Is this forever? Another record month in Victoria

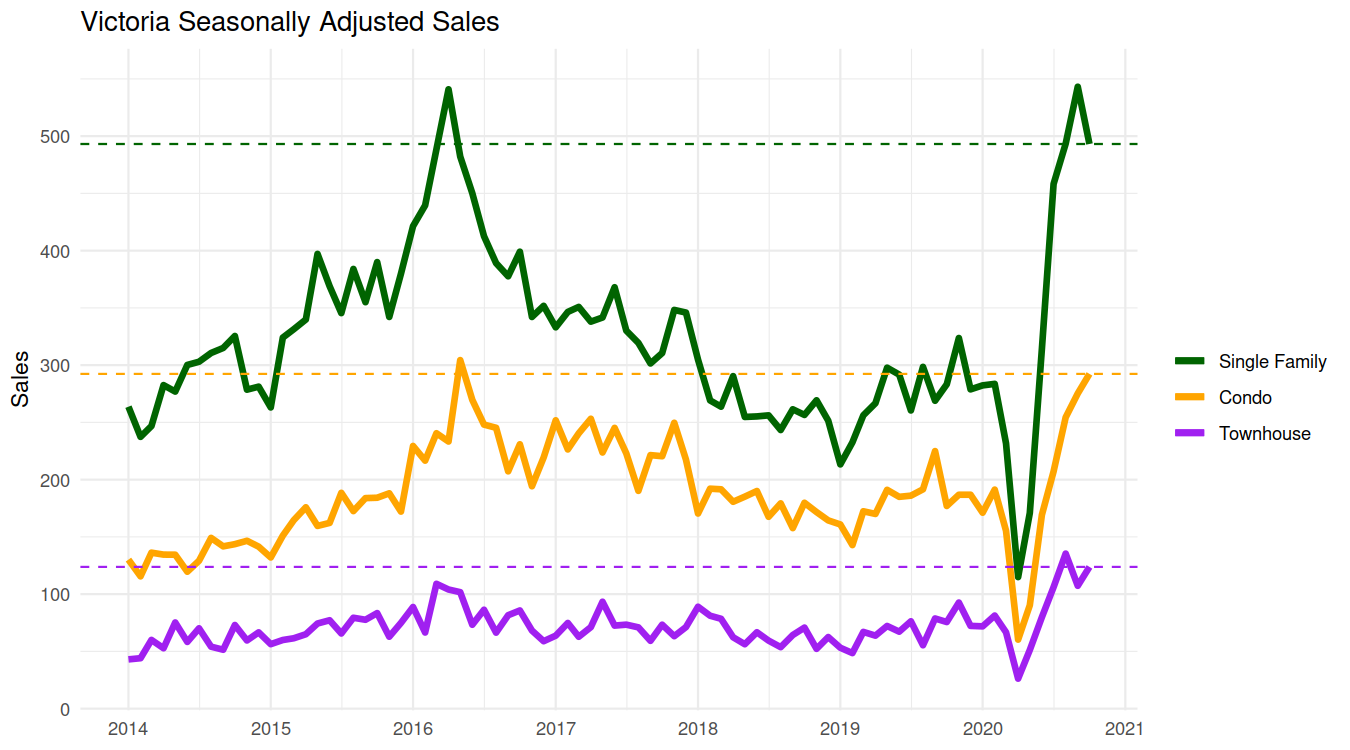

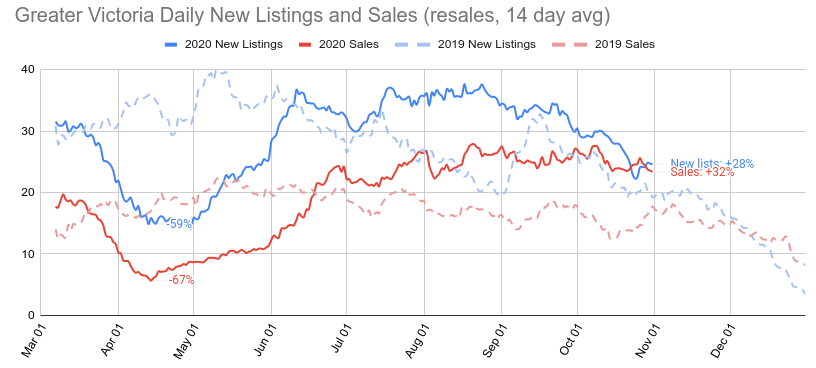

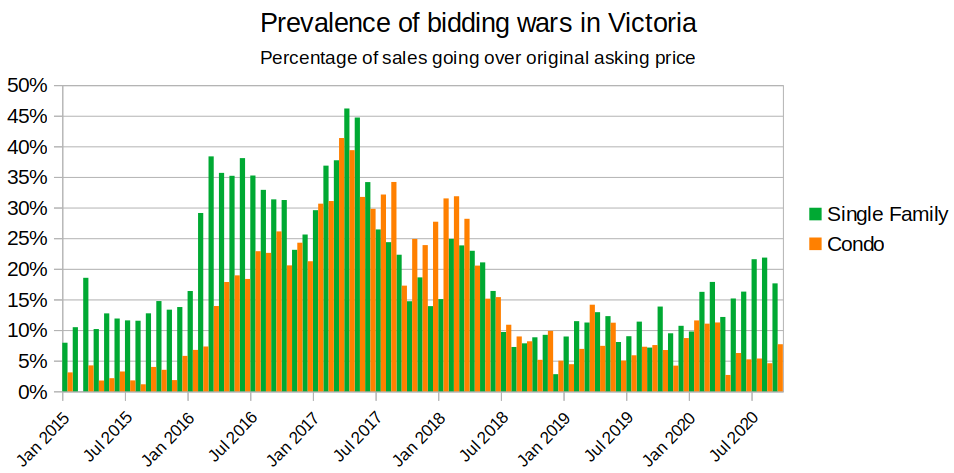

We’re on month four of record activity in the Victoria real estate market with sales up an astonishing 60% from last year. Although pent up demand from the spring is now likely exhausted, the resurgence of out of town buyers has driven sales to record levels again in October. Sales normally decline in October, but this year they stayed high, in fact October with 990 sales is the most sales we’ve had all year, which I hardly need to point out is highly unusual. Single family sales took a dip from September, but given the extremely limited inventory, I would not say that necessarily reflects a decrease in demand. There is simply so little inventory on the market that it is very likely limiting sales in that sector. One in four detached properties sold over ask.

Condo market strengthens substantially

The condo market is worth particular note this month. While it remains true that the condo market is substantially weaker than detached, it is no longer weak. All summer, sales were down compared to single family, and new listings high. In September and the first half of October, sales picked up, but new listings remained up by the same amount, so the market stayed in balance. However with both sales and new listings high, it’s like two adults on a seesaw: if one hops off things change rapidly. Well it seems that the person on the new listings side has gotten off in the last half of October, with sales continuing while new listings dropped off. For October, sales were up 63% over last year, while new listings were only up 43%. Prices are roughly stable and there is no uptick in over ask sales (7% in October), but this is something to watch as the market on this trajectory is heading towards price gains.

