Let’s talk immigration and housing

I’ve been meaning to write this article for a while now, but coincidentally Royal LePage published their latest survey today on the home buying habits of newcomers to Canada, which was a good prompt to dive into what our current immigration levels might mean for our local housing market. Key findings from the survey like that newcomers purchase one in five properties in Canada or that immigration contributes significantly to housing demand were quickly turned into headlines in the media. What’s really surprising about the report though is that anyone is surprised about the findings.

When talking about the local market, I’ve often mentioned that pure demand is what really drives it. That is, buying demand with no associated selling. Pure demand comes from out of town buyers, first time buyers, and to a lesser extent multiple property investors. On the supply side we have people leaving town or dying as well as new construction. In the middle we have a bunch of locals trading one house for another with basically no effect on the market at all outside of making the industry richer.

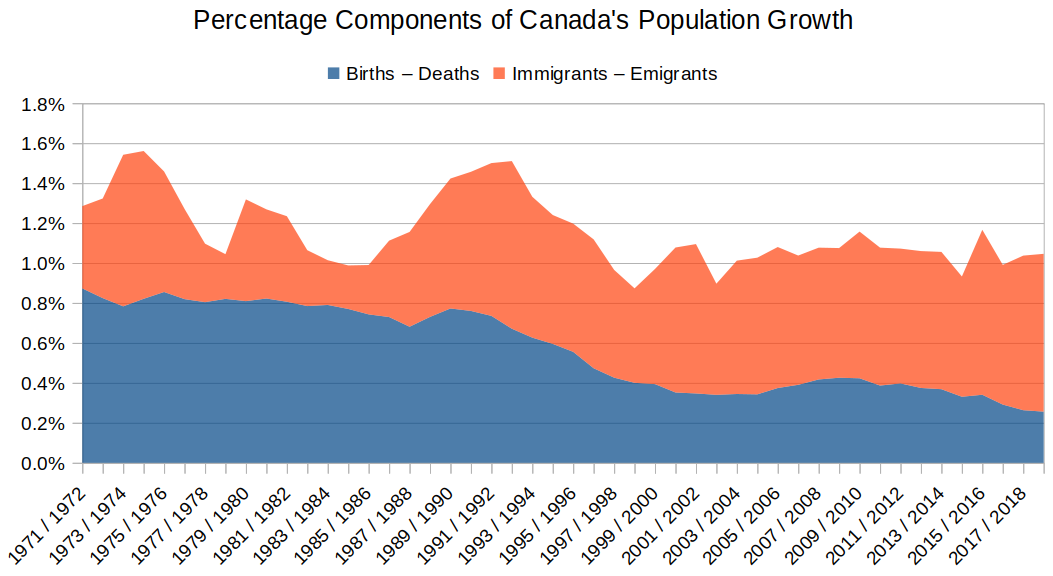

Extend that picture out to Canada as a whole and it remains much the same. Pure demand comes only from newcomers to Canada, first time buyers (from natural growth), and property investors. So it should be no surprise to anyone that if one of those groups increases, demand will increase. Last year 313,580 people immigrated to Canada, and that is set to increase to 350,000 by 2021. But before you have a Bernier about that number, let’s dig a little deeper. I mentioned 3 groups contributing to pure demand, and that’s just one of them. Here are the first two put together.

This makes it a little clearer. Immigration is up substantially in the last 30 years but much of that increase has just gone towards filling the gap left by a declining birth rate (or accelerating death rate, whichever you prefer). If we further adjust for population, we see even more clearly that despite the big numbers being used to scare people, it is actually business as usual in Canada. Combined natural and migration growth has been at about 1% for two decades and is down from where it was in the decades before that.

Would cutting immigration reduce real estate prices in Canada? Almost certainly. Again this should not be a surprise to anyone. Take away demand and prices fall (or at least upward price pressure is removed). Of course it would also cut economic growth and lead to widespread skills shortages. Regions with shrinking populations tend to have badly performing housing markets, but no one likes that outcome either (Exhibit A: Detroit).

