Out of town buyers surge in Victoria

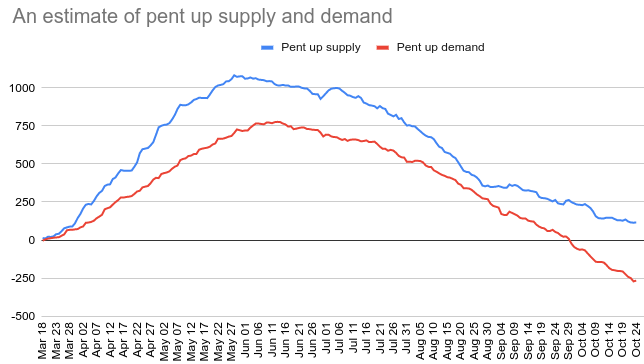

Back in June when sales started to come back from the COVID dip, I estimated how much pent up market activity there may be based on what we should have expected if sales had proceeded like last year. Well all summer that pent up supply and demand was resolving more or less in balance, with sales and new listings up by similar percentages. That is until about the start of September, when the usual surge of fall sellers failed to materialise, but the elevated sales continued. Here is what that estimate of pent up demand looks like now.

New listings have nearly recovered from the spring slump, but sales have simply smashed through the estimate of pent up demand.

How is it possible that sales increase more than new listings? Well clearly it isn’t local owners moving to different neighbourhoods or upgrading their house since that would equal one new listing and one sale, leaving market balance intact. It has to be either:

- First time buyers – Although interest rates are low, young people have been hit harder than most by employment losses, and the condo market where first time buyers often start is still weak, indicating there probably wasn’t a huge upswing in first time buyers.

- Investors – With the rental market substantially weakened by reduced demand meeting increased supply, and the condo market not showing big price gains it’s also unlikely there’s been an increase in investor activity.

- Out of town buyers – A month ago I suggested that the surge in sales, and the near tripling in luxury market activity was due to out of town buyers. And now we have the confirmation of this in the data.

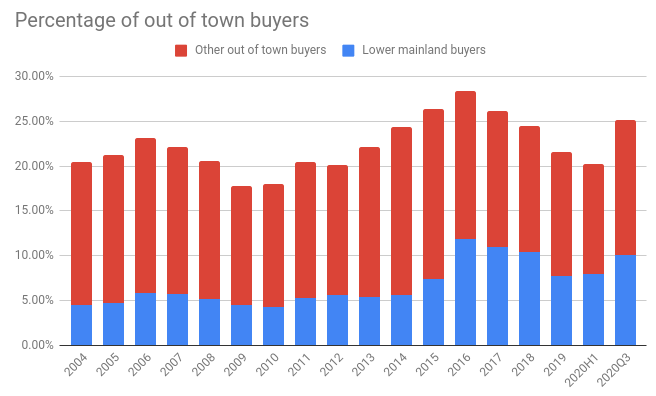

Buyer origin data is out for the third quarter, and sure enough, there was a big jump in out of town buyers, mostly driven by a return of buyers from the lower mainland, but also increases from elsewhere in BC, Alberta, and the US.

At about 25%, the level of out of town buyers is still shy of the recent peak in 2016 when we had a surge from the lower mainland, but it’s a big jump from the first half of the year and a stark reversal of a multi-year trend of declining buyer interest. A couple hundred more buyers (pure demand), mostly concentrated on the detached side, likely explains a good chunk of the activity we’ve seen on that side of the market. Inventories were already low and that increased demand tipped it into crazy territory.

Speaking of inventory, it’s not looking particularly promising. New listings have simply dropped off a cliff lately, and are barely above last year’s levels while sales are still substantially higher.

Sales are still very tilted towards single family properties (sales up 91%), but condos are also up substantially (60%) over last October. The similar increase in new condo listings has kept the market in balance, but the market could shift very quickly once the unusually high levels on either the supply side or demand are exhausted. October is going to be another record sales month.

How many businesses are on CEWS?

