The Wealthy Buyer

Victoria is a destination city. The best place in Canada. It doesn’t rain much. We have flowers in January. Everyone wants to retire here. If only a fraction of a percent of the millionaires around the world come here prices will go to the moon.

Everyone knows at least a few stories of a wealthy Vancouver resident that cashed in on his $3M Burnaby rancher and thought an Oak Bay house for a paltry $1.5M was a deal.

So what’s with all my nannering about affordability? What does it matter what somone earns when we have no idea how much money they have? Buying houses with incomes is for the plebes, and Victoria is full of the wealthy who instead of bringing mortgage documents to closing bring a suitcase full of cash.

Typical Victoria Buyer

But is that really true? About a quarter of Victoria purchases are all cash with no financing, so with a sales volume of nearly six billion dollars last year there is certainly quite a lot of cash being thrown at houses. It’s a bit difficult to find national stats on this, but the mortgage industry association estimated in 2015 that about 20% of buyers were buying without a mortgage. Hence we may have a marginally higher rate of cash purchasing than the national average, likely largely due to our older population.

The big unknown is the 50% of buyers that use a conventional mortgage to finance their home. They have at least 20% down, but how big is their debt load? If we subscribe to the idea of buckets of money entering the city, one would imagine that mortgages are small relative to incomes.

The Bank of Canada has been measuring this, and they use the term highly indebted borrower to describe borrowers with a loan that is more than 4.5 times their income. A decade ago only a couple percent of households (nationally) fell into that category, while recently 20% of new mortgages went to people that were highly indebted. No wonder they thought the stress tests were necessary.

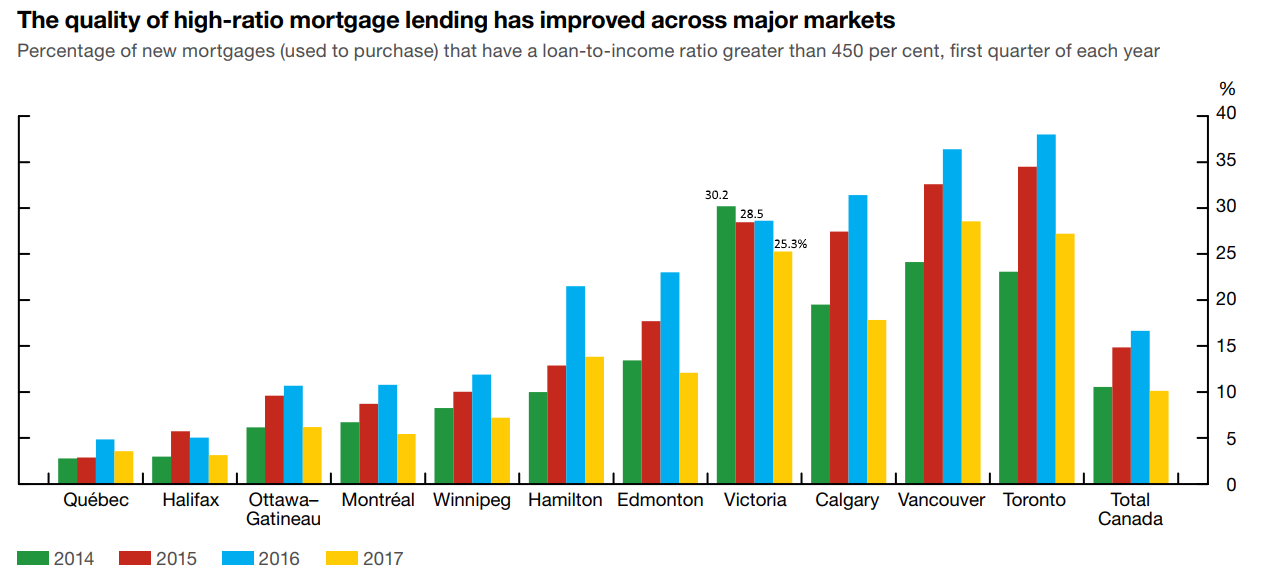

In the summer edition of their bi-annual Financial System Review, the Bank of Canada measured the percentage of new mortgages where buyers were considered to be highly indebted for high-ratio mortgages and found that the high priced markets of Victoria, Calgary, Vancouver, and Toronto had the highest percentage of these debt-bingers. It kind of puts a crimp in the argument that our high prices are fueled by a lot of wealth rather than a lot of debt.

Another takeaway from this graph is that the stress test for high ratio mortgages that took effect in the fall of 2016 drastically reduced the percentage of highly indebted borrowers in all markets. We had a smaller decline than cities like Vancouver and Toronto, but we are now essentially tied with those cities for the highest percentage of highly indebted borrowers in the country. The new stress test is designed to target exactly those people.

In the winter issue of the FSR, the Bank of Canada provided some more information. What I found interesting was that before the stress test there was no difference between high-ratio and low-ratio borrowers when it comes to how many are seen as highly indebted. I had always assumed that those with more than 20% down were also going to have lower debt to income ratios, but it is not the case, at least nationally.

You can clearly see the effect of the 2016 stress test on the rate of highly indebted borrowers in high-ratio mortgages, dropping the proportion from nearly 20% to 7%. As the BoC says, “Cities with the greatest share of highly indebted borrowers before the rule change (Toronto, Vancouver, Victoria and Calgary) all saw large drops.”.

Let’s review the facts then.

- The percentage of highly indebted borrowers is the same for high-ratio and low-ratio mortgage loans in Canada.

- Higher priced markets like Victoria have higher than average rates of highly indebted borrowers.

- The stress test for high-ratio mortgages caused nearly two-thirds drop in highly indebted borrowers.

- The stress test for low-ratio is essentially the same as for high-ratio.

As they say, the definition of insanity is doing the same thing over and over again and expecting a different result. In this case given the inputs are the same I expect a similar result from the new stress test as the old one: the number of highly indebted borrowers will be reduced significantly. In a city with high house prices and a high percentage of highly indebted borrowers, that’s not a great sign. It doesn’t mean we are going to lose all those highly indebted buyers (a quarter of our buyers), but it will be a substantial reduction. Many of the rest will find it increasingly difficult to manage their payments with increasing interest rates.

