Affordability Update – Single Family

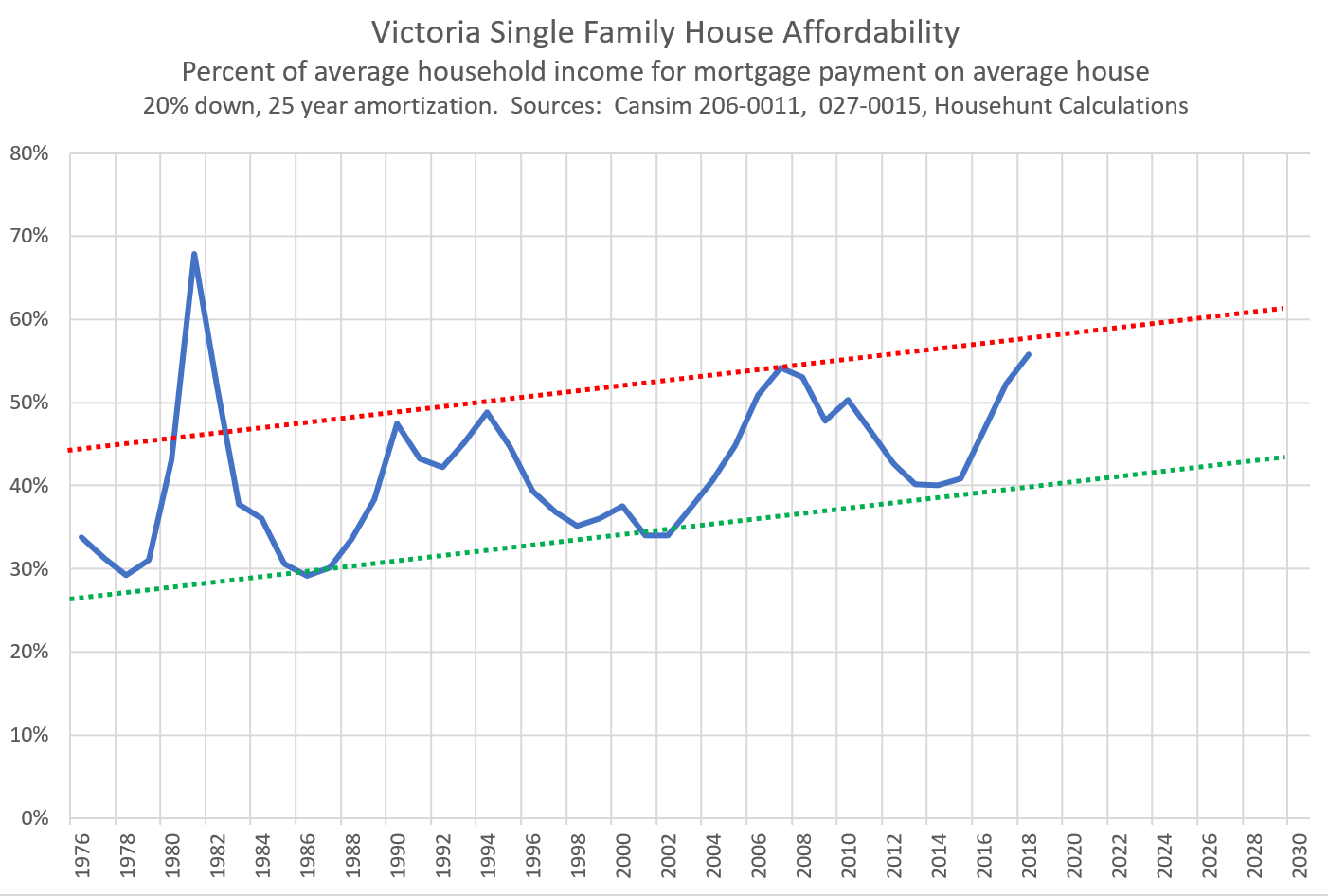

Time for an update to the affordability situation specifically for single family homes. As I’ve said dozens of times before over the years, affordability is one of the key, if not the key measure useful for gauging the longer term direction in the market. While poor affordability does not guarantee large nominal price declines, it has lead to poor returns going forward, and conversely good affordability has been followed by outsized price appreciation.

Here’s the affordability picture for single family homes today:

A few things to note from this chart:

- The chart shows how the mortgage payment on the average single family house compares to the average monthly household income. Higher levels indicate worse affordability, lower levels are better affordability.

- Mortgage payments are calculated based on the average 5 year rates obtained by consumers at the time using a 25 year amortization and 20% down. It does not take into consideration changing credit conditions like the recent stress test (or the 0 down options a decade ago).

- Don’t get hung up on the actual percentages. It doesn’t mean the average home buyer is spending 56% of their income on a house, these are just averages. What’s important are the trends over time.

- Outside of the spike in 1981, we have currently the worst affordability levels in over 4 decades. In 1981 affordability rapidly deteriorated due to a spike in interest rates.

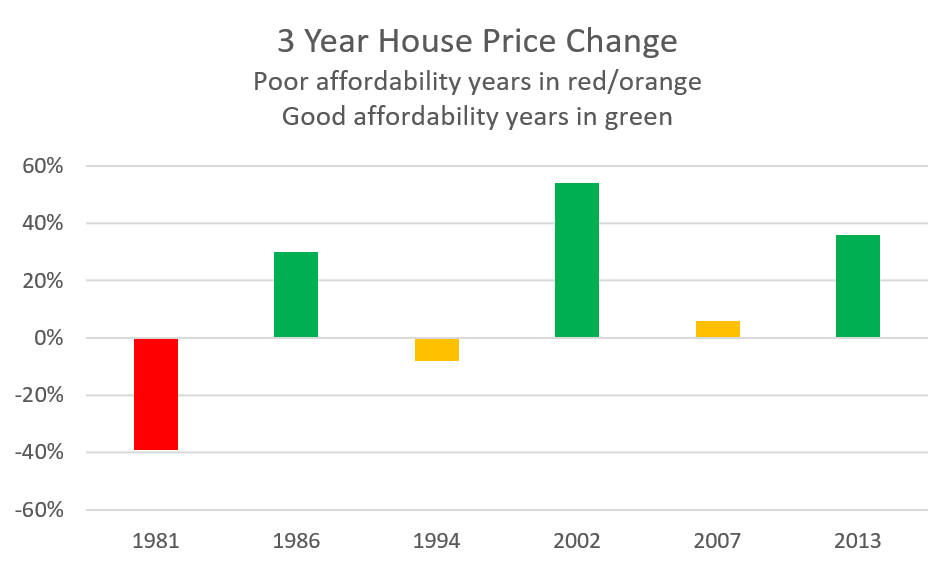

- Poor affordability has lead to poor house price appreciation in the past and vice versa. This can be clearly seen by looking at how house prices performed when affordability was poor and when it was good.

- Affordability of single family houses doesn’t return to the same levels. In other words, over time, single family homes become less affordable to the average family. Why is that? Simply because of the increased density of the city over time leading to the proportion of people living in condos and townhouses increasing while the proportion that live in single family homes decreases. In general, out of the population of property buyers, the higher income ones will be purchasing single family homes. This means that as condos make up a larger percentage of available housing stock, the percentage of the population that is purchasing single family homes decreases and the income of those single family buyers increases. If we had statistics for incomes of just single family home buyers, I would imagine that affordability for them has not deteriorated over time. See the approximate affordability band in the chart below.

- In the past three periods of poor affordability (2007, 1994, and 1981), the situation was largely corrected through decreasing interest rates. Today the more likely scenario is flat or increasing rates going forward. Outside of decreasing rates, affordability could also be improved via decreasing prices or increasing wages. Of course another possibility is that Victoria prices will completely detach from affordability constraints and go to the moon, but I find this quite unlikely in the short or medium term given our history and current political climate.

What do you think will happen going forward given current poor affordability levels? In the next article in this series I’ll examine various scenarios and see what impact they may have on prices.

“I totally get you vicinvestor and I agree but it’s funny that 1.5 million seems normal for a crappy house… At what point is it not worth it for people?”

The reality is, a decent lot in Oak Bay is approaching $1.5M. Build a nice home for $1M and voila` there’s your $2.5M home.

