Aug 13 Market Update

Weekly sales numbers courtesy of the VREB.

| August 2018 |

Aug

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 94 | 218 | 736 | ||

| New Listings | 168 | 402 | 1035 | ||

| Active Listings | 2551 | 2561 | 1917 | ||

| Sales to New Listings | 56% | 54% | 71% | ||

| Sales Projection | — | 530 | |||

| Months of Inventory | 2.6 | ||||

Sales are currently off by 27% month to date compared to a year ago, with 34% more inventory. New listings are around the same as last year, with 422 in the last two weeks, down 1% from last year’s 428. If sales end up this slow for the rest of August we will end up around the same level as 2013.

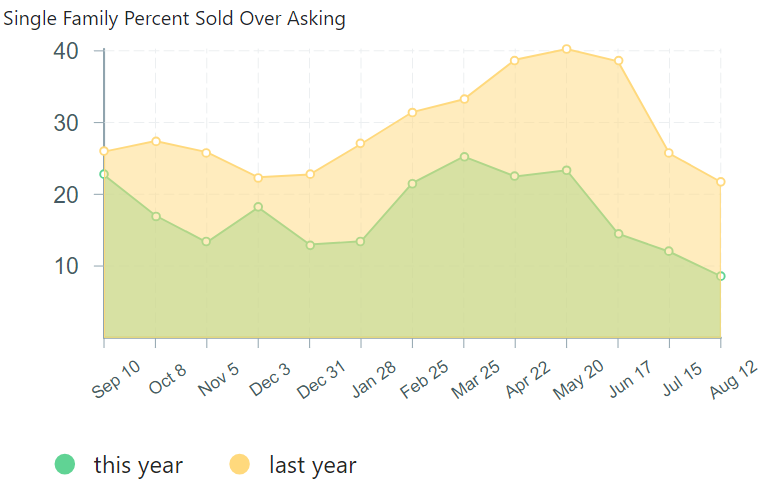

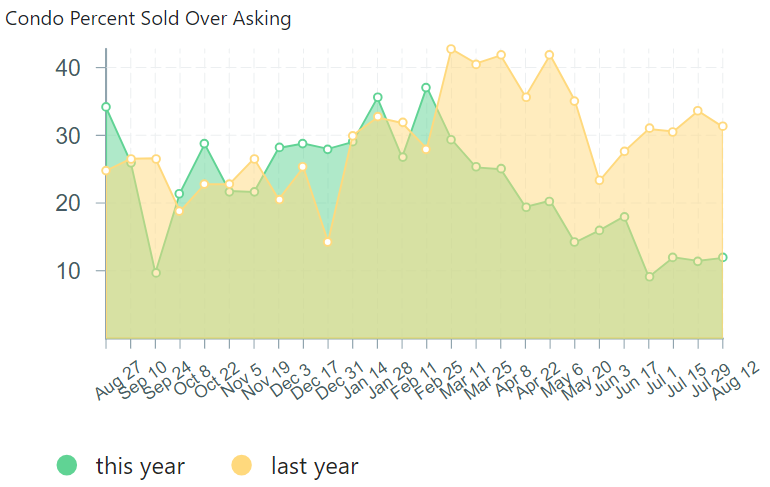

The median sale last week went for 2.5% off original list price, which is certainly not a lot but slightly better than last year, when the same sale got no discount at all. The percentage of over-ask sales also continues to decline.

In condos, we saw a more abrupt shift from a market that was essentially performing the same as a year ago up to February, and then got capped by (I assume) the stress test really hitting as the pre-approvals ran out. It makes sense that the entry level market will feel the effects of credit restrictions more given fewer buyers will have existing equity to draw on.

The same outsized effect was seen in the low end of the single family market where sales have dropped the most on a percentage basis. If the market digests this credit restriction anytime soon, we should see it first in that entry level space.

Victoria Realtor Alice Kluge’s update and commentary on the August numbers thus far…

https://www.youtube.com/watch?v=bZtbCUQ4reM

I usually shy away from such discussion but find this millennial-bashing based on mostly unfounded stereotypes tiring. Note, I am not a millennial. I don’t think millennials would lash out at boomers so often it that generation was not under constant attack. Not a good look. At least when the ‘Great Generation’ critisized their offspring (Boomers) they were not kicking people when they are down. I could post a multitude of links to data and studies demonstrating that Millenials face a multitude of challenges but I’m sure everyone here is familiar with them. I fear that those who refuse to acknowledge what is considered a demonstrated fact in fields such as economy or sociology are not reachable.

Am also tired of this mindless glorification of people who have financial/business success and the assumption that material success is due to being smarter or greater in some way.The quote: ‘thanks for correcting the English of one of BC’s greatest businessmen and most generous philanthropists; with an University Business School named after him. One day I will hope my English is as bad as his. ‘

At the very least Numbers should acknowledge that his mentor’s english could be improved. I’m sure his business acumen is phenomenal but he is no Winston when it comes to quotes.

https://www.thebalance.com/mortgage-crisis-overview-315684

https://www.businessinsider.com/how-widespread-mortgage-fraud-toppled-the-housing-bubble-2010-5?op=1

Even your article supports what I’ve been saying. Excessive greed was the primary here. Just because the government encouraged home ownership in and of itself doesn’t mean that all borrowers whose income was at or below median meant they were at risk of default. Plenty of people with income above median defaulted as well. If it were only just about defaulting on a note but read the BusinessInsider article I provided above and you’ll see that the scams within the mortgage industry played an outsized role in the crash. Check the last 2 sentences in the article:

Different here? I notice that Canadian housing / mortgage markets are different but is it true that the difference is enough?

Renter in paradise:Patrick – pretty simple explanation there. As I lived amongst a good part of that crash in the U.S., I can tell you it’s significantly more complicated than “increasing homeownership rates”.

————

There were many factors for sure, but many of them were caused by Fannie and Freddie being forced by government into lowering mortgage standards leading to subprime liar loans etc.

He is s an example article discussing it ….

How The Government Caused The Mortgage Crisis

“It wasn’t greed that caused the mortgage mess. In large part, the mess was the product of government policies designed to increase homehownership among the poor and ethnic minorities.”

https://www.businessinsider.com/how-the-government-caused-the-mortgage-crisis-2009-10

Remember I’m not saying that caused the bubble, I’m saying those bad loans and foreclosures caused the crash. We don’t have that issue in Canada to the same extent. So maybe that’s why it’s different here.

Oh – and teenagers.

usually individuals of varying ages who suffer from narcissism, were spoiled as a child, or are overcompensating for past wrongs.

@josh

Another great answer. Congrats:

1/ The quote, thanks for correcting the English of one of BC’s greatest businessmen and most generous philanthropists; with an University Business School named after him. One day I will hope my English is as bad as his.

2/ Wow, a tech company? using OPM “Other People’s Money”…sounds like a great success and roaring out record profits YoY.