So as a whole in Canada, the rate of population growth is nothing extraordinary. But is the immigration that’s happening perhaps concentrated into BC? Also no.

The picture in BC is much the same as nationally. In the last 20 years all components of population growth together have averaged around 1%. We can see why the market in the early 90s was completely off the hook though!

So there is no unprecedented pressure on housing in BC due to the numbers coming here. But perhaps it’s an income thing? Are immigrants disproportionately wealthy and buying up more houses when they get here? Again, the evidence suggests no, with newcomers (within 10 years) to BC having one of the nation’s lower ownership rates, and based on Royal LePage’s estimate accounting for the lowest percentage of all real estate purchases of any province. It seems like in general newcomers to BC struggle with our high prices just as much as everyone else. Note that this is quite different from the foreign capital flows that helped distort the Vancouver market (and overflowed to ours).

As we already know from when I talked about this in April, Victoria is also not all that popular with newcomers to BC, coming in between Kelowna and Nanaimo on a per capita basis.

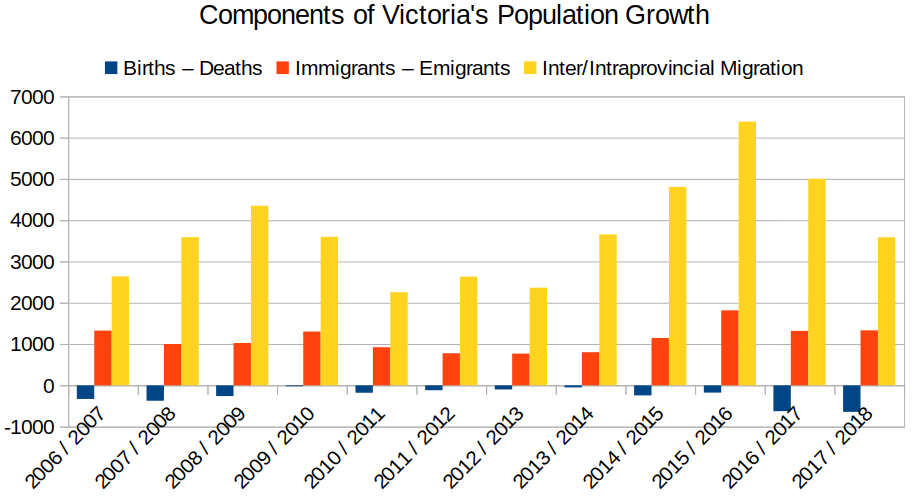

To further put the nail in the theory that direct immigration drives much of the Victoria market, we can look at the components of growth of the Victoria population. Natural population growth has been negative for the last decade and direct immigration relatively constant. The big driver is migration within Canada and not coincidentally our most recent price runup coincided with a big surge in growth there (largely from Vancouver).

In short: Headlines like “Immigrant-fuelled demand is helping to power Canada’s housing market” are there to trigger the Fear Of Missing Out in house hunters. And yes, of course population growth whether through births or migration represents housing demand, but if you look closer the feeling you should get is that little has changed here for a long time. Both the Canadian and BC population have experienced growth at a rate of about 1% for many years. As the population grows older, more and more of that growth will shift to migration. The challenges of accommodating that growth through new construction is not to be taken lightly in an era of rampant NIMBYism, but in general I don’t believe our recent housing affordability challenges are primarily driven by the immigration rate. In fact if anything because growth is largely driven by migration, the market is more exposed to ebbs and flows in that migration rate and from our current high level there is seemingly more room on the downside than the upside.

wow.. i over estimated the damaged Trudeau have done…. didnt expected that the east still love Trudeau that much. but then again, then the CPC and NDP just selected easy leaders to pull down

Monday number: https://househuntvictoria.ca/2019/10/21/oct-21-market-update

Relatively active week last week so back to matching last year’s numbers

Scheer is correct about the tradition. There has been only one coalition federal govt in Canadian history. (That “Great Coalition” in 1864 before Confederation united Canada East and Canada West https://en.m.wikipedia.org/wiki/Coalition_government#Canada ). There has been lots of minority govts, including Harper’s ones, usually where the party with the most seats became govt. as chosen by the Governor General.

