2021 Market Predictions

Every year we make predictions on this blog about the real estate market and every year we take a look at how far off the previous year’s predictions were. Usually we get a wide range of guesses, some accurate, some out in left field, but the average tends to be not too far off reality. Accurate or not, it’s fun to put some actual numbers behind your view if only to see that the market always surprises.

In 2020 we all have an excuse for missing our forecasts due to the black swan of a global pandemic. Last January I said prices were set to rise in 2020, and even when the pandemic hit it was clear that we were well positioned to withstand the blow. Back in May, even though I expected the pandemic to have a negative effect on our housing market, I wasn’t expecting any substantial price declines because of low rates and the uneven nature of the pandemic’s impact. What I didn’t expect was that an unprecedented disruption to our economy, a massive health challenge, and record unemployment would lead not to market weakness, but an explosion in demand and prices, at least in the detached side of the market. Although a substantial part of that additional demand came from a resurgence in Vancouver buyers, the market would have been active and prices very likely increasing even without that additional demand.

Before we get to making new predictions, here are the predictions we made for 2020:

| User | Annual Sales | SFH Median | Condo Median | BoC Rate |

|---|---|---|---|---|

| NatoK | 6745 | $777,000 | $369,000 | 1.50% |

| gwac | 8326 | $853,000 | $452,000 | 1.50% |

| Grant | 7400 | $816,000 | $440,000 | 1.50% |

| Patrick | 7800 | $840,000 | $435,000 | 1.75% |

| Marko | 7300 | $800,000 | $415,000 | 1.75% |

| NE14T | 6789 | $780,000 | $410,000 | 1.5% |

| RenterRabbit | 7125 | $835,000 | $442,000 | 1.50% |

| Gate | 7800 | $805,000 | $425,000 | 1.50% |

| Garden Suitor | 7300 | $800,000 | $410,000 | 1.5% |

| Cadborosaurus | 8100 | $720,000 | $290,000 | 2.0% |

| The Underwriter | 8100 | $840,000 | $440,000 | 1.5% |

| DuranDuran | 8080 | $838,000 | $408,000 | 1.75% |

| Mt. Tolmie Foothills | 7554 | $800,000 | $427,000 | 1.75% |

| Caveat Emptor | 7500 | $808,000 | $388,000 | 1.25% |

| Leo | 7700 | $830,000 | $425,000 | 1.5% |

| ACTUAL | 8497 | $899,900 | $425,000 | 0.25% |

The real figures are:

- Sales: 8497

- Bank of Canada Rate: 0.25%

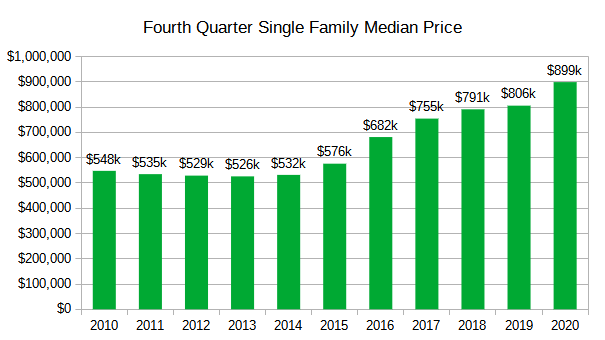

- Single Family Median (December): $899,900

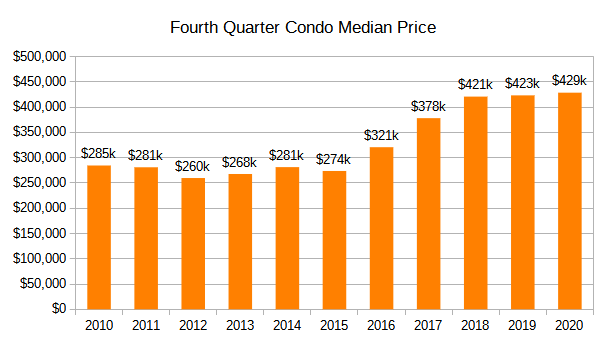

- Condo Median (December): $425,000

Note that prices are based on December pending sales rather than reported sales which is what the VREB releases so they may change slightly in the VREB press release on Monday at which point I will update them.

No surprise, many of the forecasts were not that accurate for 2020. Gwac had the most bullish forecasts for sales and single family prices, so he takes the prize for both of those categories. The condo median stayed fairly flat and was guessed exactly correct by Gate and myself. On interest rates, only Caveat Emptor predicted a rate cut, but of course instead of one step to 1.25% the Bank of Canada cut overnight rates to their effective lower limit of 0.25% and promised to keep them low for a long time.

2021 Predictions

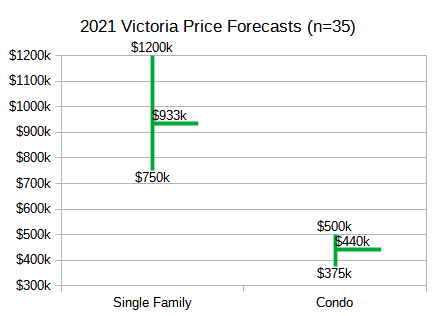

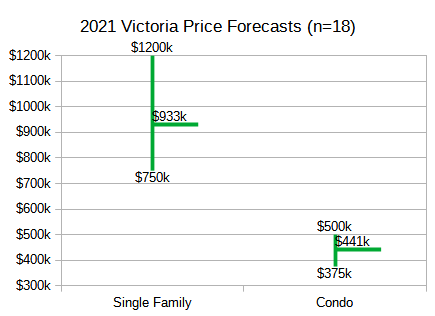

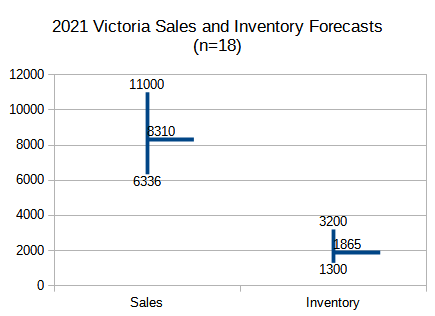

On to the new year then. A small change to the prediction categories this year. Because monthly medians are so volatile we’ll be guessing the fourth quarter (Oct – Dec) median for single family and condos instead of just December. Also I’ve added a category for inventory.

Like last year, this is a tough one to forecast because pandemic economics is uncharted territory. On the bullish side:

- COVID will be over in 2021 with most people either having had it or getting the vaccine.

- Interest rates are at record lows. Any gains in single family affordability due to dropping rates were quickly erased by the price explosion, but condos have been nearly flat for 3 years now, while mortgage carrying costs and incomes increased.

- The firehose of stimulus continues. Government has promised to spend what it takes until the pandemic is over and the recovery takes hold. That means tens of additional billions piled on top of the hundreds already pumped into the economy. Call it stimulus or call it stealth inflation, but we can’t deny this will have a big effect.

- Rental demand will return. Students are coming back to the city slowly in the spring, but very likely almost completely back to normal in fall 2021 which will restore the rental demand.

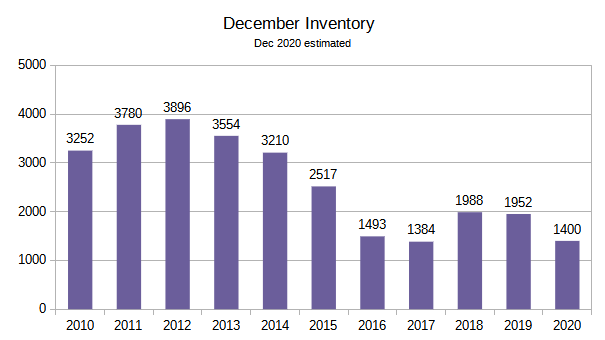

- Market conditions are incredibly tight. That’s especially true in the detached market where market conditions like we have now have historically lead to 10-20% annual price appreciation. Even the condo market has heated up substantially in recent months and market conditions there are pointing to price gains as well.

- Vancouver remains considerably more expensive. The increased price gap compared to historical norms has enticed more Vancouver buyers over in the past, and may continue to do so this year.

On the bearish side:

- The economy will not fully recover for years. Low interest rates are here for a reason: the economy is very fragile. Unemployment in Victoria is still 2.6% higher than pre-pandemic, and industries like tourism aren’t likely to recover until 2022 at the earliest.