My property in Gonzales is assessed at $1.15M

the lot is assessed at $1.1M and my 1958 raised bungalow 1750sq ft home is assessed at $50K……go figure.

There are days where I wonder anyone would be 1.5 million for a crappy Oak Bay little house on a crappy lot?

wow that’s what 1.33 gets you. I have no words..

I totally get you vicinvestor and I agree but it’s funny that 1.5 million seems normal for a crappy house… At what point is it not worth it for people?

The high end may be moving more slowly but I truly believe that’s where true ‘value’ lies. If I can afford it, why would I pay 1.5 million for a crappy standard oak bay house when 2.5 million buys me a must bigger lot and a better house.

Well, I suspect we are all looking forward to seeing how this month ends. Slower sales but nothing dramatic. I was wondering if, like Vancouver, the high end sales are down a lot (over 2 million). There appears to be a lot of inventory in the Uplands.

Wow – killing strata rental restrictions would cause a massive change to the province. Not sure I agree with that.

$1.33M

Grant:

Need to ignore some comments on this blog.

Lore, I had to go back to that thread and see what I possibly could have written that would cause you to wish ill on me. Apparently it was my stating some rather obvious facts about mortgage lenders that upset you so? Or maybe it was my statement that mortgage lenders have no responsibility to “look out” for those who borrow from them? Likely the latter. Stating facts does not make one an apologist and I’d like to know when taking personal responsibility for your actions and decisions became so reprehensible? Mortgage lenders are not going door to door looking to swindle grannies out of their last dollars. Most mortgage lenders, which really is mostly the banks, have pretty conservative rules about who they will lend to and for how much. And for the overwhelming % of loans there is no predatory lending at play. Are banks Saints? Hell no. But for those who are $200 away from insolvency, most are in that position due to their own decisions, full stop. There is a great amount of economic disparity in this world, which I think is where your scorn originates from – so how about we direct the moral outrage towards those deserving of it?

@nan

Speaking of that, I saw a post on fb a few days ago about a woman having 2 houses in East Van that she’s been trying to sell for a month now (I believe) and that she’s had to drop the price once or twice already.

And on another note, saw a house come up for sale in the Comox Valley recently that’s listed at double the assessed value and double what the last almost exact same house on that block sold for in 2017. I shake my head. Apparently they haven’t gotten the memo yet 😉

Now that would be interesting. I wouldn’t support removing the right to restrict rentals but removing the right to age discriminate I am fully behind.

That’s what I call putting your money where your graphs are!

Latest v-blog from Owen Bigland on the NDP rumour mill, regarding what they are planning to do next with RE. He says he’s heard that changes to the Strata Property Act disallowing rental only or removing rental caps may be coming, as well as changes surrounding purchasing bare trusts.

https://www.youtube.com/watch?v=97KXKWAm2pU

The bare trust one will probably have a fair bit of public support, but changing the Strata Act could be more controversial, depending what they do.

LeoS: How is the 2 mil plus sales doing?

$980k

And the renovation and repair category is also mostly consumer spending. As for investments, many people call things investments that aren’t actually.

Very slowly. Still selling pretty good out there

Probably not. If affordability returns to the market I will buy again at the next bottom and see if we can’t prove that logic has a place in real estate. That’s a few years off though.

Very interesting. The first thing you see when a condo bubble is about to blow up.

“@SteveSaretsky

I’m seeing Vancouver pre sale developments now offering bonuses and lower deposit structures. We could be onto something here”

Interesting conflicting statements Deryk, it’s more unaffordable now since 2007/2009 and on it’s way to 1981 levels. Harper isn’t here to bail out the banks for all their shitty mortgages this time on the backs of the tax payer. That would be a great election theme tho. “Vote for me and I won’t foreclose on you”

I could only imagine the number is twice the 2008 level of $113 billion, maybe more. Imagine the shadow bankers losses, it will be crazy.

nan,

That just confirms what I posted a month back via my buddy who has real estate connections in the area and that the Chinese have left and open houses are ghost towns. The only ones left are the bagholders who now need the money back in China or are underwater like Andy’s stats are clearly showing. Good old shadow banking.

Trade war with US could be the tipping point for China’s $14 trillion debt-ridden economy

Nearly 20 percent of China’s exports go to the U.S.

If a trade war ensues with the U.S., China’s GDP growth would drop 0.5 percent and could continue to fall as things heat up, the IMF warns.

China’s debt-to-GDP has ballooned to more than 300 percent from 160 percent a decade ago.

Chinese officials now warn of a financial-sector debt bubble that’s waiting to burst.

” The biggest issue? Its $20 trillion shadow banking industry, which is nearly impossible to figure out. In fact, the value of nonperforming loans could get even worse, if only people knew just what was happening inside of this murky shadow banking sector.

“No one knows who owes what to whom or how much,” said Pauly. “Only when it starts to go bankrupt will things start falling apart.”

https://www.cnbc.com/2018/04/24/trade-war-with-us-may-be-tipping-point-for-chinas-debt-ridden-economy.html

What was the sell price for 2490 Dryfe?

A Vancouver anecdote for all: I was talking to a family member last night who lives in the Dunbar area of Vancouver. He was telling me how “ prices were down 20%” in his neighbourhood and that he and his wife had taken a few drives to check out the market. According to them “All the empty houses are starting to come on to the market” – for sale signs were popping up on tons of houses they had noticed were empty over the years. They expect reported prices to come down in the next few months.

I bought in late 2011 and that was long after the Great Recession. Sure it was bearish here on HHV (and we know how that worked out) but the point being is: rates were already rock bottom for a long time, QE had had plenty of time to work its way through, US had recovered, the Van to Vic gap was huge, basically the same situation as now. But…. no one was buying. The single biggest thing that affects sales is perception. Next would be availability of money. I don’t think logic is a big contributor.

So another financial crisis at the same time as affordability is worst? I guess if prices stagnate or decline for the next few years we still won’t agree on the cause 🙂

Patriotz:

You are absolutely right about the fact that the 30 year terms were at a fixed rate. But someone else was correct that you need a relatively small number of houses to be put on the market to have prices plummet. The fact that over 80% of US mortgages are thirty year terms provides a real ballast of stability over the long run..

“Victoria was a bargain in 2008………And yet prices stagnated for years while affordability caught up……”

Because in 2008 the world was on the verge of entering one of the worst financial collapses since the great depression. Many people were predicting the collapse and kept their financial powder dry at that time and waited until the collapse to then start buying after people panicked. People who followed international news could see that the gulf wars were costing America an absolute fortune and would become a major haemorrhage to the US economy. (One trillion dollars just to take care of the veterans who were left with stumps instead of arms and legs.)

I believe that there will not be another world financial collapse until later in 2019. That’s when the music will likely stop in my humble opinion:)

A 30 year term in the US – offered though FHA, Fannie Mae, etc. – means the interest rate is fixed for 30 years. You are talking about a “teaser” rate or “exploding” mortgage that had a 5 year term. You might be thinking about a 30 year amortization which is not the same as the term.

They haven’t.

It is, but i think affordability is the most important factor. If Victoria is a bargain now, it was a hell of a bargain in 2008. And yet prices stagnated for years while affordability caught up. So why didn’t prices keep appreciating if it doesn’t matter? Why didn’t all those global buyers keep driving up prices?

An earlier post by Leo, whom I respect but don’t always agree:)

“And yet, the pattern remains the same. A price explosion when affordability is good, and a slowdown (now) when affordability is bad. If it didn’t matter we wouldn’t see a 4 decade long pattern”.

I was not aware that ” prices” have dropped in Victoria. Yes….there is a slow down in number of sales, but the prices are still going up. ( I see asking prices being dropped but no drop in the realistic value of houses.) I also believe that prices exploded not because the “affordability” factor was good in the past few years, but because of a number of other factors such as massive quantitive easing by governments…(inflation), money laundering through casinos, and the movement of cash around the world to safe havens. It’s much more complicated than just local “affordability”. The bottom line is that Victoria is still a bargain…….. And yes….. the music will stop eventually and some people will not find a chair:) But on a world scale…Victoria is still one of the best places to invest in a home for your family.