Yeah what I don’t understand is Scheers talk about the party winning the most seats forming government. Without a coalition they are lame ducks and can’t do anything and they’ve already said they won’t form a coalition. Not sure what the plan is there

Who is making that argument? Clearly immigration is a significant driver of demand as I said in the article. What my point was that from a growth perspective, much of the increase in immigration simply filled the hole from a decreasing birth rate. So it used to be that it was mostly births that led to population growth, now it is mostly immigration. But population growth has been at a steady 1% in Canada for the last two decades.

As for Vancouver, the source of capital there is not just direct immigration. Lots of foreign capital flows outside of just that which certainly compounded affordability issues there.

It is close, yes. We were there for about 20 minutes and didn’t hear any air traffic, but I imagine you could fairly easily. A friend of mine lives on Canora which is basically next door and he hears it. Curiously, he also said he can hear the Sea Kings hovering at the airport always around midnight. I suppose they practice or do maintenance there?

Couldn’t hear the Pay Bay highway, but it was also pretty windy and rainy. I’m not sure it would be that loud though as the worst of highway noise tends to drop off pretty quickly as you move a few hundred feet away. The eastern-most lots would probably hear the most of it.

It looks to be close to both the airport and highway. Was it noisy?

Canada’s birth rate is 1.6 to every 2 Adults . So our birth rate is negative . That all on its own would result in falling housing prices . To somehow assert that mass immigration isn’t a significant driver in housing demand and costs is simply not based in reality . No charts and graphs are needed I personally lived it growing up in Vancouver. Not only that I’ve hosted open houses where 95 percent of the buyers coming through the door are recent immigrants and or forgein investors . Richmond used to be mostly farm land . Now it’s a massive gridlocked chinese suburb . The only marketing I see in all of this is to somehow assert that adding more folks to our current population has little to no effect on housing prices . That’s like saying you’d catch the same amount of fish if you had one rod or 3 in the water . Simply not mathematically possible .

A decent observation. I think that makes sense. I still balk at the privacy issue, but not everyone cares about that.

Hmm… 😛

The other thing I didn’t like is most of them seem to be following this contemporary design trend of building homes that look more like a chiropractor’s office rather than a home. Just so commercial in appearance. Can’t imagine it will stand the test of time.

The 70s boxes in Gordon Head seem to be selling just fine.

I rarely pay with cash, but that doesn’t mean I want to live in a cashless society.

Dont other than the conservative nobody knocked on my door or left any material.

If anyone sends or leaves me any material, I am immediately not voting for them. It is 2019 I think you can reach people without having to kill more trees. Not an environmentalist but print material is a pet peeve of mine including glossy real estate brochures everyone garbages.

I went to an open house at 43 Logan Avenue today.

43 Logan already has an accepted offer on it.

SFHs in the core as still in demand. Six places have gone over asking price in the last few days.

Sales are slow but problem is lack of have decent inventory. In 2012 we had 5,000 active listings…..right now we have 2,800 active listings and new listings are coming in very low so nothing points to an inventory build.

Mrs. Fool and I went to Eaglehurst today just for a lark. Deadsville over there. Went through one of the show houses.

They sold two last week at Eaglehurst….slow and steady kind of like Polo Village. Sales at Polo Village were never crazy brisk, but they sold out.

Also, personally I would rather go Eaglehurst vs Westhills. It isn’t too much more than new product on the Westshore but you aren’t on the Westshore.

