Where would we be without dropping interest rates?

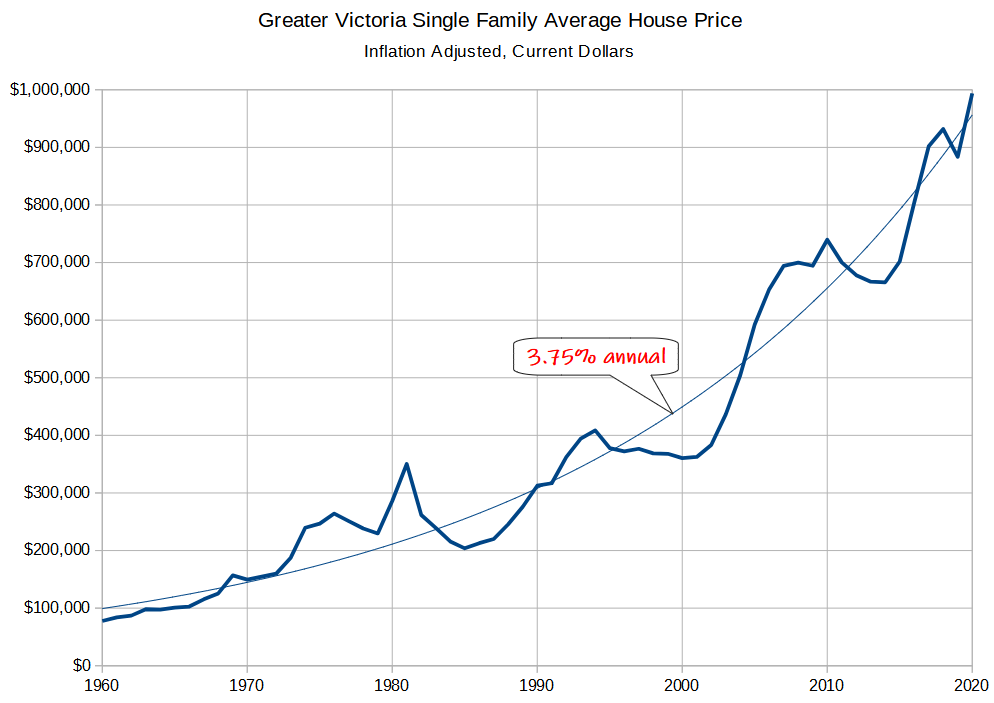

We know that house prices in Victoria have had an incredible run. With the median house price at a staggering $950,000 in November (up 54% in 5 years), one might be forgiven in thinking that this is recent phenomenon. However houses prices have been rising at about the same rate – 3.75% after inflation – for the last 60 years in Victoria, as far back as the Victoria Real Estate Board has data.

And while affordability has consistently deteriorated in that span of time, it hasn’t gone completely off the charts. Why? Because in the last 40 years, we’ve seen an incredible decrease in the interest rates charged on mortgages. To put that rate decrease into dollars, at peak interest rates of about 20% in 1981, it cost $1615/month to carry $100,000 in mortgage debt, and 99% of the first payment was interest. At today’s rates of about 1.5% that same $100,000 mortgage costs only $400/month, and only 31% of that goes towards interest. Of course because prices have gone up so drastically in the same period, it’s not like people are saving any money, they are just carrying more and more debt. Even with equal affordability levels, the buyer at lower interest rates is worse off because accelerated pre-payments are less effective and they are exposed to more interest rate risk. With a small mortgage at a higher rate, an opportune windfall can wipe years off your mortgage, but if you’re carrying hundreds of thousands in debt it’s much harder to accelerate the payoff.

When the sails go slack

The 40 year trend of dropping interest rates has been an incredible tailwind for real estate, keeping affordability from getting out of control despite prices increasing 10x. However now that we’re at or near bottom for rates, what might we expect for house price appreciation? If fundamentals have any impact on our real estate market, it should be substantially lower than the long run average.

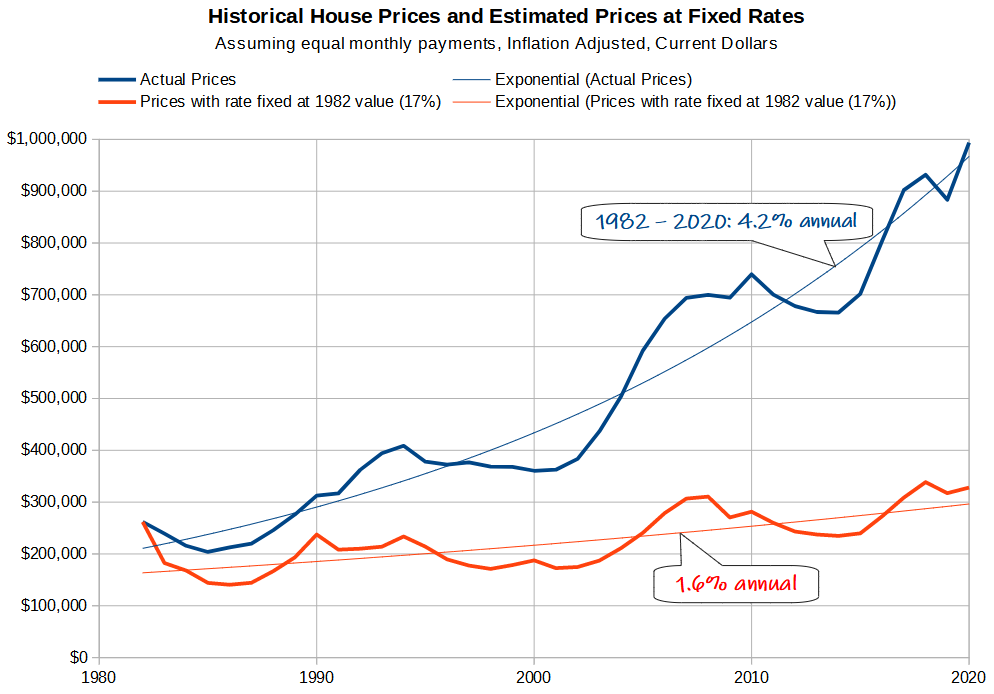

One way to estimate the impact of declining rates is to keep the monthly payments fixed at our historical levels (which buyers were able to afford in those years), and then calculate the house prices at a constant interest rate in that period. In this case I fixed rates at the 1982 average of 17%, but the rate is not the important part, it’s that it isn’t decreasing. Choosing any fixed rates yields the same level of appreciation rate. We’re looking at 1982 onward to remove the crazy prices in 1981 which distorts the long run trend. From 1982 to 2020, Victoria house prices increased at a rate of 4.2% after inflation.

Without decreasing rates, modeled house prices increase at a rate of only 1.6% after inflation. Quite a difference.

In other words, dropping interest rates have boosted house price appreciation by 2.6% a year. That may not sound like a lot, but over the 38 year period it added $660,000 to house prices.

Important to note is that I’m not saying house prices are wildly overvalued. We’re not likely going back to 17% mortgage rates in our lifetimes so the danger of losing that low rate premium is very remote. Rates will very likely stay low for years, and possibly decades. However what we can be pretty certain of is that it won’t get much lower than we are now, certainly not in the long run. Also important to note is that part of our current escalation in prices is reflective of the most recent drop in rates. Only when that demand is used up would we be in a post-rate decrease environment with associated lower expected returns.

That means even if single family homes continue to get less affordable over the long run (which I expect as the city densifies), the actual rate of price increases should be substantially less than in the past.

Assumption: Fundamentals matter

All this of course assumes that local fundamentals will continue to have influence on Victoria house prices. Alternately we could turn into Vancouver and have house prices detach from all fundamentals. However decades of data for Victoria shows us that when affordability becomes stretched in the current cycle, house prices stagnate or fall until it improves. Of course there are many wealthy buyers for whom incomes are irrelevant to the purchase, but that’s both not new for Victoria, and so far the market has depended enough on local buyers leveraging up their incomes to keep it mostly grounded. The persistently large gap between Vancouver and Victoria prices threatens our market’s adherence to fundamentals, but with today’s low rates we’re not yet at prices that are completely outside historical affordability ranges so it remains to be seen whether historical affordability constraints will put the brakes on our market this time.

