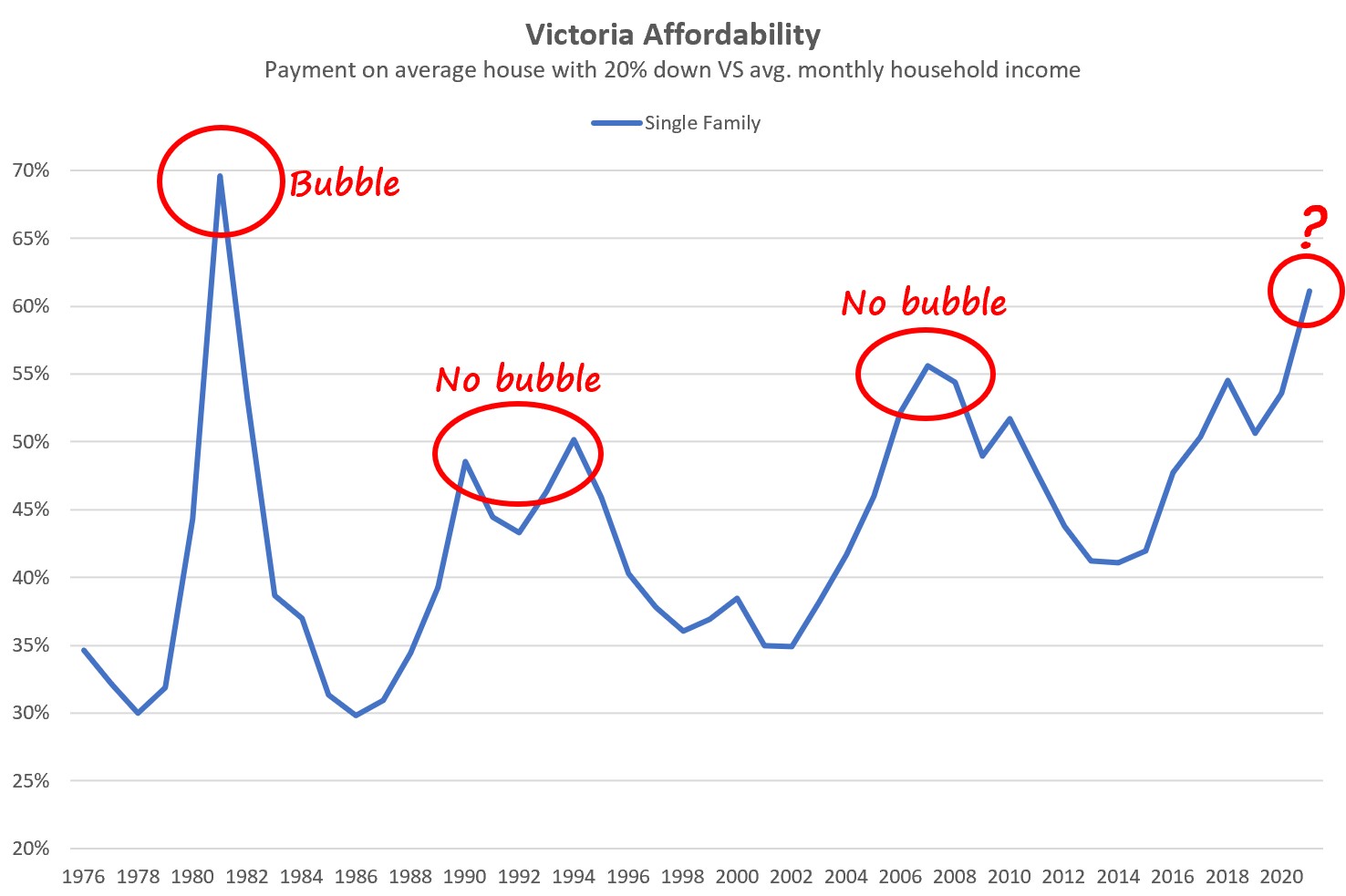

At least, that’s what has happened in the past in Victoria’s housing market. When the market got unaffordable to locals, prices stopped increasing until affordability returned. In one of those cases, prices rose way outside the ability of locals to afford them in a speculative bubble, and crashed 40% shortly thereafter. In the other years when affordability got strained, prices simply plateaued until interest rates dropped and incomes rose, restoring affordability.

So the obvious question to ask is: are current prices in bubble territory according to the affordability measure or not?

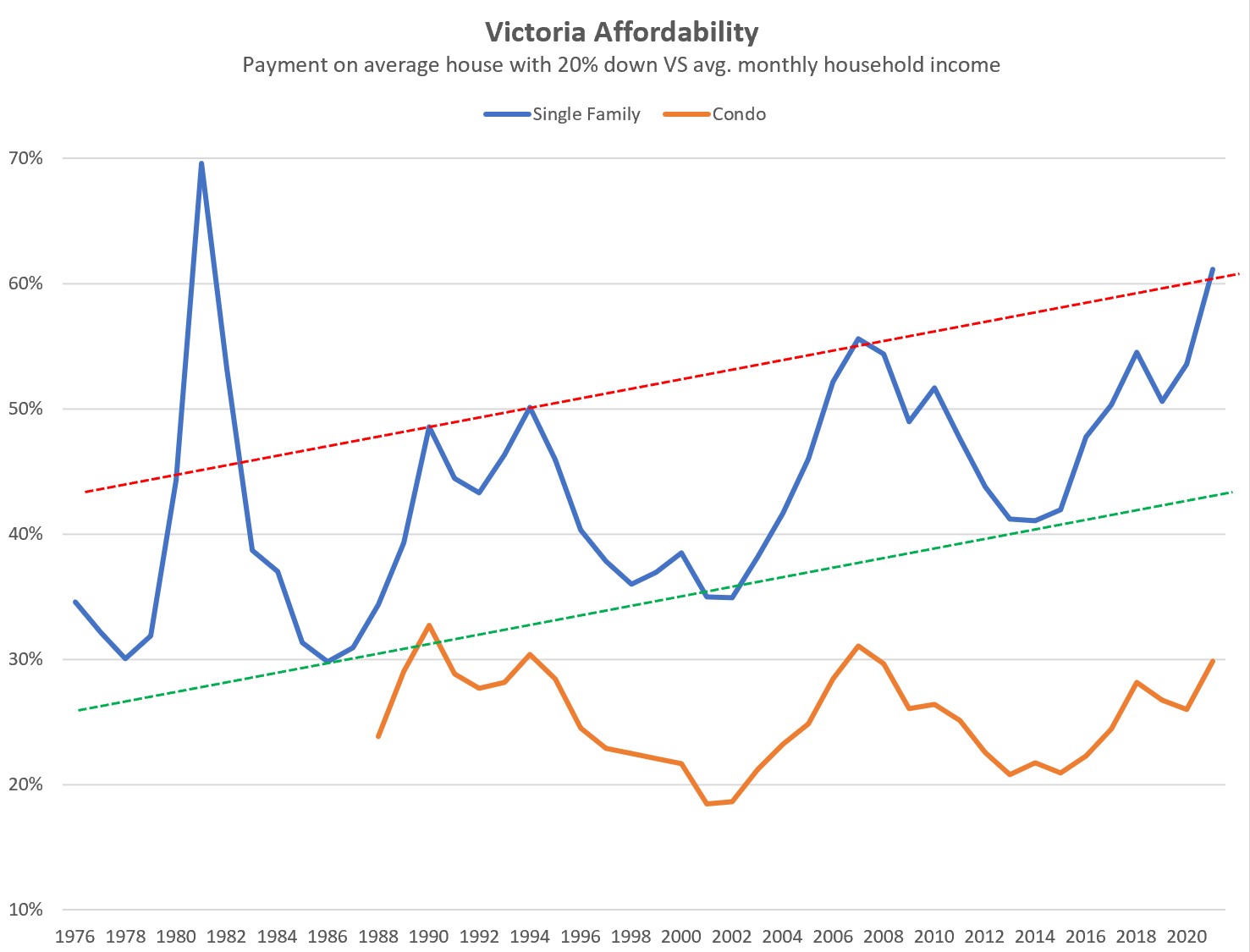

This chart assumes a 25% increase in prices from 2020, which would put the average single family price at just under $1.25M for the year. Are those prices in bubble territory? Well in the past I’ve overlaid the long term trend of deterioration in affordability over this graph. I believe that deterioration in affordability is a normal consequence of a densifying city where single family detached properties represent a smaller and smaller proportion of the total housing stock and are thus bought by a smaller and smaller slice at the top of the income spectrum. Here’s what that trend looks like now.

It’s clear that affordability at those prices is extremely strained, reaching to the poor affordability line where the market usually tops out. However it’s not much beyond it yet, and because of the drop in rates I think we’re not in bubble territory yet. However there’s a few things to keep in mind when looking at this chart:

- For mortgage interest rates, I’m using the series 027-0015 from CMHC which is the average 5 year fixed rate and is available back to the 50s, allowing us to do these long run comparisons. This is consistently higher than current contract rates, with the most recent reading at 3.3%. Remember that is true across the series so we don’t expect this to be the same as contract rates. However it takes a while for this series to adjust to dropping rates so I’ve assumed this will settle at 3.1% in 2021 but it could go lower too.