I actually think a lot of younger families with kids like the Eaglehurst concept of small easy to care lots. With two working professionals not everyone wants an older home in Dean Park on a 15,000 sq/ft lot which you could buy for a similar price or just slightly more than Eaglehurst. It is much better “value” but then you are spending your weekend working on the house/landscaping.

these house are quite common in many areas outside of the island – growing up in greater vancover areas, these seems to be the norm

About 3 quarters of them are sold now. Some of the remaining ones have DOMs of nearly 100 days, and several are offering “discounts” and/or extra upgrades free of charge. I suspect they’ll unload them, but it’s harder going into this time of year I guess.

I do wonder if the privacy situation would improve as vegetation grows in, but it was among the worse I’d seen. Like living in a fish bowl, haha.

The other thing I didn’t like is most of them seem to be following this contemporary design trend of building homes that look more like a chiropractor’s office rather than a home. Just so commercial in appearance. Can’t imagine it will stand the test of time.

Herpa Dont even want to take a guess. Dont other than the conservative nobody knocked on my door or left any material. I guess they are too busy to actually talk to people.

Local Fool –One of the things I like about my house is the ten foot hedge that at least gives an illusion of privacy. Still I guess that it less important to some than others. I wonder how well those houses are actually selling. Any idea?

Any one want to make guess on election result?.. remember to vote !

I am thinking conservative might win by seats but ndp and lib join to say no

Guessing 135conservative, 125libs, Bloc does what ever, and NDP will get 40,

I went to an open house at 43 Logan Avenue today. There were quite a few there, a couple of inquisitive passers by on bikes, a realtor with client in tow and a young couple looking depressed.

The home has been tarted up (suggestions of a suite) in the basement and it looks okay down there. Sadly nothing was done to stop the obvious damp problems and settlement issues first so most of what was completed down there may have to be removed to really get to the issues.

The ground and upper level are like a roller coasted, high points and low points on the floor. The marble I always take went madly off in all directions. I think it is going to cost a bit to really sort out. So it will probably go to someone who will rent it out and cross their fingers that nothing major happens until they can unload it for a huge profit.

Mrs. Fool and I went to Eaglehurst today just for a lark. Deadsville over there. Went through one of the show houses.

You’d sure have to be the right kind of buyer to like those homes. The inside is so parched and white it makes you squint and your eye floaters light up like a Christmas tree. It felt almost institutional in there. Almost every view outside had windows from at least three other houses looking right back at you, and in the backyard – there’s no way you could have any privacy. You’re utterly surrounded by your neighbor’s windows that look right in. I guess some people don’t mind that, but it’s not for us. Also much better deals elsewhere if you’re willing to look. Some of those things are nearly a million dollars!

That’s why I posed the topic. RE isn’t the most exciting subject at the moment so I thought what the heck, anyone want to debate something with no real right or wrong answers?

Yeah I believe Steve Saretsky is getting into bitcoin.

Not sure how you go from believing RE is overvalued to buying something purely speculative with no intrinsic value but to each their own.

Back in 2007/08 there was a lot of chatter about gold on the board. Doesn’t seem like that is as popular this time around.

@guest_63914

Many of us are aware of QE, etc. But stressing about it doesn’t help anyone. Any actions taken to hedge against risks in this ‘everything bubble’ is speculative. No one has any idea what will happen. Buy gold? Buy bitcoin? Keep $$$ under mattress? All you can do is diversify, avoid excessive leverage, and ensure safe future employment. If economists and experts are unable to predict the future conditions, then we are definitely powerless to make any resolve predictions.

Ya I wonder about that applying here.

See Global News Sept 10/19 : Cashless Society:85% of Canadians don’t pay with cash regularly.

Also google: Is Canada becoming a cashless society?

japan 101 – 3 lost decade strong

Anyone following the actions of the US Fed? They’re growing their balance sheet again after quietly shrinking it the last couple of years. It’s essentially QE, but this time, they’re insisting that it not be called that:

Got to wonder what the end game is to all this money printing and market distortions, RE included. It doesn’t create prosperity, if we look at Europe as any kind of example. And yet, they seem dogmatically driven to pursue it as though recessions were some kind of exotic disease to be avoided at all costs.

