May 7 Market Update

Weekly sales numbers courtesy of the VREB.

| May 2018 |

May

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 133 | 1006 | |||

| New Listings | 335 | 1451 | |||

| Active Listings | 2109 | 1896 | |||

| Sales to New Listings | 40% | 69% | |||

| Sales Projection | — | ||||

| Months of Inventory | 1.9 | ||||

A relatively slow start to the month. Sales down 20% from last year while the usual start of the month listings and re-listings brought inventory up to over 2100 which is an increase of 17% from the same time last year.

Back when the market was smoking hot, we didn’t see any interesting sales to speak of. Properties sold in bidding wars over ask or quite quickly at asking price. There really was no such thing as a deal to be had relative to the current market because too many people were paying attention. Now that it is slowing down I see more sales that would be considered interesting. Such as a townhouse that was presented for a bidding war and sold in a weekend… at $150k under ask.

Overall though, still about a quarter of places are going for over asking price. While we can always expect some properties to sell in bidding wars no matter what happens, in a slow market that percentage is 5%, so there is still substantial interest in well priced properties.

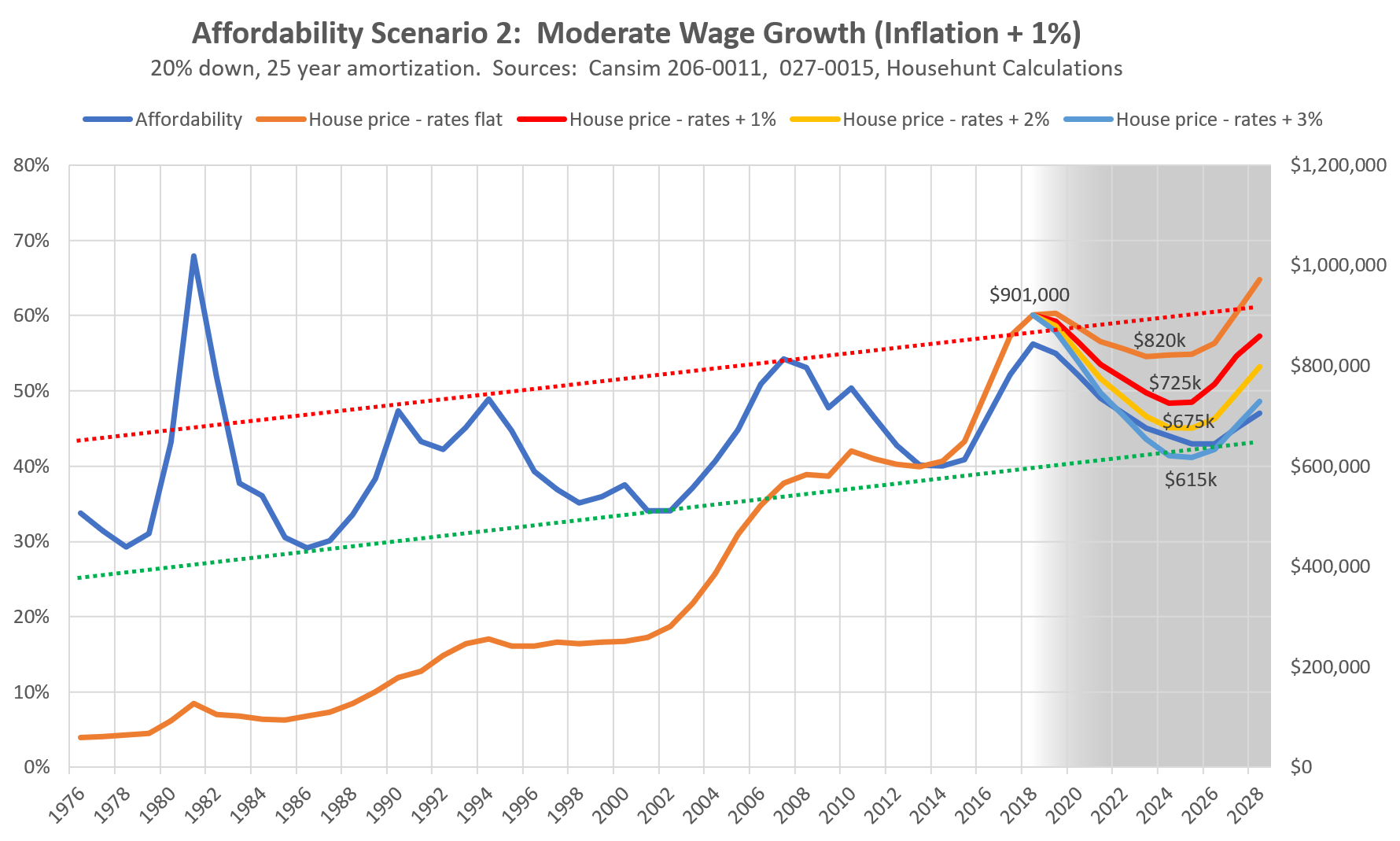

A few people commented that the previous article about affordability that only considering the scenarios of flat rates or an increase of 1% was too narrow a band. I re-did the moderate wage growth scenario with rates rising 1%, 2%, or 3% above current levels. At plus 3% that would mean a 5 year fixed is being sold at about 6.5% which is very high compared to the last decade but not at all out of the ordinary for mortgage rates in general. As you can see, in that scenario with affordability improving it would erase all of the gains from the last price runup.

I personally don’t expect rates to increase that high (the economy can’t take it) but it certainly shows how much our current prices are built on an environment of low rates.

Just reading this blog VREAA

https://vreaa.wordpress.com/

It’s like reading a whole blog by Vancouver Hawks.

Sounds pretty bleak over there makes you wonder is it really?

Good point. Calling it a school tax is a weak attempt to make it more popular. What you don’t want to pay your share for the children?

Monday post: https://househuntvictoria.ca/latest

VicInvestor:

There has never been a younger generation that has been helped as much as this one has. Nor has there been a generation that either has or will shortly inherit as much. With six siblings I inherited my portion of the family home which came down to a bathroom and a hallway. This was at a time that mortgage rates were 14%.

If you want a quick fix for the housing market stop bringing in 300,000 net immigration and you will see supply soon start to outstrip demand. Then wait about five years and you will see a major increase in supply as the greedy boomers start to either die out or downsize.

The problem with this “luxury tax” is that before you know it inflation will start to include most homes. People seem to forget that the land transfer tax was also brought in under the guise of only effecting luxury homes. Notice that the tax has no build no cost of living adjustment. I know that the politicians are familiar with the concept since all of their overly generous pensions are inflation indexed.

It is a beautiful day out there and hope everyone gets to enjoy it.

2k I cant even argue this. Deferring is the way to go. So what if you have 100k at the end. Your heirs will still get a lot of $.

Only issue I have its going to general revenue not schools so call it what it is. BC tax.

@Vicinvestor Luckily it seems that the public is not buying into it. Even in Vancouver a headline like “Owning $4 million house in Vancouver no blessing as seniors face $2,000 a year more in taxes” is so patently absurd that even the financial post can’t successfully spin it anti-government.

“They could sell their home, and are eligible to defer both the new tax and property taxes, but Kent says that’s not the point.”

Facts are not the point! I don’t want to hear facts! What about emotions!

http://business.financialpost.com/real-estate/owners-of-multimillion-dollar-vancouver-home-owners-say-they-cant-stomach-tax-bump

Is it just me or are boomers one selfish and entitled generation? If you’ve been lucky enough to see such massive capital gains in your property (we’re talking millions!), then stop complaining about a tiny $2,000 of extra tax a year! We need to stop catering to these seniors and help the younger generation.

1/ population keeps growing

2/ SFHs have not kept pace

3/ FBs have always been and always will have a place in the Canadian RE marketplace

4/ FDI or FREI is governed globally under multiple conventions

5/ % rates are at crazy levels

6/ the world is FLUSH with credit…still!

7/ prov + local governments add a gazillion new taxes to dose the fire

8/ RE is still stubbornly high, but down trending

These are all trends. Will 5/ and 6/ be enough to hold back all the other factors? Is this all FBs fault? The answer is a resounding no. Not saying we shouldn’t, but there are way more factors at play. How much does a FB pay now even if they are owner occupied? Here is a $2MM example:

PTT 38000$

FBT 400,000$

GST if applicable 100,000$

Let’s not include ongoing prop and school taxes and spec taxes… that is 548,000$ for all levels of government. Put another way extreme way, sell a $2MM new house to FB and you could use 548,000$ subsidized housing for a local? How long would it take someone making the avg wage in Victoria to pay that amount of taxes? Would the amount of taxes justify a net net gain in terms of services used in our province.

These are observations and not my opinion, but the numbers are finite for FB. FYI in the Philippines, a certain amt of the housing stock is allocated for FBs, I think it is 20%.

