Borrowing from the future

That title could apply to many things these days. With our national deficit at $381.6 Billion, it’s clear we’re either pulling from future fiscal capacity, betting on endlessly low rates, hoping that MMT is a thing that really works, or some combination of the above. But it also applies to the housing market, where much of our current demand is being borrowed from the future.

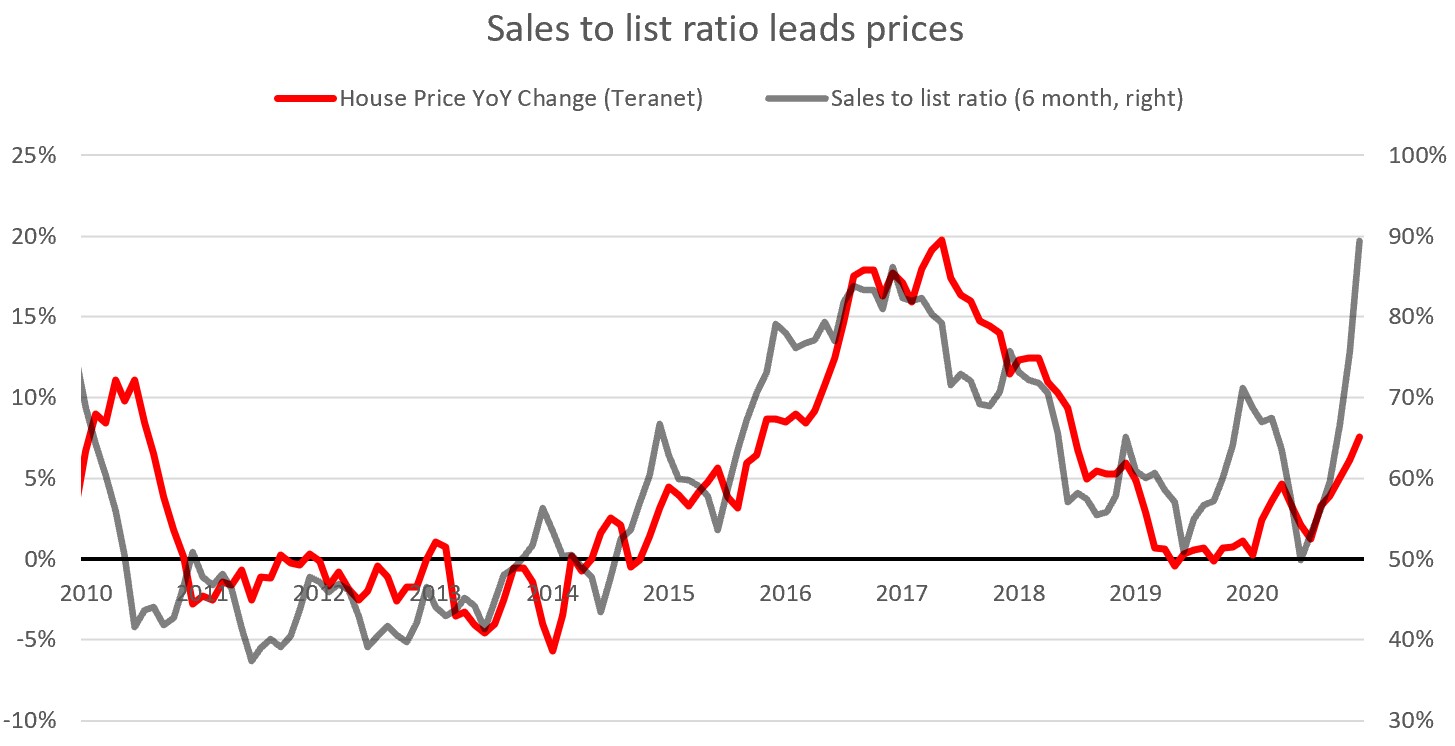

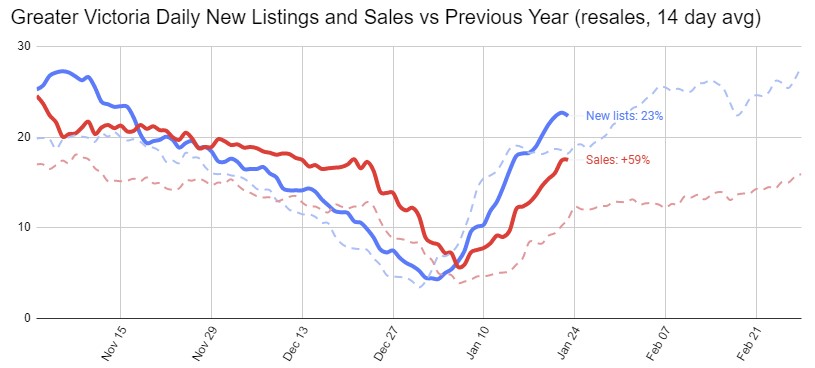

However before we get into when and why this market could cool down, make no mistake that it is currently red hot. Price changes lag changes in the sales to new list ratio, and currently that ratio is pointing to prices increasing at a rate of about 20% a year. Short of another economic shock, that should continue at least through the spring market. Note that on this chart, price changes are charted using the Teranet house price index which tends to lag by a couple months, so prices are already substantially ahead of the +7% indicated by the Dec 2020 reading. Also right now the strength is still mostly concentrated in the detached market with condos substantially less crazy, but those two markets never diverge for very long and the condo segment is heating up too.

The sudden rebound of the hot market raises the question: where are the buyers coming from?

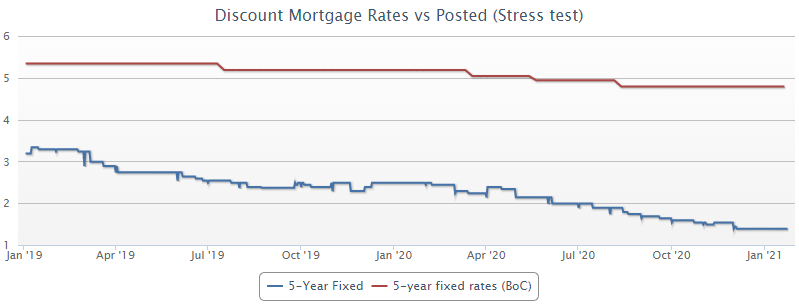

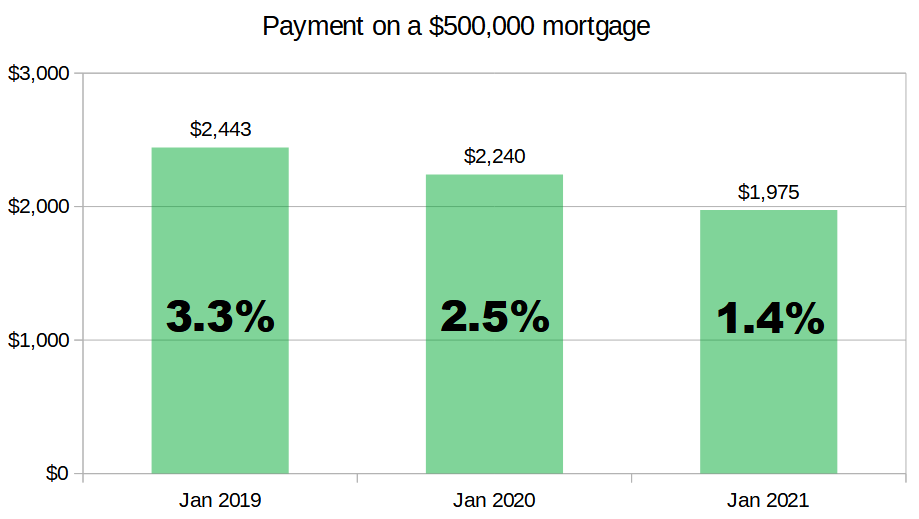

The one obvious source is first time buyers and upgraders, brought into the market by the cratering of mortgage rates which allows them to carry more house for the same monthly outlay. Discounted 5 year fixed mortgage rates have dropped from 3.3% two years ago to 2.5% one year ago, to just 1.4% now according to ratehub.ca.

Posted rates which are used in the mortgage stress test for qualifying purposes have dropped far less (5.3% two years ago to 4.8% today), but for anyone able to pass that tests, the monthly payments have dropped more substantially. However I feel that some people think the reduction in payments is more significant than it really is. Three years ago a $500,000 mortgage at prevailing discounted rates cost some $2443/month, and today it’s about $1975. That’s a significant 19% reduction in the payment, but it comes from rates dropping more than in half.

That near 20% decrease in monthly costs is about the same as what we saw from 2008 to 2010 during the financial crisis. What’s different now is that after 2010 we got nearly 7 more years of falling rates, which decreased carrying costs a further 17%. This time the best case is flat rates (which the central banks have all but promised us and our debt fueled recovery hinges on). That means even if the tailwind of constantly lowering rates is faltering, the additional demand unleashed by these rates is here to stay for some time.