So far though, prices have remained roughly stable for condos. It’s a bit surprising to me that townhouses haven’t been appreciating more strongly either, despite sales being extremely high there with limited inventory. The 6 month median price of $567k is not much more than it was 2 years ago ($547k), very similar to the situation with condos. The October median was a high one though so perhaps it is just starting.

What is there to buy out there?

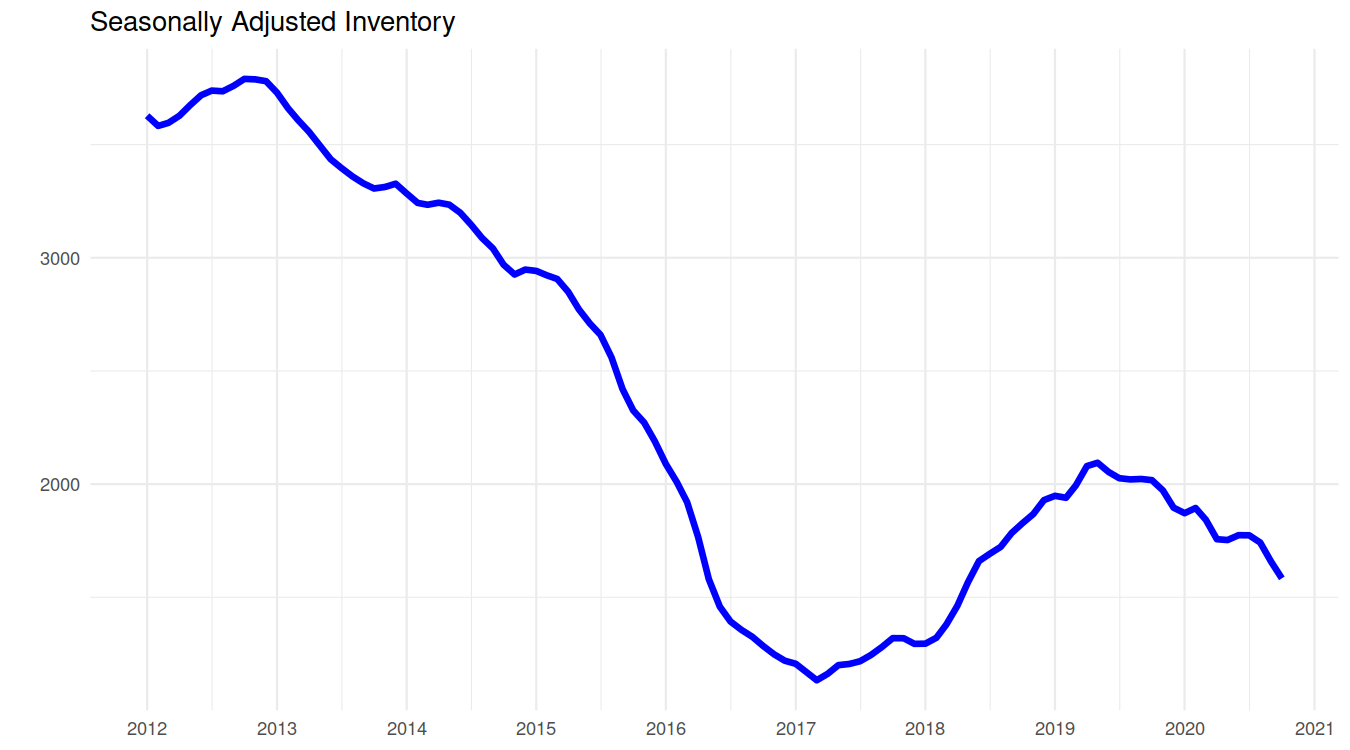

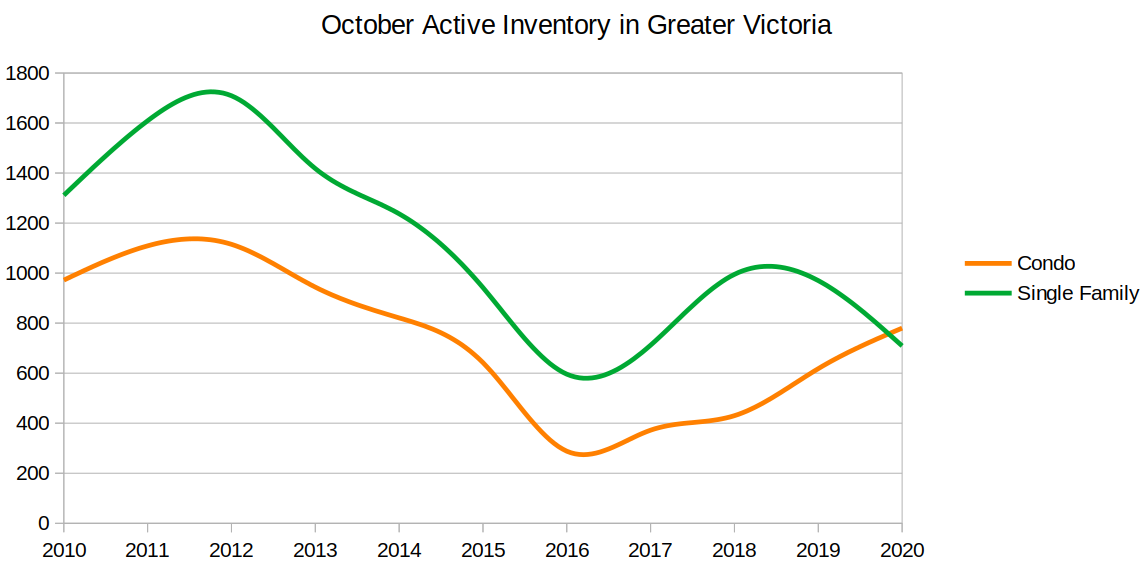

If you are looking for a house or townhouse, the answer to that is very little. When the market bounced off the bottom in 2013, there were nearly 4000 properties on the market to be chewed through before the selection got really grim. This time inventory barely hit 2000 before dropping again and with the pull back in new listings, inventory is now back to where we were in early 2018 and dropping.

For detached properties, the 709 active listings in October is second only to October 2016 when there were merely 596. Condo active listings meanwhile at 780 were 7% above the 10 year average.