- Down payment assumption is at 20%, which of course is increasingly hard to come up with at these prices. The chart looks the same shifted upwards with 5% down, but that wasn’t available over the range of the chart.

- Average income data in this series (206-0011) is only available until 2018, so incomes after that are estimated (at +1% real increase per year).

- The red and green lines showing affordability ranges are just eyeballed based on the last 3 real estate cycles and should not be taken as gospel.

- In addition there is no particularly solid reason to believe that single family affordability will continue to worsen due to densification at the same rate it has in the past. It could happen slower or faster in the future.

So with that pile of provisos, take the chart for what it is: my best estimate of current affordability in the Victoria market. While the current price runup is incredible, if rates stay low I don’t think we’re in bubble territory where I would expect a large decline in prices. However market conditions are still pointing towards increasing prices, and if we go much further up I think we’re going to be in dangerous territory. In addition, in the past affordability has been restored primarily through dropping rates, and that’s not really an option now, leaving only rising incomes or dropping prices. Will single family affordability improve in Victoria in the future, or is this the point where fundamentals are left behind?

And if affordability is strained, does that make it a bad time to buy? Well no one can predict market prices, but here is how short term returns have looked at previous peaks and valleys in the affordability cycle. In general expect returns to be poorer when affordability is strained. Holding longer mitigates the risk of having to sell when prices are down.

$801k (by the way there’s a new post if you’re wondering why there’s no new comments)

It appears that 2552 Victor is off the market already…can I ask what it sold for?

New post: https://househuntvictoria.ca/2021/02/22/how-long-do-overheated-markets-last/

No one likes their approach criticized eh?

Very good Marco. Thank you.

What ha ha…okay fair enough I am just going to go back to skipping over your posts. Problem solved. There will be no more bullying.

Exactly. Needs to change. $700k for a townhouse is still tons, but it is doable at today’s interest rate. $1M+ for a house just isn’t. And precious few 3bed condos around as alternatives.

“It is also important to think about why Sooke Rd is being expanded at a tune of $100 million and the environmental impact of that process.”

Really Marco? What a stupid remark to make. Go take your stupid bullying somewhere else.

Add the factor of there would be much more competition in the marketplace and these would be popping up all over the places which would increase inventory and suppress prices. If there were 10-20 townhome developments going up at any one time they would have to be sharp to compete.

The way municipalities and government in general operate only the big players like Abstract, Aryze and few others can afford the barrier to entry of rezoning.

Some numbers for the $700k townhouses at 902 Foul Bay.

Luke estimated $50-75k cheaper if they didn’t have to rezone and could build those by right.

Exact same lifestyle and 1/5 of the my previous SFH home and that is factoring in my share of the strata common property electricity. Also, driving 10,000 km less per year.

It is also important to think about why Sooke Rd is being expanded at a tune of $100 million and the environmental impact of that process.

Ha ha….thanks Sidekick! I am a tough old Scotsman and so will not be worn down or bullied too easily.

I really like this forum. Despite it being a bit frustrating sometimes.

I value it as a place to share ideas. For me it’s not about writing a thesis. More like sitting around spitballing and trying to understand real esate. When I make a mistake, because I might get ahead of myself in my excitement, I try to admit it.

Some people here love graphs and charts. Some people go more on gut and past personal experience. Ha ha…..and some are more like William F Buckley and that is ok too.

Everyone is just trying their best to make sense of our world and want to do what is best for their families.

Thanks for the support!

It is fun to think about things and share them with others.

We are so lucky to have such a forum as Leo’s and I’m sure we are all grateful.

Just heard this on the radio in a discussion of posting your image and information on social media: “If you’re not paying for the product, you are the product “.

If you want to study a country with declining population, Ireland is the place. Its population peaked in 1841 at 8 million, dropping to 4 million, thanks to famine and other factors, in 1931. Today the population is approaching 7 million. Ireland, I believe, is the only developed country that has a lower population than it had 160 years ago.

The other country of interest would be Japan. It has an aging population, low birth rate and low immigration. They seem to be doing fine from an economic perspective. If you can read this you have the ability to do your own research.

thanks Leo. My co worker just put his house up for sale in fairfield/oakbay for 1.5. curious to see what it goes for, I think he bought around 2014/15 for around 780 and did a kitchen reno.

Derek – don’t let Marko or QT’s comments get you down. At least you’re thinking about this stuff…

As an aside, V2G (vehicle-to-grid) was supported by the first gen Tesla roadster. Tesla don’t currently support it because of potential battery degradation. The battery chemistry is different in cars and powerwalls. It is possible to attach an inverter directly to the 12V battery so you can keep your fridge/freezer going, but I’m pretty sure they’d void your warranty if they found out.

Multi-family will always be more efficient than the equivalent build SFH. But, numbers are kind of meaningless without context. If it’s a single person using some gas appliances and eating out a lot, well, it’s not so good. If it’s two people baking pies every day in an all-electric unit, then it’s great.

I asked mortgage broker Mike Grace about that. He said:

There is a myriad of ways to work-around stress testing – adjusting allowable income, extending ratios, excluding specific liabilities – all which require a case-by-case approach/material exceptions and some solid risk analysis on the underwriting end of things. These would only be available for un-insured loans from the big banks. Insured loans are still very strict on income/ratios/benchmarks, and mono-lines are stuck with their investor agreements that limit them to hard 39/44 ratios and excruciatingly standard income calculations.

1) Extended Ratios – we’re seeing big banks commonly extend ratios beyond the 44% limitation on a case by case basis – up to 50% seems relatively common when there is a reasonable justification. A return to some more common sense underwriting seems to be theme – especially so as they are fiercely fighting for market share. Some recent examples from my book of business include:

i) Approved ratios at 54% TDS due to high personal net worth – 65% LTV

ii) Approved ratios to 206% – based on a net worth calculation – 50% LTV

iii) Approved ratios to 539% – based on a net worth calculation – 50% LTV

2) Larger gross ups for Self-Employed or Projected Income for certain professional groups – where borrowers are self employed it’s possible to build a case to “gross up” their personal income amount. Standard allowable is 15%, but I’ve had success applying much larger gross ups where it makes sense to do so. The decisioning is case by case and will generally have to meet the bar of a skeptical underwriter on the other end. New doctors and other very limited professional groups have access to ‘projected income’ programs where the banks are comfortable lending on a base projected income level.

3) Credit Unions – as you know contract rate qualification is still available with credit unions, albeit at much lower ratios – 32/42 is standard for these products.

There’s likely additional areas I’m not covering here, but the general theme should be that the stress test will still apply to each application – it’s just that the other supposedly solid confines of the applications are becoming a bit more flexible… but only when there is a reasonable justification to do so.

Leo, can you explain how stress test doesn’t apply to high income, good credit buyers? I thought the only way to avoid stress test was to go with an alternative lender?

We had the same issue.

We had to filed a writ of possession and have 2 bailiffs to remove the tenants after they damaged the house, and we found out that the ex tenants came back the night before and bashed in the doors (we changed the locks) when we came back the next day. And, the neighbors came out to congratulates us for the removal of their bad neighbors on the day that we moved in after the house repairs.

https://www.blogto.com/real-estate-toronto/2021/02/condo-sale-toronto-broke-record-3-market-street/

Seller moving back to BC…

Viclandlord….did you get anything in writing? Yikes! Tough.

Ohhh how I love B.C tenancy laws

Bought new property and gave two months notice for landlords use, we actually gave 3 months and asked the current tenant if they needed longer, because we were flexible at that time.

tenant says no that’s perfectly fine, we go on our way and sign a lease on our current home, the tenant has now filed for arbitration to fight it, they are supposed to be out apr 1 RTB hearing date April 29 :/

That decision will be made for us. World population may peak and start declining as early as 2050.

++ Hydro is the ultimate battery.

V2G is coming, but there’s no big rush for it. A big step for load shaping is just having the EV chargers connected to the utility so Hydro can scale them back if needed to control demand. That’s pretty simple, and doesn’t require any new tech.

It won’t.

BC just released their excellent report on UBI and recommended against it (in favour of more targeted supports). https://bcbasicincomepanel.ca/wp-content/uploads/2021/01/Final_Report_BC_Basic_Income_Panel.pdf

“Or, better still, figure out how to build an economy that doesn’t need to grow at all, a steady-state economy.”

I agree with that!

“BC probably doesn’t need any additional backup power to deal with surges in demand.”

Certainly that could be very true. I did tour the Bennet dam at one time and was very impressed with the new turbines and upgrades. I have heard from people who are in the know at BC Hydro that they are quite worried about the surge in electric vehicle ownership and how that might be a new challenge for them.

Europe also has the benefit/disadvantage of having very expensive electricity costs and so reaching for solar makes sense right now.

Out in Sooke, we get power outages and so I am thinking of power walls and going solar. I predict that electric costs are going to increase a lot to cover the cost overruns of the Site C which has hit some real major technical issues. Some people are predicting five billion dollars of over run costs with the real possibility of not even having a dam because of safety issues.