Also the weekly numbers, courtesy of the VREB:

| Dec 2020 |

Dec

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 142 | 315 | 461 | 402 | |

| New Listings | 142 | 266 | 391 | 394 | |

| Active Listings | 1775 | 1668 | 1584 | 1952 | |

| Sales to New Listings | 100% | 118% | 118% | 102% | |

| Sales YoY Change | +71% | +58% | +52% | ||

| Months of Inventory | 4.9 | ||||

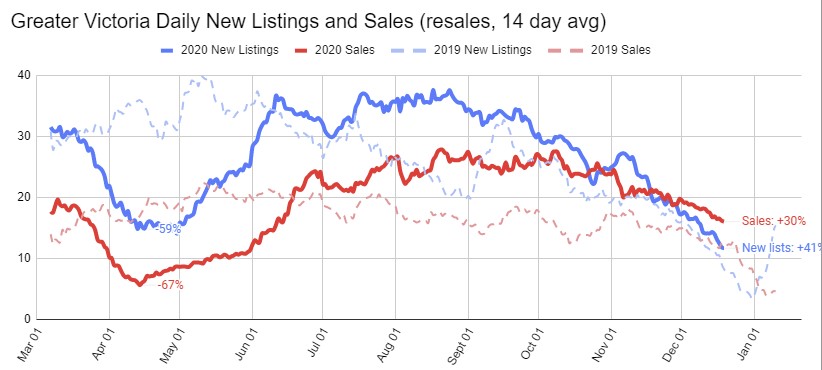

The unseasonably active market continues, with sales still up more than 50% from last year, while new listings are only up 32%. Interestingly the increase in new listings is being driven by the single family side, where December new listings to date are up 50% from last year. It seems some owners are taking advantage of the active market. With record low active inventory on the detached side every one of those listings is welcome.

2020 Sales over $2M (detached, greater Victoria): 194 (5.2% of market)

–

The absolute number doesn’t surprise me but the fact that 1 in 20 home sales over 2MM does! We ended up being one of those 2MM plus buyers, kids entering teenage years required more space and I finally got my two car garage.

I am happy to take out a mortgage again with 5 year rate at 1.49 tax deductible, and property tax deferral

New post: https://househuntvictoria.ca/2021/01/01/2021-market-predictions/

Are you concerned with the FX fees on the Avantis ETFs? Apparently for US listed ETFs FX can be 1.5% or more …will you apply Norberts Gambit (which I’m only just learning about).

Yes massive increase after July so the yearly numbers don’t quite capture the explosion in luxury sales. But good intuition on the twice as high as a percentage, it’s exactly that.

2020 Sales over $2M (detached, greater Victoria): 194 (5.2% of market)

2019: 79 (2.5%)

Coming up in an hour or so.

It all depends on shares volume and price of each stock that are in the index, and for the majority of the companies/stocks it doesn’t make much of a dent in the S&P 500, and that included the recent addition of Tesla.

S&P 500 Index is standing at 3,756 points, and if Tesla drop from $706 to 0 tomorrow it will effectively drop the Index roughly 64 points or 1.7%. But, that is highly unlikely because it will take months or years for TSLA to drop that kind of amount if they don’t get kick out of the Index before they are 0, and that would give the rest of the stocks in the Index ample time to pick up the slack (balanced out the index average), hence nothing to worry about.

I don’t have any formal financial education or work experience, and the little that I know is enough to be dangerous so I’m all ears and willing to learn.

I’ve taken a couple of Camosun College investment courses from 15+ years ago, and the rest are from reading and self direct investing/trading. And, perhaps out of shear luck it worked out quite well for me since then.

PS. My teacher were completing her CFA master at the time and had 12 years of experienced at CIBC and BMO. And, I would love to see her again to thanks her for the knowledge and guidance that she shared with my class and I.

QT I’m not sure if you’ve taken the CFA exams or what the depth of your portfolio management experience is. The s&p 500 is not an average it is a market value weighted based on the shares only available in the public float. Not to get into the details of index calculations, but each index is calculated differently so it’s important to know how they are calculated to know what is going on. With the DJIA, the price of each component stock is the determining the value of the index so the price of a single security can have a heavy impact on the index.

Can we first see how we did last year 🙂

Everyone got their 2021 predictions ready?

Yeah condo market could have dropped there but the explosion in single family price supported it enough and now activity is at levels that would indicate price increases in condos as well

https://www.nytimes.com/2021/01/01/business/GE-wind-turbine.html

If you hit the paywall:

https://docdro.id/sASPnfh

https://financialpost.com/real-estate/burning-questions-have-we-reached-peak-condo

The index is the average of all 500 companies, so during a run up many companies that get added to the index would generally grow pass the index average.

However, one must take into account on how those companies rise, and look at its financials specially diluted EPS, operating income, cash on hand, and cost of revenue vs. the rest of the competitions in the sector to see if it is a good buy or will it get a haircut once everything settle back to the norm.

Usually is a good strategy, because many funds rearrange portfolios for tax purposes in late December or early January.

I usually do a bigger buy in early in the year. 2020 I delayed for a bit to see how COVID would pan out but the market kept going up so I bought just before the crash lol. Maybe I’ll do the same this year.

Yeah same for me. Right now it’s basically all in VGRO with a couple random stocks I bought for fun.

Back when I did the 3 fund model I didn’t bother rebalancing I just bought whatever was down to try to restore balance. For sure more of a pain with 5 but I’ll give it a go this year.

There was an interesting discussion on rational reminder about how the S&P 500 is basically set up to underperform in some ways because companies are added after a big run up on value and at that point your expected return is lower. If you had just bought the original companies in the index they have outperformed the index itself.

Thanks Leo. Part of the consideration for me is I like the simplicity of my 1 fund portfolio (VEQT) and moving to 5 complicates trades, fees, rebalancing etc. But overall it’s do-able and their arguments seem to be based on logic.

Peter Lynch once said, the average norm is between 10 and 20 P/E ratio for companies that are in the S&P 500 index, and sometimes it is slightly higher than 20, but eventually they will drift back to the norm.

At the moment many companies in the S&P 500 are now well above P/E of 30, which suggests that that large caps (possibly the entire market) are way over bought.

July 2020 was before the market really took off, so again the current assessments don’t really reflect market value

Also on the topic of BC Assessment values. Land valuation in Esquimalt up 14% and 15% (principal and rental property) and 8% in Fernwood (rental).

Up 5% here in Gordon Head.

Their model portfolios are posted here: https://static1.squarespace.com/static/5093f3c5e4b0979eac7cb481/t/5fdab7e2e401234a59456a9e/1608169442374/Rational+Reminder+Model+Portfolios_12-2020.pdf

In their practice they use the dimensional/dimension funds which aren’t available to retail investors but apparently this collection of ETFs is about as close as a DIY investor can get.

Also the scary run in large caps lately has made me extremely wary of putting more money into those. I’m not about to start stock picking but a sensible tilt away from those seems pretty safe.

Interesting – anyone else notice that the ‘building’ portion of the assessments seems to be down more than usual this year? I had a poke around of a whole bunch of properties in Esquimalt (where I live). Most are down 15% – 20%. I wonder if BC Assessment used a different methodology? I sent a funny note to my good friend and neighbour to tell him his house is now assessed at $91,000 (a lovely renovated 3 bedroom, 2 bathroom mid-century house). You can’t build a garden suite for that! 🙂

Never mind! Just heard the rest of the rational reminder episode on this subject.

Leo – you mentioned you’re moving to factor based ETFs…how do you plan to do this? With a brokerage or DIY?

The assessments are out! I guessed 4%, was 3.5%. Happy new year everyone! I’m an infrequent poster but regular reader and appreciate the time put into this page.

Happy New Year to everyone on here including all the lurkers. May everyone have a wonderful evening and we all all sure a shit looking forward to a better year ahead.

I’m curious about our assessment this year, too! Last year, it increased by 2.5%; this year, I’m predicting 4% (Strawberry Vale).

