Why houses get less affordable in the long run

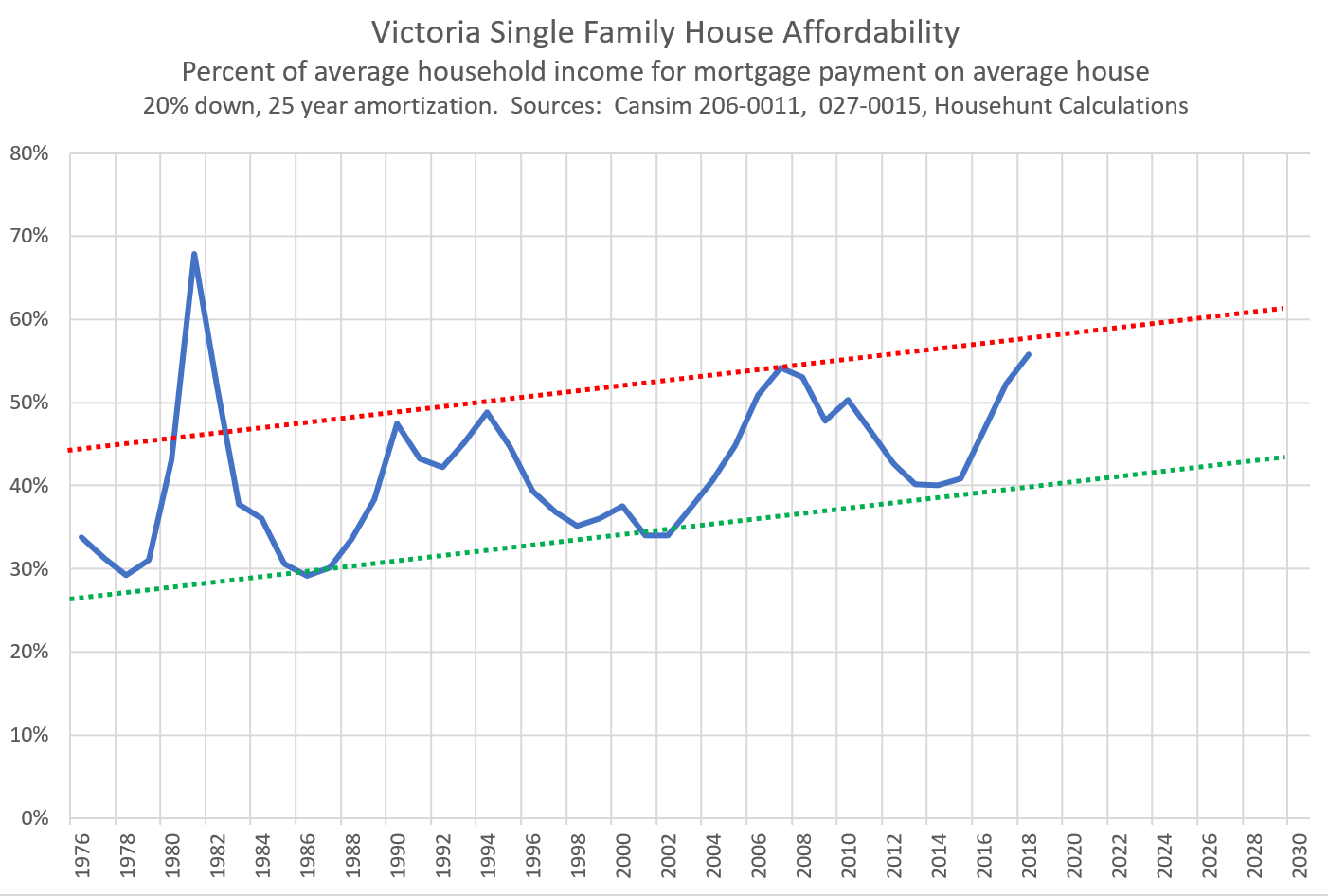

I’ve written a lot on the topic of affordability in Victoria and pointed out that there are two patterns that are evident in our history of single family affordability:

- A 12-14 year cycle where affordability swings between bad and good and back again

- A long term trend of gradually worsening affordability over time.

That second trend means every time affordability improves for single family homes, it doesn’t quite get back to as affordable it was in the last cycle, and every time affordability gets bad, it gets a little bit worse than the last time. The first affordability cycle and the long term trend of worsening affordability (red and green lines) is shown below.

I’ve previously hand waved this long term trend away by saying it is caused by the city densifying. I believe this is true, but let’s look a little closer at why densification causes affordability to deteriorate. We don’t need any self-aggrandizing theories about a retiree wave or the desirability of our region to explain this long term affordability deterioration: it is simply a function of the change in the housing mix in our region.

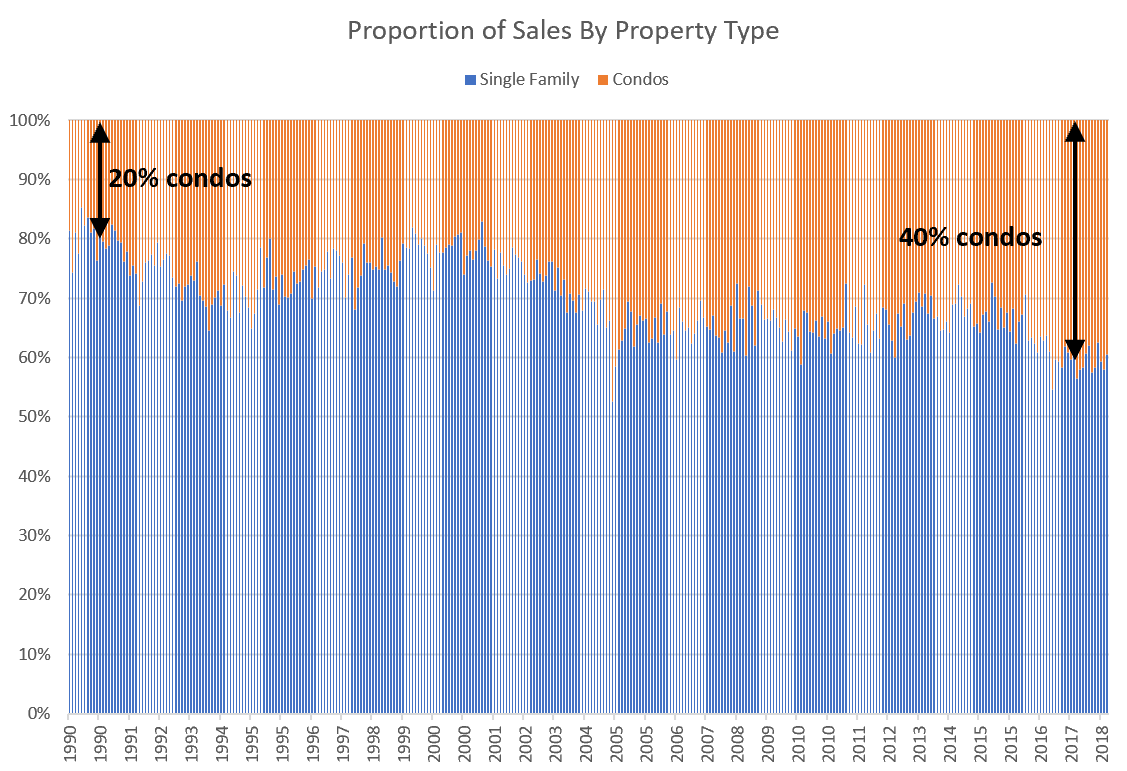

If we look at how the sales mix has changed between condos and single family homes, we can see a slow but dramatic shift in the pattern of sales over the last three decades.

Although single family home sales still outnumber condo sales, the proportion of condos has doubled in 30 years. Now the proportion of sales is not the same as the percentage of people who live in condos but we can safely assume that if condos make up a larger proportion of sales over time that this is because a larger proportion of the population is living in condos. I would look the exact numbers up from the census but as usual the Statistics Canada website is broken (in 2016 about 18% of Victoria’s population lived in condos).

