How to measure short term price movement

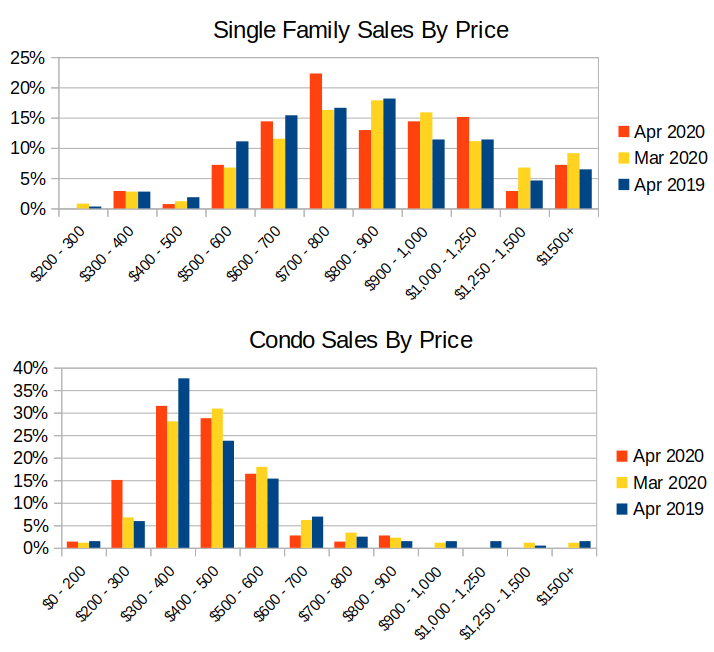

If you’ve been reading this blog for a while, you know that I repeatedly caution against reading too much into the monthly median and average prices. They are notoriously noisy, with nearly one in three months showing a 5% or greater swing in the average price ($40,000+ at today’s detached house prices). This is caused by a shift in the sales distribution, and April prices were no exception with large drops in both single family and condo medians. As shown by the sales distribution below, this was caused by a shift downward in the price bands, with especially more lower end condos ($200-$300k) selling than in March and in the year ago month.

Monthly median prices are just fine but you need to look at them over a longer time frame. In monthly stats roundups I usually average over 6 to 12 months to smooth out the noise. That’s fine for identifying larger trends, but doesn’t do us much good when we’re wanting to see what prices are doing in response to the current market shock. So how can we watch for price changes?

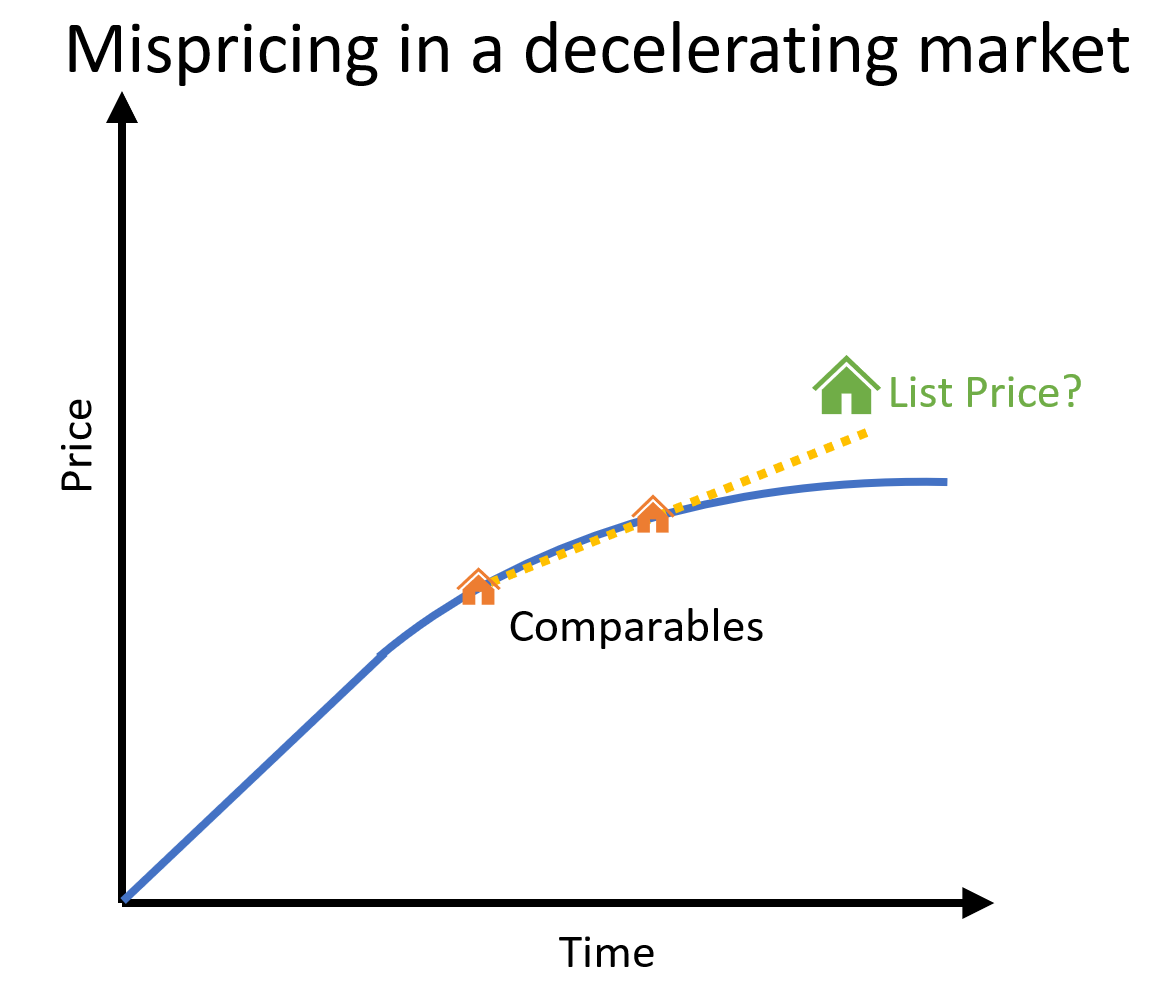

The first thing that happens in a changing market is mispricing. When the market is accelerating, that takes the form of bidding wars and sales prices that are way above the asking price as sellers underestimate how hot the market is. When the market is decelerating, we see mispricing in the form of more downward price changes as sellers misjudge their asking price based on the previous trajectory of the market, not the current reality. I’ve written previously that downward price changes don’t necessarily mean prices are actually dropping, just that the market is slowing down. Before the virus hit us prices were increasing so the first part of the shock just went towards bringing the market back to balance.

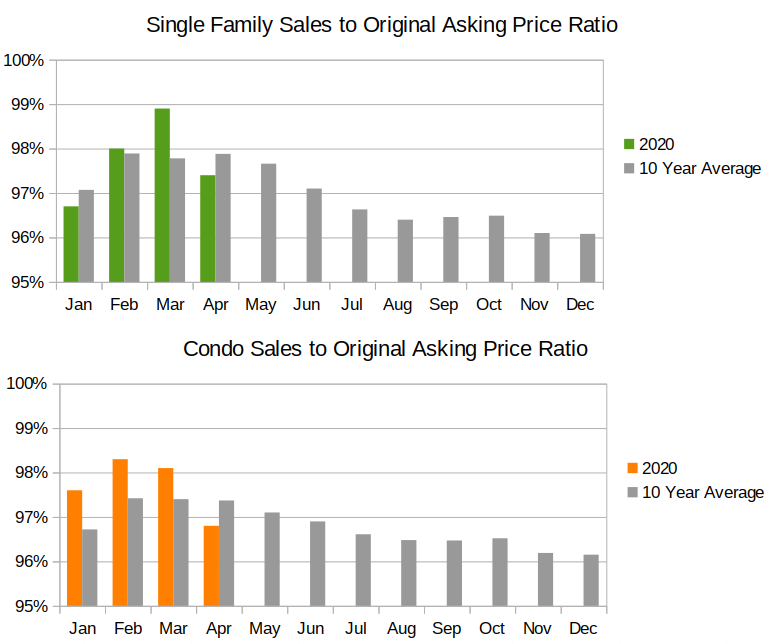

Of course after price changes, we would expect some places to eventually sell, and then we should see the average sale price be lower compared to the original list price. Although individual properties can be purchased for bigger discounts, the overall market usually ranges from selling for about 95% of list in slow markets to just over 100% of list in very hot markets. Note that original list price does not account for the tactic of listings being cancelled and re-listed. The measure is fairly seasonal, with spring sales happening closer to list price, while leftover listings sell for less in the fall and winter. Looking at this measure, we can see that the market was hotter than the 10 year average before the virus hit, and April saw sellers accepting larger discounts due to the sales drop. Some of this shift is also due to the fact that most discretionary listing activity evaporated in April, and the remaining sellers were more motivated to sell and thus more motivated to take lower offers than the spring listing crowd in a normal year. What we basically have this year is winter sellers in the spring.

