COVID unemployment and real estate

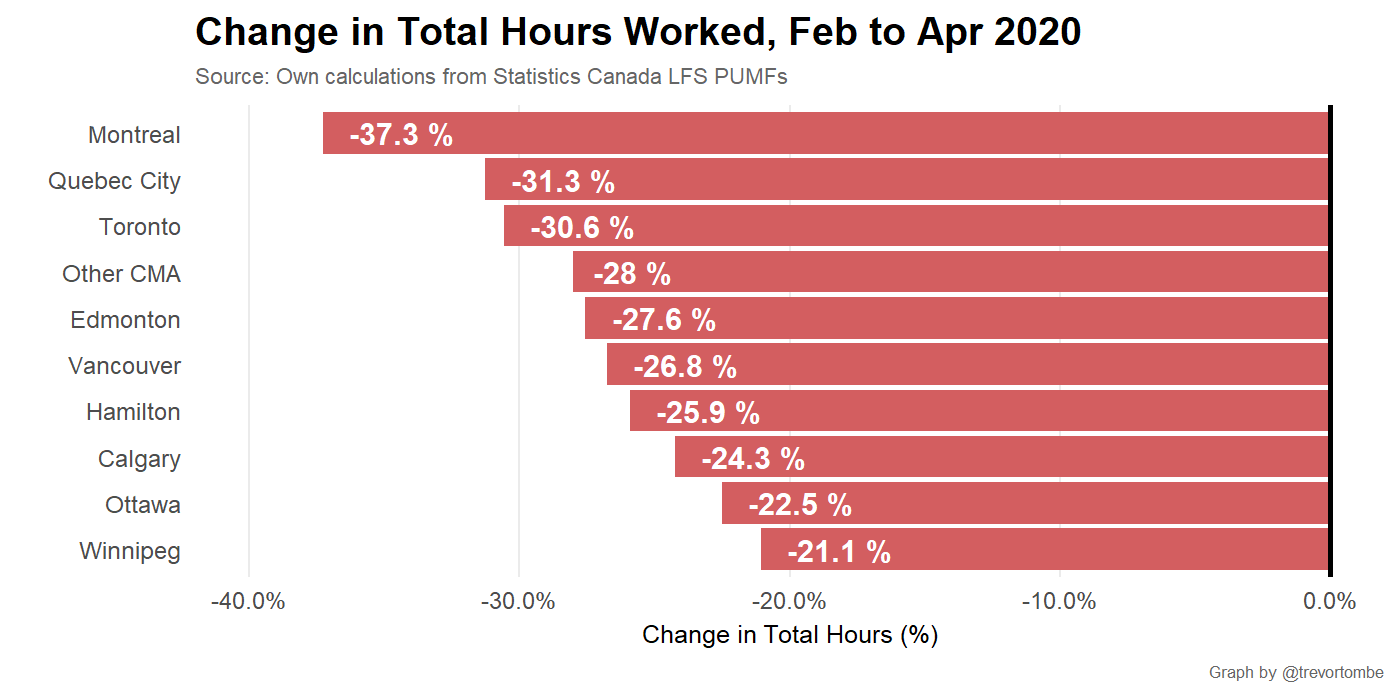

The April jobs data was released on Friday, and I wrote a short piece in the Capital about the release as it pertains to Victoria. The official unemployment rate for April in Victoria was 7.2%, but you can completely ignore that number since it doesn’t reflect reality. First of all that’s a 3 month averaged figure (February, March, April), and secondly it doesn’t count the vast number of people that were not technically unemployed but had their hours cut drastically or entirely in April. Taking that into account, the effective unemployment rate for the country was north of 30% as shown by economist Trevor Tombe in a startling graph. Because Victoria isn’t big enough to get detailed data, it’s impossible to calculate the exact rate for this town, but hours worked dropped 26.8% in Vancouver so we’re very likely in the same ballpark with an effective April unemployment rate of 20% or more.

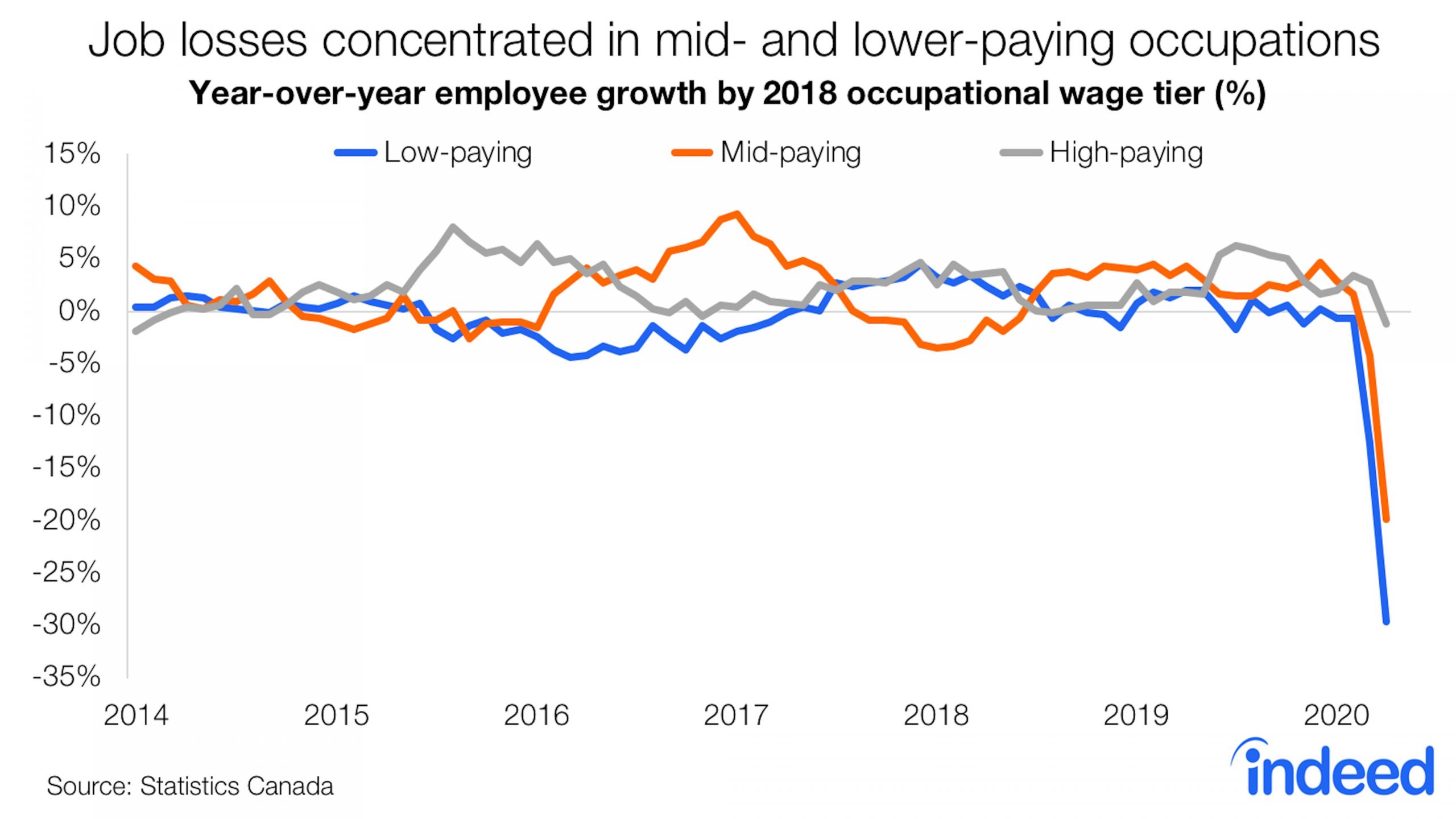

However, unlike the Great Financial Crisis which caused unemployment across all ages and income levels, this has been a very lopsided shock, with young and low-income being hit by far the worst. In fact, a chart from Indeed economist Brendon Bernard put this into stark perspective, showing that nearly 100% of the job losses came from the lower two thirds of the pay scale.

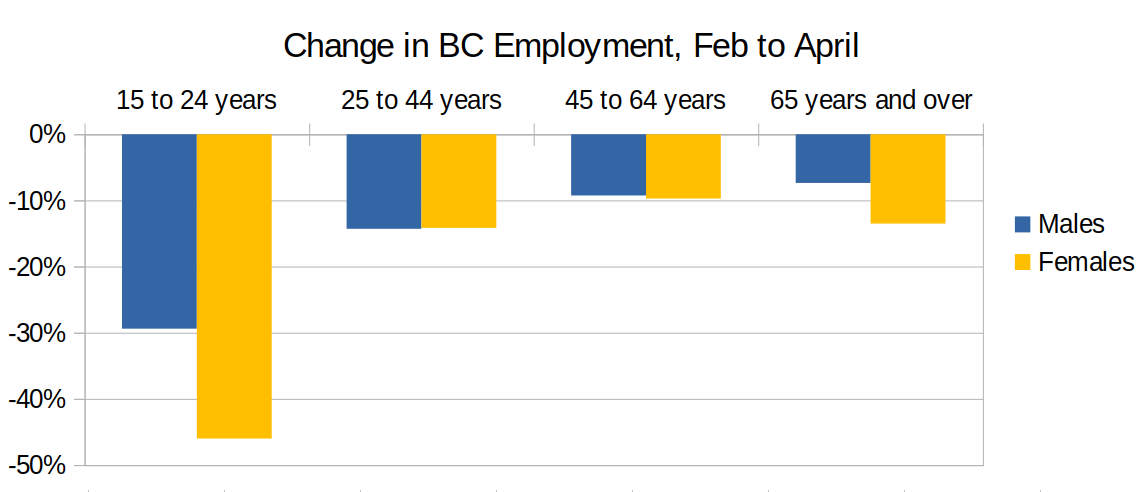

The age profile tells the same story, with the vast majority of job losses in BC coming in the younger age groups.

When thinking about the impact on real estate, there are two primary ways that an increase in the unemployment rate can affect the market:

- Decreasing demand if current renters put off a purchase due to loss of income and

- Increasing supply if current owners are forced to sell due to the same.

