June numbers: Steady as she goes

June numbers are out and coming from a more active May, sales were nothing to write home about. A somewhat glum VREB press release announced the end of spring had come with a whimper. Although sales are up 4.5% over last June, benchmark prices for single family properties are down 4.3% in the year while condo prices are up 3%. No surprise when you look at the sales numbers, which the stress test knocked down to multi-year lows on the single family side, while condos remain near their long term average. Note that sales have been essentially flat since the introduction of the stress test. Unlike any of the other credit tightening measures that were introduced in the past decade, the stress test has had a large and importantly a long lasting effect on the market.

The VREB hoped in their press release that perhaps buyers were waiting on CMHC’s first time home buyer plan (coming this fall) and delaying purchases, but I sincerely doubt it. That program will have such limited effect (and only on the lower half of the condo market) that we likely won’t even see its impact on the numbers at all. It was designed to partially offset the negative effect of the stress test in lower priced centres, while doing nothing in high priced cities like ours, and that is what it will do.

Overall market months of inventory has struggled to really increase in the last year or so. I don’t think the weakening trend has actually changed, but the introduction of the stress test cooled the market in one jump which was followed by some retrenching. I expect the months of inventory to keep increasing (aka market to keep cooling) for quite some time to come but it’s a reminder that this is still nowhere near a true buyers market. Single family is somewhat weaker than condos, but both are still roughly balanced. If you’re expecting big price declines in a balanced market you will be disappointed.

There were 101 fewer new listings in June than last year which is a little disappointing, but I wouldn’t be overly concerned about that yet. Firstly, if we look at residential new listings in Greater Victoria they are only off by about 50 and new listings so far this year are still up substantially over the last two. As usual, in real estate it’s usually a good idea to zoom out from the month to month noise to find out what is really going on.

From multiple housing metrics, you can again see the overall trend towards a cooling market. While months of inventory only made more minor gains this year, you can see that properties are taking much longer to sell (Days on Market or DOM) now compared to a year ago, and buyers are getting a little more off the list price on average (note: does not account for relists).

June is the end of the traditional spring market in Victoria and sales will slow down from here on out. I think the better deals are to be had after June in the market because a larger percentage of sellers are keen to sell and getting increasingly nervous that their properties are still on the market. The average condition of properties may go down somewhat as there is usually some reason places haven’t sold, but opportunities for good deals slowly increase into the fall and winter.

There’s an election coming up and if the Liberals are out then we might expect some changes to the stress test like Sheer’s promise to allow people to switch lenders on renewal. However I doubt there will be any meaningful changes as even industry opponents to the stress test begrudgingly admit that it is a prudent risk-management tool and are only calling for minor tweaks.

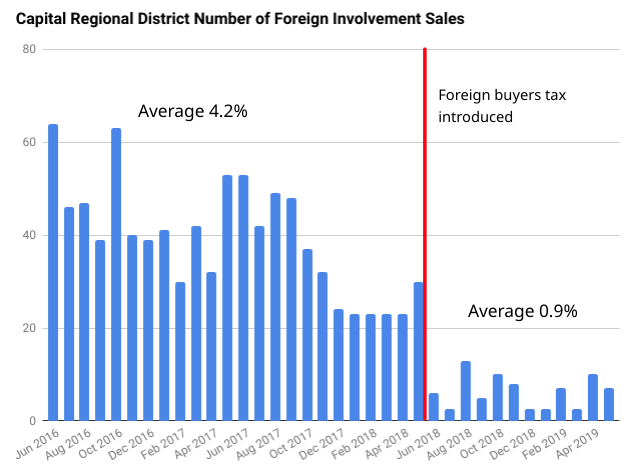

The foreign buyers tax also seems to continue to do its job, with foreign buyer numbers stable at an average of 0.9% after the introduction.

Overall it should add up to a fairly stable regulatory and macro environment. No major regulatory changes on the horizon combined with rates remaining in a narrow and low zone should mean that local factors like affordability are likely to dominate house prices rather than external shocks.