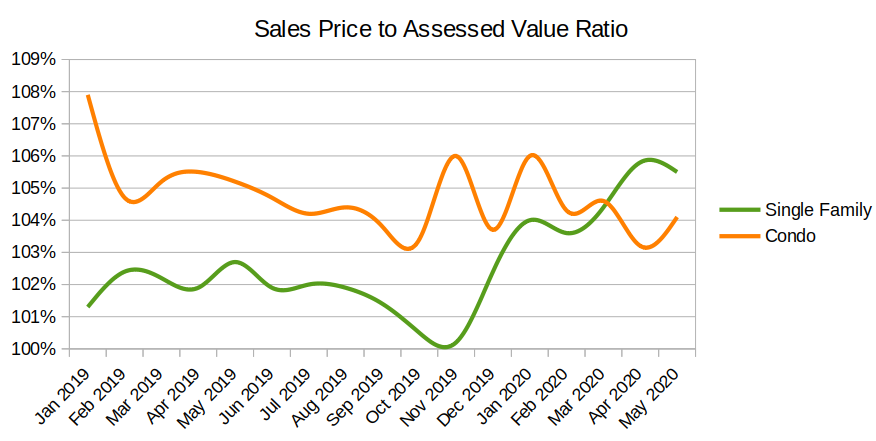

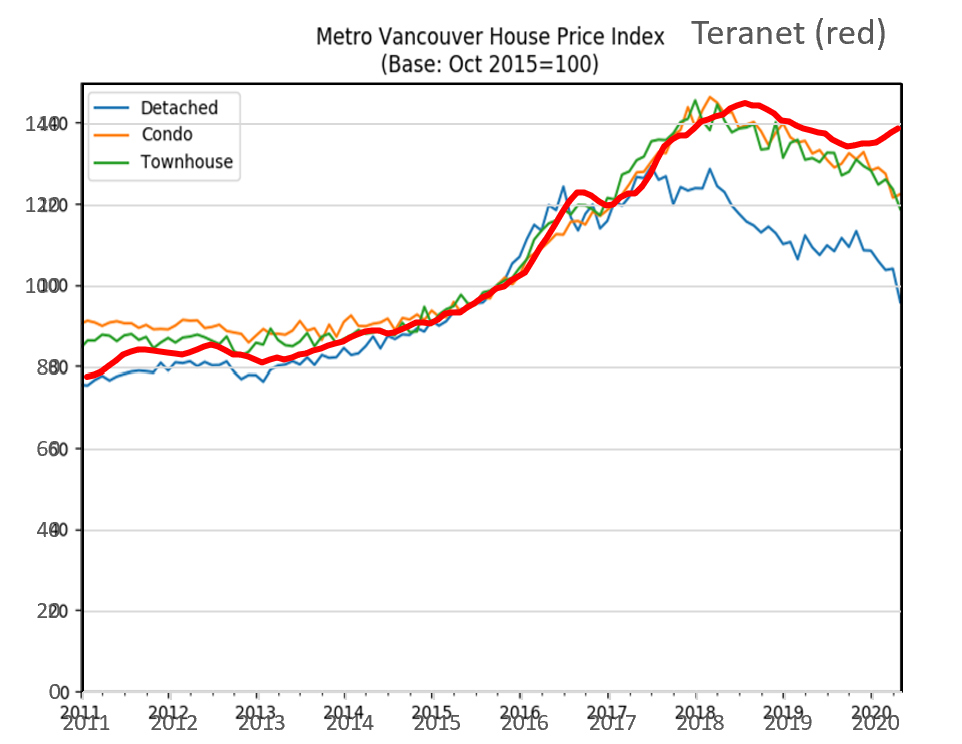

That tells us that sellers aren’t getting quite as much as they were hoping for, but it still doesn’t tell us if prices are actually dropping, or if it’s just a mispricing. For anyone watching individual sales you know that there have been some that came in at lower prices than would have been likely 2 months ago. However if this is to spread to the broader market, we should see it in repeat sales indices like Teranet and the MLS HPI. However the Teranet is somewhat lagging, and the MLS Benchmark price tracks only the benchmark home so it doesn’t capture price changes in other market segments. As a proxy, we can look at the sales price to assessed vhttps://househuntvictoria.ca/2020/05/19/how-to-measure-short-term-price-movement/alue ratio, which tells us how the market is selling compared to the BC Assessment valuation. Those assessments are not that accurate on any given property, but for the market as a whole they’re pretty good. In this case it’s advantageous that the assessments haven’t been updated in the VREB database since the sales from January 2019 onward are all relative to the July 2018 assessed value.

As you can see, the broader market has not really moved in price. Single family properties are still selling on average 5% above their 2018 assessed values, while condos are at about 4% above.

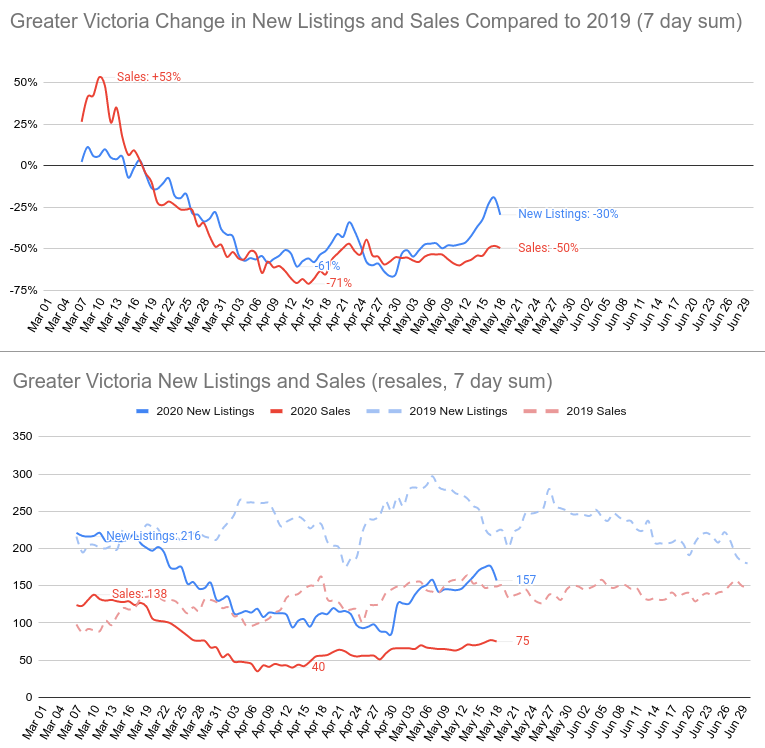

Looking at sales, we see a continued gradual ramp up, with resale activity being 80% above the lows hit in early April, but still some 50% below the level of this time last year. Listings have increased in the last week, which might stimulate some sales as inventory is down 16% from this time last year. With BC’s Phase 2 starting today, we should expect sales to continue to increase in the coming weeks but it remains to be seen if listings or sales increase faster.

Looking at the weekly numbers which include all regions and commercial sales, we are down 46% from this time last year. I expect the final monthly tally to be down perhaps 35-40% (compared to -58% in April).

| May 2020 |

May

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 28 | 124 | 230 | 848 | |

| New Listings | 89 | 287 | 600 | 1613 | |

| Active Listings | 2289 | 2319 | 2447 | 3019 | |

| Sales to New Listings | 31% | 43% | 38% | 53% | |

| Sales YoY Change | -31% | -46% | -46% | ||

| Months of Inventory | 3.6 | ||||

Unemployment Likely Peaked in April

On another topic, last week I wrote about the job losses and their possible effect on real estate. At the time I didn’t have a way to estimate the real unemployment rate in Victoria, the official rate being not reflective of reality as it is a 3 month average and doesn’t take into account those not counted as unemployed because they can’t look for work. However using the change in employment by industry in BC, we can apply the percentage change to the Victoria job market on the assumption that declines by sector are fairly consistent and come up with a reasonable estimate of the effective unemployment rate. Some industries like retail had large drops while others like tech and the public sector had only small declines, but it adds up to an effective unemployment rate of 18% in Victoria for April.

That’s an unprecedented number, but it also should be the high water market and that effective unemployment rate should start to fall in May and June. However, because StatsCan continues to report the 3 month average for Victoria, I will bet the media will run lots of stories about how unemployment in Victoria continues to go up, when in fact the real unemployment rate will likely be dropping (albeit from a much higher level).

New post: https://househuntvictoria.ca/2020/05/25/why-im-not-that-bearish-on-housing-and-why-thats-a-problem/

A bad tenant can happen.

But “needing to take on a car payment” isn’t a thing. No one puts a gun to your head and makes you sign a car loan.

Borrowing money to buy a steeply depreciating asset is utter stupidity, and I have zero sympathy for anyone who has car payments and bemoans how they can’t get ahead.

We bought in 2009, in our mid-twenties, with 18% down, on a 35-year mortgage. To buy in the core, we needed a suite to make the numbers work, since our incomes weren’t that impressive. At the time, $500-600K for a house seemed like a heck of a lot.

Continuing for the last seven years, we’ve lived on one income + suite income, because we wanted one parent to stay home with the kids.

When the house is paid off (in five-ish years) we will take back the suite and effectively double the square-footage of our living space. Right now, it’s four of us in 1100 square feet, which is cozy but doable.

It wasn’t a gamble. The math added up. We ended up paying slightly more monthly than we were renting taking the rental suite into account. We were paying over 2% towards the principal of the house each year. That was a 40% return on our investment of 5% down. We ran a (calculated) risk of prices dropping and losing our principal, but we were planning on staying in the house long term. 5 years later the value of the house was the same, but we had built up equity by paying down the principal.

I agree there is more risk now with a higher chance if prices dropping, but just because the CMCH is recommending against something, it can still make sense for individuals to decide to go ahead with a purchase that makes sense to their circumstances.

It’s easier to make fun of basement suites and wait for the crash.

My parents also bought a quarter section, but they “overpaid” – it cost them $130,000 🙂

And no Marko you can’t buy an equivalent quarter section on Vancouver Island with small house, road access, power and telephone today for an inflation adjusted $575,000.

You took a gamble and it paid off. The CMHC is shouting loud and clear that it does not recommend anyone to take this exact gamble today.

I’ve owned a few places over the years, but not for the last few years. Even with a >50% deposit and low loan-to-income ratio, I’m not buying in now. Too much capital risk and with the mortgage rates where they are (and everything else going on), I don’t see the upside potential.

Patriotz, why would I be afraid of people being lazy? Lol, if anything that helps me… I wish more people were lazy and never gave any additional effort other than putting in 35 hours a week at their union job.

I’ve noticed the same. I’ve seen the same number of resumes submitted pre and post CoVid, for entry level jobs above min. wage, low CoVid risk. Strange. Doesn’t seem like many of the eight million civil CERBants are applying for work.

What would happen if everyone had the same attitude as me? Maybe that’s what you’re afraid of?

And Marko I was able to buy my first SFH in Vancouver on one income, because I put 40% down. And it was all my own money.

When we bought our first house about 10 years ago, our house was 9x our income and we also needed a suite to make it work. Lots of people thought we were crazy to spend so much on a house, especially so short after the financial crisis. My income ended up rising fast enough that we only needed to live with a tenant for 5 years.

At the time we were able to do it with 5% down. This couple already has 200k to put down on the house.

Yes. But this time is different, Chinese government broke 50 years-no-change promise after just 23 years, and no one is strong enough to stop it now. So it is not about rich people, but the middle-class or anyone in HK who can work and don’t want to live under communist dictatorship. I do feel very sorry for HK people. Exodus is the only viable option for them now.

This is the state of our society…..I am helping my father out on our construction site on Saturday and the builder across the street is nailing to the side of his townhome development “labourers/apprentices” wanted. That is how much people want to work.

If you actually want to work and think just a little even in this pandemic there is work, but of course it is easier to collect $2,000/month and play video games.

btw so far zero flex on trades prices. As I’ve been noting since 2010 on HHV….absolute shortage.

Were nurses making upwards of $100k/year back then?

My parents worked hard.

They also bought 160 acres for $75,000

I think it’s all those lattes and avocado toast.

When my parents came to Canada mentality was do whatever needs to be done to get into real estate which included spending 6 hours every Sunday delivering flyers in Oak Bay. I still remember I use to throw all the flyers into the middle of the Canadian Tire flyer and then we would get complaints 🙂 actually once we got suspsended for two weeks because I dumped flyers in a dumpster and skipped a number of street but I was excited as a 10 year old to have two Sundays off.

Once we got ceral sample packs we had to delivery but I kept a few hundred boxes….no complaints 🙂 Good times.

“I think most of us would be prepared to work overtime at 1.5x our base rate. Working a second job for minimum wage just to support an overpriced RE market, no.”

If you have this attitude while others don’t then that SFH would be more beyond your reach as time goes on. Most salary jobs don’t give over-time period, I have worked many 60+ hour weeks.

329 + 99 (last week) = 428 but I think Thursday/Friday we will big unconditional days so I’ll add 45 to 50.

My revised prediction is 475 +/- which is pretty close to my 500 guess at the beginning of the month given all the uncertainty.

That’s about on the mark for this job.

https://www.payscale.com/research/CA/Job=Personal_Support_Worker_(PSW)/Hourly_Rate/6c20ee2a/Long-Term-Care

I don’t think we’re getting to 500 sales Marko. Not even 100 in the last week.

“let alone work beyond 36.5 hours/week.”

I think most of us would be prepared to work overtime at 1.5x our base rate. Working a second job for minimum wage just to support an overpriced RE market, no.

While we’re at it, would a lender actually include a precarious 2nd job in qualifying income?

Don’t have time to read an article but how do you make $35,000/year in health services? Wouldn’t a housekeeper be more than that. Any short dipolma at BCIT and you are over $50k/year.

Average person isn’t prepared to do that. HHVers find it inconvenient to have a tenant in the basement let alone work beyond 36.5 hours/week. You can still get into a SFH without being a genius if you have the right game plan/work ethic, but most people don’t have either.

That’s like me saying, “I need a root canal, have horrible arthritis in my knees, and a herniated disc. I can’t stand all this pain.”

And you say,

“Hm. Eh, take a tylenol.”

Haha.

If b20 is a problem, they can get a loan from a credit union.