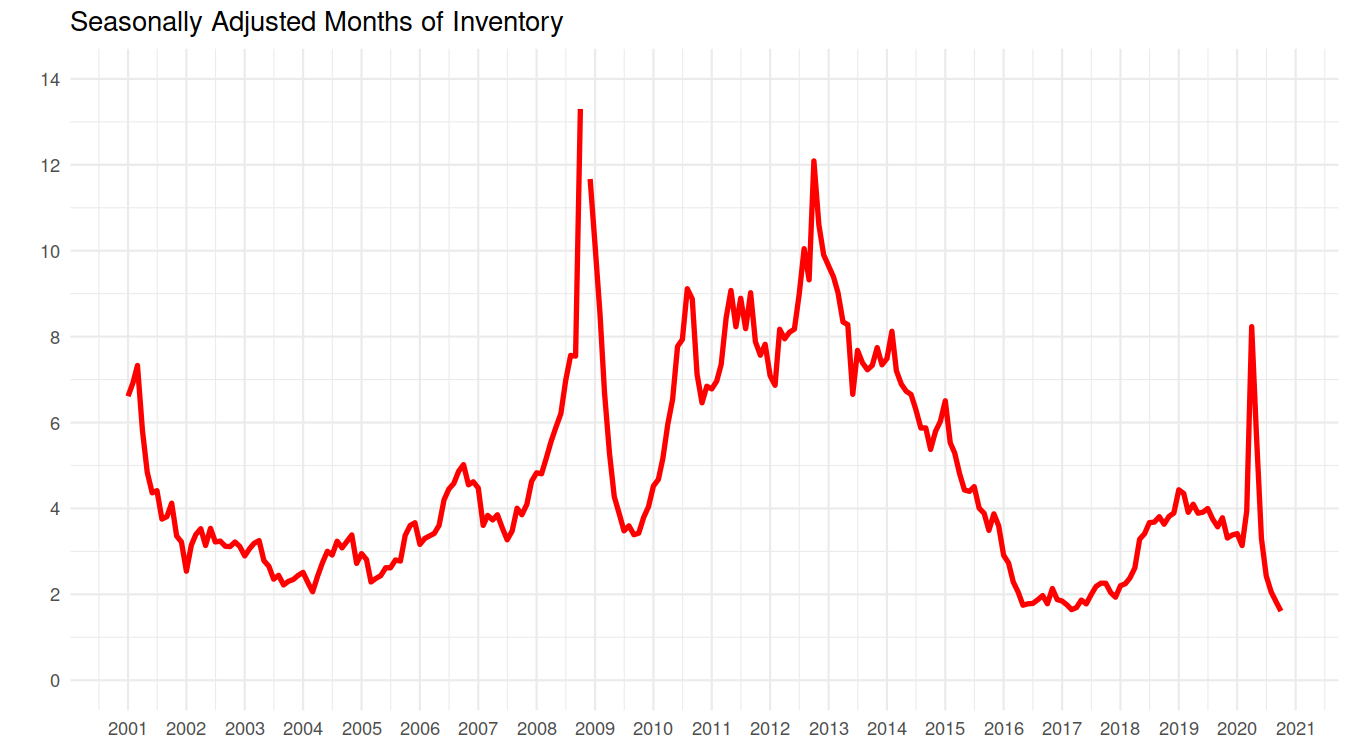

The low inventory combined with record or near record sales in most market segments has pushed the months of inventory down to record lows.

And we know what that usually means for prices.

What’s in store for the fall?

Daily sales are trending down now, and in a normal year both sales and new listings should be dropping gradually until the end of the year. That said I’m pretty sure that both November and December sales will still be up over last year. Last fall was pretty active, with November sales of 577 only 17% below the November record. With sales currently running 32% higher we may have another record coming.

So far we’ve seen the impact of powerful tailwinds on the market like an increase in out of town buyers and record low rates. However it’s too early to dismiss the headwinds that the COVID recession has created for real estate as well. A reduction in first time buyers as jobs are destroyed amongst younger people, an increase in business failures, soon to be increasing mortgage delinquencies, increasing affordability pressures from higher prices, and a reality check on the permanence of remote work amongst some who may have thought this is forever. All that will play out over the next one or two years and I think will take quite a bit of the wind out of our sails. However we went into this storm in a strong position, and for most of the market that has only increased. Especially for the detached market I can’t see the reversal being strong enough to turn the market to decreasing prices, but I don’t think we can project the current strength out that far either.

new post: https://househuntvictoria.ca/2020/11/09/market-volatility-not-over-a-closer-look-at-condos

KennyG- that’s correct if you assume I paid cash for the properties, which I didn’t. Also does not factor in the rent that I received to cover the mortgage and expenses. My initial investment of approximately $110,000, gives me a much higher rate of return. That’s the way one should look at a real estate investment.

‘

‘

‘

Of course most people calculate their rate of return leaving out real estate fees, transfer taxes, mortgage interest, legal fees and inspections, moving costs, renovations, etc…..

Ted, I see the government doing longer amortizations to keep their cash cow going.

12.25% to around 2.00% now – probably couldn’t have a better scenario for price appreciation & debt expansion . However, something other than interest rates & debt will have to drive the market now. Wages? Immigration? Longer amortizations?

KennyG- that’s correct if you assume I paid cash for the properties, which I didn’t. Also does not factor in the rent that I received to cover the mortgage and expenses. My initial investment of approximately $110,000, gives me a much higher rate of return. That’s the way one should look at a real estate investment.

“Bought my first investment property in 1989 for $122,000 in Cloverdale. Interest rate was 12.25%. Took possession in May, Tiananmen Square erupted in June, prices jumped $50,000 in that area. Sold the property 5 years later for $202,000 and bought in Victoria for $305,000. Price stagnated for 8 years with minimal appreciation, until increased activity around 2002. Today, $1,000,000 plus. Took 30 years, not exactly a get rich quick scheme. Also provided quality rental at reasonable rates.”

‘

‘

‘

Sounds about right at about 5% rate of return.

Bought my first investment property in 1989 for $122,000 in Cloverdale. Interest rate was 12.25%. Took possession in May, Tiananmen Square erupted in June, prices jumped $50,000 in that area. Sold the property 5 years later for $202,000 and bought in Victoria for $305,000. Price stagnated for 8 years with minimal appreciation, until increased activity around 2002. Today, $1,000,000 plus. Took 30 years, not exactly a get rich quick scheme. Also provided quality rental at reasonable rates.

From the CBC Archives:

When mortgage rates below 9 per cent were tempting to sign up for

https://www.cbc.ca/archives/when-mortgage-rates-below-9-per-cent-were-tempting-to-sign-up-for-1.5782055

Last two weeks relative to same weeks a year ago.

Single family detached new listings: Up 17%

Condo new listings: Up 77%

We haven’t seen the end of market volatility

Sales to list ratio below last year’s for the first time since end of August

The hits keep coming…

Alberta government demanding 4-per-cent salary rollback from civil service

https://www.cbc.ca/news/canada/edmonton/alberta-government-demanding-4-per-cent-salary-rollback-from-civil-service-1.5793131

https://financialpost.com/personal-finance/taxes/cra-cracking-down-on-abuse-of-principal-residence-exemptions-but-their-assessments-arent-written-in-stone

It’s still free for those who willing to work for it. The actual cost is $25 application fee plus GST and survey fee for a maximum of 65 hectares (160 acres).

https://yukon.ca/sites/yukon.ca/files/emr/emr-agriculture-land-applications-information-sheet.pdf

Hmmm… Prairie…Was that from last week? Lol. I think it would take many more acres for people to be willing to accept the requirement of being a degenerate Roughriders fan.

