Musings on Future Affordability

Last time we examined the pattern of affordability for single family houses in Victoria. It seems that the long term trend of deteriorating affordability for single family houses is overlaid with a regular pattern of affordability deteriorating and improving in a 12-15 year cycle.

This time let’s look at what might happen to single family house prices in three scenarios over the next 10 years:

- Affordability is not important and prices detach from incomes

- Affordability improves and wage growth is moderate

- Affordability improves and wage growth is strong

In all three scenarios I assume inflation will continue at the rate it has been and I only varied wage growth, interest rates, and the affordability ratio to estimate house prices. As with any predictions about future house prices, they should be taken for more or less entertainment value only.

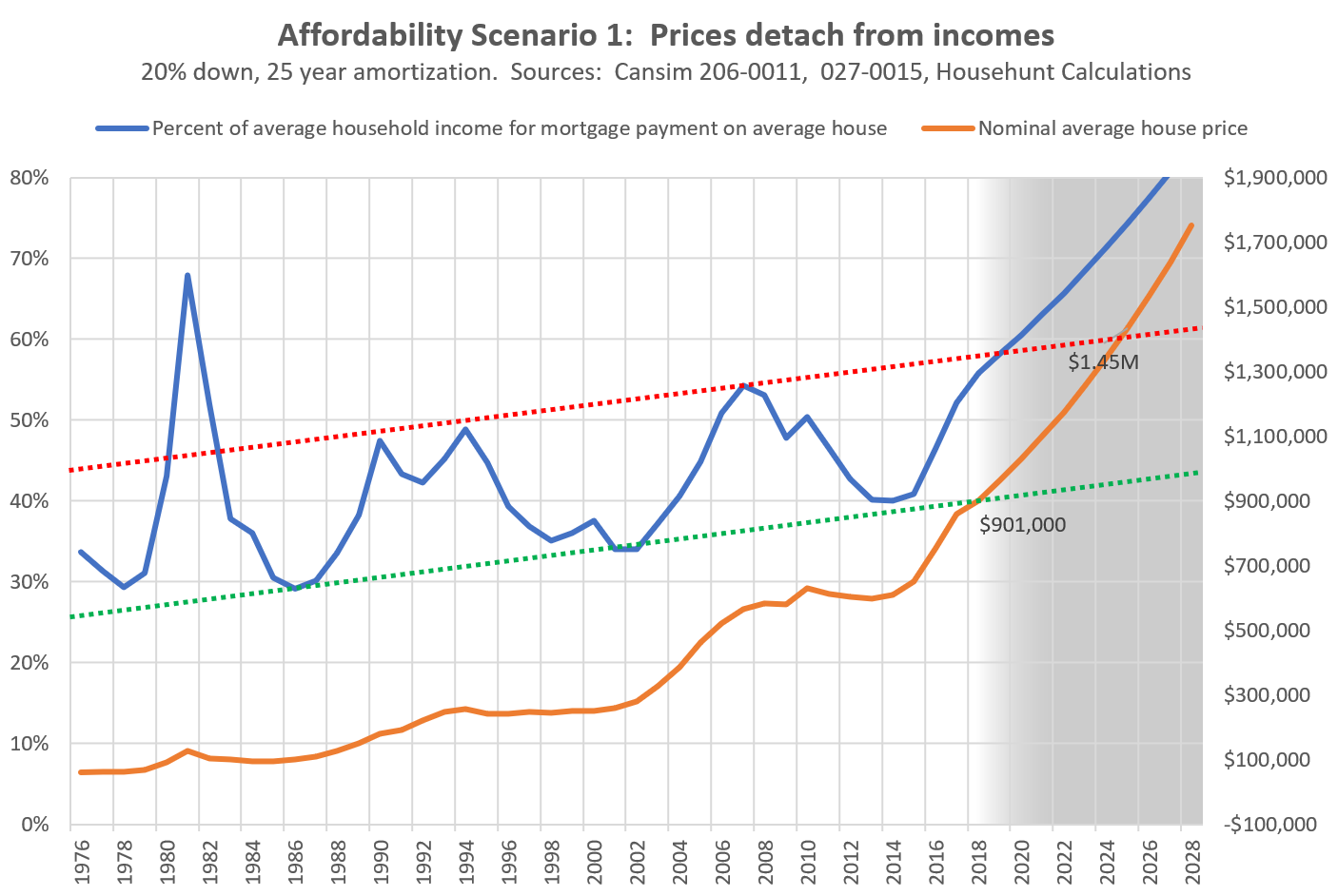

Scenario 1: Prices detach from incomes

There are many that say affordability doesn’t matter because of the number of outside buyers bringing wealth into Victoria. It is certainly true that we have seen house prices detach from local incomes in cities like Vancouver, so it is not outside the realm of possibilities that Victoria could do the same. In that case, we break our affordability pattern and prices keep increasing by some rate. At a similar rate of increase as we’ve had in the last few years, the average single family house will cost just under $1.5 million in 2025 and consume 75% of the average family’s income.

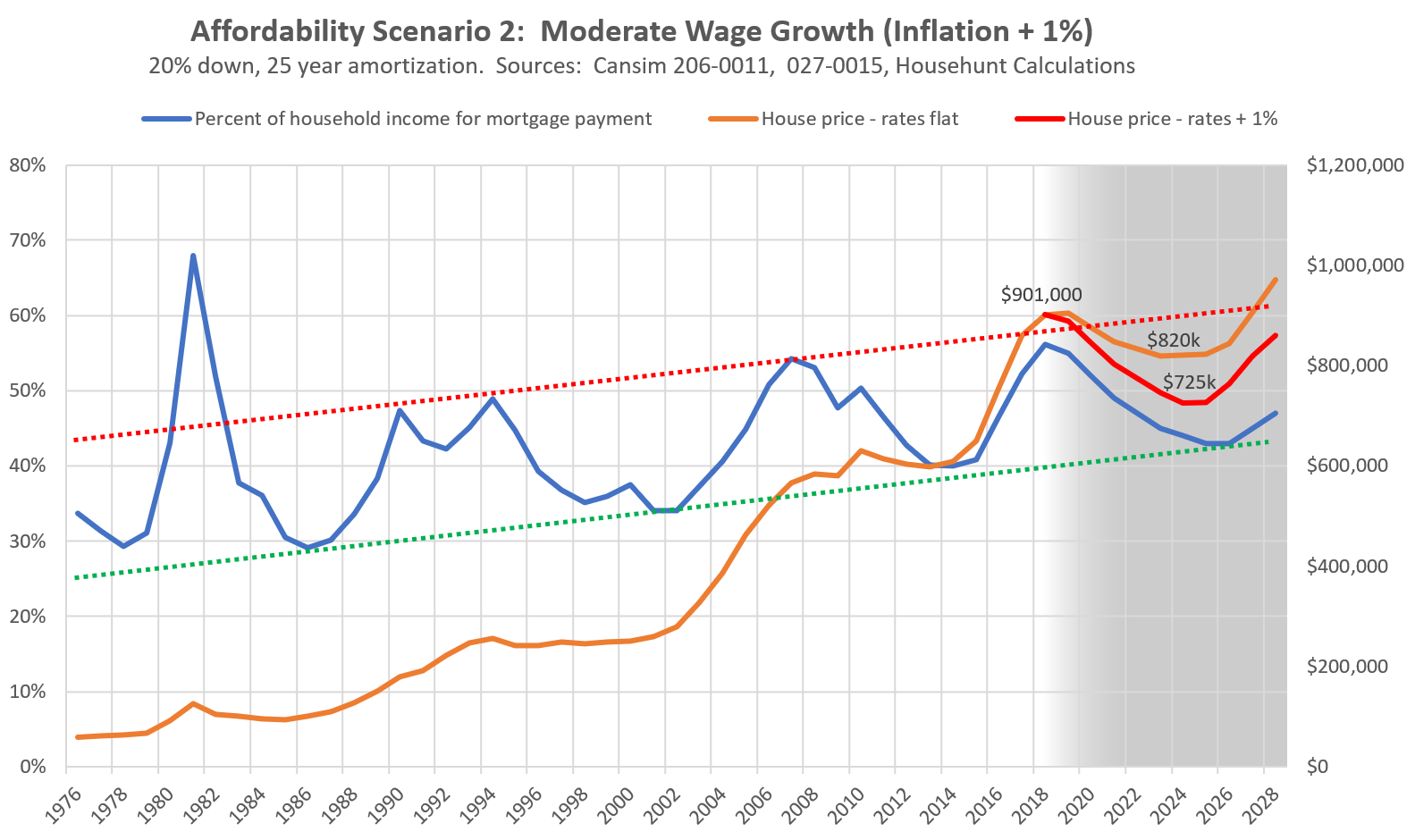

Scenario 2: Affordability follows cycle, moderate wage growth

In this scenario, affordability improves similarly to how it has in the last three cycles and wages grow at the same rate they have been for the last decade (1% faster than inflation). I estimate prices under two scenarios: flat mortgage rates and an increase of 1% by 2025. If rates stay flat, prices would only decline mildly, by about 10% over that period, while a 1% increase in rates might lead to an approximately 20% decline.

