A quick note about resiliency

We still don’t know how much of a hit the housing market will take from COVID-19. The initial shock of the lockdown is wearing off, and sales are likely to recover somewhat from the lows of the last few weeks over the summer. On the price side, we’ve seen some interesting outliers in the sales from motivated sellers, but it’s anyone’s guess to what extent that will translate to overall price declines. Much of that will take many months to sort out, as the temporary emergency income supports are likely to keep many on the margins solvent until late summer. Remember the real estate market as a whole usually moves very slowly, even if individual deals often necessitate moving quickly.

Overall prices are affected by economic factors like the unemployment rate, incomes, wealth, debt availability, population growth and many others, which translate into market metrics like inventory, affordability, sales, and months of inventory. The extent of the impact on prices (outside of individual deals) depends on where we end up on those metrics, and that is a function of the magnitude of the shock, and our starting point. If you’re going to get clobbered, better to take the hit from a strong position than a weak one.

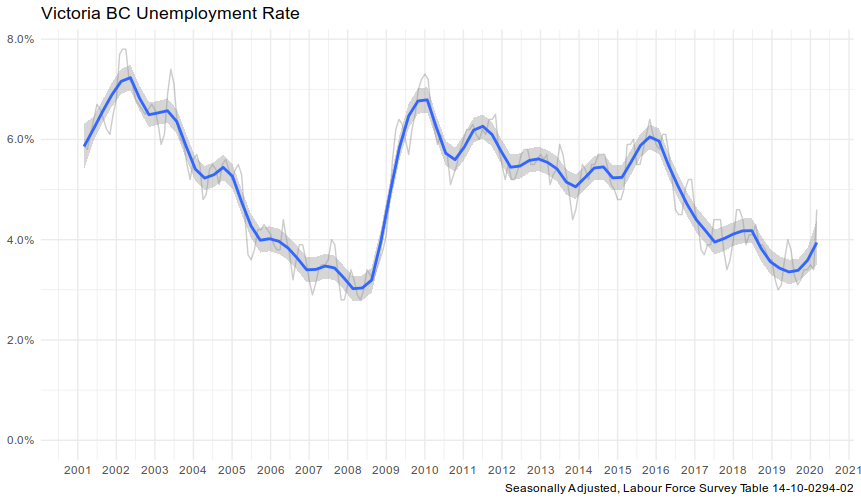

On unemployment, Victoria had previously been in a very strong position, with historically low unemployment rates and strong employment growth. That ticked up in March, and April’s unemployment will likely be into the double digits, which would be an unprecedented deterioration. But better to add 10% to a 3% unemployment rate than to a 7% rate.

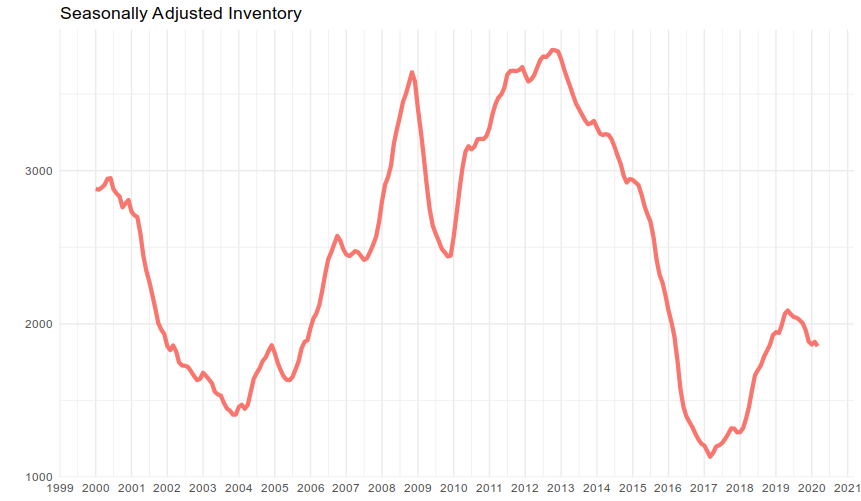

Similar with inventory on the market, while inventory had been building for 2 years since the recent low in 2017, the trend had recently reversed and increased sales were drawing down inventory. Overall we are in the lower third of the historical inventory range, and the market is relatively well positioned to absorb a surge in listings if it was to come.