How does it break down? Still an imbalance towards condos, or is it up across all types of inventory?

Free 160 acres. Those were the days

This would be so much easier if they just made a global cap. Everyone gets $500k or gains tax free and then it’s taxed. https://financialpost.com/personal-finance/taxes/cra-cracking-down-on-abuse-of-principal-residence-exemptions-but-their-assessments-arent-written-in-stone/wcm/08f78ae1-6e96-40dc-9024-8b5adcf06897/amp/?utm_term=Autofeed&utm_medium=Social&utm_source=Twitter&__twitter_impression=true

Victoria employment essentially unchanged in October from September. Down by 4600 people from last October.

Nice to see a bit of a listings bounce

We may just grow out of the house/property in 2+ years prompting a move in Victoria or perhaps up island or out of country. Not sure lots of options. Depending on the market we would consider keeping the house and renting it as it has options for multiple suites, or we just sell if we get a good offer. In the meantime the property has a lot of potential for adding square footage and updated.

The point is the time was perfect for us to buy even tho the market was the worst possible.

Leo. Great post again. Consistently excellent content in this blog. Gibberish data made meaningful. Also enjoying the many unpaid entertainers in the comments section. A good lunchtime read, although infuriating at times.

I frequently have to remind myself that this is the “Victoria” housing blog, and as such, is about as representative of Canada as Waikiki would be to the USA.

B.C. real estate agents asked to suspend open houses to protect clients from COVID 19

https://www.cbc.ca/news/canada/british-columbia/b-c-real-estate-agents-asked-to-suspend-open-houses-to-protect-clients-from-covid-19-1.5791492

Follow Sam Cooper for updates on the Cullen Commission

$101,915.14 in tax-free appreciation on a 600k home not counting your principal paydown after four years. How do you get that transaction costs wipe out your gains? You can take the surplus appreciation and principal paydown and apply it to the next down payment, reducing the buy-in costs if this makes you more comfortable.

Hey any tips on how to pick a realtor for a purchase out of town?

But that means you’re buying for the long run. Someone buying for the short run is making a much riskier bet on appreciation versus transaction costs.

You need to do the long-term math for each transaction. If you are moving from a so-so 600k house to a nice 900k house and each house appreciates at 4% per year you make up the difference in four years in additional appreciation

‘

‘

‘

A nice 900K home, that’s pretty funny in Victoria, maybe back in 2008. Actually if you move after 4 years from 600K home you most likely wipe out any equity gains you may made, assuming the market grows at normal rate of return. But lets say you move to the 900K home and make more gains, the only way to access those gains apart from a reverse mortgage is to downsize and pay the 50K min again.

Often true, but it depends – you are failing to account for appreciation in your analysis. And I know appreciation is not a guarantee, but it is a pretty good bet in our market if you can stay put through a downturn.

You need to do the long-term math for each transaction. If you are moving from a so-so 600k house to a nice 900k house and each house appreciates at 4% per year you make up the difference in four years in additional appreciation and gain a home that may be easier to sell in a buyer’s market and much better for your family to live in. In this market you definitely don’t need a realtor to sell so you could easily save yourself 15-20k on that. This takes your payback time to about 1.5 years and after that you pull ahead exponentially in tax free gains.

Staying put in a single home has many advantages, but it is not always the best financial move.

“but it’s not our dream house far from it. Just something we could make work for 2-5 years and build equity while planning our next move. Better than renting”

‘

‘

‘

at a min cost of $50,000 to move between land transfer taxes, real estate fees, inspection, lawyer etc.. it’s really not smart to move every few years. Think about this for a minute, instead of moving 2 times over 20 years save that 100K and watch it compound to 300 to 400K over 20 to 30 years, same thing with new cars on a new car you immediately throw 6K away on taxes on 40K car, then watch it depreciate 15K over the next 3 years at a minimum. By minimizing these types of unnecessary expenses you cold easily have 500K with compound interest over 30 years which would then generate you 30 -40K year in retirement. It’s really that simple.

People definitely are the problem. And yes…. I’m sure they will not give up their flight to the beaches in far off lands or they will have live in mega homes.

I’ve also met so many people who do an amazing job of living relatively lightly on the planet. I generally always feel guilty and know I could do better. We do what we can. I believe that going electric is one of the best changes we can make.

Perhaps the public would feel a little more motivated to lift a finger if governments didn’t approve $40-billion LNG export projects while professing to care about the climate.

Governments are basically saying, “We’re gonna dramatically crank up emissions to make a fast buck, but gosh we’d like to meet our emissions targets — so, everyone, please turn your thermostat down three notches and ride your bike more, k?”

I’ve heard the “personal lifestyle tweaks will do the trick” argument a lot. But the reality is that corporations have spent millions over decades to control, delay, or block climate-motivated policy precisely because they understand that, as the biggest contributor to climate change, they will be targeted.

To: Ummm…really?

We felt the exact same way.

Eventually we started looking at overpriced places that had sat on the market, then we made them a solid low offer. Eventually one accepted, we only had about 3 choices….. we are happy because we will not be renovicted or saleovicted, but it’s not our dream house far from it. Just something we could make work for 2-5 years and build equity while planning our next move. Better than renting

Yup. Advocacy is good and can lead to change, but in the end the only solution is via technology that will decarbonize our economy and simply be the better choice regardless of environment. Most people should not be expected to change voluntarily. It will shift when the replacements are better, and we are basically there right now on many fronts. Shaming people into adopting something they don’t want to adopt always backfires.

Interesting article on crime in Victoria, but the focus on the 2019 increase misses some perspective. https://www.capitaldaily.ca/news/crime-police-victoria-vancouver-island-saanich-oak-bay

The same can be said for electric car drivers. I would bet a lot of money that the current electric car driver on the lifestyle whole impacts the environment more negatively that someone driving a Toyota Echo, for example.

When I bought my Tesla 5 yrs ago I went to a few meetups and the owners were so nauseating to listen to…..all this talk about saving the environment as they drove back to their 5,000 sq/ft homes….give me a break.

People spin the narrative that bests suits them and I lot of things that are really beneficial to the environment like not having kids, not havings pets (you know your bags of dog food have to be shipped), living in a condo (I am using 10% of the electricity I was using in my SFH), etc. are just not popular so people buy an electric car and recycle some cans to make themselves feel better.

Seriously who is going to skip the yearly (post covid) vacay to Hawaii or Mexico because of the environment.

“It sure would be nice if we could solve climate change without lifting a finger ourselves.”

Yes…that’s so true. I drive an electric car. I am always amazed to see hundreds of gas cars, parked every which way, where people have arrived to protest an oil pipeline.