@ Grant: I read your response to my note under the April 16 Market Update, and your response is textbook, very tidy, what one would expect from an apologist. However, pat rationalization doesn’t redeem evil. A great wrong has been done. When the imbalances unwind, the human cost will be terrible. It may be asking too much, but I hope your ilk comes to see and feel some of it.

Ah, but if real estate only rose as much as inflation it would be boring. Then what would all the people on this site speculate about?

You don’t need great swaths of the population defaulting on their mortgages. In the American example, less than 7% of mortgage holders actually defaulted in 2008, and that was enough to create a cascade effect in the credit market. Over the next few years it caused the entire edifice, and almost the entire global economy, to collapse.

The other point is with the thirty year terms, a lot of the ‘investors” had a pricing regime not unlike what Shaw cable has here – pay a lower introductory rate for a period of time (usually 5 years), then afterwards it goes to the higher rate for the duration of the amortization period. So in some ways, it had similarities with how mortgage renewals would work here presuming a rising rate environment.

Even if the rates were to rise to levels they couldn’t afford, it “wouldn’t matter”, as they were doing the same thing that folks in our markets are doing now – counting on capital appreciation and the ability to sell into a virtually liquid market. It sure worked, at least for a while.

Local Fool:

I am not disagreeing with your main point but the housing bust in the USA did not effect the majority of American homeowners. The critical difference was that the vast majority of homeowners had standard thirty year terms. I am not suggesting that there was not a major crash in the USA but rather in many ways the situation here is much more sensitive to rising interest rates than south of the border.

I dont believe that there will be hordes of first time buyers defaulting but increased rates will certainly curtail their spending in other parts of the economy.

Victoria born, I would be happy to meet you after class one day for a drink at the pub and I will tell you about Victor Lustig.

He doesn’t live in Victoria in the first place. He’s just a frequent visitor who spends < 6 months a year in Vic. All he has to do to avoid the spec tax is rent the place out to a long term tenant for the other 6 months. He’d make a lot more money doing that than leaving it empty – which makes me thinks he’s not really leaving it empty. AirBnB anyone?

Good post. This last week has been a good demonstration of the principle that has been expressed here a few times – don’t presume the Central Bank has sole control over what you pay for your mortgage. They don’t. They have less influence than many think, and where they do have influence, have less flexibility than many think.

As bond yields rise and the Fed continues its aggressive trend upwards, it’s not going to be a matter of whether the Poloz “knows in his heart” that over-leveraged folks will be hurt if rates rise, any more than it was for Gerry Bouey in the early 80’s. He can sooth-say all he wants; his mandate is what it is.

Here’s some rather amusing, if not silly, quotes from the US Fed shortly before, during and after their housing bust. See if any of it sounds familiar to things you hear up here today.

“Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.” – May 17, 2007

http://www.businessinsider.com/bernanke-quotes-2010-12

for 800k, check out MLS 385885, haha.

I agree with you, Barrister, and enjoy reading your posts. It is not different this time. Decades of history tells us that an average annual rate of return of 3 to 5 % for RE is the norm – in time, we revert to the mean (average) [reversion to the mean]. What we have seen is not the norm – and cannot be sustained. Those that think that RE will continue to climb (and I read from many of them here), unchecked, should see me after class because I have a nice, gently used, bridge to nowhere I would like to sell to them. When you look at where the market is, well, res ipsa loquiter applies: the thing speaks for itself. To quote from Mr. Justice Major, as he then was, the market will revert to its “original position” [See Athey v. Leonati (SCC 1997)]. I took some license using that quote from tort law, but you get the point. The RE market is a long way from its original position, so the fall may be especially painful for some.

The laws of equity and dictates of the Chancery Courts do not apply here – Equitable Estoppel will be of no assistance as prices grind down. Fairness has nothing to do with this. The laws of economics are not guided by the laws of equity. Those buying or that bought at the peaks are sheep, and sheep get slaughtered eventually.

Hawk – those are sober words and no truer words have been spoken. Matters little what the Bank of Canada does when the bond market players are selling bonds [we have inflation, we have QE reversal, tight labour markets, a US Fed reducing its bond portfolio, etc.] – bond market is falling and yields are rising – the US 10 year treasury is now about 3%. Mortgage rates MUST rise as a result. This is an arithmetic certainty. RY followed TD, and you can bet the rest will follow – they have to, or lose money.

This is not a Pumpers vs Bears exercise, in my humble view – each dog has its day – it is time for one camp to retreat – which is it?

“.. it is ramping up demand there which will raise the entry level prices into the market………sad, sad, sad.”

What’s sad is when salesmen pump the bullshit that prices will only go up, especially in light of a .45% mortgage rate hike just in one swoop yesterday with many more on the way.

The experienced and savvy builders I hear have sold, and now awaiting for the cleansing of the rookies. Experience speaks volumes. 😉

Victoria Born:

I agreed with you that a house should be primarily be viewed as a home. That has its own intrinsic value. Personally if it just kept up with inflation I was pleased.

Thanks Totoro:

I am just repeating what the young guy at the desk told me five years ago. Obviously he misread his online program. Good to know. Actually I remember thinking that 12 times a night seemed high at the time and all I could figure that there must be a lot of old people getting sick. Did not have the time to check it out further. As always you are the Queen of the facts here.

Thanks Barrister – good thing to know.

Richard – that is the exact thing that I have been thinking as well. The new rules, as they stand, push people to the lower end of the market and that increased demand pushes up prices there. However, demand creates supply and we will see increased building in that segment of the market [mid to lower end SFH and condos]. In economics it is called “Says Law”, which says that supply does not create its own demand. The “chicken and egg” debate does not arise here – we know that demand creates supply and, in fact, the NDP are focusing increasing new builds to supply this segment – that is where builders are focusing to make profit. This, with the outflow of foreign money, leaves the upper middle and high end SFHs with fewer buyers – so, for an astute buyer with cash or credit, an opportunity may be at hand – or 12 to 18 months from now.

Fingers crossed and raising cash…………….with dividends and capital gains accruing in the equity market [DRIP, DRIP, DRIP] which over the long run [10 years plus] beats the RE market every time (data supports this over and over). A home is a place to live, not an investment.

They respond to about 1400 requests for assistance a year – or 3.8 call outs each 24 hour period – most of which are during daytime hours. Still annoying to live next to but it is not 12 times a night.

The stats are here: https://www.oakbay.ca/public-safety/fire-department/news and in the annual reports.

MLS 390009

Doesn’t 800K for a 3600 sqft lot seem a little steep? It is a great location and all, but wow.

It has got a 550 sq ft cottage and a 8×10 “studio”, but I am not sure those add that much above lot value.

Probably true, but in referring to the Vancouver condo market, the prices began their parabolic ascent long before B20 came into play. Its intro just made it more acute. It’s a little like arguing that the foreign buyer tax is what cooled the market, when it’s more an aggravating factor acting upon larger and more cyclical market dynamics.

In fact, sales volumes in the condo segment are actually decreasing but the crisis-levels of inventory are providing transitory support for prices. The run up actually looks very similar to what detached homes were doing until that market segment exhausted itself. But unlike SFH’s, there’s a huge volume of new supply coming online very soon and over the next year. I have said before and will say again, I think it’s the folks buying presales and/or spending 800k on a 650sq foot condo that’s going to be our achilles heel.

The irony to the new mortgage rules and proposed new Provincial regulations is forcing all attention onto the lower end of the market because that is all people are qualifying for and it is ramping up demand there which will raise the entry level prices into the market………sad, sad, sad.

Leo:

If the pattern continues is it likely that we will experience a build up of inventory?

Victoria Born

The problem with York is that the fire hall is around the corner. They called out about 12 times a night, according to a very nice fireman who looked up the starts and they are required to pull out of the fire hall with both lights and siren. If you are looking at the old Manor house then you really need to get an engineer to look at the foundations particularly the foundation of the main house on the patio side.

