Market Sentiment

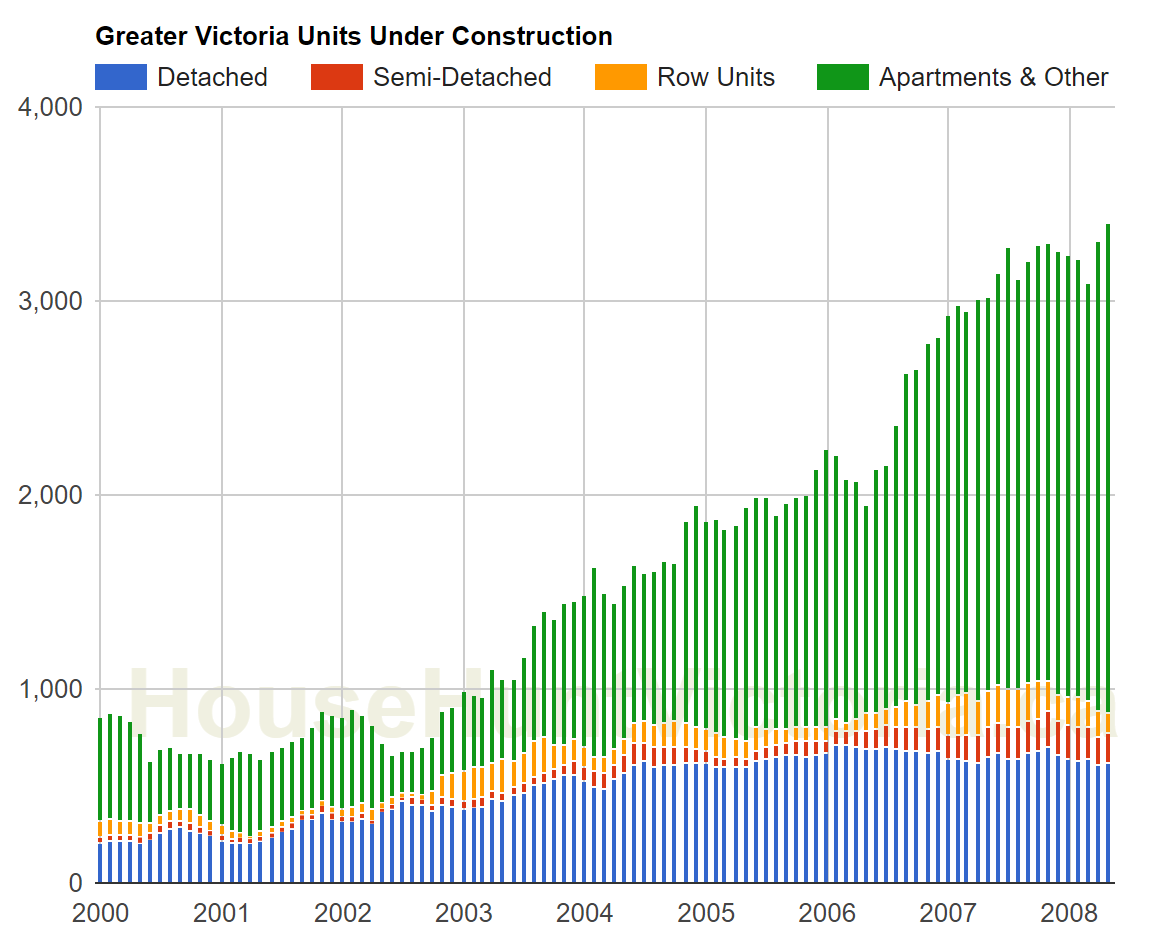

Let’s take a trip back in time to May 2008. Things were going well in Victoria with the spring real estate market in full swing and the economy doing well with a record low unemployment rate of 2.6%. Vacancy rates were low, and there was a record number of units under construction, which was obvious looking at the downtown skyline dotted with cranes. Sure there were some rumblings about the housing market in Florida but it all seemed quite far away from Victoria.

The median single family home that May sold for $545,000 which worked out to $2865/month for a regular mortgage (20% down) at prevailing interest rates. That deal sounded good to the 441 people that bought a single family house that month. After all, house prices had just doubled in the last 5 years and it was impossible not to hear about all all the people that had made a fortune in housing. There was no way to lose with Victoria real estate. Oil was north of $100/barrel and that was causing a flood of Hot Albertan Money to pour into the city. In addition wealthy boomers across the country were approaching retirement, and what better place to come than here? Even foreign investment was on the horizon, and if only 1% of the millionaires in China decided to come here prices would continue to appreciate.

Fast forward 5 years later to May of 2013. The median single family house sold for $525,000, but due to a crash in interest rates, the mortgage payment on that had dropped to only $2221/month. And yet, people were cautious, with only 346 people deciding to buy that month. Real estate had become boring. Stories of outsized appreciation were replaced with stories of difficult sales and stagnant listings. It didn’t seem like a good idea to jump into a market that was that uncertain.

I bring this up because it’s extremely difficult to imagine how a market will feel until you are in it. On the way up, it is nearly impossible to imagine that prices would come down. After all, if people were willing to pay $2865 a month for a house in 2008, why would there be 20% fewer people willing to buy 5 years later despite the fact that they are paying 25% less per month for the same house? Victoria did not get less desirable in those 5 years. Cherry blossoms were still blooming in the spring, incomes were up, and the local economy provided more opportunities. The only thing that changed was people’s feelings about the market. The same happens on the way down when suddenly that optimism disappears and it just seems like it will keep declining even when it’s turning around.

Last month, the median single family home cost $800,000 and to finance it cost around $3500/month.

Is it possible that in 5 years people will only be willing to pay $2900/month for the same place?

Thanks Leo S for the reply.

Hey Leo, how’s the market summary looking this Monday?

cc @guest_47551

Always wonder why those innovative brokerages are over in Quebec and the Maritimes but not here. What makes them so much more open to think about this stuff?

Nothing has happened in Victoria in the last 8 years and with the market going into a slow down for likely 2 to 5 years it doesn’t help innovation.

Already starting to get emails from my mere postings….”is my listing being blacklisted?” when the real problem is price/market conditions. It hasn’t happened in the last few years as everything was selling but my favorite logic that was a common occurrence from 2010 to 2014 was cancel the mere posting and re-list with a full commission brokerage at 50k lower list price. Common sense = zero.

Same with MERs and mutual funds. Common sense = zero, but the majority of the population is paying through their nose.

Amen.

Purple Bricks is less expensive and you get a full service realtor and MLS listing and photography, but they do charge $3600 to list your home whether or not it sells and 2-3% in buyer’s commission. The model seems really good for those who have to sell or those offering their home in a seller’s market.

Great charts, but I wouldn’t put any stock in the “overvalued/undervalued” statements based on price/income.

Always wonder why those innovative brokerages are over in Quebec and the Maritimes but not here. What makes them so much more open to think about this stuff?

U.K. real estate firm brings its full-service, no-commission model to Canada

An international online property powerhouse has purchased one of the world’s top web-based, commission-free real estate companies in a bid to shake up the Canadian home-selling industry.

Last month’s successful $51-million bid for Quebec-based duProprio means “For Sale” signs bearing the name Purplebricks will soon start popping up across Canada, says the company’s president, Michael Bruce. Also watch for some major advertising campaigns.

Traditional Canadian real estate agents scoff at the idea Bruce can disrupt how homes are sold here with his discount model that charges a flat fee for the services of a real estate agent rather than a sales commission.

But from a standing start in 2012, Purplebricks has taken over about five per cent of the British market and has expanded to Australia, the U.S., and now Canada.

https://www.cbc.ca/news/business/discount-real-estate-1.4787422

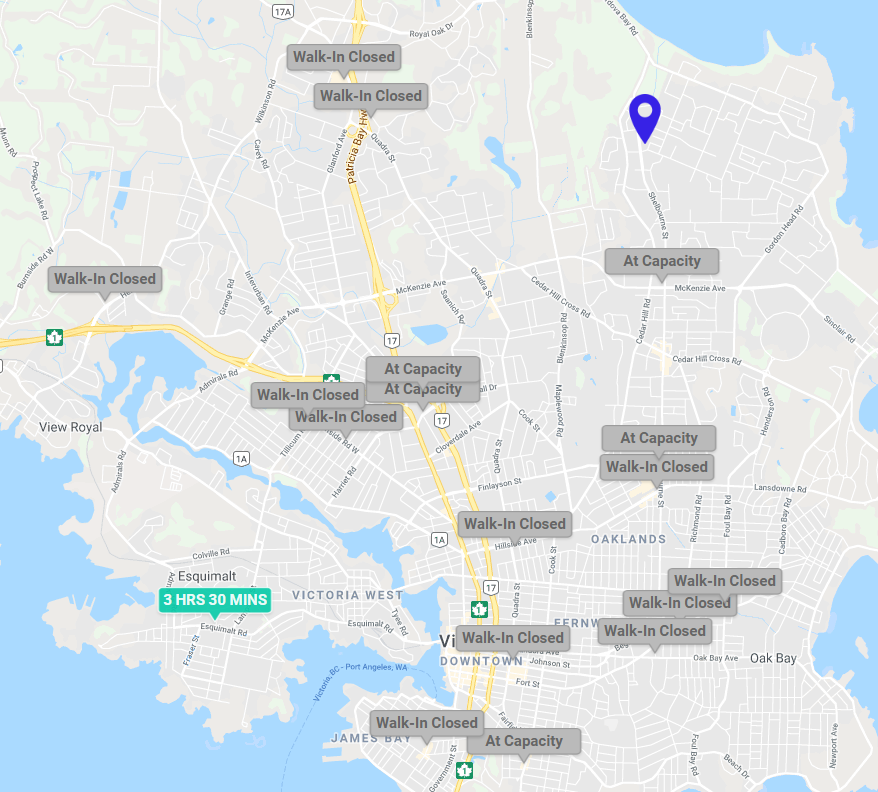

Leo, thanks for posting the Medi-Map yesterday. I don’t think people who are relatively healthy realize how the shortage of family doctors in Victoria has worsened over even the past few years. Remember when walk-in clinics were there to serve people on evenings and weekends when regular GPs offices were closed?

