Aug 7 Market Update

Weekly sales numbers courtesy of the VREB.

| August 2018 |

Aug

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 94 | 736 | |||

| New Listings | 168 | 1035 | |||

| Active Listings | 2551 | 1917 | |||

| Sales to New Listings | 56% | 71% | |||

| Sales Projection | — | ||||

| Months of Inventory | 2.6 | ||||

This being only three business days of sales, there isn’t much point in trying to analyze the numbers from the first week. Looks like things are continuing roughly as before as we begin the long slow slide into the fall. Sales should decrease every month until January, and inventory will drop a bit in August and then stay approximately constant until October when it will drop quickly into the winter.

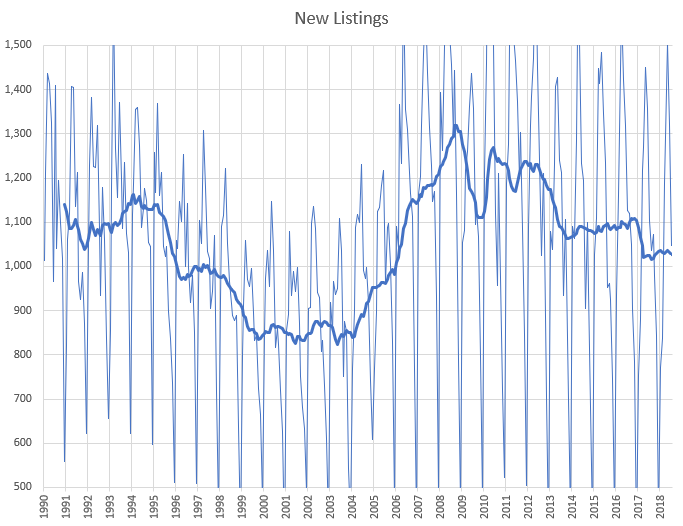

There’s been some discussion about new listings, and how June’s brought the lowest number of them in over a decade. This is true, but there hasn’t really been a significant change on that front if we look at the bigger picture. On an annual basis we are about middle of the range for the last few decades on new listings as you can see below.

There isn’t a convincing pattern on new listings that I can see. In the last boom we saw new listings stay low until the middle of it (2004) and then increase strongly to hit a peak at the top of the market (2008). So far no sign of an increase yet, so either people believe there is more run in this market and they are hanging on for gains, or prices and new listings aren’t strongly connected and there are other more important factors (demographics, employment?).

In the history of Vancouver real estate at least, we always see a 2-3 year breather, then everything higher again in 5 years. Trudeau is printing $1 Trillion dollars in Government Spending. Interest rates may be rising, but money is being printed nonetheless. It will result in higher prices in desirable places, including Victoria, Vancouver, Fraser Valley, Kelowna… Just to give you an idea of what kind of money is being printed out of thin air..1 billion seconds leads to 31 years, 1 trillion seconds equals to 31,000 years! Thats a lot of dough~!

New post: https://househuntvictoria.ca/2018/08/09/why-houses-get-less-affordable-in-the-long-run

Thank you Paul much appreciated.

Because they need to sell every barrel they can. Read this and tell us who’s in the stronger position.

https://www.independent.co.uk/news/world/middle-east/saudi-arabia-could-be-bankrupt-within-five-years-imf-predicts-a6706821.html

LOL. gwac you need to go golfing, fishing, or something. Wishing ill will always comes back to haunt you.

Barrister –

“I know that one can get a demographic breakdown of ages for Oak Bay or Victoria but is there somewhere to get a demographic breakdown of the ages of homeowners as opposed to general population?”

The CHMC Housing Market Information Portal provides data on primary home maintainer by age group for Victoria. Unfortunately, I cannot send a link directly to the appropriate page. Start at this page: https://cmhc-schl.gc.ca/en/data-and-research and click on Housing Market Portal. Once in the CHMC Portal, select BC near the top and an adjacent box pops up to select cities. On the left side of the page select “Population and Households” and then “Full Report”. That will take you to a table listing home ownership and rentals by age group or “principal maintainer” among other demographic data.

I don’t want anyone to become homeless. What I want is for all homes to bear a resemblance to the economy in which there is underlying support for the prices. Not having that is bad for the economy and the people that live in it.

I wouldn’t worry about me. I’m not in a difficult position, I’m just essentially refusing to participate in panic…with the potential risks and rewards that that entails. Not expecting a “cheap” place. Just one that actually makes some sense.

I think you’re misunderstanding things a little. Anecdotes are anecdotes and should always be understood to be exactly that. They’re tangible tidbits of interest, chewing gum if you will, that some people are interested in hearing about. If you perceive that people are posting anecdotes with the intention that they function as an actual market bell-weather, then I would suggest you’re underestimating the people here and their ability to separate casual pieces of interest versus actual empirical data.

This is why we also talk about the actual indicators that matter including sales volumes, M1 data, net migration, employment, employment distribution, DOM, relisting patterns etc. Throw in some market history, comparative market analysis – and some anecdotes – and hey, you have something pretty cool and useful. If you’re not interested in any one of these things – scroll past them.

I still don’t think you’re making your case so far as to why this market is different. The position a first time buyer finds themselves in is not unique to Victoria, it’s common to overpriced markets that have had the largest speculative run ups – and that principle applies to any such market in Canada, the US etc. These are also the same markets that the data to date, indicates are starting to reverse. That’s not an anecdote; that’s just the way it is.

Just Janice: “Demographically, Victoria is older. To the degree people have moved from more pricey markets to here (ie. Toronto to Victoria, or Vancouver to Victoria), many of them might have mitigated the amounts they were carrying in mortgage. I suspect, even the average first time buyer in Victoria is different than their Canadian counterpart, and that its far less likely they scraped together their own downpayment, or alternatively that they lived with their folks much longer.”

<<<<<<<<<<<<<<<<<<<<<<

……………. and despite those advantages

https://globalnews.ca/news/3659206/bc-household-debt-levels-mnp/

RBC has estimated that paying down a mortgage in the Vancouver area would take up 79.7 per cent of household income, according to its most recent affordability index.

In Victoria, it’s 56.7 per cent; both are higher than the Canadian average of 45.9 per cent.

Hawk

Just maybe this will get Canada/s act together build the pipeline to east build some refineries and stop relying on Saudi oil. Do ya think the Liberals will use this to move that agenda. Politics Hawk.

From the CBC

Saudi Arabia has a “firm and long-standing policy” that petroleum supplies are not influenced by political considerations, Khalid al-Falih said in a statement.

“The current diplomatic crisis between Saudi Arabia and Canada will not, in any way, impact Saudi Aramco’s relations with its customers in Canada

One big huge political gift to the liberals to stop dealing with a regime that does not jive with their agenda.

Don’t sweat the Saudi thing gwac, it only means another $20 billion down the tubes when they cut off the oil flow, if you could even replace the 100,000 barrels a day they get from the Saudi’s.

PS, it’s a “real article with real info”. 😉

https://business.financialpost.com/commodities/energy/why-canada-still-needs-saudi-oil-for-now?video_autoplay=true

Local

LOL good one….

I am really torn I want you to get a home but want hawk to remain Homeless. I want to get a bargain in the Highlands. You see my dilemma in seeing the market crash here.

Just not worth it to see Hawk become a homeowner…..Sorry

LF,

I’m trying to be generous. Don’t want to upset gwac. 😉

Gwac.

What would be the point of a mortgage of $150 a month. Would the bank even do that? That’s barely more than my monthly parking. And that color scheme is so bad you could probably just repaint it and triple the asking price. Silly newfies.

