The season for seasonality

All too commonly real estate analysis suffers from either mistaking noise or seasonality in the data for a trend. Both mistakes are commonly featured in the media and are used to spin the data in whatever direction the author happens to support. You’ll see a lot of stories in the media about the market heating up in the springtime, which is then replaced by discussion on the internet about the market cooling off in the fall. The fact that real estate is extremely seasonal also makes any kind of analysis more complicated in that you have to separate out the normal seasonal movements from the market shifts. Contrary to how it appears at first glance, the market can be slowing down if sales are increasing, and it can be heating up if sales are dropping because the seasonal ebb and flow is more powerful than almost any market change.

Normally I’m not a huge fan of seasonally adjusting data, because the method is never entirely clear, and I’d rather present the raw data rather than something that has gone through a bunch of processing. However it is sometimes the case that the raw data is more misleading than enlightening so let’s give it a go.

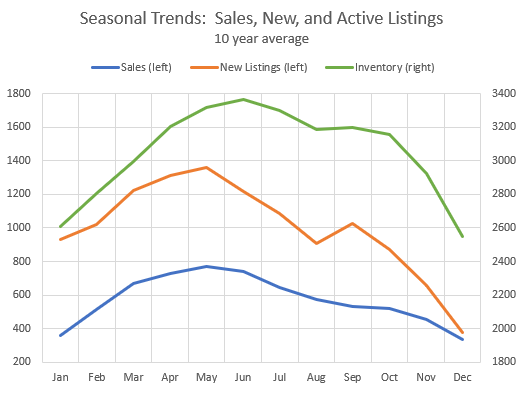

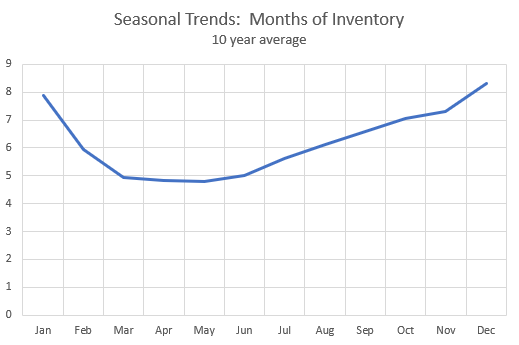

Before we can adjust for seasonality in the data, we have to see what it actually looks like, so here it is for sales, new listings, active listings (inventory), and months of inventory. As you can see, sales and new listings typically peak in May while inventory builds until June. There’s a small listings bump in September after vacations but it isn’t enough to keep sales from declining into the winter. On months of inventory, it is usually lowest (hottest market) from March to June and cooler outside of that period. All very much in line with the subjective impressions most people have of the market.

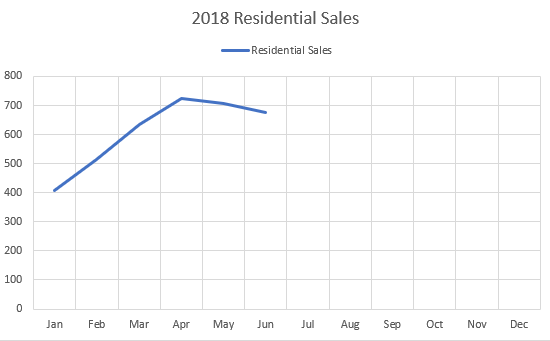

Knowing the seasonal trends in these measures, we can extract the pattern (how do they typically vary through the year) and separate that pattern out of the current market data. Let’s take a look at 2018 to date.

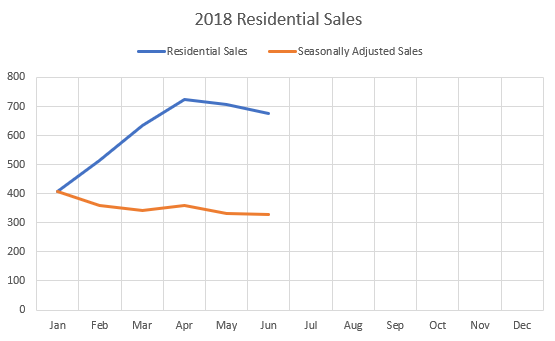

Based on the the raw sales data, it isn’t at all clear what is actually happening in the market. Sales are up in the spring as expected so I suppose everything is normal? Let’s add the seasonally adjusted sales:

Now we get closer to the truth. Yes sales have followed the spring market up, but if you extract the seasonality, they have actually been declining. In other words, while they increased in the spring, they normally increase more. The difference is the shift in the market itself.

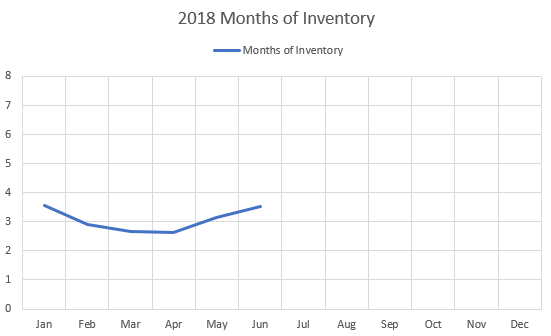

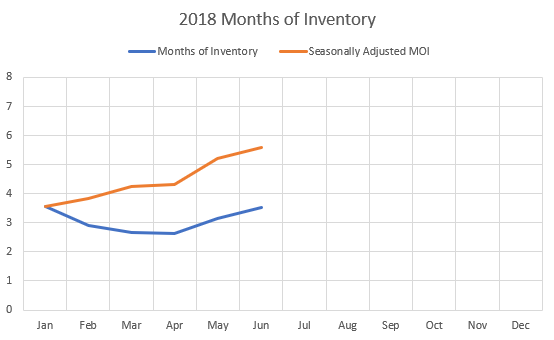

We can observe a similar pattern in the months of inventory which is also difficult to interpret if we only have the raw data.

