Why I’m not that bearish on housing, and why that’s a problem

COVID-19 is for sure negative for Victoria’s housing market. Whatever trajectory we were on before, it’s been bent downwards by this shock. But I don’t think we’re in for a housing crash, and here’s why.

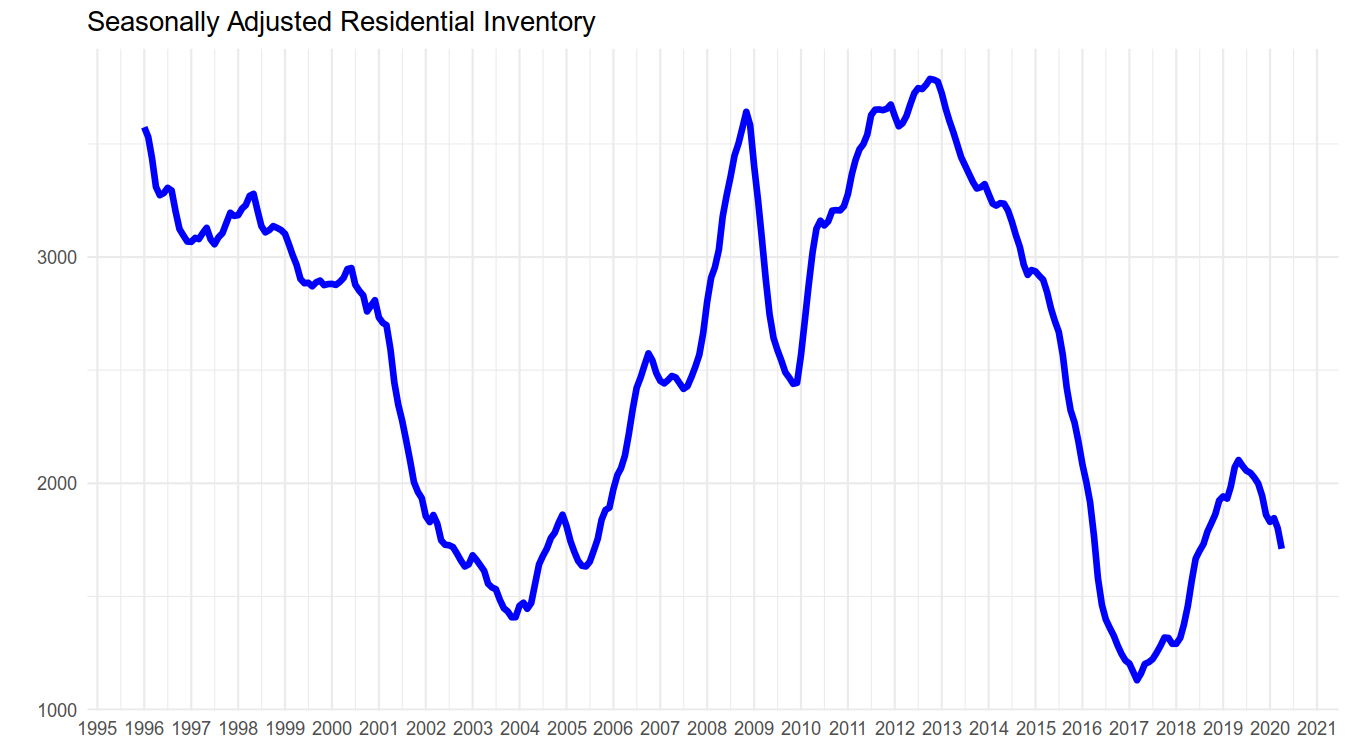

I’ve covered before that this shock comes at a time of relative strength for the local economy and housing market. The local economy was looking very strong, and after 18 months of weakening following the introduction of the mortgage stress test, the housing market was strengthening again with prices set to rise. Compared to historical ranges, inventory was at the 20th percentile in April, meaning there’s a gap of about 2000 active listings from this level to peak. The last time we had a big economic shock, it added about 1200 to the seasonally adjusted inventory.

That means a good chunk of the impact of the virus can be absorbed by bringing the market from a developing sellers market to a balanced market and buyers market, rather than if it had hit a year ago when we were already tilted towards buyers.

Unemployment

I estimated real unemployment at 18% in Victoria which normally would be catastrophic for the real estate market. With 1 in 5 people out of work we would soon be swamped with distressed listings and seeing a drought of buyers. But we know that this pandemic has hit low and middle income workers the most, and has disproportionately affected younger people. Although job losses are staggering for those under 25, once we get to the age ranges likely to be first-time buyers, employment declines are a more moderate 10-15%.

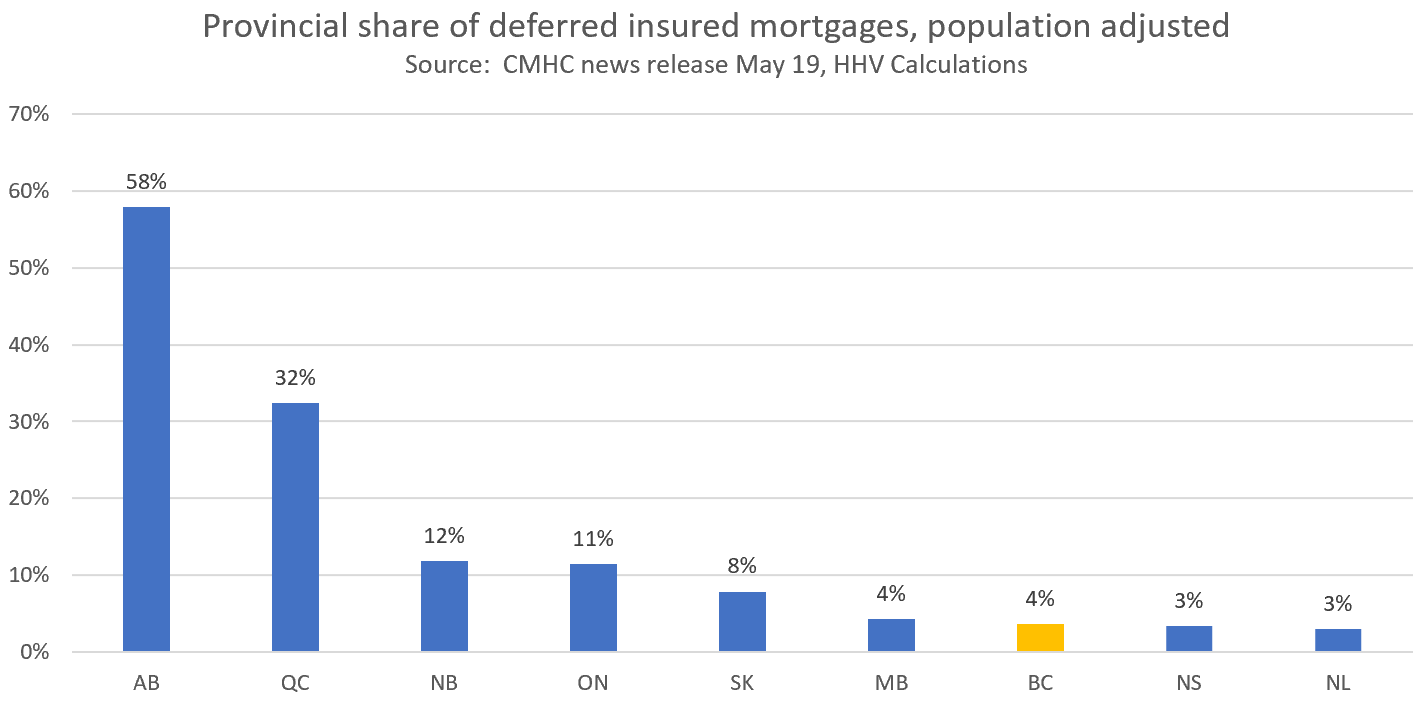

CMHC has released some data on the deferrals by province, and here the news is pretty good for BC as well. Adjusting for population, BC has the smallest share of deferred insured mortgages of any major province.

I think this is for two reasons:

- Stress test and high prices limiting the incidence of low down payments. CMHC data indicates that nearly 70% of deferrals are for mortgages with less than 10% down. The stress test has made low down payments difficult with BC’s high prices, meaning we likely have fewer of those high ratio mortgages recently in BC.

- High prices have kept out lower income buyers. BC hasn’t been cheap for many years, and that means recent buyers have likely had higher incomes on average than recent buyers in other areas. Higher income folks have seen a lesser impact on their income and thus are less likely to have to seek deferral.

That’s promising for the fall when deferrals and income supports expire, and should keep forced selling here lower than in the rest of Canada.

Prices

CMHC predicts a nationwide price decline of 9 to 18% from now until early 2021, then rebounding shortly afterwards for the mild case while prices under the more severe scenario would not start coming back until 2022. They expect price declines to be more severe in high priced markets like Vancouver and Toronto.

