The month of no good very bad numbers

April is the month where every economic indicator drops off the cliff. In the coming weeks as different economic indicators are released you are going to see a lot of squiggly graphs followed by a quantum jump or drop. April was peak lockdown for Canada, and so it will be peak economic impact in most areas, with real estate no exception.

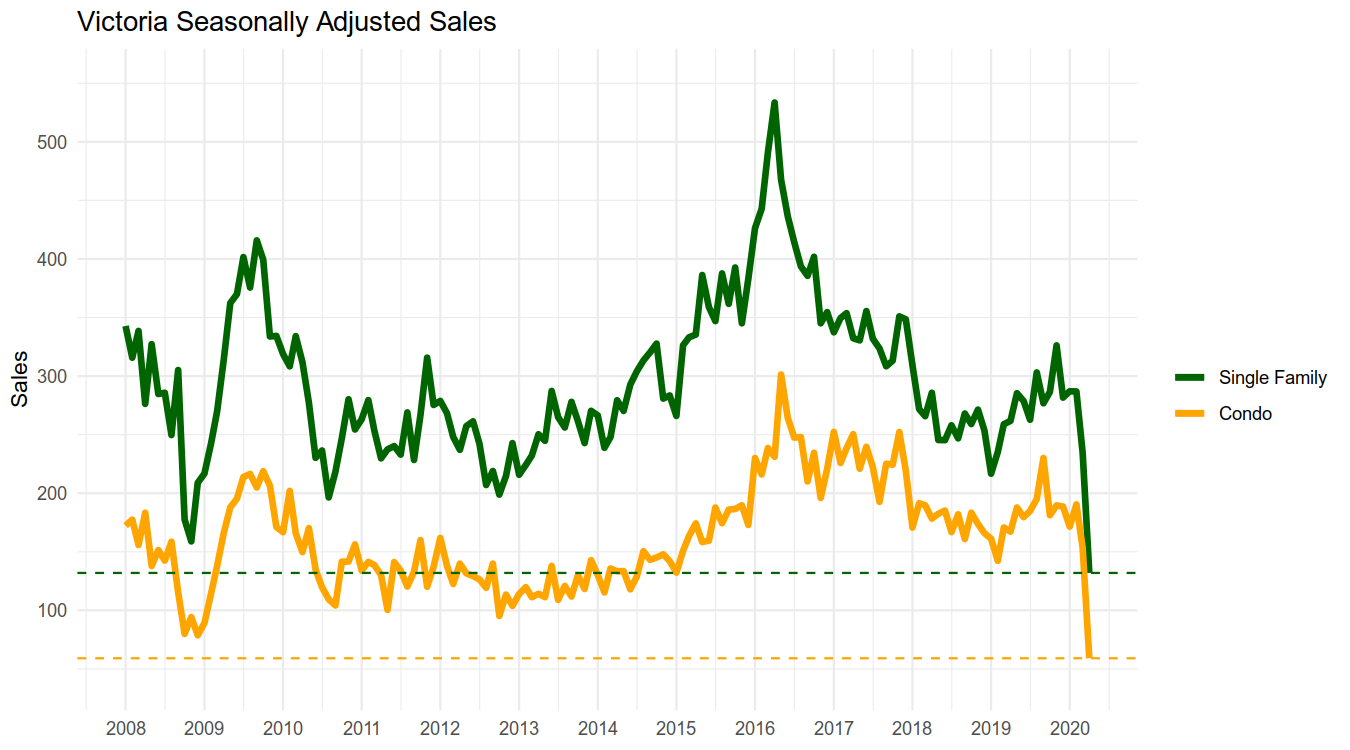

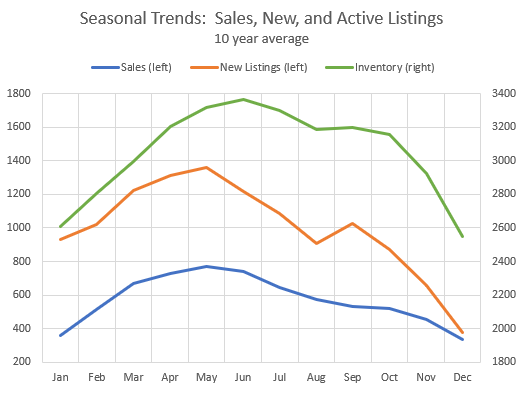

Starting with sales, which finished the month down some 59% from last April. Because last April was already a weak month due to lingering mortgage stress test impacts, the seasonally adjusted data is truly astonishing. For the past few months I’ve started producing the seasonally adjusted sales data using the data analytics platform R. Well the seasonal adjustment algorithm I use (X13-ARIMA-SEATS) is normally great at showing the trend in the data, but this time it immediately assumed the April values must be outliers and essentially threw them out. After puzzling over why the chart wasn’t showing a big drop, I fiddled with the code and extracted the raw adjusted data which shows the true magnitude of the decline. You’ll notice the rest of the chart is a bit noisier than usual though.

New listings are similar, down some 53% from this time last year. Here we see even more of a divergence from the bottom of the Great Financial Crisis, where despite the very bad news on the TV the market went on more or less as usual for anyone wanting to buy or sell. During the lockdown, no one was keen to have people coming through their house, and most of those who could hold off from selling did so.

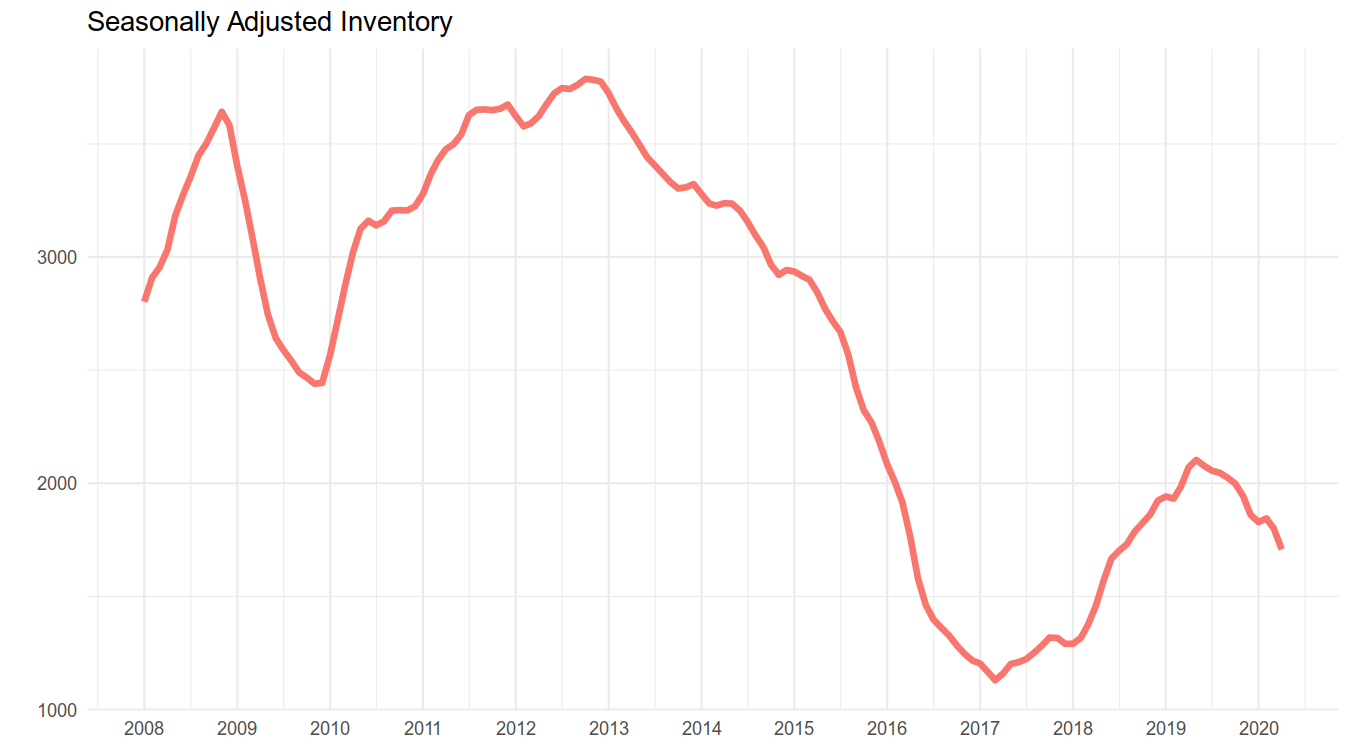

The huge drop in new listings prevented inventory from increasing like it usually does from March to April. That means on a seasonally adjusted basis it continued the declining trend that has been in place for about a year.

What of prices?

Last month I told you to pay no attention to monthly sales prices as the single family average jumped 10% to an all time record. That’s because that figure didn’t reflect what was going on in the market. Well this month the average dropped nearly 10%, and it is equally meaningless, as it was caused mostly by mean reversion and changes in sales mix. In many segments there just isn’t enough selling to really know what the price will be, but so far there is little indication of substantial movement in the entire market. Remember the real estate market moves slowly and though sales can crash or explode quickly, prices tend to move over months or years, especially on the downside.

There are two ways to think about prices:

- The market value for the place you are looking for OR

- The price you can actually buy a house for.