They shouldn’t be spending more than 600k. If you run the numbers roughly as the article provided, 880k would be technically possible with a renter paying $1,400 a month, assuming a rate of 2.29%.

If they found the right lender and had good credit, they’d be right on the wall with no room for anything else. Their GDS and TDS would be the same at a dangerous 42%, when it shouldn’t be more than 32/44 respectively. One bad tenant, or if they need to take on a car payment, or god forbid have a kid, they’re screwed.

Fools.

Edit: Oh, they do have a kid. And I forgot about B20. Now that doesn’t work at all. WTF?

Straight up RE porn, by which I mean a completely fake and unachievable scenario; they would only qualify for a $400,000 mortgage. Another pathetic attempt by the bubble inflation industry to lure the unwary into deep water.

We’ve been told for decades that one of the reasons for Vancouver’s high prices is that the rich HK’ers and Chinese already own houses there.

“Sid is 34 and earns $55,000 a year in the hospitality industry. Kamala, who is 29, earns $35,000 a year in health services. The house they are eyeing is $880,000.”

https://www.theglobeandmail.com/investing/personal-finance/retirement/article-should-millennial-savers-sid-and-kamala-hit-pause-on-their-plans-to/

Perfectly normal, perfectly healthy.

https://homefreesociology.com/2019/09/03/hong-kong-to-canada-to-hong-kong-and-back-again/

Looking at the numbers for BC and Vancouver, it appears that Vancouver has the vast majority, with very few with ties to remainder of the province. But if there’s an exodus then that could definitely be a material factor.

I predict much higher home prices for Toronto, Vancouver and Victoria given the social unrest in Hong Kong. There will inevitability be a substantial exodus of people and money that will hit Toronto first, then Vancouver, then Victoria. House prices will increase 50% in the next 2 years.

Ks12 or 112 – I agree that 2 professional incomes of $80k each can afford the sfd in victoria. However it is still a large mortgage payment even with a 20% down and there are many buying with less of a down. Factor in kids, car payments, normal costs of living etc and let’s just say LOCAL vacations, there is not a lot of dough left, even in this low interest rate environment. Not a lot of wiggle room when shit hits the fan. We are seeing that now aren’t we both In this city and nationally. I am not so much bearish, RE is a long term commitment, but even those who can afford to buy in the pricer markets in Canada, on average, are spreading themselves very thin on current market pricing. Sure there is the potential of suite income etc but if that’s what it takes to be comfortable, not ideal. Further do you have any idea the number of otherwise law abiding people committing tax fraud annually with their mortgage helpers? And to hear their justifications doing so? There’s been a major uptick in the avg sfd price in Victoria in a very short period of time in the scheme of things. Low interest rates and low inventory have been maintaining that for now. I am looking forward to Leo’s fundamentals post to learn some more detail about the Victoria market in the coming days. Thanks to all posting for all comments and opinions and of course to Leo for this blog! Cheers all!

Sounds like advice from an experienced divorce lawyer? Haha …

Does anyone know where to find statistics on zoning variance applications for the City of Victoria? (I just can’t seem to find anything past boiler plate FAQs) Primarily, I am interested in the types of variances applied have been applied for, the success rate and the length of time to process. Just trying to work out if something is worth attemting, but unless there is a realistic chance of some minor zoning variance approvals the attempt becomes unlikely. Thanks!

Victoria Born, it has been discussed and agreed upon many times on this site that TWO professional incomes (80k plus) can afford a SFH in Victoria. Marko has personally represented many of them in purchasing a SFH. The point is that due to its finite supply and the fact that Victoria is a desirable place, a SFH in Victoria is now considered a luxury item and not one the average Joe is able to afford.

Your impression of wages are also a little off for Victoria. Let’s take your example where you say private sector lawyers can earn much more than $145K a year in Victoria. Lawyers in Victoria (assuming you are not a main equity partner at profitable firm) are actually paid less than their government counterparts for the most part going by years of call. Many lawyers at local law firms actually actively try to get a government gig. If you want to compare the successful partner salary of lawyers in town then you should compare them to some of the higher paid public sector lawyers also, those can range from the low 200k’s being senior level at the provincial government to almost $700k at BCI.

I used to work at a government related entity and made around $80k a year a number of years ago, I was able to transition out of that job into a new one which significantly increased my total compensation. But it took me over a year and half to get that job and I had applied to over 30 different other jobs and participated in about a dozen interviews. Through that process I became quite familiar with the pay bands for finance/business functions at most large places (public and private) both here and Vancouver.

Your 14x affordability ratio also doesn’t take into account the significantly lower interest rates on mortgages compared to the past. If you want to look into affordability then you should look into the chart Leo S made. Income to price ratio is not valid for comparing leveraged purchasing power on assets when there is a significant difference in interest rates.

Hello Ks112 – unfortunately, you did not look through the sites I provided to the group – these are the actual Province of BC data provided to the public that shows the salaries of all jobs. Take a sample of the highest paid jobs [there are far fewer of them] vs the “clerk” type of job that you are referring to [there are 30 to 40 of those jobs for every high paid position]. People tend to focus on the senior management or executive deputy minister positions, of which there are few. This is like looking at a cardio-vascular surgeon’s pay and saying that this is what the average physician earns.

I would commend you to simply click through the jobs that you think are really high paying – you will be surprised to see how few make more than $100K a year. A manager of a department earns about $70,000 to $75,000 gross per year. A senior social worker [10 years plus] earns $70,000 a year. A senior policy analyst earns $75,000 per year gross. A team leader earns $72,000 per year. Legal counsel [senior] earns $145,000 per year. A director [senior management] earns $101,000 per year full time. An executive director earns $107,000 per year. Don’t believe it, see this:

https://ca.indeed.com/cmp/Bc-Public-Service-Agency/salaries

Even software / technology positions, at the senior level, pay only $80,000 gross per year. The highest paid are for lawyers / counsel at $145,000 a year [crown counsel, ICBC, policy, solicitors]. That person would earn far more in the private sector, which I know from personal experience. This site, in fact, shows you a bar graph next to every position showing you the low and high for these jobs along with a depictions of the available volume of positions. As an example, it shows that an Executive Director earns [range] between $32,000 and $152,000 per year; but the distribution of those positions shows that the vast majority earn $117,000 per year – hardly enough to support your thesis that these jobs will save the RE market in Victoria.

Rather, the data shows that these public service jobs are really not highly paid positions. In fact, the average salary of all BC public service jobs is $64,000 to $72,000:

https://www.payscale.com/research/CA/Employer=BC_Public_Service_Agency/Salary

https://neuvoo.ca/salary/?job=Bc%20Public%20Service

The Vancouver Sun and The Province published all of this early this year:

https://theprovince.com/news/local-news/b-c-public-sector-salaries-database-10th-edition/wcm/c76d588a-37a4-4307-bae1-124c4bc4359c

https://vancouversun.com/news/local-news/b-c-public-sector-salaries-database-10th-edition/

We also know that the median household income in Greater Victoria is around $89,000 before taxes and $61,000 after tax.

https://www03.cmhc-schl.gc.ca/hmip-pimh/en/TableMapChart/TableMatchingCriteria?GeographyType=Province&GeographyId=59&CategoryLevel1=Population%2C%20Households%20and%20Housing%20Stock&CategoryLevel2=Household%20Income&ColumnField=HouseholdIncomeRange&RowField=MetropolitanMajorArea&SearchTags%5B0%5D.Key=Households&SearchTags%5B0%5D.Value=Number&SearchTags%5B1%5D.Key=Statistics&SearchTags%5B1%5D.Value=AverageAndMedian

So, since everyone must pay taxes, and using an average house price of $850,000 – in Victoria this leave a ratio of 14 time. Affordable? The long term average is what 3 to 5 times.

Local income, be it public sector or private, do NOT support these outrageous ratios – now, add in 20% unemployment and a workforce virtually on welfare [CERB].

Residential rents are falling as the COVID-19 pandemic drags on

I believe Lufthansa has already been bailed out.

Victoria born, as discussed before there is a finite number of SFH in the core and there are more than enough ppl earning high salaries to buy them. Those 40k-60k jobs in government are glorified clerk jobs which require minimal education. Competent and capable ppl will not stay in those roles for long.

BCIMC made a billion more than what they needed in the last decade, and the entire pension corp/bci staff is entirely paid by the money made off of the fund. I think the taxpayers are doing fine.

Only people making bank from the govt are the contractors.

I don’t think they’ll be doing too well out of this.

Indeed, Victoria is not immune, expect perhaps on this blog. Don’t get me wrong, I love Victoria, but the cracks are already showing:

https://www.timescolonist.com/news/local/residential-rentals-facing-pandemic-pressures-amid-absence-of-tourists-and-students-1.24140008

As rental rates fall, landlords / owners go under water where the revenues generated do not cover the financing / mortgage / property taxes / maintenance / etc. This results in listing them for sale, active listings rise, demand is stale due to joblessness, loss of confidence, unaffordability, etc. Foreign buyers [China] are gone or listing their own properties. Economics 100 takes hold, as it is right now, and if you intend to sell, you can only wait for the robins so long – Spring comes and goes.

You may wish to closely examine these so-called lucrative government jobs. The only thing lucrative is the defined benefit pension that is guaranteed by the tax-payer [a rip off for the tax-payer]. Politicians gave in to the union while also padding their own retirements – a greater conflict of interest never existed. If you take the average salaries and deduct the statutory deductions and the employee contributions to the pension and extended health plans, the actual net [take home] pay is not as great as you think. Now, people tend to focus on the senior management level jobs with the government as indicative of what these jobs pay. Those are not the median incomes for thees jobs. Here are the salary grids:

https://www2.gov.bc.ca/gov/content/careers-myhr/all-employees/pay-benefits/salaries/salarylookuptool/grids

Here you can look up the actual gross salaries job by job:

https://www2.gov.bc.ca/gov/content/careers-myhr/all-employees/pay-benefits/salaries/salarylookuptool

The average or median income are between $40,000 and $60,000 annual gross income. It really is an overstatement to think that this employer will save the day for Victoria. Victoria is not immune.

Marko: If you are too lay to work two jobs or long hours there is always the option of simply marrying money. Good chance you will not have a particularly happy marriage but then you can always have a spectacular divorce.

Marko J – I suggest it is the presence of the bc gov as a relatively large local employer that we will not have a market crash. There are a large number of locals earning above average incomes employed in the south islands provincial government sector. Were it not for the our economy would be in poor shape.

Just renter, I like to diversify my assets and don’t want it concentrated in Victoria realestate. And again I never said house prices always goes up. I just said there is probably more chance of an increase than a significant decrease.

Marko, one can have the security of a government job. But that doesn’t stop one from say delivering for skip the dishes on the evening for couple of hours and also on weekends. Probably can make an extra $1k a month and then all of a sudden u can buy a townhouse instead of a condo.

Intro i think he means – Zero chance they will be back to busy – at least by previous standards of the word ‘busy’.

What does this string of words even mean?

Ks112 you care so much about the local economy why don’t you go and buy a few condos, you have the big salary, equity from house and most importantly prices will only go up. What are you waiting for?

When I rode my bike downtown on Friday around lunch there were around 300 parking spaces available in the View Street Parkade, this would normally be full at that time most of the year, Id say that qualifies as pretty dead especially on a Friday

Couldn’t be more true, but if you like the low stress low risk of a government job than all you are left with is praying for a market crash.

I do have an update on rental prices dropping. I know of a place in the Janion (2 bed 2 bath overlooking the new bridge) that got rented recently for $2k a month on a long term lease. So that I would say is a good deal and would not have happened 3 mths ago.

