May 14 Market Update: Slowdown at the Periphery

Weekly sales numbers courtesy of the VREB.

| May 2018 |

May

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 133 | 295 | 1006 | ||

| New Listings | 335 | 670 | 1451 | ||

| Active Listings | 2109 | 2218 | 1896 | ||

| Sales to New Listings | 40% | 44% | 69% | ||

| Sales Projection | — | 734 | |||

| Months of Inventory | 1.9 | ||||

Another slow week. Sales month to date now down 27% compared to last year while inventory is up another 100 for the week (up 20% from last year’s levels). We’ve seen the latter half of months pick up significantly before though so it could still reverse itself.

A common question is which segment of the market is slowest or most active. Condos or single family? The core or the westshore? The entry level or higher end? Usually it’s more consistent than most people think. Although there are small differences between areas and luxury properties almost always take longer to sell than those for the mass market, overall the submarkets are linked, and none of them can get very far away from the others before the rest of the market adjusts.

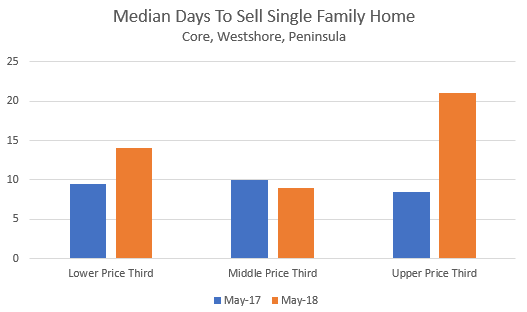

That said, when looking at single family homes the current slowdown is being felt most strongly in the higher end (above about $950,000) and lower end (below $750,000) of the market with sales down and days to sell up substantially while the middle segment continues to be very active. So if you are looking for a detached house around $750,000 – $950,000 you likely haven’t noticed much of this supposed slowdown that has hit other segments. The types of houses themselves in these segments are quite consistent from last year, with the lower third averaging 1800 sqft, the middle 2200, and the upper near 3000.

The numbers above are also lagging the market if the last week is anything to go by, when only about 60 detached homes sold (compared to 106 in the same week last year).

The question going forward is what will happen with this slowdown going forward. The VREB expects that the market will pick up again when people adjust to the stress test and increasing mortgage rates. This is a perfectly reasonable theory and something we’ve seen in the past in response to regulatory changes. Normally I would agree, however I believe this time we are at the end of the cycle and the market is simply tapped out. I expect a continued orderly slowdown throughout this year and likely the next as the market rounds out this upwards cycle and starts the next period of improving rather than deteriorating affordability.

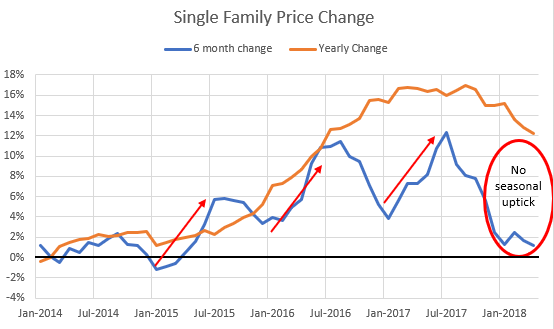

Prices have more or less ground to a halt in the single family market. Although the year over year comparisons are still positive, those increases largely took place last year. Looking at price changes over 6 months shows that medians have been roughly flat (+2% this year). Those appreciation rates also usually increase into the summer, but haven’t this year.

I’ve said it many times and I’ll keep saying it until the fall makes it obvious or a change in the market proves me wrong. The usual spring pattern of increasing sales has masked a larger slowdown in the market. This market weakness won’t really be evident to most people (i.e. covered in the newspaper) until past July when the seasonal slowdown combines with it to really decrease sales. Unless we see a substantial reversal in market sentiment by then we will likely be seeing very weak sales towards the end of the year.

That’s good news for house hunters in Victoria.

Oh thumbs up work now…never mind

I cannot thumbs up on a comment, why

Andy7

When do you see the lower end will move to the 2015 level?

Just reading a few blogs and crash article. VREAA is like reading a whole blog from Vancouver Hawks. (By the way I am a fan of Hawks posts here)

https://vreaa.wordpress.com/

https://www.google.ca/amp/www.macleans.ca/economy/business/crash-and-burn/amp/

Is the market really that bleak in Vancouver? Do they have a blog like Victoria house hunters for Vancouver?

Let’s make a bet Marko 😉

If we start to see prices moving towards 2015 levels in the high end market, I’m betting in time, we’ll see this pattern start to appear in the lower end market as well.

Bought Jan 2016 $4,050,000

Just sold 2018 $3,800,000

How will they ever put food on the table.

because a house that he is building too close to my property boundary (a little less than 1.1m from the property boundary).

Honestly, something doesn’t add up with this story…….how is he or she going to get the survey certificate signed off if they are within the minimum offset? Every house being built needs to be surveyed multiple times during the process. Langford is pro development but it isn’t Siberia.

Pretty sure the professional surveyor would catch the mistake right away when surveying the foundation and doubt any surveyor is going to forge documents to get it past Langford.

The question is, should I be compensate for this or I should just take my lost of $6K out of pocket for the survey and legal fees?

Survey $1,000; therefore, you spent $5,000 on legal fees and you are still looking for a lawyer? Strange.

The builder offered to build a retain wall but I do not trust him,

A wall is a wall? Have him or her build it down the surveyed line. What is there not to trust?

Marko Juras, I gave them a call last year but they were too busy .

Odd, they haven’t been too busy for my clients in the last year or so.

Just heard that UBC offers an incentive of a $250,000 interest free loan to new faculty (for the purpose of buying a house). The practice isn’t uncommon, but the amount is 5 times what is normally offered.

There is a lot of stuff out similar to this but it just isn’t common news. For example, a few weeks ago military decided to cover CHMC fees for their personnel.

Leo S, I cannot vote up.

iPad safari.

I’m watching to see if we start seeing homes sell close to 2014/2015 prices. Here are a couple:

Just sold near 2015 purchase price:

* Looks like a 1950’s 2 story home – bushes in yard need to be cleaned up.