Will be interesting to see B.C.’s property assessments when they come out tomorrow even though they are largely reflected to this past summer. Our area was one of the very few where assessments rose last year.

Any idea how many homes sold over 2MM this year vs last year and as a percentage of homes, it would appear to be twice as high

i was going to post a cartoon but couldn’t. I wanted to put a smile on everyones face going into the New Year. Just ignore:)

https://about.bnef.com/blog/batteries-in-solar-installations-becoming-the-new-norm-qa/

https://twitter.com/Billius27/status/1344141323310395396

Patriotz: Happy New Year.

Yes Moncton has somewhat high property taxes and low house prices. But the two are not necessarily related.

There are other things going on that are much more complicated that has caused low house prices. The English / French issue was a really big problem for example. NB is the only bilingual province. If you don’t speak French and English you can’t be a paramedic for example. Everything is duplicated. That is why taxes are high. They have French hospitals and English hospitals. Same with the post secondary education. It has caused a lot of friction between people and some gave up and moved away. But there is a change happening because there are other pressures and developments that are having a bigger impact on people deciding to move there. The collapse of the oil industry in Alberta has had an effect. There are large movements of immigrants new to Canada who are looking for an inexpensive province and where there are good employment.

More people moving out of Quebec and Toronto because they can work from home. This is what the stats are showing.

Attitudes and peoples needs are changing.

Prices have risen dramatically over the past two years and realtors are shocked at what is happening and have never seen anything like it.

The whole of the Maritimes is experiencing this explosion.

In reply to Introvert: yes….being a landlord from a distance might not be everyone’s cup of tea. That’s what property management companies are for. One simply get’s the rents deposited into our account every month. Dead simple. No calls from tenants. One can view everything by logging into a portal. It makes tax time a lot easier also. Every screw, nail or issue is accounted for. Could not be simpler. It does not cost a fortune either. It’s the way to go when owning properties from far away.

Anyway…I’m done for a while.

I wish everyone a Happy New Year!!! Stay reasonably sober and good luck in the new year ahead.

The provinces with the highest taxes have the most affordable housing. You gave a good example yourself.

Landlording from a distance of 5,500 kilometres sure doesn’t appeal to me.

GC….yes, I agree , you do need to change a whole bunch of things to bring down the cost of building. That can be… less taxes on building supplies. Less bureaucracy, Less taxes at every level…. plus all of the things mentioned here on this forum by others. Those things would likely encourage more supply. Our governments, in general, only look at the short term loss of tax income and do not consider that by driving up costs with heavy taxes and bureaucracy, they will cause higher rents, resulting in more people being on the street, more people opting out of society…. which increases costs at the other end where society has to spend a fortune on ambulances, police, firetrucks, social workers etc etc etc. Not to mention the complete misery for these poor people.

I am also interested in joining for Investment Club- so much to learn from you.

What people forget is that even if you increase supply it will not reduce construction costs, they are escalating every year due to changes in the building code and lack of individuals going into the trades. Nothing is being done to fix the labour pool and that is just going to compound the problem in the future. Being a tradesperson was once a career that had pride and value, these days it is hard to find any bright individuals with critical thinking skills going into the trades as it is looked down on by a younger generation.

More precisely, it means less expectation of appreciation. It’s expectation of appreciation that makes investors willing to pay high price/income multiples for RE or stocks. That may or may not turn out to be accurate.

Indeed according to Teranet, appreciation in % terms from 2000 to 2020 has been almost the same in both Victoria and Winnipeg. From 2000 to about 2016 Winnipeg was clearly ahead.

https://housepriceindex.ca/#chart_compare=bc_victoria,mb_winnipeg

Moncton etc could be a value trap. There is usually a reason why a property will cash flow in a market and it means giving up capital appreciation to some degree. We’ve been invested in Winnipeg, MA for decades. The properties all cash flow and did so strongly from day 1 even after the high property taxes (snow removal etc).and are paying down the mortgages at a nice clip. A reasonable investment but the downside is that capital appreciation only seems to match CPI inflation over time. It’s OK but I think the total returns even factoring in the stronger cashflow would have been double in Victoria.

That’s looking at the right coin but the wrong side, so to speak. The real problem is that government incentives for home ownership encourage overinvestment in principal residences, inflate prices across the RE market and make rental properties relatively unattractive as investments.

If the government simply treated RE the same as stocks in all respects, the rental market would take care of itself. And both rents and prices would be lower.

To “underachiever”, I totally understand your gravitation to rent controls, but I’m sure you would not want to support something that has been proven to have the opposite effect to what you want to achieve. It is a counter intuitive idea because on the one hand it would be great to stop rents increasing, but is it a good idea to drive away those who might invest in building new rental units.

I believe that the only productive way to bring down rents would be for the Federal and provincial government to introduce “massive” incentives for people who build rental properties. Increasing supply and bringing down costs is the only way to reduce rents. (BC Housing and the provincial government seems to be doing a great job of trying to introduce new low cost housing. It takes time though. The whole country needs help at a Federal level and that is not happening. Immigration is a good thing but they keep bringing in more people without providing the means to house them.)

I don’t want to see tent cities either. It’s why my wife and I volunteered, almost every day, at Woodwynn farms, the therapeutic community project for people with addictions and mental issues. We did that for five years.

It’s also why we keep our rents below market value.

The photo shows the Peace Garden at Woodwynn Farms.

As Marko said, the Citified database is good: https://victoria.citified.ca/condos/ Just search for ones that are in pre-sales or selling. Not 100% but probably the best collection for Victoria developments + the chatter about them on VV.

You can also set up a Matrix/PCS search for new condos only. You won’t get everything, but often developments will put in a unit to MLS to draw people to the sales centre. Feel free to drop me a line I can set that up leo.spalteholz@gmail.com

“a 300K place in Moncton has property taxes of $8300.”

Well there you have it……it’s the high property taxes that have kept the cap on property appreciation.

Citified/VibrantVictoria are a decent tool.

Is there a place to access all the presales that are currently on market?

Thanks for your help.

Do you like tent cities?

It look like just DuranDuran, rush4life, and I are interested in an investment club. And, I hope to have a first meet up sometime next year once Covid 19 died down.

Hi Patriotz, The rents in those rental buildings in Moncton were probably below current values and the rental companies (from Ontario mostly) that are buying them are raising the rents as high as the market will allow. In NB there are no rent controls. It’s raising the bar. It’s similar to Victoria and Langford, where we are seeing a lot of rental units being built and the new higher costs result in much higher rents. It brings up all the rents.

There is currently a building boom in Moncton.

I do not like rent controls because I feel that it kills anyone investing in rental properties. It does the opposite of what it is meant to achieve. Any costs, such as high taxes, gets passed on to the tenant. It’s a difficult conundrum and I’m not sure how to fix it other than encourage building more units.

Hi Marco….. no. I’m too old to want to have “any” mortgages:)

It depends on your age and your needs I guess. We took some chances when we were younger but we never took a risk where we might lose our principle residence. We always considered the worst case scenario and if it meant we could lose our principle residence we didn’t take that risk.

As you say, there is no free money. It’s always a calculated risk. We never risk what we can’t afford to lose. That idea…for us….get’s more drawn in the sand, as you get older and have limited funds.

We recommended to our kids to take chances when getting their first house. If it was a bad time to buy then they would have the years ahead to reap better times. It seems that the advice has served them very well.

It’s the reason I write on this blog. My advice is for any young person who isn’t sure what to do.

Victoria has a solid future. Invest in it if you possibly can.

Image shown below is an art piece I created a number of years ago.

Sounds like free money. Have you remortgaged your Sooke properties to buy up places in Moncton?

You’re saying that the previous owners were renting below market?

It’s true that house taxes are “somewhat” high in Moncton. (But maintenance is much less expensive because tradesman don’t have high mortgages.)

It’s also true that historically they have not appreciated in value that much.

In the past, people in Moncton didn’t feel the need to buy a place because the prices were not going anywhere. There were lots of rental units with generally low rents and so there was no rush to buy.