There are actually tiny nothing towns in BC where you can find homes near that price. Have to be a real isolationist, though.

A newfie rolls into his factory job at 10:30. The floor manager comes up to him and says, “You should have been here at nine o’clock,” to which the newfie responds, “Why, what happened?”

Heh no, it’s actually closer to half of that if the US is the comparative metric. Our overleaveraged sector is proportionally much larger than the US’s was.

LOL. Hilarious.

Assuming the Canadian average applies to Victoria is foolish. It doesn’t – just as many Canadian averages simply do not apply to BC generally. If you used the Canadian average to estimate the number of smokers in BC you’d be woefully wrong. Demographically, Victoria is older. To the degree people have moved from more pricey markets to here (ie. Toronto to Victoria, or Vancouver to Victoria), many of them might have mitigated the amounts they were carrying in mortgage. I suspect, even the average first time buyer in Victoria is different than their Canadian counterpart, and that its far less likely they scraped together their own downpayment, or alternatively that they lived with their folks much longer.

Further, the plural of anecdote is not data. There have been examples of substantial price reductions, but that’s making the assumption that the original ask was reasonable and ignores the specific reasons those people are willing to make those adjustments. I’m sure Marko can still dig up examples of places going for over ask or very near their ask prices.

At any rate – movement towards a balanced market should be welcomed by buyers and sellers. It’s nice to know you can do due diligence and make decisions without fearing you’ll lose out.

Saudi thing has just started, they stopped buying our wheat and barley, on top of anything else Canadian. Who knows how much real estate they secretly own they could dump into the market en masse. They are a sick regime who have no ethics.

You said things will get ugly when HELOC’s get called in which is exactly what I’ve been saying. “Ugliness” isn’t 10% bud, try 30% with a 168% household debt bomb. Only need 10% who need out of the market ASAP to tank it as per the US crash.

Hawk

Someone asked a question I answered it.

I will state again

4 year to 5 years before the next upswing

5 to 10% correction

higher price points and less desirable areas large price correction.

I post real articles with real info. Not just BS about crashes all the time and price drops.

That Saudi thing really sent the market on a tailspin. LOL

gwac is talking crash now ? Interesting how he plays good cop/bad cop on here.

Intorovert’s circle probably never lost more than $20 in a casino slot machine. When the real money is lost soon I’m sure those attitudes will change overnight as Pepto sales go sky high.

Local

Check this out

https://www.point2homes.com/CA/Home-For-Sale/NL/Cox-s-Cove/31-Country-Road/58749381.html

Yes but it would take the bank quite some time for their computer systems and analysts to catch this. In my case it was well over a year into a crash and renewal time before they reassessed my home value and significantly lowered my credit limit. Banks may be getting wise now but my guess is they still want to make money on the interest, slowing their response time to reassess the secured property. I suspect regulating the response time to reassess value may be future business for Mr. Poloz.

Judging by that graph, it’s truly amazing how many Canadians must be borrowing vast sums of money to buy in shitty places that aren’t desirable. That is risky, IMO.

Here’s some notable price adjustments here in Victoria…

1252 Oxford Street: Previously listed at $1,800,000 on June 9th. No takers. Dropped to $1,650,000, no takers, finally dropped to $1,399,900, and appears to now have a sale pending. Total asking price reduction is $400,100 or just over 22%.

A few apartments:

1007-21 Dallas Road: Previously listed at $2,700,000 on April 5th. No takers. Dropped to $2,299,000, no takers, now to $2,099,000. Total asking price reduction to date is $601,000 or over 22%.

101-1120 Fairfield Road: Previously listed at $549,000 On May 22. No takers, then asked $499,000, no takers, then dropped to $439,000, current market status is unknown. Total asking price reduction to date is $110,000 or 20%.

And there are other substantial reductions (more than 10%), but most are around 5% right now. I’m noticing virtually all of the largest reductions are in the core, and I don’t know whether that’s a sampling bias in the data or they are indeed largest in that region.

Oh and, today’s BC RE top drop, just for fun:

31861 Beech Ave, Abbotsford: Previously listed at $1,425,000, MLS #R2256842. Pulled after several months, relisted with a new MLS #, now asking $724,777 for a total asking price drop of over 49%.

https://www.estateblock.com/abbotsford-real-estate/31861-beech-ave-abbotsford-bc-v2t-1g8-mls-r2295687-1?mls=R2295687

But the kicker here is, even with a near 50% price cut, the seller paid $400,000 four years ago in July 2014. Kind of goes to show you the level of greed out there right now – do you want to be the buyer that hands over your present and future earnings to this seller, enriching them with an 80% nominal price premium?

Anyways, remember, asking prices are expressions of aspiration, nothing more. They aren’t a price ceiling nor a floor. If the seller misreads a market on a downward trend because they’re stubborn and/or have a crappy realtor, the losses can be substantial.

For anyone interested:

A while back, there was some discussion on the Toronto market and whether it was actually rebounding. Similar to what LeoS provides here, the latest weeklies have been released, and so far, they are continuing their greater than seasonal slide from July, as July did from June. This appears to be the same phenomenon that Vancouver faced last year. I believe this has relevance to our market, because both are experiencing the same liquidity contraction that is starting to occur on a national level.

There is not enough data yet to confirm the trend but, if it continues, then I would say it’s similar to that which both markets saw in 1990 and 1991: The markets dropped off, and in the first half of ’91, sales numbers and prices started to improve. Cheer-leading in the press resumed, but soon after they were let down again. Prices didn’t recover, in real dollars, for a generation. We’ll see what happens this time, I guess.

http://torontostoreys.com/2018/08/toronto-home-sales-snapshot-14/

@ Intro:

My suspicion has always been that most buyers in Victoria (especially in the core) aren’t borrowing as much as many would assume.

What we know is that Canadian household debt is at an astounding all time high of 168% of household income:

Yes, because that’s statistically, one of the fastest growing debtor populations as well as bankruptcies. It’s actually very sad and unnerving.

We must have different circles.

Authentic dungeon S&M.

@ Leo M

It’s true that QE, by inflating the money supply, has devalued the currency, even relative to the insanely printed US buck the C$ has sunk 30% in the last five years.

But it is in fact the creation of debt in that has expanded the money supply massively, not QE. Debt creation by banks is, in fact, the private creation of money. Banks can lend up to ten times their deposits, but every loan creates new deposits, so in effect the money lenders have a license to print their own money.

And the absence of adequate regulation of usury has resulted in the subjugation of a large part of the population to a condition of debt slavery in which they devote an unprecedented proportion of income to debt service.

@ Josh:

“Dude I have spent so much time seriously considering buying a castle.

An ideal place, perhaps, to start many a small business: furniture making, horse breeding, Internet casino, whatever….

Absolutely, you can only have so much debt versus equity, so if prices decline the bank can freeze the HELOC or even demand repayment – remember it’s a demand loan.

@ Marko:

“A better comparison to Victoria (than Paris) would be something like Nancy, France in my opinion.”

Well that’s a reasonable point! Still, I’d go for this high-ceilinged, spacious two-bedder in a fine old stone or brick building in Nancy, in preference to any apartment of the same size (1367 square feet) you could buy in Victoria for the price (C$359K), if you could buy an apartment that size in Victoria for that price.

That’s what they’re doing.

Anna

yes the amount available. My understanding these things are callable by the bank so a real decline in prices could set off some ugliness.

https://business.financialpost.com/personal-finance/home-equity-lines-of-credit-may-lead-canadians-to-use-their-home-as-atms-consumer-agency-warns

I don’t know much of anything but would house prices declining have an affect on someone’s HELOC or LOC?