“47 x 122 lot; Point Grey

Bought Jun 2015 $3,200,000

Just sold 2018 $3,288,000

28% below July 2016 assessed of $4,551,000

21% below July 2017 assessed of $4,169,000”

Flip-Flop: $250,000+ loss…

* nice 2 story heritage house

“Bought Jan 2016 $4,050,000

Just sold 2018 $3,800,000

13% below July 2016 assessment of $4,370,000

12% below July 2017 assessment of $4,317,000”

There’s always resistance in the beginning Barrister. Bunch more slashes today in prime areas.

Can you share a few examples?

San Franciscans need to earn $333,000 a year to buy a median-priced home

https://m.sfgate.com/business/networth/article/San-Franciscans-need-to-earn-333-000-a-year-to-12916553.php?t=527592fb3d&utm_campaign=twitter-mobile&utm_source=CMS%20Sharing%20Button&utm_medium=social

Only 15 percent of households in the city can afford a median-price home, which averages $1,610,000,

Interestingly enough that is about the same percentage as here.

There’s always resistance in the beginning Barrister. Bunch more slashes today in prime areas. The ship is taking on water captain. 😉

Seems like a slowdown but I am not seeing it yet in the asking prices.

That would be a taxable benefit and may not be worth it depending how the benefit is calculated… IE what rate must be used to calculate the benefit. Bank posted rate??

Edit its 2% so worth it

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2018/interest-rates-for-the-second-calendar-quarter.html

Just heard that UBC offers an incentive of a $250,000 interest free loan to new faculty (for the purpose of buying a house). The practice isn’t uncommon, but the amount is 5 times what is normally offered.

That is good advice!

Sorry to hear about your story QT. Sounds like a royal pain. I had a friend that had to deal with a blatant property encroachment. She ultimately prevailed legally, but there was a lot of stress leading up to that.

It sounds like Langford should have some responsibility to ensure that a building they permit meets setbacks?

Victoria Born: ” A flat yield curve [still positive at this point] spells recession in the making.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Historically, you are absolutely correct, as inversion is typically a recession. You are correct on bond yields. The bond market may very well outpace Poloz.

One of the bigger challenges that is overlooked by "bulls" are the not so smart home owners. This blog seems to be a siren call to the smartest of the bulls that can't understand how so many other home owners may not be as financially astute.

… a little more support for Hawk.

http://vancitycondoguide.com/national-home-prices-drop-in-april/

"But it’s not just new homebuyers who are feeling the pinch. Canadian mortgage broker Tracy Head noted in a recent blog post,

“the clients I see who are most impacted by the Stress Test are ones who already own their homes and are looking to refinance to pay off outstanding credit cards and personal loans. I see more and more clients who are finding that their only option for accessing equity in their home is an alternative lender.”

City of Langford has rules regarding where a property can be built in relation to the property line and they cannot turn a blind eye. Unless it really is the wild west in Langford.

I would not go with advice on here. Only a lawyer can tell you what your case is.

Thank you Barrister and Victoria Born. I will give Lee Fisher a call once I’m more confident with my claim.

Marko Juras, I gave them a call last year but they were too busy .

I’m sorry this question is out of topic, but it is related to property and most people here are well versed in it.

Do I have a case vs. the builder/developer that blasted a 560 sqf area at 10 feet deep into my property?

The action of the builder/developer is deliberate, because they are using it as part of an access into their property to built 4 houses.

They weren’t remorseful when I caught them after I paid a survey company to resurveyed the boundary (the newly installed property iron pins are now missing).

The builder offered to build a retain wall but I do not trust him, because a house that he is building too close to my property boundary (a little less than 1.1m from the property boundary).

The question is, should I be compensate for this or I should just take my lost of $6K out of pocket for the survey and legal fees?

PS. The city of Langford do not deal with property issue, as I was told by the city that it is a civil matter.

Grant – too late – interest rates are already rising [look at the bond market] and WILL continue to rise (grind higher). The US Fed is tightening AND reducing its balance sheet. It is a foregone conclusion. Look at US retail sales reported 2 days ago – the consumer keeps spending. Look at debt levels in Canada – surveys show that an extra $200 per month debt payment would put many under water – yeah, that is a strong sign of confidence. We should see 3 hikes in the US this year and, if Poloz is doing his job, we should see 2 in Canada. A flat yield curve [still positive at this point] spells recession in the making.

Can’t believe anyone would quote Trump. To each their own.

Victoria, B.C. has landed the top spot on Christie’s global list of hottest luxury housing markets.

The real estate arm of the famed auction company says strong year-over-year sales growth and high domestic demand for housing catapulted the Vancouver Island community to lead a list of cities around the world on the annual list.

Trailing Victoria on last year’s list are San Diego and Orange County, Calif., followed by Washington D.C. and Paris.

Christie’s says the Victoria market earned such a high ranking because it is seeing an influx of buyers from the United States and China and sales rates that rival frenzied and neighbouring markets Toronto and Vancouver.

It says the average time it took to sell a luxury property in Victoria last year was only 32 days, down from 41 days in 2016, making it one of the most fast-paced markets in the world.

Christie’s also listed Toronto in the ninth spot on its list of most luxurious global cities for prime property and Muskoka, Ont. in the second position for its rankings of the hottest secondary home markets.

If this is not proof of over-valuation and a bubble – then keep buying……….

https://www.bnnbloomberg.ca/victoria-tops-christie-s-luxury-housing-markets-list-1.1078273

Grant – welcome to Victoria – the land of “not what you thought it was”. Wait until you discover what hubs & I call “BC math” where the rooms are actually much smaller than claimed. Hint: Always verify! I took to taking a tape measure with me for those listings where the measurements seemed quite suspect. Notice that I’m still renting – definitely not overthinking it as some would suggest but just too much junk out there these last few years.

Since falling to 1.36 in July 2016, the yield on the 10-year bond has been in a more or less continuous uptrend. It is now at 3% and showing no sign of an “inability” to rise further.

The US Fed has embarked on the sale of one and a quarter trillion of US paper this year, providing continual upward impulse to rates. Rising US bond rates will give some uplift to the US dollar, which will also be aided by increased US oil production and natural gas exports; the imposition of tariffs on steel, lumber, etc.; plus NAFTA renegotiation to boost the US auto industry.

Under these circumstances, how well the loonie stands up to the greenback remains to be seen, but the BoC may have little choice but to raise rates more than a trivial amount if it is to prevent the C$ heading much closer than now to 50 cents US.