To be more precise, the impact on real estate is really about what happens to the people right around the owner/renter divide. That is, if renters who were previously ready to buy (likely the highest income renters) lose their job, that would take away demand. If marginal owners (those without a buffer) lose their employment, then they may be forced to sell. Conversely a renter with no path to ownership or an owner with substantial wealth or no mortgage losing their income would not affect the market.

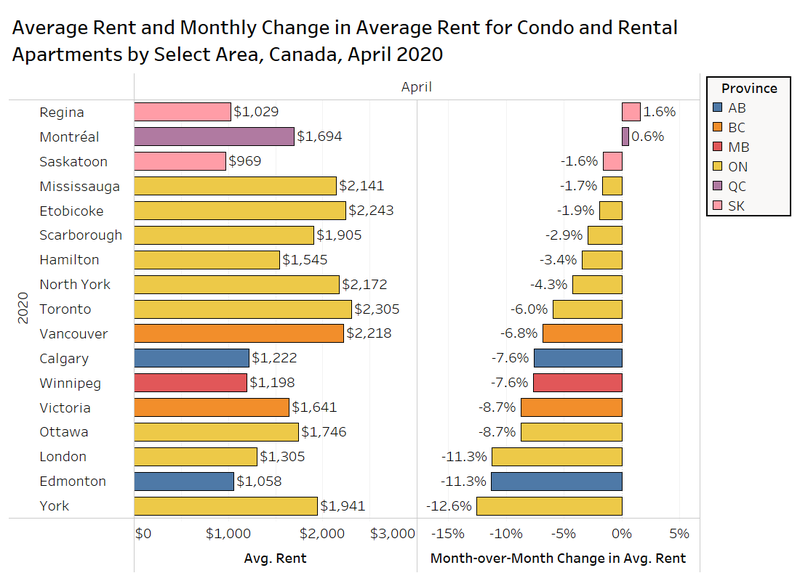

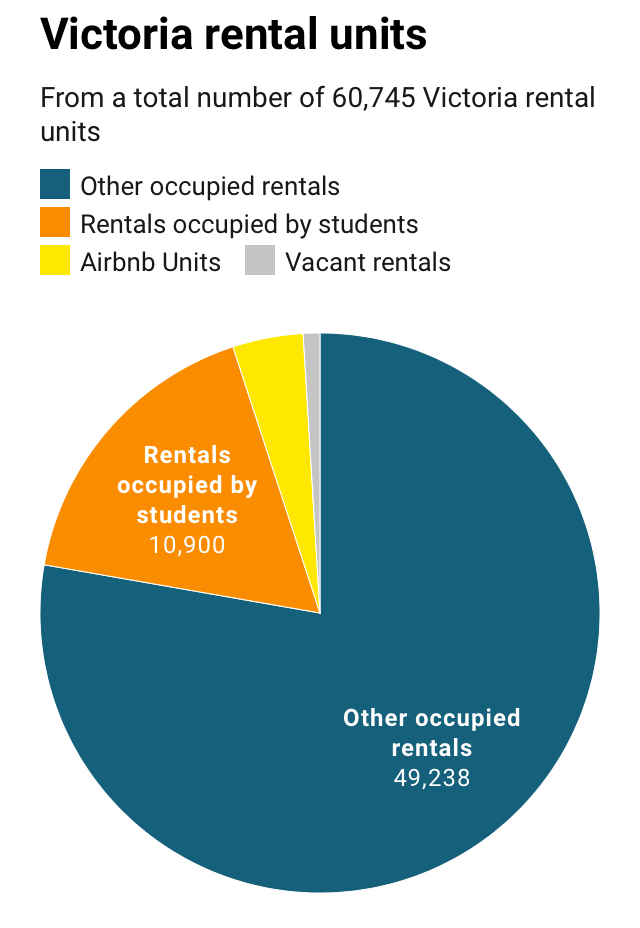

Of course there is also the secondary impact from a weakening rental market, and that is on investors. There are 21,030 multiple property owners in Victoria, and if a rental is non-performing (either due to vacancy or because it’s negative cash flow and not appreciating) it may motivate some of those owners to liquidate. I’ve seen a few former AirBnB units listed, but so far no compelling evidence of this in the market.

Right now we can confidently say that all things being equal, the current jump in unemployment is less negative for the real estate market than a similar jump where job losses are more broad based. Job losses are concentrated heavily amongst those that previously had no near term ability to buy. Also, as staggering as the effective unemployment numbers are, we should expect them to bounce back much of the way quite quickly. StatsCan says that two thirds of the unemployed have a direct connection to a specific job, and should be able to return to that job once businesses open up again. Although I’m enjoying reading a thesis on the Great Depression in Victoria and the high effective employment rate makes the comparison tempting, this won’t play out anything like that dark period in Victoria’s history.

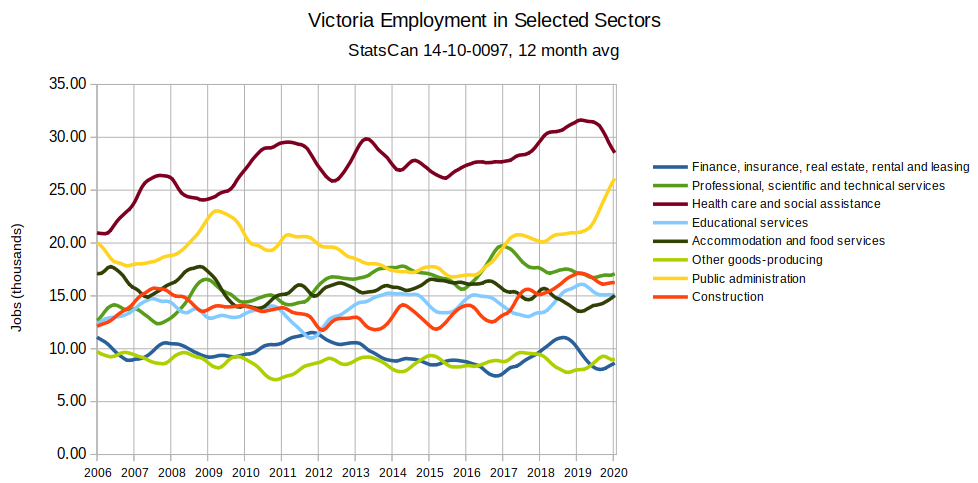

That said, it will certainly take years before we are enjoying the ultra-low unemployment rate we had two months ago. We may be in for a very strange situation where unemployment in the high income / professional space continues to be low, while unemployment in other sectors is very high. I’m hoping the government continues to direct their support to those groups and the small business space during the recovery. Even the public sector will not be able to escape large budget deficits though, and employment will likely decline in the coming years. People think that the public sector is rock solid, but employment there dropped by some 6000 people after the financial crisis, more than in any other sector. I don’t expect mass layoffs, but quite possibly a very long hiring freeze and substantial declines through attrition.

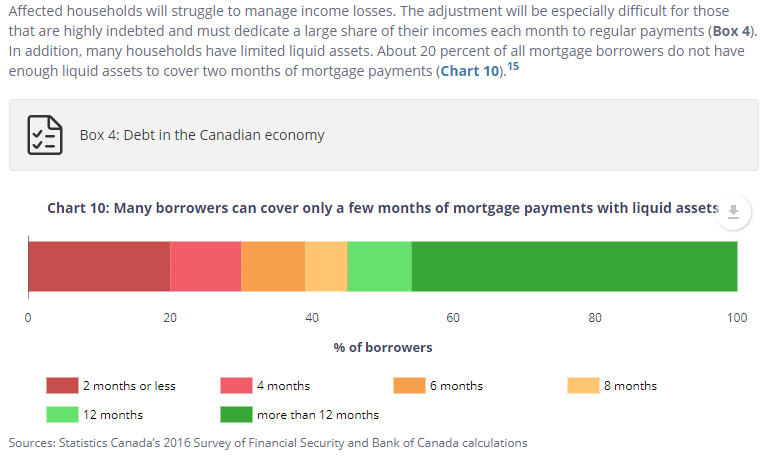

About 10% of the mortgages that Canadian banks have on the books are in deferral. We don’t know how many of those are in Victoria, and we don’t know how many of those people deferring will be just fine when the deferral expires. Quite likelythe majority will be fine and return to paying their mortgage in the fall. However it remains to be seen whether there will be some increased listing activity in the fall when supports expire and real life returns.

And that’s really the theme of this shock to the system: uncertainty. If there’s one thing I’ve learned in 10 years of analyzing the market, it’s that the market will always surprise you. Predicting much about the future of the market, especially pricing, is dicey at the best of times and COVID has piled on the uncertainty. Thinking about various price scenarios for the future of the market, I can’t discount any of them and could imagine a set of circumstances that would support nearly all of them. “Official” projections are similarly uncertain, with TD projecting prices to keep climbing, while others are factoring in a substantial decline. As I’ve said before, the figures for market activity and economic indicators during the crisis are less important than the ones in the fall and beyond for the long term health of the market. Until then you can only evaluate your own risk profile and watch the listings to see if any of them make sense for you.

