Of price changes and gains

We all know the market is slowing out there and has been for quite a while. Well you may not know if you are reading the misleading newspaper coverage, but it is. Listings up, sales down, over asks down, price cuts are up, the picture is more than clear. But where are we really in the real estate cycle? Are prices crashing?

In the last three days there have been more price reductions than sales. It’s easy to interpret that as sellers chasing the market down, but in reality, this indicates something more general: seller mispricing.

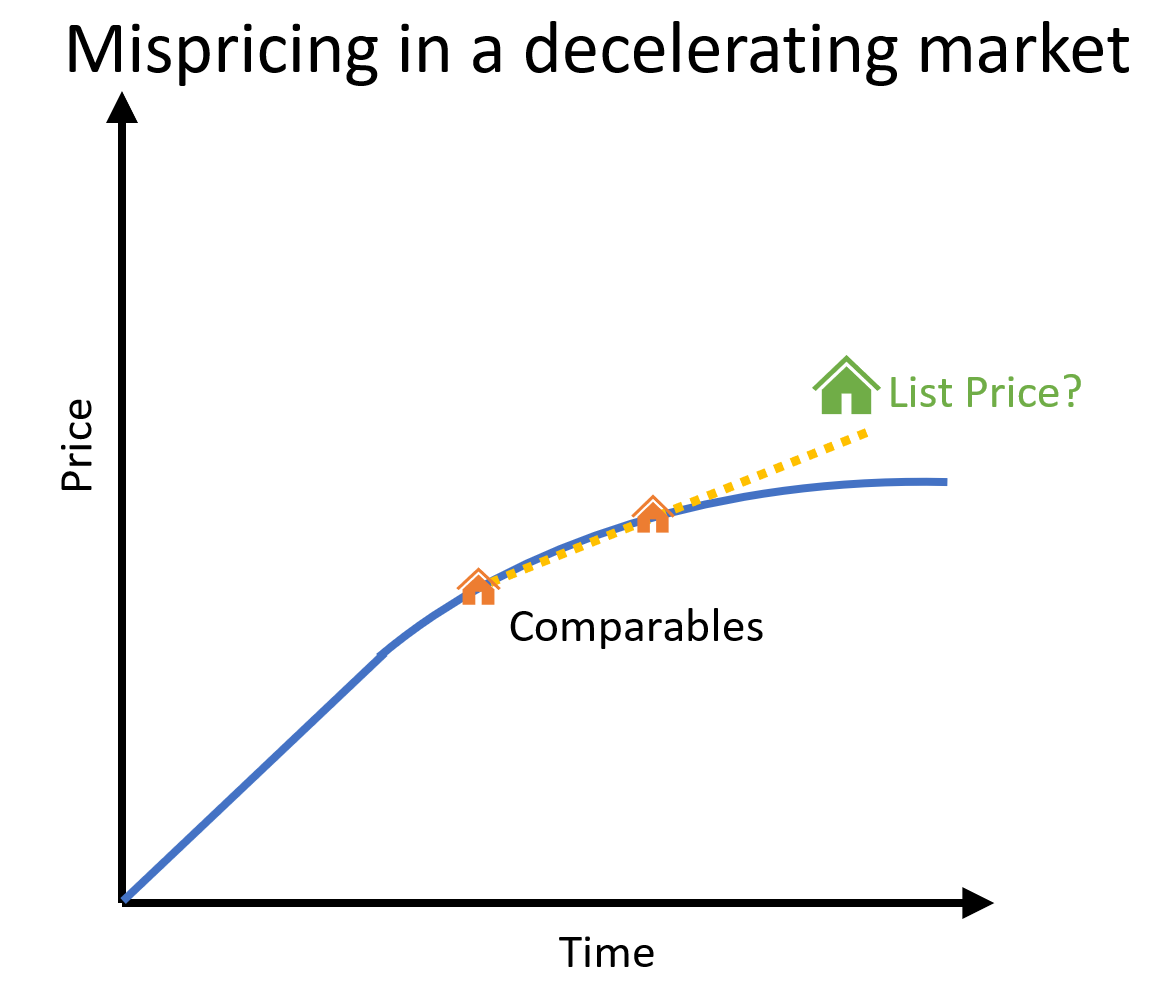

To understand why sellers are mispricing their properties so badly, you just need to understand how selling prices are generally set. When you ask a real estate agent what you should list your house for, they will pull a few of the recent comparable sales, adjust for when they sold and the differences to your house, and then estimate what your house would sell for in the present.

As a highly simplified example, if John wants to sell his house and an identical house sold 3 months ago for $500,000 and another house sold 6 weeks ago for $515,000, John might expect to list for $530,000. This method works well in a market that is stable (increasing or decreasing at a constant rate), but in a slowing market like we find ourselves in now, it results in a lot of sellers listing at a price that they later find out is above the market. We then see the current situation which is a lot of sellers dropping prices even though the price of houses are not declining yet. This phenomenon is illustrated below.

By the way, the same thing in reverse happened in 2016 when the market was heating up with the curve going the other way. Sellers were listing at what they thought was reasonable and were routinely surprised by bidding wars when the market had moved above their list price.