When the high-ratio stress test hit, some borrowers found additional funds for down payments and some dropped out of the market (the Bank of Canada estimates a 50/50 split). The same thing is happening now with the new stress test. Some buyers are dropping out of the market, some are finding additional down payment funds, some are choosing cheaper homes (guess why condos are still on fire), and some are seeking ways around the stress test. Private lenders and provincially regulated credit unions are one way, but they tend to charge bit more for the risk, and they don’t have unlimited money either. Especially since the CMHC cut back drastically on bulk or portfolio insurance, which was one way that smaller lenders can get sell off their loans and thus get them off their books so they can lend more.

Another way that some have suggested people will mitigate the stress test is by going from 25 year to 30 year amortizations. That would lower monthly payments, and lower the payments required to pass the stress test. However the opportunity there may be limited, as over 50% of low-ratio mortgages taken out in 2016 already had amortizations longer than 25 years. And I’m going to guess that those highly indebted borrowers are disproportionately taking out those 30 year amortizations already so there is no room to extend.

So there may be some small loopholes and strategies to mitigate the stress test, but it is clear to me that both CMHC and OSFI are determined to stamp out the debt bingers by any means necessary. That means if a significant loophole materializes, they will just tighten the screws again. The reality is we are in a period where credit is being restricted and that will not change until the regulators see it working well.

As for the Victoria buyer, what hits the headlines and tickles our fancy are stories of the wealthy coming here who think a million dollars is a rounding error. We love to talk about those stories so they seem like a bigger factor than they really are. These people certainly exist and as a retirement destination we likely do have more of those than most cities in Canada. However the reality is much more mundane, with our high prices also being carried by a lot of high debt loads. The headline “Ordinary couple feels stressed about their mortgage” just doesn’t attract as many clicks or likes though.

Weekly numbers: https://househuntvictoria.ca/2018/01/22/jan-22-market-update-lets-go-bananas/

Home equity alone only accounts for 1/3 of the net worth of the median Canadian. House millionaires have a huge equity cushion so that needs to be accounted for in any event.

http://www.statcan.gc.ca/daily-quotidien/171207/t002b-eng.htm

Do you do taxable investments before mortgage?

Personally we do

RESP

RRSP

TFSA

Mortgage

i/ RRSP; max it out every year and this is one account I’ve vowed not touch under any circumstances with the exception of major health problem. My thoughts on this are the older I get the greater the chances for health problems; therefore, the larger the safety net should be.

ii/ Pre-sale condos; it’s probably pure luck so far but I figure I have a talent for picking them well. Some I flip for profit and others I keep for long term rentals (pension plan).

iii/ TFSA; I only use this when I want to gamble on a small caps that interest me.

iv/ Dividend paying stocks (taxable)…..but don’t have enough $$ for this.

v/ Mortgage…..I’ll only get to this when I start taking losses on the pre-sales (will have to happen sooner or later) and mortgage rates are higher than your large cap CND dividend paying stocks (approx 4%), and I have no interest in gambling on any small caps. With interest rates so low the mortgage principal drops a substantial amount every year without any extra payments. Principal has already dropped 5% in the first 2.5 years of ownership.

Maybe. Or maybe houses will get smaller and parents will step in more with their equity – like in many other countries. I’m not saying that prices will continue to rise, just that it is my guess that as affordability erodes people will continue to search for and find ways to own a home.

In the future generational wealth we be required to purchase a SFH in the core. Old concept in Europe.

Sure because of RE prices. Someone that works an ordinary job but happened to have bought a house in Oak Bay that they now own mortgage free isn’t really who we’re talking about though. I mean real millionaires, not house millionaires.

That means they are no longer highly indebted. That’s the point of the stress test.

I am definitely not suggesting that the people that fail the stress test all leave the market. They certainly didn’t after the first stress test, and won’t now either.

Maybe. Or maybe houses will get smaller and parents will step in more with their equity – like in many other countries. I’m not saying that prices will continue to rise, just that it is my guess that as affordability erodes people will continue to search for and find ways to own a home.

Victoria will have substantially more high net worth individuals than many other places – just like TO and Vancouver do – demographics, desirability and high RE values.

http://www.environicsanalytics.ca/footer/news/2017/09/05/environics-analytics-wealthscapes-2017-reveals-canadians-financial-fortunes-continue-to-rise

Sure. But I don’t see any evidence that Victoria has substantially more high net worth individuals than other places that wouldn’t be due to our generally older population. Problem is there aren’t any great stats that I’ve seen on that.

Most of the people that are highly indebted will no longer be able to enter the market. Or at least that is the intent

Yes, a significant segment of the market will struggle to get in the market and be on the highly indebted scale based on debt to income and debt to assets until they build equity and net worth.

Actually, it is if the proceeds are invested with a view to profit.

Yes, but highly indebted should include net worth to be a reliable measure imo. Don’t think folks in other high re markets in Canada are generally behaving differently from one another, but the ones I know in the high net worth category sure do.

Do you do taxable investments before mortgage?

Personally we do

RESP

RRSP

TFSA

Mortgage

Roughly in that order. No taxable investments

BC Leader, Real Estate Industry Leader, what’s the difference eh?

Good to see she’s keeping busy…

I agree with Leo….most people are going to be dumb and use HELOCs for stupid crap like boats, campers, dream vacations, etc.

There are people that use HELOCs for various smart reasons but I believe they are the minority. For example, small builders would use HELOCs so they don’t have to go through the process/fees of obtaining a commercial mortgage on the homes they are building.

As for mortgages….not sure why anyone would be in a hurry to pay it down. I much rather throw my money at RRSPs and TSFAs before paying down a <3% mortgage. If it goes to >4% then I would use my excess income and pay the mortgage down a bit every year. That being said age should be factored in. I wouldn’t want to be 55 with a mortgage on my principal residence. At that point that would be my safety net in the event of major health issues which obviously increase with age.

I do know someone who borrowed maximum HELOC against their principal residence, and used the funds as down payments for rental properties, so the interests on the HELOC are tax deductible.

Since then (15 years or so), they moved principal residence status among these houses (and houses they bought afterwards) based on value increases, convert HELOCs into mortgages to get better rates, and so on.

They do live on their rental incomes. Their net worth is high, but income is not, as most (if not all) of their houses are still mortgaged and tax deductible, and they have been though multiple audits and fights with CRA.

It needs certain quality and capability to do this, definitely not for everyone, high net worth or not. Actually when this couple bought their first home, their income (and net worth) was so low that none of the banks would give them a mortgage.

These are all mortgage originations, so it would be both. However about three quarters would principal residences and not investments.

Agreed. Maximizing the mortgage is almost certainly the financially optimal choice. However, it is also not what people in Canada are doing. Just like paying a 2.5% MER is a terrible idea and yet most people still do it.

