Victoria Comings and Goings

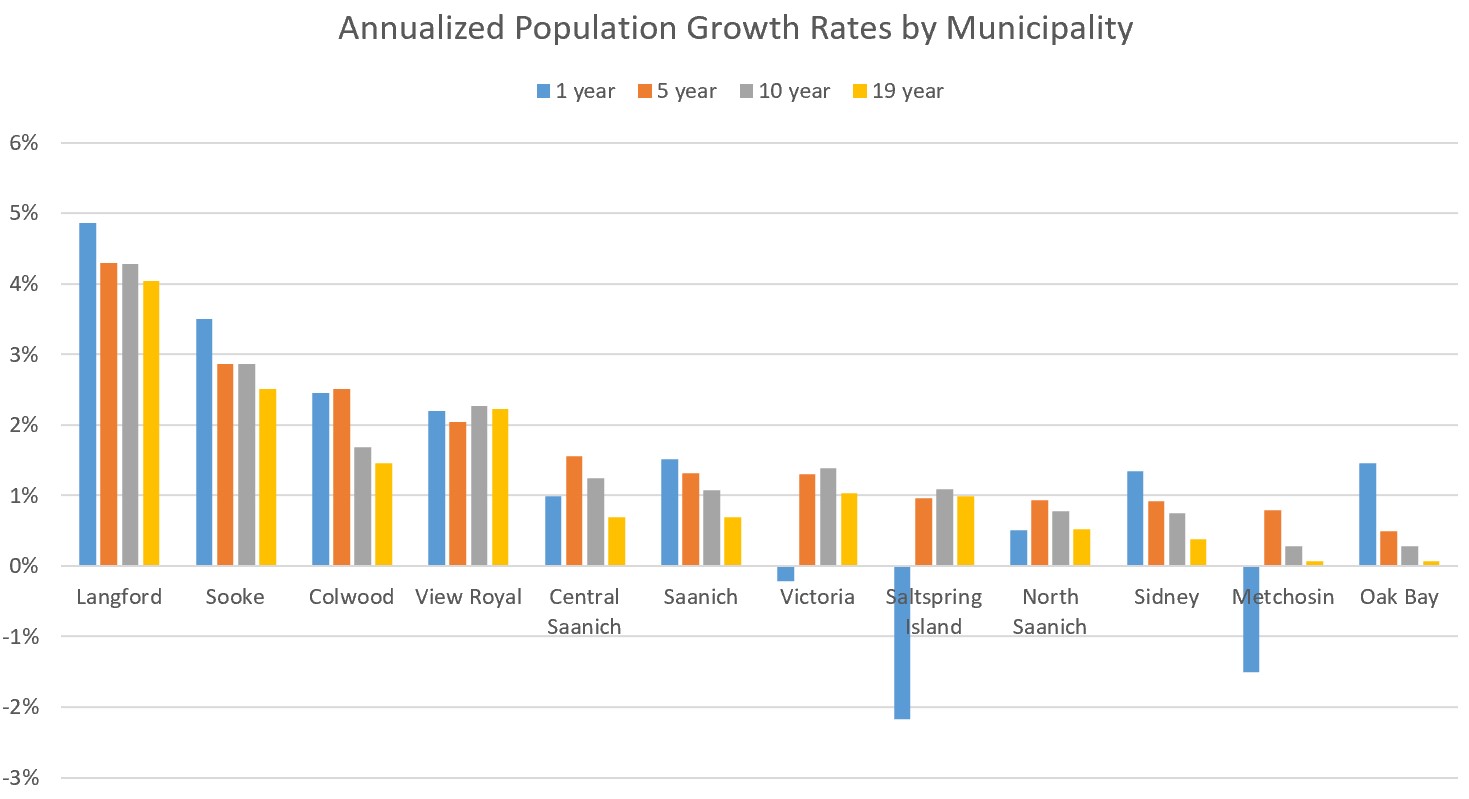

New population estimates are out for the region, which gives us a chance to see how the various municipalities are doing in terms of growth. There’s some interesting results in the data, including an almost cessation of growth in 2020 in the city of Victoria proper, Metchosin, and Saltspring Island population declining while other municipalities continued their more or less usual growth patterns. The reason isn’t entirely clear. A reduction in temporary workers because of no tourism? Fewer students? Or just data glitches due to the pandemic?

One year growth rate excepted it’s clear who’s carrying the water of our regional growth. The low growth regions are largely at or below 1% annual growth which is far below demand, as evidenced by strongly increasing prices. Saanich and Sidney show some promise, with steadily increasing growth rates from the long term to the short term. However if we are to have any chance of containing rapid price growth in the region, the low growth regions will have to step up on allowing more housing to be built.

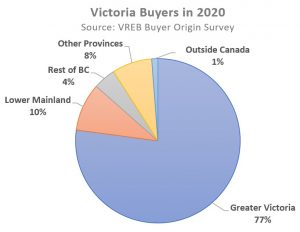

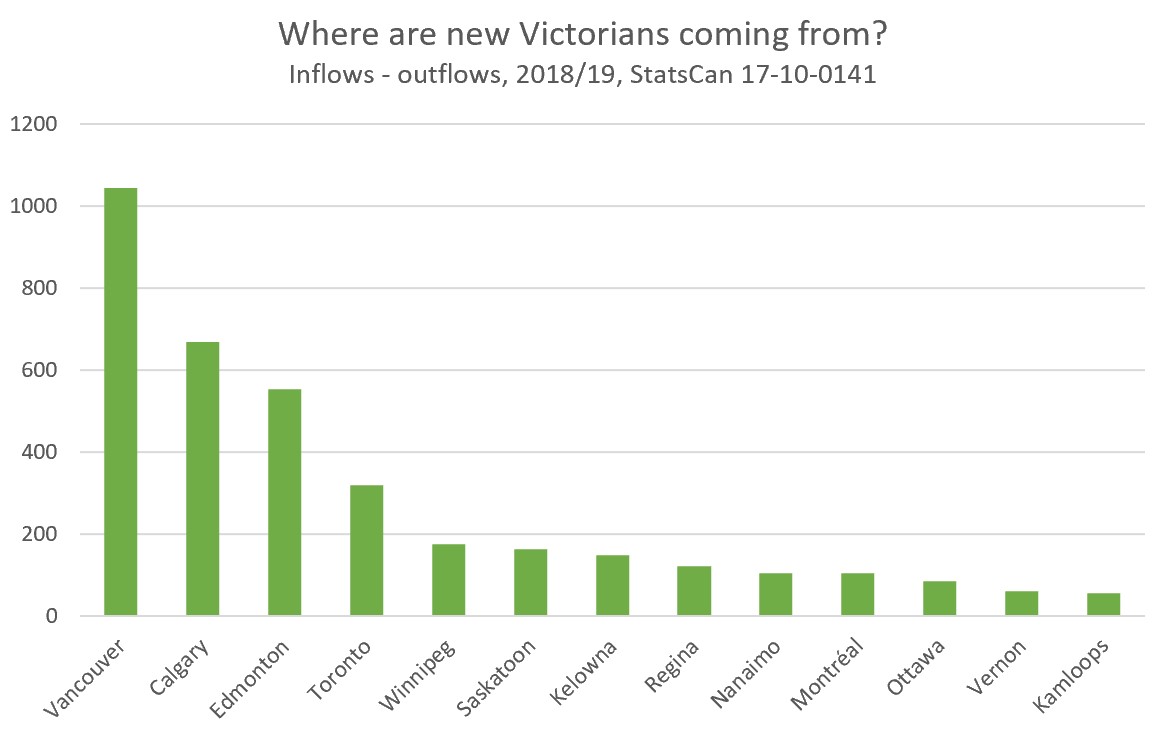

There’s also new data on migration between cities, which allows us to get a better handle on where new Victoria residents are coming from. Victoria has almost no natural population growth and little direct international migration, so we know that inter and intra-provincial migration is the major source of population growth in our region. In the past I’ve often discussed the VREB Buyer Origin data, which is gathered on sales from Realtors in response to the question “Where is the buyer currently residing?”. That data is not perfect but it gives us good information that has helped explain past price movements. Most recently a resurgence in buyers from the lower mainland helped fuel the rapid recovery in the detached market. In the past 15 years, out of town buyers have made up between 18% and 28% of the market.