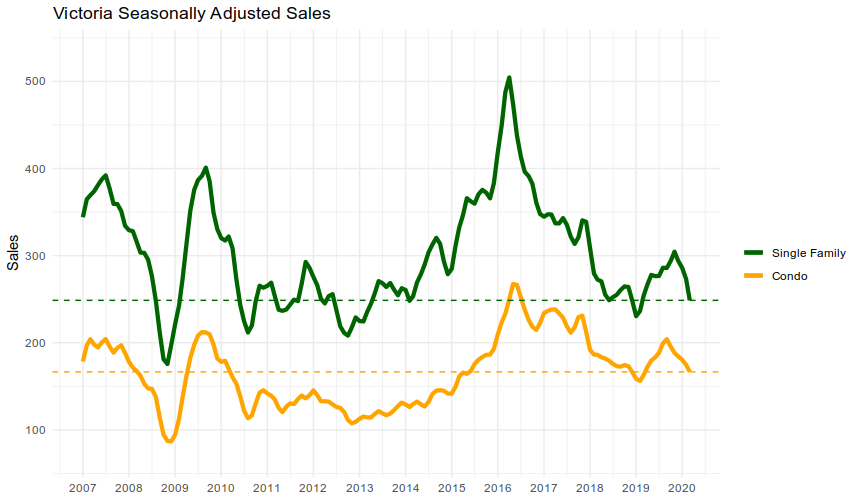

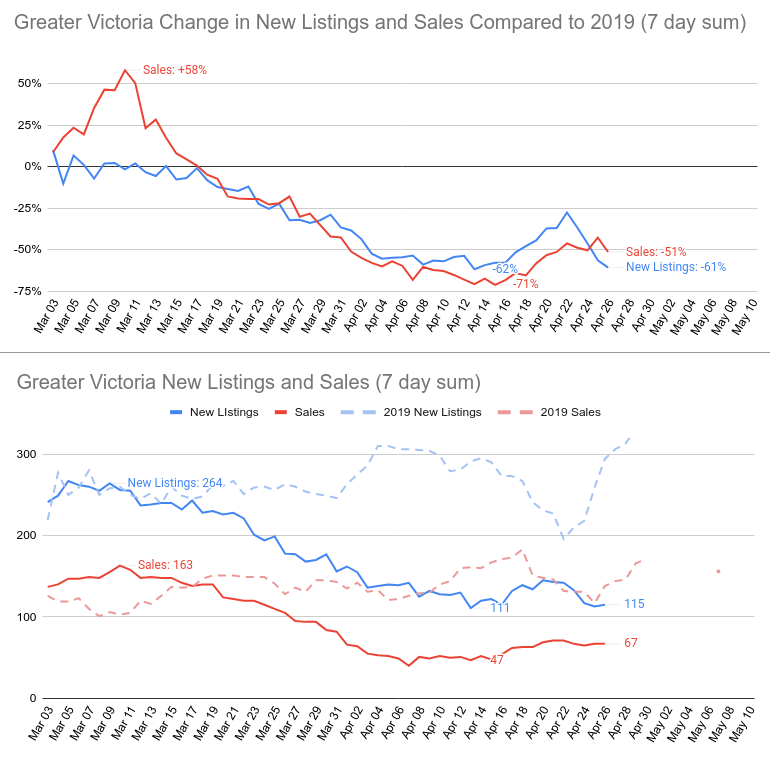

Sales are more of a mixed bag. While there was a bit of a surge in sales in late 2019, that had mostly diminished even before the pandemic. That may have been partially due to inventory constraints as I discussed here, but regardless it’s clear that sales were relatively slow and the current 50+% drops will put us into unprecedented territory as far as sales go.