In normal markets, those two are essentially the same, which leads to the common misconception that whatever a house trades hands for is equal to market value. It’s true that in a normal market those two prices are pretty similar and you’re not likely to get any great deals. If the seller doesn’t like your offer, they will move on and find another buyer. Only in extreme markets do we tend to see people buying at prices that significantly diverge from market value. That’s because market value (which I wrote about in more detail here) depends on a competitive market with buyers and sellers not under undue stress and a reasonable exposure to the market. That falls apart in extremely hot markets like 2016 when we saw a lot of above-market sales, and during a locked up market like we saw in April, where we have neither a competitive market and a lot of sellers under duress. I wouldn’t say there’s been a huge number, but there have certainly been sales at prices that I don’t believe would have happened 6 weeks ago. I won’t go over it again, but during these times it’s important to watch individual listings more closely than overall market pricing.

Market value shifts more slowly, and generally moves up when the months of inventory in a market is below about 5, stays roughly constant around 6 to 7 months of inventory, and declines above about 8.

The collapse in sales has spiked seasonally adjusted months of inventory to 8.5, around the same level as we saw from 2010-2013 when prices were drifting downwards at about 2-3% per year. What effect will it have on prices? It likely all depends on how long it stays this high. As I discussed last week, the fact we are starting from a low base means we have some increased resiliency built into our market but this is certainly a sharp deterioration of conditions.

Overall, prices are still roughly flat to slightly up over the last 2 years.

April’s market was all about fear and uncertainty. That is slowly easing as the province becomes more confident in their ability to control the virus and starts easing economic restrictions. That’s why I don’t believe that we’ll be going back to the extreme lows of about 50 sales a week we were seeing around Easter. Year over year sales declines will likely continue to be very large for months to come, but absolute sales will likely increase into the summer.

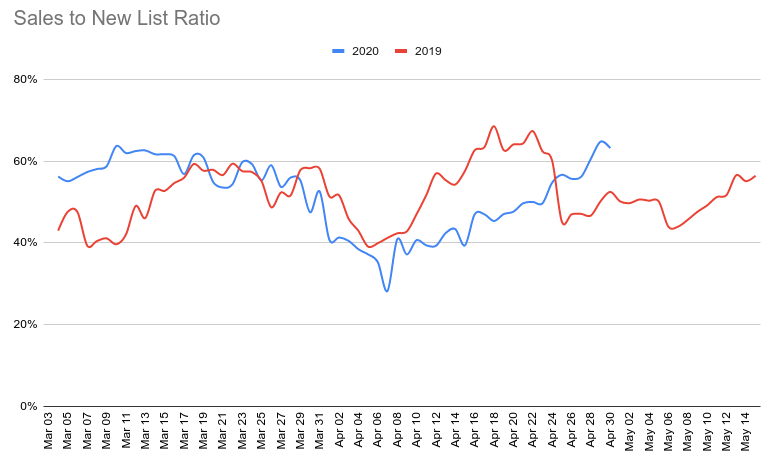

What it will take for the market to shift towards buyers is more listings. While sales have come back a bit, listings continue to be at rock bottom levels, and that has surprisingly brought the sales to new listings ratio higher than this time last year.

I expect sellers to start listing again in May, but so far buyers have come back sooner. As I’ve said before, the bigger impact of this situation is not the market activity collapse during the acute lockdown period, it’s the longer term impacts on unemployment which will depress demand. We won’t know how that unfolds until late summer when the temporary economic supports start to expire.

Thanks.

No still pending. Definitely not business as usual though. Very likely some kind of hybrid approach with graduate students on campus and undergraduate mostly online.

New post: https://househuntvictoria.ca/2020/05/11/covid-unemployment-and-real-estate/

Didn’t UVic already do the same?

Mcgill University announces fall courses will be offered primarily online. Rental prices will take a hit throughout Canada if other universities follow

https://www.mcgill.ca/newsroom/channels/news/mcgills-fall-2020-semester-322097

“Large compared to where I grew up. But let’s call it a small city. Do you think it’s reasonable to question whether a small city with big drug and homeless problems should be so expensive?”

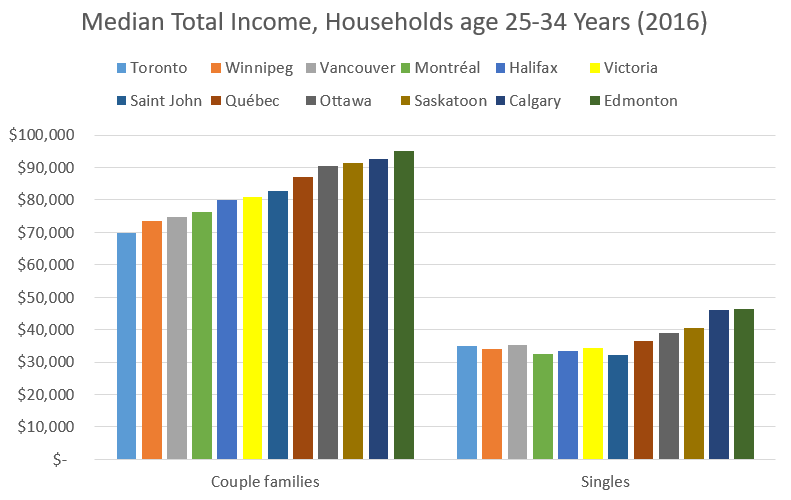

Have you considered that maybe part of the reason is because it is arguably the most desirable place to live in the country? And is it really that expensive when a couple making $75k – $80K a year each can purchase a SFH in the core in this city? Minimum wage is $30k a year now, so really it’s just 2.5x minimum wage. Think about back when minimum wage was $8 bucks an hour, was making $20 bucks an hour to be able to afford a house really that unreasonable?

Major currencies (US, JPY, EUR) get away with huge money printing, borrowing and low rates, but not the minor players. Let’s wait to see if Canada finds actual buyers (other than the BOC) for the $200 billion of borrowing (bonds, at tiny interest rates) needed to fund this year’s deficit. In the last 10 years plenty of currencies have had huge falls >50% (e.g, Russia, despite high interest rates) and “petro-currency” Canada may be next. For some perspective, the total of RSP and TFSA invested by Canadians is $60 billion.

Patriotz, Sure it is reasonable to question that. Show me why it would not be reasonable.

No disruption of production, in particular China was able to grow its supply of goods at low cost. Things are very different now. That’s not a prediction by me of high inflation, just pointing out that the situations are not the same.

Large compared to where I grew up. But let’s call it a small city. Do you think it’s reasonable to question whether a small city with big drug and homeless problems should be so expensive?

Lots of people predicted runaway inflation after the QE during and after the financial crisis as well. It never materialized. I think higher interest rates than the low rates we have had over the last 10+ years would be a good thing, but I don’t see that happening in the foreseeable future.

Geezus. How many kids do you have?

I still think that spring/summer hockey is totally over blown.

Kids need a break.

Here’s an illustration of the huge level of QE (“money printing”) that’s going on in the US in 2020. Money supply (M1/M2) expanding at huge annualized rates . This is intended to counteract the deflationary forces of the CoVid related economic contraction, but if it doesn’t reach Main St. all it does is increase stock/bond (and perhaps house) prices, and set us up for big inflation down the road.

Great CoVid site with interactive charts for data junkies… (Click “select countries” to customize) https://ourworldindata.org/grapher/covid-daily-cases-trajectory-per-million?country=CAN+DEU+SWE+AUS+NZL

Victoria is a large city now??

Ignore Patriotz, he gets testy if people point out the obvious and goes into controlling mode telling them what they should write.

News flash: Large cities don’t have just one problem. And instead of implying that people who think that Victoria is too expensive are off their rockers, try to be more positive. Talk about the nice weather and stuff. Otherwise the finger may point back at you.

No idea about groceries but I estimated I have saved about 8 -10K with no kids spring hockey and lacrosse etc..

That’s all part of the plan… change density, sell, piss off neighbours, buy their property & repeat.

Infinite money.

Talking about shopping, just add a bit fun observation about the toilet paper. Since started having Covid symptoms 5 weeks ago (have recovered since), I was given a private bathroom, with my own toilet paper rolls. By today, I am half way through the 4th roll since my privilege started (the rolls were from different brands and feel different, that is why I remembered).

With this newly gained knowledge, I wonder why people were so rushed to buy/stock that much of them early on? 😉

Good to know it’s not just me (although my case does seem to be the worst).

I’m reining in our grocery spending this month! Beans and rice, rice and beans. No ice cream.

Probably spending $150 per month more on groceries. I bet in the past 5 years we have bought ice cream at the grocery store maybe 3 times. But not now. We eat ice cream for desert maybe 5 days out of 7. Cashier at Save-on-Foods said, without me mentioning it, that she can not believe how much ice cream is being purchased. A form of comfort food I guess. Also eating more sweets than usual. Gained a couple of pounds as well. Spending a lot less on gas. The same on liquor, and much less on restaurant food. Also, trying recipes out that I probably wouldnèt have before. Garden is looking great too.

It really depends on individual’s personal situation.