- Some of our current demand is only pulled forward. We’ve had a surge of Vancouver buyers some of whom decided to retire early and thus pulled demand forward. We also have low rates pulling buyers from the future. That’s created a surge in demand now but trades it for a lull later. This is likely our last hurrah of dropping rates before we can no longer count on them being a tailwind for house prices.

- Immigration is still slow. Although targets are at record highs for 2021, it’s uncertain if we will come close to hitting them because we haven’t been so far. Border restrictions look set to continue for the first half of 2021 and it’s quite likely it’ll be another down year for new entrants to Canada.

- Government cash is not endless. Currently the big cash transfers to individuals (CRB) and businesses (CEWS) are set to expire mid 2021. While the vast majority will be OK without them by then, the drop in dollars will certainly be felt in the economy and we should see an increase in defaults and mortgage arrears.

- Canadians are burdened with increasing debt. How indebted can we get? It’s unknown, but if the response to every crisis is endless bailouts and cheaper money, we will never solve our debt problems and are simply kicking the can down the road.

Despite the above factors, unfortunately I don’t see any relief for house hunters this year, and I think the bullish side has it for 2021. Although I do not expect our current frenzied market conditions to persist throughout the year, we are so hot right now that it would be nearly impossible to wind down the market to a point where we see price drops. So here are my predictions:

- Sales: 8600. I expect sales to be roughly unchanged in 2021. Although the market is extremely active now, I think inventory constraints will be a drag on sales, and the market will slow down somewhat during the year.

- Single family Q4 2021 median: $980,000. I think prices will continue to increase in 2021, however the rate of increase will slow down throughout the year and I’ve kept it just under a million because I’m just not that keen on the idea of a small city where a house costs a million dollars.

- Condo Q4 median: $475,000. I think we’ll see a decent price jump in condos this year. Affordability is OK with our super low rates, COVID concerns are waning, and prices haven’t moved in 3 years.

- Inventory: 1800. I expect inventory to be a challenge for all of 2021. I think it will build slowly but we will still be very short of listings historically speaking.

- Bank of Canada overnight rate: 0.25%. I don’t expect any changes in 2021. There is talk of another partial rate cut, perhaps to 0.15%, but I just don’t think the economy needs it.

This year we’re doing the same predictions in the Vancouver Island Housing Market Facebook group, so to facilitate collecting responses, I’ve set up a quick survey.

Click here to submit your prediction for 2021

What do you think will happen in our housing market this year? Leave your prediction for sales, single family price, condo price, inventory, and interest rates either below in the comments, by using the Google Form above, or both!

To barrister

Call lambert law re: prospect lake waterfront property

New post: https://househuntvictoria.ca/2021/01/11/construction-is-faltering-when-we-need-it-most

And to answer your other questions Introvert:

1. Yes, mild winters means resistive heater isn’t as big of an impact. That said if it’s near 0 and pouring out such that you have to run the defrost (AC) + heat constantly it is a substantial hit on range. Preheating while plugged in helps a lot in the winter for range, but that requires a L2 charger at home. Also only the SV and up have remote app access via the app. The NissanConnect app is trash by all accounts, but does work to start pre-heat remotely.

2. Yeah you can switch it to km. No real difference between american and Canadian vehicles except climate control is in F and can’t be switched on the S.

3. I have an ODB connector and LeafSpy. I would recommend checking it. 12 bars can mean anything from 85% to 100% battery health. I would not rely on it, and the official Nissan battery health report is useless. I’m happy to lend you mine, but I realize that wouldn’t fit your name 🙂

Looking through the old ads to try to estimate prices back to 1900.. seems like around 1950 or 1960 the market really took off on a long term trend of fast appreciation. Of course dropping rates after 1980s really lit a fire under it, but prices were going strong even before that.

Few more fun facts. The median income for a man in 1940 was about $1000/year so you could buy a house for 1.5x income. 25 year mortgages became available at that time and the prime rate was about 4.5%. If that 1500 house had simply kept pace with inflation it would be worth $25,000 today. But instead, here we are at 1.4 million.

20% cap rate in 1940. Look at those taxes though. $109 on a $1500 house! Currently the median in Fairfield is $1.1M. The equivalent annual taxes would be $80,000

I have a friend who is looking for a property on Prospect lake. I know that they rarely come up but if anyone hears of one let me know.

Leo, you’re a saint for answering all of my questions.

If I understand correctly, your 2013 Leaf S-trim has the resistive heater, not a heat pump. But based on your numbers it doesn’t seem to knock off much range in our mild winters. So, if the battery has sufficient bars remaining, the resistive heater shouldn’t be a deal-breaker for me in Victoria — do you think?

Yours is an American car. Miles can be changed to Km in the settings, correct?

Did you check the battery’s state of health using an OB2 connector and the Leaf Spy app before you bought, or did you just go by the battery bars?

I have to agree. Batteries chemistry hasn’t change much in the last 20+ years, but monitoring, charging, and cooling has come a long way and will continue improve to extends battery life and performance.

I generally agree with Leo’s points. Certainly I’ve heard from members of the EV club different opinions on buying new versus used. If I were to guess overall, most might probably say buy a good recent used. They seem well informed and I’m sure they have done the math.

I personally prefer a new one. Even the battery advance on the new Bolt has made a leap from the previous ones offered.

I find used ones are priced too high in my opinion. Missing out on the $8,000.00 in grant money and the rapidly improving technology seems odd to me. But it’s well established that I am odd:)

The main thing is to make the switch and over time you will have your own opinion based on your needs etc. Good luck.

Try and go for the level two charging station in your home if you can. If you rely on an ordinary outlet plug it will work but it needs several hours to fill a battery.

@Introvert

At this point I would also consider a used Bolt. Prices have come down, can start to find them for ~$25k used. If you intent to keep it for a long time it will likely serve you better. 135 km EPA range on the first gen Leaf then count on ~2-3%/year battery degradation in our climate. I expect the batteries in the original 24kWh Leaf to be serviceable for about 10-15 years before the range becomes unusable. The Bolt with ~350km range (and liquid cooled batteries which degrade more slowly) the battery will very likely outlast the car.

More reliable in general because of fewer parts, but of course early models can have teething problems. As for getting your neighbourhood mechanic to fix everything, those days are over anyway. Any modern car is highly computerized. Electric drivetrains and modern batteries should outlast the rest of the vehicle (400,000+km)

Most reliable car I’ve ever had. Almost no repairs ( brake pads are still original should get 400,000 km out of them). The repairs I’ve had done (my motorized door handle failed) Tesla sent a mobile tech to my house.

Frank…in regards to reliability of EV’s: Ask the taxi people why they have switched to and stayed with electric. It’s well documented that electric cars cost less to maintain. One hears this over and over again and it makes sense because there are less moving parts. Plus the system is much simpler.

My “regular” mechanic has told me that he can fix most issues. I’ve never had to test him on that claim because I’ve never had “any” issues for the past four years.

Talk to people who “own” an electric vehicle. You will always find people who don’t own an electric vehicle… who will always throw shit at the idea.

Some people see the glass half full and some people see it as half empty.

It doesn’t matter what you or I think really. Electric cars are going to be the only choice because it’s well proven that they are much much better in every way.

You can wait and not get the government rebate of $8,000.00 or you can wait until they don’t give a rebate anymore because people have woken up and don’t need the encouragement.

Once you understand how cheap an electric car is to run, I guarantee you will never switch back.

The car dealerships will often try to swing you over to a gas car. We found that out several times. That’s because dealerships make their real money on servicing ICE cars.

Volkswagon is having this problem in Europe. The top brass are shooting for all electric future. But the dealerships were caught on a Green Peace hidden camera/secret shopper ….trying to talk people out of the electric option.

Hope this info helps!

I’m curious about the reliability of EVs and how easy it is to have repairs done. I suspect that only dealerships have the ability to do repairs at their high hourly rates. And I wonder how many of their mechanics are trained to work on them, that could create long wait times for repairs. I’m currently driving a 15 year old van that cost $4000 three years ago. My excellent neighborhood mechanic can usually fix any repairs or maintenance in a few hours. No appointment necessary. I also wonder if an EV can last 15 years.

I also own Brookfield renewable but it is starting to look stretched.

NPI is worth a look. Also gives a dividend.