The best way to stop a pipeline is to stop using oil.

The same people trying to stop pipelines often also launch into stories about their trip to Europe to see a soccer match or to see castles. In some ways it’s funny as hell.

And…..Please….. don’t tell me your car is quite small, so it’s ok. No excuses. I’ve heard them all:)

I challenge people to put their money where their mouth’s are and change the world.

For sure this would be an appropriate place for 3br family oriented apartments.

Outside of that, I have heard that requiring developers to include 3br condos has not been very successful at providing family accommodation. They end up being occupied by groups of working singles who can outbid families.

Are out of town Canadians going to Victoria required to isolate on arrival.?

I am guessing that was the Colville Rd. listing that popped up this week. I saw it come up and was “hmmm maybe”… But then, I thought… ” there’s no point even to ask about it”. It was frustrating the last few months to watch listings come on and go quickly over ask, but now there isn’t even listings to consider and anything that’s not terrible gets a lot of attention. It looks like it’s time to pack up the money and just wait for some sort of viable inventory to arrive… maybe… Too bad my work ties me to Victoria. I have been exploring the up island options, but not knowing what post covid work from home looks like, makes it a tough call to depart the area. It appears the post covid work balance decision is getting kicked down the road from January to later 2021 or possibly 2022 and it is really hampering any planning process. I guess that all fits under the phrase..”sounds like 1st world problems” because in the end if it doesn’t work out, the savings just keep building and there’s only a lifestyle inconvenience from cramped quarters and a lack of a yard.

Still a straw man. Not actively preventing people from owning is completely different from saying it is a right to own in the core (which of course it isn’t).

It sure would be nice if we could solve climate change without lifting a finger ourselves. Unfortunately it won’t happen. I’ve heard the “It’s not me it’s the big evil corporations” argument a lot. But the reality is the corporations only pollute because of consumer demand from me and you.

Thank you….complete waste of time. I wish they never come back, wishful thinking.

Open houses being cancelled again due to rising case counts

I agree with introvert in that people need to stop complaining. If you want a SFH so badly just move. You don’t even have to move that far, jsut 70 km to Crofton?

At the same time I am pro-development. I really think there should be a blanket rezone to R2 with 5′ offset on each side. That would allow for two 20′ wide duplexes on a 50′ lot. 1,800 sq/ft each side with 3 beds up and a nice little yard…what else does one need?

It is either that or a 3,500 sq/ft mini mansion as Leo points out.

+1, North American culture…..a couple with children will heavily lean towards a SFH on a tiny lot in Langford or Sooke versus a two or three bed condo in the core next to a playground. Therefore, developers just don’t build 3 beds.

I grew up in a one bedroom condo before we moved to Canada, loved it. I would meet all my friends outside and we would play in the park next to the apartment towers. Mind you things are different in Croatia…..I was going outside by myself at age five.

Again, not sure that we should be striving to elevate owning RE in the core of Victoria to the level of basic human right.

As for climate, inefficient ’70s Gordon Head boxes aren’t contributing diddly-squat to emissions in Mediterranean-climate Victoria. And as for the emissions coming from people forced to commute from Langford because the core isn’t dense enough, let’s go ahead and tackle that right after we cancel $40-billion LNG megaprojects, OK?

After contacting the listing agent about not being able to find a 15 minute slot before Sunday to show a home in the showing schedule….delayed offer property in the core.

“I have had over 75 appointments in the last two days on thIs listing!

Maybe, but this would potentially be for affordable/subsidized rentals of which there is most definitely a shortage and no affordable land unless it is donated by the government. I don’t think we have to accept the stigma. We lived in family housing at UVic and many families were in the apartments there. Great community and set-up with playgrounds and a daycare on site. When we moved to a house we all missed it and the community.

Fair point. However I feel there is an important difference between wanting to restrict what others do, and wanting to be less restrictive of what others do. Some of this is because of self interest, I would like my kids to have a chance to live in Victoria in something other than a condo even if they don’t end up in the top quartile (or decile at that point) of wealth.

Also it is more equitable, more socially just, and more climate friendly not to restrict most of our land only to the wealthy living in energy inefficient housing and car-dependent neighbourhoods. Because I value those things, zoning reform is something I support as well.

That’s the market speaking. A developer can make more money selling the same floor space as 3 x 1br, or 1br + 2br.

I really don’t think putting families in apartments is needed in a metro of only 400K. The stigma against raising children in apartments may be unfair, but it exists.

I wonder if this hot market is why 2290 Estevan Avenue sold? It was on the market for years and I always thought it was overpriced for a semi-detached. Did it sell for under asking, anyone know?

As you (and I) have said, most homeowners are NIMBYs, so this sentiment obviously occurs to a lot of people.

+100

Introvert have you seen the pace of development there? Not a good choice for you. I repeat my earlier suggestion of Tahsis. Woss would also be a good possibility if you want to be close to the highway and great skiing.

So you wouldn’t feel entitled to (try to) stop it, but you do feel entitled to encourage it? What’s the diff?

Change is hard. I read the Fairfield Neighbourhood Plan and thought it had a lot of good ideas for smart densification and retention of existing rentals: https://www.victoria.ca/assets/Departments/Planning~Development/Community~Planning/Local~Area~Planning/Fairfield~Gonzales/Fairfield_NP_Final-web.pdf

I also don’t mind living in a neighbourhood with more infill and missing middle housing. It is good to have integrated walkable neighbourhoods in core areas for environmental, affordability, and social reasons. I think those that currently own SFHs in areas that might be impacted by this have options because their property values will likely increase at a greater rate and, as Leo says, you don’t get the right to control development by owning a home – except via vote for your municipal leaders.

That said, Barrister has a point when he looks at what is going on in downtown Victoria. With greater density and servicing around core areas come greater noise/homeless/social issues. I personally avoid going downtown and have for years. I now also avoid the Beacon Hill Park area which we used to love. If we don’t tackle homelessness and addiction effectively as a society my concern is that densification will create less livable neighbourhoods.

Finally, I also disagree that families can’t be raised in apartments. Works successfully all around the world. The problem is the type of existing apartments we have are not built for families ie. three bedrooms, adjacent to playgrounds, and with enough sound-proofing and other amenities.

The market will do that. Jobs attract workers who will create a market for housing and services.

Putting the cart before the horse is the sort of thing they did in the USSR.

Some might find this link interesting. It’s about people moving to the suburbs after the war. (Ideas do change back and forth and we might just be witnessing a new trend in where people choose to live. Nothing stays the same.) https://oxfordre.com/americanhistory/view/10.1093/acrefore/9780199329175.001.0001/acrefore-9780199329175-e-64

Demand always equals supply at market price. Demand is the quantity demanded at a given price. Supply is the quantity supplied at a given price. These are the only objective definitions.