True all right, because praying for a market crash, or for no crash, has no effect on what actually happens. But other things do.

Leo, I guess I should have used the term “busier “instead of “busy”. Basically all the restaurant and pubs I been to or seen so far (earls, browns craft house, Yates street tap house, Pagliacis, El furniture Warehouse, chucks burger, Local) is operating every other table with the bar area having designated spots for stools. Almost all were at capacity with multi hour line ups at a few.

From what I can gather, those places might do ok due to the 75% wage subsidy that kicks in if revenues decrease by 30% or more. I believe lots of stores in the malls are opening on Monday so be interesting to see what happens there, although the mall business is dead in Victoria anyways.

Also, shame on you bears for wishing a crash on the local economy just so you can afford a house or rent a decent place.

Caveat emptor, no one has told me how to embedd videos in this forum. And I am pretty sure yesterday other posters chimed in how busy or not busy downtown was.

No, I own a house in GH that I rent out fully (purchased in 2013) and I myself rent a condo downtown due to working downtown (been doing that since before I bought the house). I am not being combative, I am just trolling you bears a little due to some of the smart ass remarks.

Just remember my advice from last year: you are more likely to afford the house you want by spending time trying to improve your income situation than praying for a market crash.

🙂

We WANT to believe you ks112.

It’s just that we are “Earl’s truthers” ……. AND you still haven’t submitted the documentary evidence we requested…

We’ll see I guess. Zero chance that they would I’ll be back to busy by then by previous definition of that word. The restaurants that shifted to takeout are doing just fine and others may go out of business.

I agree with 50% employment in hospitality in a month or two. That’s likely about the split between local and tourist supported jobs in the summer

KS you’ve been very combative as of late. Could it be you own a place downtown that you are renting (or AirBNBing) and you are worried about your investment and taking it out on the people of this blog and trying to convince yourself everything will be OK (despite of mounting evidence it may not – temporarily)? Well don’t worry – everything will be OK one way or the other. Nobody here wants you to lose all your money – many bears just want the opportunities that were afforded to those who were able to buy 5 years ago – and that is opportunity to buy now – which for most means some reduction in price. And if prices drop, like we have seen historically, well prices will come back – like they have historically – so i dont’ think you have to take all this bearish talk so personally.

“The economy has only been force-closed for two months and most areas are open or opening soon (with restrictions). In the case of BC and VI in particular, the govt have done a great job so far IMO.

Do you have an example of an area of the economy that is still closed by the govt that you think they should open or loosen restrictions?”

Patrick you will have to ask all the bears to chime in here. I tried telling everyone before the weekend that things are opening up and places are getting busy and we should be back to around 50% employment for the hospitality workers (minus hotel) by mid June. They just don’t believe me and still thinks downtown is dead…. Just a hopeless bunch unfortunately.

They will contact trace to identify the source, and likely increase restrictions or re-lockdown certain areas. Hopefully that works until a treatment or vaccine emerges.

The economy has only been force-closed for two months and most areas are open or opening soon (with restrictions). In the case of BC and VI in particular, the govt have done a great job so far IMO.

Do you have an example of an area of the economy that is still closed by the govt that you think they should open or loosen restrictions?

Introvert: BC has not had enough cases to “flatten” the curve, rather we have probably just shifted the curve to later. Time will tell as we begin to open up again. Will the government lock down as cases increase, I guess that is a matter of opinion and time will tell.

I guess if Lufthansa, KLM, and British Airways go under I’ll have trouble getting to Croatia.

It would, if I had a real job but I can get someone show places and then I can send contracts from my laptop.

I am also thinking in 4-5 months you should be able to pay for a test on landing and they call you with the results in a couple of days?

I disagree. I think we’re reopening now largely because we’ve flattened the curve, new cases are low, and more people are spending time outside, where they’re less likely to contract the virus.

I think governments and health officials fully expect a second wave to occur, most likely in the fall, at which point they won’t hesitate to reinstate all restrictions and add even more, if necessary.

I very much doubt the feds and the provinces are thinking this way. I think they will continue do their utmost to limit deaths even at the expense of the economy.

I think there has simply been a decision to reopen regardless of the probability of a second wave of Covid19. As pandemics go this one is comparatively mild in that in general the mortality rate is a bit less than 1%. Equally important most of the mortality is amongst those over sixty (not exactly the most productive part of the population).

When the second wave hits, and it very likely will, the curve can mostly be flattened simply by protecting the nursing homes as best as possible and ensuring those nursing where there is an outbreak do not remove the victums to hospital but let them be treated in the nursing homes. Worst case scenario is that the hospitals are a bit overwhelmed for three or four months. But the worst case is unlikely since at least a percentage of the over sixty or vulnerable will continue to self isolate to some degree. (far from all considering human nature but enough to prevent the hospitals from being totally swamped.)

I am sure the government accountants have already figured out that the main financial impact is reduced nursing home costs along with less pension payouts. The cost of closing the economy on the other hand is staggering. Dont mean to sound cynical but at some point reality needs to be reviewed and the simple fact is that it mostly kills a very small portion of the old and sickly. (By the way, I fall into both categories before I get swamped by hate mail).

Having said that, I do worry that we crashed a fair portion of the economy. We may have toppled over a tower of debt that will have implications for a whole generation.

Drove up to Cow Bay yesterday and was surprised to see the amount of building both there and in Mill Bay. Not huge by Langford standards but still significant for that area. Wonder how many people are rethinking the joys of living in a cramped condo downtown.

.. so i wonder after this blows over .. how many will stay at home to work, how many students will be online. things are changing .. even in stable government sectors. Langford is building like no tomorrow and victoria is taking in more homeless … fun to see in 10 years

People are still sitting at home, frightened I guess. It’s really quite sad and in most cases, pointless. You’re not protecting yourself by doing that. Are people still buying crates of toilet paper? I don’t know whether to laugh or cry.

Without hesitation, I’d go to a Chinese buffet tomorrow if the ones I liked were open. I miss going to Purple Garden. I went to a Japanese restaurant today in Brentwood Bay though, and it was great. Some of the best Sashimi I’ve had in ages.

I would always wear fabric gloves and spray off the machines after I use them, long before the fear train started. It’s common etiquette and most people respect it thankfully. If a truly dangerous virus were on the loose I’d probably stay away, but otherwise exposure to most germs is actually not a bad thing, believe it or not. Having said that, I’ve never been willing to directly touch handles in public bathrooms. The psychological ick factor is a tad much for me. 🙂

I will prepare for a deluge of irate Reddit posts.

Possibly. Don’t underestimate the societal unrest that will come from this.

Yes, I had to line up today. The in-store limit was higher, so the line moved faster.

The 14-day self-isolation upon your return will suck, though.

We will be driving to Calgary in the summer, as usual, to visit family.

I read about a poll that was conducted recently and apparently Albertans are the most enthusiastic to have visitors come. We will be testing that!

Not sure which Marxist utopia you are living in, but I expect it’ll be the Millennial and Gen-Z working class that pay the most.

Hopefully the airline your flight is with is operating August, shut down or no shut down. I wouldn’t be surprised when folks go to use their travel vouchers in the future, that newly added costs appear in addition to what was originally guaranteed with the rebook or cancellation during the crisis. Airlines may be able to use the change in economics of flying if there are less seats available on flights to allow for social distancing, less competition on routes as airlines scale back or have gone under as excuses not to honour past commitments to already paid travellers.

My flight to Europe got cancelled for June 2nd so I’ve rebooked for August….thing is not many of my family members have made it past 65 yrs old so I am not going to waste a summer or two (3 or 6% of summers left to live) living in fear of something that has a <1% chance of killing me. Common sense yes, living in fear no thx.

In fact I am super annoyed that my strata is refusing to open up our gym and outdoor pool. We haven't had a legit case in 10 days on the island. Everyone is worried about liability….what about someone with tuberculosis and other infections? Worried about it then don't use the gym so I can use it before I pack it in from a cardiovascular event.

Right, I saw the same thing. Though Dr. Henry lives here and commented favorably today on what’s going on, and expects little transmission from outdoor activities or outdoor socially-spaced restaurants. I hope she’s right. I’d like to see masks on everyone.

I don’t see it as a way to tax wealth, but as a way to tax capital misallocation, which actually makes us less wealthy in real terms.

I drove by Peppers around 2pm, and there was a lineup outside the store of about 10 people, nicely spaced. So there’s still a limit in-store, albeit a higher limit than before.

Well yes, but that’s why I used the word “progressive”. You said you’d give $1 tax saving for every $1 extra property tax (“ 1:1 trade between increased property taxes and less income taxes. ”) .

And so if you’re increasing property taxing for people with low incomes the same as high incomes, and then cutting income taxes overall, the high income people would end up paying less total tax, and the low Income would end up paying more total tax. Because your taxing less of the progresssive (income) tax, and more of the non-progressive (property) tax.

Take the extreme example, where you increased property taxes enough to match total income tax revenue. And everyone’s income tax is cut to zero. Now do you see that rich and poor people would be paying the same property tax (for the same condo) and they’d pay NO income tax, and how that wouldn’t be progressive at all, it would be a flat tax.

Property taxes as they are now would be a bad way to tax wealth. They are based on assessed value, not equity. Do you want to shift the tax burden towards a first-time buyer with 10% equity and consider him a wealthy owner of the house? And shift it to non-wealthy landlords with mortgages who can pass it on to their renters?

Eh? I didn’t say only cut income taxes at the top.

Are they ever.

“ I needed to have emergency dental last week to remove a tooth that I split. The surgeon charged $250 for extra cleaning and supplies, and also justified it by only being able to see 4 people a day vs the 40 he usually would see. Dental insurance didn’t cover a penny“

https://www.reddit.com/r/britishcolumbia/comments/gp7jsn/dental_surgeon_charged_250_covid_surcharge/

All I can say is WOW!!!

Spent some time around town today and saw many people strolling around, open restaurants and pubs with people sitting inside and outside, and everyone acting like there was no fear of a ‘pandemic’ and not much social distancing. And what are ‘masks’ … who knows, I didn’t see more than ten.

As I said before, Common sense is not as common as stupidity!!! If there is a contagious virus floating around then the second wave will arrive within 6 weeks judging by the activity I saw in town today. Or maybe Trump was right when he said the virus will disappear when the warm sunny weather arrives.

Businesses needed plans for how they would be handling social distancing. I don’t think it’s prescriptive about numbers in the store but if they just said it’s a free for all and one of their staff got sick there could be WorksafeBC repercussions.

Just back from Pepper’s. Asked the cashier if they’d recently relaxed the 10-customer in-store limit (Friday and today it looked like >10 shoppers were inside). He said, “Yeah, we’re letting in more people than before, especially on weekends when it’s busier and many customers are only grabbing 2-3 items.”

Maybe Home Depot is doing the same thing, and I happened to walk in on Friday when they were busy but not over their (new, higher?) limit — hence no lineup?

What are other people seeing out there?

It is an example of how to shift taxes from income to wealth. You could shift your question around to: why should a wealthy low income earner that can afford the same condo as a poor high income earner get a bigger break?

What, precisely, was the restriction on the number of customers permitted inside a store deemed an essential service? And wouldn’t the number have a lot to do with the layout and square-footage of the building?

I was under the impression that hardware and grocery stores were essentially guessing at the number of shoppers they ought to allow inside at one time.

Bears, u should all come downtown today and see how dead it is. Don’t worry, lots of room on the side walks to avoid bear traps.

Why not just charge non primary residences full pop instead of capital gains – not sure how much that would bring in but makes the most sense to me. Also Evan Siddal is going off on twitter right now:

Really? Nooo!

