Jan 15 Market Update – The stress test starts to bite

Weekly sales numbers courtesy of the VREB.

| Jan 2018 |

Jan

2017

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 41 | 115 | 478 | ||

| New Listings | 124 | 276 | 753 | ||

| Active Listings | 1398 | 1417 | 1516 | ||

| Sales to New Listings | 33% | 42% | 63% | ||

| Sales Projection | — | 368 | |||

| Months of Inventory | 3.2 | ||||

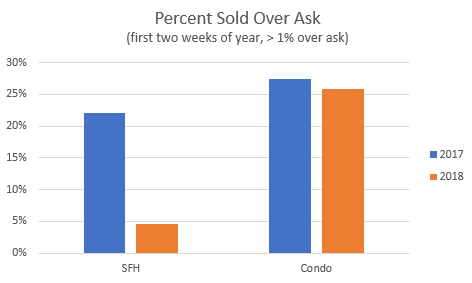

Seems like the stress test is biting already despite some pre-approvals not requiring it. Sales are down about 23% from this time last year, lead mostly by a drop in condo sales. Despite this, one in four condos are still going for over asking price. The last desperate people with pre-approvals looking to lock in before they expire?

Meanwhile single family homes are selling at only a somewhat slower pace than last year, but bidding wars are almost completely gone from that market.

Did everyone selling a house just get disgusted at the delayed offers tactic and stop using it? One would think that if the market in single family had cooled that much we would see a steeper sales drop. Maybe that is still coming.

Going forward I see a lot of headwinds piling up for condos.

- The stress test will likely hit first time buyers the hardest,

- There is a lot of new supply coming for condos,

- An increase in dedicated rentals being built will slow rent appreciation and reduce the incentive for condo investors,

- AirBnB restrictions will almost certainly take effect in Victoria this year (even Saanich and Mechosin are starting to investigate).

In the last corrections condos took the biggest hit, and I suspect the next one will be no exception.

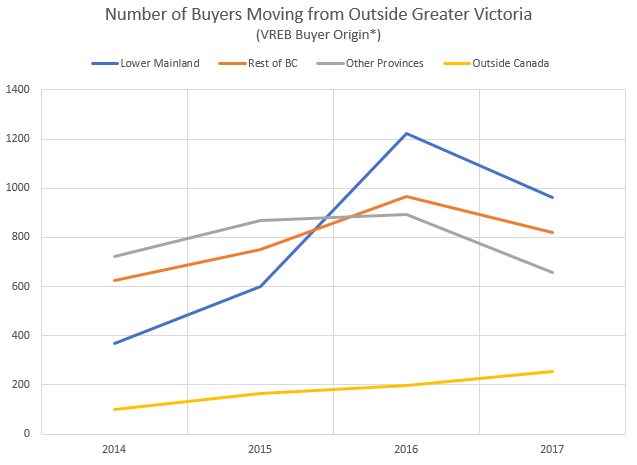

In other news, as mentioned in the previous post, the VREB Buyer Origin report was also released for 2017. These are the results.

As the VREB notes, when interpreting these data be aware that: “This information is based on data supplied by member REALTORS® who reported the unconditional sales of their listings during the reporting period. The answers supplied respond to the question: “Where is the buyer currently residing?” This data cannot be used to deduce the nationality of the buyer”.

A few takeaways:

- Buyers from the lower mainland were down significantly in 2017 however they are still elevated compared to previous years, and represent our single largest group of non-local buyers

- The number of buyers from outside Canada is low but steadily increasing, going from 99 (1.5% of sales) in 2014 to 253 (2.9%) in 2017.

- In 2017, sales to out of towners slowed down more (down 19%) than sales to locals (down 13%).

- Buyers from Alberta dropped by almost a third, going from several years of about 450 to 309.

@ Introvert

“We’re not so much arguing as comparing notes. (I too love cheese.)”

Yep, sums it up.

@Luke

Hey Luke… Orchard Park is in Comox, not Courtenay. Comox has significantly less crime than Courtenay, but it still has some.

I was surprised a while back talking to some of the dog owners down at the Comox Marina to find that they had to be careful with their dogs there because of the needles in the grass/bushes. I was surprised as I wasn’t expecting that in Comox.

I don’t say any of this to scare anyone away from the area, it’s a lovely area, I just mention it as if you come from a safer area, this can all come as a surprise and I think it’s wise to go into any situation with your eyes wide open. It’s odd that your relatives aren’t aware of this stuff, it’s always in the papers and on the news…

https://vancouverisland.ctvnews.ca/man-50-injured-in-late-night-targeted-shooting-in-courtenay-1.3652982

https://www.comoxvalleyrecord.com/news/one-man-in-hospital-following-targeted-shooting-in-courtenay/

https://www.cheknews.ca/rcmp-still-searching-courtenay-shooting-suspect-293817/

New post: https://househuntvictoria.ca/2018/01/18/the-wealthy-buyer/

Ethical, honest.

Low pressure approach.

Experienced while still having time.

Good testimonials.

Good reputation in the industry.

Hi Grace – not sure if Leo can pass on my email to you, if you can do that Leo go ahead.

Or, if you want to post your email on here I can email you. I do have something that may work for you. Not sure about a week at a time during the summer, but several days is probably fine.

Or, you can post on here next time you’re coming down to Victoria and set up a time/place to meet…

Yes, the whole time pretty much I was trying to figure out how to move to Victoria – wish I got here a bit earlier but better late than never! The one thing I still remember about living up there was how it was so quiet you could hear the swish of birds wings as they flew past. Sounds like you live in Qualicum Woods…

We know the condo market is hot in the core and the core house market has cooled significantly but what about Langford and Colwood.

Just like the core, the detached housing market has cooled down this month

Months of Inventory now stands at 5.

New Listings replaced sales at the rate of 2:1

And the average days on market now stretching to 44.

What a massive difference from the year before. These economic indicators still show a balanced market but it is surprising how fast the market has moved from strongly in favor of sellers to one where we could possibly see declining prices.

At a little over half way through the month Active Listings in Langford and Colwood are at 154 which is higher than all of January 2017 when they reached 122.

And this is where the core housing market and Langford/Colwood differ. In the core it is fewer house sales and in the westshore it is an increase in supply.

The spooky thing is how fast the market has changed. But we still have a couple of months left till spring so things could reverse or get worse

Leo, what’s your criteria for “good” realtors?

https://househuntvictoria.ca/referral/

I was disappointed to see that Jordan River did not make the finalist list for Amazon’s new HQ2.

Meanwhile, in Nanaimo [sigh]:

Eight Nanaimo schools in hold-and-secure as student threatens self-harm

https://www.saanichnews.com/news/eight-nanaimo-schools-in-hold-and-secure-as-student-threatens-self-harm/?utm_source=dlvr.it&utm_medium=twitter

Oh yeah people are OLD in QB. And pretty cranky.

We paid 430,000 for a 1500 square foot rancher on a beautiful 1/4 acre lot. The roof, siding, hardwood floors and bathrooms are all brand new. One year ago. A perfect home for young or old couple. our assessment was up 70,000!

We get so many birds in our yard and most of the time it is pin drop quiet. I like that in my neighbourhood but not for the whole darn town…lol

So if a young family could make it here they could get a lovely house for the price of a condo in Victoria. Kids roam around here without adult supervision too which is lovely to see. They ride their bikes everywhere.

The other day I met an American family with two young children who moved here from Seattle. He is agame developer and they can live just about anywhere. They absolutely love it here. They completely remodeled an old,farmhouse and it is stunning.

What might you get for 1M$ plus in the Comox Valley.

First of all not a lot of mid-winter inventory in that price range.

$1.079 M – waterfront, 1 acre in Courtenay, older (1956) smaller house

$1.4 M – view, 14000 sf lot, Courtenay East, 4800 sf modern home

$1.288 M – 12000 sf lot, Comox, 6100 sf modern home

$1.25 M – 1.2 acres subdividable, 2000 SF home

$1.299 M – 1.3 acre, 5700 sf modern home

$1,25 M – 5 acres, 2200 sf

The latter three are not in one of the towns but are literally across the street from Comox or Courtenay. It is hard to compare to Victoria because there are less large neighbourhoods of established character. The nicer areas IMO are pockets of the Courtenay core, view houses on the hill in east Courtenay, large parts of Comox , and areas in the RD just to the east of Comox on the cape.

Some of them have been coworkers over the years :P. There’s a local place called North Studio and a sister/parasite company called IdeaZone. I would hire exactly no one there and they charge $120/hour (only $20 – $30/hr goes to the “developers”). The people working there are not programmers. They honest to god just click things in Drupal and WordPress. Whenever something goes wrong, they just install a different plugin and cross their fingers. If they really get stuck, that’s when they call me in, and I left. Everyone worth anything leaves that place within 3 months. They also owe me thousands which I haven’t bother to sue them over. Fun times.