Again, although months of inventory declined as expected in the spring, it did not decline as much as it usually does, and in fact on a seasonally adjusted basis it has been rising since January. Once we have the final numbers for July I’ll take another look to see if the pattern continued.

I’m going to be looking into the seasonally adjusted dataset some more in future articles, particularly if there is much seasonality in prices, both medians, and the various price indices out there and whether the seasonally adjusted data can provide some insight into the real estate cycle. In the meantime, I’m out to enjoy the seasonally warm weather!

I’m sorry for my poor memory, UVIC First People House was the only ramearth that I worked on, the one in the Highlands were straw bale house with mud walls.

I’m sorry that you see it as FUD, but manufacturers rating efficencies of HRV heat pumps, etc… are way higher than in actual practice. Because manufacturers and all of the research/papers that you sited have vested interest in making money by selling green products.

The advice that I and honest people who work in the industry to the lay man is to get a good company and installer/service people is the first and foremost thing. Then look for products that have readily available parts locally, easily service able by local techs, and buy reliable with ease of service access units. And, efficiency rating is the last thing on the list of requirement.

Lumber at a 6-month low, down 29% from its peak in May. Was up 45% on the year, now up 5%. $LUMBER https://t.co/xOFYY7nmlt

Barrister, I’m good early afternoons all week, how about 2 on Weds?

@QT – not the strongest of references you’ve provided there. Instead of spreading FUD, why don’t you link to some journal articles or professional documents? For example, this document by RDH outlines the expected savings in different climates in Canada: http://rdh.com/wp-content/uploads/2015/12/HRV_Guide_for_Houses.pdf

And, to some degree, this document agrees with what you’ve stated – that the milder the climate, the lower the return an HRV will provide.

Here is a journal article which explains some of the testing protocols and differences: http://digital.library.ryerson.ca/islandora/object/RULA%3A4238/datastream/OBJ/download/Analyzing_the_Impact_of_the_Phius_HRV_ERV_protocol_on_North_American_Passive_House_Certification.pdf

Also, which rammed earth buildings have you worked on? They’re a rarity around here but perhaps much more widely used in other countries.

Ian:

Pint sounds good; how is the Penny Farthing for you. What is a good day and time for you?

Sidekick,

May I ask if you are an HRV salesman or benefit from pushing LEED/green?

“energy is used to power the electric fans in the HRV system (typically about 50–100 watts, and as high as 300 watts in some cases)…

HRVs are expensive to install initially (several thousand dollars is typical) and they’re not guaranteed to pay for themselves (typical annual savings might be a few hundred dollars). In milder climates, the benefits are much reduced and may, in some cases, be nonexistent…”

https://www.explainthatstuff.com/heat-recovery-ventilation.html

The only true benefit that I can see is heath benefit for people with asthma, dust allergy, and lower indoor humidity. Which can simply serve by shut off the heat and open a window, run a bathroom fan, or employed less costly natural gas furnace with filters.

HRV SRE efficiency rating at ideal temperature and humidity with coefficient between 0C and 20C. However many homes temperature are set lower than 20C in the winter, and our mild climate average of 5-8C during the winter hence the efficiency drop to roughly 33% or less, and one must also factor in the energy loss from running the fan as well. Now your net energy saving is so minute that it will never recover the initial cost of install, and to make matter worst it also cost to maintain.

PS. In the past I specialized in geothermal heating and cooling and often worked on air source systems as well. And, I have worked on many LEEDs projects as well as ram earth buildings.

I’m sorry that I hijacked the forum being off topic, but the missed information by the green initiative climate activists are doing more harms than good, because of their agendas plus the local bureaucracies contribute to the acceleration of housing costs with out merits or benefits.

I’m having déjà vu.

@QT – yes – most domestic HRVs/ERVs are not great, however even at 50% efficiency they are way better than open windows, passive vents, or nothing. Let’s take a simple example. It’s 0C outside and you keep the house at 20C. Outside air that comes in through your window, your passive vent, or your heat pump needs to be heated from 0C to 20C.

Now, let’s throw a 50% efficient HRV in there. Instead of needing to heat that outside air up by 20 degrees, the outside air is tempered by the HRV all the way up to 10 degrees. So you have effectively cut the energy required to heat infiltrating air by half. Now throw an 80% or 90% unit in there and we only need to add two to three degrees of heat. I have the modelling software – it makes a big difference. And, if you use the passive house component database I linked way back, it takes into account all the energy used by the motors etc., so you can get a real-world efficiency value: https://database.passivehouse.com/en/components/list/ventilation_small

As for insulation in our climate, R30 to R40 seems to be a good range. There is more to the story however: https://www.rammedearthworks.com/blog/2014/11/3/indoor-comfort-isnt-just-about-r-value-addressing-the-relationship-between-insulation-and-thermal-mass

I was speaking specifically to the heating system. Don’t think you can argue that it’s going to be cheaper to buy a heating system for a high-efficiency house than a low-efficiency one.

I didn’t realize you could have just a heat pump…you sure about that? Seems like the BCBC is pretty clear on the ventilation requirements.

Well I worded it poorly. Multi-unit buildings are highly efficient in that cohabitation within one envelope is the most efficient design. Typically you’re leaking your heat into the neighbor above/below/hallway etc. Often only one exterior wall per unit. However, the actual structures tend to be piss-poor at retaining heat. Just take a look at some of the IR photos of some of the LEED platinum towers. Some light reading if you’re bored: https://buildingscience.com/documents/insights/bsi062-thermal-bridges-redux

Now I realize there is a lot of ‘green washing’ floating around out there so it’s understandable to be skeptical of a lot of these claims – but the step code, and passive house, are rooted in building physics. The theories have been tested tens of thousands of times in the real world and proven to be remarkably accurate.