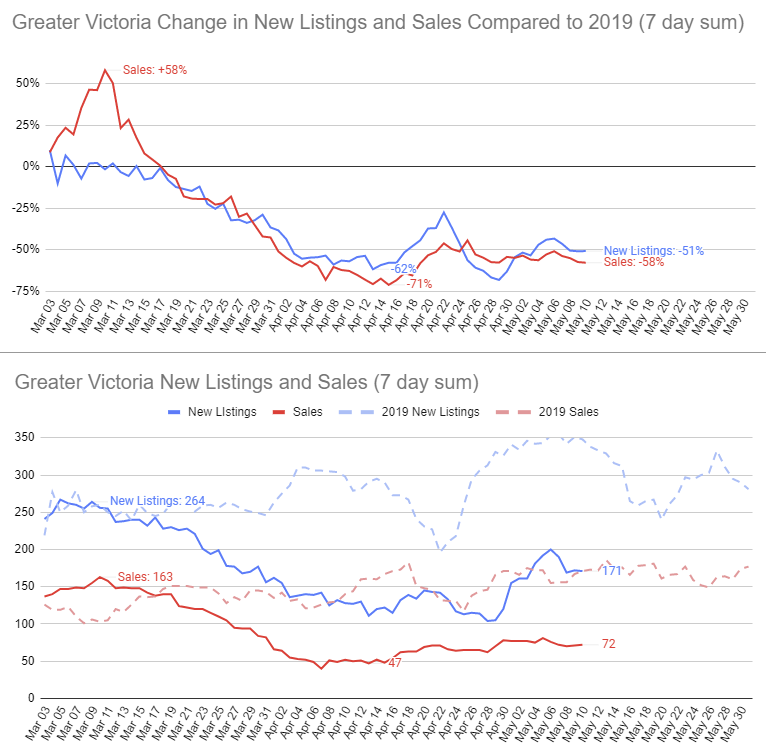

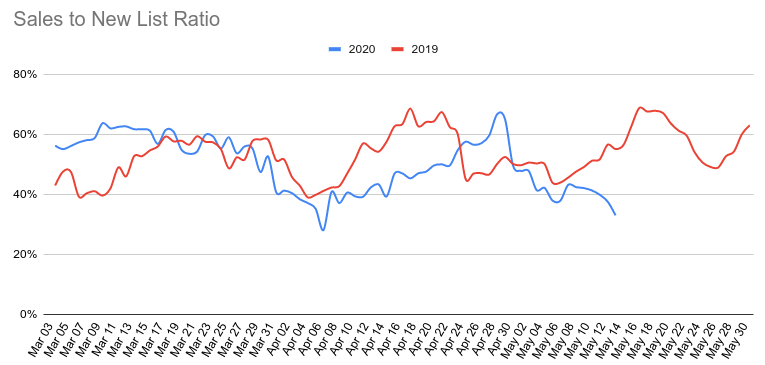

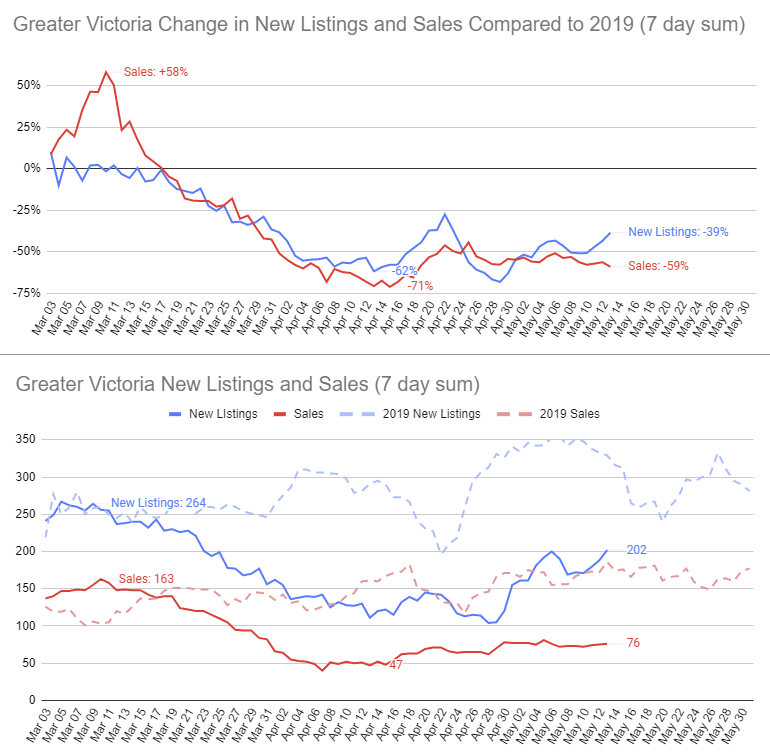

Market activity continues to improve, albeit slowly. We still haven’t been able to crack more than 50% of the activity from last May within Greater Victoria. However I expect strengthening in the coming weeks especially with BC’s restart plan announced.

Also weekly numbers courtesy of the VREB for continuity purposes. Note that sales that the VREB reports are for the entire board trading area, and include commercial property, which is why the percent change from last year is different than in the chart above. Inventory is down some 20% from last year.

| May 2020 |

May

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 28 | 124 | 848 | ||

| New Listings | 89 | 287 | 1613 | ||

| Active Listings | 2289 | 2319 | 3019 | ||

| Sales to New Listings | 31% | 43% | 53% | ||

| Sales YoY Change | -31% | -46% | |||

| Months of Inventory | 3.6 | ||||

New post: https://househuntvictoria.ca/2020/05/19/how-to-measure-short-term-price-movement/

Ks112 do you buy chance own a decent prime downtown rental condo?

@FormerLandlord : “Don’t attribute that quote to me. I didn’t write anything about protesters.”

Indeed. Apologies, @FormerLandlord. That nugget was from @ QT. Note to self to not post on my cellphone.

Since the downtown condo rental bears got a hard on for Used Vic instead of Craigslist (mind you many places are on both) I thought this one here is a slight price drop until I realized it is a 2 bed and 1 bath unit and not one of the 2 bed and 2 bath units:

https://www.usedvictoria.com/classified-ad/The-Aria—Beautiful-2-Bedroom-Condo—Steps-to-the-Inner-Harbour_35803673

🙂

Someone smrt on the internet told me that decent prime downtown condos on the seventh floor with windows facing east and south are totally the place to invest

If you ever start feeling anxious about B.C.’s finances, just remember Newfoundland. Its debt-to-GDP is approaching 75% and insolvency is a realistic possibility.

Apologies if you hit the paywall:

https://www.theglobeandmail.com/canada/article-economic-storm-brews-over-newfoundland-and-labrador/

Gee, my tenant might begin paying market rent if prices drop 20%!

“Prove to me that a sliver of the market in a small city in a small country has changed prices.”

Go prove that it hasn’t.

Anyways hope you downtown prime condo rental bears do better in your predictions than the housing bears on here 😉

“Opposing your claim so far. 1. the twqeet Leo posted. 2. The rental.ca link cited earlier 3. The actual experience of a renter posted earlier. 4. Marko’s view that places have come down in price slightly. 5. An owner who posted here saying she reduced her rent.”

Lol so basically you can’t find any actual proof right? Ya that’s what I thought. Btw, leo agreed rents wont come down right away. The other landlord that reduced rent doesn’t own a decent downtown condo which is what I am talking about, same with the other renter “quadra and bay” does that sound like a decent prime downtown condo to u?

Sure, but the question is how temporary. As someone pointed out, losing a month’s rent is a different matter than losing a year’s.

The rent control issue is a valid one but it’s little more than guesswork with respect to future market rent, allowed increases, and length of tenant stay.

I think it’s likely the BC government is going to bring in an aggressive non-profit rental housing program by next spring. The long term effects? Again, who knows.

A rational analysis would be to not lower rent right away, if the landlord believes that economic factors are temporary. Because a lowered rent can never be raised back up to market because of rent controls. (in real terms, for that tenant).

Don’t attribute that quote to me. I didn’t write anything about protesters.

A Fairfield VRBO hits the market.

https://www.realtor.ca/real-estate/21847947/3-9-moss-st-victoria-fairfield-west

Hardly firesale price though.

Bwahaha. Ks112 you are the one with the oddball claim that the biggest economic shock to hit Canada in three generations has had no discernible impact on rental rates in downtown Victoria whatsoever over the last month and a half.

To support your claim? You glanced at Craigslist.

Opposing your claim so far. 1. the tweet Leo posted. 2. The rental.ca link cited earlier 3. The actual experience of a renter posted earlier. 4. Marko’s view that places have come down in price slightly. 5. An owner who posted here saying she reduced her rent.

So I was legit rental hunting during the first bit of Covid, we found our place mid March and moved April 1. I looked mainly at usedvic and the Victoria rentals Facebook group. I still get a lot of notifications from the Facebook group and am seeing ads relisted for usually $100 – $150 less and people loosening up on pet restrictions. While I was hunting, we emailed around 15 places and viewed 6. We got 5 follow-up emails from landlords offering us reduced rent if we’d take their place. For example, a renovated 3 bedroom suite near Quadra and Bay, advertised for $2300, offered to us for $2100 and then $2000. The place we ended up getting was never even advertised I saw a comment mentioning the place and just followed up directly with the landlord. My point is a lot of this is not visible when you’re just casually viewing rental ads. But in my opinion, ya rents are down 5-10% and dropping more every month.

Came up with a reasonable way to estimate more correct unemployment rate in Victoria given the issue with the 3 month averaging and that many unemployed people weren’t counted as such due to inability to look for work. By looking at the change in unemployment by industry in BC, we can get the impact by sector. Then applying those percentage changes to the employment levels by industry in Victoria, we can estimate employment for April in Victoria relative to our labour market. That gives a total employed of 167,000 in April, or 18% unemployment, before taking into account any lost hours or anyone that wasn’t unemployed but not working.

We should see a drop from that 18% in May. Local GC said construction was some 45% slower in April due to absences / SD requirements, but that has eased to about 20-25% now.

Lol ok caveat, show me one example of a decent place downtown that’s reduced their rent currently then.

A bunch of rental listings on craigslist doesn’t prove much as to whether rents have fallen or not. Even in good times a perusal of craigslist is going to show you more overpriced rentals than not. This is simply because the average overpriced rental is going to be listed longer than a market priced rental. Either till the landlord reduces price or finds a tenant willing to pay.

Same reasoning applies to real estate listings. At any given point in time most listings are either overpriced or crap (or both). Well priced homes sell quickly so don’t languish on MLS.

@DuranDuran

So who would put their family in an Air BnB that you do not know has been properly cleaned or who last used the bed and did they cary Covid-19? Just a bit scary for some.

https://www.usatoday.com/story/travel/hotels/2020/03/18/coronavirus-road-see-how-sanitize-your-hotel-room/5041000002/

@FormerLandlord

“You have to thanks our regulatory bodies and protesters for lack of business and factories in Canada.”

I do thank protesters – they’re the ones desperately trying to ensure our planet isn’t further destroyed, that humans have rights, FN authority is respected on their land, etc.

I generally don’t thank regulators. They have largely been captured – stacked with industry insiders administrating for the interests of other countries & corporations, both domestic & foreign – not Canadians, not the environment.

For evidence, one only has to look to the oceans filled with plastics, the polluted air, heavy metals & various other toxins poisoning our air water and soil, habitat loss, species extinction, unconscionable cruelty to farmed animals & wildlife, etc. Done with impunity, and without serious consequences.