Thinking of different island communities a few statistics

Community, percentage of population 19 or under, average age

Langford 23.7% 38.6 y

Victoria 12.5% 42.7 y

Oak Bay 19 % 49.2 y

Sidney 14% 54.6 y

Saltspring 16.4% 50.1 y

Parksville 13.5% 54.5 y

Qualicum 9.5% 60.1 y

Courtenay 19.3% 45.8 y

Campbell River 21 % 44 y

The ages above are average ages. The most amazing fact to me was the MEDIAN age for Qualicum Beach – almost 66 years old.

Interesting that Victoria is relatively young but low kid numbers. Oak Bay is relatively old but with higher kid numbers – possibly skewed a bit by Oak Bay

Well thank you. I even clipped my claws recently. Still suffer from a bit of mange, though.

If we ever move up-Island in our golden years, we’ll be sure to rent first, to ensure the city/neighbourhood is a good fit. Then, if we buy, we’ll be recorded as “local buyers,” and the Qualicum Beach regulars will be at the coffee shop discussing how risky these $800,000 mortgages are that buyers surely are taking out.

haha, I love it! 😛

“Hawk, do you want to do coffee sometime?”

Sorry, I’m already spoken for.

8 years in QB Luke! I won’t make it that long and I am in the older demographics.

My husband loves it here and I am just going to appreciate the good things for now. I drive down to Victoria at least once a month and just spent two glorious days there.

I would like to do a week sometime so if anyone knows a reasonably priced suite or wants the best house sitter you could ever want let me know. I wish there was a PM function here.

We are well known in Victoria ( for very positive reasons) so references would be easy to come by.

A dating AND a house finding site now!

For anyone interested, here is a link to a new and fairly interesting slide deck covering a lot of the metrics and underlying risk factors of the Canadian housing market. It also covers the Australian and US housing markets.

Lots of graphs and associated commentary, with some comparisons between the markets being made. Worth a look.

https://www.macrovoices.com/guest-content/list-guest-publications/1503-josh-steiner-hedgeye-slide-deck-macrovoices-january-11-2018/file

Now we’re a dating site.

Soon Leo will seek to cash in with pop-up ads: “Hot bears in your area want to meet you!”

Well I lived near QB for 8 years and so I know all the areas up Island very well. my relatives do live in Orchard park though they haven’t ever mentioned the type of problems you speak of Andy. I will ask though.

QB was way way too quiet for me, but I had to escape Van and so getting the job up there is where I ended up. It was a life lesson learned and no regrets as later I realized Victoria is the happy medium. QB is a beautiful place and once you find the very few young people to get to know it’s a great place to be. I still head up there to see old friends. I found a better job down here though.

Port Alberni is very affordable for a good reason. there’s lots of fog and rain and crime there. It’s redneck territory. But it is near the west coast and up and coming I hear. I personally would never live there or probably anywhere up Island again now. I’m in the know having lived up Island already. I’ve now found paradise here in Victoria 🙂

Grandpa’s World, as our 4 year old so aptly described it.

Edit: Although Grandmas’ World would be even more accurate

Not at all. People’s personal impressions are refreshing and important. A straight numbers blog would be unbearable.

We’re not so much arguing as comparing notes. (I too love cheese.)

Half a dozen visits to Qualicum Beach have led me to conclude that it is far too quiet for me—and I’m someone who can appreciate quiet, trust me.

Outside of the summer tourist season, QB is dead. Absolutely dead. Not many people walking around. Not the slightest bit of bustle. It’s just a beautiful, tranquil place where a few oldtimers are living out their final days, drinking tea indoors because it’s a bit nippy outside.

@caveat emperor

“In the Comox Valley a significant number of houses in the 1-2 M$ range are going to be one or more of (a) acreage, (b) waterfront, (c) very large or otherwise high end.”

I agree and disagree. The numbers closer to 1 M-ish are newer homes, not on large lots, and in decent neighborhoods. The homes closer to 2M are on large lots (about an acre or so) and high end homes. None are waterfront in Comox, for that you’ve got to go up in price.

Personally, I think prices in Vic should be about double what they are in the CV, as Vic is bigger, has a larger population, more high paying jobs and so on. So it’s a bit of a shame to see what was an affordable community such as the CV, losing that affordability.

Yes, you absolutely could move to the CV and have money in the bank, but there will also be trade offs, so I guess it just comes down to what’s most important to you.

Grace — I love Qualicum and would move there in a heartbeat if the demographics were a little younger. Safe, clean and a beautiful area.

Grace – yes, character over boxes, absolutely.

Now back to Vic news… 🙂

Andy – I think your characterization of the three communities up there is pretty spot on. If I moved up there I would choose Comox even though it is a bit less hip than Cumberland. Best mix of good air quality, lower crime, nice houses and access to the ocean.

In the Comox Valley a significant number of houses in the 1-2 M$ range are going to be one or more of (a) acreage, (b) waterfront, (c) very large or otherwise high end.

Prices have shot up a lot in the Comox Valley. More percentagewise than Victoria. But one could still move there from Vic and end up with a better house and less debt or money in the bank.

Bottom line the east coast of Vancouver Island from Victoria to Campbell River is a beautiful blessed part of the world in a lucky country. If you live anywhere in this area, with stable employment, good health, and friends and family then raise a glass to your good fortune.

Arguing what community is the best in this strip of land is kind of like arguing over what is yummier – Emmental, Gouda, or Jarlsberg.

And I agree with you Andy. I was trying o be nice and there are many things to like about the CV. Many.

If I moved back there I would move to Comox over Courtenay any day. ( yeah we also lived there- we moved a lot in our younger days).

There is a definite underbelly which you don’t see at first. With all the crime in the Old Orchard area I didnt sleep at night if my husband was away. No way to live but after neighbours had men in their house, a beautiful house that seemed secure, in the middle of the night I was terrified.

The traffic is also terrible going over the two bridges

from about 3 pm…a mini Colwood crawl…lol. Sure not that big a deal but it is aggravating.

Wish more people would check out Parksville -Qualicum. Qualicum has gorgeous heritage homes, beautiful trails and parks. So very safe….our neighbour hood is dead quiet and full of trees and beautful yards. We have our own minimStanley Park a few blocks away. We see eagles every day. Add in a nice golf course, warm sandy beaches, nice restaurants and it is a pretty desirable place. It needs more energy and youth….come on up!

And now I will shut up and let you number guys get back at it.

Port Alberni looked pretty shabby when we were there a few weeks ago. I hear it,is,doing well but yeah would really not want to live there. Sorry Port.

Also Comox boxes depress me and the price for one these days is insane. That is why the Old Orchard is special..not cookie cutter homes. Sadly many house in the CV are very boring architecturally.

China’s Capital Outflow Plunges 67% In 2017 As Beijing Squeezes Outbound Deals

Capital outflow from China is estimated to have fallen sharply in 2017, demonstrating the effectiveness of the Chinese government’s campaign to strengthened capital controls and rein in overseas investment.

China’s total capital outflow was estimated at US$166 billion in 2017, down 78% from US$761 billion in 2015 and 67% from US$500 billion in 2016, according to a report from Pictet Wealth Management.

As a result, China’s foreign exchange reserves increased by US$129.4 billion in 2017 to US$3.14 trillion in total, reversing declined of US$512.7 billion in 2015 and US$320 billion in 2016, according to the Chinese State Administration of Foreign Exchange (SAFE).

The decline in capital outflows primarily reflects the effectiveness of the Chinese government’s strengthened capital controls, such as cracking down on underground money transfers, restricting large overseas mergers & acquisitions, and fixing various loopholes in the capital account transactions.

https://www.chinamoneynetwork.com/2018/01/10/chinas-capital-outflow-drops-67-2017-reflecting-effectiveness-governments-control

@Luke

“True. My aunt and uncle are visiting tomorrow from Courtenay where they live in a heritage house near downtown. They did mention some issues with down and out types too. I’ll ask them about it.

Still, it must be cheaper than the core here. Tofino is pricey true. Ucluelet even so these days. There’s always Port Alberni which is up and coming now but he said he won’t go smaller than here.”

I agree with Grace. To add to that…

Sounds like your aunt and uncle live in or near the Old Orchard in Courtenay which is a very cute area but does deal with crime (break ins, car thefts, homeless people living in tents in the trees etc)

You would be surprised at the amount of crime, homelessness, drug use and shootings (yes shootings!) in the CV. And a lot of the overdoses are happening among working professionals like you and me.

The CV is a beautiful place, but it does have a seedy underbelly that can be surprising to anyone that comes from a “safer” town. And like anywhere, some areas of town are safer than others, and it’s just a matter of knowing what’s what. It’s not a place that you can just look at realtor.ca and say, “oh look, that’s cheap, let’s buy that” because that might be the house next to where shootings keep happening (seriously) or where there’s a drug issue. Add to this, they also have air and water quality issues.

So all these things are elements to take into consideration when you think of moving and the costs, no matter where you choose to live.

Although Victoria has a homeless issue, crime seems to be less of an issue, and the air and water quality issues are non existent (although sewage is a different story!) and I don’t hear of many shootings in Vic.

I really don’t think you can compare Courtenay prices to the core of Victoria prices as the areas are not similar enough to act as comparables.