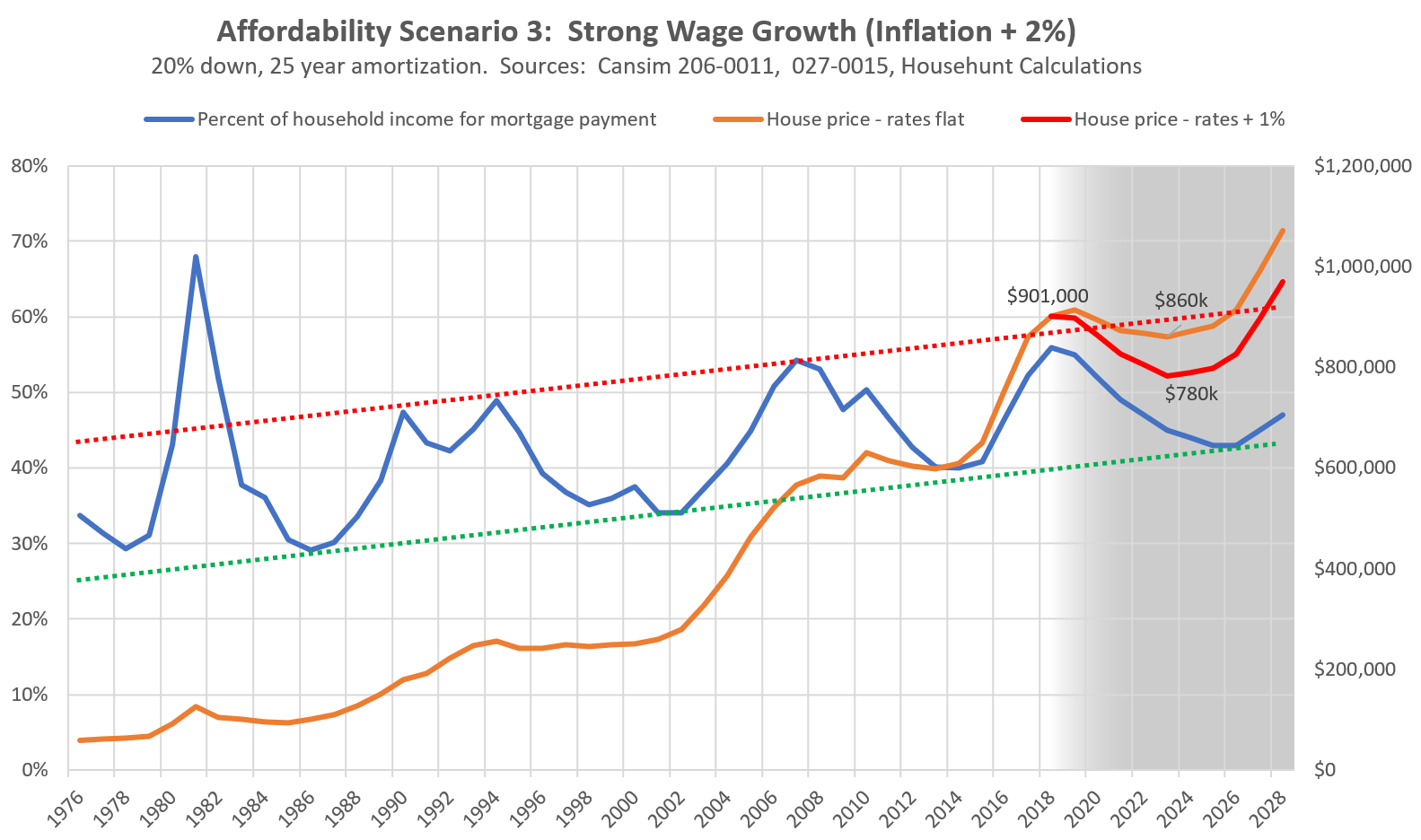

Scenario 3: Affordability follows cycle, strong wage growth

Wage growth has been quite strong recently. If this continues, it will put a floor under prices sooner. This scenario uses wage growth at 2% higher than inflation (about 4%/year) under otherwise the same conditions as scenario 2. If this happened and rates stayed flat we could essentially pull off a flat landing with prices only down 5%. Moderately increasing mortgage rates would increase that to about 15%.

Of course mortgage rates could increase further, and this doesn’t take into account any changes to credit availability like the stress test or new taxes that are being brought in. While those could have a noticeable effect, we have now had a decade of tightening credit conditions through various federal government actions and the effect has been minimal, so I’m not convinced that the impact will be massive.

Thoughts? Where do you think prices will be in 5 years?

I found the following interesting.

http://www.cbc.ca/news/canada/british-columbia/q-a-former-finance-minister-kevin-falcon-1.4654152

On another note I noticed “sweethome” mention to someone on the forum …….”Why are you focused on amassing houses?” …….suggesting that he or she must be young and perhaps foolish. I happen to disagree. There are many positive reasons for buying real estate other than just the financial side. One is that it might be something that the person understands and loves. For example: How do you put a value on buying a duplex and renting one side out to a single mom or dad at a really good rental rate. You rarely hear this side mentioned, but I know several landlords who get great pleasure out of doing this and that’s why they invest in real estate instead of pieces of paper sitting in a drawer.

Monday numbers: https://househuntvictoria.ca/2018/05/07/may-7-market-update

Consider a move to NL. For the price of one mediocre house in the core here you could get a six pack of houses in Corner Brook (just to pick an example). Corner Brook is a pleasant city of 20,000 with it’s own local ski hill and neighbors that won’t judge you if you want to club baby seals. It’s conveniently located a short 7 hours drive from the famed metropolis of St John’s.

“We already have gargantuan power, to meet peak demand, from gargantuan dams. If 25% of the population got solar panels (through incentives, maybe), the present dams would be even less relied upon, and Site C would be unneeded for the foreseeable future”

Right, but the solar power would cost several times as much as the hydro power. Moreover, there will be no surplus hydro power. What is not consumed in BC will be sold where it will displace thermal (carbon dioxide producing) power.

The decision to build Site C may be questioned. But with Site C, as with the TransMountain pipeline, you cannot chop and change economic policy in midstream without incurring horrendous costs. In the case of Site C, a $2 billion cancellation fee. In the case of Transmountain, hundreds of billions of dollarsinvested in oil sands production without adequate means of transport to market.

Canada’s prosperity (and the ability to sustain a crazy REmarket) depends largely on the resource industries. If you want to see the Canadian dollar at fifty cents US, and the standard of living correspondingly reduced, then, sure, lets shut down Site C and terminate the oil sands. Otherwise, the Greens should quit making a political issue out of what should be recognized as water under the bridge.

@ Lammy

Why are you focussed on amassing houses? As a “non-expert” without much liquidity, why would you want to leverage yourself so much for one asset class? I can only assume you are young and have just seen real estate go up. Well, that trend seems to have stopped, at least for the next couple of years.

I was wondering about the appeal of variable interest rates. My first mortgage was a VR, and it was great from 2006-2011. So the bond market raises rates for fixed rate mortgages, and Poloz, in his prudent way, holds the BoC rate low (say below 3%) which makes VR mortgages suddenly much more competitive. Is that the recipe for the much-ballyhooed soft landing?

That post was written almost five years ago, and here we are. Not really fair to say, “now I’m even more certain than ever!” If we pretend that that was posted today, what would someone say to argue against the point? Could prices actually go higher? I guess I can argue yes without being called a “pumper”, so, nationally prices could rise further (in real value) if:

Additional, larger markets start experiencing massive price growth. Montreal and Ottawa could certainly do this given the low interest rates, even with B20. This is especially possible if the GTA continues to falter. Hard time seeing Calgary spiking, but who knows what oil will do next.

Interest rates drop further. That’s not what’s happening now, but the BoC could theoretically change course if a major economic downturn occurs. That’s a bit of a circular argument though – if that happens houses aren’t likely to be doing well.

Drop the B20. Anything that eases or inhibits access to credit will affect prices.

Alt lenders drop their rates to entice more buyers (that would be a bit of an affront to their business model, but perhaps they could be desperate for business).

Feds reintroduce 40 year mortgages or even longer, or introduce interest-only mortgages.

The dark figure of money in the housing market is underestimated (money laundering).

We hire the same staff that the PRoC hire to report national housing data. 😛

Are there any others? Part of the question here is to what extent government will attempt to prop things up, and to what extent any attempts can be successful. History doesn’t really show a whole lot of success in that respect, other than a proclivity for magnifying or distorting existing imbalances.