I have been at a walk-in clinic around 5pm (after I checked in hours earlier) and have seen sick people come in looking for assistance, only to be told the clinic is full for the day (posted hours until 8pm). There are several outcomes from that, but one is the patient goes to the emergency department right away for something that could have been treated less expensively. Another is they wait and get sicker, and then it really is an emergency.

If the shortage of family physicians seems bad now, it’s only the tip of the iceberg. For example, two of the main doctors at the clinic I go to graduated in the 70s. They won’t be working much longer. I do have a family doctor who is younger, but he sees too many patients (likely trying to pay his mortgage) and is burnt out. I don’t know how long he will be around either. And then there are the aging baby boomers…

In a gatekeeper system, as our medical system is, if the gate is broken, we are in big trouble. We can argue about what the best approach is, but if your health has been compromised by lack of primary care, please voice your concerns to the politicians. Any and all possible solutions need to be looked at. The attractions of a city mean nothing if one can’t get healthcare.

Here is one of Keith Baldrey’s three modes on display (stating the obvious), but he’s not wrong:

(His other two modes, if you’re interested, are fortune-telling and popcorn-eating spectating.)

Warren Buffet has for decades.

Set up for a bidding war, and it worked. $730k

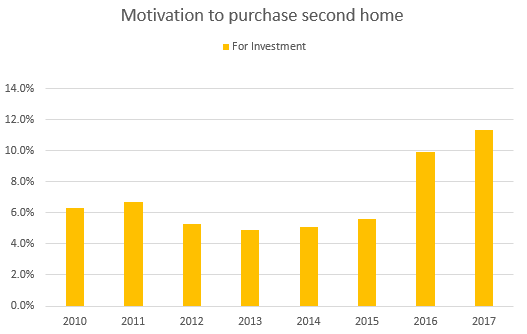

Not sure if we have it quite this extreme. One would imagine that simply the barrier of sky high prices would prevent too many people from buying a couple blocks of anything, but I am concerned about the increase in second home purchases by self-proclaimed investors.

Research is pretty clear that higher levels of investment lead to higher price declines in a downturn.

If I recall correctly, a family friend and his mother declared bankruptcy (circa. 1984) because they couldn’t sell any house to cover theirs leverage of 2 blocks of houses in Gordon Head.

LF: “Some people are undercutting to get out now at any price, and as devastating as that may be for them, they might soon be glad they did.”

When I think back to 1982, LF, I was too young and naive to recognize the market change and chased that market down.

Even then it took me less than a year to finally get a buyer …. after a 40% drop.

When you have to sell you don’t have the luxury of time.

The pain will come quicker than most will believe. It is unfortunate.

Any update on this pending sale?

It look like people hasn’t got the memo, and Vancouver isn’t going to be affordable at anytime soon even if the market crash by 75%. I’m not sure how much Point Grey has changed over the last 30 years, but IMHO it wasn’t that out standing (as I recalled from 30 years ago) to warrant a cool $4 mil for a 6000 sqf patch of dirt and rubles.

Assessed as of July 1st, 2017 $3,713,000

Land $3,703,000

Buildings $10,000

Land size 50 x 120 Ft

Previous year value $3,845,000

Land $3,709,000

Buildings $136,000

Sales history 16-Nov-2016 $3,000,000

OK Andy7. I can see we are on opposite ends of this. We are all entitled to our opinions but none of us is entitled to the facts. Pseudoscience is rampant and until someone can face their peers with solid, replicated, controlled research, they are fodder for quackademia.

Ooops – thank you very much for posting that link. You will note that it talks about the negative wealth effect [domino] that takes place because of the drop in prices at the “luxury” high-end and how it trickles down. So very true. Again, those that bought in 2016 and 2017, and are carrying that large debt load are really caught, particularly as their mortgages come due [some will be in open contracts] and they are under-water. Steve’s comments in the article echo what he has been saying for the past few months. What this is all telling us [OK, me] is that the foreign money inflow [be it money laundering, drug money or flight from China looking for safety] has been far, far greater than reported – forget the 8% or 10% or 15% – it is higher, particularly in the luxury market in West Van. It is, as you will note, a global phenomenon now – the adjustment is geographically vast and the damage will impair an entire generation with huge debt.

No sane person can claim that there has been no direct or indirect upward price pressure in the Victoria market and sales volumes. It has been occurring here too – directly or indirectly, or both – it is all connected, just as Steve said in his most recent vid. We all knew it. Bears and bulls – pumpers and dumpers – change is upon us, I would think.

As LF says, best to sit on your wallet, enjoy Labour Day, Thanksgiving, a quiet Remembrance Day, Christmas in that warm apartment and maybe even Easter 2019. Give it 1 to 3 years [take the mid-point of 2 years, I say – 2020] – hibernate and let it come to you. It is and will happen here too – Victoria just is not that special. The laws of economics prevail. Good comments, LF. Those over-leveraged speculators, well, you live by the sword, you die by the sword.

And that Hawk guy – man, he is a true visionary.

Andy7,

On the other hand, with the way things are starting to look in the RE market, it might be good to keep your links handy for all those over-leveraged speculators…

I couldn’t resist. 😛

Bitterbear,

Unless you’re looking at major events (death, divorce, trauma etc) a lot of anxiety, depression, sleep issues and chronic pain can’t be solved simply by counselling or a psychologist; meds can be used in an emergency but have their own issues, and don’t tend to be a long term fix. A lot of it ties to deeper root issues that need to be resolved for healing to occur – Ie mold exposure, night shift work, gut issues, excess screen time, sunlight/magnesium/ferritin/B12 depletion, thyroid issues, gluten exposure in those susceptible etc etc

This literature may be of interest:

Dr. Victoria Dunckley, MD, Psychiatrist

https://drdunckley.com/

Dr. Kelly Brogan, MD, Psychiatrist

https://kellybroganmd.com/

Dr. Mark Hyman, MD (Functional Medicine)

https://drhyman.com/

Dr. Carolyn Dean, MD, ND

https://www.amazon.ca/Magnesium-Miracle-Second-Carolyn-Dean/dp/0399594442/ref=sr_1_1?ie=UTF8&qid=1534723815&sr=8-1&keywords=carolyn+dean

Dr. Ritchie Shoemaker, MD (mold)

I could go on an on, but I’ll leave it at that and let the discussion head back to RE…

Big sister down south is beginning to tank too.

Seattle-area home price reductions surge, signaling market shift

By Marc Stiles

Staff Writer, Puget Sound Business Journal

Aug 15, 2018, 2:48pm

Asking prices dropped on 12 percent of the homes for sale in the Seattle region in June, the largest wave of reductions since October 2014.

Here’s the latest ‘rates vs price’ from our big sister to the south.

(once interest rates turn down in the 2020s, it will be time to sell us)

Good grief, this is the same old story going back to antiquity. Boom. Over-exuberance. Bust. More over-exuberance? Bigger bust. Totally different here, until it totally isn’t.

Well for those apparently “astute” few that do believe there just might be a correction happening, why yes, they’re correct. It’s been actively underway for the last 2.5 years. It just takes that long to grow to an extent that it the deterioration of the market can’t be hidden behind all kinds of mathemagical tricks.

Housing markets move very slowly and the price declines haven’t really even started, IMO. VanRE volumes are continuing to slide and show no signs thus far of growing again. Some people are undercutting to get out now at any price, and as devastating as that may be for them, they might soon be glad they did. You speccing on that opulent West side home? You’re getting your proverbial clock cleaned with industrial grade Formula 505, as I type.

It’s not going to be pretty over there. My guess is for you readers on this site that are waiting (I know there are a number of you), your patience will more than likely be rewarded over the next few years. Don’t get caught up in the rebound hype, keep your eyes on the data. RE markets don’t usually rebound until they’ve sputtered for at least a few years. And at these preposterous levels of consumer debt…heh…goodnight Alice.

