April 23 Market Update

Weekly sales numbers courtesy of the VREB.

| Apr 2018 |

Apr

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 158 | 340 | 543 | 885 | |

| New Listings | 331 | 643 | 967 | 1270 | |

| Active Listings | 1842 | 1921 | 1966 | 1690 | |

| Sales to New Listings | 48% | 53% | 56% | 70% | |

| Sales Projection | — | 734 | 769 | ||

| Months of Inventory | 1.9 | ||||

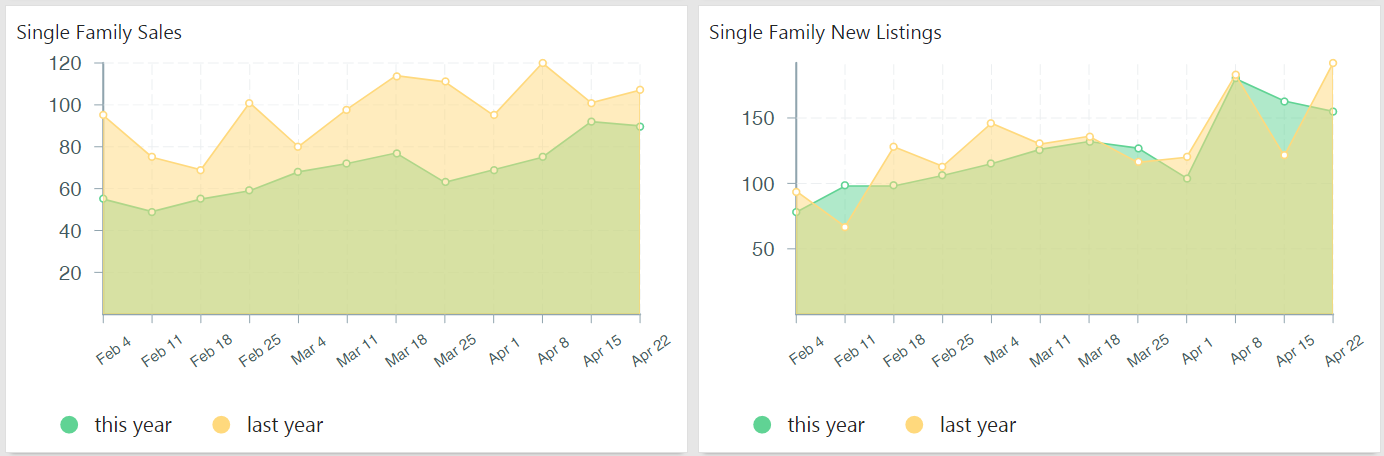

Another pretty strong week for sales. The dip we saw in late March / early April seems to have been short lived, with sales now off only 13% month to date. As discussed last week, sellers are having to adjust their prices by larger amounts to get single family homes sold, but clearly there are still enough buyers out there to keep the market going pretty well.

This comes at the same time that inventory is finally increasing. It’s possible that because inventory has been so low for so long, the recent increases are bringing out some buyers that have been sidelined not by prices but by selection. Now that we see some product back on the market those buyers finally have something to buy.

Prices overall are holding pretty steady, with the median single family home and condo going about 15% over 2017 assessed values. As far as market segments go, there isn’t really one that stands out that is substantially different. There is more activity in the lower priced bands of the market and the luxury market is certainly slower but not drastically so. Inventory is up by about a third but sales are similar to previous years.

Coming later this week, an updated look at affordability and where we stand going forward.

Andy7…would be interesting to see data points from high end areas in Vic (eg. Uplands, South Oak Bay).

I’m more of a Gordon Head guy, but have been noting from some MLS listings (when I have access) that properties are currently selling under ask and assessed, and the bidding wars seem mostly dead.

More Van West Side SFH recent sales:

33 x 129 lot; Vancouver West, MacKenzie Heights

Just sold $2,350,000 ($550k or 19% below 2017 assessed)

Tax Assessed July 2017 $2,900,000

Tax Assessed July 2016 $2,933,000

*normal looking house

51 x 100 lot; Vancouver West, SW Marine

Just sold $2,320,000 ($860,000 or 27% below 2017 assessed)

Tax Assessed July 2017 $3,180,000

Tax Assessed July 2016 $3,185,000

* nice, large heritage home

2748 W22nd, Van (Arbutus)

33 x 122 lot; Arbutus, Vancouver

Just sold $1,850,000 ($662,400 or 26% below 2017 assessment; 32% below 2016 assessment)

Listed: 2,188,000

Tax Assessed July 2016 $2,738,400

Tax Assessed July 2017 $2,512,400

* old timer/tear down

33 x 122 lot; Point Grey Vancouver

Just sold $2,580,000 ($557,000 or 18% below 2017 assessment; 25% below 2016 assessment)

Tax Assessed July 2016 $3,435,000

Tax Assessed July 2017 $3,137,000

*normal looking house, 3 levels

Just sold by LeHomes (previously New Coast)

33 x 122 lot; Point Grey

Sold for $2,740,000 (9% below 2017 assessed; 17% below 2016 assessed)

Tax Assessed July 2017 $3,026,500

Tax Assessed July 2016 $3,312,500

Bought Apr 2015 $2,299,999

Interior listing pics showed a currently empty house. Yard unkept, 2 level home.

* owner still made a tidy profit

Meanwhile, in West Van, this one looks like it’s headed for a loss:

1388 Inglewood, West Van

Last sale: Sept 2017: $3.8M

Asking: $3,550,000

2017 Assessed: $3,506,000

2016 Assessed: $3,615,000

* nice house

** curious to see what it ends up selling for.

New post: https://househuntvictoria.ca/2018/04/25/affordability-update-single-family

Creating jobs.

True. They’ve been out in Europe for quite a while so there probably is some real-world evidence out there. It’s all heavily tested stuff though: http://www.structurlam.com/whats-new/news/structurlams-crosslam-clt-achieves-superior-fire-resistance-rating-following-150-minute-test/

Pay him a little extra to tell you how smart and good-looking you are. Might help with the insecurity thing you have going on.

Whether you love, hate or are a “halibut” in regards to the NDP, you have to give them props for at least doing something to address the issues. Can’t believe how the Libs let things slide for so long.

Anyone heard anything about when the pre-sale/assignment reporting will start?

Yeah fair number of price changes. Last three days:

132 new listings

102 sold

60 price changes

Not $100k drops but real price changes, unlike the $1k drops we saw a year ago that were just done to bump the listings a bit.

I would, except I have to put up with people like introvert.

@Hawk

What price range are you seeing that in?

https://www.bloomberg.com/news/articles/2018-04-25/canada-oil-logjam-may-ease-as-drillers-near-deals-with-railroads

As I said, it’s coming anyway.

“Just hired a guy to stock my beer fridge every week. That’s how well things are going for me. I actually pay a guy to stock my beer fridge. He probably rents too.”

Classic case of little man syndrome.

Man, the slashes are really stacking up across all areas of town tonite. From Cordova Bay,Broadmead, Queenswood to Oak Bay and Westshore. Looks like a bloodbath in the making. $100K average slashes.

Bearkilla will soon be the rubby on the side of the highway collecting empties. 😉

So how many have had real fires ? I wouldn’t want to be the guinea pig to find out.

Wikpedia:

“Not enough track record – CLT is a relatively new material so it has not been used in a lot of building projects.”

Not how it works Hawk. They’ll be use “CLT”s which have excellent fire performance.

So bears now that spring is here how bad do you feel? Just hired a guy to stock my beer fridge every week. That’s how well things are going for me. I actually pay a guy to stock my beer fridge. He probably rents too.

Not really true and this article is making this a bigger deal than it is. They still pay for power just not more than your total yearly usage. Very very few residential customers will have a system big enough to generate more than their entire yearly usage.

I totally agree. There is lots of beauty in Alberta, even outside of the mountain national parks. I thoroughly enjoyed my life when I lived in the City of Champions but it would take a lot to get me to move back there now. I have spent a lot of time in Calgary too and have similar sentiments about moving there.