But at least we aren’t quite as bad as the countries typically favoured by the corporate offshore tax dodgers these free trade riders favour.

But I should thank you for making my point that “free” trade has been disastrous for the 99% & the planet, as it encourages corporations to head to the countries with the worst human rights and environmental protections. It’s more palatable to exploit & poison brown people, it seems.

I did not say that all or even most landlords will do the rational thing, i.e. ask for a realistic rent at the outset. But as time goes on almost all will be forced to do so.

Nor did I claim the “because” relationship. I said that the market price will go down whether or not individual landlords hold out. The reason is that some will rent right away. That may be because they’re performed a rational analysis or simply because they need the money right now.

You guys are missing the point. Air BnB rentals can make 2-3x what you get from long term rentals. Your $1500 a month condo goes for $120 a night on ABnB. It’s not always occupied, but in the good days it did very well. So the advantage of holding out is the possibility (distant at this point, for sure) of the short term rental market returning. Some experts are making a point of saying that domestic tourism will have to take the place of bigger vacations this year. So landlords are hoping that Vancouverites, Calgarians, etc may yet sign up for Victoria vacations this summer. It’s a simple risk-reward quantified rationality.

I remember a conversation with a property broker in Vancouver a number of years ago that made a lot of sense to me. For every month a property sits vacant, the landlord might as well have lowered the rent 8% because that’s what they lost by having the unit vacant for one month over the next 12 months on a one year lease. Now keeping vacancy at zero probably doesn’t always make sense if you tend to get longer term tenants but how many people live in the same rental unit for more than 2 years? My average tenancy has been 2 ears across 5 different units in my life, then I bought and settled down. The flip side to this is that as I have been told by a local RE investor, the mortgage are often collateralized by the net income/ cap rate., which I think is more the case of why things are sticky. They do want to lower the price but can’t because the mortgage contract will negatively affect them more than the lost rent.

Deb, this isn’t directed at you but for the 100th time, I am not disagreeing that rents will eventually fall if this persists. I am saying that it takes time (probably 2-3 months atleast) as prices are downward sticky (which is why you see the same ads sitting there).. Patriotz thinks this will be reflected right away because he assumes all or most landlords will do the rational thing etc…

@ks112

I never advertised my rentals on Craigslist, I always found UsedVictoria to be a better and less cumbersome site. As for rentals not going down in price the fact that there are so many examples available that have been advertised for over a month and are still vacant just proves that they are not renting and that the price will either fall to find a renter, be taken off the market to wait for better times or sold.

If you want to see what is being reduced just do a search:

https://vancouver.craigslist.org/search/van/apa?query=Reduced&availabilityMode=0&sale_date=all+dates

https://victoria.craigslist.org/search/apa?query=Reduced&availabilityMode=0&sale_date=all+dates

🙂

I mean this in the most polite fashion possible.

I don’t give a fuck.

Maybe you should retake econ 101. I am pretty sure the curriculum doesn’t feature any modules on the evil “protestors” that seem to loom large in your mind.

Hey Patroitz, I just had a look on craigslist lol if anything I think some rentals are going up in price. Check this one out for $1875:

https://victoria.craigslist.org/apa/d/victoria-south-1st-month-free-fully/7126193606.html

Landlords at the jukebox also doesn’t seem to be phased by staying empty and they probably been empty since the building completed months ago:

https://victoria.craigslist.org/apa/d/victoria-south-modern-condo-downtown/7124613586.html

https://victoria.craigslist.org/apa/d/victoria-beautiful-3rd-floor-condo-in/7124603529.html

https://victoria.craigslist.org/apa/d/victoria-new-condo-in-downtown-victoria/7114487961.html

https://victoria.craigslist.org/apa/d/victoria-modern-1-bedroom-downtown-condo/7124949196.html

Wave landords also not giving in:

https://victoria.craigslist.org/apa/d/victoria-beautiful-modern-downtown/7120735915.html

https://victoria.craigslist.org/apa/d/victoria-large-downtown-victoria-condo/7124100735.html

or Juliet

https://victoria.craigslist.org/apa/d/victoria-spectacular-downtown-views-2b/7105004326.html

Only one i see of reasonable value is this at the Astoria:

https://victoria.craigslist.org/apa/d/victoria-one-bedroom-condo-downtown/7112235628.html

Or this one at the Falls, but its an obvious ex-airbnb short-term so won’t help if you actually live in Victoria:

https://victoria.craigslist.org/apa/d/victoria-available-1-3-months-luxe-2/7105508639.html

You could argue these ones in the Manahttan are ok, but it’s an older building:

https://victoria.craigslist.org/apa/d/victoria-south-one-bedroom-condo-in-the/7119293760.html

https://victoria.craigslist.org/apa/d/victoria-spacious-1bedroom-downtown/7121434436.html

With that said, I suppose the 2 bedroom places face more pressure as I think alot of them are rented to students and hospitality industry employees whom are roommates and that market has dried up substantially. But if you are a professional looking for a decent one bedroom downtown, there just aren’t many deals to be had if any. You could argue that I am posting anecdotal evidence, but the downtown Victoria condo market isn’t that big and I bet most of the rentals end up here on craigslist.

Alumni = a group of male graduates, or a group of male and female graduates

Alumnus = a male graduate

Alumna = a female graduate

“Nope. Any individual landlord can ask above market and let their property sit empty – until they run out of money. But they don’t control the market. If they want a tenant they are going to have to meet the market. The market isn’t going to come to them.”

Which is exactly why price discovery takes time and doesn’t happen instantly, not sure why that is such a difficult concept……

Nice to see the encouraging results from the Moderna phase 1 CoVid mRNA vaccine study. All tested participants developed antibodies comparable or exceeding levels seen in recovered CoVid patients. The study was done in Seattle. This is one of the “warp speed” vaccines that they are manufacturing now, and hope to have ready for some groups by the end of 2020. https://www.cnbc.com/2020/05/18/moderna-reports-positive-data-on-early-stage-coronavirus-vaccine-trial.html This was a small study (45 people), now being expanded. If more good news comes from further studies, I’d expect them to speed it up further by doing a human challenge https://1daysooner.org/

Nope. Any individual landlord can ask above market and let their property sit empty – until they run out of money. But they don’t control the market. If they want a tenant they are going to have to meet the market. The market isn’t going to come to them.

Looks like she lived here for a while… she was a Royal Roads alumni.

Canadians are quick at patting ourselves on the back for a job well done and tend to miss the forest for the trees. If you take a look at the PDF in the link that I provided, it make it easy to misconstrued the picture by focusing only on the overall ranking as indicated in your links because it glossed over the details.

Canada overall doing business ranking is very high at 23/190, with ease of starting a business at an incredible 3rd place out of 190, protecting minor investor at 7/190, getting credit at 15/190, and resolving insolvency at 13/190. However, factors that I described in my previous post are hurdles that stop business from functioning in Canada to down right put it into insolvency before the business get off the ground.

Canada make it easy to borrow money to start a business, business permits are easily obtain, and simple to declare insolvency.

It translate to big investor chance of losing money and declare bankruptcies easier/higher than other economies. Getting building permits is a drawn out process that cost money, get electricity to the building also is another drawn out process, then the investors are hit with protesters that abuse the poor judicial processes by drawn out the permits/claims, and then the authority make it easy for the investors to declare bankrupt and walk away. And, if investors make it past the permits and protesters (average of 1297.5 days before/during shovel in the ground), they still have the challenge of import and export goods for their products.

Welcome to econ 101.

I really hope it’s January 2021 but the problem is that’s right in the middle of flu season. I guess May 2021?

Incentives are often seen on rentals before rent reductions because then the landlord isn’t stuck at a lower rent which is then rent controlled. Better to offer first month free, free move, whatever.

How to find a motivated seller.

I don’t disagree. I don;t see the rental market improving until January at the earliest, maybe not until next summer. Also we get a pile of completions in that time frame to add to supply.

I don’t do sales. I only refer other agents if someone wants one.

What lack of business?

“ As of December 2015, there were 1.17 million employer businesses in Canada. Of these, 1.14 million (97.9 percent) businesses were small businesses, 21,415 (1.8 percent) were medium-sized businesses and 2,933 (0.3 percent) were large enterprises.”

And maybe we aren’t such a terrible place to do business:

This survey ranks us third – https://www.usnews.com/news/best-countries/open-for-business-rankings

Forbes ranks us sixth – https://www.forbes.com/sites/kurtbadenhausen/2018/12/19/the-best-countries-for-business-2019-u-s-down-u-k-on-top/#5b08644c52d5

Sure we aren’t perfect and some aspects of doing business in Canada could definitely be improved, but let’s not get all negative Nellie.

It time to put money into well deserving programs such as health, essential/skilled education, and perhaps military, and upgrade our flying wings instead of dumping it into useless programs such as drugs user lifestyle, etc… The snowbirds are obsolete 5 decades old flying death contraptions.

You have to thanks our regulatory bodies and protesters for lack of business and factories in Canada. We are rank 51th out of 190 economies for trading across border, construction permits is rank 64/190 (249 days), getting electricity is rank at 124/190, and what make matter worst is the 100/190 ranking for enforcing contracts with poor quality of judicial processes (average 910 days to resolve claim).

Doing business 2020 Canada — https://www.doingbusiness.org/content/dam/doingBusiness/country/c/canada/CAN.pdf

She was from Nova Scotia too… that province right now 🙁

I am saddened to just hear that one of the Snowbirds crashed killing one of the two pilots. This year just gets worse. My heart goes out to the family of the pilot and all of the air crews of the Snowbirds.

My search criteria was just starting tomorrow to the end of the month. I think a number of air bnb owners will only rent for 30 day minimum now so if you broaden the search criteria you would probably get more hits.

My point of posting that link was to show there are people whom are willing to forego all revenue and not drop their price enough to the point where it will be rented. I can’t get that information for rentals on craigslist so I used airbnb as a proxy. I am just trying to convey the point that not every landlord is desperate to drop their price right away and it takes time for it to work through.