I do think the conversation surrounding digital currency will become increasingly relevant as central bankers feel they are unable to effect monetary policy as before.

^^ from the article referenced

some major cities in china such as shanghai has pretty much transformed by leaps an bounds in cashless payment – started with few card payments at the beginning of the decade to almost no card payment to mostly mobile payment

for all those savvy condo owners here, a question: what type of insurance coverage did you get?

Sweden is well in the way to cashless society (via mobile payments and cards), and reports “less crime and higher tax revenue,” https://www.theguardian.com/money/2019/mar/09/sweden-how-cash-became-more-trouble-than-its-worth

Special note. This is different than the statcan definition of “newcomer” which is people who have been here less than 5 years. Those that are here between 5 and 10 years are “recent immigrants”

It’s not the same thing, and I don’t think it’s the same intention. Despite the paper’s claims of digital currency modernizing money, being more efficient and enhancing competitiveness – a switch to all digital cash is, IMO, actually a bid for control.

If all cash is digital, every transaction you perform will be completely traceable. It’s actually worse though, and I think this next point is more salient to them: to ensure they will be able to control how you spend your money by being able to actually enforce upon you whatever monetary policy they see fit – including negative interest rates. If they don’t want you to save money, they can make it so unattractive for you to do so, you won’t.

Horrible idea, IMO.

The demographics of immigrant adults are close to Millennial age (25-39) so their home ownership rate should be compared to Millennials, not the general population. Newcomers “Up to 10 years” means the average is 5 years after immigration, and 32% is an impressive number in that short period of time. After 10 years it will be higher.

This is intended to become a complete replacement for cash, not a replacement for credit/debit cards.

from the article…. “It would initially coexist with coins and paper money, eventually replacing them completely“.

A cashless society would make illegal cash-only operations (drugs) very difficult to get away with. I don’t kinow what the BOC have in mind, but anything like a cash replacement has to be as easy to use as cash.

Maybe I’m missing something, but isn’t that what we have right now with credit and debit cards? Some people still prefer cash of course, but I don’t think that’s going to be done away with any time soon.

A couple of items from the report that must be noted.

First, a “newcomer” is anyone who has been in Canada for under 10 years. Second, the current home ownership rate for these “newcomers” is only 32%, less than 1/2 of the population as a whole.

So is it really that surprising that such a group might account for 20% of purchases? Wouldn’t you expect that if they are going to catch up with the ownership rate of the general population?

That is Intra and inter combined so captures both within province and outside province migration

Thanks for the charts. Those numbers are illuminating. Especially to put the Victoria “boogeymen” in perspective by the numbers.

This “traceable” digital currency idea from the BOC sounds like a great way to fight the drug epidemic (with associated problems of money laundering and other crimes). If widely adopted, it would be much harder for a drug dealer to operate if transactions are traceable, Yes, it’s “big brother”, but IMO the problems solved would outweigh that. This is the solution, let’s get on with it.

https://outline.com/mpGnxq

Local fool, according to that IMF article the “attainable price” is higher in Victoria vs Calgary. That is very interesting as I would have thought income would be higher in Calgary compared to Victoria.

Thanks for this Leo. Well done. From this, we can see that low birth rates combined with deaths in Victoria are quite marked. Your data points out that immigration is not a big factor for us; however, inter-provincial migration is where the “population” growth is coming from. This is, no doubt, (a) the Vancouver residents cashing out and moving to Victoria and (b) Alberta folks looking for sunny skies. Yes, I know, those east of Alberta too. Very informative.

No doubt that the Royal LePage report was designed to stoke FOMO – Phil Soper and Royal LePage have a vested interest in getting everyone to buy.

Any news, on a related issue, on the launch of the beneficial / transparency ownership registry:

https://www.rebgv.org/news-archive/what-is-the-beneficial-ownership-registry-and-how-will-it-work-.html

This link gives a good discussion of who or whom it catches [everyone] and the reporting requirements of existing owners / corps / trusts / partnerships.