I am not dissing Alberta or Albertans at all. I just like it quite a bit more here.

HEY HAWK !

“after polishing up the clubs for the season. Ahh,”

I knew we had SOMETHING in common! How about a game when I’m back in heaven in 3 weeks ?!!

Your eloquent description of Alberta brought a tear to my eye …..!

“Some of the most beautiful parts in Canada (IMO) are in Alberta.”

I’ll second that LF. I have very fond memories of my uncle’s large farm and the beauty of a small river weaving through the hills and valleys with the fields or yellow rape seed and barley/wheat growing all around. Very picturesque.

Intorovert must have been bullied a lot or lived in a basement suite in the grimy side of Cowtown to harbor such ugly memories.

Intorovert promoting wood buildings now of 12 stories when the tallest fire truck ladder in town only goes up 10 stories. One match and it’s one massive weenie roast.

Lovely day in the penthouse after a nice stroll along the beach after polishing up the clubs for the season. Ahh, the life of the renter, all that spare time and bucks, not slogging it on a house or wasting hours of life in Home Depot. 😉

Some of the most beautiful parts in Canada (IMO) are in Alberta.

Most of Alberta is so ugly they have to bribe people with well-paying jobs just to keep them there.

“I’m definitely moving into my basement suite before I move back to Wild Rose Country.”

Geeze CE ! Don’t tempt the Gods, your crazy government might just fulfill your wish !!

Does this mean you’ll be making your upstairs available ? Let me know and I can come and stay (for a buck ?) during the winter while you sojourn off to Mexico, Tahiti, or Hawaii !

Yeah, BC Hydro doesn’t have any other “major costs” on its hands at the moment…

I’m definitely moving into my basement suite before I move back to Wild Rose Country. Nothing against Alberta – life was good there, but it would be hard to leave this island paradise.

But thanks anyway for the offer!

You must have missed the previous discussion on here. an option still exist for periodic leases of a property you own and plan to occupy in the future.

The book keeping is turning into a major cost for BC Hydro.

Speaking of energy efficiency/sustainability, BC Hydro seems to be considering reversing its policy on paying customers for surplus electricity generated.

Super disappointing.

https://armchairmayor.ca/2018/04/25/bepple-bc-hydro-selleth-and-taketh-on-solar-power-but-not-payeth/

It does look cool. But…. No evidence of affordably here.

Scepticism aside, prefab is the future.

The Vancouver tax doesn’t require reasonable rent, or any rent, just occupation.

@Patrick and @dasmo

I am just saying that is having an effect. Do I think it is the right effect, probably not. As we have all said on here it really is a “vacation” tax and not speculation. I think the key point is FIRE is getting all up in arms over it which I can only assume is because it is causing people to have to sell. Let’s be realistic when we talk about the general population of Victoria if they all had to go out and qualify to buy a house right now they would be looking at $500-700k homes so if the median is $850k looks like they are SOL.

The median household income is $89,640 that is $600k for a house. Where are those homes? Langford? Tillicum? Up island, Sooke they are disappearing fast. How can this continue? That is all what we are on this blog looking at and wondering.

If they wanted to as dasmo or others have said they should make it on speculation then. Tax 100% of the gains on a sale if it has been done within the past 2 years without certain circumstances (death, move for work, loss of job etc) that way the $400k on https://www.realtor.ca/Residential/Single-Family/19332504/1484-lang-St-Victoria-British-Columbia-V8T2S7 would be taxed as income which is really what this is.

Purchase for $500k last april, fix it up, change it to your principle residence and resell a 1000 sqft place for $950k should be taxed as income. Listen to the video link of owen bigland on how Chinese are using principle residences to essentially make a killing. (Grant linked it a while ago or just go to his youtube)

That is what is going on. That is the real “speculation” along with local people doing the same thing.

I think it would be great to contact builders to find out what the actual cost a SQFT currently is. I know a friend who does high end custom houses and they were somewhere around $350 last year. There is no way those homes going in any of these subdivisions are even close to that quality crazy wood work etc.

Think the CBC article is consistent with Georgia Straight. We’ll see where they hit this year and the big question: next year – just different in numbers they focus on.

https://www.straight.com/news/1063066/vancouver-empty-homes-tax-expected-generate-30-million-year

Absolutely this. I don’t have a problem with the step code, we have the knowledge and the tools to do this affordably today.

And this is exactly what I’d expect to happen. Does nothing to address the actual problem – and in fact, probably remove ‘pure’ outside money from the local economy.

That corvette landing project is awesome. Don’t tell me we can’t build quickly, affordably and in an energy efficient way. It can be done we just need to promote the innovation.

This is what I see:

http://www.cbc.ca/news/canada/british-columbia/vancouver-empty-homes-tax-1.4631597

Don’t know what the real truth is there then.

The empty homes tax has already brought $17 million into the Vancouver treasury.

It’s expected to reach $30 million by the end of the year.

It cost $7.5 million to launch the new tax, according to the city, and annual operating costs are around $2.5 million.

1200 self-declared vacant. 2100 were assessed the tax as they did not file a declaration. Who knows where the 2100 will land eventually.

@Barrister

“Simpler solution is to sell the place and spend your money in Oregon or anywhere other than BC.”

Yup, if BC keeps this up the BC Government might just be the saviour to Alberta’s shattered economy “irregardless” of the pipeline outcome! Here in Alberta we welcome all of BC’s wealthy…guess what, you are welcome here ! Bring your money, the jobs will follow no onerous taxes on ya, you get to spend your money however YOU want to! No envy taxes, no PTT, no class distinction tax, flipping or flopping tax, Airbnb welcome, not even a sales tax! and the best Death taxes in the country! Come one come all ! Your future awaits! And for all those first time buyers… there are over 10,000 fabulous SFH under $400K !

They are still going through the backlog, $30 million isn’t the final number. Also I believe 3300 houses were dinged at an average of nearly 10,000 a pop.

“What if they rent it out to their ground keeper for $1 a month?”

Sweet ! the Grounds keeper gets to tell everyone that the $25M mansion is his Principal Residence ! 40 years ago anyone posing or even suggesting such a notion would have been shut up in a loonie bin ! My…how far we have come !

Only those living under rocks or so wealthy they just don’t care won’t deal with this and get an exemption next year. 30 million minus the 9 million set up and operation the first year. Still, 21 million is pretty significant.

30 million a year on affordable housing will surely have some impact as well. Not to mention people taking this into consideration when they look to buy a place in Vancouver.

80k is much less than 250k. Win, win for everyone.

I love gardening, and would gladly take 80k for tending a nice garden on my spare time.

And, it is likely that a good portion of the homes that are caught with the tax is well beyond the affordability of most renters budget.

I know a family that does exactly that. They have a home here but live in the States – and pay the gardener 80k to tend the grounds (it’s a big property) and just provide a presence while they’re gone.

A sweet gig for the right person.

What if they rent it out to their ground keeper for $1 a month?

The exemptions are online. Someone using it as a principal residence for six months works. I’m sure more people will sell but with only 1200 caught by the tax not sure that those that do will have a big impact on vacancy rates.

Richard: I am not sure that just finding someone to stay in the house as their principle residence works. it is an issue of ownership and if you are not one of the owners on title then you are a renter.

Richard:

Simpler solution is to sell the place and spend your money in Oregon or anywhere other than BC.

They don’t have to cover it with the rent. It is well worth it to eliminate the tax by having a friend, family member or house sitter stay six months of the year or rent it out under market with a fixed term lease if you intend to return and occupy the home part of the year.

If 30 million is being collected that is an average of 25k per home. That is enough money to spur someone to look for a solution to an empty home designation unless they are living under a rock.

I guess that owner that paid $250,000 on the empty home tax does infact exist. They didn’t want to rent out their $25M home !!! Perhaps they should lower the rent, to say $25K/mo they were asking just too much at $35K/mo !!

It was just too audacious of them trying to cover the empty home tax with the rent !!

You’d think they could find SOMEONE to stay in that house for 6 months as their “principle residence” !!