Thanks CE – I agree with your take, but never been fond of Rockland. I only ask because at times like these [3 listings for every 2 sales and the volume of price drops we are seeing] a good gauge of the market’s weakness is in the high end [or psychologically what people see as the high end of the market] of the market. There is very little moving [sales] in these areas though I am seeing 5 listings for every 1 sale and far greater price drops than the other core areas that we the masses occupy [LOL]; however, the asking prices are still far above the property tax assessment values. Prior to 2016, we could confidently forecast that a home in these areas would sell for about 10 to 20 % above the property tax assessment – well, sellers have been asking for 50% above that and more. Demand has dried up in these areas and it makes one think that a bargain may be had at some stage if a seller is a foreign owner subject to all of these new taxes OR is that just a cost of doing business.

Gordon Head is the proverbial middle class area. But, lots of dumpy places there too. Lots of drugs everywhere and expect more once Trudeau’s dream of a “reefer” in everyone’s hand becomes a reality. Yes, I am opposed to it because it is a revenue generator and the Liberals will come to regret this due to the social ills.

2 really nice listings on York in Oak Bay. If you have $2.5 to $3.0 M sitting around.

Uplands, waterfront Oak Bay, Rockland, patches of South Oak Bay, Ten Mile Point, parts of North Saanich. Other than Uplands and waterfront, all of these areas are plagued with sub areas that are veritable ghettoes of more middle class inhabitants

“The pattern of 3 new listings for every 2 sales and 1 price reduction still pretty constant”

Slashes really stacking up now in all the prime areas the last week. When it rains, it pours.

“Well known drug house. The hilarious part is there was an open house a couple houses down at the same time.”

Well there goes Golden Head. First the gangs, now the druggies. No wonder the open house was happening, the smart money is dumping ASAP before it turns into the next Surrey. Intorovert’s next door neighbor by the looks of it. Nice hood. Not.

Respectfully, I have never liked Gordon Head. Growing up, this is where all the civil servants tended to buy and live. It is a fish bowl. Close to UVic which is nice, but tends to be a homogeneous crowd. I used to like Ten Mile Point, but find Wedgewood now a mirror of Gordon Head. Parts of Ten Mile are very rural [the roads are terrible]. So, curious on your opinions, where is the main “upper class” area in Victoria? Growing up, it was Uplands – does that remain the standard bearer for Victoria?

From winter to summer in one day ! It’s going to be 26°C today here in Calgary, Yahooooo !

Realtors already had their OPEN HOUSE signs out at 10am this morning….optimism indeed !

The pattern of 3 new listings for every 2 sales and 1 price reduction still pretty constant

Photo reminds me of LA.

Hey “surrounded by SWAT” sounds like ADT Security on steroids. Sign me up – Who is going to rob your place when there police are making such a ruckus a few doors down?

Hawk last seen in Gordon Head with a Darth Vader helmet on encouraging all the neighbours to come to the Bear Side and to those who resist he bellows : “I find your lack of faith disturbing!”

Well known drug house. The hilarious part is there was an open house a couple houses down at the same time.

So… good neighbourhood for $900,000. Well at least the 70s original green carpet will comfort you when your house is surrounded by swat

This is all I could find on it this evening:

First thought: grow-op. Second thought: renter going berserk after comparing his net worth to most homeowners in Victoria.

Does anyone know what if anything is going on?

“Huge police presence in Gordon Head. Suspect armed standoff or something.”

Hawk is out there low balling a home owner telling them the house is only worth half of what they are asking! Furthermore he’s telling them that the bank is going to call on their heloc since the value is no longer there to cover the outstanding debt. He’s telling them to throw in all the toys they bought on the heloc, since they won’t be needing them when they move into some “shithole” basement suite. I guess the homeowner can’t handle it and has flipped out!

“Huge police presence in Gordon Head. Suspect armed standoff or something.”

Intorovert finally snapped from the rising

rates ? 😉

Re: #390488 (1484 Lang St.)

I was curious if it was a flipper; sold last year for $532K. I think those purchasers will be disappointed. Also, that has traditionally not been a good area.

Cant find anything on the news about Gordon Head.

Bitterbear: Then its lipstick on a piglet.

Yes, Richard, “little” being the operative word.

Huge police presence in Gordon Head. Suspect armed standoff or something.

“Agreed Beancounter,

lipstick on a pig.”

Quite the little oinker !

Agreed Beancounter,

lipstick on a pig.

Yes have thought about it. There is the everpresent conflict of the truth and sales though 🙂 Agents that may be quite eager to purchase an info sheet when it says “good time to buy” may not be so enthused when it says “high risk”.

However easier to understand market analytics are definitely top of the list of what I want to do. One should not have to understand what months of inventory or sales to list are just to get an unbiased picture of market conditions. Just have to find the time / resources.

We stopped for lunch at a little place downtown; “Taste of Europe” Both of us found the food fantastic and the prices really affordable. One of Victoria’s secret gems.

#390488

Apparently Bubble World ain’t just a place that serves asian milk tea. Among all the head-scratchers I have ever seen, this ranks right at the top. If this things sells anywhere near ask you can officially book that we are in a bubble of unprecedented territory, and when the dust settles this listing should be the poster child of the era.

What’s Manhattan’s Land Worth? Try ‘Canada’s Entire GDP’

This is fascinating:

https://www.citylab.com/life/2018/04/what-manhattans-land-is-worth/558776/

@Leo, it also got me thinking that maybe there is a more friendly “info graphic” summary of the market that could be generated. Still having the more technical available. IMO this visualization is key to your monetizing your awesome analysis and automated data summaries. Agents could buy a printout package from you with their branding for instance.

Anyway if I find some spare time sometime I might do an illustration of something….

“22% used the HELOC money for investments, 28% for debt consolidation (presumably at a much lower rate), 31% for renovation or repair (presumably increasing asset value in some cases and enjoyment)…”

So that leaves 19% that blew theirs on trips, keeping heads above water etc along with the 28% that are future debt risks as well with the potential to tank the markets. Looks like a recipe for a major market cleansing.

A half a percent just knocked out another huge chunk of potential buyers that won’t qualify. Credit squeeze in process. Forget 3% they said on BNN earlier today. The focus is now on 4%.

The average house in the core would pay for about 14 years of living at the Berwick, far longer than the average length of stay in a long-term care facility (18 months).

https://www.theglobeandmail.com/globe-investor/retirement/long-term-care-costs/article26913111/

RBC just matched TD’s hike in mortgage rates. Don’t be fooled, these are big moves up. CIBC says 47% of 5 year mortgages mature this year.

Plus the knowledge that you have home equity as you age would likely create significant peace of mind and security for most.

500,000 Canadians have a HELOC, and another 1.48 million households have a HELOC and a mortgage. That’s about 20% of all homeowners.

22% used the HELOC money for investments, 28% for debt consolidation (presumably at a much lower rate), 31% for renovation or repair (presumably increasing asset value in some cases and enjoyment)…

https://betterdwelling.com/1-91-million-canadians-are-borrowing-against-their-home-equity/

Leif:

Re: James Bay

Not only was I here but in 2013 i was very actively house hunting. Totally agree that houses in James Bay were often selling then in the 500k to 600k range. You could also buy a knockdown in the heart of the Uplands for between 600k and 800k.

But I was also in Toronto when you could buy a house in Yorkville for next to nothing. Whether you call it gentrification or something else the relative value of neighbourhoods in a city can dramatically change as a city grows. I dont follow James Bay generally but it would not surprise me if the average selling price is around a million these days with a knockdown going for around 750k.

I dont have a vested interest, nor do I have a crystal ball, but it strikes me as a neighbour that it has undergone both a rapid and fairly extensive transformation. But, if I have time I will do a drive through this weekend and see if I can get a better feel. Lets get other, perhaps better informed, opinions.

Downsizing, moving to a new city, and moving to a different area in the same city are benefits that many people realize before they are dead. It’s not rare.

Royal Bank joins TD in raising fixed five-year mortgage rate

RBC confirmed in an email to BNN the bank will raise its five-year and 10-year rates by 20 basis points effective Monday, April 30. It also plans to raise its one-year and four-year fixed rates 15 basis points, and will lower its variable closed mortgage rate 15 basis points.

The confirmation comes a day after TD said it would increase its posted five-year fixed rate by 45 basis points to 5.59 per cent as government bond yields touched their highest levels since 2011 this week.