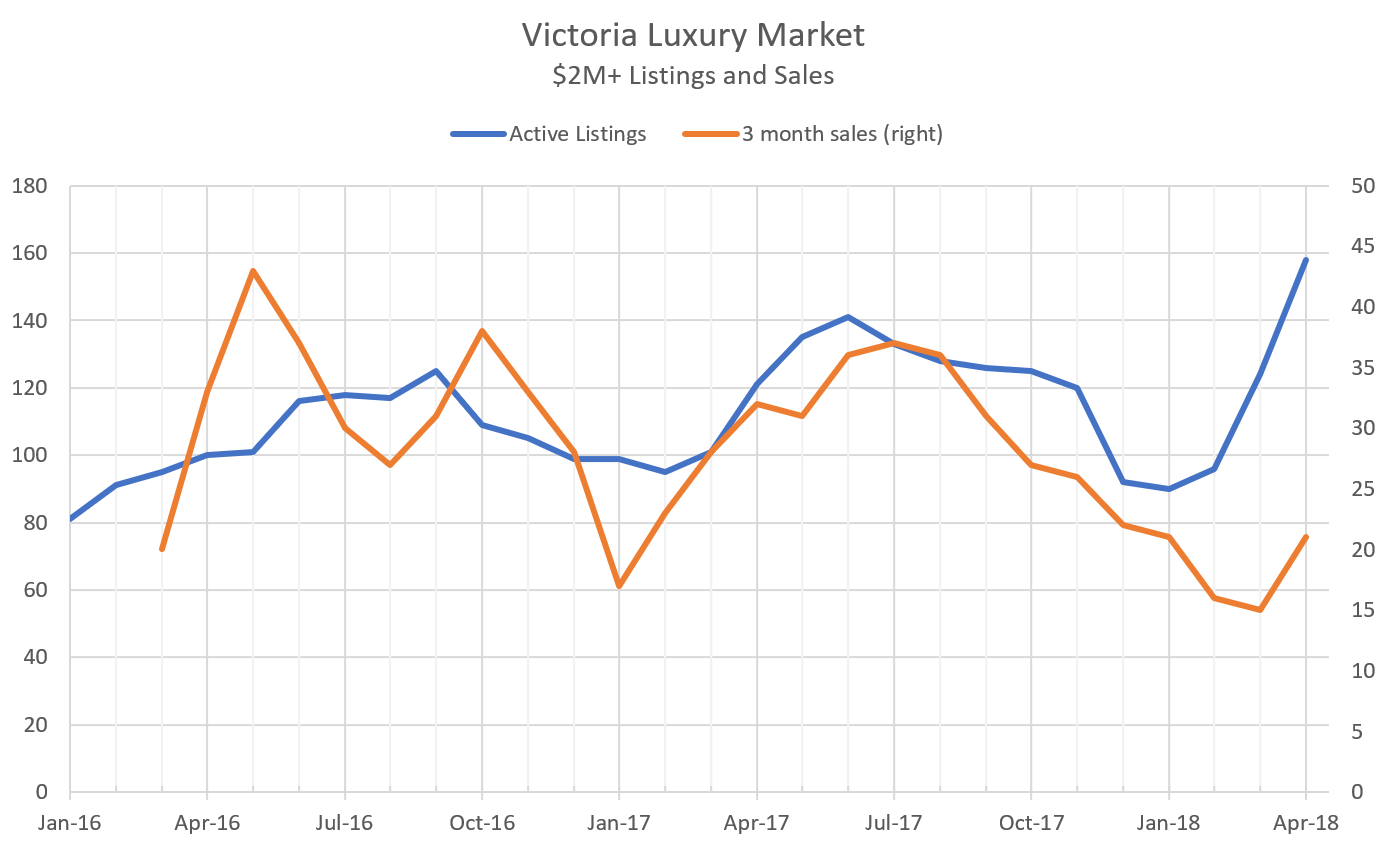

I find the “luxury” home market rather interesting. Not sure how to interpret the trend but I am wondering if the new spec tax will result in a number of vacation properties being tossed into the market. Curious as to what the numbers will be by the end of the summer.

You are not “info” unless info had a personality transplant. Info had only one note, never admitted she was wrong or even entertained the possibility that her predictions were anything other than mathematical certainty. Debate with info was impossible. You either accepted her view of inescapable RE doom or you were a useless pumper.

Info’s style was more like Hawk than you, however even Hawk seems to be a much more flexible thinker than info.

The one good thing you can say about info was that she was a perfect inverse indicator. If she said interest rates were about to shoot up you could be confident they would hold steady or fall. If she got excited by a one month blip in the data you could rest easy that it was a statistical anomaly. And finally her call that “sales will tank” was followed by literally five years of year over year INCREASES in sales.

Leo, you conclude your analysis with this:

“Of course mortgage rates could increase further, and this doesn’t take into account any changes to credit availability like the stress test or new taxes that are being brought in. While those could have a noticeable effect, we have now had a decade of tightening credit conditions through various federal government actions and the effect has been minimal, so I’m not convinced that the impact will be massive”.

The concluding sentence is of note and causes one to pause. The last decade (2008 to 2018) has not, with great respect, been a decade of monetary tightening – it has been the polar opposite. We have had 3 rounds of global quantitative easing by central banks [where the monetary policy has been characterized by lowering interest rates through central banks buying bonds (open market operations), thereby increasing bond prices, and resulting in lower interest rates all along the yield curve] who have exercised a concerted effort of literally flooding the market with liquidity resulting in cheap money [record low interest and mortgage rates]. The evidence reveals that the yield curve actually sifted down and pivoted to the right such that long rates fell more than short rates. The result has been rock-bottom mortgage rates = liquidity. This is one of the causes of the RE bubble we are looking at and why the Canadian households have so much debt.

The impact of rising interest rates on RE will be profound, according to modern neoclassical economic theory. Perhaps you could clarify what you meant by that last sentence. Thank you.

I also think your advice to wait 6 to 12 months is very prudent. Also your analysis of luxury sales, listings, is exactly what I have been seeing.

Intro, for all you know, I am Info. As certain, intransigent and bitter as ever, now posting as VREU on Garth’s cesspool of a blog. 😀

Calling the shots on a particular market is usually not a good idea “It’s going to the moon, it’s going to crash”. My particular interest is in this local market, but I am not quite as interested in Victoria sales data as I am in bond rates in the states, the availability of credit nationally, and the velocity of debt acquisition. Things are changing, as you can see. Where it goes, who knows.

In any case, at least it gives you something to argue with. And – when the market does go south, you’re still covered via: “You bears predicted it for (select time interval, preferably as long as possible for dramatic effect), wow some geniuses you are. It takes a special kind of doofus to be so wrong, for so long”.

I’ll be speechless.

Thank you LeoS.

Here I am, five years ago, making fun of bears—a pastime that endures:

Impossible to give advice to people without knowing the details.

If I personally was looking for a house I would wait 6-12 months and see how it plays out. If the market is going to correct it should show substantial weakness in that time period. But I would not keep my eyes shut to one-off deals in that time. Those deals basically do not exist in a hot market, but they will arise as the market slows down. The risk you are taking by waiting is prices continue to appreciate and you buy later for more money. I believe that risk is currently relatively low, but you have to be comfortable taking it.

Posted by info, the blog’s original version of Hawk (someone extremely persistent yet comically wrong), from five years ago:

Sounds like the exact same shit to me…

Barrister:

Change from last April:

3 month sales down by a third from 32 to 21

Inventory up by a third from 121 to 158

We already have gargantuan power, to meet peak demand, from gargantuan dams. If 25% of the population got solar panels (through incentives, maybe), the present dams would be even less relied upon, and Site C would be unneeded for the foreseeable future (which is arguably the case even without considering potential added solar, wind, geothermal, etc.).

Yet BC Hydro is contractually buying power from IPPs in vast quantities, for vast dollar sums, at prices far higher than full retail.

I do believe that bears will, in five years, regret not having bought in 2018.

People five years ago were saying the exact same shit as today. It didn’t go well for them.

Wealthy people of working age who move here only need moderately well-paying jobs. And wealthy retired people who move here don’t need any job.

First thought: with all that flooding, is his new house underwater?

Second thought: how’s New Brunswick’s medium- and long-term price appreciation going to compare with Victoria’s? A Victoria homeowner with a lower-paying job has probably done way better across any time interval in the last 25 years than someone with a higher-paying job in Atlantic Canada.

Third thought: many people can live just about anywhere and not care a wink. For people like me, however, place matters a great deal. Living in a place I really don’t like would probably take a few years off my life, and my goal is to live forever.

Sure they didn’t fall as much as the mega bubble markets like Phoenix, Vegas, and Miami. But the California markets did fall 40% and Seattle over 30%. I don’t think anyone on this forum would disagree that a similar fall in Victoria or Vancouver would border on catastrophic.

Also in an expensive housing market, buying at 100% of peak versus 60% of peak makes a very big difference to your personal finances for your whole life.

https://blog.seattlepi.com/realestatenews/2011/05/28/seattles-most-famous-bubble-blogger-buys-a-home/

Josh:

Ottawa is a great city to live in when you are younger and an even better city to raise a family. After 65 then the weather may start to get to you as the bones age. But a great place to be before then.

So, what advice would you give the average non-expert? Buy now, or wait? I bought modest townhouse in downtown Victoria because the market is so freaking weird and it seems anything could happen. My dream is to buy a SFH in the downtown core with revenue potential and keep my townhouse and the other out of town house I own that nets me $300 per month. I just want to own a lot of houses but I don’t have a lot of liquidity so the goal is slow moving. Even if I did have the funds now for a 10% down payment I’m happy to wait around because of the weirdness of this market. But, it is always true, “don’t wait to buy real estate, buy real estate and wait”?