STRAIGHT FROM THE MUNICIPALITY OF VANCOUVER PAMPHLET ON EMPTY HOME TAX.

“Enlist a property management firm to rent your property on a long-term or periodic basis

Invite a family member or friend to occupy your property as his/her principal residence for at least six months of the current year”

Typical Government……one arm of the law having no idea what the other is doing.

Provincial Government has outlawed the use of “Periodic Leases”.

As for inviting someone to occupy your home for six months…. well that just “invites” all kinds of abuse and anyone paying this tax and doesn’t take advantage of this “out” is simply what…..???? …. an idiot ????

12-storey residential building in Esquimalt will be built with timber modules

The Corvette Landing project will be the second-highest tall-timber building in the province next to the 18-storey Brock Commons student housing at the University of British Columbia.

“As the project is passive-house certified “the livability of each of the homes is greater than it would be otherwise. That makes it special. Because it’s so air-tight and efficient, the operating costs of the building make it sustainable for people to buy and live and enjoy,” Grant said.

http://www.timescolonist.com/business/12-storey-residential-building-in-esquimalt-will-be-built-with-timber-modules-1.23279691

))) Leif: Because it is working!

Your post lists several anecdotes presumably to support your statement that the speculation tax is “working”. Your post lists several anecdotes presumably to support your statement that the speculation tax is working unfortunately, none of your examples are even alleging that the people affected were in fact speculating on houses in Victoria.

A few weeks ago when I suggested that some people in Victoria might be affected who are merely vacationing in Victoria a few weeks a year I was rebuffed by many on the forum who said there are only very few people who would have a vacation home in Victoria

So please clarify your post do you really think that the speculation tax should be considered to be “working” when we are driving vacationers (not speculators) from the US out of Victoria home ownership?

Since your post includes many examples of houses you know details about, how about an example of a true speculation owner that has sold his house as a result of this tax, not a vacation or from Alberta or the US !

I know. When I die, I’m going straight to Hell.

@Introvert

Stop picking on the Gorge!

It is a nice place, great access to parks and super central and the people are nice.

@Hawk

FYI, got lots of eggs in the RE basket haha

Many “smart” people tend to agree with you, including KKR. Hiding in gold is not a bad thing!

https://www.zerohedge.com/news/2018-01-31/kkr-sees-100-probability-recession-24-months

Marko:

If you have an American buyer who comes to you are you ethically obliged to inform them of the spec tax? Would you possibly considered negligent if you dont?

Re North Dairy project 9-0 vote….I guess the public is putting the pressure on councillors re density.

Depends if you are adding it to code or not I guess. But if you think it’s going to cost 50k make that 100k….

There is no way it will be more than 50k; 3,000 sq/ft home without suite vs 3,000 sq/ft home with a suite. The trades are already at the home so extra insulation/drywall/extra panel/a tad of extra plumbing, etc., are all really small additional costs. The kitchen (about 10 to 15k) is really where the expense is.

Sure, it will be more than 50k if you are comparing 2,400 sq/ft home no suite/no basement to a 3,000 sq/ft home with suite/with basement.

In that article on empty home taxes it mentioned a range of taxes paid to a high of $250,000 ? Is that possible? What kind of home would have paid that amount? Who on earth would rent a house with that evaluation? Must have been a misprint. Must have meant $25,000 surely?

Introvert:

Play nice with poor old Hawk.

Having a suite is also a huge selling feature: not having a suite (or suite potential) is a deal-breaker for many (possibly the majority) of buyers, especially in the core.

Same experience here.

We’re in year six (or seven?) of the same tenant in our basement suite. Rented it by word of mouth—our tenant is an acquaintance of ours. We charge well below market rate, and have never raised the rent.

Symbiotic relationship—great deal for our tenant; quiet, responsible, no drama, fantastic tenant for us.

Total suite maintenance/repair costs over the last six years: replaced the 70s-era dryer that finally died ($600) and replaced the kitchen faucet ($80).

Hawk lives in a ground suite in an old building in the Gorge.

B.C. government to give cities power to create rental-only zoning, cracks down on presale flipping

http://www.cbc.ca/news/canada/british-columbia/rental-only-zoning-1.4633273

Depends if you are adding it to code or not I guess. But if you think it’s going to cost 50k make that 100k….

I think a suite may really vary in cost depending on the house if you are adding it later and can be 50k or less. Not sure with a new build.

There is no disputing the poverty insurance angle to a suite but I would say it costs a lot more than 50k if you aren’t building it yourself….

@Leif, tell me how a handful of waterfront multimillion dollar homes being put up for sale affects affordability for the masses?

As you have illustrated in your post, it’s more aptly named “the revenge tax”….

If your house is paid off no one needs 200k. 6 to 8k a month a couple can do perfectly fine with travel included…. little tax on that if equal amounts. At 65 the gov will kick in anywhere from 1200 to 3400 depending on work history for that couple,

If you can live with 50k with a paid off home you’re only paying 5% average tax. Means you only need to have $1,250,000 invested or a legal suite netting 20k and about $750,000 invested. 50k and a paid off home is more to live on than the median family has in Victoria with a mortgage – don’t know why you’d need triple that amount but depends on your priorities.

“This is why the spec tax does nothing for affordability.

So why is the industry freaking out about it? They must think it will have an effect.”

Because it is working!

Our friend of the family emailed to tell us they sold their waterfront home on South oak bay because their accounted told them they would be spending close to $200k in and I quote” something called a speculation twx”. This along with the new taxes for homes over $2.5 million.

They only use the house for a few weeks a year in the summer and reside in the US. The house is now sold.

I know of lots of homes sitting on the waterfront in North Saanich which are not occupied. They have people come by and care take or check on them once and a while. The majority seem to be rich people from Alberta or the US. Most of those homes are $2m+ so that’s $40k in extra taxes for US or $20k for an Albertan.

I think this has FIRE scared and you can see it with the aggressive stance they are taking.

Leo S: Empty homes tax collecting $30M for $2.5M in ongoing operating costs (7.5M setup)

-=-=-=-=-=……..

Problem here is that’s a projection of future revenues and future operating costs. If you project that the future tax revenues from the empty-homes-tax will be the same, you are also projecting that the number of empty homes will stay the same, and if that is the case then the tax has failed its major objective. The main idea of this tax was to reduce the number of empty homes over time.

So why isn’t the Vancouver projection for less empty-homes-tax in the future? The article headline should read “Vancouver projects no drop in number of empty homes in the future”

Do people really consider the empty-homes-tax a success, even if it doesn’t reduce the number of empty homes?

Marko:

Well, you certainly have made a good case for why a developer would put in a suite. What I left out of my calculations stems from the fact that I grew up in an era where basements were not all finished with three piece baths. Actually, if recollections serve me right, basements were not even included in the square footage of most listings in Toronto. I do recall when looking at housing here in Victoria that I had to adjust my thinking to take into account that the 3000 square foot house was often a 1700 square foot house plus a finished basement.

But you, and others here, have made out a good case for a suite. But at my age I am not going to rush out and do anything about the unfinished basement in this house.

200k/year from investments would mean roughly a 20-25% average tax rate, since the income would be from dividends and capital gains. A working stiff making half as much pays about the same rate.

So many options.

And if you really run into financial difficulties just move in the suite. I have a nice suite which I would be happy to live in need be. The main part of the house rent would cover the mortgage, taxes, insurance, utilities (including car charging), internet/cable, and $500 to $700 left over each month. Rent out the second bedroom in the suite for $800/month to a roomate and I could survive.

A suite in a Vic city new build is a pretty big expense IMHO. There are upsized servicing requirements, fire codes (sprinklers), accessibility requirements, double panels/meters/kitchens/bathrooms etc. Not to mention sound proofing and so on. Then you get into the zoning issues where in order to access the maximum floor area (300 sq. mtrs) you must excavate and put 60 sq. mtrs of it below grade. Excavation and removal of material is rather pricey, especially if you happen to hit rock. You may need sump/septic pumps, which aren’t a big deal, but extra expense.