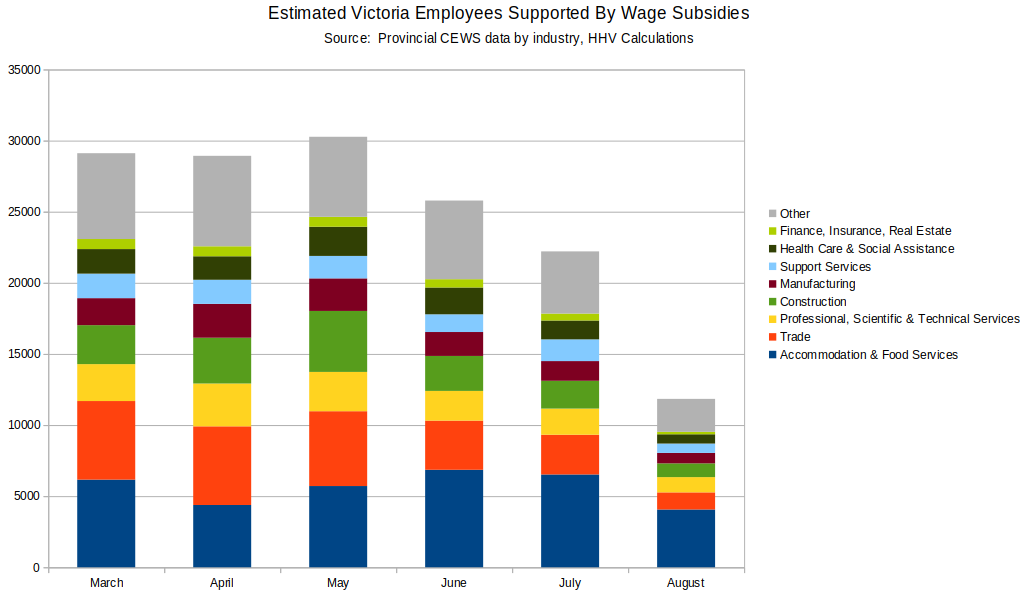

We know that in September employment in Victoria was still down by about 6100 jobs compared to a year ago, and job losses are concentrated in the service sector and amongst younger employees. However the government has also offered generous wage subsidies to businesses that have lost income in order to prevent people from losing their jobs in the first place. How many employees are supported by businesses that are benefiting from those wage subsidies? Well Victoria-specific data is not available, but we do have data for BC by industry. Applying these to the Victoria labour market, we can estimate the number of employees in Victoria that may have been supported by wage subsidies as of August.

The latest numbers show that about 12,000 employees may be supported by wage subsidies in Victoria, which is nearly twice as many as the drop in employment from last year. That includes an estimated 4000 in accommodation and food services, 1700 in construction and manufacturing, 1200 in wholesale and retail trade, and 1000 in high tech. The good news is that there was a sharp drop in beneficiaries in August, which indicates that a lot of businesses were getting back on their feet and didn’t require or qualify for the wage subsidy any longer. How secure are those jobs when the wage subsidy dries up? That’s anyone’s guess, but with the extension of the subsidy program until June of next year, businesses should have time to slowly adjust to the phaseout rather than facing a sudden shock.

Thanks Leo! I would love to read more about this survey! Do you know if the survey results are summarized and shared somewhere?

Hi Zoe. The source is a regular survey of realtors asking the question where the buyer is moving from. It does not indicate citizenship

The foreign buyer stats are provided by the province.

Great analysis! Just curious, what is the source of buyer origin data?

Sales up 60% in victoria: https://househuntvictoria.ca/2020/11/02/is-this-forever-another-record-month-in-victoria/

Brick: Enjoy and celebrate your new home. What part of town are you in? ( Patriotz, stop always being the Grinch, let Brick enjoy).

Tell us a bit about the house (lot size, age, your favourite feature) and what projects are on your list.

Welcome, Brick. I love a good lowball story. Give us some details if you don’t mind – what % off asking? And what % of assessed value did that end up being? How long was it on the market? Anyway congrats!

Your right patriotz. It’s sad, it’s not realistic. But I do love the area, it really is a great place.

I live in an alternate universe, hopefully I can help my kids in the future….if there is a future

That’s not really cheaper than rent, you just got someone else to share the cost.

Long time reader first comment.

Thank you Leo for all your analysis, and all the regulars for the entertainment.

We were one of those thousand buyers, first time local family (10 years on the island) SFH purchase.

The time was right for us, no other reasons.

Made 3 offers on homes in our price range outside of the core, lost them all. Made a very lowball on a place in town and closed in 2 weeks. Very stressful but very happy.

The market is crazy, the world is crazy but now we have a house to live in, cheaper than rent (Down payment help from parents) and gonna build some sweat equity!

leo .. you should overlay the price chart on top of the population growth chart ..