However rates are not the whole explanation for our red hot market. We’ve also got a lot of demand that isn’t new, but is pulled forward from the future. In other cases the real estate market has seemingly been left unscathed by the pandemic, but we’ll feel it later when economic impacts propagate through to buyers. Some more sources of pulled demand include:

- Early retirees – When COVID hit and work changed, some that were close to retirement anyway decided to call it quits early rather than retraining to go remote. Others got a jump on buying that retirement home while they had time to shop. For those from Vancouver, it contributed to a resurgence in out of town buying, mostly in the detached market. Those retirees will be here for a long time but they likely would have come anyway at some point, so we’re feeling the bump now but may hit a dip later.

- Remote workers – There’s no doubt that work will be more remote after COVID than before. However the pendulum will also swing back part way, and many people that are now working remotely will be back in the office full or part time by the end of the year. That brings a resumption of commuting costs, and a resurgence in the value of being close to your job. If buyers moved to Victoria because they could work remotely, that arrangement may be reversed for some.

- Unemployment & first time buyers – Back in April we talked about how the uneven nature of the employment shock left the real estate market relatively unscathed. The people hit by job losses were disproportionately young, lower income, and in industries with lower home ownership rates. Many of these people were not in the market to buy and so demand hardly faltered. However many were on a path to buy in the future, and the pandemic has derailed those plans or knocked them back by a couple years. We may well feel that dropoff of first time buyer demand in the coming years.

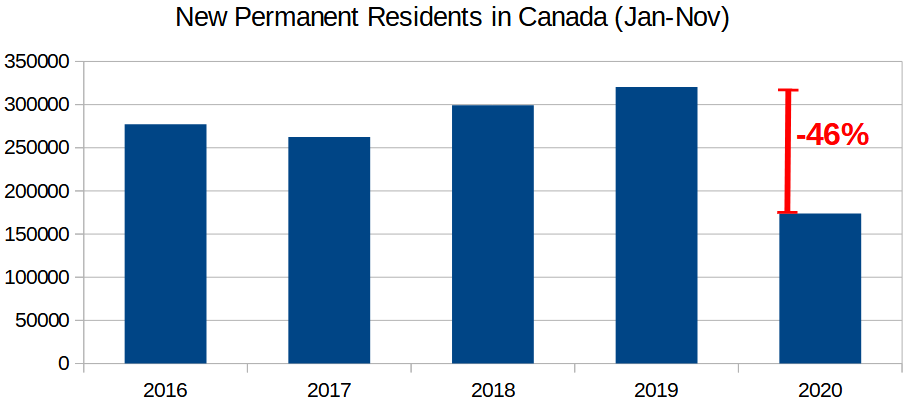

- Immigration – Immigration was down 46% in the first 11 months of 2020 and it’s very likely it will remain at substantially below pre-pandemic levels this year as well. Most new immigrants rent so the drop has not affected the resale market yet, but that’s not to say it won’t have an impact on the housing market. Royal LePage estimates that new immigrants on average purchase a home three years after arriving in Canada, so we will be missing those buyers between 2022 or 2024.

- Intergenerational FOMO – Rising prices beget rising prices. There’s a real fear of missing out, not only by buyers themselves, but by their parents. One response commonly reported by mortgage brokers is for parents to put their retirement savings or home equity towards helping junior buy their own place. With low rates both on the purchase and on the HELOC to fund a down payment, that’s all well and good, but again these are first time buyers that are buying today but not tomorrow.

While the strength of the housing market in the face of an unprecedented economic shock has been surprising to say the least, I think it would be naive to assume that we won’t also see the negative knockdown affects of the pandemic in our housing market. It reinforces my belief that we may be in for a similar situation as in 2010, when prices suddenly went from rapidly increasing to flat and then drifting downwards as buyer sentiment fizzled out.

However all of that is likely at least 6-12 months in the future. For now the market remains on fire with no immediate sign of a slowdown.

Also the weekly numbers, courtesy of the VREB:

| Jan 2021 |

Jan

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 107 | 241 | 447 | 411 | |

| New Listings | 201 | 422 | 667 | 879 | |

| Active Listings | 1319 | 1351 | 1347 | 1958 | |

| Sales to New Listings | 53% | 57% | 67% | 47% | |

| Sales YoY Change | +90% | +67% | +62% | ||

| Months of Inventory | 4.8 | ||||

The incredibly strong sales pace continues, with bidding wars rampant and inventory flat when it should be increasing. Of the 129 detached properties that have sold so far in January, nearly half have gone over the asking price, and 22% have gone for $50,000 or more over.

We’ll end the month with at least 50% more sales than a year ago despite the inventory crunch. Super strong activity in the detached market is spilling over to condos, with signs of increasing froth there as well. I suspect we’ll see increasing prices in that segment after a mostly flat 2020. With the median detached home from Sidney to Sooke cracking a million dollars in January, the segment has simply moved out of reach of most buyers.

In my view, the lack of affordable housing presents real challenges to economic competitiveness for the region. Local governments fiddling at the margins of affordability will have to change course drastically if we are to ever have some semblance of affordable housing for a diverse population.

new post: https://househuntvictoria.ca/2021/02/01/market-starts-off-with-a-roar-in-2021/

R Haydon it’s funny you’d mention Calgary, I’m from there and my parents are still there. We’ve been in Victoria for 15 years, have a really well established support network of friends who are now having kids the same age as ours, and our decent jobs are here but at least 1 is transferrable to any major city. How long have you lived there?

The Calgary pull is real… At our max budget no suite, we’d get a hell of a house for 660k there. Probably wouldn’t even, as the 400k houses are fantastic. But it’s not all about a house. One of us works at the University and although possibly transferrable, Calgary has just so many qualified unemployed right now (I know a few of them and it’s a pretty depressing time), and Kenney is showing no indication he’s going to reverse cuts to post secondary so we can’t count on 1 of 2 jobs. Politics in general in AB is whack… I still have a lot of friends there and unless they’re stated NDP supporters my jaw just drops at what people think and how they live. Its a huge contrast to our own political values and I don’t see it getting any better anytime soon. It’s a great place for kids though, I grew up in a lake community in the south, so swimming all summer, skating all winter. We don’t have anything like that here, it’s why I’m looking at Kelowna.

Still have considered buying in Calgary but returning to Vic a couple years later while renting out the 1st place just to have a foot in the door on a house but I don’t know if it’s feasible. I’m also finding it strange there’s basically no houses with suites there, if anyone can chime in I’m interested as to why. Are they illegal? No one wants to live in one? Just bizzare to have families and investors trampling eachother for a SFH with suite in Colwood but it be non-existent in Calgary.

True, very few countries have their act together.

Really isn’t a Canadian phenomenon, it’s global.

Leo- Thanks for the video featuring Harper. I’m also not big into politics but our country would be in much better shape if the Conservatives were still in power. Why the people in Canada fell for Trudeau’s “charisma” , I don’t know. Trudeau is not very intelligent or well educated ( Drama school teacher?) and is ill prepared to be a national leader. We made our bed and now we have to sleep in it, no matter how uncomfortable.

“Cadborosaurus” if you are considering Kelowna to raise your family why not Calgary?! You can get real good value on a house here, and lots of inventory, hardly any multiple bids, great schools in good neighborhoods. Eventually the market will turn. One thing I’ve always noticed about Calgary, it’s nicest here in a downturn, there’s no more frenzy, the panic is all gone, people are more friendly, it’s easy to get around, it is a young person’s city.

Not familiar with Harper’s policies as I haven’t followed politics much in the past but first interview I’ve watched and wow this guy is 10x the intellect Trudeau is. Leo, what were the issues that made you a non-fan? Makes Trudeau look like a joke imo.

Not a Harper fan, but the answer to this question is very interesting: https://youtu.be/HAKetLKjCP8?t=1052

Ummm…really? I’m right here with you feeling the house hunt pain.

We were seeing at least 1-2 places a week in December trying to buy our 1st home. now I just look at PCS, text my realtor and try to guess the price it’ll go over and how many bids. I feel it’s not even worth my time now to book a showing (dragging family of 4 to Langford) because every place we check out goes to a bid war and we don’t have ammo to play that stupid game. I’m hoping for more inventory and less insanity this spring, the FOMO is real but so is the looming thought that these prices will be corrected shortly and we will not regret waiting. Today I’m 50/50.

I’m starting to test the waters in Shawnigan, Kelowna etc… Messaging people i know in “plan B” areas about what it’s like to raise a family there and thinking about job, commute and childcare logistics. They’re telling me the same story as here, crazy prices and bidding wars (and out of towners driving up prices so we’d be a part of another problem). Something’s gotta give this is so frustrating for so many of us and it feels usustainable, I just wish I knew for how long.

Follow up.

Victoria — https://www.onthisspot.ca/cities/victoria

The E&N Railway: The Little Railway that Almost Killed Canada — https://www.onthisspot.ca/cities/esquimalt/eandn

You gotta respect the fact that the city’s top-earning realtor builds his own fence.

