July: Single Family Enters Balanced Market

July numbers are out, and it’s an interesting market out there that is difficult to pin down exactly. First of all, the headline numbers: Sales overall (of all property types) are down 18% from last July while inventory is up 36%. Those are less tragic numbers than June where we had a 30% slump in sales. Prices meanwhile are up as expected with the median single family house going for $800,000 (up $20,000 from June) while the median condo traded hands at $415,000 (up $15,000). The VREB press release is saying that the market for homes under $750,000 is red hot while only luxury properties languish.

So, all good news then? The market is digesting the policy changes and bouncing back? Let’s dig a little deeper to find out starting with sales.

Before we can compare sales, we really need to figure out how many of those 651 properties that changed hands in July we really care about. It’s important to realize that that figure actually includes sales of:

- Commercial and industrial properties

- Properties that sold in the past but weren’t reported until July

- Properties outside of Greater Victoria that were listed in the VREB database.

What does the sale of some office space in Vic west or a cabin on Lake Cowichan have to do with Victoria real estate? Basically nothing. Especially when the board is actively increasing collaboration with the Vancouver Island Real Estate Board and we are likely to see more of these cross-listed properties. So we aren’t going to get a lot smarter by looking at overall sales, when most people are really interested in the Victoria area (Core, Westshore, and Peninsula).

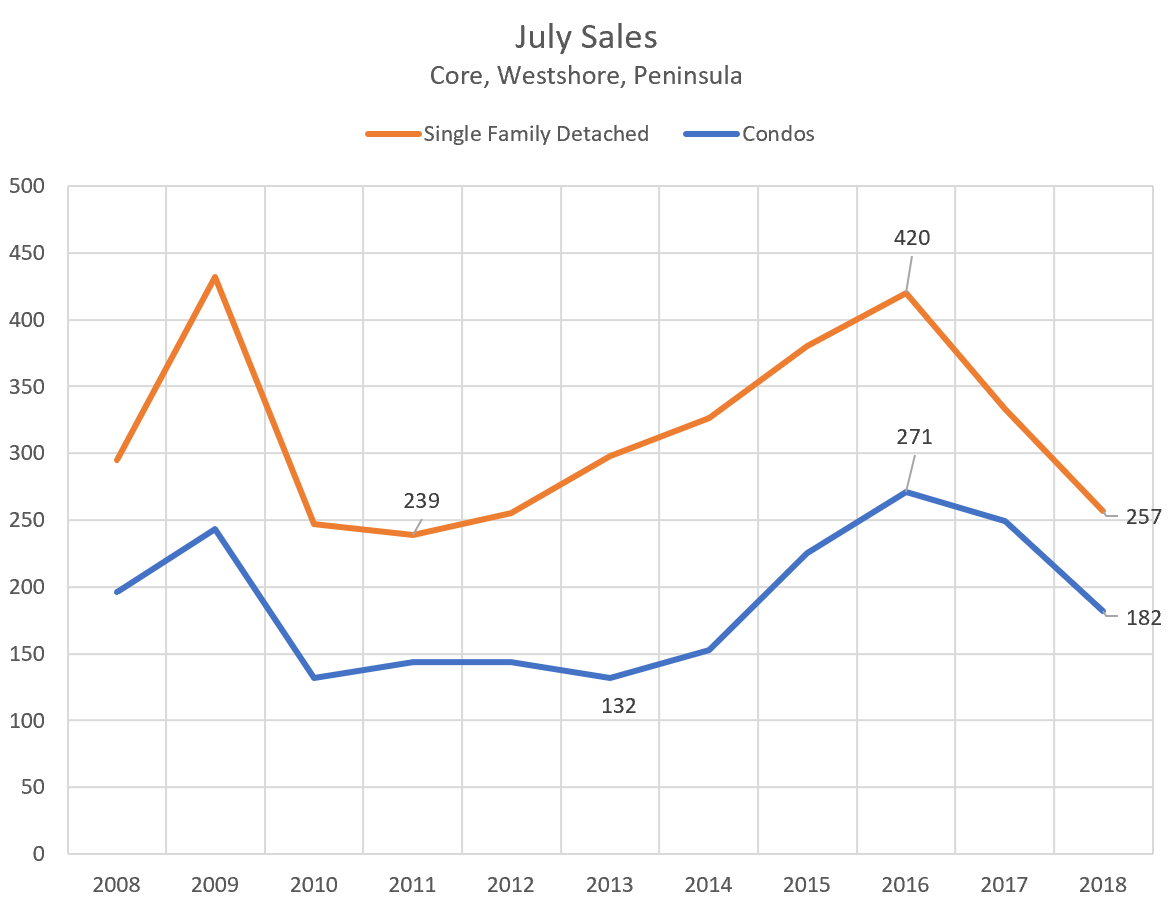

Here are the sales in that region.

Single family sales are back down to the levels of 2010 – 2012 when the market was very slow, just above the 10 year low of 239 sales in June 2011. Condo sales are meanwhile around middle of the road, just below the 10 year July average of 188 sales.

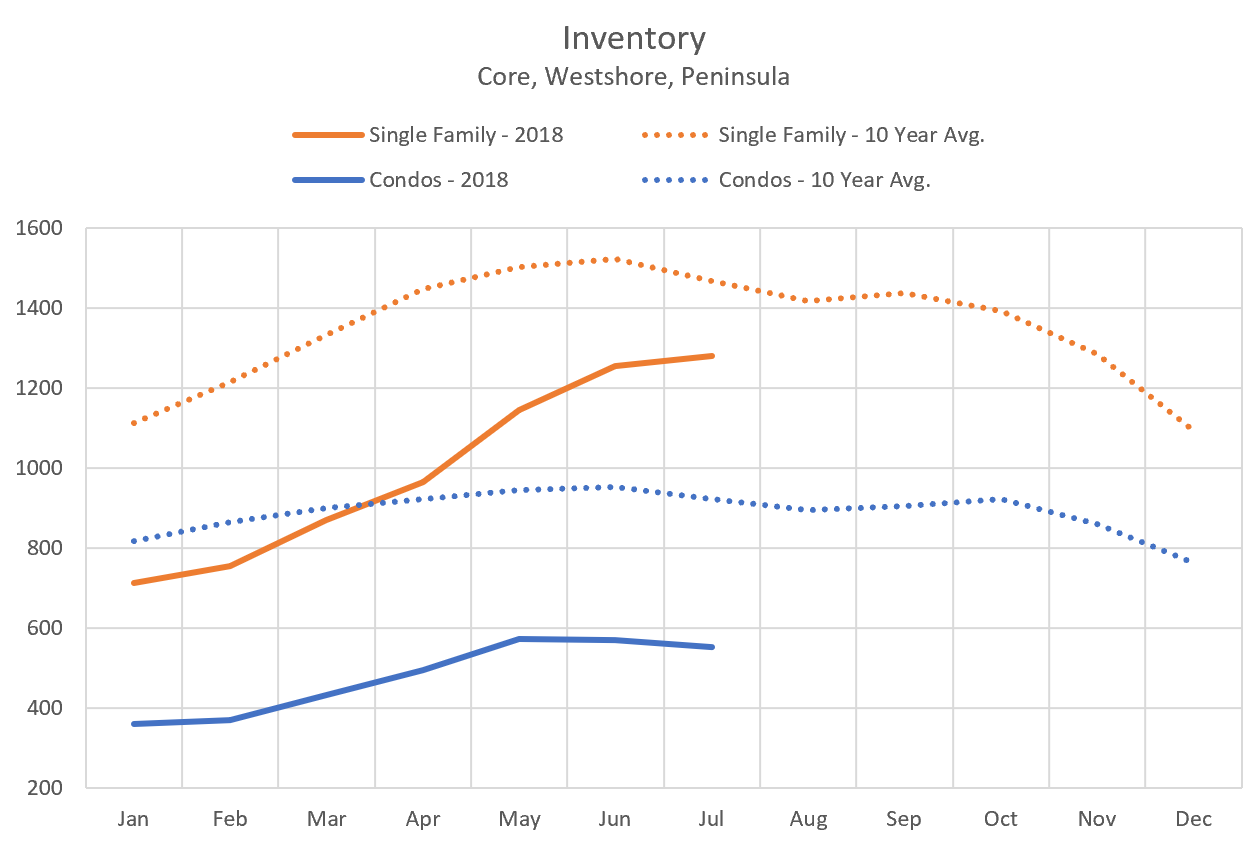

Looking at inventory, both single family and condo inventories are still depressed. Due to slow sales, single family inventory is quickly closing the gap on the 10 year average, while condo inventories are following more normal seasonal trends, well below normal levels.