With these lot prices ($700k-$1.1 million) to make the economics work you have to go 300 sq.mtrs so whether you have a suite or not you are going one floor below grade either way and that is the biggest expense.

Sizing requirements are minimal…maybe you have to go 1.25” water line verus 1” but that is nominal. There are no sprinklers required in SFHs with suites. Second panel for electrical is really not that expensive whatsoever. You are already going to put in a 4-piece bathroom in the basement. If you are building a half decent luxury house without a suite you would insulate between the media room and the main anyway….etc.

Comes down to added cost of a kitchen and entrance to suite which is nice to have even if not renting. Building a new home in the City of Vic is insanely expensive, but the suite component doesn’t add too much to the insanity. It would certainly be less than $50,000 and this is on $1.4 to $2 million (lot + construction).

I agree with Marko on the rationale for putting in a suite, especially if the added cost is not excessive. So many options. Renter, visiting family, care of an elderly relative, nanny for your kids, live in caregiver for when you get old, adult kids need a place to stay, STVR if you are in a place that allows or overlooks them. Even just a place for visitors to stay.

Our old existing house came with an OK suite in the basement. It has been rented some of the time. We have also used it for a nanny, visitors and family over the years. When it has been rented it was the easiest money I have ever made. Mostly rented by word of mouth and at somewhat sub market rates.

I designed our house to have a spare room that would make a nice STR. It’s large with a nook that could fit a bunk bed or couch etc. A pocket door can close the zone off and make the downstairs bathroom seem like an en suite. It has its own door to the outside etc. This makes for a nice place for extended family visits and also legal BnB usage. Who wants tenants with all their rights, stinky food and domestic issues? We did rough in basic plumbing to the garage to future proof things though….

Basically what you are saying if I understand you correctly is the security factor and flexibility of a suite is really worth it for you in a home even if you don’t have to rent it out. I’d agree.

A suite in a Vic city new build is a pretty big expense IMHO. There are upsized servicing requirements, fire codes (sprinklers), accessibility requirements, double panels/meters/kitchens/bathrooms etc. Not to mention sound proofing and so on. Then you get into the zoning issues where in order to access the maximum floor area (300 sq. mtrs) you must excavate and put 60 sq. mtrs of it below grade. Excavation and removal of material is rather pricey, especially if you happen to hit rock. You may need sump/septic pumps, which aren’t a big deal, but extra expense.

The thing I think is silly is that the zoning restricts both your floor area and your envelope, but if there was no restriction on floor area, you could quite easily fit quite a bit more floor space into a legal envelope. Why the city wouldn’t want you to maximize the livable space within a legally sized envelope is beyond me. In my case I could probably have fit an entire 3rd floor within the envelope I have now (and that suite just got a whole lot less expensive).

It is only a small modification if you are talking about a finished basement with a washroom in it already.

With five million you’d have 200k a year and not touch your capital with minimal risk. You need 200k a year? Lots of tax at that level.

I could easily live on 40k but at 200k a year I would still find 20k from the suite significant.

If I was retired pulling in 200k/year from investments and someone asked me to do 2 hrs of real estate consulting per month for 2k per month I would pass it up and say….no no, 200k is more than I need.

Sounds like someone with too many toys or very extravagant lifestyle. This is when the real estate bizz folks lose touch with the real world and why crashes need to, and do happen.

Says the person living in the penthouse at the Oak Bay Beach Hotel.

Well there you have it, a suite would have solved all your problems 🙂

I didn’t build a suite in my house and I will be poor after building it.

Safe rate of withdrawal to retain your capital if you invest in safe index-style TD e-series is 4% Marko. With five million you’d have 200k a year and not touch your capital with minimal risk. You need 200k a year? Lots of tax at that level.

Unless the house is in Broadmead 😉

“I would want to have at least $5+ million in cash sitting around before considering a home without a suite.”

Sounds like someone with too many toys or very extravagant lifestyle. This is when the real estate bizz folks lose touch with the real world and why crashes need to, and do happen.

So why is the industry freaking out about it? They must think it will have an effect.

What is needed is both. No point building affordable housing if it’s all being snapped up by speculators. At one point the janion was billed as affordable housing. Look how that turned out.

Why? One might argue someone who is taking a tired old garbage house and renovating it is improving the neighbourhood. Punishing that has a much more clear downside to me.

Part of your equation also has to take into account your age and family commitments. Six kids under twelve is really different than two kids who are thirty.

In on scenario you need the security to put food on the table and in the other scenario odds are one of your thirty-year olds probably can’t afford real estate and might need to crash in your suite which is a lot better than crashing in the spare bedroom next to the master.

As I noted if you are building a luxury home odds are basement has a 4 piece bathroom, a spare bedroom, and a rec or media room…suiting it simply requires a modern linear kitchen in the rec room (can look like a bar if you do cooktop and built in oven) and throw in an exterior entrance.

It is not like you are overhauling the home for the suite.

Marko:

Part of your equation also has to take into account your age and family commitments. Six kids under twelve is really different than two kids who are thirty.

Five million in cash? Way more than you need Marko if you have a paid-off house. Also I’m assuming you mean invested cash.

Invested cash at 3% = $150,000 per year….I would still find 20k/year or so from a luxury suite a meaningful chunk of change.

So many things can happen like you get sick and can’t work anymore, etc. Personally, I would not feel comfortable in a $2 million paid off home (without suite) plus $2 million invested.

It is such a small modification in a brand-new build that I would have to be ridiculously well off to forgo the small modification which in my opinion adds a layer of security.

Of course, I could invest with Garth in a well balance portfolio at 8% return and with a bit of compounding have $10 million in a few years.

Five million in cash? Way more than you need Marko if you have a paid-off house. Also I’m assuming you mean invested cash.

The thought that struck me is why would anyone who can afford 2.6 want to have a rental suite in the basement and have to deal with tenants? Would you not be better off finding a house for 2 mil to 2.2 million and forget the aggravation of tenants?

I would never build a house without a “rental suite,” which just means instead of a bar in your basement rec room you have a bar and you add a stove and an exterior entrance. You don’t have to rent it….just use it as a media room or whatever, but it certainly gives you a ton of flexibility. Going away travelling for 6 months? Rent the suite so you have someone coming and going from the property every day. Annoying family member falls on hard luck? Stuff them in the suite. Want to lease that Porsche 911 ? Throw in a tenant to pay for it. Etc., etc. Even if you don’t need the suite income if you took the rent and threw it against the principal every month I am sure the mortgage principal would come down a lot faster (this will be important as interest rates trend up).

I would want to have at least $5+ million in cash sitting around before considering a home without a suite.

because there were less red tapes.

The massive amount of red tape doesn’t bother me as much as various levels of government bringing in massive amounts of red tape and THEN talking about affordable housing….wtf.

Just come out and say “hey, we are bringing in all this red tape BS including the owner-builder exam amongst other useless BS and brand new homes will be for the top 1%….the rest of you, good luck.”

Re Alberg development…..you have to do the cost calculation based on today’s lot prices; not what the builder paid at time of purchase. Those are 800k lots now.

Add:

10″ logs or 12″ logs are at least 5 times stronger than nominal 2×10″ or 2×12 lumber.

Most product being built downtown is concrete…..aside from Shutters and the Falls most buildings post 2000 have held up really well. Shutters and Falls are catching up too on addressing all the initial construction defects.

Labour shortage is a symptom of everyone having a super useful English degree and the government bringing in 300,000/year educated professional immigrants.

I had trouble finding people to work on my house in 2014 and that was pretty much as slow as it gets in terms of real estate in Victoria.

I have to agree with you Barrister and DuranDuan. It is not just land and materials has gone up, but wages and regulations also add greatly to the over all costs.

For an example:

In the 80s a 2×4 stud cost as little as $0.25 each on sales, and drywalls was around $4-5 for a sheet of 4×8′, 3/4″ sheet of ply can be had for under $12.