I was there 2-ish yesterday. No snaking lineup outside. No lineup anywhere. The normal entrance was open, which had always been closed to make people enter through the lumber area. And it was busy inside.

Maybe they briefly tried returning to unlimited customers but found that proper physical distancing wasn’t happening?

You made my day, Leo.

That’s a non-progressive “gift” to the highest income earners. Why should someone with a high Income get a bigger break than a low income earner if they both own identical condos?

Doesn’t much matter, what we all will be getting is higher income taxes and higher property taxes.

You got me there. Let me see if I can run the numbers again and remember why I said that back in 2016. Maybe I’m misremembering things.

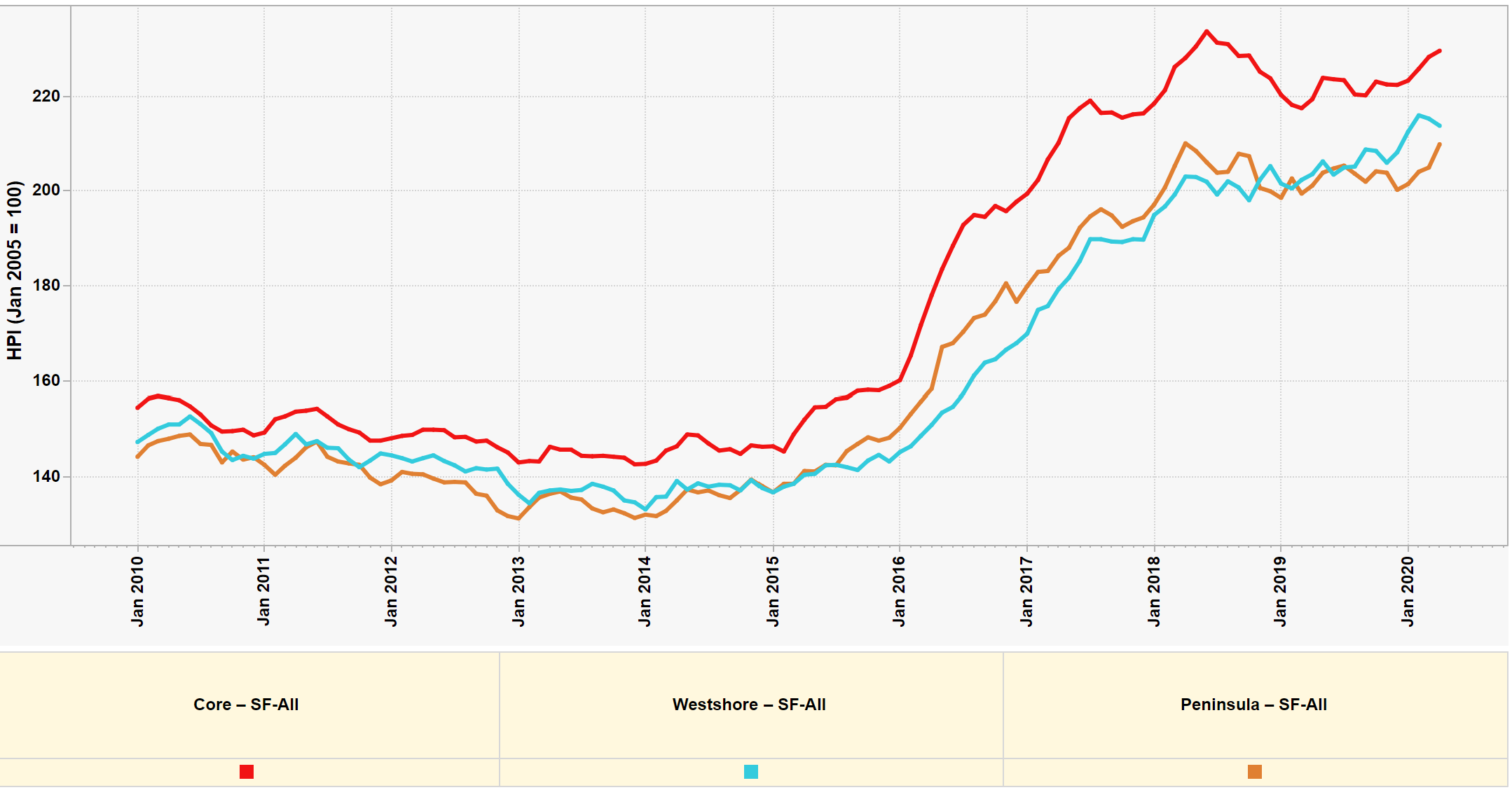

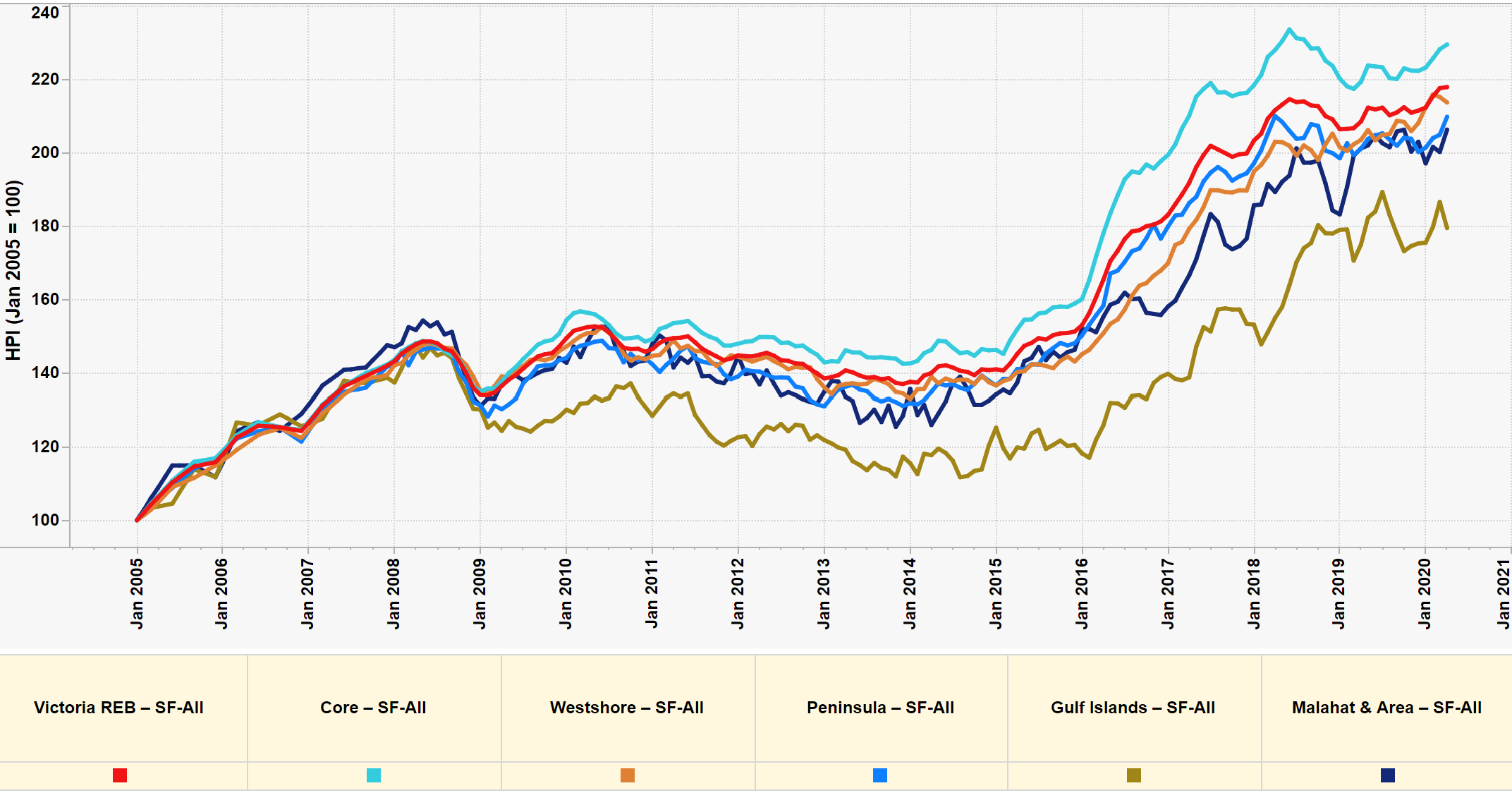

edit: Pulling the numbers now I can’t see strong evidence for a wave between westshore and core. Both changed price direction at about the same time and when there’s differences it’s not consistent and only by a few months. For sure marginal properties decline first, but that’s a different thing. It may be true that the really outlying areas like Sooke lead Victoria on drops but we’d have to dig down a lot more.

Another thing that’s interesting is the divergence of the areas after the financial crisis. 2005-2008 all areas pretty much moved together. After the financial crisis the Core outpaced everyone else, while the Gulf Islands lagged behind substantially.

Yeah I would love to see a 1:1 trade between increased property taxes and less income taxes. It’s tricky because of the jurisdictional problem, but we could cut most support by the province for municipalities and make up the difference with property taxes.

Also a steep inheritance tax would be good after a say $2-$5M threshold.

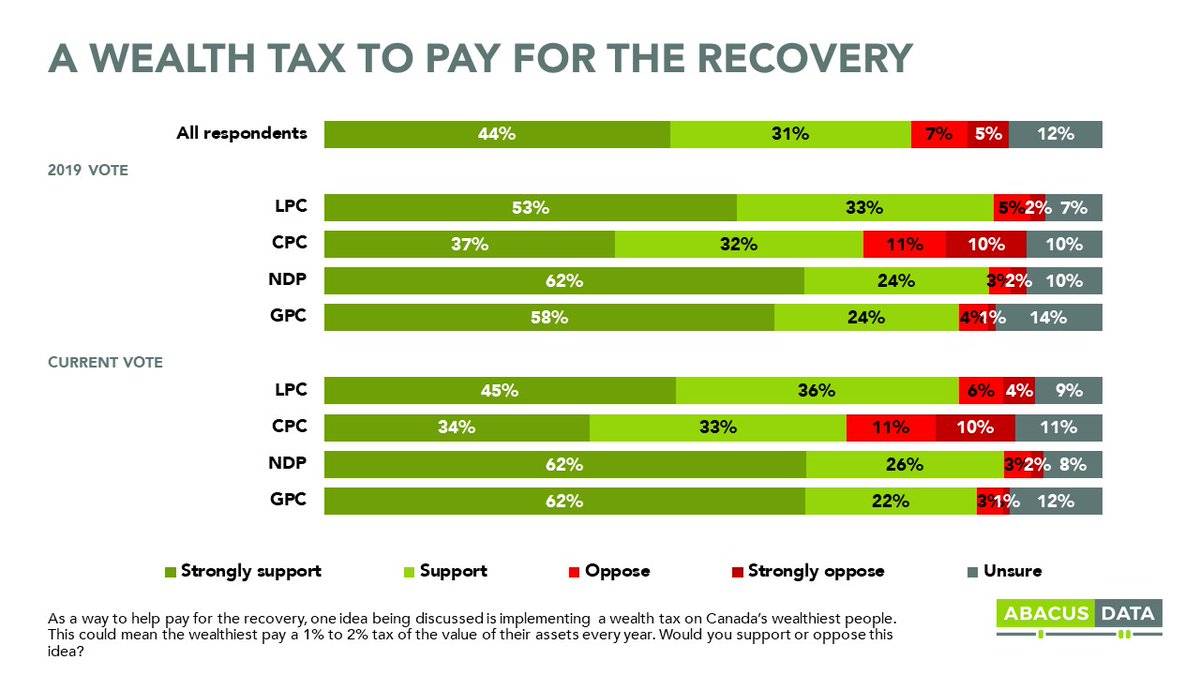

That’s the inconvenient truth for the wealthy I guess. They’re in the minority. And the reality is that the people that have been clobbered by this have been the least wealthy, while those at the top didn’t get hit at all or even benefited.