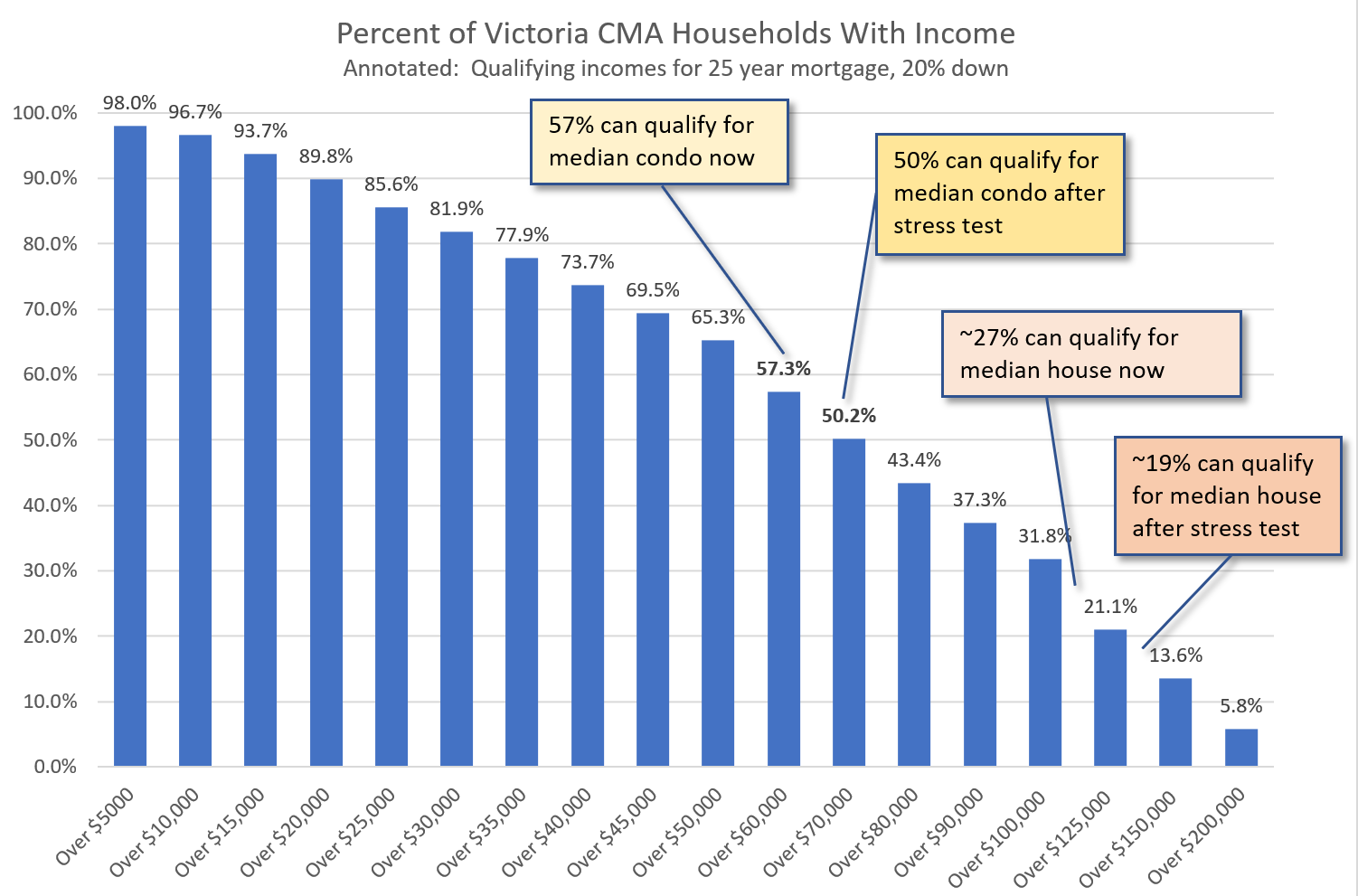

Mostly because they bought in the past. At this point the average household can certainly not buy a detached house. However they could still buy a condo.

The average guy CAN afford to buy a place because many do. Bears cannot because they don’t make enough money because they didn’t pay attention in school. Which life would you choose?

Has it occurred to anyone that one of the reasons that the average guy cannot afford a house is because we are being taxed to death already? The average working guy is a lot worse off than he was in my dad’s day. What percentage of the jobs in BC are either directly or indirectly from one level of government or another?

It’s easy to be doom and gloom, but I was under the impression that you were in your 70s, Barrister. Are we talking the 40s here? the 50s?

I mean, all levels of government taxation amount to around 42% of GDP. But consider what we really feel is government spending and what we feel is a waste. My GP is a small business owner, but he bills island health. So he’s part of that government gravy train. The guys widening the road on my way to the office all work for various construction companies, but they bill the city. So they are part of that as well. Should we fire my GP because he’s a bum on the government dole? Or what about the road crews?

We have more doctors, better roads, and more services then ever before, and people recognize it. So we rarely hear calls for fewer doctors or road crews. Where the benefits are less tangible to the electorate the government often cheaps out big time and this is where government can often fail us. A great example is the CRA. The CRA should’ve been clamping down on foreign buyers, flippers, splitters, etc etc etc decades ago. By counting heads at the CRA the federal government gave up on tens of billions of dollars of lost revenue – and that’s free money to us as a huge portion of this is foreign bankroll. They were penny smart and pound foolish. A few million in salary would’ve brought in a ridiculous ROI. Now the NDP (and before them, the provincial liberals) have had to step up and come up on their own taxation regime where the fed has failed.

They are certainly the weakest of the bunch. That said it’s sometimes a little difficult to tell since there are so few of them that the chance sale of a few more or less will substantially change the picture.

Condo sales only down about 20% compared to same week last year.

Leo, interesting about the SFH sales this week, How are condos doing. Iwas told that sales above 2 mil. have just about frozen, is this true?

Getting away from all the academic theories for a moment, went to an open house for a new listing down the street and in spite of being there for twenty minutes not a single soul walked through during that time.

I suspect that I have just made Hawk’s day.

Hmm.. Single family house sales down nearly 50% compared to same week last year.

Yeah the idea that increasing income inequality (by decreasing taxes on the highest earners) will make housing more affordable is likely not defensible.

However the relationship in both directions is rather tenuous. Tax policy certainly has an impact on house prices, but the level of taxation is not one of the primary factors.

That’s not my thesis, just a fact. The highest RE prices in Canada are found in the lowest tax provinces, and also affordability in BC has gone down hugely since the BC Liberals and federal Conservatives cut taxes. That was my response to someone who claimed high taxes are responsible for unaffordability. But there’s a lot more to it.

The big picture is the tax system, through legal exemptions (e.g. principal residence, HOG, property tax deferral), lack of enforcement (e.g. flippers getting away without paying taxes, illegal short term rentals, evasion of taxes on foreign income), and low property taxes, encourages RE as a vehicle for parking money legally or illegally. Add to that government guarantees for mortgages that would be considered insane for any other asset.

Unfair exorbitant taxes are obviously unfair and exorbitant. But the point in question was what proportion of the tax a government raises — whether the total be fair or unfair, exhorbitant or reasonable, should be based on property, and that really has nothing to do with the risk of fascism or the probability of the expropriation of property.

And when discussing the taxation of property it is necessary to be clear as to what is meant by property. In advocating a capital tax, I referred to the taxation of all property, real estate, financial assets, works of art, jewelry, etc. Such a tax, at a rate of one to one point five percent, as in non-fascist Switzerland, would presumably have an impact on the RE market, but it would have many other effects. In particular it would have something of a leveling effect since it would oblige the wealthy to pay tax on unrealized capital gains on RE, financial assets, etc.

A capital tax, would indeed be the answer to Warren Buffet’s plea to be taxed more heavily than his secretary. At one point five percent, a capital tax would cost him something like a billion a year, which would indeed be more than his secretary pays, but well within his ability to pay while accumulating billions more.

As am sure you will agree, Patriotz, that is only half the story. House prices also depend on availability. If the black death swept across BC and reduce the population by two thirds, house prices would fall to a very low value indeed. Equally, if Victoria’s municipalities rezoned to several times the present density, land prices would fall sharply, as would the price of houses.

Many of these things have become a lot harder due to recent changes. Reporting of sale of Principal residence, spec tax, AirBnB licensing. More transparency on presales and beneficial ownership. Much of the rest would be easy to catch with a bit more sophistication on CRA’s part. I’m fairly confident that the vice is tightening in an appropriate way on those fronts.

Hmm.. And you are betting less than 9% decline? That’s not a bad bet, I’d expect about that much so pretty much even odds whether it will land on less or more. I’ll take you up on that, but only beer for you not all the readers! Remind me in 2020 🙂

That’s going to be a tough one. I have not heard a single peep from inside Quebec that they are interested in killing the QIIP.

You really think David Eby’s actions on money laundering are not real? They are attacking it from both ends. I don’t think it’s fair to say they are only focused on the tax side.