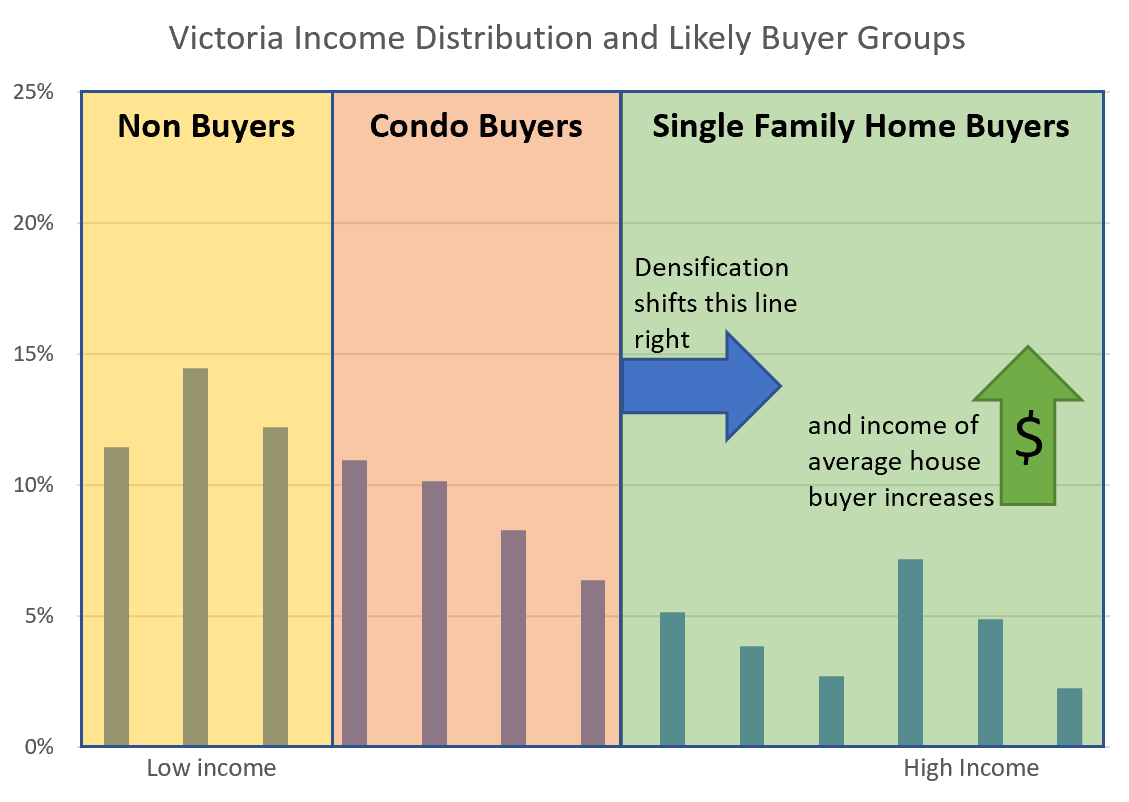

This shift in purchasing means that in 1990 a significantly larger percentage of buyers were in the market for single family detached homes than now. Secondly I believe it is reasonable to assume that lower income buyers are more likely to purchase condos and those with higher incomes tend to look for detached homes. This means that as buyers shift to condos over time, the group of single family buyers consolidates more on upper end income earners who are better able to afford the higher prices.

So while single family homes gradually become less affordable to the entire population over the long term, the group of single family buyers becomes smaller and wealthier at the same time which counteracts this trend.

So while single family homes gradually become less affordable to the entire population over the long term, the group of single family buyers becomes smaller and wealthier at the same time which counteracts this trend.

This of course doesn’t mean that single family house prices cannot decline. The medium term trend in affordability has been stronger than the longer term trend in the last 4 decades and we have seen affordability improve for years in past cycles. Just don’t expect it to get back to where it was in the 80s.

There is a lot of discussion here about how inevitably prices are attached to income. That’s fine and makes sense. But what about the other players – the financial institutions – who have serious financial incentives in making their products affordable. In some markets where prices are not attached from incomes (e.g. London), banks are devising creative ways to make their products marketable to those who wouldn’t otherwise access them. I’m thinking here of inter-generational mortgages. So, I don’t think it’s inevitable that prices will adjust simply because they have flown away from incomes. I do think it’s inevitable that there will have to be some adapting somewhere, maybe just not how we think.

https://www.telegraph.co.uk/equity-release/mortgages/the-mortgages-where-70-year-olds-borrow-to-help-their-grandchild/

Grant: In the very short time since we’ve settled here, my daughter (who is a bit of a car aficionado like me) has commented about how many more luxury brands, sport cars and “cool old cars” there are here. The wealth is on display for all to see.

…………… or maybe there are a lot of people enjoying the equity in their homes, Grant.

http://autotalk.com.au/industry-news/car-sales-slack-reflects-house-price-slump

“The recent drop in house prices is linked to a dip new car sales, especially in the luxury segment, new research shows.”

Unless I’m reading something wrong, he answered his own question by giving an example from 2018. Here’s a whole article with examples:

https://thinkpol.ca/2018/04/03/vancouver-houses-sold-assessment-march/

Andy7 ask when was the last time Vancouver house prices sold for less than assessed value.

I posted this link below but I’ll post it again. The link goes to an apparently inactive website that tracked price declines until 2014 when prices started increasing. So the answer to your question is 2014.

https://vancouverpricedrop.wordpress.com

@LF:

You entirely miss the point of restrictions on usury:

First, although it is true that, as you say, “your income still has to pay it back,” what is important is that if regulation reduces the amount you can borrow, it also reduces the amount that “your income still has to pay back.”

Second, if borrowers are limited in what they can borrow, then prices cannot be bid so high, meaning that borrowers get more for their money.

The cost of borrowing restrictions, if it is reasonable to call it a “cost,” is borne by the vendors, people who bought ten, twenty, thirty or forty years ago, who now enjoy windfall profits — millions in some cases — on the sale of houses purchased when real prices were lower, often massively lower, at least in part because restrictions on borrowing were tougher when they purchased than now.

Then we have a different understanding of what is logical, and I think we do.

The main thing that restrains population density is zoning in high demand, highly priced areas.

In Victoria downtown there is currently no minimum floor space for condos, elsewhere it is 355 square feet and council has recommended the minimum floor space be removed everywhere for condos.

Change is happening in the expectation of what a first-time buyer can buy in the core with income-based affordability.

I agree that living in such small spaces is not the norm here and that prices are not at a point where this is super desirable and we have different cultural norms (which shift slowly), but, again, there is now a market for smaller spaces here due to income-based affordability. Unlike Hong Kong there are other choices though, like not living in the core, which will likely be more desirable for many. Still, you see the smallification of the SFH in Langford new, more affordable, developments – both in lot size and square footage.

Sorry if I misunderstood or misquoted. Working from memory of what you’ve said in the past as well as this statement you made below:

You also said, “The impact of home equity is the same regardless of home values.” Many people, like me, have a parent that lives in a different housing market than they do. Plus many parents bought a much more expensive home than average buyers could afford today because houses have appreciated so much.

Or, based on the stats, you and your one sibling. Your parents pass away and leave you an 800,000 home in Victoria. You each inherit 400k. Now you can each buy an $800,000 home, at the least and assuming you have no equity of your own or inherited nothing more than house equity. If you do have more, maybe you buy a much more expensive home, or help your own kids get into the market.

Income-based affordability is a big factor in our market, but it is not a hard line on affordability for a lot of people, even many first-time buyers.

When Is the Timing Perfect for a Price Reduction? How Reducing the Price Can Bring Multiple Offers

https://www.thebalance.com/when-is-the-timing-perfect-for-a-price-reduction-1799065

Obviously incomes aren’t the only thing that contributes to one’s net worth or their ability to buy – especially in Victoria. In the very short time since we’ve settled here, my daughter (who is a bit of a car aficionado like me) has commented about how many more luxury brands, sport cars and “cool old cars” there are here. The wealth is on display for all to see. And lo and behold Victoria ranks 3rd (behind only Vancouver and Toronto) on highest average household net worth. A large portion of the wealth is in RE, however that doesn’t detract from the fact that this area is a magnet for the wealthy and that their purchasing power greatly warps the overall affordability factors.

As we all wait for the numbers. It is like reading tea leaves.

Small houses engender or are equivalent to feudalism?

Perhaps if Google Translate had a” Gibberish” function we could all make some sense of this, but while we wait for that to appear perhaps a few of you could restrain yourselves.

Unlucky are the ones who live in a high-priced market but have parents in lower-priced cities. Seriously, though, the inheritance factor is going to make a huge difference in the net worth of people whose baby-boomer parents lived in cities like Victoria, Vancouver, and Toronto. It also makes a difference how many siblings one has, of course.

From family scenarios I know of, city and number of children could be the difference between inheriting $100,000 vs. $1,000,000. I would like to see an inheritance tax to even this out, but only after I get mine, of course.

Steve Saretsky posted this today, “When was the last time Vancouver single family homes sold for 20% below assessed value?”

I’ve been curious about this as well, would be interesting to know the answer…

Steve also made note of this Van SFH sale (English tudor style house) that was posted online:

“Sold for same price in 2015, erasing two years worth of appreciation. Seeing more of this in the pricier detached market.”

64 x 113 lot

Dunbar

Just sold for $2,630,000 (the same price it was bought for in Nov 2015)

$746,000 (or 22%) below July 2017 assessment of $3,337,600

$818,000 (or 24%) below July 2016 assessment of $3,448,000

Totoro, that argument doesn’t make any logical sense. The UK has a population density that is over 6,400% greater than Canada. Hong Kong has a population density that is, wait for it, 167,325% greater than Canada.

Even when you zoom down to the density of our region, it doesn’t even come close to comparing. Victoria is not a dense city at all – there’s no reason for everyone to live in closets. It’s not going to happen, Totoro, not within our lifetimes anyways.

For prime area of Victoria first time buyers are the outside money moving to Victoria. To some degree money enters at the top of the market and then flows down the property ladder as old people downsize. In that sense the prime real estate is detached and will probably remain detached from local incomes. The flow of outside money will determine whether prices in prime areas will increase or decrease to a far greater extent than local incomes.

A more pure example of this would be Whistler. The cost of a chalet is totally detached from local incomes and unless some tragedy befalls Whistler they will remain detached in our lifetime.

To the degree Victoria remains a nexus for retirement for the rest of Canada then prices in prime areas will not be determined by local incomes as much as the number of first time buyers to the city who have deep pockets.