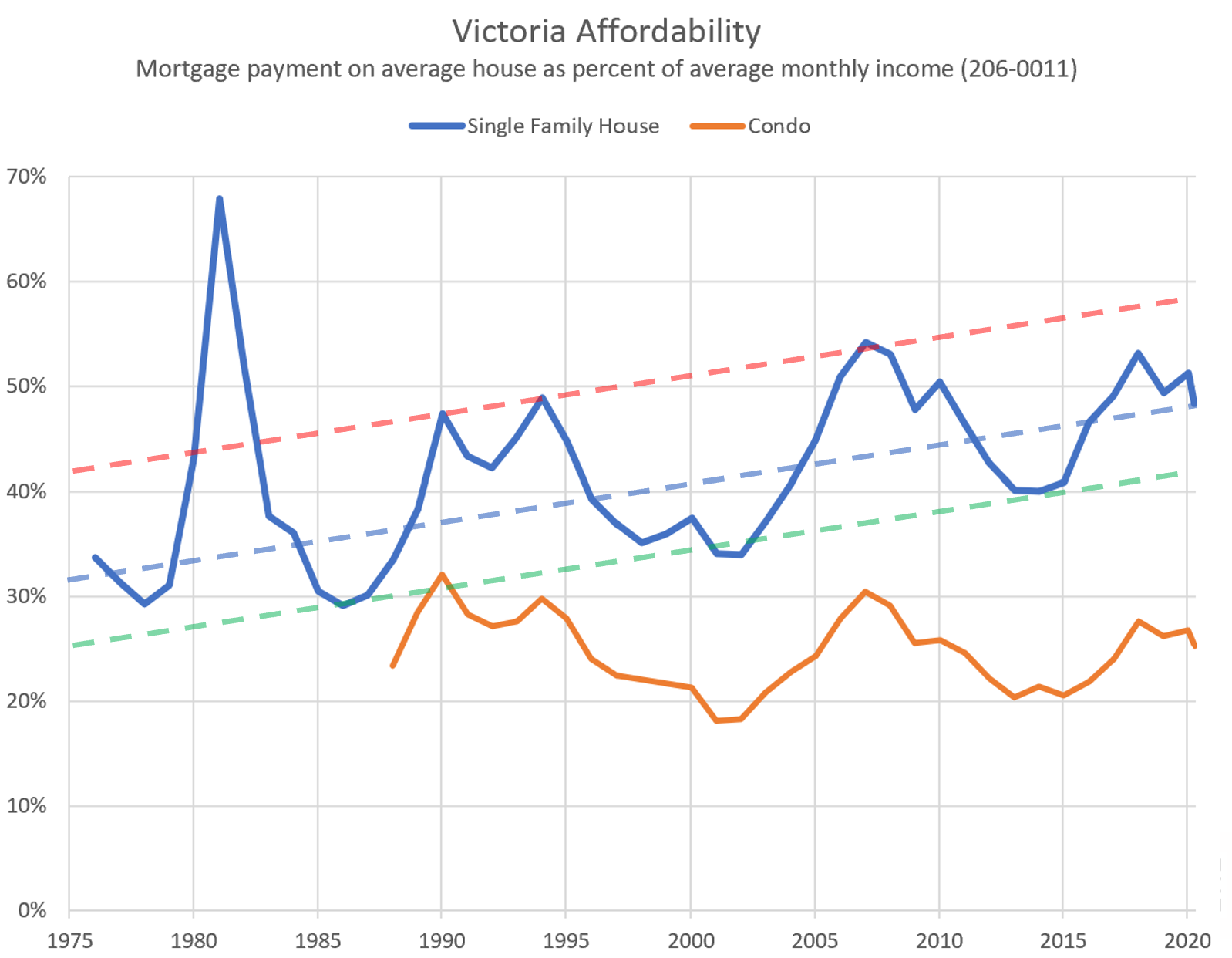

The introduction of the stress test in 2018 definitely increased the resiliency of our market. That, plus other demand-side measures like the speculation tax and foreign buyers tax put the brakes on house prices, and kept them essentially flat until now. That stopped the deterioration of affordability, and in turn decreased the vulnerability of our housing market to a shock like we are experiencing now. Both single family and condo affordability is in the middle of the historical range.