So who’s going to pay for the recovery? Not those that got clobbered, that’s for sure.

Eh? Long line outside of Home Depot right now. It’s not up to them whether to relax that restriction. You must have just been there at a quiet time.

Haha

Have you seen this IMF report on Canadian house prices Leo?

https://www.imf.org/en/Publications/WP/Issues/2019/11/15/Assessing-House-Prices-in-Canada-48777

When we’re talking about ‘fundamentals’ I think we need to talk about mortgage interest rates. At close to 2%, the ‘fundamentals’ may support a loan-to-income multiple of 6x. At 6%, it may support a loan-to-income ratio of 3x-4x (page 15 in the report).

The affordability graph that you’ve posted before where the prices bounce about within an upper and lower bound seemed to indicate that it would always head up and to the right. But I think it would make more sense to plot that along against mortgage interest rates, due to the inverse correlation.

From the report:

“Declines in mortgage rates have been quickly priced in by housing markets, increasing price to-income and loan-to-income ratios. A household’s capacity to borrow increases when interest rates decline and its debt-service ratio is stable. Over the sample examined here, estimated attainable house prices closely track observed house prices in most metropolitan areas. With interest rate declines quickly reflected in house prices, the price-to-income, loan to-income, or price-to-rent ratios increase. Higher loan-to-income ratios for new home buyers increase the economy’s sensitivity to shocks to interest rates, income, and employment. ”

But we no longer get to dump the interest rate to steal wealth from the future and bring it to today. The wealth effect is goosed.

Of course there are other ways to keep us debt junkies shooting up, such as 30 year amortization etc. But the recommendation of the report is not to do that. Instead:

“Policy measures that increase households’ capacity to borrow—such as increasing mortgage loan amortization period, making mortgage interest expenses tax deductible, or subsidizing loans—will likely put additional upward pressure on prices. Indeed, for such measures to work, the supply of housing would need to be exceptionally (and unrealistically) elastic even in the short run. As such, policy measures focused on increasing housing supply and/or reducing tax benefits associated with mortgage debt are the most likely to durably improve housing affordability in Canada in the future.”

Personally I hope that the capital gains exemption is killed off. It’s an incredibly unfair advantage for those that already own property. If a property owner gains $100k equity as a benefit of lowering interest rates, I need to earn over $200k NET income (through productive work) to match that due to corporate and personal income taxes.

Google Advanced Search is pretty neat.

HHV is a lot of fun.

Slow clap from all the anonomous blog people you’ve impressed this am. Not only are you the greatest closet economist this blog has ever seen, but your ability to search out old posts to display your economic prowess can’t be matched.

All joking aside, your need for recognition is quite interesting, especially as you seek it from a place like this. Is it emotional insecurity? Does your boss not tell you that you do a good job?

I’m actually quite curious.

That “rosy” forecast is dependent on the “hope” of the virus fading away without a second wave of closures in the fall. We all hope that’s true. Otherwise we get the “dire” forecast they made.

The “rebound” they’re talking about occurs “after the health crisis” ends.

https://www.bnnbloomberg.ca/poloz-says-risks-to-canada-s-economic-outlook-overblown-1.1439635

“I’m relatively optimistic, what I find, compared with what the talk is,” Poloz said, adding that the economy is currently tracking the central bank’s best-case scenario of a sharp drop in output of 15 per cent. When the economy gets “turned back on” after the health crisis, “you should see a very rapid return to production.”

Historically, immunity has been very strong:

I am guessing somewhere in the range of top 6 to 10%?

There aren’t many countries in the world where a SFH is attainable for the general population. My cousin in Croatia is an oncologist (like a really talented one, worked in Toronto for a number of years on various research) and his wife is a GP and all they can afford a decent condo. He was making $340,000/year in Toronto and his salary in Croatia is $36,000/year (mind you after tax). Real estate is not much cheaper, certainly not 50% cheaper.

Our standard of living here is so ridicolously high that we poke fun of Happy Valley, myself included.

Came across this interesting article: with immigration at zero, rental rates are tumbling and this will impact home prices [Vancouver’s rental prices have fallen significantly]:

https://www.livabl.com/2020/05/immigration-decline-threatens-toronto-property-investors.html

This supports what CMHC has projected. But, of course, Victoria is immune. To the sky…………

For 640k you don’t need to settle for a townhouse on the Westshore. You can get a brand new SFH down Happy Valley. A 1800 sqft home on a 1400 sqft lot, you know where you can high five your neighbor through the window.

Vindication is sweet!

Here’s what I thought of the “wave theory” back in 2016:

https://househuntvictoria.ca/2016/04/02/a-march-of-records/#comment-7201

Leo subscribed to the theory back then, responding to me:

https://househuntvictoria.ca/2016/04/02/a-march-of-records/#comment-7203

For good measure, here’s me in 2017:

https://househuntvictoria.ca/2017/10/25/no-we-arent-underbuilding-in-victoria-and-other-census-bits/#comment-33553

Poloz rejects ‘dire’ forecasts, says economy will rebound quickly

https://www.theglobeandmail.com/business/article-canadian-economy-on-track-for-healthy-post-pandemic-recovery-poloz/

“Where we are today suggests we’re still tracking to our best-case scenario … not the ‘dire’ scenario.”

Interesting way to think about it. What percentile can afford a house in the core now based on purely income?

Average for all properties is ~$640,000. I guess a teardown in the core?

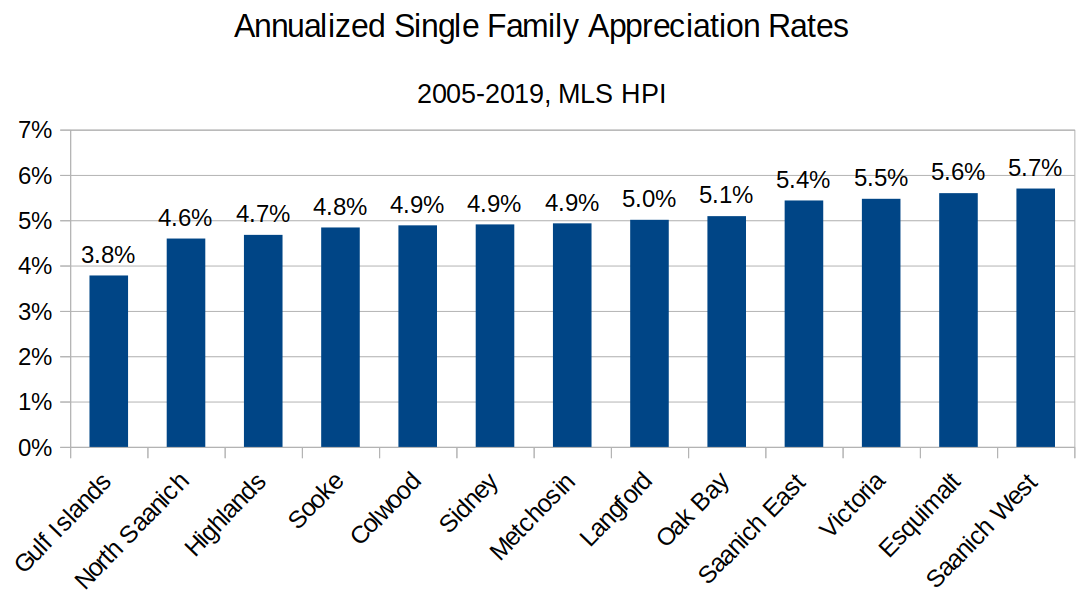

There has been so much talk on the blog for years about what regions should contract first, and how there is a wave of house prices. That is observable between cities (Vancouver jumps up, Victoria jumps up, up island jumps up all on a delay) but I’ve pulled the numbers several times and I can’t see any appreciable difference between municipalities or Core/Westshore. They basically move together., There may be minor differences between regions in long term appreciation

More on that here:

https://househuntvictoria.ca/2019/12/19/which-municipalities-appreciate-the-most/

Yup. Will write a larger post for Monday on why I think the fundamentals are not that far below where we are now. I’m not saying prices won’t come down, just saying I see the floor for detached at closer to -10% than -30%.

I’m all in favour of a Case-Shiller method for Canada, but I’m somewhat puzzled by Thinkpol’s version, which has diverged substantially from the Teranet since late 2019. Market has been strengthening and prices rising, but Thinkpol’s case shiller kept dropping. Prices dropping in Vancouver most likely but something is a bit funky here.

Dentists are back, and they are hungry!

Early in the lockdown, my dentist’s office rescheduled my next appointment for August. I got a call from them on Thursday wanting to book me for Monday.

Monday it is!

Only several weeks after they were apparent 🙂

“Sheets said the lack of tourists is just one more challenge faced by short-term rental owners, who are already hit with the speculation tax, commercial taxes similar to hotels and a $1,500 City of Victoria business licence fee.”

A distributed hotel is still a hotel.

“She knows of one property owner with a suite who uses profits earned during the high season to offer below-market rent to students from September to April.”

Well halleluja. Who knew short term rentals are actually a charity that reduces rent for students.

Swiss Chalet was in rent arrears and owed other money.

Also, “the smart money” isn’t a real thing.

https://www.timescolonist.com/news/local/on-the-street-swiss-chalet-outlet-closed-a-mask-wearing-requirement-1.24139972

The rental market changes are now apparent https://www.timescolonist.com/news/local/residential-rentals-facing-pandemic-pressures-amid-absence-of-tourists-and-students-1.24140008

I see that Swiss Chalet has closed and it looks permanent. I drove through downtown last evening and it looks tragically forlorn. I suspect that some of the smart money is trying to figure out how to get out of Victoria.

I’t’s a consumption tax on the use of RE, not a wealth tax. Two people each owning a $1 million house could have wildly different net worth. It could even be negative.

I’m all in favour of higher property taxes, as our current low taxes encourage both locals and offshore buyers to park money in non-productive RE. I don’t think a wealth tax is workable, in particular because it’s very likely principal residences would have to be exempted to make it salable politically. And you can see what the outcome of that would be.

That’s a tautology really. The only objective measure of how desirable something is, is how much it costs.

But I would substitute “has always been” for “will always be”. The future is not known with certainty.

A long time lurker on the site here. I know in the past there has been much discussion about the high cost of housing and modular and pre-fab options. Well my husband is launching a new Island-based business to try to fill a portion of this demand. Not an ideal time to be launching a new venture, but thought I’d share his website here: http://www.westcoastcontainerhomes.ca

City of Victoria has approved the development permit to install the first one in Fernwood this summer.

What is property tax if not essentially a wealth tax already? As well, what gets included in an annualized wealth tax? One could argue that funded pensions, defined benefit or defined contribution, rrsps, TFSAs, stocks, bonds, savings accounts and etc…The demand for wealth taxes may fall a bit once implementation comes. The fundamental thing about taxes is that people that they should pay none on what they have, but the other guy should pay on what he has (taxes bring out the best in hypocrisy). So, is there a difference between a self-employed plumber or an electrician who has property worth over a million and a teacher or government worker that has a pension worth over a million? Should one type of wealth be exempt from a yearly wealth tax and another not? Don’t forget the progressive debates about gender based taxation to support equality or taxation to mitigate the impacts on historically disadvantaged groups. When taxes are weaponized as political tools instead of a means to simply generate revenue in a balanced way, the taxes tend to become cumbersome, inefficient and a lot times detrimental or harmful to the original altruistic goal of it’s implementation.