Or more people rent than buy or buy smaller spaces or turn to family for help. Just like in much of Europe and some of Asia.

When we are talking about affordability we need to acknowledge size of accommodation as a factor as well. In Hong Kong in 2016, the median floor area for a home was 430 square feet (sq ft) and more than 90 per cent of households living in accommodation of less than 753 sq ft. On average, you can fit 5.7 UK homes into one Canadian home.

Houses can certainly get smaller without feudalism taking hold.

https://nationalpost.com/news/canada/the-incredible-shrinking-home-why-canadas-houses-are-getting-smaller

https://www.elledecor.com/life-culture/fun-at-home/news/a7654/house-sizes-around-the-world/

I did not say that. The discussion is about new buyers in general and how critical they are to the entire market. Not about the core, or single family, or even Victoria. This is true in every market.

The impact of home equity is the same regardless of home values. If your parents die and leave you and your 3 siblings a $200,000 house in Halifax, you each can put $50,000 down on a $200k house of your own. If they die here and leave you an $800,000 house, you can each put $200,000 down on an $800,000 house. You each inherited 4 times the money, but in the end it doesn’t let you buy 2 houses, only one (assuming you can qualify for that $600k mortgage).

In a high priced market, parents can give a lot of money, and you need a lot of money. In a low priced market, they can only give a little money, and you need only a little money.

I can accept this. What those segments of the market cannot do though, is separate themselves from the market as a whole – the whole being the entire region, core and surrounding areas, including Westshore.

Let’s say that the last point of entry for the “entry level buyer” is the Westshore, or View Royal, or where ever in the region. But say now that becomes unaffordable. One of two things happens: either an entirely new social system takes hold, ie, feudalism, or, the market will eventually enter into a correction. If it does, that ripples through the market the same way that rising unaffordability at the top worked its way down. And the latter is what’s happened: right now, you have large segments of the market that are now completely unaffordable. That does not, IMO, represent a new, outsized portion of the metropolitan market that can defy gravity henceforth.

So if I’m feeling less cranky to our mutual friend below, I could say yes, certain market segments are less connected to income affordability. Some of them are also not directly connected to economic fundamentals of the area. But I don’t think that means that incomes have no bearing. The incomes of those in the market as a whole is much, much larger than the segment of the market where incomes matter less, and thus will exert that affordability impact broadly everywhere, and to varying degrees. I don’t think that’s new and you assert, it’s not unique to this city at all. However and again, that does not divorce that segment from everything else; they still remain tethered and affected by what the market writ large is doing around them.

Does that make more sense?

A few neighbourhoods in Victoria are of the incomes-be-damned variety, and have been for a while. As you noted yourself, Local Fool, “house prices across areas and segments” are stratified. Most of these neighbourhoods aren’t going back to income-based affordability no matter what happens. They have left (some) fundamentals in the dust.

One thing that some here seem to implicitly object to is the notion that the entire core of Victoria can permanently defy fundamentals. And maybe it can’t. But there are several pockets in the core that can and will, IMO. It happens in many cities; it’s not a Victoria or B.C. thing.

Sure, FR has its impacts. But whether lending is loose, or lending is stringent, your income still has to pay it back. If that’s 5% of your income, or 50%, the concept is the same. The stress test regulation is another example – that’s a market pressure that is entirely extraneous to incomes, and it has a role in restraining the housing market. But how?

Because…with X level of income, you are now forced to borrow less money, and you cannot afford as much house. That’s part of why people are getting rejected for jumbo mortgages this year. It’s also straining the first-time buyer, which is having a role in causing the move up market to freeze.

@ LF:

That is incorrect. You are ignoring financial regulation: specifically, regulation of usury.

Usury has always been seen as pernicious threat to social well-being and has been subject to regulation of some sort at most times in most societies.

In Canada The Office of the Superintendent of Financial Institutions regulates mortgage lending thereby directly impacting house prices. However, financial regulation of usury in Canada remains remarkably weak, and the restrictions on mortgage borrowing are much weaker than was the case in the Canada of forty years ago when mortgage payments as a percent of household income were held to a lower proportion than today, and a wife’s contribution to household income was heavily discounted.

House prices could and should be radically reduced by much tougher regulation of mortgage lending.

))) leoS: The sentence you were replying to goes on, it does not stop where you cut it off.

You are correct. Sorry about that! Next time I’ll read the entire sentence 🙂

Yes, I read it. He doesn’t say that anywhere at all, and the quote you chose to use doesn’t generate a rebuttal to my comment. If you choose to believe his argument was that prices disconnect from incomes and remain that way, you can.

What he hypothesized, rightly or wrongly, was that while single family homes gradually become less affordable to the entire population over the long term, the group of single family buyers becomes smaller and wealthier at the same time which counteracts this trend.

It sounds to me like he’s talking about is the market as a whole and shifting sales mixes over time as the city densifies. No one is arguing that because the population as a whole makes 80k a year, exclusive neighbourhoods should all be priced at 250k. Incomes are always stratified, so are house prices across areas and segments. It’s nothing new. Neither is anyone saying that intervening factors can’t affect the market – but they aren’t fundamentals. And we have seen the influence of these factors recently, in many markets in Canada. Right now you have almost every RE segment out of kilter with the economy, and it isn’t going to stay that way.

You can argue this incomes-be-damned thesis with as much analysis, conveyed certainty and written eloquence as you wish. The fact remains this RE market is not going to be the first one in human history to leave its fundamentals in the dust. It’s somewhat puzzling that you continue on with it, given what the RE market in BC is doing right in front of our faces.

Don’t quietly move the goalpost. That’s not his argument and you know it.

And yet they are absolutely not. Did you not read the article above?

Leo, you’ve said many times that it is this “new demand” from first time buyers that supports appreciation and now with decreasing affordability “the whole thing falls apart” when first time buyers can’t buy in the core? I don’t think that is correct, at least not entirely correct, given the impact of home equity and family transmission of wealth in our market.

If first time buyers can’t buy the same SFH they could ten years ago based on income the whole thing just does not fall apart. People and markets adjust. The desire to own doesn’t go away without a big cultural shift caused by prices higher than what we have now and government regulations that take away some of the advantages of home ownership.

It is not the lack of a first time buyer that is going to cause prices to drop here imo, it is going to be other things that impact consumer confidence in general like a stalling market and new government regulations and higher mortgage rates. Or an earthquake.

So the first time buyer who wants to remain in Victoria and would like a SFH in the core will instead buy a condo in the core or a house in Langford UNLESS they have assistance from parents in the form of a down payment gift and/or cosigner. The parent’s ability to gift a down payment is most often going to come from, yep, home equity and their home equity position also allows them to cosign for their child.

Five years later when the first time home buyer’s condo has appreciated (if it has), they sell, take their home equity and put it down on a SFH in an area they can now afford. Those with parental help, inheritance, or very good incomes or other assets may be able to buy in Fairfield. There are enough non first-time buyers with equity around to support values in the core for SFHs as they are imo given the limited land base and perceived desirability.

Now what happens to those that don’t have any parental help? They don’t buy in the core but stay in Langford, where they do just fine both financially and community-wise.

Not by itself. Somebody else decided to top your price by 400K and had to get that money from somewhere.

Inherently transitory condition

Do you mean the (dramatically) lower price that has been “right around the corner” for the past 35 years?

Unless there’s a pandemic of speculators snapping up starter homes…

The people behind Seattle Bubble and Prof Piggington (San Diego) both bought very near the bottom around 2010-2012. Here’s a post with some discussion (there are others). Take note that the availability of fixed rates long term in the US makes some parameters different.

https://seattlebubble.com/blog/2011/05/27/guess-what/

https://seattlebubble.com/blog/2011/06/17/knife-catcher-how-did-the-tim-pick-everett/

Yup exactly this. Sure fire way to win in real estate is to keep transactions to a minimum. The higher prices go, the worse it gets because many costs are in percent.

That’s not the argument. Of course equity exists. But it doesn’t drive house prices.

Bingo. That’s who drives the market. If that first time buyer can’t buy, the whole thing falls apart. That’s where the income drives the market

That’ll set them straight, once and for all. 😛

Honestly, I’m kind of amused watching all these intellectual acrobatics below, attempting to depict and justify something that you can’t really do in all fairness.

Prices in a RE market over the long haul are always going to be anchored to incomes and the cost of money as a whole. That’s never going to change, it never has changed, it never will change, no how many “superstar” authors put pen to paper and argue…

I’m in the Victoria tech industry and I think that’s an inflated statement. Very few of Victoria’s buyers are rolling around with big tech dollars. I really don’t think it’s a driving factor let alone “the main driver”.

And yet, it does. Perhaps in the future it won’t, but so far it has. If it didn’t, prices would have just continued upwards in 2008 rather than flatlining for 5 years.

That’s a great question.

Firstly, I’d suggest you don’t try to time it to where you will only buy at absolute bottom, especially if this is going to be your principle residence and for a long period of time (10+ years). Chances are you won’t be successful, and doing so is way harder when you’re actually faced with the decision to buy: Am I catching a falling knife or not? Loss aversion is extremely powerful at this point. In my mind, I think it’s easier to just wait for the excesses to be taken out, however much that is, and then reassess and take the long view out – that means not buying right now, IMO.