What I’m objecting to is totoro’s theory that somehow Victoria residents are far more sophisticated than the average homeowner in Canada and are holding their very large mortgages by choice rather than necessity.

But that’s not the stat we’re talking about. Highly indebted household is defined as having a mortgage over 450% of your income. So not only would that borrower need to have a large mortgage to show up in the stats, they would also need to have a comparatively low income. Of course those households exist, but they will be comparatively rare.

Luckily we don’t need to guess because it is playing out as we speak. So far, a rush to condos is a part of the effect. And I’m gonna guess it’s not because very high net worth individuals have suddenly decided they really want a condo instead of a detached house.

Barrister saw that place. In my view ugly and out of place in that area. Not worth 2.7m

That whole area I love. Much nicer than OB by a mile.

The boats

https://vibrantvictoria.ca/forum/index.php?/topic/389-extreme-victoria-weather/page-149#entry421073

Number 6: You have a good point and it does happen.

Would Harvey Weinstein’s divorce be strategic?

Not to sound calculating but a strategic divorce can go a long way for him to keep a lot of his wealth.

It was a bit of a blustery night. We did an open house at ten mile point. New build but really badly done. 2.75 mil and not on the water with poor design and construction. But some fool will buy it.

4 more boats on the beach in Oakbay. Oakbay/ Saanich border 2. Others 2 closer to the marina.

Generally speaking the Hollywood crowd are not known for their financial acumen. A couple of strategic divorces can really punch a whole in one’s financial planning.

Generally, one would not take out a mortgage to invest since the interest on the loan is not tax deductible. This is different than having a business loan that might be secured against a principal residence.

Introvert it is a self explanatory statement.

Thanks for the clarification. Going back to the comment.

It isn’t the house or the size of the mortgage it’s the person’s ability to pay.

Have you looked into it, Leo? Or is your gut feeling sufficient?

What scapegoat? I didn’t see one mentioned but maybe I missed it.

In the interests of accuracy, he was $644,000 behind on payments on $4.8 million in mortgage loans. He had negative net worth after two divorces and a broken neck. If you had 3.4 million in equity in the home you’d sell at below market and be done with it or, more likely, refinance.

This sure sounds like a lot of you are looking for scapegoats to blame if the market corrects.

The price of the house or the size of the mortgage isn’t the factor. It’s the ability of the person to pay the mortgage.

Ed McMahon at 85 years old went into foreclosure with a $600,000 mortgage having a home worth $4,000,000.

Exactly. Particularly when their other investments are paying the mortgage and costs of living. No advantage currently. If interest rates rise a lot some will re-evaluate.

Probably a stat out there on that.

No, like everything, there is a spectrum. Nothing is black and white in housing as far as I can tell.

What I’m saying is that if you want to be accurate you need to plot net worth as well as debt and annual income. Only then will you be able to understand what kind percentage of”highly indebted buyers” (a term that does not currently consider net worth) might be under with a rate hike or how the high ratio stress test might impact the market.

You are proceeding on the assumption that high net worth individuals pay off their houses. I question that because high net worth individuals sometimes look for a higher return on cash.

I don’t know whether wealthy buyers with expensive new homes have huge mortgages or not. But several times in the posts on this site Leo and others have expounded the advantages of holding mortgages at low interest rates (say, < 4%, given that we’re talking about after-tax funds). There are many advantages of holding mortgages, including portfolio diversity (ie not having all, or most, of your net worth in one RE basket), the availability of HELOC funds, and simple ROI. At the low rates we’ve had for the past 10 years, it’s kind of an obvious strategy for sophisticated investors to avoid putting all cash down. Also, most investors who have high holdings of securities will have to pay cap. gains when selling these (to purchase), so paying off the principle over time via dividend income or strategic selling makes a lot of sense.

Someone with a 2-3M (say) net worth who bought a 1M+ home in the past 10 years – would it make sense for them to liquidate enough assets to pay all cash for this? I’d venture that most of the time it would not. But this decision – whether to put 20%, 50%, 70% or 100% down – would have a lot to do with individual risk tolerance and future plans. I’d expect a lot of variation in the answers.

Are we talking about mortgages on principal residence or rental/investment properties?

I would think that for high net worth people who are over age 45, the percentage of them still carrying mortgages on principal residence is very very small comparing to general population. Rental and investment properties are, of course, different matters.

The Calgary Herald has 30 pages of advertisements for shiny new cars. Not a single one mentions how much the car actually costs, it only tells you about the low, low monthly payments.

Calgary is either full of people sufficiently obtuse to make the monthly payment their sole budgeting criteria when buying a depreciation time bomb, or is it is full of sophisticated households intentionally carrying a mortgage for net-return reasons. You can’t have both.

I know which one I believe is true.

So Vancouver and Toronto and Calgary are all filled with high net worth individuals that are at carrying mortgages by choice and artificially keeping their income low?

I don’t buy it for a second.

Thanks for the article, Introvert.

I hope that, as competition increases, the drive for efficiency will push the more wasteful practices down. Also, with such a sudden start to the industry, I think we will see a lot of strange and surprising business activities before it all settles down.

Regarding where to produce? I assume it will just add to the existing demand for agricultural land in the province. The economics are a trade-off between all the same pressures that farmers face: land price, labour, water, proximity to markets, cost of inputs.

Personally, I think they should be looking further into the interior. Some of the forestry dominated areas are ripe for a good co-gen electrical plant that would provide both heat and light for greenhouses.

The other issue is local municipalities, many of them won’t allow it with present zoning, even though it is legal to grow. Find a friendly interior town with cheap land and lots of wood waste to burn.

Don’t forget the Prohibition!

http://vancouversun.com/business/local-business/thousands-of-dollars-of-single-cask-whisky-seized-in-prohibition-era-raids-of-b-c-restaurants

Time to lock and load our tommy guns, oops, wrong side of the border.

Retired wealthy buyers don’t care for OB, they buy waterfront / acreage in Saanich. Close to pony, airport, and marina, dock their yacht and Break Out Another Thousand. OB is too rat race for them.

Comox has a way lower crime rate than Courtenay. That is true. Just like Oak Bay has a way lower crime rate than Victoria. Sadly as we have recently seen even low crime areas can have the most heinous crimes occur.