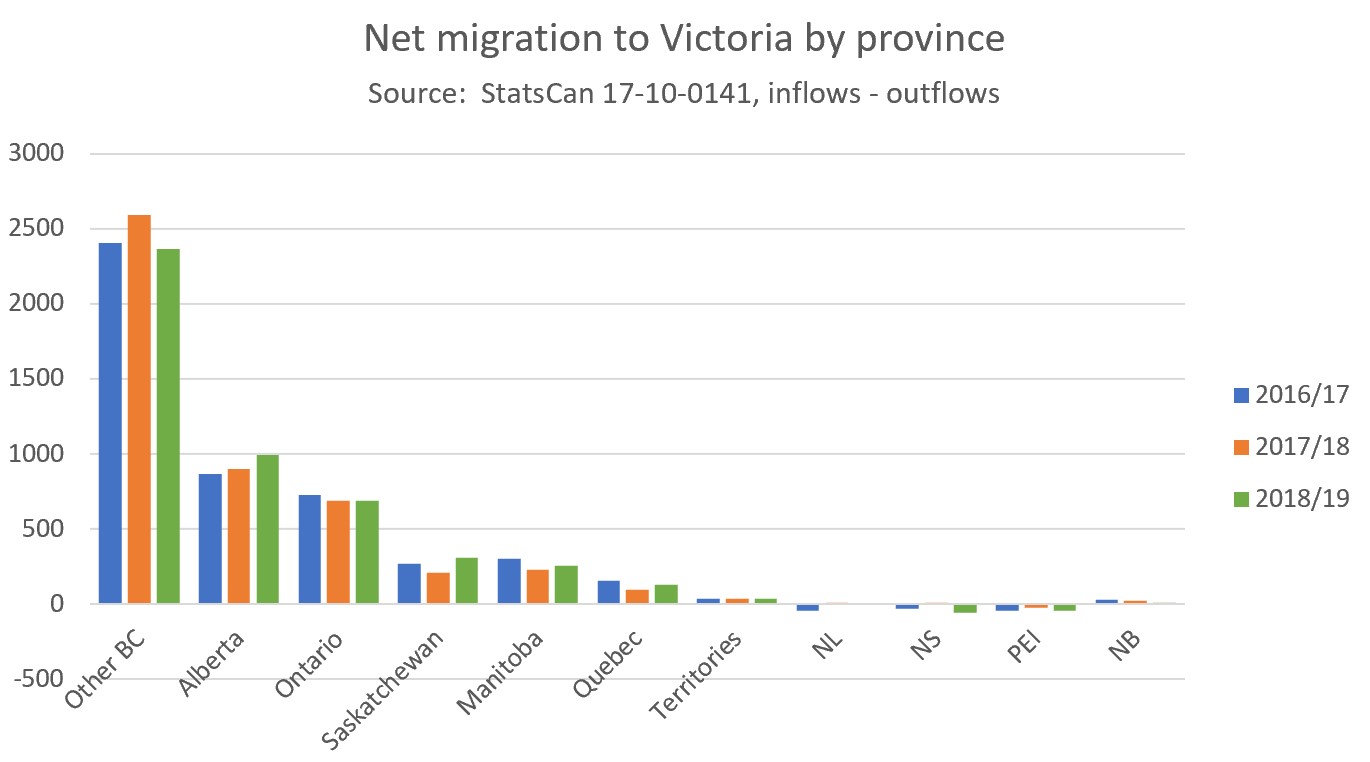

For a more accurate look at migration (of all residents, not just home buyers), StatsCan provides this data in Table: 17-10-0141 both for people leaving Victoria and people moving here. Based on that, we can calculate the net flows by province and city.

To no great surprise, most migration is from nearby provinces, with the majority coming from elsewhere in BC or Alberta. The 15 million people in Ontario – even with high prices in Toronto that support cashing out to the west coast – contribute comparatively few new residents. The top 5 most popular destinations for those leaving Victoria were Vancouver, Duncan, Nanaimo, Calgary, and Toronto.

Also the weekly numbers, courtesy of the VREB:

| Jan 2021 |

Jan

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 107 | 241 | 411 | ||

| New Listings | 201 | 422 | 879 | ||

| Active Listings | 1319 | 1351 | 1958 | ||

| Sales to New Listings | 53% | 57% | 47% | ||

| Sales YoY Change | +90% | +67% | |||

| Months of Inventory | 4.8 | ||||

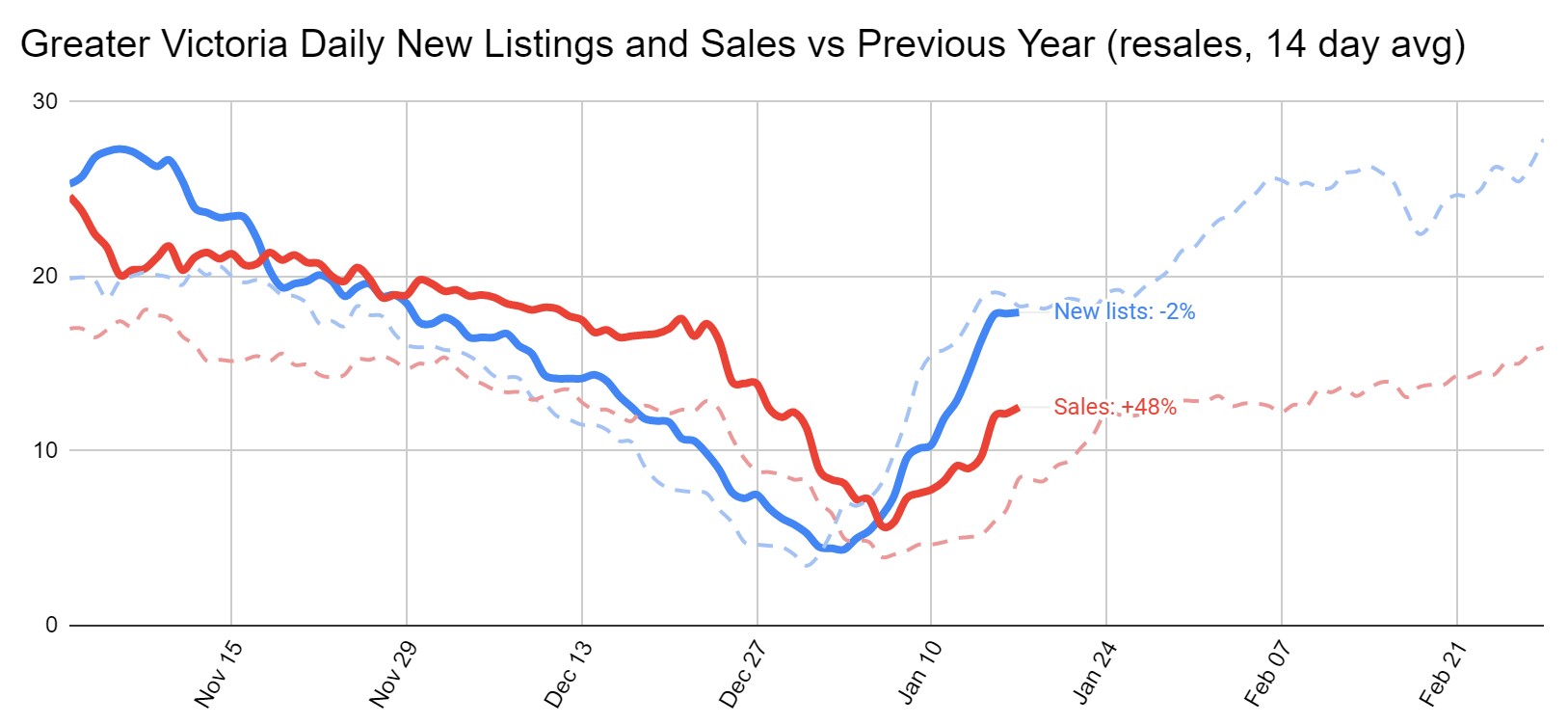

Last week was much the same as the one before, with new listings roughly in line with historical norms, while sales drastically outpaced last year’s rate. Multiple offers abound, with about a third of detached properties going for over the asking price, while condo sales are also selling briskly but with only about 7% going for over ask. There simply is still an extreme shortage of inventory out there. Normally between January and the inventory peak in June, we add about 800 properties to inventory. That will only get us to just over 2000 properties, which is still very few. We’ll have to see a sustained drop in demand before we will see substantially more selection out there.