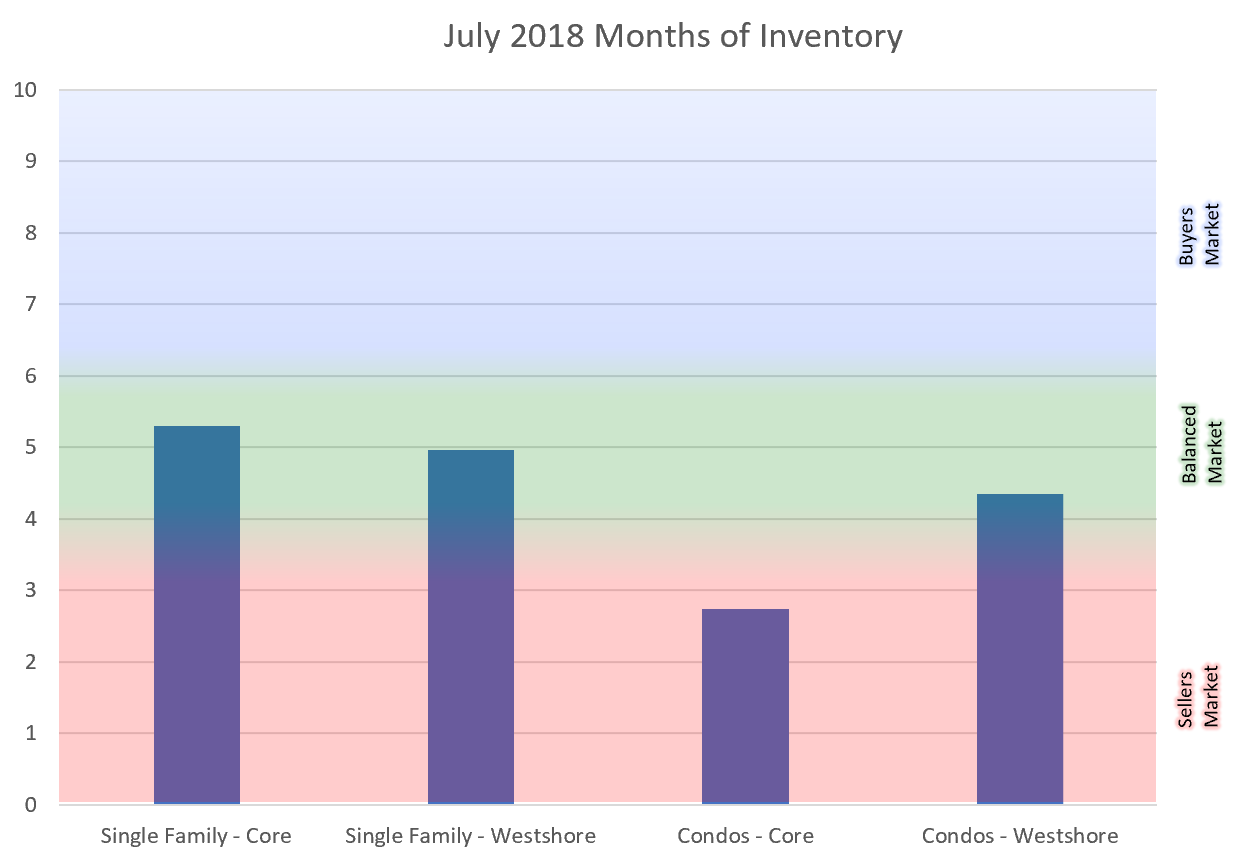

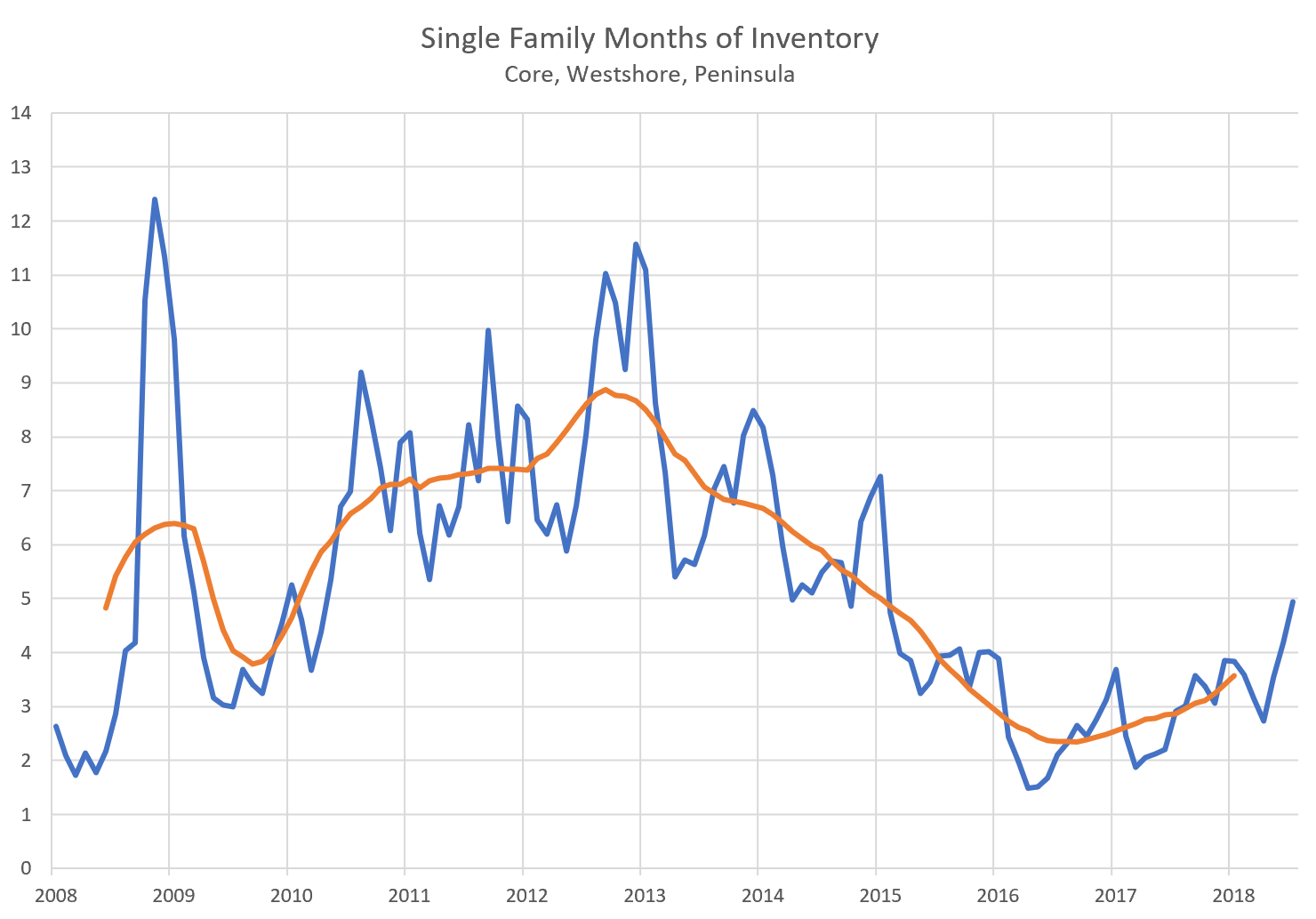

What does it all add up to? Months of inventory is a measure of the overall market balance, with values between 4 and 6 indicating a balanced market. For the last couple years we have been in an extreme sellers market, but in July we moved into an overall balanced range for single family homes in the core and the westshore. Condos in the core are still in a sellers market, while condos in the westshore are more balanced.

Prices are trundling along, roughly flat in 2018. The market is still moving well enough that there isn’t any significant overall downward price pressure. We shouldn’t expect that until months of inventory goes to 7 or higher.

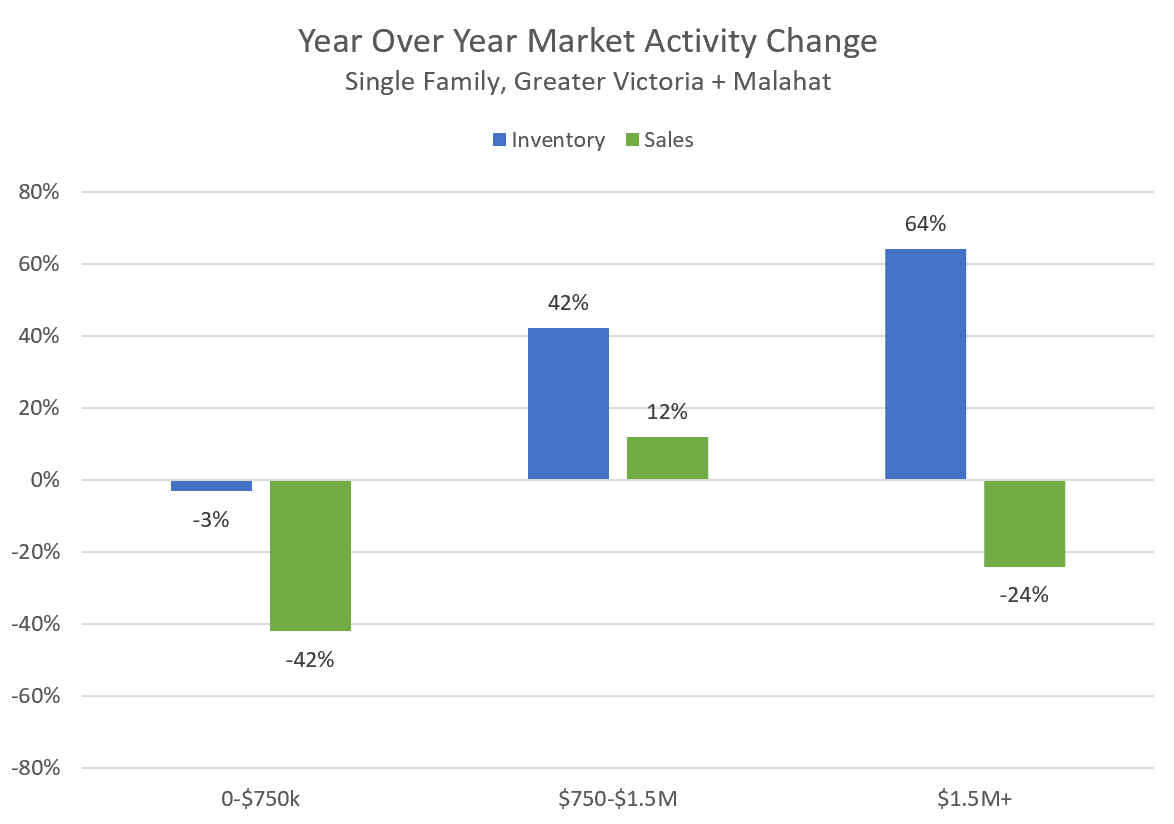

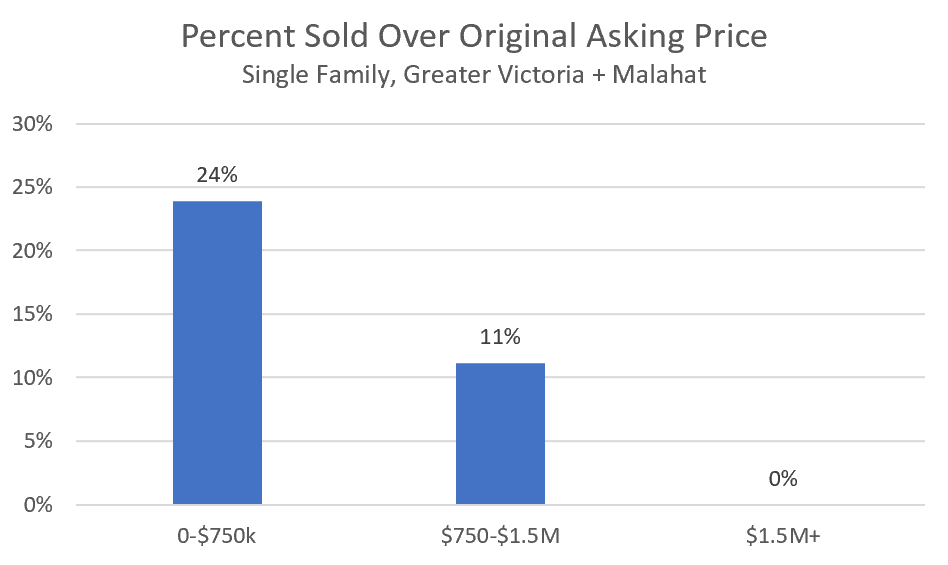

However let’s take a closer look at that VREB press release which states that the low end single family market (defined by them as $750,000 or less) is red hot with “30 per cent fewer homes listed for sale under $750,000 than this time last year” and in the Core and Malahat “47% sold at or over list price”. So is this slowdown really confined to luxury properties? Is the market as hot as ever for us commoners that cannot afford a multi-million dollar property?