Nevertheless, when a market hits bottom, it’s usually not immediately after you see the largest price drops. It tends to happen a while later, where the market sputters over a period of a few years. Ignore the media and pundits completely. People smarter than you or I will be calling the bottom and an imminent recovery every 15 minutes, just like the bears constantly called the top earlier in the cycle. To wit, a few months of better data is not necessarily a recovery. An increase in spring or early autumn activity likewise, is not a recovery. You will see fits and starts back upwards, cheer-leading will abound, then it falls back down – it’s irrelevant.

If you have a look at mortgage origination data, the bottom is probably not far when you start to see it increasing again over a few quarters, debt levels, unemployment levels and foreclosure activity area are all falling, and you start seeing rising price-to-rent multiples. That could be called the entry point for the smart money, ie a professional RE investor.

But this is all just one perspective, and to make it even more complicated – everything I just said may very well be proven wrong in time. Markets tend to follow principles and themes with very consistent regularity. You can bank on it happening again, this time. But no two patterns between markets or cycles are identical. It’s why you can say, it’s different this time, except really, it isn’t.

As for pent up demand or supply, I don’t put any stock in either argument although one hears both variants constantly for any given market condition. I’ve also never seen any market effect that can be best explained by either of those.

Better than what? Certainly not better than buying later at lower price. And that holds true regardless of whether interest rates go up.

As per Steve Saretsky this morning, we’re beginning a global real estate slowdown. We’re a global economy and Victoria even more so now with the main driver being the tech industry being global and not local. Keep your eye on the big global pic if you don’t want to get burnt to a crisp.

Housing market has hit a ‘significant slowdown’ in recent weeks, Redfin CEO says

Redfin stock dives after top exec says sudden downfall is expected to continue in August and September

https://www.marketwatch.com/story/housing-market-has-hit-a-significant-slowdown-in-recent-weeks-redfin-ceo-says-2018-08-09

Dubai Builder Sees Property Slump Lasting for Years

https://www.bloomberg.com/news/articles/2018-08-07/dubai-property-builder-sees-lasting-slump-despite-state-stimulus

London Real Estate Losing Steam

https://www.marketpulse.com/20180809/london-real-estate-losing-steam/

India sees the job-growth slowdown in the real estate sector: Indeed Report

http://bwpeople.businessworld.in/article/India-sees-the-job-growth-slowdown-in-the-real-estate-sector-Indeed-Report/20-07-2018-155358/

House sales slowing in Central Okanagan

https://globalnews.ca/news/4326631/house-sales-slowing-in-central-okanagan/

It is not wiped out. It is real money. Your 30k became 430k tax exempt in ten years.

And house prices rose faster than your income, but you can buy laterally for sure and likely up as in ten years your income has likely risen as well. But someone with your income and only a 10% down payment now cannot buy your starter house. It is only home equity that powers your ability to re-buy in this market, not income-based affordability.

We know that the strongest indicator of where prices go is inventory. When inventory gets low and stays low, things like bidding wars happen and upward pressure is put on prices. The leading indicator of the price bottom of the market should be when inventory peaks then falls. How delayed that leading indicator is, I don’t know. Then the challenge is evaluating if an inventory peak really was the peak, or are we about to be flooded by a bunch of desperate sellers? No one has a magic 8-ball. At least one that works.

An important thing to remember is that you as an individual don’t represent the entire market of buyers. The price trough is a market thing. While it might statistically be “the best time to buy”, that doesn’t mean whatever you stumble upon at that time is a steal. Individual variation is huge. You can find a desperate seller at times other than the price trough, and you can still make a poor decision and get over-leveraged when buying “at the bottom”.

The way I’m approaching it is by evaluating what my floor and ceiling is. The floor is the property I could buy with a mortgage + taxes + condo fee equal to what I’m paying in rent now. It’s not a whole lot. The ceiling is what I’m safely able to afford even if rates go up, even if I lose my job and can’t find another for ~2 months. It’s not the amount a bank/mortgage broker tells you. I’m hoping that my personal ceiling would be able to afford a place with an income suite. The financials of living in the income suite and renting out the house above are great.

People say “there’re too many factors” because there are, and many of the most important factors are personal.

Intro – as someone who sold my home in Nova Scotia last year, I agree that moving from one market to another can be brutal!

Off-topic, but worth posting: Jack Knox’s column this morning:

Battling and punishing the queue jumpers at B.C. Ferries terminals

https://www.timescolonist.com/news/local/jack-knox-battling-and-punishing-the-queue-jumpers-at-b-c-ferries-terminals-1.23397238

Leo, you’ve tidily demonstrated the illogic of the “moving up the property ladder” concept.

It’s better to buy your dream house, if you can, and hold it for a long time. We also have to factor in PTT and other costs, which weren’t mentioned in your example.

But boy does equity play a role when a Victorian moves to Moncton, or when a Monctonian moves to Victoria.

I have a friend in Van who is very successful (makes a lot of money) and just went through a divorce, and sold their house. Friend said the crazy declines are only in the detached segment and that’s putting pressure on the condo market where the competition to get in is as frantic as ever. I guess it has been 2 months since we talked, perhaps it has changed since then. In any event Victoria seems to be a less crazy version of the Van market to me.

As for this:

“The real tragedy is, how easy all this was to see coming. I’m not talking about precise predictions, I’m talking about basic principles in finance, economics and market cycles, and broadly what you can expect to see happen when housing jumps the economy. And the more it does so, the more the backlash.

Pity we have to once again feel the apple slam us on top of our own heads, before we can re-confirm for ourselves what Issac Newton’s Principia so eloquently showed us nearly 400 years ago…”

My question is this. Ok, so we can’t predict because too many factors. But, do the “basic principles in finance, economics, and market cycles” tell you when a market is at the bottom? I would like to buy then.

In metro Victoria, only 29% of households have 3 members or more

Are dogs included in this statistic?

My bad. It was 11,200 new self employed jobs in June, which we know from statistics that half of new businesses fail in the first six months.

Good summary of what I was trying to get at in this article.

Of course equity is used to buy homes, but it does not accelerate home price appreciation. Simple example:

You have $30,000 and really would like to purchase your dream house for $500,000 but you don’t have the means so you settle for the starter home at $300,000. Housing market doubles in the next 10 years and you decide you can afford to upgrade to your dream house.

Now you have your original $30,000 + say $100,000 you paid off that original mortgage. And you gained $300,000 in equity from market appreciation! Great news, but does that help you buy the next house? No since it has gained $300,000-$500,000 in value, so your gain is immediately wiped out and more.

You will have a solid downpayment on a much larger mortgage. Still need to figure out how to qualify for the $500k mortgage and that can only be done with income.

The absolute value of the housing market doesn’t matter either. Equity plays the same role in Moncton as it does here.

On your second point, I do agree. Outsized localized price appreciation actually removes demand because it encourages people to leave the city (both first time buyers who can never afford to get in and market winners that can cash out and leave).

The sentence you were replying to goes on, it does not stop where you cut it off

Because everywhere in Canada, there are far more small households than there used to be. In metro Victoria, only 29% of households have 3 members or more. The % of housing stock that is SFH is larger than that. So the high price of SFH in Victoria is not due to insufficient SFH relative to the number of households who reasonably need that much space.

We are. A lot more. There’s always been price “slashes”, but the phenomenon of people losing mega bucks in VanRE has just been in the last little while. There’s about a dozen I’ve seen recently where the sellers stand to lose more than one million dollars over what they paid, and virtually all of them bought in 2016 or 2017. The common slang for these listings is “flip-flops”. I’ve also noticed if they still don’t sell they occasionally show up on AirBnB. I haven’t noticed one go to the rental market yet, but I guess that’d be easy to miss.

But the amount of apparently speculative purchases losing tens to hundreds of thousands of dollars in the detached segment is starting to become prolific and widespread all over the GVRD. 250k+ loss isn’t hard to find anymore and what’s more, the market rot is absolutely working its way into condos now. The volumes are disappearing, price drops are becoming larger and more numerous, and there’s tonnes of people trying to dump pre-sale condo assignments. What did you think was going to happen, all you pre-sale buyers?

People who’ve bought pre-sales in 2016/2017 and haven’t sold their contracts yet, are IMO, going to get a horrible awakening. Heck, even Owen Bigland shudders at that segment. At least with a detached home you have the land. A condo is just straight up liability. Worse, (or better, depending on your perspective) the ability to determine prices is a bit easier in a building of similar or identical condos, whereas detached homes can have unique attributes. So if one goes at a fire sale rate, the pressure on the other units in that building is that much greater – just as the reverse was true on the way up.

The real tragedy is, how easy all this was to see coming. I’m not talking about precise predictions, I’m talking about basic principles in finance, economics and market cycles, and broadly what you can expect to see happen when housing jumps the economy. And the more it does so, the more the backlash.

Pity we have to once again feel the apple slam us on top of our own heads, before we can re-confirm for ourselves what Issac Newton’s Principia so eloquently showed us nearly 400 years ago…

If we see more of these, and I think we will, all those numbered corps will start sweating. Assuming they can sweat.

I was just thinking today about how volatile construction jobs are. All it takes is a shift in sentiment for the investor money to dry up. Then a big chunk of those construction workers experiencing unprecedented ease right now suddenly have trouble lining up work a few months from now.