Pretty incredible what is being done by the WSB crowd with things like GME. Mini uncoordinated ponzi schemes

New post: https://househuntvictoria.ca/2021/01/25/borrowing-from-the-future

Interesting phenomenon going on how or why young people are investing in stocks. I’ve been waiting for years for young people to start a revolution and fight back against getting screwed out of a future by the older generation. What’s interesting is the following link, where Robert Deniro plays the interviewer and interviews the Joker, a fellow who explains why he invests his last dollar on the stocks….because he has nothing to lose anyway and no future anyway…and is tired of grinding coffee beans for $7.00 an hour. I find it very interesting. New technology is allowing someone sitting on a couch to play with stocks without the usual intermediary mechanisms. These large groups now have power. Listen to the interview very carefully. https://www.reddit.com/r/wallstreetbets/comments/l1u036/wsb_gets_emotional_on_mad_money/

By the way ….Watch for Blackberry stocks to rise.

I’ve just finished Waugh’s Decline and Fall. I didn’t think anything in God’s wide world of wonders could make me laugh harder but now there appear to exist adults who are sufficiently wide-eyed and innocent that they would buy a house with another couple.

I thank you all for a giddy Sunday afternoon.

Def could be. How many divorce situations are as well when it comes to the family home? Lots of litigation on that where no agreements are in place. Harder to have it get to that with a well-drafted agreement in place that covers things like triggering a sale and adding/removing parties.

Did anyone take the time to read the sample agreements before airing the disaster situations? This is the type of scenario you can plan for and should.

I really appreciate that many would never do this. I’ve done it and we are still best friends just as we have been since we were a year old. Do it again in a heartbeat with the right person and a written agreement if it was clearly mutually beneficial. If I was just starting out I would be actively canvassing for and vetting people to do this in this market.

It definitely could be a “sh*t Show” when buying a house with someone else. It’s strange thing because even something as simple as…. say with a family and they decide they want out…and you buy them out at fair market value…..then you make a whole bunch of money in a year or two years …there is always that feeling that somehow you ripped them off. You have to listen to the little jokes about how you are the little miser etc etc.

People are people. And then there is the catastrophic events such as I mentioned earlier where someone turns on the gas. (Twice)

It still has an appeal though as sometimes the alternative is never getting into owning in any way. Just be sure that you understand that you might have to sell or move one day.

I would never take the risk myself.

Just imagine on top of everything if one of the co-owner demand to have a for sale by owner.

Exactly. So how does buying with another couple make sense? Now you have to worry about their relationship going sideways as well.

In my real estate dealings I’ve seen nothing but disasters with friends/couples buying together. I remember once I sold a house for two women that bought together in their late 20s. One ended up getting married/had a kid. The roommate/co-owner absolutely hated the new husband and didn’t want to sell versus the married one needed to sell so she could buy a place with the new husband. It was a complete sh*t show.

Certainly thinking outside the box is good Totoro. I have sold and bought without a realtor a few times. I simply get my lawyer to handle the paperwork which only costs a few hundred dollars. I can’t understand why more people don’t do that more. The big word today is “Do your own due diligence.” ….. so in other words you are really on your own anyway:)

I would point out that 71% of Canadians will marry or have common-law relationships. Most homes are already co-owned. Half of those relationships will not last. Most people don’t have a coownership agreement in this situation and this often ends poorly for one or both. Ask yourself what makes buying with a friend or family member so different from buying with a spouse? If you want to optimize your ability to purchase and manage risk it makes much more sense to own with a coownership agreement imo even if you are not in a marriage-like relationship. Given the run up in prices people who want to stay in Victoria and own without family help are going to have to get creative about how and what they do for housing imo and I’ve always admired how other cultures have pooled their resources to get ahead in this manner.

I’m fine not to follow what the common person judges as the way to go if it doesn’t make sense to me. For example, I may be in the minority of people posting here who do not use a realtor. I’ve saved well over $100,000 buying and selling in this manner. For those who are interested you can list on realtor.ca for $499: https://www.forsalebyowner.ca/real-estate/canada/victoria/BC/homes/for-sale-rent-lease We sold our last house the first day we listed it.

A realtor may still make sense for some people, but thinking outside the box has always been worthwhile for me.

What are the odds Canada gets hammered while globally things are just fine? Oil has already been depressed for years so that risk is pretty much removed. I guess the problem with my approach (piling into CND dividend paying companies in various sectors) is I am all in on Canada but I feel like that is a relatively small risk.

Every couple of years I have to rebalance a thing or two with my individual stock picking but that is pretty simple. Last year Innergex had such a massive run-up that I need to sell half my position and pick up some other things but all in all it’s like 5 minutes of my time.

Thank you, I guess there is one person with common sense on HHV. I agree with Leo, but 100 times over before buying with another couple. 600k +/- you can buy a used townhome in the core or a new/newer one on the Westshore.

My first purchase was a 500 sq/ft condo at 834 Johnson, no parking spot and no bedroom window (interior bedroom) but I made it work parking on the street. You have to start somewhere.

Yes. However, they are hard to get into in more desirable areas, many with restrictions on who is eligible and things like no pet rules, and there are lengthy wait-lists in Victoria. You can buy a nice co-op share outright in ex. Oak Bay, but financing is almost almost impossible to get and you normally need to be over 55.

The best way to protect against downturns of any given equity sector is to have a stake in literally all of them globally with something like VEQT (or VGRO/VBAL/VCONS for some bond exposure). If you’re only in one sector to begin with, then yup picking some in other sectors is good. But the most diversity in equities you can get is through VEQT et al.

It’s not bad being less diversified, just a different approach. Concentration builds wealth (with more risk), diversity maintains it (or grows it much more slowly).

Sure. But that is not static. This type of arrangement is typically more popular with first time homebuyers either with family or friends. As their equity grows, home gets paid down, appreciation comes into play and they continue to increase their salary this is likely to change. Most people don’t own for longer than five years anyway.

If you are ex. a 28 year old couple and you bought a 700k home five years ago with another couple with 5% down in total you would likely be at in Victoria:

current value if house appreciated 7% on average – 981786.21

paydown 20,000

original equity – 35,000 (17,500 each contribution plus closing costs)

So you now have turned your 17.5k into 168,393.11 tax free less any additional costs of ownership or sale – which you can reduce by selling yourself and with the cost of rent in Victoria the ownership costs may have been equal sharing with another couple. Assuming you have also been saving an additional 10k/year as a couple you now have 218k approx for your next down payment instead of 67.5 as a renter waiting for prices to fall.

No-one knows how the future will work for appreciation so that is always going to be a risk. However, my view is we do know the past and if you can hold through a flat or downturn period things have worked out. This is not for everyone but I would have done it if the house had a suite and we each had our own space.

Random internet chatter = HHV comments.

Good point. Put an option for sex in the contract.

Those vandals have it all wrong. The applicant is a housing affordability superhero, trying to increase density by 12x. In fact, if everybody stepped up to the plate like this person, the housing crisis would be over, never to return again. We’d even be able to identify all 26 of our closest neighbours by their sneezes!

House Hunter: You might wish to consider a co op. You don’t build equity but you live where you want to live and fairly reasonably.