In Victoria, I’ve long used affordability to gauge the level of risk of price declines. Affordability tends to move in a range that increases slowly over time, with price appreciation petering out when affordability is stretched in relation to incomes. If you’re wondering why the affordability range for single family homes slopes upward (i.e. affordability gets worse) over time, I talked about that here. The below chart shows the current affordability picture and what it would look like under various price scenarios. The assumptions are no change to average household income in 2021 and continued low interest rates.

As you can see, if rates stay low, a 10% decline in prices would get us nearly to the good end of the affordability range for single family detached prices. A 20% decline (moderate) or 30% decline (crash) would bring us beyond the bottom of the range. That’s not impossible of course, but it would be quite unprecedented for our market and thus I don’t think there’s a large probability that we’ll see declines of that magnitude. Condos may be a bit of a different situation, I’ll look at those more closely in a separate post.

My Take

So why is it a problem that our housing market may be more resilient than most to this shock? Well one of the main concerns about our economy is that it is heavily fueled by consumer debt. We are amongst the world leaders in consumer debt, and if we make it through this shock without a serious deleveraging, then we will merely be exacerbating that situation. Canadians never deleveraged after the great financial crisis, and now with the money printers in full gear, it seems there’s a good chance we may not deleverage now.

The mortgages not paid will be added to the balance sheets (with interest of course), interest rates near zero will keep the borrowing up, while HELOCs, RRSPs, and credit cards will be tapped to bridge the gap. CMHC expects debt to disposable income to jump from 176% to 200%. Maybe we can weather that, but it will just drag on economic growth going forward and make us more vulnerable to the next shock to come along. The CMHC has been tightening credit since 2008 when we had zero down 40 year mortgages, and Evan Siddall is pushing to make 10% down payments the minimum up from the current 5%. However he’s leaving after this year, and we don’t know if the next CMHC president will be just as debt-adverse or if they will loosen the reigns to pump the economy up again.

A bigger concern of mine though is that the uneven impact of this shock will further widen the gap between the have and have nots. While many people’s jobs and lives are unraveling, others are working from home, saving hundreds on child care while they cash in with low interest rates on their mortgage. High home prices are already pushing the home ownership rate down after decades of it increasing, and the uneven nature of this impact will kick that trend into high gear. Of course the housing market cannot remain at stratospheric levels without those first time buyers, but I’m afraid that inequality will increase drastically after this shock and that will lead to a disintegration of societal cohesion like we are seeing in our neighbors down south. It will take a careful policy response to get out of this with our pre-COVID society intact.

On to current market conditions, listings and sales have been relatively steady last week. I keep expecting sales to ramp up some more but it seems they have been relatively consistent at just over 70/week all month.

With one full week left, we should end up at around 450 sales for the month. Inventory is down by 16% from this time last year.

| May 2020 |

May

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 28 | 124 | 230 | 329 | 848 |

| New Listings | 89 | 287 | 600 | 828 | 1613 |

| Active Listings | 2289 | 2319 | 2447 | 2516 | 3019 |

| Sales to New Listings | 31% | 43% | 38% | 40% | 53% |

| Sales YoY Change | -31% | -46% | -46% | -45% | |

| Months of Inventory | 3.6 | ||||

New post: https://househuntvictoria.ca/2020/06/01/condos-hit-harder-as-single-family-sales-gain/

B.C. bans commercial landlords who eschew federal rent relief from evicting tenants

https://www.cbc.ca/news/canada/british-columbia/bc-finance-minister-covid19-update-1.5593410

Vreb for month of May:

June 1, 2020 A total of 457 properties sold in the Victoria Real Estate Board region this May, 46.1 per cent fewer than the 848 properties sold in May 2019 but 59.2 per cent more than the previous month of April 2020. Sales of condominiums were down 55.7 per cent from May 2019 with 108 units sold. Sales of single family homes were down 42.9 per cent from May 2019 with 254 sold.

“Our market continues to respond to the current health crisis,” says Victoria Real Estate Board President Sandi-Jo Ayers. “Activity in real estate right now echoes the activity in our broader community – as restrictions gradually begin to lift – so too have our sales and listings numbers. Of course, like any industry, we do not expect a sudden shift back to any kind of normal. That said, one theme that persists in our market is that well-priced properties in high demand areas continue to see multiple offers. Demand exists and we continue to have motivated buyers searching for their perfect home.”

There were 2,544 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of May 2020, 15.7 percent fewer properties than the total available at the end of May 2019 but a 10.4 per cent increase from the 2,305 active listings for sale at the end of April 2020.

“If you’re considering buying or selling a property right now you will find the experience different than pre-pandemic,” adds Ayers. “REALTORS® are doing our part to ensure that there is not a resurgence of COVID-19 in our community by following government health and safety guidelines, by leveraging technology to facilitate many aspects of the real estate transaction virtually and by implementing various clean showing protocols. Your Realtor will navigate the new processes and requirements to keep you, your property and our city safe and healthy.”

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in May 2019 was $863,000. The benchmark value for the same home in May 2020 increased by 2.6 per cent to $885,400, 0.1 per cent more than April’s value of $884,600. The MLS® HPI benchmark value for a condominium in the Victoria Core area in May 2019 was $516,400, while the benchmark value for the same condominium in May 2020 increased by 3.5 per cent to $534,300, 0.1 per cent more than the April value of $533,600.

Oops! I shouldn’t have assumed.

After losing her income as a real estate agent, and income from two tenants and an Airbnb suite, Kristina Barybina could no longer make her $2,780 monthly mortgage payments on her East Gwillimbury home.

When shoeshine boys talk stocks or in this case when realtors buy real estate. Never get high on your own supply.

They bought it 10 years ago, pretty sure that doesn’t qualify as a flip.

Freedom, of coarse I read the article.Obviously we desperately need a universal symbol for sarcasm. Sigh.

In fairness real estate agents are really not required to be experts about mortgages or come think about it they are not required to know much about houses or their construction either. Or come to think of it….

The banks are already getting aid of sorts, in the form of wage subsidies to businesses that would otherwise close resulting in loan defaults. But nobody’s calling that a bail-out to the banks that I’ve heard. That’s the kind of bank bailout that’s likely to continue – aid to debtors.

And of course the taxpayers are already covering the banks’ most risky mortgages.

Did the seller make or lose money on this flip? Guesses?

1749 Kisber Ave

Assessment: $696K

Ask: $750K

Sale: $785K

DOM: 1

Same goes for the banks. If they get into serious financial trouble, no government bail-outs. (But of course there would be bail-outs.)

I think we have a generation of newer homeowners that have never confronted circumstances that expose the true risks attached to real estate. 2008 wasn’t the wake up call for them, because government measures taken in response muted the economic fall-out in Canada. Unfortunately the RE/financial system and the indebted didn’t have to shed risk in response; risk was instead permitted to snowball behind the smokescreen of low interest rates.

I admit to being exceedingly risk-intolerant at this stage, but it seems that recency bias and the ‘normalization’ of huge mortgages have blinded too many people to the folly of dumping every penny you earn into RE, at the expense of savings and diversification.

Claiming that no one could have seen this coming as an excuse for being ill-prepared is not going to cut it with the bank.

Did you read the article? The fixed term mortgage penalty “victim” in that CBC story IS a real estate agent herself.

While she has my sympathy, but anyone who needs to run an in-house AirBnB plus sharing with two roommates to afford a house is clearly over-stretching way too much, pandemic or not. So I agree with a few other posts here, the overspending mainstream has to stop.

LeoS: Good point about the penalty for variable mortgages; I am sure that most real estate agents give their clients this advice as well.

Guess we are all looking forward to this weeks numbers. But it is a beautiful day out there and my wife is baking again while I am getting ready to go out and garden. Talking to friends of mine who are determined to sell their condo and move back into a SFH again. Covid I think was just the last straw.

One more reason to go variable. Not only is the rate lower 80% of the time, but the penalty for breaking it is always only 3 months interest

Airbnb cowgirl bites the dust. She got into a risky business without planning for contingencies. She also doubled down on her risk by going into the same sector as her primary employment.

Because she was asking too much, which she ought to know as an RE agent. She also ought to know about mortgage breaking penalties.

A quote from that article: “Ideally banks would show some compassion”.

I don’t understand why people believe they deserve some type of handout or that they should be immune from any downside to their investment after reaping the benefits of the upside.

So the bank made you pay the IRD penalty for breaking your mortgage. It is called a contract that you agreed to. But yes, run to CBC to tell your tale of woe in the hopes the banks give you a deal.

Whatever happened to being responsible for the decisions you make and the risk you accepted?