Dude I have spent so much time seriously considering buying a castle. There’s some smaller pretty reasonable (by comparison) ones for ~$700k. I’ve access to a UK passport. I could do it.

In other words people who were able to buy back in the 1980’s. Well yes I’d expect them to be mortgage free and debt free in general. What I find surprising is how many people that age aren’t debt free.

How about something radical like building student housing on the campus instead.

+1 for Uvic Housing.

Also, driving around Langford yesterday wholly smokes are there a lot of apartment buildings going up. Two massive ones across from Loghouse Pub and looks like the piece of dirt can fit another 10 🙂

I would be a tad concerned in Langford if I was depending on an inflated rent from my basement suite to make mortgage payments as there must a be a couple of thousand professionally managed rentals coming up.

Much needed:

UVic puts focus on student housing

Mike Wilson, director of campus planning and sustainability at the University of Victoria, said the project will see the construction of two buildings with a total of about 785 beds.

https://www.timescolonist.com/news/local/uvic-puts-focus-on-student-housing-1.23393135

My suspicion has always been that most buyers in Victoria (especially in the core) aren’t borrowing as much as many would assume.

Of the people I know who have mortgages, the mortgages aren’t outlandishly large and in most cases the household has two strong income-earners (e.g., one is a teacher and one works for the government).

Of the people I know who don’t have mortgages (generally people of my parents’ generation, in their sixties), many of them paid off their mortgage years ago and others retired here from colder climes and bought their house with cash.

I understand that my social circle may not be representative, but these are people in my life who aren’t worried about prices declining (many have small kids and busy lives and like where they live) and I suspect wouldn’t sell even if prices declined a lot.

Yeah, compared to Victoria, a twenty-fold difference in population, plus a better art gallery and many more side-walk cafés.

I was comparing Paris real estate to the castle to emphasize the importance of location.

A better comparison to Victoria would be something like Nancy, France in my opinion. I’ve spent time there as my cousin lives there. In my opinion Victoria>Nancy and good luck making a living in Nancy. My cousin pays mechanics 1,100-1,400 Euros/month at his dealership and everything is as expensive as Victoria when comparing oranges to oranges.

Yeah, compared to Victoria, a twenty-fold difference in population, plus a better art gallery and many more side-walk cafés.

There is a simple reason why globally the price of real estate skyrocketed beyond local wages ability to pay during the past ten years. Canada, Croatia, France, New Zealand, Australia, UK, … everywhere!!!

Quantative Easing printed TRILLIONS of new dollars in every major country and all that new cash trickled through the system from factories, to businesses, to employees, to investors, etc. That new money began circulating, passing from one hand to another, and it became easy to capitalize and make many people easy money. And all that easy money started spiralling into global real estate. The end result is real estate is now beyond the reach of average working families. On a smaller scale, this is what happened in China before Mao Zedong took power and immediately started executing all the landlords who had accumulated wealth and real estate to the extent that average people were beholding to the real estate elite. Most revolutions start when working class people are shut-out of home ownership and become either tenants or homeless. But it could never happen in rich western countries…

House prices in dynamic urban areas in Canada and throughout the Anglo world are determined by affordability, which is to say how much people can borrow when they borrow their brains out. This represents the triumph of the usurers over the people in a process of exploitation dependent on the complicity of a treasonous elite.

The solution to ridiculous housing costs would be financial regulation to limit mortgage payments to some modest proportion of income assuming an interest rate not at the current abnormally low rate of 3%, but at a rate providing a real return of, say, 3% in excess of the current inflation rate. That would kill all current and all future house price bubbles.

Hawk according to you this market has been leaking for many years. That’s one big balloon.

Local

Anytime you want to meet up let me know. All in fun with you.

Sorry about the date I really never know what day it is

I just did, I actually laughed at the Newfoundland jab. Too funny. If you were here with me right now, I’d buy you a beer and hear your NDP rants to your heart’s desire. Incidentally, it’s the 9th.

Fine, no castle for you.

Funny watching a couple of salesmen tag-team WWE style trying to justify the leaking real estate bubble. Must be some real nervous teeth gnashing goin on in the offices as the Chinese money has left for good and is trying to get out with only losing their shirts. Sales must be sloooow.

Proposal for luxury condo tower in Vancouver pulled amid signs of weak demand

https://www.theglobeandmail.com/canada/british-columbia/article-proposal-for-luxury-condo-tower-in-vancouver-pulled-amid-signs-of-weak/

Barrister to add 40% of Canadians are mortgage free so the others owe a tone. Any large increase will cause some issues.

https://www150.statcan.gc.ca/n1/pub/75-001-x/2011002/article/11429-eng.htm

Not all of them are in the middle of nowhere, either.

I’ve been to Europe over 20 times and every time I make a point of visiting a couple of countries outside of Croatia. Everywhere that I would personally want to live is expensive. Even Croatia and Poland where I want to live are expensive.

There is a reason a so-so 800 sq/ft condo in Paris is $1.4 million CND just like the difference between Vancouver and Kamloops.

Local you are right market going to crash cause I found this place in Newfoundland for 49k

https://www.kijiji.ca/v-house-for-sale/corner-brook/this-cabin-sits-on-a-nice-spot-in-the-gallants-area/1375183072?enableSearchNavigationFlag=true

Calling my broker now Sell Sell Sell I am moving…..

Wonder why a 5000 sq ft lot is double the price in Oakbay vs Langford. That’s a real head scratcher for me. Anyone Anyone???

I wonder why a money pit of a castle in france is Cheap Anyone Anyone?

Maybe also because its not the 1600`s anymore and people don’t want to live in a bloody Castle.

Local smile its Aug 8th and no crash yet.

GWAC: Interesting article. Actually I may be miss reading the charts but this seems an enormous amount of debt taken on by Canadians. has anyone figured out what happens if actual mortgage rates climb to 6% or 7%? Unlike the US we dont have thirty year terms

and actually I have always wondered why we dont.

Marko,

That’s the part where I say, “Just for fun”. 🙂

Not all of them are in the middle of nowhere, either. That site has tonnes, some are isolated, others aren’t. But it does offer some perspective at the ludicrous levels Canadians have driven their RE market. I mean, an entire castle on multiple hectares, versus a quasi urban bungalow. Sell out of Vancouver, buy a castle in Europe and have money left over. Sounds like a good deal for someone.

Do you know that while he was shunning RE over the last few years, he’s been quietly flipping houses? Funny…

Citing Garth when discussing real estate is like citing Jenny McCarthy when discussing immunology.

🙂 Garth Turner interviews on YouTube from 10 years ago are so funny to watch. It isn’t the fact that he is completely wrong, that is okay, but that he is so sure of himself and is making fun of people with a differing opinion. I wonder how many 10s of millions he last lost people in equity. There have to be 100s of people that had his bs in the back of their head when they failed to execute purchases 2009-2015.

Marko stop talking Logic it destroys the overall theme of death/crash is just around the corner on here.

I know better than to predict the housing market but I found Victoria a bit overpriced, in terms of value, back in 2013 when I bought. At the moment it seems seriously insane. Again not a prediction but I can easily see a crash of 30% occurring over the next few years. I just dont think it is going to happen over the next six months. Probability of my being wrong is about 90%.

If it happens I do feel really sorry for all the young families that bought starter homes in the last few years.

https://betterdwelling.com/canadian-mortgage-growth-plummets-to-the-lowest-levels-since-2001/

Real story about mortgages.