Just a thought:)

Check this out if you are thinking of co owning. (Not a co op)

https://houseoflawandorder.com/co-owning-property-with-family-or-friends-11-pitfalls-and-how-to-avoid-them/

It doesn’t mean that you should not do it…..just be aware of some of the pitfalls. This article is based on American law, but it should give you some thoughts to think about.

Very tough market out there HouseHunter, I feel for you. Unfortunately for Victoria buyers, it seems we’ve been the recipient of some of the Vancouver outflows. I think right now we are borrowing quite a bit of demand from the future so should see the market cooling substantially towards the end of the year, but in the meantime price pressure is so strong that it will very likely go up further before then.

So then it depends on what housing compromises you would want to make to stay. Townhouse? Condo? I tend to agree with Deryk that as nice as Victoria is, it’s not worth a lifetime of debt and restricted choices / stress that comes from that even if in 20 years you end up further ahead economically. Plenty of great places to live and while prices are going up everywhere, most are still substantially less than here.

I’d take a townhouse 10 times over before buying with another couple. Too many things to go wrong there in my view.

But the reason for entering into the shared ownership in the first place is that one party can’t afford to buy the whole house.

You can negotiate other terms but the most common is a shotgun clause which allows one party to trigger a sale or buy-out and the other party has a right of first refusal at a price set by an agreed-upon method. If the party who wants to stay is not in a position to buy out then the property has to be sold.

Here is one for interest sake, but you would want a lawyer to draft one if you plan to go forward:

https://www.sample.net/business/contracts/agreement/ownership-agreement/#Co-Ownership-Agreement-Sample

We haven’t heard from Grant for a while. I wonder how he’s doing?

I agree with Tototo. (Make sure you do the legal work to protect yourself.)

One question for Totoro: How do you get out of one of these partnerships if the other does not want to sell? (Assuming that you don’t want to sell or move yourself…..you just want the other one out?)

How do they word that?

All the issues with co-ownership can be adequately planned for with a co-ownership agreement. Agreements are readily available as this arrangement has become commonplace in Vancouver. Yep, believe it or not there even ways to proactively deal with divorce and ways for one party to trigger a sale or buyout. And if you get a mortgage you will be required to have this worked out in writing.

I’ve been suggesting it for years for people starting out who want to stay in town and have co-owned myself without issue, but, hey if it is not for you and you are at a 650k buy in another option is to purchase a duplex unit outside of the core and commute, or buy an apartment in town – both will build equity much more slowly and a less optimal living situation potentially but come without the drawback of other people besides your spouse – unless you and your spouse separate… like 40% or more do and usually without a prenup.

One of the major advantages of this approach is that it allows you to get in earlier which saves a lot. A house you could buy for 600k last year this time might now be 700k now. Not saying this will continue but it is a really tough thing to see happen as you try to save up to buy that 600k house.

https://www.vice.com/en/article/59xp9z/how-six-friends-pooled-their-money-to-buy-a-dollar13-million-house-in-toronto

I don’t claim to be a “market genius” and of course it depends on age, risk assessment etc.. It does take research, due diligence and patience but stock picking, even if it’s just a few can help protect you from downturns in sectors. To each their own. Just sharing ideas out there for people who want to try different investment strategies. I’ve been doing this a while now. Its not for everyone.

On a housing note I had a chuckle at a Rezoning application while biking in the Blenkinsop valley. The application was a single lot divided into 12 parcels. The rezoning applicants name was crossed out and replaced with “greedy assholes”.

I think houses are expensive in every desired cities in the world.

The last time I was in my birth city Saigon (HCMC) in 2012, a half decent house (row house) in the downtown core (district 1) cost roughly $3.5 millions USD, and Vietnam GDP per capita at the time were $1444 USD. And, in 1971 my parents built a house in district 1 with surrounding gardens and a 2 space car port (land area were 3X of average house then and now) for a total of 66 ounces of gold (roughly $2871 USD for construction and land).

Group marriage without the sex. 🙂 But the possibility of a messy divorce is there.

Thank you all for your feedback, it is greatly appreciated. We will keep you updated when a decision is made.

Honestly…. Buying a house with another couple might work for some, but keep in mind it is also fraught with many dangers.

Here are ones just off the top of my head.

Make sure you write up an iron clad agreement.

Make sure you both agree on what happens if one member wants out.

Make sure you both agree on how you will decide the buyout price… when one member wants out.

Make sure you both agree on what the rules will be on issues like who decides on whether the house really needs those expensive double glazed windows or new heat pump.

It get’s really tricky and you need to think of the worst case scenario.

Ask Yourself: What would you do if you didn’t want to sell or move, but you wanted the other person out of the house because you no longer felt safe living in the same house and the other person didn’t want to sell or leave either. How do you force them to sell their interest in the house?

How do you find another co owner if you do manage to convince the other person to sell and move?

I know of a situation like this where the person turned the gas on in the house and the entire block had to be evacuated. (The courts let him off because of personal issues which were beyond his control. )

What happens if they can’t make their payments but don’t want to sell?

What happens if one of you goes through a divorce?

My point is that things happen that are hard to plan for.

Think carefully before buying a house with anyone. (Yes….even with family.)

If you want to stay you might consider looking for another couple in your situation and buy a home with a suite together around a million with a plan to sell as soon as there is enough equity to for you to buy independently. https://www.vancity.com/Mortgages/TypesOfMortgages/MixerMortgage/

On the bright side this article may give some hope that things will get better. There are many beautiful places in the world crying out for young families and if Canada is only available to those with deep pockets it may be a good time to look elsewhere.

https://www.theguardian.com/world/2021/jan/24/as-birth-rates-fall-animals-prowl-in-our-abandoned-ghost-villages

Amongst all the depressing news this is probably the most depressing thing I read today.

To House Hunter in Victoria: As you will know, the west coast is pretty well the most expensive real estate in Canada. I’d suggest the idea of a move ……rather than banging your head against the wall for ever. (Unless you honestly have a chance of buying. )

The Cheapest place in Canada is in the Maritimes. Moncton for example has beautiful houses (Duplexes…you own both sides) for around $250,000.00.

Life is short. Goes fast. Might be too fast to be wading in debt all your life.

My prediction is that prices in Victoria will rise further. It’s a prize city. But not everyone can afford a Rolls Royce. (Actually I wouldn;t want a Rolls Royce but you get my point.)

My parents left Scotland because they could not afford to live there. They made a choice and came here. When I say “Could not afford to live there”, I mean more than just the cost of houses. It was opportunities and jobs that drove them here.

Opportunities are available in many places all across Canada. Cheaper housing frees up more opportunities for exploring and thinking outside the box. It could be a great adventure. Depends on how you look at life.

Good luck to you and your family. It’s not easy.

Yup, single stock picks and WSB style gambles are for that massive unlikely upside.

But I was responding to Random Poster who suggested picking single stocks to provide diversity alongside ETFs.

Hi all, my wife and I have been following this blog the past year and have thoroughly enjoyed all of the insightful comments and perspectives. Thank you Leo!

From the perspective of a first time home buyer, mid 20s, both of us have decent jobs, this market has beat us up. We started our search last March on the fringe of SFH. Pre qualified for $565k. 7 full price offers rejected. Today, we sit at $650k and are further away from buying a home than we were almost a year ago. It’s no wonder young people are leaving the major Canadian cities in droves!

https://www.google.ca/amp/s/beta.ctvnews.ca/national/canada/2021/1/16/1_5270161.html

What advice would you give to young people attempting to buy into the market in Victoria. Ride it out in the hopes of a flattening of the market, or is a move away from friends/family necessary?

It’s not for diversification it’s the gamble to try to get outsized returns. Research shows people on average badly trail the market with stock picking, but there’s always the chance you’ll hit an explosive stock pick that goes 10x or 100x. If you like the excitement of that gamble then having a small % of your portfolio for individual picks is better than taking it to Elements. Not really my thing, don’t have the time to do the deep research into a company’s financials and prospects that good picks would require, and know enough that going off random internet chatter and technical analysis is a fools game. Lots of people think they are investing geniuses now though with the ultra bull market.