This is exactly why more rate hikes may not materialize. A flattening yield curve means investors are worried about the macroeconomic outlook.

“The inability of 10-year yield to rise above 3 percent (similarly, the curve is largely pivoting on a 30-year yield of close to 3 percent) suggests that the Fed will be hard-pressed to raise short-term policy rates above that level without risking a downturn…Altogether, the resumption of yield-curve flattening indicates that the Fed likely will not get to that 3.4 percent. ”

Next we have

This is just ridiculous, complete conjecture and quite dishonest. US inflation rates are no mystery and are available for all to see: spoiler it’s currently at 2.46%

https://inflationdata.com/Inflation/Inflation_Rate/CurrentInflation.asp?reloaded=true

So, no, it’s not true that interest rates MUST rise. It looks pretty damn bumpy from here on out.

Lastly, there’s enough ominous warnings signs about the economy and markets without having to sensationalize. So many people here have this apparent addiction or NEED for a bust to happen. In the words of Trump, “Sad!”

Anna – the 2008-09 global financial crisis created by the US-sub-prime housing debacle and banks bundling up these worthless mortgages [people in the US with no income or down payment were getting mortgages on homes; and in many US jurisdictions there is no personal covenant on the mortgage, unlike all of Canada] and sold them to unsuspecting investors worldwide. A recession resulted and to get the world economy growing and employment growing, central banks cut rates and bought bonds [Quantitative Easing] to flood the world with liquidity – the end result was historically low interest rates (intended), including mortgage rates. Our central bank governor Mark Carney warned the consumer. But, to no avail – everyone could not resist – the demand for housing rose, plus global trade rose, and China loosened fund flow restrictions. Viola – we get a housing bubble in many regions, not just Canada.

Now, with corporate earnings strong, employment strong, and inflation ramping up [the US reported 0.4% Month-Over-Month inflation – that is an annual rate of 4.8%; bear in mind that the Fed target is 2%], interest rates MUST rise. The US 10 year treasury bond hit 3.06% yesterday – first time in many, many years. The yield curve is flattening. The US is on pace for 3 more rate hikes this year, may be 4. Canada will hike 2 times. Add to all of this the regulations of OSFI [stress test], the BOC 5-year rate hike, and the BC & Ontario housing measures = a hosing market correct, whether you like it or not. Expect a rise in foreclosures and defaults. The peak of the cycle is behind us. Time to pay the piper, IMHO.

There are quite a few homes in the Rockland area but sales this spring have been really slow. Maybe it will pick up in the next couple of weeks but this is sort of the end of the spring market already.

@InfrequentPoster

Moving to Reddit would be a bad idea as Leo would (more or less) lose all control over the platform and he’d also lose any chances at monetizing it. Plus in an attempt to better monetize and transform the site to be more Facebook-like, Reddit is undergoing some big changes that don’t look so promising. However the Reddit site source code is available as open source, so he could implement one of his own, but that would be a pretty big undertaking.

Leo you’ve mentioned reddit a few times… have you ever considered moving the blog over there entirely just to take advantage of that already really good commenting platform? r/househuntvictoria…

Anyways, good changes.

If I believed in conspiracy theories I would wonder if the financial industry had a plan to get so many into expensive housing at rock bottom interest rates and then to start turning up the interest rate screws.

There’s not much more deflating than getting excited by a property that is in your price range, new construction, with a drop dead gorgeous view of the ocean just to later realize that it’s not located where you thought it was but instead is on the other side of the road and about 30m from the Trans Canada Highway. *&#@!

Do you practice civil law, or know anyone that you can recommend?

Specifically property encroachment?

https://sll.ca/lawyer/daniel-mildenberger/

Funny – I find that Safari is the most compatible w/ odd websites. Though I second the recommendation for Firefox w / uBlock plus I use NoScript (you have to have patience for that one but I find it worth it)

QT: Give Lee Fisher a call at Randall & Murrell at corner of Vancouver and Fort Street. (250) 382-9282

FireFox has got to be the best browser – and free too. The Brave is another good one if you want privacy.

The easy solution is to go with a decent browser. Safari is the bane of my existence, the equivalent of Internet explorer back in the day. Things that work in all other browsers just happen to break in Safari. I’d recommend Firefox (with uBlock extension to block ads).

Looking into the Safari issue. Should be fixable shortly

I like the new look Leo, nice a clean. I can’t see the highlight for the previously viewed comments, I found that very useful. Apart from that it’s all good.

@Barrister. You registered an account, first comment is always held for moderation.

Why does my post say “Comment awaiting moderation”?

QT: Actually I am a retired Toronto lawyer and not familiar with the lawyers in Victoria.

Sorry that I could not be any help.

The blue-new highlighting does not work for me either. MacBook Pro.

Barrister,

Do you practice civil law, or know anyone that you can recommend?

Specifically property encroachment?

Thanks

A lot of retirement destinations. So are we more of a retirement destination or more of a tech/government hub?

Interesting report and map showing where in the uS prices have recovered to pre-recession levels and where they haven’t.

Some of the notable areas yet to fully recover are Florida, inland California, Arizona and a good chunk of the US NE.

https://www.attomdata.com/news/market-trends/home-sales-prices/q1-2018-u-s-home-sales-report/

On a laptop. Do I need to register or something?

Haha yeah. After some more testing it seems it works but only if you are logged in. Not if you are browsing as guest. Annoying. Should work regardless, will report to plugin devs.

Nice job Leo…..

Blue highlight not working in Safari on a Macbook.

@Barrister. That should be working, you on a smartphone or desktop?

Comment from Steve Saretsky today:

“The ability to continuously refinance your home as an ATM machine is coming to an end. This is the least discussed component of the mortgage stress test but arguably the biggest.”

LeoS:

Before all the comments that were new since my last visit were hghlighted in blue. Can you add that back?

So when Victoria house prices jumped by $100k in a few months in 2016 CD Howe would have concluded that the government suddenly imposed massive new barriers to development when in fact the opposite is actually true (developments were fasttracked in the past little while to create more supply).