(It has cost around 6 billion so far and it is only half way there….”not” counting the major technical issues that were once only a possibility, but have now fully materialized.) It might still get cancelled apparently. (They are waiting for a couple of reports from international experts on dams to access the situation.)

Either way, taxpayers will have to pay huge sums of extra money.

Reports out of Toronto that activity is subsiding and market is starting to build inventory again. Normally I’d say their market is disconnected from ours but there’s been such an astonishing synchronicity between markets in North America through the pandemic that it’s worth watching.

‘And you can see them there

On Sunday morning

Stand up and sing about

What it’s like up there

They call it “paradise”

I don’t know why

You call someplace “paradise”

Kiss it goodbye’

I heard that Glenn and Don wrote this while staying at the old Oak Bay Beach Hotel in late 1975. They seem to be inspired by hotels.

That property has been so much fun to watch over the years. I suspect the owners were/are the owners of Chintz & Company for obvious reasons. It’s actually become a lot less strange over the years. I didn’t realize it had sold in the last few years. It was up for 1.8m in 2016 if my memory serves me right. Seems to be a property for price fishers.

It’s not? I can’t stand Oak Bay.

One of the central causes of lack of housing affordability everywhere is continued population growth, which is also not a long-term sustainable model, in my view.

Here’s hoping that one day we figure out how to grow economies without having to grow the population. Or, better still, figure out how to build an economy that doesn’t need to grow at all, a steady-state economy.

I wouldn’t be so quick to generalize those living in Oak Bay are wealthy or even affluent. There are 3 good friends I have in my cohort who bought there within the last 10 yrs. They certainly have good incomes relative to the average bear out there, but 2 of them are incredibly frugal and its not a stretch to say they are cash strapped. One had to replace a roof last year and I couldn’t believe the amount of financial stress it caused him. The house needs work and there is no plan to do it. However, they are proud to be Oak Bay residents are good natured and down to earth folks. Would they endorse developments to add density? Doubtful, but I know they would welcome legal suites.

This could also be done in BC, since BC Hydro already allows feed-in from solar installations. It is a similar concept as feeding in from battery backup. However, currently I think only 2 Nissan models support pulling power out of them. Also the investment needed in each home to support this is probably not worth it at this time. BC probably doesn’t need any additional backup power to deal with surges in demand. BC already has a tone of stored up backup power in the lakes behind our Hydro dams.

lol!!!!

This will be the new normal when CERB turns into UBI.

You’re talking population, I’m talking character. Character requires more than a monoculture in my view.

We’re seeing the end state of this kind of approach (no change forever) in places like San Francisco. Not a long term sustainable model.

4798 Amblewood Dr, ask 1.3M, sold at 1.2M, assessment 1.1M, DOM 14

1276 Alan Rd, ask 950K, sold at 899K, assessment 891K, DOM 24

Is the market gradually returning to be rational? Cannot wait to see the sale price for the three 1.15M Gordon Head rental properties.

Generally, yes. But in Oak Bay, maybe not. Recall OB’s 60-year population growth of, what was it, 50 people or something. That’s an astonishing track record of stopping change.

A large portion of the wealthy do like the same things, which is why most of them bought (and continue to buy) where they did (do) and willingly paid (pay) a mega premium to do so.

Generally, I think the wealthy like exclusivity and the lack of densification/change that accompanies it. Exclusivity often also affords tranquility — and not at the cost of convenience. It’s tranquil in Cobble Hill, but it’s not convenient to be so far away from the big city.

https://www.vancouverislandfreedaily.com/business/cowichan-simply-doesnt-have-enough-homes-for-growing-population/

Actually Marco…it is not “MY idea”. Europe and Britain and China are integrating their grids in this way. They see a real benefit to the community by being able to tap into vehicles and power walls that are not being used at the moment in order to balance out peak power needs.

It’s fascinating because they also calculate the weather and people’s habits and needs. For example: if it looks like rain or clouds the next day, they will draw down less power etc from people’s vehicles. (They pay for your electricity or replace it if they draw from you and you can participate or not.)

By the way, I thought QT was just being sarcastic:) I didn’t think he was serious about the government saving the planet.

I certainly would also support a government that chose to incentivize something that would end up all of us using less power.

Anyway I have nothing against Oak Bay, it’s lovely mostly because of its natural setting.

But I do think change is inevitable. You can try to hold on to a place with an iron fist and try to keep it the way it is but it will change out from under you in ways you won’t necessarily like. Better to plan for growth in a way that preserves the parts that you like (slow, leafy, walkable, with some little centres and small shops) instead of locking it up and leaving the keys only with the wealthiest fraction of the population and hoping they happen to like the same things

And he lives in Gordon Head! 🙂

+1, Wesley St in Oaklands just went 152k above ask to a bully offer.

Sorry not first hand. Could get you a second hand recommendation if you like

I think affordability window for Oak Bay is gone more than a decade ago. I had a co worker who barely able to purchased a house in Oak Bay 13 years ago was due to the fact that his in laws gave him $400,000 for down payment.

Oak bay is perfectly good now. But you’re looking at the oak bay and its residents shaped in the last 60 years when prices were much lower. Lots of relatively ordinary middle class families could still buy a house and people that had been living there for decades.

That’s not the case now. Price of entry is well over a million which means you’re excluding 85% of people from the city. Probably a majority of people currently living in Oak Bay could not afford to buy there anymore if they were starting out now.

Your hydro bill was less than 1/5 of what some of my co workers pay to charge their Nissan Leaf EVs to commute from Sooke to our work place for the same period.

Your idea is to increase grid capacity via solar panels and give incentives to EVs, his idea is to use less energy and have less cars on road in the first place. Pretty big difference imo.

List prices don’t mean much in this market. I’ll take a closer look to see if there’s a difference in increases by price band but I suspect not huge. Everything is up.

Not sure….lots of Oak Bay long timers complain about the massing and style of the new “boxes.”

I get all squishy inside when I see QT so enthusiastic and standing up for my brilliant ideas:)

I support what QT notes

This makes a lot more common sense to me. My last hydro bill was $41 for two months (I do have a south facing unit so might be a bit more on the north side of my building).

I am guessing thought this does not fit your narrative as you live in a SFH in Sooke? Just think of all the waste and resources going into expanding the road to Sooke. Why is the road being expanded? Because there is clear cutting taking place to put up streets for new subdivisions in Sooke. At the same time we have people in Fairfield protesting 5 trees.

QTs counter argument is one of the best I’ve ever heard on HHV. It is common sense reality, but no one is going to like it because it doesn’t fit with anyone’s narrative of having their dog chasing a ball in their SFH backyard so let’s pretend we care about the environment by supporting incentives for EVs, a problem that has already been solved by market forces.

I sometimes read this blog to see if the information can help me to estimate what my own home is currently worth. But then I look at listings that are roughly comparable to my own home, like 2552 Victor, which is listed below its assessed value, and wonder how to make sense of it all. If the “median” SFH is selling for 25% over its 2020 assessed value, what does that mean for houses at the lower end of the spectrum?

From my perspective, Oak Bay is plenty vibrant. Lots of shops, parks, beaches, two rec centres. People out walking and gardening.

Not sure why Oak Bay needs to up the “vibrancy” by densifying. It’s lovely as is and more people around won’t improve a thing, IMO.

Huh? Tons of people who live in Oak Bay ride their bike to work downtown. And lots of families live in OB and are able to stay.

I don’t mind mansions. Others don’t seem to mind them either. Sometimes families even live in them!

Wonderful idea with incentives on low carbon emission vehicles.

Perhaps, the government can go further to save the planet by give up to $80,000 rebates and 100% tax free RRSP withdraw to everyone who buys downtown Vancouver/Victoria condos. Not only the act would save tax money in the long run, it would lower carbon emission, cut down traffics, enhance air quality, and give urban dwellers more time to practice healthier lifestyle.

Marco… I gather then that you do support the idea to some extent of encouraging and expanding the electric grid through solar panels and power walls.

I’m sure you are aware that your Tesla (which I am extremely jealous of) can be considered part of the grid, if not at this moment, but will be able to flow both ways soon. (Not sure which electric cars have that capability at the moment but it will happen as manufacturers have to compete with the best.)

The idea of feeding back into the grid was a bit tricky because they were worried about cars feeding power back into the grid at the same time workers might be fixing a power outage down the line. I believe that they have found a way around that issue now. But definitely feeding into the grid from your car is being done and is a plus for the community when needed. (You probably know this but I thought it might help others who haven’t heard.)

Leo or Marko (or other realtors) –

Do any of you know of a good and no-nonsense Montreal realtor (Concordia/Mount Royal area) you might recommend for a condo listing?

Thanks in advance.

I didn’t say anything about the grid.

Marco…. I don’t know what else to say that I haven’t said before:)

I feel that “anything” that can feed into the grid to help cover peak electric needs is a big plus for the community and should be encouraged. Allowing people to use their RRSP’s would do that.