It is just more complicated than pointing to tax rates. I grant you that higher tax rates result in less disposable income, but it is more complicated. Federal tax rates are the same, subject to territorial rates to encourage migration. If low taxes are the cause of high RE prices, then RE prices in the Yukon, Northwest Territories and Nunavut should be through the stars – they are not. here are their tax rates:

Yukon

6.4% on the first $46,605 of taxable income, +

9% on the next $46,603, +

10.9% on the next $51,281, +

12.8% on the next $355,511, +

15% on the amount over $500,000

Northwest Territories

5.9% on the first $42,209 of taxable income, +

8.6% on the next $42,211, +

12.2% on the next $52,828, +

14.05% on the amount over $137,248

Nunavut

4% on the first $44,437 of taxable income, +

7% on the next $44,437, +

9% on the next $55,614, +

11.5% on the amount over $144,488

Here are the provincial and territorial income tax rates:

QUEBEC:

$42,705 or less: 15%

More than $42,705, but not more than $85,405: 20%

More than $85,405, but not more than $103,915: 24%

More than $103,915: 25.75%

Newfoundland and Labrador

8.7% on the first $36,926 of taxable income, +

14.5% on the next $36,926, +

15.8% on the next $57,998, +

17.3% on the next $52,740, +

18.3% on the amount over $184,590

Prince Edward Island

9.8% on the first $31,984 of taxable income, +

13.8% on the next $31,985, +

16.7% on the amount over $63,969

Nova Scotia

8.79% on the first $29,590 of taxable income, +

14.95% on the next $29,590, +

16.67% on the next $33,820, +

17.5% on the next $57,000, +

21% on the amount over $150,000

New Brunswick

9.68% on the first $41,675 of taxable income, +

14.82% on the next $41,676, +

16.52% on the next $52,159, +

17.84% on the next $18,872, +

20.3% on the amount over $154,382

Ontario

5.05% on the first $42,960 of taxable income, +

9.15% on the next $42,963, +

11.16% on the next $64,077, +

12.16% on the next $70,000, +

13.16 % on the amount over $220,000

Manitoba

10.8% on the first $31,843 of taxable income, +

12.75% on the next $36,978, +

17.4% on the amount over $68,821

Saskatchewan

10.5% on the first $45,225 of taxable income, +

12.5% on the next $83,989, +

14.5% on the amount over $129,214

Alberta

10% on the first $128,145 of taxable income, +

12% on the next $25,628, +

13% on the next $51,258, +

14% on the next $102,516, +

15% on the amount over $307,547

British Columbia

5.06% on the first $39,676 of taxable income, +

7.7% on the next $39,677, +

10.5% on the next $11,754, +

12.29% on the next $19,523, +

14.7% on the next $39,370, +

16.8% on the amount over $150,000

Yukon

6.4% on the first $46,605 of taxable income, +

9% on the next $46,603, +

10.9% on the next $51,281, +

12.8% on the next $355,511, +

15% on the amount over $500,000

Northwest Territories

5.9% on the first $42,209 of taxable income, +

8.6% on the next $42,211, +

12.2% on the next $52,828, +

14.05% on the amount over $137,248

Nunavut

4% on the first $44,437 of taxable income, +

7% on the next $44,437, +

9% on the next $55,614, +

11.5% on the amount over $144,488

“Tax changes are always going to be contentious, so rather than start there I’d prefer that Canada stop pussyfooting around and address the issue head on: restrict foreign ownership, kill the QIIP, track beneficial owners, clamp down on money laundering and permitting lawyers to circumvent FINTRAC, etc. We should send a message — loud and clear — that ours is not a country for wealthy unethical parasites. Want to build a life in Canada? Great. Want to steal from us? Intolerable”.

Bravo – I fully agree. One thing further – the income tax system needs a complete makeover. We should have a flat tax. How about 10% across the board.

Patriotz – trust me, I understand your thesis – it is just plainly wrong. Allowing governments to tax more and more, just breeds more foolish spending by governments. Taxing people so they have less money to spend on housing is what you are saying is propping up RE prices. Your thesis is that lower tax regions have higher RE prices. The money will never end up building affordable housing – our PM will just take another expensive vacation. Incomes and higher paying jobs, after you take out the blood-sucking money-laundering and dirty foreign money, are what housing prices are based on. Respectfully, take the blinders off and read the investigation reports of the real reason for the price-tags of the real estate in the areas mentioned: foreigners parking their ill-gotten gains in our RE market [looking for safe areas], fentanyl drug money being laundered through casinos and RE, housing speculation by unscrupulous flippers, etc. Read the Vancouver Sun reporter’s, Sam Cooper, findings. Here is a good start for you:

http://vancouversun.com/news/national/huge-b-c-money-laundering-investigation-pivots-to-drugs-and-guns

http://vancouversun.com/author/samcooperprov

One of the best is Madam Justice Griffin’s recent decision which goes through what is really happening – it has nothing to do with taxes:

https://www.straight.com/news/1014966/two-families-feud-over-three-vancouver-houses-and-money-transfers-china-canada

Clearly not, since Ottawa and Edmonton, which have higher incomes than Vancouver and Victoria by quite a bit, have far lower housing prices.

As for the rest, I don’t think you disagree with me as much as not understanding my points. The biggest being that taxes per se are not the problem, but disparity in taxation among sources of funds going into the housing market.

And you’d better believe that Quebec has the highest taxes in Canada. Nova Scotia is pretty close, but its housing is also among the most affordable.

Patrriotz, I could not disagree with you more. Firstly, housing prices are based on incomes. Indirectly, a person’s willingness to pay is based on income. Secondly, we collectively as Canadians are over-taxed [income tax, sales tax, excise tax, tax, tax tax]. The income tax system is flawed because it creates a disincentive to work and innovate. You say, “he more affluent pay (or should pay) a higher % in taxes than the less affluent, so the income tax system makes buying more affordable, not less”. That is patently inaccurate. You need to define “affluent” – I suspect you are referring to higher income earners. However, income is earned in many forms, namely: wages, salary commissions, dividends, interest, and capital gains. These are taxed differently. The fact is that the current income tax regime hurts our competitiveness on the world stage – Mr. Morneau disagrees, but every leading economist and corporate executive has argued that our income tax system punishes [not rewards] innovation and success. The end result is a lower standard of living for all.

Quebec does not have the highest taxes in Canada. You point to “BC, Ontario, and Alberta” – please focus in on the pockets of disequilibrium – it is Vancouver, Victoria, Calgary and Toronto [not the entire province] – so income taxes have nothing to do with it. Foreign buyers are now focusing in on Quebec – Montreal is now the hottest RE market in Canada and, unchecked, will catch up to Vancouver, Victoria, Toronto and Calgary.

No disrespect, just a difference in opinion.

No. House prices are determined by how much buyers are willing and able to pay. In fact, the more affluent pay (or should pay) a higher % in taxes than the less affluent, so the income tax system makes buying more affordable, not less. Provided all the money going into the housing market is subject to taxation, that is. The problem is when it isn’t.

Note also that Quebec, which has the highest taxes in Canada, has among the most affordable housing. The provinces with the lowest taxes, namely BC, Ontario, and Alberta, have the least affordable housing.

Leif said: “I agree with franc the real issues are

“restrict foreign ownership, kill the QIIP, track beneficial owners, clamp down on money laundering and permitting lawyers to circumvent FINTRAC”

There is another way to reverse escalating home prices… start reporting your friends and neighbours who are ripping off the system.

In the past five years I’ve met so many people who are not reporting income. AirBnB, basement suites, people picking up discarded receipts at the landscape material yard to claim on their income tax, claiming home owner grant on their rental, claiming the home owner grant on their Victoria property that they use during the summer while living in Alberta, American’s living here part time then selling and claiming the principal residence exemption and not reporting the profit to the American IRS, and now empty house owners scheming ways to pretend they live in the house like the Alberta doctor and his vacation house in Victoria. If I was inclined to cheat on my taxes I’d keep my mouth shut, but many people boast about it and rationalize it.

Unfair exorbitant taxes on land owners has a history worth studying. It’s often the first step to fascism, expropriation/eminent-domain, especially when the government deems the property is under utilized. Be careful what you wish for because it’s possible to go down this path in a passive way when the various levels of governments chip away at the affordability of property by imposing ever increasing forms of taxation and fees. Taxes never go down once imposed. Property purchase tax is a good example, the government will never lower the rate and the PPT is cumulative, meaning it keeps adding to the price of property with every transaction. After four sales (~25 years) the PPT adds about $200,000 to the cost of an average SFH.

Barrister you hit the nail on the head.

For me to makeup the difference between a house in 2015 to 2018 is around $300k for what we are looking at.

That requires me to make 500k more to pay off. This is why I think government workers have it pretty well. They pay little tax on 70k, they get 75% of their income for the rest of their lives in retirement. In the private sector if your doing well your paying 50% tax and have to save millions for retirement.

Yes I can take a massive mortgage out and still buy the same house for a million dollars but I’m not going to. I just can’t see how much further this can go on. I currently see all the 500-700k places being gobbled up but million plus SFH are not.

I agree with franc the real issues are

“restrict foreign ownership, kill the QIIP, track beneficial owners, clamp down on money laundering and permitting lawyers to circumvent FINTRAC”

Josh and Vic it’s interesting to think we all saw this going to school here.

” I even know of some whose kids apply for bursaries due to claimed low income status. Why would they set up a business here when the making a killing in their home countries?”

I remember multiple friends from Hong Kong in Uvic that would get free government grants. Around 10-20k a year because on paper their parents made no money in BC. They then used that free money for whatever. Some bought stocks and it was crazy to me that since both my parents worked and paid tax I couldn’t get the same grants.

How ####ed is that?

That was 17 years ago and I bet it is still happening. I great statistic would be to see how much of our tax dollars went to students abusing that system. They were Canadian citizens then the father or parents would go back to HK.

This has been happening for ages as explained on those pod casts. The interesting party is we pay for that. We subsidize the schools and universities and health care with our tax. This year I’ll pay more in tax than I made when I graduated from uvic with my first job. Why should I have to pay such a crazy amount of tax when 28000 people sit in BC and countless others that abuse the system yet probably own a huge amount of BC s real estate under primary residences making a fortune and paying nothing.

Beautiful sunny day out there.

Has it occurred to anyone that one of the reasons that the average guy cannot afford a house is because we are being taxed to death already? The average working guy is a lot worse off than he was in my dad’s day. What percentage of the jobs in BC are either directly or indirectly from one level of government or another?

Exactly Franc, no BS. Instead we get a tax the poor and rich land owner scheme and who can best afford the tax? Meanwhile the real issues are skirted. AirBnB negotiated just in time to stop that issue. A trip to a foreign country put an end to the other. What was left to make the voter base happy?