We can agree to disagree as to whether or not it’s “worth it”. It’s heavily dependent on the house in question…but as an example, an extremely efficient house in NB had a heating bill of $77 for an entire winter: https://www.ecohome.net/guides/1401/new-brunswicks-most-energy-efficient-home/

They go on to show some of the financial calculations…

Just wanna say I felt waaaaay smarter before reading this blog regularly.

Barrister, let’s go for a pint this week.

I agree that insulation is an easy low cost addition, but in our mild climate the energy saving is already low going from 4″ (typically R11 to R15) to the required 6″ (R19 to R21) exterior wall. Hence, 8″ (R25) exterior wall/insulation IMHO is a waste of money.

I beg the differ. The higher the efficiency the more it cost with diminish return.

I’ve been out of the residential HVAC game for more than a decade, but from what I recalled the true Heat Recovery Efficiency (HRV) Sensible Recovery Efficiency (SRE) at best is around 50~55% in ideal condition, and way less than 50% in most condition specially in our mild climate. And most people would consume more energy if they install HRV, because most would opt for central air condition (heat pump) if they have to install HRV due to little added cost to include cooling. And, Energy Recovery Ventilation (ERV) is even worst for true efficiency at between 5-15%.

Heat Recovery Ventilation Guide for Multi-Unit Residential Buildings — https://www.bchousing.org/publications/Heat-Recovery-Ventilation-Guide-MURBs.pdf

“The HRV Sensible Recovery Efficiency (SRE) is assumed to be 65%.”

An HRV is one of the pillars of efficient building, and massively reduces the energy requirements. This lets you skip the heat pump and go with baseboards, if that’s your thing. It has many other positives too.

Before the code change you could go baseboards without the HRV so now your option is HRV + baseboards or heat pump. When you factor in the cost of the baseboards + HRV + lower re-sale value of baseboard you end up going with a heat pump and you simply don’t see as many homes with baseboards. I know everyone hates baseboards, but I look at my gas fireplace and heat pump service costs and I don’t think baseboards are the devil. Click on/off for next 50 years. No service, unlikely to break down. Doubt my Futijsu heat pump will make it past the 10 year point. Three-year-old gas fireplace already gives me issues with the electronic ignition.

You and I will continue to disagree on the energy efficiency component 🙂 I look at my electrical/gas bills and they are already so low, standard Milgard windows and all, that if there is a 50% hypothetical drop (I don’t buy it) the absolute starting amount is so small that even a 50% drop would take decades to pay off half decent windows and various energy upgrades. If I am spending $1,000/year on heating on a brand new house 10 years x $500 savings is only $5,000 when a half decent window upgrade will set you back at least $10,000.

The delta is much bigger older versus new but when you go new basic house versus new efficient house I just don’t see a crazy delta in terms of economics.

Those towers of concrete and glass are ridiculously inefficient – even though they often like to tout themselves as LEED certified.

I lived at 834 Johnson in a south facing unit and I think I turned on the baseboards once in 12 months? Hydro was less than $250 a YEAR probably mostly for laundry and stove.

I agree completely, and it is going to get worse because the bureaucrats have to pretend that they are actually doing something at their jobs, so that they can justify appreciation of taxes and property price.

http://www.timescolonist.com/news/local/costs-of-running-capital-region-s-13-bureaucracies-add-up-1.23383375

“Local government executive salaries are out of control, say some critics, adding that the costs can’t be sustained.

The combined salaries for the chief administrative officers of the 13 Greater Victoria municipalities totalled more than $2.2 million in 2017, according to their statements of financial information. That’s for a total population of 383,360.

By comparison, Surrey, with a population of 517,887, paid its CAO $391,058 last year.”

It’s the opposite. The more efficient the building, the smaller/simpler the heating system. An HRV is one of the pillars of efficient building, and massively reduces the energy requirements. This lets you skip the heat pump and go with baseboards, if that’s your thing. It has many other positives too. This is one of the few areas where the step code reduces the cost of a house – your heating (and/or cooling) system gets much smaller.

Blower door test is critical to finding the weak spots in the building. It’s pretty hard to seal it up after its all finished, so a one-time $500 during construction will pay for itself (in energy savings and $) many times over the life of the house. I’m on the fence as to whether or not pre-construction modelling should be required. It’s pretty useful when it comes to fine tuning the design but perhaps overkill.

Very true. Poly is a terrible VB for this reason (and why the high performance builds typically use ply or OSB instead). Also the reason for a service cavity wall – the “airtight” plug boxes, switch boxes, and light fixtures are anything but.

The single family home is the easy target for the step code. It’s pretty easy to slap in some more insulation, do air sealing, and install an HRV. Those three changes are probably good for a 50% drop in energy usage alone. It gets much more challenging when you go multi-unit / commercial. Those towers of concrete and glass are ridiculously inefficient – even though they often like to tout themselves as LEED certified.

I think the step code may actually be the stepping stone to cheaper house building, as it will probably make factory-built buildings much more competitive. A local, large-scale factory could probably turn out a house a day using human labour. As automation starts to kick in more, that will drive costs down as well.

A lot of automation has been a flop in Victoria so far. My neighbour used the Slegg Lumber prefab wall assembly which looked awesome to my untrained eye but then Slegg shut that down, not sure why?

And the step-code is long overdue IMHO – too much crap being built these days.

The end product might be better, but it will be more expensive.

With the new code is isn’t really economical to build a house with baseboard heat anymore as you need an HRV so might as well go with a heat pump to skip the HVR. The houses are better, but the cost just keeps going up every year.

That being said there is also a waste of money that doesn’t actually improve the house. As of January 1st everyone will have to hire an engery consultant. He or she has to put together a report plus do a leak test at either vapour barrier or drywall stage. Just more non-sense. After they leave your reliable trades person rips the vabour barrier by accident and doesn’t seal it and so much for the blower test. Some of these ideas are awesome for commercial type activity but for SFHs I don’t know.