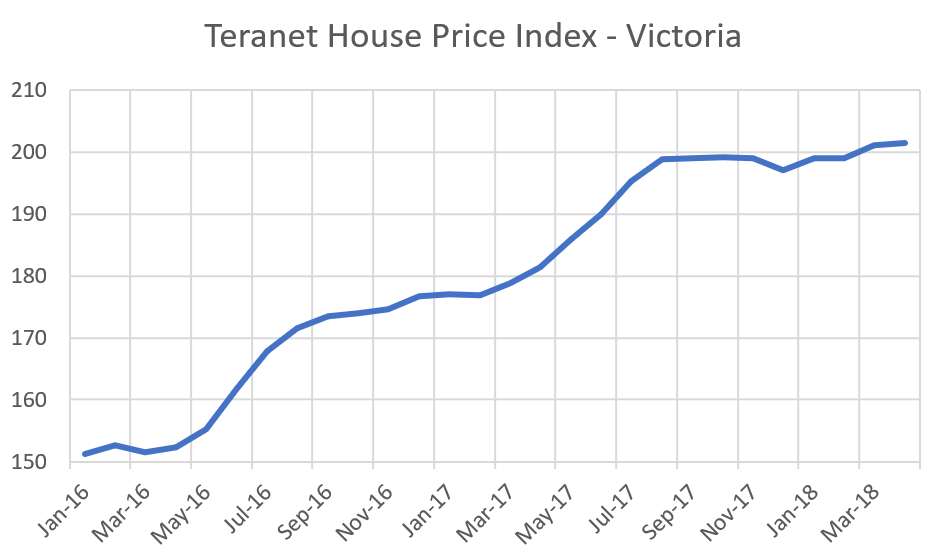

We’ve seen average and median prices for single family houses mostly stop their gains, but we know that those measures are influenced by sales mix and a lot of month to month variability so they aren’t the most reliable. The Teranet house price index has flatlined since last August while the MLS House Price Index continues to drift up slowly.

The house price indices are definitely useful, but I am always a bit wary of a measure that is completely inscrutable to anyone without a PhD in math and in the case of the MLS HPI will predict the price of something based on zero sales.

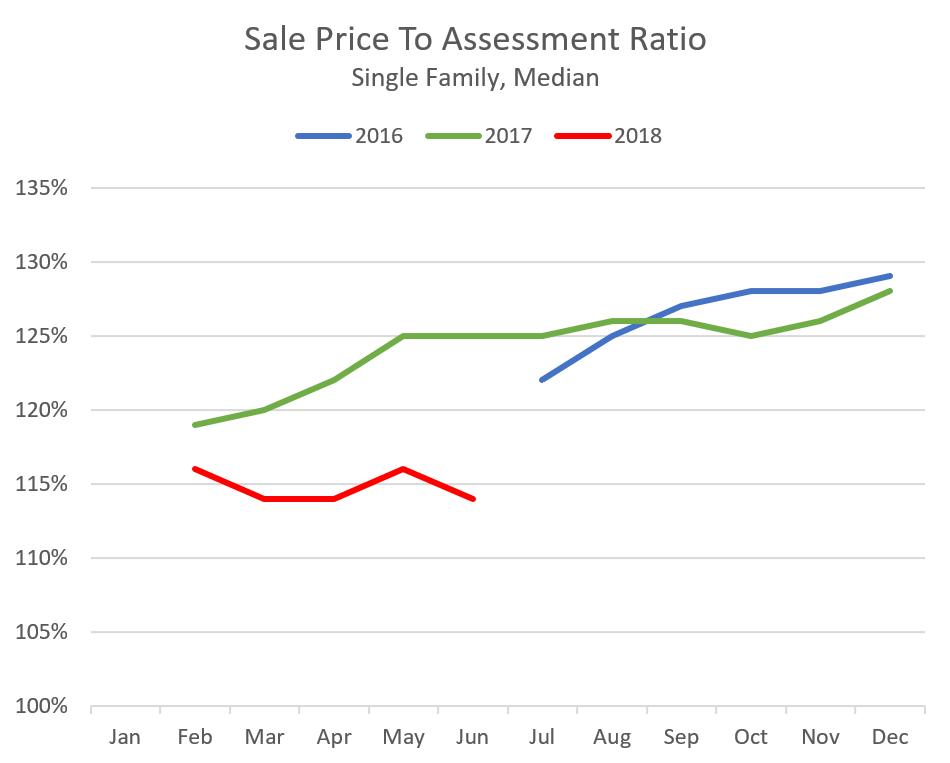

Another less complicated way to monitor house price appreciation is by comparing sale prices to assessments. While individual assessments are not highly accurate, they are quite good for properties as a whole. Thus, looking at the median sale price to assessment ratio gives us a good idea of how much properties have appreciated compared to what they were valued at as of July of the previous year. It’s a bit like a repeat sales index with the complexity offloaded to BC Assessment. And if we look at that data, we see that it aligns quite well with the Teranet index. It also shows prices for single family houses have flatlined since mid last year but have yet to decline by any significant amount.

If the market stabilizes at this level we should see the number of price cuts decrease as sellers start to realize the days of heady appreciation are over and start becoming better at pricing their listings. If it continues to weaken we will keep seeing the price cuts and those will translate to actual price declines as we move from a flat to declining market.

How about townhouses? You talk about about single houses , I’m wondering if townhouses are declining in price as well ..

The trend has been to go to a user pay system with public/private ventures not for more government.

But if it were made free then which budget should the money to maintain this system be taken from?

Health, Education, Police?

In the NDPers world money just appears by magic. Well it doesn’t. There is no such thing as a free lunch. And I don’t want to have to pay more taxes so that you can satisfy your curiosity.

Open up that wallet. You can pay for your own data.

Why are you so against the growing trend of the government making its databases open and useful to citizens? This isn’t even a left or right issue. Governments of both stripes have increasingly made data that used to be difficult or expensive to access available for free.

As one example – if you wanted maps you used to have to buy expensive topographic maps. Now you can download entire databases of topographic information or just print off a little piece of one map that you need. Governments have made this data freely available.