The tell tale job stats the pumpers ignored were the job losses in the real estate and support sector. No wonder the crash warning went out last week. This sucka is done like dinner.

Great stats Andy. Coming soon to Victoria.

“Losses were felt in finance, insurance, real estate, rental and leasing jobs (-6,400); and business, building and other support services jobs (-4,200).”

Tax changes are always going to be contentious, so rather than start there I’d prefer that Canada stop pussyfooting around and address the issue head on: restrict foreign ownership, kill the QIIP, track beneficial owners, clamp down on money laundering and permitting lawyers to circumvent FINTRAC, etc. We should send a message — loud and clear — that ours is not a country for wealthy unethical parasites. Want to build a life in Canada? Great. Want to steal from us? Intolerable.

That should stem further abuses. Addressing existing ones might be more tricky, but a clear crackdown on the input should make existing transgressors reevaluate their schemes.

We could also consider taxing them on the way out by making the principal residence exemption contingent on proving that funds used to purchase their property was subject to Canadian taxes.

8,653 Sq Ft lot; S.W. Marine, Vancouver – SFH

*looks like a nice, well kept family home built in the 80s.

“Just sold for ~$1 million under July 2017 Assessed

Sold for $2,580,000

28% below July 2017 assessed of $3,571,000

27% below July 2016 assessed of $3,538,000”

Coming up on 30% below assessed…

Vicinvestor1983,

Depends on what you are looking for in quality, but the standard corner cabinets can be had at any big box stores such as Home Depot/Lowes for less than $400.

SweetHome,

Standard distance between the studs should be 60″ to 60 1/2″. or install the studs sideway (gain 2″) so that it will fit the tub, however the wall must be frame around the tub to accommodate it. Or, at least mount a small section the regular way to accommodate lights/fan switches and door frame.

The other way is to reframe the opening for 54″ bathtub (cost more because not really a common size), or reframe for 54″ drop in tub then tile the left over if there is a separate shower.

Barrister,

I’m not sure as well, and I agree that it would be very interesting by the middle of the summer if those addition homes are added to inventory.

Local Fool,

Leo S,

I know it hard to trust an old immigrant with broken English, but IMHO as many others on here is that it make sense to buy whenever you can afford.

@ Once and future:

You might have noticed that the capital tax that I advocated (at a rate of one to one point five percent as levied in Switzerland) would be applicable to all assets. So, yes, my view remains what it was. As for elderly people with a disproportionate amount of wealth tied up in their own homes, it would seem reasonable to allow deferral until death, as with the existing property tax.

And what you are missing in you view of the property tax is that without the existence of the state, with its parliament, its courts, its police, its army, its navy, its air force, its security services, its hospitals and schools and all of the other infrastructure that it creates, there would be no hope for most people elderly or otherwise to enjoy the benefit of property: they would simply be booted out or have their throats cut by local war lords or feral immigrants out for plunder.

…. But now I see that Patriotz said that, but more pithily.

Should have waited on the early renewal of the mortgage. Competition is pretty fierce for renewals as volume is reduced. Banks are going to get more competitive for business.

Slow sales week. We had several weeks there where sales were 220ish. Last week 172.

The ratio for quite a while was 3 new listings, 2 sales, 1 price change.

Now it’s 3 new listings, 1.5 sales, and 1 price change.

Sales still supposed to be increasing, not decreasing, but maybe it’s just a blip.

““We haven’t put our house on the market again and we need to close in seven weeks. There is no point. We are watching the market so closely with our realtor and we can’t afford to take the amount of money that we will get offered right now. If we got a delay in closing then it would be fine. I’m sure the market will recover in time,” Darren Evans told the Star.”

” So ingrained is this idea that generating real estate wealth has become an industry in and of itself, with entire cable channels devoted to flipping and equity building, and get-rich-quick experts offering classes, workshops and conferences; A recent Real Estate, Bitcoin & Wealth Expo in Toronto included bizarre and rambling inspirational speeches by Sylvester Stallone and Pitbull.”

The wake-up call for a generation of wide-eyed home buyers

http://www.macleans.ca/news/canada/the-wake-up-call-for-a-generation-of-wide-eyed-home-buyers

Good Morning:

Looks like a beautiful day out there. Hope everyone gets a chance to enjoy the sunshine.

Yes in theory it is more worthy, going all the way back to Adam Smith. Why? Because it’s not ultimately the product of labour and saving, like true capital. It’s just there. Ultimately its ownership is based on force of arms, not production. You can tax it as much as you want, and it does not affect the incentive to save or work. Nor can it be moved or hidden like other assets.

So, your solution is to punish every land owner in BC because we have screwed up our immigration and foreign ownership policies? I agree that the US has other significant wealth disparity problems, but that is another issue.

It concerns me that many smart people see a short term problem in BC and decide to alter the fundamental fabric of our economy to fix it. We have simple tools to deal with this problem, even if we have waited too long to use them. In fact, they may turn out to be more “effective” than people want.

While I am not a fan of Hawk’s continual doom posts, there is a significant chance that real estate is in for a sizable correction.

In theory it isn’t more worthy, but in the current socio-economic environment the rules are kinda messed up and as a result we have some very acute issues with land ownership. Owen Bigland is bang on that allowing immigrants to bring cash to buy property, pay low property taxes AND gain the principle residence exemption is a big problem. Because nothing had been captured from them. It’s like a big neon sign – BUY OUR PROPERTY, PAY LITTLE IN TAXES, GAIN PRINCIPLE RESIDENCE TAX EXEMPTION IN A STABLE FIRST WORLD COUNTRY WITH FREE HEALTHCARE!! When you think about it, is amazing the problem isn’t bigger.

Similarly the US has a huge problem with a lack of taxation on wealth – and a disproportionate amount of on taxation of labour. That one is slowly eating the country alive, and here again while taxation on wealth isn’t inherently more deserving, the rules in the US have been setup such that, disparity is so bad that now wealth IS more worthy of taxation.

To clarify my statement about land taxes being “evil,” I think that most of what we call property taxes are just reasonable fees for local services (roads, fire, police, etc). They are essentially glorified strata fees. However, going beyond that requires caution.

As a counter-thought, let me take it to another level. Let us define “property” to include all the assets you own, including all you high-earners who have salted away your savings in sensible ETFs, or own a nice car (or two). Are you so keen now?

I am of the opinion that local housing issues are solvable using tools like “building homes” and “taxing foreign ownership.” If housing goes through a correction (which it always does), why is land ownership so much more worthy of taxation than any other kind of “property?”

They are neither necessary, nor evil.

Not necessary, because revenue COULD be raised by other taxes instead.

Not evil unless you take the view that all governments are evil, taxation is theft and the services government provides are useless or worse.

31 x 134 lot; Kerrisdale, Vancouver

“Vancouver Special”

Just sold for $1,900,000

24% below July 2017 Assessed Value of $2,508,900

26% below July 2016 Assessed Value of $2,562,500

I hope you like the idea of never ever being able to retire.

Taxes on land are a necessary evil, but evil nonetheless. Just because we have a mess created by corruption and poor central bank planning doesn’t mean we have to destroy everything in the province to fix it.

Rather a myopic view on immigration because of RE.

We live in interconnected and global economy. It isn’t the world of 30, 20, or even 10 years ago. Everything and literally every product/service requires teamwork/collaboration from another country.

People who efficiently facilitate efficiently and innovate are the winners in the global economy OR any economy for that matter. The senator is ABSOLUTELY CORRECT, we have to leverage this ASSET.

If all we are going to do is TAX THEM, rather than saying, how cay you turn my wood to furniture? Salmon to Processed products, minerals to metals? ideas to products? That is stupid. The wealth gap will even get larger and what values of RE are inconsequential.

People fail to realize, China and Asia in general are ahead for some reason…I would call it sacrifice and lots of elbow grease. Drive on Friday night in any large city in Asia…and do the same in Vancouver or Toronto…what is the difference? The lights are still on…

People around the world are outworking us plain and simple. This is not corrupt money, it is money earned. Only the anomalies make it to the news, anyone who has been there and worked there will tell you something entirely different.

Focusing more on taxing land and less on taxing income has another great advantage other than the ones discussed here. Very easy to avoid or minimize income taxes. More or less impossible to avoid land taxes.

Not likely to happen though in a province full of land rich income poor seniors.

The senator makes no sense. Data shows that investor immigrants pay less income tax than refugees! I even know of some whose kids apply for bursaries due to claimed low income status. Why would they set up a business here when the making a killing in their home countries?

Josh I think that is one of your best posts, except for those last 3 sentences which are really loaded statements – let’s skip those for now 🙂

In a low property tax environment (like BC) it is madness at the worst and foolish at best to allow ownership by anyone who isn’t contributing to the local economy.: Either by operating a business that employs people or by paying income tax. Vacationers are a really really tricky situation. Yes they may show up 2, 4, 12 or however many weeks per year but even if they spend like bandits while in town they place more of a drag on the economy then they add to it in comparison to locals.