I would actually say it effects almost all sectors, except maybe bankruptcy trustees. In a declining home price environment, people rein in discretionary spending to effect deleveraging. The wealth effect goes into reverse. It’s why they say, where RE goes, so does the broader economy. That’s especially true right now in BC.

Wait till the “blame game” phase starts. And we’ll be pointing the finger at everyone, except those that actually caused this terrible mess – us.

No. The price of teardowns, or lots, goes down. Endogenous pricing. Not theory, but fact.

Problem is teardowns have an alternative buyer that from experience is quite competitive on teardown offers (someone willing to fix up the home) and vacant lots need to be developed and developers aren’t stupid in that they will develop at a loss. Fact is we don’t have 100’s of vacant services lots just sitting waiting to be sold in the core. Right now, I can’t see a single vacant lot under a million in the City of Victoria. There is one on Stanley and one on Elford being advertised as lots, but they have teardowns on them.

How many condo buildingss were built in Greater Victoria between 1996 and 2004? Construction costs don’t automatically fall far enough for a margin to always exists to continue building.

I was just in Nootka Sound fishing and there were a couple of guys there from Vancouver that export wood products to Japan. One guys said he has been to Japan approx. 80 times on business. It’s not like Victoria real estate cools off and all of a sudden plywood and OSB drop in price and a new home is cheaper to build. Global market for a lot of things. Massive bureaucracy is here to stay and will only get worse. Absolute shortage of trades people.

My personal conclusion is the odds of construction crawling to a stop is much higher than it dropping substantially in cost.

Job creation has flatlined in BC after years of growth partly due a sharp drop in real estate transactions

“After several years of torrid job growth and a steadily falling unemployment rate, B.C.’s labour market looks to have cooled off.

In particular, job creation has come to a shuddering halt so far in 2018. In Statistics Canada’s June Labour Force Survey, for example, employment was down 0.3% from the month before. In fact, monthly job gains have been so lacklustre that the overall level of employment in the province is slightly below where it stood a year ago. Even Metro Vancouver – once Canada’s hottest job market – has experienced a dip in year-over-year employment. Moreover, the provincial unemployment rate has ticked higher, compared with both one month and one year ago.

While the limited supply of available workers is clearly curtailing job growth, a downshift in the demand for labour in some sectors of the B.C. economy is also part of the story. The unfolding slump in the housing sector has implications for the labour market. One aspect of this is the modest decline in home building that is now occurring.

But the bigger impact is being felt via the sharp downturn in real estate transactions. Fewer existing-home sales mean less need for the services of real estate agents, property appraisers, home inspectors, real estate lawyers and mortgage finance experts. Indeed, Statistics Canada’s figures show a sizable drop in the number of people working in B.C.’s large finance and real estate sector.

Lower levels of real estate activity also have a knock-on effect on some segments of retail (e.g., businesses purveying home furnishings, carpeting and flooring). The pace of retail spending growth has visibly slowed in recent months, while the number of people working in retail has declined since the beginning of the year. As the province’s formerly booming housing market loses steam, there might also be a forthcoming drop in renovation spending as well as further weakness in some parts of the retail space.”

https://biv.com/article/2018/07/bc-job-creation-stalls-provinces-job-vacancy-rate-still-high

I think the step code may actually be the stepping stone to cheaper house building, as it will probably make factory-built buildings much more competitive. A local, large-scale factory could probably turn out a house a day using human labour. As automation starts to kick in more, that will drive costs down as well.

And the step-code is long overdue IMHO – too much crap being built these days.

Today’s largest potential capital loss in VanRE, just for fun…

5830 Sperling Ave, Burnaby

Paid $2,800,000 in May 2016. Attempted to unload for $2,650,000 for a potential loss of $150,000 + carrying and offloading costs. No takers.

Now asking $2,290,000, for total potential loss of $510,000 + carrying and offloading costs.

Ouch.

https://www.estateblock.com/burnaby-real-estate/5830-sperling-ave-burnaby-bc-v5e-2t7-mls-r2292157-1?mls=R2292157

If new homes don’t get cheaper to build, but the price people are willing to pay for them goes down – due to higher interest rates, recession, whatever – do new builds stop?

No. The price of teardowns, or lots, goes down. Endogenous pricing. Not theory, but fact.

The community has changed over time. Just the fact that “average” families haven’t been able to afford the neighbourhood in the last 5-10 years is clear evidence of that. Whether these changes are “natural” is a different question.

I think you and I just have a fundamental disagreement about the permanence of the relative price increase in places like GH.

But it’s OK for us to disagree. As crappy TV news reporters like to end most of their stories, “only time will tell.”

If I’m correct that GH remains relatively pricey going forward, then it will be tough for young first-time buyers to purchase here without significant assistance regardless of whether the market is at a peak or in a valley.

I started commenting on HHV back as early as 2011 re escalation of bureaucracy in new home construction and that I felt new SFHs in the core would soon be unattainable. I didn’t anticipate the market going up but it was evident to me back then that it was going to get ridiculously more and more complicated to build a new home.

I don’t think there is a scenario where new homes are substantially cheaper to build. I think a much more likley scenario is new construction grinds to a complete stop. The various layers of government are simply not going to cut the bureaucracy. You think WBC will simply waive the abatement regulations for teardowns? Nope, if your teardown has lead paint with high leachability it will still need to be shipped to Edmonton. I guess wages for truck drivers can drop but it is still crazy expensive versus just demolishing a home 10 years ago with no abatement and starting excavation the following day.

Unless you’ve built a house before it is difficult to comprehend the amount of bureaucracy and BS involved. Just ask individuals on this blog who have built in the last two years…Dasmo, Mike Grace….and they can correct me if I am wrong 🙂

Same with trades….I had a really tough time in 2014. You just don’t have enough young people going into trades to adequately service a slower construction market let alone what we have now. Immigration doesn’t help as Canada is pumping in app designers and PHDs not stone masons.