Well here is where it gets confusing. I’ve pulled the numbers and cannot match that data at all. Here is the comparison between July 2018 and 2017 on active listings and sales for the entire region (including the Gulf Islands and Malahat):

Yes, active listings are down (by 3%) in the under $750,000 segment, but that’s a far cry from a 30% decline, and meanwhile sales have decreased by 42%. I’ve reached out to the board for on this and they have clarified that the 30% decline refers to new listings not active listings as I had assumed and the comparison period is year to date (January to July). By the definition, there were indeed 30% fewer new listings from January 1 to July 31, 2018 compared to the same period in 2017. Precise language is important folks!

The mid-priced section has seen inventory grow by 42% (but sales are up year over year) while listings in the high end have increased the most with sales dropping by a quarter. What about properties going over ask? I’m not a fan of the “at or over ask” category since that a bidding war is quite a different situation than a sale at asking price, so here are the over asking price sales by price range.

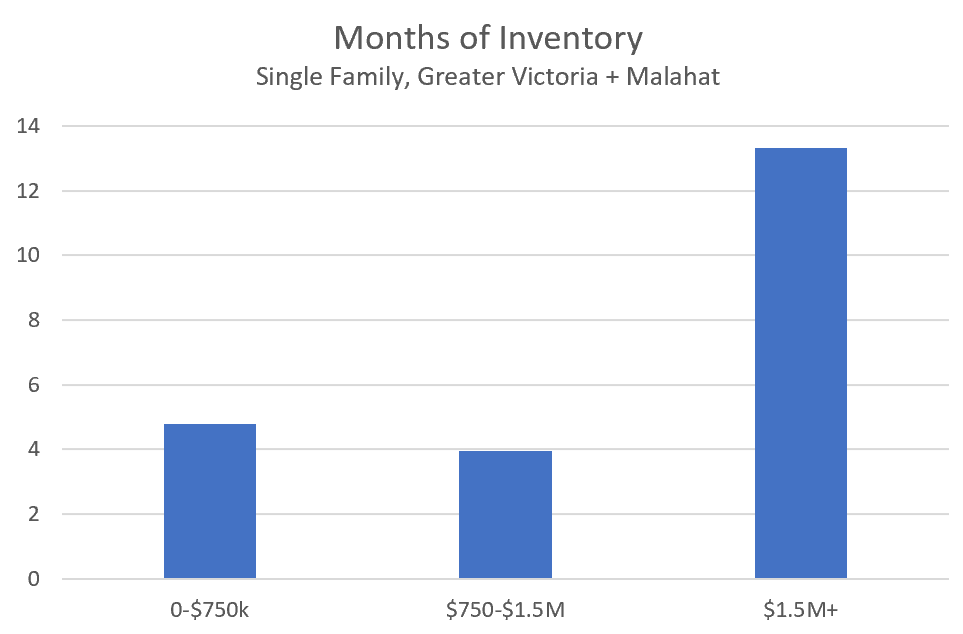

The lower end is certainly where over-ask sales are the most common, but that is largely due to this strategy being more common in that price range. No one sets up a mansion to sell in a bidding war on the weekend. The months of inventory by price range show us that the mid range is actually the most active, with the low end approaching a balanced market, and the high end slow.

There are other interesting questions about the market, like why new listings are at their lowest point in years, or whether this slowdown is slowly being digested by the market. I’ll leave that for the next article.

How long will these insane prices go on? If the foreign buyers already left, then this is a delusional market. If this goes on for much longer it is doomed.. leaving this city

gwac,

How did the casino thing die ? Eby’s just getting revved up for the bigger report on real estate money laundering that will put the BC Libs into extinction til our grandkids vote.

If 10% of those Saudi’s live here and pull up stakes without paying rent, that’s over 1000 rentals easily hitting the market and a lot of sad faced landlords. Since Victoria is in hot demand for schools it could get ugly. I have many families living in my building.

88% of real estate companies lying about fraud is significant unless you’re a criminal too or think crime is a good thing.

Eby troubled by lack of anti-money-laundering compliance in B.C. real estate sector

“B.C. Attorney General David Eby says he is troubled by the continued lack of compliance with anti-money-laundering controls at B.C. real estate firms revealed in the latest deficiency reports.

According to figures obtained by Postmedia News, and reported Monday, Canada’s financial intelligence watchdog found “significant” and “very significant” deficiencies in the money-laundering controls at 88 per cent of 130 real estate entities they examined in B.C. over the last two years.”

https://vancouversun.com/business/local-business/eby-troubled-by-lack-of-anti-money-laundering-compliance-in-b-c-real-estate-sector

Yes, but that kind of goes back to the conversation about the degree of connectedness between the two markets. Victoria is a secondary, regional market to Vancouver. I don’t believe what happens in Vancouver, especially if it’s significant, doesn’t eventually effect here in some way.

Because the scale of the run up there was among the most extreme in the world, its potential downside can’t really be considered irrelevant to us on the Island. If not via home prices directly, the wider drag on the economy that a downturn on the mainland causes. We’d all feel it in home prices, employment, etc. It just depends how significant it is.

Just keep your popcorn hot, I guess. But don’t put Frank’s Red Hot on it. Tried that last week on a recommendation. Soggy and disgusting.

Hawk

The Saudi thing is another non event. Just like the Casino as I said would happen. It will die in the next week. No one cares after the headlines die.

Nice to see you rev up again. Its cute….

Local

Victoria is what is important not Vancouver not Toronto not Windsor. Victoria…

From the BD article below. I thought that was a really salient point. What you’ve seen going on in Vancouver was not about houses or land. It was about an asset class flavor-of-the-day that was exploding in value. Its merit was just this; little else. It could have been toothpaste lids, soybeans, coyote skins or tulips.

When that smoke clears and the asset is no longer in vogue, you’re left with nothing more than run-of-the-mill, yet exorbitantly expensive, shelter. Yet that shelter remains what it always was: four walls and a roof. Doesn’t sound so sexy then, does it.

Further, while the percentage decline is currently slight, you have to keep that into perspective. The sheer volume of liquidity it took to drive the prices up the the level they got to was absolutely gargantuan in scale. And now, that tidal wave is shutting off. If VanRE has to be supported by its own, relatively small economy, it’s not going to be an easy adjustment to put it mildly.

Okay, though you’re getting increasingly late in the game to be chuckling it off. There are a lot of people already in trouble. A few of them have already lost millions, many others are losing hundreds of thousands. This isn’t just in West Vancouver, this phenomenon is growing all over the mainland. And if it continues, very few people here or there will be laughing.

Looks like some rentals coming open. Better grab an extra bag of popcorn gwac… and some Pepto. 😉

Saudi Arabia withdrawing students from Canadian schools, suspending flights

“A Saudi government source, who wasn’t authorized to speak publicly on the matter, said on Monday more than 15,000 Saudis study in Canada on scholarships, grants or in trainee programs funded by Riyadh. Accompanying family members bring the number to 20,000 or more.”

https://www.theglobeandmail.com/canada/article-saudi-arabia-to-withdraw-all-saudi-students-studying-at-canadian/

The Vancouver Detached Real Estate Market Officially Plunges Into Negative Territory

“This isn’t Vancouver West, or Vancouver East – it’s the general region. The relatively minor decline may not seem like much, but could have a big psychological impact on buyers.”

“New detached listings are slowing down across Greater Vancouver. REBGV reported 1,723 new detached listings in July, down 18.5% from the month before. This represents a 21.7% decline compared to the same month last year. Despite the decline in new listings, sales declined much more. This resulted in a significantly higher total inventory.”

https://betterdwelling.com/city/vancouver/the-vancouver-detached-real-estate-market-officially-plunges-into-negative-territory/

Rents doubled ? When Mike ? Mine went up $40 this year with a nice pool to cool off in the heat wave to boot.

I wonder how many negative monthly equity landlords will get the stress test and denied refinancing ? Many I would bet.

Seattle showing major weakness. Bulls in denial is pretty funny. 🙂

More Seattle-area home sellers lower list prices as market cools way down

King County home prices have fallen from the peak reached earlier in the year as home sales hit their lowest point for the month of July since the market bottomed out in 2012.

Lol

yep there going to be a lot of pain coming. The pain is from you all waiting for a crash AGAIN.

Fun to watch all the excitement….Got a big bag of popcorn for the show….

I tend to side with Steve’s analysis: the RE market is turning over, and Victoria is no different.

The Victoria market has a strong correlation to the Vancouver market. Just as the Canadian economy has a strong correlation to the US economy.

We used to say, “when the US gets the sniffles, Canada gets the flu”.

To go from a sell’s market to a buyer’s market, the journey necessarily entails crossing through a “balanced” market. That said, the direction is down, not up.

There rarely is. As has been said here, most downturns occur during a chronic “shortage”.

What types of property will fire sell in down turn?

Condos (cash neg), Acreage (money pit), McMansion (again money pit, won’t age well), Sooke & over the Hat (location x3)

Everyone wants a “starter” – SFH in core, 20 min from DT, ~5000 sqft lot, ~2000 sqft living space, 3beds upper, newish kitchen, suite(!) etc. I highly doubt “starter” homes that 1st time buyers are looking for will drop much in any part of the cycle.

I wouldn’t feel sorry for the second property holders, with rents almost doubling lately and now getting to renew at rates around 2.5%.

https://www.ratehub.ca/best-mortgage-rates/5-year/variable

Having lived through 2 pretty severe downturns in the U.S., what I remember most is that the first signs of a serious crack in the dam was when those who were juggling more than one property realized that values were no longer increasing. I remember a story in the Washington Post (around early 2006) about a realtor who had 7 investment condos and was stretched thin each month. As with so many in the region, she was banking on that big growth in value we’d been seeing. Any one of condos vacant for a month meant she was out of pocket. Add to that the slowdown in house sales and she wasn’t earning an income as a realtor. She eventually put all 7 investment condos up for sale and when those didn’t sell, she went bankrupt.