Barrister, you old fool. Everyone buying in Oak Bay & Rockland is a local (defined as anyone residing in Victoria longer than two minutes) and everyone is taking out a $1 million-plus mortgage because wealth doesn’t exist, and if it did it wouldn’t want to buy in Oak Bay or Rockland.

I haven’t met any of these people or seen them post here. All these black and white-isms get tiring. Everything needs context. The reason no-one here has ever been able to accurately predict the near future of the housing market is that there are way too many factors at play, and factors that can change like taxation and government regulation, to know what will happen with accuracy.

Maybe. I have no way of gauging this, but I do know that those with high net worth generally are not going to have less today than they did two years ago. The 80th person competing for a house in the core today has a bunch of factors at play, but perhaps the biggest one that will impact the decision is whether they believe they will get a better price or a better house in six months, not whether they are rich enough.

I believe that is changing:

https://www.cbc.ca/news/business/cmhc-self-employed-mortgages-1.4753446

Still one would need to put their money where their mouth is. If those construction jobs go there will be a mass exodus out of Vic as fast as they arrived.

If you continue to have significant numbers of retirees moving to Victoria from the ROC with deep pockets of cash then the housing market wont reflect local incomes. Most of the upper priced houses are bought without a single penny of local income.

In desirable neighbourhoods, like Oak Bay, I would not be surprised if almost 50% of the houses bought in the last few years were bought for cash without a penny of local income being involved. When one of my neighbours sold last year they had three cash offers from couples in Vancouver and one from Calgary. These people were bidding against each other and local incomes did not come into it.

I am not saying that local incomes dont influence house prices but they dont determine house prices when a lot of the buyers are not local.

I believe I read 10000 new self employed jobs. They don’t get mortgages easy and probably contruction related and can disappear just as fast.

Patrick

I see the argument you are making but I would offer the alternative

If there are 80 houses available and 200buyers

I would argue given market conditions, decline of foreign buyers, the new rules on mortgages that the 80th richest guy today is less rich than the 80th guy of 2 years ago.

That while there are still people coming from Toronto and Vancouver that the median financial capacity is shifting or will, I think currently is – significantly to the left and as such prices at least in the short to mid term have no where to go but down

I realize houses are going over asking for some prime properties but that is probably becoming less and less frequently

Again there are people who argue that Victoria is an exceptional cultural Mecca with a dirth if available land and as such argue that prices have no where to go but up

I don’t know what argument they can make – that anyone can buy to explain this phenomena

I mean it can’t be that people are waiting on the side lines because according to them the smart money would just be buy buy buy.

I appreciate that others argue that this is a slow down that might be here for the short term – and I can see that as a viable possibility

In the short term I think it is either steady as she goes – down a little or down a lot – but not up

With all the rapid price drops in Vancouver this inactive website might get re-activated. The site tracked Vancouver real estate price declines until prices started escalating in about 2014.

https://vancouverpricedrop.wordpress.com

))) local fool: I clearly showed you why demand cannot remain high forever.

I didn’t see anything where you showed why “demand cannot remain high forever.” That sounds like an interesting post -please repost it.

Ditto.

Yes, I’ve been watching that Applewood house. There is one on Larchwood that was for sale forever. In fact, it still might be.

Larchwood is a bit of a busy street to live on, but this general part of Gordon Head (which includes the Applewood house) is extremely walkable; I compare it to living near Oak Bay Ave in terms of proximity to a diverse set of amenities.

Interesting article from Australia – When FOMO becomes FONGO in a Falling Property Market

https://www.domain.com.au/money-markets/fomo-to-become-fongo-in-a-falling-property-market-20180806-h13l8z-756589/

“Tighter lending standards, poor affordability, rising supply and falling capital gains expectations could create the conditions for a top-to-bottom fall ”

Sound familiar? I have seen quite a number of houses purchased these last few years which were then turned into rentals. When you sum net income vs. what the property was purchased for, it’s clear that the investor was counting on price appreciation. What happens when the market goes flat? Will FONGO (fear of not getting out) take over? Hmmm….. time to fire up the popcorn machine and see how this all plays out.

The updated MLS has just reduced the price by $908,000, for a new price of $3,380,000.

Seems like a steal for a 1956 built rancher.

I think that the VREB should do what is done in many US states – if a property is off the market for less than 90 days then the previous listing DOM is added into the cumulative DOM. Doesn’t matter if with the same agent or not.

Today’s top drop for VanRE, just for fun:

2526 Edgar Crescent, Vancouver.

Purchased in February 2016 for $4,300,000.

Earlier this month, they attempted to sell it for $4,288,000, for a loss of $12,000 + carrying and offloading costs. No takers. Dropped the listing, and got a new MLS#.

The updated MLS has just reduced the price by $908,000, for a new price of $3,380,000.

Total loss if a buyer is found and pays asking: $920,000 + carrying and offloading costs.

https://www.zolo.ca/vancouver-real-estate/2526-edgar-crescent

I think what the VREB should do is if you cancel or expire your listing you cannot re-list with the same REALTOR® for 30 days. Guaranteed the practice of re-listing would dry up.

While I do acknowledge your hedge, I’m not sure you actually read what I wrote. I clearly showed you why demand cannot remain high forever. You then essentially repeated a scenario where demand continues growing year after year. I guess I could say, you’re not the only one who contemplates a perpetual motion RE market – plenty in Vancouver did (and some still do) too. I’ll toss a little anecdote your way in just a sec.

I thought of this article when reading your comment, Barrister.

https://m.huffingtonpost.ca/2018/07/07/recycled-listings-housing-data_a_23476792/

If it sells at asking, without accounting for realtor fees or other costs, that’s a $70k loss. Minus 8% ROI.

That.Would.Suck.

Hopefully a speculator and not a family that got caught up in the hysteria and is now forced to sell/move in a declining market. That is a lot of money to lose.

Unless someone has to sell a home due to bad luck reasons (poor health, etc.) there is no way I am feeling sorry for anyone losing money on RE. People need to grasp the simple concept that markets go up and down and you take a risk when you buy. Your average person walks around somehow thinking real estate only goes up.

I personally fully expect to be burned sooner or later on a pre-sale transaction. You can’t expect to make money on every RE transaction.

Lots of 2016 sales going re-selling for less.

408 Lands End purchased for $2,400,000 in 2016; just resold for $2,250,000.

9706 Fifth St purchased for $869,000 in 2016; just resold for $790,000.

I’ve said before….if the Sooke population grows and we need another surgeon at Vic General the meet the demand the odds are he or she is looking in Oak Bay, not Sooke, for accommodation.

The absolute number of 1% and 5%ers will increase, the inventory in Oak Bay won’t.

)) You’re not going to have perpetually high demand for homes in a market to a degree which permanently negates local fundamentals.

If the population (demand) is increasing faster than the number of available detached houses (supply), then the price will increase faster than “local fundamentals”.

If 100 people are looking for to buy 80 available oak bay detached homes one year, then the “richest” 80% will get a home.

If next year there are 200 people looking to buy these 80 houses, then the richest 80/200 = 40% will get a home.

The richest 40% can afford more than the richest 80%, so the prices will rise, there doesn’t need to be increasing incomes for that to be true.

I would say markets will rise and fall but is the long-term rate of appreciation which is most reliable – like it is with stocks. You need to be able to hold long enough not to get caught in a downturn.

What really matters is how you define fundamentals. I think income, employment opportunities, local economy, amenities, credit, and available land/zoning are all factors. So is the long-term rate of appreciation as this underpins the ability of many not to rely solely on income as a determinant of affordability.

Who said it was immune from a downturn? It is not. All markets are impacted by a series of factors including such things as lending criteria, interest rates, economic conditions, government regulation, taxes, and other local market factors. A Vancouver downturn will have an impact here. The question is what the downturn looks like and will we see a return to income based affordability as a result.

Except we have 60 years of data on Oak Bay that shows a rate of appreciation of 7%.

Is there going to be a “crash”. Doubt it. Can prices keep going up like they have? I’d bet against that given that the long term rate is 7%.

Will prices in Victoria further diverge from income-based affordability over the long term. I’m inclined to think so in many areas long-term.

No-one said you could. What I said is that it is a factor. It is illogical to presume that home equity is not a factor in ability to purchase a home in Victoria given the economic impact of appreciation. You can do the math yourself on your own home and you’ll realize you could sell and rebuy a bigger better home, or cash out and move to Courtenay with not much of a mortgage left – which is what some Vancouver sellers have done here and which has nothing to do with income-based affordability.

1737 Applewood

MLS 394890

DOM 42

$804,000 assessed

$889,000 original ask

$819,000 new ask

Sold in 2017 for $889,000, paid $130k over ask and was only on the market for 6 days.

If it sells at asking, without accounting for realtor fees or other costs, that’s a $70k loss. Minus 8% ROI.

That.Would.Suck.

Hopefully a speculator and not a family that got caught up in the hysteria and is now forced to sell/move in a declining market. That is a lot of money to lose.

“incoming escapees from Ford’s Ontario”

This does make sense. If one is in Ontario and is grief-stricken at the thought of losing a preening, self-righteous lefty government with absolutely no concept of basic math, much less responsible budgeting, well….. BC is your refuge.

