Affordability: We’re not there yet

Anyone reading this blog for a while knows I have a thing for affordability. That measure encompassing the monthly cost of a mortgage as a percentage of household income is, I believe, the #1 most useful metric for gauging risk levels in the market and where prices are likely to go. Sure you can look at the months of inventory and that will give you a sense of how fast prices will move, but why is the months of inventory at a given level? What really drives the market?

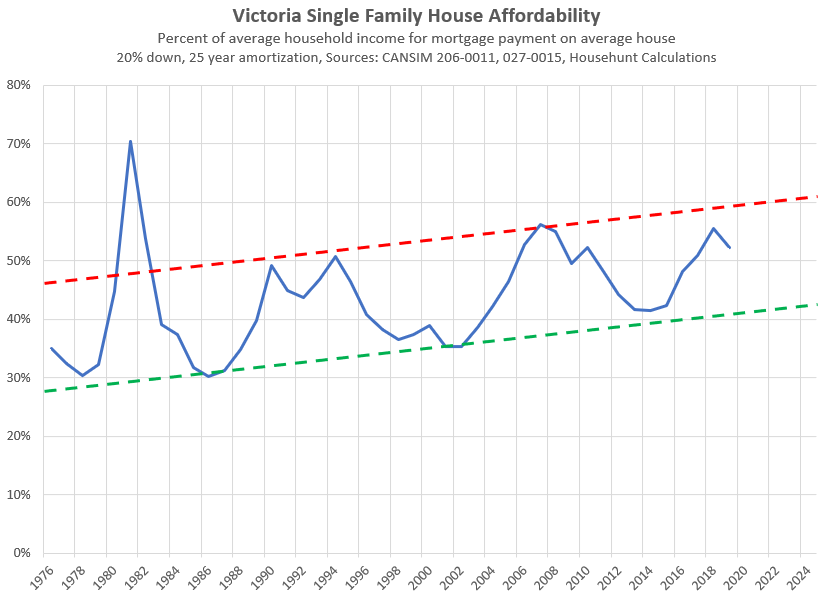

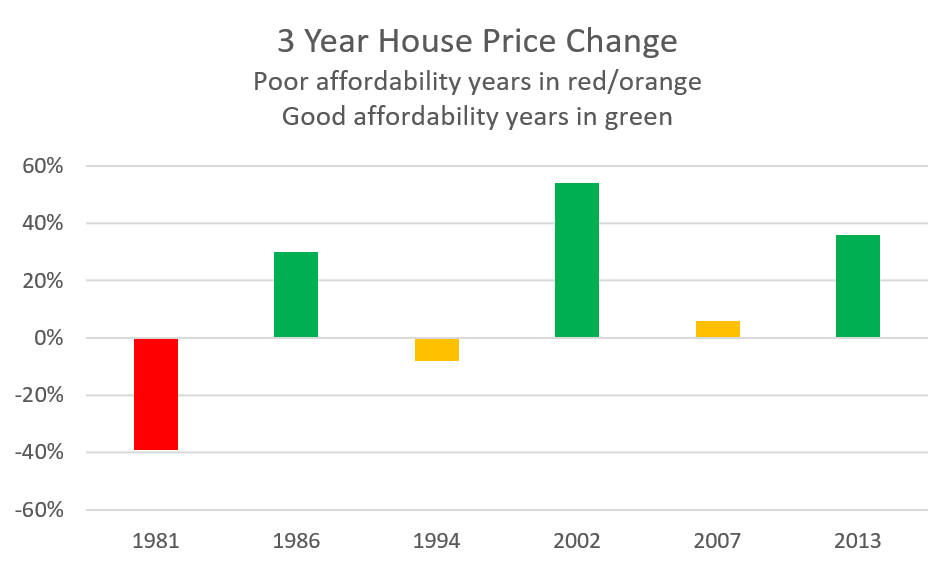

Well I’ve found nothing better than affordability levels to explain that one. Despite changes in wealth inflows, retirees, monetary policies, immigration, unemployment, population growth, or any number of other variables, we’ve got several decades showing that when affordability gets bad, prices tend to stagnate or decline, and when it is good, prices tend to rise quickly. Overlaid on this cycle is a longer term and slower trend where affordability of single family detached homes gets worse over time as they represent a smaller and smaller portion of all housing units.

Well it’s been a minute since the last update of affordability, so here is how the picture looks now.

A few things to note from that chart:

- Affordability has improved from the peak (worst level) in 2018, due partially to a small decline in prices and a decline in interest rates since the peak in December.

- Affordability in this cycle didn’t get as bad as the patten might have suggested (red line). I believe it is due to the stress test which kneecapped people’s ability to borrow while the market was still hot and prices increasing.

- Another reason affordability didn’t get as bad this time around is because a large jump in average household income in 2017 when it went from $80,900 in 2016 to $86,800. Normally average income doesn’t change more than one or two thousand in one year and I haven’t been able to find a good explanation for the jump.

The current value of 52% is still elevated and falls into the poor affordability side of the balance. If I had to guess, I suspect it will keep improving to bottom at around 45% in 2-3 years and that will come about through some combination of house price declines, income increases, and maybe even some more (small) interest rate drops.

What does it mean for prices? Well obviously no guarantees but if I were to extrapolate from previous patterns, it means prices will be flat or down for the next couple years until affordability improves. 2018 was one of those orange years in the chart below. The primary difference this time is that in previous poor affordability years there was a lot more latitude to decrease interest rates which did the lions share of the work to restore affordability while prices stayed flat.

Are you really picking on elderly homeowners with dementia or other illnesses, and the intervention you are hoping for them is that they just sell and leave their house quickly, so it somehow improves the house buying price point for you? If so, be aware that there is almost noone in society that agrees with you. And it’s still worth pointing out to you that your opinion is pathetic and disrespectful of the elderly, who have spent their lives building the society that you live in.

There are times I feel sorry for some of you bears, until I read a post like that.

June numbers: https://househuntvictoria.ca/latest

Getting killed by a paywall, but apparently BC is still contemplating the seizure of assets (ie homes) even if there is no evidence of a crime.

Does anyone have a subscription?

British Columbia mulls ‘invasive’ tool to combat money laundering, despite civil liberties concerns: The Globe and Mail – Mike Hager

“British Columbia is still contemplating a controversial technique now used in Britain to combat organized crime and money laundering through investments in real estate – one that “does not rely on criminal prosecution or evidence of a crime.” Britain’s National Crime Agency is systematically combing…”

Wonder how they’d work that with S8 of the Charter. I could see two possible constitutional work-arounds and another slippery one but I still don’t see the issue being pressing enough to justify doing it. Guess we’d really have to know what was being contemplated, but taking homes away from suspected launderers without due process is ripe for a slippery slope argument.