Already there is more sales information available for free than a few years back. Most likely it will all be available for free soon.

Monday numbers: https://househuntvictoria.ca/latest (protip: bookmark this link to always go to the latest article).

Fewer sales, although a number of over asks in condos in the last week.

RE: NAFTA

Interestingly, markets starting to tune out Trump – SP500, TSX flat to up, $CAD down a bit with oil, both recovering,

Seeing more in this price range getting reduced in all the prime hoods. I think the Vancouver money has gone way down or most of these places in nice shape would have been long gone.

Number of Hongkongers planning to leave for new lives in Canada jumps 30 per cent as experts warn of brain drain

http://m.scmp.com/news/hong-kong/hong-kong-economy/article/2150091/number-hongkongers-planning-leave-new-lives-canada?amp=1

(Apologies for the mobile link, hopefully desktop users will be redirected appropriately)

I had a Super Sized helping of all things G7 news related but that is not something I noticed.. Barrister where did you see/hear that?

Yes, that was a very smart thing to do someone sloping towards Lugano.

For someone planning for a life in Canada total exposure to exchange rate risk would be a bit daft.

Might be interesting to keep an eye on the loonie over the summer. Trudeau’s threat to not sign a NAFTA deal might have been music to Trumps ears. I have to wonder if Ottawa is living in its own little bubble. Getting out of Canadian assets was one of the few really smart things I have ever done.

It’s the market itself that’s unhealthy. Can’t blame anyone for getting emotional over a crisis that involves one of the basic needs of life.

I don’t think there would be 44,765 comments here if it wasn’t an emotional topic. That will inevitably lead to some personal attacks. Thanks for reading…

Sold, with incorrectly entered sale price but I believe $1,010,000. An example of an “over ask” sale that was actually under original ask.

Not in any predictable way unfortunately. I have tried before to determine if we could count up vacant properties which would indicate more motivated sellers, but the data quality is too poor to allow any meaningful stats.

Off Topic, BUT: please take a look at what the NDP is planning to do with ICBC – go to http://www.roadbc.ca and consider signing the petition. “Caps” rob us of our rights – where will it end? Join me and have your voice heard. I say “no”. The ultimate aim is “no fault” auto insurance – it does not reduce annual premiums, does not provide more assistance to victims, and gives all the power to “big brother” – I prefer access to the courts. If anyone has had the displeasure of dealing with WCB [a pure no-fault system] you will know the nightmare planned.

It WILL cost more to insure a vehicle in BC and you will get less. The Liberals took profits for a decade in to general coffers and now the NDP are fudging the numbers – they are not telling the public the truth.

I indicated previously that, at times such as these were prices are just plainly unreasonable when compared to median incomes, I like to focus on the luxury market.

So, today: 3230 Beach Drive [west side of the street of the “golden mile” of Uplands]:

– originally listed for $3,215,000 on March 16, 2018

– 0.65 acre – registered plan prevents subdivision [true for all of Uplands]

– May 2, 2018 – price drop to $2,975,000

– June 1, 2018 – price drop to $2,775,000

– Sold today for $2,737,500

– 2018 Assessment: $2,966,000

I have noted many, many $2,000,000 (plus) listed homes taken off the market entirely. No wonder given the policies, what is going on in Vancouver [discussed below] and the foreign buyer being absent (or indicted). I just loved that Global New intereview with Sam Cooper and the arrest of the “whale” at the River Rock – money laundering – drug money. I have read that Montreal’s new mayor is looking at foreign-buyer’s tax and similar policies.

Lastly – please take a look at what the NDP is planning to do with ICBC – go to http://www.roadbc.ca and consider signing the petition. “Caps” rob us of our rights – where will it end? Join me and have your voice heard. I say “no”. The ultimate aim is “no fault” auto insurance – it does not reduce annual premiums, does not provide more assistance to victims, and gives all the power to “big brother” – I prefer access to the courts. If anyone has had the displeasure of dealing with WCB [a pure no-fault system] you will know the nightmare planned.

You are right about that. The real estate industry is terrified about open data, but we have seen that in the US it didn’t make a bit of difference. You can go to Zillow and get all the data on sales prices and trends. And yet average commissions have stayed constant and the rate of people using a realtor has stayed steady too.

Just Jack is right. It’s not the data, it’s the making sense of it.

Even more than that for realtors is the relationship.

Correct. No way to get complete sales history publicly. However, with a portal access (sometimes called PCS or Matrix) you can pull down floorplans for listings and see sales prices are they sell.

Much more limited though. The information that is in Viewpoint will be published here within a couple years once the TREB loses their final appeal and someone starts publishing it here. Can’t be soon enough.

One would think, but people don’t work like that. Much fewer people sell when the market is going down.

They cost something in that being a licensed realtor costs a few thousand every year. The service itself does not cost anything on top of that.

Which is silly. Public data like the land title database should be public (outside of private info on the titles of course).

And that folks is why fixed term leases are a bad idea for investment properties that the owner might want to sell at short notice. Note it’s possible for the seller to give the tenant 2 months notice before closing:

https://househuntvictoria.ca/2018/06/05/of-price-changes-and-gains/

An observation from an American:

I’m from Seattle and I’ve experienced real estate bubbles. I’ve developed, owned, and sold myriad homes and multi-family projects. I’ve never allowed any conception of the housing market to become an extension of my ego. It is what it is. I’ve noticed that in BC people (even those that choose not to participate!) become very emotional about the housing market…bulls and bears alike. That’s very unhealthy IMO. There should be absolutely no personal attacks on a real estate forum…

All this said, I’ve really enjoyed reading the posts/comments. Thanks for having me!