Victoria is rated 30th in Canada on the crime severity index, Nanaimo 37th, Courtenay 45th, Langford 123rd, Oak Bay 212th and Comox 214th

Do you have stats on that ie. comparing net worth to mortgage debt? I think I looked them up a few years ago and they seemed to paint a different picture – more like this: http://www.environicsanalytics.ca/footer/news/2017/09/05/environics-analytics-wealthscapes-2017-reveals-canadians-financial-fortunes-continue-to-rise

I’d have to do a bunch of looking up data and analysis to confirm but my bet is that high net worth folks do have mortgages a lot of the time because they also have access to sophisticated tax planning and investment advice.

The original concept of ICBC (a non-profit crown corporation) was a good one. The wheels really fell off when the BC Liberals started using it as a governmental ATM.

It’s like what U.S. Republicans do: they fuck up government, then say, “See! Government is terrible!”

Health care shouldn’t be subject to the profit motive.

So…

We are all Ok with:

-the government taking over car insurance and outlawing competitors

-the government taking over health care and outlawing competitors

-the government entering into the housing business and upsetting the business cycle for contractors

-the government happily facilitating the creation of a dope-addled citizenry no matter their responsibilities (judges?surgeons?)

-the government operating the notoriously enslaving gambling industry and outlawing competitors

but we object to the owner/builder exam

It’s a bit late to object to the barb on the arrow when the shaft is six inches deep in your chest.

Welcome to the left coast.

I know the story has kind of disappeared but still getting over 10 emails a week re owner-builder exam….have to love the optics of politics and the “housing crisis.” Completely useless policy that doesn’t protect anyone other than huge developers/builders while restricting supply and increasing costs for the average Joe.

From one of the emails today….this is at least the 15th person that has emailed me in the last 1.5 years that has resorted to living in a trailer on their building lot while waiting to deal with the exam BS.

Please any information would be so appreciated, I am a red seal electrician and have been in residential construction for 6 year. I really cant afford to let my family down, we are currently illegally living in a trailer on our land after losing our long term rental so there is a lot of pressure to pass.

Shell company brokering so they can be public. So I think we might benefit in the financial services domain.

How does California tie in? They can’t export it so all the California consumption will be home grown

Interesting, don’t hear a lot of those stories, but buyers from up island have increased recently.

It’s been tolerated here for well over two years now. ImIn downtown we went from dozens of FOR LEASE signs to none in a a matter of months. Pretty much all dispensaries. This affected our marketing because it isn’t legal. Where to grow it? A Gordon Head box is perfect! Where to park all that cash? Why real estate of course! Where to make and bake all those edibles? New money in making tinctures and other product let. Landlords more flush and lots more new money moving around. AND it’s not even legal yet. I know local financial and venture firms are getting involved especially now with California being legal. The Legalization will support our market in the future. The past was simply the cowboy pot boom that happened here a few years back. This was timed with Alberta going under and the the Vancouver exodus. A triple whammy! Now we have Millennials having kids…. this is all the counters to the ridiculous debt and rising rates and regulations. Resulting in….. Flat like a Halibut!

Speaking of wealthy buyers, it will be interesting to see how the NZ case unfolds and whether Canada should, in the spirit of the “fairness” initiative (which started with taxes on small business), enforce a similar style ban:

http://business.financialpost.com/personal-finance/mortgages-real-estate/foreigners-are-banned-from-buying-property-in-new-zealand-canada-should-do-the-same#comments-area

Regular folk from up island also moving here. Moved from Nanaimo last year as the gap in prices between Nanaimo and Victoria had narrowed. Was able to sell and purchase a home with a small mortgage. Not going to lie, it was tough with bidding wars and “Silence of the Lambs” type homes. We landed on our feet in the Sunnymead are and enjoy the bike trails (25 min bike ride and I’m downtown) and the variety of things to do compared to Nanaimo. Had two other co-workers do similar moves within the last 2 years. Found this blog as I was house hunting.

I like your wealthy barber reference by the way…

@caveat emperor

“And, the violent crime is not that far away.

Isn’t that a statement that could be made about any Canadian city?”

Um, no. As an example, Comox doesn’t tend to have violent crime, yet Courtenay does. In Comox, 2 blocks away you don’t get a shooting. In Courtenay you may. I’m not aware of violent crime in Cumberland.

Victoria doesn’t seem to have a big issue with violent crime, while Nanaimo does.

Squamish, Point Grey, Kits, West and North Vancouver not much of an issue with violent crime, Surrey and Downtown Eastside do. And so it goes.

Actually growing pot up by site C makes a lot of sense since it requires both a lot of electrify and also water. It would be great for the local economy. Think of all the creative names for a new town up there. It could be the new Napa of the North.

Isn’t that a statement that could be made about any Canadian city?

Good thing we’re building Site C then. No natural gas industry, but we’ll switch to growing pot and bitcoin mining instead.

By the way, Leo. I have to hand it to you on this one—it made me laugh pretty darn hard.

@Luke

Okay, well glad we cleared that up 😉

The Old Orchard is exactly as Grace has described it. It’s a lovely area, but there is constant minor crime in that area. Not violent crime, but cars broken into, garages broken into, minor theft, homeless in tents in the nearby trees and so on. If you’re working in your backyard, it’s wise to lock your front door. The area doesn’t feel unsafe, but stuff does happen.

And, the violent crime is not that far away — there was an incident this summer on 6th, which is just 2 blocks away from the Old Orchard area, right downtown.

It’s not about focusing on the negative, but rather just being aware of your surroundings. It’s a wise course of action, especially if you’re going to invest in an area, which was the original point of my post way back when.

I’m glad they love the area, the Old Orchard is great, I know it very well having spent a lot of time in that neighborhood myself over the years and I’m also very aware of what goes on there as well.

I think that about sums it up 🙂

Regarding growing pot, I found this recent article very interesting:

Ottawa urged to consider environmental impacts of legal marijuana

But when Sutton asked academics, horticulturists and engineers for advice, they all told him that no crop on the planet is grown indoors on a commercial scale.

http://www.timescolonist.com/ottawa-urged-to-consider-environmental-impacts-of-legal-marijuana-1.23138938

https://thetyee.ca/Opinion/2018/01/18/Housing-Crisis-Really-About-Globalization/

Interesting article – some snippets I liked… we are now competing w/ the global elites people… and Horgan isn’t going to do enough about it…

“Of course, the reason for the wage-price gap is that the Vancouver housing market is no longer strictly local — already an unprecedented 20 per cent of high-end condominiums in Vancouver are foreign owned. The world sees Canada as a safe, economically secure and politically stable country, and Vancouver as a particularly attractive city.