From all accounts, Bitcoin could go to 50 grand easily and soon. Instead of buying Bitcoin or other crypto you could buy into the QBTC fund. It closed at $51.50 on Friday.

Congrats. Given /r/wallstreetbets is 95% TSLA right now that’s probably a good move

That’s rough, one of those unforseen government imposed costs that has driven me away from considering some property options.

Speaking of Tesla, I just sold most of my shares. I put a meager amount in back around $200/share before the split and now it’s an alarming amount of money. It’s been a hell of a ride but it looks too much like Bitcoin to me now. It’s still a company I see a lot of good things from and a lot of growth in but the valuation makes no sense.

Best part is BC Housing doesn’t offer study materials and recommends a $899 one day zoom course put on by an individual that was hired as a consultant at BC Housing for the exam.

Everyone says my free study guide is better than the course 🙂

I gave a mock exam to one the best residential licenced builders in Victoria, in my opinion, and he failed it (dumb questions that aren’t relevant to building a solid house).

I can change the brakes on my 5,500 lb Tesla that accelerates like a rocket without supervision/licensing but I can’t build my own house under supervision of engineers and inspectors, go figure.

The entire thing is so ridiculous it’s not even funny.

In 5 years BC Housing hasn’t released one statement as to how this exam has improved anything.

It is true.

I would say the majority are owners looking to build homes on vacant land in smaller/more affordable markets.

There aren’t many owner builders in the greater Victoria area I am in touch with. If you have enough to drop 800k on a tear down and 800k for the build you are probably in a position to hire a licenced builder or just buy a $2 million spec home.

Very few people writing the exam for garden suites. I am guessing most are being built by licensed builders as once again if you have a million dollar place in Fairfield you probably have the means to swing a 250k line of credit/refinance for the garden suite. The difference between 200k and 250k is not super relevant for those building. Muncipal and BC Housing obstacles put into places means most people don’t start the garden suite after a bit of research.

And a ton of random shit it’s unbelievable. A guy started a reno in Saanich with permits. I guess he demolished a bit too much where Saanich considered it to be major enough requiring BC Housing Owner Builder authorization. So in he got delayed three months with the exam non-sense while he is renting a place trying to reno his home.

My understanding is you have to write it for each permit you pull. Ridiculous if true.

My old car has been giving me trouble so I just jumped on the EV bandwagon.

Marko, out of curiosity, are you aware of what the owner builders contacting you are taking the exam for?

– Building garden suites?

– Building a new home on a purchased lot?

– undertaking a teardown and build?

I looked at the owner builder years ago, but the requirement to attach it to an existing property title before being allowed to take the course and exam kept me away from it. That requirement in order to take the course and exam seemed really odd to me. I had other questions and when I contacted the office and they seemed irritated that someone would be looking for clarification on things. The other item that seemed extremely weird is that the exam is required each time a person would want to build and attach it to a new title. To make it worth my time to do it, I was looking to do two builds at once with a primary and recreation property, but that would of required the course and exam twice…It was just so weird.

Leo, a few more Leaf questions for you:

Thanks again!

https://www.clickorlando.com/news/local/2021/01/06/not-acceptable-after-botched-daytona-beach-event-officials-promise-smoother-vaccine-rollout/

Tried emailing the MLA or the new minister?

Snowbirds that went to Victoria are probably kicking themselves. Those that went to Florida are enjoying 20 degree weather and they are getting vaccinated now.

Owner builder emails just keep pouring in….so many people getting screwed over/stressing out over a useless exam.

I’ve been holding since 2017 and will cash out Monday if it opens up again and re-invest in something else. Insane run up last few months given the sector the company is in.

I was looking at an out of date price. It’s now actually up 80% from when I bought it ($23.571 versus $13.11).

Algonquin Power is on my watch list, and I have to agree that AQN seems to be a good long bet with half decent dividend. However, they still heavy on gas for electric generation as well as gas delivery and pipelines.

For what it worth did have TransAlta Corp. (TA) stocks in the past but due to their legal troubles of price manipulation I pulled the plug on the company. And, now I may give them another chance that they had ironed out the legal issues.

I believe that TransAlta Renewables Inc. (RNW) green washing is a subsidy of TransAlta Corp. and both are energy type companies with RNW arm energy generation focus on solar at 2%, hyddro 4%, wind +50%, and natural gas 43%. While TA focus on coal, natural gas, and hydro.

The combine companies under TransAlta umbrella energy generation is describe in the picture below and it shows that RNW is not a truly a renewable company.

https://www.transalta.com/wp-content/uploads/2020/02/TransAlta-Investor-Presentation_Jan-2020.pdf

As for Brookfield they pretty much focus on hydro electric, and I’m not sure if one could really call that green.

Yes Leo…wow…. you have a good memory!

We actually loved the Volt. It was a great introductory to electric cars and how the system works. The Volt as you might know is completely electric….until it runs out of battery. Then the gas backup engine kicks in to recharge your battery. Most people drive 85klm a day. The Volt was designed for that. What we found was that after we moved out to Sooke, combined with side trips to our obligations for work and doing some renovation help with our kids, we found that we were using the gas backup more often at the end of each trip. Not much at all. But enough to be somewhat annoying. We also recognized that with battery range improvements increasing a “lot”, then it might be best to trade in the Volt at this time because people will soon look at the low range of the Volt and think… not enough range. Even though it might actually be all they need. The Volt is great but it depends on your driving needs. Our needs changed. We also have a grand child on the way and I’m sure that we will be driving more!

Didn’t you have a Volt before Deryk?

Oh God…..i’m already posting too many times but when someone brings up electric cars I have to jump in.

We bought the Bolt and absolutely love it. It has a good range even in the winter. (About 335kl range. More in the summer.)

It did not make sense to buy a used one because we didn;t want to kiss away $8,000.00 in grants by buying a used one. Yes there is depreciation, but we feel that the grants helped take care of that. The technology is changing fast as well. And so with a new one, you are getting the latest and best in the battery range and advancements.

I’d have loved a Tesla, but we just could not justify the extra price and settled for something that we could honestly afford.

The car companies offer very low interest rates. But….it’s a bit of a shell game because if you pay cash you get $2,000.00 off the sticker price. So…those low interest rates are not really as low as they make out. We opted for saving $2,000.00 by paying cash.

We installed the fast charger in our home and I recommend that.

Our builder had actually included all the wiring and plug for a charger. (Something all new builds should do….including condos! I would not buy a condo without a charger for everyone. )

Plus we got the government grant for the Unit on the wall.

Anyway, we love our Bolt. The grants from the government are not going to be offered forever as people all start to make the leap to electric.

Once you go electric vehicle you will look around you at every stop sign and think about the crap that’s coming out of every tailpipe and wonder why we ever did that.

The last electric car we had had zero maintenance. Not even brakes because of the regen braking system.

You don’t use the brakes very much with the Bolt either. It has an amazing regen feature that means stopping without using brake pads until you are basically stopped. (For the most part that is)

The car also has an automatic braking feature for cars ahead in case you didn’t see the cars in front of you stop. (This is an option feature but worth it.)

No real maintenance. You get $8,000.00 from the BC and Federal government. It costs approximately $6 or maybe 7 bucks in electricity to go around 350kl

If electricity goes up substantially I will install solar panels and make my own.

Costs on that are coming down also. It’s already quite reasonable getting close to Hydro prices.

We can go from Sooke to Victoria and back again for $1.75 in electricity.

Most people are shocked when they learn that.

Still a gamble. Public sentiment shifts, dirt gets dug up, black swan events happen, etc etc.

Some of our domestic green energy stocks have done OK over the last few years. I’m thinking Boralex, Innergex, Brookfield Renewable, Algonquin. Considering these are basically dividend paying utilities the returns have been good. Obviously don’t hold a candle to sexier green stocks like Tesla

Off the top of my head there are RNW (own it, up 27% plus dividends) and BEP.UN .

That’s my view too. There’s probably room for one more oil boom before the world as a whole gets really serious about climate change.

By making municipal taxes slightly less painful for most homeowners it probably encourages municipalities to tax higher than they would otherwise. That plus the cost of the running the homeowner’s grant means that society wide we are paying more because of the homeowner’s grant.

It will sell like hotcakes as well. Problem is they can’t make nearly enough of them.

Don’t count out the gold standard reliable car company Toyota 2021 RAV4 Prime PHEV at $44,990 CAD.