In both downturns, I don’t recall big inventory. Maybe there was and I just didn’t pay much attention. What you did have was desperate sellers – divorce, death, job transfer, bankruptcy. These are the types of transactions that forced the price of homes down.

When things down south look bad, it’s inevitable what’s going to happen here with no secret bailouts this time around.

The U.S. Housing Market Looks Headed for Its Worst Slowdown in Years

‘Affordability is becoming a headache for homebuyers’

https://www.bloomberg.com/news/articles/2018-07-26/american-housing-market-is-showing-signs-of-running-out-of-steam

Dasmo,

It’s more like the stock market than it ever has been. Houses are traded like commodities and stocks all the time now. People spend more time picking out a pair of shoes or a new TV than they do a house. You can get a mortgage over the phone now or walking into a grocery store, or mall.

I can only imagine how many are sitting on a big regret right now waiting for the push to hit the sell button. As Patriotz says, the wannabe landlords losing by the month will be the first. We know the majority of the flippers have been flushed out, the landlords and those in deep are next.

What`s preventing people from selling

In my opinion, another trigger to sell is when rental properties become vacant.

As construction slows down, most of the itinerant workers will leave Victoria for work opportunities elsewhere. A rising vacancy rate and longer lease up periods will be a catalyst to sell for some landlords.

As a side note, while social housing is important to the government a rising unemployment rate is a bigger concern. That’s why most social housing projects will not be cancelled even though there might be a future glut of rentals in the marketplace. The government would be trying to spend its way out of a housing recession.

Exception being cash flow negative landlords, whose only reason to continue owning is rising prices.

yup, keep waiting for the the Big Crash.™

I envy the bears, they are immortal animals. Just keep waiting, and waiting, and waiting….

No one (we’ll almost) watches the market and suddenly wants to sell wen the market turns. This ain’t the stock market!

”What’s preventing people from selling?”

Mental turmoil.

People (potential sellers) who are strung-out will get by for many more months yet before they start to panic. The first stage is denial with mental turmoil. People deny that the market will drop significantly until they realize their paper profits are slowly being eroded by expenses and price reductions.

In about 18 months, late January 2020, when BC Assessment notices are received and people are shocked that their property values have declined and property sales are averaging less than assessed values, and the ensuing spring rush is a bust, then panic will bring many more properties to market, but I predict not many will sell, so MOI will rapidly climb and price declines will accelerate.

Autumn of 2020 will be when all the factors preventing people from selling are replaced with all the factors that are forcing people to sell.

Via Craigslist Victoria RE… signs of a changing of the tide?

Exclusive Zero Down Payment Opportunity*

https://victoria.craigslist.ca/reb/d/ideal-for-large-families/6664076120.html

and this title is my favorite so far…. 😉

Built by experienced Builder who has been building homes

Exclusive Zero Down Payment Opportunity* PRICE REDUCED!!

https://victoria.craigslist.ca/reb/d/built-by-experienced-builder/6663636637.html

Most people live in their homes or are renting them out for a while now. Perhaps they aren’t selling because they are simply living…. The market only really affects those in it….

Saw Marko in his red BMW on Saturday? He made eye contact with me. It was a thing I think.

@Introvert

Let’s revisit this thread in a year or two; maybe then you’ll see that the two cities are linked and that Vic does indeed follow Van’s lead, just like the Fraser Valley and Squamish both follow Van’s lead. And here on the island, up island follows Vic’s lead. You can also see this pattern by taking the time to look at the stats over a multi year period, in these different towns.

When Vancouver becomes too expensive, people move out (to Vic, to up island, to the Okanagan, to Prince George etc etc). If Vancouver retracts, people move back or they won’t leave in the first place.

LF,

It’s a tough gig when you have to defend developers for living. 😉

Vancouver, Toronto housing slowdown takes toll on Canada’s economic growth

Falling home sales in Toronto and Vancouver this year are reverberating throughout the economies in both regions, pulling down broader economic growth in Canada.

Residential real estate activity – including resales of existing homes, construction of new homes and home renovation – accounts for about 7 per cent of national gross domestic product on a direct basis, and a significant drop in resale activity this year is cutting GDP growth forecasts, economists say. The spinoff effects of a real estate slowdown, such as reduced spending on furniture and appliances, will amplify the impact.

Bank of Montreal senior economist Robert Kavcic said the decline in [realtor] commissions cut one-10th of a percentage point off of GDP in the first five months of 2018, according to Statistics Canada data. “We’ve seen retail spending in areas like home-improvement stores and those types of places come down noticeably in the past six months or so,” Mr. Kavcic said.

https://outline.com/4uUCdc

One word. Greed.

I don’t think there’s been enough time yet. Plenty of folks still have no idea anything’s changed or if they do, aren’t making anything of it. People seem to have an impression that sales slow and boom, everyone runs to the exits and inventory skyrockets. That’s usually not the case, as you know. If this slowdown continues, spring time could get more interesting but I’m not guessing panic will ensue this year.

I don’t think it’s that simple. If I understand you and we play that out, then the downturn proceeding a market peak wouldn’t be noticed by the construction sector, as the pre-peak demand would keep them going for years afterwards. And we can see clearly, that doesn’t happen – demand on the industry grows rapidly, construction activity almost explodes, peaks, then drops off precipitously when demand slides soon after. You don’t have a substantial market downturn and the construction sector thereafter saying, “what downturn?”

If there’s a major turn in the local market, the customers just cancel the orders. In fact, that can happen midway through a project. It’s not pretty, but it’s good at employing lawyers, arbitrators and judges. This city has seen plenty of empty holes last for years, some even longer.

What is least understood is that housing supply and housing stock are two different things.

My impression as well from talking to builders and engineers. Everyone swamped for forseeable future. Maybe some slight slowdown on new bids, but the existing work takes them a couple years out so unless there is a global crisis that kills projects, they will be fine.

Yup. And a big part of affordable housing is lesser quality. Endlessly appreciating prices allows people to pack in luxury, but good enough is good enough. I live in a slapped together house from the 70s that looks the same as every other house within a few clicks. House has no issues and doesn’t lower my quality of life one iota.

What’s the margin then? Never seen anything but guesses.

Better system for sure, but do consumers make better decisions? I actually don’t think en masse they do.

Same way the Duncan market is connected to ours and any market is connected to any other to a degree specified by how interchangeable the product is. If prices are too high in Victoria, more people will buy in Duncan and commute. If prices drop in Vancouver, fewer people will be able to sell and retire here. If prices drop in Toronto, more people will move from Vancouver, etc. The more barriers to interchangeability (for example there are bigger barriers between Seattle and here because of the border) the less connected the markets are, but there is always some connection.

Perhaps potential for the new NAFTA deal here????

One of the most interesting and least discussed and understood areas of real estate markets is the supply side. We saw in a number of US markets that were exceedingly undersupplied during the price runup with limited inventory that the listings came out of the woodwork once prices started dropping. Very little has been written about this phenomenon and how to identify markets where this hidden inventory exists.

Also the new listings story is mysterious in Victoria. Why are new listings down despite theories around a slower market encouraging move up buyers and spec tax possibly encouraging some to liquidate investment properties? What’s preventing people from selling?

Just too many limitations. A steel frame just isn’t great for energy efficiency so you end up either insulating the outside and building an entire house frame around the container, or you insulate the inside and take up already limited space.

Still think that strategy was absolutely brilliant. People love the idea of ALR because they think it means some grass and maybe a fluffy sheep or a not too loud variety of blueberries. Put a real farm on the land and they quickly change their mind.

On the topic of golf courses, Cedar Hill GC is a beautiful piece of land. Love walking around there. That said the golf course is meaningless to me and it would be even better as a mix of a bit of housing in certain corners and a wilder public use park.

I always wasn’t around when the Titanic sank; therefore, it would be impossible for me to comprehend the dangerous of the great seas.

You’ll get your chance to see it soon.

Any day now.

Non sequitur. You cannot compare the economic realities faced by construction workers (an inherently feast/famine sector) versus that faced by government workers (a typically constant sector). Now if the downturn got very, very severe, then government could look at hiring freezes, reduction through attrition or several other means; layoffs are typically the last thing done. Most of the changes currently occurring in government are via demographics, not economic cycles.

Have you ever seen or studied a downturn, even a moderate one? All he’s saying is that as construction demand falls, so do labor and supply costs. It’s not a controversial or complicated proposition.

Realtors and industry beneficiaries have for years argued that rapidly rising prices are due to supply and demand imbalances. Now that demand may be sloughing off, you can’t simply downplay or dismiss that dynamic by suggesting a downturn will have little to no effect on the construction industry.

That’s not a reason to feign ignorance of how markets move through cycles and how it can effect surrounding economic sectors. You have the same access to data as anyone else, whether you’re 20 years old or 200.

You’ll get your chance to see it soon. Rates going up another 2 points plus stress test up another 2 to 7% will have the same effect as the 13% /14% rates in 1982 going to 19% with a massive credit/debt bomb that didn’t exist back then.

Ooops, forgive Marko as he’s only been on a one way train and is clueless what a real bear market is in real estate.

1982 was before my time unfortunately.

Ooops, forgive Marko as he’s only been on a one way train and is clueless what a real bear market is in real estate. When the majority of the massive non-union construction workers have their wages whacked it will be a sad sight. Been there, seen it.

More and more middle management jobs and regular public employees jobs are being eliminated as they retire and departments downsize. That’s nothing new.

Tech is a wild card that tariffs could crush the sector as Trump continues to lose his sanity.

“Q: How many construction workers are actually unionized in B. C.?

A: Both the union and non-union sides have produced competing numbers. B.C. Building Trades says its 40,000 unionized members make up 58 per cent of qualified non-residential trades. But this only counts the type of trades that can build highways and bridges. The Independent Contractors and Businesses Association says if you look at the total number of construction jobs in B.C. (roughly 250,000) the unionized rate falls to 16 per cent.”

Marko: *For sure. All the middle management government employees and Android app developers in town pulling in 70-110k will continue to thrive and a skilled carpenter/framer will be installing trusses three floors off the ground in the rain for 40k/year begging for work.

I am literally LOLing.*

<<<<<<<<<<<<<<<<<<<<<<<<<

Marko, as a kid, did your parents often ask you what you were laughing about?

Out of 11 categories, trades managed to make number 8 on the list of average Canadian wages in 2016.

So, yes, that carpenter/framer will be installing trusses three floors off the ground in the rain for 40k/year begging for work, especially considering that their average wage in 2016 was $51,700.

I'm also quite sure that they may work more than 2000 hrs. per year when the market is hot and may even demand more in terms of hourly wage but …

https://globalnews.ca/news/3531614/average-hourly-wage-canada-stagnant/

?