3/ Yes, white grumpy old men don’t know anything about the internet and that tech stuff; but only provide funding for PE and VCs so they can invest in startups from profits generated in an old economy company that boringly turn a profit year over year over year….

Have a good day sir. Your outlook and temperament are a precursor for the success that lies ahead of you.

NEW ZEALAND BANS FOREIGN BUYERS FOR MOST RE:

The country’s parliament on Wednesday passed a law banning foreigners from buying into most parts of its residential property market as the government seeks to cool red-hot house prices.

The Overseas Investment Amendment Bill will prevent overseas investors from purchasing existing properties in New Zealand, but they will still be able to buy into new apartment complexes and certain other parts of the housing market.

New Zealand Prime Minister Jacinda Ardern campaigned on a promise to clamp down on foreign buyers, blaming them for soaring prices that have left many New Zealanders unable to enter the property market.

Nearby Australia has also tried to slow runaway house prices with measures including a similar ban on foreign investors buying existing properties. Prices in the country have been falling since the end of last year.

Appreciation is a historical fact, not a personal accomplishment, and people don’t readily have access to the stats most of the time so examples are probably useful – they would be for me. And I’ve proposed more than once that the capital gains exemption be taxed if government wants to add more downward pressure on the market.

If government treated housing like stocks we would have much greater affordability issuses. You need a place to live, you need to pay for this whether renting or owning, and you can’t live in a stock and don’t need to own any. They just are not the same from a social policy perspective.

Housing is an investment for those who own, but it is also a basic need. We need to put government money into alternative affordable housing to meet this need if we want to reduce demand and create more opportunities. Co-ops seem like a pretty good model of affordable ownership and there should be incentives for creating new ones imo.

My point was that you’re wrong that “young folk” (we’re ~30) don’t make sacrifices. 2 friends of mine taught English in Iraq and were forced to leave when ISIS was 40 km from Irbil. Another 2 friends moved to rural China where they were the only English speakers. In each case, they did this cause they were sick of being paid close to minimum wage and only sinking further into debt. You get your opinions of millennials from conservative op-eds written by other baby boomers who have evidentially never met millennials. I work 60 hours/week building a tech company from scratch, but go ahead, enlighten me as to how I’m entitled for wanting a home.

If home prices were mid 80’s + inflation, I could buy a house with cash. A nice one. Bring on the higher rates.

I don’t know where to start with this. The most outrageously entitled people on earth are middle aged / older rich white folk. Ask literally anyone who works or has ever worked in customer service. The growth of social media is the result of it being available. The internet proliferated and social media has been growing across every generation since then. Good god, get a clue.

That isn’t a coherent sentence.

@guest_47496

Except in both those cases you were subject to the stress test. Prior to the recent changes you were subject to the stress test if you were applying for CHMC insurance(<20% down).

Fun fact for U.S. # of licensed real estate agents:

* 2006: 2.6 million

* 2009: 1.13 million

https://activerain.com/blogsview/1235492/how-many-realtors-are-there-in-the-usa-

Other fun fact I just learned:

https://www.thebalance.com/real-estate-agents-and-realtors-1798898

Marko, I get the feeling you’re safe here

I hope so. Ordering the Rimac Concept Two ahead of a big downturn probably wasn’t the best idea….a little behind on bills but Leo S still hasn’t sent a collection agency after me.

but what do you think about the realtor community in toto?

Could care less for someone who leverages too much and doesn’t plan for rainy days. If you can’t make it two years without income that is poor planning imo.

Realtors that are great sales people will weather a downturn.

I am a horrible sales person…guess I am screwed.

@Local Fool

You remind me of what a mentor said to me early in my career

some guys have a answer to everything, but answers nothing

I can’t remember the sales maxim precisely, but it’s something like 20% of the people make 80% of the money. Realtors that are great sales people will weather a downturn. Average or worse will probably just drop off, or might treat it as a side gig from time to time.

I’m talking about Canadian stats, not the US.

https://www.ic.gc.ca/eic/site/bsf-osb.nsf/eng/br03805.html#a0303a

@Local Fool

Stanford/US Gov’t Study of bankruptcy by age groups

https://www2.census.gov/ces/wp/2017/CES-WP-17-54.pdf

@josh

Congratulations, perhaps we should give you a thumbs up for … OMG … for the sacrifices you made from moving from Ottawa to Victoria? Sarcasm can go both ways.

1/ Inflation has been rather tame the last 15-20 years, ask someone who has experienced a mortgage at 15%/annum

2/ Yes, younger generations do feel entitled and do want instant gratification. The growth of social media is a testament to that

However, younger people are more worldly and adept. Put those good skills to use and instead of b***ing day in day out about how you cannot afford something or its overpriced, go do something that makes you a few bucks. You can’t beat the system, work within it and pick your spots. Who knows? You might make it rich.

Marko, I get the feeling you’re safe here, but what do you think about the realtor community in toto?

“Brookfield real estate services (BRE) (royal lepage), estimates a total of 90,000 cdn realtors. Nearly all own properties, and many own more than 1, with leverage. When sales collapse, realtor income disappears. What happens to them, & their properties?”

Hillard MacBeth

“Don’t be fooled by Aryze Developments slick advertising. They want to tear down our traditional SFH neighbourhoods and replace them with these ugly high density monstrosities as they advertised on page 59 of this issue of Boulevard Magazine.”

You mean the same density as the townhouses beside it and across the street(I live down the road) on a busy Shellbourne street. Or do you mean houses that people can actually afford.

As far as I’m concerned one of the biggest and easiest solutions to the housing problem is to allow density along busy roads(Hillside, Quadra, Shellbourne, Cook, Fairfield, ect.). Doing that could really move the needle in terms of adding supply without disturbing the character of the neighborhoods. Also when I walk down Shellbourne(I’m sure this is true in other area’s) the houses along the major roads aren’t that well taken care of and look a little dumpy. The development that has been done is much more taken care of and enhances the look of the neighborhood.

Anyone remember my Low-Balling story!

link

Answer C!!!

Something I forgot to mention…

I found an old listing of the house on someones real estate sold list, still listed on the inter-web, and it says:

Sold Date: Aug, 2007

Price: $425,000

[UPDATE] : So, the way I look at it is that we got our house below assets value, and below asking AND for 2007 market value in 2012!

What is happening is simply the action of government tax breaks, subsidies, and lax enforcement on an asset in limited supply. Who’s been boasting about all the tax-free gains owner-occupiers get? If the government treated housing the same way it treated stocks we would never have this problem.

OTTAWA — The Canadian Real Estate Association says home sales in July were up 1.9 per cent compared with June.

The increase was led by the Greater Toronto Area, while more than half of all local housing markets reported an increase in sales from June to July.

Compared with a year ago, sales in July were down 1.3 per cent due to fewer sales in major urban centres in British Columbia.

The actual national average price for homes sold in July was just under $481,500, up one per cent from the same month last year.