At 56k CND this is a game changer imo. This will crush everything Audi/BMW/Benz/Acura/Lexus, etc., make in terms of small to mid size SUVs but I also think at 56k a few people might start springing for this instead of the CR-Vs of the world once you factor in savings on gas and maintenance.

I crunched the numbers: a Leaf would have cost us 6x less money to run over the last 60,000 km than our current vehicle. Isn’t that insane?

We wouldn’t be taking a Leaf long-distance — too annoying to charge that often. But 99% of the time we’re driving short distances around Victoria.

$16K-ish for a used EV is what we’re considering. Don’t want to take the depreciation hit on a new car + don’t want to direct more money than is necessary away from paying down the mortgage.

Just over 4 years. Paid $16k.

Front right brake seal blew a couple years back. Seemed to be bad luck since I haven’t seen anyone else have that problem.

Just charged off 110V for the first 3 years and never had an issue, but installed a 220V charger last year because it was free through ZapBC so why not. Definitely more convenient since it has enough power to properly pre-heat the car in the winter.

Leaf is great if you treat it like what it is: a city/second car. I’ve taken it on 1200km trips around the interior but just for fun, it’s really not meant for that. May want to consider a used Bolt if you want something with a lot more range without going up to Tesla prices.

Bunch of new next gen SUVs out this year. VW ID4, Model Y standard range, Mach E. All around the $55k mark though. Also the RAV4 Prime Plug in and Escape (~$45k) should be more widely available this year.

Crazy out there no doubt but this place was wildly underlisted. Assessment is $1.61M, same as sale price. No pictures of interior in the 2015 listing so likely substantial updates. That said +$600k in 4 years is something alright. “Sellers has never lived in property”

Hi Leo. I’m taking a hard look at getting a used Nissan Leaf, and I’ve got some questions:

Thanks!

Bidding wars have started….home on Beach listed for $1.399, sold for $1.611 today. Purchased end of 2015 for $989k. This is going to be fun times.

I don’t gamble and bet, because I invest. And, I have seen that exact chart that touted by many green articles. You are correct that PV adoption rate is much higher than prediction as many articles that I read, and so as PV price, as well as Li-ion batteries. It is like everything with growth, production, costs, etc… Take construction for instant, it is common knowledge that the first 90% of the work is done in 50% of the time, and the last 10% of the work will take at least 50% of the time. So it will take much longer for PV to grow after the initial spurt if it does grow.

Add: As of 2 day ago, Germany and Russia has completed the last leg of the Nord Stream pipeline that is going to supply gas to Germany and several other EU countries even those they were facing economic embargo from the American.

I bet you will be surprised at the pace of this transition QT. Official forecasts of renewable energy adoption rates have been spectacularly incorrect in the past, I wouldn’t put any stock on them right now.

A quick peruse on India, South East Asia, and Africa long term outlook for the next 45 years and you get a better picture. Even China is not going to slow down fossil fuel consumption in the next 40 years, however they do have a vague pledge of maybe carbon neutral by 2060 (plateau of use).

Calgary sales up 40% year over year in December.

In the next 18 months we are going to see layoff of roughly 5000 direct, and 3500 of indirect oil workers due to restructuring and consolidation in AB. However, the most recent article that I read, Canada oil sand is seeing an investment growth of 15% for 2021 due to the oil price recovery. I think long term AB will be just humming along, because oil companies are focusing on drawn down their debts and return on investment for share holders. Unless there is a change in government that want to boost revenues from natural resources, then that will give reasons for the oil sand companies to expand.

They’re not going to switch for environmental reasons, they’re going to switch for cost reasons. Makes no sense to spend money on fossil fuels when you can get clean energy for free with relatively cheap equipment. Gov’t policy can advance or slow down this transition, but the real shift is driven by economics.

One thing I learned is to invest in what I know, otherwise it is a gamble, and Canada do not have any mid cap or large cap companies that are into green energy. Hence, I don’t invest in green stocks.

As for TSLA, let it be warn, put your money into it at your own risk. IMHO, TSLA is extremely over bought because at the current price Tesla is effectively worth more than all car manufactures in the world combine, and TSLA produced 500,000 cars for the year amount to 0.6% of the planet annual sales. Current Tesla road map is to produce 2,000,000 by 2025 or 2.2% of global vehicle sales per year (would still be well below the bottom of global manufacture list for volume). If Tesla some how able to produce and sell 10,000,000 cars per year in the next 20-25 years (even Elon Musk don’t dare to entertain such a tall order), it only equate to TSLA at best worth 1/3 of today price and only if investor willing to hold onto the stock with out demand some kind of return.

Another thing is Tesla is now no longer alone on the EV path, because traditional and non traditional car and tech manufactures are ramping up as well as the like of NIO and Xpeng.

Having said the above, there are many hurdles for green companies to overcome specially if they required cheap, advanced mining, processing, manufacturing, and recycling methods with out damaging the environment. Another gotcha is that the incentives gravy train, and carbon credit golden goose have to continue flowing otherwise green companies will fall of the face of the planet if they have to compete with fossil fuel on dollar value.

I also agree with Marko that energy will bounce back in the short term, and flatten out in the long term. The reason is that there are an extra 70+ million people added to energy hungry urbanites in developing countries per year and these countries do not have the money or infrastructures to invest in green energy. Plastic, asphalt, cement, steel, fertilizer, medicines, etc…, and existing ICE will need fossil fuel as well as airplanes, ships, and trucks. Therefore, fossil fuel consumption will keep on the rise and hopefully level out in the next 20 years as indicated by many energy sources.

I also bought energy heavy during the 2020 crash, and average SU at $15.63 among 9 other energy stocks, and the best performer so far is formerly Encana the jewel of Canana OVV at $3.02, and like you I’m looking at holding onto my energy portfolio for the next 2-5 years.

For oil consumption from travel: https://oilprice.com/Energy/Energy-General/Scientists-Find-Way-To-Convert-CO2-Into-Jet-Fuel.html. No idea how viable at scale yet but super cool.

For restaurants getting stripped of earnings by delivery companies: LSPD POS/ Upserve. No restaurant should use delivery services long term and if they keep doing it, they will run themselves out of business because food at places that use better tech than delivery co’s will simply be 20% cheaper.

I agree with Marko that energy will bounce back but only in the short term. I personally bought suncor stock at $21 on avg. Is it something I plan on holding long term? Hell no. The short term prospects (2-5 years)are favourable. I also own clean energy stocks. It’s a good thing to own both right now.

I bet we’ll see more of these stories https://www.cbc.ca/news/canada/british-columbia/condo-insurance-fire-1.5829511

In this case looks like a mistake, but lots of reports of strata insurance policies only possible with large deductibles, so any claims will have to be largely paid by the strata

Every equity has done well IF you invested at the bottom 8 months ago, especially on the day oil traded at -$40 a barrel (that’s negative $40).

Stock performance has little to do with where the industry is going. Railway stocks in the last 100 years outperformed the market despite going from over 60% of the market to a tiny fraction today.

The new hot technology stocks are often overbought and so even if they are wildly successful the returns underperform because it’s all already built in. For example electric cars will take over the entire market in the next 10 years or so in developed countries but TSLA already has all that priced in so may return nothing despite being hugely successful

Those whom invested in energy stocks in the past 8 months has actually done fairly well.

Alberta is like the restaurant owner who is working his ass off to provide take out meals while his dining room sits empty. The delivery services are stripping all the profits and he is unable to benefit from selling beverages and desserts that are the high margin producers in his business. He’s spinning his wheels and still losing money. Rail is the most inefficient way to transport oil and painfully slow with limited capacity. There is no shortage of easy, cheap oil that OPEC and Russia are eager to sell at any price before the party is over. If someone is so confident in the oil sands, put a couple hundred grand into the beaten up securities, but kiss your money goodbye before writing the check.

Re oil….even thought I am pro clean energy/EVs, etc., I have literally zero faith in human kind. Once the pandemic is over I predict the travel industry and everything else will explode and mass consumption will continue as if nothing ever happened. I wouldn’t be surprised if demand for crude oil in 2022 was 5% higher than 2019 which was a record at around 100 million barrels per day.

I wouldn’t put a nail in the coffin for Alberta quite yet. Long term they are screwed but 2-20 yrs who knows.