So as that one gent on the CBC podcast said, we need to also encourage foreign owners to bring their business HQ to BC. Now, here’s the rub – a lot of Chinese businesses (and their owners) are wealthy precisely because of the “competitive advantages” that China offers. Lax environmental controls, dirt cheap labour, exploitation of IP etc. So as good an idea as it sounds, even if Mr Chinese Business Man wanted to move his company it may not be viable in BC. So now what? This leads back to the discussion of shifting the tax burden to property owners and lowering the income tax burden. Now the foreign owner is hit regardless who lives on the property or not. Let them have it be empty, the taxes will flow in! BTW this is exactly what Texas does. No income tax, and property taxes that certainly get your attention. And property is cheap as a result! The bad news is to do this in BC a lot of people would lose a ton of equity in the transition. So the BC government is trying to band aid the situation. Will they invent a good band aid? Drum roll please…

Another quote from our lovely Senator:

“I totally think we should focus much more on how to create a welcome environment for high net worth families, who are already landed here anyways, they’ve bought the big house and they got their fancy cars”

Yuen Pau Woo

podcast-a.akamaihd.net/mp3/podcasts/s…

#vanre

The millionaire migrant program that BC ran (IIP) began as a political idea. If the applicants had actually immigrated, it would have done what politicians were hoping to accomplish – stimulate the economy. Instead, they spend all their time in Hong Kong, keeping their high income, and then pop over to Vancouver (HK2 as they call it) for healthcare, safe RE investment and send their kids to UBC with no foreigner tuition while paying no income tax. I went to school with those kids. They bragged about how good a deal it was. Targetting missing income tax and working with China on capital control violations is how we fix it, and we’re doing that.

Quebec’s millionaire migrant program has no requirement to stay in the province and everyone hates it, including them. I don’t know why they’re still running it.

The lesson here is don’t cater to the wealthy. They’re no one’s friend. Cater to workers.

Well, Mrs. Fool and I are off on vacation for a week and a bit.

Catch ya’ll later, and stay out of debt.

Well it is in the data, and anecdotally I know a number of people that got increases in the last year. Michael even posted the constant dollars, too. The question is why are the hikes so substantial and are they sustainable.

A hot housing market causing a shortage of labour can be inflationary to wages. Looking at the BC numbers contrasted to other regions makes me wonder if that’s at least in part what we’re seeing.

A slumping housing market would probably exert a downward impact on those numbers, so I kind of think it’s a bit early to say if it’s a broad inflationary trend.

“The year is 2030… oil $300”

12 years ago oil was $40, now $70. So 12 years from now will be $300 when newer tech is finding billions of barrels more daily along with renewable energy ? Man, reality for some must be fricking scary.

“Next up, double-digit wage growth.”

No one here has fessed up to getting a 5% plus wage hike this year after multiple requests. Anyone thinking big wage hikes are coming are asking for mass unemployment, and either will tank the real estate markets even faster.

The year is 2030… oil $300, lumber $1500, mtg rates double digits, LF’s gross income 350k/yr… yet everyone is still somehow confused how rates & prices tripled together since 2018.

Okay, so along the same lines as the “average Canadian owes $1.70 for every dollar they earn” isn’t really true, (ie 30% have no debt and a small portion have enormous debt), 8% of people having 350% or more becomes alarming.

I wonder what that 8% would look like if you broke that segment down.

Ah debt. I just paid off my credit card, too. Owed about $220 on it from a few little things. Now back to zero-point-zero. Gloating, but no house. Guess it’s a wash?

The devil is in the details. 350% …. Or More.

8% of households would be 1,125,766, which means on average they’re carrying a mortgage of $373,079 – about 3x the rest of the average of households. That’s not great, but that is also the average of those 8% across Canada.

In particularly expensive cities, well …..

Already been noted on this thread. A massive crash can happen with only 1% of owners in trouble at a given time. The tail wagging the dog, so to speak.

That’s not a bad point, and it’s one I don’t really understand. The two things I think of right away is that the CB is alarmed, so they’re obviously seeing something I’m not. Secondly, the mortgage debt levels in the USA were not as high as ours are now, and yet look what happened to them.

So I’m missing something here…anyone?

Damn NDP and their economy killing

$100K gross household income, $350 K mortgage? Is that alarming? I agree it would be very alarming if more than a sliver of that was high interest debt.

caveat emptor: “But IF it was true you could argue it is good news:”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

… and of course, conversely, you could argue that it is going to be a debacle with over-leveraged homeowners facing higher rates because their bank understands that they can’t shop around without incurring the stress test.

https://www.bankofcanada.ca/2018/05/canada-economy-household-debt-how-big-the-problem/

“Notice that the 170 per cent figure represents an average across Canadian households. It includes all those who have little or no debt, which means, to make the average level of debt so high, it also must include some very highly indebted Canadians.

In fact, about 8 per cent of indebted households owe 350 per cent or more of their gross income, representing a bit more than 20 per cent of total household debt. These are the people who would be most affected by an increase in interest rates.”

…. and where do those 8% live???

https://betterdwelling.com/cmhc-finally-says-vancouver-is-too-expensive-for-local-incomes-toronto-overvalued/

Canadian Real Estate Is Highly Vulnerable

The CMHC believes that Canadian real estate is highly vulnerable in April, with moderate evidence of overvaluation across the country. Analysts noted prices are high compared to “fundamental factors such as income and population.” They specifically called out Vancouver, Victoria, Toronto, and Hamilton as the markets having a broad impact on national numbers.

I don’t believe the 47%.

But IF it was true you could argue it is good news:

47% of folks will be renewing at still fantastically low rates (3.25-4%) and if historical trends hold a lot of them will be locking in for five years.

Heck you could lock in for 10 at under 4%

Victoria Mill Rate is out:

http://www.victoria.ca/assets/Departments/Finance/Documents/2018%20Property%20Tax%20Mill%20Rate.pdf

Introvert: Fake News

I guess, Introvert, that it’s a matter of who you believe and what sounds more plausible.

http://nationalpost.com/pmn/news-pmn/canada-news-pmn/nearly-half-of-existing-mortgages-face-renewal-in-2018-cibc-report

“A CIBC Capital Markets report suggests an estimated 47 per cent of all existing mortgages will need to be refinanced in 2018, up from the 25 to 35 per cent range in a typical year.

The increase is an unintended consequence of various rounds of regulatory changes in the past few years aimed at reducing risk coupled with rising house prices that made it harder for homebuyers to qualify, said Ian Pollick, CIBC’s executive director and head of North American Rates Strategy in a report released Tuesday.

“Over the past two to three years, as home prices have risen unchecked, you’ve had people trying to get into the housing market unable to afford longer term mortgages and taken out short-term mortgages,” he said in an interview. “And in 2018, everything is falling on top of one another.”

Next up, double-digit wage growth.

https://www.bnnbloomberg.ca/bad-for-everybody-magna-ceo-says-nafta-ontario-both-need-to-help-auto-industry-1.1075795

Really good interview. Especially the last minute. Very blunt. Very accurate.

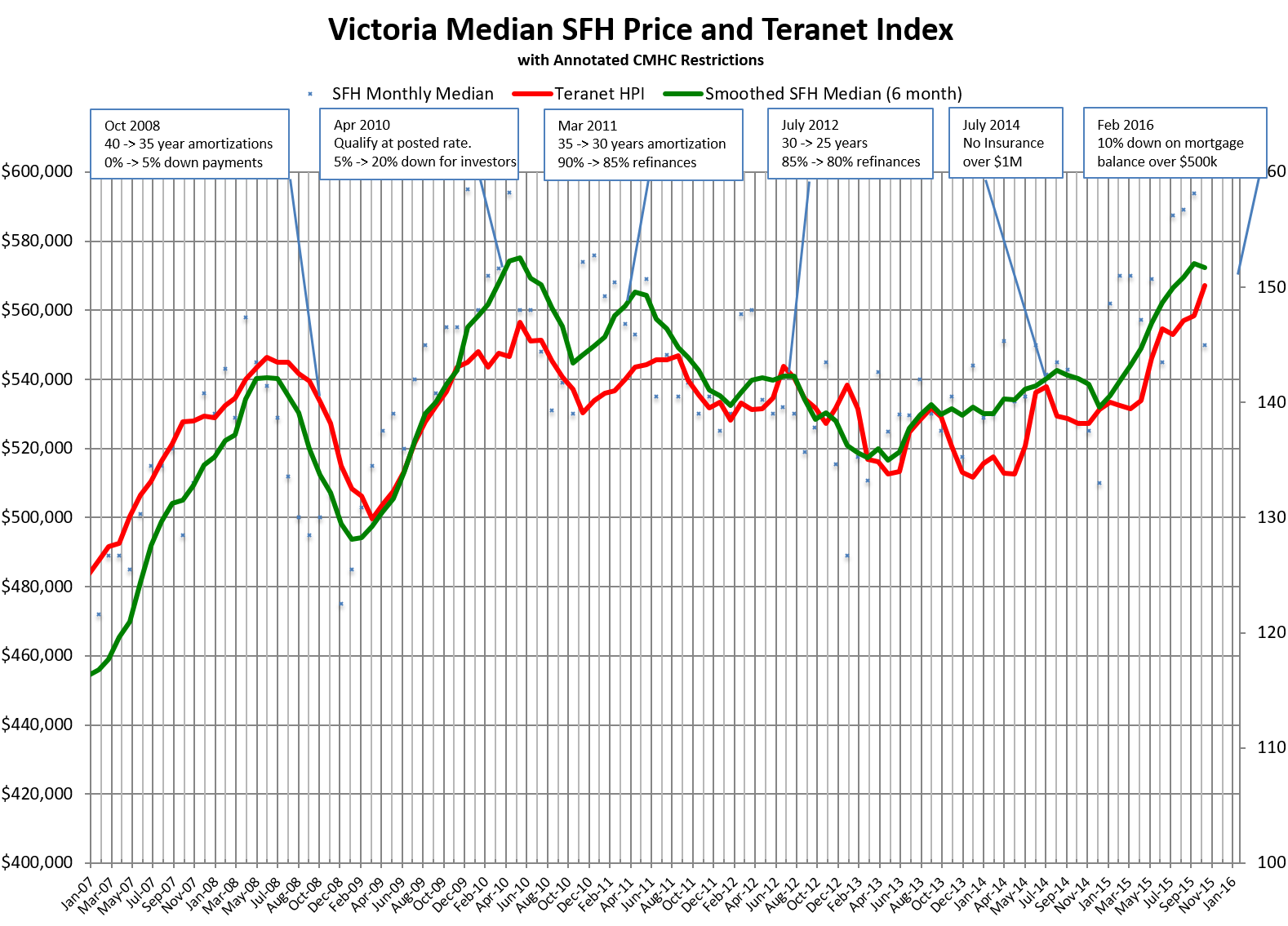

So I checked back, and in 2015 there were 3758 active listings in the first week of May, in 2014 there were 4404. So in reality it’s only the latest run up in prices that have been caused by lower inventory (among other things). The rest of the run up seems linked to the increase “affordability” through decreasing interest rates. So why wouldn’t the reverse happen as interest rates go up?