CREA says it was the first year-over-year increase since January.

Excluding the Greater Vancouver and Greater Toronto markets, the national average price was just under $383,000.

I moved here from Ottawa, a city with 3x the population and the highest incomes in the country, for a job. My friends generally my age from Ottawa are now scattered across the country (and other countries). New York, Whitehorse, Toronto, Montreal, Japan, China, Korea, etc. For jobs. But you’re right, we know nothing of sacrifice. We’re all lazy and entitled and addicted to the sinful instant gratification of avocado toast and fill our veins with liquid hot FOMO. We got too many participation trophies as kids so now we all complain (something our generation invented) when we have to pay dramatically more than any previous generation for education and shelter, or heaven forbid, start a mortgage before we’re 45. Excuse me while I go make some more avocado toast, I’ve got the instant gratification jitters.

Have owned both in the U.S. and here in Canada (Alberta). When we moved here in 2014, I was sure I would continue to be a homeowner. Notice the moniker – yup still renting. I have to agree with Bitterbear that there just wasn’t anything worth going deeply in debt for. Perhaps if we’d landed a year earlier it would have been easier.

Renting has shown me that homeownership comes with a lot of bills (of which there are many – roof, mechanicals, drainage systems, taxes and the like). Renting a smaller abode has shown me that I don’t need all the trappings or “stuff” that one accumulates in life. Renting has shown me that I don’t need to own a house for my own self-worth.

Patrick – pretty simple explanation there. As I lived amongst a good part of that crash in the U.S., I can tell you it’s significantly more complicated than “increasing homeownership rates”. What I saw then leading up to 2006 and beyond was a lot of what I’ve seen here – manic speculation and lots of FOMO. Once the flippers and speculators fled the marketspace then the real dance happened. Home prices started decreasing and people found themselves underwater. Add to that loss of job and other life changes forced the hands of many who were paycheck-to-paycheck. Then there was what is commonly called “foreclosure-gate” which exacerbated the crisis in many areas of the country. I had a relative caught up in that illegal scheme by a prominent bank and he spent the better part of a year trying to get out from that. So while you might see rosy days, I see ominous clouds.

Will it happen here? Who knows. Not you. Not me. Only time will tell.

PS: SweetHome – one saying I strive to live by and it does help… Home is Where You Hang Your Hat.

It is not class warfare and setting things up as a battle between owners and renters does nothing to solve anything but divert the dialogue to nowhere effective.

What is happening is simply the action of a capitalist system on an asset in limited supply without adequate government investment in addressing the social need for affordable housing. This is government’s job, not the private market’s job, and you are going to get price escalation in desirable areas if you leave it entirely up to the private market.

I’d really like to see a lot more government investment in co-ops like there was in the 70s. Co-ops could be wildly successful and affordable if government policies and funding supported their set-up by groups of like-minded individuals.

Mayfair Man said: “In a time when we need more density to provide houses Gonzales is looking to restrict: https://www.talktoaryze.ca/take-action”

Don’t be fooled by Aryze Developments slick advertising. They want to tear down our traditional SFH neighbourhoods and replace them with these ugly high density monstrosities as they advertised on page 59 of this issue of Boulevard Magazine.

https://issuu.com/boulevardlifestylesinc/docs/2018_06_blvdvic_web/58?ff=true

I suspect that with all the rules and government regulations that one can longer do what my dad did. He bought a tiny two bedroom home an hour out of Toronto on a really nice lot. For the next twenty years he just kept building one addition after another in his spare time mostly with his own hands. I still have a vivid memory of my dad and my uncle pouring cement for another foundation. Somehow, in spite of the endless hard work and construction, both my parents seemed to be able to fill the house with laughter.

))) Actually Victoria has one of the lowest ownership rates in the country at 62% so really we’re talking nearly 40% who are renting, couch surfing or homeless. That ownership rate has been on the decline since at least 2006.

Yes, that’s true, that Victoria has a low home ownership percentage, and I consider that a bullish sign for real estate in Victoria. One of the reasons for the house crash in the US was that low quality subprime loans were made to increase home ownership rates. At the top, the rates of home ownership rose to highest levels ever, and they had “run out of buyers”. As home ownership rates increase, credit quality of loans at the margin decreases, which is a risk for the market.

With our low home ownership rates, that also means a high rate of potential new buyers, compared to other cities in Canada.

In the context of your post, I presume you’re referring to spending without saving first, ie, going into debt. Statistically, those aged 65 or older are the fastest growing cohort in the country declaring bankruptcies, consumer proposals and insolvencies.

You could argue that that’s the worst time of your life to face that kind of financial turmoil, you’d think those old-timers would have their life experience and half a mind to better manage their…

See, anyone can play that silly game. The phenomenon of wanting instant gratification isn’t generational, it’s endemic to all human beings.

Sweethome and Stellar,

Thanks for sharing. Similar story for us. Moved here in 2006 with uncertain incomes (self-employed and casual) so the banks wouldn’t touch us (except for CIBC who embroiled us in a coercive lending scheme). We waited it out until our incomes settled out then 2008 hit and the uncertainty held us back. Then our priorities had a massive shift into out children’s education which consumed income for the next 6 years or so. By then prices were so out of reach that even with 160K income, I couldn’t find anything of value on which I was willing to stake the rest of my working life. So we rent and are planning to shift out of the city once I can relocate my business and our kids are out of uni. Seriously looking at yurts.

Thanks for the correction patriotz

It’s not.

https://housepriceindex.ca/about/our-methodology/

In a time when we need more density to provide houses Gonzales is looking to restrict: https://www.talktoaryze.ca/take-action

Not true at all. Young people leaving TO and Vancouver have been widely reported.

https://www.huffingtonpost.ca/2018/05/14/millennials-leaving-toronto-vancouver-statistics-canada-data-shows_a_23434284/

@ Stellar

Well, at least you didn’t buy a house for $720K a couple of years ago.

Not to dash your hopes, but I was waiting for prices to come down after 2008; they barely did, especially in the core. We kept renting. Then we had other priorities in 2013/2014 and got caught in the rapid increase in 2015/2016. So, waiting did not work out well for us. We would have been much better off just buying something, even in 2008 (like $200K better off). However, those were different times because interest rates fell, which kept the prices up.

For what my opinion is worth (given my bad track record), it sounds reasonable for you to wait a year. However, I wouldn’t count on more than a 10% price decline. Of course it could happen, but you might just be disappointed like I was. Also, if prices decline and then stay flat for awhile, my experience says that just might be the bottom so don’t wait too long.

I really do empathize with you. It’s draining to put time and energy into being a long-term looker and also to feel like you’re not really “home”.

The neighbourhood has a lot to do with it. My impression from watching houses in the core since 2001 is that areas that were already more expensive got disproportionately more expensive (i.e. increased at a greater percentage). This is especially true for Oak Bay and Fairfield. However, there were some surprises in the past few years with areas that had traditionally been considered poorer neighbourhoods.