I’m pretty sure that optics are not at the top of the banks’ list of concerns.

https://www.cbc.ca/news/business/mortgage-penalty-pandemic-1.5588741

I think people are experiencing forced savings due to the pandemic. They cannot go on any vacations, cruises, etc… They aren’t going to restaurants, movies, concerts and sporting events. People are saving thousands of dollars and might realize how much money they were spending beyond their means. The pandemic has taught us that our overspending is out of control. I’m sure that people who were not financially impacted by the lock down are experiencing a new found wealth and may change their spending habits.

Hard to say, but at some point the government going have to address the mountain of debt that we are incurring during this pandemic. And, we will have to wait and see where the economy heading when the lock down is fully lifted.

Will the BoC keep rates artificially low to stimulate the economy and risk a hyper inflation, and what tough measures will the government take to reel in debt (deep spending cuts and/or taxes hike)?

I have a feeling that the government will dust off the old play book from the early 90s and jack the GST back up to 7% or more to pay the debt. Increase immigration to help shoulder the load (new working age immigrants have no debt), increase income tax, and there definitely will be belt tightening on unnecessary programs and incentives.

Fewer and fewer tenants are available to fill all those vacant rental units.

Young folks are returning to the parents home because they can’t afford to rent. Tradespeople are leaving town because the lucrative work has dried up, many are returning to their hometowns. There will be many ripple effects, vacancies is just the first obvious effect of a battered economy.

Will anyone be shocked or surprised when an entire economic system, that is built on a mountain of debt, flounders when trying to recover from the pandemic? The proposed cure will, of course, be built on more massive debt and possibly some form of devaluation.

Link to CBC re young people moving back home.

https://www.cbc.ca/news/canada/british-columbia/covid-19-millennials-parents-homes-1.5590956

Times are changing.

Reminds me of these lyrics:

Come gather ’round, people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You’ll be drenched to the bone

If your time to you is worth savin’

And you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’

——- Song by Bob Dylan

Sorry, we’ve heard time and time again. No new builds in the core.

https://youtu.be/dTRKCXC0JFg

The bank could also cap the HELOC at the present level of indebtedness. I guess the we’ll have to wait and see which economic forecaster is closest to the eventual reality.

https://betterdwelling.com/canadian-real-estate-prices-forecasted-to-rise-12-or-drop-over-30/

I believe this to be a hyperbolic false statement. How does that serve the bank or society?

Banks can call in a HELOC for payment at any time but my understanding is they don’t take any action unless someone is not making interest payments and there are other red flags putting the bank loan at risk vs. other creditors. Banks may become aware of this if the mortgage payments are in default as well, the client account is being garnished beyond capacity, or they have received a significant legal notice of attachment to accounts.

How do you think the optics of making a call on a HELOC where someone who has lost their job but is making minimum payments looks in covid times? The negative press involved in this would be extremely ill advised for a bank imo. Even in regular times I’ve never heard of this occurring. This is a secured loan – like a second mortgage.

Far more likely that banks will do what they are doing, limit exposure by further limiting access to HELOCs and reducing the amounts they will lend. In my view the demand loan nature of a HELOC provides the bank with security that they can go to court for an order for full repayment or, alternatively, proceed in priority through the foreclosure process.

Not so likely that they would want the money back right away, or want to foreclose, but they could demand a new loan agreement at a higher rate.

HELOCS are demand loans; if a bank gets a whiff of a client’s job loss, they’ll call that loan in a heartbeat.

We knew someone who went for opening-bidding process there at beginning of March, and likely bought one lot in Cortez.

And, alternatively, HELOCs may represent a way to get through the covid crises for some homeowners. They are very low interest as they are backed by equity (ex. 2.49%). Unfortunately, if you did not already have one in place and are in a “non-essential” jobs or employment in hard-hit industries like energy, travel, retail and restaurants the bank is very unlikely to approve one now.

https://rates.ca/resources/can-heloc-get-you-through-covid-19-crisis/

This translates to approx. $160/month on an interest-only payment. It is the cheapest form of credit apart from a mortgage that I’m aware of? While it could represent a risk to some homeowners right now, it may also be a lifeline if covid is to last for another year.

Keep in mind that unsecured personal loans require payment of principal and interest at double the HELOC rate over a fixed term turning that 160/month payment into $600-1200/month. Credit cards are at an annual average (calculated and compounded daily) of 19% interest, with many as high as 29%. People with this type of debt are higher risk.

The average consumer debt (non-mortgage/HELOC) of Canadians is $20,967, but this includes student and car loans which are generally at much lower rates than personal loans/credit card debt.

https://www.whichmortgage.ca/mortgage-guide/why-canadians-should-be-careful-about-helocs/323027

totoro:

The slowdown in new HELOCS doesn’t change the number of prior helocs, totoro … and the last two years of price increases haven’t helped much.

https://www.whichmortgage.ca/archived/many-canadians-are-using-helocs-just-to-pay-their-bills/298814

Gotta say I think I’ve run out of any benefit of the doubt

Yeah the B&B scene seems to be a thing of the past. That said they’re seemingly zoned in to many places while AirBnb is being squeezed out.

This is not the best timing if you have to sell. There is talk in my neighbourhood that one or more of the bed and breakfasts might be coming on the market. Not sure who would buy them at this point.

The latest parcel of bare land in Gordon Head to be turned into SFHs:

http://kasapiconstruction.com/1812-feltham-road/

Sale was very late in 2018, as the closing was Jan 25, 2019. So the owner decided to bail after owning just over a year. Note BC Assessment photo shows previous teardown but description is of current house.

https://www.bcassessment.ca//Property/Info/QTAwMDBITkM3RA==

I supposed it is the price for people that insisting of living it up in the core.

However, I would much prefer to practice social distancing 15-30 minutes out of the core for that kind of money or save some for a rainy day.

MLS #: 421977 – 10 ac – Top of the World – Estate with 180 Ocean Views of Juan de Fuca Strait, Mt. Baker & Olympics.

MLS #: 424667 – 3.18 ac – 360° degree views of the city, mountains and ocean.

MLS #: 420341 – 17.24 ac – Prime real estate, 2 ac of manicured landscaping, tiered garden, multiple waterfalls/ponds, extensive walk ways, sprawling patios the outdoor space.

Wow, just saw this pop up – MLS#:426668

Sold in 2018 for 2.2m

Listed for 2.5m back in March

Just re-listed at 2.15m

That has to really hurt just on fees and taxes alone……

I don’t think “common sense” can be applied to a situation unless you have good information to work from. In this case you’d need to know, among other things, homeowner indebtedness and determine what level of current risk there is, what type of job losses will be permanent, what level of government assistance will be provided to renters and owners until this situation is resolved. There are too many variables here, some of them unknown.

My first reaction post-covid was that the housing market would be impacted negatively fairly quickly. Appeared to be common sense. What I didn’t factor in was how few listings there would be and how many people were still interested in buying and how many people still had higher income jobs. I’m not saying there won’t be an impact on the housing market, it just wasn’t what I expected because I extrapolated based on my version of common sense and a lack of information.

In BC the 90-day delinquency rate pre-covid was .15%. This is late payments, not defaults. Most loans are not considered in default until after the borrower has not made any payments on the loan for 270 days or more.

The reports from major banks currently predict there will be no significant rise in delinquency until the mortgage deferral program expires. Mortgage deferral is not delinquency. After this, there are varying predictions -with a 1% arrears rate being at the higher end. CIBC is predicting a deliquency rate of .4% in 2021 and a drop in prices of 5-10%.

https://business.financialpost.com/real-estate/pandemics-economic-hangover-will-hit-home-prices-by-2021-cibc-economists-predict

Regarding this article:

I don’t know who Mr. Wong’s is other than a contributing editor to better dwelling, but I disagree with his analysis as to the cause of the US crash. This article is also now two years old predating the application of the stress test to HELOCs and the last two years of price increases in our market. Canadians have slowed in the use of HELOCs over the past two years, something Mr. Wong states here:

I do agree that we don’t know what will happen next.

“There will probably somewhat mild damage if as the economy reopens demand returns to normal. But in no way shape or form is the current environment (ie, unemployment mainly hitting the lower wage earners) indicative of the extent to which the coming full economic effects are going to be. The global economy today operates within a fiat system, and the advantage of that is economic crises/damage are not quickly realized. 2008 was considered an economic neutron bomb, but the effects were not fully realized for almost 3 years (or something around that). The idea that, if demand does not return to normal, this is going to just remain an economic issue with the lower tier working class is not going to happen.”

To paraphrase someone else: no one saw coronavirus coming, no one saw lockdowns coming, no one saw mass unemployment coming, and now no one saw mass rioting in the US coming. Whatever is next, it’s very unlikely that we see it coming from here.

totoro:

https://betterdwelling.com/canadas-heloc-problem-is-one-of-the-biggest-risks-for-real-estate/

The first great thing in 2020!