If one has secured income or/and good pension set for life, then why not to enjoy it and support local (and non local) businesses at the same time? If not, one might need to keep a balance between saving and spending, so one can support local businesses now and also for a long time to come.

freedom_2008, I actually never really looked in detail on much I spent on those “pleasures” until now, I knew it was ball park in the $1000 range but didn’t really think about how much I can cut out and still not feel like I am skimping on life. Now that I am thinking about it, I am just as happy and can do without most of that stuff so will probably will keep it dialed back after things open up again, which I guess doesn’t bode well with supporting local businesses.

KS: Avoided Pandora, downtown still looks pretty bad.

If one used to spend average $40/day or night extra for bars and restaurants before Covid time, that’s not really savings, but lots of Lost “pleasures”. Should we feel sorry for ya? 😉

Don’t really know if we’re spending more or less I stopped tracking spending in detail a couple years back. probably a bit more, also because we are ordering more takeout and shopping at the local market to avoid the lines.

Did you drive down Pandora barrister?

Yes, but that’s only relevant to the portion of money laundered through real estate, and that speaks to my point that it is high real estate prices that is the real target, and not the underlying crimes. The hope isn’t just that the beneficial registry catches money launderers and stops their associated crimes, the main hope is that it reduces the prices for Real estate. The govt is targeting anything that might be raising RE prices, so money launderers get attention. Same with foreigners and satellite families – targeted merely because they may be raising RE prices.

Anyway, if real estate prices fall on their own from CoVid, if my theory is correct, I predict that the public and the govt’s interest in money laundering and the other boogeymen will vanish. Thanks for the discussion.

We are spending a bit more maybe but not a lot. On reflection probably spending a bit less. Not really enough to make a difference.

Drove through downtown today and in spite of the nice weather and early spring. Large parts of it look like a shit hole. If this city council is not extremely careful it is possible that we could cross a threshold where the downtown becomes hollowed out.

Yep, ours increased, too, but less than 50%. Also I stopped checking price at the cashier as I do sometimes before, so when they put in $13 for a bag of potatoes (at root cellar), I didn’t say nothing even I knew it should be $7. Once you have gloves and mask on, you are at war and it is not the time for little details, plus the money went for a good cause to support local businesses.

Not much change in restaurants bills, as most places we like are still open for taking outs.

On the spending -less side, filled car gas in Feb 28 at Costco, still have about half tank left today 🙂

Plan to buy e-bikes soon, as no more money needed for travel for this year and likely the next year as well.

Our grocery bill is the same. Go to Costco once every 2 weeks before and after restrictions were imposed for most of our grocery needs. Also was working from home already so did not eat out all that much. Spending about the same on takeout. Spending more on liquor though.

Saving on insurance by not renewing one of our vehicles that ran out April 1st and I have only visited the gas station once since the restrictions began. Saving on gym fees and pre-school classes for our youngest 2. Also 0 ferry costs for visiting grandpa and grandma in Vancouver.

So overall spending a lot less.

I saved $1200 last month due to the lack of options in eating out and no places to buy drinks other than the liquor store.

Fool house spent, on groceries in 2020:

Jan $750.70

Feb $814.66

Mar $1,005.15

Apr $1,027.43

No known change in buying behaviour, but our monthly restaurant bill has fallen about ~50%.

Holy smokes, our grocery expenses have really gone up lately. Feb-Mar-Apr were all higher than normal months for us, and in April we spent 50% more than average! We haven’t been stocking up like crazy — at least I didn’t think so.

Is anyone else experiencing this?

Barrister, when did the police get told not to enforce the law on Pandora? I swear I seen drug busts there on the news in the past year.

Not long ago many people on this board was having a hysteria of how the problem was housing, cost of living, etc…, and now people finally agree that it is a drugs problem that we have in this city.

“Why can’t do just have a few of them patrol up and down Pandora and Johnson?“

Crackdowns disperse the problem over a wider area while a select few people get sent through the revolving door criminal justice system at great expense.

Our housing problems in a nutshell.

Tons of dumpy single family properties in Victoria that would be infinitely improved with some more density.

It just mean that we really got rip-off on the deal, and at first drugs problem would just move indoor till it spilled out on to the street even bigger than the present.

The Uplands house looked solid to me.

Quick 360 tour of the house shown that it has been extensively updated at least once somewhere around mid 90s. No foundation crack to be seen in the craw space, very minor/aged mud and lath cracks in a few place, wiring and lighting are updated, Poly-B water main tubing with compression fittings (good solution for Poly-B) indicated that it was updated in the mid 90s (minor water seepage through wall that can easily be reseal), popular 90s central vacuum system, heating is updated to top notch 10 zones copper and PEX-AL-PEX (popularity started in the 90s) with high efficient condensing boiler. A quick count of single panel windows and doors suggests that one might want to upgrade to double panel that could cost 20-25K, and if the roof and gutter need to be address then that may cost another 15-20K.

KS 112: The police are told not to enforce the laws on Pandora. Little point in having more patrol.

I am getting the feeling that this summers tourist season is pretty well dead and I dont know how many the businesses can hold on till next year. A city council that seems almost exclusively focused on attracting more druggies to Victoria seems to be under estimating the potential economic carnage.

Given where Our Place is, that site on Pandora is ideal, which is probably the Leverage Kang and Gill had. IMO the police are pretty much useless in Victoria. I can’t believe the city pays cops at over time rate to do walk through at bars on weekends.

Why can’t do just have a few of them patrol up and down Pandora and Johnson?

I cant believe that the city paid that for some land that they had allowed to turn into drug haven. If I did not have so much faith in our public servants I would be hoping that the police would start looking for corruption.

Hope we can manage to get a sane slate of candidates to run.

926 and 932 Pandora Avenue

Is the address a secret? What does BC Assessment say?

I am sure the neighbors would love that Leo 😉

The city should buy up some residential zoned properties, rezone to higher density, and sell to a developer.

Infinite money printing machine.

Marko u should write to the tc and get them to do a story

Does not appear that any physical improvements were made to the property. It is a development site (building is going to be torn down).

It’s a disgrace that there are people making 150k/year plus a lot of 100k/year plus salaries at city hall so they can pay 2x market value. This is getting to the point where enough is enough, it is beyond ridiculous.

Did the Developer do any development of the property?

Late 2016 thought (market was approaching peak)

“Head – Strategic Real Estate” making over 150k/yea”

That’s is the problem right there Marko, that’s what u get when you pay 150k a year for someone to be the head of your “strategic real estate group”. That’s same as the all-in analyst compensation at my firm assuming top performer.

Not sure how hard the city negotiated, I am sure it’s not ideal for a developer to build anything across the street from Our Place. City should have done a partnership with Kang and Gill, some type of design-build-lease with an option to buy structure since clearly the city has zero idea on how to solve the homeless problem at the moment.

Imagine Saanich having lax building codes. Ha!

I’m not disagreeing at all. It’s the reason for the price discrepancy, that’s all.

Barrister, but one is on a 7000 sqft lot in South oak Bay with no water views while the other is on a lot twice as big in uplands. I dunno unless south oak Bay rivals uplands in prestige I don’t see why it’s worth 500k more. Especially since the older house in uplands is updated and looks well taken care of.

Barrister: $3.7M in 2016.

Marrko: When did the developer buy this property; if it was in the last ten years the city got robbed.

Have to love this….so the city of victoria has a real estate department with “Head – Strategic Real Estate” making over 150k/year and they just dropped $8,885,000 on a property on Pandora that the developer paid $3.7 million for….I think everyone deserves a bonus.

Of the two houses. it is hard to pin point the value without a pretty detailed set of inspections of both. This particularly true of the 1933 house. How old is the wiring, is it all update, age of roof, engineering report for the foundation. What updates on plumbing and age and state of heating system. All the usual. But new does not necessarily mean either high quality or trouble free particularly if this is planned as a long term home.

I’ve covered the report, it’s garbage in garbage out modelling

https://househuntvictoria.ca/2019/05/10/5-bajillion-dollars/

The beneficial owership registry is a concrete thing they are doing right now. Not just talk

One is landscaped/treed, character, tasteful with hydronic heating (for 500K one could do wonder plus add infloor heating in every room), and the other is characterless white scheme square box on 1/2 size lot, lack of landscaping with neighbour walls for view.

To me the 1933 house is much more value, and I would consider it over the new house even if both house price are on par.

One was built in 1933, the other is brand new.

There won’t be any crack down on money laundering here, just more, talk, reports, panels and hearings.

And if you believe the govt ML reports (which I don’t) , you’d know that Alberta supposedly leads the country in ML, with twice the ML that BC has. So by your reasoning, Alberta RE prices should be very high already. https://edmontonjournal.com/news/local-news/b-c-report-estimates-billions-of-dollars-laundered-in-alberta-each-year/

Patrick, think of it as BC helping out our friends in Alberta. If we crack down on money laundering here, then the money launderers move to Alberta and help support their suffering housing market. Win win.

Another way of looking at it is that the government discovered money laundering was a large problem in BC thanks to the panel finding it played a large factor in real estate prices. Making it harder to spend dirty in money can be a good goal on its own. Cracking down on the underlying crime is the police’s job. Not sure how the government can solve crime by passing legislation.

Also the underlying crime might not even be happening in BC.

Well yes, and and indication of that is that the only bad thing I’ve ever heard the govt say about money launderers is that they are driving up RE prices.

It’s easy to find articles about how the crackdown on money laundering will lower RE prices.