Pretty close. Median east saanich detached sale this month is 19% over assessment. That puts our place over a million, although I suspect actual market value is a bit short of that, maybe around $950.

Q4 2020 median core detached price was over a million. So, Leo, when will your house and mine (very similar) reach a million? Or are we already close, because assessments lag?

Sales to list ratio is 91% in the last two weeks. Average for January is 43%

I think that was 1607, which started at $1.09M before finally selling for $785k a year later.

Leo, wasn’t that house listed for, like, $970K during the height of the 2017 boom? And if I recall correctly, you were especially aghast. (And it ended up not selling for that amount, or possibly at all — I can’t remember.)

Victoria 1936, so much has changed so much remains the same. https://www.youtube.com/watch?v=15NwoHAfeeE

Also a good experience with Tower. Not cheap and we waited several months for a slot but they were brisk and efficient on the actual install.

We have had a good experience with Tower Fencing. They have done three areas of black chain link for us.

The margins in the fencing industry are along those in the mattress industry 🙂

It isn’t rock science. Dig a few holes, pour some concrete (mixing concrete isn’t rocket science either), install posts, buy fence with some lattice top.

Hopefully your neighbour(s) aren’t as annoying as my last one.

Then never gave me 50% for material and didn’t help at all with labour.

“I’d love some thoughts on a move to Cobble Hill/Shawnigan/Cowichan Bay and even Maple Bay.”

The Cowichan Valley is great. We moved up here seven years ago and love it. It is very family oriented, with lots of kids around. We were fortunate in that we were able to rent for a couple of years to get a feel for where we wanted to live, but that’s pretty difficult right now. The rental market is tight. There are apparently bidding wars for rentals right now.

I can give you a breakdown of the areas that might be helpful:

Maple Bay is very pleasant, more upscale, near the water, but far from amenities. There aren’t any good schools in the area (Maple Bay school is surprisingly problematic).

Crofton is more affordable and near the water, but it is right by a pulp mill that smells sometimes and can belch out something toxic that has been known to cover peoples’ gardens.

Cowichan Bay has lots of families and a couple of new subdivisions being developed. It’s a nice area. The villiage of Cowichan Bay is a quaint tourist town, but with few practical amenities. For some reason it has never been developed, but I hear there is some association of organized crime with the commercial ownership.

Mill Bay is very nice, more expensive, near the water, some amenities and Brentwood school. Closer to Victoria, of course. It’s a pleasant area.

Cobble Hill is more rural, family oriented, inland, access to hikes (Cobble Hill Mountain is very popular).

Shawnigan is an interesting area. It attracts a certain kind of person as it has traditionally been a summer playground for the wealthy. There is a big presence of Shawnigan Lake School and all that is associated with the school. It gets very busy in the summer with tourists, summer cottagers, jetskis and ski boats, if that’s your thing.

Here’s a breakdown of the schools I know for young kids:

Public Elementary schools that get positive reviews: Bench (Cowichan Bay), Mount Prevost (French immersion, Duncan), Ecole Cobble Hill (French immersion, Cobble Hill), Crofton Elementary, Mill Bay Nature School (a nature based public school without a lot of structure, but people seem to like it, very passionate staff).

Private Elementary schools:

Sunrise Waldorf – a touchy feely school with a slightly cultish vibe – you either love it or hate it. (cowichan station)

Evergreen school – a small community oriented school reasonably priced, involves lots of volunteer hours from parents to keep it going – highly recommended for preschool (cobble hill).

Queen Margaret’s – good reviews (in Duncan), more expensive.

If you’re into home schooling there are a bunch of small private and private/public programs that can be accessed to help facilitate that.

Josh – we had a great experience with Tower Fence last year.

That takes the prize for Most Appropriate Collective Noun of the Month.

Bring Cash.

I just don’t like leaving it to luck. It would be nice just for the market to take a breath (just for a moment). A competition where it’s jumping 10s and 100s thousands isn’t one I want to win especially if it requires no conditions.

I mentioned to me realtor I was interested in a property and told my thoughts on an offer. He said he didn’t think it would get it done. So, I decided not to put the offer in. He seemed genuinely surprised that I didn’t put the offer on the property. I said what’s the point, I trust your advice… I determined what the value of the property was for me and I guess he thought me making an official offer would pull me into the competition.

$500 is pretty meaningless with these sums of money… I am pretty lucky that I am able to make solid evaluations on properties without an inspection. My offers have been without an inspection condition. The issue right now is that the no condition offer isn’t trimming any cost right now. Those no condition offers are happening on well over ask on offers. I am good with near no conditions, if I am getting a deal that I can anticipate some big costs on.

Yes, the BoC rate will be staying low, however, the bond market will be driving the mortgage rates up faster than anyone is anticipating right now. For me, monthly payments is not a big concern. I have a lot flexibility on that item. My focus is more on the percentages of committed funds both now and the long term, and how much of that is committed to debt servicing against anticipated asset growth (I do view a housing purchase more of a lifestyle choice than investment, so I am willing to take a financial hit to a certain limit). But if I take a severe financial hit, it better be one hell of a lifestyle gain. For me, the 30 year amortization plays to much of the hi-ratio debt servicing game/scam, I prefer the higher monthly and save the sucker trap of the big interest penalty (I will not be flipping or having a property ladder party, so long term interest costs matter to me).

Thanks for your thoughts, I try to consume all the perspectives I can and apply them into my scenario… Cheers.

The market catches up to stale listings:

1564 San Juan

Listed Feb 2019 for $769k. Dropped to $729 then $699 that year. Cancelled.

Relist October 2020 for $739k

Sold full price 105 days later.

For a rural/small town setting Mill Bay/Duncan have a wealth of top independent schools like Shawnigan Lake, Brentwood College and Queen Margaret’s. Schools that would be extremely competitive to get into if in Vancouver. It would be worth a move just for that alone if you are into that for your kids.

Josh

Wood is up huge so don’t be shocks when u see the price.

4349 Kingscote.

Assessed: $1,246,000

List: $1,299,900

Sold: $1,750,000

Unconditional

Perfectly normal, perfectly healthy

Does anyone have a fencing company they would recommend?

Some friends of ours moved to just outside Chemainus quite a few years back with young kids now school age and love it.

Prices have exploded there too but still a good third cheaper than here at least.

I’m feeling the squeeze of the Victoria house prices. I’d love some thoughts on a move to Cobble Hill/Shawnigan/Cowichan Bay and even Maple Bay. Commuting to Victoria for work isn’t required. I have young children so input on schools would be great too.

Yes, only way I would do it would be to have a suite and we are already doing this. The census does not capture this situation as it treats a suite as a separate private dwelling which is counted on its own even if the occupants are related to those in the main house or if they are co-owners.

https://www12.statcan.gc.ca/census-recensement/2016/ref/dict/dwelling-logements005-eng.cfm

Looking for the reasons why Canada’s housing prices are rising faster than in the U.S.

https://financialpost.com/real-estate/looking-for-the-reasons-why-canadas-housing-prices-are-rising-faster-than-in-the-u-s

If a child and their family (or the parents) were living in the suite would that count as 2 households?

I know of plenty of lot of families choose to go in together with their parents like this to be able to afford a house in this market. I could see a structure like this delaying the young family from upgrading their house longer.

The 2016 census shows a grand total of 4,875 families with 5 or more persons in Victoria CMA, out of 101,615. Average size of census family is 2.7.

Looks a bit small to have an appreciable affect on turnover, but we’ll see what the 2021 census numbers have to say.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=PR&Code2=59&Data=Count&SearchText=victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1

Interesting read in this story about people leaving some of America’s key cities. (Even prior to Covid)

I could see the same thing happening here in Canada and might serve as a wake up call to our city leaders.

https://reason.com/2019/09/10/its-not-a-mystery-why-americas-biggest-cities-are-losing-population/

+1 and probably more difficult for a multi-gen household to upsize/downsize or just move in general.

I think the reason people are not anxious to list their homes and buy another one is the huge expenses involved in each transaction. To lose over $50,000 in realtor fees, land transfer taxes and legal fees, is just too hard to swallow, so they stay put. Also the daunting prospect of trying to find another home in such a competitive environment, just isn’t worth the hassle.

But unless you just have one kid there are still going to be major issues. Another factor to keep in mind is the increasing number of people retiring in debt and staying that way (including deferred property taxes, reverse mortgages) which adds another level of issues in bequeathing property.

Not true even for prime rate. Maybe true for BoC overnight rate but that’s irrelevant.

https://www.ratehub.ca/prime-mortgage-rate-history

I wonder if people are staying in their homes longer as they age and with young adults staying home longer there may be decreased downsizing occurring and a greater move to multi-gen households as prices continue to rise. Multi-gen households were the fastest rising household category between 2001 and 2016 (37.6% increase) – we don’t have reliable stats since then but I’d guess the trend has continued.