May have cracked 1000 sales this October. Going to be very close anyway.

The situation today is about as different from 1973 as it could possibly be. Gulf producers trying to unload their product while they still can, no political (remember what was going on in 1973?) or economic rationale for a producer boycott, US self sufficient and with productive capacity that can be ramped up on short notice.

In a nutshell – today peak oil means consumption, not production.

More importantly is the low oil rig count and peak production may trigger a repeat of the 1973 crisis.

https://postimg.cc/tnVBrB6n

https://postimg.cc/Q9z6k2Fr

True but it can’t really be directly watched because the official data is lagging. By the time it shows up in the data the impact is already played out in the market. Anecdotes, more sales vs listings, high end market, etc. All kind of indirect indicators for out of town buyers

Oil is down to 35.59 which if it does not worry one perhaps should.

Definitely a concern for agents that there isn’t many listings, simply from a business perspective people then shift to trying to solicit listings as you mentioned.

That said if we look at times of low inventory it’s also usually times of high sales volume, so earnings in the industry are high (possibly more unequally distributed though)

Sales to new listings go above 100% most every year, but usually not until December at least on a monthly basis.

Couldn’t answer this question for a while due to the broken stats, but fixed now so

October MOI:

Single family: 1.8

Condo: 2.77

So both are very low.

It’s hard to believe, that if the federal government does move ahead and bring in over a million people into Canada over the next three years , that it will not have a substantial ripple effect all across Canada for the cost of housing as people compete for places to buy or rent. I can see the seductive logic of using immigration as a way to bring in more revenue for the government… but there will be major costs as well…such as providing schools, hospitals, all sorts of new infrastructure etc.

One has to wonder if this is like the guy in his basement trying to build a perpetual motion device and thinking he just needs one more magnet to make it work.

Mr Potato- and what caused the loss of jobs?

maybe partly because the jobs aren’t there and rent is expensive in town center?

you can raise the targets as much as you want .. but we are way behind before covid – after covid shut down and delays , the back log are set back 3-4 years from previous point .. gov’t can give you as much targets as they want .. action on words is a whole new ball game

Maybe a tourniquet….

https://financialpost.com/commodities/energy/why-a-biden-victory-may-turn-out-to-be-an-unexpected-boon-for-the-canadian-oilpatch

The funny thing is, it has been more an oversupply and market share battles that has been hammering Cdn oil and gas production and exploration more than any environmental movement, change in public behaviour or new technologies providing energy. The US over the last decade has emerged as a major producer and now exports globally causing the command economy production from places like Russia and Saud to flood the market in response to maintain market shares. Even with the potential cancellation of Keystone XL by a Biden administration wouldn’t be a huge negative if US oil production and future US exploration is curtailed. Which would likely lead to a price stabilization and support an Alberta recovery. Then it still comes down to the consumption of oil globally is still increasing for many years down the road, which will continue to stabilize the industry in Canada.

But hey, that’s why no matter how people feel about the industry, that’s why is was a great buy in Canadian energy stocks back in March and April.

Introvert,

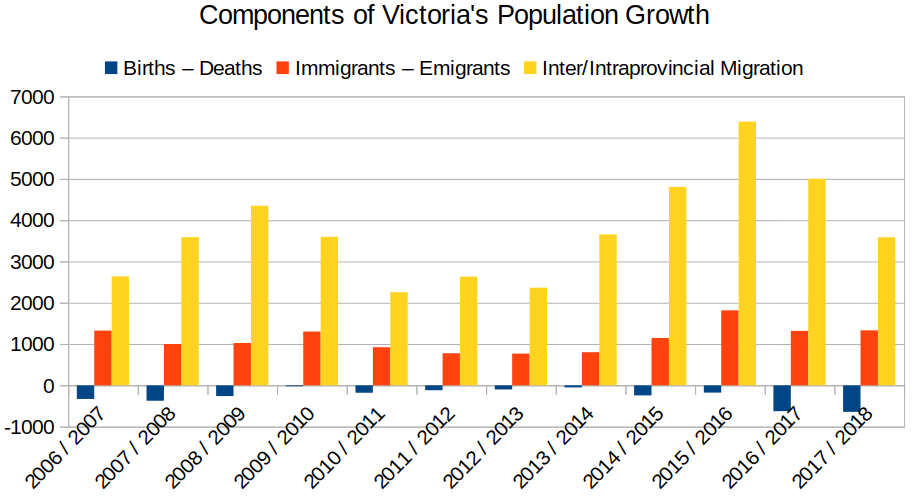

International migration isn’t a big driver of population growth in Victoria, so I don’t think increasing it will have much impact, at least not directly.