The thing to take note of is that everything is changing as people realize how low the house prices and they have been observing the increases in rents. The apartments are being bought by big companies that are dramatically increasing the rents. ( Much easier to get rid of a bad tenant in Moncton.

People there are waking up and along with a large influx of people it is driving the market up.

I believe that the trick to investing in any real estate is to get in when you can recognize the early indicators of a change about to take place.

In the case of Moncton, it is easy to predict the explosion in prices over the next few years.

NB has the cheapest real estate in Canada. There is an influx of immigrants moving there. The NB government has been working hard to swing things around and with good success. Large companies are buying up apartment complexes and dramatically raising rents.

The first three condos I bought were $200k – $195k – $215k and rent average was over $1,200 per unit. Strata fees under <$200 on all three. Taxes around $120/month and insurance $25/month. At 20% down (and variable mortgages) I was cash flow positive on each unit by a few hundred right at completion (presently a lot more since rents have gone up and interest rates are even lower). Ironworks studio (279k) is the first unit I've ever bought where I've been neutral at 20% down.

I have $ right now for more pre-sales but I haven't found anything that makes sense, in my opinion, the last couple of years. There is a studio at the Pearl for $340k that I would pull the trigger on if it was <315k, but that is the closest I can think off.

“What’s amusing is reading about US investors. Buying $250k properties that rent for $2000/month. What I never understood is who is renting in those markets. Just an access to capital thing?”

Leo I think you are referring to 2009, the risk at that time was that in the month it took you to actually close on the $250k property it might only be worth $225k.

I looked into investing in these types of areas ages ago. Rents are higher but appreciation is generally low or non-existent. People rent in these areas because they can’t afford the down payment to buy or for the other normal reasons (divorce, transience..) and because housing is not a great investment due to the lack of appreciation. If you have a lot of cash and are just looking for cash flow it might make sense, but leverage works more effectively in an appreciation market like ours where you can combine it with the capital gains tax exemption.

“Believe it or not, this used to be the standard for RE investing. Money in your pocket you know.”

I don’t think that scenario has existed for a long time with minimum down payment. I was barely cashflow neutral in 2013 when I bought in GH and thats with upper and lower units rented separately. I am pretty sure Marko’s condos weren’t cashflow positive by much when he bought, it was most likely neutral.

Obviously if you put 50% down you can be cash flow positive all day but then you might as just go buy stocks at that point. Real estate is pointless without leverage due to its illiquidity and transaction costs compared to other assets.

What’s amusing is reading about US investors. Buying $250k properties that rent for $2000/month. What I never understood is who is renting in those markets. Just an access to capital thing?

it should be noted the property taxes in Moncton, and in many snowy cities, is considerably more expensive due to snow removal costs; according to this calculator a 300K place in Moncton has property taxes of $8300. Not a deal-breaker but something to consider – https://wowa.ca/taxes/moncton-property-tax

Believe it or not, this used to be the standard for RE investing. Money in your pocket you know.

Ks112 That full duplex house in Moncton sold for around $200,000.00 in the spring of 2018. There are many duplexes available today in the $170,000.00 range but they are not in as good shape and tend to be in more undesirable areas. (always good to actually go there in person if you don’t know the areas well in Moncton. Having said that…. I would actually buy anywhere there because it is going to change fast. The city is generally shabby and needs work but that is happening. Moncton is the cross roads to the Maritimes.)

The best ones are between 250 and 350 thousand price range.

I find the low prices astonishing and can only see everything increase. Do a google and you will come across articles that talk about many homes being sold sight unseen, many over the asking price, large investment companies buying large apartment blocks and raising the rents by as much as 60%….. all signs that Moncton NB is being discovered. I would expect that this spring will see another big surge in sales because the prices are crazy low when compared to anywhere else in the country.

There seems to be a big push to change Moncton’s image. Large new investments in things like art center, convention center, Conversions of castle like buildings into very high end expensive condos etc.

Investing in a place like Moncton might leave you some money left over to invest in things like the next big thing ….. fermented agriculture. (Beyond Meat or the Impossible burger.) One thing for sure is that traditional farming has no future unfortunately. Everything will be brewed.

Deryk, the cashflow profile in your Moncton example seems too good to be true. I can put min down and get a property manager and still be cashflow positive.

Nelson really is short of land. Everything within the city limits is built up and there are physical barriers to expansion. You also have to keep in mind that in a town of under 10,000 people, an influx of a few hundred residents is a lot. Also these towns have had a static or declining population for a long time so the public and private sectors are not well equipped for expansion.

If the population shift is for real in the long run- which I’m not at all sure of – these factors will adjust. There are also the alternatives of the Kootenays’ sprawl capital, Cranbrook, and former mining town Kimberley.

This raises a question: has the luxury SFH market experienced better historical appreciation than non-luxury?

Also upisland may make sense, port alberni for example

Hi Vic&Van for investment you might wish to think about a place like Moncton NB. You can get a duplex like this one in great shape (Both units are 3 bedroom) for around $270,000.00 or perhaps even less. Close to 2 universities, Modern Arts center, 2 Hospitals, and a ten minute drive to the downtown core etc etc. Lot’s of good property management places to choose from. Each unit could rent for around $1,400.00. Tenants pay their own heat and light.

The east coast real estate prices in the maritimes are starting to take off as people sell their homes in Toronto and Quebec. It is also a place for immigrants to go to because of the low cost of houses.

Yes we’re running out of land all over BC I’m sure.

So bizarre that towns and cities all over have failed so badly at allowing new housing that now people wanting to come live in their area is some sort of tragedy

Living that hard Realtor lifestyle eh?

So small and medium towns real estate is on fire supposedly because of people coming from Vancouver. But Vancouver and Toronto are also active. Meanwhile immigration flows well down from targets.

I uploaded a PDF so y’all won’t hit the Globe and Mail paywall. Hope it works:

Small towns in interior B.C. and Alberta face intense housing crunch

https://docdro.id/RmSG37T

That’s a given on capital gains, but not on total return.

True, but a 1990 house is still considered relatively new in the core and I think a 2020 home will be considered newer in 2050 and by that time I’ll be towards the end of my life span anyway so who cares. In the meantime it will cashflow well and not much maintenance/headaches to worry about compared to an older house.

I think there’s an argument to be made that it’s the land that appreciates so a new house on 3000sqft will appreciate less than an old house on 6000sqft. But I don’t think it’s linear. Unless you’ve got subdivision potential it’s not like the 6000sqft place will appreciate twice as fast

OK so it is decided that core SFH is a “no brainer” and will outperform condos. How about Westshore SFH vs. core (new) condos? Thoughts? I am looking for an investment property and trying to decide.

Gotcha.

I think west shore will do pretty much just as well as the core. Soon we will run out of greenfield land to develop and the exact same pressures will apply. Not like most of the west shore is even that far away.

SFH price spread between core and Westshore were around:

21% for 1990,

21% for 2005,

30% for 2015,

46% for 2017,

26% for 2020.

The other question is, will Westshore price appreciation continue to grow to the get back to the historical 21% spread?

VREB — https://www.vreb.org/historical-statistics#gsc.tab=0

I was referring to the introduction of capital gains tax and the principal residence exemption in 1972

+1, between the above, COV/Saanich bureaucracy, building code going forward, etc., making it insanely difficult to build, and dirt cheap interest decided not to sell the new build project in the COV. Will just rent it out on completion, finance at appraised completed value pulling out all the invested capital, and it will be cash flow neutral. Will just let it sit.

Next 10-25 yrs core SFHs will be for generational wealth the way things are going and I don’t think anything will change. The bureaucracy will get worse, the governments will print more money, immigration will ramp up when COVID dies, and there won’t be any new supply of SFHs in the core.

Depending on the last few days we might finish the year with the lowest inventory ever on record.

It has made the most sense to leverage and use the exemption, so it depends what you can afford. A suite in a primary home provides additional leverage above the value and expense of a second investment property or the most expensive SFH without a suite you can afford.

Has the government actually signaled that changes to CGs are in the offing, or is this pure speculation from newspaper columnists (and some HHVers)?