Broad market ETFs like VGRO, etc, are highly diversified already. It’s tough to imagine individual stock picks increasing the diversity of a VGRO portfolio without being massively overweighted to those individual stock picks.

Now, if you buy asset types that aren’t covered in equity or bond markets, then it would increase diversity. But I can’t think it would move the needle much and for most net worths isn’t worth it.

A hundred years from now is here today.

Oh and on the topic of epic bull runs, I still remember oak bay houses costing about 300k in 2000 @ like 3-4x income and now they’re over 3x that now maybe even 4 at like 6-8x income If anything has increased to nose bleed levels relative to income, housing is it. Stocks maybe high but I fully expect inflation and profits to support current PEs over time. I am not sure what will happen with incomes in Canada but based on what continues to happen in global labour markets and with automation, 2-3x isn’t it.

I feel more and more each day that unless something massively changes, wealth inequality will only get worse and buying productive assets that will entitle my family to the fruits of physical and non physical automation earning value on my behalf in the future will be critical to my family’s future.

In addition to the net worth bump today which is nice, philosophically, a hundred years from now I’d rather have a bunch of robots earning money for my kids and grandkids if no one can get a job because human labour is obsolete. My wife’s pension doesn’t do them any good since that dies with her.

@Random after 8 years of decent returns, I felt like i had a pretty good investment base that serves as a foundation to take a bit more risk from so I do now have about 10% of my portfolio invested in individual stocks and another 5%in ARK etfs. I only made this change before Xmas though and the rest is still in the same old broad etf’s where it will stay for the next 20 years. I feel very strongly about my individual stocks because I understand them and believe in ARK as an investing thesis long term but I would never invest in that stuff without the base I’ve built up to serve as a worst case retirement if my picks blow up – it’s just too risky for me to rely on individual stock positions or sector etfs for retirement. I have been very happy with my “slow and steady wins the race” approach so far and with my latest changes, I figure my “souped up Toyota” approach will go close to just as fast as most fancy portfolios out there in good times but it will be much more predictable (and comfortable for me

To hold onto) in bad times than it would with a bunch of things I picked from industries I don’t really understand that well.

Correction: I bought my house in 2014, and I didn’t have any help from the bank of mom and dad for my education or down payment.

It’s great to be in a couple of ETF’s but you may wanna diversify a bit more and pick some single stocks. Start with one financial, one tech, one semi conductor and maybe a clean energy small cap like Polaris infrastructure; its rocketing and gives a decent div. The thing with broad etf’s is that one sector can really drag it down. All the best.

Pretty much our approach. But we are in year 12 of an epic bull run in the markets. Can also go sideways for a decade.

The gains on my investment is similar to Nan, and we only have one income.

I purchased my SFH in 2015. And, just the shear gains in stocks investment since 2015 to yesterday (not counting book costs) is roughly $70K less than the current amount that I owe on my mortgage.

And, no I don’t have Tesla or cryptocurrency in my portfolio.

My experience with investing instead of paying my mortgage has been massively important to my current net worth. I started investing in about 2013 and bought a house in 2015. Over the last 8 years, the gains on my investment portfolio have been roughly equivalent to my mortgage outstanding today. I don’t invest in anything crazy – my wife and I both have decent jobs and budget well but other than one decent but not life changing windfall, we pretty much just max out our rrsp and tfsa every year, pay no fees and mostly invest in VCN/VUN/VTI. Basically, in 2015, when I bought I could have started with a smaller mortgage and paid most of it by now. What I did instead is carry a mortgage that is now about 15% smaller than it was when we bought but I invested as much as I could. My net worth is at least double what it would be if I’d favoured paying the mortgage and on top of that, last year being pretty good, that portfolio “saved” 3 times as much as my wife and I did last year.

Depends on what you are considering downsizing into. Right now you could downsize into a condo and take advantage of a detached market that has shot up vs a condo market that hasn’t, so there’s a bigger differential. That said if I was going to bet on which one will appreciate more over the long term, I’ll bet on the house/land every time.

So then the question is why you want to downsize. Less maintenance? Free up money to invest elsewhere? Better area? If you’re staying in a detached house it’s definitely a great time to make a quick sale, but a terrible time to buy back in because of little inventory and crazy bidding wars.

Whether lots will be opened up to development depends a lot on where you are. Feel free to send me an email if you want to chat more specifics (leo.spalteholz@gmail.com). I don’t do sales so won’t try to sell you on any particular path but might be able to recommend someone to speak to.

Definitely have to compare risk adjusted returns. Equities and mortgage pay down are very different there.

Of course the expected return of a diversified portfolio is higher than of the mortgage pay down, but I think at today’s valuations everyone should be prepared to accept lower yields than historically no matter what the investment.

My assessment jumped 15 percent this year and I have a house on a 2 acre lot that I was planning to try subdividing(non alr) but it seems very difficult .

I’m a single guy early 30s but I want to downsize. With a 15 year outlook with money as the goal am I better off holding on or just selling and moving into something much smaller ? Will these large lots be opened up for development ? The houses a block from me are all on 7-10000 Sq foot lots . Are there companies that will assess wether it’s worth even trying to subdivide ?

You nailed it. (But I’ll also have no mortgage payments for 20-25 years before retirement.)

Insightful and well said.

Oh but their investments are earning 5%, so they’re actually financial geniuses.

Tried to have a look at 133 cook street, dated 4 plex with 62k gross rents, they had nine offers in hand on day two. absolutely insane

I think the smartest thing for 90% of people is just to pay off their mortgage. If you pay down your mortgage and don’t use your home as an ATM you are already ahead of the majority from what I’ve seen in my daily travels. Sellers frequently tell me what their mortgage is and it often higher then their purchase price.

If you are not paying down your 1.5% mortgage, investing the mortgage paydown money at a 4-5% return without MERs, and using a mere posting to sell you are well on your way to being a 1%er imo.

1911 Shotbolt Rd – $305,000 over ask.

The underappreciated luxury of having enough is that you don’t need to care so much about economically optimal methods as long as you are doing the basics right. In the end it’s your money, you can choose what to do with it.

Was recently listening to a discussion about the book “How I Invest My Money” which is basically a bunch of stories about how finance experts invest their own money (https://rationalreminder.ca/podcast/126). What’s interesting is how many don’t follow what would be the optimal way to structure investments, and that’s OK. Not carrying a mortgage on a principal residence is one common way.

I invest a differently than Introvert, but also pay down the mortgage faster than is financially optimal. And it’s just fine.

When it comes to investing, I guess the one thing that stands out for me the most is when either side (Those pro paying off their mortgage or those pro diversifying investments) is when I see one side or the other telling the other side that “their” outcomes is by far the best.

If it makes you feel better diversifying investments then fine, that’s your thing. If it makes you feel better knowing that the banks can’t take away your house one day, then all the power to you.

It’s very rarely about the amount of money you can make one way or the other.

Life is about all the other intangibles.

Peoples needs vary.

Great to follow the discussions on House Hunt Victoria.

It’s like sitting on a park bench watching people go by.

You can’t say that with certainty. You also can’t say with certainty that your mortgage rate won’t go up before end of amortization.

That said, a good case for making RRSP/TFSA contributions along with regular mortgage payments (instead of prepaying the mortgage first) is that increasing the period over which you buy stocks reduces the risk of a bear market adversely affecting your overall return.

Many of posters have tried to explain to Introvert that prioritizing mortgage repayment over diversifying investments beyond your house is not the best financial long term strategy.

Introvert’s dislike of paying $500 a month in interest to the bank seems to outweigh the benefit of receiving $1500 a month from investments. Even if it would leave you better off in the long run.

No amount of reasonable arguments seem to be able to sway Introvert.

Probably the guarantee of a government pension while having no mortgage payments during retirement is considered sufficient retirement planning. For everyone not able to rely on a generous pension plan, a better investment strategy is more important.

“when the mortgage is gonzo I’ll have no choice but to start investing”

There are a number of reasons why that may be the wrong order of events.