I agree, with Marko, Deb, and Kenny theories.

Interest rates has been below 6% since the mid 90s and well below 2% since 2009, plus chronically low vacancy rates let amateur landlords hold onto their rentals even when real estate prices are down.

Anyone got a theory on why new listings for detached homes are down by 30% in the last 10 years?

People hanging on to houses as rentals?

‘

‘

I know several people who kept their first home as a rental when they upsized too a new home. It would be interesting to know the percentage of single family homes that are now rentals vs 20 or 30 years ago, my theory is new amateur landlords are putting the squeeze on availability of homes for first time buyers and driving up prices and holding for long term

Speculators hate to loose money. They are going to hang onto properties and try to sell at the top of the market. When enough decide to sell the bull market will loose momentum.

I could be entirely wrong but it is one theory.

Good theory. The appreciating market strikes again. Although new lists were also decreasing 2011 to 14 when prices were flat to down, but could be coincidence. Hard to pull separated data much further back.

Yup, the Mariash building is top notch and by far the best. I lived there for three years. I now live in one of the Bosa buildings and I can confirm it isn’t quite as good but totally acceptable.

The Mariash building (Bayview One) is the best per sq/ft bang for buck in Victoria imo -> https://www.youtube.com/watch?v=fGnf17xZLps

My theory is it was a lot easier to upsize from a 200k to a 300k home versus 800k to $1.2 million. As affordability is eroded there will be less and less detached listings imo. At some point people will start passing on detached homes to their kids who can’t afford to purchase (although I think this is 20 to 30 years out). Especially with people having 2.2 kids it will be easier for the kids to work out a deal versus 3-5 kids splitting an estate.

Anyone got a theory on why new listings for detached homes are down by 30% in the last 10 years?

People hanging on to houses as rentals?

People moving less often?

I’m a bit stumped.

That’s my brother

Is the guy who found this pillar related to you, Leo?

https://www.timescolonist.com/news/local/stone-pillar-found-on-dallas-road-beach-likely-once-used-in-indigenous-rituals-curator-1.24273748

You can create what you want in retirement but that is the problem, it is up to you only and much harder to replicate for some people depending on what drives you (ie. if you enjoy prestige, professional recognition, peer interaction – all legitimate things). If you love your job and want to keep working at it despite being FI that is great too.

Marko, you were right. I drove by Swallows Landing yesterday evening and it is a pretty rough area, the Songhees area is much nicer. I have heard that out of the Bayview buildings, the first one is the best quality built by the Mariash and the other ones built by Bosa aren’t quite as good. Can you confirm?

Vancouver renters eye incentives as vacancy rates continue to rise during the pandemic

Note those numbers are for purpose built rentals, which typically have a lower vacancy rate than condos.

About a quarter of condos are investments. Big buildings are most popular amongst investors (also newer buildings don’t tend to have rental restrictions)

Maybe that’s a place to start then?

The main misconception you seem to have that it’s about retiring and doing nothing. That’s not the case. It’s about having autonomy over your own time which requires a certain amount of financial independence. The retire part of it is really a bit of a misnomer.

That’s a perfectly fine take. But I will say:

Who’s carefree in their 20s and 30s nowadays? It’s hard to afford to be.

And what does childlessness have to do with anything? Many F.I.R.E. folks have a child or two (e.g., Mr Money Mustache and our very own totoro). Or is choosing not to have children a bad thing in your books?

And just because you found yourself wandering aimlessly in early retirement certainly doesn’t mean that everyone else’s experience will mirror yours. You may just have a very poor imagination.

And making sacrifices to achieve an objective is not something to be mocked, I don’t think. It’s quite the opposite, even if the sacrifices and the objective may not be your cup of tea.

‘

‘

You seem a little touchy, maybe my comment hit a little to close to home. I have no idea what FIRE is or who the hell mr money mustache is, but there seems to be a common theme here that, in their own word, says that working a traditional job is a death trap and the only way to escape is to live live on the least amount possible during your 20s and 30’s then you can start living. It seems for many of them kids get in the way of reaching their dream of not working anymore. I don’t know if you have kids but i can’t imagine not having any; I have had several clients who said not having kids was the biggest regret of their life and I have only ever met one client who said maybe they should not have had kids. but to each their own.

What I realized in leaving the workforce for a few years was that being good at what you do is very satisfying, but its not always easy and that’s the rewarding thing about it and I now understand why retirement is hard for people who have complex jobs that challenge them as they will most likely never get that feeling again.

I think maybe this sums of working better then I can say about working

https://www.youtube.com/watch?v=2jIia7aXins

Thanks for the correction.

Nope. 1.06^8 = 1.593848075, thus $1 million becomes $1,593,848.08 . To the nearest cent. 🙂

Yes! Now you have it 🙂

yup, I never looked into the actual detailed calcs. of my property taxes and I own up to it. I never said the cost of property tax is a concern, but I certainly wouldn’t mind paying a lower amount. End of the day I care about cash flow when it comes to real estate until I am ready to cash out.

I see someone’s getting schooled on how property taxes work.

I do. Prices were a lot lower when I bought. Now they’re higher.

$4500 in annual property tax is a concern? When house prices have probably appreciated by that amount monthly, as of late?

Advertising your lack of understanding with respect to property taxes on an anonymous internet forum is also a really interesting way of spending your work day though.

Interesting, so the mill rate is actually reverse calculated to balance the budget and the mill rate would be higher if there was a house crash unless there is a decrease in the municipal budget to offset. Never looked into that in detail.

Exactly Former Landlord.

The Saanich tax calculator applies this year’s mil rate. It is of no use in assessing increased tax burdens yoy and not relevant to your complaint. I don’t know how to make it clearer but maybe read those links again.

The average rate of return trend in Victoria for real estate is roughly 6% per year. Therefore, $1 million compound over the course of 8 years is $1.9 million.

And, IMHO, inflation, stimulus monopoly money, and ultra low interest rates are factors that kept the upward trend. Plus the CAD went from 6 CNY/0.75 Euro in 2013 to 5 CNY/0.64 Euro at the present.

Your property taxes don’t go up if the municipal budget stays the same and all houses in your municipality go up by the same amount.

So even if all the house prices doubled in Oak Bay year over year, each individual owner would pay the same.

If your house doubled while the rest of the municipality stayed the same value, your taxes would more or less double.

So for an individual home owner it would impact their taxes if they got a higher/lower assessment change than the average. But if the whole market moves in unison it has no impact on property taxes.

No, it doesn’t. Property taxes in oak bay have not risen $2450 on a house based on increasing values since 2013 because that is not how property taxes work. Even if they had risen that much it would not be related to the appreciation in value, but to a massive increase in the municipal budget. This means that you would be paying higher taxes anyway.

Please read the link to understand more: https://info.bcassessment.ca/propertytax

And here is why it all depends on your municipal budget and not your valuation:

https://info.bcassessment.ca/services-and-products/Pages/ThePropertyTaxEquation.aspx

I use past trends to estimate future net worth. Net worth is far more important to me whatever form it is in (savings, stocks, RE, business) than costs of ownership which I cannot control but calculate before making a decision to invest. Net worth may vary based on appreciation or depreciation but I’m comfortable proceeding based on calculated risk.

Here is a tax calculator for Saanich where I own, go put in some different assessed values and see the results.

https://wowa.ca/taxes/saanich-property-tax

I am not a tax expert but the BC assessment suggests that if your house increases inline with the market average then there are no additional property taxes which just doesn’t make sense.

What impact does appreciation and depreciation have on you other than property taxes if you are not in the market to buy/sell or heloc? Maybe if you worked in a industry connected to real estate but if not then it doesn’t do much to you other than make you feel good/bad about your finances in your head.

My point was that everything being the same, you pay more property taxes the more a house is worth/assessed at. I don’t know why you are arguing that point…. Using your data about the oak bay house, had the boom from 2013 to now not occurred, the assessed value of an oak bay house is likely atleast $500k lower and translates into $2450 extra a year savings in property tax. So if you are not selling or taking out a heloc, wouldn’t you rather have that money in your pocket? Go take that $2450 and buy some calls on reddit meme stocks and you can move from oakbay to uplands.

This explains how property taxes work better than I can and why your taxes probably won’t increase if your house value goes up the same as the neighbouring homes:

https://info.bcassessment.ca/propertytax

The basis for appeal would not be a high assessment, but an incorrect assessment. You can ask for this whether you appeal has risen, fallen or stayed the same if you believe the appraised value to be wrong based on other home values in your area. 98.8% of people don’t appeal btw.

The amount of additional tax you pay if your assessment is found to be, say 50k too high on a 900k property in Oak Bay, is $245. I would never go through an appeal for that myself unless there was a glaring error (ie. floorspace incorrect) because you need a lot of evidence to do so (burden of proof is on you and you’ll probably need to pay for your own appraisal at about 500 dollars) but you should know that if you think your property is assessed too high you can just call bc assessment and an appraiser will:

• discuss your property file;

• explain how the market value was determined; and

• refer you to sales of similar properties in your neighbourhood.