Certain areas of Courtenay deal with drug use, homelessness, crime and shootings. Courtenay in general (with pockets of exceptions) would be more like Esquimalt 10-15 years ago would be my best guess. Cumberland would be more like the Westshore with an Alberta influence (think big trucks and toys) with a hippie and sporty twist. And Comox would be more like older, retired Vic, with certain areas being higher end.

If you’re talking core Victoria like James Bay/ Oak Bay/ Fairfield/Rockland/Uplands, there isn’t really an equivalent, although the pricier CV properties in the 1-2 million $ range (non waterfront) I guess would be the closest comparable.

A few years ago, the CV was noticeably cheaper and a good deal but since the mass exodus out of Van that came to all parts of the island, prices exploded, like everywhere. It is still cheaper than Victoria, but not by much for comparable properties/neighborhoods.

So my viewpoint nowdays is, live where you really want to be…

Lol, please don’t tell him to live in Port (no offense to anyone that loves Port).

We lived in aheritage house in the downtown core of Courtenay ( known as the Old Orchard Area) for a few years in the early 90s. Had many wonderful attributes but everyone around us was broken into..in fact our neighbours woke up in the middle of the night with guys in their living room. Honestly did not feel safe there….so many B& Es. Our car was stolen from our driveway.

Drugs are a huge issue there. Ask any cop.

Not to say one shouldn’t move to the CV but it has crime and quite a bit of it. Never had one incident in our Victoria home. And we were right in the core.

The CV has gone through a lot of growing pains..not a town and not a city Great foodie scene though!

Qualicum is too quiet for most young people although it is a fantastic place to raise kids from all accounts. I like that it is only two hours to Victoria. That extra hour to the CV adds up in a day trip.

And googling things. Lots of googling things. Those can be learned.

Can it really though?

I have multiple times where I will deal with a Senior Developer who has been stuck for days and after I read the issue and spend 5 minutes googling a answer usually on stack over flow I am able to provide them with details to get them going.

It can be taught but as someone else pointed out not everyone has certain skills and I would say great developers are problem solvers not everyone has that skill. I have thought of this many times when they describe the next blue collar jobs as programmers.

I have interviewed many people that I cant not believe even have jobs as developers and in my opinion they are people who don’t understand programming fundamentals. Mainly in the US where there is a massive shortage of devs it seems and on H1B’s BUT even these guys are expecting 60-80 USD a hour for monkey work. (These would be bottom of the barrel people I would not hire getting those rates).

Honestly it puts Victoria to shame to see that over in Seattle these people get work for way more than we are making. If my wife wasnt working for the government for a pension we would have moved to Seattle already… though their housing rates have gone skyrocketing as well.

Wow, Saanich is on there too.

For most people yes, some people just never develop that programming common sense.

Civil Forfeiture has been abused horribly in the USA. You can google many stories of police departments essentially stealing people’s money.

I support seizing assets from this immigration and housing scam revealed in the court case, but only if due process is followed. Remember that the law is not only for the people you don’t like. Some day you may face it yourself.

True. My aunt and uncle are visiting tomorrow from Courtenay where they live in a heritage house near downtown. They did mention some issues with down and out types too. I’ll ask them about it.

Still, it must be cheaper than the core here. Tofino is pricey true. Ucluelet even so these days. There’s always Port Alberni which is up and coming now but he said he won’t go smaller than here.

lulz. I guess I didn’t specify population. Greater Victoria is 383k, the Ottawa area is about 1.1m and Hong Kong is about 8 million.

This is why I could never be a programmer. I have no idea what that means.

For your entertainment purposes. Victoria is a hot spot for millenials:

http://dailyhive.com/toronto/hottest-cities-millennials-canada-2018

@Luke

“if you can live anywhere there are plenty of nice spots on the island that are much cheaper than Vic – though they are quiet they still have the ‘West Coast’ quality of life factor and make great places to raise a family. Have you considered the Comox Valley, for ex.?, or other towns on the island? It’s not all retired people there are actually quite a few family people up there. You can jet easily to many places from Comox Valley. If you wanted to be closer to Vic maybe consider some of the new developments near Sooke or Shawnigan Lake? You could even live in Tofino or Ucluelet!”

Luke, have you been to other parts of the island lately? In the Comox Valley prices have skyrocketed from what they were, and in the decent areas, prices are snapping at the heels of Vic prices. The CV has a lot of crime and crappy builds so where and what you buy really does matter. Tofino/ Uki are not cheap either.

Victoria (and Saskatoon) are the smallest places I’ve ever lived by a factor of 3. Before that, Ottawa was the smallest place I’d lived by a factor of 8. Small towns aren’t my jam, at least right now. I think I’d seriously consider retirement in Ucluelet, love it there. It comes down to my wife’s job. Big busy hospitals are the best thing for her career.

I’ve taught programming, and I’ve found it mostly comes down to their desire to learn programming. Part of them has to enjoy troubleshooting mysterious errors and behaviour. It’s all just logic, math (not much tbh), organization and accuracy. And googling things. Lots of googling things. Those can be learned.

I am not really numbers/ stat person and I am not a snarker ( just too darn nice!) but I come here to stay on top of RE news. Someone suggested a poster who had not posted for awhile might be a murderer? During a very sensitive and heartbreaking time for a family in Victoria? Wow

So my contribution…husband asked awhile ago if I thought it might be “ too busy downtown to go to the bank “ Qualicum Beach 3 pm.

Old habits die hard.

Stay safe everyone. We lost power up here for about two hours because of high winds.

Hawk, do you want to do coffee sometime?

Columbo? Geez, you must be old!

Horgan must be waiting for the bitcoin style crash fallout via China real estate so he won’t have that hanging around his neck.

China’s Hot Housing Market Begins to Cool

State measures push down prices in megacities and raise debt peril

Mr. Luo said his real-estate agent told him that to find a buyer for his apartment now he would need to sell for half of what he paid. “I’d be short too much money,” Mr. Luo said.

Chinese families have taken on bigger and riskier loans to buy apartments as homes or investments. Price drops could leave some owners owing more than they can sell their homes for, just as new restrictions in many cities make it harder to unload a property. To ease the pressure, the government is encouraging the growth of a rental market.

https://www.wsj.com/articles/chinas-hot-housing-market-begins-to-cool-1516098600

“You stopped posting two days before the incident. The timeline matched up pretty well.

It was in poor taste.

Not to mention improbable”

Exactly caveat. Detective Columbo obviously watches too much Dateline and can’t even piece together simple logic from months /years of posting. Needs some serious psych counselling. I can only imagine what the renter in the basement goes through.

@6 – i wasn’t actually being sarcastic. I did cancel the cleaning lady and cut back on those other things. I also called the telecoms and got retention rates when i said i was cancelling. All in all expenses dropped hundreds per month, and quickly.

RE landscapers. I hear you, but you also have to consider that finding any contractor to do anything in victoria is very difficult right now and rates are very high. I called 7 roofers for roof repairs. Waitlisted or no responses. Been two months haven’t had anyone fix the roof yet. I called landscapers when we were thinking about moving; “we’ll swing by this week and provide a quote” – never to be heard from again.

This article states that BC can legally seize lawbreaking foreign buyers homes. “The Civil Forfeiture Office can seize the ‘proceeds of unlawful activity’—a broad and nebulous definition which gives them a wide power,” If this is true and the NDP are serious about money laundering and fraud they should act

https://thinkpol.ca/2018/01/16/bc-can-legally-seize-lawbreaking-foreign-buyers-homes-lawyer-says/

He’s hunched over the computer, alone. There’s a cold Mountain Dew sitting on his desk … but does he have the “programming instinct”?

One of the fastest ways to a higher income if you know how to program. Nothing more useless than someone retrained into programming without the programming instinct.

Sarcasm aside, these are not just names and things they’re jobs and small businesses. I was at a meeting downtown last year with a lot of people that have started business of this type. Ones that are the first to get burned in an economic slowdown.

In construction, its the landscaping companies that don’t get paid when the economy slows as they are the last ones to finish a property. The best job for getting paid is the excavators as they are the first to be paid. Laborers and carpenters never see their last two pay checks but at least they get employment insurance.

Let me know when our population density increases by 14 times to match Hong Kong’s

What I am more sure of, is no politician wants to be seen as the one who applied the pin. I know I wouldn’t.

The problem with a market intervention approach is what do you do when mean reversion occurs and even overshoots? Backtrack the policy? That would almost be insult to injury, and make the government look completely incompetent.

Preventing force and fraud in our RE market though, is a different matter. And in BC, that’s probably a substantive variable. I really do believe that Eby genuinely wants to see that tomfoolery stopped. I’m not interested in what the housing minister does.

Initially misspelled “incompetent”, above. Spell check suggested “impotent”. That could have worked, actually.

I do, both he and Carole James do not get it! Maybe they need to travel more to places like London, Dubai or Hong Kong and then they’ll ‘get it’. Maybe he’ll ‘get it’ after his Asia trip? Not if he’s pandering to Asians though.