Seems to me a lot of the ‘reversion to the mean’ and ‘it’s (not) different this time’ talk is really arguing from the perspective that everyone is a flipper and treats housing just like stocks. Sell now, before the crash! Don’t buy now to maximize revenue!

In reality, people don’t treat homes the same way they treat stocks, and thus the housing market is unique. And local. And slow (illiquid). And different overall in Canada than the US ( we are better educated, more tech-savvy, and have face a totally different mortgage availability and regulatory framework; e.g. no 30 year mortgages, no tax deductions on interest, PR exemption, etc.).

Rather than seeing patterns, the more I look at the past 50 years of housing in communities across Canada and elsewhere, I see unique situations and a lack of geographic or temporal correlation: 1981 crash in Vancouver/Victoria, but not Toronto; 1990-1995 – rapid price acceleration in Vancouver while Toronto dropped; price peaks in 2005/6/7/8/9/10/never depending on which Canadian or US city you are talking about; stagnant Victoria in 2010-2014, but not Vancouver.

Seems to me the main take-home is buy something you can afford, and try not to buy right before a global recession. Good luck with the latter. Everything else seems mostly luck.

CE,

Apparently, my communication skills must be even worse than Mrs. Fool lets on. 😛

Point 1: In the US, nationally speaking, falling volumes preceded price drops.

Point 2: In the US, nationally speaking, the most aggressively rising cities tended to experience the largest drops.

Point 3: Could be fun to debate whether this experience might have some commonalities to Canada.

Not point 1: Housing markets recover.

Not point 2: San Francisco fared better from the RE market bottom to today, than Los Angeles.

Not point 3: Las Vegas hasn’t quite recovered.

Not point 4: More desirable housing markets recover faster.

Not point 5: If X city in Canada has a price drop, it will never recover or not recover in X years.

That shall be all on this from me. 🙂

I basically agree with you. If you bought at the peak and held to now, the returns have been terrible relative to other options. So you lost money relative to better investment options and depending on how much you paid for rent you may have lost money relative to renting and buying later or renting and buying never.

The nominal price recovery is important though as housing is a leveraged purchase and the loan is in nominal dollars.

I was generalizing the US experience to Canada. If you were talking the US market only then what is your point? The market writ large HAS recovered within a 15 year period.

Buying at the peak was still a mistake, and a lousy investment in most cities, but the market recovery has more or less made you whole again in nominal terms

I’m not seeing a whole lot of symmetry here:

http://www.socketsite.com/wp-content/uploads/2017/03/SP-Case-Shiller-Condo-Tiers-01-17.png

unless it is on the level of “sometimes prices go up sometimes prices go down”

The desirable west coast cities didn’t fall as far as others and have recovered more fully:

http://seattlebubble.com/blog/wp-content/uploads/2017/06/Case-ShillerHPI_Decline-From-Peak_2017-04-915×650.png

Read your quote of me again, perhaps? I’d never predict a market that far out. And if you go back to that entire post, you’ll see I was talking about the US market anyways. Looks like you were too, actually.

The Dodd Frank reforms are not Canadian.

–

For 16000 beers could you be convinced to fudge the data a bit Leo?

Betting that Victoria SFH prices will be lower than now in nominal terms in 15 years is a pretty aggressive bear prediction

Crudely extrapolating, we should see a price plateau in fall of this year and a price cliff in fall of next year. Except that it took a recession to trigger the 2008/09 cliff.

Just got back from a quick visit to Ottawa. Everything is cheaper there. By like 30%. Food, restaurants, gas, just about everything except beer and public transit. And man the craft beer scene has exploded there.

@ Leo S

“An acquaintance completing his PhD decided to take a job as a prof in New Brunswick. Pay is significantly higher than here, and they are buying a nice detached house for $300k.”

If the decision to relocate was made solely on the basis of housing cost, and assuming all other things were equal, then it was a smart move, from the point of view of the individual. However, from the local community perspective it reflects Victoria’s declining economic competitiveness. We are driving away talented young workers because of zoning bylaws that have driven residential housing costs to a ridiculous level for such a small and economically insignificant town (GDP only 5% of Toronto’s, one sixth of Vancouver’s and no larger than that of Saskatoon or Regina).

Hmm… 7927 unique visitors to the blog last month. That’s a big bet..

By what measure will we measure price decline?

I kept an article published in 1990 in the Bankers Institute Journal ( UK ) because the analysis contained comments proven over time. They were especially relevant at that time in Canada. In my work there were virtually no sales of building lots for almost two years in North Vancouver.

Extracts from the 1990 UK article:-

The housing market is quite unlike any other.

In any normal market the seller would simply reduce the price until buyers are attracted. But in the housing market, sellers would prefer prefer to take their house off the market rather than lower the price.

The result is that initial evidence of any downturn is a sharp reduction in the volume of sales. This is exactly what happened in the latest episode.

The volume of house sales has dropped off by roughly 50% in the past year. However prices remain about 10% up on a year ago. Within two years of the sales decline price inflation has dropped significantly.

When all those who are reluctant to reduce prices have dropped out of the market, there remain those more desperate to sell for financial reasons/personal circumstances. This group will be willing to cut their price. The consequence is that prices begin to fall.

Because of the sharp drop in sales, those that do take place become less representative as a picture of the underlying demand for, and supply, of housing, and may tend to overstate the weakness in the market.

Changes can initially be masked by the seasonal nature of real estate sales which tend to grow in terms of price and volume in the spring and early summer

Whatever the economic cause,do not expect a fall in house prices until a downward trend in sales volume is well established.

Each cycle has its own special features, reflecting developments in the wider economy but cycles also share common external influences. The end of the boom for all of the three most recent cycles coincides with the tightening of macroeconomic policy of the government of the day. Perhaps of this more direct policy interest in the housing market the trough of the current cycle is likely to be deeper than normal

My comment is, if you in the market for the first time, timing is now important. Also, buy the best location you can afford because in a downturn housing in less desirable areas will fall the fastest and furthest and recreational properties, except waterfrontage, will become unsaleable at any price.

My thought on the recent bubble in the Lower Mainland is that sales volume and increased prices overstated the strength in the market. Downturns in the past 50 years have been precipitous. As a homeowner I would like to see the market fall 30-40% which would benefit my children and other millennials who work and pay taxes in Vancouver.

@LF

Re: rising price on falling volume

It’s the Wile E. Coyote Moment[um]

An acquaintance completing his PhD decided to take a job as a prof in New Brunswick. Pay is significantly higher than here, and they are buying a nice detached house for $300k. Can likely pay that off in just a few years. Seems like a smart move to me.

The tendency for symmetry on a rapid ascent and its subsequent descent is one of the most basic points of observation in that phenomenon. The chart I posted actually demonstrates this for you – perhaps you can scroll down and look again. Secondly, I’m not talking about all historical/local market movements writ large. Just because a market ascends, it doesn’t mean it’s a bubble and will descend with symmetry. Indeed we’re talking about bubbles, which are large scale price movements unjustified by their fundamentals. Generally only confirmed in hindsight. Is BC real estate in a bubble? Let’s find out. In the meantime, argue apples to apples please; don’t just post to contradict.

I encourage you to go look at the S&P/Case-Shiller HPIs for most of the major coastal US cities during that time. Coastal cities in the US were absolutely ravaged when the US housing bubble popped; their gains were the steepest and so were their falls. The reason for their volatility has to do with their desirability. “Investors” don’t crowd the market in Eureka Springs, Duluth or Montgomery, so there’s less of them to flee en masse when things go south. I don’t know why you’ve quietly shifted my point to “which markets have recovered”. It’s irrelevant to the premise I was demonstrating.

Another little side point for contemplation – have “recovered” areas in US RE endured a market recovery…or a price recovery? I don’t know. But it’s an important difference.

The first scenario is highly unlikely in my view though. It would require a departure from a decades old pattern. Personally I’m expecting something between 2 and 3 and a 1% hike in rates

Patriotz:

How many SFH or condos are not principle residences if you know. I suspect that over half of these are rentals but at least we might have a hint of what sort of numbers we are looking at.

Not “just like with stocks”, because with stocks you can buy or sell any increment you want. In other words you can always afford to buy. With RE it’s the whole property and it’s commonly bought with far more leverage than is available for stocks. You don’t get a second chance if you make a bad call. Which means there is far more risk associated with market cycles and interest rates than with buying a small amount of stocks at small intervals, which is what most people do.

You can only do this looking back – not forward. The problem is you don’t know what will happen with interest rates, prices and other factors affecting rent and home prices. Without the aide of a crystal ball it is a gamble to an extent. You can even the odds out a bit buy looking to hold long-term – just like with stocks. Just like with stocks, buy when you can afford to and prepare to hold through the ups and downs. Trying to time the market is largely a fools game and your ROI will be reduced by it most likely.

Seems like this is largely untrue. Look at the graph of house prices for Victoria. RE markets are local, not national, here and in the states.