“Adjusting our rates is not a decision we take lightly,” Bellissimo said. “We look at a number of factors when determining rates including the competitive landscape, the cost of lending and managing risk.”

https://www.bnn.ca/royal-bank-joins-td-in-raising-fixed-five-year-mortgage-rate-1.1067804

Then that Leo. I think sales/list is a “leading indicator” and trying to use your graph has led to an OJ situation where the DNA evidence is just confusing and the power of a simple rhyme “if it doesn’t fit you must acquit” wins the day. So it made me think there might be an easier way for that graph to communicate what it’s communicating.

anyone know what mls 390328 sold for?

Usually for sales to list it’s under 50% for sellers market, 50-70 for normal, and over that for sellers. CMHC defines over 80 as “overheated”

Candlesticks-

Jan mean or median ( open) Dec mean / median (close) , highest price of the year, lowest price of year.

Prices aren’t seasonal but sales are. So it makes sense to use a candle per year to split the data up. Which month had the peak price isn’t too important, except if the overall pattern was increasing or decreasing during the year.

True just the smooth line with 50% and 100% clearly illustrated would probably be better. Maybe like your heat background but simpler.

Got it. I agree the individual monthly data points are not very enlightening, and the annual average trend is much more useful. So getting rid of the noise of the individual points would clean it up. Not sure the range for a year would be particularly helpful because it is so seasonal.

This is where seasonal adjustment starts to become useful.

@Barrister

“Some areas like James Bay would only see a very minor price decline while other less premium areas would experience a greater decline. Actually, on reflection, it would not surprise me if a couple of areas like James Bay actually were either flat or even possible increasing in value while others do decline.”

Were you here in 2010-2015?

James bay had lots of homes for $500-600k. I know because my brother was looking at the 450-550 range. Those 500k homes are now 800 to 900k. I don’t see how that would not have a decline as well.

So on prices they would show last years price and current price, and.. what else?

Edit: or do you mean similar to how stock charts show the day you would have one bar for each year and show the range of monthly prices?

TD raises mortgage rates “Biggest Move in Years”. 45 basis points. Stick a fork in it. The affordability charts need an adjustment.

Throw in HELOC’s and credit card debt plus daycare, exploding gas prices an 1981 levels aren’t so far off.

Stock candlesticks show the open, close, high and low. They are an excellent visualization tool. I think they would actually be the perfect way to show YoY prices, say weekly or monthly RE medians.

@Leo, In essence the candlestick just popped into my mind because shows a spread and a positive negative. This is more what I meant. Sorry to throw you off since a true candlestick doesn’t really work. Here is perhaps a better attempt at describing something that shows the spread between sales and list. Because I think the spread is what is important in that part of the graph. The pattern and direction is important in the line.

So….instead of the zigzagging line where you show the the non smoothed sales/list % you show that as bars with a little less resolution obviously and colour them different when they cross the 100% mark and again under the 50% mark. Bars are the average of some block of time depending on resolution.

Updated Q2 housing market assessments at the following link:

https://www03.cmhc-schl.gc.ca/catalog/productList.cfm?cat=192&lang=en&fr=1524793389148

How many people enjoy their rental properties? I assume you meant the primary residence but I wouldn’t consider someone that buys a house an investor. Only in rare cases will that investor benefit from the appreciation before they are dead.

Pretty much the only reason I am in a huge house is benefit from tax free appreciation and I will benefit when I downsize versus having lived in a 700 sq/ft condo (realistically what I need).

It kind of pays off to pay for square footage that you don’t need, or at least has in the last 20 years.

How many people enjoy their rental properties? I assume you meant the primary residence but I wouldn’t consider someone that buys a house an investor. Only in rare cases will that investor benefit from the appreciation before they are dead.

Before we discussed how much money one would need to be comfortable. For me that would be about $1M and a paid off house. It doesn’t matter if that house is worth $200,000 or $1M. Sure the $1M house gives some more options if we left town but it will also cost more to insure and maintain over its life.

Really? I’m talking about “innovative” building products – not sinks and tiles etc. GRK screws, Siga tapes and membranes, Engineered mass lumber (CLTs), Insulating fiber boards like Agepan, Zehnder HRVs (or any euro HRV), Euro windows (now in duncan: http://www.fensturwindows.com/) etc.

But hey, PEX is still locally made and has pretty much taken over plumbing. How about Roxul, made in Canada. Most of the dimensional lumber any ply/osb is still local. Tyvek made in the USA. I believe most of the simpson stuff is still made in the USA as well.

Come to think of it, I’m not sure I’ve used much of anything from china so far.

I always remember one of my clients saying “the best thing about investing in RE is that you get to enjoy your investment.” It puts a whole different perspective on investment. The only other investments one can enjoy are art/sculpture collections, classic cars, antiquities.

I’d say a more realistic ratio might be 1 in 1000 new products is a major disaster.

Not sure if I agree with you….half the stuff these days is coming from China. Who knows what is in the various glues and crap. Nothing is solid anymore…it all glue together veneers, etc.

That’s an odd observation. Who has ever said, “my conclusions must be correct because my pile is large”? My arguments do have holes. So do yours. I try to focus on data and use it as best and honestly I can. If you cannot refute the argument through facts or logical means, dismissing it or pathologizing it isn’t a rebuttal. Nor is it a fallacy to present data and challenge the opposition with it, or to recognize patterns in data and their underpinnings. If you don’t agree with something, point out why and give me the opportunity to learn.

The fallacy actually lies in the argument of “it’s wrong because it hasn’t happened for X period of time”. You could say, “I needn’t wear a seat belt as I’ve never crashed”. Every market corrects and when it does, it will be more than some people thought and less than what others thought. And so what? Not sure I’ve seen a great preponderance of folks here on either side guaranteeing anything.

Regardless, if you feel a “technique” is being used improperly or subversively in certain posts, scroll past them. A better option though, is to challenge yourself. Or simply delight in the debate, revel in the bet of what the future holds, while acknowledging the market will do whatever it will without regard to either. 🙂

and then I met people both in Canada and the US that had held real estate for a long time and when they eventually sold, they sold for a loss. I don’t know all the details around the purchases but it was an eye opener for me.

There are still lots of examples of properties for sale in Greater Victoria right now selling for a loss. A few condos at the Falls, condos in Colwood (old Aquattro development), condos on Bear Mountain, etc. People make dumb decisions all the time. Not sure why people thought it was a good idea to buy at Aquattro at a cost greater than the Bayview One (top notch concrete building in Songhees) at the time.

I think you have to look at some sort of average and not sure if there are two points 10 years apart in Victoria where prices were lower at the later point?

I’m not so sure “affordability” means anything today. It would mean something if you are looking at wages, but there are tens of thousands of people who have very little income and yet are buying houses.

I think affordability is a larger factor; however, I agree that local incomes are less of correlation than they were before. Victoria is changing a bit…today I saw 6 model Xs ($150,000 a pop), few Ferraris, a Mclaren parked on 800 block of Johnson of all places.

Nan:

So how is the guy any different than any other tourist that we get in town? His property taxes and school taxes are probably a lot more than the hotel tax he would bring in and he definitely spends more than the average tourist off the cruise ship. He does not pay income tax but on the other hand he does not draw upon either medical or education resources which are the big ticket items in the budget.

I am old enough to remember the unemployment rates in BC during the 1980’s that averaged well above 10% and at one point hit 15%. It is easier living with a housing crisis than an unemployment crisis. Perhaps him leaving is positive for the province but one should not ignore that it also does represent a net loss of income for the province.

I know that the province is doing great but as a banker friend of mine pointed out the picture changes if you convert our export numbers into US dollars. Obviously I am not as convinced as NAN that the speculation tax is wonderful for BC. What worries me is the amount of rather foolish and one sided views that get expressed. Both sides seem to be arguing a simplistic view that expresses only one side of the equation.

The good news is that it is a beautiful day and my wonderful wife is back from the USA.

Sorry not sure what you mean. Can you elaborate? Sales/list ratio like the second chart on this page? https://househuntvictoria.ca/market-summary/

Candle stick charts are usually used to show range of the data vs 25th/50th/75th percentile points or error range. I’m not sure how they would be applied here.

CS I am not a pumper. I am just a firm believer a home is a place to live and enjoy and over the long term it goes up in demand areas. If you can afford buy. If it goes down 10% how does that change your life. A lot of people have lost out waiting for the crash.