Thanks gwac. Always thought you were a cool cat.

New post: https://househuntvictoria.ca/2019/07/04/predictions-how-are-we-doing-so-far

HSBC 2019 world survey of expats shows Canada rises to # 3 worldwide as preferred destination out of 30 most popular countries for expats. (After Switzerland and Singapore).

https://finance.yahoo.com/news/hsbc-global-survey-expats-move-100000053.html

“Canada was named the 3rd best country in the world overall for expats, rising one spot from its 2018 ranking. Before arriving in Canada , 58% of respondents planned on staying more than 20 years in Canada compared to the global average of 26%. However, upon arriving in Canada , that figure jumped to 75% of respondents planning to remain in the country for longer than 20 years compared with 41% of respondents in other countries.”

More here https://www.expatexplorer.hsbc.com/survey/

Wrt house buying/moving cost:

It is definitely true about the cost. But remember 29 years is a long time, I have heard before that in NA, average time people stay in the same house is about 7 years (seven-year itch? 😉 ) .

As for us, yes, the 7 purchases were in 3 different cities, and some due to job change (did write off moving expenses) and schooling (for child in US), only 3 of them in Victoria (1990, 2004 and 2009). Also we did “sell by owner” for most of our house sales, including 2 in Victoria.

Did try but couldn’t find the right house/condo to downsize to. So the current one is the “forever” home until we find the right one 😉 .

replying to Kenny

“Kenny G#61597

“After bought 7 (sold 6) homes in past 29 years, we still feel privileged and thankful”

That’s a lot of moves, current cost to buy and sell an average house in Victoria is around 50K to 60K with land transfer, real estate fees, lawyers fees, inspections..etc do that a few times and with compounding those costs invested at 7% over 20 or 30 years you could easily have an investment portfolio of an additional 300K-400K, do the same thing with new cars which are even worse. Instead only move 1 or 2 times, really minimal costs on the first move, and buy 2 or 3 year old car and retire least 10 years sooner if you want and have an investment portfolio of easily over 500K that will generate you 3K month mostly tax free dividends, although you wont make friends with the real estate industry.”

If you had to move because of a job, you can write off all your expenses on your tax return and of some Company’s also cover all or some of costs for employees to move for a new job.

The rare typo that improves a post . 🙂

CRA may consider this to be a business, even if it’s your principal residence, and tax you accordingly.

https://highgateproperties.ca/qualifies-flipping-real-estate-canada-revenue-agency/

Congrats to all the buyers!

Earthquake north of the island last night… another bigger earthquake down in California.. my house insurance up for renewal.. yup I think I’ll stick with the earthquake coverage!

Good choice. I didn’t think much of this area at first sight, but in the last few years some friends have bought out there and I have spent more time in the area walking and biking the trails and visiting some of the neighbourhood parks. It’s given me more of an appreciation for the neighbourhood. Good compromise between being close to the core and still being able to get out of town quickly.

Kenny may be more to this. Some people buy renovate move and have a tax free income so that cost you have can be more than offset.

People do this over and over. If you can do a lot of the renos yourself it can be very lucrative.

“After bought 7 (sold 6) homes in past 29 years, we still feel privileged and thankful”

That’s a lot of moves, current cost to buy and sell an average house in Victoria is around 50K to 60K with land transfer, real estate fees, lawyers fees, inspections..etc do that a few times and with compounding those costs invested at 7% over 20 or 30 years you could easily have an investment portfolio of an additional 300K-400K, do the same thing with new cars which are even worse. Instead only move 1 or 2 times, really minimal costs on the first move, and buy 2 or 3 year old car and retire least 10 years sooner if you want and have an investment portfolio of easily over 500K that will generate you 3K month mostly tax free dividends, although you wont make friends with the real estate industry.