Really? Seems like this is also largely untrue to me. The places that lost the most relative value and have not yet recovered are in the rust belt. Desirable coastal areas tended to lose less relative value and have now fully recovered. Places like Las Vegas dropped a lot and have not yet fully recovered.

No. It’s known how many properties are principal residences (via HOG), but it’s not known how many of the rest are qualifying rentals. It is known how many properties report rental income but the rentals may not be qualified, plus some properties may be rented out and income not reported.

You have to compare buying now with renting now and buying later. If the latter costs you less in total you have lost money buying now. It’s not enough to say you haven’t lost money if the market eventually recovers to today’s purchase price. That happens for just about any asset.

In terms of the new vacation home tax do we actually know how many SFH are impacted? Are we talking a hundred or is it closer to a thousand in greater Victoria? While not in the same class as death or divorce, this would create some very motivated sellers.

I probably should repost this after we get today’s numbers.

If we presume similar price behaviour in Canada as there was in the States, the data I posted would seem to suggest your bet may be a toss-up. Four years out is a totally different story. You’d be buying everyone 6 pints and a taxi ride home. Good thing I don’t generally drink beer.

Ascents and declines tend to have symmetry in the absence of an external shock. This is why I do not believe that the market is going to provide people with any notable returns for some time forward. Markets with the most aggressive appreciation in the States also tended to take the hardest falls. In Canada, cities like Vancouver, Victoria, Toronto, Hamilton and a few other satellite markets are at the greatest risk IMO.

Possible, but I wouldn’t bet on it unless CB’s continue their meddling. Prices are increasing again due to persistently low rates and yields in other investment classes – this latest degree of price inflation in sections of the States will eventually have a similar outcome as before, albeit hopefully less dramatic in a post Dodd-Frank environment. San Francisco is already experiencing quite an exodus of people.

Does this halibut finally need a barber? 😛

QT:

People here would argue for months as to whether it really was a price drop or just a remix of the type of sales.

My initial thought is that by piratically excluding foreign buyers and people from the US and Alberta from buying vacation properties here that there might be much more of an impact than some might imagine. I have no idea if it is true but someone was saying that close to 30% of properties in Bear mountain are owned as vacation properties. Might be interesting to see if an usual number of properties are put on the market over the summer up there.

http://www.calculatedriskblog.com/2018/04/case-shiller-national-house-price-index.html

If you look at the US data to present day it seems like it has taken roughly 12 years for prices to return to previous bubble highs. If you look at individual cities ( you have to google that one yourself) some have blown past bubble peaks while others are still 20% or more below bubble peaks. That is nominal dollars.

So even in a big crash it is likely that if you can hold for 10 or 15 years (and keep your job) you won’t lose in nominal terms.

Let make it a bit more interesting.

I buy everyone on this board 2 pints of beer if there is a 9% or greater price decline in the next 2 years, and you pickup the tab if it is less than 9%.

Note, the houses that don’t sell don’t affect prices…. only if there is mass capitulation or forced foreclosure fire sales (as in the US) will you see prices decline. If you are shopping, wait for late summer or winter or next year and brush up on your lowballing skills. Desperate sellers are out there. I know, I was one of them…. if you are waiting for the stats, well you know what they say about over analyzing….

You could be right, but it might be a case of flatten out price for the next 4-5 years as history indicated in Victoria.

Sales volume for this year so far is down 17% than from last year of 4069 units, and this year it is look to be on track for somewhere around 3377 units. But, IMO it would take several years of low volume at 3000 units for us to see a realized lost of 5% as what happened in 2010 between the 2007 through 2013 ride.

Volume for 2007 were 4464 units and 2008 volume were 3355 units or a 25% drop in sales Year over Year.

Volume for 2009 were 4117 units and 2010 volume were 3236 units or a 23% drop in sales YoY (price peaked).

Volume for 2011 were 3069 units and it marked the first year of price drop (total of 5% price dipped by 2013 compare to 2010 peak).

https://www.vreb.org/media/attachments/view/doc/ye782017/pdf/Annual%20Summary%20of%20Single%20Family%20Sales%20from%201978

@LF that is why sales volume is a leading indicator. I just might steal those graphs to illustrate that concept elsewhere….

Local Fool:

Thanks for the graphs, they paint an interesting picture. I cannot speak for other neighbourhoods but the houses listed in Rockland have not exactly been flying off the shelf these last couple of months. We drove up to Lands End Rd. today and there seemed to be a lot of listings compared to last year. But that was just my impression.

@Local Fool

Great chart, thanks for posting!

Local Fool, I have been trying to find that data you just posted for a long time. Thanks for the post.

A few of you who have been watching the BC real estate market, may have noticed a very recent phenomenon: Sales volumes are falling, yet prices are in some cases, still rising. Those of you who read my posts know I like to refer to history, and so I will direct you to the charts below. These charts represent the US housing market sales volumes and prices as they hit their peak, then decline.

The top graph represents new home sales, the middle graph represents existing home sales, and the bottom indicates prices. Have a look at the red line I put in through all 3, right as the market started to see a decline in sales volumes. Notice anything about the prices in the bottom graph? For several months, they kept rising – as volumes were falling. Sound familiar?

What you’re seeing there is momentum – this is the force that propels the prices higher based on extrapolated expectations. When reality changes, a lot of people don’t like, or want, to make the adjustment. So that momentum, like a train that’s on a sharp acceleration curve but suddenly runs out of coal, keeps going for a little while after. Then prices begin to follow. So here at home, our sales volumes are declining…but will we follow a similar path as the US moving forward?

Thanks to Formafist for providing the idea for this analysis.

You’d be surprised by what tech companies operate in Victoria and what they do. For example threre’s a company that essentially handles 30% of the music industry’s distribution that has their entire engineering department here.

Or take workday for example. The 2nd largest hr software company in the world has a big development shop in town.kixeye has a big shop here too. Many such cases.

https://www.integratedmortgageplanners.com/blog/monday-morning-rate-update/the-unfairness-of-last-weeks-posted-rate-hikes/

Here’s a good blog on the recent hikes to posted mortgage rates by the big banks. Doesn’t make a lot of difference to what people pay as few/no one pays the posted rate. It does impact the penalty for breaking the mortgage and it affects the qualifying rate.

Money is still cheap, cheap, cheap – 5 year low to mid 3% still widely available, but qualifying is a lot harder than before.

Local Fool says, ” Overpriced housing eventually impoverishes the economy; it doesn’t enrich it.” Bravo !!! So correct.

Nailed it.

@Hawk & co

correct, I am wrong/misquoted hawk. I did not find that Hawk had ever said 7 rises this year.

Hawk has been consistent with the 5 year-bond rate link.

And yes, with that in mind I still think 7 is unlikely by 2019 for the BoC, but it is certainly possible. And if it does that’ll be the HELOCs that our bearish-types love to chat about.

I wasn’t saying our economy supports these house prices…. i was simply pointing out we are not a tourist economy. What supports these prices is people’s willingness and ability to pay them. Cheap money plus other equity is what it is. No big mystery.

I see that Hawk was misquoted. He is quoting the consensus of senior economists, namely that the Fed is expected to hike 7 times between now and the end of next year [2019].

Second, Canadian banks are not following the lead of the US Fed. The banks are huge bond market players – in the bond market [which is far, far larger than the stock market] the banks sell bonds to raise mortgage money to loan. If they have to pay a higher coupon to get the funds, they pass the higher rates on to borrowers – their profit is the spread. If rates are rising, bond buyers want a higher coupon rate to buy the bond. Simple.

Michael Campbell sees the tea leaves – the regulatory changes and rising interest rates clearly show what is to come. If you don’t see it, then open your eyes. And, yes, Victoria is not immune even though you think it is paradise. Even in paradise, one has to pay to play.

Local Fool says, ” Overpriced housing eventually impoverishes the economy; it doesn’t enrich it.” Bravo !!! So correct.

I have noticed that many homes listed above $3 million are now reduced and many are just below $3 million. The added property purchase and school tax above that number plays a psychological role here. Interesting. Took a drive through Uplands and Rocklands – very quiet, many “For Sale” signs. Very quiet.

“We have a diverse economy here. Tech is bigger than tourism FYI. Plus we have gov, FIRE, military, education, resources, weed, manufacturing even….”. Tourism remains the #1 industry in Victoria. You mentioned a number of others – the average annual earnings for these other jobs fall within the income ranges that I outlined. Be it firemen, teachers, pot-growers, etc., the average worker in those fields are not six-figure incomes. You have proven my point. It may be a diverse set of occupations, but they are not paying wages and salaries sufficient to provide a foundation for the average SFH price in the core of this city.

My experience in Victoria is that the seller’s lawyer confirms the “foreign” status of the seller, then represents this to the buyer’s lawyer, who confirms to the buyer if they need to do a hold-back.

Ultimately, CRA will go after the buyer (because it is easier), but the lawyers would be at risk for mis-representation if they didn’t make it clear before money changed hands.