Less than that, foreclosures only exceeded 1 million in two years. That’s out of about 100 million private dwellings. Total over 2006-2012, which is generally considered the full duration of the bust, looks like about 6 million.

https://www.corelogic.com/research/foreclosure-report/national-foreclosure-report-10-year.pdf

These overtures seem crazy to an introvert, I guess.

🙂

Actually, it was about a third less than that if we just look at 2008, and that was enough to create the momentum down. I think the ratespy article is a case of splitting hairs. The risk wasn’t from the renewals per se, it’s more to do with highly leveraged borrowers whom would be subjected to rate hikes over the next little while. However, the biggest risk for those people isn’t simply that, it’s a declining and illiquid market. I don’t really think the risk landscape has materially changed.

You do seem to like to call out ordinary social overtures to others. I don’t know why. You know, I would grab a coffee with you just as well as almost anyone else on here. I have a feeling you’re probably fairly quiet and mild mannered in person.

As someone who appreciates retarded jokes, that was great.

“As for renewers this year, “Our staff estimates that roughly 25% of mortgages will be renewed this year, in line with historical norms,” says Bank of Canada spokesperson Josianne Ménard.”

It matters not, it only took 10% to crash the US housing market, and more and more will have to renew over the next years after that. People will look ahead and see they can’t afford the higher rates and will be forced to sell. Been there.

I see listings only increasing bigtime from here on out. We’re not even touching on the increasing amount that won’t qualify, now 1 in 5 to 2 in 5, etc. The freighter is beginning it’s massive turn and can’t be stopped now.

Leo as matchmaker!

gwac,

What are you crying about ? Victoria job rate is better than last month. Christ, the rate has been in best the past year in decades and you greedy Liberal pricks still want more. Unreal. It’s no wonder this pig is going to blow bigtime. The trough is overflowing and is never full enough.

“After four consecutive months of being on the rise, Victoria’s unemployment rate dropped three-tenths of a per cent in April.

Statistics Canada released new job figures Friday morning and Victoria unemployment sits at 4.2 per cent, compared to 4.5 per cent in March.”

“Stats Canada says wages were up 3.6 per cent last month compared to a year ago, the biggest jump since October 2012.”

https://www.cheknews.ca/unemployment-drops-in-victoria-climbs-in-b-c-stats-canada-449320/

Hey Cool. As a computer-y person in the health informatics field we should connect (Leo has my deets). A major player is looking to setup AI for breast imaging analysis in the BC digital supercluster.

Or even 10 years out for that matter, but it is not a huge leap to suggest that some knowledge jobs will be replaced by AI over the next decades. Of course there will still be lots of employment in health care in 50 years. The demand for healthcare is huge and ever-growing.

“In 50 years or less I suspect many healthcare professionals will be replaced by AI. On the other hand I am quite confident that fixing your wiring or pipes will still require a human being in 50 years.”

As a healthcare professional who is currently completing a health informatics degree, I find this claim laughable, completely speculative, and based on zero evidence. I have a few comments. First, no one can predict the future with any degree of accuracy 50 years out. Second, the structure of a house could be so radically different in 50 years that trades people may no longer be required. Third, if healthcare professionals in the very complex world of medicine lose their jobs to AI and robots, it is very likely that most of the workforce will also be unemployed. This could result in a dystopia or utopia depending on how things pan out.

For now, healthcare professionals are amongst workers with the highest job security. IT in healthcare is moving very slowly. Just think about the iHealth project on the island that has had a failed implementation and massive cost overruns. Medicine and healthcare are very complex with many variables and moving parts. Anyone who thinks otherwise is very ignorant.

I’m glad you at least admit the past is relevant. The world of economics and real estate in particular is filled with year over year comparisons, so someone forgot to send your memo that only last month is relevant. I guess we can’t compare the economy under different leaders as that would exceed your one month rule.

Check out the graph I linked to. Unemployment climbs month over month dozens of times. It isn’t the blips that matter it’s the trends

I avoid shipping my goods with the worse shippers.

When I look back in Canadian history I see that what happens in Canada mirrored quite a bit of what happened in the US and Europe, so a lot of the up and downs were outside our leader’s control. Still I agree bad government can definitely make things worse and good governments can slowly make things better.

I wasn’t alive then but Louis St Laurent seems like some sort of high point of Canadian governance. Socially progressive (for the day) and fiscally conservative. Mind you he had economic tailwinds.

https://www.ratespy.com/47-of-mortgages-will-not-renew-this-year-05116120

http://www.bcstats.gov.bc.ca/Files/a92991a6-fa62-4c3f-be77-b9e849be3cee/LabourForceStatisticsData.pdf

Unemployment for Horgan’s first year is below any point in Clark’s term. That said it is pretty much pointless trying to give any one leader credit for this. Globally unemployment has been on recovery since 2008. The list of countries at or near record low or cycle low unemployment is long: Russia, Germany, France, Canada, US, Mexico, Spain, Poland, Netherlands, the list goes on.

@ CE:

“In 50 years or less I suspect many healthcare professionals will be replaced by AI.”

Let’s hope it’s much sooner. AI systems already perform better than the average GP, and if properly programmed, they won’t dole out unnecessary prescriptions for opioids and other dangerous drugs.

Caveat last mouth is relevant as a basis not last year as was in Leo Post. Unemployment is a leading indicator of your future economy. You NDP worse shippers really need to look back in history through Canada and realize what happen to an economy when the government is not business friendly. Enjoy the ride down.

@ Patriotz

“Yes there is [ effective way to completely stop foreign investment in housing], but it would also involve torpedoing domestic investors.”

You mean that raising property taxes while reducing income taxes would reduce property prices, i.e., it would be good news for Canadians looking to purchase a home, but bad news for speccers and flippers, and old folks sitting on windfall RE profits.

Sounds like the best strategy. And it’s consistent with Adam Smith’s contention that property should be the basis on which taxes are assessed because without state protection there would be no private property beyond what the individual is able to defend by the strength of their own right arm.

True, today the state does more than defend the rights of property. But still no great accumulation of wealth is possible without the state, therefore, wealth should be the chief basis of taxation.

So if the present Provincial Government wants to do something both smart and principled, it should institute a capital tax, applicable on world-wide possessions, with confiscation of all Canadian property the penalty for evasion. An annual tax of one to one point five percent on all assets, as in very conservative Switzerland, would seem a reasonable plan, with an exemption on the first $1 million.

If all you care about is present and future then please explain why last month is relevant.

Ding ding ding! 100 points for Barrister.

However I don’t think the political parties are ignoring the elephant, rather it would be political suicide for them to publicly say they still want these immigrants and their money. Instead they will nibble at the edges in an effort to cool the market. And it’s actually likely to be pretty effective, as perception often is more important than reality. (The exception is it looks like Eby and the gang will go full bore after the money laundering.) But shutting off the spigot of foreigners arriving with their money would be very bad news for the RE market and the economy in general – the politicians might as well sign their own death warrants in that scenario.

Then I guess anyone can view the numbers from whatever instance in time suits the narrative one wishes to convey. We already know you don’t like the guy. 🙂

Tensions high on the construction site. No need to worry about handguns up here, worry about the guy building your house.

Worker shot with nail gun at Colwood construction site

http://www.timescolonist.com/news/local/worker-shot-with-nail-gun-at-colwood-construction-site-1.23298322

In 50 years or less I suspect many healthcare professionals will be replaced by AI. On the other hand I am quite confident that fixing your wiring or pipes will still require a human being in 50 years.

Leo you can twist it all you want its still up .3 from last month. Present and future I care about. The NDP has done zero for jobs and businesses and only made things worse with the 2% tax.

A letter in this morning’s paper echoes my thoughts:

Victoria can’t add more families

http://www.timescolonist.com/opinion/letters/victoria-can-t-add-more-families-1.23299456

Down from 5.4% Same month last year.

“Horgan doing a great job. From 4.7 to 5%. Need people working to pay for your freebies Mr Horgan.”

Can’t blame Horgan taking over as the bubble peak is popping. Happens to every NDP government. They get blamed for the Libs/Cons reckless spending, and Libs mysteriously shutting down the money laundering watchdog so the corrupt foreign money could run wild with zero repercussions. Now it’s time to pay the piper.