I imagine the government might argue that the whole idea of RRSP’s was to make sure people have enough for retirement. I would counter that the benefits of a robust, clean electrical grid would outweigh any downsides and save loads of taxpayers money in the long run. (Wait till you hear what it is going to cost the people taxpayers of BC for site C Dam fiasco).

If the government has the vision to acknowledge that it is beneficial to allow, in certain situations, for people to buy a house with their RRSP’s, then the benefit to the power grid might be viewed in the same way?

I walked through there the other day….can’t believe someone went through the effort of ordering those “save the trees” signs. Ha ha, are peoples personal lives so sad they have nothing better to do then to stick those in their front yards?

When aren’t these same people protesting when a subdivision gets thrown into Sooke and small forest is clear cut?

It is the worst I’ve ever seen. I called a framer that framed my person house 7 years ago and I sold a property for him recently so we are on very good terms. I asked him if he was interested in framing a super simple home and he basically laughed and said he is booked for 6+ months. I emailed the plans to 5 framers we’ve used before. Three replied completely booked months in advance. Other two haven’t replied.

If I can’t find anyone for the foundation in next 10 days literally will order ICF blocks and will do the foundation ourselves.

It isn’t complicated -> https://www.youtube.com/watch?v=PUblI5Lyr48

I like Oak Bay and find it very walkable in most areas and extremely scenic and safe. Oak Bay has made some movement on secondary suites but I agree that neighbors are pretty quick to push back on development variances of any kind – like the United Church site. I thought it was funny when the neighbours all around put up “stop overdevelopment” signs protesting in front of their huge houses occupied by one or two people. Now there are all the “save the trees” signs on neighbourhood lawns against the proposed townhouse development on a large single family lot on Foul Bay and Cowichan. Really, the trees? On an urban lot? And there is a replanting plan.

My argument was simply electric cars are competitive at current prices and there is no need for incentives. Let the market do its thing at this point versus spending more tax dollars. When I bought my Tesla 6 years ago I received a 5k BC rebate on a 110k car, what a joke. I would have bought it without the rebate. In my opinion the Model 3 is such a good car at 53k (and dropping) there is no need to be throwing further tax dollars at it.

If I wanted a new car right now I would buy the Model Y for 56k with or without incentives. What are my other options? An unreliable gas guzzling Q5 where the dealer will take me for a ride from the initial purchase to the servicing.

As for the 15 to 35k market just give it two years. As I said when the Model 3 is at $44,900 a bunch of EVs will be forced to $29,900.

Leo, agreed that wholesale erosion of media is problematic (see: Hitler, Trump), but it’s important to question the motivations of the media.

Media is virtually all owned by massive conglomerates, and they exist to make money. This can be problematic for 2 reasons:

Think about this Marco: (By the way, I don’t think we are that far apart on the logic of electric cars etc.)

In Europe, they are drawing power back from people’s electric cars in order to cover the peak periods of electric use. (Replacing it later in the night etc)

Covering the peak electric use is a massive incentive to encourage people to have electric vehicles and storage walls and solar panels.

It helps the community big time.

Yes…electric cars are becoming more popular and that’s exciting. But it is still only a small percentage at this time because people still don’t understand how cheap they are to run etc. (They keep focusing on the purchase price for example.)

The other alternative is to fund massive projects like the site C dam. (I actually like hydro power. But it seems like a huge engineering mistake has been made with the site C project.)

Meant to say like the Mazda MX-30 will be forced to be at $29,900 or they won’t sell a single one.

No longer necessary imo. Price of some EVs like Teslas has dropped 50% in 5 years. Tesla just dropped the Model Y price in the USA to the equivalent of 50k CND after exchange rate. Even without any incentives Teslas will sell like hot cakes. My prediction is Model 3 Perhaps also allow people to use their RRSP’s “Tax Free” for buying an electric vehicle.be $44,900 and Model Y $49,900 CND within two years which will force all the competitors down ever lower.

Like the Mazds MX-30

I wonder if House Hunt Victoria, as a group of us, could lobby the Federal government to allow people to take money out of their RRSP’s “Tax Free” for installing solar panels and battery walls in their homes. It seems like this would be a good incentive for individuals and also a benefit to the community because it could then draw on people’s storage walls for peak periods. Perhaps also allow people to use their RRSP’s “Tax Free” for buying an electric vehicle.

Add: I think Covid shut down and municipality policies also play a hand in the difficulty of finding contractors, because contractors spends half of their time between the permit office and neighbourhood meetings.

“Where did they go?”

The went to CERB from what I hear (anecdotally).

Obvious not to work, because IMHO most of the unemployed in construction are unskilled.

Unlike public sector, private employers trim the fat during slow period and it take a long time for companies to ramp up, when there is a small number of skilled individuals in a small pool of mediocre workers. Thus, if there is a larger number of people in the trades then there would be more astute industrious skilled individuals for employers to pick for a ramp up.

B.C. skilled trade shortage continues in COVID-19 work slump — https://www.kamloopsthisweek.com/news/b-c-skilled-trade-shortage-continues-in-covid-19-work-slump-1.24261520

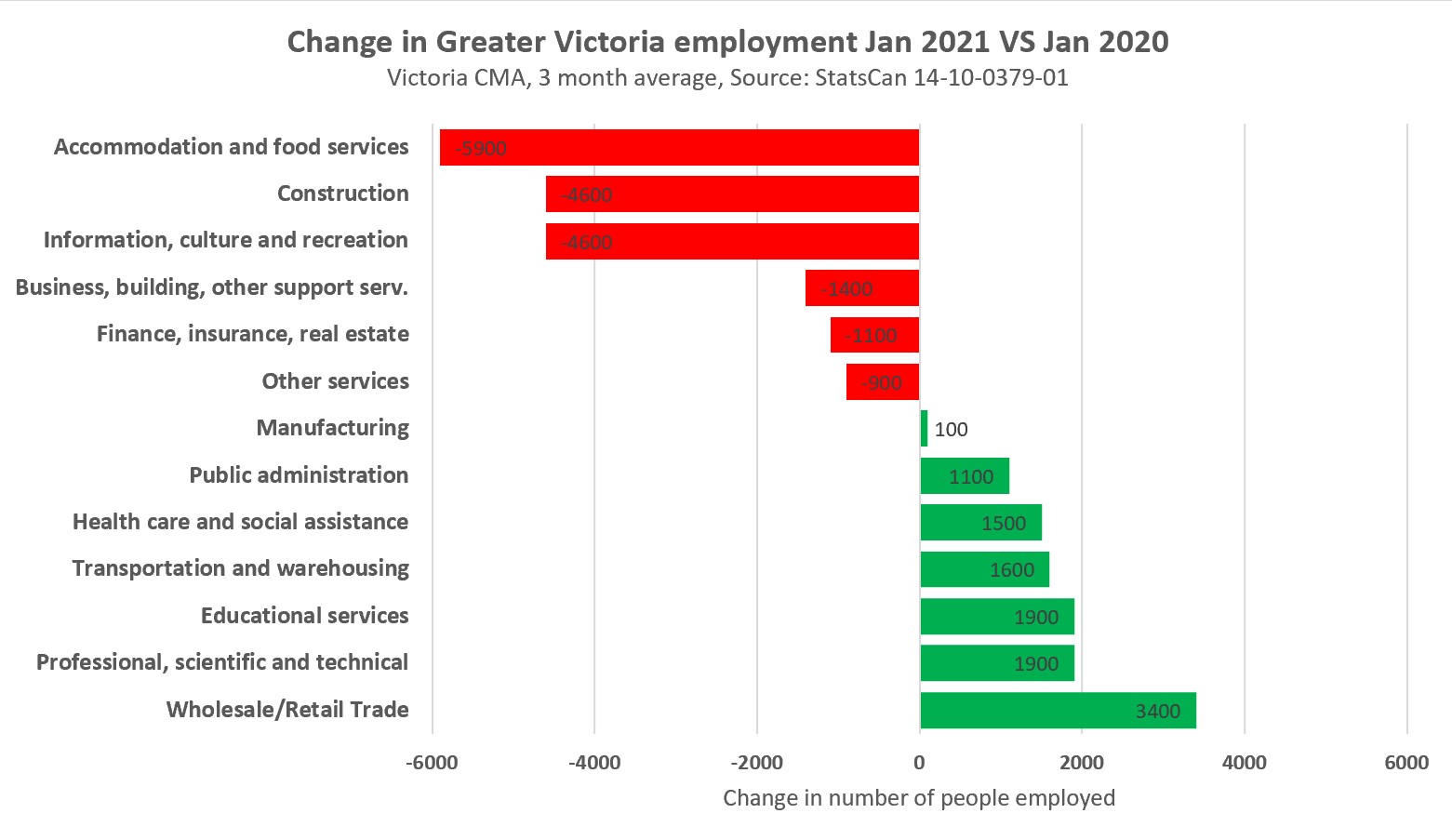

Sure. But according to StatsCan there were 4600 fewer people employed in construction in January than a year ago. Where did they go?

Because swinging a hammer is so beneath paper pushing, therefore the unemployment rate is high while there is a shortage of skilled trades.