Totally agree. I would say it predicts we are in for a cycle of improving affordability, nothing further. That does not necessarily require declining prices.

Based on my 2010-2015 observations I think the rental market would has to considerably weaken to see significant downward pressure on prices. For whatever reasons people accept a financial loss on cars and other items; however, not homes. It is like people are allergic to selling homes at a loss.

Lost a lot of listing 2010-2015 where sellers simply rented them out as the rental market has never been that bad where you can’t rent for a reasonable clip.

@GWAC

“This blog is amazing. Only 1 issue and that issue has been around for 10 years. It is very slanted by posters in finding reasons not to buy real-estate. ”

LOL

Very slanted by posters finding reasons not to buy except for the fact that there have certainly been more poster finding reasons why folks should buy.

What’s interesting is the logic behind either view, and when it comes to reasons not to buy, GWAC and the other pumpers, flippers, or speccers rarely seem to have anything to refute the logic, except the claim that “RE always goes up”, which is false.

Affordability just worsened [BUBBLE POP = OUCH]:

Toronto-Dominion Bank has lifted its posted rate for five-year fixed mortgages by 45 basis points to 5.59 per cent as government bond yields touched their highest levels since 2011 this week.

“It’s a big move, the biggest move in years,” said Rob McLister, founder of RateSpy.com, a mortgage comparison website. “There’s a lot of reasons why that could be — maybe they’re taking a position on rates going forward, which is not that typical; maybe they’re trying to get people to lock in and generate better spreads.”

Toronto-Dominion, Canada’s second-largest lender, lifted its five-year closed rate on Wednesday, along with increases to its two-year, three-year, six-year and seven-year mortgage rates, bank spokeswoman Julie Bellissimo said Thursday in an e-mailed statement.

Banks generally give homebuyers better terms than their posted rates. Canada’s big banks are charging their preferred customers with sound credit quality 3.39 per cent for five-year fixed mortgages and 2.75 per cent for variable mortgages this month, according to RateSpy.com. That’s little changed from late January.

Canada’s housing market is has been on a wild ride. House prices in Toronto have begun to stabilize after dropping sharply from last year’s dramatic spike, while prices in Vancouver have rebounded. Sales volumes are still down from last year however after the government introduced regulations to make mortgages more costly.

Bond Yields

“Adjusting our rates is not a decision we take lightly,” Bellissimo said. “We look at a number of factors when determining rates including the competitive landscape, the cost of lending and managing risk.”

Even with the change, rates “remain competitive and at historically low levels,” Bellissimo said.

The change comes as the yield on five-year federal government bonds rose to 2.18 percent Wednesday, the highest in almost seven years.

Toronto-Dominion’s posted rate is now higher than rivals including Royal Bank of Canada, Bank of Nova Scotia and Bank of Montreal, which each advertise posted rates of 5.14 percent. Canadian Imperial Bank of Commerce has the lowest posted rate, at 4.99 percent.

Previous returns to better affordability seem to have often been associated with/triggered by recessions. What is going to move us back to better affordability this time?

Initially the interest rate hikes may further worsen affordability.

Wage gains would do the trick, but only if there is a long period when house prices don’t rise much. Likewise inflation.

@ Leo, Do you think a candle stick chart might be handy for your sales / list? Going red when it shoots over 100% Green if under. Then you can see the spread better. I could be wrong here.

I never said that the pattern you’ve identified won’t hold, so I’m not sure why you’re asking me this.

Your pattern isn’t an example of the “technique” I outlined. The technique is often employed by Hawk, Local Fool, and a handful of others.

Totally agree. I would say it predicts we are in for a cycle of improving affordability, nothing further. That does not necessarily require declining prices.

Yes this is certainly a possibility. I would hope now that the government has dropped their hear no evil see no evil act that will not happen here. But it could.

@Introvert

If you think what’s happening in Van (even in the overpriced market) has no effect on Victoria, that’s a very short sighted viewpoint.

The West side of Van is where this whole mess started. And it’s where it’s starting to retract. You could see Victoria posed to take off after Van took off.

So look at the patterning…

It started in the high end SFH’s in the West side, and then spread out to lower priced properties in the suburbs and then to Vic and then up the island.

It’s retracting first in the high end SFH’s in the West side, and if that high end continues to fall, it will affect the lower end. So yes, it’s very much is something to keep your eye on, and it very much has implications for the Vic market over time.

Depends on rates and wage growth but I suspect that is very unlikely since that was basically the previous trough.

Estrada said he thought they might move to Portugal where there is a Golden Visa program that gives legal residency to people who spend at least €500,000 Euros ($781,000 Canadian) on a property. Immigrating to Canada is harder, especially for people like him who are retired or semi-retired, he said. “I don’t want to work. I want to enjoy life, ride my bike every day.” /

“I don’t want to work” exactly why you can’t have a house here. You are rich, pay diddly into the tax base and take up space. They also failed to mention how much his house actually cost. I bet it was a lot more then $800,000.

Andrew Wilkinson: “The speculation tax is a very blunt instrument that is antagonizing a lot of people who feel their roots are in British Columbia and now they feel like they’re being sent off because their assets are slowly being taken away from them by the NDP,” he said. /

There is a big difference between “feeling your roots are here” and paying for the privilege of putting down roots here.

There is a reason this guy lives here and it is because he can get all Canada and Victoria has to offer without paying for it. The deal has changed my friend. Enjoy Portugal.

Ben / Richard, I owe you both a beverage (or two) of your choice!

Andy like any data point you can always find someone or a few who lose money in an up market.

Point is you want a home and can afford it buy it.

You want to speculate buy a stock.

You want to speculate on home prices be prepared to wait a long time or give up and end up paying more. Lucky people who waited from last year get mortgage rates 1% higher.

What does the affordability index mean?

Prices are going down/ prices will remain the same while income goes up or prices are going up slower than income or prices go up while interest rates go down?

The analysis is great but it does not predict prices are going down.

I’d be interested to hear your reasons why the pattern of poor affordability in Victoria being followed by a period of poor house price appreciation will not come to pass this time around.

There are very few forecasts I would bet on, but this is one of them.

@gwac

I used to think that RE could only go up as well; and then I met people both in Canada and the US that had held real estate for a long time and when they eventually sold, they sold for a loss. I don’t know all the details around the purchases but it was an eye opener for me. And part of that is location. Do I think you’ll be ahead if you hold for over 20 years? Yes. But that’s not always possible for everyone and sometimes people have to sell earlier than expected (ie illness, divorce, job relocation etc).

Another thing you’re not taking into consideration is we’ve been in a decreasing interest rate environment for a long time. We’re now going into a likely rising interest rate environment – that changes things significantly. Interest rates start rising, prices might just start decreasing.

The ‘breathes’ argument is a pet peeve of any high efficiency builder. Older houses with lots of air leakage through the walls (and less insulation) could dry the wall cavities in the summer. Richard is fully correct that making wall assemblies that couldn’t dry out was, and continues to be, a major problem. When you put poly on the inside, and foam on the outside (which is what acrylic stucco is typically placed on), the moisture that inevitably gets into the wall has nowhere to go.

but, air leakage is bad. The most common way that moisture gets into a wall in the first place is from hot humid interior air exfiltrating through the interior vapour barrier and condensing inside the wall.

A good wall should not let air from the interior or exterior into the cavity space. It should also be made of materials that will allow moisture to diffuse out of the wall cavity when it inevitably gets in there. This is the purpose of building wraps like Tyvek or Typar – rain will not get through but moisture can diffuse out, letting the wall dry (think gore-tex).

Poly is a terrible interior vapour barrier because it is not permeable at all, and it is practically impossible to detail it in a way that is truly air-tight. Plus any time you poke through your drywall (and therefore poly) you have a place where moisture will get into your walls (not to mention all the light switches, plugs, plumbing bits etc).

So the ideal wall is air-tight on both sides (no breathing) but “vapour open” – water vapour can diffuse out to the interior/exterior/both. High efficiency walls typically use sheathing on the interior as the air and vapour barrier (no poly) as well as a “service cavity” which is a small separate wall on the interior in which to run wires, plumbing etc. With a service cavity, there is no need to poke holes in the interior sheathing.