You are probably right that they are pandering to voters as well, as that’s what their motive is – get re-elected – I get that! If they banned foreign buyers I’d bet it could crash the housing market – and many voters wouldn’t want that given our high number of home owners at 70%. Not seeing the bigger picture, just their equity. Banning foreigner’s is not banning immigrants from buying. Maybe one day they’ll ‘get it’.? But, it’s already too late…

Weaver is right that there are 7.5 billion people in the world and only 4.5 million here. We are probably in the top ten of places that the elites of the world eye to park money in RE. Of course, it’s so complex and there’s so much to it, but Horgan and James need to ‘get it’. After all – the slogan I see at work every day is ‘best place on earth’.

I think in Feb. we’ll see if they get some of it, but like others on here – my best guess is they still won’t ‘get it’.

This is why I work for a Crown Corp. Can’t get fired unless I did something really stupid. Job security, I can work until I retire with defined pension at 55, and never a bounced pay-check. Not everyone can do it as some people don’t like the Gov’t bureaucracy, but I put up w/ it. I worked for two municipal Gov’t’s before and the bureaucracy there is way worse! Also, I don’t do the office politics much as my job takes me away out on the field and I’m virtually 100% independent and I love that. Not sure I could deal w/ the office stuff.

However, I know nothing about tech and it seems you’re making really good money – I was wondering – if you can live anywhere there are plenty of nice spots on the island that are much cheaper than Vic – though they are quiet they still have the ‘West Coast’ quality of life factor and make great places to raise a family. Have you considered the Comox Valley, for ex.?, or other towns on the island? It’s not all retired people there are actually quite a few family people up there. You can jet easily to many places from Comox Valley. If you wanted to be closer to Vic maybe consider some of the new developments near Sooke or Shawnigan Lake? You could even live in Tofino or Ucluelet!

@ Number 6.

“If they’re buying a $750,000 home with 10 percent down payment, a rise of a quarter percent would just mean they would have to fire their dog walker or the person that cuts their lawn and do that work for themselves.”

–> you’re not wrong. Once i got laid off… had to clean my own place for a few months till i got a new job. Cut down on starbucks, microbrew, and avocados too. Those were dark days.

Luke: Horgan “gets it” he is just BSing you. The man is not a moron but he is pretty confident that the average voter is. Do you honestly believe that he does not get it. And if he does get it what should you be thinking at this point. But feel free to write him and explain it all for his benefit.

Wow Marko – that Elm St. house is right next to Shelbourne – busy! I don’t get PCS for all the area’s so I only see what goes on in OB/Fairfield and bits of Fernwood, and I don’t see condo’s so your insight into knowing all area’s is appreciated.

And today I see some fool coughed up $1,277k for 1415 Monterey Ave – this was the place by OB village that was basically falling apart when I went to the open house some months ago.

Not recommended, the microsoft certification job ecosystem died a long time ago. I think development is still one of the fastest ways to a higher income, but that’s not to say it’s easy.

Thanks Dasmo, I guess I should’ve known as this is what my realtor did in the past – but when you find out it’s just a numbered company, then what – this is when we don’t know who owns that. They don’t make it simple either (like ‘just enter the address’ as they do in the UK), they require you to do some sleuthing to find the PID number – but that’s the typical Canadian way – as on this page they say ‘hire a professional’. https://ltsa.ca/property-information/search-title

Thanks for that article Leif – despite not being a ‘green’, I’m really starting to like this Andrew Weaver guy. It always seemed before that Canadians were a bit of a laughing stock in the world – seen as meek – because even in the rare cases these foreign criminals were found out – our laws lacked teeth to actually seize assets.

I was thinking this – this morning on the radio when I heard Horgan say almost all Canadians were originally immigrants (everyone was ex. FN) and he didn’t want to ban foreign buyers because of that. It seemed to me he just didn’t ‘get’ the issue, much like Carole James. We aren’t saying go after immigrants who want to move here and become PR and eventually Canadians. We’re saying stop the conglomerates in numbered companies in the office towers in Shanghai (for ex.) from buying up properties. But, they’re going to allow this to continue because they just don’t get it!

It all depends on the size of the condominium. Smaller units sell for a higher price per square foot than the larger units. So while a 611 square foot condo in the building might sell at $800 a square foot a 970 square foot unit might sell at $600 a square foot. It’s known as diminishing returns or marginal utility.

Just quoting a price per square foot isn’t very helpful unless it is accompanied with the size of the unit. Or something like one-bedrooms sell at $800 a square while two-bedrooms sell at $600 a square.

Stupidly cheap compared to these two apartments 🙂

http://www.businessinsider.com/most-expensive-apartments-hong-kong-149-million-2017-11

(not that I disagree with you, but when does it end?)

If they’re buying a $750,000 home with 10 percent down payment, a rise of a quarter percent would just mean they would have to fire their dog walker or the person that cuts their lawn and do that work for themselves.

I know, some of you are going to take that as a vicious remark. But that’s what happens when money gets tight. The workers at the bottom get laid off first. And these workers have mortgages to pay.

Now for the first time since 2009 someone that has to renew their mortgage may be paying a higher rate. Now when some of these people go to renew and their payment increases they may be less likely to borrow more equity to buy things such as cars, tv’s, a condo.

So for those that are landscapers maybe it is time to take some microsoft courses and become a software engineer.

The new construction at 300 Michigan had a unit listed for $717/sqft last year. It’s also wood frame. I think it sold but I don’t know for how much. There’s just no term for that other than stupidity. Maybe “astounding stupidity”.

Here I was thinking $150k/year was doing pretty well. Apparently it still qualifies for government handouts. Is this kind of subsidizing not a massive waste? Subsidized rentals that prefer young families seems a much better way to help people. How messed up is it that the government is giving handouts to people making over double the median Victoria income?

I think that legitimate. I don’t want to do that, and apparently no one else does either. I don’t think it’s snobbery or a culture of instant gratification gone wild, it’s just massively inconvenient. What if completion is delayed, that could mess up life plans. The longest I’ve held a job is just over 2 years, so being asked to plan 4.5 isn’t reasonable for me. Tech companies can thrive and die twice within that timeframe.

That made me cringe. When I buy, I’m hoping I can fit the payments into 20-30% of household income. And only 30% if it represents very good value. Do you guys have a rule of thumb for % of income?

As Marko has mentioned he is very busy with condos. And he should be.

That market is still “hot”, especially the pre-owned condos in the core. With only 2.7 months of inventory, and the average days on market at 21.

The silver lining to this cloud for prospective purchasers is that listings are replenishing sales at a rate of 1.7 new listings for every sale. But it will take a while, at this rate, before most people would start to see the market cool down for previously owned condos in the core.

The current median price for the last 150 previously owned condos to sell in the core is $382,000 or about $410 per square foot. That’s up from the same time last year when the median was $337,000 or $365 a square foot just before there was a steep increase in condos. The average annual price for a condo for all of 2017 was $375,000.

So by the standard that most of us accept on this blog, being the days-on-market, the market for condominiums in the core remains “hot”.

So what do you think? Is this a bear or a bull market? Should you be the using the equity in your house to buy an investment condo?

At a median price of $385,000 for a two-bedroom condo in the core will the cash on cash return be positive or are you willing to hold for a few years at a loss speculating on big gains in appreciation?

Interesting take on the rate hike. Still think the bank needs to go a couple more times.

https://www.bnn.ca/rosenberg-bank-of-canada-done-for-the-year-with-raising-rates-1.970779

I like CBC’s video on the subject. “Take your typical homeowner, let’s say they just bought a house for three quarters of a million bucks. Let’s assume they put down 10% and got a mortgage for the rest”

If that were the typical homeowner we’d be in deep trouple.

http://www.cbc.ca/news/business/bank-of-canada-rate-decision-1.4490918

I see that interest rates have gone up by a quarter point with a signal that we should expect at least one more hike this year. My guess is for two more hikes before the end of the year.

In terms of inventory I am not seeing a whole lot of SFH listed in the core.If you restrict the search to under 1.9 million then the numbers really shrink in James Bay Rockland, Fairfield and Oak Bay in particular.Maybe more inventory will come on by the end of the month.

@LeoS:

Further to a post by Number, with whom I am trying to arrange lunch, can you give him my email? Or how can I arrange to exchange email addresses with him per his request?

That is a lot Marko. Some people did very well there. Thanks

I’m inclined to think there’s a reason they’re listing it “below market value”.

Reason they are “below market” is BC Housing is financing the project and there are criteria to qualify….you have to make LESS than $150,000, you have to move in for two years but after you can do whatever you want with it.

I’ve pitched this to four of my clients over the last three months and no one is willing to go for it (and they are not waiting for a market crash). Why? 2.5 year buildout + live in unit for 2 years = 4.5 years of planning. Most people don’t want to plan that far ahead and are also impatient……they would rather buy something at market right now that they can move into versus waiting…..instant gratification.

Marko Yates street. What was the pre construction on an average 2 br vs today?