Now, 2×4 studs are $3.50 each, drywalls at $22.50 each (price doubled since the 2016 tariff), 3/4″ ply are $40-45 a sheet.

The cost of construction was much lower previous to the mid 80s, because there were less red tapes. true dimension rough sawn lumber that was thicker and stronger were allow to be use, and the cost to mill enough lumber for an average house if you provide your own trees were $2000-3000 (high was $5000). But due to regulations, it became prohibitively expensive to get your lumber stamps hence everyone purchase inferior manufactured lumber once the regulation came into effect. Septic fields and tank were allow to be installed by owner with plumber help that used to cost around $5000 or less, but now it is well north of $30K that not include inspections (under VIHA jurisdiction instead of plumbing code).

You can’t use standard 10″ or 12″ logs and must use 2×10″, 2×12″ or engineered products for joist

Probably not but probably will exceed inflation.

Or retire knowing you have enough capital to invest and live on if you rent. Or buy a motor home and travel the continent. Or become an expat in a country with a low cost of living. Or just keep the home, invest the equity and live on the proceeds while renting it out and paying down the HELOC again.

We all only have so much to invest and have to live somewhere. Someone investing in the stock market presumably also has to pay a mortgage or rent.

Yes. Same with stocks or any investment class, particularly if you don’t understand it well or certain factors are really unpredictable. And then back to life being time limited so you need to decide what to do to grow your capital if that is a goal.

@Dasmo

You’ve got some great points there.

Totally agree. I commented on this awhile ago after hearing two construction workers talking at Thrifty’s. I wonder if it is worse now than it ever has been? Aside from leaky condos, I think a lot of houses built during the 70s, 80s, and mid-2000s during boom times have some quality issues.

However, my sense is there was a larger labour pool in the past because of demographics and the housing prices not being so out-of-sync with construction wages.

Aside from the quality of the workers, I wonder what issues come up from delays due to not being able to get the right people at the right time. We walked by a house being constructed in our neighbourhood during the winter, and it was raining on everything for months. Then the house was closed up under still damp environmental conditions. I am no expert, but it seems to me that could cause mould issues.

I don’t know why their progress was so slow, but seems like it could have been due to labour shortage.

People sell for all sorts of reasons including death, disability, divorce, move-up, down-size and changing jobs or retirement. Selling within two years does not make it a flip for tax purposes or any other purpose. For tax purposes the test includes the intent at the time of purchase, the time frame between the purchase and sale, the number of purchases and sales that a person has made, the number of primary residence designations a person has made, etc.

Great. Are you buying 900k of stocks with 90k down and getting all your net appreciation tax-free at the end?

If you are buying stocks on margin you’d be paying a huge interest fee if you could find anyone to lend you 800k and I personally wouldn’t sleep at night knowing I could be subject to a margin call. Doubt you are doing this with stocks; however, most start with a secure low interest long-term mortgage for a home.

There are quite a few free online calculators. Do the math first starting with 100k of savings as a payment for a house and using our average rate of appreciation in Victoria over the last ten years vs. 100k in the stock market with a drip over the last 10 years.

Here is an example:

Buy in 2008 for 500k with 100k down. Value today, approximately 900k. Net proceeds about 400k after expenses tax exempt assuming you would have paid rent somewhere else anyway and the 100k you paid down on the mortgage was put into the house for costs of ownership and sale (at 1%). https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

Invest 100k in the stock market and your total return would have been 155.689% with dividends reinvested, not accounting for taxation. https://dqydj.com/sp-500-return-calculator/

Would you rather have an extra 155k partially or fully taxable or 400k tax exempt in 10 years?

Both options carry risk that is smoothed out over the long-term and reduced with knowledge of how to invest and reduce transaction costs. Add in a suite and the numbers shift again. Sell in a down market and all the numbers change in both cases although the effect gets diluted over time it is magnified with leverage.

DISCLAIMER:

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, …….will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio.

So, this was what I was fishing for yesterday when I was guessing what would be reasonable for the Alberg development, where we know the lots costs around $700K. Does anyone with professional building experience know how much it actually costs to build a similar 3000 sq.ft. house? I’ve heard the $200-300 per sq.ft. number, but then recently a lot of talk about increasing costs due to labour, materials, and regulations. It seems like even $300 per sq.ft. might be too low for a custom build.

The interior doesn’t look brand new. My guess is the updates were done between the 2015 and 2016 sales. This is very optimistic pricing; I’ll eat my new summer hat if it goes for this price. There is a similar listing on Winchester (same area) for $928K, and a nicer one sold for $1M on Winchester about a month ago (though not sure that had suite potential).

Do you actually believe you’ll make 7.4% a year going forward?

Good post Victoria Born. Nice to see someone with a brain.

Also nice to see Cam the Scam agree with pre-approval flips reporting. Ahh, the winds of change.

B.C.’s condo-flipping crackdown law targets tax evasion to keep down prices

“British Columbia’s government is moving to ease the province’s housing crisis by cracking down on tax evasion in the condominium market and giving municipalities more control over the protection and development of rental housing.

Finance Minister Carole James says proposed changes to the Real Estate Development Marketing Act will require developers to collect and report buyer information on the purchases of pre-sale condominiums to ensure the proper amount of tax is paid when the units are sold.

James says the prices of pre-sale condominiums are inflated by people who buy and sell the properties without ever living in them or paying capital gains tax.

Cameron Muir, chief economist at the B.C. Real Estate Association, says compiling data to track pre-sale condominium sales is a long overdue move.”

https://www.bnn.ca/b-c-s-condo-flipping-crackdown-law-targets-tax-evasion-to-keep-down-prices-1.1066516

Exactly DuranDuran. This is why the spec tax does nothing for affordability. It just makes some of their voter base happy getting a bit of revenge….

What is needed is looking at how affordable housing can be built and where through positive action not punitive.

We don’t need a building code that will dictate every house to be net zero. (say goodbye to the SFH altogether)

We don’t need to stop owner builders (not everyone can afford the extra 200k by using a builder)

We should rethink planning to allow for row housing and family friendly multifamily developments (do we really need giant front yards and useless side setbacks in urban settings?)

We should convert evalueBC to an index value ( No more letters to everyone telling them their house is officially now worth a million dollars, this is market manipulation on a grand scale)

We should restrict speculation by attacking flipping not long term owners. (let’s not dwell on the past)

We should restrict foreign ownership ( a two year ban right now perhaps).

All of these flip examples, like 1445 Jamaica Rd were it’s sold 3 times in the last 3 years, got me wondering: is there any data out there that shows what percentage of homes sold over the last few years are flips? The long run average of how long a house is held onto (US study) is 13 years. Anything less than 2 years is almost certainly a flip.

Totoro – you may not know this, but a Canadian can invest in US companies by the click of a button [$9.95 commission, vs the real estate commission]. There is no, none, 10 year rolling period ever in human history where any real estate market returned higher returns that the S&P500 [even with dividends not reinvested] – EVER.

Principle residence – here is the point you miss – you pay property tax year after you, maintenance, insurance, the list goes on. You then cling to the principle residence “tax free” status, but then when you sell you have to replace the home and buy in the same market – only if you downsize are you enjoying your profits – more likely you will “trade up” or go sideways.

With a diversified portfolio of stocks, US and Canada, you earn a nice stream of dividends [you get the dividend tax credit if the company is Canadian], and you are “liquid”. Let’s look at the current comparison of the last 10 years. There is no real estate market in the world that has provided the returns that the S&P500 has over that time frame with dividends reinvested. And that is an index investor. If you had picked stocks and focused on blue chips [McDonalds, Wal-Mart, Apple, Microsoft, Fed-Ex, Cisco, General Mills, Pepsi, Proctor & Gamble, Visa (my personal fav), Intel, United Technologies, Applied Materials, Google, Facebook (later), Amazon, JP Morgan, etc,] you would have done much, much better.

I have tested it and, in fact, experienced and lived it from May 2009 to present. Not the Vancouver, Victoria, Toronto, New Zealand, Australia, Hong Kong (anywhere else) real estate market even comes close. And, without maintenance, property taxes, tenants, insurance………

I suspect the market will slow down irregardless of spec tax but I find it funny that so many communities are asking to opt out. It’s got all those local speculators freaked the F out.