Forcing a second rate lifestyle is what happens when you don’t build missing middle housing. Young people can live in apartments and condos, but once they have a family they will be forced to either stay in those condos or move away, because the single family homes are out of reach. If we open it up and allow ground oriented homes suitable for families in all single family areas, it will allow more young families to stay in the city. Of course if they want to move to smaller centres they are free to, but the last 100 years of population migration tells us people prefer cities.

I think most owners are NIMBYs. No one likes change, a human tendency.

Here’s why I want zoning reform:

1. I don’t consider mixed neighbourhoods with missing middle housing worse, I consider them better. Single family neighbourhoods are alright too, but they will be hollowed out of ordinary families over time and replaced with only the wealthiest, who will tear down the ordinary homes and replace them with fenced off mansions. Missing middle housing allows the neighbourhoods to retain the character they have now, or even diversify more. Never mind that they are more walkable and more climate friendly.

2. Controlling what others can come into your neighbourhood seems incredibly entitled. We bought this house because we like it, that doesn’t give us control over what gets developed around us. It wouldn’t bother me if more townhouses, fourplexes, or lowrises started appearing in my area at all, but even if it did, I wouldn’t feel entitled to stop it. Let’s say in 30 years it’s too busy for me where I live, I would just move to somewhere quieter. It would never occur to me that the neighbourhood would freeze in time the minute I moved into it.

No one is saying single family owners can’t enjoy their homes and neighbourhoods. The only thing that zoning reform to allow missing middle does is to give others the option of living there too. It doesn’t take anything away from those that live in single family homes.

Average down 4.1% from September, up 15.8% from last October.

Median up 1.7% from September, up 11.3% from last October

Benchmark up 0.3% from September, up 4.9% from last October.

Leo- Any change in average single family home prices for October? Thanks.

Off topic, shocked to see a possibility that Trump will win again.

MJ: Ba Economics (Harvard) LLB Osgoode, DJ; UofT. and for those that enjoy condos, townhouses, etc. perhaps consider Vancouver or Toronto.

But return to your eco 101 and start to question the demand side of the curve in a country that has virtually no natural population increase. Then question whether ever increasing density in a handful of cities is the best way to go . Anyway it is not an argument that I want to restart so I will concede that high density is really required to keep developer in extra millions so they can afford the private jets and yatchs.

You may call it a second rate life style, but others enjoy living in condos, townhouses and duplexes. Bsc in Econ for me, but I did enjoy the comment, it made me chuckle. My guess is a BA English for you or was that Introvert? 🙂 Anyways I have said my piece, back to lurking on the blog and filtering for Marko, Leo’s and Totoro’s comments.

Best way to follow the election: https://www.macleans.ca/politics/u-s-election-2020-the-most-relaxing-way-to-watch-the-results/

There is always the other option of creating new small towns with solid economic bases rather than this drive for increased density. Why are we forcing a second rate life style on the younger generation. They deserve better.

Part of the problem is that people seem to have never got any further than Eco 101.

True. But I’m also against density because it has downsides unrelated to money.

I just think folks should reacquaint themselves with reality: some neighbourhoods are out of reach for some. And that’s OK, because there are other places to live and buy a house.

I don’t think diversifying my investments will change how I feel about this, because my feelings on this aren’t solely governed by financial considerations.

Fair point. I admit to being contradictory in certain ways. A foolish consistency is the hobgoblin of little minds!

Introvert, we don’t know what will happen in the future, but we can try to improve the situation now by building more housing. We could argue about this back and forth, but at the end of the day it comes down to the NIMBY attitude. I think your real intention is the fact that you bought a home in Gordon Head and want to see that investment go up in value. I get it, I own two houses myself, but I don’t want to see people struggle and resent home owners, this leads to populism. I would suggest instead of paying off your home aggressively, you start diversifying your investments a bit, so you don’t have that “I got mine” attitude. I know you said that you don’t feel buying equities is a moral way of earning money, but it doesn’t feel like you are taking the moral high ground.

“Why are you surprised? Aren’t a majority of homeowners in the core NIMBYs?”

I always assumed that NIMBYs are a small but vocal minority.

Demand will always outstrip supply, in the long run, in places like Victoria. And were we to achieve low(er) prices for a spell, that would likely cause even more people to pile into the market, causing prices to rise again. Then we’d have to densify some more — and on and on it will go — and our neighbourhoods will get better and better and better until our heads explode.

Why are you surprised? Aren’t a majority of homeowners in the core NIMBYs?

First let’s fill up Colwood and Langford with houses squished as close together as possible (isn’t that density awesome!), and then we’ll talk about densifying every neighbourhood in the core. Hopefully the former will take another 20 or 30 years and core homeowners can keep running out the clock.

“The other thing is that densifying neighbourhoods isn’t a permanent solution. It’s, at best, a temporary fix that will last only until more people want to live and buy in Victoria and then, lo and behold, we’ll be in ANOTHER HOUSING CRISIS!!! And guess what the proposed solution will be.”

It’s been painful reading your comments on this blog for sometime, but sure i’ll bite. So your belief is that building more permanent housing will create another housing crisis? The exact opposite direction our municipality took for the past 30 years that led us to a housing crisis? If Econ 101 has taught me anything is that more supply needs to keep up with demand to keep prices low.

1) I am a millennial

2) I didn’t try to densify pleasant SF neighbouhoods as the way to get myself in

And calling me a NIMBY isn’t insulting. I’m a proud NIMBY! (And the world’s only thirty-something NIMBY 🙂 )

“So we’ll be worsifying neighbourhoods and not solving any of the problems some have set out to solve.”

What I don’t understand is why you would buy a house in the core of a growing city if you are that opposed to density? We’re not going to stop growing, and since there is a limited land base, that growth is going to be accommodated by increased density.

100%.

Cue the calls for me to move to Port Renfrew… (and not argue the issue in good faith).

Densifying=worsifying, good explanation of your position.

The other thing is that densifying neighbourhoods isn’t a permanent solution. It’s, at best, a temporary fix that will last only until more people want to live and buy in Victoria and then, lo and behold, we’ll be in ANOTHER HOUSING CRISIS!!! And guess what the proposed solution will be.

So we’ll be worsifying neighbourhoods and not solving any of the problems some have set out to solve.

I love it Introvert, I got mine, but lets make sure you don’t get yours. You are quite the NIMBY 🙂 . You are every millennial/Gen Z worst nightmare.

Maybe. But many people clearly love core neighbourhoods featuring mainly SFHs. Hence people paying minimum $1.3M for houses in low-density Oak Bay.

How about we let the density-lovers enjoy their more-dense locations like Cook St Village and the new subdivisions in Langford, and how about we let the lower-density-lovers enjoy Oak Bay, much of Saanich, etc.?

People who can’t afford to buy expensive cars aren’t trying to alter reality by lobbying governments to force luxury car makers to lower prices.

But that’s what’s happening with SFHs and “affordable housing” in Victoria.

Look, nice places are expensive. Victoria is a nice place. Can’t afford to buy here? The world’s second largest country is open to you, and RE in the vast majority of it is super duper affordable. Off you go!