MLS #391935

918 Fairfield Rd had a price drop to $998,000 from over a $1,000,000 a few days ago, and is now off MLS. I think the price dropping below the million dollar threshold would have both practical and psychological implications for buyers in this market. Can someone please share what the final sale price was?

Thanks.

LeoS, is it possible for you to determine the number of SFH listed for sale that include “Subject to Tenancies” clause? If yes, is it possible to graph it on a monthly basis going back a few years?

I’m starting to notice anecdotally through friends and acquaintances that suddenly people with several rental properties are anxiously planning to sell very soon, but are hindered by their tenancy leases. Since I haven’t heard this complaint from property owners before, the sudden concern from several people makes me suspect that landlords are scrambling to preserve their substantial appreciation gains by selling sooner rather than later.

The Fed has a surprise in store that could mean an early end to interest rate hikes

https://www.cnbc.com/amp/2018/06/08/fed-has-surprise-that-could-mean-early-end-to-interest-rate-hikes.html

I agree with Josh – the perception is without merit. However we’re actually pretty lucky in Canada that we don’t have the extremism that is running rampant down in the US. More often than not the parties in Canada (more or less) respond to whatever is economically happening. For the PCs, Harper ran surpluses, yet Mulroney ran massive deficits. Trudeau Sr (and Jr) are running deficits, but Martin ran a surplus.(1) In general a good government runs deficits when the economy needs stimulation, and runs a surplus when the economy is doing well(2).

More generally though (and at the risk of throwing this thread completely off the rails), what many citizens don’t realize is that while many conservatives trumpet fiscal conservatism it’s really just a fig leaf for the continuing effort to concentrate wealth and power into the hands of a select few. (Again this is much more acute in the US) One only need again look south to see the latest tax cuts that were passed and how the majority of economists said those tax cuts would do nothing to grow the GDP but would instead simply make the rich richer(3). And who trumpeted those tax cuts? Aside from the orange orangutan, none other than supposed fiscal conservatives like House Speaker Paul Ryan. Ryan used to bleat about debt and deficit during the Obama Administration and then promptly signed off the latest tax bill. Of course he’d reply he really does care about the debt and what he really wants is tax cuts AND to slash all sorts of spending so as to balance the budget – a great shot of adrenalin to widen the gaps in equality even more. Since they couldn’t get entitlement reduction down, they went for option 2, to “starve the beast”. Hardly a fiscally sound move but that’s not what they are about anyways…

Sources:

1) Canada’s Deficits and Surpluses 1963-2015

http://www.cbc.ca/news/multimedia/canada-s-deficits-and-surpluses-1963-to-2015-1.3042571

2) Keynesian Economics: The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom times so that there is no net deficit over an economic cycle:

https://en.wikipedia.org/wiki/Deficit_spending

3) US Tax Reform

Question A: If the US enacts a tax bill similar to those currently moving through the House and Senate — and assuming no other changes in tax or spending policy — US GDP will be substantially higher a decade from now than under the status quo.

52% strongly disagreed or disagreed

36% uncertain

2% agreed

http://www.igmchicago.org/surveys/tax-reform-2

Good point Andy and good digging on the numbers. The longer the Westside keeps tanking the more the Vancouverites who have sold just rent and try to ride this out. I heard of several that are frustrated trying to buy anything here with their new found riches. I think many didn’t do their homework on how many aging homes in prime areas need complete gut jobs. The reno nightmare stories also continue.

Unless they have family here and more over there, the odds of them moving back is high once the final flush out kicks in over the next year or two. Trump is doing a bang up job and taking us into the next recession much faster than I expected.

Barrister, in the three most expensive areas of the core namely Saanich East, Victoria and Oak Bay sales are slowing and active listings are rising. This is most noticeable for homes priced around $1,250,000 +/- 10 percent. I expect the months of inventory for houses in this $1,250,000 price range to break 4 months by July and will continue to trend higher for the rest of the year.

Median prices for houses in the core have been stagnate for this year and that is having an affect on house flipping. Without any significant house appreciation over the last 18 months, the big money in house flipping just ain’t there anymore.

The trend for the last few years was to buy a house but not list your original home for sale but to rent it on a month to month basis or as a vacation rental. The idea being that your original home would rise in price and when you sell it, then you could pay off or down the mortgage on the second home. That’s not happening anymore.

House sales in the core were at their lowest level since 2012 with only 190 houses sold in all of the districts that make up the core. Yet active listings are rising and are at a three year high. As we finish up the spring market it appears that the market has turned and the pendulum is on the back swing as the marketplace transitions from a sellers’ market back into a balanced one.

“So the ‘mating call’ of the left would then presumably be: penalize success, waste money, make up any shortfall by borrowing against the wages of generations yet unborn”.

Amen. We are a nation taxed to irrelevance – we can’t compete as a direct result. Trudeau/Morneau own this one. Say what you will about Harper – he stood up in Parliament and answered every question put to him – we await Trudeau’s [drama teacher] first answer. Morneau’s off-shore tax trusts and numbered company conflicts resonate loudly. First they projected a $10B deficit and now it is more than double that amount. They think converting the masses to “pot heads” will hide their mismanagement. Canada’s federal finances are a mess.

“Strong economy”. Canada shed 7500 jobs in May 2018 [expectation was plus 23,000]. NAFTA in jeopardy. Impact of “Trump tariffs” to come as NAFTA looks perhaps to be on its final leg.