Do you mean the Era? I had three clients buy pre-sale two bedroom units there for 365-390k and that was mid 2015. Last two bed on a lower floor sold for $619k so they’ve gone up a lot.

That’s a pervasive sentiment in Canada, but I think that’s a simplistic line of reasoning.

A significant increase will hobble the housing market, but the wider economy is another matter. Yes, housing definitely interacts with the national GDP, but the BoC is not wanting to see housing continue to be such a significant aspect of the national economy. Poloz has been warning policy makers for a some time to prepare for a downturn in the housing market, and has even said directly that it isn’t his job to save people from making foolish choices.

He’s got to keep a lid on inflation, because if he doesn’t, a scenario of growing inflation and lower economic activity due to heavy debt loads could create a stagflation scenario, which is difficult to break free from once it starts. He’s also got to defend the dollar against the Feds hiking in the south, because a falling dollar spikes our import costs on an already over burdened consumer. The surge in exports that he might have been hoping for has so far, not really materialized. And with the coming tax changes in the States, we’re at risk of getting a get a whole lot less competitive…

Marko Yates street. What was the pre construction on an average 2 br vs today? Tia.

Marko that’s when people turn to variable if it’s cheaper and sleep a little less 🙂

75 bp on 300k is not chump change to a tight budget.

Fair enough, but won’t be islolated to variables. Pretty much everyone in a year from now going forward for 3-4 years will be renewing 5 year fixed mortgages at higher rates in relation to their current fixed rate.

This is the first one I’ve seen this year like this, it’s early days yet and maybe some people still getting around the ‘stress test’? Still, goes back to what I say about ‘rare’ properties, though this does not rate all that high on my ‘quality’ scale.

There have been lots to start the year….for example 1665 Elm for $855,000 3 bed/1 bath.

The numbers are telling one story (maybe it is cooling down) but on the ground it is ridicolous. A condo was listed yesterday on Harriet and I went to see it with my client right away. In 10 minutes we were there saw 4 other realtors with clients. Had multiple offers yesterday evening and went for $475k unconditionally (asking $439k). More importantly $507 per square foot for wood-frame. It is a new benchmark.

Another condo on Fort went over ask today at $455,000 and purchased in 2014 for $287,500.

Things are getting out of control imo on the condo front.

Leo they have been variable for years and based their current budget/ expenditure on what they were paying over the long haul. So these increases to them are just increases and have nothing to do with fixed rates. I am sure this person is not alone.

75 bp on 300k is not chump change to a tight budget.

Bizarre. According to ratehub the cheapest variable is 2%. The cheapest 5 year is 3%. So variables goes up to 2.25% and people are stressed?

Yea I don’t get this either….all my mortgages are variable and even with a rate hike will be lower than the cheapest 5 year. I’ve gone with variable on smaller spreads then 0.75….right now I would be doing a variable of 2.25% over 3% fixed.

I’ve always done fixed-rate mortgages—no stress.

I’ve always done variable and saved tens of thousands to date…..as far as the “no stress,” I’ve never understood this…….what happens at the 5 year mark when you have to refinance and rates are 10%? Still no stress?

Imo the 5 year fixed is a false sense of security. What are the odds you get a 5 year fixed, interest rates go up to 10% 2.5 years into it and fall back down to 3% at the 5 year mark? and you go phewwww….thank god I had a fixed.

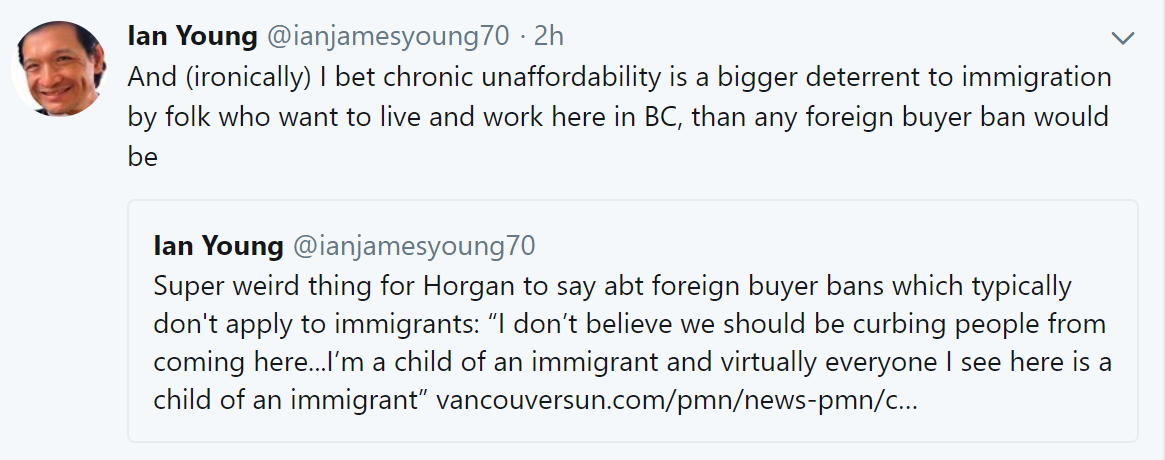

Ian hits the nail on the head as usual

Bizarre. According to ratehub the cheapest variable is 2%. The cheapest 5 year is 3%. So variables goes up to 2.25% and people are stressed?

I’m gonna go variable at renewal I think. I just don’t think the interest rate increases have a lot of legs in them. Any significant increase will hobble the economy immediately and put a stop to it.

I wonder what people on here think about these hikes, as far as when it will start to really begin to cause hardship en masse.

I had said before that I thought by the time we get to a 75bps increase, that’s when the pain would start, for the most precariously positioned people. People who went under with a 25bps hike probably would have burned anyways, no matter what happened.

My understanding is in China, the views upon state laws are different than here. Here, a law says you’re not allowed to do X, and we think, don’t do X. There, it’s more like you can do X, but find a way to do it differently. Almost like it’s the State saying, “okay, your move” – and the State knows it.

Gaming the system with a sprinkling of nepotism is almost endemic and your status to a large extent will dictate how much the laws will apply to you. And there, it isn’t even controversial, it just is. I don’t know if it’s their culture, an artifact of communism, a feature of a less developed economy, or some combination.

Heh, a friend of mine was visiting China about 5 years ago, and he was attending some kind of music/entertainment event – there were areas that were cordoned off to visitors by using those fabric strip barriers like what you’d find in a bank line up area. He watched a little boy who was apparently with perhaps his grandfather, and the little boy crossed the barrier. The boy was immediately scolded by a police officer – and then he saw the grandfather grab the police officer by the ear and escort him somewhere else. Views towards elders, law, government – it’s just so different there. You have a lot of freedom, but in different ways than here. But, you cannot criticize the PRC Government. Well you can, but you might as well sign up for some falun gong while you’re at it.

I’m waiting to see how this pans out.

“This is the type of forthright action that will send the signal that it is no longer ok to skirt the laws and treat our housing as a place to park foreign capital. When the legislature resumes I’ll be asking the Attorney General why he hasn’t seized the assets if he hasn’t already done so by then.”

https://thinkpol.ca/2018/01/16/bc-can-legally-seize-lawbreaking-foreign-buyers-homes-lawyer-says/

I’ve always done fixed-rate mortgages—no stress.

My playbook says every year is a year to pay down debt.

You can look up who owns what with BC Land Titles.

2325 Belmont Ave. in Fernwood was just sold in one day and was listed for $979,9k. Went over asking for $1,101k. Why? Probably b/c it had a suite in the basement and another ‘guest accom’ in what looks like a shed in the side yard. Not in the greatest area very near Bay St.

This is the first one I’ve seen this year like this, it’s early days yet and maybe some people still getting around the ‘stress test’? Still, goes back to what I say about ‘rare’ properties, though this does not rate all that high on my ‘quality’ scale.

Wow – things are getting a bit odd on here today, never a dull moment I guess it’s what keeps me coming back – that, and Leo’s awesome research 😉

Sorry Hawk, I was a bit harsh when I thought you’d disappeared – 65 is the new 55! This means you have loads of time left to see that graph play out. 🙂

Exactly! And this is why we should follow the lead shown by the European countries from Jan 1, 2015 in establishing public registry’s of who owns what. http://www.europa.eu/public-register/

In the UK – for a fee of £3 (approx. $5) you can look up any property bought since 1 April, 2000, and find out who the owner is : https://www.gov.uk/search-property-information-land-registry

You can even find out the flood risk on a property there. We have nothing like this in Canada – land of ‘free for all’ for anyone to launder money in property, whoever they are with no questions asked!

And I’m not the least bit surprised… while they do not ban foreign buyers in the UK, at least anyone and everyone now knows who is buying what – this is at least what we need here, otherwise we have no idea who owns those empty condo units in that dark building in the West End Mr. Fool posted yesterday. I’m going to closely follow how things play out in NZ now, and I wonder – are those foreign buyers there going to find any loopholes? (that’s what they do).

BTW I talk to someone today about the 2 rate hikes. Being on a variable, tomorrow’s hike is going to make their life very hard financially. Seems it does not take a lot to strain people.