The issue there is no market anywhere behaves like that. You’re not going to have perpetually high demand for homes in a market to a degree which permanently negates local fundamentals. Demand will wax and wane over time. This is plainly evident in Vancouver right now.

The demand for SFH’s over there hilariously outpaced supply, for years. If you weren’t following that market, it’s difficult to convey to you how seriously imbalanced it really was. It was incredible, it seemed like it’d never stop, it got so bad that at the peak, you could almost ask any price at all…and now look. Like a light switch was flipped, suddenly, no one wants them anymore. Now, some sellers are literally losing millions, and many others hundreds of thousands. Absolutely unthinkable a few years ago. Yet here we are. “Oak Bay” is not going to escape gravity by some magical, perpetually high demand. That’s just recency bias, in overdrive mode.

If that’s the metric, I agree. 😀

You could be right Marko. One counter-balance is check out today’s TC biz section if you get a chance. Vic’s employment growth still leading country. Something like 10,000 jobs lately (5.4% employment growth). Sizzling hot for a mid-size city if it keeps up.

I suppose. But what it would do is spur me to seriously consider buying an $800K Vancouver investment property.

Climate-wise, Canada is a nasty country to live in, and Victoria happens to be the best mix of large-enough-city + mildest climate in this nasty country, so that certainly makes Victoria a “superstar” city in terms of Canada.

Precisely.

This is the cold truth of it: after any price correction Victoria stands to incur, an Oak Bay or Fairfield SFH will still be unaffordable to most. And I bet we could throw in a few other neighbourhoods into that category.

Yup.

How can some folks not get this? It’s basic beyond basic. Not only that, but that universal reality in an open RE market never changes – it never has, it never will. Adding a bunch of externalities, this circumstance, that circumstance, and mixing it all together to argue that the net effect is perpetual motion is still false. Yet, they continue to employ variations of that argument.

In a real estate market, there are two fundamentals: what is the income availability to pay for the mortgage, and what is the cost of borrowing that money. That is not to say other dynamics can affect a market – they can, and they do, sometimes for years – but at the end of the day those two fundamentals will always assert themselves in a RE market, one way or another. There are no exceptions to this, no matter how creative you are with your numbers, or how badly you wish it to be “different” here.

So you did, sorry I missed it. Thanks for responding.

More likely “so much pent-up supply” from sellers previously refusing to list their homes for various reasons, and locals which cannot afford the prices or refuse to pay exorbitant amounts for shelter.

The demand is gone more fundamentally because the excitement is disappearing, as it always eventually does. I happen to agree with Michael that autumn could see an uptick in sales, only because sales usually behave that way then, and not because of the metrics he stated. But I don’t think it will be an impressive uptick, even less of one that meaningfully steers the market into “excitement” mode again.

rent increases & low rental availability (almost cheaper to own again)

I really think in the next 12-24 months rental vacancy will increase and rental increases will come to an end if not a bit of a correction.

Kind of shocking how many apartment buildings are being built in Langford right now + every other new house has a suite. Even downtown despite some huge rental projects being finished (V1488, Yellow, Hudson Towers,) you still have more coming on in the next 12 months so as the large Bosa development on Pandora. That is all rentals too.

The building on Johnson by Kang and Gill that was suppose to be condos is now rentals as well.

My bet is sales really ramp up this autumn. Some reasons…

so much pent-up demand now from a year of waiting out rule changes

prices have come off (at least for houses)

buyers can now get a variable 5-year at 2.45%”

Pent up demand from where ? The demand has gone down because rates are going and up, credit lending is tightening due to the 2% stress test that is only going to increase.

Fantasy buyers who would squeak in before with some financial shenanigans, are now out of the market for good.

2.45% if you have great credit and aren’t a new buyer making average wages. That’s becoming a minority as sales continue to tank and slashes increase.

Who wants a 2.45% mortgage from a place called Canwise Financial if things go south ?

))) Leo: You cannot sustain appreciation that outpaces local incomes over the long run

Wait, doesn’t your graphic near the bottom show that, as density rises, single family homes get purchased by people with higher and higher incomes (ie outpacing average local income)?

So that if I own a specific desirable house, that can appreciate and “outpace local incomes over the long run”, because there are relatively more “rich people” than “desirable homes”.

If incomes are flat, but population rises 50%, the price of a specific detached house would be expected to increase, because of greater demand, even though average incomes have stayed flat. Your “likely buyer group chart” shows that!

Many people here are looking for a specific type of property (e.g detached home in Oak Bay, and not a condo). The supply of those detached homes is not increasing as fast as the population that wants them. So if that continues to be true then those desirable properties can “sustain appreciation that outpaces local incomes over the long run”.

If I buy a house, I’m only concerned with how it appreciates, I’m not concerned with the average price of a mix of houses and new condo developments.

They miss it because it is not a factor. You cannot sustain appreciation that outpaces local incomes over the long run via equity from that same appreciation. If that were true all it would take is a few years of outsized appreciation in any market to take it to the moon.

No such thing as a perpetual motion machine.

Now here’s an idea. Abolish income taxes and move them to property taxes instead. Would roughly double property taxes in Victoria but abolish any provincial income tax.

https://doodles.mountainmath.ca/blog/2018/08/10/taxing-property-instead-of-income-in-b-c/

It’s not as simple as that. Condos don’t merely exist because of high priced single family homes. Look at the cities in the superstar paper that have had the lowest rate of house price appreciation. They still have tons of condos.

Small correction here, it is because of supply inelasticity. That can come from a lack of land, or it can come from restrictive zoning. Perhaps calling cities that have done the poorest job in providing housing through appropriate zoning “superstars” was a bit of a misnomer 🙂

My bet is sales really ramp up this autumn. Some reasons…

What it means is that a growing proportion of those who do not have high incomes or family help will remain renters. The rate of ownership starts to drop as the effect becomes more pronounced. The beginning of this is likely what you showed here:

Not all incomes rise, only those that can afford to buy a SFH, and in Victoria, you can still buy with move up equity or family help which are both common, so the price to income relationship is does not create a solid indicator of affordability. Until and unless the theory accounts for retained equity and its impact on these markets I would suggest it is an incomplete theory.

The ROI on a low down payment on a high value home that is appreciating at a faster rate than inflation and remains tax exempt is a skewing factor. If you can start in 2008 with 100,000 to buy a house worth 700k and end in 2018 with 800,000 tax exempt (600k appreciation, 100k down, 100k equity payments) when you sell, this gives you a lot of buying power at a median income to re-enter at the same price, higher or lower.

1550 Rockland Ave just showed up as a “new” listing where it has been on the market for months now. Considering how common this deceptive practice is the stats for days on market really are suspect.

While speaking of Rockland almost nothing has sold for the last couple of months and in spite of that people dont seem to be lowering their prices any. Makes one wonder how long it will take for the optimism to drain out.

Yes. Past periods of poor affordability have had the advantage that they were corrected mostly by lower rates and people were able to pay off those mortgages on an accelerated schedule over time. That doesn’t work as well if interest rates go up instead of down.

I wrote about that here: https://househuntvictoria.ca/2017/02/16/equal-affordability-but-some-affordability-is-more-equal-than-others/

No, the demand is greater because of the price point in large part. The same reason that condos are a greater part of the market now than they used to be – houses became less affordable.

I don’t know those markets well, but short-term appreciation rates are not the measure.

It is long-term above-average appreciation rates in a desirable area with limited land base. It means that cities can differ in their long-run growth rates of house prices, not just price levels, so some areas can become increasingly more expensive and unaffordable for typical wage earners as the price to rent ratio also rises.

If this is correct for Victoria, what it means is that the fact that median income earners in can no longer afford to buy a SFH at current prices in some core areas is not necessarily evidence of a housing bubble and that the link between income and affordability can become permanently skewed. This effect also plays out for desirable areas within desirable cities. So Oak Bay and Fairfield might have even higher skewing. Doesn’t mean they will never stall or fall, just that long-term they are not going to correct to income-based affordability.

What the study misses imo, is, again, the role of retained equity in move up and parental help for first time buyers in these markets.

Couldn’t tell you. That is Bank of Canada data.

I could be, I guess. Yesterday I spent 10 minutes looking for my sunglasses and discovered I was still wearing them. Anyways, I am saying that those with the means at the time, wishing to invest in something other than the stock market, saw RE as an avenue protect their cash and essentially borrow for free.

Yes, I agree with the HAM vs less HAM, or we could also say more spec vs less spec. That’s why I believe this market will not be as affected in a hypothetical, major market event. However, Victoria is not a substitute market for Vancouver, thus it will not be able to command an equal or greater price for its RE over Vancouver’s. If, for instance, the price of a 1.6 million dollar Vancouver bungalow dropped to 800k, it would be very challenging for the Victoria market to bear its former 900k price for a similar home.

Uh huh…and a Bugatti Charon could personally be more “desirable” to you than a Civic. But the market’s desire is vastly greater for the latter. It doesn’t really help Bugatti much – in fact, it has nothing to do with anything.

I think people not from here watching people talk of VicRE as a “superstar” market would find it a bit funny. It’s a quaint little city with a relatively small economy, not a superstar anything. The reason people wanted the houses in several Canadian markets from southwestern BC to all over Ontario, is they were seen to be rapidly rising in value. If you consider Victoria a “superstar” market then so is Brampton, Hamilton, Mississauga, Niagra Falls, Guelph, Chilliwack, ect. There’s a tonne of them. Vancouver is at the epicentre of this “superstardom”, I suppose.