RE markets are local, not national, and this article is from the US.In our market take the 4% and bring it up to 7.4%.

Now add in the power of leverage and tax exempt capital gains. No contest for a primary residence bought with a mortgage vs. the stock market using your down payment.

With all the online free calculators I’m always surprised more people don’t sit down and run the numbers. Always good to test what someone is telling you yourself.

Spec tax is not law yet…Once legislation is passed and everything is known. I assume the government will than go through the process of some sort of notification.

A home is a place to live, not an investment. Nice article today comparing stock market returns to real estate over the long term:

https://www.marketwatch.com/story/7-reasons-stocks-are-better-than-real-estate-2018-04-24

Diversified portfolio of stocks returns 10% per year, while real estate returns 4%.

DuranDuran:

You bring up an interesting point that I was wondering about as well. The cost of every type of building material seems to have shot up through the roof. A sheet of 3/4 inch plywood is outrageous. Now I am really sounding like a cranky old guy.

Josh:

I suspect that you are right that the full effect of the spec tax has not been felt yet. In particular I suspect some American owners might not even be aware of it. Do you know if they have actually sent written notices to owners. If so I have not got one.

If local prices are too high (and they probably are) I guess I’m curious what people think they’re worth. I’ll throw out a straw dog:

If a decent modern SFH built to code is typically $200-$300 a ft^2 today, a typical one-off custom family home of 2500 ft^2 would cost 625,000 (@ $250/ft^2) excluding the lot. Maybe you could build a simpler spec house for 500,000, if my numbers are at all close. Current lot prices in the prime core areas (OB, Vic, Saanich East, View Royal? Esquimalt?) appear to be around 500,000-1,200,000+, depending on whether we’re talking Lakehill (cheaper) or Estevan (much more $$), as well as the size. Anyone seeing anything deviating wildly from what I’m suggesting?

So if a 5,000 ft^2 Fernwood lot (good luck finding one!) is too much at $600,000, would it be great value if the lot dropped by 50% to say, $300,000? That would put the ‘decent’ new house I described above at $925,000 with no capital gain whatsoever. Realistically, you’d never see this house sold for less than $1,000,000, which is still less than we’re seeing for brand new homes in the core now. You could argue that many people would be happy in a smaller house, say 2000 ft^2 or even 1500, but your costs per ft^2 go up with smaller builds, so I doubt anyone’s able to build a ‘one off’ custom for less than $450k today, say, for a $1500 ft^2 house ($300/ft^2). That would produce a $750,000 new house in my Fernwood example, even if lot values dropped by about 50%. These are closer to current lot costs we’re seeing in medium-size towns in the BC interior.

I strongly doubt lot values are going to drop by 50% in Victoria anytime soon.

The point is that with expensive wages and building materials, the intrinsic value of a SFH is really high in Victoria right now. Older homes are definitely cheaper (but they have more maintenance issues). I don’t know if this is helpful, but a few people have brought up what the ‘correct’ value should be. Yes, I guess if there was a deep recession, wages and material costs would likely go down as well as lot values (but so would your downpayment value, unless you’re in cash).

AZ:

lets hope the flip, flip, flip is followed by a flop.

Pretty disappointed in Saanich for asking for an exemption to the spec tax. Particularly because they’ve had the highest share of foreign buyers.

I wonder what kind of warnings will go out about the spec tax. It’s been all over the news but I think a lot of people aren’t paying attention to that or just passively assume they’re not a speculator. Is the impact going to come down to the effect on tax returns next April? Maybe we have yet to see the lions share of the spec tax market effect.

Loving Life:

Irregardless is a username that I was responding to on this blog. I will happily show you my diplomas and my call to the bar of Ontario if you can show me a high school graduation certificate.

Hey thanks Gwac. Looks like the buyer info will not be publicly available, but each transaction must be shared with the CRA and any applicable PTT and cap gains taxes paid. Ouch.

Also seeing unconfirmed reports,

“OSFI is now asking banks to rely less on collateral value, and more on the income of borrowers when issuing mortgages “where housing prices have risen rapidly.””

BC just crackdown on condo flips. Taxes must now be paid based on reports that must be given to the government by developers on pre sale assignments.

Flip, flip, flip?

1445 JAMAICA RD

Asking: $950,000

Assessed: $772,000

Previously sold:

29-Nov-2016 $810,000

30-Nov-2015 $620,000

New real estate podcast coming May 1st about Vancouver. Looks interesting.

http://www.cbc.ca/news/canada/british-columbia/events/cbc-vancouver-launches-original-podcast-sold-1.4631375

And Saanich caves to industry pressure and asks to opt out of spec tax https://www.reddit.com/r/VictoriaBC/comments/8ekkgb/saanich_council_votes_to_ask_ndp_government_to/

Also found this interesting from the HELOC report that was linked. “On the other hand, the HELOC market is significantly larger relative to GDP in Canada (11 percent) than it is in the United States (3 percent). In addition, the overwhelming majority of HELOCs originated in the United States have definite terms, which could mitigate the risk of debt persistence, credit deterioration and adverse selection.”

hahaha! I figured someone was going to say something like that. For all you know, we just might be the same person. And no, I wasn’t kidding in the slightest.

Yes, it’s different in that unlike a true P.S., there’s an actual asset underlying it, ie it’s unlikely to collapse to zero. But the underlying architecture and behavior of the participants (spending money to make money when the asset being bought is already clearly overvalued) is strikingly similar.

Call it ponzi borrowing, then. If people are raiding equity to buy more homes purely on the expectation of higher gains (and regardless of their short or long term market value), that effect goes all the way to the top, where the greatest benefactors of that process can buy with all cash. Others only need a bit of debt. Others need a lot, and it would appear that many in our most inflated markets are raiding their equity to do it. That chart speaks for itself. Another aspect of the ponzi dynamic is:

“The schemes require the continual attraction of new investors; as soon as new investors fail to materialize, the operation runs out of money and fails.”

And the greater the prices get, the more and more capital we need to enter the system to keep it growing. Eventually it stops, whether the craze was in houses, Enron, toilet seats, tulips or Dasmo’s half-eaten Vibergs. We’re lucky in that Victoria has not seen that to anywhere near the same degree as Vancouver, but it’s here nonetheless.

I love it when a grammar nazi fails so miserably.

1) Merriam-Webster says “irregardless” is a word. Not generally accepted, but still a word.

2) “Irregardless” is a user name. In the quest for perfect grammar, basic reading comprehension was skipped right over.

1000 sqft in the Oaklands for $950k. I wonder who buys this (and all the other tiny $800k+ places in the Oaklands)

1484 lang St

1924 house redone (more or less).

Purchased and fixed up for a flip.

28-Apr-2017 $532,500

That would be $400k. It does not take 400k to reno a 1000sqft place.

This would be one of the places in which I have no idea who buys these tiny places in Oaklands for this price. I guess we will wait to find out.

Barrister… your use of “ irregardless” may show that maybe your not a “ barrister”? Or just a brain fart kinda day??

Assuming you meant regardless… as irregardless is not a word…

Grammar nazi out

LF, is that you or is that Hawk using your account? 😉

I’m not sure if you’re being humourous or not, but HELOCs, while risky, are not ponzi schemes.

HELOCs capped at 65% LTV Nothing “ponzi” about that.

I agree, and to dive a bit deeper into what that means:

Ponzi [pon-zee]

Noun: an investment scam that pays existing investors out of money invested by new investors*, giving the appearance of earnings and profits where there are none.

*Ostensibly refers to debtors:

Grant:

If I have time I will look it up but the original stats are provided by the agents in a voluntary buyers survey. LeoS can probably give you precise numbers. There is a secondary and more minor issue as to who is a local buyer. I am pretty sure that I was listed as local because I was renting a condo for a few months before I bought. The point is that origin of purchasor is not a mandatory reporting requirement. The stats give us some idea but far from an accurate picture.