Every dollar you place against your mortgage reduces your annual costs by a little more than 1%. Every dollar you put into TFSA investments will gain 3% annually at the very least.

Supposing the house in future is mortgage free but the investment holdings are minimal, what will your future self do with the grocery bill? You can rent a home. You cannot rent income.

That’s awesome.

Now Victorians can join in on the #DontHaveAMillion hashtag on Twitter!

Gotcha. Makes sense.

I’m aware of VGRO and Wealthsimple and Canadian Couch Potato but haven’t done a shred of investigation because I don’t invest.

But when the mortgage is gonzo I’ll have no choice but to start investing. Not looking forward to it, tbh.

Median for Greater Victoria detached (Sidney to Sooke) in January cracked a million for the first time ever. $1,003,425 as of now. Incredible.

Wealthsimple is a pretty good way to go for a beginner. And if you want to branch out from the fully robo-managed account you can add some ETFs for free, or even allocate a couple % of your portfolio to individual stocks if you like to play in the future.

Just google which mutual funds are holding these companies. For example, a BMO mutual fund has over $100 million worth of Fortis stock. So I can pay BMO 1.8% MER or I can just buy it myself and not give half the dividend to BMO?

I know literally nothing about websites or coding and using YouTube I’ve kept my WordPress website running for 10+ yrs and it is all I need.

VBAL or VGRO all the way. Or even Wealthsimple if she needs her hand held and convenience for slightly more MER.

CanadianCouchPotato is a great resource too.

Please explain how Grade 4 common sense would tell a person to invest in Fortis, Telus, and TD.

Marko:

You can make it a lot easier for your investor friend. Buy VBAL and only VBAL from now until retirement. At retirement convert the entire holdings to VRIF. Foolproof, cheap and absolutely zero oversight required.

Not sure about the Median but I think the average will hit $1.25 million for January.

The industry does a genius job of using scare and other tactics; however, the problem is the average person in Canada is just way too comfortable so they don’t think too much. The new flashy “high-end” brokerages in Victoria are doing extremely well. People just eat up the BS, it is truly fascinating imo. I remember having lunch with the original HHV founder in 2010 and being like “I am doing these mere posting, guaranteed in 5 to 8 years it will be 10% market share.” I completely underestimated how little common sense the consumer has.

I was counselling a friend that has 6 figures to put into TSFA/RRSP so she makes an appointment at her TD Branch. I suggest she set up a TD Waterhouse self-directed TSFA and RRSP. A week later I am talking to her and she is like “the individual at TD told me I was risking my retirement, bla bla…..so he suggested mutual funds and it really seemed like she knew what she was talking about, they have investment people actively managing these things for best return, etc., etc.”

I finally managed to convince her to open up the self-directed accounts and I am like okay use 20% of your money and buy Fortis, Telus, TD, etc., self-directed. Since this idiot at TD bank convinced you that you are risking your retirement put the 80% in mutual funds. Let me know in 5 years how the mutual fund is performing versus your self-directed account after accounting for the MER.

Whether it comes to real estate fees or investing people can’t seem to use grade 4 common sense.

If people weren’t buying houses for 500k and selling them for 900k 7 years later they would think twice about real estate fees, but people are way too comfortable so they spend 33k (commissions may vary) to sell a million dollar house or $6k/year for someone to “manage” their 300k portofilo.

Actually the opposite if they were a realtor:

A REALTOR® shall not engage in conduct that is

disgraceful, unprofessional or unbecoming of a

REALTOR®.

21.1 This Article is intended to deal with conduct

that, having regard to all of the circumstances, is

egregious in nature and goes beyond simple error.

21.2 “Conduct” in this Article is not restricted to

conduct in the course of providing real estate

services.

Indeed. Q4 2020 Median core detached price was $1,020,000. First time over a million.

There used to be a poster on here that went by ‘Michael’ who back in ~2016, if memory serves right, would predict that the core median house price would reach a million by 2020. No one really took him too seriously. Does anyone remember that?

I don’t even think the current cut was that effective. What’s way more effective is fiscal policy, and there governments have shown they are ready to spend essentially whatever it takes. That said I feel these spending levels are extremely risky.

As for what tool is left on the housing side, the very easy one they have in their pocket is relaxing the stress test. Before COVID they were about to relax the stress test from posted rates to simply contract + 2%, but that was shelved temporarily. Right now the qualifying rate is 4.79%. If they simply went ahead with that change it would probably drop to around 3.5%. Substantial increase in buying power for anyone limited by the stress test.

I’m all for ragging on CMHC, but the 48% decline was not a prediction. They specifically said that. They’re just stress testing their finances against extreme scenarios. Seems like a sensible thing to do.

Yes indeed how dare you give them a heads up on a potential listing for one of their clients.

Hope it worked out well in the end.

Was just reflecting on what Marko was recommending earlier re: saving realtor’s fees and doing a mere posting listing. Several year ago, I attempted to do this to sell my place in Esquimalt and as part of my efforts I emailed a bunch of realtors (using their public contact info).

This was one of the emails I sent out:

Hi Team Pemberton,

Just wanted to let you know we’re having our first open houses this weekend Sat and Sun from 2pm to 5pm for ____. It is a totally renovated 4 bedroom 2 bathroom house with a legal suite close to downtown. We’re selling ‘for sale by owner’ but are happy to pay your buyer’s agent commission. Our features sheet is attached.

Cheers,

Annie

I got a response from a Don King asking if I was a licensed realtor. I said no. He said, “then I block you and put you in a sleazy category.” I responded, “No problem. I won’t email you again. I don’t see how selling my own house is sleazy, but we can disagree.”

He then responded with the following email:

From:

Subject: Re: New Listing – Open House – Renovated House With Suite

Date: Fri, 23 Oct 2015 14:29:43 -0700

Selling your own house is not sleazy!

Just do it yourself without tagging onto the coat tails of professionals!

You remind me of some woman who was doing the same thing a year or two ago on the wrong side of the Bay Street Bridge!

I post this now because at the time I was quite young and thought maybe I’d violated some sort of realtor’s code. But now as a late-30s- something woman, I can’t believe this person responded in this super hostile, rude way! I think this is really indicative of how threatened some in the industry feel about people taking the selling process into their own hands.

CMHC tried to sound like they are a relevant organization.

The last time we saw that kind of housing crash were 1982 (CRD price drop 35% to 45% ), because the BoC rate shot up to 21% and inflation were over 12%. And, for the rest of the decade bank rate were well above 9%.

Similar to 2008-2009 market crash with inflation rate at 1.3%, bank rate today is 0.25% and likely to stay well into 2023 with inflation rate at 0.7% . If history repeat itself we might see a 10% dip once the BoC raise rate to 1.0% after a run up to $1.3+ million for an average SFH in Victoria.

Interest rates will probably go up a tad before the next calamity hits, thus giving the BoC a small amount of ammunition.

EIther that, or rates will have to stay low indefinitely (which is basically what was happening already, before the pandemic).

In September, CMHC was still standing by its earlier prediction of a 9-18% price decline. How accurate is that prediction looking today?

Clearly, they have no fucking clue what they’re doing.

Problem with CMHC prediction is they are already wrong – also they are saying most likely scenario is high, single digit drop – but we are already up from when they said it and prices will likely continue up into the spring so even if there is a drop it’s going to be offset by the gain that they didn’t factor in putting us at even. That’s assuming they are even correct.

I like the battling predictions of government backed agencies right now…. BoC v. CMHC

For the the opposite look from CMHC:

https://ca.finance.yahoo.com/news/cmhc-home-prices-could-fall-479-in-worst-case-scenario-without-government-help-185740208.html

Regardless of what that image caption says, Etobicoke is not central Toronto. Central GTA? Maybe.