City sees over $800,000 in funds after first six months of Airbnb regulations (it is $14 millions at provincial level):

https://www.vicnews.com/news/city-sees-over-800000-in-funds-after-first-six-months-of-airbnb-regulations/

Assessed for $576,700.

https://www.bcassessment.ca//Property/Info/QTAwMDBITk1TNA==

Not hard, if it’s not paid within the prescribed time the property goes to tax sale, just like any unpaid property tax.

There are plenty of people with dementia or other issues who don’t have an empty house that they could sell to pay their expenses. Oh and it doesn’t take any “means” to sell a house. Just call a realtor, they don’t get paid until it sells. Planning for contingencies like ill health is one of the responsibilities of home ownership.

Perhaps it’s possible, but are they any? Certainly would be more newsworthy than a 669 sq. ft. dump in a street of nice houses.

Yes, bizarre. And also has the Mario Bros. Nintendo characters as part of the game.

They can’t use money from the spec tax, as that’s been promised to fund affordable housing in the spec tax areas only. There will be annual meetings with the mayors of spec tax cities to insure that this is happening. Should be interesting to hear what the mayors have to say after that first meeting.

I wonder how the government going to make up the shortfall from property transfer tax and capital gains tax?

It would be hard for the government to collect spec tax if the property owners have health issues that don’t have the mindset or means to deal with their abandoned properties. Or, could it be possible that the city bylaws such as heritage house, or NIMBY prevent the owners from developing the properties?

“Owners whose property is not exempt from the[spec] tax have until July 2, 2019, to pay their assessed tax.”

The govt extensions to declare are over, so we should expect to hear some PR from the govt about how many people have declared as owing spec tax.

Followed by tax bills sent out to everyone that hasn’t declared (48K people as of the last update). That should reshine the media light on this train-wreck implementation of a tax.

Because the market downturn began over 3 years ago, long before any of these rules were even announced. The problem more than anything is the same as it always is – assets that are priced beyond what the critical threshold of buyers that support the market, are willing to pay.

Perhaps another way to put this is – Vancouver’s valuations are much more stretched than Victoria, but both have been subjected to the same regulatory changes. One market is collapsing, and the other is attempting to hold water but still in the process of faltering. If Victoria somehow got the same valuations as Vancouver, I suspect you’d see an even more consistent pattern between the two.

Just wait and see what happens if it forces a recession. The regulation changes are an aggravating factor IMO, not the primary one.

Steve Saretsky

@SteveSaretsky

“June saw the fewest single family house transactions on record dating back to 1991. Condo sales were a little better with transactions slipping to an eighteen year low.

9:31 AM – 2 Jul 2019 ”

This is for the Vancouver market but how can this not be because of the new spec. tax and the stress test?

Purely anecdotal but I’ve noticed an uptick in properties going under pending/sold and then being listed for rent. Clearly some think that at these prices, there is value in having holding properties. I did notice that several are asking eye-popping rents given the area, size of property, and condition. Will be interesting to see how these play out. I’ve also noticed some for sale signs out but properties not on the MLS yet.

From the VREB….

Victoria Oceanfront

CURRENT STATISTICS

A lukewarm spring comes to an end for the Victoria real estate market

July 2, 2019 A total of 740 properties sold in the Victoria Real Estate Board region this June, 4.5 per cent more than the 708 properties sold in June 2018 but a 12.7 per cent decrease from May 2019. Sales of condominiums were down 6.1 per cent from June 2018 with 216 units sold. Sales of single family homes increased 10.4 per cent from June 2018 with 394 sold.

“June has trended lower than May for the past few years and tends to signal the end of the active spring market,” says Victoria Real Estate Board President Cheryl Woolley. “The summer months of July and August generally see less activity than the spring, as people’s attention shifts to vacation and away from real estate. This year, we have seen slightly more sales compared to June of last year. We have also seen one hundred fewer new listings enter the market this year, which continues to make a challenging market for buyers who are hoping for more options.”

There were 3,040 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of June 2019, an increase of less than one per cent compared to the month of May and a 17.1 per cent increase from the 2,595 active listings for sale at the end of June 2018.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in June 2018 was $898,500. The benchmark value for the same home in June 2019 decreased by 4.3 per cent to $859,600, slightly less than May’s value of $860,800. The MLS® HPI benchmark value for a condominium in the Victoria Core area in June 2018 was $509,000, while the benchmark value for the same condominium in June 2019 increased by 2.97 per cent to $524,100, higher than May’s value of $519,300.

“It is possible that some buyers are waiting for the federal government’s new first-time home buyer incentive to roll out this September,” adds President Woolley. “The program is intended to assist first time buyers with their down payment. It’s hard to estimate how many local buyers may take advantage of the incentive, but because of the low threshold for maximum purchase price, the program may only help those in our area who seek to buy condos. This could mean a slight uplift in lower priced properties in the fall, if more buyers are enabled to enter the market. If you are interested in exploring options and strategies for either buying or selling, it would be a good time to connect with a local REALTOR®, who has the expertise necessary to navigate today’s market conditions, neighbourhoods and property types.”

There are 23 “derelict” houses/properties in city of Victoria alone, wouldn’t the spec tax impact their owners?

https://www.timescolonist.com/news/local/jack-knox-derelict-house-leaves-a-bad-taste-in-neighbourhood-1.23872596

Huh?

https://www.walmart.ca/en/ip/hasbro-gaming-monopoly-for-millennials-board-game/6000198671431

Oregon Becomes First State to Ditch Single-Family Zoning

https://reason.com/2019/07/01/oregon-becomes-first-state-to-ditch-single-family-zoning/

Very low new listings.

Month Jun Jun

Year 2019 2018

Net Unconditional Sales: 740 708

New Listings: 1,221 1,322

Active Listings: 3,040 2,595

Leo, rest and relax, postings can wait.

Just read this article below. Looks like co-living is not only for young ones:

https://www.bbc.com/news/world-us-canada-48765641

Sorry to hear that Leo S.

LeoS Hope you are feeling better soon.

Picked up some food poisoning at a BBQ.. end of month article will be a bit delayed.

@guest_61431

Nice. Thanks for the info

Our house inspection noted a minor issue whose fix would probably cost a few hundred dollars. Through our realtor (and with his advice), we notified the seller of the issue and requested a $3K price reduction from our accepted offer. The seller came back with a $1.5K reduction offer, which we accepted. The fix ended up being a few hundred dollars, just as we suspected, but having the extra cushion was nice.

Any words of wisdom for house inspection results? What would be a big enough issue that you could ask for a reduction or them to fix it?