Re downsizing from experience one the biggest problems is you can’t pocket much cash once you pay commissions, PTT, lawyers, moving costs. People want to sell a dated home and typically they want to buy a newer townhome or condo (often with a view) and there just doesn’t end up being much spread between the two products.

No one really has a mindset of I will sell my 1970s house and I’ll buy a 1970s dated condo.

Two bedroom condo in Paris without a balcony ->

http://www.lodgis.com/en/paris,apartment-for-sale/apartment/LPA19054-rue-de-duras-apartment-paris-8.mod.html

I am sure you can buy a castle in any country in the middle of no where, but then what. It’s like buy a huge house in Campbell River with an ocean view but all your career opportunities are in Vancouverr.

Couple of interesting slashes on nice places in nice hoods. The bleeding continues.

744 Wesley Crt in Cordova Bay slashed $154K to $1.53 million.

3140 Wessex Close on second slash for a total of $189K to $1.39 million.

Little tweet from an economist about liquidity in the Canadian mortgage market…

Somebody asked an interesting question last night and I am hoping that someone here might have the answer or at least know where I can look it up. I know that one can get a demographic breakdown of ages for Oak Bay or Victoria but is there somewhere to get a demographic breakdown of the ages of homeowners as opposed to general population?

The question arose in the context of whether we are are likely to see a significant rise in inventory in the fairly near future due to death and disability.

I have no idea what the answer to this question is and I dont recall ever seeing it in print.

I agree. One thing to keep in mind is the cognitive and physical decline that sets in as one gets older. I have experienced this firsthand with family members. The whole project of moving can simply be too much for an older person to contemplate, let alone execute, so they just stay, even if they can’t maintain their house.

The illogical nature of that inaction has nothing to do with it at that point. If they can’t pay the heat or buy food, that would be a different story.

Wonderment – that could be the ticket!

If it were in West Vancouver and someone bought it last year, they would have lost several million dollars by now, with that number growing by the day.

Incidentally, here is the latest sales/inventory graph for all RE segments in Metro Vancouver:

What’s interesting is that inventory spike isn’t being entirely caused by a surge of new listings. In fact, sellers have pulled back their listings by almost 25% YOY, in a move similar to what we’re seeing here in Victoria. But the scale of the sales drop-off is so much larger in Vancouver, that’s it’s overwhelming that listing deficit and causing inventory to rise anyways.

Why are sellers not listing? I don’t think it’s that mysterious. IMO, it goes back to that US poll I posted earlier, done by Case and Shiller in 2003. It asked sellers what they would do if they couldn’t get the price they wanted, and about 2/3 of them said they’d simply pull the listing and sell when the market picked up again.

I think what we’re seeing is that in action. Sellers are waiting, and hoping to sell into a hot spring market. Whether or not buyers will make that happen, is another story entirely.

@LF

The trick is to stir the Frank’s Hot Sauce or Siracha into some melted butter and then pour it over the popped kernels

If that were here, someone would bulldoze it and build a new house.

@LF, forget France. Check out Bulgaria for cheap property….

Little things affect little minds.

– Benjamin Disraeli

Quite the exhilarating life you live.

Tomato:

Don’t recall opening a thesaurus since high school. But thanks for the compliment.

Look up Disraeli’s quote on name calling. You actually made my evening.

Hawk, you gotta relax. You’re spreading it on a bit thick.

Even though I share you views, I loathe your delivery.

At least your not as condescending as Barrister who is an absolute moron with a thesaurus.

I guess not. I can’t stand most of the rooms’ interior color schemes anyways. But not even the pool? 🙁

If you look at some of the other listings on that site, it’s not the only castle and there are in fact several properties one might fawn over.

I’ll take the Chateau with the pool table and the pony.

Local Fool:

Dont see how that Chateau is any better than than the equivalent priced house in Fairfield.

Just for fun and a little perspective…

A castle on the western coast of France. 11 bedrooms, 3 grand reception rooms, including family accommodation, staff quarters, separate suite, lake, pool & 2 hectares country estate.

Price? ~$1.5 Million CAD.

http://www.frenchestateagents.com/french-property-for-sale/view/63861PH44/chateau-for-sale-in-pontchateau-loire-atlantique-pays-de-la-loire-france

GWAC: I agree that it is an interesting video that raises some questions that need to be examined. Worth watching.

Yup. Buy and hold, baby. Get rich slow.

Citing Garth when discussing real estate is like citing Jenny McCarthy when discussing immunology.

Classic Hawk.

I remember that name from a long time ago. Welcome back to the blog.

Great line.

You, too, would be shitting uncontrollably if, like Hawk, you sold a few years ago thinking prices would tank only to see them increase 40%, costing you probably $250-300K.

https://www.bnnbloomberg.ca/80-of-canadian-boomers-choosing-renos-over-moving-survey-1.1120893

great info in this video especially near the end.

Local Fool:

Glad to hear that you are open to having your often unsubstantiated views dealt with directly and bluntly. But I will make sure that I avoid any possibility of you interpreting

my statements as passive aggressive but clearly stating when I think you are making an idiotic argument. I am sorry that I have caused you any possible confusion in the past.

I second this. The environment is fine here especially for an online forum. No need for any further regulations. Just scroll past to ignore. It’s not that hard. Prepare for counter arguments if you post an opinion.

And nice dig LF. This is where Barrister will complain about his pains and ailments 😉

Interesting article Leo – thank you for posting.

Moving out is hard. Packing up and deciding which of one’s stuff to take and what to get rid of is very hard. It’s easy to say – yeah, I’ll downsize by moving to something smaller but it’s different when the time comes. Many people have inflated views of value for their household goods or have a nostalgic memory which prevents them from getting rid of unused items that take up space.

https://eldersense.com/help-older-people-downsize/

Interesting take and one I would expect. If you can cash out and move to a much cheaper area, why not?

After reading & rereading the article, I’m not sure what to make of it. There are all sorts of numbers and it’s a hodgepodge – 17% of boomers plan to buy in the next 5 years, 25% expect their kids won’t have moved out by age 35 (kinda hard to downsize w/ kids still in the picture).The headline – BC Boomers keen to move on to smaller homes doesn’t seem to be supported by anything but anecdotal. Just because 42% would consider doesn’t mean they actually would.

Jerry #47192

The forum is once again accumulating a thick layer of hawk guano. Any chance the forum could accomodate an “ignore” feature? I’d be willing to pay a subscription fee for such a facility.

<<<<<<<<<<<<

I guess a lot of people are watching the market, Jerry. The comments tend to reflect the market direction.

An ignore feature would be great so I wouldn’t have to see the Jerry’s of the blog who post zero substance.

Interesting that the conservative Wall Street Journal is waking up to BC the money laundering capital of North America.

The Money Laundering Hub On the U.S. Border? It’s Canada

Strict privacy laws, a reluctance among banks to report suspicious activity and weak regulators contribute to low number of convictions

“After a Vancouver-based real-estate agent wired almost $240,000 from Canada’s Bank of Montreal to an account in Boston last year, U.S. authorities swooped in.

They arrested Omid Mashinchi and in January charged him with laundering drug money. Mr. Mashinchi pleaded guilty to the charges in late July in federal court in Massachusetts.

When British Columbia’s attorney general, David Eby, was briefed by law-enforcement officials last year on alleged money laundering in his province, the scale of activity described to him “blew my mind,” Mr. Eby said.