It’s hard to find articles that say a crackdown on money laundering will lower the rate of the underlying crimes.

Here’s the articles I found, these are quotes from the govt or govt press releases…

“Billions in money laundering increased B.C. housing prices, expert panel finds”.

https://news.gov.bc.ca/releases/2019FIN0051-000914

“Our government is tackling the housing crisis head-on and taking action to combat the money laundering has been allowed to drive up housing costs for British Columbians for far too long.” https://news.gov.bc.ca/releases/2019FIN0051-000914

2020: By cracking down on money laundering, stopping fraud, targeting speculators, closing loopholes, and making renting more secure, government is working to make housing more affordable for British Columbians.” https://www.princegeorgecitizen.com/b-c-budget-2020-no-new-relief-for-renters-or-homebuyers-1.24078870

Therefore, it seems to me the primary motivation for BC to take a huge interest in money laundering isn’t to crack down on the underlying crimes. It is to feed on the public’s belief that RE prices are high because of money launderers, and the govt is helping to lower RE prices. When have you heard the govt talk at all about the underlying crime rates, and which of the crimes are more important to concentrate on? They’re telling you in these articles that the goal of the ML crackdown is to lower RE prices, and not even mentioning the underlying crimes.

Can I have a few more chime in on my question below? Is south oakbay a more prestigious neighborhood than uplands now?

Can someone tell me why anyone would pay $2.8M for this house:

https://www.realtor.ca/real-estate/21541087/586-oliver-st-victoria-south-oak-bay

when they can get this one for almost $500k less?

https://www.realtor.ca/real-estate/21637956/3350-upper-terrace-rd-victoria-uplands

Things were looking up in Dec 1933 for real estate.

The $1.7M in sales volume for 1933, approximately $33M in today’s dollars, compares to $4.5B sales volume in 2019.

Stock market discounts all gone.

Mortgage rate down to almost free.

No amazing deals in the condo market yet.

Looks like it’s time to go all in BTC.

Leif: I am in Rockland and not the Uplands. Nice house on Upper Terrace though. A little bit over priced in my mind but I have not been in the house. (Mind you I think most things are overpriced and they still sell.)

Well when you put it this way society should be thanking those money launderers for helping the economy!

Reality is though the entire attraction of the crime is being able to use the money. If we made it hard to launder so people could only bury it in the backyard many of the crimes would never happen in the first place.

So what if a lot of the money is from money laundering?

The underlying crimes (drugs, thefts etc.) damage society, and should be punished, but the laundering of the money actually mitigates the crimes and allows the money to re-enter the economy, often with taxes paid too.

$1m in cash doesn’t help our economy, that’s dead money until it re-enters the economy and gets circulated again. For example, if someone made $1m cash as a “bookie” with technically illegal sports betting, that’s a minor crime. If he buries that money is his backyard he’s also hurting the economy. Now if he digs it up and launders that money and buys a house, he’s helping society, not hurting it. And if he pays tax along the way, even better.

Most people here on househunt hate money launderers for self-serving reasons, – mainly because they believe they are driving UP the price of Real estate. That’s the “real crime” for them. An illustration of that is that I haven’t seen much discussion here of a need to increase investigation of the underlying crimes (theft, selling drugs, prostitution, illegal gambling etc). Where are the calls for govt task forces, hearings, and expensive reports for investigating those crimes?

Well if they lost their job due to COVID. That could be a part time job (they can work 20 hours/week) or a full time co-op job.

But yes, a small minority of international students would qualify for CERB.

That is a really funny statement. Students’ main job is to study, most (if not all) Canadian students don’t even qualify for CERB (that is why government offered $1250/month support to them for this summer), how international students could qualify is way beyond my (possibly limited) imagination ….

Yes, any resident should be eligible. And that should include most foreign students and temp workers, and should likely be expanded to include all of them. This is “helicopter money” being borrowed by the govt (printed by the BOC) and there are plenty of examples already where it isn’t going to those most in need. But so what, it’s more about circulating money that will only be in their hands for a few weeks before it is spent in the Canadian economy on goods and services, which is the value of it. Because it doesn’t matter if a landlord or restaurant receives money from a temp worker or a Canadian citizen. Since the program is limited to people/businesses affected by CoVid, odds are high that the money will all be spent quickly in Canada, helping our economy.

Pretty sure Barrister lives in Rockland.

Anyone saying non-citizens in this context gets zero credibility from me. Permanent residents have all the rights of citizens except for a few exceptions such as voting.

/puts hand up

Hey barrister did you finally list your house?

https://www.realtor.ca/real-estate/21712749/3495-upper-terrace-rd-victoria-uplands

Not sure if it’s yours or not but the description you have written before seems to match.

I think the eligibility criteria are based on taxable income made in Canada in 2019. Why wouldn’t they be eligible if they are paying into our tax system. Also a lot people working in Canada on a temporary work permit are in the process of getting permanent residence. I worked in Canada for 2 years under a temporary work permit until my permanent residence application was approved (it took 3 years for the application to get through the system).

This part is misleading. Temporary workers that are only here for a seasonal job would probably not qualify and international students that did not have enough Canadian taxable income in 2019 do not qualify.

Also saying non-citizens would technically include permanent residents, and I assume that group is even bigger.

No no. The main value of SFHs are the land, check out the lot size and then compare again.

LeoM

You mean is happening??

207-1525 Hillside Avenue, Victoria, BC, V8T 2C1

$324,900 2020-02-20

$319,900 2020-02-25

$314,900 2020-03-09

$311,000 2020-03-18

$307,500 2020-03-23

$304,600 2020-04-06

$299,999 2020-04-09

$295,000 2020-05-05

Overall Change= -$ 29,900.00

Percent: -9.20

203-1000 Park Boulevard, Victoria, BC, V8V 2T4

$649,900 2020-02-20

$599,900 2020-03-03

$575,000 2020-03-09

$569,000 2020-04-21

Overall Change= -$ 80,900.00

Percent: -12.45

106-103 East Gorge Road, Victoria, BC, V9A 6Z2

$569,999 2019-09-03

$549,900 2019-09-17

$519,900 2019-10-03

$488,000 2020-02-24

$459,000 2020-03-18

Overall Change= -$ 110,999.00

Percent: -19.47

708-103 East Gorge Road, Victoria, BC, V9A 6Z2

$537,800 2020-02-20

$499,800 2020-02-25

$484,900 2020-03-16

$474,500 2020-03-20

$446,800 2020-05-04

Overall Change= -$ 91,000.00

Percent: -16.92

ks112 – requirement for $500k of renos to modernize?

Can someone tell me why anyone would pay $2.8M for this house:

https://www.realtor.ca/real-estate/21541087/586-oliver-st-victoria-south-oak-bay

when they can get this one for almost $500k less?

https://www.realtor.ca/real-estate/21637956/3350-upper-terrace-rd-victoria-uplands

No.

I said it wasn’t do-able if one has lost their job.

As in what was once do-able is no longer do-able.

Not sure how an all clear, could help out in this situation if there so many false negatives and everyone that tests negative you would still need to do a follow-up test.

It sounds like this test would be better suited to get a potential quick positive for people that have a high likelihood of having Covid-19, to get them into isolation quickly.

Lol James Soper, you are saying that a James Bay home should be affordable to the point where one person making 80k a year can carry the mortgage?

Can this possibly be true??!!

https://thinkpol.ca/2020/05/08/government-extends-cerb-international-students-foreign-workers/

If they ran a battery of tests, think of everything we could get rid of.

What’s happening in Vancouver will happen in Victoria too.

“Metro Vancouver condo prices plunge in April as COVID-19 pummels struggling market”

https://thinkpol.ca/2020/05/08/metro-vancouver-condo-prices-plunge-april-covid-19-pummels-struggling-market/

Assessed value is $1.092, or if you go by MLS it’s 1.11 (because they use last year assessment).

If you look at houses in the area, you’ll see just a few doors down at 48 Menzies St sold a year ago for more ($850k), even though it’s assessed at 900k (it’s also a 4 bedroom 2 bathroom, smaller plot of land though).

Not if one of them has lost their job.

There’s more government intervention to keep prices high than the opposite.

They were about to loosen the stress test before this all unfolded.

Interest rates have barely budged in over a decade despite very low unemployment.

So far, in 2 months, with absolutely mind boggling support from government. Like compare what’s happening now w/ what happened in 2008.

The amount of money being thrown around is absurd, and we’re only 2 months into this.

Don’t know how you continue that for another 10-16 months.

A 3600 mortgage is doable for a couple each earning 80k a year.

ks112:

I don’t know Ks112. If the Zolo data is correct about the size of mortgages, just in James Bay, perhaps Victoria might be skewing the data.

That monthly payment reflects an $800,000 mortgage. Yikes.

Marko Juras:

Perhaps the new price reflects the new market??

https://www.zolo.ca/victoria-real-estate/533-rithet-street

I don’t think the price adjustment had to do anything with the market as a whole; it was listed too high for the market when it came out at above $1 million.

I agree but the fact that it hasn’t dropped with all the government interventions is crazy. 1950s box have been trading hands in Burnaby for $1.5 +/- for two years when imo they should be somewhere around 800k to $1 million.

It’s like saying stock market crashed with COVID19…..well it did from the super short peak in February/March peaks but TSX is not down even 10% from where it was trading the bulk of last year.