Woohoo!

Lunch

Launch https://youtu.be/bIZsnKGV8TE

Yes. This is why I stated “Business owners with business debt who are now in financial trouble due to covid may have difficulties as it is common for a personal guarantee to be required when borrowing to start a business – which could put home equity at risk in the event of bankruptcy.” I agree that private sector business could be in greater trouble overall soon – already tourism and service sector jobs are at risk of permanent loss due to business bankruptcy.

What is highly indebted? Are you talking about homeowners with mortgages only now?

Statistics Canada’s SFS data define households as highly indebted if their ratio of mortgage debt to disposable income exceeds 500 per cent. In Canada a small proportion of borrowers hold a large proportion of total debt and this is more unequally distributed in populations that are considered more economically vulnerable, such as the less-educated, unattached individuals and renters. Mortgage holders are younger households with children and recent purchasers typically make larger mortgage payments as a % of disposable income at this point in their life cycle.

Among Canadians:

63% own their own home

47% who own have no mortgage

the median amount of mortgage debt among those with a mortgage is $180,000O

annual mortgage payments averaged $13,400 among those who had been in their homes less than 10 years, compared with $10,800 for those who bought before 1999

In British Columbia, those with a mortgage had the highest average mortgage payments ($14,900/year) in Canada and paid 20 cents of every dollar of their disposable income on mortgage payments, also the highest in Canada.

I don’t see that the majority of homeowners are going to be in trouble because of mortgage debt. You have to live somewhere and pay for it, interest rates are low, and those that bought recently had to pass the stress test and the amount of mortgage debt as a median is relatively low. If interest rates rose this would turn more sharply imo. There will be some homeowners who are impacted, just not sure how many who will need to sell as a result of job loss or income reduction due to covid.

I don’t know if prices in Victoria will fall – seems unusual if there was no impact, but there are a lot of qualified buyers who have been waiting to buy who still have employment via government, university, and health care in Victoria. I guess we’ll see if more inventory comes on the market.

Looks like SpaceX is good to go today. 25 minutes and counting.

Aside from Wuhan & Hubei though, China didn’t really shut down for long. We’ve been shut down longer than they did.

In a few words all Totoro is saying is:

DEBT IS MONEY WE OWE TO OURSELVES

DEBT IS MONEY WE OWE TO OURSELVES

DEBT IS MONEY WE OWE TO OURSELVES

DEBT IS MONEY ….

True. Lots of phases of this, but I still think the longer term unemployed will be more the lower income (tourism, retail, food services). That of course will spill over to consumer spending which means higher income jobs that depend on that spending will be impacted. But I think the impact will always be concentrated mostly on the lower side.

Heard somewhere on a podcast that it’s a bit like a snowblower that you use once a year and when the blizzard hits you are really hoping the thing starts back up again. We have no idea how the economy will start back up again after a abrupt halt because we’ve never done it before.

Note that it appears China has basically restarted. Not back to pre-virus levels and they will hurt from slowdown in global demand, and of course there are many things that a totalitarian government can do that we can’t, but still.

Just speculation, but I think people have been wildly underestimating the damage to the economy, and that is due mainly to what they see on the ground currently, which is due not to an economic crisis, but a public health crisis. We had a government ordered shutdown of the economy. The people on the front lines of the service sector were hit immediately. Right now the government has created a stop gap with the flurry of programs like CERB, wage subsidies, etc. to mask the damage. And of course let’s not forget the totally insane amount of liquidity that central banks have flooded the system with.

There will probably somewhat mild damage if as the economy reopens demand returns to normal. But in no way shape or form is the current environment (ie, unemployment mainly hitting the lower wage earners) indicative of the extent to which the coming full economic effects are going to be. The global economy today operates within a fiat system, and the advantage of that is economic crises/damage are not quickly realized. 2008 was considered an economic neutron bomb, but the effects were not fully realized for almost 3 years (or something around that). The idea that, if demand does not return to normal, this is going to just remain an economic issue with the lower tier working class is not going to happen.

Switching gears, not sure what the stats say, but a realtor friend has told me that asking prices are starting to drop pretty much all over the place, all price brackets. Maybe others can confirm or deny?

CMHC has also said it’s definitely over 10% deferring already, and they are forecasting it will be 20% by September.

I think while we’ve seen mostly low income jobs being lost so far, I think the next economic wave will involve higher paying jobs. Contractors who’ve contracts have expired and aren’t being renewed, management positions as companies go bankrupt, we’ll see if construction & real estate jobs can last through a real estate down turn.

Do you have any idea how big a segment 10% of the market is? It’s no understatement that even 5% of people defaulting would be disastrous for the housing market.

A housing market decline and rising unemployment represents a liquidity problem, not a net worth problem. Aside, do you think that “most owners” were at the edge of affordability during any of the other downturns? Indeed, they were not. In fact, when has that ever been true? Has that ever helped the market then?

When you have no job, and the economy is horrid, central banks can lower interest rates as much as they want and that still won’t save the housing market. This is why declining mortgage rates are paradoxically associated with falling house prices, not the reverse.

On the one hand there’s making an optimistic argument, one the other, making one simply devoid of common sense. You can try to reframe a precarious situation by putting lipstick on a dead pig, but I think most folks will see through it in an instant.

It might be a perception of high net worth, but having debt is not wealth and real estate is an illiquid asset. As more restrictions are placed borrowers to mitigate risk, the greater difficulties the highly indebted will have, especially if the primary asset they hold is no longer maintaining the perception of an increasing value and possibly that perceived asset becoming a liability if it moves into a declining value.

Don’t low or medium income workers generate profits for the business owners who employ them? If they aren’t working then the owner is not generating profits. How can this not be an issue to the higher income owner, who may be a home owner as well?

The fact is that most homeowners are not at the edge of affordability. Some are. Ten percent of Canadian mortgage holders asked for deferral – 90% did not.

Business owners with business debt who are now in financial trouble due to covid may have difficulties as it is common for a personal guarantee to be required when borrowing to start a business – which could put home equity at risk in the event of bankruptcy.

And we also had very high net worth among homeowners and mortgage rates have declined. Mortgages remain affordable vs. income – unless interest rates rise.

Those who are most at risk appear to be renters with consumer debt who lose their employment, and, as always, homeowners with consumer debt who also experience divorce, disability, or spending due to addictions such as gambling.

Covid job loss will impact homeowners to some degree as well, but the stats don’t currently support this as a widespread effect on those with higher incomes who could afford to buy in the first place. Those that bought years ago will have significant equity.

What is troubling is how long covid will affect our economy. I would expect our government to assist those who are legitimately unable to pay their mortgage or rent due to continued covid unemployment via a further deferral of or subsidy of some kind.

You also have Leo’s analysis on this above.

We already had record high RE prices versus income and record high debt versus income.

The US bust of 200x, Toronto bust of 199x, and Vancouver bust of 198x all started while unemployment was going down. Now we already have unemployment that is higher than those downturns were are their worst. We already have more mortgages in arrears (de facto even if you call it deferral) than we had in previous busts.

These are just the facts.

Don’t worry – the best minds in the real estate industry are toiling day and night to fix that assessed value display issue.

Enjoy Barrister! I’ve been spending a lot of time in the kitchen and garden. Maybe this weekend I’ll take a trip… upstairs.

You do realize that you can only borrow up to 65% of your home’s value via a HELOC and that before approving a HELOC a lender will need to confirm that you have:

In addition, banks apply a stress test to HELOCs.

Many folks won’t qualify for the full 65% HELOC. Those that do can afford to pay for it should they use it.

What makes you think that someone who purchased prior to December 2017 is going to have so little equity that they will need to provide more for security? Not to mention, why would someone refinance rather than simply renew if they are concerned? Banks don’t ask you to re qualify for a renewal in my experience, it is an automatic offer if you have been making your payments. Not in their interests to do this.

There is a lot of hyperbole here. I am concerned that some people are going to have a really rough go in the next two years but the majority are not going to be homeowners imo. We will see bankruptcies that do affect ex. business owners who have put up their home as collateral, but far more service and tourism sector employees will have a rough go until the world is able to right itself through a vaccine, treatment or the virus mutating into something less destructive.

Already on for 57 days. A re-list with a $30k asking price drop. I’m sure if it sells DOM will be reflective of reality (sarcasm).

Also like that it still is showing last year’s assessed value of $694,000 vs this year’s of $660,000.

Gosh that must be one hard programming or contracting nut to crack.

Is just me or does the person writing this seem out of touch trying to draw in first time home buyers on something priced at $869,900? Lol…. How does a person convince themselves that’s sensible marketing? Your entry level home at a $130,000 less than a million!!!! Don’t miss out.. This went for $490,000 in 2016, that means in 2024 you can sell it for 1.6m!! The logic is flawless..