Mr. Eby said he was embarrassed to learn that Australian authorities had even dubbed a common tactic among Chinese gangs, in which illicit money is processed through casinos, as “the Vancouver method.”

https://www.wsj.com/articles/canada-comes-under-fire-for-money-laundering-lapses-1533729600

““I’ve had many clients that have said you don’t really want to go from, say, a 2,400-square-foot house to a 1,200-square-foot condo. That’s a complete lifestyle change.”

Going from that same house to a 2,000-square-foot townhouse with its own front door and neighbours who tend to keep an eye on things in the area is a much easier transition”

I don’t buy the idea that many elderly will sell their single family homes for a slightly smaller townhouse. Unless the maintenance becomes impossible people just stay put until they are forced out.

https://vancouversun.com/news/local-news/b-c-boomers-keen-to-move-on-to-smaller-homes-real-estate-report

She’s not a new poster, just an infrequent one. If it’s an argument on her part, there’s nothing wrong with dissecting it; neither post was a personal or emotionally driven “attack” at all. Sure, it’s a direct scrutiny upon an idea, but that’s part of what this board is about. 🙂

In any case, repeatedly attempting to be some kind of etiquette and blog content martinet while you yourself regularly slip condescending and passive aggressive insults to others is a bit goofy. People are perfectly capable of handling themselves or, making the choice to not respond to inquiries.

An apt analogy, given how much professional ticket scalping companies distort that market.

It just doesn’t follow how FOMO would be irrelevant to primary residences. There’s the added motivator of losing 10’s of thousands to rent, but that doesn’t mean people don’t leap out of fear that they’ll be “priced out forever”. Slimy bobblehead salesmen aren’t going to convince me otherwise.

Wow, that’s a net worth of like, 2 homes.

It’s different here™

Vancouver was a much better place for IT workers in the 1990’s than today. Good job opportunities and far cheaper. Actually it was a much better place for just about everybody.

Just Janice:

Sorry about the rather harsh reception to your comments. Being cranky to a new poster is seriously bad manners. Their lack of social skills might be connected to the fact that they have not left their basements in the last four years.

Is this just your intuition or are you making an argument? What are “many other markets”? How do those other markets “behave” and under what circumstance do they exhibit that particular behavior? What metrics have you observed in VicRE that when compared to these particular markets, sees this market exhibit a consistent and marked difference from those others?

I see what you mean now. I wonder how pervasive that phenomenon is – you never hear of a south to north brain drain, although Americans tend to threaten it on the eve of every election. Well, hope the move works out for them.

Really? I don’t see that. Please elaborate as to what makes this a “different” market. I see buyers & sellers all with similar motivations to other markets. One difference I see (and it’s seems to be a Canadian thing not just limited to Victoria) is that Canadians will stay with a house to the bitter end. In the U.S., there seems to have been more of a willingness to just give up and move on. You can see this stubbornness borne out in people who are willing to live in a house that is in extreme neglect.

It’s a combination of everything. A very large percentage of us who graduated with computer science degrees in the mid 90s bolted to the US. The brain drain was real, but you couldn’t blame us – fresh out of university we were able to make $50/hr USD vs finding a job in Canada that paid $20/hr. And with the advent of the TN visa (NAFTA) we had no issues getting a work permit – you literally showed up at the airport with an offer of employment, a copy of your degree and you were in. But things have changed a lot in 20-25 years. Now a lot are not happy with the political and socioeconomic climate in the US and the IT job markets back in Canada (Vancouver and Toronto specifically) have become much stronger. Then add in that working remotely is now becoming main stream (so you could theoretically even stay with your US employer) and moving back is a real choice. If you have a Canadian employer wages are still not as high as in the US with the heavyweight IT players, but wander over to reddit’s /r/bayarea subreddit and you’ll see just how many people want out of the San Francisco Bay Area due to the out of control costs and quality of life issues. Getting paid $200K per year is enticing for many, but if you’re rent/housing is ultra high and you’re stuck in a rat race where Google/Apple etc do everything they can to keep you on campus working, well it’s novel at first but gets old quick. Lastly add in family considerations and that’s why living and working back in Canada (again, Vancouver and Toronto specifically) is so much more appealing than it used to be.

For what it’s worth, Victoria is a somewhat different creature than many other markets. I’m not saying that it’s immune to price corrections, just that it might not behave in the way that other markets behave under similar circumstances.

The forum is once again accumulating a thick layer of hawk guano. Any chance the forum could accomodate an “ignore” feature? I’d be willing to pay a subscription fee for such a facility.

IMO, the fact that an analyst refuses to make a prediction has little impact on whether they’re worth paying attention to. Predictions are merely the end game of an analysis of metrics. It’s the metrics and substance of the analysis you want to look at. Another way to look at this is, when a scientist submits their paper for peer review, do you think the committee is interested more in the conclusion, or determining the methodology and level of rigor the scientist used in getting to it?

People like Garth Turner occasionally can have valuable insights into certain topics, but then they might put their own spin on it. Identify and toss the spin, and research the insight to see if they’re on to something. Sometimes they are. Sometimes they aren’t. But I never care what someone thinks rates or housing prices will do next year, because I know they’re as clueless as anyone else. Doesn’t mean it isn’t fun and engaging to speculate.

To be clear, this is not about Garth, it’s anyone. It’s all the same principle and it comes down to being able to evaluate data, making best efforts to suss out dubious logic and think for yourself.

The market might evolve, but it’s not going to evaporate and those hoping for price crashes are likely not going to see them. The days of double digit appreciation are likely done though.

Still lots of opportunity – and arguably better opportunities going forward for those taking “the long view”.

Even with a 20% pull back on the market, anyone who will have bought before 2016 is likely to still be “above water”. Further, certain segments of the market might be far more sticky than others.

“For the market to drop 10%, for example, imo we need to be at inventory of 6,000 to 7,000 and sales of around 500/month”

Please show us some proof of those numbers Marko. When I see a salesman whose never experienced a real bear market, I put them in the idiot folder too. Your false facts claim there is a never ending pool of buyers during a major correction and tightening credit market, which is just not true.

ICYMI Marko, the banks are calling for the rates to go up, not Garth, the one who kicked you off his blog for flagrant pumping of your failed mere sales program.

Whenever anyone hints at anything remotely close to being able to predict the direction of the real estate market, or stock market for that matter I immediately throw them in my idiot folder. If one could predict such with a solid degree of success they would be billionaires.

Our friend Garth was positive in 2009 that interest rates would go up substantially….and they haven’t. Interest rates have gone up a bit but now the discount on prime is now upwards of 1.25% so almost a wash.

Y’all didn’t recognize the previous two decent opportunities to buy in the last decade, but I’m sure you’ll nail the next one.

For the market to drop 10%, for example, imo we need to be at inventory of 6,000 to 7,000 and sales of around 500/month. 99% of buyers that are indecisive or looking for that buying opportunity are not going to be pulling the trigger as the situation in their eyes will look like a complete market collapse is just around the corner.

If you didn’t buy from 2011-2014, but were able to do so, not sure how you execute on the buying opportunity next time. The market metrics would have to look way worse to see any sort of drop, but prices will still be higher compared to 2011-2014.

So your credit limit determines your credibility ? Sounds like famous last words to me. Tell that to the sucker who bought in Van a year ago and is down a million.

Everyone thinks their place is worth more than it is, try a $600K plus loss and we’ll see whose crying. I love how the homeowners keep saying “I can handle a X amount of decline”, when there hasn’t been one yet in almost 10 years or have never experienced one in their life. The whining will be something to see when the real correction hits bigtime and reality hits deep.