If you and the appraiser agree there is an error, the assessment can be corrected without an independent review.

Property taxes are not something I pay too much attention to. Appreciation/depreciation have a much higher impact.

lol so the assessed value of a house is not correlated to property tax now and the people appealing a high assessment has nothing to do in their free time and choose to do it for fun?

Probably not. If your property taxes rise it is a function of the municipal budget rising, not valuations rising. If your property didn’t appreciate and the budget needed to increase they would still need to raise the mil rate and you’d still pay more taxes on a property that did not appreciate.

I haven’t gotten bored with ER but I do have a big family and lots of projects I work on. Also more introverted so likely depends on personality a bit.

Introvert, as a home owner why do you constantly cheer for home prices to go up? I would rather they stay consistent until I am ready to sell, this would save me property taxes and also be able to better assess other investment properties to purchase. Do you understand the concept of buy low sell high? Unless of course you are trying to take out the largest possible heloc to invest in another asset class.

Being allegedly paper rich while paying extra real taxes and then bragging about it on an anonymous internet forum is an really interesting way of spending your work day though.

That’s a perfectly fine take. But I will say:

Who’s carefree in their 20s and 30s nowadays? It’s hard to afford to be.

And what does childlessness have to do with anything? Many F.I.R.E. folks have a child or two (e.g., Mr Money Mustache and our very own totoro). Or is choosing not to have children a bad thing in your books?

And just because you found yourself wandering aimlessly in early retirement certainly doesn’t mean that everyone else’s experience will mirror yours. You may just have a very poor imagination.

And making sacrifices to achieve an objective is not something to be mocked, I don’t think. It’s quite the opposite, even if the sacrifices and the objective may not be your cup of tea.

I know that I am probability exaggerating a bit but it seems to me that properties that were selling for a million when I arrived in 2013 are now going for two million. A friend of mine is looking and is finding it difficult to find anything worthwhile.

On the topic of how to bypass the stress test. Mortgage broker Mike Grace provided a lot of helpful info:

Regarding the stress test:

There is a myriad of ways to work-around stress testing – adjusting allowable income, extending ratios, excluding specific liabilities – all which require a case-by-case approach/material exceptions and some solid risk analysis on the underwriting end of things. These would only be available for un-insured loans from the big banks. Insured loans are still very strict on income/ratios/benchmarks, and mono-lines are stuck with their investor agreements that limit them to hard 39/44 ratios and excruciatingly standard income calculations.

1) Extended Ratios – we’re seeing big banks commonly extend ratios beyond the 44% limitation on a case by case basis – up to 50% seems relatively common when there is a reasonable justification. A return to some more common sense underwriting seems to be theme – especially so as they are fiercely fighting for market share. Some recent examples from my book of business include:

i) Approved ratios at 54% TDS due to high personal net worth – 65% LTV

ii) Approved ratios to 206% – based on a net worth calculation – 50% LTV

iii) Approved ratios to 539% – based on a net worth calculation – 50% LTV

2) Larger gross ups for Self-Employed or Projected Income for certain professional groups – where borrowers are self employed it’s possible to build a case to “gross up” their personal income amount. Standard allowable is 15%, but I’ve had success applying much larger gross ups where it makes sense to do so. The decisioning is case by case and will generally have to meet the bar of a skeptical underwriter on the other end. New doctors and other very limited professional groups have access to ‘projected income’ programs where the banks are comfortable lending on a base projected income level.

3) Credit Unions – as you know contract rate qualification is still available with credit unions, albeit at much lower ratios – 32/42 is standard for these products.

There’s likely additional areas I’m not covering here, but the general theme should be that the stress test will still apply to each application – it’s just that the other supposedly solid confines of the applications are becoming a bit more flexible… but only when there is a reasonable justification to do so.

My take is that this doesn’t add any additional credit risk into market.

I heard that UVic was planning on being online again in September?

1317 units added to purpose built rental universe in the last year.

Have you tried Mike Grace? (HHV supporter ad)

on a side note, could anyone recommend a contact /or a bank/credit union for a commercial strata unit purchase?( located in Victoria BC). Thank you

CMHC data:

Vacancy rate (in purpose built rental): 2.2%

Rent: up 3.3%

Less of an impact than I thought. May be that secondary rental market saw more impact as that is where more students live, but will have to dig into the data some more.

If rates are significantly higher there’s a good chance prices will be significantly lower and your equity may be gone. Less risk of that with a 10 year term but it will cost you.

I was going to put a portion of my RRSP portfolio into ETF in the near future, and then I found out that many mutual funds and ETFs, are behind the Wallstreet investment firms that are rushing into Saudi Arabia to help them greenwashing blood money.

Wall Street Returns to Riyadh — https://www.nytimes.com/2021/01/25/business/dealbook/wall-street-saudi-arabia.html

Rental data out tomorrow. Guesses on vacancy rate? It was 1% in fall 2019.

I’m guessing 3-4% vacancy. Rents roughly flat. Vacancy rate should pull back a bit from this level as students come back this year but with vastly increased rental construction we won’t be going back to 1% vacancy rates anytime soon

“Enjoyed this episode of Rob Carrick’s podcast called Stress Test. The topic was F.I.R.E. (Financial Independence, Retire Early).”

‘

‘

‘

Great another story about a childless couple who lived like Monks for 10 years (during the usually most carefree time of your lives in your 20 and early 30’s) so they could retire before 40 and wander aimlessly while watching their pennies, no thanks. I retired in my 40’s and after a few years off I realized that having another 40 -50 years of not being part of the real world was not all it was cracked up to be.

+1

“Umm..really” I get your frustration but here are a couple things you should consider.

Don’t assume that every home is going to sell over ask. Yes, a lot of them will but sometimes you get lucky, the stars align and for what ever reason your competitive buyers are tied up, out of town and those other bids against you have just entered their very first offer and are scared sh..less and guess what you luck out. The 30 years I have been in real estate has taught me there is a lot of luck involved. I’ve had fabulous listings that should have sold in a day and just for bad luck took 30. Similarly I have had garbage listings that I wondered how will this ever sell, and then it goes on day one.

If you find a property that you absolutely love, arrange for a home inspector to go with you on your initial viewing, yes, it will cost you $500 but then you can write an offer without the home inspection condition which will give you a big leg up on any offer that asks for it. I’ve seen sellers take an offer for $40,000 less than the one with a home inspection.

One of the most important considerations to remember when buying a home is what will be the total cost of buying a house till all financial obligations are met. So a more expensive home now may well cost you less overall than a cheaper home later with mortgage rates double than what they are today.

Keep in mind with mortgage rates so low today the vast majority of your monthly payment will be going to pay down the principal. So your mortgage will be substantially smaller 5 years from now. If rates for whatever reason are significantly higher (which I don’t see happening) you will be able to refinance the lowered amount of your mortgage with a 30 year amortization to overcome your concern of higher mortgage payments. Good luck bud!

Victoria RE has been a heartbreaker for a long time, for a lot of folks. The dude that created this blog in 2007 kept hoping for a substantial price decline. He waited years. It never came. He left the province.

It is definitely frustrating out there and the buyer mentality is hard fathom. I initially thought I was prepared in 2016/17, but with the way that market went, I had to pause and decided that I needed to build some more cash reserves for a purchase. The subsequent years after, the “life happens” issues needed to be dealt with, so sorting a purchase was a low priority. Then coming into and through the pandemic my window for a purchase was opening up again. However, we can all see where that market went.

In December, I took a couple of shots thinking that a down payment that I could flex between 150k and 200k (without harming other assets) would leave me well positioned. It really did not, the places went for well over ask with zero conditions (not that I had many conditions, but I need to know who owns a house before buying and if I need to spend another 100k or 200k on it).

Enter January, I saw few possible listings pop up, but I didn’t even consider picking up the phone or sending emails about them because I am operating on the assumption that the listing will go a 150k over ask with zero conditions. I know the insane rate that I got from a major bank is going out to many others as well, and that cheap credit is really driving the market. However, I wonder if anyone thinks about debt servicing costs if that 1% to 1.5% rate becomes a 3% to 3.5% in 3 to 5 years?

Since I am bursting at the seams in the space I am in, I am going through a reduction of stuff and trying to change to more small space friendly furniture in an attempt to stretch time out more in the space I am in. I will focus on building the assets I can, and wait and see if anything ever becomes realistic for me and my circumstances. Well, in the end, luck is only when preparation meets opportunity.

I used to be anti Chip Reverse Mortgages, proof in a comment I made in HHV over a year ago. Now that interest rates have dropped so dramatically I am actually seriouly considering a reverse mortgage. Now with some new players competing for business you can get a 5yr Am. Reverse Mortgage for 3.79%. Yes that is pretty well double the rate of a current bank mortgage, but in relative terms to where competitive mortgages have historically been, this is an opportunity that needs serious consideration.