This makes the Vancouver property market highly attractive to foreign investors, legitimate and otherwise, so local housing prices now reflect global realities. Vancouver is not a high-income city, but local wage-earners must now compete with the world’s growing millions of super-rich for a piece of their own city.”

“People no longer live in economies that reflect local conditions and serve basic needs, but must now adapt their lives and communities to global economic realities and the rule of capital. With globalization, workers in Canada and other “advanced” economies have had to compete with impoverished foreign workers for their jobs; they are now being forced to compete with wealthy foreign elites for their housing.”

“Massive taxes on foreign buyers or empty house taxes might help fix market inequities, but an outright ban on foreign ownership would be more honest and effective. In the absence of serious civil unrest, however, such “extreme” measures are unlikely to be implemented. Money talks — indeed, somewhat ironically, major resistance comes from thousands of local resident property-owners whose houses have made them millionaires and who are loath to give up their unearned bounty.”

Pot caused prices to spike here 2 years before legalization? I don’t follow. And if you’re growing pot why would you choose super expensive real estate? I assume most of it will be grown in greenhouses so the climate won’t have a huge impact.

Exactly, those people set the price. 2 years ago they had a golden opportunity to come and come they did. At 3 times the rate as normal. Last thing I heard was a couple came over from Vancouver and toured a few places but decided that prices weren’t as good here as they were expecting. The opportunity to sell the house in Vancouver, buy in Victoria and retire with the difference is gone for most.

I would imagine not, however I don’t know. The big 5 probably make up the large majority of lending in the country

Remember folks, they’re not making any more skyboxes. Ok in Cordova bay that may actually be accurate

Wondering how this plays into Victoria RE?

I think Introvert posted something about potential new greenhouses in Saanich a while ago. Yes, it’s certainly been interesting in the stock market lately. Canada is poised to be the world’s leader in production possibly.

One thing I wonder is how come more production facilities aren’t setting up in these parts? I know we have some but I wonder about the heating and lighting and ability to produce in cold places like Sask.? Maybe I just don’t know enough about it though.

http://www.courtenay.ca/assets/Departments/Development~Services/LAP_Old%20Orchard.pdf

Andy – They are in this ‘hood… Old Orchard (if I got it mixed up w/ Comox in an earlier thread my mistake). I think the apple tree in their yard – biggest one I’ve ever seen – is from the original orchard. The shootings you mention were in other parts of Courtenay.

My relatives don’t have a TV, don’t believe in it, and they keep really busy with musical related activities all around the CV, they are well known there and extremely talented, so maybe they just missed those news items? They don’t focus on negative stuff I guess.

No doubt there are a lot of the above.

However, youngish people cashing out of Vancouver may be disproportionately choosing to buy in places like Oak Bay, if this tweet is any indication. And these folks do have a ton of money, and they’re not old.

Go for it. It will clear up confusion.

My question may have gotten buried. Here it is again:

Don’t forget the green rush. It was just legalized in Cali and the federal issue means it is difficult to do a lot of things related at scale. There is going to be more listings on the Canadian exchange as these US players have a way to function once we are legal here. It’s why the Canadian growers are shooting skyward. I still think this new money is one of the key drivers here.

Yes I thought about this as well but ultimately I doubt this is moving the needle for the whole region. It would be extremely unlikely that Victoria residents are behaving so radically different from other Canadians by purposefully not paying off their mortgages and investing instead. Even wealthy people like a paid off house.

The old part is the key. Older people tend not to have mortgages. I bet if there was an old part of any other city the stats would be very similar. In other words those people don’t have mortgages because they’ve been there for 20 years and are 65 years old. Not because they have a ton of money.

The people sitting in their houses in Oak Bay with no mortgage have zero effect on market prices. What matters is whether new people can afford to buy their houses when they die.

You are right of course, this data does not tell us anything about where those highly indebted buyers are concentrated (or if they are evenly distributed). However it does tell us we have more than most cities, so while there are pockets that are driven by money rather than debt (perhaps Oak Bay or the uplands), overall the high prices seem to be largely driven by debt.

Agreed. I’m specifically not predicting any particular decrease in sales or prices from the stress test. However we will see a decline in those highly indebted borrowers in the stats. That will almost certainly come with reduced sales, but the market has surprised me many times so we’ll see.

I have had many a happy client that found divorce not only liberating but very financially rewarding. Whereas I only found it only financially rewarding.

@josh

“Can’t lose your job if you’re retired”

Check out Sears.

http://www.cbc.ca/news/business/sears-pension-reduced-1.4289380

So where in the world does this fictional town exist young Josh Hawkins? Perhaps on Treasure Island?

I’m feeling a you tube moment is coming! Time to open a 12 year old bottle of Rum. I just need to find 14 more people and a chest.

Unlikely to lose your CPP and OAP but if the company you worked at now goes belly up so does that pension.

The young can always look forward to divorce as the rate is about one in every two.

Myself I don’t believe in divorce -murder yes- but not divorce.

Tell me that you did not barbecue the Parrot, Number Six

I think you’re on the right track there but it would be how fast median prices are accelerating or decelerating. The velocity of price is used in appraisal text books to describe market change.

Or by the use on analogy. The real estate market is a mighty leviathan plowing through the great Accountant Sea, skirting the banks of Ruptcy. For the market to decline the speed of this great beast has to slow first before it can reverse.

The rate of increase in prices has to slow, drop to zero and then go negative.

I’ll sea what kind of treasure I can dig up.

-Long John Silver aka Just Jack but without the parrot.

Can’t lose your job if you’re retired. And likelihood of your spouse dying is extremely low if you’re young. Still though, prices are determined by seller and buyer. An area may look like it’s doing better if everyone owns their home and doesn’t have to sell despite increasing rates and/or a market downturn, but those that do sell will have to lower their prices to find a buyer.

@Bman

It is always a good time for divorce lawyers although during the first stages of a recession divorces actually slow down a bit. The reasons for that slow down require a fair bit of cynicism to appreciate.

@Number 6

“Just like the core, the detached housing market has cooled down this month

Months of Inventory now stands at 5.

New Listings replaced sales at the rate of 2:1

And the average days on market now stretching to 44.”

Thanks for the stats. Are you able to post the last 6 months’s MOI for detached so we can see how fast/slow it’s shifting? Thx.

Whoops, posted this on the wrong thread, so here it goes again…

@ Introvert

“We’re not so much arguing as comparing notes. (I too love cheese.)”

Yep, sums it up.