Average Commenter,

I never said 7 hikes over one year, I said 7 US hikes over to the end of 2019 and our 5 year rate will follow as per the bond markets. It’s happening, next one is June and is 97% certain. More to follow.

Maybe you missed this from the mid 2000’s when the US hiked 17 times over 2 years ?

Dateline 2006: “After 17 consecutive increases at each meeting since June 2004, the central bank voted to hold its benchmark interest rate steady at 5.25 percent.”

Nice to see long time real estate pumper Michael Campbell on TV this morning saying the party is over for the pumpers.

He pointed out all the renewing mortgages this year as well as a total of 70% renewing over the next 3 years in a rising rate environment. The 2% stress test was the last straw, and also mentioned my last points of higher gas, property taxes and all the other increasing costs that we’re getting hit with daily now it seems.

Also mentioned those many who have said a mere $200 hit to monthly costs will put them in a bad spot. The real world is hurting financially and the pumpers stories where everyone is rolling in dough because they own a house is pure bullshit. If you’re in it to make money you better be dumping ASAP as the buyer pool is shrinking by the day.

What matters is what the banks do. We have already seen that they are willing to follow the Fed, rather than wait for the BoC.

Tech has grown and hasn’t been like this forever. I’ve been in it since 1990 and have watched it grow.

Same with the city in general. It’s a different place than the 80’s.

Leif – check Mao v Liu.

I think it’s very clear what the process is in this case. The buyer is responsible. And their lawyer/notary will be left holding the bag if they don’t do a good job.

Yes, the data we’ve been seeing does seem to suggest that.

Yes. And this “growth of tech industry + housing market” argument has been almost unchanged since at least the early 1980s. If people were willing to look they’d see it’s nothing new, and isn’t going to be some magic cornucopia for this housing market. Tech has played a role in this economy for almost as long as tech has been a thing.

But as another poster indicated, there are far better markets in which to live (income potential, job diversity potential, housing prices, geography, connectedness with other urban centres) if you’re a talented programmer. Not sure what competitive advantage living here would have, other than the city boasting on your behalf how cheap you’re willing to work compared to some of your southern friends. Overpriced housing eventually impoverishes the economy; it doesn’t enrich it.

It’s 25% of the sale price. The purchaser doesn’t have the means to determine the gains, or to determine whether they are taxable as capital gains or straight income. CRA policy is to tax gains from flipping (i.e. property not a bona fide rental investment) as straight income whether the seller is resident or non-resident. Gains from selling a pre-sale are always considered straight income.

This part seemed crazy to me

“Developers and lawyers say the situation has been open to interpretation, but the CRA’s response to Postmedia this week was clear: When there is a sale of any residential property from a non-resident seller to a local buyer, it is the local buyer who is required to either get a clearance certificate or hold back 25 per cent of the gains in order to pay potential capital gains taxes. This is presumably because it is much harder for the CRA to track such payments from a non-resident seller.”

Im wondering how many local buyers will end up with a bill for hundreds of thousands of dollars because they can’t determine if the seller is foreign. This totally seemes backwards to me. It should be the lawyers or selling agent that should be responsible not the buyer.

Have any agents or any lawyers on here dealt with this?

https://www.google.ca/amp/vancouversun.com/business/local-business/sellers-buyers-and-developers-liable-for-presale-condo-related-taxes/amp

Scene…

AbeBooks (owned by Amazon) employs 100.

https://www.amazon.jobs/team/abebooks

That is the Victoria tech seen. A number of small firms and startups that no one knows about…. except Aggregate iq….

Looks like another beautiful day out there today.

LeoS, or one of the other stats masters, can we compare how many SFH over two million sold in each of the past three months with the numbers of sales last year. I know that this is an unsophisticated comparison but it might still give some insight into the top end of the market.

Affordability matters. What you qualify for based on your income, interest rates, savings and credit rating is what it is.

This is why people will likely keep moving out towards Langford and first time home buyers will increasingly buy smaller homes and condos. Affordability is not a hard check on SFH prices in desirable core areas because as they increase in relation to income past first time buyer affordability people choose other more affordable options.

Local people who accumulate move up equity or inherit their parents’ equity will be able to afford places in the core eventually. It is not just about outsiders buying in.

Long term, Victoria RE is likely to continue to increase in a manner similar to the long-term average imo, but unlikely not to have flat or down periods following increases beyond the long-term average.

For the American behemoths that have the sort of really good compensation that might begin to reasonably afford our housing markets, the answers are “not many” and “almost none”, and I suspect that this is unlikely to significantly change.

Career opportunity is a big reason. We have nothing that comes remotely close to the critical mass of Silicon Valley, Seattle/Redmond, NYC, etc. This is what pulls a lot of fresh grads down south to begin with and often keeps them there. If this is going to develop anywhere, it’ll be in Kitchener/Waterloo, Toronto, or Montreal — not Victoria.

Compensation is another major factor. Tech workers can easily net twice as much outside of Canada, especially with higher upward mobility, more competition, and lower tax rates.

You may be inclined to counter that cost of living in big tech hubs is very high, but our housing markets are so insane that it’s not actually that bad. For me, the price-to-income ratio of a house in the Redmond/Kirkland area is about half of what it’d be in the CRD. Vancouver’s dramatically, almost comically, worse. Waterloo and Montreal are much, much better than BC or the GTA, but have limited appeal.

From the outside looking in, I can’t help but wonder just what the hell my fellow British Columbians are thinking when it comes to real estate. Why work twice as much — or more — for the same thing? Considering that tech workers tend to be a more rigorous and analytical sort, I wouldn’t bank on them ignoring this differential and propping up the market.

Yeah, that’s a good point. This (“Norbert’s Gambit”) may be a good option for infrequent conversions. There are caveats, though. For example, it typically involves having to call the brokerage and ask them journal over from the Canadian listing to the US one (or vice-versa) before you can sell on the other exchange.

Penguin:

I assume that a portion of that 4000 people are the boomers who are retiring. I am guessing that 4000 people probably means that we need to be building about 2000 units a year to keep up (and yes I am guessing at that number). How many units did greater Victoria build last year.

A friend of mine did point out that if we dont build it then they wont come. While not politically correct, there is the question of whether increasing density makes life better or worse for the people that are already living here.

Thank you for explaining Amazon more clearly. Now how many of their tech jobs are actually in Canada and for that matter how many of the their tech arm are actually employed in Victoria. I appreciate that the company has different businesses but do they have a real large tech presence in Victoria.

I do appreciate learning things on here and having grown up in the world of slide rules it is nice to be able to have younger (or at least more knowledgeable) people explain matters.

I’m not arguing this necessarily but I just cannot wrap my head around how these 4000 people per year miraculously get high paying jobs. I get that there are a lot of jobs where people can work from home but I don’t personally know anyone who works from home. Unless they have a pile of cash how is this going to drive prices up? What about those days long ago when work was hard to find? It wasn’t that long ago… It’s all good to say I’m going to move to X but where would I work? What about when that job I do get disappears after a few years? What about when those people who work remotely get laid off and now they live in mill bay with a big mortgage? It just doesn’t add up to me. I don’t see scenario 1 happening. It’s like people forget how bad it can be. I predict a decent (10%ish) decline in the next 2 years followed by flat or slow decline. Hopefully there is no doomsday coming for the sake of everyone I know but you can never be sure.

I guess you don’t understand that a huge proportion of all internet infrastructure runs on backend hardware provided by amazon?

https://aws.amazon.com/

“As of 2017, AWS owns a dominant 34% of all cloud (IaaS, PaaS) while the next three competitors Microsoft, Google, and IBM have 11%, 8%, 6% respectively”

https://en.wikipedia.org/wiki/Amazon_Web_Services

If amazon is not a tech company, then no-one qualifies.

(The book and retail thing is just a very small part of their business)

[Advice ahead] A few minutes on wiki will save you public embarrassment in many cases.

Dasmo:

I am not being argumentative but can you actually give me a good definition of what is a tech company.The term seems to be so broad and vague that almost every business can be deemed tech.

I dont consider the cable companies as tech companies nor is Amazon a tech company in my opinion.

Every business virtually uses some technology of some sort, The term is so broad that when people start boasting how many people work in “tech” I find myself rather suspicious of the numbers. If one starts to include everything that remotely functions with computers it becomes meaningless.

So help me out with a definition that does not include communication companies or merchandising companies or my bank teller. To my mind developing software is clearly a tech company but manufacturing a gizmo that uses software and computers is manufacturing not tech.

Westshore is developing Skirt Mt., Mount Wells, N/E of Langford Lake, East of Leigh Rd interchange, Latoria, Belmont developments, and Royal Bay (total could be in the ten of thousand homes).

IMHO, all of the developments will keep prices relatively stable for the next decade till it run low then price will rise quickly once the SFH become scared. And, the great local services/shops will also contribute to the price ascend.

I agree that more supply in the Westshore will affects prices in the core, but for now the majority of the population still have the snobbish mentality that prefer tinny rundown old homes as well as rat infested Jamesbay. IMHO, once people lose the old Colwood association to redneck hick town then prices will even out a bit better than currently (just as the old mentality of calling Gordon Head, Broadmead, and Sunnymead the cold impersonal homes of Victoria because it didn’t have yards or trees).