2018 is a year to pay down debt.

I’m predicting “not enough”, but I hope I am wrong. Let’s hope they at least crack down on some of the outright criminality that the last government studiously looked away from.

Thanks number Jack appreciate the effort to make our communication more efficient.

For the record I am not worried. I have been saying since at least 2009 that I hope Victoria house prices stagnate or decline for a bit to improve affordability.

My free advice to anyone wanting to buy now is wait a bit if you can. Prices might not fall much but at the very least we seem to be (slowly) entering a period where conditions are a bit more in buyers favor.

Thank-you Gwac,

You can call me Jack if you want but it might be hard for some people to follow the thread. I’ll answer to either of them to make it easier for you.

Jack you are so polite to everyone. Like a saint.

Disagreeing in a constructive manner doesn’t make them a troll but being malicious to others does.

Bears are all feisty and pounding their chests. Cute and adorable.

I know a few housing bulls who proclaim that the market will never drop and things are “different this time”. Seems they’re a little more aggressive these days in pushing this stuff. Must sense that we’re at top and going over. 🙂

B.C. premier rejects Green call for foreign buyers ban days before Asia visit

http://www.cbc.ca/beta/news/canada/british-columbia/john-horgan-ndp-housing-1.4490512

Disagreeing with a bearish point of view doesn’t make someone a troll.

Thanks for the data, though. It’s nice to have it put out there for discussion.

50 days on the market, while being very different from this last little while, doesn’t really strike me as unusual from the long term trend…? The most innocent explanation is it’s a return to “more balanced” conditions, but it nonetheless represents a very large shift in sentiment – that sentiment being the dominant force behind the irrational increase in prices.

Reserved judgement here, because the stress test has probably not only pulled demand forward, but it’s also a bit of a market shock – most especially if the level of speculation in the market is elevated. It could get more intense if Uncle Steve hikes again tomorrow, and who knows what the NDP will do in a few weeks.

Half way through the month let’s take a peak at the market to find out why Introvert and Caveat are so worried?

A little over 4 months of inventory for houses in the core.

Average days on market to sell a house in the core now 50 days

New listings outpacing sales at the rate of 1.76 to 1

And the median price of a house in the core over the last 145 sales is down to $810,000. One year ago the median price for the same time period was $818,750.

While house prices in the core may be down from their height in 2017 by 5% , what most people are noticing is how long the For Sale signs are staying on the lawns. And that visual clue has an affect on buyers as they take a wait and see approach to buying.

That wait and see approach is more risky than just choosing to not buy this month. It can snowball as the longer a house stays on the market the more that sign positively reinforces that the buyers were right in waiting. Now you hear people talking about a house being on the market for a month or more without a buyer and people are talking about a drop in prices. That lack of confidence might just be the straw that breaks the camel’s back.

No wonder the trolls are out attacking and misdirecting any discussion. They’re worried.

The time renting counts for ……? Just fill in the blank Caveat.

caveat, what is wrong with you? Stop commenting on this.

Factually incorrect

http://www.courts.gov.bc.ca/jdb-txt/sc/17/09/2017BCSC0907.htm#_Toc483898265

Note I don’t actually recommend anyone following this link, but it does prove Introvert’s statement incorrect

@Introvert

What is wrong with you? You’ve been asked to stop commenting on this.

Neither Hawk nor the person in question owns real estate in Victoria.

It was in poor taste.

Not to mention improbable. I like to take posters at face value unless they are obvious trolls. What Hawk has told us includes (1) that he was old enough to have first hand recollection of the 81 interest rate spike and impact on housing, (2) that he does not own real estate in Victoria. Either fact was enough to rule out your theory.

Guess what Jack, just because someone is renting doesn’t mean that time doesn’t “count”

Enough of this please - adminI didn’t really take Barrister’s remarks to mean that the creme de la creme neighbourhoods are immune to price drops, just that the stress test and rising interest rates are liable to impact areas where there are a lot of first time buyers, rather than areas where fat-cat migrants retirees move to. Which makes sense to me.

On the other hand, our assumptions about condo buyers could be all wrong. Maybe they aren’t a bunch of angry millennials booted the margins, and forced to borrow the maximum amount to buy a box of concrete, steel and glass. No doubt some of them buy condos so they don’t have to borrow the maximum amount. Maybe they are practical. Maybe it’s the professional couple that just haaaaavvve to own in Oak Bay that are taking the biggest risks.

Who knows – Canada is a backwater when it comes to collecting/disseminating housing market and mortgage data. We don’t actually know who is buying what, where, and how they buy and how much they borrow – we have high level data, but we can’t look beneath the surface. Apart from that, we have anecdotes, but as the old saying goes, the plural of anecdote is not data.

We’re all basically guessing.

Weak attempt to flip it off Intorovert. Goes to show how sick and wrong someone(s) can be over a simple blog poster with a different opinion. Very disrespectful to the family and to those who may know them who visit the blog to put out such a disgusting accusation.

Over 75 Luke ? Another arrogant one out of touch with reality.

I hope there’s a lot more like you. Right or wrong, good for you for thinking about it critically and not getting sucked into the hype.

I agree. I don’t think Barrister’s point re external migration is a non-event in terms of market influence, but concurrently I don’t think that somehow makes a market considerably more resistant to correction. A correction virtually always entails a broad-based destruction of wealth, whether it’s stocks or homes, young people or old. This is a natural part of the financial cycle.

In fact, I would more ready assume a deeper correction in Fairfield than in the Westshore. History demonstrates over and over again, that the more expensive areas tend to see the most aggressive shavings – or more precisely, the ones that have seen the more precipitous rise in prices. Who would imagine a year and a half ago, what’s now going on in the West Vancouver RE market. That tier of the market is where it starts – not where it’s protected.

Welcome back Hawk.

Funny how we all missed you when you stopped posting for three weeks.

Barrister: “They have bought a lot of houses in Fairfield and Oak Bay and most of these houses will not be back on the market for twenty years. Inventory is likely to remain low for SFH in prime areas.

For a significant segment of buyers coming from Vancouver or Toronto, or for that matter from places like LA, Victoria is extremely affordable. I suspect that you wont see a dramatic drop in houses prices in the core until the baby boomers start dying faster than they are retiring.”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

I’m not quite sure whether you are pandering to the bulls or engaging in wishful thinking, Barrister. There has yet to be a “correction/crash” where house prices in the core of Vancouver, Victoria or Toronto were spared big drops in prices.

As the B20 legislation ripples through the various cities in conjunction with interest rate increases, specuvestors will start to panic and try to dump their holdings.

http://business.financialpost.com/personal-finance/debt/one-in-three-canadians-say-they-are-unable-to-cover-their-monthly-bills-as-rate-hike-looms

Those properties won’t sit on the market for more than a month before prices start there race downwards. When the bottom of the pyramid gets cut out, too many properties searching for any buyer will expedite that slide.

The realtors friend then becomes their enemy as the media starts headlining major price drops, bankruptcies and job losses.

All it takes is one job loss, separation, divorce or death in the core for everyone to realize that “golden” home is only worth what the buyer can get in a down market.

It’s not pretty and it’s certainly not wishful thinking because the devastation to family and friends is terrible.

As a married 30 yr old, I can’t imagine going back to having a room mate, particularly in such a small space. If that makes me a snob, so be it. Worst case scenario, the value of it tanks by the time it’s constructed and I’ve made a horrible decision by buying the first thing I’m capable of buying, especially when I don’t find it desirable as a place to live, even if only for a few years. I’m inclined to think there’s a reason they’re listing it “below market value”.

The amount I have in savings and where I have them is completely offsetting my rent (just a hair over). I’m not convinced that Victoria RE is a better place to invest that money right now. I’ve got a big fat spreadsheet that compares the loss of renting vs the loss of buying and attempts to compare RE return vs stock market return with my current savings. If I knew RE was going to continue it’s pace of the last 2 years, then ya, I should buy now, but I’m not convinced of that. I probably won’t wait 5 years, more like 2 or 3. It hinges on where my wife’s career takes her. I work remotely, I can go where ever the internets is good. I appreciate all the concern and advice, but I assure you I’m doing fine.

Thanks Barrister. I mostly agree with what you wrote, although I am far more interested in how the stress test/rising rates, etc., impact the cheaper (shittier) core areas, rather than the golden quadrilateral of Oak Bay, Fairfield and Rockland. FWIW, I don’t hear a whole lot of whining about not being able to afford living there from people near my age. The whining seems to be about $599k for a 50s bungalow on Admirals Rd, for example.

Hawk, you’re back!

In your absence, we learned that:

• you might be older than many of us thought: “It was obvious by his style of writing that he was in an older demographic – probably over 75 years old”

• your bearish outlook could ultimately kill you: “Given all that energy he expended into trying to grasp at any and every straw to try to talk the market down on a blog, it might have proved to be too much negativity”

and

• you’re easily mistaken for a different repetitive doomsayer from before your time: “Hawk has only been here since 2015. I find that hard to believe. I though for sure he was on the old blog from 2010 ish. I could be wrong and could be confusing him with info”

At any rate, welcome back, Hawk!