Barrister, coffee sounds great – estate grown, adjacent to the roses, I presume?

Barrister, I’m curious, do you have a source for the 30% classified as no geographic origin?

Grant:

The statistics from the VREB as to is buying needs to be taken with consideration given to the fact that

they have no geographic origin for about 30% of buyers that they then simply leave out of the stats. There is strong suspicion that a large part of that 30% are not local buyers. Basically I would use this chart with a lot of caution.

totoro

Page 3 you are 100% right. Good summary

https://www.canada.ca/content/dam/fcac-acfc/documents/programs/research-surveys-studies-reports/home-equity-lines-credit-trends-issues.pdf

Grant thanks but not where they come from but how they obtained the $$$.

Well according to Leo’s post from last year:

75% are from Vancouver Island

12% are from the lower mainland

9% from other Canada

The reaminder from other BC and foreign

https://househuntvictoria.ca/2017/03/16/whos-buying-in-victoria/

Home equity primarily.

Also, large new houses with a suite might be candidates for multi-gen co-ownership or co-ownership in general. Buying a condo in the Westshore is going to have much lower ROI than a suite in a house imo due in part to construction costs and also the differences in borrowing for a rental vs. a primary residence.

You’d have to do all the math to determine whether it is worth buying a more expensive home with suite vs. buying a less expensive house without a suite. Not sure that the loss of the capital gains tax exemption on the suite portion and the income tax on the income will even it out, but it will help affordability overall as 1700 a month in suite income pays $375k of mortgage and part of that is principal pay-down and you generally don’t pay 375k extra for a home with a suite.

Almost completely renovated with an addition on the front. Not sure if it is worth 950k as it is just about 1000 square feet (!), we will see, but it is not merely appreciation at play.

Local

At the end of the day 35 to 40% are mortgage free. Where all this money is coming from I have no clue to pay these prices. It never adds up in my mind. Restaurants are busy, renovation people are busy. Granite /tile and countertop people are busy.

No idea where the flow of money is coming from.

Yes agreed. Don’t mind me, someone brewed decaf this morning and I’m still not over it…

Irregardless, sorry I am in Rockland and not Oak Bay. Happy to have over the house one day for coffee if you are into 100 year old manor houses.

Local

Like anything else its worth what someone is willing to pay for it. There are no guarantees this market is going down yet or ever. It`s Victoria nothing is rational here.

I would not pay that but I am cheap. I would also not pay 2m plus for the cow pasture area but people are 🙂

2m should come with ocean front but I am living 20 years ago. 🙂

Barrister, joining you behind the Tartan Curtain. Look forward to your guided open house tours 🙂

Not what I’m arguing.

That house isn’t worth 950k if it was brand new and twice the size. And in that area?

Local look at the before and after. Before is on google maps. There is no 80% increase. Maybe 200k profit after all expenses.

That’s a nearly 80% increase in less than 1 year. For people who don’t know or have long forgotten, a 5% per year house price gain is quite aggressive. A gain that’s 1500% higher than that is why we’re in real trouble, especially if that scalper actually finds someone willing to pay that. This is not “fundamentals” at work, this is just insane speculation. Don’t know whether to laugh or cry…

AZ

Is that a tear down or work around? Either way thee looks to be 200 to 300k work in there but still a nice profit.

This has to be one of the more “profitable” flips I’ve seem attempted especially this late in the cycle.

1484 LANG ST

Bought: 28-Apr-2017 $532,500

Selling price: $949,000

Assessed: $559,000

1000 sq ft & only 2 bedroom. Good luck to them.

I do not believe there is an income cap on the tax credit to put against the spec tax but don’t quote me on that. From the fact sheet:

“British Columbians who are Canadian citizens or permanent residents, and not part of a

satellite family, will be eligible for a tax credit that is immediately applied against the

speculation tax. This credit will offset a total of $2,000 in speculation tax payable. For

homeowners with multiple properties, the tax credit will only apply to one property.”

https://www2.gov.bc.ca/assets/gov/taxes/property-taxes/publications/is-2018-001-speculation-tax.pdf

Can someone help recap the total costs now for a second property?

-I believe it’s 25% down.

-If it’s Vacant Land I’ve heard it’s higher (up to 50%?)

-Speculation tax (credit of $2000 but only for lower income?) this part is a new wrinkle of course.

We’re debating whether to explore and upgrade to a better location or pay off the mortgage. If we pay off the mortgage it would take us years to save up again.

Totoro:

You are right but that seems like a pretty limited segment of the market but I might be wrong about that. My point is that it makes little sense for a straight commercial rental arrangement. The number of new expensive houses that have suites does not seem to be geared to nannies and caregivers and they seemed to be marketed in terms of pricing as rental units.

Patriotz:

The alternative is to buy a rental condo in the west shore which provides better financial flexibility since you can sell it without having to mess around with your principle residence. Having a business investment living in your basement seems like a questionable proposition particularly for people who can afford 2 mil. for a home.

People with very high net worth may want a suite for a live-in nanny or guests. In older age, a live-in caregiver/personal assistant. Very handy.

Richard:

I can sort of understand the logic of a modest buyer that really needs a tenant to get into the housing market and possibly people who actually need a suite for a family member but as a rental proposition it makes little or no sense to me.

I know one of the neighbors that had been renting out a suite which had just been vacated decided to not rent again because of the change to term leases.They did not have a particularly bad tenant but after taxes and expenses it was not worth the aggrevation.

I see that little dig there. 😛

Well first they can’t really afford 2.6, which is why they need tenants. Second, they get more return on that guaranteed appreciation when they buy at 2.6 rather than 2 mil. 🙂

” Would you not be better off finding a house for 2 mil to 2.2 million and forget the aggravation of tenants?”

No kidding Barrister ! Especially now that you can only get rid of tenants when “they” decide to leave. (No more periodic/term leases)

Judging by the sales numbers so far it does not appear that Armageddon is about to occur any time soon.

Speaking of ridiculously priced house I find the asking price of 2.6 mil for 1326 Richardson completely out of line for that street. The thought that struck me is why would anyone who can afford 2.6 want to have a rental suite in the basement and have to deal with tenants? Would you not be better off finding a house for 2 mil to 2.2 million and forget the aggravation of tenants?

Irregardless:

So what part of the island are you moving to anyway? And you are right that moving is really stressful but having professional movers look after it is one less bit of stress.

You are all safe! Barry’s Moving gave us a good price to do the whole move, so I don’t get to commandeer the U-Haul 5 ton. Crazily, they won’t confirm availability until 24 hrs before pickup. And that can be anywhere in the lower mainland. Because moving isn’t stressful enough. Hat tip to DuranDuran for that one.

For the first time this year, the market is pricing in a >50% chance of 4 Fed hikes in 2018 (to a yr-end range of 225-250 bps). https://t.co/qjiMnDnzmf

How far behind can Poloz be?

Richard ,

It’s Choke Bruins Choke…

LF,

Imminent downturn but no severe downturn. Sounds like ass covering because they know the debt bomb could unravel the whole works.

Lief:

The answer is a whole lot of shitty construction.

No risk of “imminent severe downturn” for Toronto and Vancouver housing markets: RBC

A new stress test for uninsured mortgages in Canada that was introduced at the beginning of this year has raised the likelihood of a national housing downturn in the near-term.

But, the chances of a severe downturn and significant home price declines over the next year are still quite low, according to RBC Economics’ Canadian Housing Health Check, released last week.

“Volatility generated by the new stress test eroded the near-term risk profile of several major markets including Toronto, Vancouver and Calgary. Yet none of these markets appear to be at risk of an imminent severe downturn,” reads the report.

For RBC, affordability is the most meaningful indicator of underlying market stress, as it takes into consideration interest rates which are at historically low levels.

http://news.buzzbuzzhome.com/2018/04/risk-imminent-downturn-toronto-vancouver-housing-bank.html

I’m no Leafs fan, but………….Go Leafs Go…..