?

Bang on Ooops. Most don’t get that trades wages will get smoked in a major correction/crash. All those whining about no tradesmen will have their pick of the litter.

For sure. All the middle management government employees and Android app developers in town pulling in 70-110k will continue to thrive and a skilled carpenter/framer will be installing trusses three floors off the ground in the rain for 40k/year begging for work.

I am literally LOLing.

Bulls will have a cardiac. Never underestimate the unexpected.

Jamie Dimon cautions the 10-year Treasury yield could hit 5%: ‘It’s a higher probability than most people think’

“I think rates should be 4 percent today,” Dimon says. “You better be prepared to deal with rates 5 percent or higher.”

J.P. Morgan Chase chief Jamie Dimon says people should prepare for U.S. yields of 5 percent, warning investors that borrowing costs throughout the economy are likely to rise beyond even his prior forecasts.

https://www.cnbc.com/2018/08/06/jp-morgans-jamie-dimon-cautions-10-year-treasury-note-rate-to-hit-5-percent.html

Bang on Ooops. Most don’t get that trades wages will get smoked in a major correction/crash. All those whining about no tradesmen will have their pick of the litter.

With lumber and copper tanking the builders will have no choice but to slash prices as well.

Interesting how the Chinese have left Seattle now too with the loot. Along with the coming tariff wars it’s bound to soon teach a few more some hard financial lessons on how gravity works.

Seattle housing market is under pressure as Chinese buying ‘dries up’

https://www.cnbc.com/2018/08/02/seattle-housing-market-is-under-pressure-as-chinese-buying-dries-up.html

Sweethome, We were interested in “4253 Oakview” after watching it drop 150k until our realtor told us the listing realtors called her before our second viewing and said they had an offer they declined and they had so much interest in the place they were taking offers at 5pm on Sunday. I’m thinking trade war, overtype of tax, law and policy of these governments trying to slash prices, and prices plummeting and I’m getting shilled by these realtors? No thanks, we moved on! Be interesting to know if it sells based on their tactics. Most used term by realtors now is “Low Ball” it’s the “Fake news” of the delusional.

A couple of points. First it’s only fixed until the next upturn. Second you want to keep trades people working – this will encourage the long term growth of labour in construction rather than feast or famine.

There will never be a point in time when you cannot truly say “It’s different now than before”. The particulars are always “different”. Particular circumstances, the actors within those circumstances, the timelines of circumstances, the pervasiveness of circumstances, all ebb and flow over time. It’s not really saying anything. The overall oscillation in themes don’t really change though, from cycles in housing, business, credit, wealth distribution and even war. It’s the underpinning for sayings like, “History doesn’t repeat itself, but it often rhymes”, and, “the more things change the more they remain the same”.

I know you think “this time is different”, we’ve “turned a corner” and “we’re not going back.” But that’s always true, and it’s what they said in the 80’s here and almost anywhere else in similar circumstances. The term here back then wasn’t so much “globalization”, but “interconnected markets”. Victoria was unstoppable, it was becoming a “coast class city”, a large regional tech hub…and do you know that they similarly said land was scarce, too? A few fascinating minutes in archives or hearing from people that were there, will tell you how repetitive these themes are. 1990 was the same story, right across Canada.

I can certainly agree things aren’t like the 1980s. Then, people piled into housing to hedge inflation, then as a means of getting rich. More recently, people piled into housing to find yield somewhere, and then again, as a means of getting rich. You have far more “innovation” in financing today, systemic global debt imbalances on a scale the world has never seen, and a Canadian consumer that has never seen their debt levels rise so far, so fast. And that’s not even getting into 35 years of declining rates – we’ll see if they keep declining over the next 35 years, I guess.

No, the data indicates that the overall trends in the two markets do follow each other. In other words, you are unlikely to see a large decline or ascent in one market, and no activity in the other. But the speed/intensity of those trends are rarely the same between those markets. There is a difference between these two principles; yet this does not render one mutually exclusive of the other. The return to peak pricing is a case in point, as is the huge 2016 run up. If you look at the data yourself, what I’m talking about becomes pretty obvious.

There is always demand for subsidized or free housing. So the government will build it. It is politics not problem solving.

Beautiful day out there and I hope everybody is enjoying the holiday.

Dasmo: The government is now planning to build housing. That will eat up a lot of trade because who doesn’t want to work on government projects! There is still demand for housing, that wont suddenly disappear.

….. and that my friend is the key. The government is planning!! So, if the market “crashed”, would there be a point in continuing to build a solution for something the market fixed.

In fact, demand for housing does disappear. It disappeared in the U.S, it disappeared during the last crash and apparently it is disappearing on the coast.

Perhaps, the definition of a crash would be: the demand for housing disappears.

http://vancitycondoguide.com/bc-home-sales-june/

“BC Home Sales Drop 33% year over year in June”

The most significant being that the 80’s were the start of the longest and biggest decline in interest rates in history.

@oops, It’s the same but different this time. This isn’t the 80’s and there are other things at play. So the property market is slumping but it’s a different world and situation than the 80’s. I think we will see more reasonable prices though. There is some serious bravado out there when it comes to pricing out jobs. It’s the gravy train right now that is for sure. But…. The government is now planning to build housing. That will eat up a lot of trade because who doesn’t want to work on government projects! There is still demand for housing, that wont suddenly disappear. Lot’s of infrastructure being built. Super low vacancy and super low inventory…. So it’s not so easy as history repeats itself.

I will add that the suites in Eaglehurst seemed better laid out than Polo Village but who would be renting way out there anyways (airport or ferry personnel)?

Care to elaborate? I don’t know how it can get any better than the carriage homes at Polo Village in terms of a suite (no noise transfer, etc). Eaglehurst has the carriage homes too but they are a completely difference price range at $1.15 mill versus 849k. Everything at Eaglehurst in the 800k range with a suite the suite is within the main structure.

My experience renting in Saanichton is don’t rent to anyone that works in Victoria as typically they find something closer to town and ditch. After I gained that experience it was easy. I rented to a naval architect working at a company in Sidney producing aluminum boats and then I rented to a geologist workings at the institute of ocean sciences (right at the base of the airport).

If I had 6 applications and 3 were acceptable, for example, I would give it to the person with the closest proximity of work.

The difference is my downtown condos I get 15 applications, on the peninsula you get maybe 6-7, but either way you still rent with easy. I typically aim to list my units 10% below market. Quality tenant way more important than top dollar for me.

So you have observed that Victoria and Vancouver trend similarly, except for that time Victoria’s real price peak returned 14 years sooner than Vancouver’s.

Yes, our markets are so closely tied.

Vancouver offers better jobs?

Median household income, 2016:

Vancouver: $76,040

Victoria: $86,430

???

You’re just restating your opinion. You’re not offering any evidence.

Absolutely. It’s all so easy to foresee and understand, and that’s why we all bought houses at an opportune time and have accrued significant net worth and security!

This cool guy and his market analysis. He speaks logic.

https://youtu.be/7lR56hRxnhQ

My issue with this number is that it’s skewed to the low side. So many houses are cancelled and relisted which makes the DOM smaller than it really should be for the property. While I’m not saying that we’re above that 30-90 days balanced market number, I am saying that we don’t know without actually looking at cancelled/relist & adding in those numbers.

@Ian – have you checked out VarageSale? Another awesome place to score stuff.

Jalek:

It might be a long shot but on rare occasions a much older house that has been fully restored comes on the market. The house I bought five years ago had all new wiring, new plumbing with instant heat, new roof, new furnace, new chimney liners and two of the three fireplaces had new gas inserts and all the floors (solid oak) had been redone. For that matter all the floor joists are solid oak and I have been told by one of the historical people that most of the framing was also done in oak (there is a historical document showing that the contractor had bought a large amount of surplus oak at auction from the British navy). In the five years I have been here the only real maintenance issue was a minor repair on a perimeter drain (cost under 4k) and putting up a new fence in the back yard.

Finding a really high quality older home in Victoria is rare but they do come up from time to time.

@Jaleek

I am quite sure you will not find a SFH new build in the core area of Victoria for under $1M, especially when I see what they are asking for those small lots in Polo Village. The areas closer to downtown were basically built out by the 1980s, so usually something has to get torn down for a building lot to be available.

An example on the market now is this one for $1.25M in Gordon Head. It is on the corner of a pretty busy street, although the 6000 sq.ft. lot is larger than Polo Village:

https://www.realtor.ca/Residential/Single-Family/19657667/1509-San-Juan-Ave-Victoria-British-Columbia-V8N2L4-Gordon-Head

For comparison, this one for $1,050,000 was built in 2002 and is also located in Gordon Head area but on a quiet street:

https://www.realtor.ca/Residential/Single-Family/19759165/4253-Oakview-Pl-Victoria-British-Columbia-V8N6M7-Lambrick-Park

This site has a map of what is considered the Victoria Core Region by the VREB

https://www.vreb.org/buying-selling/about-victoria-bc/the-vreb-core-region

In my mind, the border is smaller because I consider most of View Royal and Saanich West to be pretty distant to downtown.

So, those properties that you have been watching that are not selling for under $1M are probably at least 35 years-old. I am not sure if you consider that a “newer” property. Will something like either of the two houses above drop to under $1M by next spring? I could see $100,000 drop, but I would not bet on more.

If you are waiting until the late fall, you should be prepared to wait until spring, unless this a very unusual year or you happen to get lucky. The listings dry up after October and inventory pickings are usually pretty slim during the winter. (See Leo’s July 27th post)

Funny that you guys are talking about polo village and Eaglehurst as I drove out there today to see what they had to offer as I am not too familiar with places outside of Victoria proper.

My wife liked Eaglehurst and i kinda liked the Heritage homes at Polo village. But not being from here I have no idea as to their value in that why pay that much for something that far out. Is there comparable new builds closer to town?

I mean the plan right now is to just wait it out until the late fall. Is anyone able to provide the pros and cons of each area? When it comes to buying I don’t want to end up being a rube.

Stopped by Sidney it seemed pretty laid back?

I will add that the suites in Eaglehurst seemed better laid out than Polo Village but who would be renting way out there anyways (airport or ferry personnel)?-

I will add that i have kept my eye out for properties in town for up to a million dollars and they are not moving saw one drop 100K last week. I think if you are a normal joe $1 million might be out of your price range if you don’t have a decent down deposit and if you have greater means you are probably looking at 1.5 and above which is probably where the real deals can be had.

Anyways I am looking for newer like properties as i am no handyman – if you have any insight please throw me a bone.