QT

Well, if you’re patient enough, apparently the core will become more reasonable.

905 Lawndale Avenue, Victoria, near the Fairfield/Oak Bay border

2020-03-04 : $968,800

2020-05-04 : $899,900

533 Rithet Street, Victoria, BC, V8V 1E4

$1,110,000 2019-11-04

$998,000 2019-11-18

$899,000 2019-12-03

$849,000 2019-12-20

$839,000 2020-01-13

$829,900 2020-02-06

Overall Change= -$ 280,100.00

Percent: -25.23

Now you’re talking like a real estate board Marko.

45% higher than what? Quick check says in was one of the worst Februarys in 2 decades. Is it even above avg?

Detached market in Vancouver hasn’t had rising prices in 2 years now it looks like.

Yep. But the issue is we simply have no data on what percentage of properties have unclear ownership.

Land owner transparency act data collection is scheduled to start in June for all transactions. We will know more about all this by end of the year.

For sure it’s primarily a lower mainland thing

Patrick is correct that owning real estate through a corporation is usually done for legitimate tax planning reasons. Whether this is in a numbered company or not is irrelevant – the only difference being that a name search was done and chosen for the latter and this extra step and cost generally provides no utility for a non-commercial entity that doesn’t need a brand name.

The main issue in the money laundering report was the disclosure of beneficial ownership. This is applicable to those who hold RE in trust for a third party which is, imo, more prone to money laundering than corporate ownership.

We were likey going to see price appreciation this year in Victoria until COVID hit and that’s with the foreign buyer tax, spec tax, and everything else applied.

As for Vancouver it has dropped, but not substantially in those market segments that are within the grasp of people working in Vancouver. Sales in Vancouver in February were 45% higher than February 2019 so it was definitively stabilizing. Yet still It’s not like you can go to Burnaby and buy a fixer upper for 800k which in my opinion would be somewhat “affordable” to young professionals and then you could chip away at fixing up the place.

The first CoVid antigen test has just been approved (emergency use) by the FDA . An antigen test has the advantages of low cost (<$10) and rapid results. They are specific (low false positives) but not that sensitive (so high false negatives). So a negative result would be followed up by the standard PCR that takes longer. But that accuracy Is expected to improve with other antigen tests coming. This may lead to tests every day for high-risk workers (hospitals, dentist offices, Nursing homes, auto assembly, meat packing, airline passengers etc). Why not test everyone in high-risk situations every day if it costs <$10? The tests could be administered at drive-thru sites so every workplace or restaurant doesn’t need to become a hospital lab. We accept the time and cost of airport security screening, this testing may become the cost of the new normal to get things going again. Getting that “all clear” test would be posted to your phone and give you an all clear access to high-risk situations, including restaurants, flights etc.

FDA PR: https://www.pharmiweb.com/press-release/2020-05-09/coronavirus-covid-19-update-fda-authorizes-first-antigen-test-to-help-in-the-rapid-detection-of-t

“The U.S. Food and Drug Administration has issued the first emergency use authorization (EUA) for a COVID-19 antigen test, a new category of tests for use in the ongoing pandemic. These diagnostic tests quickly detect fragments of proteins found on or within the virus by testing samples collected from the nasal cavity using swabs. FDA:” This is just the first antigen test to be authorized and we expect more to follow”

This latest FDA authorization is for an antigen test, which is a new type of diagnostic test designed for rapid detection of the virus that causes COVID-19. Each category of diagnostic test has its own unique role in the fight against this virus. PCR tests can be incredibly accurate, but running the tests and analyzing the results can take time. One of the main advantages of an antigen test is the speed of the test, which can provide results in minutes. However, antigen tests may not detect all active infections, as they do not work the same way as a PCR test. Antigen tests are very specific for the virus, but are not as sensitive as molecular PCR tests. This means that positive results from antigen tests are highly accurate, but there is a higher chance of false negatives, so negative results do not rule out infection. With this in mind, negative results from an antigen test may need to be confirmed with a PCR test prior to making treatment decisions or to prevent the possible spread of the virus due to a false negative.“

She was being rhetorical. There is no inherent difference in transparency between 1234567 BC Ltd. and Big John’s RE Holdings Ltd. The former just sounds more sinister.

Down or not, the price reflect the demand because many people only want to live in the core, and can’t entertain the idea of living in the ghetto… “can’t stand Langford… Not to mention…it’s Langford.”

Patrick :

The provincial government disagrees.

“Right now, businesses operating in our province can hide their ownership behind numbered companies and offshore and domestic trusts,” James said.

“This is hurting communities throughout our province that are dealing with the consequences of criminal activity and high home prices, and it needs to stop.”

https://globalnews.ca/news/6087012/bc-hidden-home-ownership/

What does that have to do with construction jobs disapearing?

Hey Marko, what happened in 2015-16 to cause a huge run up in prices here?

Bunch of people came over from Vancouver.

Why do you think they came?

Foreign Buyers in Vancouver.

Ergo…

Right, and there’s nothing special or sinister about a numbered company that gives it anonymity or secrecy. Because if the numbered company instead calls itself ABC Enterprises, there’s no difference than the default name e.g. 123456789 Inc,

Real estate transactions in particular see numbered companies when it makes sense for a company to exist solely for the purpose of holding real estate. Why bother with a name? It’s usually for legitimate, routine tax reasons, and not to do with hiding ownership.

I said in Victoria thought….

There have been years where I’ve been involved in 100+ transactions and not seen a number company on a contract. It’s not super common, in Victoria.

Canada is continuing high immigration during CoVid…

https://www.cicnews.com/2020/05/canada-increases-immigration-australias-intake-declines-0514315.html#gs.5lpjv4

“ Canada inviting even more immigration candidates during COVID-19 pandemic

The coronavirus pandemic has understandably affected both country’s immigration systems, however Canada is still trying to come as close as possible to achieving the economic class targets outlined in its immigration levels plan.

In April, Canada issued 11,700 invitations to apply for permanent residence under its federal Express Entry application management system, compared with 7,800 the previous month, and 8,000 in February. In addition, Canada’s provinces continue to provide permanent resident pathways for immigration candidates during this period.”

Marco : “Foreign buyers and investors have never made up a huge % of SFH purchasers, in Victoria as much as people want to blame them for the run up in pricing.”

The data was never robustly collected, with numerous holes, and “Canadian” numbered shell companies could buy & transfer residential property, skipping the PTT.

In Vancouver, there have been agencies/realtors devoted to Chinese business; speaking Cantonese or Mandarin was a requirement.

I’m wondering if that might be a barrier and skew your perception, unless you are fluent, because the data seems full of holes.

Not saying you don’t know your business, but wondering if it’s possible that only folks catering to Chinese clientele were aware of the scale.

Marko Juras > I understand the things are down but they are down from such highs that it is still super expensive. For the same price here you can get a newer place in Oak Bay

…. or you can simply get a better deal as prices drop in Victoria, as well.

904-630 Montreal Street, Victoria, BC, V8V 4Y2

$1,249,800 2020-01-13

$1,098,800 2020-02-17

$998,800 2020-03-26

$978,000 2020-05-04

Overall Change= -$ 271,800.00

Percent: -21.75

429 Oswego Street, Victoria, BC, V8V 2B8

$1,165,000 2019-09-03

$1,049,999 2019-11-07

$999,000 2020-01-24

$899,000 2020-02-26

Overall Change= -$ 266,000.00

Percent: -22.83

I lived in Burnaby for a year and it’s not special imo……untouched 50s home still well into the 7 figures. I understand the things are down but they are down from such highs that it is still super expensive. For the same price here you can get a newer place in Oak Bay -> https://www.realtor.ca/real-estate/21821235/2111-sutherland-rd-victoria-south-oak-bay

The Case-Shiller comparison data published by ThinkPol Media (Openhousing.ca) shows a different story than the skewed benchmark pricing data. It isn’t just the high value properties with large declines anymore. Data just released show Van condo values were hit particularly hard in April.

https://thinkpol.ca/2020/05/08/metro-vancouver-condo-prices-plunge-april-covid-19-pummels-struggling-market/?fbclid=IwAR21f2tQvT3YxSkAqLKn3tnN7vt4OvE-bTz4lGwlVs3U5RQxJXmKhx1e1zg

50s box in Burnaby is still a crazy $1.3 to $1.6 mill….that’s great that a $8 million dollar home is $6 million but doesn’t really help the average Joe.

That’s exactly what they were saying about Vancouver a couple of years ago. Did they start making more land?

https://twitter.com/mortimer_1

Still seeing people moving here….not sure that COVID19 will make Victoria less attractive in terms of relocation in the long term. First time buyers these days are usually in their mid 30s with pretty solid jobs. Investment, I agree; however, I think this factor will be more pronounced in condo market weakness versus the SFH market.

I just looked at my buyer database again and had to go back to 2017 for the last time I represented a buyer on an SFH acquisition where they didn’t move in.

Foreign buyers and investors have never made up a huge % of SFH purchasers, in Victoria as much as people want to blame them for the run up in pricing.