“Anyone drive through the old cow pasture near Mt Doug. Nice houses but 2.1m to 2.3 that’s a lot of money. Alberg lane”

Funny I drove through there yesterday. I had never taken that route I figured the homes would be under 2 million. Seems crazy to me for that price and houses right beside each other. I think the developers are making a killing. If they are doing a while development they are not paying 300 a sqft. They are getting discounts building at the same time.

I was waiting at the bus stop the other day listening to 3 construction workers that looked in rough shape talking. One was saying he was looking to save a few dollars to go party and take a vacation then come back as there’s tons of work out there hitting nails into boards. The other was saying he was going to quit in a few weeks but wasn’t going to tell the boss. Looking at them and listening all I could think is man I would hate to be buying that house. I hope they have a really good foreman watching what these characters are building.

I’ve seen postings on Facebook trying to attract what looks like anyone to come “hit a hammer” for residential construction. I’m curious if we will have another leaky condo situation. The funny thing to me is I talk to friends doing construction on various condos downtown and all of them say they would never buy in the places they are working on. How much shitty construction is going on?

So much for not covering costs.

Empty homes tax collecting $30M for $2.5M in ongoing operating costs (7.5M setup)

http://www.cbc.ca/news/canada/british-columbia/vancouver-empty-homes-tax-1.4631597

Gwac said “sad day in Toronto…”

Apparently many of the injured are in critical condition. I wonder who’s responsible this time and what their motive is…

Me too, but I’m not facing that dilemma 🙂

In the US it’s far from certain that interest rates are going to keep going up, in fact one of the best predictors of a recession, the spread between rates on 10 yr and 2 yr Treasury bonds, is in danger of inverting. This means the US economic cycle may be turning and if it is, lowering of interest rates is far more likely than them rising.

https://www.washingtonpost.com/news/wonk/wp/2018/04/23/dont-worry-about-a-recession-worry-about-the-federal-reserve/?noredirect=on&utm_term=.eb2e67fa84c7

That was a well-conceived sentence.

LF,

Some food for thought for those who may not make it thru the bank renewal process. The loan sharks are waiting with jaws wide open.

Meet the alternative mortgage lender who’s a last resort for desperate homebuyers bigger banks won’t touch

‘We tell the borrowers if you are dishonest to us, it’s like pulling a loaded gun on yourself’

“There’s no question Firm Capital would be considered a lender of last resort for a home buyer given the punitive fees that mortgage investment corporations can levy, sometimes around 20 per cent all-in, including other professional fees, said Shawn Stillman, a broker at Mortgage Outlet. Nevertheless, he’s seeing greater demand for mortgage investment corporations from his clients that have been shut out of the housing market due to the new regulation, he said.

“Would they be the first lender I would go with? Absolutely not,” Stillman said by phone from Toronto. “But if there wasn’t this demand for the money, they wouldn’t be in business.”

http://business.financialpost.com/real-estate/mortgages/meet-the-alternative-mortgage-lender-whos-become-a-last-resort-for-desperate-homebuyers-bigger-banks-wont-touch

Nearly half of existing mortgages face renewal in 2018 – CIBC

Nearly half of all existing mortgages in Canada will need to be renewed this year, amid rising interest rates and new rules that are making it tougher for some borrowers to shop around.

A new CIBC Capital Markets report suggests an estimated 47% of all existing mortgages will need to be refinanced in 2018, substantially more than the 25% to 35% range in a typical year.

“Over the past two to three years, as home prices have risen unchecked, you’ve had people trying to get into the housing market unable to afford longer term mortgages and taken out short-term mortgages,” Pollick told The Canadian Press. “And in 2018, everything is falling on top of one another.”

The increase in renewals comes as mortgage rates have been rising. Borrowers who renew their uninsured mortgages with their existing lenders are not subject to the new B-20 stress test, which took effect January 1.

In turn, there is less incentive for lenders to offer lower rates to compete for market share, as they did during the so-called “mortgage wars” roughly five years ago.

“Some of their customers won’t be able to leave the bank,” Credit Counselling Society president and CEO Scott Hannah said. “Where is the motivation for financial institutions to offer the best rate?”

https://www.mortgagebrokernews.ca/news/nearly-half-of-existing-mortgages-face-renewal-in-2018–cibc-241304.aspx

I would take the linked properties below if I have 2.25 mil spare change laying around before I would even look at the Alberg Lane houses.

https://www.realtor.ca/Residential/Single-Family/19222037/820-824-Kangaroo-Rd-Victoria-British-Columbia-V9C4E2

https://www.realtor.ca/Residential/Single-Family/19280967/3220-Eagles-Lake-Rd-Victoria-British-Columbia-V9E1C8

I don’t know about you all but 8,000 to 9,000 square feet for a lot is not “executive” or “luxury” and certainly does not demand a $2.3M price-tag. For that price, a buyer should be expecting more, far more. For the home, the finishing look like the build cost is $300 per square foot. I also have difficulty saying the location is true “core” – I don’t think it is.

Looked at the photos – your neighbor is looking right at you.

Gee Leo; And I thought you were throwing us a couple kisses but I guess 13% makes more sense.

sad day in Toronto 9 dead 16 injured.

Whoops, should say sales down 13%. Need more sleep

I have driven by on Mt. Doug. Cross Rd., but not down the actual lane. I see two of the houses are now listed on realtor.ca

They look nice in the pictures, but that is a lot of money. However, they are about the same price as the smaller houses I mentioned last week that are being built in Oak Bay by Maison. Barrister looked at one of those in person and wasn’t impressed. So, for a bigger house and a bigger lot, I guess the Alberg houses are in the same ballpark for where they are located. When you compare to a newer condo with prices approaching $1000/sq.ft., then $700/sq.ft. with your own land doesn’t sound that bad.

Definitely it is disappointing for a “normal” person who had hopes of a ever owning a newer house in the core. I am wondering how much of the price is profit? According to the T-C from 2016, the lots sold for around $700K in 2016. So, at $300/sq.ft., the house would be about $900K to build, which leaves at least $500k for profit. Or, is a custom house like this now costing $400/sq.ft. to build?

lot size are 8000 to 9000. Its tights in there. House are long. Nice development. just expensive. New is expensive these days.

@ caveat

I looked at MLS 390247, which is 4105 Alberg. 2.25 million. 8000 sqft lot. 3000 sqft house.

Awesome finishings, and great appliances (awesome built in grill outside).

That said, for 2.25 mill, one may expect to use said grill without the neighbors houses looking down into one’s yard. In this case the photo alone shows at least 3 other houses looming over the back yard.

To each his or her own… but having neighbors that close is often not a good thing. Especially if you get bad ones (been there).

Alberg Lane – 4 acres turned into 16 lots, so presumably lots averaging a bit under 1/4 acre each (because of right of ways). For new developments in Victoria that’s actually a pretty generous lot size?

I think that we really need to break down the sales by segments. The sales activity is in the lower to lower-mid price homes. For the balance of the market [middle to luxury] we are seeing seller’s drop prices. This is especially so in the luxury market.

The Mt. Doug development reveals some nice, over-priced, homes. The lot sizes leave a lot to be desired. Hardly “executive” in my mind. But to each their own.

Yes, Leo, can you clarify the “XX”?

Don’t keep us in suspense, Leo!

you’re not kidding. very nice houses, but 2.25 million to have neighbors 5 feet away on both sides seems excessive. Cant hide that, even with $50k worth of appliances….

Just my luck to be dealing with an almost vicious buyers market here in Calgary and a still hot sellers market on the island. ‘¯_(ツ)_/¯

Anyone drive through the old cow pasture near Mt Doug. Nice houses but 2.1m to 2.3 that’s a lot of money. Alberg lane

Despite the uptick in sales my on the ground impression is that the quantity of showings has slowed down substantially. Also, the properties going over asking price are doing so on a much lower quantity of offers. For example, it will go over asking on 2 or 3 offers; whereas, last year it would have been 4-5 offers and 2016 7-10 offers.

I think it could be a slow summer kind of like yr 2010 (hot spring, slow summer).