Meanwhile they put faith in a salesman who says you’ll never be able to buy a condo in the city soon. That’s called a snake oil salesmen for the young and dumb. 😉

@AK — I nearly posted that one as well. Definitely a different sounding ad than we’ve read previously. Plenty of houses now being priced below assessment (for whatever that is worth).

PS VicInvestor, ICYMI the US Fed is predicting higher rates as well as Canadian banks broadcast it daily and have been the last year or more. Your ignorance is beyond belief, but whatever, I’m just the messenger and a lowly renter. Off to the pool for a morning swim. 😉

Via Garth:

“In under a month the cost of money will rise again. Yeah, just weeks after that last increase. It will be the 5th time in a single year, and come at a miserable moment for realtors. B20 wrecked the spring market. Now the BoC will nail the autumn.

The call’s being made by the economists at Scotiabank. Pay attention. These guys have been wicked accurate. They forecast more interest increases by the Bank of Canada on September 5th, December 6th, then twice again in the first half of next year. Thus, in 12 months the bank prime will be 4.7%, five-year mortgages about 4.5% or higher, and the stress test sit at 6.34%. That’s exactly three times the qualifying rate for a fixed-rate home loan just two years earlier.

Since there’s an irrefutable correlation between rates and house prices, this additional increase will reduce available credit, ensure people qualify to borrow less, and reduce real estate values. In other words, it will take courage, stupidity, or both to buy a house in a major Canadian market before next summer. Of course, if you don’t mind paying too much, go ahead.”

https://www.greaterfool.ca/2018/08/06/dont/

Fed’s Barkin says US interest rates need to rise further

“In a speech on the U.S. economy, Barkin argued that the Fed’s benchmark interest rate was below normal levels”

https://www.cnbc.com/2018/08/08/feds-barkin-says-us-interest-rates-need-to-rise-further.html

Hawk is all about noise and no substance. If you read any high quality investment book or listen to any reputable investment guru, you will be told to tune out the noise and think long term. Not only is noise bad for your portfolio, but it’s also very damaging to your psychological well-being.

Hawk: I own a $2+ million 1/2 acre house in the core. I am not one bit worried about a cooling luxury market. I make a solid wage and will hold onto and enjoy my property until I subdivide it and make a killing in 20 years. Unlike you, I think long term. Sure, my house could drop in value by $300k in the next couple of years, but I don’t think anyone could disagree that the land I am sitting on in the core will likely be worth tons more in 20-30 years.

For what its worth, this is the first line of the description for MLS #397260:

“The market has changed, and so have the prices !! Priced bellow assessed value.”

Hawk

The only person Hawk cares about is Hawk so please get off your high horse….

This Saudi thing will all come to an end soon. Only people being punished is his own people. We will find markets for our stuff elsewhere.

Yes gwac, that’s all we need is corrupt red necks back in charge who secretly rig the books. Everyone is milking poor gwac’s wallet while he spews out his dislike for international students who bring in tax dollars.

Did you miss the part about 2000 lost jobs worth $15 billion to Canada gwac ? Faulty logic or what but it’s just a joke and no one cares right ?

These homeowners defending the bubble are hilarious. When I do buy this will be the last place I hang out all day.

Saudi Arabia spat with Canada hits home at armoured vehicle plant in Ontario with 2,000 jobs on the line

Fears grow a $15-billion contract at a London, Ont., plant to make armoured vehicles for Saudi Arabia may be at risk

https://business.financialpost.com/news/economy/spat-with-saudis-hits-home-for-ontario-plant-making-armoured-vehicles-for-regime?video_autoplay=true

Well, I guess our arms market will shrink a little, as well as our clandestine bird-of-prey exports. Too bad for the students that are having their scholarships pulled though. 🙁

I think the real geopolitical threat to Canada and our housing market is uncle Donald and Comrade Xi. Love or hate the former, he’s serious about the trade deficit, even more serious about America First – both of which could have much larger implications for us than a caterwauling prince that’s misplaced his soother.

Hawk

Everything to you is a big deal and is going to send the market down. Always wrong.

Great Bye Felicia to the students and those using our medical system Bye Bye.

Also a few equities yippee. Just shows the rest of the world the prince is a big Baby and stay clear of investing in that country. All about flexing his muscles.

Hopefully this is final straw for Trudeau and the mismanagement of just about everything. The world love affair with him is over thank god. Time to get those conservatives back.

Yep, this Saudi thing is no big deal, no one cares. 😉

Saudi Arabia is disposing of Canadian assets ‘no matter the cost’, FT reports

Saudi Central bank and state pension selling Canadian equities, bonds and cash holdings

https://business.financialpost.com/news/economy/saudi-arabia-sells-off-canadian-assets-as-dispute-escalates-ft

Well said LF. If you are too stupid to get the Chinese are gone for a very long time, then you never got that they are the reason our real estate went stupid the last decade. Take that away and what do you see ? Massive amount of Vancouver houses sitting empty with major slashes, along with Victoria houses over a million bucks locked up and few there to buy them. 20 year lows in sales, and buyers forced out from stress tests that will only increase as rates rise.

You can be like VicInvestor and claim global events have no bearing on Victoria, or you can sit back and see how this plays out over the next year with tarriff wars, US government in turmoil, Saudis ordering students out of Canada, as well the most massive and dangerous debt bomb in history with rising rates never seen in 40 years.

If you think that’s fake, then keep on buying, I care not. All I know is I am in no hurry when the bubble is clearly leaking bad gas.

https://www.myrealtycheck.ca/

While I think MMM has great things to say, I don’t think the FOMO hype of a Vancouver realtor is something he would buy into. I think his suggestion would be:

If you live somewhere too expensive, move. There are lots of great places in the world with job opportunities for motivated people. Don’t flail around debating about the Vancouver condo market.

Well well the separate door article while a satire last week is true in Vancouver.

https://www.theglobeandmail.com/canada/british-columbia/article-vancouver-developments-poor-doors-renew-debate-over-segregation-in/

Truly sensible advice.

Okay, I’ll have a go at this if anyone feels like reading all this.

Owen tries to be balanced, I think. I watch most of his videos because he offers IMO, the most credible telling of the other side. Lauding his investment acumen in as far as RE is a bit questionable – anyone participating in VanRE the last 10+ years has been an automatic genius. Doesn’t mean he has no skill, but it’s something to keep in mind.

The problem with Owen that I see is he doesn’t seem to acknowledge the outside world in which he lives. For instance, Steve Saretzky spends more time talking about macro and geopolitical indicators as well as financial education/principles. From there, he analyses the data. Owen does little of either, certainly not in any real detail.

I get the impression he works more with wealthier clientele, because a lot of what he says is woefully out of touch with the reality of most people who live there. For instance, when he says “get together a 150k-200k down payment” – I mean, that’s a little out there. Some folks can do it, sure. But that’s a small portion of the population. When he’s selling $500,000 condos to hairdressers and says his clients don’t over leverage, you wonder where her money came from. When he’s saying FOMO doesn’t apply to purchasing your PR’s, that is essentially ridiculous and demonstrably untrue.

He also democratises his assertions in an attempt to make them heavier. For instance, he’s saying the window is closing on condo affordability in the core – then he states that his contact in NY, who is “in the know” with VanRE, completely agrees. Except, who cares? Then he says that he was with a cohort of other VanRE and TorRE realtors recently and their opinion on affordability windows closing was “unanimous”. As a matter of logic, it’s a bad way to buttress an argument.