Oops, this kind of says it all in that article.

“My thoughts are if they went up that fast, they can certainly go down that fast. That was a one-time Chinese money infusion and a spectacular frenzy, which are both over. Vancouver will never be affordable, but it will drop 25 per cent or more,” says Watt.

Barrister: “In terms of long term investments, I can confidently say that I will be occupying a rose garden in 20 yrs.”

<<<<<<<<<<<<

I beg your pardon. I never promised you a rose garden.

…. and so it continues.

https://vancouversun.com/business/local-business/some-realtors-believe-major-price-correction-underway-in-metro-housing-market

“There has been a drop of 25 per cent in average home price and 22 per cent drop in median home price since the highs of 2017, according to Bonner.

“Detached, attached and apartments on the west side are now all experiencing price reductions and while this is creating good buying opportunities, buyers are holding off in anticipation of further declines,” Bonner wrote to clients in a note.”

In terms of long term investments, I can confidently say that I will be occupying a rose garden in 20 yrs.

1817 San Pedro [middle of Gordon Head] – .28 acre

Original: – $899,000

Assessed: – $826,000

Dropped to: – $838,000 (Aug. 6, 2018)

Dropped Today: – $799,000

Reality hitting the market [buyer and seller]. Full speculation tax around the corner. 3 Bank of Canada announcements remaining for the year. Longer term, 5-year mortgage predicted to hit 5.7% by 4th quarter of 2019. Add the stress test [200 basis points] and one needs to qualify for a 7.7% mortgage by end of 2019 if [a big “IF”] this all plays out according to the script. Not saying it will, but there is a real probability here facing buyers and sellers alike. We are heading to a “balanced” market faster that most think and, if you blink, it may pass you by.

What is taking place in Richmond [minimum 10% of sales were to Asian buyers – now less than 3%] is fascinating. The exodus of the foreign buyer and all of the policy changes are filtering through to buyers and sellers alike. 20 years from now prices will be higher – but can you confidently say that for 1, 2 or even 3 years from now?

Fascinating to see foreign exchange flows in to Canada slowing so drastically. I maintain that 2016 and 2017 were excesses, particularly 2016. Retracement to 2015 sales volumes / balance / prices would be healthy. I suspect that there is a good possibility that if you bought in 2016 and 2017 you may be underwater, but over the long-run [5, 10, 15, 20 years], you will be just fine. I just think that the next 3 years will be a retracing as interest rates rise, taxes stay in place and foreign money departs. China is making it much, much for difficult for their citizens to get funds out [tough as their currency devalues against the USD] but those that do surely don’t want to face a 20% hit here and perhaps legal action by local and China’s authorities.

Just fascinating to watch. Yes, LF, Steve did a great analysis of all of this. here is an interesting vid [June]:

https://www.youtube.com/watch?v=UPf6gH-cIoE

Most recent:

https://www.youtube.com/watch?v=WyjiTYtc3z4

Good day……………..

Thanks Marko

From the VREB re definition of bedroom.

There is no standard definition of a bedroom.

Typically, we think of a bedroom as being an enclosed room with a door, a window, a built-in closet and of a size that could accommodate typical bedroom furniture.

However, there are many exceptions that we would still consider bedrooms: rooms in older Victorian-style homes that do not have built-in closets; loft rooms; rooms without full height walls; rooms in modern condos with limited square footage.

Where you are classifying a non-traditional room or space as a bedroom, use the M2M Notes field to communicate that the bedroom configuration is not traditional.

The property management firm is based in Vancouver… is this a flipper that is willing to eat several hundred a month?

After you pay the management firm those numbers aren’t so hot. Must be anticipating appreciation.

That just might cover the mortgage with 20% down but certainly not strata fee and property taxes.

I don’t believe one can predict the real estate market or the stock market. I also don’t believe that one can outperform the stock market; too my experts and big players involved. However, residential real estate I really think you can do better than the average transaction. Reason being is there are so many unsophisticated investors and emotional owner-occupiers making poor decisions every day.

I remember when the ERA was pre-selling one bedroom units for 215k I emailed probably about 15 clients that expressed interest in investing and I personally ended up being the only pre-sale purchaser. The numbers made sense. 215k, concrete and right downtown, rent safely for $1,200 to $1,300 at the time, strata fees <$200 and property taxes <$150/month.

Fast forward 1.5 years later, numbers make no sense, I sell my unit for 363k (seven offers), all the other units going in multiple offers as well. Unsophisticated heard mentality.

At 20% down it needs to be cash flow neutral at minimum otherwise you are gambling on the direction of the market.

gwacked, you were agreeing with Numbers statement of:

“1/ where else do you find a fully functional cellulose acetate plant? To build a new one it would be $200 to $300MM”

You can’t create something out of nothing in the middle of nowhere with zero resource or market. You’re the dense one who doesn’t get small towns all over BC can’t be revived with some magical wand or it would have happened over the past 15 years.

For all your bitching you haven’t suggested anything past tourism which they already do. Jeezuz you’re stunned.

More info on 201-1015 Rockland. Strata is $280/month, property taxes $182/month. The property management firm is based in Vancouver… is this a flipper that is willing to eat several hundred a month?

Found another property on the rental market that I was watching earlier. 201-1015 Rockland sold for $487k last month (originally $539k) – 1 bed plus den without parking. For rent asking $1895/month. That just might cover the mortgage with 20% down but certainly not strata fee and property taxes.

http://www.usedvictoria.com/classified-ad/Lovely-new-1-br–denoffice-and-2-bath-condo-on-Rockland-Avenue_32167319

Hawk you really are dense. When did I say give money to the mills. I said work to transform their economy into something else. . Mills are done on the island.

Tourism or something else more viable. These little town need to find their next stage in life and it ain’t mills or fishing so…..

Inflation and higher rates will be a major market killer over the next year as emerging markets debt won’t be able to handle the higher international rates along with indebted Canadians. September hike is likely and the following BOC meetings.

Remember inflation? It’s back to haunt us

“The CPI’s surprise jump emboldened the handful of analysts who think the central bank is in danger of falling behind the curve. Brett House, deputy chief economist at Bank of Nova Scotia, said the data reinforce Scotia’s call that borrowing costs will be headed higher when policymakers next gather to set rates in September.”

https://business.financialpost.com/news/economy/kevin-carmichael-remember-inflation-its-back-to-haunt-us

Thanks for the reference Tomato. What was the STAR*D control condition? I can’t see it in the NIMH report. Without a placebo control or even a no treatment group, you can’t actually measure how effective any drug is against the rate of spontaneous recovery.

When you come up with a viable master plan and learn how global markets work I’ll be all for it. You can’t subsidize one pulp mill without doing it for all of them. Doesn’t work that way.

ICYMI Port Alice already has a tourism market for fishing etc without taxpayers dollars supporting it. Try Google sometime.

https://www.vancouverislandnorth.ca/things-to-do/nature/parks/alice-lake-loop-tour/

https://www.tripadvisor.ca/Tourism-g1514407-Port_Alice_Vancouver_Island_British_Columbia-Vacations.html

https://www.northislandgazette.com/news/sea-otter-watching-business-starts-up-in-port-alice/

Bitterbear: The Star*D trial indicated that about 50% of the placebo group didn’t have depression 3 months after treatment initiation. The anti-depressant group was about 57%. So 7% absolute difference, which some say seems small.

Bitterbear, I agree with you 100%. Anti-depressant bad, treatment good.

Also FYI, most third party insurance covers psychologists up to about 900$ (about 5 sessions).

You are dead right Totoro. Instead they are paying physician’s fees for “counselling” hours which amount to several times more than the cost of a psychologist. And physicians have virtually no training in therapy. The other problem is Island Health Authority pays only 25 cents on the private practice dollar and has eliminated something like half of their psychology positions in the last 10 years replacing psychologists with more expensive psychiatrists and less expensive service providers with almost no training.

It is faster to hand out a prescription for medication (fyi: I think it was British Journal of Medicine, but don’t quote me, that reported that in one of, if not the, largest randomized placebo controlled experiment, anti-depressants were ineffective) and send patients on their way (hoping they make some friends before their next appointment) than to actually invest in 8 sessions with someone who can be more effective than medication and cheaper over the long run.

Yes nurse practitioners would be great for monitoring and treating chronic conditions, but the point is to change the behavior that led to the condition in the first place rather than just reacting like the rest of the health care system does.

Anyway, back to real estate.

Because the Medical Services Plan in British Columbia does not provide coverage for the services of Registered Psychologists or Registered Psychological Associates in private practice. They usually aren’t covered by employer plans either – counsellors are less expensive. Not saying psychologists don’t have value, but most people can’t pay for the service privately and, unlike a broken leg, you can suffer along for a long time without treatment or get access to medication through your doctor or a psychiatrist who are both covered.

I strongly agree we need more nurse practitioners. It has been proposed many times by many different groups as a measure to address what Leo’s post demonstrates about the failure of the system to reasonably meet the need for accessible health care.

ok Do nothing and pay the higher price later on. Good strategy.