Scanned the report very briefly. Their methodology seems to be to take new house prices, subtract the construction costs, and then assume the difference is due to regulatory barriers. That seems fundamentally flawed to me. Prices are high due to lots of factors, not just regulatory burden. Assuming the difference between construction costs and sale price is due to governmental interference seems fantastically naive. It’s possible I’m misinterpreting it though.

https://cdhowe.org/sites/default/files/attachments/research_papers/mixed/Friday%20Commentary_513.pdf

There was never a posting delay. Before, you had 5 minutes to edit your comment after posting (but the comment is visible to others immediately). Now you have 15 minutes to edit your comment after posting but it still is published immediately.

@onceandfuture

Thanks for the feedback. I’ve fixed the load more comments issue and reported the rest to the plugin devs. It does seem like the sorting is still quite primitive but hope they will improve it.

I do have that option. We tested it for a while a couple years ago and the consensus was that people preferred the flat (no replies) mode so it would be easier to catch up on all comments rather than having to skip around the page to find new comments. One related option I can enable is a notification option where you can @username mention people in replies and they would be notified.

Ah, Patriotz – true, “IF” the true ownership structure is disclosed. That did not happen in the Court case I referred to and does not happen in the vast majority of these money-laundering purchases – it would defeat the purpose. Be mindful, drug dealers [criminals] tend not to be truthful on property purchase title documents [or under oath in Court]. Your post may relate to the bare-trustee-corporation, which is very different from the scheme that is taking place and reported in the press by Mr. Cooper.

Oops – the cloak has already been lifted and the light of day has revealed what had been suspected. It is real. No alleged strawman – it is happening in your neighborhood, and mine. It takes only a few minutes to get up to speed, which I am certain you are:

https://globalnews.ca/news/4155822/vancouver-model-david-eby-money-laundering/

Investigations reveal gangs, drugs, illegal casino activity and eventually that dirty money ending up artificially inflating RE right here right now. Fascinating stuff. Grisham or Turrow could not have written it better:

https://globalnews.ca/news/4149818/vancouver-cautionary-tale-money-laundering-drugs/

Here is a good BNN video on the subject:

https://www.bnnbloomberg.ca/real-estate/video/money-laundering-and-vancouver-real-estate~1325744

A few high profile prosecutions will open everyone’s eyes. A few civil forfeiture seizures [if the law is found constitutional, which I doubt] would be a great deterrent too.

Hawk – you have it exactly correct, IMHO.

Leif – you got it.

James Soper – it is all illegal. That’s the point.

Mr business man(usually who has political power individual/officer. Or their relatives could be a Mr business man) and his wife(s) never wanted to live here anyway( via the Quebec immigration Program). A typically store goes like this.

Wife ( or a female assistant) brought their kids to Canada for safety reasons via the Quebec Immigration Program, and while they stayed here, kids went to school and graduated. Then the kids headed back to China or HK to learn from their Mr Businessman and look after family business with their Canadian passports. The first wife(legal wife) may never want Mr business man to go to Canada, but the assistant may come to Canada look after their kids.

Kids never have to report their global income after they ditched Canada….

Wife ( or the femal assistant) never want to live a English “prison” speaking country at all so they would never brother to come back.

When thing go wrong, the assistant will bring over the MR Business man and flea out of China and hide somewhere safe. Mr business man has a PR status, too.

Give or take, it is the reality. Some of you may hear Mr Gao Shan. I wonder how many “GaoShans” are now have moved to YYJ or Nanaimo

Victoria Born: “But, that is not what is happening. Instead, we have Chinese students at UBC and UVic, and also housewives, all with little to no income, owning multi-million dollar homes in the most expensive areas in BC.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<

The Chinese buyer has become the greatest straw man argument that the realtor groups have ever come up with. They are the constant in the market that will keep the housing market at unheard of levels and protect everyone's equity. Well, at least when the market is hot.

The most interesting dynamic of this market is the media. While they were regurgitating market renaissance via realtor gobbledy gook, people were at home suddenly realizing they had to spend more money for a home because of the much feared "Chinese buyer."

They were so good at this nonsense that legislation came in … which they fought tooth and nail. Why? Only because they knew that they couldn't control market sentiment if the foreign buyer was taxed out of the equation.

Yes, there are Chinese buyers and yes there is fraud, maybe significant, but give me a break.

These "buyers" were gobbling up the most expensive properties in Vancouver (holding properties for their millions of ill gotten gains). Do we all believe in trickle down economics, now or are Canadians just that philanthropic, sharing that wealth with overbids on their next residence?

When the tax came in Vancouver, the media, courtesy of realtors stated that homes would be purchased outside of the tax area … then Toronto … then Montreal. Voila …. instant market jumps.

We soon discovered that we had it wrong and they wanted "more reasonable" properties .. perhaps after the luxury market was dying.

http://business.financialpost.com/personal-finance/mortgages-real-estate/number-one-reason-chinese-buyers-want-canadian-real-estate-is-for-a-place-to-live-during-education-listings-data

"The data also indicated that the majority of Chinese property searches were for Canadian homes priced below $655,050."

They have been buying properties by the handful, online and by helicopter. They want our luxury homes, our middle class homes and soon our condos and mobile homes.

In the meantime, Canadians haven't been making untold millions of dollars and running off with their (ill gotten) ill gotten gains, lol ……… they are wallowing in more debt than at any time in history, lead, not coincidentally by B.C. and Ontario.

CMHC pushed their limit on loans, subprime has taken off and rate increases have scared the beejezus out of the average Canadian. Historic debt … historic rates. Who would have figured?

I think that we will find out within the year whether these "saviours" of constant high priced homes will be there when home owners need them the most.

The legal owner is a “taxable trustee” under BC law and is liable for FBT even if a citizen or PR. That doesn’t mean nobody is cheating, of course.

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/help-centre/glossary#taxable-trustee

Marko has been pointing out the scandalous amounts of money extracted by government entities during the housebuilding process.

His friend Garth today relays information from CD Howe that in Victoria an extra $264,000 is extracted for which the homeowner receives precisely nothing of any quantifiable value.

Interesting post Beancounter. It jives with similar anecdotal stories online and in the investigative news by Sam Cooper and others. The shock of how bad it is will blow many away. Then we have the subprime auto bubble/crisis in the US, highest delinquencies in 22 years.

Also interesting, for one of the rare times I’ve read an actual newspaper these days, I noticed one hell of a lot of used pickup trucks for sale here that are about 2 years old or so in prime shape. Can’t all be expired leases.