Marko is spot on, Vic West is the place to be, “if you cant afford Fairfield or Fernwood”

‘

‘

Fixed it for you

Introvert I’ve seen Tiff saying that a few times now and i think he’s saying that to cover his own ass – which i get. They only know how to push one button. Either they don’t drop rates and we go into a recession or they drop rates and it runs house prices out of control impacting present and future generations. Clearly they are looking at right now with little regard for the future . From Tiff: “We start to get worried when people buy houses for the sole reason of thinking the price will go up.” How out of touch do you have to be to say that – you think anyone is buying at these levels because they want to be stretched to capacity and be tied to a mortgage for the next 30 years so they can break even? If people were looking at just what today is – buying a beatup shit box for 800k – no one would buy it – especially a shitbox that you have to share with some person you don’t know just to afford the payments. But the risk is you don’t buy now and you pay 1 million for that shitbox in a decade or less. People are buying with the hopes that the past repeats and prices continue to climb. They have heard they grandparents, parents, and friends all talk about the riches they have made buying a house. Its understandable.

What I’m not sure about, and maybe an economist can chime in, is what happens on the next recession and there are no interest rates to cut – negative rates are iffy at best and only shown to be favorable for a small amount – what happens when that isn’t a tool in the toolbox anymore? IS there another tool in lieu of? What are the European countries doing that already had negative rates before this happened?

‘This doesn’t look like 2017:’ Bank of Canada Governor isn’t worried about a housing bubble

https://financialpost.com/news/economy/bank-of-canada-governor-isnt-worried-about-a-housing-bubble

Marko is spot on, Vic West is the place to be. Close to town, quiet and easy to get out. It is funny because in the 90’s nobody ever wanted to cross the bridge.

An appreciating core mansion. A phenomenon that is happening everywhere in Canada.

House prices in Canada, red hot in the midst of winter — https://www.rcinet.ca/en/2021/01/06/house-prices-in-canada-red-hot-in-the-midst-of-winter/

The asking price for this house in central Toronto ( Etobicoke) is listed at $1 million. ( Google streetview)

Feds are failing before they even start on money laundering. https://vancouversun.com/business/progress-on-anti-money-laundering-efforts-but-no-additional-rcmp-resources-b-c-attorney-general/wcm/c0ed2f34-bf6e-43e3-ab70-a809ef46fcfc/amp/?__twitter_impression=true

It might come with a free sheet of drywall, which has been an appreciating asset in the last couple of years!

Tricky to say mid-month, but in December it was 1.46 in Greater Victoria.

Under $1M, the system tells me there were 161 sales and 146 active listings which makes no sense. My understanding of active listings is that unlike the month end stats of inventory which represents the number of listings active at the end of the month, active listings is a count of all listings that were active at any point during the month, so it should always be higher than sales. Some of those are direct sales reports from new construction, but even excluding that it seems fishy. Checking with the board on that one.

So far almost entirely in the central island, but could easily spread from there no doubt.

24 hours, 3 sales reported over $2M.

So far this month, 6 sales at more than $100,000 over ask. 23 sales more than $50,000 over ask.

2710 Victor Street… asking over a million for a fairly regular looking house in Oaklands. Nice updates and six bedrooms, but still. That must be testing the price ceiling I would think…

Interesting point about the different prices for homes in Canada. I want to hear more. One does wonder if there is a fair way to compare the two countries as there are so many big differences in the two systems. But I am interested to read more for sure.

@ umm… really

There’s an article in the London Times today that has headline fashion news: the cinched-waist-look is back “in”. As we speak, hordes of women who would describe themselves as free-thinking, independent, and ‘nobody’s fool’ will goosestep down to the boutique to comply with the new order. A logical disconnect, yes, but in complying they will use their own money.

Our local government uses public money to fund their own personal pretensions while enabling civil disorder. Perhaps if a tent city blocked a bike lane there would be action?

You should be able to sign up for some automated hack monitoring for a couple bucks a month. Various services out there

Canadian prices 46% higher than the US. Nuts

I’ve been told all my life that I am not making enough money with my investments.

“You could have made more if you had done this” or “You could have made more if you had done that”.

I never listened to any of them because they didn’t have a clue as to why I was investing in the things that I chose to invest.

I’ve done very well by anyone’s standards . I’ve made a modest living and want for nothing.

My advice: Don’t listen to others….. other than for your own amusement:)

Overheard at a Moncton Tim Hortons: “My house isn’t worth a hill of beans, but the percentages are good.”

Thnx for the heads up, will fix. Russians keep coming after my DIY wordpress website 🙂

Great discussion as always, hope everyone and their families are staying healthy.

Marko, FYI I was just poking around on your website and I noticed the link to “Sample Landcor Data Corporation Report” takes me to a weird Chinese language page with no sample report. Not sure if that’s intentional, but it seemed weird.

47 new cases today on VI – new record. I look forward to the day when i can walk through someone’s house and don’t have to arrange everything through a realtor. Stay safe HHVers.

Don’t worry introvert, you would have not been able to afford a house in oak bay back in 2009 that would be worth $1.85 million now.

Well, it would be nice if the local government wasn’t building it’s policy based on ideological dogma in an attempt to pander to vocal supporters of the failed approach taken in the last decade. As always it appears the solution is to blame the other levels of government for a Victoria policy that seemed to focus on importing more homeless from other areas.

Honestly, it is the citizens of Victoria that hold the responsibility for this situation because of the embarrassingly low turn out for municipal elections turns the level government that has the most impact on our daily lives over to a bunch of zealots not focused on the needs of the community, but on building their ideological credentials to get their base support for next level government they seek to obtain a seat in (It should really be required to live in the municipality where you are running for a council seat). Maybe moving to a ward or district system for council would be best in Victoria to help dilute the activist influence.

vancouver and johnson are not improving either. …

Leo, any chance you can tell us what MOI for SFH is at right now?

Thanks as always for your insightful posts and top-shelf analysis

“It was decently smart to buy in GH in 2009. It would have been about twice as smart to buy in Oak Bay in 2009.”

I think Vic West might have offered the best return over that time period. Well, if you believe the HPI anyway.

It was decently smart to buy in GH in 2009. It would have been about twice as smart to buy in Oak Bay in 2009.

Sigh!

What’s really frustrating is that

• when governments don’t do much to help, the homeless situation is really bad

and

• when governments do a lot to help, the homeless situation is really bad

Markets operate in %, but people think in $

Wow, it’s absolutely nuts in Moncton — houses there are now worth HALF a Victoria condo!

Highly recommend the other side of the bridge. I am on Saghalie (cul-de-sac) so we don’t have randoms coming through. Five minutes to cross the bridge and go downtown on foot. Nice walk along the ocean to Saxe Point. Quiet at night (I’ve never been awaken once) and I’ve lived a total of 5 years on Saghalie (for 3 years before my SFH life and after I sold my SFH moved straight back to same spot). Far enough from the float planes/harbour traffic but close enough for a nice view. Short walk to grab groceries on foot at the village. A lot better than James Bay for commuting. You do have to deal with living with a bunch of seniors thought -> https://www.youtube.com/watch?v=ir5JUg5tKrY

When I lived at 834 Johnson would probably get woken up once a month by **** going down outside. I imagine it is even worse now.

He might be disappointed in high rise life after being Oak Bay. Yesterday at 3pm, I left my high rise walking out via the parkade (taking the recycling down). Leaving we have to stop and wait for the gate to come down, just in case someone is trying to sneak in (to break into cars). As I was on lookout for the people trying to get through the gate, I thought I saw some candidates that would be trying to get in, but no. They were just shooting up in the visitors parking spot under a patio awning. I asked them to move on, but they were adamant they are not making a mess and wouldn’t be too long (called the bldg manager to take care of it). I am in a well run building with engaged residents, extra security (at night), trimmed hedges, lighting and these occurrences are more and more common with even more brazen attitude coming from the junkies. They are even becoming aggressive with the older folks from the building.

The downtown situation is becoming more and more tiresome especially since I am on a constant lookout to make sure my child isn’t finding sharps just at our front door, or not being able to make use of any playgrounds and parks because they either occupied or full of discarded needles.

a classmate of mine brought in oak bay 6 yrs ago at 850k for a 2 beds 1920 or 1931 yr old box. He told me he is going to cash in and live in downtown high rises…..