Investing in commuties to attract new business and infrastructure is a good long term plan.

Not worth arguing with mr crash so let just end it.

gwac, I lived a quarter of my life in small town BC and I know for a fact you can’t just resurrect a town without a viable resource, and a market to sell it to. Ain’t too hard to grasp with declining fish stocks and lumber that sells on a competitive world market.

I thought you righties wanted less government and now they are supposed to be the savior and subsidize everyone ? Entrepreneurship and private capital drives real markets/businesses ICYMI, not temporary government intervention.

Horgan has done more in one year than Christy did in 3, which was nothing, along with uncovering the Liberal corruption machine. You need to quit drinking so much on the weekends trying to bury the past.

Hawk

I am not premier. When you take the job you need to find solutions to problems in the province. All of the province. Not sure how this is so hard for you to understand.

Gwacked, I said small town BC, not where you happen to own a second home and flog properties up island.

You can’t create jobs in lumber and fishing out of thin air. Tourism is seasonal and who goes to Shithole BC to see burning trees? Again tell us your master plan because you say nothing but BS.

I guess Horgan should be on the front line with a shovel too. Christy took weeks to show up to Mt Polley disaster.

Leo S or anyone, what exactly is the rule for listing a bedroom? I have seen storage rooms (no closet) listed as bedrooms, dens with a murphy bed, an unfinished basement and at one house, the third bedroom was actually a garden shed with a bed in it that wasn’t even connected to the house by anything more than a deck. And does the definition apply to buying and renting?

Andy 7, not sure what your training is but I’m a PhD in a health profession. the vast majority of run of the mill depression, anxiety etc are psychosocial not medical problems and should be dealt with not by MDs, NDs (?!), psychiatrists or nurse practitioners. Funny that psychologists who are the experts in these kinds of problems aren’t even in the equation.

“So, 4001 Hollydene sold for $100K less this year than last year. Anyone know why? Prices falling? They overpaid last year? Some problem with the house?”

Anyone who bought a house in Gordon Head in the spring of 2017 overpaid and will lose money. I remember many 70s teardowns selling between 900 to over a million for a short time frame. Some of this had to do with foreign buyers last year which hit close to 20% one month in early 2017 in Saanich as well as local speculators who were piling in. Any areas with the highest runups from pure speculation like Gordon Head are going to see the largest drops. I think the big price drops for that area have only just begun.

Thanks Leo great piece. The May 2008 peak seemed a bit longer and seemed to include my 2007 summer purchase, which I’m only happy paying my monthly costs now 10+ years later!

4001 Hollydene, is an amazing location but yes prices are falling and the owners were from Vancouver and maybe decided the declining market or sleepy Victoria wasn’t for them. It is an old house on a sloping lot that had some improvements in 2010. It was sold unconditionally the evening we went to see it, possibly to a developer who might be able to subdivide or do a better job renovating it then I was able to image. It had an asbestos disclosure, which made me think a developer bought it, but everything of that age should have a disclosure and buyers need to price it in to their decision making.

“Nice place in Golden Head/Arbutus at 3910 Rowley Road slashed twice now for a total of $128K to $1.36 million. Sitting on .29 of an acre too.”

Rowley, in my opinion, is an amazing property on a nice flat lot but has a home that has few redeeming features. “Nice” would not be a term I would use for it. I turned around within 5 feet of entering the basement suite and the listing agent is taking some literary liberties in the write up. They bought years ago and it seems to be rented by ghosts so they will do fine at whatever it sells for, which should be 999,999 in my opinion but there are few things for sale near cadboro bay so they will likely get a lot more than that!

“62 DOM

$891,000 Assessed

$849,888 Original ask

$699,888 New Ask

$738,000 Sold (pending)”

This one surprised me. I never saw the house in person, but from the pictures it didn’t look too bad. However, it did belong to an elderly person who lived there for 45 years, so maybe was not maintained. The price it sold for seems like it was a tear down since that is the assessed lot value. It will be interesting to see if it does get torn down.

So, 4001 Hollydene sold for $100K less this year than last year. Anyone know why? Prices falling? They overpaid last year? Some problem with the house?

I am familiar with the floor plans at the Promontory, and it looks like they left the wall out to form the second bedroom, even though it is listed as 2-bedroom. So, that price is for a one-bedroom (one could maybe say “with den area”). Also, I think the sq. footage listed include the balcony. E-value BC has only 720 sq.ft. listed. So, it’s still over $850 per sq.ft.

For comparison, #909 sold for $590K in November 2017, so not below that level yet.

Hawk

What are you talking about. I know small town Vancouver island very well. Spend over 60% of my time in one. Wtf are you talking about tech. I am talking about the numerous mill/fishing towns that are suffering because of the loss of the mills and closing of the fishing. These towns need to find their next growth. Tourism or whatever. Government t needs to help them. IE port Alice.

What nonsense are you going to spout from your Coushy oak bay condo now.

Hawk you have demonstrated over and over you have one selfish goal and that is to see a crash so you can buy a house. You do not care about anything but that.

Good video from Steve. Almost chuckling when he’s saying, this is so typical late cycle dynamics, it’s unreal. It’s not just housing – it’s inflation, wage growth, record low unemployment – all of these things are almost stereotypical indications of a cyclical rollover.

The only problem is unlike previous cycles, household debt has been pushed so high, the housing stretched to such an extreme, that some markets in Canada are going to face a reckoning. I don’t think Victoria is going to be exempted in that, either. Million dollar bungalows are ridiculous on its face; we’ve just acclimated to it and think that’s “normal”. Far from it. Funny, there are actually still people in Vancouver who don’t believe a correction is coming despite the growing abundance of evidence that it is, and the ease of accessing that information.

Personally, I believe that people in Victoria withdrawing their homes from the market now to get the “next leg up” are making a mistake, possibly a big one. But history as well as poll-research says, that’s precisely what a lot of them will do.

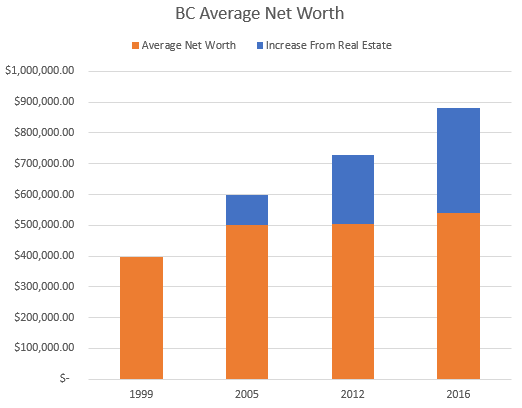

The problem I have with discussing net worth in such general terms is that one is mixing-and-matching liquid and non-liquid assets in one group. Having a net worth of $1 million on paper in real estate is not the same as having $1 million in local trading currency like Canadian dollars.

https://www.investopedia.com/ask/answers/032715/what-items-are-considered-liquid-assets.asp

So cash of course is king and next are easily sold assets including stocks, bonds & mutual funds. Non-liquid assets can be very difficult to sell and quickly convert to currency. In this class of assets are land and real estate investments.

So that person who may have a net worth of $1.05 million might really only have 2 cents to his/her name in hard currency. It all depends on the asset classes owned.

@ Bitterbear

Not sure I’d say anxiety, depression, sleeplessness and intractable pain are necessarily mental/behavioral health issues; there’s often a root cause there that has nothing to do with mental health.

It’s a shame MDs and NDs don’t work together in clinics here; our medical system would likely be a lot healthier for it. Not to mention hiring and training more nurse practitioners. But I digress…

There was a study done some years ago that showed roughly 70% of GP visits were for mental or behavioral health reasons (anxiety, depression, sleeplessness, intractable pain, smoking, ETOH, diet). Primary mental health care is being trialled in lots of places.

Didn’t find it much better in Alberta. Yes I had a family physician but darned if I could ever get in to see her. Generally booked up at least 3 weeks in advance. Walk-in hours were just 3-4 hrs in the evening provided 1) not a holiday 2) not a weekend 3) some other excuse.

Needs to be a hard look at how medical services are provided as there are inefficiencies and deficiencies everywhere. I’m not sure that will happen anytime soon anywhere.

Please explain with economic numbers gwac. Did you miss the tech expansion the past 15 years? How are small blue collar towns supposed turn into tech meccas? You’re talking gibberish and don’t get small town BC at all.

Leo, both hospitals at capacity right now.

Gotta love our screwed up medical system.

Hawk

NDP allowed the export of raw logs which started the death spiral of the mills on the island. Catalyst is on is last legs in Crofton.

If logs and mills are not the future han it’s time for the government whether is NDP or liberal to spend money and time in helping these communities transform into their next stage after forest. Spend money now and help the transformation or spend a lot more on social and policing later. Simple.

Horgan vacationed last week in a struggling former mill town so hopefully he can witness the struggles and help. He spent time talking to local business owners which is a good thing. Give him credit for that.

Trouble in Hong Kong, who woulda thought.