But the reality is, that star shining quality is looking more and more like ice cold anthracite as time goes on. In an incredibly low yield world, people chase after unconventional asset classes that are rising in value. They run away from that which isn’t.

Renters are saving huge. Prices in Golden Head listings are slashed every day by $50K or more. More $150K slashes lately are indicative of sellers learning a new reality.

All you need to know is more buyers are getting pushed out of the market with with every rate increase and 2% stress tests and major credit/Income scrutinizing by the lenders.

No more money to make flipping takes out another huge segment of buyers. Prices have nowhere to go but down.

So you’re saying most renters here are brainless.

Um, why?

I could see Vancouver suffering a severe correction while Victoria suffers only a mild one because, for one thing, Victoria never experienced HAM to any comparable degree.

And if one person observed this:

…there are likely a whole bunch more, right?

As I semiregularly point out, Honda outsells BMW, but that doesn’t mean Hondas are more desirable.

4.5% is historically very low. Prior to the 1990’s it had been over 10% much of the time, and hadn’t been under 5% since the Great Depression.

https://www150.statcan.gc.ca/n1/pub/11f0027m/11f0027m2014093-eng.htm

https://www.cbc.ca/news/business/savings-decline-canada-1.3403923

There is a positive correlation between ownership rate and prices. The higher prices get, the more people think home ownership is a “good investment”. So the higher prices get, the more people are willing to resort to unorthodox and risky means to buy.

Until something knocks down the house of cards.

@Patrick –

The chart you posted showed a decrease in homeownership percentage from 2011 to 2016 (from 69% to 67.8% which is below the 2006 levels of homeownership. Could it be that increasing home prices coupled with stagnant wages & inflation have eroded home affordability?

With an atomizing, hair splitting comment like that – you have got to either be a lawyer, or trained as one. 😛

We’re talking about a market here – if someone desires but cannot pay, they aren’t part of that market (ie, their effect on it is zero) no matter how much they covet whatever it is. In other words, that distinction is a bit moot. I agree with Patriotz. It’s one in the same…

They crowd out lower income brackets from buying. I think the missing link in the article is the effect of home equity accumulation and transmission in “superstar” cities. Income is only part of the affordability picture when it is possible to inherit, move up or have parents co-sign or gift a down payment.

Hah, I’d take either. I’d ask my boss if it was ok to move to a French castle but that risks him asking if he can move in with me.

Because we’ve also had a long-term trend of increasing debt levels, especially since 2008.

Desirability and demand are different I think. Desirability is the wish for something. Demand is the wish and ability to pay. As desirable markets appreciate at higher than inflation rates they remain desirable but demand, which is tied to economic ability to pay, shifts, which is why as land values rise floor space shrinks and more families choose condos.

On a macro level it would appear to be that Canadians are overall very prudent in saving. At the micro level, the story is different:

“Notably, households in Alberta, Saskatchewan and Newfoundland had the highest saving rate last year, despite the drop in disposable income growth.

British Columbians and Nova Scotians, on the other hand, have negative saving rates, at -0.7 per cent and -3.6 per cent respectively.”

Also from the story I’m linking here is this statement about BC:

“British Columbia and Ontario are the provinces where households spent the largest share of their income on making interest payments, at 7 per cent and 6.8 per cent respectively.”

The article is from Nov 2017.

https://globalnews.ca/news/3850091/here-are-the-provinces-with-the-highest-and-lowest-disposable-income-growth-according-to-statscan/

Really desirability is the same as demand, or it has no objective meaning. Demand is defined as the number of units which the public is willing to buy at a given price.

I have another musing about the affordability chart LeoS posted (percent of median income to housing costs), and I was wondering if anyone had any thoughts on this:

I’ve long thought that chart was the best way to measure affordability of a market, as it corrects for inflation and interest rate variation. But now I’m wondering if it has a weakness. The chart is clearly showing that the latest cyclical price increases are essentially normal in their scale: we get to X percent of income affordability, then it goes back down. It’s done this time, and time again. Yet something…feels different about this cycle’s rise. It seems larger, longer, more systemic across communities, across the country…does it not? A horribly lousy metric to judge of course, but it got me thinking.

If someone makes 50k a year, but buys a 100k car all on credit, most people would say that person has paid far, far too much for the car relative to their income. This gets at the notion of generally accepted conventions established over time on how long is “reasonable” to pay a car off. If they can’t afford to pay it off in 3 years, what if I extend the payment out to 6 years? What about 8 years? 10? 15? Almost anything can be made “affordable” if you take enough time – but would you really say that that 100k car was “affordable” for that buyer? They’re still only making 50k. This type of chart would not reveal the extent, and the resulting precariousness, that underpins and contextualises this “affordability”.

So in the housing market, that chart by design cannot account for unusual monetary events such as a sudden change to the lowest rates in history – and when pricing goes through that filter, the cyclical rise looks like the same rise as every other time. And yet, people are now taking on astounding amounts of debt, making the peak a comparatively riskier one from the others.

Yes? No?

That was more a tongue in cheek remark at the cheerleaders who will justify any price no matter how high with “Victoria is desirable” . Of course it is, but that is not a justification for any given price point.

Or the other way around. You can argue it either way and it is commonly accepted that densifying increases land prices due to the highest and best use of a piece of land being more valuable.

I also see this as an academic distinction that doesn’t matter either way. The end effect (land prices increasing and single family valuations increasing due to the land component) stays the same.

As for the superstar cities, it’s an interesting paper but the argument is somewhat circular. They say these cities attract high income earners that crowd out the lower income earners. This is certainly possible, but that means that incomes will increase more rapidly over time and measures like affordability will not be distorted in those cities. Indeed, look at the incomes in a place like San Francisco and that should be clear.

Chop, chop time.

2642 Victor St Oakland’s slash of $40K to $799K.

Condo at 66 Songhees Rd , T503 slashed $55K to $549K.

1519 Robinwood Pl in Golden Head slashed $50K to $999K

107 – 75 Songhees Road slashed $101K to $1.24 million

Was speaking to a Vancouver SFH owner the other day. Was mentioned that they’d looked at buying on the island a few years ago because it was cheap, but now that prices have gone up so much on the island, they just didn’t think it was a good deal anymore and it didn’t sound like they would jump the pond as a result. Just one anecdote from a potential Vancouver buyer. I know everyone’s different, but if one person is saying that, likely a whole bunch more are as well.

Steve Saretsky posted today: “Vancouver condo prices are getting slashed noticeably lower. Unlike the detached market price discovery is much easier. Much more turnover and each unit in a building is essentially the same. Each lower sale price sets the benchmark for every other unit.”

LF,

You missed the opening sentence, he’s been “found to have committed multiple counts of professional misconduct.” Not just the assault.

“Shahin Behroyan, an award-winning real estate agent who described himself as “ranked in the top five in the world for Re/Max,” made headlines last year when he was disciplined by the Real Estate Council of B.C. for “deceptive dealing” and demanding a $75,000 bonus from his client.”

Home ownership rates in Canada have increased steadily from 60% in the 1970s to 68% (current). https://www150.statcan.gc.ca/n1/daily-quotidien/171025/cg-c001-eng.htm

So if we’ve had a long term trend of unaffordability, why is it that a greater percentage of Canadians can afford homes?

analysis paralysis it’s a real thing.

While I’m a believer in cycles and a disbeliever in It’s different this time™, I do think that there’s a few things occurring this cycle that could have an impact on how it unfolds.

Firstly, Canada has not had a nationwide correction since about 1990. The market tried to in 2008, but that was stymied by interest rates going almost to zero. People had just been crushed by the stock market, and wanted something perceived as safe, inflation hedged, and tangible. With interest rates less than inflation, buying a home became a no brainer. That has, IMO, caused an unprecedented reliance on the housing sector to support GDP growth. This has not been a minor change – it’s been a huge one, and it’s occurred very rapidly. As having a national GDP so devoted to RE doesn’t fundamentally generate wealth, it isn’t something that can be a long term change. A similar thing happened in the US after the dot-com bubble burst – people wanted houses instead of stocks. Their national economy then did the same thing, houses in many “superstar” cities rose to crazy heights, and guess what? They lost more than 40% of their value. I doubt Victoria would see a 40% drop in real dollars – but it’s possible, if not necessary, for something like that to occur in Vancouver. If it does, we’re not going to be looking at a quaint 15% off peak, of our 1.2 million dollar bungalows.

Secondly and related to the first, the level of consumer debt is so high, the amount of time it will take for people to deleaverage is probably going to be longer and more severe this cycle. I don’t think some people realize how high it’s actually gotten. While there’s an argument to say “It doesn’t matter as long as people can afford to repay it”, the sheer volume of it amongst a sizeable portion of the population (about 10% are estimated to be dangerously over leveraged) makes it a more delicate proposition to engineer an orderly landing. The huge growth in HELOC debt IMO, amplifies this risk – even more so if it was used to acquire non-durable goods.