Subprime Chaos: The Auto Bubble’s Bursting And IThe Data Is Worse Than 2008

https://www.valuewalk.com/2018/05/subprime-auto-bubble-collapse/

@Grant Actually I used the term “funny money” for anything that has an uncertain origin, but mostly just to characterize the ridiculous amount of credit that has been created in the last 10 years.

While anecdotal, I have a friend in China who says the amount of loan fraud going on (bogus collateral, etc.) is much larger than anyone thinks. Basically what people will do is apply for a business loan, misstate the collateral to back the loan, then funnel the loan proceeds overseas and let the loan go bad. Apparently it’s so bad that there is a saying in China that every business has three sets of accounting books – one each for the government, themselves, and investors/banks.

I believe time will tell how bad it is, if the spectre of rising rates holds this will be the equivalent of the tide going out revealing who is swimming naked:

https://www.cnbc.com/2018/05/15/mortgage-rates-are-surging-to-the-highest-level-in-7-years.html

@Victoria Born

Did you listen to Owen’s video on how this is happening? Grant posted it a few weeks ago. (https://www.youtube.com/watch?v=w0P5KsIpzvA)

I would highly recommend watching it all the way through. His primary residence changes proposed would be great on tracking where the money comes from and you can only use funds generated in Canada to get a PR tax exemptions on houses.

I think he sum’s up the issues pretty well and I think you and Grant area actually talking about the same thing.

” Instead, we have Chinese students at UBC and UVic, and also housewives, all with little to no income, owning multi-million dollar homes in the most expensive areas in BC.”

The thing is that these students and housewives are the husbands and kids of the businessman who is off in China or elsewhere generating all the cash. They come via QIIP, they can then buy 3 properties, use each as a PR for each of the 3, demo/rebuild or fix or hold and resell without capital gains or income tax. (rinse and repeat)

Or they just buy them for wife and kids and then head back to China and not report any global gains. Like the person in this court case you mentioned

“Judge Susan Griffin scoffed at one family’s breadwinner, Guoqing Fu, for declaring to the Canadian Revenue Agency he had a worldwide income of only $97.11.

“This was an incredible assertion, given the fact he owns one of the top 10 textile manufacturing and distribution companies” in China’s biggest production zone, said Griffin.

http://vancouversun.com/opinion/columnists/douglas-todd-explosive-b-c-court-case-details-seven-migration-scams

Until all this get’s sorted out real estate is still going to be pumping along. Let’s hope Eby keeps going and the public continues to see more and get some changes at the federal level and CRA.

That would be illegal from China’s perspective.

Grant – that may be so, but that is a small % of the foreign buyers. If that were the case, it would be simple for Mr. Chinese business-person to register title to the home in his name. But, that is not what is happening. Instead, we have Chinese students at UBC and UVic, and also housewives, all with little to no income, owning multi-million dollar homes in the most expensive areas in BC. I encourage you to spend 5 minutes and read this real life situation [Vancouver] where the court got all the facts on how this is being done [note Mr. Businessman’s under oath evidence of his world-wide income]:

https://www.straight.com/news/1014966/two-families-feud-over-three-vancouver-houses-and-money-transfers-china-canada

As Sam Cooper reports, this is the tip of the iceberg. So, these inflated RE prices are built out of sand. Over the last 100 years, average house prices have been 3 to 4 times average household incomes – 5 times was considered very expensive. Now, in some areas, 27 times is the “norm”. In fact, in Victoria, it is between 15 and 20, depending on where you look. As an example, look at Uplands – the average household income is around $200K to $225K, yet the homes are listed for average $3 to $4 million. That is 17.5 to 20 times the average income in that area. But, if you look at the average household income in Victoria, those homes are selling for 30 to 35 times that. Do the same analysis for any area in Victoria, and then consider, “hmm, is that close to the historical average, even after adjusting for the historically low interest rates?”. Answer: not even close.

Even with this, some think it will still rise even as interest rates rise.

I like the new look. What I miss is the comments counter that used to be near the “leave a replay” box.

It’s not necessarily funny money, or at least not if the definition of funny=illegal. Yes there is foreign money getting laundered and then there is clean money coming in via the 300K new immigrants every year. Mr Chinese business person could have a legitimate business in China, he applies for entry in Canada, get accepted, takes a whack of his money out of China and uses it to buy real estate in Canada.

And that is exactly why the detached home price in Vancouver has been able to reach an astounding 27x the average household income. Anyone who thinks that this price stratosphere could’ve been reached with inconsequential effect from foreign capital needs their head screwed on straight. If the funny money spigot were turned off you’d see prices in Metro Van fall off a cliff. 75% in some cases would not be unthinkable. After all, the 4 million dollar house in Dunbar would still be a million after that kind of haircut.

It is pretty standard for commercial buildings with any low-slope (“flat”) roof. I like slopes on a roof, but low-slope is all the rage these days for “modern” residential design.

Grant,

we have torchon currently, as well as having had it on a house we owned in the states. I think ours is at least 10-15 years old, based on when this house was remodeled prior to our purchase. The section of our roof that is mostly south, slight SE, oriented, and gets full sun all day in summer, is a alligator skin-cracked, but our inspector advised keeping an eye on it and it has not gotten worse in the 4 years since we moved in. We needed a patch job for a single section that was about 3×4 feet 2 summers ago because it was blistered. The patch job was cheap (good experience with Parker Johnston) though. I would say overall, it is holding up very well. On our last house, it didn’t get full sun the whole day, and was OLD but holding up brilliantly. I have no concerns with this type of roofing.

Foreign money is being laundered through BC RE – there is a distinction between the “legal” and “beneficial” owner. The law of equity holds that the beneficial owner has superior title to the legal owner [see section 44 of the Law & Equity Act]. The foreign money is funneled through BC RE. The “citizen” becomes the legal owner, but that is just in name only, and the transaction “wrongfully” avoids the foreign buyers tax.

@caveat emptor

The point Owen is making is that Yes these buyers are citizens or people with permanent residency, BUT the bigger picture is that the money they are using to purchase property in Canada was not earned in Canada and thus not taxed in Canada. These individuals are getting to have their cake and eat it too because they now qualify for principle residence exemptions as well.

If he is selling to “citizens” then he is selling to Canadians whether he sees it that way or not.