Homebuyers getting cold feet in Hong Kong’s property market amid growing uncertainties

Buyers are starting to have second thoughts on flats, which some analysts say could signal a turn of sentiment in a market that has become used to ever-rising prices, cheap loans and stiff competition for tight supply

Some buyers are so edgy about the Hong Kong property market that they are pulling out of deals, despite losing big deposits.

https://www.scmp.com/business/article/2160103/homebuyers-getting-cold-feet-hong-kongs-property-market-amid-growing

Numbers,

As per your handle, if the numbers don’t add up, then you go broke, basic business math. It’s obvious if the prices and market was feasible the plant would be up and running ages ago. You can’t just make a plant economic for a few hundred jobs.

Imagine every other mill town in BC demanding the government/tax payers subsidize their mills who can’t compete due to low prices and lose multi-millions. I think that’s called communism.

Sobriety:

https://www.youtube.com/watch?v=QGtMff5kyZQ

Right on point – late cycle, BC RE slowing, FX flows drying up, global RE slow down and rate hikes continuing. Victoria activity down 19%. Buyer beware – late cycle tops never turn back up. Many here believe that Victoria is so “special” that macro factors don’t apply – markets are far more interconnected now than at any time in history.

@GWAC @Hawk

Investing in communities has always had a bigger bang than in capital assets. Like investing in people in a company. In business, I am as right leaning as they come, but Gwac is absolutely right. Here is the caveat:

1/ where else do you find a fully functional cellulose acetate plant? To build a new one it would be $200 to $300MM

2/ this stuff goes into clothes, why the hell is not marked like Roots Canada? Or Canada Goose?

3/ Why not build down-stream items so that it isn’t a one trick pony?

It’s like you have a mid century house that only needs some lipstick and elbow grease before it is a beauty…our society is so PI and all about finger pointing, it makes me sick. Where is the vision in government anymore?

Sure gwac, tell that to every other small mill town in BC the last 15 years that has died and your BC Libs did zero. Now the NDP has to clean up their mess again just like last time.

Housing promises ? They’ve began many projects. Do you read ? What did the Libs do ? Sweet FA but create the housing crisis letting the money launderers run wild with zero recourse. Corruption has its price and now we’re finding out in spades.

The BC casino story is not going away anytime soon either. Perverted rich guys allowed to do what they want with no recourse. How conservative to try and bury it.

B.C.’s gaming regulator investigating ‘deeply concerning allegations’ of sex assault, harassment at River Rock Casino

https://globalnews.ca/news/4394252/bc-gaming-investigating-allegations-sex-assault-harassment/

Hawk.

Right or left when communities are struggling. The government needs to be there. It will cost of hell of lot more in social programs later than actually doing something now. Spend some now to gain later on.

Not a lot of voters there so I doubt we will see anything. Bitter bang for the NDP are Victoria and Vancouver and all the BS housing promises.

Nice place in Golden Head/Arbutus at 3910 Rowley Road slashed twice now for a total of $128K to $1.36 million. Sitting on .29 of an acre too.

High end townhome in Golden Head/Arbutus slashed $150K to $1.05 million.

Another Songhees condo, 83 Saghalie Rd , #809 slashed $56K to $619K.

Lots of others out there in all the prime hoods.

If you read the article the mill can’t compete as the price of the cellulose dropped back in 2015 and is why it closed on top of the competition.

One trick ponies in small towns are at the mercy of the markets. I’m surprised gwac the righty wants subsidies for jobs, that’s so lefty.

As well only 20 people a day use the arena. Do the math with the high costs of running gwac once pointed out. Probably needs a safety upgrade too.

Hopefully the town gets back up and running but blaming Horgan is typical corrupt BC Liberal bullshit. Where was Christy and Campbell all those years ?

“Fulida ran into a perfect storm almost immediately: prices for Neucel’s sulfite pulp fell as kraft mills converted to make the same product; oil and chemical costs shot up; the loonie flirted with par, bad news for a company that sells its product in U.S. dollars but pays its bills in Canadian.”

Numbers it’s about potitcal perception and not truly helping. All parties do this. Biggest bang for the buck in votes.

What is happening to Port Alice is disgraceful. Closing the

Arena in a small community is very sad. That town needs help. Now that the premier is done his vacation last week maybe he can find a way to really help this community.

He spent last week vacationing in a small town on the island while the province burns. Everyone deserves a vacation but in the

Middle of a declared emergency I question his choice and priority.

Why don’t/can’t we repopulate once vibrant parts of our economy?

BC’s rural population keeps on getting hollowed up because of holier than god socialist bent! Arguing over1$MM RE over lattes whilst Port Alice is going to loose it’s social fabric over 1$MM in unpaid taxes?

Where’s the money for Cities like Port Alice/Port Hardy/Port McNeil?

Government spending billions of housing when they could have an equal focus on re-vigorate sectors in our economy, provide good jobs and alleviate cities like Vic/Van when people can stay in their home towns and work/raise a family.

Example in point, Neucel, great company, great products, have a market…but wait, no fiber to feed the mill. OMG. What a shame. 400 jobs and likely as many families affected.

That’s who I feel for, and people who deserve our attention and investment. Stable jobs = stable homes = stable environment = less social problems of all kinds.

Now back to your regular programming.

https://www.timescolonist.com/news/local/jack-knox-an-unpaid-tax-bill-brings-big-headaches-for-port-alice-1.23404760

That’s a good resource. Another one you can use in conjunction is REW.ca/insights

That will sometimes provide sales records a bit further back than BCA does. And that’s where the meat is – $4,000,000 price drops are fun to hear about, but it’s how much the seller is gaining or losing that really matters. You could have a 50k price drop where the seller is losing much more than in the 4000k drop.

Opengovca.com is another info resource.

Mathew:

Thanks, interesting site for price drops that may well get more interesting as the year wears on. Did a fast scan and most of the drops were pretty trivial. But it should make Hawks job easier.

Does anyone know what 2406 Fleetwood Crt, Victoria, V9B 5X3 listed at and sold for?

Thanks

A couple of things. An average net worth of $1.05 mil doesn’t mean the “average household” has net worth of $1.05 mil, because wealth is skewed. That is, there are a lot more households with net worth under $1.05 mil than above.

Second, the net worth isn’t in cash or liquid securities. The more you get away from the truly wealthy, the more that net worth is in the family house. Sure they can buy a house – by selling the one they have now. Big deal.

I didn’t know about this web site until Dan’s Youtube channel called “FORMAFIST” pointed it out. The site is called “Point2homes.com” and it has a filter (near the top left of the site) that enables the reader to see recent “price drops”. Very interesting. Here’s the link:

https://www.point2homes.com/CA/Real-Estate-Listings.html?location=Victoria%2C+BC&search_mode=location&CheckboxPriceDrop=on&page=1&sort_by=DESC_price&SelectedView=listings&LocationGeoId=735634&location_changed=&ajax=1

@ Introvert

These ones are for you 😉

I know, I know, Victoria is different…

Vancouver West… aka one of most desirable/expensive areas to live in Van.

Single family homes:

1243 64th W, Vancouver

Assessed: 1,951,700

Listed: $1,980,000

Sold: 1,400,000

1827 2nd Ave

Assessed: 2,057,000

Listed: 1.6M

Sold: 1.4M

2334 Stephens St

Assessed: 1,943,000

Listed: 1,960,000

Sold: 1,700,000

@ Patrick

As you alluded to, that’s deceptive logic though. Yes, it’s true if say you bought back in Victoria when homes were $100,000. You’d likely own your house outright and be sitting on 1M+. Even if you bought 10 years ago you’d be well on your way. But if someone bought in the last few years for example, a house for 1M and they put 10% down, the banks are the millionaires, not the owners. And let’s not forget all the people that pulled money out of their homes via HELOCs… that’s a whole other can of worms… I believe Steve Saretsky has some interesting stats on that one.

Rook:

Great Chart, scary where Canadian house prices stand.

We all thought Leo was good at graphs.

https://www.economist.com/graphic-detail/2018/08/09/global-house-price-index

I’m not saying millions of people actually desire moving to Victoria, but many people can’t afford what they desire. Cue my Honda/BMW analogy.

And by buying an investment property, Leo would be helping to kickstart the next upswing 🙂

Yes, and we have a disproportionate number of well-paying, hard-to-lose union jobs (e.g., BC gov, federal gov, military, all the municipalities, BC Ferries, UVic).

No doubt Leo became this way from reading my posts for seven years or so.

I’m sure we’re outliers, but my partner and I moved from Calgary to Victoria after university because we specifically wanted to live in Victoria and have a family here; we had no jobs lined up and quite poor prospects in our field. Luckily for us, things have worked out.

Based on comments here, it seems like there are so many people waiting in the wings to buy a house in Victoria. If prices drop enough for these folks to buy, the act of them all buying will start the next upswing in prices.

People always forget this.

That million is only 758,000 in US dollars. A bit less impressive.

Leo,

Try this out at your next Victoria cocktail party. Ask people “Do you know that the average Victoria household is a millionaire household, with a net worth of over million dollars?”