Patriotz, you’re referring to a Tax Information Sheet, not an actual piece of legislation. How things like “satellite family” actually get defined is going to make a big difference. Perhaps they will craft something that is relatively loop hole free, but we have to wait and see.

$90M for rentals in Victoria: http://www.cbc.ca/news/canada/british-columbia/greater-victoria-funding-rental-units-1.4657379

Great job numbers. Our governments are doing a fabulous job at building the economy.

Horgan doing a great job. From 4.7 to 5%. Need people working to pay for your freebies Mr Horgan.

Same thing was said of Vancouver’s empty homes tax. Wasn’t true then but we’ll see how it goes with the spec tax

But unless those owners move out of town or it is their secondary property then it’s just a big game of musical chairs. Lots of commotion but someone is still not gonna have a place to sit

Patriotz:

Wont apply if there is a separation agreement between the parties. But lets see how the draft legislation reads.

Yes there is, but it would also involve torpedoing domestic investors. Increase property tax drastically and in proportion reduce or eliminate provincial income taxes. Our low property tax / high income tax regime is an open invitation to foreign tax evaders, as the SFU/UBC analysts have pointed out.

That is precisely the definition of satellite family. Read what I posted. Satellite families will be levied the speculation tax even on their primary residence.

The most recent data shows 28,000 of these millionaires are living in B.C. The spec tax does not effect these people since they are legal immigrants. Victoria may not get a lot of them directly but when that 50 year old postal worker sold his Vancouver house for three million and bought in James Bay it means that Josh is left wondering why he is out in the cold. Incidentally there are a half dozen other programs that account for the 300,000 net immigration every year.

All of the political parties simply ignore this elephant in the room.

My family doctor (who moved here a few years ago from the USA) is closing up his downtown Victoria practice this summer to move his practice up island. The reason is he says he cannot afford to live in Victoria.

He was a great doctor, so it is very sad. His office staff let me know by pointing with a finger to the sign in the treatment room & then leaving the room. Other notices repeat over & over again that there will be no replacement & that there is no system in place to follow him up island, so do not try. It is distressing even for healthy people – I can’t imagine how distressed people who are ill must feel about not being able to access care.

BC should have family health teams like ontario (doctors with nurses & multi-disciplinary team)

Leo. With all do respect, you should be able to see that what he really is telling Vancouverites to do is ‘surrender’.

Regarding Woo, I would also like to point out he refers to CMHC, an entity that also had a large part in creating the mess we see before us.

Also, CMHC admits that they can not estimate the impact of satellite families/tax evaders on the demand of properties.

Woo is a hack who from lobby group pushing Asian buisiness in Canada. Because he somehow bought the title Senator does not mean we should give him audience, especially regarding Canadians homes.

I don’t necessarily agree with his point, but I did think the idea was an interesting one. He may be right that there is no effective way to completely stop foreign investment in housing so why not figure out how to make the best of it? Set up big ambitious new projects to fund affordable housing for the middle income earners financed by the investments made by the wealthy rather than trying to get rid of the investments completely.

Kinda like the question of whether BC is better off collecting $200M in foreign buyers tax per year or are we better off if there were no foreign buyers at all? I’m not sure what the answer is, but seemed like an interesting way to look at it.

Leo,

“To the extent that foreign buying is a factor in #Vancouver house price increases, it is because locals BELIEVE it is a major factor and bid up prices!” – Woo

Woo is the former CEO of the Asian Pacific Foundations – “Its mission is to be Canada’s catalyst for engagement with Asia and Asia’s bridge to Canada.”

Of course he is looking to further buisiness with Asia. Do you think he cares about Vancouverites struggling to find homes in the city? He is in power to further ties with Asia, period. His op-ed is despicable in my mind.

An interesting thought from the most recent episode of Sold (http://www.cbc.ca/radio/podcasts/current-affairs-information/sold/) Senator Woo suggests that instead of thinking about how to keep foreign investors out, we should accept that they will come to BC and then the question becomes how you attract their more productive investments.

“How do we get them to make BC their business HQ now that they’ve made BC their family HQ?”

His op ed is here: https://www.theglobeandmail.com/opinion/foreign-capital-is-part-of-the-housing-solution/article38017421/

@ Vicinvestor 1983\

“GP practice just isn’t worth it. Why go through so much education and stress just to make as much as a trades person. It’s a joke.”

A joke most be people would be quite content to accept.

My GP grossed well over $300K in 2014, so assuming a 30% overhead he cleared well over $200 K, which is quite a bit more than most tradesmen(with a seven year apprenticeship) are earning even in today’s overheated market. And surgeons and other specialists mostly do much better.

Many female doctors, it is true, earn less, but then many of them work only part time, providing perhaps a poor return on the public investment in their education.

Patriotz”

These are not foreign owners; they are being let in as landed immigrants through the Quebec program.

They move here often with millions. A close friend of mine who is an immigration lawyer in Toronto has whole bunch of multi-millionaire Romanian families. How they got millions is a question no one asks.They are not caught by the spec tax but they are buying expensive homes.

Only 43% of Vanvouver condo presales sold in April at peak time of year versus 94% in January. The sheep have been sheared and now the pain begins.

As a victoria healthcare worker, I can tell you that office family medicine in BC doesn’t pay enough to attract enough doctors. Most go to work in higher paying juristiciations and positions. There is even less incentive with the Liberal tax changes. GP practice just isn’t worth it. Why go through so much education and stress just to make as much as a trades person. It’s a joke.

“Foreign owners and satellite families — households with high worldwide income that pay little income tax i B.C. — will be captured by the (speculation) tax and will not be eligible for a primary residence exemption.”

Only the NDP and David Suzuki’s disciples can reach these alpine heights of fatuity.

The family will continue to pay not one dime of tax in BC or anywhere else in Canada as the $40,000,000 the husband made last year in China is off the CRA’s event horizon. He isn’t a Canadian citizen, his Point Grey wife is.

She is most certainly eligible for the the primary residence exemption as the house is (drum roll) her primary residence.

She will pay not one dime of the “speculator” tax because she resides in her home.

@ Cam and @ Introvert Re: GP shortage

Generally it seems that not enough of the doctors who are trained are opening up family practices. This is due to financial reasons (i.e being hospitalists or specialists pays more). Also, Victoria is an expensive place to live if one starts with almost $200K of debt.

I would like to see some sort of forgiveness of tuition fees in exchange for a graduate going into family practice.

Below is a link to a comment written by local Dr. James Houston. Maybe we all need to write some letters to politicians. People complaining about housing got the government’s attention. Medical care is at least as important.

http://www.timescolonist.com/opinion/op-ed/comment-ask-candidates-how-they-will-improve-health-care-1.17498911

Thursday has been the traditionally largest day getting the house listed for the weekend. Compare it to last Thursday. That will give u a sense of what is going on. Inventory is definitely on an up trend though.

“So far today has had the largest number of homes listed in a single day (for my criteria) that I’ve noticed. Anyone else notice this? Hope it’s a trend…”

Mine too – I have SFH up to 800K and today marks the most I have seen … i think all year. Do any realtors out there know if there are more popular days of the week to list or is it totally random?

“Foreign owners and satellite families — households with high worldwide income that pay little income tax i B.C. — will be captured by the (speculation) tax and will not be eligible for a primary residence exemption.”

https://www2.gov.bc.ca/assets/gov/taxes/property-taxes/publications/is-2018-001-speculation-tax.pdf

@ CE

“CS – LMGTFY”

Ha! So you don’t know. Thought not.

@ Barrister

“Are the ferries going to be using “D” cell or “C” cell batteries?”

Triple Z, probably.

To drive one of the big ferries, would require a battery of at least 8 to 16 thousand KWH (the existing diesel units are 21,444 horsepower), assuming the batteries could be fast-charged after each crossing, which means that they would compete for power at times of peak demand.

Production of batteries of that size would involve carbon emissions probably in the order of 15 to 30 thousand tons (CO2 equivalent).

CS – LMGTFY

http://www.wsdot.wa.gov/NR/rdonlyres/AF8C5114-E659-4FF0-B339-4924D1550779/0/TIGERIIIHyakHybrid102811FINAL.pdf

“I strongly suspect that WSDOT HAS done some analysis and found that the new ferries will (a) improve air quality …”

You strongly suspect, while chiding me for not knowing.

LOL.

But in fact, I have already given a reference to the prime reason for the electrification of Washington State ferries and it has to do with nitrogen oxide and particulate emissions not energy efficiency or carbon emissions.

Sure there may be some marginal benefits of other kinds but what evidence do you or anyone else have that such benefits would justify Introvert’s apparent belief that BC Ferries should be electrifying our ferries?

Most probably electrifying our ferries would turn out to be an ill-conceived boondoggle. But if you have the numbers to prove otherwise, let’s have them.

Pot meet kettle. CS – What analysis have you done on the cost or benefits of WSDOT’s move to hybrid ferries. I strongly suspect that WSDOT HAS done some analysis and found that the new ferries will (a) improve air quality, (b) reduce lifecycle GHG emissions.

They may even save money in the long run. Several of their boats are over 50 years old and probably need to be replaced soon anyhow

“Have you done even the slightest bit of research on that? Lifecycle analysis is done on these projects before they move ahead and someone that knows a great deal more than you on this topic found it favourable.”

The argument was made that BC Ferries should electrify their ships. Has that person or anyone else done the slightest bit of research to justify such a demand? If so, perhaps you will refer us to the relevant papers.