Our city is basically gerrymandered. Oak Bay has almost entirely single family homes, and few renters. So the voting base is mostly NIMBYs and I could imagine they might vote down any new housing forever.

Victoria is mostly renters, and/or condo owners that might like a chance at a townhouse or similar. I think their missing middle program will go ahead.

Saanich too is becoming more diverse and more residents are raising hell about affordability. The new council is very different than the old one, and it shows a turning tide. Eventually politicians will be more concerned about appeasing the priced out rather than the comfortably housed.

Of course at some point the province could step in and override the municipalities. That’s what they did in California, where if developers can’t come to an agreement with the city they can develop through state authority and bypass them in certain situations (https://www.gravel2gavel.com/assessing-sb-35/). Basically forces cities to be reasonable (or at least that’s the idea) so that they get at least some of what they want from the project rather than being sidelined.

So far the province has said they’re not interested in this, but there’s signs they are taking steps towards it. All municipalities need to complete a housing needs assessment every 5 years which shows the need in their community and the progress (or lack thereof) to meeting it. California uses this kind of data to override cities on housing that aren’t meeting the need themselves.

This is why I can’t make sense of the figures from StatsCan that show construction work still way down from last year. How can there be so many people out of work and yet no one available to do anything?

LOVE the Senakw development. https://www.theglobeandmail.com/canada/article-senakw-in-vancouver-the-squamish-nation-shapes-a-sustainable-village/

They’ve been fishing for a while though. Last summer it was listed for $2.15M. Who knows what it could sell for. Unique place, that’s for sure.

It is? Not for me. I’d prefer a neighbourhood that stays vibrant over time, focusing on active transportation and allowing housing types that enable families to stay instead of a car oriented place that will slowly transition to being covered in maxed out mansions because nothing else can be built. Oak Bay is so out to lunch Andrew Weaver of all people spoke out against bike lanes.

Also, I find it endlessly fascinating the lines we draw in terms of which communities and neighbourhoods we think should (be forced to) support affordable housing and endure densification.

Oak Bay? The Uplands? West Point Grey? Municipality of West Vancouver? They all more or less get a free pass.

Everywhere else, it’s open season for 6-storey condo units and aggressive rezoning.

And some folks wonder why Oak Bay is THE PLACE TO BE in Victoria.

It isn’t necessarily the most affluent areas that escape densification. If you look at the Cambie area in Vancouver, a former upper middle class area equivalent roughly to Henderson in Oak Bay, the sprawling bungalows on manicured lots have been replaced by 6-7 story condos.

In Victoria, upscale Rockland has always had some pretty tall condo/apartment towers and many of the old mansions are now multifamily.

Wow, that sucks.

Mike Grace, the guy who advertises on this website, has done mortgages for me with success and I am self-employed. It requires what I feel is like 50-60 documents but it can be done.

Half of my CoV build is stucco on DP which is a massive pain but at this point I figure easier to deal with the pain of that than to submit a change to exterior appearance.

I thought you said you paid the same as the original buyer? If there was an original buyer my guess is you bought an expensive spec home, but not a custom.

X2 on using a different lender or mortgage broker, we take minimal out of our company

Thanks! I’ve been working with Coast Capital and they have been able to provide variances as well but it’s not 100% the same as T4 income. I could get a second opinion at RBC.

Go to RBC and talk to them about how your business can be considered when applying for a mortgage. There are exceptions when you can show that you have a good business with a track record and are retaining earnings in the corporation instead of withdrawing them.

I appreciate the info about building, certainly makes me think twice of starting one now, even if my builder thinks he could do it for $300 a foot. I may just hunker down and hope my landlord doesn’t sell, and that one day my savings catch up with home price growth again.

Do I drop my salary again though to save taxes? I’m paying myself 200k a year but only need half that for my lifestyle. It’s a tough call because lenders look at 2 year average as a self employed individual. Damned if you do, damned if you don’t it seems!

Houses sell for what people are willing and able to pay for them. That’s why house prices are so sensitive to mortgage rates. I’m not saying that the development costs in CoV are reasonable but if they were lower that would not affect the selling price.

I feel for anyone starting to build a house at the moment, we are just finishing one and just poured the foundation on another.

Cabniets on the house we finished 32k, quote for the one we are starting 44k, same size and material !

We also just managed to get ourselves a 45k quote for siding :/

Good luck trying to get three quotes these days, you will be lucky to get two and that’s being established.

It sure would be nice to get the first house finished, still waiting on the CoV to approve our DP permit to change the driveway material and build 4 retaining walls, All under 4’ so not engineered. Cost for new drawings, application, DP fee, survey 3700$

Here I am still trying to figure out why houses cost so much….

“Wow I’m surprised you were able to get a quote 6 months ago for 200 to 250 sq foot, does that included builders fees , plans, permits etc.. I’m guessing that is more builder grade then custom.”

Yes, more like custom-ish. And he is a family friend so I suspect there was a bit of a break in that pricing.

“Principal payment is forced savings, not an expense so it doesn’t factor into it directly”

More like forced speculation at this point. There is no guarantee that people won’t be underwater in the near future.

What frustrates me even more about this market is as a self employed contractor, I have control over the wage I pay myself which is great for tax reasons. But since I need an exceptional income for this market, I’ve had to increase my salary well above what I actually need to make me more attractive on paper, which means (even after modest RRSP deductions), I’m paying a boat load of income tax right now just for the PRIVILEGE to LOOK at homes. And now I’m basically ready to give up, so it feels like that extra tax was wasted. I just hope my landlord doesn’t sell our current place for under us, but it is a risk that constantly hangs over our head. The other day we had some nasty plumbing issues and rather than call the landlord about it I paid to deal with it myself because I’m so scared if anything else goes wrong in this 50s home, he’ll just cash in.

The market sucks for young families, especially with pets. Never in a million years did I think I’d be in this spot, with (what I think is) a lot of of savings and an excellent income. I feel like I’m being punished for doing the right things and playing it safe with my savings. Friends of mine are taking on bigger and bigger risks just to try and get ahead (high risk stocks/options, crypto, etc). This is not the behaviour the government should be encouraging. I hope there is some public pressure in the future to cool things down because this isn’t sustainable.

There is a huge redevelopment underway of the 90 acre Jericho Lands. As well Vancouver’s city wide rezoning to duplex applies to West Point Grey.

Jun 11, 2019 $1,120,000

61% increase.

255 Government St is back on the market. I’m not sure if I remember correctly but I think it sold last year for a good chunk under the current asking price. From the look of the pictures nothing much has been done to the interior so I guess this is just a speculator with big dollar signs lighting up their eyes.

.https://www.realtor.ca/real-estate/22754119/255-government-st-victoria-james-bay

Yeah it’s not entirely clear to me why the stress test has stopped biting. It’s only down marginally from pre-pandemic.

My guess is combination of larger down payments (parents supporting FOMO), high income good credit buyers where the test doesn’t apply, and higher concentration of those in the detached market

Leo the mortgage payments may have dropped 20% but did the stress test also drop by 20%? If not then I guess people are just getting bigger down payments?

Also, I find it endlessly fascinating the lines we draw in terms of which communities and neighbourhoods we think should (be forced to) support affordable housing and endure densification.

Oak Bay? The Uplands? West Point Grey? Municipality of West Vancouver? They all more or less get a free pass.

Everywhere else, it’s open season for 6-storey condo units and aggressive rezoning.

And some folks wonder why Oak Bay is THE PLACE TO BE in Victoria.

I talked to my builder today and he said with lumber costs I should expect to pay 250-300 per sq ft now (up from 200-250 he quoted me 6 months ago

‘

‘

Wow I’m surprised you were able to get a quote 6 months ago for 200 to 250 sq foot, does that included builders fees , plans, permits etc.. I’m guessing that is more builder grade then custom. I was talking with a friend who builds very high end homes locally and he said average new home material costs up 20 percent in 1 year. Custom homes would be starting at 300 to 350 sq foot including builder fees, if you can actually find someone to bid.

We bought custom 2 year old home about 2 months ago, I felt maybe we over paid 40 -50K, but given the run up in the last 2 months that seems pretty funny given how much prices have risen

The three kids are sharing a bedroom. It’s not just for a few weeks — not a tough spell while mom gets things sorted out — it’s their entire childhood. And there’s no end in sight.

While it’s a Canadian social norm for every child to have his/her own bedroom, it is sadly not a constitutionally guaranteed right, nor should it be.

Homeowners are stridently entitled and indignant about changes to single-family neighbourhoods and fearful of poor, racialized people moving in.

OK, I’m sure some of them are fearful of poor, racialized people moving in. But mainly they just don’t want a 95-unit building in their neighbourhood, which is a legitimate stance.

Pretend that only rich white people were going to live in that proposed 95-unit building — I bet you anything these homeowners would still be against it. I know that because I’m a NIMBY like them, and I would be.

“The land-use planning system stifles new housing supply in two ways: first by restricting growth through lengthy, uncertain and costly processes, and second by allowing anti-development interests to apply political pressure on decision makers.”

Um, it’s perfectly right for “anti-development interests” to “apply political pressure on decision makers.” The same goes for pro-development interests. That’s how this works.