To be clear, I’m not saying that prices cannot drop, or affordability cannot go outside of historical ranges. If there is extended high unemployment or wage decreases that can certainly drive prices down. However we’re better positioned to absorb the shock now after two years of flat prices than if the market had kept appreciating after 2018. Previously the stress test rate was set to be lowered on April 6th, moving it from contract rates plus 2% instead of being based on posted rates. That plan would have increased buying power and boosted sales, but was shelved in order to avoid stoking real estate speculation while rates were dropped. The current regulators are concerned about goosing the market, but that may change if there are substantial price declines and even though rates don’t have much room to move down, the stress test gives them a tool to increase credit availability. Hopefully regulators continue to see the value of these kind of buffers going forward.

Sales

Sales have bounced slightly from the bottom of about 50 per week, with recent days coming in at just under 70 per week in the Greater Victoria area. Some of the initial shock has worn off, and the real estate, lending, and legal industries have adjusted by scrambling to move as many processes online as possible which is helping to remove physical barriers to transactions. Sales to date are down 59% from an already weak April 2019, but I bet we won’t revisit the 50/week sales lows until the fall or winter.

Note the change in relative sales is mostly due to the comparison to last year’s Easter weekend. It’s interesting to note that the small bump in sales was not mirrored by an increase in new listings. They dropped back down after a small post-Easter bump, which has prevented inventory from growing.

Also weekly numbers courtesy of the VREB for continuity purposes.

| April 2020 |

Apr

2019

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 36 | 95 | 155 | 233 | 696 |

| New Listings | 103 | 268 | 412 | 555 | 1392 |

| Active Listings | 2225 | 2268 | 2301 | 2303 | 2751 |

| Sales to New Listings | 35% | 35% | 38% | 42% | 50% |

| Sales YoY Change | -56% | -66% | -60% | -59% | |

| Months of Inventory | 4.0 | ||||

Canadian real estate is intriguing , especially in areas like Victoria . I cannot understand how a bank can give a person a mortgage for six or seven times of what they earn per year when the average family brings so little home at the end of the month. The top of the pyramid scheme is getting close , just look at the homes for sale and judging by the furniture and car parked outside most places look like they’re vacated by college students .

Leo I just saw your article in The Capital – i quite enjoyed it. Are you going to post it here?

Ha ha Introvert i’ve been reading this blog for a long time and I’ve never seen anyone call this place an “unknown backwater” – we are the capital of the Province, anyone who’s over the age of 10 at least knows the name of the city and most know it as beautiful. That is no secret. I have seen people disagree on the extent of that beauty and i would say, in general, people who live in a town quite often have a bias for it (quite often the reason they are living there). I used to work with some Saskatchewan boys on a rig and they loved where they lived in Northern SK. One had gone to school at UVIC and lived in Kelowna and he still said our Province had nothing on northern SK in terms of beauty. To each their own.

New post reposting my article about the rental market in the Capital: https://househuntvictoria.ca/2020/04/29/renting-is-getting-a-lot-easier-in-victoria/

Why is that?

Well whaddaya know. Surely an intentional pun (I know it’s the guy’s name, but they could have called it something else).

Haha. In this case “Tafe Measure” is the name of a company that provides floor plans

https://www.tafemeasure.com/

” Floor plans and room measurements are done by Tafe Measure ”

So much for that English competency requirement. The house is empty – was it even occupied after the previous sale?

That is why my name is YeahRight. I put yeah@right.com in the Email box and now I’m stuck with this username and email if you want to do any back searches of me…. Not that anyone would 😛

Been on the market for quite a while. Sold last on Jan 22, 2019 for $1,675,000. The back yard is nice but I always worry about having big trees that you are not allowed to cut down in the yard. Might be worth a look if you are wanting to renovate.

What’s a guy from the U.S. East Coast doing looking for a house in our fair city? And the bears tell us that Victoria is an unknown backwater…

The site uses Gravatar to show the pictures based on the email address you enter. It’s possible that some service you used in the past registered your picture with Gravatar and hence it is showing here. You can change it: https://en.gravatar.com/

Or feel free to use a fake email, there is no requirement that the email is actually valid to post.

It is pulling it somehow from my email.

Regarding assessments, its best not to value just the homes assessed value, but also the neighborhood value, that would provide a much more reliable view of where the price should be.