I believe an agent could see past assessments for a particular property, which would give an idea. Of course there are flaws with looking at assessment, but consider looking at a few actual houses to see what they did during the first (2001-2008) and second (2013-2018) run-up. I would be interested to see if my impression is correct.

Actually Victoria has one of the lowest ownership rates in the country at 62% so really we’re talking nearly 40% who are renting, couch surfing or homeless. That ownership rate has been on the decline since at least 2006.

https://www150.statcan.gc.ca/n1/daily-quotidien/171025/t001c-eng.htm

Something I’ve witnessed these few years I’ve been here is investors who go in and bid well over asking with no subject-to’s on the contract. They then turn the property over and make it a rental. When you run the numbers, it’s pretty clear that they are out of pocket month after month. Pure speculation. Cheap money has made it difficult for families to get onto the property ladder as it allows this type of competition for housing stock to occur. OTH perhaps I should say “hats off” to those investors willing to go month after month in the red because it makes the rentals cheaper.

@ Josh,

Your points are good. But you might consider want to consider:

1/ outside of TO, Van, and Victoria, homes are STILL VERY AFFORDABLE

2/ people just don’t want to move to those other affordable cities. There is always some reason, but there is a thing called sacrifice + hardship that many younger people cannot relate to anymore.

3/ younger people today, perhaps not you or many on this board in your age group, are all about instant gratification. A lot of millennials want everything NOW.

We are at a cross-roads. Meritocracy and substance has always ruled capitalism, however instead of competing with a people in G7 countries; our competition is now the world. It is a very big place and more people “want it” more than us, so we better pull up and pants and starting working smarter and more collaboratively if we want to keep up!

@Koalas

So you’re saying they would do a 6 hour commute each day (when they didn’t sleep at the office)? That’s insane.

That’s still 1,481,920 people that are renting (or homeless). The complaint isn’t “only 68% of people own their homes”. It’s “owning a home used to be an attainable goal and now it’s not”. I’m not sure what the point is in pointing out majority ownership. Screw the minority cause they’re the minority? Their problems aren’t real problems because most people don’t have them? Ownership % has actually fallen across Canada from 2006 in every province except Quebec.

I believe Teranet is inflation adjusted. Also that 2.2% is an annual number.

Not if you account for inflation which was 2.2% in February.

Amen. In a very similar boat myself. Fight the good fight!.. by sitting and waiting.

Quick facts:

1/ Prices trending down in short term, no new $ coming into the system

2/ housing stock will not keep up with housing demand

3/ 1 hour> or less commute is fairly standard in mid-size to large size cities that I have travelled to

4/ RE Prices in the long term 5, 10, 20 years +++ will outpace wage growth, wage/asset valuations will continue to worsen

End game, RE will go up and or there will be a revolution or black swan event that re-evaluates our way of capitalism in the next 25-30 years. This is class warfare, the haves and have nots. Blame it on a bunch of red herrings IMHO.

Holding it together all together precariously is that the majority 70% of people own homes. The 30% are super vocal and you know, he who complains the loudest…

Lots of finger pointing and rhetoric, but very little in terms of solutions…

Koalas I was just about to bring up London as well. I was living in Kensington which was expensive but had friends and coworkers commuting 2 hours into town easily. They said it was cheap out there in the sticks. When I looked at their cost of gas to drive to the park and ride and there transportation cost not even factoring in 4 hours of there say they actually were not saving a much.

I rarely left zone 1, so a 2 hour one way commute seemed insane. I have met people who say they love it though. 1.5 to 2 hours and it’s totally normal for them.

I could see taking a nice fast train home and then living within a 5 minute walk of it would not be so bad but when you mix in a sweaty subway in the summer, buses or street cars they are not very relaxing.

Ha! look at this city. If you tell someone downtown you live in North Saanich it’s the equivalent of Mars let alone Langford, sooke or Duncan. A 10m drive in Victoria in like a 1 hour transit time in any large city subway to see a friend. Once I left this island to live in London, New York and Toronto you realize it’s tiny here.

When I lived in downtown Victoria I think I used my car twice a month and rarely went out of a 10m walking circle. It was crazy when looking back to think my friends in hillside or tillicum were far to visit. Everything is relative but you need experience to understand other people’s perspectives.

Quick facts:

1/ Prices trending down in short term, no new $ coming into the system

2/ housing stock will not keep up with housing demand

3/ 1 hour> or less commute is fairly standard in mid-size to large size cities that I have travelled to

4/ RE Prices in the long term 5, 10, 20 years +++ will outpace wage growth, wage/asset valuations will continue to worsen

End game, RE will go up and or there will be a revolution or black swan event that re-evaluates our way of capitalism in the next 25-30 years. This is class warfare, the haves and have nots. Blame it on a bunch of red herrings IMHO.

Holding it together all together precariously is that the majority 70% of people own homes. The 30% are super vocal and you know, he who complains the loudest…

Lots of finger pointing and rhetoric, but very little in terms of solutions…

local Fool, try talking to people from London UK. Good friend of mine and her husband used to both do a 3 hour commute (one way) to London. The crazy thing was that they both earned top money. Don’t know the exact figure but he works at Barclays and she was a corporate lawyer focusing on tax. Crazier still, she was sometimes asked to stay at her work place for 20 consecutive days if there was an important contract. She had what she described as a ‘sleep pod’ in the office. And they had 2 young kids.

Glad to say she eventually saw the light and opted for part-time work which is a mere 35 hours a week but much of it from home. They do get 5 weeks off a year but still…

Stellar could move to the most liveable city in NAmerica today, where houses are closer to 3x family income and will eventually catch back up to Vic prices.

https://www.ctvnews.ca/lifestyle/calgary-named-fourth-most-livable-city-in-the-world-1.4051997

When I lived in Ottawa for a bit a while back, I worked with a lady that drove in to downtown Ottawa every morning from Montreal. Got up at 3:30am every workday, worked an 8 hour day, then drove home. Her husband had a well paying, location specific career so that’s what she did. Absolutely nuts beyond nuts. I have never heard of anything that came close.

Also, don’t forget about duplexes if SFH is out of reach. No strata fees, sometimes they have suites, and lower entry price point. Not trying to promote my listing but it is a good example of a decent setup (only attached by garage with its own private yard) ->

https://www.realtor.ca/Residential/Single-Family/19806215/B-1046-Princess-Ave-Victoria-British-Columbia-V8T1L1-Central-Park

Re stress test. I have a friend I went to Respiratory Therapy school with and now he is a manager at VIHA (approx. 100k/year). Ended up caught by the stress test and bought a SFH in Duncan. Now drives four days a week Duncan to the Jubilee Hospital.

Townhome in Langford or continuing to rent in the core seems like a more sensible option in this scenario but he had two young kids and didn’t want to risk having to move.