Intraprovincial and interprovincial migration are the main sources of population growth on Vancouver island so those are the ones to watch. FWIW, Intraprovincial migration has been negative in Vancouver and positive in Victoria for awhile now…

Gotta love the inter-muni trash-talking. Gordon Head is in Saanich, BTW (not Victoria).

To someone from Edmonton or Toronto, you both live in Victoria.

(Amalgamation NOW!)

Cool. Feel free to scapegoat me for the longstanding regional and provincial doctor shortage.

BTW, I got my doctor in 2007 when I lived in Central Saanich.

And do you suppose adding 11 more subdivisions to the outskirts of Calgary will help or hurt RE prices there?

https://www.cbc.ca/news/canada/calgary/new-communities-developments-calgary-city-council-1.5761580

Roughnecks and blue-collar workers often find their way into the B.C. construction industry.

On the white-collar side, I have friends in Calgary who are CPAs working at O&G firms; I’d imagine jobs like that would be fairly portable.

They’re not going to bring bags of money from selling their houses either.

https://www.theglobeandmail.com/canada/alberta/article-albertas-high-rate-of-mortgage-deferrals-raises-red-flags/

When I was travelling the Island a while back the slogan was “Canada’s Riveria” (no kidding, I saw this in print). So I suppose this would make Victoria Canada’s Monaco. Buy you don’t escape paying taxes. 🙂

I hear you, but there aren’t exactly oil and gas jobs here for them to come to. I’ve seen lots of oil and gas applicants try to apply here for other engineering jobs and it’s just a very hard sell.

Cool. We’re in Sidney and don’t have a doctor because people in Victoria are taking up the spots. Maybe we should be branching out to smaller communities and take their spots too..

Umm..really? and Alinda, re-posting this in case you didn’t see it before:

https://www.findadoctorbc.ca/

Heard that it has been helpful for some.

Hope you guys find a GP soon.

This doesn’t even make sense.

Also, interprovincial economic migration. Alberta is hemorrhaging jobs and there’s no tourniquet in sight.

Just a few days ago, Cenovus and Husky announced a merger that will result in 2,150 jobs lost (25% headcount reduction), mostly in Calgary.

And that’s just the most recent one; massive job-loss announcements have been occurring with regularity over the last few months.

https://financialpost.com/commodities/energy/cenovus-husky-confirm-up-to-25-headcount-reduction-as-oilpatch-layoffs-continue

Barrister:

I agree with Introvert. I am willing to drive virtually anywhere in the greater Victoria region for a family doc. At the moment I’m in a wheelchair but will find a way to get there.

Thanks.

Alinda

I have been without a family doctor since arriving in Victoria in 2005. It is extremely irritating, however, I would not mind it so much if the majority other medical service access wasn’t bottle necked to having a family doctor. Everytime I receive I medical service that is not through a GP, I get the question, “who’s your family dr and where do we send your files”? They hate my answer, “whatever one of a dozen walk in clinics you want to send it too”. They almost become indignant and say: “you need to go to the same walk in clinic”. As if someone has the time to wait at a walk in clinic for 4 or 5 hours…Having GP family doctors as the gate keepers to health care system has been a failure not only for medical service access, but for continuity of care as well. I know two doctors that recently moved to Victoria that initially planned to open a family practice but decided not to because it is more lucrative to work on contract and avoid the expense of running and managing a family practice.

Seems like the bulls and bears are flipping – it used to be immeasurable impacts like b-20 guidelines, spec taxes, and foreign buyers tax that lead to bear arguments and now i see anecdotal bull stories of people from off island buying up all our real estate, or Victoria being the “Hawaii” of Canada, and our Covid free city being so enticing. Introvert has turned into the very thing she once hated… its an interesting turn of events.

Stark difference from 30 years ago. Current targets pretty similar ~60% economic migration.

Yep they are raising targets 15%. So far in 2020 the actuals are trailing the targets substantially, but if borders open up there could also be a catchup period where inflows are above targets. Unclear so far if they intend to catch up the deficit later, or just go back to the targets.