Just wait the for the step code….that will be fun.

Renter we can review all you want. As I repeated numerous times we will see a 5 to 10% downturn from peak before we start up again in about 4 years.

Here is the population growth. 2 to 3k a year after in/out and dead.

https://www.crd.bc.ca/docs/default-source/regional-planning-pdf/Population/Population-PDFs/census-pop-2001-2006-2011_2016_abs_change.pdf?sfvrsn=5d8d31ca_8

GWAC – I’m sorry that facts are an issue with you. I am not arguing core pricing, all I was doing was stating population growth numbers. We can easily agree to disagree and if you would put facts to your beliefs, I’ll be very happy to review.

Renter you go with your beliefs on what is and will drive Victoria core pricing and I willl continue on with mine that I have held for years. No use arguing.

FYI YMCA sold in Victoria for condos.

Yes average immigration has been 250k – no dispute on that but what is called in question is that 5-15k number. Looking at stats for 2010-2015, 15k total over that 5 year period came to Victoria. That 15k is total population growth and not just immigration numbers so immigrants & Canadians. 15k over 5 years is 3k a year. Now let’s look at 2015-2018 – granted the numbers are not in for 2018 (duh!) but based on growth numbers of less than 1%, we’re still at tops 3k / year in population growth.

When I look around Victoria, I truly do not see limited land. What I do see is poor land use and these last few years, tons of FOMO.

Whatever LF. You guys can manipulate the data.but since 1982 the most in non inflation adjusted numbers is 10%. Using inflation adjusted is garbage because you don’t have the money sitting earning inflation returns. People borrow the vaste majority of the house purchase. You can argue this till you are blue in the face. Year 1 house 100k year 2 house 105k inflation 15%. Same interest rate You are not 10% better unless you had 100% of the money earning 15% after tax. Most are 5% worse.

Calling it false is also garbage because on here we have living proof of both no house or giving up and buying more expensive. Guy who started the blog.

That is qualitatively and quantitatively false.

Unlikely, and this isn’t some expression of hope on my part. What you’re essentially saying is not even a correction will occur. Except, both the current and historical market data actually suggest otherwise.

In fact, 5% to 10% max over this cycle is in contradiction to the actual history of the Victoria real estate market both in terms of its tendency to have greater than 10% corrections every decade (more if the affordability deteriorated especially quickly), as well as the cycle of affordability that’s been remarkably consistent in Victoria over the last 40 to 50 years. On the latter, we can see that if the pattern holds true moving forward, we’ve hit peak. Juxtapose that with the fact that our market is currently contracting, and I’m pretty confident we’re going down the same road we always have.

Unless…it’s different this time™? 😛

I am the one who directed Leo to the immigration chart. Canada has 250k on average coming to Canada over the past 30 years so 1m more people come to Canada every 4 years . Obviously 250k are not moving to Victoria but when 5k to 15k do move to the core area a year and there is limited land it has an impact.

You can all just deny the factors that drive up housing costs in Victoria and keep believing in so sort of crash. 2 things will happen that have happened over and over. No house ever or buying more expensive in the future. All because of this wait for a crash. Your crash will be 5 to 10 Max here. Anyways enjoy the day.

Back from the Oregon coast beaches and can’t wait to see all of the comments I’ve missed since I asked for a link. FYI LeoM – the reason to ask is to understand one’s viewpoint. I can easily find links to support my position but I wanted to understand QT’s point of view.

Well people are moving here but not at the rate of 250,000 a year. Leo posted last year’s growth rate and at just under 1% it’ll take a LONG time to double the population here. So here’s an interesting link that estimates growth through 2030 (hint – not even close to doubling today’s population):

http://worldpopulationreview.com/world-cities/victoria-population/

I have a number of articles bookmarked and will post once I’ve read through the previous comments about density, infill, and crime. It has been eye-opening to be sure. Density does not automatically mean huge increases in crime – smart development has in some areas actually decreased the rate of crime. One item that I found most interesting is contained in this document:

http://ceds.org/pdfdocs/Chapter8.pdf

For the TL;DR crowd, here is the tidbit of interest: A study conducted in Phoenix, Arizona found that the perception of crime was a significant barrier to infill development.

So if one wants to be safe – the safest places to be are cemeteries, schools & parks. Lovely places but no alas no homes on those properties for the currently living. To answer an earlier question, yes I have walked some sincerely sketchy neighborhoods and gasp at night. I don’t let FUD lead my life.

Now I’m off to read what I’ve missed whilst enjoying some seriously beautiful beaches.

PS: I use DuckDuckGo.com for searching for obvious reasons.

@ Tomato:

“If you lived in the 4th storey of a 4 storey building or the 4th storey of a 20 storey building would it have any appreciable effect on your quality of life? (That isn’t rhetorical)”

No, but it has an effect on the quality of life of Introvert, who wants to live in quiet, low-density neighborhood, a privilege he intends to insure by preventing other people doing what they want with their property.

Whatever Josh. Keep the dream alive of some big crash . It’s painful To keep debating this. You win there is lots of vancant land in Victoria core. No one is moving here. The cost of building a house is not up 50% in the past 7 years. All fake news and the end is near.

Enjoy

Victoria is not a major city.

That’s not happening in Victoria.

Seems you have turned to entirely false narratives to justify your positions.

Addendum:

If you lived in the 4th storey of a 4 storey building or the 4th storey of a 20 storey building would it have any appreciable effect on your quality of life? (That isn’t rhetorical)

I would suggest that the lower end of density (eg. basement suites, townhouses, low and mid rise apartments) are relatively inefficient at what they do.

A good example is the humboldt valley. The Astoria, Belvedere and Aria probably have around 400-500 units in a few acre area. To provide a similar amount of lower density housing you would have to put a basement suite into every other house in Fairfield. I understand that doubling the supply without the parking, transit, and amenities the area was designed for would irreparably change a community let alone destroy the SFH stock. The recent allowance of suites in OB is a popular decision albiet less practical than a higher density option.