My breaking point / reconsideration of priority would look like a move back to Ontario where my dollars throw twice as far, instead of packing my life into a floor plan that looks like someone saran wrapped an Ikea apartment starter kit.

It’s not a forever condo by North American standards, but it’s a roof over your head and gives you a few options. In a worse case scenario you could rent the second bedroom for approx. $900 given the two bathrooms. In five years you can sell it if the market has appreciated or if the market hasn’t appreciated then it may be a good time to rent out the condo and buy a SFH.

“Victoria is a nice place to live but it isn’t worth what you’re giving up.”

Victoria new slogan.

When you value homes do you knock off 40% because Victoria is such a shithole and the people should know better.

Barrister leave a message with Leo_S and he’ll give you my email address and we can set up a meet.

Josh, you’ll never get that time or money back. You’re young enough to go where the money is to be made. Victoria is a nice place to live but it isn’t worth what you’re giving up.

Oh dear he’s back – I’m glad not dead though – I wouldn’t wish that even on you ol’ Hawk. You were clearly missed here. Only a tiny part of me missed your creativity in finding any and every angle to down talk the market – takes some talent, maybe if you turned it the other way around once you finally bought back in if you ever do that would be interesting to see. All those stock profits must be outpacing the market anyway but wait and see what this year brings is what I’d advise almost anyone at this point.

The Andrew Berry comment struck me as odd b/c I can tell your demographic/generation by the way you write – no one under 65 would write like that. Nevermind – 75 is the new 65! You clearly have many years to post your favourite graph ahead and this could be your year to finally see everything go the way you want in Vic RE! Massive calamity is just around the corner!

Or…

Uh oh – these aholes may keep on acoming – esp. if the Gov’t doesn’t do enough to stop speculators and foreign entities from descending on Vancouver and we’re just the valve for that apparently. Then there’s the desirability factor – nowhere else better in Canada unless one loves frigid winters and humid summers with horseflies the size of mice flying around eating chunks out of you! And… there’s always Horsefly, BC 😉

I for one am waiting to see what Feb. brings, and the blog wasn’t the same without you…

My breaking point / reconsideration of priority would look like a move back to Ontario where my dollars throw twice as far, instead of packing my life into a floor plan that looks like someone saran wrapped an Ikea apartment starter kit. It would suck but I’m not so proud that I wouldn’t do that. I like it here enough that I’m willing to sit for 5 or so years and see what happens, and enjoy life while I do. I think plumwine may have played the role of the old man yelling at kids to get off his lawn cause I insulted his oak bay sensibilities. This came to mind: https://twitter.com/doththedoth/status/911265693466849282?lang=en

I don’t pretend to know what’s going to happen marketwise and I’ve learned to not get emotionally invested in the crash hype train that betterdwelling and huffington post keep shovelling coal into. I think what’s most likely is a plateau / slower rise until some external shock (good old fashioned recession) causes assorted bubbles to deflate. The writing on the wall with rising rates and how leveraged many Canadians seem to be indicates that the walls of the bubble are razor thin, but I don’t think it’ll pop until some metaphorical pin comes along and does the deed.

Hawk! I knew it! 😀 😀

Barrister

That is the post 0f 2018 so far. Well said.

Welcome back Hawk.

I thought the Andrew Berry comment was disturbing as well.

Hawk! Welcome back. I was going to post at how ridiculous that theory was but then I figured it should be self-evident.

Hope you had a good vacation.

@Barrister, good post. Agree wholeheartedly.

“Last post Dec 23. No indication he was leaving.

A dark thought occurred to me: Hawk is Andrew Berry, and he has no Internet access because he’s incarcerated.”

Seriously Intorovert ? You’re one sick mofo. What a disgusting thought, you need some major mental help. I’m surprised LeoS allows a post like that to stay up, but there is double standard here for awhile now.

When your neighbor goes on holiday and doesn’t tell you, you must automatically think the worst of the worst. Again seek some help dude, you’re bent.

Glad you miss me but too busy at work and making a killing in the markets. The table is set for several more rate hikes this year, more lending rules coming in etc. Not to mention folks are struggling out there using HELOC to pay the monthly bills.

One in three Canadians say they are unable to cover monthly bills as rate hike looms

Canadians risk falling into a ‘dangerous debt trap’ as they borrow more to make ends meet, new survey says

“The MNP Consumer Debt Index and another study released on so-called Blue Monday paint a disturbing picture of how close Canadians are living to the edge, just before the Bank of Canada is expected to hike rates this week.”

http://business.financialpost.com/personal-finance/debt/one-in-three-canadians-say-they-are-unable-to-cover-their-monthly-bills-as-rate-hike-looms

Funny how people think a $40/ month expense for someone bringing home $9k/ month is the difference between buying and not. Im a frugal guy but that doesn’t move the needle.

B-man:

Let me start by saying that I did not walk in the snow for ten miles to work nor did I build my own log cabin. But I did commute to work for an hour or more each way for thirty years and a ten per cent interest rate would have been considered unbelievably low.

You refer to affordability in the short and medium term but that is wonderfully vague. Is the short term five years from now and the long term being fifteen years from now?

With the caveat that I dont have a crystal ball, I would agree that it would be worth waiting for about six months to see what the impact of the new stress test and any NDP policies has on the housing market. The combination of the stress test and rising interest rates will likely drop prices in the Westshore and Sooke and possibly in parts of the condo market. I suspect that it will have very little impact on Fairfield, Rockland or Oak Bay.

We can all agree that Victoria is bad on the affordability scale compared to local incomes. But for the past five years, the obvious reality is that Victoria is very affordable for retiring baby boomers and the inflow of baby boomers has set pricing in the inner core. Is it really surprising that a thirty year old is going to have trouble competing in the market with a retired 60 year old who has been accumulating assets for an extra thirty years. The impact on the demand side is pretty obvious but what may be overlooked is the impact on the supply side. The flood of retires that has descended on Victoria are relatively young, often in their mid fifties (particularly from Vancouver). They have bought a lot of houses in Fairfield and Oak Bay and most of these houses will not be back on the market for twenty years. Inventory is likely to remain low for SFH in prime areas.

For a significant segment of buyers coming from Vancouver or Toronto, or for that matter from places like LA, Victoria is extremely affordable. I suspect that you wont see a dramatic drop in houses prices in the core until the baby boomers start dying faster than they are retiring.

If I was a young man like Josh this would at the least give me pause to think about whether Victoria is were I would want to be. B-man you are right that a drop in prices of 10 or 15 per cent in the next year or two might be quite possible and that it is worth holding off but if Josh is hoping for a drop of 30% then he is likely looking at ten or fifteen years from now if ever.

Strangely I dont think that Josh’s situation is any different than my own at his age. Mt choice was to either rent closer to work, buy something that was crappy in a sketchy neighborhood or buy something out in what was then the boonies of Toronto and live with an hours commute each way (and that was assuming that I avoided rush hour by showing up at the office by seven and not leaving until at least seven to go home.). In spite of being reasonably successful, I never was able to afford the prime SFH areas of Toronto like Forrest Hill or Rosedale. Looking back on it I would have been wiser to move to somewhere like Waterloo.

Whether he wants to brew beer is really not material to his house choices.

“yup, keep brewing, keep doing the same and hope for different result.”

Worsening affordability in perpetuity would be a different result. Clearly there are times when affordability is relatively good, and relatively bad. I would hedge my bets that affordability is relatively bad right now, and will improve in the short to medium term. But if you are using basket-case Vancouver over the past 10 years as your measuring stick, then all bets are off.

@plumwine

And then you went on to say that “people said the same thing in 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017….” in reference to it being the worst time to buy in Victoria. Clearly, some of those years were better than others. A few reasons I can think of that right now is a bad time to buy are:

-affordability (about as bad as it’s been in recent memory according to RBC)

-rising interest rates

-the stress test

-the oil rebound and Alberta’s improving economic prospects

-a bunch of supply coming on (how perfect is that timing?)

-a government that has nominally committed to doing something on housing

I am sure you built your own log cabin, walked 10 miles to school in the snow etc., but it seems reasonable to be apprehensive about buying after a big run-up, and the above headwinds.

And hey, thanks for the dig about drinking and reading comprehension:)

Bman, stop drinking, learn to read.

yup, keep brewing, keep doing the same and hope for different result.

HELOCS – One thing to note is that plenty of people buy homes on their HELOCs. In my immediate social group I have several friends that all have their full mortgage on a HELOC. That’s not really a mortgage vehicle option in the states. I honestly don’t think the growth of HELOCs is as big an issue as newspapers make it out to be. It’s still secured debt and most lenders don’t allow the ratio too high.

Speaking of the market more generally, I can’t believe how tight inventory has gotten in the sub-600k price ranges. Median/benchmark/blah blah prices might be stagnant, but the entrance to the market continues to crazy it up.