Condo new listings: Up 16% from last December

Single family: Up 49%

Monday numbers:

Sales: 578 (up 58% from this time last year)

New listing: 429 (Up 18%)

Inventory: 1449 (down 27%)

And I expect land to continue to appreciate more than condos so the principal residence should gain more over time. Totally agree that future appreciation will be less than in the past but I think core land will still appreciate faster than inflation.

Good point regarding capital gains tax introduction. Wonder if there is a noticeable effect there in RE prices.

Depends on how the CRA sees your suite for tax purposes I guess.

Good point that unless the bigger PR allows you to have a suite it probably doesn’t make sense from an investment perspective over a separate property

The subtext of this question is, does the lost investment income get offset by the capital gains exemption on the principal residence if you choose the latter? My view is that the past trends enabling capital gains have pretty much run their course so the former is likely to come out ahead.

It also illustrates how the principal residence exemption distorts investment in residential RE. That is, without the exemption we’d likely have people living in smaller personal residences and more properties for rent, and probably a smaller RE sector overall. Note the principal residence exemption has only been around since 1972, since that’s when capital gains taxation started.

Isn’t the former pretty the same as having a principal residence with a suite?

From a pure ROI point of view the former is a better investment. You will have higher capital gains but this would be more than offset by the rental income you would get.

We did this for a while and I found the stress from dealing with tenants was not something that I liked dealing with. I find it much less stressful to have that capital invested in the stockmarket.

As for RE investing. What do you think is better, a Principal residence valued at X and an investment property valued at Y (say Y about half of X), or buying a more expensive principal residence valued at X+Y?

Anyone know of any local ones already going?

Have recently been devouring the rational reminder content. Such incredibly high quality stuff.

Thinking I will move to the factor tilted portfolio going forward instead of just single index fund approach.

I’m in for the investment club as well!

Frank – I like to share this comic regarding privilege. Don’t worry it’s a quick read:

https://www.boredpanda.com/privilege-explanation-comic-strip-on-a-plate-toby-morris/?utm_source=google&utm_medium=organic&utm_campaign=organic

I would also be interested in taking part in a local investment club. Perhaps Leo could connect a few of us by email?

Thanks, but no thanks, since most people don’t trust free advice, because they believe that they get the best service from pay services and specially from those with lots of papers hung on their office wall. As Marko put it, “Leo does a MUCH better and accurate job, for free.” that doesn’t get nearly as much attention as some overpay govern body that provide inaccurate reports and costly red tapes. And, many wouldn’t like my strategy that focus on return of investment instead of activism investment.

PS. I would love to meet you and those that are interest in creating a small HHV investment club, because I have much to learn and perhaps trade ideas and strategies.

QT is now the resident HHV hedge fund manager.

Kenny G, just a suggestion here, but have you put some thought at putting a portion of your portfolio in the S&P 500 Index Fund to see how it is performed against your balanced fund? I think you will get a better return than 10% or 12.5% average, because the accumulate for last 5 year is 94.69% return, and roughly 50% for the last 24 months.

•

•

That’s not my portfolio return I’m just pointing out a moderate risk portfolio return

I agree that the equities santa has treated everyone well this year. My TFSA account returned 72.90% in the last 12 months, cash trade portfolio jumped 135.58% for the year, and the icing on top is a gain of 4.83% on my SFH.

Kenny G, just a suggestion here, but have you put some thought at putting a portion of your portfolio in the S&P 500 Index Fund to see how it is performed against your balanced fund? I think you will get a better return than 10% or 12.5% average, because the accumulate for last 5 year is 94.69% return, and roughly 50% for the last 24 months.

Remember Hawk’s 400% returns? So many good memories.

@QT– Those invested in equities instead of RE did just fine this year, thanks

‘

‘

Yeah, not bad at all, balanced fund up around 10% with 2 years return up around 25%!

Yes Alexandra…I actually love Commercial drive. (I really like their street festival days) and one of the galleries that represents my work is just off Commercial street. I grew up in Kitsilano and watched as areas changed from “I’d never live there” to a neat an interesting community. Commercial drive is one of those areas. I’ve always looked at Esquimalt the same way. Great potential there still. I know someone who now lives in Fernwood and swore at one time that there would be no way they would ever live there. But now Fernwood has re invented itself…. as you will know.

We have almost always lived in hundred year old houses. They are wonderful. We now live in a super modern place and I love that too. (Everything built to code. No lead paint. No asbestos. No dampness in the basement. The Wiring is all to code. Same with plumbing. Easy to insure. Easy to heat.)

There are always compromises and two sides to a coin.

Agree with you on the parent and grand parent stuff. Isn’t that the truth!

We used to love the buzz of the city but still moved away. The cost of living was just too high a price to pay. We wanted to have more choices in our lives. The ability to see the world. We didn’t want to be a slave all our lives to a high mortgage.

Maybe your daughter will swing around one day. I’m so glad that they were able to get into a home.

Have a great New Year! (That goes for all of you on House hunt Victoria. Thank you Leo. Thank you Barrister! Thank you everyone.)

Happy New Year.

Thanks Deryk. All good points. What I was meaning about similar to Fairfield (I grew up there), is the particular block my daughter is on has mostly homes built in the 1910-1913 era as were many of the South Fairfield area ones. Such as in the 1100 Block between Cook and Linden from Rockland down to Oscar. Also having sidewalks, boulevards, & large trees. Fairfield village is okay but certainly can’t compare with Commercial Drive. Such a fun street to explore and dine!! Also I was wondering would most couples pick that newer home on 63rd or a grand very old one with all the character still in tact? Her house does have a suite in the basement but my Granddaughter lives in it for free. I believe she pays part of the utilities!! She also went to an elite private school over on the “good side” from around the ages of 2 to 13 … and I paid for it!! Only thing was, it was a long drive there and back everyday. What parents and grandparents don’t do for their kids these days.

They were lucky not to be ” priced out forever.” They paid about $700K (more than $100K over asking) about 11-12 years ago. Today that old house would probably go for around $1.6M.

I so wish they would move to Victoria but they love the big city.

Have a very happy and merry Christmas season!

@QT– Those invested in equities instead of RE did just fine this year, thanks 🙂

The 2020 Christmas present for homeowners in Victoria is a price growth of 4.83% for the year, with Chilliwack at 9.89%. And, I’m sorry that bears got another big lump of real estate coal this year.

B.C.’S Best Performing Real Estate Markets Are Underperforming The National Average — https://betterdwelling.com/b-c-s-best-performing-real-estate-markets-are-underperforming-the-national-average/

alexandra…. merry Christmas:) Those areas you mentioned,They have definitely changed a lot over the years> I wouldn’t compare them to Fairfield in Victoria or Kitsilano in Vancouver. Yes..the east side has become more desirable than they were years ago, but in reality they still don’t come anywhere close to the west side of Vancouver such as in Kitsilano. That is reflected in the price and for a good reason. If you do a google for sfh, the east side of Vancouver keeps coming up around $1.5million or so. The west side, generally around two million and more. The west side is sought after for good reason. The beaches, bikeride to downtown, UBC, The best Private schools etc etc. The east side along that north edge, is close to the docks, there is a bones and fat rendering plant that belches a stench that can make you choke some days…. depending on which way the wind is blowing. I personally would not want to live anywhere on Vancouver’s east side. But tens of thousands of people do like to live there and they enjoy the benefits of being somewhat close to Vancouver center where work opportunities abound….they prefer it over areas such as out in Surrey or Langley etc etc.

I prefer the simplicity of the island. If I need something extra, then I can explore the world beyond when I need to… then slip back to paradise:)

Everyone likes what they like and everyone has different needs. I recognize that. My main point was to point out how inexpensive even the prime areas of Victoria are when compared to a city that we live right next door to…..which is hard to do because it’s difficult to compare. But it can lend perspective.

Kenny G, not all core government employees are union, but if you are talking about union employees then the incentive to do work just isn’t there. why would anyone do more than the absolute minimum when your raise and pay will be lockstep regardless of the effort put in. If you look the exempt positions you do see some younger Executive Directors (30-40) that are educated and I assume somewhat motivated. However as I understand it, the ED position is essentially where the exempt employees are capped at as there are far far fewer ADM positions available for the next step up.