The best thing about the stress test being applied to down payments above 20% now is that those folks have to prove income to sustain mortgages as well. Instead of the insanity where some folks got the parents to draw the 20% from HELOCs and getting mortgages that were way out of reach and should not have been granted, especially to first time buyers. I wonder how many of the pre-B20 are out there that were needing a perpetual capital gain to keep themselves afloat maintaining lifestyles off their HELOCs and planning to sell at a profit? It will be interesting to see those go for re-financing in the next couple of years and if lenders ask for more money down for security.

My wife just baked two loaves of egg bread and croissants are on the way tomorrow. We have a lot to be thankful for and hopefully everyone has a great weekend to look forward to with pubs and restaurants opening up.

The problem is when prices are going down why would people buy? Why would a buyer buy now if they know the price is going down and they can get the place for cheaper later.

There would be plenty of motivated sellers, but not much buyers in a deflationary market. And because house prices are pretty sticky, it will take a while for the market to adjust and there would be low volume of sales, so less commission to go around.

That is why most Realtors will always tell buyers prices are going up even if they know they are going down to convince you to buy now.

Rents are falling fast in some areas. Victoria landlords will suffer the same fate in the coming months as renters move from their expensive rental unit to a lower priced unit. This happened several times in the past few decades, it becomes a spiral downward as tenants move in, stay for a couple months then move to a lower priced rental unit. I did this myself in the early 1970’s. I moved three time one year, each time to a nicer place with lower rent; I was saving over $3000 per year (in today’s dollars) by moving frequently as rents kept falling.

https://globalnews.ca/news/6995320/lower-rents-canada-covid-19/

Sidney is awesome in a lot of respects. YYJ flightpaths would suck though (north part of the town would be better). The other pain would be access up island

Remarkable graph showing the vertical spike in US Savings rate to 33% in April. Easily the highest month ever recorded. https://fred.stlouisfed.org/series/PSAVERT

That means about $3T was saved during the month. A lot of things went into that, including people saving govt. relief cheques. The main idea is that people spent less, so saved more, and the sum total would seem to indicate that people are flush with $3T extra cash.

I’ve kept my studios/one bedrooms and I sold all my two bedrooms. Last purchase was studio at Ironworks @ $279,900….just ordering a murphy bed off Costco for it now. That being said I can’t see myself buying anything for a while and will certainly never buy two bedrooms again. Too much stress, large mortgages, piss poor rental return, etc.

Studio or one bedroom so easy to pivot with…small mortgages. If the market tanks you lose a small absolute amount (unlikely a 280k downtown studio will drop to 140k). Easy to rent to weather a crappy market, etc., etc. Ironworks I’ll rent out for next 10 to 20 years until the area develops nicely and it will likely be cash flow neutral from day one and within 5 years I am guessing cash flow positive. Capital Iron just sold today to a developer.

I can’t see how you can go too wrong. Tenant pays it off over 20 to 25 years and then you have a huge capital asset plus cash flow. Key is too buy smartly and be patient. If I have to wait 5 years for the next buy that makes sense I am waiting 5 years…..so many FOMO amateur investors piled into 450k one bed “investments.” Good luck to them.

I’ve posted this before and the numbers have changed but here is my condo investing philopshy and the reasons behind it

http://victoria.citified.ca/news/stay-small-a-guide-to-buying-an-investment-condo-in-victoria/

So have you done that if it really is just that easy? You are late 30s (i’m assuming because of your name). If you have then hats off to you. Perhaps I am the outlier here.

To me, the average person/couple juggling life, kids, etc are not going to be able to invest and take risks when they have to pay for daycare, before / after child care, put away for education and all the other costs. But that is a choice people make when they have kids.

If they can and do, good for them but saying it is not difficult is a bit of a ridiculous statement. Perhaps it was easy at one time with the rapid increase in prices. I doubt the appreciation is still there now.

Marko has a fan club on here. That’s awesome. Did you Know Marko?

Any updates on activity in the Comox Valley?

https://www.huffingtonpost.ca/entry/toronto-real-estate-pandemic_ca_5ece8c2cc5b68bd699260325?ncid=fcbklnkcahpmg00000001&fbclid=IwAR2PEEt-wpJMf9QHG80GsKNlNDpdhEDA5864bzHkJzM3z_fKwJQ8DcjQdyY

This article points to more people moving to the countryside as a trend made possible by covid work from home changes? I wonder how this will play out here.

Sure do. And if the house appreciates 10% a year then it will be worth over $8 million dollars. Easy Money. Future value calculators are a wonderful thing. Compound interest is a beautiful thing as well. I did not say the route I would choose to go with the money was better. I said I didn’t understand in this scenario why someone would purchase the house. And thanks to your post, I understand the allure of the potential.

I would say though, there are a lot of ifs in your scenario and also a lot of assumptions. As well, a lot of non-accounted for time as well. How much is your time worth dealing with tenants and house issues over 25 years? I know, I know, all tenants are awesome and not much time is spent dealing with anything. But there is a cost and for me, something I don’t want to deal with.

My 4% dividend did not include any capital appreciation on the original amount or the amount the DRIPs would bring in. The dividends, and the dividends only, simply provide me with $500 per month. I nice little stream of income with little to no maintenance. Yes risk, but I’m really only worried about the ETF or blue chip cutting or stopping the dividend. Could happen.

I guess it also depends where you are in life and what you want out of it. You aren’t getting many people under 40 that have a principle residence and then have another $160K to invest on a house with the hopes of selling it 25 years later so they can retire. In my scenario, instant positive cash flow with potential for capital appreciation. For those looking to retire or at that mark where they should be planning for it, having different steady streams of income may be more advantageous without having to take on any debt.

To each their own. Like I said, I can see the allure with that nice big number of $2 million or more. You just better hope you can find someone to pay that much for it The debt and risk is too much for me. If I already have a home, I would rather diversify a bit.

I’ll take my $500 dividend.