I think the prediction of a drop in immigration demand due to high unemployment here is missing the mark. I don’t think there will be a drop in demand. However a federal government change may lower targets in the future due to political pressure if high unemployment persists.

Not discussed enough is the focus on economic migration. Current immigration quite different than how it used to be 30 years ago.

Add another tail wind to Victoria RE:

Canada raises immigration targets to record level, eyeing COVID-19 recovery

https://www.thestar.com/news/canada/2020/10/30/canada-raises-immigration-targets-to-record-level-eyeing-covid-19-recovery.html

Rolling around in my head are Marko’s periodic stories of the Croatian families he’s helped move to Victoria, most of whom buckle down and buy RE as soon as they can rather than bitching and moaning and waiting for a crash.

Our family doctor is in Sidney and we live in Gordon Head. We’re just happy to have a doctor.

just my own observation: 3 of IT guys from in Montreal decided to move to Sooke due to the covid 19 and they have kids too.

Another seasoned property investor from mainland china who currently lives in yvr ( do not ask me how) is actively developing Duncan and Sooke area. project size is noticeable.

out of town buyers buy….. they feel our island land is cheap and there are room for them to make a fortune

Alinda: Happy to help if he actually decides to settle here. He is looking into a couple of other alternatives. So i will post when it is finalized. But you understand he is looking at the West Shore and not Victoria.

No worries there. If word gets out of an actual GP accepting patients it’ll probably take 6 days not six months

Do we have any actual evidence for this? Certainly the condo market is weak in downtown Toronto and elsewhere, but that doesn’t mean that population is actually declining. Past price declines haven’t gone together with a declining population.

Barrister: I’ve been looking for a family doctor in Victoria for over a year. Would you be willing to give me this fellow’s contact info?

“I was talking with a younger man (in his forties) who is moving here to Victoria and he has decided that he would rather buy a SFH on Bear Mountain than be in Victoria”

‘

‘

‘

Not surprised, a lot of people move to Victoria who have never lived here and think Bear Mountain is awesome, then talk to them a few years later and their looking to move to the core for a more walkable neighborhood that isn’t so car oriented.

I was talking with a younger man (in his forties) who is moving here to Victoria and he has decided that he would rather buy a SFH on Bear Mountain than be in Victoria, Figures that he will open his business in Langford. Lower overhead. Since he is a GP he thinks he should be able to find patients over six months without having to invest too much. (I have no idea what the situation is in the West Shore but if it is remotely like Victoria I dont think it will take six months to find patients.)

Frank my guess is very few are moving away due to covid i think its all work from home, air bnbs up for sale, and no students. I’m sure there are a few that are moving out of Covid due to Condos but my guess is the vast majority are from the other reasons.

International migration negative to BC. Not sure if it really matters to house prices if it’s mostly outflow of international students though, as those will be back next year sometime

rush4life- If covid levels are not influencing where people want to live, why are the major centers losing so many residents in the densely populated downtown areas . Manhattan has never had so many apartments for sale, it’s almost an exodus. This is happening in most major cities, partly influenced by people working at home, but more importantly, people wanting to avoid people. Human behaviour can change drastically in situations like the pandemic.

Thanks, great to get the information again, even if it’s depressing from a buyer perspective. I am curious if there is concern from realtors about a lack of listings impacting overall sales volume down the road? The lack available SFD listings drives prices up, but is there a point where that becomes a negative? Can a market stall because of lack of inventory? I have talked with a couple of acquaintances that have purchased in the last few years and their realtors have contacted them looking to list their properties. Even though they have an interest in upgrading their properties, they refused to list because there was no inventory for them to upgrade too. They could pocket a couple of hundred grand or role it into a new property, but there are no properties for them to consider or close to affordable for them as an upgrade and they want to have a place to live. So, they are staying put and are unlikely to join the market again any time soon because of the constraints.

Active listings finally fixed in the system.

September:

Detached down 24% from last year. At the 13th percentile of the 10 year range.

Condo up 23%. At the 58% percentile of the 10 year range

That is what I have heard anecdotally. Also dual citizens choosing Canada because of current craziness in the US. Finally by making it harder for immigrants to get in we may be seeing some talented immigrants that would have otherwise gone to the US.

Balanced against all of that is the fact that the US is a better place to be if you want to make a lot of money

Love these long run charts. Interest rates to the rescue.