I vote for high density where high density can be accomadated. I’ll get shit for this but it seems like they were onto something in the 80s in James Bay…

Some people seem to think that the push for densification is a sort of Commie plot to provide cheap housing for entitled nobodies who should just shut up and move to the West shore or better still Prince George, or better even than that, should never have been born.

But in fact, densification is what happens in a growing city with a free market economy and without zoning bylaws, which are a sort of Commie plot to prevent land owners doing what they want with their own property, i.e., subdivide it or maybe construct a duplex, some townhouses, or an apartment building.

Some zoning laws would no doubt be approved by the vast majority of the population. But when zoning bylaws result in zero population growth in sprawling city center suburbs such as Oak Bay, they are clearly contrary to the interest of the majority of the population. Moreover, they create massive costs to individuals and the taxpayer, by forcing a large part of the city’s workforce to commute long distances using publicly funded highways or transit systems, while generating masses of unnecessary toxic air pollutants.

@ Barrister

I’m curious on this, what have their results been… what countries etc… would love to hear more on this.

LOL. Found the core too expensive, so call them shitholes….

Lay off the Ikea catalogue and HGTV.

Wolf and Others:

First, I dont have a dog in this fight since even if Victoria goes full speed at densification I will be planted in the rose garden before most of the foundations are in the ground. But I do have a concern for what we are offering the younger generations to come. The conversation needs to take a step back and take a look at the bigger picture to grasp the challenges but also the fantastic opportunities ahead of us.

The simple fact of the matter is that if we are to keep increasing the population through immigration then we need to build more housing. How much immigration is a really legitimate question in terms of the housing issues. What i hear is a load of crap from both the left and the right dumping inane arguments that seem intentionally designed to prevent any intelligent analyzes of the situation. But I am going to leave that for another time. Lets just assume that we have to deal with both population increases and geographic shifts.

In its simplest form the question can be broken down to whether we are wiser to turn Victoria into a city of 600K or is better to create a new city of 300k and leave Victoria at around 300k. Just to get rid of the stupid argument that keeps being raised here. we are not talking about sending people to Prince George or to Churchill. While I am blowing off steam Victoria is not the best place on the whole earth and even if it was why are Canadians totally unable these days to think that we cannot build a even better new city for people to live. My dads generation had a quiet fiery determination to build a better life not just for themselves but also for their children and to a great degree they were successful. I have traveled across our island during the last few years and there are many ideal locations to build beautiful small cities that would offer the next generation wonderful places to live and work and also great locations for older Canadians to retire (none of which involve sub artic conditions). Will this require investment in infrastructure, will it require vision and creativity, will it need determination and fortitude; of coarse it will need all that and more. Mostly it will need a real belief that we can do better.

What I find depressing is that we are not even having the conversation of whether we can do better. Instead we have moved to arguing on how to get old people out of their homes five years earlier since the boomers will be carried out of their homes soon enough already. Maybe high density is the better alternative but if we never compare it to other alternatives how we will ever know. Other countries have turned away from high density but we never even examine their results. We are blessed with incredible potential and cursed with a lack of vision and optimism.

First, how dare you assume I am hardworking.

Second, perhaps hardworking people ought to be guaranteed the opportunity to own a home, but the question is where.

One thing that’s informing this whole discussion is that some people here are super peeved that formerly regular, affordable, family neighbourhoods like Gordon Head have in the last decade or so become quite unaffordable and out of reach.

My shy friend, what is your point? Now Gordon Head – a perpetually middle class area – is the new Uplands? That giggly thought almost reminds me of that poster “Luke”, if you remember him. GH is not at its price levels due to natural changes in the community over time, lol.

The good news is, I don’t think you’ll need to help your kids buy a place here, any more than your parents needed to help you. Unless of course, they plan to buy at or near market peak.

I’ve been looking at other markets globally, and it’s been really interesting. Almost all of them are experiencing serious drop offs in activity. It’s actually quite disturbing how simultaneous it is. Canada is slipping, almost all of the western US is wilting, the south east, New York etc. Same story in England, India, China etc.

Australia is a special mention too – they’re potentially facing an absolute disaster in their housing market. Out of 1.7 trillion in mortgages there, 700 billion in interest only mortgages are coming due almost all at once and people simply can’t afford to pay the interest + principle. Sounds very much like the USA a decade ago – except Oz only has 24 million people to pay all that off!

So by that logic, introvert should move to Oak Bay. Wait a minute….

“A home in Gordon Head was in reach for me, but probably won’t be (without help) for my kids. But my kids (or anybody’s) shouldn’t be guaranteed an affordable SFH in Gordon Head, and likely won’t be.”

You said Victoria is full, not that there was room for people with help. I didn’t insinuate that a SFH should be guaranteed. What should be “guaranteed”, if anything, is the opportunity for hardworking individuals and families to own a home (like I’m sure you were). That is what matters. At current prices that’s not possible without densification. Victoria is not full and never will be.

“The real question is whether cities should have a limit to growth in order to preserve the quality of life for the people who already live here.”

The answer is no. Homeowners tell prospective buyers that if you can’t afford a home, quit whining and move somewhere else. Works both ways. If you’re not happy with your quality of life deteriorating due to a population influx, feel free to move elsewhere. I hear Prince George is nice in the winter.

CE

There are genuinely some industries that have shortages. We’re trying to recruit people from Calgary to grow our business right now. It wouldn’t matter how much we offered, there are no prospects in Victoria.

Granted, they aren’t baristas.

Barrister

What I find absurd is people who have a family income of less than 100k who purchased a house a handful of years ago acting like they’re better than those who didn’t and don’t want to be complicit to these prices.

I’m looking in the 1-1.5 range right now. Entitled? No. But these houses are absolute shit holes. It’s funny that those who own them who haven’t earned 1.5 million in their lifetimes have an easy time justifying that value to those of us who have.