Probably why I’ll never be rich like you or some of the other real estate Tycoons here.

~~~

not trying to be a smart cookie here. just a fan of Marko.

Like Marko did in a few years ago, he had invested in purchasing pre-sale condos and just hold them for a few years and harvest the profits(200k?) and then he builted his own house and hold, live for a year, and sold it again. more profits!(another 200k?)

it is not difficulty to get 160k and have a principle residence before 40 😉

I have to say: commissioned sales ppl are motivated to get people to think either price are going up or DOWN, it does not matter to them as long as the sales are happening regardless the process , they get paid for a nice 1.5% +GST

Point taken and fair enough. And if that can continue to work and you are comfortable with the debt load I can see how advantageous that could be.

I despise debt. So I will just take my stream of income. Like i said, I will never be rich. But I will be comfortable enough to then focus on the things that matter to me, like what Totoro said.

Agreed, and it gives you an instant sizable square-footage boost without any transaction costs when you take back the suite.

Saves you thousands and the stress of moving.

This is the most important thing within your excellent post, totoro.

I’m not interested in narratives.

Doesn’t change anything. Just interested in the data.

Rent control really isn’t the issue. The issue is that you can charge at most market rent, and that’s not affected by the increased interest you have to pay if you borrow more money. You can’t just decide to pass it on in any case.

I didn’t say using a HELOC. After your 5 year term, you can re-mortgage back up to 80% and reset the amortization period back up to 25 years and your payments would stay the same assuming the interest rate is the same and the value of the house stays the same.

The path you choose is not binary, you can invest in RE and a TFSA and RRSPs – you just probably can’t do them all at once at the beginning.

I read comments like these:

and I can understand the risk aversion to a point.

I look at things a little differently. Coming from a low income background I always thought, “how can I create economic security for my family and a good life”. Then I did the math – both long and short-term taking into account how gains would be taxed and all transaction costs. Once you understand the math you can analyze all your options. Not understanding the math and being able to project forward leads to less optimal decision-making if you are looking for ROI.

I never thought about how i would live ideally and without discomfort at the beginning, or invested in some specific idea of the right type of comfortable living, because the thought of not saving and investing to create future security made that way less attractive to me. This doesn’t mean we didn’t live well – at least from my point of view. Attitude can make a big difference and home is some physical and a lot the quality of the emotional connection you have with your loved ones.

The first big thing you can do if you are looking to increase your capital is look to where you can save. Far easier to save than to make more. I still focus on this today as it is an easy win. If I can sell a home without any RE fees I will. I buy the same way, without representation and requesting a discount in lieu of the buyer’s agents commission. I don’t pay an investment advisor but use low fee online DIY investment platforms. I don’t carry consumer debt.

Then, using leverage to buy a primary residence with a suite to manage risk was the single most effective first move and remains so imo.

After that, starting a business is the next place I’d consider if suitable for you and your situation.

Then I’d consider the pros and cons of rental properties vs. putting additional money in a TFSA, plus the math of RRSPs which may or may not be a good idea.

Against all of this you can balance what it means to have enough – your life is time limited so unless you just love building wealth then I’d have an end goal.

When we hit enough I stopped working and invested my time in the things I love the most – family, friends and home. I have never for a minute regretted the work and decisions made that made this possible. In fact, despite doing the math, it still seems like a bit of a miracle to me that it happened as projected despite many bumps along the road.

For those of you who have pensions (we don’t) and love your work, your decision-tree may well be different. You might feel secure and happy with a home that you pay off over time and some additional savings and decide more stress is just not worth it. This is not the optimal way to increase your personal capital, but your definition of enough may have been met. Nothing wrong with that and there are no “winners” based on more money as everyone gets to live with their own decisions. You can be very happy (or not) in many different circumstances and how happy you are is the test imo.

As far as covid goes – wasn’t on my radar. Now we have a shock to the economy. If you don’t have to sell, a drop in RE prices is not going to affect you much. There may be a good opportunity to buy. I’d get ready if you are in a position to buy with a prequalification for a mortgage.

The stock market dropped a lot, it was a really good opportunity to buy. I don’t understand why it recovered so quickly, maybe there will be another big drop. Be prepared to invest then if you can. Get yourself a TD eseries or Questrade account and learn how to use it if you haven’t already.

Ignore my previous post. Too early and no delete function.

The assumption was the original mortgaged amount and expenses were cashflow neutral. Re-mortgaging and extracting $100k has a cost associated with it. The cheapest HELOC I could find is prime minus .10 (2.35 %). You need to pay for that.

If you’re going to move the goalposts and pass that cost along to the tenants, along with every other cost to maintain your house as cash flow neutral throughout the 25 year lifespan, then I accept you will be perfectly cash flow neutral. But here is the issue.

Rent increases in BC are limited to a certain % as you know. This year was 2.6% (prior to the moratorium). So in fact, you would only be able to pass along $78.00 of the $195.00 monthly cost to borrow the $100k. So you wouldn’t be neutral.

At the same time, they’re making it more attractive to other people.

I don’t understand. My comment was if you want access to the equity. I understand it is cash flow neutral and therefore you are not paying principal or interest.

But if you borrowed against the equity (a HELOC) which you stated you could do

You would be paying the interest to access that $100k.

You are now moving the goalposts. I can say the same that companies can raise dividends.

Anyway, thanks for the perspective.

I have to concur that I really like Sidney. Even before the pandemic I was not really going downtown for much of anything. City council seems hellbent on making sure that downtown is increasingly less attractive for a lot of people. Dont want to start a full out debate but it is just my opinion.

You wouldn’t be paying the interest on this, the tenants are paying the interest on the mortgage (and the principal) since the assumption is that it is cash flow neutral. Also keep in mind rents can be increased with inflation, while the mortgage stays the same (interest rates may change though).

After the second year it would be $27k/$174k = 15.5% (Mortgage remaining of $604k, house value of $805k, initial investment of $174k).

You’re selling yourself short. But you’re also not including any costs to sell and realize that gain. Until you do that, you haven’t “made” anything in my opinion.

If you want access to your gains, you either sell and pay the costs associated with that (then calculate true ROI) or you borrow against it and pay the bank interest on borrowing your own equity.

Not saying that is a bad thing… but is has a cost that needs to be taken into account.

Yes, in the first year you would be mainly earning the transaction costs back. The 2nd year your ROI would be 20k / 180k = 11.1%.

Not the first time the industry has been pissed off by a negative forecast. In that case prices did indeed fall 25% (Toronto)

Source: https://twitter.com/extraguac4me/status/1266159289376354305?s=21

The listing agent’s spin is so funny: “Don’t miss out on this amazing opportunity to OWN your own home without strata and without tenants! ” (for 1749 Kisber Ave

http://www.farupscott.ca/homes-for-sale-details/1749-KISBER-AVE-SAANICH-EAST-BC-V8P-2W8/426551/288/)

I don’t think I understand. Perhaps it is all just perspective.

The way i see it, after one year in your scenario you have “invested” $174,000 of your own money. If the market value of the house remained the same, you would have an investment worth $805,000 and a mortgage remaining of $625,000 (your renters paying 20K of principal). So you have “equity” of $180,000. Basically $6000 more than you originally invested. $6k / $174k is a one year ROI of 3.4%. That is less than just the 4% dividend on its own.

And we didn’t take into account that in order to actually have that money, you need to sell the house to realize that gain. And that would incur real estate transactions costs and either IRD or 3 months interest to break the mortgage. Pretty sure your ROI is then negative.

All just the way you look at things I guess.

If you are in a situation that you have a chance of losing your job, than buying a house with that much leverage is probably not a good idea.

In the first year you would already be paying almost 20k towards the principal, so already have more than earned back the transaction costs. Your yearly return on the 160k investment would be over 10%. After 5 years assuming the price stayed the same one of your options could be to remortgage back up to 80% and pull the 100k you have earned and invest elsewhere.

But I agree, being a landlord is more stressful than investments in the stock market, so that is why I am a former landlord.

Being 9x your income in debt is security if you lose your job?

Easier to move on up to 10x? Well I’ll give that to you.

MaxBravo,

Understand the leverage advantage. In terms of security, the scenario / situation I was commenting on was the house sale on Kenmore where it was pointed out it could be rented for $3000 per month. This would make it an investment property and require the 20% down as per the org post I commented on. Hence the discussion on what I would do with $160K if I had it. So security wouldn’t be an issue in this case as this is an investment so I’m assuming I already have somewhere to live.

Didn’t forget about taxes as it is invested in the TFSA therefore no taxes (except for one the tiny amount above the max allowable in TFSAs. Just to be clear though, because I’m looking for dividend income, this is not the most advantageous use of the TFSA owing to the Dividend Tax Credit but I’m ok with that for now (TFSAs should be for interest income investments such as bonds as you pay 100% tax on that income).

Once again, I think it is very situation dependent and you can’t say you are way better off sticking that cash into a rental property. Sure can look tempting but not for me.

And for the record, agree completely with you that the prices here in Vic have necessitated a lot of things. And it sucks for those starting out.