The problem with this that it would discourage moving. If I got a good job offer in another city, but now I have to pay CG, I could no longer get the same priced house. Also would discourage people downsizing.

So they would probably have to exempt the amount that got reinvested in a new principal residence (maybe within a year). Either way it would probably not raise as much revenue as expected, since it would discourage sales.

A much more effecient tax is (raising) property taxes. It is less lumpy and also encourages effecient use of property. The higher property taxes are the less sense it would make for speculators to sit on idle property.

Leo, GC. So what I have heard is that public sector infrastructure jobs are much more attractive than private ones due to the uncertainty of the economy. U can pretty much count on the public sector to pay their invoices but you might get the answering machine at some private developers when things get tough, ala 2008/9

Maybe the government should change the rules around PRECs and Holdcos and actually get rich people to pay their fair chunk of taxes.

Wonder what inventory would be then 🙂 but I do think that would be the best way to raise some $. Maybe full taxation if re-sale within 5 years, sliding scale between 5 and 15 years, and no CGs after 15 years of ownership. Maybe raise GST back to 7% too.

I was annoyed when the government started jacking income taxes and I had to setup a PREC and a Holdco, etc. But it’s worked out really well personally. Never thought 6-7 years ago I would be taking off 3 months per year. If they bring a wealth tax or jack up income taxes any further I’ll be in Croatia 5.9 months of the year and 6.1 months here. At some point zero very little incentive to work. Someone called me today to do a mere posting in Sooke and I was like thanks for the call but not interested too far of a drive.

But who cares about me, I am more worried about medical specialists and other critical professionals not having enough incentive to work crazy hours.

Easy to implement but a tough sell politically given how widespread home ownership is in Canada. Just raising property taxes would also be a wealth tax of sorts too. Also politically challenging.

“Broad support” for a “wealth tax” from the “non-wealthy” is no surprise. Because as George Bernard Shaw said, “ A government which robs Peter to pay Paul can always count on Paul’s support“

It would be more revealing to hear from people asked an additional question…. “and what would you be willing to pay for the recovery?”

Easiest wealth tax would be a capital gains tax on primary residences.

Thanks GC. What I heard is that so far costs are up due to those factors but once those enhanced protocols aren’t needed any more (maybe next year) they predict costs to drop due to Canada/world being in a recession, driving material costs down and keeping labour costs steady.

Thoughts?

GST will be going up, it should have never been cut in the first place.

Broad support for a wealth tax to pay for the recovery.

Not sure if it’s workable, but we are going to see all sorts of ideas on the table that previously weren’t.

https://abacusdata.ca/what-kind-of-recovery-broadbent-institute/

Rush4life – it is without question that for MOST people affording prices in the 3 premium markets in this nation, Victoria being the 3rd priciest, access to debt/credit, has replaced the gap in income. That was the new fundamental at play that got the premium markets to where they are at today. It is that simple. I don’t feel there will be any 10-20% adjustment however but I would expect over the medium to longer term a flattish scenario until incomes can better afford the financing required to carry the middle price bands in all housing categories. That’s the fundamental I feel is sustainable.

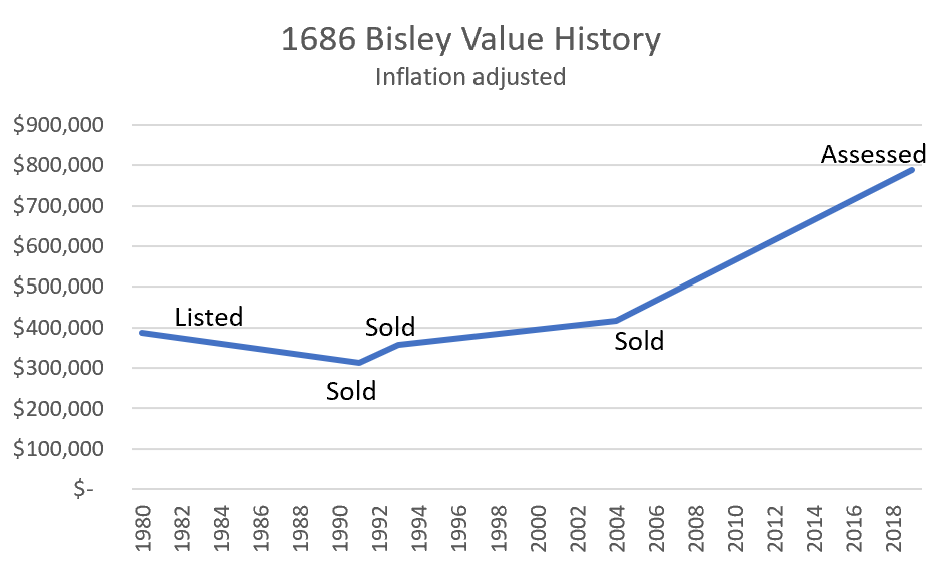

True, but that fairly ordinary house got to $800K by 2018. When will similarly ordinary houses in Regina, Winnipeg, or Halifax reach $800K? Maybe in 2040? And what will the prices of ordinary homes in Victoria be at that point?

Lots of things that aren’t really investments are called investments, I’ve noticed. Like roofing companies calling a new roof an investment.

I like GICs as I don’t invest in the stock market.

Bluesman that’s too simplistic. Unquestionably, there are cities that are more desirable than others. Victoria is is one of the most desired in Canada and therefore there will always be a premium to live here. It’s a popular retiree destination and people of all walks of life are willing to pay more to be here. Yes, you can point to every run up and blame it for something (most recently foreign buyers in Van pushing up prices throughout BC) but the fact is most of Victorias run ups have given far less back. While I am bearish on the housing market I don’t believe that prices will just go back to ‘fundamentals’ as Victoria prices haven’t been connected to the job market for quite some time (if that’s what fundamentals you are referring to). I’m hoping for a 10% -20% haircut and then I’m buying and not looking back. And if that never happens then my wife and I find a better place to rent and either move out of this town or move on and just be happy renting – plenty of benefits renting as well.

there were a lot of air bnb in victoria that supported the floor .. but now the floor is sinking

I think we’re at 1 active case.

I think you’re forgetting about the 5 people who have died.

“SFH in the core is no longer average though….average is leaning towards a townhome in the Westshore”

Maybe some comments on what happened with our HPI from Nov/Dec 2015 to about May/June 2018. Go on, everyone give a comment. What prompted such an ascent? Surely not long-standing fundamentals. Fundamentals did not lead the average to a townhome in the Westshore. Why has inventory been so low since then. And what happens when the market returns to fundamentals?

Does a Guaranteed Investment Certificate increase in value? How about the machinery, computers, etc. that businesses buy? What makes them investments?

Well the house I posted below didn’t move in real dollars for 24 years in Victoria so it can happen here too. The only reason price went up in that time was because of very high inflation. Will it happen again? Unlikely for that long of a period because 1980 was a truly extraordinary year for prices in Victoria but I would not count on 7% avg appreciation rates either.

The last two years I haven’t really noticed what I noticed in my first eight years in real estate; Westshore slowing down before core.

Westshore is certainly not my personal cup of tea but now it’s own a solid community with lots of amenities for young families. Leo can speak better to actual stats but from what I see on the ground I didn’t see it contracting any quicker in a downturn than the core.

Personally I was always super super negative on wood-framed condos in Langford and I think wood-framed condos saw the biggest % increase of any market segment from 2017 to 2019….I guess buyers ended up being priced out of everything else so they piled into the last “affordable” market segment. For me I’ll take a studio downtown any day over a larger condo in Langford but that’s me.

My father and I are building homes in Royal Bay and we sold one five weeks ago in the middle COVID19 without any advertising at full price no questions…buyer moved in yesterday. Complete surprise. At this point we just have one house left and are looking for other projects but there are so few vacant lots available I can’t see anyone cutting their prices substantially and not really interested in playing the 800k teardown in Fairfield game and being stuck with a $1.8 million house for sale.

Hot take: the belief that a house is not an investment exists partly because, in so many places, houses don’t increase in value (much) and thus don’t behave like investments.

LocalFool:

I guess that depends on when it’s listed. If the condo was listed this year, the sellers seem to be a little quicker to drop their price. Mind you, these could be realtor’s investment properties. They would certainly know when to get out of a deteriorating market.

A couple of one bedrooms and a two bedroom. They will certainly get more reasonable as the months go by.

There are currently 99 listings for condos under $400K in Victoria.

Patience grasshopper.

304-1155 Yates Street, Victoria, BC, V8V 3N1

$419,900 2020-03-19

$399,900 2020-03-30

$379,000 2020-05-19

Overall Change= -$ 40,900.00

Percent: -9.74

207-1525 Hillside Avenue, Victoria, BC, V8T 2C1

$324,900 2020-02-20

$319,900 2020-02-25

$314,900 2020-03-09

$311,000 2020-03-18

$307,500 2020-03-23

$304,600 2020-04-06

$299,999 2020-04-09

$295,000 2020-05-05

Overall Change= -$ 29,900.00

Percent: -9.20

104 – 1252 PANDORA AVE, Victoria, BC, V8V 3R4

2 bed|2 bath|1094 sqft|condo

$399,900

“That’s even worse then, as far as how out of whack things are. Condos, the entry segment of the market, shouldn’t look like that IMO and for a number of reasons.”

Are downtown condos really the entry segment of the market though? There are definitely newer build condos out in Langford that are $300k and under, and then of course you’ve got old stock wood boxes throughout Victoria, Saanich, Esquimalt…I feel like that’s your entry segment.

Of condos, yes. But the provincial government will put the idle resources to work building non-profit housing. There’s an election next year, right?

Music to my ears.

Was talking to a fellow former Calgarian who, like me, has lived in Victoria for the last 10-15 years. He was telling me that he recently looked at the assessment for his old house in Calgary and its price is basically the same now as it was back then. Damn!

And what are the prospects for Calgary RE going forward, with Jason Kenney’s UCP government doing everything wrong by not diversifying the economy (e.g. it canceled three different tax credits meant to cultivate growth in the tech sector) and betting all the marbles on fossil fuel revenues continuing forever?

I mean, what the hell are they doing over there? Just look at this news story from … [checks notes] … today:

Alberta rescinds decades-old policy that banned open-pit coal mines in Rockies and Foothills

https://www.cbc.ca/news/canada/calgary/alberta-coal-policy-rescinded-mine-development-environmental-concern-1.5578902

In reference to the cost of project pricing (way way back), there has been no material decrease in hard costs as of late. In fact they have increased due to low productivity and the costs associated with these social distancing measures that will have to be priced in any future estimates/contracts. Some government projects were not scoped properly and estimated correctly (Uvic student housing and BC Transit facility) so the preliminary budgets and tender packages were not realistic when they were initially prepared.

Farmer has been putting in a few really low estimates as of late since they are struggling to maintain their workforce and client relationships, while Campbell has shown no interest in government work. With that being said both Campbell and Farmer have lost hundreds of thousands of dollars on projects over the last few years and it seems Campbell just got lucky due to Farmers history of burning bridges with the Jawls and Chard. With that being said neither company looks positioned to have a bright future unless there are significant changes made in either organization. It is going to get interesting in the construction community over the next five years.

I completely forgot about that.

That’s even worse then, as far as how out of whack things are. Condos, the entry segment of the market, shouldn’t look like that IMO and for a number of reasons.