Some people have been lied to too many times and no longer believe things they can’t see.

It is a deplorable state we are in.

Yeah further evidence how important debt and local incomes are to the market. Mortgages become 20% cheaper -> nearly immediate 20% jump in house prices. If the market was all driven by wealthy buyers lower rates would have zero effect since they don’t depend on financing.

I know a person that smoked two packs a day every day never got sick and lived to 96. So based on my experience I’ll conclude that smoking is safe?

The dam at what cost? Right now, there is no ceiling.

As I’ve pointed out before, there is also the possibility that Site C cannot be completed at ANY cost due to insurmountable geotechnical issues.

Politics, economics, geology, and behavioural psychology are all at play with Site C. See the concepts of Loss Aversion, Status Quo Bias, and especially Sunk Cost Fallacy.

looks like good deals were had up until October last year. 4600 BONNIEVIEW PL VICTORIA! Anyone know if there was anything wrong with that house?

I’m expressing my opinion based on information and experiences I have encountered, not submitting a PHD dissertation. I made sure my mother, who lived to 94, got Vitamin D every day and she never got sick. She also never smoked but endured decades of second hand smoke from her siblings, who never saw 60.

Climate change, covid, media discussion…..wow, didn’t think the HHV level of intellect was so disappointing.

True, but also some insane lots sales as well like 1609 Earl for 840k.

After the COV took 5 months for the building permit now can’t find framers or anyone to do foundation. The COV is so unreliable you can’t line anyone up 1, 2, or 3 months in advance as you simply don’t know when you will get your permit. 1,650 sq/ft home is going to turn into a two-year build start to finish 🙂

I just might have to order ICF blocks and I’ll have to put them together with my father to get things started.

I have a builder friend that just paid $48,000 for exterior siding on a house in the Westshore. Some of the prices are insane. Often you are lucky to even have someone provide a quote.

“I believe thousands of lives could have been saved for 10 cents a day. I also believe that most people who died from the virus were avid smokers who damaged the lining of their lungs, further weakening their immune system. This is never reported due to patient privacy concerns, a bunch of B.S.”

Wild speculation is cool and all, but where is the supporting evidence?

Long time reader infrequent poster I think the last time was 3 years ago. A house on my street was listed Thursday for 1.298 million. Showings started yesterday morning. There must have been at least 20 showings, I was off work and my cul de sac was packed all day. Owner tells me it sold yesterday evening and I am guessing for over asking. They tell me the purchaser is local they must have sold their current home.

I can understand bidding wars at the under a million range but I would never have thought that Victoria had all these people with the ability to buy at that price level.

I guess cheap money is causing this. Yikes when interest rates go up

We want to move and would make a killing but given we need to stay in Victoria it does not seem like a good time to do a sale and purchase. I don’t want to be caught in a bidding wars with unconditional offers. Things are crazy

Yup. Will be interesting to see where commodity prices land after the volatility ends. High prices unleash new supply. The market will correct to some extent.

Inflation is based on a basket of goods that reflects average spending patterns and is periodically adjusted to reflect changes in those patterns

How much lumber does the average person buy?

As for the impact of housing prices on inflation, it’s a little complicated, but basically only the expenses are counted. Principal payment is forced savings, not an expense so it doesn’t factor into it directly. Will probably write an article on it at some point.

Citation required. The solution to errors and bias in media is to push against specific articles and get them corrected. We know where a generalized anti-media sentiment leads and it’s a very bad place.

???

We’ve seen plenty of examples lately of the mainstream media not just getting things wrong, but deliberately lying. They are little more trustworthy than the fringe media.

The resurgence of “flat earthers” is an indictment of the corruption in journalism and sciences.

I’ve noticed some higher priced lots sitting on the market for a while (and by a while I mean more than a week in this market). I talked to my builder today and he said with lumber costs I should expect to pay 250-300 per sq ft now (up from 200-250 he quoted me 6 months ago). Makes sense why these lots don’t sell right away… once you factor in a decent sized build you’re now well above comparables in the neighbourhood in most cases. Can someone explain to me how inflation is only at 1%?

I think if you are going to continue to be skeptical of climate change or any other science-based topic you’d be much better off learning to read and reference peer-reviewed scientific articles as the basis of your skepticism than a weird article by a “financial advisor” with zero background in the science.

I do get annoyed when people quote unreliable information as providing any sort of factual basis for their opinions. Seriously, please focus on developing your ability to assess the reliability of the base data. The world will be a better place.

LEO: “Good grief. Global warming is as much in doubt as evolution. I.e not at all. Take the nonsense somewhere else plz.”

I think we still need to be skeptical of any info fed to us by the media.

https://www.thestreet.com/mishtalk/economics/lets-review-50-years-of-dire-climate-forecasts-and-what-actually-happened

I’d just like to say that unpopular viewpoints are not all “conspiracy theories”, nor do they all turn out to be wrong.

Keep an eye on the news this year about the potential effects of radiation from cell phones and wifi on human health. For years, anyone who was worried about this or claimed a health problem as a result was considered a nut job and lumped in with anti vaxxers, 911 hoaxers, and chem-trail believers. The science has caught up over the last couple of years, so we can now all believe it without being anti-science.

I agree on the immune system thing too. It’s an “alternative” opinion that some foods and supplements can help the immune system function better. That’s not really an out-there opinion. But in our polarizing news culture, reasonable thoughts like this got lumped in with real conspiracy theories like that covid wasn’t real but really a government control program.

“There’s lots of evidence that smokers who contract Covid are more likely to die from it than non-smokers”

Of course there is. Smoking, asthma, hypertension… anything that contributes to increased morbidity will be further increased by the introduction of covid. Disease is nature’s answer to overpopulation, a problem that’s slowly suffocating our species.

But, fuck nature… right?

Despite pandemic, Canadians take on record amount of mortgage debt in 2020

Surprise!

”Let’s stop allowing a few blocks of homeowners to hold hostage entire communities that need to find room for everyone.”

“The land-use planning system stifles new housing supply in two ways: first by restricting growth through lengthy, uncertain and costly processes, and second by allowing anti-development interests to apply political pressure on decision makers.”

https://vancouversun.com/opinion/maya-russell-lets-make-way-for-the-homes-we-need-in-b-c/wcm/abfa5ebe-e765-4652-b7d1-a17abfd8da09/amp/

That’s not a claim, that’s an obvious fact. You think sea level is hard to measure?

https://www.epa.gov/climate-indicators/climate-change-indicators-sea-level

There’s lots of evidence that smokers who contract Covid are more likely to die from it than non-smokers. That’s not the same as saying that most people who die are smokers.

As for your contention that this kind of information is never reported, that’s nonsense. For example:

https://www.ctvnews.ca/health/coronavirus/smokers-more-likely-to-develop-severe-covid-19-complications-study-1.4935035

Only works for the people at the front of the line. And then things get ugly.

The problem with mainstream media, I find, is not what they’re telling you, but what they are not telling you. This is also accomplished by disallowing, or ignoring other points of view. During the entire pandemic I have never heard one medical expert in Canada recommend taking vital (hence the word vitamin) supplements to ensure proper function of the immune system. Tests conducted in the U.S. have shown that every person requiring hospitalization , who were tested, suffered from vitamin D deficiency. I believe thousands of lives could have been saved for 10 cents a day. I also believe that most people who died from the virus were avid smokers who damaged the lining of their lungs, further weakening their immune system. This is never reported due to patient privacy concerns, a bunch of B.S.

I don’t really understand the concept of mainstream media being bad. Do you really think fringe media is more trustworthy? I would rather get my news from sources that check their facts before publishing than media that has no checks and balances. Don’t get me wrong, I do realize the “mainstream” media will get things wrong on occasion and that they also have their biases. However, we should realize we are blessed to have journalists out there working to get us accurate information. Not every country has hat privilege.

Socialist hoax. Also jet fuel can’t melt steel, vaccines cause autism, Trump won the election, and chemtrails are a thing.

Whew! Glad to get that off my chest.

Even better. It would be disgraceful if we couldn’t build a dam in 2021. Hoping for the best

Why only 60? Generators and turbines will be replaced along the way but Site C will most likely be cranking out the megawatts 160 years into the future.

I like science becuase it is willing to change when it finds new information. Trying to figure out sea level changes is not easy. I like this article because it admits how difficult it is to know exactly.

https://www.theatlantic.com/science/archive/2019/01/sea-level-rise-may-not-become-catastrophic-until-after-2100/579478/

The main takeaway is that there is no question that the sea levels are rising. It’s just a question of how fast.

Good grief. Global warming is as much in doubt as evolution. I.e not at all. Take the nonsense somewhere else plz.

Activists have been claiming rising sea level for decades and oddly enough China and India keep on investing/throwing money at the Maldives, knowing that climatologists been calling for the island nation to be under the ocean for the last 33 years.