That being said most of my RT friends did end up in single family homes in the core/peninsula/westshore. Typical scenario is RT ($75k-80k/year) meets a nurse in ICU, emerg, CVU, etc., and most of those nurses are $75-80k//year and then you are at $150k+ combined + suite.

Look at his YouTube video about basement suites. It is his house.

Huge place!

That looks suspiciously similar to Marko’s house (at least from his youtube vids).

Find looking house I must say.

Lots of slashes the past 24 hours. Many sellers are learning a valuable lesson that markets don’t keep on going up forever. Feels like a large tsunami coming this fall/winter as the buyers continue to dry up.

Not true now, doubtful if it ever was. Probably came from the prevalence of interest only loans which are no longer allowed as of 2016

In the spirit of Stellar I thought I would share our stats to try to make sense of the impact of the stress test. Before stress test the bank offered max $750,000 for $155,000 household income with 5% down payment. After stress test the same bank offers max $1,000,000 for $170,000 household income with 20% down payment. Credit score, debt, and employment similar to Stellar.

I guess if you are living 25 years or less and your alternative is not, “Wait a minute, this i nuts. I will have to pay inflation-adjusted market rent for the rest of my life”.

It might be true in Sweden where the average mortgage term is 140 years. Finland is 60 years so that is closer to the rest of a lifetime.

Stellar – thank you for sharing your real world story. This is the real negative effect of the what we have seen particularly over the last 3 to 5 years. RE prices are out of touch with “local” incomes. As you remove the dirty money laundering and apply lending safeguards, we are left with looking at sellers expecting 7-figures for a box on dirt. The “looker” (potential buyer) does not have access to 7-figures. Put as much supply of those 7-figure boxes on the market as you want, without a buyer with access to that kind of credit, forget-about-it. Sellers rub their hands together, use the number “8” as often as they can and wait for the foreign money to drive their dreams. If that fails, well they cling to ultra-low borrowing rates as their salvation which surely will bring a 6-figure, 2-income family knocking. Well, not so fast – stress tests prevent even a 6-figure, dual income, family from those lofty-heights. So, finally, there is the rich Vancouver land-baron theory – he or she will sell for 8 figures, slice a small 7-figure chunk off and fund the seller’s retirement. But, that land-baron faces the exact same challenges [look at Richmond, B.C.] – no buyers with 8-figures [or access to that kind of credit].

So where have all the deep pocket buyers gone? Sales continue to fall. Prices rise at a slowing rate [past the inflection point], meaning that the trend is down. Inventory is nudging up [supply]. The “hot” Sprint buying season was impotent. It still may feel like a seller’s market, but the buyer is catching on and, like Stellar, rents and waits. The graphs LF shared below show that this is normal on the eve of an adjustment.

My take on it has always been that structural changes, as we are seeing in place now, will result in concrete and objective changes in supply mix, development, density, supply overall and, yes, price. You don’t have to buy. If the right home comes along, and you can afford it, there is your answer. But even then, you need to look at the market landscape, trend, policies and the like.

Eventually, the vast majority of buyers say, “Wait a minute, this is nuts. I will have a mortgage for the rest of my life”. And walk away. As prices catch up to this reality, policies will be adjusted. I am confident that you will find that home. But right now, the music has stopped playing and there is nothing that says you must sit down.

Thanks for sharing. I shared my 2 cents. So, do what is right for you and your growing family.

Stellar is doing the right thing.

+2

@ Patriotz:

” If loose lending standards could support prices long term the US crash never would have happened.”

Loose lending standards don’t need to support prices long term to create havoc.

And indeed if loose lending standards support prices short term only, then that means that they will create bubbles and crashes, which is what we have seen over the last 50 years:

http://4.bp.blogspot.com/-bkWCH9kIWpM/UyxsnbzIL0I/AAAAAAAAEOg/wvnQLrs42mM/s1600/graph+soft+landing.jpg

Which means that momentum constitutes a fourth factor determining prices. When prices are rising they tend to rise quickly until buyers are sucked dry, at which point the upward momentum dies and a reversal follows as prospective buyers are deterred from entering a falling market.

That looks suspiciously similar to Marko’s house (at least from his youtube vids).

Stellar, I enjoy real world updates from posters on HHV, thank you. I empathize that your geographical expectations have changed over the last couple of years. I remember in 2015 homes in the Happy Valley Rd area were going for $575K or less with a suite and rooftop patio (Piano development~Phase 1). I know prices have inflated drastically since then but this would be a development to keep an eye on for devaluation and offers from the developer. They are building duplex style homes there now:

http://bobstarr.ca/mylistings.html/listing.389664-3317-radiant-way-v9c-0k3.74253913

If you are patient, you may be able to score a detached home with suite for resale in this development. In fact, I am confident a deal will be yours in Langford come January 2019.

~All the best

+1

Stellar is doing the right thing. One doesn’t have to own right now and one doesn’t have to move. Take your time and determine what’s right for you. The market may go up, go down, go sideways, crash, explode, implode, or any number of things which none of us can predict with any degree of certainty.

So Stellar – my advice to you is “you do you”.

Lending standards certainly matter short term but I’m not so sure about long term. If loose lending standards could support prices long term the US crash never would have happened. If people are allowed to borrow more than they can pay back reality has to set in at some point.

Stellar:

I would like to say that the market will adjust soon but I am not so sure that it will or at least not as much as you need it to adjust. I dont know how portable your skills are but you might want to consider cities like Ottawa where you can still afford a three bedroom for 500k.

I can see prices maybe declining a bit but interest rates are likely to increase.

Can anyone here give some help or suggestions?

@ LF:

“at the end of the day, those two factors I mentioned [INCOMES and INTEREST RATES] are what the RE market ultimately has to answer to.”

If by “what the RE market ultimately has to answer to” you mean the factors that determine prices, then, again, that is clearly wrong. We’ve seen recent action by Canada’s Superintendent of Financial Institutions (requiring borrowers to qualify at interest rates above current rates) that by general agreement had an impact on house prices. So, to use your terminology, the market ultimately has to “answer to” three factors, of which the third is regulation of lending.

Thought I would share my personal experience with the new stress test rules so you can see what’s happening to a lot of first time buyers like me.

I was recently pre-approved again for a mortgage. Some background… family income 100k from long term stable jobs, excellent credit scores, 0 debt. With a 5-10% downpayment we are approved to spend up to 500k for a house or up to 575k for a home with a suite (est. $1200/m rental income). We are looking for a min. 3 bed 2 bath SFH as we have 1 kid and will have another so there is basically 0 for sale in our price range that meet our needs. We are looking specifically in the Westshore because Victoria will not be attainable. If the market doesn’t move in a year or so we may adjust our priorities and look at townhouses with yard space but we will not buy a condo with a growing family.