@Luke

Hey Luke… Orchard Park is in Comox, not downtown Courtenay. Comox has significantly less crime than Courtenay, but it still has some.

I was surprised a while back talking to some of the dog owners down at the Comox Marina to find that they had to be careful with their dogs there because of the needles in the grass/bushes. I was surprised as I wasn’t expecting that in Comox.

I don’t say any of this to scare anyone away from the area, it’s a lovely area, I just mention it as if you come from a safer area, this can all come as a surprise and I think it’s wise to go into any situation with your eyes wide open. It’s odd that your relatives aren’t aware of this stuff, it’s always in the papers and on the news…

https://vancouverisland.ctvnews.ca/man-50-injured-in-late-night-targeted-shooting-in-courtenay-1.3652982

https://www.comoxvalleyrecord.com/news/one-man-in-hospital-following-targeted-shooting-in-courtenay/

https://www.cheknews.ca/rcmp-still-searching-courtenay-shooting-suspect-293817/

But the demographics don’t make someone more likely to lose their job, or have a divorce, or illness or lose their spouse.

You’re reading more into this than what it is. Obviously some jobs are going to be necessary even in a recession.

For those that don’t know. Introvert always alludes to me as Just Jack as if in some ways that’s derogatory. In those days I constantly called him a moron and that is where his hate originates from. I chose to be a better person and not make personal attacks and changed by handle.

But if it will make him a happier person I have no problem changing my handle back to Just Jack. But I won’t sink to that level of derogatory remarks again. I’ll think them – just not post them. As I don’t think anyone wants to hear that shit.

“Then we’re back to the point that Oak Bay isn’t a market by itself. Oak Bay is part of the marketplace.”

I understand that Oak Bay is part of the marketplace. It’s just a different segment, and the demographics are different. It’s not just the distance from Oak Bay.

“But we have neighborhoods closer to Oak Bay that have similar or lower prices than Langford such as Esquimalt and Vic West or even Central Park or Burnside.”

It’s the inventory that would come on as a result of foreclosures in a serious default crisis. There would be more inventory relative to demand in Langford than in Oak Bay, which leads me to believe that prices would fall further in Langford and recover slower. In the last correction, I believe that was the case but I don’t have access to the stats on hand.

“And these people have jobs that could be in more demand in a downturn such a car repossession who needs a hedge fund manager in Oak Bay in a downturn.”

True, but it might also be a good time for divorce lawyers.

I distinctly remember foreboding musings like this one coming from Just Jack and others years ago on this blog.

Apparently conditions are such that they are back.

So I missed your comment on the last post about a possible place Luke. Easy to miss stuff on this forum.

Look forward to hearing from you.

Old Orchard, the area I am talking about is, right off 5 th Street in downtown Courtenay. Orchard Park is a new neighbourhood to me but I am guessing it is near the Filberg Lodge in Comox.

Then we’re back to the point that Oak Bay isn’t a market by itself. Oak Bay is part of the marketplace. I understand what you’re saying that Langford is so far away that it would have a lower impact on Oak Bay. But we have neighborhoods closer to Oak Bay that have similar or lower prices than Langford such as Esquimalt and Vic West or even Central Park or Burnside. And these people have jobs that could be in more demand in a downturn such a car repossession who needs a hedge fund manager in Oak Bay in a downturn.

Exactly, no redemption period and the lawyer is asking for immediate conduct of sale as the mortgage is well above the value of the property. A long delay would just add to the costs.

Mostly its CMHC. The master of the court will usually give more time for a person who is trying to get out of foreclosure. But if CMHC is holding the bag, It’s gone. And the taxpayers pick up another loss.

“Houses don’t stop making payments, people do. The price of the home has nothing to do with making or not making payments. Rich man, poor man, beggar man, thief when something occurs in your life and you can’t make the payments it doesn’t matter if you live in Uplands or Port Renfrew.”

The point is there are fewer households that have to make mortgage payments in Oak Bay than in Langford.

“The foreclosure process isn’t necessarily lengthy. I’ve seen it happen in under 3 months with some of the credit unions and private lenders.”

I assume this could be the case if the mortgage holder does not file a response to the petition.

Houses don’t stop making payments, people do. The price of the home has nothing to do with making or not making payments. Rich man, poor man, beggar man, thief when something occurs in your life and you can’t make the payments it doesn’t matter if you live in Uplands or Port Renfrew.

But as I said prices are set by those buying and selling. And while it is true, you don’t have to sell anyone caught up in the downside and has to relocate will have to compete with foreclosures.

I hear home owners in down markets say that their homes are worth more because they don’t have to sell or will never sell. But that has no bearing on market value.

“You’re assuming that Oak Bay is an island onto itself. What happens in neighboring areas such as Saanich and Victoria will also have an affect on Oak Bay.”

Never said Oak Bay was immune to falling prices. I’m saying I agree with Barrister that a correction would hit areas like Langford harder (where 75% of owner households have a mortgage, and there are way more working age people) than South Oak Bay (where the number is less than 40%, and its full of retirees).

House prices would fall in SOB, but old rich people without mortgages get to say “meh, it’ll recover eventually.” Young tradesmen with $650,000 mortgages that are suddenly unemployed and underwater? They don’t get to ride it out.

The foreclosure process isn’t necessarily lengthy. I’ve seen it happen in under 3 months with some of the credit unions and private lenders. And yes it is costly but that gets added to the mortgage. For the typical property my guess is another $100,000 is added to the mortgage by the bank and lawyers in fees and penalties.

When you start missing payments things really start to add up fast. And even when the property is sold and there remains a deficit, CMHC has its own collection agency called CRA.

https://youtu.be/o3Si4_0gfJQ

However, many who were considering selling will simply choose not to. And if enough people aren’t selling, by definition, inventory will be low—and low inventory could moderate price declines.

Good point.

Great, thanks Leo – when you email Grace I can send more info. and pictures to see if you’re interested.

My relatives have lived in Old Orchard since 1999 – they’ve never had a break in and never heard of any in their immediate ‘hood. They are very involved in the community up there too and haven’t heard of shootings. Their daughter and granddaughter live in the basement so there’s always someone there, the house is never left empty. they have a few ‘down and outer’s’ straggling about in downtown of course, but they say but nothing but good stories about all their neighbours. Nice old lady on one side and family on the other side. Beautiful home w/ big porch on the front and heritage features throughout. 100 year old apple tree in the yard. Maybe they’re in a different part of the ‘hood than where Andy mentions but they’re close to downtown. There’s a house near them (larger than theirs) recently come up for sale for $739k… https://www.realtor.ca/Residential/Single-Family/18910267/543-5TH-STREET-COURTENAY-British-Columbia-V9N1K2-Z2-Courtenay-City

They said their assessment was way up this year… seems they are quite happy and loving it there.