Maldives airport to be expanded with controversial $800m China contract — https://www.theguardian.com/world/2016/apr/08/maldives-airport-expanded-800m-china-contract

Maldives: India seeks to counter China influence with bridge project — https://www.msn.com/en-us/news/world/maldives-india-seeks-to-counter-china-influence-with-bridge-project/ar-BB17V70h

30 yrs. later, global warming still hasn’t sunk Maldives — https://onenewsnow.com/science-tech/2018/09/22/30-yrs-later-global-warming-still-hasnt-sunk-maldives

QT…thanks for clarifying that about Tesla Power walls. I clearly was wrong.

Ha ha….I’m still right on the wind turbines though:)

No one would likely argue that the Texas power grid needs to be re thought.

Tesla Powerwall 2 price is $7,500 USD ($12,000 with install cost) per unit of 13.5kWh, and the average US house hold consumes 30kWh per day (possibly 45+ kWh/day during weather emergencies). So you will need at least 2 units at $15,000+ just to last a regular 24 hour, or roughly $232,500+ USD just for the pack with out install (possibly $500,000+ calculation for peak usage/demand) to last a standard 2 weeks of emergency. IMHO, it would be much more economical to have a top notch diesel generator with uninterrupted auto start for less than $30,000 CAD installed with a 1850 L tank to tied you over with full power usage for 2 weeks.

Tesla increases the price of Powerwall again — https://electrek.co/2021/01/17/tesla-increases-price-powerwall/

Thank you Mt. Tolmie Foothills ……..for making my point.

Wind turbines can work in cold weather, as can natural gas plants. The news report said “natural gas is the problem, not wind turbines!” Of course, both were parts of the problem. It is sad that the mainstream media mislead without compunction these days.

That’s been predicted for decades now. Whenever it fails to happen, the projections are merely extended another decade or two.

Yes, Mt Tolmie, critical thinking is definitely important.

Our world’s future depends on alternative energy and we need everyone on board to make that happen. It’s important that we don’t spread miss information.

If you can point to the science showing that wind turbines can’t work in cold weather then the world would love to hear it because countries around the world are spending biliions on the idea that wind turbines work. Texas did not install systems that would have protect it against the cold. (They did that because it would save them money and figured that their gas facilities could handle the load. )

I believe that this is an important topic on House Hunt Victoria.

Rising sea levels due to global warming is predicted to flood places such as Bangladesh and many other areas around the world. Several “million” people are going to be displaced and will be seeking refuge in Europe. This will put a crush on countries around the world as people seek new places to live. Eventually that will also effect Victoria. It’s a good bet that this will happen in about seventy five years or less.

This is not my opinion.

It is strong science.

Yes….Frank…. certainly a good idea to fill your car with gas if you knew the weather was heading into a deep freeze.

Keep in mind that a Tesla power wall can keep your house warm for seven days and more.

It’s why Texas might have benefitted from better planning at the higher level.

Many European countries have much more sophisticated electric grids than north America. They are starting to track the weather days ahead and each individual’s power patterns to know how much they can draw from people’s electric cars for example and use it for the community grid as needed. (Paying back what they take from the electric cars and electric buses, vans and trucks etc) knowing that they can replace what they took when power is in lower use. It’s actually an amazingly smart system and the way of the future. I wish BC Hydro was doing this kind of thing but they are miles behind.

Battery Storage is the next big investment boom.

Most homes will have that eventually….either in people’s electric cars or in the power wall, or probably both. You will have the choice of feeding into the grid or keeping it for your own use.

There’s some truly odd conspiracy thinking around inflation. According to Saretsky it’s a “massaged index” designed to “steal from savers and suppress wages”. Presented without evidence of course. Of course no measure is perfect and there’s debate about how to best measure inflation, but that’s far from a conspiracy.

https://twitter.com/SteveSaretsky/status/1362638118814248961?s=20

I think it’s been posted before, but the personal inflation calculator is neat: https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2020cal-eng.htm

Pending now, $885,000. Only $6k over ask.

I’m well aware that gas pumps require electricity to run. There’s these things called weather forecasts, and when you become aware that a dangerous situation is imminent, you go to the gas station and pump 100 litres of fuel into your vehicle and any gas container you can find. That would probably provide a weeks worth of a temporary warm up shelter that could save your families’ life. I doubt an EV battery would last a day in that temperature with the heat on. As for wind turbines, I also doubt they would have made much difference even if they were functioning, demand was just too high. Ted Cruz had the right idea, head to Mexico.

Hmm. 60 years of clean energy or a mars rover? I like both, but if I had to choose I’ll take the dam.

If you do the math, you’ll see that wind turbines were more affected than the natural gas plants. The only reason why they were “not the problem” is that wind turbines are a smaller part of the supply mix.

Critical thinking is needed these days when the mainstream media is so politicized.

“No word yet on whether a woman’s dream has come true”

Poking around recent sales in Gordon Head…

2234 McCoy Rd

Frat house; big lot; literally 30-second walk to UVic

Ask: $799K

Sale: $975K

DOM: 6

1856 Laval Ave

Bizarre 11-bedroom house; took 4 months, but seller only had to shave $15K off asking

Ask: $1.1M

Sale: $1.085M

1483 Edgemont Rd

Description begins with: “This is the handyman or woman’s dream. The renovation of all renovations.”

Description ends with: “Sold as is where is.”

No interior photos; big lot; backs onto Mt Doug Park

Ask: $800K

Sale: $905

DOM: 5

No word yet on whether a woman’s dream has come true

2060 Ferndale Rd

Gigantic lot; Grandma’s house; every single inch of the house unchanged since 1962; carpet-lined jacuzzi (true)

Ask: $1.339M

Sale: $1.5M

DOM: 6

Bank of Canada would end the multiple purchase programs this May. Money printing would be over by then. When QE gets lifted and BoC’s huge deficits calls need for cash, they would start to resell provincial bonds. It seems the crisis is deemed ending, but the economic recovery just gets started…

1929 Belmont Ave

Finished sq ft: 1148

Assessed: 639,700

Asking: 699,900

Pending: 835k

wow

Two articles looking at inflation:

https://www.economist.com/briefing/2020/12/12/a-surge-in-inflation-looks-unlikely

https://www.economist.com/leaders/2020/12/12/after-the-pandemic-will-inflation-return

That is unprocessed well head gas that are often call raw make or y-grade which tend to have condensate, but CNG (commonly in transport pipelines) or LNG are processed to extract heavier gas/liquids and to remove impurity. It is possible for natural gas to have trace amount of condensate and impurity (wet/sour gas) in the past, but since the 50/60s gas processing has improved therefor we now have natural dry gas (the word dry was drop many decades ago).

Warm region codes do not require for well pipes to have heat trace like cooler regions, therefore Texas well head frack pipes are frozen, but supply pipelines are not. Hence TC Energy was able to send more CNG to Texas in pipelines.

Like wise.

How many cars in warm regions have block heaters? Same argument for instruments and equipment.

https://interestingengineering.com/wind-turbines-fail-cold-weather

the product that we call “natural gas” is actually a refined gas, of almost 100% methane … which will not freeze in any ambeint temperature on the planet.

the issue in TX is likely the gathering and processing system. “natural gas” as it comes out of the well is primaily methane, but also can contain a significant amout of water, and heavier hydrocarbons – which can liquify. unless these liquids are removed the gas can’t be compressed and transmitted.

in Canada we know how to do this!

I think it was buildup of moisture inside lines and valves that froze.

https://www.texastribune.org/2021/02/16/natural-gas-power-storm/

It would be cool to hear where people are moving to after they sell their home in Victoria. Like the Dunsmuir rd house….. what are their plans? Where are they moving to?

$715,000

Could someone please let me know what 1034 Dunsmuir Rd sold for? I

Point well taken Leo.

My appologies QT.

Expand that out to international relations and the same thing happens. You push or slap someone and they want to push or slap you back.

It’s a good reminder that even the best of us forget sometimes and the idea needs constant work:)

No doubt wind works fine in the cold. Operators of both renewable and fossil fuel generation just messed up here by not setting up for cold weather.

This is getting a little heated though (and also off topic), let’s leave out the insults please

For the red necks out there, who will not be persuaded anyway because facts leave a part in their hair as they fly over them, here is a story that gently points out why wind turbines are not the problem. https://www.cbsnews.com/news/wind-turbines-texas-power-outage-electrical-grid/

Ohhhh QT is in a horrible mood today apparently:)

No offence here, because it is came from an uninformed and ignorance source.

<– Licensed gas fitter/pipefitter

Sure that they should have invest more money into the system, but everything contributed to current situation due to lack of funding.

Similarly, Californians also blames the power companies during every wildfires that they had, and PG&E had to file for bankruptcy even those their grid is tie to coal generation states (so they can buy cheap power while singing the virtue of renewables). Hence, the main inconvenience truth that Texas and California have these emergencies is due to poor/lack of grid infrastructure investment and power plant closures, because power companies had to divert their resources to unreliable renewables.

On the side note, TC Energy sends record shipment of natural gas to frozen southern state by diverted all of it pipelines gas to Texas. And, it is unlikely that natural gas pipes are frozen because the boiling point of LNG is -160 C.

Frank …. watch out while you are kissing that gas pump as your lips are going to freeze to the cold steel. You might wish to know that gas stations were unable to pump fuel because the power was out.