To put this in perspective, we were pre-approved to spend up to 720k (2 years ago when our downpayment was smaller and our incomes were less) for a home with a suite before the rules took hold. We thought that amount was insane, being over 7x our family income with most of it mortgaged. I agree with the rules even though they’ve cut the legs out from under us; it’s now time for prices to catch up.

Patrick,

I don’t disagree with your source, but I don’t think it tells the whole picture. Leo has pointed out one issue, and I can point out another, using an earlier post:

https://househuntvictoria.ca/2018/05/04/musings-on-future-affordability/#comment-43223

)) ” The monthly rise of the Vancouver and Victoria indexes has slowed markedly since last September. Seasonally adjusted, both indexes would have been down in July for a second consecutive month. “

Perhaps rising at a slower rate, but the big picture for me isn’t found by trying to seasonally adjust a single month, but instead to see that those markets (van, Vic) are at all time highs, up markedly year-over-year and still rising.

And this rise is occurring despite the various “cooling” factors that have been applied by banks (mortgage rules) and government (foreign, vacancy taxes).

Sorry, I copied the wrong section:

” The monthly rise of the Vancouver and Victoria indexes has slowed markedly since last September. Seasonally adjusted, both indexes would have been down in July for a second consecutive month. “

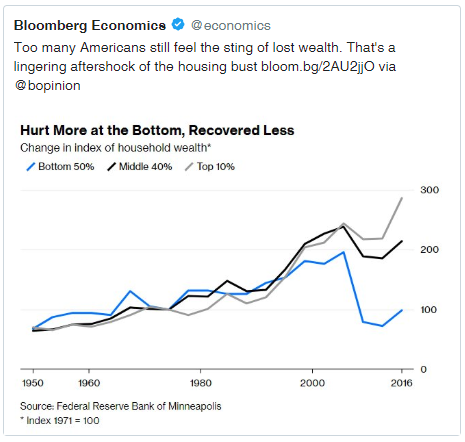

Housing crash in the US hurt poorer households the most:

It’s a far greater % of Canada’s total RE valuation. Which leads to the second point, that Toronto and Vancouver are really the only RE markets in the country comparable to Victoria price wise, so I wouldn’t call it cherry picking.

Because it’s not so much the numbers as the analysis of the numbers. Ala:

Looking at larger markets and in particular those which have lead in the up of real estate sales these last few years gives lots of data to really dive into and analyze. We can all cherry-pick numbers just as realty boards do. That’s not the point — it’s the taking of the raw data and trying to tease out trends. That’s the fun of looking at other market spaces and if by chance one can use the large dataset to define trends, perhaps that can overlay onto the local market. Maybe. Maybe not. Certainly is worth looking at and discussing.

Local fool: It’s fine to want local content only, others want the broader picture.

Fine, if you want the broader picture, and don’t want to talk about Victoria (+6.8% yoy), then talk about stats for Canada overall (+1.8%), not “Toronto” (-4% yoy). Cherrypicking a certain city (Toronto, with 15% of Canada’s population) isn’t the broader picture , it’s just different local content.

Because we’re seeing mortgage volumes and credit growth drop on a national scale. And what happens in ToRE has an effect on the national picture. It’s fine to want local content only, others want the broader picture. Personally, I like both but with the small size of this market, it’s harder to find local content/analysis to share that Leo doesn’t already do. If you have some, I’d encourage you to put that content up yourself.

Better Dwelling has an entire article out this morning on exactly that topic. Check it out.

https://betterdwelling.com/teranet-canadian-real-estate-prices-continue-to-decelerate-smallest-growth-since-2009/

Ahh! I totally thought it was some kind of skill testing question, the answer to which would surprise and educate us all. I answered with the hope that’d you’d come back with the answer and explanation. All disappointed now 🙁

Yes. A better rebuttal would be to say that in a market with declining buyer interest, the idea of listing much too high, then correspondingly dropping the price by mega bucks, theoretically gets more attention and may make it more likely to sell. In other words, the price “drops” aren’t always entirely what they seem. And you’d be right, that’s why I say I wouldn’t call it a bloodbath…yet. But the selling volumes and inventory stats speak for themselves.

Keep in mind, sellers were raising prices by similar leaps and bounds two years ago; almost any price was a good price no matter how high. In the 4000k example, I would guess they aren’t going to get their asking, either. Shame I don’t know what they paid for it, or when.

Why is the Toronto house price index relevant to a discussion about Victoria house prices? Abbotsford BC prices are up 17.6% year over year in Teranet. Is that also relevant?

Another way of looking at it is that the year-over-year change is seasonally adjusted by definition. And it’s down 4.01%.

The published (non-seasonally-adjusted) Toronto index rose for a fourth straight month in July. In contrast, the seasonally adjusted index would have declined for a fourth straight month. This means that the recent monthly rises in the published index reflected only seasonal pressures instead of an underlying trend.

https://housepriceindex.ca/2018/08/july2018/

Teranet July 2018 numbers are out. Victoria prices up 0.4% from June 2018. Vancouver prices up 0.4%. Canada overall up 0.8%.

Up less than a typical July, but up nonetheless.

Victoria is up 6.8% for last 12 months..

You’re right, it is. Good thing an asking price above assessed value is equivalent to money in the bank.

Still more than assessed value.

Mean while it is assessed at $12,214,000.

Ouch! I bet the owner wish he had listened to Hawk’s advice. I wonder does he have enough change to fill his tank??

.

..

…

a) $800,000

Land appreciates, Buildings depreciate.

cop outs? moi? 🙂

My first thought was a) $800,000 and it still is. Here’s my thinking: Bob bought a WWII crap box but likely in what is now considered an in-town desirable location. Doubling in price is still within range (potentially) of a first-time buyer. Linda bought a cookie-cutter ’70’s model so built further out from a core district. Lots of similar housing in the neighborhood so nothing to differentiate. This coupled with the fact that her sale would be out of the starter market home price range would restrict it’s value to a degree. $800,000 – final answer.

Victoria Born thanks for sharing the Province article. Hearing the CBC story of Paul Manafort laundering money using real estate is definitely making me think about 4 houses I have looked at.

What I don’t understand is there an active attempt by our governments to go after homes that were purchased with the proceeds of crime (beyond the bc civil forfeiture act that can’t seem to deal with known criminal gang property)?

So do the various segments get further apart as the market appreciates because everything doubles? The starter home goes from $300k to $600k while the mid priced home goes from $500k-$1M and the high priced home goes from $1M to $2M?

And after it doubles you also need twice as much to upgrade?

Genuine question, I haven’t actually looked closely at whether house prices tend to increase evenly across price ranges by percentages, or more by dollars. I.e. if the starter home increases by $300k, the mid priced one does too.

So the point is not that, even after a big drop, the house is still 35x median household income but rather that prices can drop a lot. OK, got it. Silly me!

The future holds wonderful possibilities.

For example, I’m off to go camping for a few days.

errr…I’ll try…

$1,000,000?