I’ve tried that today on a few friends, and they all said “what? That’s incredible, How can that be?” .

The answer is yes according to Environics 2016 survey. To me, that’s an amazing stat.

We are used to reading things like to “the average Canadian only has savings to last for two months” or similar. Or, if interest rates rise 2%, house prices are screwed. And then someone (Environics) does data like this for all major cities in Canada, and shows that Victoria average household has $1.05 million net worth. Enough to buy a house for cash. Wow!

Anyway, I don’t want to argue it with you.

But I would love to see you write a column about it “Myth or Reality: the average Victoria household is a net worth millionaire.”

Subjecting this statement to your usual rigorous analysis will show us how much of this can be explained by house price rises ( e.g. if the average house is $800,000 and only 62% of people own houses, if this 62% had bought those houses for $0 that would still only account for about 0.62x800k=500K per household. But they didn’t buy for $0, so house prices are less than 500k of that $1 million.

I’ll drop into the shadows for awhile, and want to thank you again for the great site you have here, and look forward to your future thought provoking articles .

I’m always a fan of looking at the history of RE markets to make my arguments, but that was just beautiful. Ha! Love it.

I think a less “safe” way of putting that is, net worth tied to inflated house prices is inherently insecure. Net worth of the home owner population always drops in a housing downturn. In a major housing correction or cash, net worth can be absolutely destroyed. In some cases, for life. I find the argument of “the housing market will be fine/debt matters less because of high net worth in RE”, to be just goofy when considered against history. A RE market is not immune from a significant correction because its houses are too expensive to correct significantly – which is essentially what the argument is.

Huh? Of course it’s correlated. House prices went up and increased net worth. That was the point of the chart I posted.

Also you will note that patriotz said it says nothing about house price stability. Not house prices.

Sir, According to the evidence from antiquity, the main cause of excessive house prices is the substantial increase in the money supply due to high leverage and quantitative easing, rather than a dearth of construction.

Suetonius, in The Twelve Caesars, describes how the emperor Augustus, bringing the treasure belonging to the kings of Egypt to Rome in his Alexandrian triumph, “made money so plentiful, that interest rates fell, and the price of land rose considerably”.

Leo: Also it doesn’t matter if the average net worth is $800k or $1M or $1.2M as patriotz pointed out. None of the figures say anything about house prices.

=======

Obviously (to me anyway) net worth of average buyers has an influence on house prices. Just like annual income has an influence. Your only supplied supporting evidence for this strange claim is that “patriotz pointed it out”. Do you have any actual data to support that average Victoria family net worth is not correlated to house prices, or is it just because patriotz says so?

Because stats Canada has substantially different data for the same cities for the same year as I pointed out.

No I didn’t, completely different claim. The point there is that the high net worth is mostly due to real estate appreciation, not because the population is otherwise wealthier.

Also it doesn’t matter if the average net worth is $800k or $1M or $1.2M as patriotz pointed out. None of the figures say anything about house prices

Leo,

You post comments on Environics data for Victoria showing VICTORIA net worth to be $1.05 million, and express some skepticism with this statement “But I don’t doubt we are somewhere in the vicinity of $800k-$1M” which doesn’t even include the possibility that they are correct with $1.05 million not being in your possible range.

Worse, you then show a graph of BC net worth to support your claim. Obviously BC net worth per capita isn’t the same as Victoria.

The Environics number is from 2016. Prices and stock markets are up since then, so I’d assume that the numbers are HIGHER than $1.05 million, not lower.

Also, since only 62% of Victorians are house owners, and so much if the gain has been from housing, one would expect the average and median net worth of HOUSE OWNERS, would be much higher than the Environics data of all families.

And the increase in net worth has been driven almost entirely by real estate.

https://househuntvictoria.ca/2018/04/12/economy-on-fire-net-worth/

Seems to me the interesting thing about these stats is the discrepancy, as far as I can make it, between average (much higher) and median. Usually, such a difference is indicative of a community where wealth is not at all evenly distributed. Indeed, some scholars take the difference between mean and median as a measurement of inequality.

Yeah, the stat was from environics Wealthscape Report. Specific stat for 2017 median not sure but for BC the median in 2016 was 430k. I’d say Victoria is above median most likely and it has gone up in the last couple years.

https://www.cbc.ca/news/business/statistics-canada-family-income-survey-1.4437137

Interesting. 20% different than the statistics Canada data which puts average 2016 net worth at $1M for Vancouver not $1.2.

But I don’t doubt we are somewhere in the vicinity of $800k-$1M

The average net worth in Vancouver West Side is undoubtedly higher than that, yet we are seeing documented price declines for SFH in that area. So I don’t see what high average net worth has to do with RE price stability.

Leo: Source? Average net worth in Vancouver is $1M. Can’t find the statistics for Victoria

One source is Environics 2016 survey…. Victoria is 3rd in Canada at $1.05 million average family net worth.

https://www.huffingtonpost.ca/2017/09/05/millionaire-cities-abound-in-canada-as-household-wealth-hits-record-high_a_23197541/

“Canadians’ wealth grew to the highest levels on record in 2016, pushed forward by rising house prices and a solid performance by the stock market.

According to the latest edition of the Wealthscapes survey from Environics Analytics, four cities are now in the “millionaire club” — places where the average household net worth is above $1 million.

Vancouver, Toronto, Victoria and Calgary, in that order, all have an average net worth above $1 million. Prior to the 2016 data, only Vancouver had been in that club.”

Source? Average net worth in Vancouver is $1M. Can’t find the statistics for Victoria

The average net worth in Victoria is over one million dollars. The median is about half that I believe.

I believe a HELOC is counted as a second mortgage – not sure about it in that article.

You need to have equity and ability to repay to get a mortgage of any kind. Just because people borrow doesn’t make it high risk. Consumer debt is higher risk generally. Depends what the money is used for as to whether it becomes good debt or bad debt.

If it is 1 in 10 in Victoria, that would actually be very significant. It could actually be even higher here, for two reasons.

For instance, that 1 in 10 number sounds like it’s aggregated nationally, not market by market. If you chopped out all of them except the top 3, it would probably be a lot higher than 1 in 10. It’s a bit like extracting the average national house price, but then doing so again without including Toronto or Vancouver. Big difference.

I’d also guess that these numbers are under-reported as well, if they don’t take into account loans from alt lenders.

In any case, I think that’s way, way too much of the population that was looking to expose themselves to the upside. Leverage is a potent amplifier on the way up, just as it is on the way down.

Canada’s inflation hit the 3 per cent mark for the first time since 2011 in July, an unexpected surge that puts pressure on the Bank of Canada to accelerate interest-rate increases.

The consumer price index recorded an annual pace of 3 per cent, quickening from 2.5 per cent a month earlier, Statistics Canada said Friday from Ottawa. Economists expected the inflation rate to remain unchanged.

September 5, 2018 – what say you? Hike or pass? I think they will pass in September but will hike on October 24, 2018. The dates are:

Wednesday, September 5.

Wednesday, October 24

Wednesday, December 5.

Localfool: If that’s a positive for this market, even in relative terms, I can’t see it.

======

I’m with LocalFool on this multiple-mortgage article. The data presented is absolute numbers, so naturally big cities like Toronto show high numbers. It looks like Victoria has 1,200 or so new multiple mortgages issued, compared to 1,000 the year before. Those are still small numbers to me, and a small fraction of all mortgages, so hard to make a case for anything from that IMO.

Deb, September 5 is when the BoC make their next announcement, followed by Dec 5.

I just heard the inflation rate is up so how long before interest rates go up again? More pressure on mortgages and home prices.

If I understand the numbers properly, not sure I can agree with your conclusion.

The numbers in that BD article are raw numbers – you can’t compare this city to Toronto or Vancouver on that basis. I’d be more interested in knowing the per-capita number if there was one, but I don’t see it in the article. We can roughly extrapolate, though.

For instance, Victoria 2016 CMA has a population of about 367,000 people, while Vancouver has 2,463,431. Toronto has nearly 6 million. Just a back of the envelope calculation using these numbers would indicate that the proportion of each member of the CMA holding multiple mortgages is:

Toronto: 0.0047%

Vancouver: 0.0051%

Victoria: 0.004%

Not precise as I am measuring multiple mortgages against each person in the entire CMA, but household size would presumably be comparable in each. And when we look you can see that Victoria is, mathematically speaking, almost the same as the other two, with Vancouver the worst of the three.

If that is correct, then we have comparable rates of multiple mortgages as the other two, among the fastest rate of growth of it in the country, and among the highest prices. If that’s a positive for this market, even in relative terms, I can’t see it.

I wonder if these are including all the private lender mortgages for those with bad credit or can’t cut the stress test ?

These stats seem to be a positive signal for Victoria actually. Some of the highest house prices and some of the lowest rates of multiple mortgages.

This is quite different than the stat on percentage of highly indebted borrowers, which showed Victoria up high along with other high priced markets.