Perfect opportunity for Victoria first time buyer to get that SFH at a discount of $500,000 by the endowment land for an insignificant pocket change of $3 millions.

https://www.vancouverisawesome.com/2019/02/06/maps-how-much-home-prices-dropped-metro-vancouver/

According to BD today, sales of new construction in Vancouver has dropped over 89% YOY.

Sales across categories for June in the region, after a small tease in May, have fallen through the floor again.

At first no one wanted the detached houses, now it seems all those immigrants, downsizing boomers, tech workers, Amazon employees and FTB’s don’t want the condos either. Funny, the lack of land there doesn’t seem to be making a difference – even more oddly, it doesn’t seem to have done so in the past either.

Hmmm. Could something else have been responsible? 😛

Just imagine hearing this in 2016. Impossible. Like declaring gravity wouldn’t exist in 3 years. All kinds of great reasons why it could never happen. And today, go have a look at any number of those forums where you’d see people spouting the same rhetoric that gets spouted every market top. #VanRE for example. Almost all of those voices are silent now.

Some voices in our spillover market of Victoria remain. They’re saying much the same things as our friends across the Strait said a short while ago. Let them. For those of you who want to drop 1.5M on a SFH today, go for it. Once again – expect upticks in sales, but watch the trends in credit, originations, and purchases made with disposable income and credit (cars, restaurants, furniture, RVs etc). It tells you the story that CBC, BIV, Global, Bloomberg and everyone else, won’t.

If I used Twitter, I’d invent a new hashtag: #housingledrecession. Unless it’s in use already. Haha.

Cs-

Not sure what all the anger is all about with the immigration thing. You, me, and 96% of the population in this country (non-First Nations) are immigrants or descended from them; and the remaining 4% just came here a few thousand years earlier.

Sure, if a city’s population is growing then demand for housing is generally greater than supply and prices rise; and if population is decreasing then vice versa, prices go down. But that’s where the substitution issue comes up. Canadian population may be increasing, but that doesn’t help the people of Vavenby, BC, where Canfor just announced a mill closure. So don’t worry about Canada’s pop – worry about Victoria’s. In the long run, and at the global scale, we don’t know what will happen. The ice caps melt, Bangladesh and Florida and Richmond are inundated, hundreds of millions of climate refugees swarming around the globe, mass societal breakdown, yikes. Whether our neighbours are the same skin colour as us is the least of our worries. Or maybe we figure out how to avoid some of this.

Either way, it’s not exactly at the same scale as trying to figure out when or how to buy a tear-down in Gordon Head is it?

Doesn’t work that way. First of all “desirable” doesn’t mean anything objectively. Every city is desirable because somebody wants to live there.

Second, if all the housing stock is SFH, some of it is going to have to be rented or sold to the poor because there’s nobody else left to rent or sell it to.

Not just theory, there are loads of cities in North America with population in the low 100K’s where the poor live in houses. Even some in the millions.

RBC tracks Victoria affordability separately for condos vs SFH. 1986-present

Page 3 – http://www.rbc.com/economics/economic-reports/pdf/canadian-housing/house-mar2019.pdf

This illustrates the SFH affordability hasn’t been cyclical over time, its been ever increasing, from 30% (in 1986) to 62% (all time high since 1986) . Condos on the other hand have been much more cyclical, exhibiting the “up then down, in a predictable cycle” behavior that some have told us about here. Current condo affordability is 38% where it’s been a few times before in the 90s, and 00s.

People can afford condos in Victoria, just not SFH. That may be disappointing but isn’t a “crisis” for the govt to solve, as condos are perfectly acceptable “shelter”. Feel free to wait for that trend to end, but given SFH are falling in the housing stock %, I wouldn’t advise it. If you want a SFH, best to buy what you can afford now.

Yes, why do Victorians, Vancouverites, and Torontonians “choose to go nuts over houses,” when the denizens of all other Canadian cities maintain their composure? Tell us, Local Fool.

You’re wrong there. My statement was “SFH are disappearing fast from Victoria City.” and it is correct. Detached SFH in Victoria City also fell in absolute numbers by 215 or 3% from 2011 to 2016 (see census links below)

Year 2011: 6760 SFH/ 42960 dwellings =15.7%

Year 2016: 6545 SFH / 45765 dwellings = 14.3%

(6545-6760)/6760=-3.2% fall in SFH stock in 5 years (due to SFH tear downs, We are losing about one detached SFH per week in Victoria City)

2011 https://www12.statcan.gc.ca/census-recensement/2011/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CSD&Code1=5917034&Geo2=PR&Code2=01&Data=Count&SearchText=Victoria&SearchType=Begins&SearchPR=01&B1=All&Custom=&TABID=1

2016 https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/Page.cfm?Lang=E&Geo1=CSD&Code1=5917034&Geo2=PR&Data=Count&B1=All

This has been going in since the 1960’s. A little trip to archives will show anyone willing to look how this, “from this today forward, X forms of housing will only ever be for the very wealthy” argument occurs over and over again. Each time, they have great arguments for it, and each time, Mr. Market seems to have different ideas.

A housing stock may change over time making certain kinds more expensive, but that’s a trend that moves incrementally over many decades. Many folks seem to forget that the crazy price ratios we’re seeing here only occurred within the last few years. Over that short a period, it has little to do with the composition of the housing stock and far more to do with people choosing to go nuts over houses.

And for goodness sake, comparing our market with Manhattan is about the goofiest thing around. That one city has more GDP than our entire country. 30 years ago, people more credibly tried using that argument to justify Toronto’s stupendous prices, which eventually crashed to an extent that real prices didn’t recover for about 20 years.

Anyways, happy Canada Day everyone. For all its flaws, it’s still a good country to live in eh? 🙂

The “P” (price) that’s used the world over is of a benchmark home, typically an apartment in a big city, and certainly not a detached SFH. For example, numbeo.com uses 1,000 sq ft apartment in city center for the “P” in the price/income comparison. On that, Canada’s P/I values are the 13th best (cheapest prices) out of 93 countries, with a value of 7.5. https://www.numbeo.com/property-investment/rankings_by_country.jsp

The reason that detached SFH are not used worldwide, is that they are rare in many cities. For example, London England rate of detached SFH is 5% of all homes! (Page 42) http://www.iut.nu/wp-content/uploads/2017/03/Housing-in-London-2017.pdf

No.. the % of SFH is decreasing .. but the number of SFH is still almost the same .. we just have increase number of condos

Sure it does. But that’s not a phenomenon that makes homes 10, 20 30 times income or more. It’s also not a phenomenon that keeps those prices there. All you have to do is spend a few minutes on StatsCan to take a look and see what the average immigrant to Canada brings in and earns after a few years. Does it means there aren’t outliers having an outsized effect? Doesn’t mean that either, and it also doesn’t abrogate the original point.