Thanks

Dasmo: @oops, an epic crash would not help you build a craftsman quality house. It would only give you the possibility of buying one already built for cheaper. There is so much work out there for some time to come I don’t think we will see an environment where highly skilled builders and trades people are desperate for work. A major slowdown would just flush out the losers….and not even all of them.

That craftsman home in the last few years has undoubtedly grown in cost because of the shortage in trades due to the nature of the housing market.

You may be right regarding a craftsman quality house, Dasmo, but I can assure you from experience that when projects get sidelined (as Hawk and others have pointed out) by an epic crash, trades go begging.

When those trades suddenly become available and are bidding against each other for work the cost will come down. The losers and fly by night trades will be flushed out of the system but in an all out crash … everyone pays the piper and the highly skilled and quality trades will not escape.

In 1982 – 1983, after an epic crash where I escaped with $10,000 from a forced sale, I found a small development in the lower mainland being built by a “European Craftsman Builder”. I was renting for a year after the sale and watched this builder drop his price from $145,000 to $80,000 for these homes.

I approached him about completing a home for me and he told me his story of woe. He let me know that everyone (the trades) were going to make less money so I get the same quality but at a cheaper price. We agreed on a price of $76,000.

Of course, that home may not have been the “craftsman quality house” that you might envision today, but the point is, as LF pointed out with lumber costs, a lot of costs are reduced when the market changes .. hard!

Vancouver is tied to Victoria for sure, but Vancouver could probably drop a bit more without a direct impact on Victoria. When I lived in Vancouver I rented a place a couple of blocks from this home -> https://www.realtor.ca/Residential/Single-Family/19396838/4915-PARKER-STREET-Burnaby-British-Columbia-V5B1Z5

That’s a 799k home in Gordon Head, if that, and I’ll take Gordon Head over living behind Brentwood Mall in Burnaby. If that place drops to $1.4 million not sure if that puts direct pressure on the 799k GH special as it is still a very significant difference.

There is so much work out there for some time to come I don’t think we will see an environment where highly skilled builders and trades people are desperate for work. A major slowdown would just flush out the losers….and not even all of them.

+1 difficult concept to explain to people sitting at a desk job every day. Even 2011-2013 with inventory at 5,000 and slow sales it was difficult to find skilled trades people. My father and I had to do the exterior envelope on my personal home as I couldn’t find anyone to do siding that would have a/ done a better job than my father and I b/ was less than $40,000 (took us less than a month on and off as I was running my real estate business and my father had a project on the go, and the only expense was renting a cherry picker). Siding isn’t a ticketed trade nor is it rocket science and you still can’t find people.

Fundamentally we need to stop pumping out English degrees (no offense to those with a BA) and immigration policy needs to adapt. I think over 80% of immigrants these days have a university degree. Smart but probably not qualified to swing a hammer.

Half the houses in the core that sold last month took 29 days to find a buyer. By convention between 30 to 90 days is considered a balanced market that neither favors buyers or sellers.

The Days on Market (DOM) is a leading indicator of a shift from a balanced market to a bearish one, as people hold back from purchasing. And the DOM can move quickly as it has this year doubling from June when is was only 15.

I doubt we will see any improvement in the market for detached houses in the core this August as most of us are more concerned about vacations than buying a house. Come September, when the kids are back in school, we normally see some improvement.

If we don’t see an improvement in the fall market then it may be time to hand out life preservers as the winds of November come early.

https://youtu.be/9vST6hVRj2A

Getting addicted to Used Victoria – just scored 2 cheap lawn chairs this morning, then while reclining in them, spotted a new ad for free marble vanity, left outside, first come first served, 4 blocks away. Ad was 2 hours old, but we went for a drive, still there. Almost new, retails for maybe $1200. Downside is, we now need to buy a house that needs a new vanity. Need 1040 to drop price..

Those all seem like good reasons why Victoria will follow Vancouver. We share a lot of social, political and economic ties with the commercial hub of BC that is 10 times our size and not disadvantaged by being on an island.

As the meme goes “location, location, location”. It applies to cities as well. Like it or not Vancouver is the city that offers better jobs and a complimentary lifestyle on a larger scale to that of Victoria.

Because it’s a regional, secondary market to Vancouver. It would be pretty hard for Vancouver to have a sustained, large climb, or decline, and for this market not to notice. In other words, the markets tend to be connected via their overall trends, but can differ in how much or how fast they get to a particular market/cyclical position.

For example, for various reasons, our prices are no where near what theirs are, and almost certainly never will be. We can see it in other, more interesting ways too (Intro, you will love this). When Vancouver popped in ’81, they didn’t reclaim their peak in real dollars until 2005, over a generation later. Victoria popped at the same time, but recovered much faster, achieving greater than peak parity in 1992, some 14 years earlier than Vancouver.

Having said this, if Vancouver has a major event in its RE market, we’re not going to be unscathed.

1 Foreign buyers – Van and Vic now equally impacted by FBT and Speculation Tax.

2 Substitution effect – people considering moving to Van or Vic, cheaper Van = less demand for Vic

3 AirBnB – both impacted by new regs.

4 Higher Mortgage Rates – both impacted

5 Local buyers – animal spirits affected by headlines out of Vancouver.

@oops, an epic crash would not help you build a craftsman quality house. It would only give you the possibility of buying one already built for cheaper. There is so much work out there for some time to come I don’t think we will see an environment where highly skilled builders and trades people are desperate for work. A major slowdown would just flush out the losers….and not even all of them.

California constantly burning will eat up enough building supplies to keep those prices elevated too.

Sometimes perfect timing doesn’t fit into our lifetime…. waiting ten years will cost you twice as much in nominal dollars anyway….

@ Introvert

Are you serious? They are completely linked. Van is the big sister, Vic is the little sister and follows/lags behind her big sis. Vic is not going to just go off in her own direction completely unaffected. The only town that I think may beat to it’s own drum is Whistler.

I remember sitting around the dinner table years ago talking with a few people about the likelihood that Vic was gonna take off (prior to it happening) due to what was happening in Van. Anyone who was aware of Van’s situation at the time likely had the same thoughts and conversations. Also knew as soon as Vic took off, that wave would then start to move up the island which it did. This is not rocket science, rather just observation and common sense. Same thing will likely happen in reverse, in fact it’s already started with Van retracting first.

I’m old enough to remember when Introvert used to argue that people that lived here for 3 months were considered locals..

Why? Other than a small percentage of people cashing out of Vancouver and buying here, how is the Lower Mainland market tied to ours?

@Local Fool

IMHO, Vic will follow whatever Van’s doing. It took that route on the way up, and if Van goes down, Vic will too. No matter how pretty, etc etc Vic is.

It’s not a positive scenario with massive tarriffs coming to the economy.

This Week’s Top Stories: Canadian Mortgage Growth Plummets As The Credit Cycle Breaks Down, And Toronto Real Estate Inches Lower

https://betterdwelling.com/this-weeks-top-stories-canadian-mortgage-growth-plummets-as-the-credit-cycle-breaks-down-and-toronto-real-estate-inches-lower/

Like every other bust, they go bankrupt.

Recently, several people have been discussing the role of building costs vis-à-vis high home prices. The debate has centred around two positions of thought:

A) High construction costs create high home prices, or

B) High home prices create high construction costs.

They’re actually intertwined. With the global slowdown in housing, let’s have a look at the market price of lumber, with the right side of the graph being the most recent:

Don’t need to build as many homes? We don’t need as much lumber. Don’t need as much lumber? The price falls. This is Econ 101, folks. As demand for a commodity or service falls, its price falls, or it ceases to be in business.

Once again, I’m not arguing that some homes in that development aren’t going for higher prices than others. I’m also not arguing that location doesn’t play a role in which price it goes for. What I am saying is, those prices have fallen. They’re the same homes that were previously for sale that are now for sale, for less. Not a new set of homes that weren’t available before, coming online and making it seem like a price drop. Not going to argue it further.

I don’t think you understand what I’m saying, again. Firstly, we’re taking about the consumer market broadly, not a small cohort of data nerds that populate this site and know the ins and outs in where to look for this stuff.

BCA isn’t terribly useful because it only shows history of the previous 3 years, and does not show very recent transactions – it can take months to get up there. Secondly, saying, “people can just post a question on here” is lame – how much of the consumer market knows they can come here? And would you want to get such critical data from bloggers? Thirdly, asking a realtor is cumbersome – every time I want to know a particular listing, I have to contact someone to ask them and hope they respond and give me all the pertinent information? That’s like saying I can get McDonald’s nutrition information, all I have to do is email the manager and request it.

I don’t care if there’s 1,300 or 13,000 of you, I’d rather just have the data right there to myself. I’m talking about an informed consumer vs realtors hugging the data to themselves under the dubious guise of “seller privacy”. South of here, I don’t have to do any of that sleuthing. Complete sales and market history is right there at my fingertips, anytime, free, transactions shown in real time, and I know the info I’m getting is the same as everyone else. Way better for the consumer, IMO.

Marko: “What happened in Croatia is similar to what is happening in Vancouver.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I'm sure that the good people of Vancouver will look forward to that, Marko.

https://www.croatiaweek.com/property-prices-rise-2-3-in-croatia-last-year/

"In Zagreb, in 2017 the price of apartments went up 8.3%, whilst house prices only increased by 0.3%. However, when comparing apartment prices in Zagreb today with those back in 2011, they are 2.24% lower today. House prices are 17% lower in Zagreb today than they were in 2011."

Now that, is very true. A bit hard to be on guard though, when buyers in this region have almost no information they can use to determine the sales history of a particular unit.

What???? Just email any of the 1300 REALTORS® in Victoria or use BC Assessments website, or just throw up a request on this blog, etc. Lack of sales history is the least of the problems when it comes to buyers making bad decisions.

That’s fine. You were suggesting that little trick is what they were doing at Polo Village, and they weren’t, which is why I went after you earlier.

Having you walked through all the homes at Polo Village? The homes at 849k are facing East Saanich Road at close proximity. The living room and master face East Saanich directly. I live in the area and that portion is not exactly a quiet street. Average speed I would say at that section is 60 to 65 km/h and public transit is running the double deckers. It would make sense that the homes not right on East Saanich would carry a substantial premium, imo.

Not to add that the homes facing East Saanich have a lower level of finishing. Notice how the lots facing East Saanich have a level of finishing called “Craftsman” -> http://polovillage.ca/siteplan and you can download the differences in finishing at the bottom of the page here -> http://polovillage.ca/features

Different from the homes not facing East Saanich.