This is strange…I thought Victoria was all cash buyers coming from all over Canada to live in the most desirable city in the world? Why would there be a 20% increase from 2017 in multiple mortgages issued in 2018 so far? Were first time buyers removed from the market the last year or two and replaced by multiple mortgage holders taking out HELOCs to purchase? And is the real estate ponzi in Canada, including Victoria, about to collapse? Nah, its different this time.

“Over 1 In 10 Mortgages Issued In Canada Are On An Already Mortgaged Home”

https://betterdwelling.com/over-1-in-10-mortgages-issued-in-canada-are-on-an-already-mortgaged-home/

if prices crash that generally means demand has been reduced as well. The point is not that prices can never stall or fall in Victoria, the point made was that you don’t need to have caravans of people moving to Victoria to have demand.

Demand is the combination of desire to and ability to purchase. Desire to buy is made up of a whole bunch of factors including family ties, employment, weather, economic conditions, alternative housing availability, population growth, and belief that it is a good investment. Ability to buy is affected by credit rating, debt, income, assets including home equity, housing stock, competition, and availability and terms of credit.

When markets fall or stall consumer confidence does as well and some people want to wait for a better deal on the way down. Changes in any of the factors that affect housing can impact demand and that is why the market is so difficult to predict. When you have more demand than supply prices appreciate over time.

Ross Kay

@rosskay

12 hours ago

#VanRE (talking city of) has had a staggering $87,000,000 discounts applied to July 30th and older Listings in the first 14 days of August. This is record but again silence from organized real estate. #HomeBuyerBeware

Agreed patriotz. The minority have the pleasure of working from home as most want you inside the company bubble for max productivity for those big bucks.

Canada rates definitely headed up from here. This is two strong months in a row. Buckle up.

Inflation rises in July

Statistics Canada says the Consumer Price Index went up 3.0 per cent in July following a 2.5 increase in June.

I know government towns tend to have stable employment, but not that stable. 🙂

That’s true of the core of every city that isn’t a dump like Detroit. Hasn’t stopped crashes in Seattle or Toronto. Not to mention Hong Kong.

The exceptions in IT are the people who can work remotely. The majority of jobs require on-site work. Now if you do something like web design, there’s a good chance you can do it remotely with the odd visit, but that’s only a slice of the industry. They pay people big $$$ to work in places like Silicon Valley for a reason.

DOH didn’t even read the name. That’s what happens when one is distracted…. squirrel!

Renter, I think Cynic was living up to her/his name….

You are looking at “stock”, I am looking at “flow”. TC reports that the unemployment rate for Victoria has been 3.8% since 2008.

https://www.timescolonist.com/news/local/greater-victoria-s-unemployment-rate-is-lowest-in-canada-1.14530962

“It was even lower earlier in 2008 when it stood at 2.8 per cent in May. Unemployment started climbing after the recession hit that year”.

“B.C. continues to have the lowest unemployment rate of all provinces at 5.4 per cent, although it was up from 5.1 per cent in February, Statistics Canada said in its monthly labour market report released today. The national rate is 6.7 per cent”.

Hmmmm….. that’s actually -13.2% from original ask and -17.2% from assessed. Pretty hefty reductions from ask & assessed. The new ask was a game by the realtor/seller to get some sort of momentum going for a sale. Not what I’d call “on fire”

$1098k

1710 Carnegie

Gordon Head Area

62 DOM

$891,000 Assessed

$849,888 Original ask

$699,888 New Ask

$738,000 Sold (pending)

That’s 5% over ask! And probably had a bidding war. Market is still on fire.

Interesting circumstance in Oz – a Chinese developer is being told by the Chinese government to divest its holdings in overseas property investments, including a $600 million dollar apartment project.

This has been happening on a large scale with numerous other Chinese developers. They aren’t kidding – really trying hard to rake all that outflow back in. They better IMO, if they want to keep their economy intact, especially in light of new pressures from the west.

https://www.afr.com/real-estate/chinese-government-pushes-developer-to-sell-out-sydney-project-20180814-h13y6c

Also an amusing seller dynamic from Vancouver: some of you may recall this listing at 7299 Marguerite Street, which initially asked $4,888,888. No takers. They then pulled the listing, got a new MLS, dropped the price to $4,768,000 and offered to throw in a “free” Tesla with the purchase of the home.

Apparently that didn’t work, so they pulled the listing, and later dropped it to $4,480,000 plus the Tesla, and again, no takers.

Now they’re asking $3,998,000. But apparently, the Tesla is no longer being offered. Gives you perspective. Did you miss out? Well, assuming it even sells for current asking, had someone gone for the “Oh, a free Tesla” gimmick, they would have, in effect, paid over $770,000 for the car. “Free”, my aunt’s hat. Perhaps it was sold to partly cover losses?

https://www.zolo.ca/vancouver-real-estate/7299-marguerite-street

Ummm…

You don’t need caravans. You just need more demand than supply and in the core that is what you have. Limited land base and zoning restrictions are part of this.

Desirability is not just about weather.

Table 14-10-0095-01 Labour force characteristics by census metropolitan area, three-month moving average, unadjusted for seasonality. 15 years and over.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410009501

Victoria May 2008: 2.6%

LF, those are some strong arguments and interesting perspectives. Cheers.

Does anyone know what 4001 Hollydene Pl sold for (just recently, not the Oct 2017 sale)?

There’re always exceptions. A big part of the reason I moved here was weather, but it was compatibility with jobs first (which was my point). I work from home myself. I can work anywhere with an internet connection, but my wife needs to be a reasonable commuting distance to a largish hospital for her work. I’m not sure what % of people can up and move for reasons like beauty and weather, but I figured it was small. I doubt it “moves the needle” for RE.

Evidence seems to say this is true. When RE gains are in doubt digits it makes me uneasy about timing, personally. Houses shouldn’t be making more than people. That trend is inherently unstable.

Everyone’s varying definition of desirability makes it hard to debate. When someone considers Victoria vs some other location, the desirability of those locations is complex and entirely subjective. Career, friends and family rank high and various aspects of perceived lifestyle. What I was initially trying to point out is that the idea that Victoria can rise forever “because it’s so desirable” is wrong. We don’t caravans of home buyers showing up because it’s warm here.

Patriotz: If you borrowed both interest rate increases and price declines (the latter limiting your options at mortgage renewal) will affect you materially.

———

So take out a 10 year mortgage. If you don’t, and interest rates rise, that would affect you more than price declines – affecting mortgage renewals and future mortgage payments. If you’re not planning to sell, you should be more concerned with rising interest rates than falling house prices.

If you’re not planning on selling for at least 10 years, which of these would you like to see happen in 5 years time. Assume you have a 5 year mortgage and want to renew a 5 year mortgage

A.- prices are flat, but interest rates for renewal are 8%

Or

B.- prices are down 15%, but rates are 4%.

Option A has you paying 4% per year more in interest so that would be 20% down the drain after 5 years. So that’s worse than house prices being down 15%.

As I noted, that’s the data you were pointing to. I was unable to find any stats broken down by both age group and city, e.g. millennials in Victoria. How about you?

Patriotz,

At least we’re making progress. You’ve gone from stating “There is no Stats Canada data on “life satisfaction of millennials“ to now quoting stats Canada data on life satisfaction which supposedly doesn’t exist. The data you point to isn’t making reference to age groups like millennials, so I’m not sure what your point is.

Anyway, think what you want about millennials life satisfaction in Victoria or beyond.

“Things were going well in [2008] Victoria with the spring real estate market in full swing and the economy doing well with a record low unemployment rate of 2.6%.”

That is not correct. In 2008, the unemployment rate in Victoria, BC, was 3.8%. Currently, Victoria is said to have the lowest unemployment rate in Canada at 3.9% [tied with Quebec City].

That is not indicated by your reference (corrected links below).

https://www150.statcan.gc.ca/n1/pub/82-625-x/2017001/article/54862-eng.htm

https://www150.statcan.gc.ca/n1/pub/11-626-x/11-626-x2015046-eng.htm

Funny how one’s perspective can view a market so differently. I’ve been watching sub-$1 million for a few years now. I saw a tremendous amount of flipping going on with properties I’d tagged & watched. Even beat out by flippers for a couple houses as I wouldn’t go crazy in my offer. Then there are the speculators who had no issue offering $100k or more over ask with no subject-to’s and pushed those properties into the rental market. I’ve enjoyed watching some of those go on and off the rental market and know that that speculator is out of pocket every month. Now I realize that what I’ve seen does not comprise the entire market but the froth certainly contributed significantly to the FOMO. I think the argument to be made that the biggest factor in the run up not counting low interest rates was the FOMO. Fear of not getting into a house. Fear of not raking in an easy-peasy $100k. Just plain fear.

It’s a rising market that motivates people to buy.

))) patriotz:. There is no Stats Canada data on “life satisfaction of millennials”. Rather, as you quoted yourself, they took a bunch of stats which they believed were relevant to “life satisfaction”, cooked up a formula, and produced a ranking from that.