I don’t agree with the way you’ve framed that at all, or with people who think that that’s what P/I means (or should mean).

P/I is a great overall means of assessment. There’s a reason it’s used the world over. It doesn’t work as well when you apply it to a market in aggregate as it doesn’t account for the sales chain or composition. Ergo, a median home price is usually higher than the median income.

But, when that ratio overall is 10-1, 20, or more, it’s disingenuous to discount it by saying, “well people just think median income = afford median house”. You have to determine what that market’s performance dynamic is historically, what its economic and demographic realities are, and so on. When you take that sort of thing into account, I’d think most people would see that southwestern BC is pretty out of wack.

Good points Leo.

Manhattan is often used as a (correct) example of a place with 0% SFH.

I was surprised to see that “downtown” City Victoria is also officially listed as 0.0% SFH, and that’s from 2011. Not even one SFH. So SFH affordability has no relevance to someone buying downtown. Not only that, but most neighborhoods of Victoria (City) are very low SFH%, with 16% average SFH rate in 2011, and 14% in 2016. SFH are disappearing fast from Victoria City.

https://www.victoria.ca/assets/Community/Documents/2011_census_housing.pdf

Some examples of Victoria city neighborhoods (these would all be less in 2019)…

James Bay 7% (of dwellings are SFH in 2011)

Fairfield 16%

VicWest/Burnside 11%

Rockland 27%

Downtown 0.0%

Victoria City overall 16% (14% in 2016)

This amplifies the point of not using SFH prices as a measure of affordability, and instead using “homes” including all dwelling types.

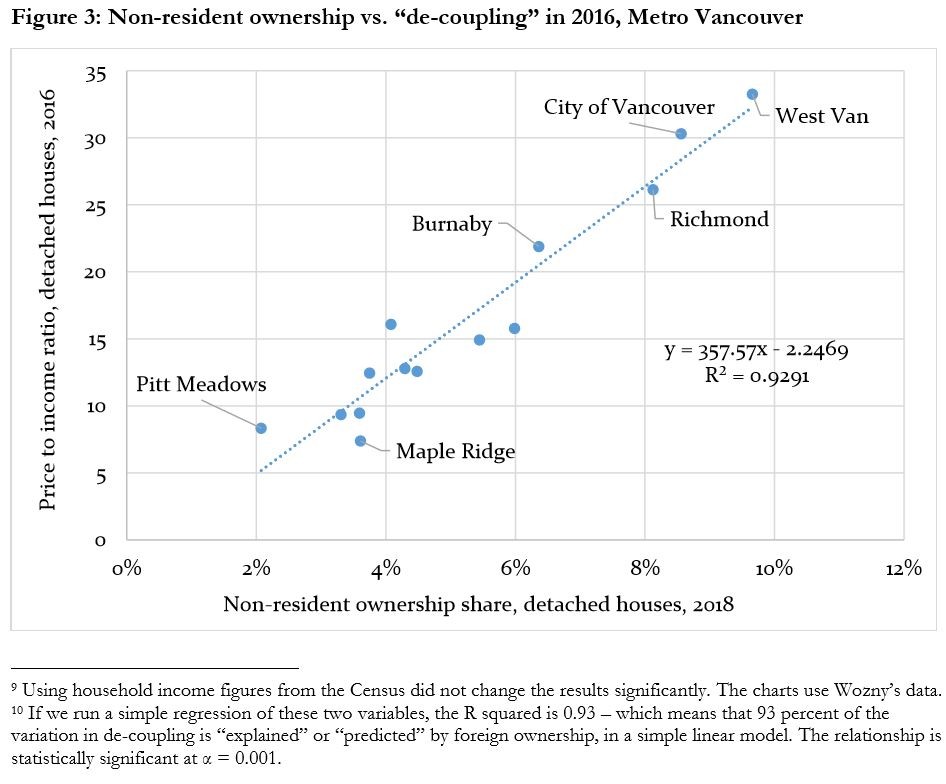

Jens won’t disagree that foreign ownership increases prices, but the paper was pretty shoddy and then held up as “unimpeachable” which got his goat. And I completely agree that we need to move away from the price/income as a measure of affordability as if a median income should be able to afford a median detached house. That measure has mislead a lot of people over the years.

The only place where price/income gives an accurate measure of affordability is a town with nothing but detached houses.

I also liked this example from the Twitter shitstorm about this article:

“Imagine two desirable cities of 100k dwellings each.

#1 is half apartments, enabling poor people to stay.

#2 prevents apartments, expelling the poor.

Which one will have better affordability?

If your metric says #2, is it a good metric?”

https://twitter.com/LausterNa

@LF:

Either you never studied economics or what universities teach of economics today has been made part and parcel of the bullshit politically correct university curriculum.

Specifically, it is idiotic to say that immigration has nothing to do with house prices, and can be entirely ignored, when immigration accounts for most if not all of the growth in the national housing market.

Without immigration Canada’s population would be falling. Let me repeat that. Without immigration, Canada’s population would be falling. That means that without immigration house prices would be on the floor, with likely more houses being demolished than built.

But sadly, one has to conclude that HHV is simply a house price pumping and RE pimping platform of no intellectual validity.

So no further mention of the I word, thank you.

Your point is well-taken – I would be a lot more productive in the morning if the news were not so accessible these days. It used to be a 15-minute read of the morning paper while eating breakfast, now it’s a daily fight against the rabbit hole of commentary and rebuttals.

Here’s a couple of good ones for you:

http://davidebymla.ca/wp-content/uploads/sites/14/2016/03/Low-Incomes-in-High-Value-Housing-Areas.pdf

https://doodles.mountainmath.ca/blog/2018/08/10/taxing-property-instead-of-income-in-b-c/

This is the kind of sloppy language we can do without. Of course, no median-earning household pays 82% of its income for housing. In fact Statscan reports that 2/3 of households spend less than 30%.

What they are talking about is a hypothetical situation where a median earner enters the market as a first time buyer to purchase a median priced property with a down payment of 10% or so. But that’s not what actually happens.

Shelter-cost-to-income ratio

Interesting. I read the same (Jens) article, and was thoroughly impressed with the logic and data backing it up. I want to read more from Jens.

I stopped reading these studies and their rebuttals some time ago. These days, I kind of perceive them as pointless and it doesn’t allow anyone to come to any certain conclusions. Any reasonable actions that we could take, I’m pretty sure we’re taking.

All these, “the Chinese did it”, “the Chinese didn’t do it”, so and so has dirty hands when they argue etc…it’s one of those examples of both sides employing the “bullshit baffles brains” method. Maybe they did. Maybe they didn’t. Does it really matter now?