If you want that data from the Land Registry then subscribe to BC Online. It’s a user pay service. But I don’t know why you want the rest of us taxpayers to pay for your curiosity. If the government can offset some of their expenses by making you pay for the service then I’m all for that.

There is no such thing as a free lunch. Someone has to pay. Either it’s you or all of us. And since this isn’t a public safety issue it’s right for this to be a user pay service. There are companies that buy this information and re-package and re-sell it for a profit. It wouldn’t be fair to charge them and not you.

You can also get limited access to the board through an agent for free. They’re hoping you will list or sell through them. They pay a monthly fee to the board and hope that by giving you limited access they will earn a pay cheque someday.

So why do you think that you are so special that you shouldn’t have to pay like the rest of us have to?

In Canada, we’re lucky enough to have a legitimate 3 party system. 4 if you’re feeling generous. So your black and white left vs right arguments are a poor reflection of our political reality. Have you ever looked up the history of our deficit under PCs? The narrative that PCs pedal about being the only party that is remotely sane about financials is a fallacy. One that has you (and a whole bunch of other fools) wrapped around its finger.

I might be imagining it but the amount of inventory seems to be going down in the last two weeks; sales are slow but steady.

https://www.searchvancouverhomelistings.com/homes/bc/west-vancouver/vancouvresdr2237924262259551/5358-kensington-crescent-west-vancouver-bc-v7v%201n4

Who said anything about forcing private companies? The government has the data for every transaction and should make it available on some existing portal like Data BC.

Yes you are finally getting the idea. I keep saying the GOVERNMENT should release the data and you keep saying “you can’t make private companies give you the data”. The government most likely COULD make private companies cough up the data, but that is superfluous since the government has it all anyhow and could make it freely publicly available if they chose.

No, that’s a lie Caveat Emptor. I have not consistently opposed free access to data. My actions over the years have shown that I have given a lot of data to this blog for free. I’ve even given the web sites where you can get free data. That’s not the action of someone that opposes free data. But I do believe in free enterprise and companies are entitled to make a buck for providing a service.

I just don’t believe you can force a private company to give that data to you for free when you can get that data from other sources at no or a nominal charge. Agents and contractors to the board pay for access to that data every month. It isn’t free to them. Since they have to pay – why should you not have to?

If you couldn’t get that data from another source, I would say then you have a case for opening up the board. But it’s available other places so there is little to no restrictions on obtaining information.

If you wanted to know what 1155 Old Esquimalt sold for in April just go to the E-Value BC web site. If you want more in depth information about trends and neighborhoods then go to the Landcor website. That’s why I don’t think the board’s in BC will ever have to open up their data base to the public. Since anyone can easily get the data from other sources.

If you want to lobby for free access I suggest you start with your own government at the BC land registry. Good luck on that one as they charge for the data too!

“This is the mating call of the PC party”

We’ll ignore the tortured metaphor for the moment and hope that you live it down (who would they be seeking to mate with?) whilst following your “logic”.

So the “mating call” of the left would then presumably be: penalize success, waste money, make up any shortfall by borrowing against the wages of generations yet unborn.

You’ll need a larger bucket of pheromones for that booty call.

I was in that line waiting. Accident was all cleaned up but traffic was backed up. Sad that there were tragic consequences.

Definitely a disadvantage to living in Victoria – Access to and from the rest of the island is subject to the whims of this one road that gets totally shut down on a not infrequent basis

Yes you have been pretty consistent about opposing free access to sales data – 100% of which is reported to the government and collected by the government.

The fact that taxes fund collection of government data sets is precisely the reason that governments should be as open as possible with data.

If making data freely available is not too costly, serves the public and doesn’t violate privacy or other concerns then generally the government should be making that data freely available.

Data sets far more costly than sales data are routinely made public

Must be that “strong economy” at work.

Flip, flip, flop!

A very greedy seller that bought at the top, trying to add ~200k in just over a month since the sale closed. They’ve done 0 work! What the heck are they thinking?

1155 Old Esquimalt Rd:

Asking: 1.15

Assessed: 868k

Previous sales:

30-Apr-2018

$940,000

16-May-2016

$825,000

The government gives away data for free? I suppose you don’t pay taxes.

The data is easily available. Private companies such as Landcor buy the information from BC Assessment, the real estate boards and the land titles offices and put it all together for you at a minor cost.

And I’m really opposing free information when I give you the places to get it from for free or at a minor cost?

Saying that giving this information out for free would hurt the appraisal business would be like saying that teaching people how to balance a cheque book would put accountants out of business.

The government gives away lots of data for free. Including data that cost a lot to gather. Past sales data should be available. The cost to make it available would be modest and there would be a public benefit to doing so.

Apparently appraisers think that this data being available would hurt their business. Opposing making this data available has been one of Jack’s few consistent positions.

Zillow is American. If you want that kind of data then the Canadian Equivalent is Landcor

https://www.landcor.com/about-us/contact-us

That may be how a realtor would view this data. I do not. I like to see how many times a home has changed hands. Again – don’t care about the nuances so much as trends. Is the neighborhood lots of rentals? Has there been quite a bit of flipping and perhaps there are empty homes? These are just a few of the many factors that affect how one views a neighborhood. It is a specious argument to say we can’t see the data as it’s not “reliable”. Ditto on the “reasonable cap” of years. How about showing the last sale regardless of how many years ago it occurred? That could be viewed as a reasonable cap.

PS: Been hit several times by the BC Assessment note of “you are a robot”. I’m sure a diligent site scraper could deal with it pretty easily. So perhaps they should just cut a deal with a larger entity like Zillow and get paid for their data.