Looks like they have 6 homes sold + an A/O and from my count when I drive by I don’t see 7 homes fully framed let alone completed. If they had 7 sales and 20 homes completed that is when I would worry, but if they can sell one per month they will sell out by completion.

Croatia’s property market experienced a long gloomy road in the past several years, as the global financial crisis, coupled with the eurozone sovereign debt crisis, badly affected the country’s tourism-oriented economy.

What happened in Croatia is similar to what is happening in Vancouver. A $2.8 million dollar home in 2016 has dropped to $2.5 million today and might drop to $2 million……still $2 million for a shack.

in Croatia prices dropped from ridiciolous to less ridicolous, but still ridicolous.

This ground floor gem in Zagreb is over $300k CND ->

https://www.njuskalo.hr/nekretnine/stan-zagreb-salata-50-m2-oglas-12330206

Average salary $1,000/month. Interest rates around 4.5%. Good luck.

That being said despite the horrible income to price ratios prices have bounced back 10%-15% in the last couple of years with little to no foreign investment in Zagreb.

That’s fine. You were suggesting that little trick is what they were doing at Polo Village, and they weren’t, which is why I went after you earlier.

Now that, is very true. A bit hard to be on guard though, when buyers in this region have almost no information they can use to determine the sales history of a particular unit.

Let’s try this in a different context, Marko. If home prices drop by over 30%, do builders adjust their prices to be competitive?

The margin is not 30% so not sure how a builder is going to adjust his or her prices to be competitive? Work for a loss?

New condos are an example. How is something like the Promontory considered “high-end”? Stick some veneer on the cupboards and put in a gas stove and Miele appliances, and that is supposed to be luxury worth $1000/sq.ft.? It just seems people are getting fleeced. Largely, they have no choice, but at least they should be aware of what is happening.

I lived at Bayview One for three years. I currently own a unit at Bayview Promontory and I bought two pre-sales at Bayview Encore.

You just can’t get people to pay for Bayview One quality (much better than Promontory). I made a video about it four years ago -> https://www.youtube.com/watch?v=9xZNZLugq0Q

And guess what nothing has changed. Last one bedroom sale at Promontory? $867 per square foot. Last one bedroom sale at Bayview One? $681 per square foot.

Bayview Encore is a notch below the Promontory but I still bought two units…..I know the average buyer won’t notice whatsoever. When I went into the showroom I was like…..hmmmm, not super impressed with kitchen build quality but who cares it won’t matter in the end anyway.

People aren’t getting fleeced……..they are fleecing themselves.

Developers aren’t dumb…..if you can’t sell quality then lower the quality.

Another great example is Lyra….wood framed buildings not half the caliber along McKenzie sell for more per square foot than Lyra. How that works is beyond me.

Is Eaglehurst slashed again ?

No change from 749k.

I’ve had several clients buy at Eaglehurst. Once again a matter of optics. As they got to the building lots that are closest to the highway they cut the square footage and finishing and brought out a 749k variant.

If comparing oranges to oranges prices have gone up slightly since the development started selling. There have already been a few resales. 2081 Wood Violet bought from developer for $819,900 gst included and re-sold for $827,500.

@SweetHome There are three Sears catalogue houses at Graham and Kings in Victoria. Lovely places, worth seeing if you’re interested in that kind of thing.

@Dasmo

I don’t doubt your estimate for $1M for a Craftsman home. In fact, to get close to the workmanship, you would probably have to import true “craftsmen”, and I don’t know what you would be able to get for wood now. I have seen some pictures of nice woodwork in newer houses, but they are multimillion dollar houses. It is interesting that you could get some pretty nice houses from a kit 100 years ago, but lumber was, no doubt, cheaper.

I am interested in the question because I don’t like the fact that people are being told things now are “high-end”, when they are really a bunch of plastic and other synthetic crap. New condos are an example. How is something like the Promontory considered “high-end”? Stick some veneer on the cupboards and put in a gas stove and Miele appliances, and that is supposed to be luxury worth $1000/sq.ft.? It just seems people are getting fleeced. Largely, they have no choice, but at least they should be aware of what is happening.

Of course old houses had their problems, and I assume some newer building materials and methods are technically superior, but quality has been lost in other areas. There are also health problems associated with formaldehyde and other off-gassing from all the synthetic materials.

Thanks, good idea – I’ll try posting a wanted ad 🙂

You cannot make affordable housing work if there is a profit motive for residents. The provincial government understands this and any housing they assist with is going to be co-op or some other form of non-profit.

No change from 749k.

Let’s try this in a different context, Marko. If home prices drop by over 30%, do builders adjust their prices to be competitive?

https://www.globalpropertyguide.com/Europe/Croatia/Price-History-Archive/croatian-property-markets-surprise-comeback-127326

Croatia’s property market experienced a long gloomy road in the past several years, as the global financial crisis, coupled with the eurozone sovereign debt crisis, badly affected the country’s tourism-oriented economy.

In 2009, the national property price index dropped 4.32% y-o-y (-6.16% inflation-adjusted)

In 2010, the national property price index plummeted by 8.91% (-10.55% inflation-adjusted)

In 2011, the national property price index dropped 1.59% (-3.6% inflation-adjusted)

In 2012, the national property price index fell by 4.37% (-8.64% inflation-adjusted)

In 2013, the national property price index plunged by 14.36% (-14.6% inflation-adjusted).

A few too many people at open houses this weekend, for my liking..

Marko Juras: “We aren’t in a desert and we don’t have Mexican labour”

You are fairly adept at deflection, Marko. Perhaps politics is in your not too distant future.

some for as little as $60 to $80 a square foot,

We aren’t in a desert and we don’t have Mexican labour.

Praying for golf courses in exchange for houses for rich people is so anal and elitist. They won’t solve any housing crisis, but a credit crunch will from excessive greed. They create healthy ecosystems for wildlife and community walking trails as well as a fun sport.

Welcome to BC. Money laundering capital of North America. Wonder how many in Victoria will get burnt too? The Strait of Georgia has never stopped criminals before.

Police investigating pre-sale development; condo buyers out hundreds of thousands

“they’d found some of the units were pre-sold more than once – and as many as four times in some cases.”

https://bc.ctvnews.ca/mobile/police-investigating-pre-sale-development-condo-buyers-out-hundreds-of-thousands-1.4040568

Actually, I think it’s the Salish Sea.

There are some hints in the rejection of the CHGC application for exemption that a smart developer could use. The ROGC property is odd shaped. I’d take the swath between houses & offer as community garden space. Donate or place convenant on the treed areas closest to Elk Lake Park. Then go in for mixed housing that supports affordable housing plus market rentals. And tie in the “can’t be sold for X years” bit.

Now those neighbors would not be amused 🙂

Dasmo #47022

@SweetHome, my cynicism aside, I’m serious about needing a million to build a true craftsman quality home and not one that just looks kinda like it.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

Or, maybe it's all in the timing. lol.

http://www.nytimes.com/2006/11/07/realestate/07land.html

Before Crash:

*PHOENIX — Until recently, this fast-growing area was a paradise on earth for home builders. Fulton Homes’ developments, for example, were so popular last year that it was able to raise prices on its new homes by $1,000 to $10,000 almost every week.

“People were standing in line for lotteries,” recalled Douglas S. Fulton, president of the company, one of the largest private builders in the Phoenix area. And they were “camping overnight begging to be the next number in the next lot in the next house.”*

After Crash:

But smart investors, he argued, were absorbing the surplus by buying up homes that builders were now unloading at bargain prices — some for as little as $60 to $80 a square foot, which local experts say is barely enough to cover construction costs let alone land expenses.

Well good, because it’s the Strait of Georgia.

If the entire history of Victoria real estate is any guide, I think bears are going to be disappointed by the price declines that may (or may not) be on the horizon.

Sorry again, Andersen, third time’s a charm.

Talking about the Saanich my Doug cattle lot. Wonder

How many of those homes are spec?? Interesting to see how things go there for those 2m plus homes in this market. Nice development.

IMHO anyone in the luxury house buying with some cash and patience may get a bargain into the next lift off.

No issue seeing golf courses coming off alr for affordable housing with gov subsidies where property cannot be sold for a profit for 10 years. Family income below x amount.

Need to think out side the box by everyone.

sorry, Kurt Anderson

Anyone who hasn’t read Kurt Alexander’s Fantasyland should. I think his points apply aptly to the false narrative slopped out to fill the bull trough (double entendre intended).

Except golf courses are an excepted usage on ALR land from 1988 to 1992. Today, one can’t get an exception permit to take ALR land and convert to a golf course.

https://www.alc.gov.bc.ca/alc/content/alr-maps/alr-history

” Dealing with Golf Courses: 1988 to 1992 ….. golf courses were removed as outright uses in the ALR”

I’m not disagreeing with you Leo about zero chance. Just wanted to point out that there are only so many golf course properties that were allowed on ALR designated land. So it’s a finite number. As for the flood of requests from existing golf courses, probably given that golf is a declining numbers sport.

I am intrigued by those investors who buy these properties in the hopes of one day converting into higher density developments. One would think that a property like the Royal Oak GC (27 acres) should have sold for far less than $3.5 million given it can only be used as a golf course or converted back to farm land.

There is zero chance any golf course will get approval to de-designate their ALR land, especially with an NDP provincial government. The NDP created the ALR system, and they are rightly proud of the longevity and success of the ALR system.

If de-designation was permitted by the ALR Commission you would see a flood of requests from existing golf courses and you’d see dozens of new ‘golf courses’ popping-up on ALR land with the sole purpose of becoming a failed golf course so they could de-designate their ALR land to build sub-divisions.

Basic survey with certificate drawing should be close to $1000 ish. Depends on what needs doing though. I got topography done as well.

The bulls golden HPI Benchmarks are all down in the core, Greater Vic, and Peninsula. No wonder you’re having probs making sense of the market LeoS. Prices are quietly leaking gas like a bad SBD, especially with all the slashes the past month. June should have been one of the hottest months of the year. With the foreigners long gone for good, this will make for a very cold winter for the pumpers.

Is Eaglehurst slashed again ? Caught a quick glance on the highway sign that looked like it.

They have and even Cedar Hill GC was shot down recently when trying to expand services to try and generate much needed revenue.

https://www.bclocalnews.com/news/alr-golf-courses-should-return-to-farming-says-ex-alc-chair-frank-leonard/

In other words, Leonard didn’t care if a golf course came and went, if the land was ALR, it’s going to stay that way.