Entitlement maybe on both sides of the equation here.

To end on my favourite quote derived from this forum so far. I can’t wait for the “bloodbath” next spring.

“Luxury” housing…. https://www.strongtowns.org/journal/2018/7/25/why-are-developers-only-building-luxury-housing

And in 2009, I couldn’t afford most parts of Oak Bay. What’s your point?

That’s true. Langford homes will be affordable again someday. As for homes in Gordon Head, my suspicion is not so much.

Cities and neighbourhoods can change relatively quickly. See: Lower Mainland.

It’s not about giving the middle finger to anybody; it’s about cities and areas changing over time.

A home in Gordon Head was in reach for me, but probably won’t be (without help) for my kids. But my kids (or anybody’s) shouldn’t be guaranteed an affordable SFH in Gordon Head, and likely won’t be.

+1000

Business folks who pay rock-bottom wages while complaining about a “labour shortage” obviously hate the free market.

It’s as ridiculous as me going shopping for a diamond for my wife (yeah right – happens all the time) and saying there is a “diamond shortage” because I can’t get any nice ones for $50.

One day they may. In fact I’m certain of it. We’ve seen it before, and we’ll see it yet again. But not today, my friend. Tomorrow doesn’t look good either. 🙁

Speaking of skyrocketing, I finally got some Coronas yesterday to stave the heat off. Nearly 20 bucks for 6. FFS. And when did Thrifty’s get into the liquor business anyways?

Metro Vancouver was still affordable in 2001 with 2 million population.

But what a lot of people aren’t accounting for is the great underutilization of the existing housing stock in metro Victoria. Only 29% of households have 3 people or more. Yet over 40% of the housing stock is detached. A lot of growth can be accommodated just by putting larger households in these houses.

Just like every other major city that people want to live in. People who want affordability and a sfh will have to commute. Within an hour of Victoria there is room for another 1 million people at least with zoning changes. It is unrealistic and absurd to think that a desirable area with limited land can have affordable sfh with an ever increasing population. You let in 250k people a year this is what happens.

Density changes will happen and the SFH will continue to sky rocket even after that.

Either stop immigration or accept what comes with it. I believe immigration is needed due to our lack of productivity and our expensive social programs. Somebody has to pay the bill.

“Victoria is full.”

If it’s full today then it’ll be full for your kids tomorrow. Remember to give them the same middle finger that you’re giving everyone else today.

“Building subsidized housing so that Star Bucks can continue to pay people less than a living wage is insane.”

Using my handy Hayek editorial app, we can make that statement shorter:

“Building subsidized housing is insane”

What they’d laugh at you for is comparing a metro of 370,000 to one of 6.4 million. I don’t think there’s anywhere in North America where a metro as small as Victoria has prices so high so far out.

Truth.

Sort of. The densest places on Earth tend to be the most expensive. The formula is complex though, it isn’t just that increasing density increases cost of living. There’s an optimal cost of living to density ratio. I’d love to know what it is. When it starts to take federal funds to build infrastructure projects, I feel like that’s already past optimal. Maybe Victoria has already passed that point.

Anecdotal VanRE article from the Globe and Mail, but it would have been unthinkable a year or two ago…

“Proposal for luxury condo tower in Vancouver pulled amid signs of weak demand”

https://www.theglobeandmail.com/canada/british-columbia/article-proposal-for-luxury-condo-tower-in-vancouver-pulled-amid-signs-of-weak/

“Soon”? We are growing at about 1% per year. The transition would be so incredibly slow you’d be dead before you’ll notice any substantial change in any given neighbourhood. Just slow transition from single family to row houses to low rises over decades and centuries.

Good luck with that idea. Luckily the population as a whole will not stand for that kind of “pull up the drawbridge” mentality.

Vancouver has extreme zoning restrictions that keep most areas as single family. They’re not cheap for the same reason (made worse by influx of outside money). Vancouver outside of the downtown core is not dense at all.

I was looking for the, “I’ve lost all respect for you,” or “I don’t really ever say such things but you are a (insert tactless insult)” remark. 😛

That comment got attention because it came across as ironic, myopic and self-serving. It carries a familiar sense of “smarter and better than thou” which is entirely undeserved, and more to do with elements beyond his control or prediction. But there’s bigger reasons it got attention.

There are many things that make a community a nice place in which to live. Family and living stability, friendly neighbours, a vibrant cultural scene, an array of unique and eclectic businesses, and the ability to save a little and make little splurges in life as one desires. IMO, any community that cannot give me most of these things isn’t desirable at all.

Excessive house prices actually erodes and destroys those virtuous elements over time, and promotes more of a stressful dog-eat-dog hellhole at both the societal and familial level. Some parts of Vancouver are becoming veritable ghost towns, young families are leaving and small to medium businesses, including ones that have made that city what it is for decades, are disappearing because no one can afford to be there.

An “if you don’t like it, GTFO” attitude while implying praise on the market for achieving ludicrously unsustainable prices because “it’s such a great place” is actually rather foolish and again ironic because it eventually promotes the kind of social and financial decay which is pompously ascribed to other, “lesser” markets and “less intelligent” people.

The good news though, is excessive home prices don’t go on forever – you never get to the point where a city actually stops functioning, as the market eventually comes back to earth and what the economy can support.

Well said.

Tomato:

You lost me as to what your point is on whether Introvert could or could not handle getting into today’s market. The real question is whether cities should have a limit to growth in order to preserve the quality of life for the people who already live here.

What I find is a certain degree of outrageous entitlement on here. The west shore has a lot of reasonably priced housing. The west shore is not a long commute to downtown and people in Toronto would laugh at you for suggesting that it is a long commute (And yes I had a longer commute my whole working life).