Yesterday Mrs Fool called it “Polio Village”. Makes sense…overhyped, over priced homes are a bit of a disease. 😛

That Polo Village ( gag at the name) is gross. This is what I fear.Victoria just becoming another Lower Mainland.

Another bad accident on the Malahat. Hearing there are fatalities. Road closed in both direction formhours.

Three years is pretty much the maximum for reliability. The past history only makes sense if prices have remained stable. If they are changing quickly then six months might only be considered reliable.

Otherwise you have to do some math on the numbers to determine a factor to apply to the dated transactions to bring them up to current prices.

BC Assessment is likely worried about you scraping data from their site and re-selling it without giving them a piece of the loot. Best to put a reasonable cap on the number of years then.

BC Assessment monitors every hit on their site and knows who is over using the site. So if you’re thinking of scraping massive data, forget it as they will block you.

They’d have to drop it a lot more than $106k for me to be willing to live in a development called “polo village”. I kid, but I swear we’re just a few developments away from one of them being called “douchetown”.

Check the value on MLS 390335. It’s a foreclosure but I’m still impressed at the individual variation in value. There’re some real dumps that get listed for a mil, then there’s that place.

This is the mating call of the PC party. Disappointing that it still fools so many people, and even more disappointing that we can’t entice more than half of Ontario to vote.

SFH Van.

3358 W 8th, Vancouver

Assessed – $2,265,800

Listed – 2M

Sold June 6 – $1,850,000

https://faithwilsongroup.com/listings/3358-west-8th-avenue/

* Sold under list and under assessed.

3388 West King Edward

https://sothebysrealty.ca/en/property/british-columbia/greater-vancouver-real-estate/vancouver-west/282808/

Assessed – $3.4M

Initial list – $3,788,000

Relisted – $3,388,000

Reduced- $3,080,000

Just sold – $2,952,381

Previous sale May 2015 – $3,050,000

* Sold for a 50k+ LOSS – under assessed, under list and below previous 2015 sale price.

2006 Whyte Ave, Vancouver

https://faithwilsongroup.com/listings/2006-whyte-avenue/

Assessed $4,317,000

Bought Jan 2016 $4,050,000

Just sold for $3,800,000

* Sold for a 250 k LOSS (from 2016 sale price)

33 x 122 lot; Arbutus

Just sold $2,050,000

26% below July 2016 assessed of $2,754,700

19% below July 2017 assessed of $2,529,600

50 x 122 lot; Point Grey

Just sold $3,590,000

30% or ~$1.5 million below July 2016 assessed of $5,104,000

23% or ~$1.1 million below July 2017 assessed of $4,661,000

@ Deryk

One thing you’re not taking into consideration is, if Van continues to drop in price, people will start moving back to Van, just like they moved away as prices increased. So many people left because the prices just became unbearably high. Saw a reasonable house in North Van listed for 1M a few days ago. If more of these type come to market, and prices continue to drop, I just don’t see as many people moving away.

As proved by BC Assessment, the sales data is readily available and not proprietary to the local realtors board. I don’t understand why BC Assessment doesn’t just do more than 3 years. Storage is cheap.

For those of us looking, I really don’t care about all the little nuances mentioned. Just looking for some ideas for pricing / sales trends and get an overall feel for a given neighborhood. Zillow in the U.S. is brilliant. It’s an easy place to see when properties are placed for sale, sold, withdrawn and what the taxes are. Makes area comparisons easier.

If you want to know the last three years of sales history on a property just visit the BC Assessment E-Value BC site.

If you want more than three years then you would have to pay to get that information. That’s just the way the world works. I don’t think any private company should be forced to give away information that cost them money to develop.

How long would any of you remain in business if you were told to give your data base away for free.

Knowing what a property previously sold for is good information but if you don’t know if that purchase price included special terms or conditions, or how the market has changed since the last transaction, or what improvements the vendor has done since it was bought then it may be of no relevance at all.

Data is cheap, it is the interpretation of the data that gets expensive.

Koalas – I found that the best way was to have a Realtor set up a PCS [private client services] link for you which filters the listings and gives you the details you are seeking.

Leo S – does this service cost the Realtor anything?

If people in Vancouver believe that the bubble has popped there, then it makes sense that they would try to get out of the market as quickly as possible. (No one would sell their house when it is going up in value more than their incomes.) So if they do start to sell, in order to capture their lottery winnings from such a dramatic rise in their house values, where will they go? It will be places like Victoria etc. Even if they have to sell their $3million dollar west side home for $2.5million because of a market drop….. they will still have a huge amount of purchasing power to enter the Victoria market for example which is dramatically cheaper than the tens of thousands of houses on the west side of Vancouver. I don’t say I have the answer. I’m just saying that they will have to go somewhere and Victoria is a prime landing spot. So, while some “asking” prices might have dropped here in Victoria …..it doesn’t mean that the actual “Value” has dropped. Many people on this forum don’t seem to appreciate that difference and I think it is an important one. Victoria is still relatively inexpensive in my opinion and offers amazing value for a city that is one of the best communities to live in Canada.

It’s the land, not what’s sitting on it.

And, to be fair, it sold for under assessment:

Where the House-Price-to-Income Ratio Is Most Out of Whack [in the USA]

https://www.citylab.com/equity/2018/05/where-the-house-price-to-income-ratio-is-most-out-of-whack/561404/

MLS 393871

The insanity continues. 625k for what appears to be a 2/1 mobile home. How could anyone feel good about sinking that much money into something like this? After sinking north of half a million, you’ll feel like it’s Thanksgiving every day when you come home to this turkey. Come to think of it, you’d be the turkey!