Local Fool: You know you might be a psychopath when you are excited that you got a chainsaw for Christmas.

Merry Christmas! We are having a tiny Christmas dinner compared to other years but it feels good to be with family.

Merry Christmas Everyone!!

Deryk H. I was looking back 7 days ago at your post. HHV d. 14 Dec. You showed a photo of a home on 63rd Ave E. I was just thinking about comparisons in areas and prices there. Of course with that house the land way outperforms in value compared to the building. If you look at 908-63rd Ave E, you will see a nice looking 2011 built house with the last assessment being $1,557,000. It has 5 beds and 5 baths at approx 2800 Sq.Ft.

My daughter’s home in East Vancouver, on Napier a couple of blocks from “the drive”, is a 1912 built home, 5 beds, 3 baths at about 2600 sq ft. Not many updates, mostly in original condition except kitchen was upgraded maybe 20 years ago. Both homes are on three levels. It is assessed at a few thousand less than the one on 63rd Ave. It is on a beautiful street with most homes built in the same era of over 100 years ago. Stately trees, sidewalks, boulevards. Very similar to many streets in South Fairfield.

Which one would sell first? Which one would you rather live in.

You know you’re a homeowner when you are excited that you got a chainsaw for Christmas.

Merry Christmas everyone!

Kenny G…..It is funny to hear people who have “friends” in govt jobs that happen to resemble the typical sterotype of govt workers. It is like how Frank peddles stupid sterotypes of poor people when he never bothered to read a peer reviewed study past 1985.

‘

‘

FYI, my wife works in the public sector and I hear it all the time, older workers take advantage of the system by gaming sick leave, and long vacation entitlement, hard to get anything done colleagues aren’t there half the time but they don’t want to leave until they get their full pension, they would be let go in the private sector but in the public sector they are protected by the union. In the private sector people with an education and skills would move around and not feel obligated to “stick it out” for the pension

Golden boy, the only thing we can’t refute is you most likely made up a fictional story in an effort to provide some sort of substance on a topic.

Merry Christmas everyone, and thank you Victoria for lending us your weather for the day.

Merry Christmas, hope everyone is having a good day

Lol wow thanks ks112. That is soo much more believable! At least you didnt missed the main message and focus on something trivial.

I literally know 0 about programming so i couldnt even say. Vba macro? Lol to me the word algorithm encompasses all that. I only use excel for simple taks like budgets and I really cant refute anything you said. But hey thanks for the tip!

Merry Christmas to you all and I really do hope that everyone has a joyous day. We deserve that after what has been a very difficult year. Remember the best house is the one filled with laughter.

“One accountant complained about having to use a calculator “all day”. So I had a computer science buddy create an algorithm for me to present to his boss.”

Come on man, if you are gona make up a story at least do it so it’s believable. How bout this: “One accountant complained about having to use a calculator “all day”. So I had a computer science buddy create a VBA macro in excel so he can do his work more efficiently.”

Merry Christmas HHVers!

Santa is just coming into BC according to NORAD’s Santa Tracker. Here’s hoping the kids sleep to at least 630!

Kenny G…..It is funny to hear people who have “friends” in govt jobs that happen to resemble the typical sterotype of govt workers. It is like how Frank peddles stupid sterotypes of poor people when he never bothered to read a peer reviewed study past 1985.

Also EVERYONE, private or public, complains about some aspect of their job. I used to work as a law student at a massive food processing company. The accountants, lawyers, buyers, sellers…everyone complained about their jobs. One accountant complained about having to use a calculator “all day”. So I had a computer science buddy create an algorithm for me to present to his boss. His whole job was easily completed with a few hundred lines of code. When I came back next summer, his job no longer exisited. Good times…

Morale of the story – stop complaining about crap. You live in Canada and have the means to support yourself and your family (hopefully) – more than most people ever get.

If you want to complain about rising income inequality, crazy cost of living, climate change, and/or wastful govt scemes – Great! These are the real problems that deserve our attention and complaining about these problems bring awareness and changes to public opinion. Much better to spend your time and energy seeking solutions to real problems. Or just do not complain at all and enjoy your life!

Merry Christmas and happy new year to everyone on househunt!

I wonder how much “working from Home” will change everything.

I have always been a big supporter of it.

But I wonder if that will mean that people from offshore will start to take those jobs. (Lower wage expectation etc)

It’s happened in manufacturing and so why not services.

I think this is a real possibility and am I left wondering how much our world might change as companies and even governments start to consider all options. now that we can see working from home as an option. Think of customer service …. where you often speak to someone on the other side of the world with a parrot squawking in the background.

So….Why not engineering , architects, legal services, online education, etc etc.

Big questions to consider as time rolls on.

Pandora’s box is open 🙂

“rush4life, why not goto a crown corp instead of core government? Those pay more and you get people more motivated than the typical government drone that show up to work in a hockey jersey.”

I guess there might be considerations other than pay, like job satisfaction, work/life balance, financial goals, ambition etc. Some people just want to live a less work-centric life. Not everyone aspires to wear a poly-wool blend suit to work everyday.

rush4life, why not goto a crown corp instead of core government? Those pay more and you get people more motivated than the typical government drone that show up to work in a hockey jersey.

But I agree with you about the lack of good private sector jobs in Victoria. I actually don’t know what they are, maybe there are some tech companies that you can work remotely at and get paid USD but most of the private sector jobs here pay shit from what I know. I don’t know many none senior management private sector jobs here that pay $100k plus that isn’t sales/commission based.

Barrister: Yes…. the wee horse is in Sooke:)

The original anyway. (I did a series of a dozen images or so of those Christmas cards for the BC Children’s Hospital a long time ago. I was told that each year they sold quite a few thousand card with my images. The publishing rights to the images were donated to the BC Children’s Hospital for use as Greeting cards.) I had fun re living some childhood memories when I painted them.

On a Real estate note: I was searching for west side houses for sale in Vancouver so that I could share them with House Hunt Victoria. It is astonishing how many luxury ones come up in the $30 million dollar range!!! Now that shocks even me.

I was looking for modest Kitsilano bungalows in particular in the $2.5 million dollar range. Most that came up were around $1.5million…. but those were always located on the “east” side and not anywhere near the west side such as Kitsilano.

Kenny I transitioned to Gov a few years back from one of the big 5 banks and you find those people every where. Lots of jaded people in the private sector. Indeed there are more in Gov just as there are more older employees who are stuck, but the places i have worked in gov have average ages closer to 35-40 and have been actually better than the private sector in terms of being able to move up and job satisfaction.

Also lots of private sectors downsizing which makes moving up to those better jobs more and more difficult (the year i left they closed two bank branches down in town of the dozen or so they had – which means two displaced managers who get the next openings etc – not to mention how many across BC they were closing). People like to bash on Public sector but really if you are staying in Victoria I don’t see a bunch of obvious jobs (with similar skillsets) that are way better paid – also typically gov has much better benefits.

Siddall is actually a pretty accomplished private sector businessman prior to joining CMHC:

Econ undergrad, Osgood trained lawyer, Managing Director at Goldman Sachs and Lazard, senior executive at Irving Oil before taking the CMHC Job.

https://ca.linkedin.com/in/evan-siddall-b98a7416

Sorry Marko, you might be a little outclassed here. Also, most likely Siddall gets a lot of political pressure to run CMHC a certain way, if it was completely up to him then it will probably be a different story.

I don’t know how gold plated Introvert’s pension is, a quick estimate of a DB pension is 2% x years of service x highest 5 year average pay. So for someone working 30 years with say the highest average 5 years at $70k , it is 42k per year for life adjusted for inflation annually.

A lot of competent private sector folks will spend their last 5 years at a high level government job at say $200k per year. This way they get 20k a year for life after 5 years with lower stress and pays pretty much for all the post retirement vacations plus they would have banked way more money in the private sector compared to staying in the public sector their entire career.

+1…Introvert is super smart imo. Ultimate job security, low stress, awesome life-work balance. Tenant pays off the mortgage.

”

‘

I have few friends in gov’t jobs and they mostly stay for the pension, pay isn’t great in general and moral is low, if that’s the way you want to spend half your life then go for.