/ Your weekly construction nonsense.

Hey, we haven’t heard from Just Jack/John Dollar/John Drake in a while. Speculations, anyone?

Couldn’t have said it better myself.

Yup. A favourite technique of HHV bears is to sweep a bunch of data and arguments into a big pile, then say, “See! Look how big that pile is—my conclusions (usually that prices will decline precipitously) have to be correct!”

A bear will do this almost every day, and it’s been happening for years. Meanwhile, prices…

Persons looking for Real Estate investments need look no further than Alberta, specifically Calgary. Yes it’s out of the media now but that’s exactly when bottoms occur ….they never make the news. I am sure as I can be, come October-December we will have hit bottom and RE here specifically SFH will prove excellent returns. (Condos will be considerably later). As 2019 approaches there will be built up optimism for the more business/investment friendly government waiting in the wings to be elected. I am already noticing in my rentals more enquiries on my vacancies.

There are very few soft costs in buying RE here and just as few rules/regulations. Probably one of the few places where investing going forward actually makes sense. Remember we are still below 2007 highs. Unemployment has dropped from almost 10% to around 7.5% now.

Speculation Tax Dashes One Man’s Victoria Dream

Fernando Estrada would have liked to stay in Victoria but instead he sold his house this week because of the provincial government’s new speculation tax.

“I’m really sad because we have to leave,” Estrada said, taking a pause at a scenic lookout on a Tuesday afternoon bike ride. “I really enjoy being here. I really feel sad because I have to sell my house. I actually just sold it yesterday.”

Once fully implemented in 2019, non-citizens like Estrada will have to pay two per cent of their property’s value in tax. On a house worth $800,000, that will mean a bill of $16,000 a year.

“I think it’s not that fair, especially if you’re already here,” Estrada said. “What I feel it’s saying is we don’t count. Because we don’t vote, they don’t care. They can punch on us because we don’t have any voice, so they can do whatever they want to us and nobody will feel sympathy.”

https://thetyee.ca/News/2018/04/26/Speculation-Tax-Man-BC-Dream/

Yes. Data is data is data, but you need an inherently biased human to interpret it. It’s better than blind conjecture, but can be much more dangerous when it’s misused, cherry picked, or misunderstood. But many of us don’t think so – so it’s the principle of the saying, “It is better not to know so much, than to know so many things that ain’t so.

Alas, cognitive dissonance never goes out of style.

This blog is amazing. Only 1 issue and that issue has been around for 10 years. It is very slanted by posters in finding reasons not to buy real-estate. That just perpetuates itself as prices goes higher.

End of the day owning real-estate at whatever level we are at is good if you can afford it and your have a long-term non speculative view.

There always data points that show prices should go down if you look hard enough.

My first instinct after reading this is to sit on my thumbs and wait for 2-4 years and buy a bunch of real estate when the number hits 40%. To me, that looks like maybe the next bottom and not being in RE, this is probably not a bad response.

That being said, a realtor might do something completely different (like marketing abroad) that might erode the predictive quality of the data, making my position completely wrong. I believe this is what happened in Vancouver – price income metrics don’t work anymore because local incomes don’t matter and foreign ones aren’t reported.

Hopefully the NDP taxes keep foreigners out and make my instinct profitable!

“What’s wrong with in floor heating and acrylic stucco? I’m out of the loop.”

There is nothing wrong with infloor heating…unless it is in Poly B. Electric radiant film heating went primarily behind drywall. Sometimes it was used in floor applications, was a source of many fires. It came in printed plastic sheets/roles in widths of 16″ and 24″ so it could be stapled between studs and joists.

Acrylic stucco was the main source to the “leaky condo” issue, its installation if not 100% correct leads to moisture getting trapped behind the all weather tight membrane causing….you guessed it…mould. Try doing a 100% application in all kinds of weather conditions and greatly varied competent levels of the trade persons.

Give me a house built anyday in the 50’s 60’s that BREATHES and I’m a happy home owner. We are building our new homes way to air tight leading to all kinds of problems, but try and explain that to a bureaucrat.

@Grant, I’ll be in Victoria between May 20 to June 6. Will gladly do a home inspection pro bono for a fellow Albertan (even if you are from Edmonton!)

Very interesting story here.

http://www.news1130.com/2018/04/26/millennial-homebuyers-migrating-east/

A young person can buy a whole “Duplex” for less than $200,000.00 in Moncton NB. (Rent the upstairs for $1,000.00 a month with tenant paying the heat and light and snow removal)

Great opportunities happening out there with the provincial governments pouring money into the economy to help the province get back onto it’s feet. (New stadium in Moncton, new hospitals, new major art centre etc etc etc. The place is starting to grow.

@swch25 it means, among other things, you don’t always know what are the ‘unknown unknowns’ you’re missing from your model, what faulty assumptions might be embedded, etc. As you say, everything has a data point, but we may not know what that is, or we may not know it’s even a factor. There is a limit to modelling, and the other poster was implying that ‘engineering types’ can be blind to that.

What does this even mean? Non engineers go with their gut? Everything is a data point.

Salesmen must really like dealing with you.

CS:

You make an excellent point and if I might add to it:- buying in the last two years might prove to be a disastrous decision for those that are unable to withstand higher interest rates at a time whem their equity is being eroded.

A huge difference between the early 80’s and the probable future is that, in the early 80’s, rates were headed for a generation-long fall while real prices were about to begin a generation-long rise, whereas in the future we will likely see the opposite trends, i.e., rising interest rates and falling real prices. So although so-called affordability was lower in the early 80’s than now, the early 80’s was a great time to buy, whereas now could prove to be a very bad time to buy.

I can see an average decline occurring but it would be far from uniform. Some areas like James Bay would only see a very minor price decline while other less premium areas would experience a greater decline. Actually, on reflection, it would not surprise me if a couple of areas like James Bay actually were either flat or even possible increasing in value while others do decline.

Always good to have stats to confirm that you’re not crazy.

If we do a simple extrapolation of the 4 decade pattern, what does would the trough look like? Could SFH in the core return to the neighborhood of $600k?

I think you’re overestimating the effect of declining SFH availability on a cycle to cycle basis. This is a very long term phenomenon; it’s not ever going to support a sudden and sustained spike in unaffordability. I agree with Patriotz opining that the rise in suited homes has had a role in this trend.

Leo, I would actually be curious to see the same graph but for row homes and apartments to see if the trend is persistent over there.

As for immigrants (foreign nationals), this is a recent and now common Canadian argument that essentially believes rich immigrants will hold up entire metropolitan markets in perpetuity. Sigh…no. Immigrants are broadly quantifiable in terms of numbers, net migration patterns, and how much they’re bringing in and spending. Are more foreign nationals moving to this city in the last 10 years than the long term trend, and is that the reason why prices have risen so quickly and at such a great magnitude? I don’t think there’s any data supporting this position, and in fact, this site has presented data several times over the last year demonstrating the amount of RE debt that folks in Victoria are pickling themselves in. This liquidity is, IMO, what drove the escalation more than any other factor.

Nationally as of 2015, immigrants have about $47,000 net worth, and a large portion of that goes to settling in. In BC specifically, the average immigrant has much more at just over $86,000, but again, less after settling in. We all know what QUIIP is, and that may be a factor in the net worth difference when aggregated. But it’s the overall numbers that will affect the overall market – are they going to support a “sharp trend upwards” from today’s historically peak values? Don’t count on it.

And of course, shady activities have almost certainly pumped values too, and that’s a wild card that’s really hard to calculate without statistical bootstrapping.

Thank you for the pseudo-compliment, but I couldn’t engineer a decent toothpick if I tried.

@Grant – if the house is under construction then you have a golden opportunity to inspect everything (at various stages). I find inspectors going over an existing house have a lot of difficulty in getting at anything past the superficial stage.

Take some photos and post them and I’m sure the handy-types will chime in.

That is true.

@Grant

I would highly recommend Jeff Erickson http://moira.meccahosting.com/~a0002a57/

I think he actually lives in Mill Bay, and would know about what’s going on in the area. He’s an older guy and seems to know a lot about a lot. Saved me from potential disaster on my house purchase and was also recommended by a guy who is also very knowledgeable. Jeff is an “inspector,” but he seemed to me to have more in his arsenal than just that. Also struck me as an honest, old school guy.