Take a look at the bathroom sink. It doesn’t even look like there’s enough space to put down my toothbrush!

Greater Victoria, Quebec City tied for lowest unemployment rate

The capital region’s employment numbers climbed by 3,700 in May from April

… average hourly wages, a key indicator watched by the Bank of Canada, increased 3.9 per cent compared with a year ago, the monthly reading’s largest annual increase since April 2009.

http://www.timescolonist.com/news/local/greater-victoria-quebec-city-tied-for-lowest-unemployment-rate-1.23329940

Article on Australian housing bubble.

Hawk’s chart makes a cameo..

https://dhcapitalblog.wordpress.com/2018/01/19/an-australian-bubble/

It’s not about the law. The British Columbia Real Estate Association and its member boards do not allow sales information to be shared with the public in this manner. Apparently its counterpart in Nova Scotia does.

Why the difference? Just part of the big picture for RE in BC – pay more, get less.

Neophyte question here. I am new to the province. Moved from Nova Scotia about 6 months ago. In Halifax, when I bought my home and when I sold it, I consulted “viewpoint”. I must say, using that site is a night and day experience compared to MLS. One of the key advantages is that it gives you free access to the sales history including changes in prices and number of days on the market. In some cases, the sales history goes back 15 years. It also lists the dimension of the rooms which I found to be immensely useful. Now that I am here, I am frustrated with MLS. I am assuming that there is no comparable site here due to different laws/regulations. Can someone confirm that? If that is the case it is really a shame. I think, given this crazy housing market, prospective home buyers and sellers would be well served by such a site and not have to rely so much on their real estate agent. It can also be an advantage for real estate agents as sellers may have more realistic expectations if they have access to quality information. In my case, the Halifax market was pretty flat when I sold. I could tell my agent was struggling to let me know and appeased her immediately as I already had a pretty good grasp on the dynamics of the housing market – due almost entirely to Viewpoint. Here is the site:

https://www.viewpoint.ca/sidebarmap#!

No I don’t have shares in that company! Just think it’s a great tool to have.

Appliances, inspired by your…local real estate board?

Does anyone know how to prevent that stack of fliers bundled in fish-wrap landing on one’s doorstep each week?

I called them and kindly asked them to stop sending them as it goes straight into recycle. At my last address the deliverer ignored the request, my current address they have stopped delivering.

One man, nearly a billion dollars laundered with his scheme (casinos, real estate). This is only the numbers they know about.

https://omny.fm/shows/the-jon-mccomb-show/alleged-money-launderer-ordered-out-of-canada

There’s a province on the other side of the country which has elected a government which says it will reduce the amount of money they extort from succesful people and stop wasting money in general.

Would that be legal in BC?

Problem is they are quite small but advertised as high end living. 1600sqft for a new build on the peninsula seems a little miserly.

Two options:

That’s one of the things that get me. I had a look at their marketing material on their site, it’s rather humorous. It sounds like you’re buying into some eloquent, blissful lifestyle, when what you’re actually getting is hosed: a hilariously overpriced, cookie-cutter, tiny non-private lot, no views of anything, not particularly close to anything, among many other working and middle class homes. It borders on absurd. No wonder no-one’s buying them.

Santa: Includes GST.

Does anyone know where Hawk gets the price drop data? Thanks a bunch in advance.

Weighing in on Polo Village:

$500+ a square foot in that location on lots that small?

Those homes need to be in the low-mid 700’s at most…and I’ve been mostly bullish.

Is GST included?

I note the discussion below about mortgage renewals and income support for the same. Odd. Given the comments I had been reading here I had, obviously erroneously, presumed that most on this board owned their homes [meaning – no financing encumbrances, such as a mortgage].

Leo S – I saw that TC article [twice] and was bewildered as to how they could print such false data – they obviously are not checking the source.

Canada shed 7500 jobs in May 2018 – expectations were for 23,000 new jobs. Further, wages grew at an annualized rate of 3.9% – well above the target and the reported inflation rate. For those that don’t think inflation is an issue – just wait as minimum wage commences its upward trajectory for the next few years. On balance, we are likely at capacity respecting employment. We have serious trade issues and employers, big and small, worry about the future. Our tax system is too onerous on employers, particularly CCPCs. Trudeau / Morneau have done a poor job, while protecting their family “fortunes” at the cost of economic growth. Now tack on to all of this a rising interest rate environment and a housing bubble [yeah, I know, house prices rise forever in a straight line – rising at an increasing rate year over year….yatayatayata…..but for those in charge of their faculties, be cautious] and we have to acknowledge that on a balance of probabilities the cycle has peaked [and did so 8 to 12 months ago].

2019 is a federal election year – Ontario has come to the conservatives and it will be interesting to see if Trudeau can survive an election. we need a government to balance the budget – we should be in surplus, but the Liberals keep taxing and spending.

Local Fool:

The two people who bought before the 100k price drop must be thrilled. Would not be surprised if you see another major drop in this developments price before the summer is over.

Perhaps because it looks like the houses are separated by the length of a polo stick.

For anyone (or perhaps no-one) who’s interested, here is the Saanichton housing development project that’s just had a $106k drop from 975k, with only 2 of 20 sold. Looks like it’s called “Polo Village”.

http://polovillage.ca/

LeoS,

I told you guys how many time that the local rag is in the industry’s back pocket. Never an article about risk, just keep spinning the bullshit to keep fleecing the flock.

https://www.youtube.com/watch?v=x04Vpbex1vw

Yes that was stunner news. RIP Anthony, his shows were awesome. Just when you think someone has it all, it shows money and success doesn’t equal happiness.