At that rate, a single analyst might be looking to afford one of those “suites” at the newly purchased Comfort Inn that have been making the news recently…

Hey Marko,

Were things also starting to dry up in the Westshore as well? Or just downtown condos…

So happy! Home Depot is no longer limiting the number of customers in the store … so no lineups outside! Same with Pepper’s Foods in Caddy Bay. (Pepper’s had closed in-store shopping entirely a few weeks ago, but pickup-and-delivery-only turned out to be a bit of a fiasco so they reopened the store and returned to a 10-shopper limit.)

Let’s enjoy these no-lineup days while they last, ’cause when the Second Wave hits in the fall, you know they’ll be back.

“That would be a notable drop as a single analyst working in gov is not going to pull more than 65-67 a year. Many of them would barely break 60. Presuming 65k income, 25k down at about 2.4%/25, that’s around 400k max.”

Stress test it at 5.19% and I think you’re closer to 300k max, which puts you in 60s Fairfield wood box territory. If single government analyst types are buying condos downtown, it’s probably with some parental assistance.

Remarkable. A total of only two new CoVid cases diagnosed in Vancouver Island Health Authority over the last 17 days (May 4-21). Population 785,000. And during that period active cases fell from 21 to 6, with only 1 currently in hospital and none in ICU. During that period Canada had 20,000 new cases. bccdc.ca

We’re fortunate to be living here, and let’s hope we keep doing whatever we’re doing!

“But who wants to live in Etobicoke?? ” – Someone in Toronto 25 years ago.

That would be a notable drop as a single analyst working in gov is not going to pull more than 65-67 a year. Many of them would barely break 60. Presuming 65k income, 25k down at about 2.4%/25, that’s around 400k max.

I haven’t looked at condo listings in several weeks, but I’m not sure how much you can get at under 400k (say 350k). I feel like that’s a 50 year old building, or a rat infested hovel on Head Street. Or, something where your bedroom is also your kitchen and maybe even your bathroom too, where the ability to sleep standing up is a plus…no, I’m not biased at all. 😛

Most of my remarks of overpricing and condos are more geared towards Vancouver units, but it’s definitely an issue here too.

Other than the Janion there isn’t much selling at $1,200 a foot.

Even before COVID19 downtown developments moving forward were drying up at peak prices secondary to development/construction costs. I do not think we will see a scenario where construction costs drop so significantly that developers are building again. It is most likely going to be dead which will limit supply going forward.

For condos I also think we have a solid support floor due to the local economy and all the government and institutional jobs. I don’t think the price of condos will drop below what a single government analyst can afford, for example. I had single income nurses buy some very nice condos and that was pre-covid19 potential correction.

SFH in the core is no longer average thought…average is leaning towards a townhome in the Westshore.

I think long term (like in 25 yrs) a SFH home in the core will be either generational wealth (you inherit) or top 1% of income earners.

Difference between US and Quebec right now is down to when our spring break was…

We got pretty damn lucky.

Pre-COVID, the “raging bulls” were simply smiling at Leo’s cautious prediction that, based on his analysis, prices were set to go up over the short term.

Then COVID hit and bulls prudently took (and are taking) generally a more wait-and-see stance.

Those were good times 🙂

The bears sure appreciated your heroics!

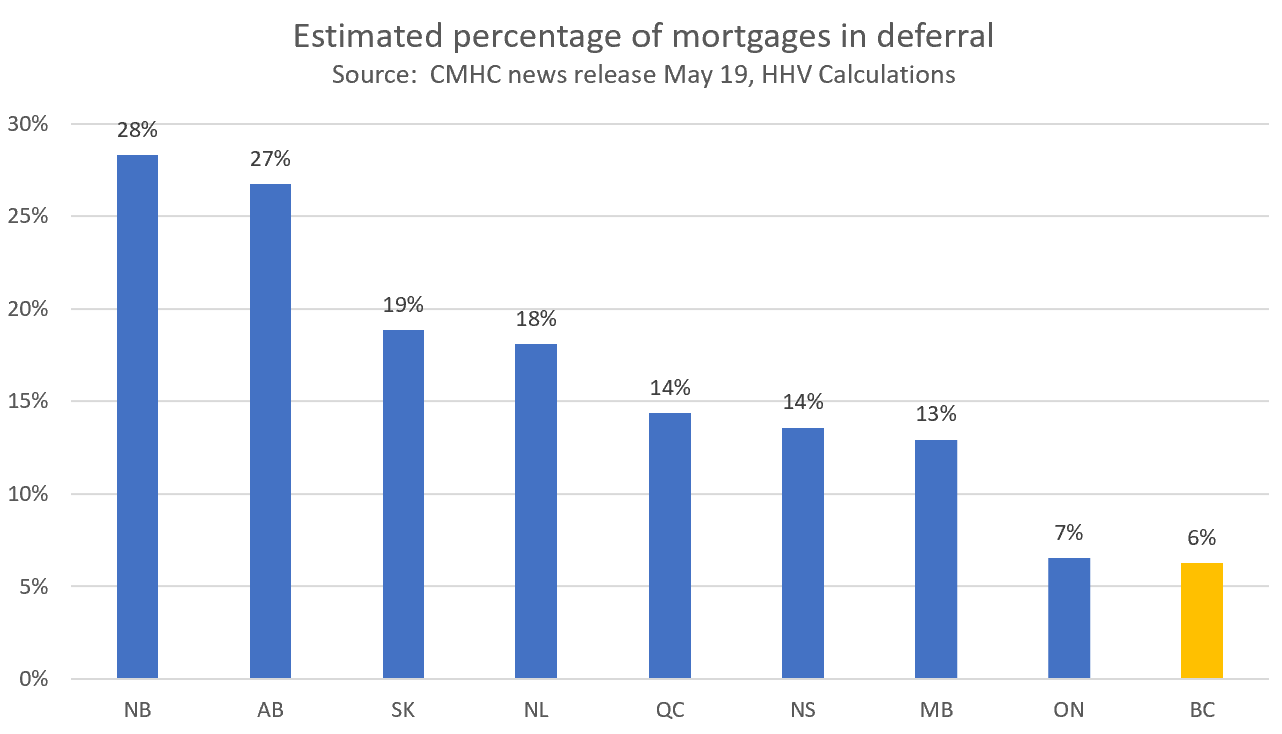

Ok so a return to fundamentals, Leo. New to house hunt Victoria. What exactly are fundamentals here. I still find an avg sfd with asks btw $850K-$900K over priced for what is offered. Many of these are unremarkable in location and condition. With two above average incomes and a reasonable down the mortgage is still relatively large. And as we have seen the high debt loads have put many in a seriously precarious positions over the past two months. I see a few posts recently of those trying to gauge the level of mortgages deferrals locally. Well on my street I have neighbors at their breaking point. I live in Saanich east. Let’s not all fool ourselves. Even before the virus shutdown started debt was rampant and the wealth effect allowed households to ignore it and continue spending. We shall see how this unfolds over the coming few years and if anyone has learned any lessons.

FYI: some restaurants and shops charge extra covid-19 fee.

https://globalnews.ca/news/6963307/bc-coronavirus-covid-19-fees-business/

“Did I ever declare the coast was clear? I said first wave…. Jesus Christ you bears are something else. What were you guys saying before covid when sales and prices were going up? If you want to hold out to wait and buy a decent oak bay SFH for $600k then I wish you all the luck in the world.”

Unscathed = without suffering any injury, damage or harm. I’m saying it’s too early to tell.

I don’t know what the bears were saying before, because I wasn’t bearish before. I’m a bit bearish now, and some modest price declines over the next twelve months won’t surprise me. But I don’t really care because, a.) I bought several years ago, and b.) have no real interest in becoming a move up buyer here. Perhaps for the right price, but if and when we sell, it’ll probably be to move somewhere more rural.

In response to your last remark, I wouldn’t buy a house in Oak Bay at any price because I don’t like Oak Bay. I’d be run out of town on a rail by the bylaw officer.

Historically speaking that is definitely true. If we’re talking the next one or two years I wouldn’t take that bet.

I agree with your outlook Leo, my only caveat is that an outsized gain is more likely to happen to SFH here than an outsized loss.

Just saying that if you feel your position is being mischaracterized it probably won’t get anywhere to mischaracterize the other side’s position in the next sentence.

I’m not that bearish myself. For sure the impact of this virus is negative for the markets, but I don’t forsee a big crash. Combination of starting from a strong base, and relatively stable labour market, plus potential increase in tech jobs long term from US companies will add some stability to Victoria. I think condos will be the weakest link. I also think those people who are counting on endless outsized house price gains to rescue bad RE investments will face a rude awakening. Return to fundamentals, but the fundamentals are pretty OK here by and large.

😀

Put it on youtube!

Or just set up a distributed internet site and give us the beaker url.

lol I don’t consider everything to be an attack, its just frustrating to see people purposely twist what you are trying to say. It’s funny because last year I was defending the bears when Introvert would brag to them about his networth etc..

But also

“You people” – Don Cherry

Easier to have a discussion if you don’t consider everything as an attack.

“I would wait until the benefits and mortgage deferrals start to run out, before declaring that the coast is clear. I feel like investors around the world weren’t a significant factor in our housing market when it was red hot. What makes you think they will be going forward? (Particularly in light of the FB tax, and the spec tax.)”

Did I ever declare the coast was clear? I said first wave…. Jesus Christ you bears are something else. What were you guys saying before covid when sales and prices were going up? If you want to hold out to wait and buy a decent oak bay SFH for $600k then I wish you all the luck in the world.

Vancouver Island does not magically confer immunity to its inhabitants, and I think people with a lot of money understand this. The current situation is mostly just luck. VI is not a country like New Zealand that can cut itself off from the rest of the world.

But only a low ball offer so far?

“We are selling our place at Shawnigan Lake. Price is over $1m. We were prepared for the worst given COVID but have literally been overwhelmed with showings”

Isn’t Shawnigan exempt from foreign buyer and speculation taxes?

“…and given we made out unscathed in the first wave of covid then there is a decent chance for house prices to increase than decrease significantly as real estate investors around the world take notice.”

I would wait until the benefits and mortgage deferrals start to run out, before declaring that the coast is clear. I feel like investors around the world weren’t a significant factor in our housing market when it was red hot. What makes you think they will be going forward? (Particularly in light of the FB tax, and the spec tax.)

Large layoffs for local companies I know of are as follows: Encore FX (obvious reasons, however the business may get purchased so I heard so some employees might get hired back), Viking Air, Schneider Electric, BC Ferries (coming). I believe public sector is only the library plus part time auxiliary workers getting let go.

minimum wage will be $14.60 starting June 1. lol wow, I wonder what bank tellers are getting paid now, I am sure they would want a premium to a cashier at mcdonalds.

You think the factors that bring about house price declines will affect Victoria but not elsewhere in Canada? The argument that I usually hear on this forum is that Victoria will be largely insulated from them. Can’t have it both ways.

You might also note that Victoria has always been cheaper than Vancouver, which is not only a major city but very close, but that hasn’t guaranteed an ongoing surge in demand.

I’m not a regular commenter, but have read the blog (and comments) for a couple years. I’m bullish. I predict stable prices for this summer/fall, then another run up in Spring 2021. I just don’t see this downturn affecting anyone who’s in a position to buy a house in Victoria. The other two factors which are laregly overlooked by locals are: 1) the location factor- as soon as our prices dip below any major city in canada, we’ll get a surge of demand from the folks who always wanted to retire here, but couldn’t afford it. and 2) geography- sure they can put up condos anywhere, but there will only ever be so many houses in the CRD. We are not at that limit yet, but we’re approaching it quickly.