RushforLife:

Well, if it’s any help, apparently last year Victoria had well over 1000 listings on Airbnb.

https://www.vicnews.com/news/city-sees-over-800000-in-funds-after-first-six-months-of-airbnb-regulations/

…. and apparently today … hmmm 300 listings …. a bit of a drop off

https://www.airbnb.ca/s/Victoria–Canada/homes?source=structured_search_input_header&place_id=ChIJcWGw3Ytzj1QR7Ui7HnTz6Dg&click_referer=t%3ASEE_ALL%7Csid%3Af0e8ece9-b30b-406c-9103-a516e42e79cf%7Cst%3ALANDING_PAGE_MARQUEE&title_type=NONE&refinement_paths%5B%5D=%2Fhomes&tab_id=home_tab&search_type=pagination&federated_search_session_id=b21ee0dd-f190-4b1d-a6f3-da8593f6bf9d&query=Victoria%2C%20Canada&adults=2§ion_offset=5&items_offset=280

300+ stays · 2 guests

Stays in Victoria

I am not doubting some places are dropping in rent. What I am saying is that this has not largely trickled down to decent condos in downtown yet despite the example Marko gave. Maybe in July it will be more wide spread.

Ks112 – I am not saying every single landlord in Victoria is running to drop their rent – especially Airbnbs who are used to receiving well above market value and can’t afford to take half the income for the next year. Of course some will wait out. I’m saying in general I think that rents are coming down in Victoria (which has been supported by anecdote and evidence if you want to call rental.ca that). Just listing an Airbnb link is not useful to determine anything – if the pool of airbnbs has not shrunk at all in the last couple months then you may be onto something but I’m not sure where you would fine that info and I don’t that’s the case. pS you will note that the majority of those listings are discounted from their normal price.

Which is why I am saying you probably won’t see any decent declines in rent until July and also why not everyone acts rational, especially the landlords whom aren’t in a cash-flow crunch. This contradicts with your position that:

“That makes the rental market very responsive to actual supply and demand.”

“One months lost rent is two years at a $100 cheaper. If you wait 3 months, like you are suggesting, instead of dropping it to $2300 now you have to wait 6 years to make up that cash flow difference – does that make sense? So no, I highly doubt there are a lot of people sitting on empty rentals waiting to see how this plays out.”

I would say because they’re delusional.

Sure, it’s going to take a while for some landlords to get real. But a month or two without rent coming in is a great motivator.

lol I am looking for confirmation bias Rush4life?? Ok since you can’t come up with any examples here is a quick search air bnb available starting tomorrow in Victoria. Why haven’t they dropped their prices to the point where they can rent them out? It’s a little too early to do a comparison for rentals on craigslist but I bet there are going to be some of the same ads on there next month as this month. Prices are downward sticky whether you like to believe it or not.

https://www.airbnb.ca/s/Victoria–BC/homes?tab_id=home_tab&refinement_paths%5B%5D=%2Fhomes&source=structured_search_input_header&search_type=unknown&query=Victoria%2C%20Canada&checkin=2020-05-18&checkout=2020-05-31&ne_lat=48.51797969364049&ne_lng=-123.31394990518174&sw_lat=48.38882745098763&sw_lng=-123.44660981519564&zoom=12&search_by_map=true

The GH house that occasionally has a Ferrari parked on the driveway is for sale:

https://www.realtor.ca/real-estate/21857340/4002-providence-pl-victoria-gordon-head

Can the new owners request that the Ferrari keep coming for visits?

Leo was your agent, I suspect.

Ks112 you obviously have a bias towards believing the market isn’t moving – you arbitrarily have chosen July as when they will, so just look for confirmation bias then. You have a realtor saying there are some prices dropping, there is rental.ca saying prices are dropping, there is plenty of reasons for prices to drop but nope, not til July.

If someone with sense had a place downtown that opened up and they knew they wouldn’t be renting to any foreign students (or any students at all) and they were going to be contending with more and more Air BNBs and the outlook for the next year was shit you think they would wait to rent their placed for 2400 rather than drop it to 2300 or 2200? One months lost rent is two years at a $100 cheaper. If you wait 3 months, like you are suggesting, instead of dropping it to $2300 now you have to wait 6 years to make up that cash flow difference – does that make sense? So no, I highly doubt there are a lot of people sitting on empty rentals waiting to see how this plays out.

@FormerLandlord : “The narrative that things were better in the past is false. In 1968 it was found 27% of Canadians lived in poverty. Programs were put in place to eleviate poverty over the years and it is now down below 10%. Just because the country used to ignore poverty and didn’t have things like food banks in place to help the poor, doesn’t mean the prevalence of food banks proves poverty has increased. Also most unions look out for their members, the “insiders” and can make it harder for outsiders to make a decent living. Unions served their purpose back in the day to get employees more rights, but their are more or less obsolete now with Employment Standards Act in place.”

It’s a nice statistic, but it doesn’t bear out. The poverty line is ridiculously low and is being reconsidered. Anyone who saw the DTES back in the day vs the war zone it is today, knows it. Governments have an incentive to pretend they’re helping the impoverished. https://www.cbc.ca/news/politics/statcan-redraw-poverty-line-1.5406874

@FormerLandlord : “It is a win win for both countries. Poor people are lifted out of poverty due to higher prices for what they produce. Poor people in rich countries are lifted out of poverty, because their meager income allows them to buy more goods.”

There are more poor, and lower income people in rich countries because many of the jobs that used to exist have been sent overseas. The days of one middle-class parent working and providing for the family are long gone.

@FormerLandlord : “By offering free trade there is a higher chance that these bright people from poor countries can make a decent living at home. Not sure how shutting them out of trade would incentivize them to stay put.”

I think you missed the “as an aside” part of my response.

@FormerLandlord : “Canada is competing just fine. Unemployment was really low before Covid-19 hit.”

The unemployment rate can’t be taken seriously. Years ago, Ottawa gamed the stat to only include those currently receiving EI. It doesn’t include those with lapsed benefits or the underemployed. Another useless statistic designed to hide the true cost of neoliberalism.

Exactly, which is why I am saying you will not see any material rent decreases right away and probably won’t until July. Price discovery takes time, the air bnb owners aren’t going to give u a deal right away if they put their unit on the market, they will put it on the market for what they think is the going rate. Only when they don’t get any hits after couple weeks or even a month or 2 will they consider lowering the price. They are most likely getting their mortgage deferred so there probably isn’t an immediate cash crunch.

Patriots, there are absolutely landlords right now making the choice of holding out for high rent/pay at risk of zero revenue. Go look on air bnb right now and see how many units u can book for tonight or tomorrow or next week. Do u think all those places are magically getting booked leaving zero vacancy when the time comes?

I think people have a distorted sense of how fast things move in both rentals and real estate. Rents generally go up around 3%/year over the long term. Down 6% in a month or two is dramatic for the rental market. Of course premium one beds aren’t about to go to $1000.

Nothing at all like the stock market. People buy stocks in anticipation of future income and capital gains. People rent accommodation to have a place to live right now. No future return on rent paid. Landlords either rent out the unit or get no revenue for the month. They don’t get more rent in the future by leaving it empty. No speculative component to the pricing.

That makes the rental market very responsive to actual supply and demand.

Prices are down a bit, but it is moving very slowly. For example, I’ve seen one-bedrooms that were going for $1,700 regularly now at $1,600 but nothing dramatic. If you take a $1,700 pre-covid condo and put it up for $1,500 you will end up with a lot of quality applications and in my opinion $1,500 is still a solid clip for a one bed. Not solid if you bought a one bed one speculation for over 400k, but if you bought when it actually made sense to buy as investment.

If you are landlord and carrying variable mortgages there is a solid probability you are better off than pre-covid19 for the time being.

Ok, so then can someone please post one ad of a decent place for rent downtown currently that is cheaper than what it would have been prior to Covid-19? My point is that prices are downward sticky, so if the current situation persists it will be probably be July before u see any significant movement.

Patriots, what you are describing is fine and makes sense but unfortunately it is purely academic. You have to remember In real life people are irrational, holes can open up at the bottom of the rental market sure, it doesn’t mean it’s going to be reflected right away throughout the chain. Just like the stock market, some stocks can be underpriced from an academic standpoint but it doesn’t mean it will play out in real life if you bought it. Hence the saying: “The market can stay irrational longer than you can stay solvent”.

KS,

It wasn’t that much, but actually, they initially wanted even more than that. Was a combination of lower prices and in my particular case, the sellers wanted out right away. The market was slow then and I put in an offer well under assessment, which my agent said was “bordering on bad taste”. But the sellers countered nonetheless, then we walked away because we still weren’t willing to pay that much for it.

When their agent contacted us a week later, we knew we had them and thereafter we were able to come to terms. Relative to the market and the comparables in the area, it was a sharp price.

I did end up meeting the sellers afterwards – absolutely lovely people. Always interesting to get a sense of the home’s history and the folks who lived in it.

Ks112 my wife, who is following more closely, has seen a price drop on a place on Whittier from 2k to 1890 and many extra incentives in places like the shire and apartments on tillicum across from the mall. In general we are seeing more places in our price range. Again all anecdotal but the rental.ca article Leo posted is worth a read. This is specific to Toronto:

‘At the start of the lockdown in Toronto, there wasn’t much of a decline in rental rates for condominium and rental apartments, with minimal monthly declines in the prime unit sizes of 500 sf to 800 sf of 0.2% to 1.2%. The chart below looks at the change in the average rent by rounded unit size for condominium and rental apartment listings on Rentals.ca in the former City of Toronto.

However, that changed dramatically in April as landlords are responding to this lower-demand market by adjusting their asking rents. Every unit size range declined month over month from 300 sf to 1,400 sf, from a low of 3.7% to a high of 20.2% for suites rounded to 1,300 sf (keeping in mind the much smaller sample size of large units).

It is clear from the chart that demand has fallen more heavily for the larger and more expensive units than the smaller more affordable units.’

Renters are a lot more mobile than owners. I’d expect there will be some move up renters right now looking for a better living situation at the same or lower cost so more attractive places will have applicants.

Students have been really hard hit by covid job losses and, despite the federal support, I’d expect many who are from out of town would not return and pay rent if they don’t have to until the schools announce a return to in-person courses. When is that going to be? September 2021 maybe?