Heya Patrick. We bought in the Marigold/ S. Vale area. Wanted to be close enough to town to be able to bike to work regularly but far enough so that we felt we were “out” of the city. It was a good compromise. 14 years of renting and 4 moves was enough for us. Also wanted to thank Leo S for the amount of work being put into the site. It doesn’t go unnoticed by a lot of users that don’t post. Thanks to all contributors. Posts are informative, usually thoughtful and sometimes amusing.

I post stuff that I, and others might, find interesting.

Just back from a short drive, and feel that our housing price is much more stable than the pump price at our gas stations 🙁

It’s not irrelevant to Victoria from the sense that the credit market is broadly national.

There’s been a bunch of people pointing at a Toronto recovery the last little bit, but at the moment the indicators are still trending well below the 10yr average. Also keep in mind, Vancouver did exactly the same thing as it turned, arguably more than once.

It’s unrealistic to expect Toronto to boom immediately after a bubble and when credit in the country is winding down. Toronto’s track isn’t likely to be much different than Vancouver, but it has much less to lose owing to less stretched prices and a much larger economy.

In any case, expect upticks, but watch the trends and the overall context of the credit market.

Happy to see some longtime posters picking up homes. Congrats..

Introvert, aren’t you the one dismissing the realestate market in Vancouver because it was considered to be irrelevant to Victoria? How come you are posing about Toronto now?

Toronto house sales up 10.4% last month compared to June 2018, while average sale price rises 3% to $832,703.

https://www.cbc.ca/news/canada/toronto/toronto-home-sales-june-2019-1.5199791

Jack Knox: Well done, Victoria, you passed the guest test

https://www.timescolonist.com/news/local/jack-knox-well-done-victoria-you-passed-the-guest-test-1.23875374

Residents see threat to Langford parkland

https://www.timescolonist.com/news/local/residents-see-threat-to-langford-parkland-1.23875394

It is nice to hear that people on this blog have bought homes for themselves.But interesting to note that it sounds like these two houses are not likely to join inventory anytime soon.

After bought 7 (sold 6) homes in past 29 years, we still feel privileged and thankful.

Well done for people who bought recently. Although the price is still high, but the market is slowed down enough for you to find the right property and can afford it, and be happy.

I’m hoping to do the same but I don’t think it’s going to pan out. I’m glad you recognize it as privilege. Everyone works hard, especially those making close to minimum wage.

Congrats, where/what did you buy?

@guest_61556

Don’t undermine your hard work. The Canadian economy is fluid and full of opportunity for those who want it and most importantly work for it.

Speaking of bears buying homes, I think there will be big boost in affordability soon due to the wage increases over the past couple of years. Was just talking to a friend at a major bank, for his direct hires out of undergrad for commercial banking, the going rate is now $60k plus bonus. Also spoke to a few people in government related organizations (outside of core government), they are in the same ballpark (sans the bonus). For the next step up, the salaries went from a starting point of 75k (when I was in that boat about 7 years ago) to 85k now. The interesting thing is that these increases happened within the last 2-3 years, it was fairly stagnant prior to.

These are business/finance related jobs.

Good to see the bears buying houses.

Thanks everyone 🙂 I definitely feel my privilege being able to buy a long term house as a first house. Not everyone has that option.

Leo I think when you start a family it all changes. We were looking for rural large lots but after kids got a bit bigger we realised we wanted space in our house, good schools, big yard. A bit of compromise but still an essence of our original desires. Lofts are pretty sweet though!

That was our thinking as well. In 2008 we were considering condos and I had my eye on a couple older ones (I thought a particular 70s condo with a loft was soooo cool). In 2009/10 we started viewing some detached houses but very small ones like 1000sqft ranchers or war shacks with unfinished basements (several of them had model train collections set up). Then we upgraded our expectations to something with a suite, more above ground, which we ended up buying a couple years later. Can’t see why we couldn’t stay here for 20+ years.

Sheesh no wonder the market hasn’t crashed. All you househunters are keeping it afloat! Congrats to you.