In my opinion immigration (if it drops substantially) long term will the biggest factor on real estate in all of this…..but yea, not sure if lack of potential immigration will impact SFH core prices. I’ve helped 7 Croatian families (country of only 3.9 million) buy in Victoria (small place) in the last 24 months and all 7 have been in Canada for less than 5 years. None of the 7 managed to swing a SFH in the core, closest is 2 SFHs on the Westshore.

The pressure on real estate 300,000 +/- immigrants put on every year has to be a huge factor. It’s not just immigrants it’s that they are highly skilled and often buying real estate within a few years on arrival as is evident by farms not being able to find employees to pick produce.

“After this massive amount of housing being built currently makes its way through the construction pipeline. Are they going to continue to build new units if immigration doesn’t pick back up?”

James Soper, you are misunderstanding one fundamental fact regarding the Victoria housing market. There just aren’t a significant supply of new or old product coming on in the core, especially SFHs which is what most on this forum are interested in. Even if you got $1.5M ready to go you probably still can’t get exactly what you want (assuming non-uplands and no water views) when it comes to getting a SFH in the core.

That is the attitude that got us to the current historically high level of consumer debt, which is a bigger problem than the pandemic in the long run IMHO. It won’t go away with a vaccine.

Pretty darn fast, by the looks of it:

https://www.timescolonist.com/news/local/clearing-surgery-backlog-will-take-at-least-17-months-and-cost-millions-province-says-1.24131366

Also, dentistry is set to reopen “mid-May onwards,” according to the B.C. government’s Restart Plan:

https://www2.gov.bc.ca/gov/content/safety/emergency-preparedness-response-recovery/covid-19-provincial-support/bc-restart-plan

Car sales have sunk. Construction is fine now.

After this massive amount of housing being built currently makes its way through the construction pipeline. Are they going to continue to build new units if immigration doesn’t pick back up?

Most people I know in govt aren’t buying houses. They already have houses. All the doctors and lawyers (who aren’t doing that great through this) as well. People that are buying houses are generally people that are moving here, or are first time home buyers, or buying as an investment. If hospitality/Retail staff aren’t able to rent + lack of students, that kind kills that demand.

oh and I would take a grain of salt with those figures of people deferring their mortgages. It doesn’t mean they need to get a mortgage deferral to keep their house, it just means they think they are better off getting a mortgage deferral than not so they got one. People take advantage of free money its simple as that (and yes I know the mortgage deferral you have to pay back blah blah blah, but it is still super cheap cash flow deferral)

Kinda of similar to how apparently the owners of the Kegs and also the Bard banker/Irish times went to city saying how they can’t survive another month of shut down and wanted help. Like seriously? you’ve been in business for like 20 years (making most likely consistent excessive economic profit because of the virtual monopoly they have in town) and you can’t survive for 2 months even after you laid off your staff?

Basically, baristas and coffee shop owners aren’t buying houses in Victoria. Same with most people in the tourism sector, I dare say. Insofar as many of these folks are renters, who may have troubling paying their rent, they will affect the RE market from that angle.

Interesting to see all those “Retired; bought with cash.” That’s called wealth, and it plays an important role in the market, IMO. And unlike jobs and incomes, wealth is harder to identify and track.

oopswediditagain, getting a $35K job back once the economy re-opens is one thing but transitioning from a $35K job to a say $65K job is another thing. just because the 25-34 year olds grew some ambition in the last month, won’t necessarily translate them into getting into a higher paying job right away..

Viking Air did lay off quite a few people in late March I believe, those are decent paying jobs that won’t be coming back for awhile.

Sorry to sidetrack a bit. I know someone who used to work in StatsCan as a field interviewer. The 10 day Labour Force Survey (for the job/unemployment numbers you are using here) is done each and every month, via calls/ house visits (online after the 1st month, for 5 more months). He said most people are reasonable and understand this is a very important (and mandatory) survey, but there are some people who don’t want to do it, and are very mean and rude to the interviewers. The interviewers get yelled at, not answered/slammed doors/phone calls, missed and kept changing appointments, … My friend is retired now, but he said If not for those very friendly people to make it up, not many people can last long on the job.

So please be kind and responsive next time, when you receive visit/call from StatsCan, especially the local field interviewers (they have badges and can be checked and verified, also StasCan always sends a letter to the household beforehand). Thank you.

ks112 > What about them? Are they a big player in the housing market in Victoria, are they all in dire financial situation?

I guess you have to consider who the big players are in the housing market and I doubt that you’ll get much argument from anyone in stating that it is the first time home buyer. Without them, you just don’t have a move up market.

How much money do these Millennial buyers make? Leo S answered that for you back in June of 2019. Are they going to be a driving force? It would seem that they weren’t that interested last year. Perhaps a couple of months in isolation may have increased their ambition or maybe they are the ones most affected by the unemployment numbers that we are seeing.

https://househuntvictoria.ca/2019/06/12/victoria-millennials-y-u-no-own/

Overall similar drop in employment across several cities across the country with Montreal and Vancouver having larger drops.

Interesting, Victoria shows a 2% increase in employment in Sciences (which would encompass much of high tech field), vs 10% drop in Vancouver. Also no decrease in trades whereas Vancouver has a decrease.

Bigger drop in Education/Government employment here though (-7% vs -2.5%)

Note 3 month averaged figures so the percentage is not reflective of full drop.

Library jobs will be back shortly. Doesn’t really matter how much they get paid. The only real drag on the market are those jobs that won’t be back in 2-3 months

Tourism, some chunk of retail, food, and related (trucking).

Unionized and stable and I guess it depends on your position. Admin and librarians are fairly well-paid. At the GVPL the CEO gets 165k/year. At least 21 employees over 75k, half of those over 100k. https://www.gvpl.ca/wp-content/uploads/2019/07/GVPL-SOFI-2018.pdf

Sorry, 10%-15% is the number the big banks are quoting for Canada-wide deferrals. The survey linked below suggests a bit more of a dire situation for Vancouver though:

“Only 68% of home owners said they could pay their full mortgage payment last month, and only 55% said that they will be able to do the same in May. On property tax, 25% said they will pay less than half of their 2020 tax bills, with six percent planning to pay nothing, according to the Research Co. survey.”

https://www.squamishchief.com/vancouver-mayor-warns-of-drastic-measures-without-federal-and-provincial-government-help-1.24116805

Who knows how accurate that survey is.

On Marko’s list, I’m not sure if we can assume some jobs are as safe as they once were.

E.g.

Government/Uvic (huge hole in tax base will probably force layoffs) (7 of 28 = 25% of Marko’s list)

Bank employee (I’m with TD and I asked yesterday when they’re opening up their Millstream branch again, and they said maybe they won’t). (2 of 28 = 7% of Marko’s list)

The rest look solid, although it will be interesting to see how quickly medical professionals such as doctors, dentists etc will ramp back up to full income.

Yes we do not have data for the number of mortgage deferrals by region

10-15 percent of Victoria home owners applied for deferral? Where do you see that? If that 10-15 percent is Canada wide then Alberta and some of the other provinces probably skewed the data.

also is working at the library really a high paying job?

The one friend I have in hospitality my father and I hired him to work on our construction site the day after he got laid off.

Vast majority of people I know are fine. Thing is outside of construction our economy doesn’t produce much. At this point and time multiple friends in IT, no impact. Tons of friends in health care, no impact. Government, no impact. Military, no impact. I just quickly scanned through my last 50 buyer deals and I can’t see more than 2 having been hit hard. Some of my buyers in the last 12 months…it’s pretty stereotypical.

etc…..

People have likely deferred for all sorts of reasons including helping out family members who have lost their lower-paying positions. Some higher paying positions have also been affected in an interim manner where lay-offs went into effect but there will likely be a recall to work later. For example, municipal and library jobs.

Makes sense, but on the other hand, why would 10-15% of current mortgage holders just have applied for deferral if this only affected low paying jobs? Could we not assume that at least 10-15% of new mortgage applicants would be similarly negatively affected?

Keep in mind that many of these people could have a higher paying spouse, and the couple could have been in a position to buy but no longer are.

I expect that by the end of the summer we will be a lot closer to normal for economic activity. As the province opens slowly a lot more old people will die but hopefully without swamping the medical system. I am concerned that some industries such as tourism and restaurants will have a very difficult time of it.

If I had to guess I suspect that SFH will only have a small drop but that condos could take a real hit.

Agreed. Complicating factor is that LFS surveying is pretty sparse, so data at the municipal level is pretty bad. Victoria unemployment rate is 7.2 in April, but I believe that’s still a 3 month averaged figure.

Leo, looking at the labour force survey and taking into account the fact that BC hasn’t shut down construction, i just don’t see any material losses of decent paying jobs here in Victoria. It’s mainly the hospitality and retail staff that are SOL and I doubt those are the ones that were going to be in the market to buy anyways. Maybe a large portion of the people looking buying a condo so they can do air bnb’s will think again that’s pretty much all I see happening on the demand side. Curious as to your thoughts?

Well I suppose maybe there’s a few more starving realtors and car salesman rooming the streets.