CS –

“I guess here in Canada we don’t care that the dollar just lost a quarter of its value over the last year or two, so we get to enjoy minimal interest rates and crazy house price inflation as a result.””

“In the last five years the CAD has lost about 28% versus the greenback. Call that pretty flat if you like. But the CAD is still worth 28 % less than it was five years ago. or an average rate of depreciation of about 5%.”

sigh you’re one of ‘those’ people. There are three kinds of lies…

Since April 2003 the CAD has GAINED 13%(or 9%, depends on how you measure it) vs USD. So we are obviously on a massive upswing over the last 15 years.

LOL. No, prices didn’t go up because of CAD to USD exchange rates. Just as they didn’t drop by 48% as the canadian dollar gained 48% on the USD between 2002-2008. A single input is not the housing market.

And the reason no one is freaking out about the CAD is because it is flat.

Holy Sanctimonious Batman

Steve Saretsky’s April report is worth a read… A snippet of it here:

“The slowdown in the Vancouver Real Estate market remains

particularly acute in the detached segment. Following a miserable

first quarter, with just 352 sales from January 1st to March 31st,

eroding the previous low set in the first quarter of 2009, home

sellers held their breath for a spring turnaround. However, those

hopes were dashed, with April home sales ticking in at their lowest

levels in recent history dating all the way back to 1990. Overall,

home sales fell 31% year over year in April, while dollar volumes

sunk 35%.

With home sales stagnating and inventory levels rising, there continues to be downwards pressure on prices. The average sales price in the city of Vancouver dipped 5% year over year to $2,397,464. With sales evaporating, this becomes a slow movement down. Price discovery becomes difficult with a lack of bids and fewer transactions.

Given the current environment, sellers will need to adjust expectations in order to see an increase in sales volumes.”

According to the gov, Victoria population will continue to grow by +4000 people per year for at least 20 more years.

2 cents from a 38 years CRD resident. IMHO, Victoria RE market will continue marching on in the near future and beyond unless Canada have a war with the US.

To me Westshore is the Gordon Head, Braefoot, High Quadra, Broadmead, and Sunnymead of yesteryears, because it is the last frontier that builder can really build SFH. Beyond that is a restrictive greenbelt of Metchosin agriculture land, Sooke/Goldstream watershed, Goldstream park, and Sannich Peninsular agriculture land. Also, Westshore do not have the geriatric NIMBY citizens of Oakbay and rat infested Jamesbay. Due to relatively young Westshore population with the highest average household income in the CRD, Westshore RE will likely ascent greatly in the next 10 to 15 year compares to the rest of Greater Victoria.

I agree with Totoro that Victoria RE will keep on ascend.

sar-chasm – the giant gulf between the sarcastic comment and the person who doesn’t get it.

For the record VB no one actually thinks Victoria RE will increase at exactly 3.74% real from today. “Totoro” who came up with the 3.74% number (that I stole) based on past returns, certainly doesn’t think that, though she does argue that we will continue to see significant positive real returns.

I think it is clear to everyone that whatever happens to price in the future it is unlikely to be a smooth exponential increase of 5.74% nominal per year.

My actual prediction/guess would be for Victoria SFH prices to stagnate over the next 5-10 years so 2025 prices will not be much higher than today in nominal terms.

I know, we all like to drive in the lanes we chose on here, but I actually don’t believe that you believe this. If you bought a GH SFH in 2009, that home has experienced almost preposterous appreciation since that time. If you felt that upcoming gains would cause folks not buying now to regret it, you’d be using that to your advantage now. A lot of your peers are, and have been, doing exactly this.

@ Deryk Houston – “People want to buy a house in paradise”

I agree, its a great place to live. But thats a big glass of Koolaid you’re sipping on.

A serious stalemate is beginning to develop in Vancouver.

Sales volumes in the detached segments have virtually collapsed – no one’s buying, but sellers are also on strike. The former is waiting for prices to drop, the latter is waiting for “game on” to resume. In market parlance, what this means is that the market isn’t really able to get a price discovery – it’s essentially paralyzed. This is virtually similar to what happened a decade ago in Miami, Phoenix, Las Vegas, San Francisco and parts of Michigan. Depending on the area, this went on for about a year.

The stalemate doesn’t go on forever. But in order for sales volumes to increase, one of two things will have to happen. Either buyers become willing once again to pay as much or more than in 2016, or, sellers will have to slash prices.

If the former occurs and we go to “game on”, then either local incomes will support upward price movement via even greater debt growth, or, foreign cash will support the metropolitan market. If the latter occurs and prices get slashed, then the folks selling initially will be those who need to. Those who simply want to will probably end up chasing the market down, perpetually wanting one extra dollar over what buyers are decreasingly willing to pay. This spreads through the market, including condos. The unwind begins, prices falter, job losses grow and recession sets in. The degree of recession is also significantly correlated with the degree of leverage in the financial system. Are we in for a run-of-the-mill recession? Can’t be sure, but I wouldn’t bet on it.

Regardless, some of the posts on here seem rather unaware of what’s unfolding next door and more broadly, a curious lack of interest in basic laws of finance and economics. Seriously – if you believe your house is going from 800k to 1.6M in 10 years, sell your existing home, use the cash to lever up and buy as much as you possibly can while rates are still low. You have nothing to lose in this magical market, and apparently everything to gain. 🙂

@Victoria Born,

We have a diverse economy here. Tech is bigger than tourism FYI. Plus we have gov, FIRE, military, education, resources, weed, manufacturing even….

Good afternoon, CE;

That is not what sarcasm means. I am also not trying to be provocative, just realistic.

You also did not accurately quote yourself.

You actually stated, “Assume 2% annual inflation. Prices increase by 3.74% per year in real terms”. This equates to a nominal rate of [2 + 3.74] 5.74% annually. Impossible.

You then estimate a total return of 94% over a 12 year time frame [1.94 times], so one must assume that you are compounding the annual return each and every year. or perhaps every month – unclear. That would be either hyperbole or simply mistaken. The math does not add up, sorry to point out.

Just stating the facts – no disrespect intended. But, if you truly believe that, you should act on your conviction and buy everything in sight. Good luck, you will need it because, respectfully, your thesis is not economically sound.

That said, I could equally be wrong – Leo’s question is like asking, “how long is a piece of string”. It is all guess-work.

VB

@ Average

“CAD to USD exchange has been pretty flat since 2015. It’s actually higher then it was on this day in 2017 and 2016. That means the CAD is worth more now then at this point in 2017 or 2016.”

In the last five years the CAD has lost about 28% versus the greenback. Call that pretty flat if you like. But the CAD is still worth 28 % less than it was five years ago. or an average rate of depreciation of about 5%.

And you think that has nothing to do with asset price inflation?

Was your sarcasm detector off-line today, VB? BTW it is 3.74 %.

Good topic. Some of the responses by the good people here highlights what I have thought for many, many years. People who live in Victoria [particularly those of us born here] like to call it “paradise” and many think that the laws of economics are suspended as one proceeds south past Goldstream Park. I assure you that is folly.

Consider this: something is worth what someone else is willing to pay for it. Not what someone is willing to sell it for. In Economics, we call that the “willingness to pay curve” [some refer to it as the demand curve].

A fellow poster here tries to take an actuarial approach by assuming that real estate prices follow the ratchet principle [downwardly rigid prices] – they can only go up. So, he or she assumes 2% inflation plus 3.5 to 4 % price increase per year, to 2030. Oh, if it were that simple to assume that today is the starting point. Friends, today is the 9th inning, not moments after the national anthem is sung. Unless you subscribe to the greater fool theory [a fool greater than you will come along and take that inflated home off your hands, so buy, buy, buy], put the Kool-aid away.

Interest rates and incomes: A rational analysis starts with the discounted value of real estate using the current interest rate. This explains so much of why we are in a bubble. As interest rates rise [that is the discount rate], the present value of the home falls. Further, home prices are based on median incomes here (not China) – remove the foreign dirty money laundering (which has nothing to do with income) and the floor feels weak and even feels like it is crumbling. Over long periods of time, prices revert to the mean [average], they do not rise unchecked unless your income doubles every few years along with everyone else’s. There is virtually no wage growth [wage push inflation is non-existent] in North America. So, who is left to pay you $2 million for your shack in Gordon Head? Surely, not the counter-person at Fairway Market or Starbucks. Victoria is a tourist town with little industry [OK, there is a growing tech sector], with the main employer being the tax payer funding BC civil service jobs paying what, on average, $40,000 to $60,000 per year (gross)? Mortgages are paid with after-tax dollars. So, a family has net income of about $60,000 to $80,000, but their disposable income is far, far less. Look at your neighbor – that is the highly indebted Canadian, now look in the mirror. Look familiar?

A millennial will not be laying down $400,000 as a down payment for that same $2,000,000 Gordon Head home today, let alone $4,000,000 in 2030. The monthly payments will eat up all of his or her income, plus that of his or her elderly parents.