Thirdly, the Victoria market has received, IMO, at least some blow off pressure from Vancouver on a scale that isn’t historically typical. Vancouver has been the target of a lot of capital inflows, which probably took their market run up further and faster than it would have otherwise. That has essentially disappeared, at least for now. A significant market event in Vancouver would make it very difficult for Victoria to endure a relatively mild correction, coupled with the previous two scenarios above.

Yes, houses are less affordable. Your graphs show that nicely.

But, despite that, the overall savings rate of Canadians has been stable over the last 20 years at around 4.5% https://tradingeconomics.com/canada/personal-savings.

So maybe other things are more affordable.

Can you show a problem that has resulted from houses being less affordable? For example, has it resulted in Canadians working more hours per week, or saving less, or being less happy?

Fair enough, but that article’s more about realtors hitting people as opposed to hitting hard times, no? Otherwise, we’re in trouble when Marko starts to beat his clients along with Ron Neal, Darren Day, Suzy Hahn – you better buy today, you market timing turkey, or they’ll whoop your @$$.

Eh, sounds more like a standard issue crook with an ego and a realtor licence…

If you go by the official RBC affordability chart using 25% down then it’s currently over 60% , exceeding the 2007 and 2009 level. Can’t rule out a 1981 style body slam with rates rising fast and debt bombs all over the place ready to blow at any moment.

“RBC’s aggregate affordability measure rose again in the fourth quarter by 0.5 percentage points to 61.6%. “

Another market top sign when the top agents start hitting hard times.

Top-selling West Vancouver realtor charged with aggravated assault

https://vancouversun.com/news/local-news/top-selling-west-van-realtor-charged-with-aggravated-assault?video_autoplay=true

If true, that’s a helluva long time to wait if you’re trying to time the market.

Well, good luck!

I so love it when totoro periodically drops by to lower the boom on someone.

This argument rings true to me.

BTW, here’s the abstract for the research paper totoro cited:

I would also imagine that most of those 2014 high ratio mortgages will be renewing at much higher rates next year. That could be very ugly if major household debt was accumulated which is highly likely.

Some “real info” for you just off the press.

The Average Mortgage And HELOC Payment Is Soaring In Toronto And Vancouver

“Canada’s real estate buying spree may be over, but paying off the debt has barely begun.

The Canada Mortgage and Housing Corporation (CMHC), the Crown corporation in charge of housing research, teamed up with Equifax to crunch the numbers on the average payment due. Larger debt loans and higher interest rates pushed the average monthly payment for housing much higher in Q1 2018. The large increases are just the beginning as interest rates continue to push towards normalization.

Average Mortgage Payments Soar

The average mortgage payment is rising quickly in Toronto and Vancouver. Vancouver homeowners had an average payments of $1,794 per month at the end up Q1 2018, up 6.53% from the previous quarter.

HELOC Payments Soar In Toronto And Vancouver

Home equity lines of credit (HELOC) are an increasingly popular form of debt held by Canadians. A HELOC allows homeowners to secure debt with the equity in their home. They then pay the loan back in monthly installments. These are typically variable rate, meaning the interest paid fluctuates with the market. House-rich, cash poor homeowners have been turning to them a lot recently.

The size of the average HELOC payment is smaller than a mortgage, but is growing at over twice the speed.

https://betterdwelling.com/the-average-mortgage-and-heloc-payment-is-soaring-in-toronto-and-vancouver/

Shows that some don’t hang in reality circles. Victoria’s debt bomb is probably the most dangerous when the inevitable recession comes and job layoffs hit.

This town has never been nice to those stuck in one trick professions attached to the real estate/construction bizz which is where a high percentage of job growth has been the past few years.

“I think it is possible we will be down 10-15% from now in 3-4 years. “

Looking at the upper end of the market, it seems we are already down 10-15% of now, which suggests that the stability of prices is an illusion, with the smart money holding off or cashing out at prices often below assessment, while at the lower levels, folks are continue to be lured deeply into debt for the purchase of houses at still rising prices.

Affordability dictates prices except that what is affordable depends on financial regulation. Stricter regulation of usury would drive RE prices sharply lower. What is needed is restrictions on borrowing that drive home prices much closer to the cost of construction — say half of Victoria’s current prices. The reduction in price would result entirely from a reduction in land value, so that the rate of new construction would be either unaffected, or more probably, accelerated.

Leo S, thanks for the info. Always informative.

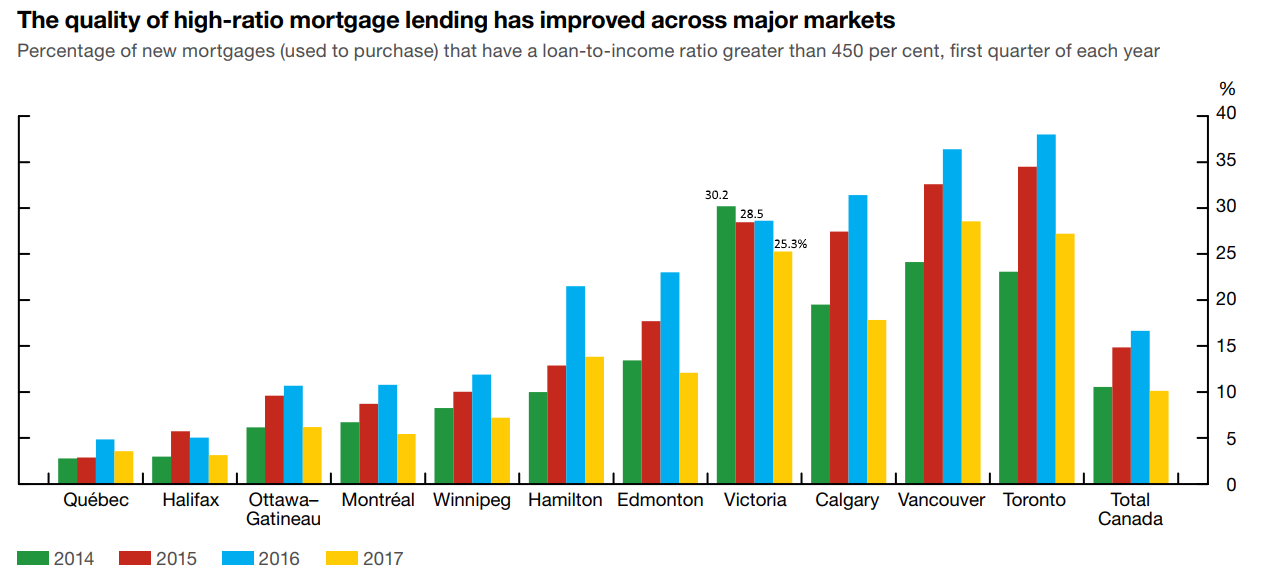

The chart that you posted below and have posted in the past about high ratio borrowers: Victoria 2014 stands out to me as an aberration. Why were so many high ratio mortgages handed out in 2014 relative to other cities? What happened here that made that year different? I bet that’s a statistically significant increase year x city. Type 1 error?

I think it is possible we will be down 10-15% from now in 3-4 years. I wouldn’t wait for it myself. Could just as easily be a stall in price appreciation that lasts a while. As people are already finding out, a rise in interest rates can negate a drop in prices quite quickly for those who will have a mortgage. The good news is that it will likely be an easier market to buy into than one that has been weighted so heavily towards sellers.

In about six years the baby boomers should be starting to die off or enter nursing homes faster than they are retiring. This might be counterbalanced with levels of immigration which would mitigate the effect.

Josh do you still want to wait six years for a more affordable James Bay house or are you going to settle for some crappy Chateau and be forced to eat French food and drink French wines.

Your stuff is always interesting and informative Leo but I think you’ve got cause and effect not logically linked. Desirability is a simply one factor underpinning demand, not some self-aggrandizing theory. The changing housing mix and densification are due to rising land prices.

Land prices rise because Victoria has a limited land base and it some areas are particularly desirable. It is demand in a scarce land base that drives the change in housing mix and impacts affordability which then changes what families can buy.

There is an argument based on research out of the states that those with resources are willing to outbid those without to live in desirable areas and, over time, these areas increase in value in excess of inflation as a result of those with resources competing for to live in the area. They’ve coined the phrase “superstar cities” for those that experience this phenomena.

Doesn’t mean there won’t be downturns, just means that over the long-term densification and the changing housing mix is an effect of rising land prices caused by limited land and perceived desirability, not a cause.

Original research paper here:

https://repository.upenn.edu/cgi/viewcontent.cgi?article=1005&context=real-estate_papers

I’m eyeballing peak to trough at 5-6 years? That would put the bottom in at 2024 ish..

Using LF’s presumption “from good to bad and back again” leads us “to “bottom” out” around ~2027/28. Seems like a fair estimate for the next bottom.

Good stuff LeoS. Hope you don’t mind me adding the 13yr boxes.

I wrote that article back in May . https://househuntvictoria.ca/2018/05/04/musings-on-future-affordability/

My personal guess is we are and will see stronger than average wage growth, and rates at +1% to +1.5% over the next few years. That would put my best guess of single family at around -10% to -15% from 2018 values around 3-4 years from now.

As usual with predictions over the long term, I also predict something completely surprising will happen to throw this out the window.

From previous article

Indeed. Victoria has a much higher proportion of highly indebted borrowers than most of canada as per the Bank of Canada’s financial system review. Logical, given we have higher house prices.