That is missing the point. Someone is only going to pay a certain amount more for the Aria than for a slightly less fancy place. Someone is only going to pay a certain amount more for that place than the next place down. And so on all the way down to a basement suite. Open up a hole at the bottom and it will affect how much renters will pay going up.

You are also missing that holes are opening up at the high end due to the shutdown in short term rentals. How are those holes going to be filled? From below.

“In my case, similar homes in my area were going for nearly 1M at their peak a few years ago. When I bought the particular home I have now, I probably paid about 100 to 120k less than if I pursued this same home during the peak in 2017.”

Local Fool, I could be wrong but I am pretty sure u mentioned before that your budget was in the $650k-$700k range. How did u get a place for almost $900k as u are implying here?

Rush4life, can u post an ad link right now that is an example of the significant rent drop?

Also regarding those high income ppl currently not working, do u actually think a dentist is going to move from the Aria to a basement suite because he or she can’t do any routine cleanings or check ups for 2 months? Why would anyone do that when u can’t get evicted atm?? Like if I can’t afford the rent due to a temporary cashflow issue why on earth would I want to pack up my stuff and move right at this moment with the rent subsidy and the no eviction rule in place? Makes zero sense.

I did reduce the advertised rent 10% from last year as I was concerned about getting qualified applicants in covid lay-off times. Had lots though – all with stable jobs – but it is a nice, legal place in a good area. After the response I don’t think I did need to drop the price to rent, but I’m fine with it as I’d rather just have a good tenant. I would not be so sure about this being the situation in September – or perhaps even now for some places.

Any program with a co-op has a bunch of summer students.

My Bad on that one Ted. I should have been a lot clearer about third party liability. Here’s my attempt on trying to be clearer.

Although you pay for the BANK appraisal, you are not my client. If you want a copy of the appraisal then you have to get it from the bank because you are not my client. I can not speak to you about the appraisal unless I get permission from the bank because the bank is my client.

I can not give you a copy of the appraisal without the bank’s permission because the bank is my client. The client – appraiser relationship lasts until they release me from being their client or the purpose of why the appraisal was done is changed. That also means I can not give a copy of the report to another bank until the first bank releases me.

If you get a private appraisal and shop it around town for the best deal them you are my client until the bank asks for a letter of release where they then become my client and you cease being my client.

The bank is not suppose to give you a copy unless they get my permission. I almost always say yes but they have to give you the report in its entirety and not pieces of the report. If you then take that bank report and use it for another purpose, like a divorce, then that becomes an unauthorized use and I am not liable, including court testimony, as the report was written for an entirely different purpose.

Most people have a lot of difficulty in understanding that just because they paid for the report that they don’t own the report. This all comes down to who has the client/appraiser relationship. The bank wants me tied to them so that they can sue me for damages. If they are not my client then they use the appraisal at their own peril as I do not have a relationship with them.

If you get an unauthorized copy of the report and sue me then you will also have to sue the bank because you are not my client. Your relationship is with the bank. I could theoretically counter sue the bank for breaking the bank/appraiser confidentiality contract I have with them or the reverse. They could sue me because I broke the client/appraiser relationship.

This makes sense if you had an appraisal done for a divorce and your spouse wanted a copy without your permission because it was paid for on your joint account. I could not give the report to your spouse because I don’t have a client/appraiser relationship with your spouse. Neither can I speak to your spouse without your permission.

Now wasn’t that a lot easier to understand.

How about a real example that can easily happen in a busy office. I perform an appraisal for the bank and the buyer calls me up to ask how the appraisal is coming along. I do not confirm that the person is the buyer but think I am speaking with the loans officer. I tell the person on the phone that the buyer is paying too much for the property. And then the crap hits the fan because the buyer does not want to go forward on the deal.

You can only work for one master at a time. Anyone that has had two bosses asking for different things from them should understand.

Heh. It’s happened here, and is still happening. 🙂

No matter how many times I say it, it doesn’t seem to matter. People expect RE = equities markets and when they don’t see something overnight, it must not be happening. In fact, improving affordability in Victoria has been a present force in the market for a few years now.

One thing I’ve learned is raw prices alone don’t tell you much. People who have a certain budget have that budget regardless of what the market prices are. You can’t spend what you don’t have or can’t service.

For example:

If I chose to purchase an 800k house three years ago, I would buy something for 800k. If I chose to buy today and my budget is 800k, I will still purchase a home for 800k. If I choose to wait and not buy, and one year from now I can afford an 800k home, I would still spend that amount. So the market is flat…right?

Not necessarily.

In this example, for that price segment of the market, the prices may not appear to have changed between each of those respective time periods, but the reality is, what you’re getting is changing. For instance, you can still buy a home here for 500k no problem; the difference is what it buys you relative to another point in the past or future.

In my case, similar homes in my area were going for nearly 1M at their peak a few years ago. When I bought the particular home I have now, I probably paid about 100 to 120k less than if I pursued this same home during the peak in 2017. But I would have had the same budget three years ago as now, or three years from now (assuming rates don’t change).

I do not believe there is less overall value in the market today than there was 3 years ago. Sales mix changes can also hide or exacerbate apparent price movements, but that’s another post.

Let’s see what things look like in 6 months. RE still needs a pretty decent haircut from here on the west coast and I’m happy to see that appears to be on the way.

engineering students are normally on campus in the summer.

It did happen in Vancouver.

Didn’t you say that you reduced your rent by $100 though?

Thoughts on 2055 edgecliffe? Selling for a lot less than assessed and dropped price quickly.

Define high income? All chiropractors, physio therapist, dentists, hygienists, optometrists, massage therapists (all of which would be getting 80K+) are out of work. Thats pretty considerable (not to mention many business owners and people who were working up north in the oil patch). So while I agree there are more ‘retail’ staff out of work i would disagree that its only impacting the low income workers.

My wife and i have been looking at upgrading recently and i would disagree with that statement – i am seeing cheaper prices than 6 months ago. (of course this is all anecdotal)

Where did you get 3 months? i don’t see why if all the students and airbnb dried up in a few weeks we wouldn’t see it sooner.

I stlll think its too early for general rent prices to come down, I would imagine this would take at least 3 months for any material declines in rent to filter through, so probably if the situation stays the same then maybe for July you would see some decent rent reductions.

I had no problem renting this month with multiple applicants. Not to say there won’t be more vacancy, how could there not be without Airbnb guests or university students?

Those units won’t be summer tourist AirBNBs this year and if the talk of mostly online delivery for universities becomes reality, well, just add more to the Covid disruption pile…

Most students would have been leaving around this time of year anyway, can they possibly make a big difference?

Living downtown in one of those nicer condos, I can say that we did have a fair number of renter’s that were international students that disappeared earlier than usual this year. Many of those units stayed rented by the students through the summer until they returned in the fall. In the building, some those units are now listed for rent or sale. Not all students were renting in the crappy low end and if the international students do not return this fall more of those units will be available.

That appraisal belongs to the bank. You might be paying for it but that doesn’t mean you are the appraiser’s client. If you want the appraiser to report to you, then you have to order the appraisal directly from the appraiser.

https://www.priv.gc.ca/en/opc-actions-and-decisions/investigations/investigations-into-businesses/2008/pipeda-2008-390/

It is, with the caveat that data quality is somewhat iffy from all these sites. Toronto which has better data is showing declines from MLS where quite a few rentals are hosted

https://rentals.ca/national-rent-report

You’re just looking at the low and high ends. There’s plenty in the middle. So the substitution can happen in small increments with the same end result.

Also I don’t think the home purchase market is a good analogy, it depends greatly on ability to borrow or capital transfers. Rental is just income, and you have much more flexibility with shared renting. Not too many people into shared buying for good reasons.

“True, although some are definitely in condos as well. More importantly though it’s all connected. Can’t have tons of vacancy in basement suites without seeing that spill over to condos. High substitution there.”

Leo, I think this is similar to house prices. The bears on here were all convinced that a drop in higher end home prices would trickle down to the the $700k-$1M range, it just didn’t happen, not in Vancouver and not here. So a bunch of basement suits and crappy apartments being vacant and slashing their prices in my opinion is not a substitute for someone with a good paying job renting a nice condo downtown. No one still employed is going to move from the Aria or the Shutters into Introvert’s basement suite even if she was renting it out for free.

“That’s the evidence. No takers at the asking price.”

Ok, so how do we know that rents are dropping if it isn’t reflected on the ads in the market place? Is there a place doing surveys on the leases actually signed? If people were that desperate to rent out their air bnb condos then I would expect people to be undercutting each other’s price left and right. Just don’t see that happening based on the ads I just saw.

Rush4life, my point is that there are pretty much no layoffs for the higher income earners (backed by evidence which everyone agreed on) so why would the high end of the market take a hit so quickly? Again, I have not seen any evidence of rents dropping for anything decent based on the ads I just saw on craigslist.

Ks112 Leo had a post a few weeks back about the rental situation – part of it is there are a lot less students – courses are online so why come to Victoria to live in the Provinces 2nd most expensive city when you can stay in Nanaimo and live at home for free. Also that guy is likely competing with a new flood of Air BNBs that are on the market. Also if you are moving there are a lot of people out of work and I’m sure the high end market is taking a hit because of it. Lastly, I agree with Patrick – downtown is losing some of its shine as people are working from home and not working downtown there is again, less reason to pay top dollar. Also have you seen downtown lately? Pandora is less than charming right now…

That’s the evidence. No takers at the asking price.

Yep, good point. I ran some numbers stripping out new builds and the pattern is actually little changed so perhaps it’s not necessary to worry about proportion of new builds in the mix. After all once they’re listed they should be reported as sold when they do so it should even out

True, although some are definitely in condos as well. More importantly though it’s all connected. Can’t have tons of vacancy in basement suites without seeing that spill over to condos. High substitution there.

But I am talking about the example in the tweet where Leo had posted, I don’t know how many students are looking for prime downtown condos. they are usually looking for basement suits and what not. I just took a quick look on craigslist and I don’t really see any evidence of rents declining for downtown condos. Decent 1 bedroom is still minimum 1400 without parking and two bedrooms are 2100 and up.