Thanks Marko – doesn’t sound like things are slowing down in the slightest yet – for anything not a dreg that is.

You’re assuming that Oak Bay is an island onto itself. What happens in neighboring areas such as Saanich and Victoria will also have an affect on Oak Bay.

The three areas of Saanich East, Oak Bay and Victoria City seem to work in tandem with each other with similar months of inventory, listings to sales ratios and days on market. That’s because they appeal to the same buyer. Buying in Rockland, James Bay, Fairfield, Oak Bay or Cadboro Bay is not much of a difference to a prospective purchaser as they easily substitute one for the other depending on what is available. Location is important but there are other physical aspects that are just as important to a prospective purchaser.

“While there may be a lot of households with mortgages only a small fraction of say 1 percent of those mortgages going into default could topple a real estate market.”

Well, assuming that .2% of mortgages in South Oak Bay are in default, that would amount to about 20 households (using 2011 data). Since foreclosure is a lengthy and expensive process, it is a last resort. Of those 20 properties, only a few will ever be foreclosed on.

I think it’s going to take a lot more than a fraction of a percent of mortgages in default, to send house prices plummeting.

Leo, in reading the Bank of Canada PDF I see that the source for several of its graphs and tables is “Regulatory filings of Canadian banks.” Does that include credit unions?

Glad to hear no problems in the Old Orchard Area of Courtenay.,we definitely had a fair bit of crime when we lived there in the early 90s

Luke- Leo sent me you email. I will get in touch.

It makes sense to me Marko. We’ve been through this several times before. Because of the hectic environment for condos some prospective buyers are willing to pay over market value for the property.

That’s their choice. But once the market returns to normal levels then all the money they paid over market value is gone. If this is the last home that they are ever going to live in, then it only matters to the estate and even then its free money to them.

But, if there is a substantial mortgage involved then the lender may take a loss. That’s why people will overpay for a house but banks don’t over lend.

@dasmo

Decora tile did a nice job on our backsplash and the price was fair. I have no other experience with tilers but i was happy with what i got and what i paid.

and before I get to another showing……some of the sales coming through obviously have nothing to do with stress tests…..condo in Cordova Bay just sold at $1.95 million; previous purchase $719,000 in 2005.

It’s only January… and…

Anything that is half decent you show up and there are five other agents there as well.

A studio condo sold last night in Vic West for $390,000 in multiple offers, listing agent says his phone went crazy when he put it into the system.

3.5 years ago I was the listing agent on the same unit and it sold for $232,000 with only 3 or 4 showings in 36 DOM.

Last year everyone was marvelling at $1,000 a foot at the Janion but we appear to be closing in on that on higher quality non-Janion buildings as well.

Hey HHV hive. Anyone have any excellent tiler recommendations or contracts? It doesn’t seem hard but the advent of glue in showers has really killed this skill. Add in a building boom and you have high potential for some crappie workmanship!

Email me at markojuras@shaw.ca and I’ll give you a couple of recommendations.

But that hasn’t changed over the decades. I remember speaking with a Scotiabank lender years back and he said that they didn’t do much in the way of mortgages. Most of their work was to do with people no longer qualifying for an RRSP.

While there may be a lot of households with mortgages only a small fraction of say 1 percent of those mortgages going into default could topple a real estate market. And that’s because only a small fraction of the total inventory of housing say 3 or 4% is ever up for sale at any time.

Adding 1 percent of 100,000 mortgages or another thousand listings would swamp our small market. And in my opinion, that’s the mistake most people make as they think the market is too big to fail. It’s what happens at the margin that dictates market prices. Even though most of Oak Bay residents may not have mortgages it is the few that have to sell in a down market that set the price not those sitting in their Oak Bay cabins watching re-runs of the Golden Girls.

Have to love booking showings in this market….showing confirmation from this morning

“All good there will be a crush of people so I will be there at the door. Thanks, xxxxx”

Barrister, agreed.

Luke, CMHC. I take back some of what I said about Canada being a backwater when it comes to housing market info. This is pretty cool, but still leaves a lot to be desired:

https://www03.cmhc-schl.gc.ca/hmiportal/en/#Profile/1/1/Canada

Grace – it doesn’t look like Leo is facilitating forwarding of personal emails on here or PM options, so I think if you’re wanting to meet up and don’t want to post your email on here (reg. looking for at least several days to a week – rental suite option) then just post on here when you’re coming down to Victoria next and we can meet up at Starbucks on OB Ave or somewhere like that.

I’ll also – probably – be heading up your way around the 24th Feb. weekend. Not sure about that yet though. Def. heading up there on 23rd March.

My days off to end of March are Thurs/Fri. and I’m working all day shifts right now so can meet in evenings or lunchtime Mon-Wed.

Exactly – and the most sought after area’s will be the last to go down and first to go back up…still an incredible lack of inventory. Really going to be interesting to see what this spring brings…

It’s only January… and…

I’m seeing some high end sales that don’t even seem make it to market! 1044 Hampshire Rd in south OB new build just one day OM… only 2200 sq.ft on a 6500 sq ft lot for $2m +GST. Pictures don’t even show it complete yet! (just renderings).

586 Oliver St in South OB – -probably going to be a building lot – basically a tear down – but it was listed at $995k and sold quick for $1,101k! This says contractors are probably still looking in the best areas, so what does that and the $2m sale above say about high end buyers?

A townhouse next to Abkhazi Gdns – high end but small living space, great setting, only 2 DOM, listed at $799k but sold for $840k. Essentially a four plex though… Live w/ three others in 1373 sq. ft in a large house on a big lot. Not my ideal – but it went over asking.

This new listing today caught my eye… looks like rare quality! In my Fav. hood (though I haven’t seen it) 151 Howe St. for $1.5k. My bet is this one will sell quick. 2500 sq ft. on a 5650 sq ft. lot in sought after south Fairfield.

Yes, it probably won’t. But that’s a bit more of a micro view – what one cohort in one neighborhood can afford over another. In a more macro sense though, a restriction in underwriting on the national level or a choke on credit would have a somewhat blanket effect over the entire country. It won’t make a whole lot of difference what neighborhood you’re in. If people are less enthusiastic about real estate, they’ll be more hesitant to buy, inventory builds and prices fall. In areas where there’s been more exuberance, you may find larger effects.