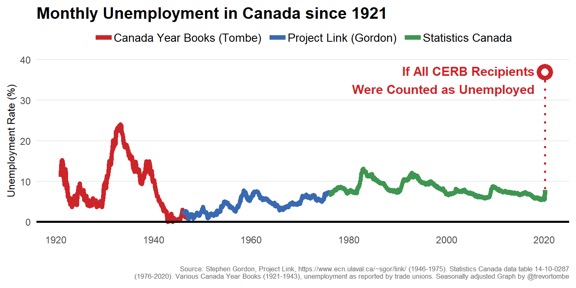

The official number of unemployed has always understated the number of people not working. If you’re not looking for employment they don’t count you. CERB covers many people who would not be counted as unemployed by the standard definition, e.g. self-employed with loss of income, employed but working short hours, or caregiving.

Trevor Tombe knocks it out of the park on the analysis as usual https://twitter.com/trevortombe

My statement was in general, not Victoria specific. Haven’t dived into the Victoria data yet

Leo my question was which high paying sectors in Victoria are hard hit.

So 7M CERB applicants and 5.5M people unemployed or with zero hours worked. Leaves 1.5M unexplained but could be lots of legit reasons for that including people working half the month. I don’t think fraud rate is that high.

Record high consumer debt was already a big problem and mortgage deferral will make it even bigger. As I’ve said, I think we were already in trouble before this pandemic and I don’t things are going to be just fine once it’s under control.

You will probably be better off deferring your mortgage and putting those funds in the shares of a Canadian bank……

Although the huge number of mortgage deferrals points to problems among many homeowners, mortgage deferrals are being offered to over 90% who ask, and expect to be given for at least 6 months and perhaps indefinitely after that.

This should prevent a huge spike in delinquencies or foreclosures until 2021 – hopefully there’ll be a vaccine and economic recovery by then and it won’t be a big problem.

This contributes to the “deep freeze” where everyone is in a “wait and see” approach to everything – the virus, their job, and buying/selling a house.

We’ll find out tomorrow. April jobs data out.

Leo just curious which sectors that pay decent in Victoria has experienced large layoffs? Salary freezes sure, not sure about actual layoffs.

No doubt that lower income jobs have been hit the worst. But still substantial layoffs across all sectors. Biggest question is what percentage is still laid off 3 months from now.

I thought it was a foregone conclusion I was providing anecdotal evidence when I referenced “personally”….

Anyways, maybe I spoke too soon, I just got off the phone with someone I deal with at one of the big 4 accounting firms in Vancouver, and apparently most of the big 4’s are forcing unpaid leaves and starting layoffs in some groups (Corporate Finance, M&A etc..) as deal flow is pretty much none existent currently.

I just compared my March CC bill to my April one (my billing cycle is on the 20th so its a perfect pre and post COVID comp). I saved around $1200 due to the lack of lunch, dinner and drink options…. I think I may look at adjusting my habits after things are open in couple weeks, it is a bit ridiculous.

We’ll call it the Barista Theory of Real Estate — which holds that when baristas are in big trouble, RE is in big trouble.

I’m looking forward to Leo’s analysis on this question. My gut sense is that there are enough people not only who didn’t lose their job but who are sitting on some cash, waiting for an investment opportunity to arise — and this will prop up the market a decent bit.

Yeah, it’s kind of crazy, but there are gonna be those who come out ahead (in some cases, way ahead) from this pandemic.

And I’m guessing the same old thing will continue to happen: the rich(ish) get richer and the poor(ish) get poorer.

Somebody I know in the trades was on EI when this started and in the process of changing careers by working on getting his class 1. Due to ICBC cancelling drive tests he was forced to put that on hold. After sitting home for 6 weeks he got tired of waiting so started looking for a job last week and got hired within a day as a mechanic. He started this Monday.

Anecdotal, but I’m seeing the same among my family, friends, and neighbours. Public servants, professional services & med. service, and construction folks are all finding ways to keep working… even if a bit subdued. No doubt there are some extremely difficult situations happening out there… but I think the average Victorian is making out alright. I’m personally saving money by not commuting…

“What about the owner of the coffee shop? or the owner of the retail store where neighbourhood barrista spent their money? or landlord who housed neighbourhood barrista?”

What about them? Are they a big player in the housing market in Victoria, are they all in dire financial situation? Me personally, I have on friend that is a chiropractor who went on CERB (he will be back to work in couple weeks looks like), that’s it, rest of them are all business as usual. Maybe others have a bunch of friends whom are done hard by this, but I just don’t think there is any significant pain felt in Public sector, healthcare, tech, or trades so far. Employees in those sectors probably account for most of the folks buying homes here.

I will never understand the desire to live there, or, to pay that much for that kind of auditory torture.

All I ever hear is chickadees, towhees, and maybe the odd owl. Most evenings I can sit outside among the trees and hear my own pulse. I think my goal is to one day, actually forget how to get to downtown 🙂

Never made that statement but okay.

I just said he was on drugs for talking about pent up demand when 10 million people had lost their jobs in 2 weeks.

It’s now been a month and the US is at what 30 million? 40 million? Hard to keep track of how many they’ve lost.

In this article he says to keep an eye on those missing jobs.

Sleeping? This is the place of never sleeps, with all the noise from shipping yard, float planes, car and people traffic day and night. Only good for AirBnb and VRBO, when and if they come back to life.

Janion units passed $1000/sqft back in 2017 and never went back. Recent sales at more like $1150/sqft. I thought the AirBnB restrictions in Victoria would slow it down but they didn’t.

Not that they’re flying off the shelf these days…

My bedroom closet is more than 1/3 that size. I hope they like sleeping whilst standing up.

Assessed $281,800 and asking $319K for 260 sqft. But here’s an opportunity waiting for you…

Looks like he’s taking his price point from unit 220 which sold for $320K in February.

https://www.bcassessment.ca//Property/Info/RDAwMDExSFZFMw==

I love it. Leo validates Soper’s least favourite economist.

So many.

I think we can keep up close to this level of support for a lot longer than many think.

What about the owner of the coffee shop? or the owner of the retail store where neighbourhood barrista spent their money? or landlord who housed neighbourhood barrista?

Finally a place with shopping bearby, heathed floors, and high-gloos cabinetry

MLS #424732

Markdown syntax works.

So right angle bracket (aka shift period).

Everyone keeps talking about unemployment, how many people who make say $60k a year or above has actually lost their jobs due to COVID? These are the people who will be in the market to buy homes. It really doesn’t matter if your neighborhood part time coffee barrista is on CERB. And for the ones that haven’t lost their jobs, are they really that scared to spend going forward?

“Right, check out this on TC yesterday: “The Greater Victoria School District 61 said 33 full-time teaching positions are being cut and $6.3 million will be lost as a result of international student enrolment dropping by almost half in 2020-21.”

Just a hunch, but based on teacher demographics I would guess a significant number of existing FT teachers will opt to retire early, or drop down to TOC teaching, freeing up some jobs. There may still be some layoffs, but I doubt it’ll be a slaughter. I personally know a few teachers nearing 60 who have thoroughly enjoyed the forced taste of retirement and don’t want/need to return to the disease factory…

edit: can someone tell me how to quote another comment please? thanks in advance

Sorry, but a bit tired seeing this complaint over and over.

Dr Henry has repeatedly stated the impact to seniors in her daily briefing, plus multiple times with charts showing the fact. What more do you need?

If one lives long enough to age 60 and still doesn’t have good sense to pick the message or just wouldn’t listen, then there is nothing anyone can do .

Actually we like the way BC handling this pandemic, they give us the science and the direction, but treat adult like adult and trust us. Not like in Ont who treats adults like children, or in AB who puts politics over the top.

Local Fool said:

LookingAtOptions, I think that both of you are right in regards to stimulus. You’re bang on regarding the market’s interpretation of the QE but Local Fool is correct in stating that the money isn’t about stimulus. All governments are doing their damndest as Patrick has outlined to ensure liquidity in the markets to avoid another Credit Freeze such as in 2007/2008.

The Markets may be having a heyday with this liquidity and their perception of where it’s heading but on Mainstreet any money that people are receiving is, by majority, going to pay debts .. mortgages, rent, car payments, cellphone payments.

Two very diverging reactions. We shall see how the markets react to numbers coming out over the next several weeks.

Well, I am glad that you weren’t one of those realtors telling your clients to buy first and then sell your home afterwards because the market was red hot. Your experience has clearly taught you that your client doesn’t want to hear your opinion on market direction.

Right, check out this on TC yesterday: “The Greater Victoria School District 61 said 33 full-time teaching positions are being cut and $6.3 million will be lost as a result of international student enrolment dropping by almost half in 2020-21.”

https://www.timescolonist.com/news/local/international-student-enrolment-plunges-teachers-facing-layoffs-1.24130292

Because the government is taking out “loans” (bonds), lots of them!

They buy govt bonds and other financial instruments, paid for by the created money. E.g. they create $5bn of money, and buy $5bn of bonds and those offset in their balance sheet. That lowers interest rates and increases money supply. It helps asset prices for bonds and stocks for sure, I’m not sure if it helps Main St.

But who other than the Bank Of Canada is going to buy the minimum $200 billion of new bonds Canada govt will need to issue for this years deficit? If the bank of Canada is the only buyer and they are monetizing the debt, our dollar could fall. Big currencies like US, Japan and EU can get away with this, but not the peripheral players like Canada without tanking our currency (against the US dollar anyway).

Canada govt has pumped $150bn of support to people and companies affected by CoVid, and this economic support is expected to last only about 3 months. The economy is running on these “fumes” at the moment. But they won’t (can’t) keep up this level of support for long, so things are going to start to reflect the reality of 25% unemployment.