8 minute blog from Owen Bigland addressing the definition of foreign buyers, how data is now collected on foreign buyers, and how foreign money coming into Canadian RE markets doesn’t mean it’s attached to a “foreign buyer” (i.e. will not be subject to foreign buyers tax)

“In the last year and half this declaration has been in place, I have yet to have one foreign buyer. I have lots of Chinese buyers. In the last 7-8 years I can count on one hand the number of detached homes I’ve sold to anyone except Chinese buyers, but they are citizens or permanent residents and not subject to foreign buyers tax”

https://www.youtube.com/watch?v=dPXn53ip0UY

What are the opinions of torchon roofing? We’re looking at a new modern-style build with torchon roofing, and I’m not familiar with it. A company out of Surrey (techproroofing) absolutely slams torchon, but it sounds like installation skill makes a big difference. Marko, from your blogs it looks like your place might have this roofing type.. any concerns with it?

Leo – the website changes have helped modernize HHV quite nicely. Branching (grouping) of comments like as in with Reddit would also be great, as that lends to a reading experience that is less schizophrenic, but I doubt you have that option in this WordPress theme?

Not having downvoting is the civilized way to do it – although there are some comments where you really wish the downvote was there. 🙂

False. You do get a salty fog on them after several storms but it just hoses off.

I agree that what it cost to build is mostly irrelevant to current value. It was worth 4.2 million to someone in the current market after being advertised for some while and list-priced significantly higher. The build cost is relevant in determining how much profit the previous owners made. Build cost for an equivalent place could have factored in the buyer’s decision for all I know. It’s definitely a windy spot, also beautiful though.

I am confident the build costs were way under that figure. Spending a ton/tonne of money on architects and high end finishes is much more likely to produce a positive return in South Oak Bay than in Sooke, so the answer to your question is likely NO – but then you already knew that 🙂

I certainly like that better, although I got used to the reverse date messages. The only problem is that now the compose box is still at the top if I want to reply to something I am reading at the bottom of the page.

Also, the “load rest of comments” button appears even in “oldest first” mode and hides all the new messages. It is not a big deal for either of those things, but new users might find them a little odd.

Interesting that there is now no posting delay. I used to use that time to edit my post for spelling (not always successfully).

Edit: And it seems to put my new post at the top of the stack (under the compose box) even when it should be “oldest first”. LeoS, if it is too much hassle bug hunting, I can live with the reverse date forum.

FYI Leo, your SSL cert expired 7 minutes ago

[Thanks, not sure why that didn’t auto-renew. Fixed. – admin]

Good point Barrister.

I just looked up the definition of tonne and found it interesting that the tonne is the metric measurement while there are also the long ton (British) and the short ton (American) each of which is a different measurement.

I dont care what it cost to build, it is still overpriced for that location. A friend of mine who lived down by the water said that if you live in a really windy oceanfront your windows get etched and fogged over by the salt in the air in about ten years. Does anyone know if that is true or just myth? If they had spent six million building the same house would it have suddenly become worth more on the market? If i spend four million building on a small lot in Sooke would anybody pay me that?

re 526 Beach. Building that thing cost a tonne. I read a bit about it. It was featured in some high end real estate/architectural magazine a few months back.

Shame to build such a nice place only to split up and have to sell it. But pretty sure they made out OK even with the nuts building costs.

Bank Street is underpriced for a bidding war. It will likely sell north of 700k.

A lot of wishful thinking that it will sell for 650k. At that price I would buy two. Nice wide street, rear lane access, flat lot, brand new house next door, you could build a 2,600 sq/ft home plus a 400 sq/ft garden suite.

Shouldn’t be too different. Just a new commenting platform to make it slightly more modern. I enabled the voting feature but disabled the downvotes since I don’t think that contributes to discussion.

Also some people wanted the ability to sort oldest first which you now can.

Anything else you’d like to see?

I appreciate all of the stats that you provide along with the insightful comments. Thanks

CPP is self-funded. OAS and GIS are paid out of current revenues, but they don’t pay that much.

The big problem is that so many people have not adequately funded their retirements and are depending on their house as a retirement plan. Thus the historically low savings rate. The new expansion of CPP will partially address this, but it’s too late for the boomers.

The housing bubble is the real intergenerational ripoff.

off topic but interesting. Can we afford social benefits as they currently stand?

https://www.aarp.org/politics-society/advocacy/info-2014/the-generation-war.html

The basic arguments made in “seniors are selfish” articles follow a similar pattern. Social Security, launched in 1935, when the average life expectancy in the United States was 62 years, is now inadequate to handle an aging population that is living nearly two decades longer and growing in size. In 1940 there were 159 American workers supporting every Social Security recipient. Today, fewer than three.

And to think we passed on 2608 Estevan in 2015 when it sold for $815K. It’s now assessed at $1.125M vs. $950K for 2669 Estevan.

Looks like pure land value minus demolition costs. Definitely a little lower than during the 2016 frenzy but I am not sure it is correction territory yet for a 5230 sqft lot. Others may have a better sense of comparison for empty lots in Oak Bay.

(the picture of the cat rafters was surreal – definitely a tear-down)

Edit: It seems we have new a forum layout. Woo, forum voting… Yay?

Leif: thanks for the kind comment.

Victoria Born: thanks for the kind comment as well.

Barrister: yes, I agree with you that inventory will have to go up substantially before we see a price break in Victoria. That’s just the way it works, I guess. But the bottom line (in my opinion) is that if the banks will no longer lend the buyers the big bucks they need to make the big purchases, house prices will have to come down. It’s inevitable.

Hawk: yes, I agree that 925 Bank Street looks like a good place for a Charles Manson seance. However, if you could pick it up for maybe $600K, and build a nice, new (smaller sized) home for $400K, you’d have a real gem for $1Mil. Compare that to the house currently for sale at 2669 Estevan Avenue. They want $1.2 Mil for a very basic house that looks like its had no upgrades since President Ford fell down that flight of airplane stairs. I know it’s closer to the Uplands and all, but geez, not even Jethro Bodine could be persuaded to pay $1.2 Mil for that most humble abode.

Right, but unemployment was up in 82 and there was a recession. That added fuel to the crash. Remains to be seen if current rate hikes trigger a similar result I guess.

“You don’t get a crash with employment and wage growth strong.”