Another good owner-builder exam email tonight…BC Housing, making housing affordable for hard working people of BC 🙂

Province doubles CleanBC home energy retrofit rebates

https://archive.news.gov.bc.ca/releases/news_releases_2020-2024/2020EMLI0068-002140.htm

Gee maybe because prices are in the toilet? And if production is up, they ultimately have to be selling it to someone.

Regarding “special interest groups will not allow it to be transported through B.C”, Transmountain v1.0 has been doing just that for decades, and v2.0 is under construction. It’s transported by rail too.

caveat emptor- If Alberta is producing so much oil, why are all the stocks in the toilet. Production may be up but what are they doing with it? They can’t transport it to other markets, Biden is committed to shutting down Keystone and special interest groups will not allow it to be transported through B.C. Could you also explain the high unemployment rate in Alberta. I doubt the accuracy of your statement, reality would suggest otherwise.

Very interesting comments QT.

We will have to disagree though I guess. But good luck to you. Your spirit will serve you well.

I also hope you will get involved and help us build a strong vibrant country. Look for ways and what you can do for your country as you remind us.

I disagree, if you only have principal residence under the threshold you are saving on taxes compared to those in higher worth homes, owners with multiple properties and investors that rent out their properties.

Recently in Victoria, no frills housing were provided to the homeless and some complaints that they prefer to live on the street because there are no rules and the housing didn’t provided TV cable or internet. And, so far we have several fires, fights, weapons, and drugs, among many other issues at free housing locations. As for undeserving, we all know full well that people will take advantage of housing and many of those are drugs dealers that infiltrate to take advantage of the system and the weak individuals.

Perhaps, it would make more sense for every Canadian to be proud as a productive/caring person, and put the effort in caring for one own family and country instead of looking for ways to dump the responsibility upon society/government.

Ask not what your country can do for you, ask what you can do for your country. — JFK

The problem is not from the street people. It is from the people that claims to be social justice warriors who benefits from having people on the street, because they get pay to pretend to take care, provide mental health and physical health, and policing. Cut out these social justice warriors and perhaps reinstate places like Riverview Hospital, etc… to take care of the health issues.

I was born in Vietnam during the war and have experience more than what the average person seen in a lifetime by the age of 12. So no Canada and the US will not fall into a revolution at anytime soon, unless the myopic left keep on seeking out of touch Socialist/Communist Utopia that provides pathway for dictators like Pol Pot and the Khmer Rouge to take over.

PS. Just look at socialist France and they practically burned down Paris and the surrounding cities for a year, and the UK system of housing that you suggested didn’t keep the demonstrations in check such as the Brexit, housing, wages, immigrants riots, etc…

QT…I can appreciate your worry about who might cheat the system and get something that they shouldn’t be entitled to. (Re: Providing housing)

Perhaps if you thought about it in the following way .

Which side would you prefer to err on?

1.Provide some basic, no frills housing for those who need a roof over their heads and can’t cope…with the downside of that being that some undeserving people will slip into those homes as well.

2. Or: Are you willing to deal with thousands of people on the street costing you forty thousand dollars a year for everyone you see in those tents or cardboard boxes?

Are you willing to pay the “added” cost of an insurrection as young people start a revolution?

I believe that we are very close to that happening. The break down of bitter, angry people seeking revenge that we see in the States will spread to Canada. That’s my opinion.

I’d rather see us share the cost and build housing.

Many of you will say…yes….I want to see houses built. I just don’t want the government to be the one to do that because governments are not efficient. Better that the private sector be encouraged to do that one might say.

But if we don’t trust governments to build our social, low cost housing needs, then why do we trust them with looking after our health care needs? Why do we trust them to do anything for us?

My point is that we do need to trust our governments. (I can’t believe I’m saying that:)

But we do….. unfortunately.

If you are suggesting that everyone should be paying their fair share of taxes, in the case of property tax and homeowner grants among other taxes. Then we should deduct the school tax portion from homeowners that do not have kids, and perhaps remove the child benefits, etc… to make it fair for everyone. And, perhaps have a flat income tax with no exception or deductions so it is fair for all.

Everyone is equal, but some are more equal than others.

Yeah I was going to say it’s a handout to the rich, and it probably is, but I can’t be entirely sure. Province pays homeowner grant for mostly relatively wealthy owners, therefore has to raise taxes elsewhere. So depends on how progressive the other taxes are that are higher to pay for the HOG.

Interesting – I didn’t realize the homeowners grant was paid for by the Province. That is ridiculous.

I would guess a single homeowner who receives it is saving a net cost off the backs of others but as a society i agree.

I’d like to abolish the home owners grant before deferrals. Makes zero sense for one level of government to pay taxes for the level below it so just from an efficiency standpoint it’s offensive to me. Owners should pay the taxes required to the local government. Giving the wealthiest people a rebate so that the entire province gets to subsidize them is backwards.

Make no mistake, we aren’t saving a dime in taxes via the home owners grant.

I like this idea. /me goes to set up a gofundme to reduce a few bps off my MERs.

I don’t like the idea of property tax deferral. Pay up, take out a LOC or take out a reverse mortgage – or the gov should increase the rate and actually break even on it. – if you are getting the deferral then you have equity in your home. It would be like Leo complaining that the fees to buy his stocks are too high and everyone, including the people who can’t afford stocks, have to subsidize those fees.

This is exactly what has happened to renters with the increased cost of housing.

They likely need a piece of paper for something (i.e. financing or similar) and that piece of paper can’t be issued without BC Housing Owner builder approval.

Guy emailed me Monday that built a home 4 years ago without owner builder approval and now can’t sell it. Bc housing forcing him to write the exam even thought home is 4 years old.

The majority of people buying land don’t know about this exam. It comes up when they start with the procedd of building.

So who would get to have that cheap or free housing?

Where it going to end, because many with higher mental capability will certainly take advantage of it over that of people with lesser mental capability who more than likely need help with housing. And, then you would have groups of people who would take advantage of it just because they can, and there will be segregation that spurs from jealousy.

Hence, we will come full circle once again that there are those that are more equal than others.

The economic statistics don’t really bear that out. Certainly we are wealthy enough to provide basic housing for most of the currently unhoused if we made it a priority to do so.

Oil sands production hit an all time high in 2019. Alberta oil production down in 2020, although the fall in conventional oil production is greater than the fall in oil sands production. This year or next Alberta will hit a new all time high in oil sands production.

I agree that some people fall through the cracks of subsidize housing, but we also have rent to own program, along with many other schemes for first time home buyer such as, 5% down, first time home buyer incentive, and home buyer plan, that help people get into housing.

If a person or a family can’t afford to save 5% for down payment, then how would they be able to afford to pay for a house. Mortgage cost is only one factor in owning a house, while tax, insurance, maintenance, etc… is another 40% on top.

If rent is too expensive in Van/Vic, then perhaps one must look at other alternatives such as moving to lower costs towns or cities. And, IMHO it is much easier for renters to move for a better job and housing, because they don’t have assets that anchor them down.

Why would this person worry about the homebuilder test? Just build the house. I grew up in a remoter area with no building permits or inspections. People still build their own houses with no regard for the test, dig their own septic fields with no regard for regulation. Amazingly hydro will hook up your new house with no particular regard to its legal status.

Hi Barrister, Some good points. You know I respect your views!

I’m sitting watching what is happening down in the States. Many people point to Trump as the problem. And that is true. But I’m more interested in why someone like Trump came to power.

I believe that there is something fundamentally wrong with our model. You are right that Canada is not as rich as we think it is.

That’s why I believe that we can’t afford to be squandering the little money we do have.

It is costing us a fortune to look after people on the street. It is well proven that it costs tens of thousands every year to look after them in this way. I believe the number is around forty thousand dollars for each person on the street. The amount varies depending on which stats you look at, but it is very high. (Ambulances, policing costs, health issues etc etc.)

I simply happen to think that we cant afford to ignore that.

So when people say, do you want to be taxed more, I say not particularly, but I want to see our tax dollars spent more wisely. It will save buckets of money if we house people and treat their mental illness and offer them some hope that there is a benefit to joining society instead of fighting it.

What’s happening in the states right now is just the tip of the iceberge. It will get worse and it is spreading to Canada. Not because of one leader, but because of the rot growing deep inside.

You are a good man Barrister. I like the cut of your jib:) Thanks for your input and thoughts.