Leonard is no longer the ALC chair. Would that make a difference now for these properties? Could a well drafted proposal (or appeal in the CHGC case) fly with a new chair? Glen Meadow was an interesting case as the North Saanich council was also opposed. What if Saanich council was amenable to the proposals, would that make a difference? I don’t have the answers but I do find it interesting to have these plots of land stuck in the middle of developed areas to be called agricultural.

Frank Leonard says that these golf course should return to farming. It’s a bit difficult to imagine who would want to take that on and actually grow crops. I guess in the case of the Royal Oak GC, maybe the new owners could go the way of the Albergs and create a feed lot for cattle. That might push some buttons and get action.

I understand the desire to keep agriculture vibrant but I’m not sure that enforcing this on what was exempted usage lands is the answer.

How about a container home, some are two level and look very modern and liveable. This could solve many problems quickly. https://www.youtube.com/watch?v=CHX6AO8BYls

Does anyone know what it should cost to get a lot surveyed?

Also any recommendations on good companies for the mid island servicing Port Alberni.

The lot is a recreational lake property, .26 Acres.

On a side note I have been trying to find prefab companies on the island that also do the installation etc. It seems like some only provide the products but not the service which males it more difficult to determine a final price. We want to expand the cabin and a prefab seemed like an easy option.

@SweetHome, my cynicism aside, I’m serious about needing a million to build a true craftsman quality home and not one that just looks kinda like it.

I started my thinking with prefab. Starting with a modern yurt. (Two joined together) https://www.yurts.com/gallery/

But because of my slope I would simply spend too much in foundation work for this to make sense. No bank would lend me money for such a crazy idea, I would also spend a fortune in engineering to be allowed to break the code on multiple levels. I also looked into a number of modern prefabs but similar issues were at play. In my case the fire regulations also ruled out wood siding and that cut out a lot of prefabs. The big thing about them is predictable price for a large portion of the build. Without experience with them I have no idea how successful they actually would be. If I had a flattish building site I probably would have gone there though. This was one of my favourites; https://methodhomes.net/homes/homb/

For the tiny home route: https://www.modern-shed.com

Seems like those home kits should be more common now with quality of prefab panels. I wonder if the increase in bureaucracy killed that business to a certain extent. Hard/impossible to build a house kit that will pass inspection in a thousand different munis

While doing some Googling to see if anyone theoretically priced out what it would cost to build a Craftsman house today, I learned some history about Sears selling kit houses from 1908 to 1940. These houses were quite attractive and some were quite large. There are links to pictures on Wikipedia.

https://en.wikipedia.org/wiki/Sears_Catalog_Home

The interesting thing is they did not cost that much, even in today’s dollars:

“Sears began offering financing plans in 1912.[5] Early mortgage loans were typically for 5 – 15 years at 6% – 7% interest. Sales peaked in 1929, just before the Great Depression. By then, the least expensive model was under US $1,000; the highest priced was under US $4,400 ($13,687 and $60,225 in 2013 dollars respectively).”

Although:

“Shipped by railroad boxcar, and then usually trucked to a home site, the average Sears Modern Home kit had approximately 25 tons of materials, with over 30,000 parts.[4] Plumbing, electrical fixtures and heating systems were not included in the base price of the house but could be included, at an additional cost, with the house order.”

One of Steve’s best videos yet. He goes into the Vancouver RE data, macro and micro, explains where our market fits into the larger economy, credit and RE cycles, and how Toronto is now experiencing a nearly identical bull trap phenomenon that Vancouver did. It’s very interesting, especially for those that are following the dubious “recovery” narrative that is being paraded over there right now.

As for Vancouver right now, the stats are almost plunging by the day. Despite a short while ago when everyone was asserting that a shortage of supply of detached houses was the core issue, now, just as suddenly as the “shortage” ensued, it’s disappearing. Funny how that works. Condos are now also starting to deteriorate with increasing speed.

VanRE sales data goes back to 1991, and so far, detached sales activity has never been worse. If you’re one of those sellers, it seems you now have a choice to make. Cut your losses, drop the price now to what today’s market will bear – or do what everyone else does, hold out and end up chasing the market down.

The Chinese cash has evaporated, the mania isn’t “fun” anymore, and I suspect fundamentals are going to do what they always have. If that happens, many are going to find out how precarious the concept of “home equity” actually is, and why I have said repeatedly you cannot sustainably have an equity based RE market. No new entrants? No market.

IMO, without a huge new influx of capital, and soon, VanRE appears to be in extremely serious trouble. The question is, what will come of our little market? While I think we have quite a bit less to worry about here than there, we have also been impacted by mania and significant speculation. If VanRE suffers a serious RE event, I don’t think the Juan de Fuca Strait is wide enough to insulate us from what could be a terrifying ride down. Good thing Mrs. Fool bought us a popcorn maker recently. We’ll be using it.

https://www.youtube.com/watch?v=cOKM2VvbVQ0

@RenterInParadise

Hasnt every golf course in Saanich tired this.

Ardmore, Glen meadows, prospect lake…. All shut down by the council. Some bought by overseas investors to hold.

Get an account on UsedVic.com and post a wanted ad. Be honest and upfront on what you’re looking for & that you need pet friendly. Also be sure to scour ads on Kijiji, UsedVic and Craigslist (lots of scammers on Craigslist so beware!). From a distance isn’t impossible but it does take a bit of work. I arranged my current place from Alberta and it’s pet friendly so it can be done. Good luck!

If the real estate board where captaining the Titanic the announcement to the passengers would be along the lines that we have a small problem of ice on the decks but we are confident that shortly the ice will be gone.

GTA home sales, average prices, climb higher in contrast to Vancouver drop

I’m glad this article was put up here, because it showcases the media’s role in parroting what is essentially misleading hubris and sooth-saying by real estate boards, intended for the mass consumption of the ignorant.

They are comparing two drastically different markets (2017, 2018). While June demand bumped compared last year, last year was almost stone cold dead. It would be almost a miracle if it didn’t increase. Within 2018, July sales were actually sharply lower than the previous month and in fact, lower than they were during periods of the winter earlier this year. Demand overall is far weaker than it was a year ago, and they’d need that demand to approximate or exceed what it was in 2017 to “recover” the prices that it achieved. I will leave it to readers to determine whether they think that’s going to happen. (Hint: Toronto’s melt up and starting of its correction has lagged Vancouver by several months).

In just that one article, look at the extent of the language they use to attempt to form your viewpoint:

encouraging;

a trend towards stabilization;

a more balanced market;

It’s improving;

the market appears to be healthy;

Toronto’s housing market is stabilizing;

This fits our broad narrative;

stronger housing figures;

transitory shock;

expects the market to improve;

looks to be trending toward positive territory in the near future

Folks, do not ever, ever rely solely on information from a real estate board, or articles like this one which blindly or deliberately perpetuate that information. It’s written to craft a viewpoint in your mind which maximizes the likelihood that you will act in a manner that will profit their membership. Nothing more.

GTA home sales, average prices, climb higher in contrast to Vancouver drop

https://www.timescolonist.com/business/gta-home-sales-average-prices-climb-higher-in-contrast-to-vancouver-drop-1.23389112

Welcome, local buyer (what the VREB will classify you as after three months of renting)!

As we all know, outsider influence is minor; the Victoria market is all about locals buying locally!

We were also once local buyers. Local buyers from Calgary.

Any thoughts on this? Owners of Royal Oak Golf Course request removal of a large part of the property from the ALR. It’s a lovely piece of property surrounded by some dense development. It’s a great place to walk the dog.

The likelihood that the property would be turned back & farmed is pretty much nil so where does it go from here? While I would love to see that property become part of the parks system, that’s very unlikely. The new owners would love to see a return on their $3.5 mil investment.

https://www.saanichnews.com/news/former-royal-oak-golf-course-submitted-for-alr-removal/

Any advice on finding a decent pet-friendly apartment in the City of Victoria? …while out of province, no less? (I realise this may be costly.)

I just sold my house in Ontario and will rent before buying. With a lot of luck I’ll have timed both markets. Or at least have more inventory to choose from next year. The threat of auto tariffs wrecking Ontario’s economy, Ford as Premier, more winter to look forward to… didn’t make staying until next Spring very enticing.

Cheers!

Absolutely! I’ve seen plenty of scam ads and have even reported a few. I keep a close eye on the rental market just in case my fabulous landlord decides it’s time to sell (always have a plan B). The rentals I’ve posted here I believe are legit.

Wood isn’t available and, in general, neither are the skills. We ain’t in the craftsman era anymore…. You would need at least a million because you will need to do things a few times over, you will need to fire your GC and find new, and it will take a long long time. Or you would need to lower your expectations.

Just want to say on the rentals, scrutinize the ads well to make sure they are legit. Sometimes houses that have just been for sale have their pictures used in rental scams.

@Ian – Craigdarroch sounds at least like a bad dream, if not a nightmare. Keep looking. The roof, radiators, toilets, and the patching in the foundation could all be signs of water damage = mould.

I did look at the pictures, though. It is a pretty house. Has anyone seen a cost of how much it would be to do a new build to that original quality? I assume you couldn’t do exact because the wood isn’t available, but the closest thing.

1040 Craigdarroch ($950K) must have been a beauty in its day. Now needs a new roof. Lot of wiring is still knob and tube. Main floor bathroom has door to basement in it. Top floor bathroom needs major redo. Windows original – stained glass is excellent. Foundation has some patching in it, and a little trench going to drain. And some random hole elsewhere. 7 ft or less in basement, with pipes even lower. Boiler could need replacing. Some leaks to 2 radiators and toilets. Needs new deck. A bit dark inside.

All doable, but at what price. Neighbouring house to south is a bit shabby with 4 apartments, according to BC Assessment. Unconfirmed noise complaints. Shared driveway and carport, need new roof, not sure if you get neighbour to cough up.

$750K, maybe I’m interested..

Nice find renter, another one!!

Will be interesting to see how this plays out. Here’s another one coming off the sales market (MLS 391855) and onto the rental market:

http://www.usedvictoria.com/classified-ad/Centrally-located-4-Bedroom-1-Office-3-Bathroom-House_32109980

I suspect we’ll see more and more of this for those homes where the homeowners aren’t ready yet to drop the price of their property. How long will they carry that property? What if home prices stay flat or drop for a period of time? Will that be enough to prod an owner into thinking that this is the best they’ll get and now it’s time to unload? Only time will tell.

PS: $2800/mo for a 2500 sq ft, pet friendly property in Reynolds Secondary catchement is pretty reasonable. Reynolds has an extremely long waiting list and pretty much the only ones who can get into the school are those in catchment.