It’s also reasonable that the most “desirable” RE markets may recover faster than lesser ones and indeed, that’s been the American experience thus far.

Bman: I agree that all areas will correct but the percentage of correction will really vary. The mortgage stress tests probably will not have a large impact on areas such as Uplands or waterfront property. Rockland and Fairfield will be impacted more but still a lot less than the West Shore. The stress tests generally speaking will probably not effect the vast majority of buyers in the two million and up market. The lack of inventory is a bigger factor. For example, in all of Rockland there is only one SFH on the market at the moment. There are only 3 SFH in all of James Bay. 11 SFH in Fairfield (four of them are 2mil plus). It is still early in the month but inventory looks a bit tight so far.

But I am often wrong so take my opinion with a truckload of salt.

I think you need to know net worth to understand the stats properly. People with high net worth who have chosen to put only 20% down and invest otherwise due to low mortgage rates are caught in the same category as those who had to put 20% down in order to qualify for the mortgage based on income and both end up being called Many people with high net worth keep their incomes low for tax purposes.

Very well said Barrister. At 8:29am. Rich people will still be looking for rare quality homes in the best areas. Langford will still be Langford… Life behind tweed will go on as it has.

Dasmo, id recommend the tile guy I had but he swore more than a drunk sailor, and I don’t think I kept his contact info anyway. Never heard so many F bombs at once. He did a great job but was messy. Had to wait many months for him as they’re all so busy. It was the last thing to get done. Through Home Depot.

Relatives in Orchard park didn’t know of problems Andy speaks of. They say they have great neighbours. When I mentioned shootings they had no idea. Oblivious?

Where are you getting those stats Bman?

Leo, great post.

Barrister, you asked: “I am curious whether we have separate numbers reported for Oak Bay for percentage of all cash buyers and are there stats that are separate for Langford?”

Don’t know, but in South Oak Bay, 62% of owner households have no mortgage at all, a staggering 50% of the population is over 55, and 43% of households have an income over $100,000. It’s rich and old.

Contrast it with my neighbourhood of Hillside-Quadra, and you find the opposite. Almost 68% of owner households have a mortgage (only 39% of households own their home), the biggest cohort is 25-35, and only 11% of households have an income over $100,000. It’s young(ish) and poor.

Yes, stress test will probably have less impact on South Oak Bay than Hillside-Quadra. That said, if house prices correct because of stress-test, you really think South Oak Bay, Rockland, etc., won’t correct as well?

@LeoS: By the way where did you get my photo from, with me bringing the house cash into Victoria?

On the plus side Mount Washington has had a metre of snow in the last 72 hours 🙂

Hey HHV hive. Anyone have any excellent tiler recommendations or contracts? It doesn’t seem hard but the advent of glue in showers has really killed this skill. Add in a building boom and you have high potential for some crappie workmanship!

With rental properties it isn’t just gross revenue that is considered but also the expenses, excluding debt servicing. It’s the net income.

With houses that have basement suites the expenses are all jumbled up with the owners space and that’s why using a percentage of the income is used. As has been pointed out numerous times on this blog the net income of operating a suite in your home is minimal.

In my experience, even using 50% of the basement’s income is too high. It should be zero because of how that income is easily manipulated by those trying to make the deal.

First let me thank LeoS for a great job digging out the numbers. He has done a great job providing what is available. The problem is that the available numbers really dont provide a clear picture of what is driving parts of the market. Rolling in the combined stats for SFH and condos is somewhat akin to providing an average vehicle cost by combining cars and bicycles (and yes I am exaggerating to illustrate the point). Combining the West Shore and the core of Victoria also distorts the true impact of out of town buyers with cash.

I am curious whether we have separate numbers reported for Oak Bay for percentage of all cash buyers and are there stats that are separate for Langford? One of the things that I have noticed is that the impact of out of town buyers is far from uniform in the city. When I was house hunting in Victoria a knockdown house in Uplands was selling for between 600k and 800k. In the last year knockdowns are selling between 2.1 and 2.4 million. That is an increase of at least 300%. Meanwhile areas like Fairfield and Rockland have only doubled.

I have had friends come from Toronto to look at possibly retiring in Victoria. If it was a matter of buying in Langford or somewhere other than Victoria the answer always was not Victoria. Obviously, that is not always the case. My point is that the housing pressure from retirees from outside Victoria is far from uniform.

The new stress test might have a major impact on the west shore but I dont think that one can extrapolate that impact to the sale price of SFH in the Uplands or even Oak Bay and Fairfield.

I am not saying that there will be no impact but rather that it is marginal. At the risk of being beaten up there is a pretty limited number of high end houses in Victoria in the first place (sorry, most of both Fairfield and Oak Bay really dont qualify as high end properties regardless of the prices they might be commanding).

Looks like another rainy day.

I don’t see any indication that their definition of income is not actual income and instead “income accepted for purposes of mortgage qualification”. The latter changes regularly so wouldn’t make for very useful stats over time.

Even if it was the latter though, it would be the same definition across the country. Doesn’t really change anything as far as Victoria’s reliance on debt compared to other cities.

And yet, people will walk on a deal over the water tank being older than advertised 🙂

Fantastic write up, using plain old data and common sense.

Thanks for putting this together, Leo.

I always question these kinds of bank numbers. For example: Banks will look at your income from “separate” rental properties and allow you to declare the full rental income as income. But if it is rental income earned from your own personal property (A Suite in your own basement for example) , they will only accept “Half” the rents as income. So…….my point is that in reality your income is actually higher by quite a bit but the numbers entered into these stats might list you as a high ratio borrower because your full actual income is not considered by the banks.

Banks are complete fools in my opinion because they don’t put much stock in the value of equity. It’s almost always about income. They have no idea how useless a home inspection is. (For example: The guy running around with a clip board, flashlight, measuring tape and a host of other silly gadgets……likely isn’t even qualified to pull the full electrical panel off to take a good look inside.) At the end of all that you get a report pointing out the obvious…that the top windows need a lick of fresh paint etc. Guess what Folks….You are paying over $800,000.00 for a bungalow in Victoria because it’s “Victoria”. Not because your $500.00 water tank is in good shape:) But the banks love that report. And yes…. of course get someone to check for oil tanks. Have a “qualified” and experienced roofer check the roof “if” it looks suspect. Have a Qualified “electrician” check your wiring.