As interest rates rise, and the drug money-laundering leaves, who is the buyer? You? Not me, yet. Perhaps that Vancouver, Calgary or Toronto land baron who sold at the top and in old age wants to move here to retire? Well, sorry to tell you, he or she is not the engine of growth and is not looking for a 7 bedroom, 8 bathroom mansion. That person is banking the profits to fund his retirement, not yours.

Mortgage rates are rising; BMO hiked yesterday too to follow the others. The monthly cost of a mortgage is rising, rising and will continue to rise. Even if you could pay cash – why would you tie up capital in a non-income generating asset when interest rates are rising? That is called suicide, my friends.

My “guess” prices will be lower 5 years from now because mortgage rates will be double what they are today. Chop up these comments as you wish, but emotion is not a sound argument. The laws of economics are real and rational.

Excellent analysis.

Based on these parameters, the price for a avg house in 10 years is between $720k and $1.8M. In another word, if you buy a house today for $900k, you may loss $200k in the next 5 years then regain most of your lost, or you may gain 1M in 10 years.

Looked at three open houses today; one in each of Rockland, Uplands and Oak Bay.Spent a bit of time in each andin all three we were the only people looking.Makes me wonder.

Interesting post. Thanks Leo. I wonder what a graph on affordability would look like in the event of a recession in Canada in the next 7 years. I’ve heard this to be an unlikely scenario, but I have to question why this is unlikely given that resets in the economy is a normal and healthy (but painful) process. I think the next downturn has to be a big one given how strongly the last was tempered by extreme leveraging. Weight of debt is a threat.

“I guess here in Canada we don’t care that the dollar just lost a quarter of its value over the last year or two, so we get to enjoy minimal interest rates and crazy house price inflation as a result.”

CAD to USD exchange has been pretty flat since 2015. It’s actually higher then it was on this day in 2017 and 2016. That means the CAD is worth more now then at this point in 2017 or 2016.

Despite the obviously ridiculous comments you just made on exchanges, I too believe that the 0% rise vs 1% rise to be too narrow a band. I think a rise of an additional 2% over the next few years is possible.

But I also believe that the government has tools to drive down interest rates and still keep credit flowing. Because a change of over 3% would probably be pretty damaging for the Canadian economy. And while Hawk’s continuous assertion that we are due for 7 more rate hikes this year is impossible, that many hikes over the next few is merely unlikely.

Looks like the market is really slowing down in my neck of the woods. It took over 4 days for my neighbour’s place to sell. I’d say the crash is just around the corner bears.

“Let’s just say the bears will wish they had bought in 2018.”

Bookmark that will ya. US going to raise rates faster than ever with jobless numbers below 2007 levels not seen in decades. Saudis want $100 oil now. Property taxes going up to pay for MSP etc etc.

You obviously can’t do math on what a mortgage qualification takes and that Vancouver is cratering. Wage growth is meaningless at this point when a major credit squeeze is now in motion.

Most of you pumpers could never qualify now under the stress tests. It’s 1981 scenario in play here but you only need another point or so for this to implode.

Leo it’s easy.

Prices in 2030 will be 1.95x the current price.

Assume 2% annual inflation. Prices increase by 3.74% per year in real terms.

Price level in 2030 = 1.0574 to the twelfth power = 1.95 current prices.

BC Hydro’s change makes total sense to me.

Net metering to my mind is for people who are trying to get close to zero power bills over the year. If you are a substantial net supplier to the grid then BC Hydro should not be buying your power at full retail.

The BBC reports from Argentina:

“On Friday, the bank hiked rates to 40% from 33.25%, a day after they were raised from 30.25%. A week ago, they were raised from 27.25%.

The rises are aimed at supporting the peso, which has lost a quarter of its value over the past year.”

I guess here in Canada we don’t care that the dollar just lost a quarter of its value over the last year or two, so we get to enjoy minimal interest rates and crazy house price inflation as a result.

“I estimate prices under two scenarios: flat mortgage rates and an increase of 1% by 2025.”

That seems a rather narrow range of possibilities. It would be interesting to know what others expect for mortgage rates over the next seven years. More than a 10% increase, anyone?

@ Rook

“@ Rook

“Does anyone have a suggestion on how to exchange CDN dollar to USD without huge fees?”

The Interactive Brokers deal looks good, but setting up an account with them seems to be an involved process.

If you have a brokerage account with any of the discount brokers, you can buy stock listed on the TSX with C dollars and sell the same on the New York exchange for US dollars. Then the cost is only $9.99 X 2, or whatever is the brokerage fee, plus whatever you make or lose on the arbitrage.

“Because if enough people were net-metering, BC Hydro wouldn’t need to make its construction buddies and big party donors rich with gargantuan dam contracts.”

There are gargantuan contracts for Site C, because Site C will produce gargantuan amounts of power: that is, power produced when needed to meet peak demand and to balance pathetic and uneconomic power blips produced by roof-top solar fanatics.

Big Hydro power is worth much more per unit than wind or solar. It provides the big power storage that is an essential concomitant of usable “alternative” power sources.

Reading the article, it looks like all the big over-producers are small hydro. It would be easy to cut out that and keep the solar/wind credits.

I didn’t see this part. It looks like they are doing some grandfathering. It is not clear what the second part covers, though.

Deryk Houston as well. There have been others over the years.

Thx.

I agree with you there.

Although Hydro has some problems to solve, there are some simple things they could do with this:

1) Grandfather the people already in the program.

2) Allow only return sale of double amount of the power you pull from Hydro over the year. That will keep the scale smaller going forward.

3) If they are really in a pinch, lower the purchase price of the power they buy beyond the zero point by a few cents. Just don’t steal it for $0.

This is some straight up bullshit, guys…

B.C. HYDRO HOPES TO CUT BACK SURPLUS PAYMENTS PROGRAM FOR HOMEOWNERS PRODUCING LARGE AMOUNTS OF EXTRA POWER

But B.C. Hydro said the change is necessary because a small percentage of the net metering customers are pocketing as much as $60,000 a year in cashback for unused electricity, which it said isn’t the program’s intent.

$60,000? 166,000 times less than the cost of the unneeded Site C dam? Oh, we won’t stand for that!

Zentner — who spent $1,000 per panel for the 18 panels she had installed last fall and has already seen a $144 reduction in her bill for the last two-month billing period compared to last year — said B.C. Hydro didn’t pay for or subsidize installation and shouldn’t get any extra energy for free.

That argument makes sense to me.

“It’s my renewable energy because I created it,” she said. “It would be different if they paid for the solar panels. To me, that’s stealing from me, because it’s mine.”

She said the new rules forces customers to donate excess electricity to B.C. Hydro, who can then sell it to other customers and profit by it.

“It’s not like I can divert it somewhere to store it,” she said.

True.

Fish said the company had recently seen an increase in the number of net-metering applications from run-of-creek hydroelectric projects — some producing 40 to 50 times the electricity needed for their homes.

What? People are providing BC Hydro with that thing it’s in existence to create? And, better still, they’re using 100% of their own capital to create it?

“Large generation size for a residential customer results in significant annual surplus payments of approximately $40,000 to $60,000,” Fish said. “It’s significant enough for us to want to put an end to it.”

But $10 billion (minimum) isn’t significant enough?

Net metering “was never intended to facilitate excess generation on a consistent basis,” said Fish

Because if enough people were net-metering, BC Hydro wouldn’t need to make its construction buddies and big party donors rich with gargantuan dam contracts.

http://vancouversun.com/news/local-news/b-c-hydro-will-no-longer-pay-homeowners-for-extra-power-they-generate

myrealtycheck.ca

for Vancouver in May thus far (4 days)

Overall change -55M. The most I have seen for a month – in the 1.5 years or so that I have been following this site – has been about -170M. At the current rate, the overall change for the month of May would come in somewhere around -250M. Will be interesting to watch.

Also interesting, Zolo for White Rock from Apr 4-May 2.

3 detached sales. Only condos are selling which results in a lower average and median sales price. New listings for detached are up for this period. New listings for detached are up because of the low sales numbers. Sales will not increase due to the increase in listings contrary to what your local real estate agent will have you believe. The first mover is credit or rather, a lack thereof. Bank turns off credit (interest rates rising) > buyer unable to qualify and sales go down > listings rise. It seems as though someone has plugged the spigot at the bottom of the credit barrel.

Many? I thought it was just me and totoro.

Typo. You mean Scenario 3.

Let’s just say the bears will wish they had bought in 2018.

Deyrk

I always wondered what all those things in Toronto where that kept sticking out of the snow banks. Good to know.

I have trouble guessing where prices will be next year. But you are right; they will be either up, down or flat.

Apparently in May of 2018, there are 516 homes in Vancouver’s Point grey and west Vancouver. (96% of them are over $2million. My friend is selling a war time bungalow in Kits for $2.6million.)

Victoria even has larger lots in general and for less than half the price of a west side or even east side of Vancouver. That’s why I think Victoria will still silently increase over the next five years… and why you ask?………because they are likely worth much more than what they are worth today. People want to buy a house in paradise. The population of Canada is getting older and no one wants to break a hip and end up head first into a snow bank. It’s about as simple as that:)