Why a reverse mortgage over conventional banking? Well because of Covid any person self employed who has experienced a dramatic loss in income or someone lost a job or been layed off and can’t qualify through a bank, if you are over 60 ( yes, I know 55 is the starting point,) and have a large amount of equity you don’t need to qualify. So you can pay out your existing mortgage with the Reverse mortgage without qualifying and have no monthly payments. Pretty enticing I’d say.

Enjoyed this episode of Rob Carrick’s podcast called Stress Test. The topic was F.I.R.E. (Financial Independence, Retire Early).

Interesting point the example couple made (I’m paraphrasing): job markets are unreliable but financial markets much less so.

https://stress-test.simplecast.com/episodes/retiring-in-your-30s-how-some-canadians-are-making-big-changes-to-escape-the-workforce

I mean, those Calgary stats are kind of BS. You can’t take the 3-5 sales in Dec/Jan seriously; sellers may well have been desperate or it’s just noise. I see a decline from 767k to 680k. Notable, yes, but not the catastrophe it’s meant to show. For most of Canada, nearly 700k is still an expensive house.

The crash of the early 1980’s was a lot worse. Even worse than the concurrent crash in Vancouver which was down about 35% overall.

You’d think that people in Calgary would have figured out that paying $1.77 mil for a house in a city dependent on a boom and bust industry and surrounded by empty land might not be a great idea. Nope.

Way more to it than just dependence on the auto industry. The metro area hasn’t done all that badly – as the income stats I posted show – it’s just that the decline has disproportionately affected the City of Detroit. Calgary is a single city encompassing almost all the metro population, and it doesn’t have the racial divisions that resulted in most of the middle class leaving the City of Detroit.

FWIW, Calgary Herald columnist Don Braid isn’t the first one to make the Calgary/Detroit comparison/prediction.

Of course there’s an element of hyperbole at work here, but the point people are trying to make is that Calgary is, and has been, far too dependent on a single industry that wouldn’t, and couldn’t, last forever. Similar to what happened with Detroit.

Friends of ours in Calgary bought a $1.775M house 7 years ago.

Just looked up the 2021 assessment: $1.51M

Down 14.93% or $265,000 from purchase price.

Mind you, what a buyer, today, is willing to pay for their property may differ a bit from assessment…

So have I.

Anyway my post was in reply to that newspaper columnist claiming that Calgary was on its way to becoming the next Detroit. Thus the comparison. I’m pretty sure you’d find that claim as ridiculous as I did. When ordinary houses in Calgary are going for $50K I might start taking it seriously.

It’s hard to get a good read with such a small number of sales in one community, but still…median of $1.06M dropping to $580K in 11 months is pretty shocking indeed.

Edmonton hasn’t experienced as dramatic an impact as Calgary. Across the board house prices in Edmonton have slipped 1-2% and remained static in some communities. The average house price in Edmonton is typically 40% less than Calgary. Because so many white collar jobs have been lost in Calgary, the higher end homes have taken a real beating whereas the lower end have held up well and demand is strong. Anyone wanting a high end home in Calgary would do well now with a very plausible 40% discount.

R Haysom: Any idea how Edmonton is doing in comparison to Calgary?

The Calgary community I live in showing the shocking statistics in the monthly community news letter

Surgical masks in boxes of multiples are available everywhere: pharmacies, canadian tire, wholesale club… We got our surgical masks at Pharmasave. We got the regular blue ones and we also have some n95s for higher risk situations like going to the ER. My guess is that with the likely 8-month gap between now and vaccination and the rise of the new variant that these items may be more in demand again soon.

https://longanmerch.com/products/arun-kn95?variant=34450833866796

Which ones did you buy, and from where?

Off topic but now that surgical masks are no longer in short supply you may want to consider switching out from cloth masks. We did so a couple months ago. Normal surgical masks are about three times more effective than cloth masks in preventing the spread of virus droplets and provide more protection for the wearer.

https://www.express.co.uk/life-style/health/1388550/coronavirus-uk-news-latest-update-KN95-KF94-European-FFP2-masks

A 699k house in Detroit pays 16,427 in property tax each year – US.

Have you been there? I have. Super sketchy and depressing. Within a block of the nice brick house you’ll likely find an abandoned boarded up one – people all over walked away when they couldn’t pay their property taxes and no-one wanted to buy. 911 can take three or more hours to respond. City is broke and the infrastructure and streets are in terrible condition.

You’re comparing an entire urban area with the inner city of a large metropolitan area which has a fraction of its population. The median household income for the Detroit-Warren-Livonia Michigan metro area was USD $63,474 in 2019.

Bricks are awesome. Not so much in a seismically active zone

Many cities going from the mid west to the atlantic are brick. Even new builds have brick facades.

Second random street chosen: the brick continues.

And a boarded-up beauty.

https://www.google.com/maps/@42.4341426,-83.0527119,3a,37.5y,82.5h,92.71t/data=!3m6!1e1!3m4!1sELqt4p2uT9bLM8uqDl1ovg!2e0!7i16384!8i8192

I chose a random street in Detroit on Google Street View.

What’s with the brick houses? Every house on this street is brick.

Detroiters really took the Three Little Pigs fable to heart, didn’t they.

https://www.google.com/maps/@42.415448,-83.1818692,3a,75y,346.71h,75.36t/data=!3m6!1e1!3m4!1soiyCv6XiojUY_yhCvEPZ-A!2e0!7i16384!8i8192

https://blog.remax.ca/skyrocketing-demand-in-the-moncton-housing-market/

Median household income in Detroit: $31,283 USD

That’s 39,925 CAD.

Port Alberni ($50,823) has a higher median household income than Detroit. Think about that.

Yes, but jobs in the US pay in USD.

New ICBC insurance rate estimator: https://enhancedcare.icbc.com/savings-and-refunds

Could be part of it. I think people in general are concerned about devaluation of money and are piling into all sorts of areas in search of return. Crazy mini stock bubbles triggered by reddit, runup in crypto, real estate mania.

It feels like there’s inflation but it’s not showing up in CPI because people aren’t spending on regular things, so it’s not showing up in CPI because there’s not too much demand for production. Instead people are funneling the money into investments and causing these manias. But once COVID is over people may direct that money back into spending and cause rapid inflation.

https://www.weatherstats.ca/

And 25k per year in property taxes vs. 4k/year here.

Anyone know the asking price for the lot in the link below?

https://www.bcassessment.ca/Property/Info/QTAwMDBIUVRZVQ==

In us dollars though. You can get this in Calgary instead for less and not live near a boarded up burned house in a dangerous neighbourhood.

https://www.realtor.ca/real-estate/22637139/205-35-a-street-sw-calgary-spruce-cliff

Don’t forget 700K USD = 890K CAD.

I’m definitely going to try to see if I can retire early and move to Moncton. A 6000 sqf house with a huge mancave and swimming pool on 3 ac for 200K less than the haphazardly renovated bungalow in mediocre part of Oaklands.

https://www.realtor.ca/real-estate/22230728/190-rural-estates-dr-moncton

You are overlooking some factors that don’t show up in the numbers like curb appeal and appeal/quality of the renovations. I honestly think the median in the Oaklands area this year will clear $1 million.

Wood prices surging.

https://vancouverisland.ctvnews.ca/mobile/i-haven-t-seen-anything-like-this-lumber-prices-hit-historic-high-on-vancouver-island-1.5283478?fbclid=IwAR0MpO_M1o55d3a9XbozcTBsEL-s5mFWZkgK2WVOJY3hJa3-89u1D8w1pqg

That’s what happened in the early 1980’s. How did that turn out?

Should also point out that we’re not actually seeing consumer price or wage inflation, unlike then. But what about future consumer price inflation without wages keeping up? Labour pricing power was a lot stronger back then.

$680K gets you this in Calgary:

https://www.theglobeandmail.com/real-estate/calgary-and-edmonton/article-tough-bargaining-cuts-sale-price-for-calgary-bungalow/

$700K gets you this in Detroit:

https://www.zillow.com/homedetails/7661-La-Salle-Blvd-Detroit-MI-48206/88588017_zpid/

Don Braid, author of the column below, tweets out his column. Real estate agent tweets back:

https://twitter.com/YYCREGuy/status/1354065597089288192

How can we stop the bleeding of youth fleeing a wounded Calgary?

https://calgaryherald.com/opinion/columnists/braid-escalating-exodus-of-young-people-a-major-challenge-for-alberta

Wikipedia: “Greater Vancouver, also known as Metro Vancouver, is the metropolitan area with its major urban centre being the city of Vancouver, British Columbia, Canada. The term “Greater Vancouver” is roughly coterminous with the geographic area governed by the Metro Vancouver Regional District, though it predates the 1966 creation of the regional district. It is often used to include areas beyond the boundaries of the regional district but does not generally include wilderness and agricultural areas within that regional district.