The other thing is you can see him hedging then going back to pumping. In one instance, he’s saying Chinese buyers were “gone” and he didn’t know “if or when they’d be back”. That’s fair to say. But in the next video, they weren’t gone, they were merely “sidelined” waiting for the deals. With West Van detached down 15 to 25% in price, you wonder where they are then, given that’s their target market. Doesn’t really talk about the global retreat of that cohort, either.

He’s even said he doesn’t want to talk to anyone who wants to talk negatively about Vancouver. He absolutely will not go near any “bubble speak” despite widespread concern that it is one. He offers little discussion on how disconnected the prices are from the economy and suggests no concern about what that means for the city’s social fabric or economic competitiveness. He has repeatedly said VanRE is overdue for a “run-of-the-mill” correction, despite the fact that the run up was far from typical, and seems uninterested in financial indicators that do not suggest a run-of-the-mill corrective scenario without huge amounts of new capital suddenly reentering the market.

Owen isn’t balanced – this is why I watch him. It’s his temperament and professional demeanour that makes him sound that way. This is not to say everything he says is wrong, far from it. His suggestion that it’s okay for those hoping for better deals to wait was commendable and very fair. But he’s not there making videos because he’s lonely and wants someone to talk to him. He’s got a business, and he needs to promote himself and his market. So he does.

Sorry, that was long. But you had me thinking, so there it is.

I love to listen to the children bicker but it is such a nice evening that I think I will go for walk.

@Hawk:

I don’t understand how you can just throw in random apple vs eggplant stories here. Really, Turkey’s interest rate? Who cares? You say 7% in a year or two? Ok, I will remember this one and we will talk in 2 years! Your hubris and arrogance is beyond belief. You can’t predict the future Hawk. If you could, you would be a billionaire and wouldn’t waste your time on this blog.

Vic,

You need to get over me bud. I only report the news with links. If you can’t handle the fact the market is bloated and taking on water you should go read the TC feel good articles.

Numbers show it’s a global event beginning to unwind in real estate as rates rise higher than expected and buyers are shut out while the largest debt bomb in history teeters. Those are facts.

See Turkeys rates blasted to over 20%. 7% here is not out of the question in next year or two. That will decimate the market.

For all the Owen Bigland haters, I challenge you to articulate a rational critique of what he says. He has a fairly balanced message. Remember, that the truth is usually in the middle. You can either listen to Bigland, a successful realtor with a net worth likely in the millions, or a paranoid fear-mongering negative personality called Hawk, who will get you nowhere in life. It all reminds me of a great post by Mr Money Moustache:

https://www.mrmoneymustache.com/2014/03/03/why-we-are-not-really-all-doomed/

Honestly:

-don’t be negative and paranoid

-diversify your assets and don’t overleverage

-work on your skills and knowledge, and strengthen your career and relationships

-enjoy life and don’t listen to Hawk

Andy NDP will be done soon enough so not worth arguing.

Hawk trillions if not zillions

Y’all didn’t recognize the previous two decent opportunities to buy in the last decade, but I’m sure you’ll nail the next one.

@ Gwac

Gwac, for about a year being in power, the NDP so far have done way more than the Libs ever did.

Short term rentals – $1000/day strata fines coming on board this fall, bringing it up to $7000/week versus $200/week prior which was just a cost of doing business.

Long term rentals – Four Month Notice to End Tenancy to end a tenancy for demolition, renovation or repair, or conversion.

Eliminated the fixed term lease loophole that let some landlords jack up rents.

Expanded the Foreign buyer tax to more cities in BC.

Put in the spec tax (whether you love it or hate it, at least they listened to the people of BC and did something)

Pre-sale disclosure rules that come into effect this fall.

School tax — this one I’m not a fan of, but it also doesn’t break the bank. Kicks in if your house is worth more than 3M, and only on the portion over 3M and can be deferred if you’re older. If my math’s correct, I think if you own a 3.5M property for example, your extra tax is $1,000/year.

Not bad for 1 year in power so far. Yes, they could do more, yes it’s not perfect, but it’s not bad and I’m impressed that they’re actually trying to follow up on their promises rather than just throw them into the wind.

Gwac, I said they are now burdened with the task of cleaning up the Libs messes, not that they have cleaned up the messes yet… this is going to take some time… ICBC, Hydro, Dirty money, etc

And this is speaking as someone who never voted NDP prior to the last election, and was a Liberal supporter prior. But the Libs messed up so bad, don’t think I’ll ever be able to vote for them again.

Billions of dollars laundered that taxpayers lost out on new hospitals, schools etc is a joke? How long has NDP been in power, barely a year. How long does it take to build a housing project, buy the land, contract out trades, etc etc ? Your excuses are beyond lame.

When Vancouver put together their bid for the 2nd Amazon HQ one selling point was that Vancouver has among the lowest IT salaries in North America. They got a lot of flack for it, but hey you have to sell yourself the best way you can.

https://www.straight.com/life/1034506/bid-vancouver-submitted-amazon-hq-boasts-citys-tech-wages-are-among-lowest-north

NDP need to abolish the owner builder exam and then I might take them seriously 🙂

Not a NDP fan but I don’t mind the 20% foreign buyer tax in Victoria. Does anyone, bear or bull, really have an issue with the tax?

Ottawa action on mortgages have impacted all areas in the country. Not something the NDP has done. Spec tax is not even law and alot areas do not want it.

If the NDP has done SFA on housing then why aren’t prices running rampant? After all there is apparently no more land?

They’ve done at least something and that’s a start

Andy NDP has done SFA so far on housing. No more affordable and probably less than when they came in

What lib messes have they cleaned up. They took tax payers money so they no longer have to collect union money. The casino thing was a joke. No one cares. They have done nothing on housing that has helped. They have kept the hydro project. Nothing on icbc. Nothing on hydro. Made a mess of the pipeline that is costing all taxpayers. NDP done SFA.

Nothing on the drug issue

Every day I see the homeless camp is all NDP ‘s work at doing nothing.

Andy from my reading on here is 30% decline min a lot are looking. Not the 5 to 10% that is potential possible. Unfortunately that decline is or has been eating away by higher interest rates.

Great video. Very logical.

@gwac

I don’t think the bears on here are waiting for a crash, rather just looking for a good opportunity which looks like it’s going to show up sooner rather than later. Take a look at West Van for instance, if you have the cash, there’s opportunities in that market these days and likely will be more as time goes on.

@ Grant

Sorry Grant, not a Bigland fan here either… something off putting about him. Much prefer Steve Saretsky. But each to their own.

@gwac

Lol, Gwac, c’mon… the NDP has put more in motion re: housing issues since being in power than the Libs ever did. Not to mention the NDP also now has the tedious job of cleaning up the Libs messes that we’re all becoming aware of as time goes on…

I wouldn’t feel sorry for the second property holders, with rents almost doubling lately and now getting to renew at rates around 2.5%

I have to re-finance one of my rentals coming up and interestingly enough the increase in interest rates is almost negated as when I re-finance the discount below prime is much higher than it was on my current mortgage.

This blog is awesome….one day Bigland is great the next day he is slickish 🙂

Better question is what does everyone do for a living if they have 15 minutes to watch one of his videos?

Glad he monetized his YouTube channel. Now he is making money of bears too.

Who really wants to live in downtown Vancouver in the first place much less in a tiny condo.Goes to prove you can market almost anything to people.

Believe it or not, not everyone wants to live in a massive 100-year old house.

Some people genuinely love country music and some people genuinely like gangster rap. The market sets how much you pay for concert tickets at each respective venue.