Builder advertised units not previously sold. Normally we don’t tend to see all or many of the new build units on MLS. Developers sell direct to avoid costs and minimize information available to buyers if there are price changes. I think right now they are just eager to get any exposure they can get to maximize potential sales.

Actual numbers are pretty much the same then?

Airbnb but more importantly most students are gone. I wrote about it here: https://www.capnews.ca/news/renting-covid19-victoria-spalteholz

airbnb units going to long term rental because owners have no other choice. Students going back to Mom & Dad. Combine with static rental market, i.e. renters staying put and what do you get?

Is it the pre-sale buyer trying to get out or is it the builder getting out after the buyer walked?

The reality: market rent has gone down and he’s not willing to take it.

So why is it that all of a sudden renters are disappearing? Is it because covid and people have lost their jobs so they are staying in their current place because they can’t get evicted and can take advantage of the rent subsidy? Leo in your example below, the rent for a prime downtown 2 bed condo is fairly pricey and I wouldn’t expect low income people to be in the market for that, so if there are minimal high income job losses then it doesn’t really explain the situation.

Listings up quite a bit but the high number of new build being listed is throwing a wrench into the numbers. For example last 7 days 29% of new listings were new builds (mostly presale) while the same period a year ago it was 19% of new listings.

For sure though, new lists are up from the lows.

It may be anecdotal, but I am interested to see the listing numbers in coming weeks. It seems like a few more sellers seem to be coming into the market. I wonder if these were the ones planning on listing in March and April, but held off because of the crisis?

That’s correct, when appraising a property that is being purchased the appraiser will consider the purchase price at fair market value if it lays within a range – usually 5%. In the example of the value range of $770,000 to $830,000 if the purchase price lays in that range at $830,000 then it would be fair market. Since lenders often do not accept a range of value, they want a specific answer, my opinion of value after weighing the evidence may be nearer the mid-point at $800,000.

What I would do in this scenario is explain to the lender, that in my opinion the subject sold at the high end of the market range; however the offer to purchase at $830,000 is considered reliable and reasonable for first mortgage financing not to exceed 80 percent.

If this were a second mortgage or high ratio mortgage at 95% then the lender would still be within their lending guidelines. BUT… If the offer was at $850,000 then I would value the property at $800,000 and wait for the barrage of phone calls that start about 10 minutes after sending the report.

This may also help Marko understand that after his involvement with hundreds of purchases he has never had a problem with an appraiser. But every appraiser has had discussions with irate agents and brokers over their careers, especially when the market place is rising very fast and properties are in bidding wars. But sometimes it isn’t the value that is the problem. The problem happens with comments about the property’s condition or remaining economic life. Things that could deter some prospective purchasers and lead to an extended marketing period. Things like wood and post foundations, knob and tube wiring, grow operations (illegal and legal), pools of oil in the yard or in a stream on the property, etc.

When you have to have an engineer comment on the adequacy of the building or an environmental study done, then the deal is usually dead right then.

… and now the second guessing begins.

https://www.msn.com/en-ca/news/canada/business-and-health-leaders-accuse-trudeau-of-shifting-the-goalposts-for-reopening-economy/ar-BB149xPm?li=AAggNb9

I’m glad that the public didn’t allow the city to take over the democratic process, and forced Helps to backpedal.

The narrative that things were better in the past is false. In 1968 it was found 27% of Canadians lived in poverty. Programs were put in place to eleviate poverty over the years and it is now down below 10%. Just because the country used to ignore poverty and didn’t have things like food banks in place to help the poor, doesn’t mean the prevalence of food banks proves poverty has increased. Also most unions look out for their members, the “insiders” and can make it harder for outsiders to make a decent living. Unions served their purpose back in the day to get employees more rights, but their are more or less obsolete now with Employment Standards Act in place.

Source for poverty data: https://www.thecanadianencyclopedia.ca/en/article/poverty

Countries like South Korea and Taiwan have shown that hard work and freeish trade have lifted them out of poverty. Now they are rich enough to worry about the environment and workers rights. In China they are seeing a similar shift as well.

I don’t think it is altruism. It is a win win for both countries. Poor people are lifted out of poverty due to higher prices for what they produce. Poor people in rich countries are lifted out of poverty, because their meager income allows them to buy more goods.

By offering free trade there is a higher chance that these bright people from poor countries can make a decent living at home. Not sure how shutting them out of trade would incentivize them to stay put.

Canada is competing just fine. Unemployment was really low before Covid-19 hit.

Based from today’s TC article, the democratic process seems to be very much alive in Victoria:

“Cars will be banned from some roads in Beacon Hill Park through the summer to provide more space for pedestrians during the COVID-19 outbreak.

But Victoria councillors have agreed to a compromise that will open up more parking lots as well as their access roads to accommodate seniors and people with mobility challenges.

The decision followed public criticism of an earlier proposal that would have immediately banned cars from the park’s primary roads on a permanent basis.

Now, city staff will consult with accessibility groups and report back in the fall before council makes a final decision.

Mayor Lisa Helps said the changes strike a balance between allowing people to practise proper physical-distancing during the pandemic and permitting people of all ages and abilities to use the park.

“It’ll give us a sense for the summer to see what works and what doesn’t work,” she said.

“It will allow us to keep the measures that staff have already put in place, while opening up some parking lots.

“And it will allow people of all ages and abilities, including kids, including seniors, including people who use mobility devices who can’t safely [pass] each other on sidewalks right now, to use the park.”

Read the rest yourself at: https://www.timescolonist.com/news/local/partial-car-ban-at-beacon-hill-restrictions-inside-park-but-more-parking-1.24135632

I guess what I’m seeing is that most those people are still bringing in income at this point. They mostly feel like they’ll have a job to go back to. What we don’t know is whether those jobs will still be around 6 months from now, or whether those people will still be getting any income.

Better that than the dreaded “underscore recovery”

Depends on what you’re talking about. For employment? Yes. Effective unemployment was likely at least 20% in Victoria in April, maybe as high as 30%. It will be less (but we won’t have a good measure of it) going forward. Note that the official unemployment rate will almost certainly go up from the current 7.2%, but that’s because of the 3 month average and the effects from many people not being actually counted as unemployed in April that were actually unemployed.

For real estate? Sales we are past bottom. Price we have only seen a small fraction of the mid-term effects.

Do you honestly see this as the bottom?

Now only if they can figure out if money from family members for a down payment came from a HELOC. You would hope that lenders would be able to establish if people were able to save their own down payments. If a people can’t at least save the minimums to qualify for mortgages on their own they really shouldn’t be getting mortgages and the result is that we get to carry market risk for unqualified buyers that contribute to price elevation at the same time.

@FormerLandlord : “The other side of the coin is that these trade deals have lifted millions of people out of poverty in these countries. Yes, workers and the environment may not be treated the same there. But the West did the same during the industrial revolution when our society transitioned from most people being poor to society becoming rich.”

There was no broad understanding of the regional and global consequences of toxins & pollution at the beginning of the IR. That’s not the case today.

These trade deals should have STRICT conditions that require workers rights, dignified wages, and environmental protections. If not, what’s the point? Being “lifted out of poverty” while being poisoned and worked to death is hardly a decent trade off. I can’t pretend there is any element of altruism involved in these exploitative situations. Canadian labour fought long and hard for workers rights here. Blood was literally shed. Exploited workers in other countries must hold their corrupt governments to account as our previous generations did, and we should be championing them by holding their governments to much higher standards. But ultimately, this isn’t about “lifting people out of poverty”. That’s just a ruse to justify the greed of offshoring jobs.

As an aside, we are draining these countries of their best and brightest – Brain Drain immigration as we exploit their resources leaving environmental devastation in our wake (Canadian mining companies have an appalling record of this, including child labour). Our government does nothing.

@FormerLandlord : “At the same time it benefits us in the West because we get goods at the best price available, which has given us immense variety of choices of what to do with our money.”

That’s the illusion. Cheaper offshore goods mean sacrificing Canadian jobs, and Canadian standards. It doesn’t matter how cheap something is if it’s substandard, and/or you can’t afford it because you aren’t working.

We’re also choking the planet with our garbage as everything is considered disposable, with nothing made to last or be repaired. The oceans are literally filled with plastic and heavy metals because of us. We need to stop this mindless consumerism, and restructure our economy. The notion of endless growth every quarter is eventual suicide for our, and every, species.

Free trade disproportionately impacts lower income workers and increases poverty. I’ve been around long enough to remember when many things were Made In Canada. Good union jobs meant far less poverty. Food banks were few and far between. If free trade with counties using exploited workers is to stay, the streets will continue to devolve into war zones. The DTES is a disgrace, and a symptom ,not the problem.

@FormerLandlord : “The government should help with retraining people whose skills are obsolete”

For what jobs? Canadian companies can’t compete under “free” trade with impoverished countries.

@FormerLandlord : “Shutting out trade leads to less competition so companies have no insentive to innovate or improve efficiency, the government is then forced to subsidize them more and more to compete (by raising tariffs even more or direct subsidies). Either way goods become more and more expensive for the local population and eventually the country is forced to open up or goes bankrupt. This seems to be the same pattern over and over for countries that try to “protect” themselves from trade.”

I’m not talking about “shutting out trade”. FREE trade with countries without worker/environmental protections and limited social safety net is the problem. Duties & tariffs were previously used to protect Canadian employers & workers.

If we’re going to continue to pull the rug out from Canadian companies & workers, it’s seriously time to bring in a UBI, or accept that homelessness, crime, and all the ills associated with poverty will continue to fester and destabilize this country as we race to the bottom, so the elites can hoard even more money offshore.

Just do it.

I never liked any of the letters. It’s not going to be a V because it won’t be symmetrical. It’s not going to be a U because the bottom won’t be flat. It very likely will some sort of Nike swoosh recovery. The way up will be much longer than the way down.

Big banks are tightening lending standards for real estate investors: mortgage brokers

Starting to see a few more cancellations and relists popping up. Not sure if this is higher than normal or if I am just noticing because of fewer listings.

Or $0-2,000 if it is reported to the city, as Saanich doesn’t allow AirBnb/short term rental in SFH.

Don’t know why everyone is proposing a V shaped recovery.

I doubt it’s going to be as rosy as they are suggesting.