The Chinese flood party is over. The domestic borrowing binge is winding down. Policies across most level of government are clamping down on fraud and opacity as never before. Isn’t that what most voters in Southwestern BC wanted? BC RE is fast descending, with, as market symmetry often shows – the one that shot up the hardest is now in the process of doing an equally nasty reversal. Victoria won’t be any different, and will do so according to its own metrics.

I agree with your other point completely. Really, all we need to know to determine the high level, relative state of health of the RE market is that simple measure you referenced. How much do people make? How much do home prices cost? How much is the cost of money? I don’t care about immigration, inheritances, Boomers or tech workers. None of that is significant enough to, over time, mitigate this very simple principle.

Vancouver’s P/I is so hilariously disjunctive that IMO, that ends the argument over how healthy that market is, at least on any rational grounds. Victoria’s, while much better, is still at near peak excess. The transition to, and degree of, BC’s reliance on RE was rapid, unprecedented and as we’re “finding out” now, dangerous.

Outstanding work? Not for the counter-argument in the link posted anyway. Mr. Bergmann’s analysis itself is sound, but the foundation is both dubious and weak, and simply counter to common sense when considering the price trends of the last five years as compared to trends in income during the same period. His questioning and following argument of using the price-to-income ratio sits in a fantasy world of its own. So much so that I would have to call into question his motivation for posting such an article. What is interesting is that his cohort, Nathan Lauster, who is a vocal critic of the role of foreign money in Vancouver real estate, has been revealed to have some somewhat dubious motivations of his own:

https://www.scmp.com/news/world/united-states-canada/article/2181447/professor-says-vancouvers-china-money-fears-mirror

Price-to-income is a commonly used metric to determine the state of health of a real estate market, and the fact that he calls it into question (as used) is an indication of how out of whack the situation has become:

https://www.jchs.harvard.edu/blog/price-to-income-ratios-are-nearing-historic-highs/

You can massage data however sexily you wish, but a pig with lipstick is still a pig.

@ Intro:

I am for Canadians and believe that those born here or naturalized as Canadian citizens, should have rights in Canada, including the right to live in Canada, that are not extended automatically to those born elsewhere. That is not xenophobia. It is the Canadian law.

Your expressed dislike of all people, is clearly a case of generalized xenophobia, i.e., a hatred of all races and nationalities including Canadian citizens.

You oppose high net immigration because you’re a xenophobe or perhaps worse. I do because I’m against population increase in general.

I dislike all people equally.

@ Leo

But you are ignoring the law of supply and demand. More lots will mean lower lot prices, whatever the sizes of the lots.

@ Freedom_2008

Typical Stats Can product. Completely useless. Like trying to tell the time with a clock having nothing but a second hand.

To provide useful information they need to add panels aggregating the data, by the minute, the hour, the day, the week and the month. Then one could draw some useful conclusions.

All one can say from looking at the second by second data is that the Canadian population is dying about as fast as it is reproducing and that most if not all increase in population —and hence all of the pressure of demand on the national housing market, is the result of strong net positive migration.

Oddly, there are those who find it “troublesome” to oppose high net immigration yet who do not want more people living in their neighborhood.

Ponder this: what if you have cash to buy a SFH [no mortgage]? That said, let’s address affordability.

Historically, 30% of gross household income was seen as reasonable to cover mortgage and ownership costs – so, how are we doing? RBC recently put it best:

“Affordability is still dreadful in Vancouver, Toronto and Victoria. Minor signs of strain are apparent in Montreal and Ottawa but conditions are normal in all other markets we track,” write RBC’s Chief Economist Craig Wright.

Canada-wide, RBC’s affordability measure clocked in at 51.4 percent, meaning a typical household in the country needs to set aside a little over half its pre-tax income to afford ownership costs, which include mortgage payments, property taxes and utilities.

In the Vancouver area, a median-earning household has to fork over an eye-popping 82 percent of its income to shoulder housing costs — so despite a quarter-over-quarter decline of 1.9 percentage points and annual drop of 5.1 percentage points, ownership remains out of reach for many on the west coast.

Victoria’s measure sunk 0.3 percentage points from the previous quarter to 58.6 percent. However, it is still up 0.2 percentage points compared to Q1 2018 levels.

Meantime, affordability worsened in the Toronto area. The measure read 66 percent, an increase of 0.3 percentage points from the final quarter of 2018 and 0.5 percentage points annually.

Because the highest and best use goes up. All things being equal, if you have one house A on 6000sqft and identical houses B and C on 3000sqft each, the properties B and C will each be worth

A/2 < B < A

Another way to think about it is that 3000sqft that you can build a house on is worth a lot more than 3000sqft of just grass.

@Intro:

“If you can’t afford the core, buy somewhere (or something) you can afford and don’t try to densify my neighbourhood just because you don’t have/earn enough money.”

Why should you deny your neighbors the right to do as they please with their own property. Or are you a sort of plutocratic communist, in favor of government regulation to protect the interests of the property owning haves against the interests of those who merely aspire to have a home in a convenient location, where they won’t have to destroy the environment commuting miles to work?

@ Stultus Pop:

“your land value will go up even more when you allow density to grow …. the problem is people pushing their own agenda to keep bylaw restrictive.. … can you imagine holding onto a 1/2 acre land in the core when every one sold out?”

It depends. As densification proceeds in Victoria now, that is true. A few favored developers get to subdivide or convert land from SFH zoning to apartment and they have a windfall profit. But that’s only because very few are so privileged. If anybody could subdivide a 6000 square foot lot, or build a condo where a SFH now stands, then why should your lot command a premium price. In fact, it will, with near absolute certainty, fall in value.

The law of supply and demand dictates that an increase in supply will result in a decrease in price. Price per lot, that is. If my lot becomes sub-divisible, then perhaps I can sell the two or more lots for more than the formerly indivisible lot was worth.

But even that is not certain. There is no economic principle that dictates that the land a house stands on should be worth as much or more than the cost of building a modest home. Indeed, forty-five years ago, in Oak Bay, a house was worth something like ten times as much as the lot it was built on. The possibility cannot be ruled out that rezoning to increase densification would result in a return to that former ratio, highly favorable to first-time home buyers.

Naw, I’m good. I’d rather lose out on some value and retain some semblance of a quiet, peaceful, relatively uncrowded neighbourhood.

You’re also pushing your own agenda.

If the core municipalities cut minimum SFH lot size in half, it would cost Intro (and me) hundreds of thousands in lost RE value.