Let’s hope the virus problem goes away before that happens.

How does the central bank print money if no one is taking out loans?

Canadians are already so highly indebited that it’s going to be much more difficult to increase the money supply.

Since the start of the pandemic, for the 785,000 people on Vancouver Island (health authority region includes part of mainland )

…

These statistics are among the best in the world, and show how remarkably well our BC public health, govt and health care systems have performed so far, and we all hope this continues!

Source Bccdc.ca

My POV is that the current economic recovery, the longest ever, was already running out of steam and we were headed into a cyclical recession. So we will get a deeper and longer recession. Could be a lot like the 1980’s recession which BC really didn’t start climbing out of until 1986.

Looks like the province is going to slowly reopen. I understand that it is important to be reassuring but I would rather see a much stronger message to to vulnerable groups which is just about everyone over 60 that they have to continue to social isolate. The simple fact is that if this virus starts tearing through Oak Bay the hospitals will be swamped and considering the backlog of diagnostics and surgeries that we already have this could put us on the edge of a disaster.

Since I am in one of the highly vulnerable categories, the thought has really struck home that even going for a walk will be more challenging when, increasingly, most people start to ignore social distancing.

At this point I am glad that I am not stuck at home in a small condo.

Each to their own, just like every where else some are crappy and some are nice. However, I think that the price are a bit high in the present market condition.

Example:

2619 Savory Rd on 11761 sqft, lake front, treed lot – https://www.realtor.ca/real-estate/21790814/2619-savory-rd-victoria-florence-lake

209 Ashley Pl on 20038 sqft treed lot – https://www.realtor.ca/real-estate/21826259/209-ashley-pl-victoria-florence-lake

539 Treanor Ave on 10018 sqft treed lot – https://www.realtor.ca/real-estate/21778212/539-treanor-ave-victoria-thetis-heights

I don’t think anybody is saying we are not currently in an economic crisis. The unknown is whether the economy will bounce back quickly or stay in a long depressed state. You seem to believe the future will be the latter. Not sure why you seem so convinced that this is fact.

As for the stockmarket, it seems like most investors have priced in about 2 years of profit lost for the average company. Based on how many profitable years a company has left, if that is 10 years than their value should drop around 20%. For a company that still has 20 years of profit left, their value should drop around 10%.

There have been so many intelligent concerns on this blog in 13 years and they haven’t panned out at all. I understand his concerns, but the market doesn’t seem to agree with his concerns at this POINT AND TIME and he probably isn’t the only person in the world that is worried about things going forward given the COVID19 fallout.

Fortunately, most of my clients can think for themselves and aren’t so dumb to think that I actually have any clue as to where the market is heading. They call me to help them buy or sell, not to take out my magic ball and tell them which way the market is going.

I personally think the TSX should be at 10k right now, but it isn’t and I am not going to pretend I am smarter than the entire system and everyone else is a fool. As it stands right now the market does not believe there will be a complete collapse and I certainly will not attempt to short it.

I am sitting on all cash hoping the market tanks 10-20% but it isn’t happening. That’s just the reality.

Local Fool said:

March 20, 2020: Federal Reserve QE Buys Hit Record To Stem Coronavirus Stock Market Crash

…

“Federal Reserve quantitative easing has quickly ramped up to a record pace to steady the plunging Dow Jones Industrial Average and surging long-term Treasury yields. By week’s end, asset purchases meant to stem the coronavirus stock market crash will exceed the pace seen during the financial crisis.”

https://www.investors.com/news/economy/federal-reserve-boosts-quantitative-easing-yield-caps-next-dow-jones/

And what is quantative easing?

“The mainstream point of view suggests that the effect of quantitative easing (QE) is pretty straightforward in the stock markets. When there is an expansionary quantitative easing (QE) policy announced, the market becomes bullish and stock prices begin to go up. On the other hand, [later on] quantitative easing (QE) tapering contracts the economy, then the markets become bearish and stocks tend to go down in value.”

“The logic behind this is said to be relatively simple too. Well, according to mainstream economists, quantitative easing (QE) uplifts a depressed economy. Therefore investors see it as a sign of better times ahead and make a beeline to buy the stocks expecting growth in the markets. However, the corollary of the same theory would also mean that investors will react negatively [later on] to a quantitative easing (QE) tapering program”

How can there be any doubt that record amounts of quantative easing have not played a big role in reversing the recent stock market crash?

Consequently, how can anybody pretend that a market that is stable, but only thanks to record amounts of quantative easing, means that we are not experiencing an economic crisis?

And especially, how can anybody say there is no economic crisis when historically levels of high unemployment, high numbers of long-lasting and ongoing business closures, low consumer spending, mortgage non-payment (deferrals), etc, etc, are widely reported fact?

This is a good article on the stock market valuations by the way: https://www.nytimes.com/2020/04/30/opinion/economy-stock-market-coronavirus.html

Every country is in such a race to print money it’s almost hard for Canada to keep up.

Yeah I think much of the supply side depends on the length of the down market. 2-4 quarters is fine and past experience has shown that owners are in general quite good about doing whatever it takes to not sell into a down market. The risk comes if the recession and price declines drag on for much longer than that and you end up seeing more supply hit the market. Then it could build on itself.

I think this is why you often see rental incentives in the form of first month free rather than reduced rents as well.

Same, hugely underappreciated factor but very hard/impossible to measure or predict.

Good question. We’ll see if the stock market is right about that one. Some of the biggest investors in the world have been caught completely flatfooted by all this. The only thing I know is that I don’t know so I just hang tight.

You really love your straw men, don’t you? Go ahead and show me any predictions I have made here.

Hoping for lower prices does not equate predicting lower prices.

If you are talking about people that apparently made predictions here years ago, then it really makes no sense to reply to me or any other unrelated person as if we are them.

But if it helps you sound off to completely wrong people for therapeutic reasons, just say so. 😉

Oopswediditagain said:

Thank you mate, that is a well-worded reply. If you aren’t in property sales already, you should get into the business!

Sorry James but buffet and Charlie are well passed their primes now

Fascinating Sidekick. Glad you worked it out.

Because people are dumb.

When Buffett is selling, it’s time to get out.

Sort-of on the subject of credit…

I’m refinancing now after finishing up my build. Had pre-approved financing in place set to close April 15th. Lender (First National) came back and demanded a new home warranty as a new condition of financing.

As an ‘owner builder’, I’m required to personally provide the 2-5-10 coverage should I sell. I’ve now learned that it is possible to purchase 2-5-10 insurance from the same vendors that provide 2-5-10 to contractors, however, the price is crazy: $5K (minimum) and a 25K (minimum) bond held for 5 years. And, this only covers subsequent owners…not the owner-builder (if they happened to mess up).

Needless to say I wasn’t going to purchase this insurance, so the financing fell through. I talked to 3 providers of this insurance and they all said that it was really rare to sell one of these policies, but some owner-builders had been tripped up by lenders requiring it. So Marko, there’s a new topic for your weekly youtube vid.

As for credit, I noticed that mcap has frozen my heloc (not that it matters). My new mortgage (assuming it closes) is at prime. That is for a 50% LTV, well qualified family. I’d say lenders are most definitely being very cautious. Also had to prove that we still had jobs even though documents were only 6 weeks old.

Alexandra: Think I will stick with my little old character house, at least it is real mahogany on the trim and solid oak on the floors. Like me it is old,

Obfuscation seems to be your pattern of response, Marco. LookingAtOptions has outlined an intelligent concern regarding the economy and not only did you not acknowledge it, you belittled the individual rather than reply to the concern.

Let me respond for you.

Yes LookingAtOptions, I have some grave concerns regarding the direction of the market but I’m not at liberty to express that opinion on an open forum because my clients may have been advised differently.

You’re welcome, my friend.

I (think) I’m paying attention – and so far, I don’t think any of that money is about stimulus.

I can’t stand Langford. We drove through the Bear Mountain development on Sunday and even in the “nicer” parts, one could high-five their neighbor from the kitchen window. Not to mention…it’s Langford. 🙁

A teacher’s salary is also completely predictable if one has a continuing contract.

Don’t forget the awesomeness of your house being six feet apart from your neighbour’s house!

If I could predict things as well as you guys I certainly wouldn’t be on HHV complaining about real estate prices . Probably be somewhere on a boat in Croatia trying to figure out where to sail for lunch 🙂

Ohhh well…..bright spot is I should be able to buy my house back at 50% off when the economic catastrophe unfolds.

We don’t know what 30-50% unemployment means yet. If it’s temporary and goes down to 10-15% over the summer then the country might not collapse. If not then I’d say 2020 is it for Canada.

Thoughts on 1821 Hollywood Cr?

So have you honestly, truly, not heard anything at all about the crazy amounts of government stimulus that Trump (who measures his own success based on the stock market) promised and has been dumping into the stock market?

If you haven’t heard about that huge government stimulus, then you aren’t paying attention.

If you have heard of that huge government stimulus, then your argument above, asserting that there’s no economic catastrophe because the stock market is doing ok, is completely dishonest.

Also, if there is no economic catastrophe happening, why does a government have to dump craploads of stimulus money into the stock market?

We’re not in the midst of an economic catastrophe, eh? I can’t believe we’re even having this conversation.