Deryk: Marry Christmas and I love the rocking horse, Is it stabled out in Sooke. Best to you and yours.

Marko: You left out the gold plated pension that goes with the job

+1…Introvert is super smart imo. Ultimate job security, low stress, awesome life-work balance. Tenant pays off the mortgage.

Even thought I am critical of government mass waste, if someone offered me Siddall’s 450k/year government job to tweet complete non-sense I would be on the next flight to Ottawa. Best part is you can spend millions on research, be completely wrong, and still collect $450k/year.

Employment on the chart is based on a combination of income level and unemployment rate – not available jobs.

Our new housing minister gets it

“We need more rental housing supply to help bring rents down. (…) Supply is totally the answer, especially in the rental housing market” – Dave Eby

Anyone remember crack shack or mansion? That was circa 2010. https://www.businessinsider.com/crack-shack-or-mansion-2012-5

Ha Ha Barrister…you might need to add some zing to your life if House Hunt Victoria is the “Highlight” of your day.

Actually… let’s face it….. we do all love Househunt Victoria and it probably “is” the highlight of all our boring lives!!!

Merry Christmas everyone!

GH gets an A for employment and Fairfield a D-, yet they are part of the same labour market. If they can let that sort of clanger go by I can’t have much confidence in anything else they say.

Here is what you get in Vancouver for 1.5million…. This tiny bungalow is away out at east 63rd avenue. (952 E.63rd) ( For those who do not know, East 63rd in Vancouver is no where near the mega prices one would find for a post war bungalow in Kitsilano). Depending on the time of day and traffic, leaving, say , Hastings and Burrard, it would take you thirty minutes to get to 952 East 63rd. More like close to one hour if you used transit.

I post this for those who think Victoria prices are crazy.

Victoria is not Vancouver. I know that. But then, Vancouver is not like Victoria either:)

Don Beach:

FYI Oxford Foods brought a lot of crime to the area. They are being replaced by therootcellar.ca. That will change things a lot.

In what way did Oxford Foods bring crime? As a semi-frequent customer I never saw it. Things will change a lot with The Root Cellar. An affordable food source will be replaced by gentrification.

‘

‘

‘

Also curious about this statement, I ran past the Oxford Food store all the time and it mostly appeared to be seniors shopping there.

Just want to wish Merry Christmas to one and all. (dont care if it is not PC, so get over it). Want to thank everyone for making a very difficult year much more enjoyable. Reading this blog was the highlight of my day often and made me feel at least a bit connected in a very isolating year.

Today I am going to try to convince my wife that Lord of the Rings is a Christmas movie since it has Elves in it.

Be joyous.

Don Beach:

In what way did Oxford Foods bring crime? As a semi-frequent customer I never saw it. Things will change a lot with The Root Cellar. An affordable food source will be replaced by gentrification.

GC, anyone with actual business acumen will not last in politics. Politics is the business of using tax payer money to buy votes regardless of actual economics, no one with real business sense would engage in that none sense.

4 new listings today, 40 sales.

KS112 – ROFL… That is pure gold… #govlife

On another note, Bezos will probably benefit the most from the BC Recovery Benefit. Perhaps one of the worst use of taxpayers money. When was the last time we had a finance minister with any business acumen?

All you guys talking about making government efficient are going to make introvert lose her job. Introvert has it the best, collects government pay chq, posts on this blog all day and then goes and collects the BC COVID Recovery Benefit lol.

The crime stats are the average for all of Victoria area and downtown is much higher than Fairfield but Beacon Hill park is high too. You can view the crime map for Fairfield at the vicpd website.

Whoa. Applied for the BC Recovery Benefit on the evening of the 18th, and I just saw that the money is in my bank account today. Three business days.

Sorry, economy. Money’s going on the mortgage.

This an outdated misconception, that poor people don’t know how to spend money wisely.

Studies have shown that when poor people are given cash (vs things like food stamps or other things that governments think they need), they spend it on the things they need. People are better at knowing their needs than governments. Also government programs setup to help the poor are prone to corruption and waste.

Here is good article from the Economist from a few years ago: https://www.economist.com/international/2013/12/12/pennies-from-heaven

One quote from the article: “Recipients of unconditional cash do not blow it on booze and brothels, as some feared.”

“Crime data for this area is not available from Statistics Canada, so estimates are used based on demographic data including, but not limited to: home prices, income per capita and population density.”

Useless in other words

Cool website.

I used it to compare Gordon Head to Fairfield:

GH:

Fairfield:

And here’s Kitsilano, just for fun:

Interestingly enough, BC is at the bottom using this composite measure of economic indicators.

Progress.

The system is broken, because the reward for a balance budget is no funding.

If there were accountability in Government it would be a private enterprise, and once you complete the report you must “work” on another project.

LOL. Why work when you can have a job?

Someone needs to get out more.

Miss Vickie’s are currently on sale at Thrifty’s – yummmmm

I know… but it seems like BC Assessment doesn’t always accurately record renos and suites – not saying the price is reasonable – I no longer have solid perspective on that!

@ totoro … FYI Oxford Foods brought a lot of crime to the area. They are being replaced by therootcellar.ca. That will change things a lot.

The people in the tents were promised hotel rooms so I believe that is temporary we just need to live up to our promise.

but $850,000 over assessed value?

Lovely home, fully renovated and legal suite are all great.

For us that area used to be one of the best, but it now gets an F on the crime index as it is close to downtown and this issues have increased with camping in Beacon Hill Park. Property crime is 82% above the national average in this area. https://www.areavibes.com/victoria-bc/fairfield/crime/ Mind you, a dog and doorcam would probably help, but there sure are a lot of car break ins there.

Yea…you know in 2010-2014 I really wasn’t doing a good job of persuading my clients to bid higher. Then 2015-2020 I upped my game and sure enough because of my persuading to bid higher the market went up 54%. Simple as that.

Where can I sign up for a 450k/year government job with zero common sense? Zero accountability. Be like COMPLETELY WRONG (even thought millions was spent on these reports) and blame someone else. Leo does a MUCH better and accurate job, for free. wtf.

It is like the CEO of BC Housing…375k/year with departments of complete waste under him. Why would he care about the unwarranted owner-builder exam putting people into hardship? At 375k/year he can go out a buy and house, certaintly won’t be swinging a hammer trying to do an owner-builder for himself.

As I said in my previous comment the day will come when the system can’t support itself anymore. It’s going to be 10 people writing reports about housing starts for every person working on a construction site.

In talking to friends that work for the government, I think there is far worse. I just wonder when the day will come when the private system can no longer support the bloated waste of the government.

I think you need to get to know more people making minimum wage or close to it. Especially people working in long term care homes.

The house on Redfern for 1.4 million looks not too bad. There is another one on Verrinder avenue. https://darrendayrealestate.com/greater-victoria-houses-for-sale.html/listing.1020-verrinder-ave-v8s-3t7.93488933 which is in the same price range.

These are solid, relatively new homes, beautifully taken care of.

Someone selling a post war, beat up old two bedroom bungalow in Kitsilano could buy either one of these properties and still put over a million dollars in their bank account.

That’s why I think they are well priced even though they seem silly expensive here in Victoria:)

FYI – this one is asking ~ $850,000 over assessed value… any thoughts?

https://www.homesonvancouverisland.ca/property-search/detail/173/862021VC/1117-chapman-victoria-bc-v8v2t5/

Hard to believe that a house, however nicely done, on a 3880 square foot lot that the current owner has a right to rent back can be 1.4 million in this neighborhood. Listed at 436k over assessed. Be interesting to see what it sells for.

https://www.rew.ca/properties/3042536/1065-redfern-road-victoria-bc

rush4life- The point I am trying to make is putting cash into the hands of impoverished people does not mean it will be spent wisely. Drugs, alcohol, cigarettes, gambling, the list goes on. Children will still be malnourished and neglected. I’m not against helping disadvantaged people. We should provide safe, clean and reliable housing along with a steady supply of nutritious food. I observe the crap people put in their shopping carts and it’s disgusting. High sugar content soft drinks, cereals, junk food, not to mention bags and bags of harmful potato chips. This all leads to the obesity and diabetic pandemics that exists around the world, which puts enormous strain on our health care systems. What people lack is a proper education, that’s an entirely different story.