I also just bought. I have never posted but have been reading this blog since the original hhv years ago. Still a bear but wanted to get in before croaking.

Penguin and Tomato,

Congratulations and good luck to both of you. Those sound like great houses and long term investments.

@guest_61556

That’s the key

Nice work, both of you! 🙂

@guest_61549 @Barrister

Thanks all! We bought in east Fairfield/Rockland. Schools were a major factor.

I was fine buying this because it was a place I can realistically see us living in for 10-15 years easily. Big enough house for a growing family. I didn’t want to buy something that I couldn’t reasonably get out of in 5 years if there were significant declines.

Also, suiting out the basement resulted in a cash flow difference of only $800 from our current rental situation. If you include the principal that we pay it actually swung to about $1000 in our favour per month.

The math worked on this one and seemed like a long term sustainable choice.

Yes have been here a while! We are in a better financial position to buy now (more money saved, make more money) and also requirement to move (expanding family). I do not regret not buying a house 3 years ago because I think we were just starting our family and priorities have changed since then. Prices were a bit lower but I would not have been happy with the type of house I would have bought back then. Would have kept renting but the right house for the right price came at the right time.

I would not be happy to see my house lose value but fully expect that to happen for some period of time before rising again eventually. I’m probably more of a halibut which is why I bought but I fully expect prices to dip. The important thing for me is that it is a house I see value and potential in and is affordable to me. I am not concerned about price fluctuations because I can see myself living in this house for 30+ years.

Congrats Tomato and Penguin!

Penguin – in my reading of old posts on this blog (and the old one), I came across your name as early as 2016. Have you been actively searching for 3 years? Any regrets that you didn’t buy sooner?

My reading of the market suggests that prices may have been lower in 2016, but in a much more competitive buying environment (bidding wars, etc.).

That’s practically Evan Siddall’s thesis these days. Been impressed with him personally.

But wait, LeoS (correctly) said it is just human nature and that 98% “of homeowners want prices to appreciate quickly”.

Are homeowners who think like that “just ignorant”? I don’t think so.

And if/when you do buy, based on your obsession with a lowered price point before buying, I predict you’ll want your house price to rise too, starting one second after you close the deal.

This is exactly correct, IMO. We’ll probably purchase within the next year – at the same time I believe we are heading into a multi-year downturn. I fully expect we’ll lose a part of our DP. And in a perfect world, I wouldn’t want that. But the world isn’t perfect and we have a societal issue that needs to be fixed. Buying and being bearish is a completely separate situation IMO; being bearish doesn’t prevent a purchase and in fact, you can also be okay as a FTB that prices are falling.

In the long run, prices that aren’t in the stratosphere due to excessive levels of debt are better for the economy and society. Cheering on higher prices from these price levels because, “oh, now I own a home” is just ignorant. Not everyone thinks like that and if you think they do, it says more about you than anyone else.

People like Tomato and Penguin who have made that choice today, are choosing to enjoy home ownership with the knowledge that that asset may well be set to decline in value in the near or even medium term. I suspect they made that calculation among other realities specific to them and went in with their eyes open. There’s nothing wrong with this, and indeed, the message is always the same:

Never, ever buy on the basis that everyone is panicking to get in and you’ll be priced out “forever”. That’s a surefire way to get burned. People who did just that are already learning that in growing numbers, and a lot more of those people over the next year, IMO, are going to be learning it as well…

Human? I mean really, find me a person that doesn’t want to maximize their own investment by buying low and selling high. What percentage of homeowners want prices to appreciate quickly? 98%?

Sure, that crosses into selfishness. And many of those will not strike when exactly that happens (like it did in 2009) because either their investments are doing poorly, or everything is negative and they expect more declines, or they are concerned about their job/income. It’s easy to say buy when others are fearful, but it is excruciatingly difficult to do so. If it wasn’t, more people would do it.