The government doesn’t fund CPP you know. Apart from that you have a point.

Barrister- Glad someone shares my view on Canada since our major source of revenue, the oil sands, has been decimated. We are not Norway, a country that has amassed an over One Trillion dollar sovereign wealth fund for its 5 million citizens thanks to their North Sea oil reserves. I believe we currently own a one trillion dollar deficit. More wealthy Canadians will look to relocate to other countries as our government sees them as their own ATM machine.

Deryk: I generally find that most people who like the idea of massive government programs also seem to feel that someone else should be paying either for all or most of it. Since you are a strong advocate of having the government taking over the rental sector would you at least, being a rich home owner yourself, have you CPP reduced by 40%, no more tax deferrals on your property tax and an additional tax of 8% of your net worth including your house?

Naturally, people always say that they will pay their fair share but their idea of their fair share usually means that someone else is paying for most of it. The bad news is that Canada is not nearly as wealthy as it once was and that is a reality that has not set in yet. Since we are leaving as soon as the renos on our new place are done I am not going to lecture as to the mess that this economy is actually facing.

I’m with you on this one Deryk. We will need substantial state support to create affordable housing. Whether that is direct building by the government or just buying up units built by private developer and subsidizing their rent is really not the issue at hand. The dollars are going to have to be spent one way or another to improve affordability beyond what the market can achieve (although we can certainly make great strides by simply removing roadblocks to market housing and it won’t cost us a dime)

MY RATIONAL FOR LARGE INCREASE IN VICTORIA RE PRICES IN 2021

In addition to continued low interest rates and low listing inventory I see international events adding to the demand for Victoria R.E. The situation in Hong Kong is going to get more dire as the year progresses. As travel restrictions are relaxed. more and more Canadian Hong Kongers are going to leave in droves and return permanently to Canada, a majority of them to Vancouver. This will put huge pressure on Vancouver RE which for similar past reasons will then bring many mainland owners to move to Victoria. Hong Kong isn’t the only place of unrest and CCP takeover. There is a real strong possibility that the CCP is going to forcibly press its claim on Taiwan causing additional mass migration.

Just as no one anticipated Covid would impact Victoria RE we are now in an era where international incidents will do the same.

I agree with everyone on the “test” requirement…. definitely an ill thought out idea. I didn’t know it was BC Housing who came up with that idea. I still support their approach overall though. Just don’t agree with testing. It seems the inspections and building code would look after most things.

For the fellow who was wanting to build a home in a remote place….have you considered some amazing kits/modular homes that are available? They tend to be a bit pricy but cheaper than trying to build in a remote place with contractors and many come in various levels of ease for the do it yourself person. Some are quite magnificent. I almost did one myself but changed my mind.

And Yes…Deb….. I grew up in Scotland and we lived in those council houses. I have friends are in the council houses today. They need improvements to the system but it works fairly well and is much cheaper than having people on the street. It also is more humane.

I grew up in a UK “council house” on a “council estate” and it worked well for many low income families. If the UK can do it I am sure Canada could but the will to do it just doesn’t exist.

https://en.wikipedia.org/wiki/Public_housing_in_the_United_Kingdom

This is government for you courtesy of BC Housing….I’ve received 7 emails this morning asking for assistance for an exam that is 100% useless. This is an entire completely useless department in government putting people into hardship. Now multiply x many useless departments.

Government building housing would be a failure of epic proportions.

As you have so eloquently stated in your videos about the OB Exam and the problems of even being able to write a reasonable

and common sense exam, have left me worried about this exam.

for our young family and absolutely want to do it as affordable as possible- meaning no general contractor! Any help would be amazing,

etc. etc.

It is interesting to see such negative responses to my thoughts on government built housing.

I guess I’m left assuming that you all believe that what we have now, one of relying on the private sector to create affordable housing, that you feel that this is the best we can do…that the current system is working? I see it as a total disaster.

If governments can’t be counted on for providing the basics of societies needs then we might have bigger problem than just housing.

Of course I should clarify…… when I said government should build the housing, I mean the example of BC Housing partnering and funding with private builders. Yes…I’m a strong supporter of what BC Housing is doing. It’s exactly what should be done with more support from the federal government which is not there. I’ve heard local and provincial governments often complain about the lack of support from the Feds.

Anyway. I know I can’t swing many of you around but that’s ok. Good to have the discussion. Thank you for the input. Some of it is good food for thought.

I like what BC Housing did with Vivid on Johnson (20 story tower). They financed the project for Chard Development and Chard had to pre-sell the units at 8% below market to buyers that met certain thresholds (income less than x amount, havd to live in unit as principal residence, etc.). I had several clients buy there and in my estimation it was right around 8% below market.

Wasn’t perfect but 10x better than the government trying to manage a build.

Ha ha …thanks Barrister. No worries. I could be off base.

It’s a hard idea for me to accept though….. as I am always right:)

(Just trying to work you up!)

Deruk: I think you are great but you are really off base with the idea of massive government build rental projects.

Think of the blue bridge project and multiple the disasters ten fold. You are a fine man but while you dont always have rose colored glasses on in this case you are seeing rainbows and ignoring the most deadly of all storms.

Canada does have a National Housing Strategy. You may not agree with everything in it of course.

The feds have never been interested in owning or managing housing. That’s something they leave to the provinces or their designated agents (regions, municipalities, co-ops, non-profits, etc.). Indeed provinces have getting out of direct ownership or management. The feds do continue the role of financing.

https://www.placetocallhome.ca/

“…the idea of Canadian govt. managing the build out of thousands of units, all subsidized is a recipe for disaster!”

BC Housing, the Capital Region Housing Corporation, etc., already do this.

I cannot think of a bigger disaster than that. I’ll see developers worth $50+ million personally doing traffic control infront of their projects need be….can you imagine that with something government run? Ha ha….can’t wait to see the City of Victoria project on Pandora. They already overpaid for the property by $4 to $5 million in my estimation.

too many ugly “rental boxes”

The designs they approved for construction…

deryk – the idea of Canadian govt. managing the build out of thousands of units, all subsidized is a recipe for disaster! We have endless examples of govt. projects running way over budget, directing funds to preferred vendors / participants and often results in sub-standard buildings.

Incentivize the long term investors (pension funds, REIT’s, etc.). Current activity in Langford probably shouldn’t dictate what goes on in the rest of the province… The views appear focused on preserving equity rather than delivering housing.

I’m fast becoming a strong believer in the government building rental buildings. It seems the only pure and simple way to get the units built. All the costs can then be spread out over time and carried by the community for the community’s benefit. (Creating affordable housing has massive benefits to society.)

Tax incentives to encourage builders to create low cost housing sounds appealing, but the taxation rules become overly complicated and they keep changing over and over again and the builders still get branded as somehow getting away with something.

Maybe it’s best for governments (You and I) to simply create so much rental units that there are some available at a standard low rate. In some ways this is happening with the BC government and BC Housing. They have really stepped up to the plate but much more is needed. The Federal government needs to wake up and form a plan….something that it completely lacks right now. There is no leadership.

I’m not an economist, but a few things are clear to me:

-New rentals are much more expensive than rent in older buildings

-Construction code, higher labour/material costs, price of land create higher total construction costs

-As a society, we don’t really want these to go down, except maybe price of land (high labour costs means better paying jobs, high material costs benefits Canadian businesses, higher code requirements reflect better safety, performance, quality of building)

-Higher labour costs reflect higher productivity of workers today compared with a generation ago; corporate agility, higher education standards, supply chains, IT tools, workforce mobility; but not everything is more efficient – is a forklift driver today really twice as productive as a forklift driver 20 years ago?

-What we want is for businesses to invest in innovation and productivity tools, so that wages remain high and quality jobs are increased; Canada is big and mobility is a problem, and transportation improvements are needed too

-Ergo, rents in Langford should be $1600/m, or whatever market rate is; workers in Langford should make wages to allow people to live in these places (not necessarily SFH – families can live in apartments/townhouses like in Europe); governments should invest in infrastructure and transportation and give incentives to encourage innovation to maximize employee productivity and justify/retain high wages

-It also makes no sense why the price of land should be so high in Canada, but that’s a topic for another time

-I think policy makers know this stuff, but it’s slow to implement, and sometimes faces opposition (some of it reasonable); and Canadian culture does not encourage risk-taking and corporate investments as much as many other places.