“If owning a SFH is a priority for you, and you can’t afford to buy in Victoria, then buy somewhere that you can afford rather than trying to densify (= worsify) existing SFH neighbouhoods in Victoria. Or, buy a townhome. Or, buy a condo. Or, rent.”

Did density worsify places like Kerrisdale or Cook Street Village? I feel like quality of life in neighbourhoods with a mix of housing types and land uses is higher than in neighbourhoods that are just row after row of single family houses.

If owning a SFH is a priority for you, and you can’t afford to buy in Victoria, then buy somewhere that you can afford rather than trying to densify (= worsify) existing SFH neighbouhoods in Victoria. Or, buy a townhome. Or, buy a condo. Or, rent.

There’s a reason why Oak Bay doesn’t densify: it sucks.

Retiring buyers are likely to stay put for the next 15-20 years, unlike younger buyers who will move 5-7 times. Pulled forward demand can have long-lasting effects on smaller markets I’d think when people settle for that long. Plus isn’t the current retirement cohort 55 plus a large demographic group?

You can still find a new build in ex. Parksville/Qualicum if you want a 5000 square foot lot with a 1500 square foot house right next to your neighbour, so the new homes are not interchangeable with existing at the same price point and there are only so many on the market. If you are talking about SFHs in Saanich, Fairfield and Oak Bay for example, demand pulled forward creates low inventory pretty quickly. This leaves a lot of people waiting for inventory to catch up for a long time.

Also, some of these buyers may have decided to retire up island because of the increase in prices in Victoria or because the island is now seen as a bit of a safe haven to those in other parts of Canada, this can also create new demand. We were not considering Nanoose until prices escalated and we’d experienced how competitive the market was. I think this happens to a lot of people once they see their options shrink.

“Really no good options other than sell and buy quick”

This is what I’m saying. When you sell in a hot market, you have a short window to buy back in. I don’t enjoy stress and I wouldn’t have been able to sleep if we sold and then rented while waiting for the “right” property. Better to buy something you can live with (and afford), and then work at improving it.

Fair enough. Negative outcome less negative when you sell first

Not sure I would say this is a reasonable option with everything going on. For example, your best offer might be conditional then it collapses on conditions, then you take another conditonal offer while timing is ticking to complete on the other property.

What if a buried oil tank or something out of the blue is discovered during course of sale.

Personally I would way rather sell first with a long completion and take the risk I might have to rent if a subsequent purchase cannot be secured.

Sounds good. Let’s reduce the land reserved for single family homes from ~80% to perhaps 25% which matches the percentage of highest earners that can still afford one.

Just gonna keep banging that drum 🙂

This is a reasonable option if you have an in-demand property yourself. Worst case you sell for a few thousand under market to accelerate the sale.

Not such a great option if you have something tough to sell or if you have no buffer to reduce price to get the sale done.

“but mostly it is that we are on the low end for a SFH in Victoria so extra competition, and inventory is just way too low up island, lower than here for the demand”

I was surprised to see places going $80-90,000 over ask in the Duncan area. I don’t put too much stock in individual assessments, but paying 30 or 40% over assessed would have made me very nervous in a market I’m not familiar with. Different labour market, and who knows where wfh is going to go in the future.

The house we were successful on in Victoria was originally listed too high and then the price dropped. There were some bumps along the way, but we were able to successfully offer under ask.

I have also heard about the bump in out of town buyers. Saw my fair share of out-of-province license plates during showings too. Seemed be mostly young couples out there, although that would make sense at our price point.

This makes a lot of sense. If you’re 1, 2, 3 years from retirement and suddenly the world shifts and you have to re-learn how to do your job remotely why not just pull the plug a bit early and save yourself the grief. Of course in that case it’s just pulling demand forward, not creating new demand.

I’m tired of hearing about it too, but not for the same reasons as you.

“Affordable housing” is a terrible term. By “housing,” I think they mean “everything” — rentals (of all kinds), condos, townhomes, duplexes, SFHs, etc.

But let’s be honest and admit that SFHs in Victoria aren’t ever again going to be affordable to average-earning people. That ship has sailed, and it’s way out in the deep ocean at this point.

So let’s stop including ownership of SFHs in our discussions of “affordable housing.” Because to me it sounds similar to people hypothetically wanting to solve the affordability crisis of BMW cars. Everyone doesn’t need to own a BMW. But everyone should be able to afford a vehicle of some sort.

You kind of have to sell thought….what are you other options?

i/ Make offers subject to the sale of your property…..good luck with that in this market.

ii/ Buy a property first and then hope to sell in the meantime? No thanks, good way to die from stress.

iii/ Buy with approved bridge financing and then sell? Also, too much stress imo.

iv/ Sell your property with a seller subject to finding a property? Good luck getting top dollar for your sale with a seller subject.

Etc., etc.

Really no good options other than sell and buy quick.

Or you are ridiculously rich and it just doesn’t matter and you can buy and sell whenever for whatever.

We’ve been actively looking for a place since July. That is four months now. Yes, we have criteria that rule out many places and no urgency other than rising prices, but mostly it is that we are on the low end for a SFH in Victoria so extra competition, and inventory is just way too low up island, lower than here for the demand. I’ve heard from a number of listing realtors and our banker that they have been inundated with buyers from Vancouver, other provinces, and from those that were close to retirement and decided to pull the plug earlier due to covid and buy their retirement home.

Can’t blame them. Salaries are top notch, job security, impossible to get fired, organization is a monopoly (it is not like you can go elsewhere for a building permit) so who cares. The more stuff you send back and more challenging you make the process of permits for owners/developers/builders the better your personal job security and you can’t fight human nature.

The thing about it being so ridiculously difficult to build is it reduces competition so it isn’t the end of the world for the builders that can remain in the business. There is very little new product to compete against. That being said policies will squeeze out the small builders eventually. For example, if you run a small operation you physically have to take a weeks worth of educational courses per year. A big builder with 50 employed sends one representative. A big builder can also take a person or two just to deal with the pile of paperwork. Small time builder dealing with huge amounts of paperwork takes him or her off the construction site and many small builders keep costs low by doing a lot of the work themselves. It is only a matter of time before GableCraft, Verity, Limona, a couple of others are building 95%+ of SFH product.

That should be Victoria and Vancouver Island’s new motto.

Maddening.

Now consider that you are building the simplest possible housing to get approved: Single family housing in single family zoning.

Now you want to build a duplex or a couple townhouses so take all those barriers and add rezoning process + fighting NIMBYs and it becomes exponentially harder.

No offence to any municipal staff, lots of great people there, but the issue is simply compounding bikeshedding. All the incentives are stacked towards adding comments and sending things back to the developer for review. If you’re an engineer reviewing drawings, then it is in your interest to be spotting errors and omissions and being thorough. What is entirely missing is KPIs around approval time. One of my top suggestions to the housing task force is to publish approval time data to the public so that the city and council can be held accountable, and then set targets around how those approval times will be reduced. Proper buy-in to that would allow engineers to justify only sending back drawings for major issues, not minor ones.