For example we just listed our home, we are downsizing and moving to the islands (even though we are on an island, we wanted to live in a smaller community 🙂 ) and I think our assessed is around 920k. All the other homes around us are assessed at 1.6million, 1.2million, 1.5 million, 6.5 million etc. Primarily based on recent build and then depreciated over the years. Ours home now is around 40 years old. Good bones though.

We had renovated our home extensively over the past 15 years we lived there. Never bothered to let bcassessments now of the renovations. Why pay more in taxes. It was was a single family home, just me and my wife.

When deciding on how to price it, we relied on our realtor, very frank and upfront, knowing we just wanted to sell, we did not care too much about the price, whatever the market price was would be good enough. Thus we came to a 1.25 million valuation. Currently finishing off some detail work around the house, pointing work (rock work), painting etc… and then we plan on moving out to the island.

From a seller’s point of view, we are not selling because we have, we dont want to rent, we did that before in Quebec and its not something that we enjoyed. Also codvid19 was a factor, since there have been so few infections on the island we felt safer to list, having people come into the house to view it.

If it doesn’t sell, well then I come out of my semi-retirement and work on my other online properties to pass the time and hunker down for 4 years.

But essentially thats just delaying our move by 4 years later. How much is that worth to me to move out earlier. Like Marko said there is some flexibility. As we age time becomes a precious commodity, it’s the same when we were younger.

I have been following this blog for while myself, I think 15 years now? Hardly post much, but very much appreciate the input of various professionals on this blog, especially Marco and Leo. Thanks for making us wiser in our journey. Wish everyone good health and a long life

Cheers

Steve.

You might consider dropping your picture from your profile, unless you don’t mind anyone here knowing all about you with 2 clicks of a mouse.

Assuming of course, the picture is actually you.

2505 Cotswold as a tear down thoughts?

A price drop always means the price was too high to start with, regardless of market conditions or locale.

Of course not. It is just the area I follow so I don’t know about others. The house being dropped 4.8% from list most likely means it was priced too high to start in this case imo.

Still listed above assessed value of $2,068,000.

However it’s the lot value properties that really get hit in the down markets and this isn’t one of them.

https://www.bcassessment.ca//Property/Info/RDAwMDBBNkJZVA==

97 Beach Drive, South Oak Bay. Listed April 4th and just dropped 4.8% from $2,390,000 to $2,275,000

Price drops are happening just not many but all areas are being affected by the virus and Oak Bay isn’t immune.

This year will not be a profitable one for many airbnb hosts, but many will mitigate by switching to long-term rentals, and a few will sell. IMO the majority of people who own rental homes on any type in Victoria will have the economic wherewithal to ride out some disruption due to equity and the fact that Canadian banks weren’t fans of using short-term rental income for mortgage qualification purposes – I guess we are seeing one reason why right now.

I haven’t seen a single “bargain” on a home in Oak Bay. Just nothing on the market and if something reasonable is listed it disappears immediately. It might still be a good time to sell for some.

‘A Bargain With the Devil’—Bill Comes Due for Overextended Airbnb Hosts

https://www.wsj.com/articles/a-bargain-with-the-devilbill-comes-due-for-overextended-airbnb-hosts-11588083336

Or if you hit the paywall:

https://outline.com/uSf8TP

New listings are so low that sales/new list ratio is actually higher now than this time last year.

If you care enough to share that much, would you be inclined to say what your decision was?

I’m curious.

And that’s why you don’t market time. Market is very irrational in the short term.

Tsx at over 15k today and it spent most of last year at 16k……go figure.

3340 University Woods

MLS 417 391

“Just reduced by $200k lower than government assessment value ($1.655mil) !!! ”

Sigh… another blatant lie. First sentence of the description. I like the three exclamation points to really highlight the untruth as well.

2019 Assessed $1,589,000

2018 Assessed $1,655,000

Quick question. How hard would it be for the Victoria Real Estate Board, since they are encountering such vast difficulties with programming, to simply put out a memo to all real estate associations and PRECs notifying them of the problem and instructing them to update the assessed value field owing to this issue when they put up the listing? That way they could ensure, and I quote from their website, they “provide its members with the tools and education they need to provide the best possible service to their clients.”

And here is a little quote I like from the Competition Bureau which seems to nicely fit this situation imo.