You did in 1981. Unemployment was lowest In years then popped in 82. 5% raises were the norm. Personal debt was low at 100%.

You only need a couple points from here for similar situation with 172% debt load. 7 more US hikes will do it. Buy gold not shacks.

Bank St looks like a crackhouse. The backyard is probably a toxic wasteland. What realtor would show those pics? You need a hazmat suit to even take a step on it.

Andy,

Bearkilla says lots of stupid shit. He drinks a lot too so that may explain it. Drunks always exaggerate income etc.

I get you have a home cookin bias Marko and can’t say anything bad to upset the clientele but anything selling under assesment in Broadmead is major news.

Trying to spin it as just a good deal when slashes have been rampant of late and Vancouver high end tanking is doing your clients a disservice. Multiple bids on a few properties is not some sign things are rockin when sales down big this month.

Well priced but set up for bidding war.

Anyone check out 925 Bank Street?

https://www.realtor.ca/Residential/Single-Family/19430188/925-Bank-St-Victoria-British-Columbia-V8S4B1

It seems fairly priced for an old teardown in a decent area and I guess more signs that prices are coming down now.

That’s my point. Not reasonable to expect it to sell for $2M

Bought for $838k in 2013. Doubt they could have torn down the old house and built that new mansion for $1.2M.

Not important what they bought it for. You have to take current lot value + construction costs. That is a ultra complicated build (for residential) plus lots of blasting too. 4,700 sq/ft x $400 = $1,880,000 but could be pushing two million+ in the current construction environment.

Bought for $838k in 2013. Doubt they could have torn down the old house and built that new mansion for $1.2M.

Amusingly enough, I just found the original listing profiled on an old Greaterfool article. That time (June 2013) was almost the exact bottom of the market.

http://www.greaterfool.ca/2013/06/09/wasted/

And a comment there: “Give me a break, 899 thou? This is borderline crackshack (or mansion according to the website from Van). After closing costs moving costs, insurance, maintenance for a 100 year old house, furnishings, interest payments now your talking a Million? For that? Helooooo, for THAT? Oh my god do we need a serious kick in the ass in this country. Over priced, over indulged POS that should really be priced for about 200K AT BEST.”

Whoops.

That is insane. That’s the windy side of the bay too…although apparently it’s a beautiful house/yard.

Sure, but only because it would be tough to string along that many months without getting into buyer’s market territory (MOI > 7).

Doubt we will see a major shift in prices this year. The market is slow. Rapid price drops require big events like the financial crisis or some other big external shock where sellers are desperate. You don’t get a crash with employment and wage growth strong.

The spec tax is not a big enough shock. It may bring a good chunk of properties on the market, but those sellers won’t be desperate like someone is when they lose their job. They will hang on trying to get a better price. It might not help them as the price might decline slowly over time, but you are not going to see a panic in the market like we had in 2008.

Could this be money laundering, mortgage fraud or some sort of malicious activity in action? I remember seeing an investigative news program on inflated assessments then sales only for someone to collect a massive windfall.

If there is a price correction I really think it needs to happen this year….if things flatten out and we roll into next year it could be more of 2011-2014 again where you end up flat give or take but affordability improves over the course of 5 years.

housing is a necessity to live a decent life and shouldn’t be so out of wack with the local economy.

10 years into the blog we still haven’t defined what the definition of housing that is required to live a decent life? Is an SFH in Oak Bay or a condo in Langford?

Submitted offers for two clients tonight on different properties and this is still the reply you get on something half decent in the core….

“FYI, now have 5 offers in hand. xxxxx is just now sitting down to discuss offers with her clients.”

Actually, make that 24-36 months of sales decline.

@Bearkilla

Seriously? No offense, but this is a dumb thing to say. So someone who is 25 now, should have bought when they were 15 years old? This isn’t about you, or when you bought, it’s about the generations coming up that are having a difficult time buying because of the insanity of prices; have some compassion. Everyone walks a different path, and bottom line, housing is a necessity to live a decent life and shouldn’t be so out of wack with the local economy.

i think 60 months of YOY monthly sales decline would have an effect on prices. Just my opinion.

I agree with Marko. If you bears had bought 10 years ago instead of bitching about prices you’d be very happy like me and every other bull. Instead, you’re miserable and sad.

The months of consecutive sales declines really have no impact on anything. What does it matter if sales decline over 15 months or 5 months? The only thing that matters is how far they decline, and where inventory is.

In 16 months of sales declines we’ve gone from an insane sellers market to a mild/moderate sellers market. Neither of those two conditions would cause price declines but that doesn’t say anything about the future.

I cant believe someone paid 4 million for that house on beach. 2 million would have been a stretch in my mind.

Very good analysis, Leo.

Matthew – your analysis is sound.

“Out of the last 16 months, 15 have seen lower sales YOY so writing has been on the wall for a while and my guess is we see another 12 to 16 consecutive months of YOY sale declines. Eventually sales will bottom out, inventory will break 5,000 and we might see prices correct flat to 5% and life will go on. We still won’t have enough GPs or construction workers and all the restaurants DT will be packed as per norm.”

Well – that’s what dreams are made of, I suppose. Flat to may be, just may be, a mere 5% drop. This is not a rational analysis of the empirical evidence. The greater-fool-theory appears to be alive and well in the City of Victoria. The reality is that the deep pocket buyer [foreigner or domestic] is gone or in hibernation. It is the seller, as noted below, who has to adjust to a new market reality. Realtor will always pump.

So you are saying at least 30 months of YOY sales decline will be followed by only a 5% reduction in price at most? Ok then.

We’ve had 16 months so far and upward pressure on prices during those 16 months.

I wouldn’t be surprised if we had 30 months and flat prices in the end.

Rithet reservoir

http://www.timescolonist.com/news/local/rithet-reservoir-pipeline-work-to-wrap-up-in-june-1.20211898

“Out of the last 16 months, 15 have seen lower sales YOY so writing has been on the wall for a while and my guess is we see another 12 to 16 consecutive months of YOY sale declines. Eventually sales will bottom out, inventory will break 5,000 and we might see prices correct flat to 5% and life will go on. We still won’t have enough GPs or construction workers and all the restaurants DT will be packed as per norm.”

So you are saying at least 30 months of YOY sales decline will be followed by only a 5% reduction in price at most? Ok then.