Bob as a presumed market entrant had a 300k capital gain, plus equity via down-payment and principle reduction? I also presume credit availability has increased…

CS:

I believe I understand what you mean, I’m just not sure what a better way to put it is. Anchor doesn’t mean the chain has no slack. If that were true you wouldn’t see cyclical action in the markets – and that cyclical action is indeed created by the changing in lending sentiment from one point of time to another. In essence I agree with you, but that’s not what I was getting at. So what’s a better term than anchor? I don’t know. It’s just saying that at the end of the day, those two factors I mentioned are what the RE market ultimately has to answer to.

It sounds to me like you’re talking about externalities, or forces that operate from outside the market, upon it. And that’s fine, but I wasn’t really talking about that when I was responding to the other poster.

I’m fine with you taking me to task but at this point I don’t share the same interest for usury as a topic, even if it’s relevant. So perhaps others might pick it up. If what I said wasn’t clear I wasn’t meaning to mislead at all. Signing off.

Common theory, but the stats just don’t bear it out. I had the same argument on VV with someone trying to argue that demand has not been reduced, merely shifted to condos. Too bad the lower end of the market dropped the most in sales. Sure some people got knocked down from single family to condos, but even more got knocked out of the market entirely.

The Richmond joint is $1m x 2 as the subdivision has been approved. $1M is for HALF of what was there before.

https://www.realtor.ca/Residential/Single-Family/19790065/6231-BLUNDELL-ROAD-Richmond-British-Columbia-V7C1H7

Look a little closer next time…

No cop outs! What can she sell it for?

@ CS:

@LF:

But you did, quite specifically, indicate that RE Prices are determined by incomes and interest rates:

@ LF:

In that you were wrong, or at least making a misleading general statement, since you ignored lending regulation, which, in any decent society, prevents unwise or totally unsustainable borrowing.

In Canada, lending is currently regulated very lightly, which is why many first-time home owners have committed staggeringly large proportions of their household income to the purchase of their home. Such massive indebtedness would not have been possible a generation ago because lending limits were then much tighter.

Ah, now I see them. There were 3 listings of 4 million dollar price drops on myrealtycheck.ca for August 12 in Vancouver, and a 55% reduction in Richmond for August 13th (6231 BLUNDELL RD RICHMOND) . And by the way, the Richmond joint is assessed at 1.82, now asking 1.00M.

To Leo’s question, I take C) Other. A house is only worth what someone is actually willing to pay for it. Bob sold so his house was worth on the day of sale $600k.

The next question is should he buy Linda’s ugly box with his new found wealth? 🙂

And it’s only $3.666M above assessed value.

4 million dollar drop? The bloodbath may be arriving sooner than I thought. Thanks for posting that one LF.

Love when sexist policies are somehow seen as a reason for happier times. Happier for who? I’ll take now thanks. I prefer higher prices and equal treatment to a bank discounting my income based on my gender.

Lets get the definition of “usury” out there. It is unethical or immoral monetary loans that unfairly enrich the lender. I really don’t see usury as a huge issue in our market or a cause of rising prices. Low interest rates; however, do contribute to this, as do qualification rules – but I disagree that the old rules were usurious – as in they were not unfair or immoral. And CMHC insurance for mortgages has been available since 1954.

I don’t think that’s the point. It’s what it’s demonstrating. Keep in mind when prices were going up vigorously, folks were wowed, and you yourself made clear on several occasions how much your home was going up in value. In fact, that’s been one of your most common Hawk-attacks. I don’t recall you ever once minimized the paper gains you were realizing.

Now it’s beginning to go the other direction, the perspective seems to be “ho hum”, it’s joked about, or derided as irrelevant. But it isn’t. The correction has to start somewhere. You’re not going to see significant drops in all segments as soon as demand falls off, that comes later in the event that confidence in the market finally goes south and unemployment starts to rise. We’re not there yet, but we’ll soon find out if we’re going to be.

Got a $4,000,000 drop today at 6188 Macdonald Street in Kerrisdale, also have a nearly one million dollar drop on 5850 Cartier Street, and this one will potentially be losing six figures if they can even get their asking price. I have dozens and dozens more. I won’t call it a bloodbath yet, but it’s getting there fast. Anyways, those are all just anecdotes, but they are consistent with the data we’re seeing now.

Question:

Bob buys a starter war shack for $300,000.

Linda buys a typical 70s box for $500,000.

After a few years, Bob sells his starter war shack for $600,000.

How much is Linda’s house worth?

a) $800,000

b) $1,000,000

c) Other

Not one person here said they were. They have been referred to as fundamentals, not sole actors.

@ LF:

There’s no need for an intricate argument to show that house prices are not solely determined by incomes an interest rates.

You simply don’t understand the function and importance of the regulation of usury, which I venture to say, has been a feature of good government at virtually all times in virtually all societies.

Moreover, it is a fact that not many years ago mortgage borrowing relative to household income was subject to greater restraint than now and, moreover, it is not that long ago that a wife’s income was partly discounted in assessing a couples borrowing capacity.

If we went back to the restrictions on borrowing that applied in that happier time for home buyers, a generation and more ago, then RE prices would be greatly reduced, in Oak Bay and other premium areas as well as the outer suburbs.

Also, I understand that many “purpose-built” rentals are in fact structured as condos as it gives the developer more options going forward.

Never heard of this (an apartment building being built; however, strata units)…..wouldn’t make any sense. You would pay a fortune more in city fees not to mention each unit would be taxed individually, etc., if you built a condo building for the purposes of renting.

From what I’ve seen investor stratify when they are ready to sell in 5, 10, 15, 25 years time.

Presale condo market is on life-support.

In Victoria and Saanich many projects have been mired in city bureaucracy that there simply haven’t been that many pre-sale launches. You have Ironsworks and Hudson Place One and both of those have enough sales to get off the ground, so I wouldn’t say the market is on life-support as it seems whenever one can make it out of years of bureaucracy and to market seems to sell ok for now.

The other factor going will be forward the market has been slowing down for two years so developers have enough time to adjust need be….it isn’t a case of massive overbuilding and then the rug is pulled. More of a case of overbuilding that slowly slows down with the pace of the slowing market.

For example, Westhills has put a concrete condo tower on hold until they get a better sense of where the market is going.

The ones approaching completion are all looking okay. Jukebox is 80% sold, 989 Johnson is around 70%, Lyra Phase One is 90%. I don’t see any development that is in evident trouble (approaching completion but <50% sold).

Apartments are a physical structure and condos are a legal structure. Also, I understand that many “purpose-built” rentals are in fact structured as condos as it gives the developer more options going forward.

Money laundering’s connection to unaffordable housing:

https://theprovince.com/news/bc-politics/mike-smyth-next-on-ebys-money-laundering-hit-list-real-estate

German’s casino report supported Sam Cooper’s reports. Expect nothing less of report #2 [money laundering & your beloved RE market] – will be interesting. Victoria is part of it.