“Making housing affordable Wish the different levels of government and bureaucracy would just come out and say they make housing unaffordable and call it a day.”

Sounds frustrating, but to be fair, infill single family homes in the City of Victoria are probably not going to contribute much to affordability. It’s condo alternatives/SFD alternatives that are desperately needed.

“When Victoria RE is hot like this, you gotta sell your place, cram your extra crap into storage, and rent until you find the property you wanna buy. Annoying AF, but it allows you to be nimble and make clean offers that are more likely to be accepted.”

In a market where prices are rising by $10-15,000 per month this seems risky to me. We recently sold and bought back into the market, and it felt like we were weeks away from being priced out of the core. We were being outbid by up to $50,000 on properties as far away as Duncan. As others have said, it is crazy out there right now. I don’t really see it abating either.

Don’t ever sell your house. That’s my advice.

Marko: The city actually fails at its real goal of making things absolutely impossible and that they are simply settling for making it unaffordable.

I was thinking more along the lines from 2016/2017 to now.

One of our small projects (1,700 sq/ft SFH super basic no suite) right now in the City of Victoria.

First wanted to take out a 8′ basement (old street, services not deep and didn’t want to deal with pumps for storm, etc.) and replace with 3′ crawl space with ZERO above grade changes. This required a DP…..two months later we get a letter back

“stamped “Final Approved”

and is for the following only:

To change the basement to a crawlspace.”

Now onto the building permit. After several attempts application is finally accepted.

On their website it says 20 business days after application is accepted…..20 business days comes and goes and I send an email and I get a reply of

“While 20 business days is what we strive for, it’s not always a guarantee. Parks is still reviewing, and once they have completed their review we will email you with comments.”

Finally we get the review back

“Please review the attached PDF which contains important information regarding the review and identifies issues that need to be addressed prior to issuance of the permit.”

Building, Parks, Engineering all have comments…..along the lines of we need to see on the drawings where the hose bibs will be 🙂

Etc.., so now back to designer to address all these concerns, pay another invoice, wait a month for the COV to review again, get more comments back likely, re-submit, so yea hoping to be able to put a shovel in the ground 6 to 8 months from a purchase of a vacant lot for a small SFH build.

Making housing affordable 🙂 Wish the different levels of government and bureaucracy would just come out and say they make housing unaffordable and call it a day.

When Victoria RE is hot like this, you gotta sell your place, cram your extra crap into storage, and rent until you find the property you wanna buy. Annoying AF, but it allows you to be nimble and make clean offers that are more likely to be accepted.

Or use a service like properly.ca

Marko, am I wrong? What would you suggest?

Marko I suspect is spot on with the observation that properties that where 1.6 just last year are now going for well over 2 mil. My wife and I were just talking about that the other day.

And I have people that contact me every week that want to make offers subject to the sale of their properties 🙂

Part of the explosion of 2+ mill sales is what use to be $1.6 is now north of $2 million but none the less a staggering number.

Sorry went for young wife instead of kids.

Do you have any daughters Barrister?

If I hear of anyone thinking of selling I will let you know. I do know of a couple of older fold who have been thinking about but are still mulling it over.

You might suggest to your kids to marry rich, marriages based on wealth often seem to work better than the ones based on love. I am sure that most would disagree buy not my experience.

Thanks Barrister. We are looking for a SFH over 2000 square feet up to 1.3 million in Saanich, OB, or Fairfield locally – and then outside town from Mill Bay to Qualicum Bay, excluding all islands, Duncan and Nanaimo. Up island it would be to replace a vacation home we sold this year, locally it would be to rent out until our children are at the stage where they are starting a family and looking to buy – but are priced out as they already would be. Despite our market being so broad, our price point doesn’t seem to make us competitive against out of town buyers. I think it is very hard to be a first-time buyer in this market at a lower price point than ours and moving up island does not make it easier at the moment as far as I can tell. This is the house we recently bid over ask on and which sold for 925k no conditions: https://www.point2homes.com/CA/Home-For-Sale/BC/Vancouver-Island/1322-Marina-Way/98012948.html Listed at 854k and assessed at only 622k. This house is renovated and in excellent condition, but we have offered on houses that need work as well with the same result – too many buyers for each segment of the SFH market for the inventory available and places that have good locations going to the highest over ask bidder.

Totoro what are you looking for by the way in case I hear of someone thinking of selling.

The roof is custom cut slate and is being imported along with the labour. Fortunately the government is coverings two thirds of the cost. Still with Covid the delays are maybe less pressing with all the lockdowns.

If the extra profit is worth it to you, sell now (taking advantage of the hot luxury market), put your stuff in storage, and rent something until your new place is finished.

We are still actively looking and can confirm the market is crazy right now. All houses being sold with a set date/time for offers to be received so you have to be the highest with short condition removal time. We recently offered over ask and were outbid by someone else offering 75k over no conditions. The house itself was listed 200k over BC Assessment value.

Ah ok. Makes sense.

Reminds me of a job my dad did 25 years ago. It was cheaper for the builders in Switzerland to fly him in from Canada and pay his way to install the windows he built than to hire local carpenters to do it at local wages.

LeoS We are fixing the new place that we are moving to not the house that we are in. Because it is a restoration there is a lot of custom work being done.

Why go through all that grief before selling?

I am hoping that the market is still this good when we finally put our place up for sale. I am getting frustrated with how slow the renovations and restorations are going on our new place. It might be as much as another year for them to finish the roof.

No doubt about that. Out of town buyers way up, and almost entirely pouring into the detached market. Low inventory + a few hundred extra buyers = super hot market

Leo: I am really guessing that it is out of town buyers, a fairly informed friend was saying he has never seen so many Toronto people out there in the market. Not saying that they make up the majority but they are stacked on top of others.

Still can’t get over the explosion in luxury sales.

Record numbers in realty sales here, record numbers in guns south of the border, record covid numbers everywhere. It’s a mad world right now, who knows what is coming?

https://freebeacon.com/2020-election/2020-sets-all-time-gun-sales-record/

Covid cases ramp up in BC – breaking all records – 1120 cases this weekend including 9 on VI. 6 deaths across the Prov. For reference it took 71 days to go from 2000 to 3000 cases and just 3 days to go from 14000 to 15000. Crazy times! https://globalnews.ca/news/7437778/bc-coronavirus-update-november-2/

Right u did – thanks!

I posted the chart last month. Generally more, up to 35-45% in some months.

Leo or Marko ballpark how many were going over ask back in 2016, 2017 when inventory was this low? Similar ?

https://twitter.com/CTVNewsSarah/status/1323347333149413378

Thanks for the analysis. I really appreciate your balance with the data. But, wow.

Thanks Leo – good analysis.

Vancouver only up 29% from last year on sales and not at all time records. Migration from the big city to outlying areas in action, but they’re still super busy