None of them overestimated the ability to get a job with an English degree though.

@Leo

I’m excited for the next article. This affordability graph doesn’t take into account what people actually have to qualify at though with the new rules though right?

Totoro:

That is actually informative and interesting.

Not cranky Barrister. I’ve just noticed that houses in suites are way less expensive than duplexes on a square foot basis and the rental return is not really different overall – sometimes that SFH and suite garner more rent than a legal duplex.

Engineering types tend to overestimate the power of data.

Quality little essay.

As for these sales, noted by Andy7 in the previous thread, I don’t find them portentious.

Tell me again why I should be concerned, in Victoria, when stratospherically priced Vancouver homes are now selling for less-but-still stratospheric prices?

As usual, another balanced and reasoned article on HHV. One note regarding the comment on SFH affordability:

Yes purchases by locals will for the foreseeable future make up the lion’s share of buyers, but for the longer term picture there is a persistent and pervasive hollowing out of the middle class that is greatly weakening if not destroying their ability to get in on SFH and the RE market in general. For Victoria specifically add in restricted supply on the SFH segment of the market and things are exacerbated further. The hollowing out is much more severe in the US than here, but we’ve still got it as well. And, this doesn’t even include pressure from foreign money coming in via all the new immigrants. As such I think that affordability graph is going to continue to sharply trend upwards.

Richard,

Your list of failed construction products gave me PTSD when I saw pine shakes listed. I was the second owner of a house with pine shakes, what an unmitigated disaster that was! 20 year warranty on the shakes.. haha, that warranty is worth zilch once the supplier goes out of business. The one good thing about pine shakes was each year as more and more of the shakes needed to be replaced, I did at least get a nice bunch of dried and untreated firewood to burn . 🙂

Richard how often are you in Victoria? Since you have so much construction experience is there any chance you or someone you know with similar experience might be able to assist me with an inspection of a new house in Mill Bay that is currently being built? I want an unbiased opinion of the build quality – I’d be willing to pay going rates for your/their time. If anyone else might know someone, please comment. I considered a traditional house inspector but that’s not what they typically do / are qualified for.

Totoro:

Obviously a full duplex is more expensive than a SFH with a suite but my point was geared to price creep (or in this case price gallop) and not to a one to one comparison. But I am sure that you already knew that so I am missing your point because I know that it is far too nice a day to just be cranky.

SFHs with suites are much cheaper than duplexes, maybe because most suites are not legal and way less desirable living quarters than the main unit?

Say what? I’d be surprised if a house today had anything in common with a house from even 20 years ago (apart from the stud framing). Stuff with toxic contents is always bad but the reality is we’re developing replacements for those without the harmful components.

I’d say a more realistic ratio might be 1 in 1000 new products is a major disaster.

What’s wrong with in floor heating and acrylic stucco? I’m out of the loop.

Jerry:

I dont disagree with your point but it has been a long while since Santa Monica has bee a very desirable part of LA. The better comparison might be Malibu.

Patriotz:

For once we agree. The prevalence of suites has raised the costs of a single family because SFH are now priced more like a duplex.

I wonder what the demand for rental units in Victoria would actual look like if the housing bubble actually bursts and construction moves to a virtual standstill.

Real Estate Consultant: Targeting tax evasion in homes may harm real estate market

If approved by the legislature, the new amendments to the Real Estate Development Marketing Act will require developers to collect and report information on pre-sale condo assignments to ensure buyers are paying the appropriate taxes.

However, Vancouver-based real estate consultant and architect Michael Geller says the new government rules could make the situation worse by reducing demand from investors.

“It may take investors out of the market, especially those whose primary motivation was to flip the agreement before they closed. The net result may be a number of projects being put on the back burner because they can’t achieve their pre-sale targets demanded by the bank,” Geller tells BuzzBuzzNews.

Geller agrees that pre-sale condo assignments should be monitored, as they are a likely contributor to skyrocketing prices in Vancouver.

http://news.buzzbuzzhome.com/2018/04/tax-evasion-bcs-pre-sale-condo-hamper-supply.html

The one thing that I am curious about in this cycle is the degree of consumer debt in the system. At no time in the previous cycles were the debt loads as high as they are now or as sensitive to evolutions in monetary policy.

Very hard to say what effect, if any, it will have on this particular market.

What proportion of the population of the the USA can afford even a basic home in Santa Barbara or Santa Monica?

Victoria cannot match either of those locations in any metric whatsoever, but it does have Canada’s only remotely bearable climate and increasingly has that oh-so-desireable whiff of a disposable-income ghetto: “I can afford to live here, can you?”.

There is a sizeable proportion of the population who will crawl across broken glass to find a place inside the circle. Expect the slope of that affordability graph to steepen in a sustained fashion .

“I can assure you that Victoria is actually paradise and on a world scale, it is still undervalued in price.”

Deryk, you can’t assure that. Victoria has always been beautiful and yet the trend still continues – people in Vancouver have always been able to sell a place in Vancouver and move to Victoria with their bank accounts full. This hasn’t changed. People always want to believe that this time is different but take a look at Toronto, prices dropped 20% in a few months – affordability matters. People who believe that it’s impossible/improbable for prices to drop here are kidding themselves.

“Not enough track record – CLT is a relatively new material so it has not been used in a lot of building projects.”

I’m with HAWK on this one. In the 40 years I’ve been in the construction business 4 out of 5 “new/innovative” products that have found their way into the market have been dismal failures, some catastrophic . This CLT push by the wood industry has “snow job” all over it. Imagine, it’s marketed fire resistance is promoted by its surfaces charring to prevent structural failure…….err,,,,, why is it burning in the first place? Seriously, this is better than concrete and steel in highrises? Can you imagine the toxic smoke emitted to get to this stage, (no 1 cause of deaths in highrise fires) and then when the fire is out, what do you have left ? A disgusting smelling charred but standing building. Now what do you do? Repair it?

Some other notable “innovative/new” products of the past;

Aluminum wiring, Poly B, Electric radiant film heating, multiple asbestos products, post-tension steel cables, pine shakes, plastic electrical boxes, formaldehyde blow-in insulation, foreign sourced drywall, acrylic stucco, galvanized plumbing, lead based paints, oil based paints.

Behold, the power of data!

Thanks Leo.

Another important reason – fewer and fewer of them actually house a single family. An increasing number of “single family” houses now have suites, so two (or even more) incomes are going toward paying for them, not just one. And the increasing prevalence of suites causes houses without them to be priced with respect to suite potential.

And yet, the pattern remains the same. A price explosion when affordability is good, and a slowdown (now) when affordability is bad. If it didn’t matter we wouldn’t see a 4 decade long pattern

I’m not so sure “affordability” means anything today. It would mean something if you are looking at wages, but there are tens of thousands of people who have very little income and yet are buying houses. How does that make sense you ask? It’s people who have just sold their $3 million dollar house in Vancouver and who are in the fifties or sixties and want to cash out. They can come to Victoria, buy two or even three houses and live off the rental income without lifting a finger while they enjoy early retirement in paradise. They might come from Vancouver, or they might come from other parts of Canada, such as Toronto, or other parts of the world where their money goes much further here. It’s very common for local people to have no idea what their property is worth on the world scale. Take Moncton NB. You can buy a beautiful, updated six bedroom “Duplex House” for $200.000.00 . (That price includes “both units”. People in Moncton NB think $200,000.00 for a six bedroom Duplex that brings in two thousand dollars a month in total rent…… is outrageous. (The tenants pay the heat and light and snow removal) Victoria people also think $800,000.00 is outrageous for a bungalow in Victoria. I believe that Victoria is still a bargain. It’s all relevant to what people have in their pocket and whether Victoria is a desirable place to live or not. We got off the plane from Moncton NB the other day, and we were greeted with the scent of sweet blossoms filling the air. I can assure you that Victoria is actually paradise and on a world scale, it is still undervalued in price.

Interesting charts that raise some interesting questions. Thanks Leo.

Standing ovation! Your best graph porn post to date! You truly need to coin yourself a Realestate Analysts TM!

To answer your question, the market will sputter as it completes it’s arc.