“The misleading advertising and labelling provisions enforced by the Competition Bureau prohibit making any deceptive representations for the purpose of promoting a product or a business interest, and encourage the provision of sufficient information to allow consumers to make informed choices.”

I made a BIG DECISION about real estate today and while this is a scary, uncertain time, I think I’ve done the right thing. I do not like making big decisions. The only way I can do it is if I have enough data and I’m a big picture thinker so, I need a LOT of data before I feel ready. Following this blog for the last five years has taught me a lot about the Victoria housing market and I don’t think I could have made my decision today if I didn’t have a sense of the big picture this blog has helped me form. Thank you for all the research, effort and thought you put into your posts! I, for one, am a grateful reader. And, yeah, we shall see what the coming months and years will bring but if everything works out, I should be a little better positioned to weather the next global crisis. Fingers crossed. Be safe, be calm and be kind. 🙂

Looks like the Inglewood house was listed for sale at $2.39 million back in 2015. Would have been much better off buying 3-4 Gordon head house back then as an investment.

Sorry.that was for you Steve.

Was that for Patrick or me? Agreed at 2.7 assessed at 2.2. I see some properties asking way over assessed but others actually selling being below. Inglewood is now under agreement which I thought was a good price. King George terrace has some tear downs but the assessed value on them has dropped 200-300k in a year and they are asking 2.2. Is there really a huge buyer pool for all these oak Bay prices?

Patrick: It might be that I am simply out of touch but more than 2 million for a house this size on a small lot seems less than good value.

Ventilator availability is on its way (production cost not calculated tax and labor cost $930 and $6,800 respectively) for VN domestic and international market.

Vingroup completes design of two ventilator models for COVID-19 treatment – https://vietnamnews.vn/economy/715972/vingroup-completes-design-of-two-ventilator-models-for-covid-19-treatment.html

“It took just three weeks for Vingroup engineers (Vinfast and Vinsmart) to complete manufacturing of the two models – VFS-410 and VFS-510 – with the strong support of relevant ministries, domestic and foreign health experts and Medtronic as Vingroup’s US-based partner.”

OK, if you only keeping it for a short time and don’t plan on cooking.

The downspout for the second level roof between the entrance and garage is draining onto the first level roof instead of continuous run into the storm drain, or at least continuous into the first level gutter in the direction of flow (increase chances of leakage and rotting), and perhaps the downspouts at the back/side of the house also is an issue.

Range hood is way too high above the island cook top that will do a poor job at venting cooking exhaust.

Modern house with old standard heating/cooling central return duct works so the hallways will be drafty and draft near the return registers, and uneven heat/cooling in every room.

One of the bedroom supply air register is in the opposite side of the windows so it is not efficient will have cold spot at the windows.

The supply and return air registers are right next to each others (short circuiting) by the wet bar so it is not going to work well in that area.

I’m seeing a large disconnect in say homes around 1.1mil and 900k in regards to quality. Anyone else seeing this? Does it mean anything to you?

Yes, and about 350 tests per day on Vancouver Island over the last few days, about double previous. Only one case positive on VI from the 320 tests done yesterday. Bonnie Henry said today that anyone dialing 811 with respiratory symptoms is offered testing now, which wasn’t the case previously. Their capacity is to test 7,000:per day, but they don’t have that many people with symptoms, and don’t want to test asymptomatic people. (They do plan on antibody testing for the community when available though)

Source Bccdc.ca dashboard.

4 days straight w/ over 2000 tests a day.

Looks like they’re starting to test more now.

Posting here on new page. Looking for a motivated oak Bay seller this year. Inventory is high so I want at or below assessed I was hoping.

Thoughts on 609 Oliver st? Mini lot and assessed at 2.2. lots of other newer homes on Oliver at 2.2 range. Would rather have more space in the yard if possible.

Thanks Leo for writing this article on our local housing market. I read it with interest.

I’m no expert, but a total of 97 in hospital due to COVID-19 in a province of 5 million people seems pretty good to me.

36 of the 97 are in intensive care.

https://bc.ctvnews.ca/b-c-announces-3-more-covid-19-deaths-50-new-test-positive-cases-1.4913324