Never mind, the $1.8 sold. The lowest priced SFH in Oak Bay now is $1.85 mill.

Bozeman was made famous when Sheldon from the Big Bang Theory decided to move there in one episode. Maybe hundreds of other people made the same decision. Unfortunately he didn’t last a day there.

The world is so flushed with monopoly money that BlackRock (world largest investment management corporation @ $7.6 trillions of management assets) announced it is jumping on the Bitcoin bandwagon.

BlackRock Files To Add Bitcoin Futures To Funds — https://www.forbes.com/sites/sarahhansen/2021/01/20/blackrock-files-to-add-bitcoin-futures-to-funds/?sh=1995db703086

In the last six years, home prices in Bozeman, MT have nearly doubled and the median price of a single family home is now $585,000 ($740,000 CAD)

‘

‘

That’s not a surprise, Bozeman is one of the so called ” IT” places to be in the US over the last decade, and is often mentioned as such in outdoor magazines, kind of like Bend Or. was before the crash or Boulder Colorado

Turnaround in the luxury market has just been incredible. This is the 12 month avg, so not even reflective of the full strength of the market. Last 6 months was 5 months of inventory.

As for Moncton. It’s exploding too.

So the only thing required for appreciating prices is… previously appreciating prices.

Leo, everyone knows Bozeman is also an appreciation market 😉

I agree, however it is not going to happen at anytime in the near future. Hold on to your hats this spring, because overnight rate is holding steady at 0.25%, and housing starts is down 12.6% YoY.

Just happened to be talking to someone from Bozeman so I looked up their real estate market.

In the last six years, home prices in Bozeman, MT have nearly doubled and the median price of a single family home is now $585,000 ($740,000 CAD)

This is what Bozeman looks like. Beautiful mountains nearby, but definitely not land constrained.

Love it. This is why totoro characterizes ours as an “appreciation market.”

450k over ask on a home in Cobble Hill 🙂

This house of cards has to implode at some point.

Borrow back to use the funds from a heloc to invest?

‘

‘

No we will take out a mortgage as rates are better.

It is written into my mere posting listing contracts and all 1,400 agents in Victoria see it on our end of the system.

Hi Marko – how would you communicate the cooperating commission? Would you include this on the MLS ad?

I am too busy these days to offer mere postings (unless repeat client) but a tip for sellers wanting to save 10-20k in this market.

The purchasing end alone, depending on how much the home was above $2 million, would be >$32k Assuming you received a 50% discount on the sale and your home was somewhere between 1 and 1.5 million he or she still made 45k +/-.

‘

‘

‘

Exactly

Yes. We ended up finally getting the fifth place we made an offer on. The experience of trying to find something in this market anywhere on the island up to Qualicum was difficult and exhausting.

The purchasing end alone, depending on how much the home was above $2 million, would be >$32k 🙂 Assuming you received a 50% discount on the sale and your home was somewhere between 1 and 1.5 million he or she still made 45k +/-.

Tesla 3 after rebates = 45k.

I would be happy too 🙂

Borrow back to use the funds from a heloc to invest?

Already 10 sales over $2M. Last few years January had an avg of 4.

‘

‘

‘

We are one of those sales, we got a high price over ask for our place and were able top pick up a 2.5 years old home for what sellers originally paid for it including gst when new 2.5 years ago. We will pay off home and borrow back at an after tax mortgage rate of aprox 0.85% and defer property taxes, crazy times. We have soon to be teenagers who need more room. Realtor was happy to discount our selling commission.

A couple more will be reported today….unconditional offers awaiting deposits.

Already 10 sales over $2M. Last few years January had an avg of 4.

Two detached properties in Oak Bay under $1 million….both sold; just need to be MLS reported. $1.175 million dollar listing has an accepted offer and the next property after that that is available is $1.8 million.

Insane.

Israeli Firm Releases EV Battery That Can Charge In 5 Minutes

https://oilprice.com/Energy/Energy-General/Israeli-Firm-Releases-EV-Battery-That-Can-Charge-In-5-Minutes.html

It’ll take a while before technology like this is implemented on a large scale but we can see where things are headed.

Someone who can afford to leave a property empty in one of Canada’s most expensive RE markets is not my idea of “regular folks”.

And you said yourself that the vast majority of spec tax payers were foreigners and out of province.

Declining household size. Fewer families with kids in the core because they can’t afford it.

Oak Bay tries to find ‘suite’ spot when it comes to secondary suites

https://vancouverisland.ctvnews.ca/oak-bay-tries-to-find-suite-spot-when-it-comes-to-secondary-suites-1.5273587

Last year, only $7m in spec tax was collected for the entire province from BC residents. https://www2.gov.bc.ca/gov/content/taxes/speculation-vacancy-tax The rest (92%) of the $88m was from foreigners and ROC. And there’s a $2,000 tax credit that BCers get on their income tax returns.

Most speculators are home grown BC residents, so it’s clear that this tax isn’t targeting speculators. It’s more commonly hitting regular folks with complicated lives that end up with a place in BC and somewhere else.

And it isn’t raising much money, $6.6m towards low cost housing won’t go very far in Victoria.

A random story from the strange world of realtors stealing dogs.

https://nationalpost.com/news/nova-scotia-realtor-suspended-fined-2500-for-taking-mans-dog

I guess the $200 made it an assignment sale on the dog and the realtor up sold the dog at a higher price and pocketed the difference…lol…

Great article as usual Leo 🙂

I would have thought the number of people coming from Ontario would have been higher, 3 of the last units we rented were from Ontario and about 70% of inquiries.

I agree. The problem is the NIMBYs are often retired with nothing better to do. I’ve seen it on my block…lots of retired lawyers/execs/etc., they lose their sense of purpose as no one listens to them and their opinion every day at work so NIMBYs is a great hobby to flex.

People that are busy with businesses, work, etc., don’t have the time to write in support of projects, etc.

Plus, everyone’s time dealing with the filing process. Two of my long term rental condos got screwed up last year after I submitted everything online and I had to call in to sort it out.

My guess is the spec tax cost $15m\yr to administer with a likely one time charge of around $5-6m to set up.

As far as the annual admin cost I’d say half is on mailouts and a third is on the 30-ish staff and assesses\supports\operates it. As far as collectability; property taxation is easy to collect on, but they’re probably spending the remaining sixth to collect it.

Although, I don’t know how to find the exact details from public documents. And despite MSP ending – which presumably is a much bigger project, the Revenue Division budget(the department that handles taxation) doubled from 2019 to 2020. So they spent an extra $90m.

NIMBYs will always exist and oppose projects. It’s pointless trying to convince someone they should not fight a project, much better to focus on changing local government approach such that neighborhood objections just carry a lot less weight. It’s a one perspective but not the majority or most important one.

+1, let’s tackle all the non-sense insignificant problems then when prices are still astronomical we might look at root causes of insane prices.

I’m lukewarm on the spec tax as far as it’s effect on supply. There were certainly some new listings pushed on to the market from the spec tax, but not enough to make a difference to prices or rents. I still support it though both because it could prevent a future problem with empty homes, and because it removes an important argument people use against new supply. Common argument against new housing is that it’s pointless because it will just be bought up and kept empty. Spec tax shows this is basically not happening.

Do we know what it cost to administer and collect this tax?

Speculation tax declaration packages on their way

In Greater Victoria, just over 1,400 property owners must pay the tax, while more than 180,000 are exempt, the B.C. Finance Ministry said.

In 2019, the tax raised $6.6 million in Greater Victoria and $88 million across the province.

https://www.timescolonist.com/news/local/speculation-tax-declaration-packages-on-their-way-1.24269293

Thank you Leo. As always great information. There seems to be a bit of a divide between SFH and condos when it comes to inventory. I know that they are not totally separate markets but they are not totally interchangeable ones either. One of our neighbours is trying to find a house outside of the CofV and he is completely frustrated by the lack of houses to even look at much less the pricing. Is he imagining it or is inventory for SFH even more drastically down than condos?