Wasn’t like that when I first bought here. The average 26 year old today could not buy what I bought back in the day making the same inflation adjusted income. I, and everyone in my age bracket / demographic, were lucky and really did hit the jackpot. And not one of us knew prices would climb the way they did. Those that try to tell you they knew are full of BS. Just like the ones on here that brag about that as well.

Time for a beer (bought with my dividend income!).

I agree on Siddall – he has been direct and that puts folks off. I actually like his approach.

On the dual $80K annual income, folks, that is gross income. Mortgages and life’s expenses are paid from net income [except your RRSP]. That $80,000 gross, nets you about $60,000 to 62,000, after tax, EI, CPP, union dues, pension contributions, benefit plan contributions, etc. So, for that lovely couple, they have about $120,000 to $124,000 in disposable income before they have even had a meal or bought diapers for missy. It is a tough go. I appreciate what everyone has said, but not my idea of comfortable.

Nice input about suites – totally valid point; just not my idea of privacy / home.

Regarding interest rates, it does not alter the math on calculating the ratio of household income to prices. The math is the same. Ability to pay the mortgage is impacted by interest rates, but that does not alter the calculation arriving at “14”. On the “salary” of lawyers, respectfully, you are mistaken [re: private sector vs public sector]. Even in BC public sector, having given you the published data, the top paid is $145K a year [gross]. The Canadian Bar Association publishes salaries / pay in the Canadian Lawyer and, even in Victoria, the private sector [after 5 years of call] exceeds that level of pay. I grant you this: private sector lawyers in Victoria earn less because there are more lawyers in Victoria per capita, last time I looked, than most places in Canada [the climate], but not that much less.

KS112 says a 4% ETF is a stretch. Really? Get another investment advisor. Take a look at ZWU, ZWB, ZWC, ZWH, ZWS, ZWE, ZWP, ZWG and ZWK. We are earning double that, and then some with the dividend tax credit and capital gains tax. And that is just one example. Try ZDV, XDV, VDY or XEI – easily gets you your 4% plus some. Have a DRIP account and let it compound every month.

Sure do. And if the house appreciates 10% a year then it will be worth over $8 million dollars. Easy Money. Future value calculators are a wonderful thing. Compound interest is a beautiful thing as well. I did not say the route I would choose to go with the money was better. I said I didn’t understand in this scenario why someone would purchase the house. And thanks to your post, I understand the allure of the potential.

I would say though, there are a lot of ifs in your scenario and also a lot of assumptions. As well, a lot of non-accounted for time as well. How much is your time worth dealing with tenants and house issues over 25 years? I know, I know, all tenants are awesome and not much time is spent dealing with anything. But there is a cost and for me, something I don’t want to deal with.

My 4% dividend did not include any capital appreciation on the original amount or the amount the DRIPs would bring in. The dividends, and the dividends only, simply provide me with $500 per month. I nice little stream of income with little to no maintenance. Yes risk, but I’m really only worried about the ETF or blue chip cutting or stopping the dividend. Could happen.

I guess it also depends where you are in life and what you want out of it. You aren’t getting many people under 40 that have a principle residence and then have another $160K to invest on a house with the hopes of selling it 25 years later so they can retire. In my scenario, instant positive cash flow with potential for capital appreciation. For those looking to retire or at that mark where they should be planning for it, having different steady streams of income may be more advantageous without having to take on any debt.

To each their own. Like I said, I can see the allure with that nice big number of $2 million or more. You just better hope you can find someone to pay that much for it 🙂 The debt and risk is too much for me. If I already have a home, I would rather diversify a bit.

I’ll take my $500 dividend.

Probably why I’ll never be rich like you or some of the other real estate Tycoons here.

Pointing out everyone’s imagined “agenda” destroys an objective discussion. Quote a statistic from a bank or a certain media source and it’s disbelieved and rejected without discussion. We shouldn’t attack the messenger – just stick with what they’re saying, and the facts behind them.

Cynic, ks112 nailed the leverage advantage.

The other factor is security: you can’t live inside an ETF if you lose a job. It’s also much harder to borrow against your equity in the ETF (especially since you’re taking the dividends, not reinvesting them!).

Maybe a $500/mo dividend (don’t forget taxes) is appealing if cashflow is that tight. But if you can afford to forgo that (not at all guaranteed) income now, you’re way better off sticking that cash into a rental property.

But yes, landlording sometimes really sucks. It is not free money; it is self employment. And like all self-employment, you don’t get to ‘leave work at the office’.

unfortunately the price of housing here has necessitated MOST young couples I know becoming amateur landlords. Some figure it out, some don’t. I feel sorry for the tenants!

On Evans tendency to talk frankly about the real estate industry. I think it’s important to point out people’s agenda. He gets a lot of flack from the industry for pointing out the industry reps have an agenda and a self interest. For some reason they act offended about that but to me that’s not an attack, that’s a job description.

Then again I don’t think it’s helping the conversation necessarily. He’s right but pointing it out just gets everyone’s hackles up which may be counterproductive to finding solutions to housing affordability which will take effort from all sides. I do hope that media will make more of an effort to cite non-industry forecasters though.

Thank you so much, Leo.

This is some of your best work and analysis.

I agree with your “Take”. The economic consequences of this shock will not be felt equally among (1) the main demographic groups and (2) socio-economic groups / classes.

CMHC is not expecting upward pressure on home prices until the second half of 2022.

Evan Siddall has told the public the truth and his forecasts are supported by data and history. No leading or credible economists, even the RE industry economists, refute what he is saying. Debt, debt and more debt creates a hole from which an economy cannot dig itself out of when a significant demand and supply shock [COVID and oil] hit at the same time. Just look at the unprecedented fiscal and monetary policy efforts to pump liquidity in to the financial system and in to the jeans of people.

Now, however, we have a second shock to occur: China. Madam Justice Holmes decided correctly that “fraud is fraud” and even Mr. Peck and his expensive team can’t change that. Meng will lose at the BCCA and the SCC – she will be extradited to the USA to face trial but that is still 12 to 18 months off [her living circumstances must be horrible in that 10 million dollar home]. However, China does not understand the independence of the judiciary and now, as before, see us more so as the arm of the USA. Soy beans, canola, wheat, oil, metallurgical coal – China can source that elsewhere and even restrict their citizens from travel to Canada [be it to visit or buy homes to launder their money: did you hear the evidence of the Vancouver Model at the money laundering inquiry?]. With immigration at zero and income growth at negative to zero and unemployment at 14% – RE is a fool’s paradise. China may even require their citizens to sell property they own in Canada – they will try and punish us in multiple ways. Tomorrow, Trump has an announcement on China – and China will see Canada as standing next to him. Trudeau knows we are vulnerable from a trade standpoint. And what about the 2 Michaels?

Leo – I read your analysis as bearish on RE, but you can paint it as sitting on the fence. I read it very differently. As for the future, no one really knows. You took the lowest in the range [9 to 18%] conveyed by Mr. Siddall – perhaps it will be 25% [that is the figure he spouted for the highly over-priced markets and surely that means Toronto, Vancouver and good old Victoria]. There are 2 kinds of forecasters in the world:

(1) those that don’t know; and

(2) those that don’t know they don’t know.

Which are you? I am in (1). Think about it. Until then, great job and keep up the good work [no, I am not boot licking; I really enjoyed this piece].

Commissioned salespeople are motivated to get people to think prices are going up . It’s their job.

Cynic, You do realize that if you were cashflow neutral the entire duration until the house is paid off then you would effectively have paid $160K for whatever the house is worth in 25 years which could be $2 million or more ($1.3M if you use 2% annual increases). Even if you assume house prices stayed the same you would end up with an asset worth $800K in 25 years that you paid $160K for.

I’ll let you do the 25 year return calculation for the 4% ETF. If you can get that kind of leverage on the ETF at a cost of borrowing the same as a mortgage then it would be an interesting proposition, but you can’t.

And this is what I don’t understand. You have $160k and you’re going to put it towards a cash flow neutral house? $160k @ 4% (and there are a lot of ETFs that are paying a dividend of 4% or higher) yields approx $520 per month (assuming you and your partner invest the max allocation within your TFSAs).

And it cost you $9.99 to do the transaction not $14,0000 as per the PTT.

I know everyone says landlording (is that a word?) is the easiest gig going. A couple solid ETFs or blue chip stocks (cdn banks / utilities) with decent dividends set up with DRIPs is where I would put that $160k.

I’m not impressed to see him tell us to “please question the motivation of anyone who wants you to believe that prices will go up.” Hopefully it was just a poor choice of words.

I believe prices are headed down, but I’d be offended at someone “questioning my motivation” for saying so. And the forum current topic here has the moderator saying he’s not bearish – I disagree, but people can disagree without questioning their motivations.

That seems very unlikely. Q2 is April, May, June which was rock bottom for sales here during peak lockdown. I can’t believe that sales will be lower in Q3 and Q4. These are seasonally adjusted numbers so the normal decrease in sales should be already compensated for.

Looking at their range for BC, in the better case they expect a ~9% decline in average price, bottoming Q2 2021

Bottom of range they expect a 19% decline bottoming Q3 2022. Hard to tell for sure since it would apparently kill them to put some gridlines in.

I’ve actually stripped out a lot of those other sales that VREB reports in its numbers because it doesn’t impact the residential market one bit if a mall sells in Duncan.

“Well there’s also townhouses, duplexes, land, commercial, out of region sales, etc. So all sorts of other sales are counted in the VREB stats that aren’t in that list, but yes, sales still relatively steady.”