Usage of the term “Greater Vancouver” is not consistent. In local use it tends to refer to urban and suburban areas only, and does not include parts of the regional district such as Bowen Island, although industries such as the film industry even include Squamish, Whistler and Hope as being in “the Vancouver area” or “in Greater Vancouver”. The business community often includes adjoining towns and cities such as Mission, Chilliwack, Abbotsford and Squamish within their use of the term “Greater Vancouver”, though since the creation of the term “Metro Vancouver”, that has come to be used in the media interchangeably with the name of the region and/or regional district”.

Who knew that Victoria is home to a now $3-billion pharmaceutical company?

https://www.timescolonist.com/business/victoria-pharmaceutical-firm-wins-u-s-approval-for-drug-shares-soar-1.24272703

Do you think that inflation, and the prospect of higher future inflation levels, may also be fueling demand? The BoC has already acknowledged that it’s going to let inflation creep up, once it’s appropriate to do so. Perhaps inflationary pressures are already pushing real estate prices higher as well.

Often. More of a referral network type coordination, not like they have any substantial influence on when people decide to buy or sell.

The problem isn’t so much lack of buyers, it’s a lack of listings. Agents may be better off coordinating with those in Port Alberni and getting some Victoria buyers to cash out!

Yeah, for sure, but is that upper Roseberry 3br/2ba the median for Oaklands? I feel like that whole hill between Haultain + Hillside would be a premium, but what about the rest of the Oaklands? The bit to the north+west of Hillside Mall? Or the flats that comprise the bulk of the eastern half?

Being a REALTOR™ and having your folks live in the area, you have more insight/knowledge/etc than I ever will, but it seems like 2710 Victor or a bungalow on that hill are a cut above the bulk of the properties in the neighbourhood.

Just out of curiosity, how much would a 33 acre emplty lot adjacent to Sunriver worth?

In fact the Real Estate Board of Greater Vancouver territory extends north of the Fraser as far as Maple Ridge and south of the Fraser it includes only Richmond, Ladner and Tsawassen.

Do realtors ever coordinate?

Realtors in Victoria should be talking with realtors in the most expensive parts of Vancouver. If more people cashed out of Van and moved to Vic (or even just decided to buy an investment property here), realtors in both locations would benefit from the extra business.

Leo the broker I was dealing with works at RBC. So my guess is if RBC is doing that the other banks must be doing it as well – at least on the broker side for good borrowers.

With prices the way they are, I would love to cash out and just rent or get out of town. If I knew I could find an adequate and secure rental, that is. Or if my family could find comparable jobs out of town.

Houses in Sunriver (Sooke) are almost hitting 900k. 918k in Gordon Head actually seems to be a “deal.”

If there is anyone left out there who thinks Victoria house prices are “outrageous” now, they might want a reality check and keep in mind what Houses sell for on the west side of Vancouver.

Kitsilano, Vancouver house for sale for $3,980,000.00 (Three bedrooms, two bathrooms, partially renovated.)

Take a look. https://www.findahomefast.ca/search/details/apc/58/

(I think that link should work) If the link doesn’t work then picture it as a bungalow. Not particularly special. But it is in Kitsilano, a much sought after area much like Fairfield in my opinion.

As long as there is still such a “huge” gap in prices between Vancouver and Victoria, then Victoria prices still have a lot of room to go much higher.

As crazy as that may sound! I’ve been saying this since 2016 and even prior. It was very irritating when people back then kept telling me, “Oh, Victoria is not Vancouver, you can’t compare them”.

Believe me….. I’m not.

But the price difference does have a huge influence on Victoria prices.

Don’t look at the median price of homes for “Greater Vancouver” when you are trying to make comparisons. People and even the media do that all the time. “Greater Vancouver” includes houses all they way out to near Chilliwack. That’s annoying as well:)

And when you see a place for sale on Vancouver’s west side and you think … that’s not much more than Victoria, you have to look closer……… because it will only be a “suite” in that house you see….not the whole house.

Haha. Marko, your video literally hit the nail on the head. Thank you.

I genuinely appreciate the responses thus far, but now that I’ve read a few I think I’m settled.

I really have two reasonable options(sell first or just wait) and a couple of wacky options(not for me). Everyone has an opinion but I feel like the fact that all of you are in agreement definitely makes it clearer for me.

I followed my realtors advice last fall and and spent a bit to prep my house for sale. But have held off listing because of the dearth of options. I believe that was a good call for me and will probably wait for the market to calm. If it doesn’t calm my mortgage is up spring 2022 and then I can at least sell without paying mortgage penalties.

I was concerned that my home would not keep up with the market – it’s in a strata with a crappy street address. But over the last year I’d guess the places I want to buy have appreciated 100-150k whereas my home has likely appreciated 80-100k. Not great, but considering I’ve paid down 20k in principal in the last year and have a house in the area I want to live, it could be way worse.

Thanks again all. Also, I’ll adjust my name. I posted a few times with it in 2016 when I was on my first house hunt. ‘newhomeowner’ is kind of inappropriate now.

Gross. I’m not selling but if that happened with my place, it would make more money than I do.

I saw this and thought this was relevant to the general conversation of wealth that happens here: https://www.compareyourincome.org.

Current detached sales basically already up 20%. Median sales/assessment January to date is +19%

During the last frenzy in 2016, a house around the corner from us was picked up for $550k, renovated (to a basic new finish), and flipped for $900k in a bidding war. In my opinion that was wildly above market value.

Just had the house nextdoor to that one sell for $918,000 which seems about right. Market is way up since 2016, but in that case nearly the same price.

Risk in this market is you can way overpay in one of these bidding wars.

Immaterial. 10 years tilts it even further in favour of the lower appreciation case in terms of how much you need to pay to upgrade (i.e. how hard it is). We’re not talking about net worth here.

No the question is how easy is it to upgrade, and does equity accumulated in an appreciating market fuel further appreciation. In other words does it self-perpetuate? And the answer is clearly no from a financial standpoint, however the behavioural factors may override this (people see prices go up so it attracts more speculation).

Immaterial. Add a suite to both places it doesn’t change anything.

Not at all small. Most will pay the customary 6/3% to sell. You can get out of that by DIY, but good luck avoiding PTT. In this specific example the buyer in the high appreciation market would pay an extra $4k in fees at least.

Not the question in this discussion because the answer to whether things going up are good is obviously yes. Was never in doubt.

Nothing you said specifically recommends against it. Normally selling then buying is a solid plan.

Theoretically protects you but it doesn’t change the market and it’s a hell of a clause for the buyers to swallow.

Risky. In this market it would probably go just fine (buy, then underlist and sell in a bidding war, communicating to buyers you want a beneficial close date), but if anything goes wrong it could be catastrophic.

That’s what I’d do.

Sale from two minutes ago in Langford…wow.

2633 Traverse Terr

Asking: $795,000

Sale: $903,313

2015 Sale: $492,500

Two sales on same street in 2020 (same builder, same size) – $709,000 and $712,500. Basically 200k pop in 6 months.

“Newhomeowner” As a realtor, in your market and with your circumstances, I would recommend selling your property with a long possession date, 3-4 months. That will give you extra time to find a place and if you can’t in worse case scenario, back it up with a rental option. It sounds to me that you would be stressed out if you bought a place without selling yours first.

Yup, I finished off my video with this point. If you find it too stressful just stay put.

The house you purchased was likely on the market for months. This does not work when the house you want to purchase has 10 offers on it and if it doesn’t have 10 offers on it it is either overpriced, not desirable, or a luxury property over $2 million (much smaller market pool).

I haven’t watched Marko’s video, and I’m sure he knows best, but I’d be tempted to stay put until the end of the school year at least. We spent six months looking for a house and were unsuccessful four times in offers we made. It is a very difficult and stressful market for a buyer and you may find yourself renting for longer than you hope and prices continuing to rise while you do. My friend is in this situation currently – house sold and they rented it back because they just could not find anything – they are paying far more than their mortgage was and prices have risen in the interim.

“What do the denizens of HHV think I should do”

.

.

Do what we did, get your house ready to sell, find the house you want to buy make a subject to sale with a 2 week close (we had 17 days) list your house on Monday, take offers later in the week.

Can you qualify to carry two properties (interm financing, not bridge)? If you can’t qualify for interm financing your realtor’s plan is the only viable one imo. Literally every other client I have is in the exact same situation so I made a video about it a few days ago -> https://www.youtube.com/watch?v=I1RuHICKKi4&t=32s

I think I touch on all your points in the video except the seller condition….good luck getting top dollar for your place with a seller condition.

Your math shows that John will be able to gain a 20% down payment in five years for his dream house if he first buys with 5% down, never mind 10, from appreciation alone ONLY in a high appreciation market and he will have more than double the equity as well. In a low appreciation market if he can’t save otherwise he’ll be stuck paying the cmhc fees again and his net worth will suffer further.

It seems like your definition of “harder” is based on a higher mortgage. Mine is based on the ability to qualify in the first place. And the test of desirability for me is not how low of a mortgage I can have, but what is the ROI is.