Interesting article. Note how few US citizens immigrate to Canada. These numbers do not include family class, who are mainly Americans who marry Canadians and decide to settle here.

https://www.cicnews.com/2020/10/has-trump-increased-u-s-immigration-to-canada-1015930.html#gs.jwt8do

PS Frank – Leo just posted that foreign buyers aren’t increasing – and with the new beneficial registry set up for next month it will get harder for people skirting the system to do so. If rich people could just do what they want i doubt they would have paid out 115M in spec tax last year. And lastly I doubt anyone is buying here because we have currently low Covid cases – that could change in a instance. I was reading recently about a spin class in Ontario that is now linked to 72 cases of Covid – it can happen here too – we aren’t immune. That being said it does seem like prices will continue to rise.

Well that’s good, I suppose.

Thanks for the Port Hardy info Leo. And Deryk, you’re a class act.

why you shouldn’t worry about the waning corona virus antibodies – https://www.nytimes.com/2020/10/27/health/coronavirus-antibodies-studies.html

COVID-19 immunity wanes within weeks, U.K. study finds

https://nationalpost.com/health/covid-19-immunity-wanes-within-weeks-u-k-study-finds-results-suggest-vaccine-needed-twice-a-year

If those retirement readiness profiles in the Financial Post are at all representative of the class of folks who choose to retire to Victoria, those retirees may have incomes in the neighbourhood of $90K a year — which would support or even drive up local median household income.

No change to overnight interest rates anticipated until 2023 https://www.cbc.ca/news/canada/bank-of-canada-rate-decision-1.5779813

There are huge numbers of Americans who do not feel safe in their country due to their skin color or sexual orientation. They see Canada as much more tolerant and are probably actively looking to relocate here whether it’s Victoria or elsewhere. The Island ‘s low covid rates puts it high on their list if they can afford it. It would be interesting to know how many Americans own property in Canada. I know lots of wealthy Americans own summer properties in Lake of the Woods. Lots of multi- million dollar places there. There are probably several ways for wealthy buyers to avoid the speculation tax. They have their ways.

I don’t think that Victoria is attractive to them, certainly not after the foreign buyer tax. The foreign buyer numbers are low so there is no uptick there. The increase in people reportedly moving from the US is very likely people that are already Canadians and moving back. Couple of our friends are considering it, since they may be able to work for their big tech employers remotely from Canada (they’re not moving to Victoria though, rather the interior of BC).

Will be interesting to see how local incomes are after the 2021 census. We’ve had a heck of a lot of Vancouver inflow in that period, so did those people come to retire (perhaps in 2016/17) or did they come to keep working remotely (the current crop)?

Thanks for your contributions Deryk. It is a good sign that 300 vs. 375 no longer registers 🙂

Listen everyone. I owe everyone a complete apology to you all for my numbers on the purchase of our new Sooke homes with legal suites in 2012. My memory failed me and I am so sorry.

Yikes! My old brain was not functioning! I double checked and the prices were $375,000.00 in 2012. (One was $347,000.00) So I (((beg))) forgiveness.

Having said that though, again…my main point has always been that prices in and around Victoria are amazing value when we look at Vancouver……even when they might seem crazy …as they did to a lot of people even in 2012 …….when they were still in the $375,000.00 range.

So again… I wanted to set the record straight and admit my error and apologize for my stupidity.

Pretty small market with ~40 sales a year on MLS. Looks like decent houses around $330-$350k. Selling around 25% above assessment but there’s a wide range. Year to date sales pretty even with last year.

Our friends (Canadians) will be moving back from California soon. Not just covid, but wildfires, school system, and politics too. Again , anecdotally, there are a number of posts from families moving back to Victoria from the US and other areas of Canada searching for temporary accommodation on the community site for Oak Bay. Also recently there have been frequent posts from those searching for homes to buy in the area. And my banker said they have had a deluge of mortgage applications from people from Vancouver buying here.

Leo, looking back at the ‘up island’ post a few weeks ago, I didn’t see anything about the north-north island, specifically Port Hardy. Have you any thoughts or data about that area? I’m sure it’s more of the same, but I was shocked to look at some SFD listings up there for more than 140% of BC Assessment value (eg. MLS no. 843903).