Also: It’s clear from QT’s earlier comments that he has also drank the cool aid:)

I’m just having fun…..don’t get too mad.

We have wind turbines in Canada’s frozen north up near Fort St John’s for example and they are set up and maintained to handle frozen conditions.

Texas screwed up plain and simple and got bit in the backside for their lack of foresight and carefull maintenance in order to try and save money.

Normally the price of electricity in Texas is half the price of elsewhere in the US. They are able achieve these lower prices by not investing in winterizing and extra backup capacity. They purposely are not connected to grids in other states to avoid federal regulations (federal government regulates inter-state trade). Texas had similar issues with power outages during cold spells in 2011 and 1989, so it is not a recent problem.

Even nuclear plants were shut down due to frozen instruments, gas lines couldn’t bring gas to gas powered power plants, because pipes were above ground and froze. So are you arguing that Texas would have invested in winterizing if it wasn’t for the windmill parks they built? I think they built the windmills because they produce electricity cheaply, especially if you don’t winterize them.

I’d love to hear an update on the Triest sales when they happen. Maybe I’m a snob, but those houses sure seem like sh1tholes to me (my friend is in one, so I hang out there).

I have heard talk that people are expecting condos to catch up to house prices. I am wondering though if there is an argument to be made that SFH are just catching up to condo prices? Lots of condos downtown running between 700 and a thousand a square foot. So is it really that surprising that a 2400 sq foot house on a good sized lot is going for 1.8 million? Just a passing thought. Now time for that second cup of coffee,

You are absolutely correct, but is doesn’t matter regulated or unregulated, electricity isn’t prejudice.

There were a lost of more than 10% of power due to frozen windmills and solar panels, and there weren’t sufficient fossil fuel base load to pick up the slack, hence the brownouts/control rolling blackouts that lead to grid failures.

Pundits blames the power companies for lack of sufficient foresight for the failures, but they missed the fact that capital spending had to be diverted over to renewables, while grid, fossil fuel delivery systems, and power generator were neglected.

You can’t have your cake and eat it. You can have expensive renewable energy or cheap fossil fuel, but you can’t have both.

BC isn’t like most of North America that got slammed by the polar vortex. That’s why house prices are so high.

BC isn’t Texas. Do a bit of research on how electricity supply is regulated, or should I say unregulated, down there.

And electric generation natural gas at $9033 per MWh or 5000% more than index price.

There are claims that renewables can’t be blame for the power outage, and climate change is posibly to be blame for the artic disturbance. However, they missed the fact that it only take 1-2% of load spike within a few seconds to cause brownouts if there isn’t sufficient power for the demand.

Heard on the radio early this morning that due to the freak weather in Texas and the scarcity of electricity, if you could find electricity, it would cost $900 to charge your Tesla. Maybe we should hug a gas pump today.

Possibly, however it is still historically low and roughly at early level 2016, so if anything we might see 0.5% or less rate hike.

Canada 5-Year Bond Yield — https://ca.investing.com/rates-bonds/canada-5-year-bond-yield

There must be like 50 offer delays to Tuesday right now. I wonder if as a seller it would be better to delay until Monday or delay until Wednesday for all the non-succdssful buyers from Tuesday?

No buyer is going to submit multiple unconditional offers so everyone delaying to Tuesday is going to backfire for a lot of sellers.

Mortgage rates about to rise slightly. This may be the bottom for rates. https://www.ratespy.com/bond-rates-highest-since-april-021817785

As someone in the market ready to buy I say yes buyer fatigue is catching up to me. It feels like some sellers are testing the market and putting their houses on for ridiculous prices. While others put them on at a bait price. I’m exhausted with bidding wars and Bully offers. I would love to return to a time when you can actually have a home inspection and do your due diligence when making such an enormous purchase. I’m already hearing from friends who were the winner in bidding wars and now regret getting caught up in emotion and wish they hadn’t done it. I just hope spring will bring more inventory and there will be enough to go around so everyone can calm down. Sorry for venting.

As usual.

Try 2471 Brookfield Dr. in the Comox Valley.

Assessed $621k

Just listed for $1m flat.

You’d think it has no chance of selling, but looking at comparables it isn’t out of the question.

At what point do we identify this as hyperinflation. Or does that term only apply if we’re referring to bananas?

So it is safe to say that everyone in GH are doing the funky chicken, because they are paper worth 1.15 M.

Productive assets is purely an economic term. It means it is an asset that produces income. So if I were to build a house and my neighbor builds a house and we rent it out to eachother we would both have productive assets because they produce income and extra GDP. If we both decide to live in our own houses they are unproductive because they are not generating income and economic activity is lower. Not sure how the former is more beneficial than the latter except that it creates more taxable income the government can tax.

+1

Leo and others bemoan the “direction of capital to unproductive assets,” but is directing your capital into Telus and TD stocks—or VGRO—so much more advantageous to the economy and to society?

Gordon Head.

1760 Triest: $1.15M offers Tuesday

1744 Triest: $1.15M offers Sunday

1861 San Juan: $1.15M offers Tuesday

This market is ridiculous. Buyer fatigue is going to catch up with this.

You are right Canadian banks are lone sharks. It was just shy of 2K but we round up the payment to make it $2000 per month @ 18.75% interest rate, 5 year variable, and 15% down. Approved in Feb of 1983 and possession on the first week of March. (immigrants with no credit history with CIBC, and our family bank were BMO and their rate were higher).

Remember when: What have we learned from the 1980s and that 21% interest rate? https://www.theglobeandmail.com/real-estate/the-market/remember-when-what-have-we-learned-from-80s-interest-rates/article24398735/

If a person wants to do something productive with their money, start a business and hire some unemployed people and pay them a living wage. Unfortunately you’ll probably fail, especially given the current business environment.

Never realized this before- you’re right. If I was 18 yrs old again, I’d go work on the AB oil rigs and buy up as many vancouver houses as possible, instead of pursuing 8 years of post secondary education. Kind of sad to realize the race to get into home ownership might contribute to the dumbing down of society. Opportunity cost of higher education is getting larger… maybe we can speed up / modernize post secondary education to combat this.

I have a hard time believing that. At that time I was paying $750/month for a house in Vancouver which I had bought with 25% down. Rate was 10.25%. I still have the statement. Perhaps that could be the case for someone who had bought near the peak of both prices and rates a couple of years earlier and was still in a fixed term. But certainly not someone who bought in 1983, unless you had to go to a loan shark.

Actually rates had come down a lot from the peak and so had prices. Quite affordable and I’m speaking from experience. Leo is correct, the unaffordability peak was a couple of years earlier.

I mean why are we all here on this board? Because housing has captured your attention because it is a basic need, a path to security or even wealth, and it is within individual control. These are powerful motivating factors.

I think the sort of conversations we have here analyzing our local market, as well as the diverse knowledge and background of those contributing to it, are valuable and have helped shape my views further on a number of related topics and have resulted in practical positive action on my part.

In order to solve other issues we need to bring the same level of focus, research and practical application (ie. linked with government policy) together and the most likely motivators for high performers, besides individual interests and aptitudes and generally wanting to do something good with your life, is also knowing that your need for security, and perhaps status, will be met in an above average manner.

The problem with higher level issues is you need a higher level of education to participate in a meaningful way and we are moving away from encouraging academic investment as lifelong wealth and ultimate security is now tied to a home and how well you do depends on how soon you get in the market.

“Who needs more than 3 kids?

I would say that any country which is fashionably and fatuously socialist, which makes more and more expensive virtue signals to an unengaged and unmotivated electorate, forcing larger and larger tax grabs from a smaller and smaller segment of genuinely productive people. That country would need more than 3 kids.

And you live in one.

Sure, but I am talking about the practical application of advanced stem and social science to the problems of today and tomorrow. I do agree that population reduction is called for but we are never going to get to solve problems ourselves (as opposed to waiting for destruction) if our world is not oriented towards innovation and less towards ex. getting into a position to be able to buy a house. The people we should admire are not the ones we hear about imo.

Assets that generate income or cash flow are considered productive. Stocks, bonds, rental properties, suite in a house, private corporations, sole proprietorships etc.

Non-productive assets would be things like owning art works, gold, personal real estate, Bitcoin.

Productive assets are good for the economy. “Betterment” of society is assumed to be an indirect benefit of improving the economy (more jobs, more tax money etc.). Of course un-productive uses of money can help society too though (charity, government spending).

It’s hard for me to see how buying an ETF in the S&P 500 (USA, stocks like Apple, Facebook) would benefit Canada society much. Also, buying a ETF in the TSX 60 isn’t much better. You’re buying the stocks from someone like you selling them so no direct gain for the companies involved. A more productive investment would be to invest in your own business or some local small business where you know how it could help in the community.

I think a carpenter, plumber, or electrician does more so solve social issues than someone with a bachelors in non-sense. I have a bsc and a masters from UBC, just enough education to know unless you are doing something tangible like engineer, medical field, etc., education is kind of non-sense. Need more doers not thinkers imo.

“if I was master of the universe”