1965:

Bonus chart added to the article on components of population growth in Victoria.

Yep, brainfart. Thx.

No one really knows why though. Not an excess of workers with a 43 low in unemployment.

Some evidence that this is turning now: https://www.cbc.ca/news/business/wages-canada-economy-1.5164665

Did you mean Detroit? Chicago’s population hasn’t really decreased lately.

Which would lead to real wage raises. Something we haven’t really had in Canada in a while.

Very much in line with my numbers on affordability so 22% higher than fundamentals sounds right to me. https://househuntvictoria.ca/2019/06/27/affordability-were-not-there-yet/

Indeed – but I like to take digs at that guy anyways. Some of the stuff he was writing a while ago, along with Benjamin Tal, was pretty outrageous at times.

Interesting article in BD today, with a mention of Victoria. Curious if anyone has any thoughts.

https://betterdwelling.com/the-imf-crunched-numbers-on-canadian-real-estate-heres-how-overpriced-it-is/

I didn’t mean upside vs downside on pricing. That’s a bit of a different topic. I meant on growth. If growth is driven by births then it is unaffected by economic conditions and there will be a constant new demand coming from kids growing up whether times are good or bad.

If growth is driven by migration then it is very sensitive to political will and economic conditions in Canada relative to the rest of the world. Given the PPC’s abysmal poll numbers I don’t see a lot of risk that immigration will be drastically curtailed, but I also don’t see political appetite for it to be drastically increased. In the article I only examined permanent resident growth but there is also the temporary residents (work or student visas) that tends to drop in economic downturns, one of which is coming likely sooner or later. Hence my thought that there is more room on the downside for migration than upside.

Actually I’m generally OK with Phil’s take on things. For example on the election it’s pretty much what I think as well.

“Well-intentioned election promises aimed at making housing more accessible and affordable to first-time buyers will fall flat if they trigger a surge in demand without a corresponding increase in the supply of homes,” – Phil Soper

https://business.financialpost.com/news/election-2019/election-pledges-risk-igniting-canadian-home-prices-realtors-warn

Great article.

To be a little cheeky – so you mean, rather like everything else Phil Soper writes? 😛

Great article. Thanks.

If you graphed the (ever increasing) number of households over time wanting core SFH vs (flattish-line) supply, you’d see core SFH falling as a % total dwellings, implying more room for upside than downside in those prices.

Immigration provides the illusion of a growing economy, but GDP per capita is not so rosy.

https://betterdwelling.com/canadas-heavy-immigration-is-the-last-pillar-preventing-a-recession/

From the Teranet:

n September the Teranet–National Bank National Composite House Price IndexTM was up 0.1% from the month before. As in the three previous months, the gain was below the 21-year average for the month, which for September is 0.2%. However, as in August, the September index would have remained up slightly if corrected for seasonal pressure (seasonally adjusted). In other words, the underlying downtrend after seasonal adjustment of the months from February to July has recently given way to an uptrend.

The composite index was braked in September by declines in the indexes for Quebec City (−0.7%), Vancouver (−0.5%) and Victoria (−0.3%) and by the flatness of indexes for Edmonton and Halifax. For Vancouver it was the 14th month without a rise, for Edmonton the fourth in five months. The Victoria decline interrupted a run of five straight increases. The other markets of the composite index were up on the month: Toronto 0.1%, Hamilton 0.1%, Calgary 0.2%, Winnipeg 0.6%, Ottawa-Gatineau 0.8%, Montreal 1.0%. For Montreal it was a ninth rise in 10 months, for Toronto, Hamilton and Ottawa-Gatineau a sixth consecutive rise, for Winnipeg a fifth consecutive rise.

Great analysis.. keep it up

Will be interesting to see if the conservatives dial back on immigration numbers when they are elected 😉