Pretty sure your value would increase substantially, especially if it was an older home.

does it really? look at Vancouver .. lots that can be subdivided into 2 lots are worth more than the lot value undivided… there are reasons land assembly is every where in Vancouver .. not to combine 5 lots to build one giant house but to build apartment complex that is worth even more .. your land value will go up even more when you allow density to grow …. the problem is people pushing their own agenda to keep bylaw restrictive.. … can you imagine holding onto a 1/2 acre land in the core when every one sold out? .. would you lose value in RE?..

If you can’t afford the core, buy somewhere (or something) you can afford and don’t try to densify my neighbourhood just because you don’t have/earn enough money.

I can’t afford South Oak Bay, but that doesn’t mean I advocate for densifying SOB so I can get in.

Why would someone who can’t afford to buy care about densification anyway? Aren’t the anti-densification people almost entirely those who already own?

Link below is interesting real time Canada’s population model from StatsCan, it includes birth, death, immigrate, emigrant, non-permanent resident, inter-provincial migrant, and is said to be “pretty close to” real:

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2018005-eng.htm

Wait wait wait Marko. You’re telling me you can’t find me an acreage in a walkable neighbourhood then?

As I’ve stated before, I’m against densification because it decreases my quality of life and because it only solves our housing shortage temporarily. After we densify, more people will arrive and then we’ll have to densify some more. No thanks.

I disagree, but I respect your opinion because you tell it like it is. What I kind stand is people moaning and complaining about affordable housing but are against densification as well. No one wants to come and say “core is no longer going to be attainable to the average person, let’s focus on the Westshore and improving transport infrastructure to move people in and out of the core.” Instead politicians are trying to bring brand new rental units to the most expensive core areas at $850/month. Things don’t work like that.

It’s funny how people don’t like densification, but everyone is moving to cities.

I had a mid 20s buyer buy a 2 bed 2 bath condo in a building where rentals are allowed, but the strata was trying to push through a “no roomate,” bylaw; basically a bunch of old farts with nothing better to do.

The thing I don’t understand is where do these people think people working low level entry jobs that are required to run businesses they go to every day live? Guess what, the medical receptionist, floor employee at Thrifties, Starbucks, etc., probably need to rent a room somewhere to make it by.

People want a variety of amenities, health care, entertainment., etc., but damned if they want more density. If you don’t like density just move to Port Alberni; no Colwood Crawl there.

As I’ve said before, I’ve worked with 100s of buyers and even retired and people working from home don’t want to be in Sooke/Duncan. If they can afford it they want to be in the core. Look at our friend Barrister, complains about density and lives in quite possibly one closest 1/2 acre lots to downtown Victoria.

Same can be said with Vancouver.. if you want price appreciation.. don’t you want more people into your City to boost the potential quality of buyers?.. . In general Biggest cities have highest house prices.. regardless of lot size

I have a lot of issues with this study, including the fact that just because there is correlation with foreign ownership doesn’t mean that’s the cause. Obviously core municipalities are more expensive than outlying ones is the obvious problem. No question that foreign capital inflow boosts prices but the logic in that paper is very shoddy in my opinion.

Jens who has done truly outstanding work on housing analysis in Vancouver tore this study to shreds in this article.

https://doodles.mountainmath.ca/blog/2019/06/25/how-not-to-analyze-the-roots-of-the-affordability-crisis/

FYI: YIMBYs outnumber NIMBYs in Vancouver

https://www.westerninvestor.com/news/british-columbia/yimbys-outnumber-nimbys-in-vancouver-housing-survey-suggests-1.23861947

We are on YIMBY side, as we do understand higher density is the unavoidable future. Just it should be done appropriately and with common sense, e.g. change wider and corner lots from RS (SFH) into RD-1 (duplex) is a very good idea.

@ Stultus Populus:

You surely know the reason why we city land hogs don’t want densification: it’s price appreciation. In 1972 a 50 foot lot in Oak Bay was worth five grand. Now it’s worth a million. Two-hundred fold appreciation, while wages rose no more than around ten-fold.

No, allow Intro’s neighbors to subdivide and his prospects for future property appreciation would slump. If the core municipalities cut minimum SFH lot size in half, it would cost Intro (and me) hundreds of thousands in lost RE value.

The Hell with that. You late-comers can go stew out in Langford, Sooke, Port Renfrew, anywhere you want but don’t even think about becoming Intro’s neighbor on the cheap.

And, yes, more smart rich immigrants please, and anyone objecting is a racist.

@ Intro:

And nobody here at HHV to talk about, immigration, the cause of the pressure for densification. No, just warehouse those native-born Canadian slobs who can’t afford to live in Victoria in some peripheral densification project for those not here first.

cf: Foreign ownership main culprit for unaffordable housing in Vancouver, a top destination for Chinese funds, ‘unimpeachable’ study says

As I’ve stated before, I’m against densification because it decreases my quality of life and because it only solves our housing shortage temporarily. After we densify, more people will arrive and then we’ll have to densify some more. No thanks.

As it stands, I’m glad Langford is warehousing most of these newcomers. If we’re gonna play the game that population can grow forever, I want that growth to be far away from me.

There is nothing to enforce in housing, the government has been clear from the outset that the CBA applies to major infrastructure projects.

https://news.gov.bc.ca/factsheets/community-benefits-agreement

@Leo S

Not sure at the moment nothing is really being enforced by the province for any project from UVic to BC housing. So far it only seems to have been political rhetoric.

why do you oppose short distance between neighbours? there are reasons people gravitate towards cities … why do you view proximity to neighbours as an evil idea to cities? densification is not bad at all … people like to be near people …. why resist development? .. great that you got a large plot of land in the city .. but if you oppose densification .. why not just sell and move to some remote island ?Let other people move in to a city that is growing ?

Good point. But the passage of 40 years won’t increase the six-foot distance between those Langford houses.

I also like the artificial turf Langford’s installed in many places around town. Classy.

I have another idea for Langford: instead of planting fragrant flowers, a truck could go around and mist all the neighbourhoods with cheap cologne.

The nice thing about the market is that if they want to sell, they will. If they don’t, let them leave it listed hoping for the best.

Problem is many people will never commute in anything but a car. Both can (and is being) done but the impact of transition to EVs will be bigger from an emissions perspective.

With e-Bike incentive most purchasers of ebikes would probably be existing cyclists and that likely increases emissions on a net basis. Better to spend the money on bike and bus lanes (which they are).

True. Part of the ugliness is the lack of varied landscaping and greenery. That will come back over time.

I noticed a number of houses that have been on the market for three or more months that have neither sold or dropped their price. You would think that after months of being on the market during the strong spring sale season that people would decide that they are overpriced.

The 70s and 80s boxes of Gordon Head and other developments only came in a few different models and all looked pretty much the same too when they were first built. After 40 years of owners making changes to landscaping and exterior finishes then they start to look a little different I guess.