-Don’t expect rents to drop anywhere anytime soon, except in less-desirable buildings (busy roads, less livable, less safe) – this would portend significant overall economic failure, probably accompanied by a major recession.

One tax change with regard to rentals which I think would be a good idea is disallowing writeoffs of net rental losses against other income. Right now you can, with the exception that capital cost allowance cannot be used to create a loss. If you’re running such a loss from the outset it means you paid too much for the property and are essentially a speculator.

To allow for unforeseen circumstances a writeoff could be allowed against past net rental income. That’s similar to what we do now with capital losses.

There is no “can’t fill a rental” or “can’t sell a property” in an open market. There’s always a taker at the market price. As someone pointed out, if new rentals are being built too quickly (for the landlords that is) the market rent will fall. Same thing with properties for sale. Then fewer properties will be built. That’s the market cycle.

As a developer you get some pretty obvious hints from city staff as to the flavour of the day with council and right now the feeling in Langford is that there are too many ugly “rental boxes” owned by reits, etc. They want to see condos that are a bit more visually interesting and not complete boxes (think the new rental buildings on the highway @ Thetis Lake in View Royal).

Seems unlike them to even show a preference. Normally they just approve anything that gets proposed. Either way other munis will have to step up on supply.

Langford is going away from approving PBR right now. They are strongly favoring condos at the moment.

You’re missing my point. The size is immaterial (but they are mostly in Langford because of fewer barriers to development and lower land costs). The point is new market rate PBR is expensive. If you build an appropriate amount every year for decades, then there is always a good mix of PBRs of every vintage and price point. If you don’t build anything for decades and then try to catch up with a huge building surge you have tons of old rentals (60s apartments) and tons of expensive new rentals with nothing in between. That can be a mismatch with the market.

Yes but if we can’t fill the new rentals then the rate of construction of them will decrease.

I don’t know at what point the market gets saturated, but it’s a concern with this boom and bust construction cycle. A steady sustainable rate of rental construction is much better.

No. You’d pay more taxes on the rental income and pay capital gains tax unless you are selling shares which is very unlikely with residential real estate.

“…there’s only so much of a market for 1br in Langford for $1600/month.”

? PBR’s only have 1 bdrms? And are only in Langford? Ok… I was thinking more of a variety like PBR’s I’m familiar with that have a mix of suites and can be built in any area zoned for it.

“… a bottleneck with low vacancy in older stock but higher vacancy in the new builds.”

would be addressed in short order by increasing/lowering rents.

Nothing, the rate is already zero for PRs

So why can’t government put a policy for different captial gains tax for different assets? What’s preventing them to single out single family residential realestate and apply a different rate?

If the return profile of investment properties are greatly diminished then there will be more supply on the market for the people looking to buy their first home. I would think that is better than having a bunch of people trying to buy as many houses they can so they can play real life monopoly.

It would if the rates were different. That’s why I think different rates are a bad idea.

I agree we are way behind and need a decade of high construction levels to catch up. But there’s only so much of a market for 1br in Langford for $1600/month. If units are gradually built over time they age and slowly become more affordable, but this huge surge of construction may end up being a bottleneck with low vacancy in older stock but higher vacancy in the new builds.

Big incentives to lower rents would be good but not sure if the money will be there. Right now most of the money flow is loans not grants

I’m no expert, but would forming a corporation and putting all your real estate holdings into it be a way around increasing capital gains taxes?

To be clear, I am not saying increasing the inclusion rate on capital gains is likely, I am just saying it is more likely than removing interest costs from being tax deductible.

The average guess tends to be pretty decent. Little bit bearish usually but close.

MY PREDICTIONS FOR 2021

Federal Liberals will: 1.) increase GST to 7% 2.)raise Capital Gains to 75% 3a.) Introduce Capital Gains on Principle residences on a staggered basis if sold within 3 years. 3b.) Introduce a lifetime limit Capital Gains exemption on Principle residences of 1Million dollars.

No. That would just add to the economic imbalances created by the principal residence exemption and wipe out much of the rental housing supply.

And there’s no equitable way you could implement it. For example, property A has a mortgage on it. Property B has no mortgage but is owned by a REIT and the REIT shareholders buy on margin. The possibilities are endless.

What ought to be done is the opposite – pare down the principal residence exemption. Not all the way, but don’t exempt suites for example. And what is most likely is more aggressive enforcement – notice all the additional information that is being collected from property owners by both the province and the feds?

I think it’s likely some pressure is put on the individual real estate investor in the next few years – this group has enjoyed so many years of appreciation with a negative outcome for renters. It’s sucked in huge amounts of capital from the economy while running up costs for the end users (renters). Direct the capital to PBR by providing massive incentives – 10 year tax free status, reduced tax on rental income (only applicable to buildings with 10+ units), etc. – whatever’s needed. In turn, raise capital gains on secondary residences and increase the tax rate on non-multi unit rental income. The outcry from owners would get little sympathy these days.

Leo – we’re so far behind there’s no reason to limit PBR. Incentives could make more projects viable at lower rental rates. Besides, if the individual investor was pushed out there’d be lots of supply for end user owners.

Interesting article on Sooke and lack of available housing for sale. https://www.sookenewsmirror.com/news/sooke-has-virtually-no-inventory-according-to-real-estate-agents/

Good tax grab scam, however it would be a case for political suicide. Similarly, the Conservatives (is now the Liberal party) that got completely wiped out in the 1992 election after they stacked the deck in 1990 to passed the GST.

It has been an on going issue for several years soon after the area was designated as a Langford downtown core, that was subjected for high density. Several of the SFH properties enjoyed low property tax for a long time, and I think one of the underlying fear is that higher density will increase tax along with traffics.

Concerns on the rise over six-storey building proposed for Langford — https://www.vicnews.com/news/concerns-on-the-rise-over-six-storey-building-proposed-for-langford/

Langford residents join to oppose apartment building on single-family residential street — https://www.timescolonist.com/news/local/langford-residents-join-to-oppose-apartment-building-on-single-family-residential-street-1.24166605

If they get rid of interest as expense, they would also need to get rid of interest expenses being tax deductible for companies. Otherwise investors would just transfer the property to a company. Although I think this would be a sensible tax policy I think it is unlikely to happen. Also they would have to probably make this a gradual transition.

As for the second point, this would also involve changing the rules on all capital gains. This I think is more likely, but they would probably increase it to 75% inclusion rate first.

But why not just enter/exit onto Goldstream Ave instead? Kills their argument that it’ll increase pedestrian risk to Fairway Ave.

Nervous? no I am just curious, my principal residence is currently designated as as a rental property which I am exempt from any capital gains if I sell (you are allowed to do this provided certain conditions are met).

If you’re really bored, go back and for each year compare the HHV prediction average against what actually occurred, to find out how accurate HHVers’ predictions, in aggregate, tend to be.

Someone’s getting nervous.

Does anyone think the government will implement punitive taxes for investment properties going forward? Something like not being able to write of the interest as expense and have 100% capital gains taxed.

Consensus so far is that both single family and condo median price to increase about 3.5% in 2021.

Sales to drop a bit (down 2%) and inventory up about 40% from current record lows.

Other forecasts

“More Vancouverites.”

“Asset inflation continues, no reason to believe otherwise currently.”

“Municipal, provincial, and federal governments promise to do something about housing affordability, then make it worse.”

“RE activity in Victoria will be very active in spring and early summer, then stall hard, and decline in the last 2 quarters, leading to a rise in inventory and drop in prices. Overall prices will be nearly flat YoY for SFH, but with gains for condos. Outlying areas and up-island will be sharply up.”

“big uptick in housing starts in 2021 over 2020 levels”

My favourite is when people buy into brand new condo towers and them complain about the next one going up.

I’m ok with being NIMBY if you’re within a couple of houses of the development, but the people that come out of the woodwork from blocks away have me scratching my head.

When garden suite legislation first came out I applied for one and the number of people who came out to tell me I would destroy the fabric of the neighbourhood was pretty shocking. I never went through with it but there are 3 on my street and there is absolutely zero difference…

I’m not talking about neighbours that say “I’m all for affordable housing but this isn’t the place for it”. That’s just an excuse. But there are lots of affordability advocates that fight any attempts to allow more supply because they’re opposed to anything that isn’t specifically shelter rate housing.