I really don’t think Canada would be that attractive to rich Americans. If they want to live somewhere nice and quiet, why wouldn’t they move to some place like the San Juan Islands – no state income tax in Washington. Why go though all the time and effort – if it’s even possible – to move to VI and pay higher taxes and higher prices?

patriotz- I wasn’t talking about a flood of immigrants, I’m talking about well heeled people with lots of money looking for a safe and stable place to live. Especially somewhere with a smaller population. They could be looking at communities like Ladysmith where the speculation tax does not apply. It only takes a few hundred or a few thousand of these buyers to skew the numbers. Net migration doesn’t matter, the people who can’t afford to live in places like Victoria are always leaving.

Yeah, half of my roofing material finally arrived on site. Wonder if the second half is going to take another year or two.

What I’m hearing from a couple of families with Canadians living state-side is that they’re strongly considering moving back. If the election turns out to be even more of a dumpster fire than the last few years, coupled with the shift to work from home, it may make sense.

Will be interesting to see what happens if Trump gets back in…

Canada hasn’t experienced net immigration from the US since the Vietnam War era. Every time some event happens down the border that looks bad to us we hear talk about a flood of immigrants from the US and it doesn’t happen.

Funny, I thought the hot money coming into Vancouver was supposed to be from China, not Finland. China’s official income tax rates are actually lower than Canada’s and most people find ways to get around much of that.

First – thanks Leo for the continued analysis. Speaking for all the lurkers, you inform a great deal more people than just those who comment on your posts.

I’m wondering about the significance of this graph – seems an unusual occurrence that new listings has dropped below sales.

When was the last time this happened and what was the context?

Also where are we sitting for SFH MOI??

Listen…I know ….because our family bought three brand new house in Sooke in 2012 for under $300,000.00. People talk about stats and averages. It means very little to me because that is what we paid for the house. Under $300,000.00.

The first one we bought with a good realtor. The other two were bought directly from the builder. (A good saving there. )

So ….while I appreciate the input of some people saying it is not possible, I’m talking about direct experience and we did it.

We have also have bought through private sales. I’ve also bought sight unseen with no subjects. The trick is to not do what everyone else does. Know what you are looking at. Know the market well. IE: Do your homework.

It was more like $400,000….I sold a brand new house in Sooke on Steeple Chase with a suite and it was $395,000.

Derek you would have to go back to 2004 to see average house prices in Sooke in the 300K range. From 300K in 2004 to 600K now is about 4.5% annual return before expenses, again within the long term average norm.

Just looked at VREB and average price for house is Sooke in 2012 was about 390K, most recent figures show average price in Sooke now is 607K, so over 8 years average gain was just over 5%, and that’s before paying land transfer taxes, real estate fees etc. That is about normal long term return for real estate at inflation plus 2 to 3%.

Hey Deryk I agree

Plus foreign buyers tax.

I took a lot of flack a few years ago (around 2012) for saying that Victoria is Cheap. You could buy a brand new house in Sooke with a legal suite for under $300,000.00. I was told back then that “You can’t compare Victoria to Vancouver you know”.

(Of course my point was missed and I was not comparing Victoria to Vancouver. Only pointing out that Victoria would be heavily influenced by Vancouver’s high pricess….as has been proven to be the case and is still being influenced today.

Well…it still holds. Victoria is still much much cheaper than a house on the west side of Vancouver. (Cheaper by almost a couple of million dollars.)

Vancouver is ridiculously high because of money laundering. The big players, the people with money and power turn to crime in order to avoid governments who think it’s just Dandy to tax people to death and the result is that a ton of money needs to be laundered. Vancouver real estate is one of those places and the results spill out to everywhere else nearby.

Haha ….I’ll probably take more flack for that idea too but I think it is something to think about and I like to stir the pot a little so please forgive me 🙂

I’m sure that’s never been said before. You should familiarize yourself with literally ANY asset graph (stocks, commodities, bitcoin, LEOS VICTORIA HOUSING GRAPH) before making such claims.

I wonder if U.S. buyers are moving to Canada or using real estate as a safe place to store their money. Remember that million dollar property costs them $750,000 U.S. I can’t imagine all those people losing their homes to wild fires will be anxious to rebuild in a burnt out neighbourhood. I also wonder how easy is it for them to immigrate to Canada. The political turmoil that will persist after the election has turned off a lot of Americans, not to mention the civil unrest in the middle of major cities. Safe haven places like Victoria will be in high demand for years to come. Don’t expect any price reductions in the future, ever.

Q3 2018: 469 out of town buyers

Q3 2020: 719

I don’t have Q3 2019 handy at the moment.

Keep in mind that is 25% of record breaking months we’ve been having.