HELOC’S are not just means of equity take-out as the media seems to imply for consumerism. I have two properties that instead of having a mortgage on them I have a HELOC on each. Now with these new mortgage rules they have proven to be a godsend as the HELOCS provide access to cash without having to requalify with these new onerous rules as in the case of a mortgage take-out.

“I response to Josh not because of his age, it is his comical reason.”

Home brewing is a perfectly good reason!

“My post is meant for breaking his bubble thinking. If he is too proud to take another approach, his loss.”

Or not. Could be his loss if he buys now. I’d sit tight (with the caveat, that I’m usually wrong on housing), keep brewing, and wait for affordability to improve.

Leif – Very few people are driven out because of an inability to renew due to a decline in value. The actual issue is that if you are too poor to pay your mortgage in a good market you just sell your house and take your profits. In a down market if you can’t afford your mortgage you either take a loss, or the bank does.

Either way it forces inventory on to the market at a time when more inventory can drive down prices.

Leo is that because people have pulled money out of their house (helix) and then are unable to refinance due to the house being worth less and unable to pay their current loans?

@Bman

I response to Josh not because of his age, it is his comical reason. Marko is also a young one, right? And I do agree with him. (nevermind, he is a REALTORS®, he must be evil….)

Fox news is part of my daily dose of internet, same as CNN, BBC, CBC, Al jazeera, NHK, CCTV…. The mix tape of world news show me Victoria RE is not unique. (I am not saying it is healthy or sustainable)

If Josh is looking for echo chamber, he can post his story on reddit, I am sure there are tons of karma waiting for him. My post is meant for breaking his bubble thinking. If he is too proud to take another approach, his loss.

Thanks Leo for the quick reply. I don’t post often, but I do enjoy reading your posts and genuinely appreciate the work you put in here. Cheers.

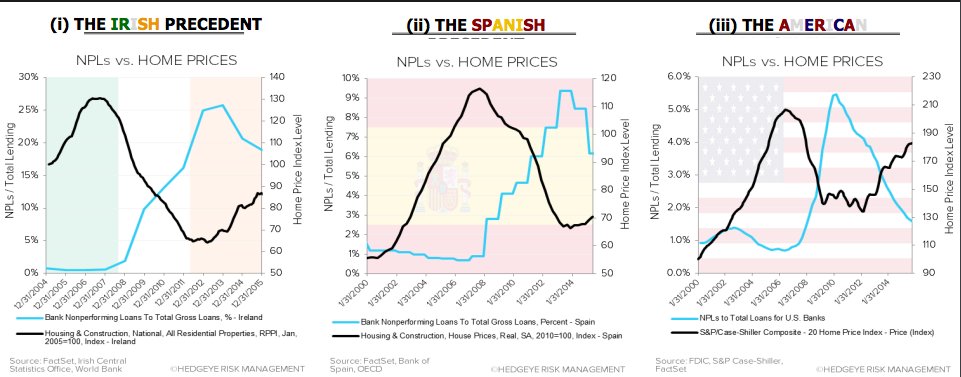

Good graph on the topic that comes up occasionally here which is Canada’s very low arrears levels on mortgage loans. Those arrears levels (non-performing loans) don’t spike until after a price decline as seen here (blue lines)

@once and future:

I dont know Josh either but taking time every few years to evaluate and perhaps decide to repriorize is generally a very sensible think to do. I can see a number of scenarios where SFH drop 10% or even 15%

but very little probability of a 50% drop. Sitting down and doing an reappraisal would not hurt in any event.

Hawk has only been here since 2015. I find that hard to believe. I though for sure he was on the old blog from 2010 ish. I could be wrong and could be confusing him with info.

He will be back I am sure.

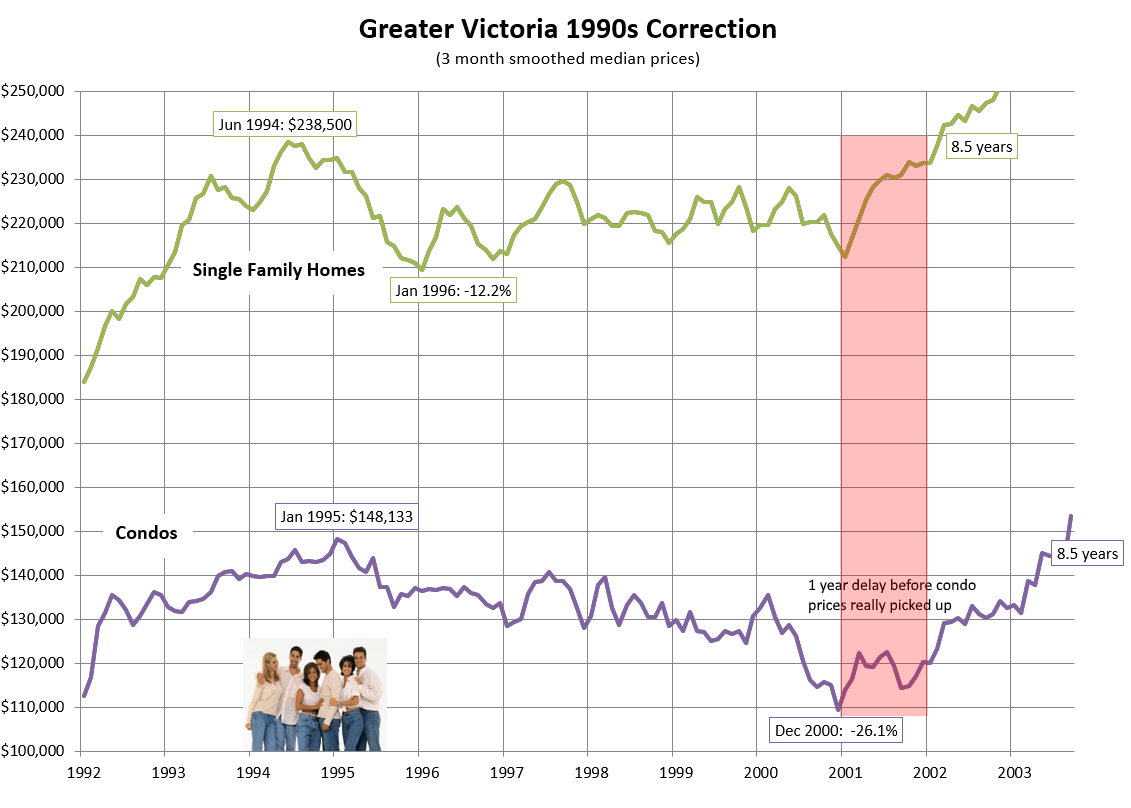

Certainly. When the market was declining from 2010 to 2013 I regularly published the “Decline from peak” graph. Here is the final one:

Measured by a 3 month moving average of medians, condos peaked in 2008 and declined 15% 5 years later. They didn’t recover their 2008 peak until mid 2016, over 8 years later!

Meanwhile SFH peaked in 2010 and declined about 13% to the bottom in 3 years. Then they regained their peak values in mid 2015, 5 years after the peak.

So condos declined more, and languished longer than single family.

If we look at the correction in the 90s, condos also fared much worse than SFH (leaky condos obviously)

You’re not alone. Optimism makes me genuinely doubt it, but it’s just so odd. No warning, no slow fade, just poof. If he’s on vacation it’s been a long one, and like I said before, the timing doesn’t make any sense. It’s not like there’s a shortage of bearish housing material out there for him to throw at the board.

I’m sure that, lots of money now or not, he wished he did something differently before and would get another chance or at least get a sense of vindication when this cycle concludes.

Hey Hawk if you’re out there, come back. If you’re sick, get well.

Jerry wrote in the previous thread, regarding Hawk:

Forget that graph. Someone should make a graph of Victoria prices during Hawk’s time on the blog. It looks like Hawk started posting in May 2015.

That would be an awesome graph.

“Let setup a safe space and talk about how unfair the world is, and no feeling will get hurt.”

Consuming too much Fox News these days?

“The info / graphs / charts / numbers / advice help blog readers proactively buying RE in Victoria. ( HouseHuntVictoria dot ca ) They are very useful in both up and down market.”

Useful in deciding if and when to buy, or not to buy as the case may be.

“Class / Age / Race (foreign buyer) warfare is tiresome.”

Equally tiresome is when old folks summarily dismiss young folks’ concerns and then imply that said young folks are lazy/entitled/weak/stupid/snowflakes. Almost seems akin to classism, ageism, racism or foreign buyerism to me.

Marko’s thought’s may be correct – and if we ever see Victoria return to a more balanced market with more inventory where people actually have choices I for one would like to see what that looks like! But – it’s going to take lots more people listing places for this to happen and what’s going to be a catalyst for that?

Another dark thought occurred to me is that Hawk passed away, and if so may he RIP. It was obvious by his style of writing that he was in an older demographic – probably over 75 years old. Given all that energy he expended into trying to grasp at any and every straw to try to talk the market down on a blog, it might have proved to be too much negativity. That, or he simply decided finally it’s better to spend retirement to take up lawn bowling and crib or whatever he enjoyed… who knows? All we can do is speculate.