And do tell us, since you apparently have done the math, what proportion of the energy consumed in propelling a ferry from Swartz Bay to Tsawwassen coould be recovered through regenerative braking.

Josh:

So when is the NDP going to take a stand against the flood of millionaire immigrants that we are letting into the country who are buying up the houses that you can not afford? And no we dont need more labour in the future at the rate technology is eliminating jobs.

Wat? I’m an NDP’ite.

Have you done even the slightest bit of research on that? Lifecycle analysis is done on these projects before they move ahead and someone that knows a great deal more than you on this topic found it favourable.

Do some napkin math about how much energy it takes to accelerate a ferry. The Coastal Renaissance maximum displacement is 10,034 tonnes. A hybrid ferry can recover a huge portion of that energy.

That’s weak, Soper.

@introvert

As good as you too, since you were dead wrong about the latest increase.

Is that BC Hydro’s forecast? Because BC Hydro is about as good at forecasting as ol’ Hawk.

So far today has had the largest number of homes listed in a single day (for my criteria) that I’ve noticed. Anyone else notice this? Hope it’s a trend…

Thankfully 1484 Lang listing is now a cancelled listing, see what it gets relisted at.

Here is another gready seller, 4103 Quadra St, listed at 949k. Looks like they bought in 2016, subdivided the lot and are selling the existing house(albeit, partially renovated, but nothing special) for big $$$. Can’t find the original sale price in 2016 but was listed at $725k.

Despite all the efforts the various levels of Gov’t have made in the last 2 years to try and reduce house prices on the West Coast, it’s not working. House prices in Victoria have not come down one bit (according to the May 1, 2018, report from the VREB).

One of the main culprits is a lack of inventory. There’s some recent signs that inventory may be climbing a bit, but it is still way too low; historically low. And that’s helping to keep the prices pumped up. So how do you get a city to increase its inventory?

How about if the City of Victoria offers a financial incentive to get more home owners to list their homes for sale? They could eliminate the seller’s portion of the property tax for the year. The BC NDP could offer a tax rebate on the sale expenses (say 1/2 of the real estate commission, or the full lawyers fee and the movers fee). The Feds (or is it the provincial Gov’t) could offer a reduction in the capital gains tax for those homeowners who sell in 2018.

Thus far, the Gov’t has only taken the stick approach to the real estate problem: penalize everyone (buyers and sellers alike) with additional taxes and expenses. But maybe they need to offer a carrot as well. I know some will say: What? Offer a carrot to homeowners who purchased 10 years ago for $400K and are thumbing their noses at $900K now? But what the heck? Victoria needs more listings and it’s become a real problem.

I’m sure that realtors would like to see more listings (cause they don’t get paid unless they get a sale). I also read somewhere that there’s more realtors in Victoria than listings. Whew, I’m glad I’m not a realtor.

Anyway, if the goal of the Gov’t is reduce house prices so that ordinary Canadians can afford to buy one, why not look at these additional steps? Yes, they will lose money in their coffers for offering the incentives, but look at much money they will have to spend on public housing if the average Canadian can no longer afford to purchase a house.

Are the ferries going to be using “D” cell or “C” cell batteries?

“So they are replacing ferries powered by fossil fuels dug up in Alberta (carbon emissions), refined in Washington (more carbon emissions) and burned with 25% efficiency (more carbon emissions) with ferries powered mostly by falling water converted to electricity.”

Well I can’t argue all points simultaneously.

The question was whether hybrid ferries saved energy. I maintain that they can save very little. It’s not as if ferries are driven like a Toyota Prius in stop-go urban traffic. They are mainly driven at a relatively constant and presumably, therefore, most energy-efficient speed.

And while presuming to take issue with me you confirm my point that the so-called hybrid ferries are merely semi-electric ferries. Which relates to my earlier point that an electric ferry needs power from somewhere, and unless from Site C or other alt energy projects it will be generated thermally, with little if any net saving in carbon emissions.

Of course if we had a surplus of electric power from no-thermal sources, electric ferries would then contribute to reduced carbon emissions. But right now we don’t, and therefore they don’t, and it is simply a misunderstanding to assert that Washington State Ferries are electrifying ferries primarily, or at all, to reduce carbon emissions.

But Greens love to tell everyone what to do without bothering to do the math or provide any logic at all.

Can’t wait for the next moves to kill the flippers and money launderers. No wonder the Chinese have left BC and the bagholders are selling for $1 million under assessment on the West Side. Done like dinner.

The BC NDP’s housing moves are so popular, even BC Liberal supporters like them: poll

https://globalnews.ca/news/4196524/bc-ndp-housing-bc-liberals-poll/

“Maybe it’s because the Greens don’t enjoy $10B tax-payer-funded boondoggles, the way the BC Liberals—and regrettably the NDP—do.”

You have to make up your mind. Either you want to replace fossil fuel with alternative energy, e.g., by powering ferries with hydro power, in which case you will need Site C or something equivalent, or you don’t.

In fact, Greens are mostly about virtue signalling. That is evident from remarks here about electric ferries. Washington State Ferries are turning to electrification not, primarily as suggested herel, to reduce carbon emissions but to reduce nitrogen oxide and particulate emissions:

As for Site C being a boondoggle, in what way? Are you suggesting corruption in contracting? Obviously no one here is for that, but where’s the evidence.

As for your claim that no one will need the power, that is nonsense. The power will be used in BC or sold to other jurisdictions more dependent on thermal power. But mostly it will be used here. Vancouver, for example, projects a 50 to 75% increase in electric power use in the next 32 years, so unless that power is generated thermally, Site C and other alternative energy sources will be necessary.

“Here’s my favourite graph, which has the added benefit of being grounded in reality:”

The reality is you’re bullshit is so stuck in fantasy land you’ll be seeing multiple shrinks as the abyss swallows you whole.

Your graph matches perfectly with the blow off top. It’s the 1981 ride all over again. Enjoy the terrifying trip down to a dark place.

Dateline May 2018 in the real world:

“Realtors, developers brace for crash”

https://www.youtube.com/watch?v=hqOn5XEm86A

Maybe it’s because the Greens don’t enjoy $10B tax-payer-funded boondoggles, the way the BC Liberals—and regrettably the NDP—do.

Or maybe it’s because overall demand for power was flat between 2005 and 2016* (even though the population increased) and demand is projected to be relatively flat for a while due to increased conservation measures.

*Interestingly, BC Hydro projected demand would rise 20% in that time; it rose zero percent. Hmmm.

LOL

if you combine that one with Hawk’s porn, maybe we’re approaching the bear trap right now…

I apologize. Some of your screeds are so long I fall asleep while reading them.

Atta boy!

I see that Victoria Born has attended the Local Fool School of Verbosity.

I’ll save reading this entry for right before bed…

The abyss that never materializes. And the ride that has trouble going down.

Here’s my favourite graph, which has the added benefit of being grounded in reality:

https://www.vreb.org/historical-statistics

So sayz the Brownie.

If we read the actual article we find out that:

So they are replacing ferries powered by fossil fuels dug up in Alberta (carbon emissions), refined in Washington (more carbon emissions) and burned with 25% efficiency (more carbon emissions) with ferries powered mostly by falling water converted to electricity.

Not only does this reduce overall carbon emissions it reduces local emissions of health damaging diesel particulate matter.

“There’s still a lot of benefit to a hybrid ferry. There’s plenty of inefficient regimes a diesel ferry runs through that can largely be avoided with hybridization. ”

As always, there are lots of hand-waving arguments from the Greenies.

“If we replace a natural gas power plant with hydro, electric ferries get cleaner. Can’t do that with Diesel.”

Yes but the Greens don’t want more Hydro power. They wanted to cancel Site C, remember?

And in any case, any hydro that is produced in BC will be used, either in BC or elsewhere, with or without electric ferries. So using hydro instead of diesel or liquefied natural gas, or whatever, to fuel ferries won’t have any broad environmental impact. It will reduce carbon emissions locally, while making them higher than they would otherwise have been elsewhere.

There it is! been a while since ‘the graph’ made an appearance. Hawks partner is getting lucky tonight!

The pumpers squawk louder as the roller coaster heads over the peak into the abyss. Enjoy the ride down. 😉

“Realtors, developers brace for crash”

BREAKING NEWS: BANK OF CANADA RAISES 5 YEAR MORTGAGE RATE.

?w=620&h=471

?w=620&h=471

BREAKING NEWS: BANK OF CANADA RAISES 5 YEAR MORTGAGE RATE. This is significant and raises the bar for qualification for a mortgage in Canada, and yes that includes Victoria as well. The authorities, including the BOC, are intent on deflating this bubble – don’t kid yourself. Fascinating that the BOC is following the Chartered banks. Read further:

TORONTO — The bar is now higher for homebuyers to qualify for mortgages in Canada after the central bank raised a key metric used in stress tests that determine borrowers’ eligibility.

The Bank of Canada raised the conventional five-year mortgage rate from 5.14 per cent to 5.34 per cent after all Big Six banks raised their posted five-year fixed mortgage rates in recent weeks.

The central bank qualifying rate is separate from the actual mortgage rates offered by banks to borrowers, but is used to assess homebuyers who are seeking loans.

Homebuyers with less than a 20 per cent down payment seeking an insured mortgage must qualify at the central bank’s benchmark five-year mortgage rate.

And as of Jan. 1, buyers who don’t need mortgage insurance are required to prove they can handle payments at a qualifying rate of the greater of the central bank’s five-year benchmark rate or two percentage points higher than the contractual mortgage rate.