However some might argue that pain now is better than more pain later and some pain is required to deleverage society to more safe levels. So expressing desire for a bigger correction is not necessarily just Schadenfreude.

Fair enough. But then I’d need another term than “bear” to describe someone who also wants prices to fall so they can buy at a cheaper price. Many of the bears here are different, they want to buy (not sell), they just want to wait for prices to fall first, so they can then buy. And I’m assuming that they want prices to rise after they buy (regardless of what they say).

There are bears here that also want mass unemployment, economic recession, rising rates, housing crash or apocalypse if it achieves their goal of cheaper buy-in price point for their house. There should be a term for them too. Until then, I’ll just stick with “bear” and hope to remind people that it’s just this smaller group of “apocalyptic” bears I’m talking about.

Patrick says:

“Most people” could never sell their house at a given time, because it would crash the market. I’m not sure what your point would be there. This just refers to the houses that are selling at a given point if time, and that’s always the case with market prices. And the median price is up 8%.

Median home prices don’t track the exact same type of home, so this doesn’t necessarily mean that you could get 8% more for the same home, but it’s a good sign. Teranet isn’t up 8%, though it lags.”

Ok, so what is your point of pointing out that median price is up 8% if you are not inferring that someone’s house is worth 8% more now than in Feb? It’s meaningless, if you want to drive that agenda then you should post some examples of actual purchase and sale prices.

I don’t think the wanting is required at all. Of course you always want to maximize your own return so you want prices to fall before you buy and prefer them not to after. That doesn’t mean you can’t be bearish on the market while also accepting that other factors are currently dominant in determining the purchase.

When we bought I remained bearish (incorrectly as it turned out) but given other factors I was willing to take a loss up to $50,000 which is the max I expected yet to come.

Bear’s delight – mls 413020, Court Foreclosure in OB, couple blocks from Uplands! Hawk, where are you? Your prophecy come true.

Right, which is why I add the “wants house prices to fall” to my definition of a housing bear. Typically it is someone who wants to buy a house, and can buy a house, but prefers to wait until prices fall, to profit from waiting.

From a purely investing perspective:

I expect people have different definitions of what a bear on this site is. I consider a bear to be someone who expects and wants housing prices to fall. Merely expecting prices to fall doesn’t make you a bear in my book.

As a new homeowner, do you want prices to fall?

You should use median sales prices, as average prices are skewed down by expensive house prices falling more $ than cheaper ones. When you look at median prices, a different picture emerges… greater Vancouver median prices up 8% over last 5 months https://www.zealty.ca/stats.html . (Set to REBGV region, and “All” types)

The latest from the REBGV…the collapse in demand continues and prices are at various stages of moving downwards accordingly.

Also note in the excerpt from REBGV below that while demand for detached homes is probably at or almost as low as it will go, as expected that effect has very much spread to attached units. Once again, if this is persistent, continued price declines are inevitable. Even more, bear in mind that over 40,000 units will be coming online in the next year or so, right as demand is falling off. As some of us have said over and over, this is an almost textbook example of a RE cycle in action.

From REBGV:

Last month’s sales were 34.7 per cent below the 10-year June sales average. This is the lowest total for the month since 2000. “We’re continuing to see an expectation gap between home buyers and sellers in Metro Vancouver,” said Ashley Smith, REBGV president. “Sellers are often trying to get yesterday’s values for their homes while buyers are taking a cautious, wait-and-see approach.”

Sales of detached homes in June 2019 reached 746, a 2.6 per cent decrease from the 766 detached sales recorded in June 2018. The benchmark price for detached properties is $1,423,500. This represents a 10.9 per cent decrease from June 2018 and a 0.1 per cent increase compared to May 2019.

Sales of apartment homes reached 941 in June 2019, a 24.1 per cent decrease compared to the 1,240 sales in June 2018. The benchmark price of an apartment property is $654,700. This represents an 8.9 per cent decrease from June 2018 and a 1.4 per cent decrease compared to May 2019.