Thank you, Leo. I think we can all agree that it is quiet in the RE market and a cooling is taking place. Foreign money inflows are dried up and, on balance, may be turning negative. Presale condo market is on life-support. The stress test [and rising rates] are playing an important role. New mortgage credit originations are falling – this is a key ratio to watch and proves that demand is parked on the sidelines. When this happens, it is best to return to incomes [multiples] as a a foundation for prices. January 2019 [and beyond] will be an important time frame, but as stated – the precursor cooling is in the mix already.

Canada’s employment numbers came out late last week – topped expectations, but a lot of part-time work. Public sector job growth was high – good or bad? In the US, employers are now complaining of lack of skilled workers [Boyd Auto Group saying they can’t find qualified autobody repair people to work] – this is common late in the cycle. Were it not for the NAFTA risks, the BOC would be more vocal about tightening. Rates will continue to rise, but if we can get NAFTA signed, business gets certainty and that is the time the BOC hikes more aggressively.

I am betting that we will see a recession [defined as 2 quarters back to back of negative GDP growth] within 2 years – I am confident of it. Late cycle, leave some on the table and head for the doors if you are an investor.

Thanks, again – a good read.

Thanks, I will stress that I have never seen a realtor with the fortitude and ability to generate information like what is continually provided here free of charge. Obviously Leo is someone who believes the world is abundant and wants to freely pass along information to help others, even though he will humbly see this from a different perspective. My kind of people in any event and without question, legendary.

Please see above comment Marko.

Today’s stats paint a different picture. Traffic is still nuts even for August but I am shocked by saturated condo construction while wondering will I get the opportunity to live in one of these places in my lifetime?

I would say majority are apartments, not condos.

Yes, I think we can all agree: this Monday morning update was legendary.

Oh, so we see it wasn’t a strawman argument. That’s too bad, patriotz.

Thanks Leo. I can’t see the stress tests not affecting the condo market just as much, with the reduced spending power for anyone who is financing, which is most people, especially if money launders are now thinking twice about BC.

Nice to see the listings still increasing and the bidding dropping. Our realtor just called that an offer went in on the place we wanted to put a reasonable offer in on and we’re going to hold onto our cards a little while longer.

It would be great to a sense of the number or percentage of pending sales are subject to sale of the buyers home/condo. We are trying to trade up and I think some realtors still remember frothy 2016/2017 a little too well, to convince sellers to accept a 30 day subject to sale offer?

Hope everyone is enjoying the summer and being thankful we are so far away from the fires.

I agree. Mozza is so great…

Everyone knows the moon is made of cheese.

Totoro, if this were the right forum, I believe you could construct an intricate argument that the moon is made of mozzarella cheese, or that Ronald Reagan never existed.

No trolling or disrespect, I’m completely serious. There’s several people I know that have this same ability, it’s very interesting to watch them go at it. It doesn’t matter what the topic is, they can contradict almost any premise whether it’s founded or unfounded, almost down to reality itself. Not an ability I have naturally or ever studied in great detail, but I recall studying the Socratic method in undergrad one year. One of the funniest pieces from that course was reading a hypothetical debate between Jesus and Socrates, on the origins of the universe. So funny.

Yeah, except we bought a house in Oak Bay 15 years ago with a slightly less than average family income and a 10% down payment.

It was a less than premium house in a premium area. Seemed really expensive at just under 370k. Now it is worth about 1.3 million – unrenovated. If it had just kept up with inflation it would be worth 469,229 today.

When my grandparents bought in a similar area in the 1940s they did it on one less than average income. It was considered a good area back then too.

Premium areas are not always unaffordable to average buyers. Houses just got a lot more expensive and the effects are stronger in more desirable areas.

Premium areas are unaffordable to average buyers by definition. Resist the urge to buttress your arguments with strawmen, they lack structural integrity.

It goes on, and it’s pretty funny: https://twitter.com/TristinHopper/status/1029012390082359296

(All from the previous thread:)

And I can accept that the entire market is (somewhat) connected. Doesn’t mean that if prices decline in Oak Bay because the region as a whole is in a slump Oak Bay will return to income-based affordability. And the same applies to a few other neighbourhoods as well, IMO.

The West Shore has perhaps entered unaffordability, IMO. When a fairly new but completely unremarkable house in one of Langford’s sardine-can communities sells for over $600K, which I saw recently, then something is out of whack.

I bet Langford, and the market as a whole, will correct a bit soon. But that won’t mean Joe Average will be able to afford a house in places like Broadmead, Fairfield, or Oak Bay (and probably several others).

Holy shit, Vancouver is fucked! Oh wait, that house is still 35x median household income. Never mind.

Leo S thank you for all your legendary posts, again and again!

Driving around Saanich this morning, I have seen many presumably stale sold signs dotting lawns in the Tillicum area. Today’s stats paint a different picture. Traffic is still nuts even for August but I am shocked by saturated condo construction while wondering will I get the opportunity to live in one of these places in my lifetime? There will be so much choice. I think the high has not worn off yet but come January 2019 Victoria will be a completely different landscape.

It’s interesting hearing the differing perspectives on this. Some opponents of the stress test have said it will backfire by forcing everyone into condos, hence condos will continue to get less affordable, while SFH’s will suffer. I’m not sure what to think.

Renter: It makes the stats suspect at the very least. The real estate bpard loves to spin good news.

I really wish that properties marketed for sale had an honest DOM listed – some do but many do not. I’ve seen several properties listed, cancelled, and then relisted at a lower price. Sometimes these lower prices will then get a contract for sale. If a cumulative DOM U.S.-style were used, we would likely see a larger drop off in median sale from original list. Why? Because that very first listing asking price would be used in the calculations and not the new listing.

Here’s a lovely example: 1898 Quamichan. MLS 394142 has as it’s asking price $750,000. Listing cancelled and a new one up at MLS 395559 with an ask of $699,900. Under contract now at $716,000. So if you used the first listing ask price, the contract is $34k under ask at a reduction of about 4.5%. If you use the new listing, the contract is $16k over ask at an increase of 2.3%. Deceptive IMHO.

I really wonder why anyone would consider using house equity to buy toys with. On the other hand I have yet to buy a brand new car yet. But different strokes for different folks I guess.

Grant: “In the very short time since we’ve settled here, my daughter (who is a bit of a car aficionado like me) has commented about how many more luxury brands, sport cars and “cool old cars” there are here. The wealth is on display for all to see.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<

…………… or maybe there are a lot of people enjoying the equity in their homes, Grant.

http://autotalk.com.au/industry-news/car-sales-slack-reflects-house-price-slump

“The recent drop in house prices is linked to a dip new car sales, especially in the luxury segment, new research shows.”

I see that 1956 Barrett Drive in Dean park dropped its price by 250K to 1.4 mil. Not sure that it will sell at the new price.

Thanks for the great job that you are doing. I wish the TC would publish your stats every week in the paper.