That is the city answer to current populous demand for high density, affordable, and low environmental impact per unit. However, there are much open space still can be had out in the Westshore as density is only 1/5 of the core.

I was once a core resident as many of my friends and family. We are now living in the Westshore and loving it, because of the abundance of amenities and parks are within walking distant or a short drive with out core traffics.

A side note, if the populous/government truly care about traffics and environment they would push for policies that reduce car commutes, and divert EV car and home improvement incentives toward e-bike and better public bus services. (Perhaps it would increase walking/bicycle commuter rate to greater than 17% if e-bike get $2000 incentive instead of the wasteful $16,000 for EV that do not solve congestion.)

Does residential building fall under that deal though? I thought it was more for infrastructure

I’m not sure the provincial government is going to have a material savings during an economic downturn. The 2018 BC building code drove up costs around $10-15 per square foot on high rise residential and the current wage rates are unlikely to decline especially if the NDP requires union labour on government projects.

IMHO that’s when the provincial government starts moving in earnest to build affordable housing. Wait until construction slows down and get the inputs cheaper – and get credit for saving jobs. Conveniently close to the next election too.

Of course Vancouver is really the big item and it’s a lot farther ahead in the slowdown than Victoria.

I’ve been tooting that horn for a while now, buddy.

Selfishly, though, it’s good for prices in the core. The West Shore is the farm team for the big leagues of the core. And the worse the environment of the farm team is (terrible commute, row upon row of the same-looking houses built six feet from one another), the more its “players” will want to jump ship and buy in the core, when and if they can.

Probably just ignorance. 20% affordable housing is more than 10% because 20% is a bigger number.

RE Council and the 20% affordable units.

Yes let’s spend money to get a review done which comes back saying no more than 10% and then ignore it because 400 people signed a petition. Can you guys hear me snacking my forehead in disbelief?

Yes developers want their projects cancelled because they are just itching to build low income housing. I don’t know how these councillors keep a straight face when they say this stuff. Oh right because they are politicians who are more concerned with appearing to do something constructive as opposed to actually doing something constructive.

Was driving around happy valley yesterday… Man some of those new developments are truly hideous. I realize we need the housing but…

Stuff like this is one advantage of having lots of municipalities I guess. If one of them goes off the rails it only affects a small portion of the city. Developers can simply concentrate on neighbouring municipalities. Assuming the demand for housing remains the same those units will still be built, but perhaps not as many in Victoria proper.

SFH as a % of total dwelling units in greater Victoria fell from 42% in 2011 census to 39% in 2016 census.

A remarkable thing is in that period total dwelling units rose 10k units (153k to 163k) but total SFH was unchanged at 64k (due to tear downs).

SFH are falling fast as a % of total dwellings. So SFH affordability will continue to worsen. Perhaps affordability of total homes (condos + houses) might cycle and stay constant %, but not SFH affordability.

Interesting that city council finally passed the new 20% affordable units measure. Pre-sales have been really slow this year and several large developments have been cancelled or reluctant to move forward. About 12-16 months from now a lot of the downtown residential construction will be winding up and there is little to no new work scheduled in the pipeline. https://www.timescolonist.com/news/local/victoria-mandates-20-affordable-rentals-in-residential-projects-despite-warnings-1.23871516

How different though? what’s vancouver’s mix?

I don’t really see why not. As the city grows single family will become a smaller and smaller proportion of the housing stock. That will continue for the foreseeable future. If the city stops growing then yes it would break down.

I believe this is due to the stress test. The stress test artificially reduced affordability and so we hit our ceiling earlier than normal. It’s not exactly comparable, but the stress test essentially boosted interest rates for most borrowers by 2% overnight. If you graphed a 2% increase in interest rates instead I believe affordability would have exceeded the previous peak.

Good point though. If the stress test sticks around as is, it could also be that the next bottom is lower than what one would otherwise expect.

Keep in mind that the chart is for single-family homes, which are a decreasing percentage of the housing stock.

I imagine the affordability of a detached house in Manhattan is greater than 100% of the average income, yet the city still functions.

Good point. Time will tell. We did 70% in the 80s and I wouldn’t recommend it.

Leo, with respect to the updated affordability chart, I wanted to make a little observation.

Some time ago I commented on what I called the “trend behind the trend”, ie, the red and green lines showing SFH affordability deteriorating over decades. I had wondered at the time was the ultimate fate of that would be, as that obviously cannot maintain that trajectory forever.

Presuming we’re going into a down cycle from here, have a look at what happened. Do you notice how this time around, that affordability peak didn’t stretch relative to the previous peak? In fact it didn’t even match it. Not only was this the case, but it was the case despite one of the strongest economic numbers in decades.

Asking rhetorically, is what we’re seeing the absolute limit of what our market can do in terms of stretching affordability? Is 50 to 55% as high as it goes for all practical purposes? I wonder if that green line won’t be the lower limit this time around, if the economy really goes south due to a haemorrhaging housing market…

One of the most amazing (and perhaps oldest) pictures of Victoria I’ve ever seen. This was taken in 1858, 161 years ago and only a few decades after photography really became a thing.

The photographer is facing southwest, standing very roughly where Humboldt St would be today. The body of water to the left is all fill in now – the Empress sits in it. There’s no inner harbour wall, no Government St – even the James Bay Bridge that allowed people to cross the bay didn’t yet exist.

The lands across the water there that looks like a nice little misty meadow, is where the first legislative assembly (the “Birdcages”) and then decades after, the Parliament buildings, would come to stand. The shore to the right of that little outcrop of rock would be Belleville St, where the “Welcome to Victoria” flowers are now.

Click on the picture to see it full size.

Agreed.

Well it might not be a waste of money per se, would be interesting to run the numbers on scaling up your PR compared to acquiring a separate rental.

However I would not do it due to my distaste for inefficiency. More house than required just feels wrong somehow.

Some prefers rental income and some is after tax-free capital gain.

Even if I was bullish on housing prices I am not going to buy more principal residence than I need or want. That’s just a waste of money. Better to buy an investment property if you think the market and timing are right

I presume the graph applies mostly to FTBs, as they are the prime movers of the market and need optimal conditions to buy in.

Interest rates don’t have much room to fall, and the latest economic news is surprisingly good (must be an election coming); rates could still head up. That leaves price drops and wage gains to restore affordability, especially for the much-coveted SFD. I know which one I would bet on.

Out of curiosity, how many housing bulls sold their starter home and leveraged up recently? Seems to me that a shrewd investor, who believes that RE only goes up, would magnify their gains by buying as much house as they could, and riding off into net worth heaven. Given that the differential between starter house and luxury home is narrowing, this would be a great time to pull the trigger.