Attached home sales in June 2019 totalled 390, a 6.9 per cent decrease compared to the 419 sales in June 2018. The benchmark price of an attached unit is $774,700. This represents an 8.6 per cent decrease from June 2018 and a 0.6 per cent decrease compared to May 2019.

https://househuntvictoria.ca/2018/12/13/de-seasonalized-months-of-inventory/#comment-53479

Funny you referenced the property cycle in that post. Probably a good idea to also consider the economic and financial backdrop of those actually buying these homes. Do you care to update your assertion from 6 months ago? Better yet – double down on it. 😛

Must have been the Perfect Storm! 🙂

..

I just bought too and also still a bear 🙂 Thanks leo for this blog during the years long process. I am a numbers person so it was very interesting reading material.

The house described in the article is clearly owned by a well-off crank who is letting the house rot to spite the neighbors. He’s obviously paying the property taxes because otherwise the house would have gone to tax sale years ago.

You are right that there are wealthy people/holding who don’t take care of their properties, however you can’t throw the baby out with the bath water because not every single abandon property are own by heartless scum that are unwilling to sell their holding to the poor homeless millennials.

Perhaps, you can look up passed derelicts houses in Victoria you would see many cases are complicated and the owners are not wealthy who had health issues that didn’t have a will or the mental capacity to deal with their finances. (For an example: try lookup 2520 and 2536 Richmond Rd. Victoria BC. For yourself to see why they were abandoned and had multitudes of break-ins/fires from the early 80s to early 2000s).

And, then there are cases that the owner/s had a hard time to sell because people were murdered in those houses. Or, the owners committed suicide in those houses.

“Most people” could never sell their house at a given time, because it would crash the market. I’m not sure what your point would be there. This just refers to the houses that are selling at a given point if time, and that’s always the case with market prices. And the median price is up 8%.

Median home prices don’t track the exact same type of home, so this doesn’t necessarily mean that you could get 8% more for the same home, but it’s a good sign. Teranet isn’t up 8%, though it lags.

Patrick, are you saying that most people who bought in Feb 2019 are able to sell their house for a profit (not counting transaction fees) 5 months later now?

Should probably look at the rolling 12 months prices instead of comparing Feb to June. I am pretty sure I can’t sell my house for 8% more now than what what I could have got in Feb?

Tomato: Big move but dont keep us in suspense what did you get? Leo, thanks for the very thorough stats and an insightful analysis. Hope you are feeling better.

Why are Greater Vancouver median sales prices (all types) up 8% since February?

Using the good site zealty.ca, (which gets data from the RE boards), greater Vancouver (REBGV region) median prices peaked (all housing types) in April 2018 at $805k. Following that, prices bottomed in Feb 2019 at $710k and have risen 8% since then, to $765k in June 2019. That’s now only -5% from the peak. (which is about the same as Teranet reports for its index). If the Vancouver market is so bad, why are prices up 8% in last 5 months? That’s way more than seasonal variations. Perhaps the mix of housing sold is changing due to stress test, and people are buying smaller homes?

GV median Prices (all types) are also up 32% since August 2016 ($580k to $765k), yet we are told by some here that Vancouver market peaked and has been declining since 2016. Some call it a collapse.

https://www.zealty.ca/stats.html. (Set to REGBV region, and “All” types)

Congrats!

Enjoy your new place! What neighbourhood did you settle on?

We’re seeing some that are edging closer to our strike point as well. Still no-can-do, but things are certainly looking to be improving.

Still need more inventory.

Just bought. Still a bear

No, I was really picking on a poster who was suggesting, with no evidence, that Victoria’s abandoned houses were owned by people with dementia or other illnesses who lacked the capacity to take measures like selling them.

The house described in the article is clearly owned by a well-off crank who is letting the house rot to spite the neighbours. He’s obviously paying the property taxes because otherwise the house would have gone to tax sale years ago.