You’re wrong. Stats can does track “life satisfaction” as a numerical number, as part of the “Canadian community health survey” that it does. And that’s the data they used, not cooking something up as alleged by you. The article I quoted used 9 data categories from stats Canada, and they show you the exact rankings in each category. The only time they have any influence is when they sum them up to make an overall winner for “best place to live for millennial as- where Victoria was #2 and Quebec City was #1. But you should note that I didn’t refer to that overall score in my post, I just referred to stats Canada ranking based on data from their surveys.

And those stats Canada rankings show that out of 65 Canadian cities. Victoria is

#2 highest % of millennial living here as % of population (27%). Ottawa has 20% millennial s for example)

#1 climate

#1 life satisfaction. (based on stats can survey lcanadian community health)

#61 (bad) house prices

You can see all the rankings here, https://www.point2homes.com/news/canada-real-estate/millennial-cities-ranked.html

Here is the reference to the stats can life satisfaction survey

https://www150.statcan.gc.ca/n1/pub/82-625-x/2017001/article/54862-eng.htm

CharlieDontSurf,

BC is currently leading in the national declines, by far.

Fraser Valley is taking a major pounding, with Vancouver right behind it. Victoria is a somewhat distant 3rd on the list, but still far higher than almost anywhere else. Funny, it’s just like what’s been said here over and over – the markets that experience the greatest run ups, will have the greatest reversals. Now you get a better than front row seat.

Then the Fraser Valley must have been the most desirable area in the country, along with Vancouver – certainly Victoria wasn’t even close, if the price run ups are any measure of desirability. What’s happened then? Judging by the precipitous drop in sales on the mainland, both are suddenly even less desirable than a smallish, isolated city with a limited economy.

Like LeoS says, the cherry blossoms are the same color. The mountains are just as tall. The greenery is just as green and the water is just as blue. Yet…no one wants the RE there now. Is it to do with people simply desiring the area, and then suddenly, apparently randomly…not desiring the area? Or were people desiring something that was providing yield beyond all reason?

Ouch ! US market slashing as well.

Housing tipping back to a buyer’s market as sellers cut prices

https://www.cnbc.com/2018/08/16/housing-tipping-back-to-a-buyers-market-as-sellers-cut-prices.html

gwac, I guess you missed economics class among others. Emerging market contagion could be very ugly for all. Saudis are just the beginning and how major financial crisis’s start.

‘Full-blown’ capital controls in Turkey could spark emerging market contagion, Goldman Sachs analyst says

https://www.cnbc.com/2018/08/16/turkey-lira-crisis-goldman-sachs-warns-emerging-market-contagion-could-follow-capital-controls.html

Victoria does have high desirability as reflected by the increase in prices. Josh is correct that employment opportunity is high on the list but it is interesting that his argument is shaded by his own situation.

I think there is an argument to be made that the single biggest factor in the run up of house prices in Victoria, particularly in desirable areas (with low interest rates being the second factor) is the number of people moving here to retire especially from Vancouver.

The job market is not a factor and most cases neither are interest rates when you are paying cash. House prices and weather move up the list and general livability of the city.

Proximity to family and friends remains high on the list for most people which is a reason that retirees from Vancouver probably see Victoria as much more desirable than people from Toronto. Moving down the list the factors become more varied and intangible.

Personally I thought that house prices were a bit high in terms of value and I bought five years ago. Now they are bordering on the ridiculous. I could also say that the city is less desirable now than it was five years ago but that is only my personal tastes and experiences in Victoria.

Data from myrealtycheck.ca

Up to and including August 15th

Overall change -183M, on pace for -350M for the month of August. The most I have seen for a monthly drop over the past couple years has been 240M.

Data from Zolo for the period between Jul 16-Aug 13, YoY change in sales, SFH only

Van -47%

W Van -54%

N Van -69%

Richmond -56%

Burnaby -67%

Langley -61%

White Rock -79%

This decline in sales has been consistently this bad throughout the year and last year. These markets are dead.

It’s only “so what” if you paid cash. If you borrowed both interest rate increases and price declines (the latter limiting your options at mortgage renewal) will affect you materially.

There is no Stats Canada data on “life satisfaction of millennials”. Rather, as you quoted yourself, they took a bunch of stats which they believed were relevant to “life satisfaction”, cooked up a formula, and produced a ranking from that.

Re: New Zealand foreign buyer ban

These are some quotes on the Independent website from New Zealand finance minister David Parker:

He said it was the birthright of New Zealanders to buy homes at a fair price. “This government believes that New Zealanders should not be outbid by wealthier foreign buyers,” Mr Parker said.

“Whether it’s a beautiful lakeside or oceanfront estate, or a modest suburban house, this law ensures that the market for our homes is set in New Zealand, not on the international market.”

I don’t think the lakeside or oceanfront is really a big deal. But the modest suburban house price should definitely be linked to local incomes.

I do think the concept of birthright applies, to a certain extent. There is a spiritual connection when one is on the land they grew up on. I know it’s not very practical in modern day. I mean, you can’t give everyone born in Victoria their own building lot (probably not even for a “tiny home”).

However, I don’t think people born in a nice city should be effectively driven out by global multi-millionaires either. An outright ban on foreign buyers is likely taking it too far, with some unintended consequences.

I was born in Saskatchewan, so I could easily return to my homeland if I wanted to. No competition there. Unfortunately the spiritual connection is weakened in minus 30 weather or after a dozen mosquito bites in an evening.

@josh

Totally disagree. I moved here because it’s a gorgeous place, the culture suits my lifestyle and the climate is pretty much the best you can get in Canada. We left family and friends behind.. we’ll make new friends and family are already planning their trips out. Now maybe I’m a unicorn in that I have a profession where I can work remotely and live where I please. But based on other posts of yours Josh you should know IT allows this kind of lifestyle. More and more are doing it all the time – my decision has a former co-worker (who loves the island and told me he’s jealous of our move) seriously talking with his wife about a move. Overall it’s true that when you’re still paid a salary where you have a job is one of if not the most important criteria of where you live. But desirability is HUGE for those who are motivated to move and find work, or can work remotely, or no longer need to work.

Yeah. The difference between a 20% tax and a complete ban is purely cosmetic. We already have too many political thumbs on the scales right now to know what we are actually achieving with affordability. It will take a while for the dust to settle.

Any further taxes or bans are just political posturing at this point. The govt has to start actually building below-market rentals or, as Totoro says, start promoting more co-op housing.

@Patrick – If we had followed your advice in post 47571 around 2004 when we first could have afforded to buy a house and if we had bought on the higher end of what we could have afforded, our net worth would now be around $700K higher. However, I really doubt that the next 15 years will yield the same result. Still, I would guess that barring an earthquake, long-term prices will still go up.

I agree. Victoria is a great market with a lot of potential. It’ll be my pleasure to buy in it, when the time is right. Indeed, not right now.

Then, one day, newer folks will come along and start the same arguments all over again – and will be completely undeterred that it’s all been said before. You thought it might be different this time? Wait till you see what posterity says, it’ll be different that time too! We really do never learn. 😛

You ladies out there ever heard the saying:

“By the time a woman realizes her mother was right, she’s got a daughter who thinks she’s wrong.”

I always find that one funny, so true and to our nature.

Don’t agree. They’ve been having the same sales drop-offs there as Oz, here, and everywhere else. Too many variables at play to draw any conclusion as to what forces or measures are having or not having a particular impact. Also several holes in there due to existing trade agreements.

Will be interesting to see what happens in New Zealand. Kind of the acid test as to how much impact foreign buying really has .

Weaver pushing for similar action in BC but I tend to think it’s better to collect a 20% tax and pour the money into affordable housing than ban it outright.

http://www.cbc.ca/news/canada/british-columbia/bc-foreign-homebuyers-1.4787079

Leo welcome to the dark side. Lol

All valid points that I agree with. All moot if you don’t have a job here.

What can I say, I’m bullish on the region long term. Just not right now.

Just for fun, today’s top loss in VanRE is…

3595 Puget Dr, Vancouver

Bought in Nov 2016 for $3,500,000.

Attempted sale at $2,999,999, no takers, relisted for $2,750,000

Just sold for $2,600,000 for a total loss of $900,000 + carrying and offloading costs

Great post. In 2008 as I recall there were a lot of trades out of work as projects came to standstill.

Some, such as Colwood Corners haven’t started up after 10 years.

We bought 2 years ago. We’re thinking of another move in the future and want to know the market inside and out over a longer period. Reading this blog twice a month keeps us up to speed.

Hawk I said last week nobody would care about the Saudi thing. Guess what nobody does anymore. Previous to that I said no one cared about the casino thing. Guess what nobody does. This week it’s Turkey.

Next week no one will care about that 2 bit country Turkey.

+5

Leo, I had no luck when I threatened TD. They would not even give me a break on the penalty if I renewed again with them. Paid the penalty and took my business elsewhere. Got $1000 cash back and locked into a 5 year fixed at 2.69% (this was last summer). I was at 3.59% so I kept the same bi-weekly payment and knocked about 3 years off the amortization. Yes I know that variable is almost always better, but I would spend too much time worrying, not worth the possible savings to me.