Getting somewhat concerned about the rental supply side too. Purpose built rental is great and sorely needed, but we should also be encouraging new supply for ownership. Although we need lots of new PBR, there is a limit to how many brand new units can be absorbed all at once and we shouldn’t be voting down ownership supply to focus it all on rental construction.

I’ll agree with that.

Which is pretty much everyone that is anti development except Introvert.

Agreed. I disagree with NIMBYs and I think you are better off allowing gradual densification than shutting it all out and turning into a neighbourhood of McMansions, but I understand the desire to minimize change.

The most frustrating anti development people are those who say they are advocates for affordable housing but then spend all their time fighting new supply.

Agreed. You’ll hear NIMBYs invariably say things like, “I’m not against development, but…”

NIMBYs should just say they’re against development. They should be honest and upfront about it.

BTW, being against development is a legitimate stance. In fact, it’s a testament to how successful YIMBYs have been at advancing their cause that NIMBYs feel the need to cloak their NIMBYism in other concerns.

Wonder why people call single family neighbourhoods residential neighbourhoods that condos will destroy. Condo residents aren’t residents?

But remember, it’s not about NIMBY, they’re against the development purely because they’re concerned about the pedestrian safety of those new residents.

And then these same people will complain about how their kids can’t find affordable places to rent/buy.

NIMBYism in itself doesn’t bother me at all but if you are going to be a NIMBY just have some balls and tell it like it is….can’t afford Victoria? Great, move to Duncan or Prince George because I want my neighborhood unchanged forever.

Some retired guy approached me in my lobby about me leadint a group together against the Roundhouse…doesn’t want to live in construction zone for next 20 years. Yet he bought into a brand new building that took 3 years to build. My building is considered higher end with lots of retired lawyers/execs/doctors but damn the level of common sense is near zero. It is painful to listen to.

NIMBYism has reached Langford!

https://vancouverisland.ctvnews.ca/video?clipId=2112176

North of Campbell River saw the highest price ascent with Tahsis at 36% jump in assessment price.

Single Family Homes by Community

+9% City of Colwood

+6% City of Victoria

+5% District of Central Saanich

+8% Township of Esquimalt

+4% District of Saanich

+7% District of Oak Bay

+8% City of Langford

+7% District of North Saanich

+10% District of Metchosin

+8% District of Sooke

+5% District of Highlands

+6% Town of View Royal

+6% Town of Sidney

+7% Gulf Islands

+7% Town of Ladysmith

+8% Town of Lake Cowichan

+5% City of Duncan

+7% District of North Cowichan

+5% District of Lantzville

+5% City of Nanaimo

+9% Nanaimo Rural

+6% Town of Qualicum Beach

+3% City of Parksville

+9% District of Tofino

+11% Town of Ucluelet

+7% City of Port Alberni

+7% City of Courtenay

+6% Town of Comox

+6% Village of Cumberland

+5% City of Campbell River

+5% Campbell River Rural

+10% District of Port Hardy

+12% Village of Port Alice

0% Town of Port McNeil

+17% Village of Gold River

+36% Village of Tahsis

+10% Village of Alert Bay

+3% Village of Sayward

+18% Village of Zeballos

+10% Port Hardy

+9% Powell River Regional District – Rural Areas

+9% City of Powell River

https://info.bcassessment.ca/news/Pages/Vancouver-Island-2021-Property-Assessments-in-the-Mail.aspx

Latest Vancouver Island property assessments show ‘moderate’ increase

https://vancouverisland.ctvnews.ca/latest-vancouver-island-property-assessments-show-moderate-increase-1.5253037

The Pearl is going in next door. That is 2+ years of construction and complete blockade after it is finished.

I would say it’s because they are expecting more housing inflation. Why would people be piling into housing if they expected housing prices to stay flat along with rising consumer prices? That’s falling real RE prices.

Marko, was it you saying you were thinking of purchasing at 409 Swift St.? Or was it another building. I see 218-409 is listed at $375K with 565 sq ft and comes with parking.

Two other around the same price and size at 1030 yates St., but both of them don’t have parking.

I’m thinking Swift St. seems a pretty good.

As a random poster, here are my random predictions.

SFH $935,000

Condos 442,000

BOC Rate 0.25%

Annual Sales 8200

Side note: Enjoying the investment chatter. I am constantly in and out of stocks, ETF’s etc…

Just sold Baidu as I’m wary of Chinese interference I.e. Alibaba.

Went in hard recently wit GPV.V . Also just bought G.M. This morning.

Also recently added to Pif.to

Started a small position with wecommerce as well. Good luck everybody.

Housing inflation is not caused by devaluation of money, but by people piling into housing as an asset class because they fear future devaluation of money (CPI inflation).

Lowest inventory ever on record, combined with 6 months in a row of record breaking sales.

Final Dec numbers:

Sales: 631 (up 50%)

New listings: 456 (Up 15%)

Inventory: 1279 (!) (Down 34%)

For some reason a huge number of properties dropped off the market between the 28th and end of the month. Last year it was only about 50.

Anyone who thinks what is going on here is stupid. You should check what is going on a lakefront or whistler. Just over the top.

Patently false on stability, unless you’re talking about the Venezuelan Bolivar or something similar. As someone pointed out, it’s not just unstable but insecure.

On nominal terms yes it trades for more than one $ but that doesn’t get you anything in itself just as it doesn’t for stocks or anything else. It’s the collective return to investors that matters and for bitcoin that’s negative.

Since PayPal started accepting Bitcoin its legitimacy has greatly increased. I’ve heard that countries like Mexico often print new currency and render the old currency worthless to discourage money hoarding by drug dealers. Hence the demand for cryptocurrency.

Leo makes a great point about housing. If you are a low income individual who spends all their money on food, shelter, and transportation. Inflation has not been kind, and CPI does not reflect what is really going on. Unfortunately vsome employees are not even lucky enough to have their wages increase by CPI.

I think it’s a reasonable position to look at the trillions of dollars being printed around the world and look for a hard asset to jump into because of inflation fears. CPI inflation is low, but housing inflation is not.

But if I’m looking for an inflation hedge I’m buying real estate and gold, which have actual fundamental value to them unlike bitcoin.

Thanks LeoS. You are a superstar.

If by “devaluing” you mean inflation, here’s Canada’s 2020 inflation thus far:

If by “devaluing” you mean the Canadian dollar is losing value against the US dollar, you’ll notice that it’s been in historically normal territory for all of 2020:

Yeah, single family market definitely hotter. I’ve covered the difference in the two markets extensively here in posts last year. But condo market has also heated up substantially especially in the fall.

LeoS: Is it possible to split months of inventory so that shows separately for SFH and for condos. I am starting to suspect that there is more of a divergence between the two than is usual.

Yeah I’m a little on the fence. Very likely I’ll use it as an experiment for this year’s additions, but I won’t be rebuilding my entire portfolio.

The other alternative if I can wrap my head around it is see if I can adapt a portfolio to get some factor tilt while retaining my VGRO holdings. I.e. no point in buying what I already own, and I can use this year’s additions to overweight some of the factors.

Thanks Leo. Good point about spreads possibly adding to the cost of this. In totality the factor tilt portfolio starts to look a bit complex compared to the one fund approach (VEQT or VGRO), so I’m tempted to stick with status quo for now. I’d be interested in how it goes for you if you go that route.

I think I am already going to revise my predictions for 2021 from 915k to 950k for SFHs…..two emails out of the blue today from people relocating from out east to Vic looking to buy this spring with 7 figure budgets. Then I went to book 5 SFHs this evening to show on Wednesday and all 5 have accepted offers. Four I thought were overpriced and two outrageously overpriced, but I guess the market has caught up to the left over stuff from the fall. The start to this year will be nuts.

Paper is here and worth reading but doesn’t include discussion on the currency issue: https://www.pwlcapital.com/wp-content/uploads/2020/12/Five-Factor-Investing-with-ETFs.pdf

Some discussion of it here: https://community.rationalreminder.ca/t/2020-model-portfolios-paper-five-factor-investing-with-etfs/2662/34

Basically you can either eat the 1.5% (or use a lower cost broker like InteractiveBrokers) which if you hold for a long time is not that significant, or do Norbert’s Gambit which isn’t free but should be between 0.25% and 0.5% depending on the amount you are moving, how lucky you are with spreads, etc.