The argument that companies cant find people to work and who will serve my coffee is a total red herring. If you cant find people to work then pay them more. Building subsidized housing so that Star Bucks can continue to pay people less than a living wage is insane. If the tourist industry needs super low wages then maybe it is time to reconsider the merits of the industry.

If high density was the magic bullet than both Toronto and Vancouver should be cheap to live in. The fact that they are not cheaper should give us all some pause to rethink matters. Moreover I am not sure that making developers even richer really needs to be our first priority.

Personalizing the issue as some form attack on Introvert is unwarranted.

@guest_46761

Introvert more likely than not you couldn’t “handle the price” if you had to get into the market in today’s dollars.

“No one is entitled to own a SFH in Victoria, just like no one is entitled to own a luxury car.”

You lost me.

To call a sfh in Victoria on a playing field of a luxury car you are out to lunch! Go travel the world and take a look at luxury in other counties then come back to Victoria, look around and tell me

what is so luxurious.

@guest_46763

” Introvert more likely than not you couldn’t “handle the price” if you had to get into the market in today’s dollars.”

So TRUE…

@Introvert

Sounds eerily similar to Christy Clark telling people that if they can’t afford Van they should just move to Prince George…

Introvert more likely than not you couldn’t “handle the price” if you had to get into the market in today’s dollars.

🙂

Knock yourself out building “smart medium density” along McKenzie or possibly Shelbourne, but don’t kid yourself that it will solve anything long-term. Soon, the shortage will return as Victoria adds more people. Then we’ll be talking about the need to build “smart high density.” After that, it’ll be “smart extreme density.”

No thanks. In general, let’s stick with current density and just call Victoria full. Because Victoria is full. The planet doesn’t need more people, and neither does Victoria. Or Calgary. Or Vancouver.

Can’t handle the high prices that are a consequence of a city that’s full? Move somewhere else. No one is entitled to own a SFH in Victoria, just like no one is entitled to own a luxury car.

(From the previous thread:)

Certainly the early 80s period was a big drop, but all drops in the 35 years since have been pretty tame, IMO. (Yes, not tame if you recently bought, then got a divorce and had to sell under duress, but tame otherwise.)

Let’s see what interest rates and inflation were at their worst in the early 80s…

The Bank of Canada rate hit 21% in August of 1981 (today it’s 1.5%) and inflation averaged 12% (today it’s 2.5%).

Yes in my backyard. How to solve the housing crisis podcast from Planet Money. https://www.npr.org/sections/money/2018/07/27/633238360/episode-856-yes-in-my-backyard

Just have to fight Introvert first

https://blackturtleredphoenix.wordpress.com/

The various indices (MLS HPI and Teranet) seem to exhibit some seasonality in the data yes. Median prices I’m not sure yet, but I will check. As for what time of the year is best to buy, that is a more complex question with multiple answers depending on how you define “best”. Will dig into this in detail in a future post.

Do prices fluctuate as well? What is the best time of the year to buy?

In the normal ranges I would say but higher than the 5 year period before.

I share your trepidation, but I think for a real bloodbath, you’d also need to see employment start to slip. Keep in mind while the market activity has “crashed” for the moment, it’s done so from such a high level you could argue the current activity is actually unremarkable one way or another.

I’m not arguing “house prices can’t fall unless employment does”, because that argument presumes a degree of exclusively between the two, when IMO, they are more intertwined now than they are normally.

In other words, what we need is for the RE market to shift to an extent, and for long enough, that it starts to sour sentiment in the FIRE sector. So in my little thought scenario, buyer fatigue will effect prices a little bit, but that little bit leads to stalling and even slightly reversing prices. In that event, developers rapidly lose interest – which I think is key given RE’s juicing of the employment numbers. You can see this rapid loss of interest mathematically and over decades: building doesn’t slowly taper over time, it falls quickly and dramatically: “Oh crap, we’re not going to make any money if we build this”.

That is what could start a chain reaction in reverse of the run up, prices fall faster and in larger amounts, bankruptcies begin to rise, people get laid off, the economy begins to redeploy to other sectors…

Quite common, really. It’s what a slump after a boom looks like. Not a good time to be piling on debt, that’s for sure.

Awesome analysis. Thanks, Leo …

I noticed that 1072 Newport sold for 250k below asking after 78 days on market (ask 1997; sold 1750). Was it just really overpriced to start with?

Assessed at 1,332k; sold in Sept 2016 for 1,007k.

Dont know what if any work was done.

Another bad moon a risin’ from down south. First come sales, then come prices.

Southern California home sales crash, a warning sign to the nation

In the past, California, one of the largest housing markets in the nation, has been a predictor for the rest of the country.

https://www.cnbc.com/2018/07/24/southern-california-home-sales-crash-a-warning-sign-to-the-nation.html?recirc=taboolainternal

Great post as usual. It would be nice to do a seasonal average curve for sales to new listing ratio. I know that this is just a ratio of two thing you have already graphed. But it has an interesting pattern (often) spiking in December to 100% or more, dropping drastically in Jan (lots of relistings), rising through spring and early summer, then dipping a bit in the late summer or fall.

Josh

28-Feb-2018 $1,645,000

09-Sep-2016 $750,000

Ditto. Although I may be saying that because James Bay always seems to be a few degrees cooler.

From the last thread, could anyone enlighten me with the sales history of 398 Constance?

LF, I think we might see an unusually high number of listings this fall, most of which being re-listings that did not sell throughout the spring/summer markets all being listed at the same time. I imagine that all the real estate agents are saying to their clients something like…” don’t worry, we will just re-list in the fall when the market picks up, no need to panic, and by all means no need to reduce the price….trust me.”

The winter will be non-eventful. Then next late winter/early spring, all the places that did not sell for the year of 2018 will be listed at the same time as the normal new listings for 2019. Bloodbath.

Nice work! An interesting read.

If memory serves, there’s usually increased market activity again somewhere around September, before it goes into the annual winter doldrums. I wonder how this winter will look?

And the full moon!