That sounds unusual. If I was in IT, I wouldn’t want to work in Canada, let alone Vancouver. Did I understand what you meant?

Are they wanting to move for friends/family, or are their particular economic prospects actually better in Vancouver?

Grant: “What a petty thing to say. Is it because he’s quite good looking, confident in himself and successful?”

<<<<<<<<<<<<<<<<<<<<<<<

You're last name wouldn't be Bigland, would it?

Lol, Grant, I think the reason that Bigland comes across as slickish is because he talks about the "window of opportunity" wherein he just sold a 500 sq.ft. condo with parking for just under $500,000 to a hairdresser!!!!! This was after he spoke about the possible correction.

That confidence looks like a rattlesnake going after a field mouse.

My preference is for realtors that provide data and a somewhat balanced opinion.

Have you tried Steve Saretsky?

http://vancitycondoguide.com/vancouver-detached-prices-july/

"Detached sales sunk an eye watering 50% below the ten year average for the month of July. To no surprise, this has solved the mysterious supply issue."

"In July, the average sales price declined 16% year-over-year. The median sales price slipped 3% year-over-year. It’s worth noting the median sales price in May registered a 12% decline year- over-year, so you can see how average and median can fluctuate rather drastically. Overall, it’s a safe bet to suggest the typical home is off about 15% from the peak."

Hilarious gwac, you must not read/watch the Canadian news with your head stuck so far….deep in the ground. 😉

Only an idiot would vote for Wee Wilkie, the school boy nerd with no spine and zero charisma.

Coleman and DeJong’s legacy as parties to criminal money laundering operations will be one for the history books.

Glad to hear you are loving Island life Grant!

I think of you every time I drive through Mill Bay.

What a petty thing to say. Is it because he’s quite good looking, confident in himself and successful?

And I completely disagree LF; and I swear you guys are watching a different video. Does he have defensive body language? Nope. Is his language defensive? Nope. Does he address criticisms head on? Yup. And like Leo here on HHV, he’s providing both sides of the story. He specifically thinks we’re near the end of historic bull run. He specifically advises against many types of “pumping” schemes. He specifically says if you want to wait a year or two and rent, and you are qualified and prepared to buy after the market has softened, then “go for it!”. But all of this doesn’t register here on HHV for some reason, probably because it goes against the narrative of most HHV commentators.

Who wants to buy condos in Vancouver? Apparently no one here on HHV. But in my field (IT / Tech) I have friends born in Canada living in the US who are looking at doing just that. My wife and I briefly considered it but we just don’t like condo living or how Vancouver has become something we’re not fans of.

Hawk no one cares about the casino thing, no one cares about the Saudi thing. I am real sure UVIC will find other students real quick. Always something in your mind that is going to send the market down here. Guess what wrong again.

Liberals will be back a lot sooner than ya think. No one care about these stupid waste of money and time reports. Do we even have a government WTF have they done lately??? Seems the NDP has disappeared.

gwac,

How did the casino thing die ? Eby’s just getting revved up for the bigger report on real estate money laundering that will put the BC Libs into extinction til our grandkids vote.

If 10% of those Saudi’s live here and pull up stakes without paying rent, that’s over 1000 rentals easily hitting the market and a lot of sad faced landlords. Since Victoria is in hot demand for schools it could get ugly. I have many families living in my building.

88% of real estate companies lying about fraud is significant unless you’re a criminal too or think crime is a good thing.

Eby troubled by lack of anti-money-laundering compliance in B.C. real estate sector

“B.C. Attorney General David Eby says he is troubled by the continued lack of compliance with anti-money-laundering controls at B.C. real estate firms revealed in the latest deficiency reports.

According to figures obtained by Postmedia News, and reported Monday, Canada’s financial intelligence watchdog found “significant” and “very significant” deficiencies in the money-laundering controls at 88 per cent of 130 real estate entities they examined in B.C. over the last two years.”

https://vancouversun.com/business/local-business/eby-troubled-by-lack-of-anti-money-laundering-compliance-in-b-c-real-estate-sector

Yes, and he’s trying visibly harder to do that, too. He’s dialed it up these last few videos, but this one was actually quite defensive. To say that the phenomenon of FOMO is not applicable when buying a principle residence…sometimes he says things I don’t agree with, but that’s just out to lunch IMO.

Lets revisit this blog next year. That will make 11 years the bears have been wrong. Waiting for the crash and you miss the small downturn we will see in the 1m and below market.

Barrister, I agree. Bigland comes across as a slickish salesman.

Grant:

Bigland seems full of BS. Who really wants to live in downtown Vancouver in the first place much less in a tiny condo.Goes to prove you can market almost anything to people.

“Let’s revisit this thread in a year or two; maybe then you’ll see that the two cities are linked and that Vic does indeed follow Van’s lead, just like the Fraser Valley and Squamish both follow Van’s lead. And here on the island, up island follows Vic’s lead. You can also see this pattern by taking the time to look at the stats over a multi year period, in these different towns.

When Vancouver becomes too expensive, people move out (to Vic, to up island, to the Okanagan, to Prince George etc etc). If Vancouver retracts, people move back or they won’t leave in the first place”

This exactly! Of course it is all linked. It is funny how a lot of my friends up island are talking about investment properties, recreational properties, moving up the property ladder, people from Victoria moving up island etc. Real estate talk is everywhere reminiscent of Victoria 2016. I have victoria and Vancouver friends talking about moving up island but I suspect it’s a bit too late. I am so surprised to see the prices in Nanaimo, Courtney, Parksville, Duncan/Cowichan/Mill Bay and Port Alberni. It seems surreal and the prices don’t look too bad in Victoria or Langford when you look at the prices of these communities with less access to good jobs. I have a co-worker quitting her government job to move up island into a job with zero stability and benefits. Not saying this is a bad decision on her end for various reasons but she is paying top dollar for a house that was half the price 3 years ago. It just seems like there is a lot at stake in these communities that don’t have a solid economy. If I owned in any of the “ports” or “rivers” I would probably sell now and rent. I know from experience that these communities can be hit HARD. There is too much money floating around out there!

I am still looking for a house but to be honest I don’t think I can bite the bullet even if I found a good one. With the cost of borrowing going up it just seems sketchy as prices haven’t gone down yet but the monthly cost has gone up. It’s suddenly not monopoly money any more when you see Toronto and Vancouver prices going down and rates rising. I just took a look at house rentals and there are some good ones out there if you can afford >$2500/month. I think it’s better to stick it out a few years and see what happens at this point. I guess I’m sort of timing the market but I think it might get nasty out there and I don’t want to be a part of it! I also love seeing my investments make money $$$ Although I wish I had a house as well but I missed that boat.

I’m not sure how everybody else on HHV spent their weekend, but we were out kayaking in Mill Bay and then multiple times we went picking the biggest, juiciest, OMG SWEETEST blackberries I’ve ever had. And they are bloody everywhere! Island life is fantastic so far!

Owen Bigland’s latest:

“Buying Your Principal Residence is Never FOMO”

https://www.youtube.com/watch?v=HiyiubEzU98&t=0s

All weekly numbers are cumulative for the month because that’s how VREB releases the data. Not really ideal from a data perspective, so I will be moving away from this system in the future.

Hey Leo

Great post.

Question about the “new listings” number. In the July 23rd market update the “new listings” increased substantially from week to week as the month progressed.

How are these “new listings” collated, is that a cumulative number for the month or is that the new listings that go onto the MLS every week?

https://househuntvictoria.ca/2018/07/23/july-23-market-update/