It seems to be declining but I dont think it is prudent to try to time the bottom. If you are looking for a home to live in which it would suggest is that you have time to find just the right house. Buying a home is different then buying barrels of oil as an investment.

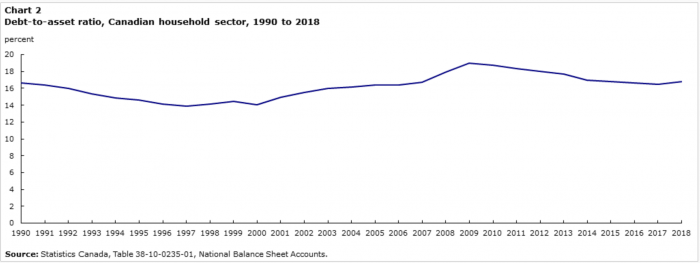

That’s the average household debt to asset ratio for the whole country. All debts, all assets. Given that metro Victoria has about 1% of the population of the country, I think any correlation between RE affordability and this average comes from macro economic factors, not the local RE market.

Caveat,

I was speaking about the overall idea of waiting to buy based on an affordability chart, and shouldn’t have included your quote as it was on a different point.

There isn’t an “absence” of buyers willing to pay higher prices. Just fewer of them. It’s called a demand CURVE . If construction cost increased in a step change it might make new residential land less valuable AND it would almost certainly make existing structures more valuable.

Agreed!

I’m not following that Leo. When I look at that debt to asset ratio graph I see a narrow range from 14 to 18% over the last 30 years. Are we to be concerned with 18% (eg owing $180k on $1m house ) compared to 14% (eg owing $140k on $1m house). Doesn’t seem like a big difference to me, and points to good numbers overall.

Patrick – If you read what I wrote I am saying it was better to buy just before the affordability bottoms rather than at the bottom or right after. eg better to buy in 2012-2014 rather than 2014-2016. If you are disagreeing with me YOU are saying it is better to wait to buy which is NOT your usual position.

If you look at the debt to asset ratio, it matches pretty well with the affordability. Affordability makes more sense to me as a predictor because that is what families think about when they buy and that is the basis of lending as well.

A few interesting things in here, especially that debt-to-asset ratio may be a better metric, which makes good sense to me:

https://www.ratespy.com/youre-more-likely-to-miss-a-mortgage-payment-if-06289864

Yup, goes up, goes down, goes, up, goes down—but the general trend is up, and that up is steep enough that some people do get priced-out forever along the way.

For some, there are no do-overs.

Patrick, if you bought in 2007 instead of buying in 2013, you would have paid a lot more than $23k in interest, taxes and maintenance combined. So in your scenario you will need to factor in those items plus the opportunity cost of your down payment vs the rent paid.

Its funny, the affordability measures mentioned on this blog here kind of serves the purpose as valuation metrics in stocks (P/E ratio, EBITDA multiple etc.) for fundamental investing. So if you are a long term investor like warren buffet, then just buy in a good location when the affordability measures show value and you should be good.

Have a closer look at the affordability graph. The “goes up ” is more than the “goes down” with the troughs rising from 30% to 42% over time.

To me the highlight point is that SFH affordability is worsening over time, regardless of cycles, and people wanting SFH should buy what they can afford now or risk being priced out of the SFH they want forever.

Leo, I think I’m with you that affordability seems to be one of the best indicators of where prices will go in Victoria.

But what about other cities? Take Calgary, for example, where I’ll bet SFHs have been affordable for many years now, yet prices haven’t really gone up.

What do you think about this? In a city like Calgary, do you suppose employment might be the the most useful metric for guessing RE price movement?

No, because you get the same benefits or more just by “owning” a house at that time when prices rise. You don’t need to wait to buy. LeoS 3-year price change chart above applies to all house owners, not just the newest buyers.

Let’s see if there’s someone here in the forum who bought in 2007 (worst affordability) who wishes they waited until 2013 (best affordability)

From the affordability data, I don’t see any economic advantage in “waiting to buy”regardless of the position on the affordability cycle that we are in.

Because in most cases ( ie all cases except 1981), buying at the “worst” time (eg 2007, worst affordability, paying $565k) instead of waiting until the “best affordability ” time (2013, $598K) means you pay less ( $23K less in 2007 vs 2013), own the house when you want to instead of waiting, have paid off 6-years mortgage equity instead of wasted rent money, and still get the price rise (actually higher in % terms than the guy who waited) that happened after 2013.

These cycles take a long time. From the looks of things, if you time it perfectly you’d need to wait about 5 more years, then you’d likely be buying in at a higher price than someone who buys today.

You’d need to add in other factors like stock investments etc. but just looking at the house I don’t see any advantage in waiting because you got the price increase anyway. And buying a house has more benefits than appreciation.

Vic prices SFH https://www.vreb.org/media/attachments/view/doc/ye782018/pdf/Annual%20Summary%20of%20Single%20Family%20Sales%20from%201978

I think you’re right. For example 2013 was arguably the ideal time to buy last time but affordability was technically better in 2014. But it also makes no realistic difference since either year was a good time to buy. Also of course in real time you don’t know where the bottom will be. Best you can observe is that you are in good affordability territory and buy and it will very likely work out. Trying to time the exact bottom of affordability is a waste of time

Affordability yes. Nominal prices less so. So waiting for improved affordability makes sense.

Waiting for a LARGE decline in nominal prices may not make sense. Just ask folks who missed the 2012-2014 affordability window. There were a few people with that story that posted here from time to time.

What sets the sale price of any house whether new or old is the buyers. Houses can only sell for what someone is willing and able to pay for them.

Increased construction cost in the absence of buyers willing to pay higher prices will result in decreased land prices. Land prices are not set externally to the market, rather they are set internally by the market.

Leo – question. It looks to me like the ideal time to buy might be in the year or two BEFORE affordability bottoms out. Especially if you have a decent down payment. For instance 2012-2014 (approaching bottom) had significantly lower prices than 2014-2016 (just past bottom) despite similar levels of affordability. Same thing buying 2000-2002 vs 2002-2004.

Affordability that comes from a lower price is BETTER than affordability that comes from low interest rates as the former is a guaranteed savings while the latter may disappear if rates ever rise

If you overlaid a chart of prices on the affordability series it might show whether there is any truth to this.

I wonder if there are other factors too? Increasing cost of new SFH construction allows existing SFHs to be sold for more because the replacement cost has increased. There is also a trend for homes to become larger and fancier over time. The latter may not be that important in Victoria as so much of our housing stock is old.

Great update.

Highlights the point – nothing truly new under the sun. Goes up, goes down, goes up, goes down.

Thanks Leo. I like your perspective on affordability.

Curious, what would your take on affordability in the next 1-3 years if you factor in a recession?