Leo S, I think James Soper is trying to say that sales are dead and no rebound can be seen. You are ruining his narrative!!

Thanks alexandracdn I missed that part. Still a good deal for someone only needing the space for a year. Be interesting to see if good 2 bed/2 baths condos downtown can hit the $2k mark in the summer.

Well there’s also townhouses, duplexes, land, commercial, out of region sales, etc. So all sorts of other sales are counted in the VREB stats that aren’t in that list, but yes, sales still relatively steady.

ks 112……….The Condo at Shoal Pointe is for a fixed term lease til August 2021 only.

god bless…

Rise of remote working is ‘biggest threat to oil demand,’ says analyst

https://www.cnbc.com/2020/05/28/rise-of-remote-working-is-biggest-threat-to-oil-demand-says-analyst.html

It’s extremely unusual for the head of a Crown corporation or other governmental body to speak so intemperately, which seems to be Mr Siddall’s default mode.

It’s quite refreshing, actually.

94 sales in the last week.

So things still not picking up.

Wonder what the thursday/friday pick up will bring here at the end of the month.

Couple things from the CMHC doc that seemed interesting:

They really expect starts to jump in 2021. Wonder why that is?

Also they don’t see a bottoming of sales until Q4 of 2020 in BC.

My first thought is that investors are staying out – for good reason IMHO – and they comprise a much larger % of the condo market.

Big disparity in what’s selling in the past week.

127 single family homes listed, 70 sales. 55% sales to list

88 condos listed, 24 sold. 27% sales to list

looks like some 2 bed condo landlords are confused at what the market rate is now:

https://victoria.craigslist.org/apa/d/victoria-south-lovely-shoal-point-two/7115535231.html

https://victoria.craigslist.org/apa/d/victoria-the-aria-beautiful-2-bedroom/7131581017.html

https://victoria.craigslist.org/apa/d/victoria-south-2-bedroom-2-bath-condo/7119068476.html

https://victoria.craigslist.org/apa/d/victoria-south-2-bedroom-condo-on/7116914062.html

Why would anyone live in the view street one when you can live in Shole Point?? City place one is of decent value though IMO.

Unless economy comes back with a vengeance in June I think my prediction of decent rent reductions starting in July would come to fruition. Don’t see much budge on the 1 bedroom side yet though.

In case anyone else wants to view the pdf that Evan Siddall was linking you can see it here:

https://assets.cmhc-schl.gc.ca/sites/cmhc/data-research/publications-reports/housing-market-outlook/2020/housing-market-outlook-canada-spring-2020-en.pdf?rev=8fe54bb4-638a-48ba-8c3b-590663bc15db

For whatever reason their page is down itself, but the asset itself is available.

Leo S. For the Kenmore house to cash flow neutral with 20% down they would need to get a little over $3K a month in rent (depending on what you count). This was doable when it was purchased, obviously now with the uncertainty of UVIC the rent is less predictable.

Hopefully that didn’t crush any bear dreams.

Evan is coming out swinging against ReMax

Yeah, it was one of the cheapest. But there were/are cheaper ones in GH:

1563 Hawthorne St

Ask: $699K

Sold: 689K

DOM: 10

4014 Osgoode Pl

Ask: $699K

Remember that Gordon Head comprises VREB’s sublocations of Lambrick Park, Mt. Doug, Gordon Head, and (roughly half of) Arbutus.

Here’s a more interesting sale in Gordon Head.

1615 Kenmore

Sold for $705k in July 2016.

Listed since July 2019.

$838k, no action, cancelled.

Relisted September 2019 for $829k, dropped to $799k, no action, cancelled.

Relisted May 2020 for $820k.

SOLD $805k.

1.6% over 2020 assessment

2.4% under 2019 assessment

No great surprise. That was the cheapest place in Gordon Head. Most everything else listed at $850-$1.2M.

Ks12 – lets keep it in perspective- it was one sale.

Hopefully the sale at 4377 Fieldmont didn’t crush any bear dreams.

4377 Fieldmont – in demand neighbourhood, less than $773k and the fact this economic situation simply doesn’t affect everyone the same, as the 2008 GFC didn’t. People will always buy RE in any market, during any crisis, period.

You wouldn’t know there’s a pandemic going on and economic cataclysm looming with sales like this…

4377 Fieldmont Place (Gordon Head)

Assessment: $711K

Ask: $750K

Sold: $773K

DOM: 4

The house is dated AF. In fact, absolutely everything inside looks original from 1975 — kitchen, stove, flooring, wood panelling, toilets (blue and beige!) and tub. Lot is 6,000 square feet, so not particularly huge.

The only major plus that I can see is that it’s just steps away from Mt. Doug Park.

Thoughts?

I am. I sure hope that trip is a success. Dropping the cost of spaceflight is one of the instrumental steps in advancing us as a species.

Or, dropping the cost of housing. I forget which blog this is.

Nope. Bad weather. Too bad. Maybe tomorrow.

Looks like it might be a no go today…

Banks today seem to putting a hell of a lot of money aside for bad loans. Clearly they disagree with RE/MAX w/r to this being over quickly.

Meanwhile Boeing lays of 12,000 people after a string of failures, both on their planes and their rockets.

for those that are into space stuff

SpaceX trying to launch people into space in a half hour.

Size of what? 1 bedroom condo? Probably somewhere in the 650sqft range.

In May 1990, I started my first job and bought my first house in Victoria. Pretty ignorant about economic situation around me then (Landed just about 3 years in Canada and had been in grad school all that time), I only remembered that my realtor then told me it was a buyers market and the seller offered to buy down my mortgage rate to 8% (from 12% or 14%).

Thanks QT and Patrick.

In 1990, BOC head John Crow pursued a zero inflation policy and raised mortgage rates 11 times between January To May 1990, which increased mortgage rates from 12% to 14%, increasing effective housing costs by 16%. Rates peaked May-July at 14.25 and fell back to 12% by year end of 1990.

Here’s a Maclean’s article from May 7, 1990 explaining it in real time …

https://archive.macleans.ca/article/1990/5/7/the-governors-gamble

“ So far this year [1990], the governor [BOC Gov, John Crow] has raised rates 11 times, to an almost eight-year high of 13.80 per cent last Thursday [May 3, 1990], from a low of 12.14 per cent last Jan.

…As a result, a middleincome Canadian pays a much steeper 16 per cent when he takes out a bank loan to buy a new car or other consumer goods. … Declared Douglas Peters, chief economist at the Toronto-Dominion Bank: “Crow is running a stupid monetary policy.”

Cover your ears: Canada’s real estate market won’t shrug off this crisis like the last one

Interest jumped from 10% in the late 80s to 14-15% in 90/91, and unemployment rate went from 7% to 12% and remained above 10% unemployment rate from 91-93. Iraqi invasion of Kuwait/First Iraq War, and crude oil jumped from $17 USD to above $39 USD in 3 months. Oil sands weren’t developed, thus Canada needed to import oil (Canada produced 1 bbpd and consumed 1.75 bbpd during the 80-90s).

I’m not sure if the May 1990 data is even real. Crazy high sales in January/February then a massive drop in May and bounce back after. Either the data is wrong or we had another pandemic then.

Anyone know what was going on then in Victoria?

Rush4life, I think you underestimate the risk appetite of most realestate investors. Lets put some numbers to the example. Currently a 1 bedroom in the Aria rents for around $1700 a month and it sells for somewhere in the mid to high $400k range. For someone to cashflow neutral (including property taxes and strata) with 20% down, the purchase price will need to be in the $350k range. So what you are saying is that people will be so scared to invest due to the potential of declining rents that prices will fall below $350k. I don’t see that has a likely scenario, I think a floor would be put in at around $350k, possibly higher as most ppl don’t take proper tax into account when doing the cashflow analysis.

If you are the buyer, have a condition on the purchase that home is to be vacant at closing. If it is not, the deal falls through. It should not be an issue for the buyer only the seller, and if they can’t get the renter to leave either walk away or have the seller take some tens of thousands off the negotiated price to cover until the eviction can happen as well as to cover the potential damage from a negligent tenant.

Get what you can now from MEC, it was pretty going under before the Covid crisis occurred. The financial support it received from the Covid support programs probably helped it out or it could have gone earlier.

I believe they would have a fair case to be compensated by the province. It could be a while before such a case goes to court.

KS I was saying that pinpointing cash flow neutral is difficult to do when rental income is reducing and could continue to do so for months. Not only that but there are shady people out there like your friends who are gaming the system and will work under the table, get the CERB, AND have the government pay you $300 for rent and at this point there is nothing a landlord can do about it. I have a friend who manages a rental building in Langford and I asked what percent of their tenants are accessing the rental subsidy and they figured 10%.

I just think we are in a more complicated time than just strictly looking at cash flows. Just my opinion of course.

Perhaps this explains why BC has the smallest share of deferred insured mortgages of any major province.

Maybe because we’ve got the highest level of corruption. Which is not good news.

“Schneider is talking about the Vancouver model, and how drug money was used to fund private mortgages, helping fuel the out-of-control real estate market.”

https://twitter.com/bethanylindsay/status/1265322249277411328

“Right. And if their business is down >30%, they should be eligible for the CEWS (emergency wage subsidy program). That pays 75% of wages, up to $847/week/employee, for up to 24 weeks. https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-wage-subsidy/cews-who-eligible-employer.html”

I know some restaurants owners are actually gaming this because they are actually better off with the wage subsidy and 30% sales decline.

“Question is what is the positive rent flow at 20% – what you can get for rents today may not be possible in 6 months so that’s a moving target.”

Not sure what your question is, are you saying investors won’t buy a cash-flow neutral condo because they are afraid that due to possible rent decreases they will be in the hole in 6 months? You should ask Marko if he ever got scared, he’s probably the one here with the most experience on purchasing cash-flow neutral or positive investment condos.

Right. And if their business is down >30%, they should be eligible for the CEWS (emergency wage subsidy program). That pays 75% of wages, up to $847/week/employee, for up to 24 weeks. https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-wage-subsidy/cews-who-eligible-employer.html

Because the banks won’t lend to you.

A disaster for our lovely Travel and Tourism sector.

https://www.cheknews.ca/yyj-facing-over-90-drop-in-passengers-and-revenue-years-before-travel-industry-recovers-670909/

Question is what is the positive rent flow at 20% – what you can get for rents today may not be possible in 6 months so that’s a moving target.

“Sounds reasonable, but I’ll bet a lot of these AirBnB cowboys didn’t put 20% down themselves.”