So this is out of left field:

We own a detached townhouse in Colwood (SFH, but strata – bought 2017). Many of the reasons we bought this place have changed(income increased and realised we hated strata) and we now want to buy a freehold house.

The realtor’s plan was for us in November to sell and once we had a signed contract go house hunting, knowing that we might end up having to rent for a while. This was ok for us in the fall but had we done it when we had talked about it we would likely be out the 20k in appreciation the last few months and we would definitely not have purchased anything (nothing worth viewing in the area and price range desired – an older 3b/2ba with 1 kitchen in wishart\tri mountain\hatley area in Colwood for 750-800k). Have two small children so a 2br for a long period would be challenging).

What do the denizens of HHV think I should do?

-Stick with this realtor? Sell first, buy after risking the need to rent for a while.

-I had a friend recommend selling our house with a condition that we had to buy a new house.

-Buy first, sell after? I do not have the cash\assets\credit to float a downpayment on a second house waiting for the first to sell.

-Wait for the market to cool a bit in the summer\fall.

Scenario: John wants to ultimately have a $500,000 house, but can’t afford it. He buys a $300,000 house with the goal of upgrading in 10 years.

Here’s the math showing that upgrading in a high appreciation market is harder than in a low appreciation market. This is true regardless of the down payment. It also doesn’t even account for fees, which scale up as a percentage of the price and thus tilt it even more in favour of the lower appreciation market.

Yes you could. A nice one at that and prices stayed that way for a number of years after – until probably 2012 or so if I have that right. And yes, a suite could be done for that price if you were willing to do some of the labour and act as general contractor and you shop carefully. This is with hiring electricians, plumbers and doing things to code.

The question was where is the 20% down coming from. And I would say a lot is coming from existing homeowners who have been in their places for a while and can move up, along with the other factors. The math is what it is and I’ve laid it out. Find fault with the math and we can discuss it but otherwise I don’t see your point. As long as appreciation is something that people see as likely they will be more willing to take on risk in the same market.

So it turn out the millennials are the speculators that drive up the housing market, while cries wolf and blames the foreigners and baby boomers.

I could not agree more with totor, as my immediate group of friends have done just that, 3 couples all living in fernwood/oaklands and also have rental properties, we are all in our mid 30’s

Not what I’m saying. Of course appreciating is better than not appreciating for any investment. But the question is, does an appreciating market fuel itself or not? I would say no from a financial perspective. Climbing the property ladder is harder in an appreciating market than in a non-appreciating one.

“Local governments fiddling at the margins of affordability will have to change course drastically if we are to ever have some semblance of affordable housing for a diverse population.” We own a 6.7 ac parcel with two homes on it, just outside of Qualicum Beach, where the market is just as crazy. We have had a young family rent our second home for 5 years, and they are now wanting to purchase a home, but are literally getting out bid on every home they attempt to buy. So, my husband and I talked and decided to offer to subdivide off the house and small bit of land, and let the family buy it. I called the Regional District of Nanaimo, who wouldn’t even entertain subdivision. Why? Because our area is ‘currently zoned for lots no smaller than 5 acres”. When I asked the rational for this, there was none offered. Just ” it’s the zoning”. Very sad that citizens can provide simple solutions, but governments in their infinite wisdom “know better”- even if they can’t tell us why.

I’m not sure if you can get a 600K SFH house that required less than 100K in reno in the core in 2009. But, if you did, then it’s going to take a lot more than 30K to put a suite in.

Really? In what scenario is having your kids own an appreciating asset in your town not a net gain? Both in dollars and non monetary terms it seems like a positive to me.

Certainly does if you would prefer a different house. It also helps you if you are going from a one bed suite to a 3 bed suite like the one in Oaklands. You’ll be better off in terms of cash flow right away.

In terms of financial gain, you buy a more expensive house in a good area and you’ll likely end up with more appreciation.

The same applies to parental money. If they are pulling from equity that they gained in the same market that they are now trying to help you buy in, that’s net loss not a net gain.

Of course equity is useful, that’s true regardless of the market. However for the purpose of climbing the property ladder, an appreciating market doesn’t actually help you (avoiding CMHC fees if you’re coming from less than 20% down is one exception, but even that may not outweigh the additional debt you would have to take on, will have to do the math on that one).

Not sure what % but we qualified under an exception so it is a real thing.

Hmm. Would want to hear more about this. What kind of borrower, and is it just for certain lenders? What percentage of borrowers access this exception?

Now you know one.

That is semantics. Let’s talk math because one way or the other that money will be needed – whether a HELOC for a rental or a sale for the next family home.

Here is a slightly modified real life example.

Purchase family home in core for 580k in 2009 with less than 20% down. Add suite for 30k. Mortgage 2400/month. Total costs of ownership are $3000/month. Rent from suite is $1500/month. Almost all of it is tax deductible. Owner’s combined incomes are 110k. They save 20k a year after expenses.

Now it is 12 years later – 2021. Their family income is 130k. The home is worth a million.

They now have 200k in their TFSA and 200k in their RRSP invested through the CCC method.

They have paid down their mortgage for 12 years and have 380k left.

They have 200k in accessible savings and 620k in equity less costs of sale. They can now afford to pay 20% or more down on a house in the core.

You can run the same scenario and adjust the time periods and you’ll find that you will have equity to move into another home in the core.

There is a lot more family money helping people buy homes than most want to admit. Based on a small sample size 95% of the people I know had

1 – Parents pay for the down payment

2 – Parents pay part of the down payment

3 – Almost all had their parents pay for post secondary schooling

The only people I know who purchased their home in the core without any financial support have a combined family income over $200k

7.5% above a million and there are more desirable streets in the Oaklands area. A 3bed 2bath in decent shape on Roseberry north of Haultain is going to clear a million based on this sale.

You can’t use equity to buy anything. It’s not money. You can borrow against equity to get money. Or you can sell the equity i.e. your interest in your property to someone, which gets you money. Where is that someone getting their money?

Existing equity is really important if you are looking at 20% down. I can tell you anecdotally that this is where the move up money for most people we know came from, along with inheritance in one case. And the question was not where the “new money” came from but where the money to put 20% down comes from in our market. Ie. where does a family get 200k in cash from to buy when the median is one million.

I’d say that when you combine an appreciating market with salary gains and principal paydown between the time you first bought and now most second time or greater these buyers have more buying power – and they may have a spouse who has returned to the market when the children enter school and adds to income. Think about yourself. If you sold now at market would you not be in a position to put 20% down and buy a more expensive home – provided you could find one and be the successful purchaser?

We’ve had this discussion before totoro but I actually believe in an appreciating market, existing equity is less important than in a non-appreciating market. In an appreciating market it’s harder to climb the property ladder, not easier.

Of course the wealth effect is not to be dismissed. Seen it plenty of times at assessment day that people suddenly feel rich and want to upgrade.

But by definition local existing home equity is already invested in the local market. So it cannot be a source of new money coming into the market.

It can be used to potentially leverage more debt, but the debt would be what is coming into the market, not the existing equity.

Money printers go BRRRR!

Is 2710 Victor the median Oaklands house though? Seems like an updated suited 2600 sqft 6br 3ba is a bit more than most bungalows in these parts.

Some Vancouver cashing out, but out of town buyers are only a quarter of the market or so. VREB surveys indicate a pretty steady 20% cash buyers.

So where else?

https://electrek.co/2021/01/25/president-biden-will-make-entire-645k-vehicle-federal-fleet-electric/

What is insane is the absolute figures. 20% of 200k is 200k to 240k. 20% of one million is 1 to 1.2 million. To put it into perspective my parents paid $180k for their Oaklands home 25 years ago, or pretty much the amount a Oaklands home has appreciated in the last 5-6 months.

Depressing. Would love to see a breakdown of where all this money is coming from.

20% YoY increase is insane, but not unheard of in our local market. However, I expect the trend to continue till the stimulus money in Canada and US peter out, and the same goes with the stock market. I think this trend will put a squeeze on the lower middle class in cities like Victoria.

The new Gordon Head.

I guess they really wanted that drywall sheet that was included…

Wow….that is an impressive sale. I guess we are looking at a median over a million going forward for Oaklands.

According to my broker the qualifying rate is much more heavily impacting insured buyers – he told me if we could pull together 20% then we would qualify for even more mortgage as they can request an exception to the underwriters. I asked what that exception would be and he said because the rates are much lower than the qualifying rate? Uhhh ok so everyone is eligible? No just strong credit buyers (which if you have 20% down there is a fair chance of that). This should help to increase the gap between the haves and the have nots.

Who are the buyers?!!!

$1,075,000

MLS® : 860911

Pending

Last Update: Pend->$1,075K

2710 Victor St Victoria BC V8R 4E4Vi Oaklands – Victoria

Single Family Detached6Beds3Baths2Kitchens2,566Fin SqFt5,500SqFt Lot14DOMOriginally$1,099,000