Yes, and the key point is that this range is done while not taking the current sale into account. Obviously if the house contract price falls within the range of market value, the loan will get approved. What the appraiser can’t do is “fudge the numbers” so that the comparable calculations are influenced by the contract price, influencing the “range of market value”, and I think Gordon has been clear on that.

And I’m assuming that what I call “fudge the numbers” is what LeoS is describing as “ …it’s that the sales price is influencing how the comparables are weighted and adjusted. “… because they’re not allowed to “adjust” (fudge) the comparables based on the sale price.

Gonna be a great time to start a restaurant in 12-24 months.

A “rosy” forecast For Victoria economy from the Conference Board of Canada…seems like we’ll only get a “flesh wound”..

https://www.timescolonist.com/business/economic-forecast-region-expected-to-weather-virus-better-than-most-1.24134093

“ The Conference Board of Canada says Greater Victoria’s gross domestic product will fall 2.9% this year.

“This year, housing starts and the resale market will both cool temporarily due to the coronavirus shock. “But they will recover by next year at the latest, thanks to low interest rates and supportive federal programs.”

Housing starts are forecast to hit 2,400 units in 2021, down from a 2018 peak of nearly 4,300 units, but still above the 20-year average of 2,160, and the resale market should regain its balanced position.

From my understanding of reading Gordon’s comments, the appraiser always comes up with a range of market value. This range is determined while not taking the current sale into account. However, after determining the range they will look at current sale if it is available to determine the final appraisal value.

For example the appraiser could come up with a value of $770,000 – $830,000. I assume they would normally take the middle of the range as the appraisal value: $800,000. However if there is a current sale at $830,000, they would use that as the appraisal value. So even though the market value is not influenced by the sale price (because it is a range), the final appraisal number is influenced by the sale price.

Gordon can correct me if I misunderstood what he was explaining.

This would probably also explain (in part) Leo’s graph that sees very little assessments under the value of the sale price.

The seller claims the suite generates $2,600 – $5,000 in income through AirBnb. They may need to update that to $0 -$5,000…

BC Assessment values at $761,000. Granted that probably misses renos, but no nearby property has sold for over $889K, nor any since February. This appears to be someone who made a big bet on a future that has disappeared, and is going to take a big hit for it.

https://www.bcassessment.ca//Property/Info/QTAwMDBIUEFHUg==

Gordon, thanks for the reply. That confirms what I’ve been saying here that the appraisers job is to arrive at market value “without being influenced by the sale price.”

It’s not that common to put this many units on mls. Often developers will just put a couple units on there to drive traffic to the website and sales centre. Individual developers deciding to list or not list units and then report or not report sales is a significant source of noise in the sales numbers month to month.

Leo S

…. or it’s exactly as it seems because new builds are dumped on MLS every year???

Yeah lots of new listings right now driving the Sales to list ratio down. However it’s not quite what it seems because a ton of new builds from Belmont East have been dumped on MLS. Looks like developers are needing to increase their market exposure these days.

The other side of the coin is that these trade deals have lifted millions of people out of poverty in these countries. Yes, workers and the environment may not be treated the same there. But the West did the same during the industrial revolution when our society transitioned from most people being poor to society becoming rich. As these poor countries lift themselves out of poverty they are paying more attention to workers rights and their environment and building social safety nets. When people are dirt poor all they are doing anything it takes to survive, which may include destroying the environment and getting taken advantage of. Offering the ability for them to sell their goods to wealthy western countries (at a fair price = free trade) allows them to lift themselves out of property.

At the same time it benefits us in the West because we get goods at the best price available, which has given us immense variety of choices of what to do with our money. And yes some people lose out because their skills no longer match with what society needs. The government should help with retraining people whose skills are obsolete.

Shutting out trade leads to less competition so companies have no insentive to innovate or improve efficiency, the government is then forced to subsidize them more and more to compete (by raising tariffs even more or direct subsidies). Either way goods become more and more expensive for the local population and eventually the country is forced to open up or goes bankrupt.

This seems to be the same pattern over and over for countries that try to “protect” themselves from trade.

My thoughts on this is that it usually takes a while to close, and a lot of times closure will be on condition of sale. That would lead to more listings before more sales. Or just no one is buying.

I’m sure that this does happen either intentionally or unintentionally. In Canada appraisers have to re-certify every two years and take a mandatory Professional Practice course and this topic seems to be brought up every cycle. So there is no excuse for an appraiser not to know that this is poor appraisal practice.

The appraiser is not suppose to be influenced by the purchase price. And since I do perform appraisal reviews it is glaring obvious when an appraiser is intentionally trying to justify a purchase price that is not at fair market value in order to hit a specific value. The adjustments become inconsistent and not logical.

In one of my reviews the appraiser couldn’t find comparable sales that supported the purchase price so they made an adjustment of $200,000 for the master bedroom being on the first floor rather than the second in all of the three comparable sales. When pressed on how they determined that adjustment they could not give an answer or an example from the market place. Their only comment was that the real estate agent told them this.

That is not going to work out well for the appraiser in court or if the appraisal comes up in front of an Appraisal Review Board. This would likely end in disciplinary action against the appraiser where they would have to retake appraisal courses, have their name published in a magazine seen by appraisers and other stake holders and recorded on their permanent record and possibly a fine. If they repeated this again and were brought up before the appraisal board they could be expelled from the Appraisal Institute.

This may seem harsh but an appraiser has a duty of care to the lender and to the public. This misunderstanding of basic appraisal methodology shows a negligence that could cost millions of dollars to the lender over hundreds of appraisals.

@GWAC : “Jobs move to more business friendly environments.”

You must’ve missed this part: “if Millionaires & Billionaires didn’t STASH personal & corporate riches OFFSHORE; lobby to BUST UNIONS; and send decent paying jobs OVERSEAS to enslaved workers”.

“People” aren’t mobile – most can’t buy multiple passports of convenience like the global elite.

But money now is mobile, thanks to treasonous “free” trade deals with countries where workers make peanuts, lack human rights, and there are limited (if any) environmental & wildlife protections, social safety nets, etc. We’re stuck with the garbage policies our corrupt politicians craft for the 1%, throwing us scraps, and handing out billions in corporate welfare.

The deck has been stacked against workers – we can’t just pick up and head to where the wages are best – unlike corporations that race to find the most exploitable labourers possible. And the “I Got Mine” class still feel entitled to bring in TFWs to further degrade wages, while scoffing at the tent cities ultimately created by these treasonous policies.

And how did that work out? You enjoying buying 8 million garbage masks from China because nothing is “Made In Canada” so multi-millionaires could become multi-billionaires? How about the lead poisoned children’s toys? Tainted foods?

Yeah, your agenda has worked out just great. Socialism for corporations, food banks for the rest of us, eh?

I’m non-partisan, but I’d pick the NDP or Greens over the openly corrupt BC/Federal Liberals or Cons. If only Trudeau hadn’t betrayed Canada by reneging on his electoral reform proimse. We could have had a chance at government for the people, instead of for offshore corporations.

I like that “millionaire” still makes the rich overlord list when a million doesn’t even get you an average house in a lot of neighborhoods anymore.

It’s not that they are valuing the property based on the sales price, it’s that the sales price is influencing how the comparables are weighted and adjusted. This is US data, but it is from after the reforms of the financial crisis which improved appraiser independence.

“This empirical concern is addressed in the current paper by using a

unique database of residential properties that were appraised twice within 6

months between 2012 and 2015, where one of the appraisers was uninformed

of the contract price. Significant differences were found between the two

appraisals, where the appraiser aware of the contract price used a different set

of comparable transactions, price adjustments, and weights of adjusted values

of comparable transactions to justify appraised values which confirmed contract

price”

Full paper here: https://www.fanniemae.com/resources/file/research/datanotes/pdf/working-paper-102816.pdf

“Finally, the post-contract appraisal was

on average 4.2% higher than the pre-contract appraisal for the identical property, after controlling for

differences in local home price index between when the two appraisals were completed.”

4221 Springridge Cres price reduction…. From 1.5 now 1.2

Surprised that sales haven’t gone higher yet. They really haven’t budged since beginning of the month. I was thinking we’d see a continued slow ramp up. Maybe it’s still coming.

You shouldn’t be valuing the property based on what it sold for. That’s wrong on so many levels.

You select the comparable sales and then adjust for the differences between them and the subject. Then you review the adjusted value range. Only then would you look at the accepted offer. If the offer lays within that adjusted range it’s at fair market.

What you don’t do is look at the accepted offer and then try to find sales that justify the offer.

So if there is a typo in the accepted offer it wouldn’t matter, the comparable sales would be indicating market value because you did your job without being influenced by the sale price.

Public Service Announcement:

Here, again, is the BC CDC’s COVID-19 Survey:

http://www.bccdc.ca/health-info/diseases-conditions/covid-19/covid-19-survey

I just completed it. It was very thorough and well-crafted.

Gordon,

Thanks for the detailed answer. But I’m looking for an answer to a simple question….. the appraisal ends up with a number, a dollar value.

Q. And is that dollar value going to end up to be different if the contract price is different ( but everything else is the same).

For example, if the contract price is $800k, and you’re about to appraise the house at $805k. And then you hear that “whoops”… a typo was made, and the contract price is really $830K, but everything else is the same. Do you stick with $805K as the appraisal, or might you change it to something like $835K?

Wow a true leftist fantasy. Must be card carrying NDPer. Fortunately what happens is jobs and people are mobile and move to where they are taxed less. Your utopia is unrealistic and dangerous and the opposite will happen when policies are implemented to introduce that vision. Tax base disappears. People hide assets and revenue disappears. Jobs move to more business friendly environments. You are about to see what government over spending and high taxes produce. The next 5 to 10 years will be brutal on the environment and the poor. Not my choice but government Fiscal mismanagement will have created this.

Socialism does not work and makes people poorer.

@GWAC – if Millionaires & Billionaires didn’t stash personal & corporate riches offshore; lobby to bust unions; and send decent paying jobs overseas to enslaved workers, our government would have the resources to fund the social services required to facilitate a more civil society, with a robust universal healthcare/pharmacare/education system; dignified housing for all; decent paying “Made In Canada” jobs; infrastructure; and environmental protections, so folks making peanuts don’t have the need to stash tips, because they’d be making a dignified living wage to begin with.