Searchable database of companies that got CEWS https://apps.cra-arc.gc.ca/ebci/hacc/cews/srch/pub/dsplyBscSrch?request_locale=en

It is tough to realize one’s advantages in life. Many things we take for granted are simply that – advantages we assume are default for everyone else.

I may be quite young on a relative scale but one of the toughest tasks I have attempted is accurately putting yourself in someone else’s shoes. It may be an impossible act by its very nature.

As always Leo S this week’s article was a great read. Thanks for all your work.

Thanks, I look forward to it totoro

Frank: I always thought this article was quite good on the topic of privilege and money https://www.frugalwoods.com/2015/02/16/the-privilege-of-pursuing-financial-independence/

Egads, the gig is up Marko! Call up the cabal and tell them to start shredding documents.

Just remember, CMHC’s forecast wasn’t wrong, it’s those dastardly RE agents causing prices to go up.

SMH

What an odd statement. Being permanently disabled means you get $1000/month to live on – for everything. And a kid with an unwell single parent on welfare isn’t poor even if they don’t have enough to eat or secure housing and no way to earn their own way? Poverty exist in Canada and unwell people who can’t earn a living also exist.

Very true. But we can make good with the handouts by donating them to local people/organization who need help (e.g. The Victoria Dandelion Society).

Frank you just said had a great mother – that is a privilege – many people have one or two parents who are shit. Its easy to say ‘look at me, i had nothing and made something of myself’ but you are discounting so many things like intelligence, upbringing, opportunity and luck among many others.

By the way the $1000 payment is better for the economy if its ‘wasted’ – that was KS’s point – give it to people who will spend rather than saving it and it will help the economy.

Don’t have smart phones? last time I checked they were giving phones out to all the homeless campers. If you don’t like data collection then don’t apply for the tax credit.

Anyone who wants to apply themselves can do very well in this country privilege has nothing to do with it. I know, I had zero privilege where I grew up, only a great single mother.

Simply isn’t true. Please educate yourself on privilege.

If you give money to people who need it, they’ll just waste it, that’s why they have no money. There is no such thing as a poor person in Canada, only dysfunctional people. They have no concept of money management, it would be great for the drug dealers though.

A lot of people don’t have smartphones, especially those on lower incomes. Also some people who do may object to the data collection. There is also the possibility that such a subsidy may violate trade agreements.

Really the government should just give money to people who need it, rather than invent schemes that benefit people who don’t, whether they be consumers or businesses.

Agreed not a great way to spend 2.5Bn – better than the 10Bn or so that would have been lost from PST but still wasted – especially as they won by such a margin it is very likely they didn’t need to offer it all – or at the very least could have made it a bit more focused on who actually needed it.

It does seem unfair to me that someone who had a particularly good “one” time higher income last year will not get the $500.00 being offered to help with Covid even though they might be in much tighter situation this year because of covid. I know several people where this is the case. It makes me lose further respect for our government and the people who come up with these rules.

They promised this handout to help win the election, not because it’s good policy. I thought that was obvious.

Nice article. This quote is important “His analysis indicates that adding 100 new market-rate apartments typically frees up 58 low-priced homes in a community, increasing affordable housing supply.”

So sad/frustrating to see affordable housing advocates vote down or oppose market rate housing. Dedicated affordable housing is great, but there isn’t enough money to address the need for affordable housing just via subsidized affordable units. We also need constant stream of market units that will be affordable in the future as they age.

They can some good points in this article: https://www.timescolonist.com/all-i-want-for-christmas-hanukkah-kwanzaa-is-affordable-housing-in-walkable-neighbourhood-1.24258748

I agree ks, man a senior couple who own their own million and a half dollar home and defer their property tax, go to Arizona, Florida, Mexico each winter, have two newer SUV’s, have $200K in TFSAs and made $130K last year get this tidy little bonus. It is unbelievable really, especially since they have been getting handouts throughout the year.

On another note: I see 2914 Aprell in Langford just sold for $870K.

Wouldn’t that drive prices up (immediate inflation) due to excess (unearned) money floating around locally?

By offloading the over printed money offshore it would take sometime for the inflation to reach our country, and hopefully by then the pandemic is over and the government can slowdown or stop the printer, effectively let the foreigners hold (the bag) our credits.

But hey what do I know, Trudeau and his team of budget balancing wizards could magically turn us into the banana republic of Canbabwe.

pheww, good to see some people know that the bond market drives mortgages, I got worried for a second here.

Is anyone here getting that $500/$1000 bucks the government is handing out? That handout is absolutely the worst act of wasting money I have ever witnessed. Instead of giving $ to the people who lost their jobs due to Covid, it is given to everyone whom made under a certain amount according to last year’s income regardless if they lost their job or not…

So if someone (e.g. realtor) made $60k last year and made $150k this year then they still get this money but if someone (e.g. pilot) made $150k last year and is laid of because of covid then they get nothing… Jesus christ, if these are the types of decisions being made I can see the province being ran into the ground before the current term is up.

Why can’t they just give a tax credit to incent people to shop, play and eat local. Just get a smartphone app out, have local businesses register and then every time you transact it is recorded and then at tax time this can be used to determine your tax credit. Instead they giving out $500/$1000 bucks to people regardless if they are impacted by Covid to go buy stuff from Amazon… unbelievable.

I don’t think they have direct control over any mortgage rates – fixed or variable. This was proven when oil prices collapsed 5 or 6 years ago and the BoC dropped rates by a quarter twice in a row and the banks only followed 15 bps each time. And in fact on the 2nd drop TD came out and said they weren’t going to drop at all but then RBC announced the 15 bps and they all followed suit – so it easily could have been nothing on the latter.

You could argue influence with their rate drops but certainly not direct control.

BoC does not have control, the market drives the rate….. BoC is not Bank of China….

It is very interesting to hear that people think BoC has direct control over fixed rate mortgages…

You mean BoC, not the government. In any case I don’t see it. Could cause a collapse of the CAD as it’s not a safe haven currency.

Of course people were. But just the smart ones who’d been saving money.

Mortgage rates are literally at 1% – bank of canada can do what it wants and go negative but the banks won’t drop rates much further then where they are. Even in countries where rates are negative the mortgage rates are not. All I was saying was one of the main drivers for this price appreciation has little to no room to continue this push. Yes, the current drop will still impact but once it’s done it’s done. No need to fear Introvert. You will just have to start learning to invest in something that doesn’t have a 1% return. You are smart enough to figure that out.

Great analysis. 2.6% interest rate effect is very interesting 🙂

Huh?

Seems to me that the train will keep running strong for at least two more years, as the BoC has virtually guaranteed that rates will stay in the basement until 2023.

And remember, rates weren’t even high before this whole COVID fiasco began — the BoC rate was 1.75% in January, 2020! Before the pandemic, Canada hadn’t even pulled itself halfway back to the rates we had pre-Financial Crisis (~4.25%).

Excellent analyst of the market, but don’t forget that the government could drop rates to negative and increase the immigrant investor program to prop up the housing market and the growing budget.

If the BoC drop interest rates to negative territory then it will surely keep the housing train running, and perhaps send the housing market to run out of control. Because, negative rates effectively is a wealth tax and it renders the CAD valueless to investors.

In 1982, when interest rates were 18%, people weren’t investing in real estate, they would take the safe path and hoard their cash in the bank without any risk. You can compare house prices to the stock markets and see the same phenomenon. Who ever dreamt that the DOW would be at 30,000. I remember when it was 700, half the price of Tesla(pre-split). I can’t believe what has happened in the span of my working life.

Great article. Now add in a chart of personal debt during the same time frame. Then incomes.

Excellent article as always Leo. When this pandemic ends I need to buy you a beer 🙂

Yeah – could see prices still go up quickly if the banks / gov choose to make it easier to approve (getting rid of b20, increasing amortizations etc) but at least interest rates won’t keep this train running