Leif…it is a water reservoir, or at least it used to be.

Haven’t been on here for a while, but I noticed an absolutely insane sale today. 526 Beach Drive (newish house but on a small, steep lot) sold for 4.2m. It’s not even waterfront.. Crazy!

@gwac

Short term perhaps, but making real estate more affordable will benefit the economy in the long run.

Speaking of 981 Perez what is that behind it? Google Maps shows a lake as does BC Assessment but when you look at the satellite image it looks like a gravel pit or public yards? I cant see anything on google maps except a gate.

@Matthew

The VREB expects that the market will pick up again when PEOPLE adjust to the stress test and increasing mortgage rates”.

Who are the “people” that need to adjust? Answer: the Sellers. The Buyers don’t need to do any adjusting. The banks and the Gov’t already did that for them in the last few months. They told the Buyers that they simply were not going to be able to borrow as much $ as previous Buyers could in the past. So now, Mr. Seller, it’s up to you to adjust.

That gave me a good chuckle as well.

Pretty good flip, 1,060,000 from 747k in 2017. $313k with probably $150 on the reno. Nice $163k tax free on the PR (Owner reno/lived in as stated in the ad description).

1728 Kingsberry Cres

Interesting tweet from a voice regarding Vancouver real estate. I know its anectodal, but could be telling:

Talked to a private broker who lends out to developers , offshore buyers and speculators from private funds .. No demand. They are seeing huge down turn . Next is failure to pay loans

Banks are getting one loan application a week at some branches @RonPolly

Yup, individual slashes or sold-over-asks are worthless info. Only in aggregate across the entire market (or segment thereof) are they somewhat informative.

excellent analysis

The market has turned. I get the feeling some realtors are beginning to see the writing on the wall.

Out of the last 16 months, 15 have seen lower sales YOY so writing has been on the wall for a while and my guess is we see another 12 to 16 consecutive months of YOY sale declines. Eventually sales will bottom out, inventory will break 5,000 and we might see prices correct flat to 5% and life will go on. We still won’t have enough GPs or construction workers and all the restaurants DT will be packed as per norm.

My guess is that somewhere around 4000 might be a tipping point.

I am guessing more like 4,400 to 4,600 but close enough with sales slightly below the 10-year average including the last three years of blistering sales.

All that matters now is how big are the price slashes while Vancouver higher end is crashing and some going under assessment. A 20% slash is substantial.

So, if I list my market value $1.6 million home for $2.0 million and then sell 6 months later for $1.6 million I took a 20% slash?

That being said Perez sold for $1.34 million and I spent a bit of time at that house (was originally built by a Croatian family). Seems like an okay buy to me. Kind of like what Leo keeps eluding too….there are “deals” that pop up in slower markets.

Home was purchased for 972k in 2012. At the sale price it went up 39% while the HPI index went up 45% during the same time period in Broadmead so it is 6 points lower than the HPI if that means anything (you have to draw some assumptions such as the 2012 purchase wasn’t above or below market value).

At $1.7 mill it was 74% over the purchase price without improvements while once again HPI is showing 45%.

Mathew:

Sellers can take a long time to adjust to a new market. I suspect that we will need to see a lot more inventory on the market before there is any real downward price adjustment.

My guess is that somewhere around 4000 might be a tipping point.

“The VREB expects that the market will pick up again when PEOPLE adjust to the stress test and increasing mortgage rates”.

Who are the “people” that need to adjust? Answer: the Sellers. The Buyers don’t need to do any adjusting. The banks and the Gov’t already did that for them in the last few months. They told the Buyers that they simply were not going to be able to borrow as much $ as previous Buyers could in the past. So now, Mr. Seller, it’s up to you to adjust. There is a Buyer standing in front of your house. He wants to buy. But all the bank will lend him is $700K. And you want $1Mil. So it’s time to lower your expectations Mr. Seller or there is not going to be any sale at all. Because the Buyer doesn’t have any choice anymore. He has been cut off by the bouncer at the bar.

Hawk, glad you were able to see where I was going with that one. The point being, 981 was on the market for a long time, and most likely sold under assessment. The market has turned. I get the feeling some realtors are beginning to see the writing on the wall.

Interesting, 981 Perez assessment is $1,524,000. Selling under is very telling where this market is heading. Down, down, down.

“Who cares what it was listed for? Bought for $972k in 2012 add about 40-45% market appreciation and you end up with $1.4 give or take.”

Who cares what the guy paid for it 6 years ago? Implying future growth based on old prices is shady salesman tactics. Of course it went up over time. All that matters now is how big are the price slashes while Vancouver higher end is crashing and some going under assessment. A 20% slash is substantial.

981 Perez Drive has a SOLD sticker on the sign but is still listed on REALTOR.ca. An agent I know says that it has not sold. So what is happening here? Any thoughts anyone? This place was originally listed over a year ago for around 1.7 and has been listed at 1.4 for 6 months or so.

Likely just waiting for the deposit to report the sale.

Who cares what it was listed for? Bought for $972k in 2012 add about 40-45% market appreciation and you end up with $1.4 give or take.

981 Perez Drive has a SOLD sticker on the sign but is still listed on REALTOR.ca. An agent I know says that it has not sold. So what is happening here? Any thoughts anyone? This place was originally listed over a year ago for around 1.7 and has been listed at 1.4 for 6 months or so.

https://www.saanichnews.com/opinion/column-building-a-coastal-refinery-in-b-c-is-just-common-sense/

David Black is proposing his refinery again. I don’t know the details of his project, but it looks better than exporting all our jobs.

Time for another flip,flip,flop?

1404 Tovido Lane

Asking : $949,000

Assessed: $736,000

Sales History:

28-Jun-2017 $850,000

30-Jun-2016 $725,000

T minus 3 months till Wile E Coyote gifs.

Real state agents and the Governments revenue are going to suffer in this market in BC. The trickle down affect happens to businesses impacted by sales.

“Normally I would agree, however I believe this time we are at the end of the cycle and the market is simply tapped out.”

A most intelligent assumption LeoS. The middle zone will eventually see increased listings to either want to move up to capture the higher end slashes they can’t resist, or to just get out of the market and take the money and run.

Since we’re now seeing the first sign of job losses in the real estate related sector this will only create more pressure on those in too deep who thought the party would never end.