Yep, just line up, and enjoy the exhaust from your fellow commuters.

https://twitter.com/timescolonist/status/1004890185396469761

What are you using as the definition of “real estate ownership”?

If the real estate you own is damaged or somehow taken away, you generally must be justly compensated for that loss. Holding ownership in a piece of real estate also gives you the right to sell or otherwise transfer it. The Crown doesn’t get compensated for your losses related to real estate, nor can they sell it for their profit. They just don’t own your land.

The fact that the government can regulate uses or expropriate under certain exigent circumstances for fair market compensation also doesn’t mean they own the land, they exercise governmental powers as a country over it. They may own some subsurface rights in some cases.

I asked the realtor for 118 Michigan why the price was all over the place.

Pretty stupid way to attract attention.

637 Beach Drive sold for $2M – $300K below ask [$1.4M above tax assessed value]. Interesting though how it was on the market for a good period of time [over 6 months, perhaps even a year] and the price was cut 3 times before this sale.

RIP, Anthony – you will be missed. You left behind an 11 year old – so your pain must have been so, so unbearable. Clinical depression is a disease that takes and takes. Society is striving to bring mental illness out of the shadows, buy there is much to be done. He lived a fascinating life. So long……………respectfully.

Is there some kind of feeding frenzy at Shawnigan Lake? Houses are selling in days including the more expensive lakefronts, sometimes at $100,000+ over list. I heard this has to do with the Malahat upgrades?

Here’s a good one. MLS 392768

“Commuter friendly!”

Just Jack is back!—with an unnecessary rehash of earlier explanations!

Who owns your house? The bank or you?

You are the owner of the house but the bank has a charge against it with the house as collateral. Don’t pay the mortgage, then you will be evicted, the bank will then take ownership and the house will then usually sold. The same is true if you don’t pay your property taxes or if the city, province or federal governments exercises their right of eminent domain. Then there are the many zoning bylaw restrictions, health, environmental, and possibly native land issues that come with home ownership. You don’t have the right to do anything you want to the property.

And then there is the legal definition of real estate ownership. All land in Canada is held by her Majesty the Queen and what you consider ownership is just a bundle of legal rights the holder is entitled to. It is written on your Title, in this way Canada is the owner and you are the holder of certain rights.

That’s why Trudeau may put the pipeline through BC. The Federal government is the owner of all land in Canada and Horgan can just rotate on that one.

You surely have to be suffering tremendously to knowingly leave behind a young child who depends on you.

Leo S, you are in a position to file a complaint against the TC with the National Newsmedia Council.

I hereby give you a rest James. No charge.

Someone clinically depressed would probably feel devastated they wanted to kill themselves and leave their small child behind. They might even feel it more than you or I would, actually. That in turn makes them feel more worthless than they already feel, “reinforces” the notion they’re not only worthless but a bad, selfish father, which in turn “validates” their perceptions. “Jesus, people would really be better off without such a loser”. And pop, they die. Calling the act selfish isn’t really fair. That’s just not how it works. I hope he’s in a better place and his family can find a way forward. What an amazing life he had.

@guest_44605

The example in Comox you give is not as bad as a couple I’ve seen in Victoria. Though none of this matters, the only thing that does is the final selling price.

916 Empress Ave : 1 Million+/101% over assessed.

Listed: 2M

Assessed: 994k

2103 Fernwood Rd: 530k/80% over asssessed

Listed: 1190k

Assessed: 660k

Grant

Hopelessness/depression is hard to fight. These 2 famous people felt the world was better without them. Very sad…

@Grant give a rest.

His shows were great, but dammit he had an 11yr old daughter.. I understand that the experts say you can’t blame someone suffering from depression, but as a father I just can’t ignore how selfish the act of suicide is.

Re: “Today in the June 7th issue of the TC Extra they reprinted the same story with no changes.”

Does anyone know how to prevent that stack of fliers bundled in fish-wrap landing on one’s doorstep each week?

Sure and I don’t expect them to, but at least write accurate articles or defend them if I have something wrong. The current numbers are still easy to present positively. Sellers market, low inventory.

Interesting. Seems like things have gotten a lot stricter than when we got our mortgage.

RIP Anthony.

You were a class act.

The TC survives of the RE industry. They will not rock that boat!

Now here’s where you start to see Van and the island diverging. Van is ahead on the curve, the island has yet to catch up. Check this out:

Comox, listed 350k over assessed:

https://www.realtor.ca/Residential/Single-Family/19542791/193-ELLIS-STREET-COMOX-British-Columbia-V9M1R2-Z2-Comox-Town-of

North Van, listed 100 k under assessed:

https://www.realtor.ca/Residential/Single-Family/19532455/760-LYNN-VALLEY-ROAD-North-Vancouver-British-Columbia-V7J1Z3

@LeoS

LeoS, I work for a company (not self employed nor on contract) and still had to provide them. Also had to provide pay stubs if I remember correctly. Was via a mortgage broker. Perhaps she was just a stickler for details. Could definitely see how things could be fudged if you only had to provide pay stubs.

So the times colonist printed incorrect statements about the market in their story about the May numbers on June 2nd. On June 5th I emailed the author of that article showing that the statements were wrong. No response.

Today in the June 7th issue of the TC Extra they reprinted the same story with no changes.

sigh

Usually only necessary if you are self employed or on contract. For continuing contracts it (at least used to be) sufficient to provide a couple pay stubs.

Hmm… Haven’t really thought about this. Reno market took off in the last few years since it was way safer to renovate or expand your home rather than risk selling and then getting locked out in bidding wars.

Also likely to remain busy just because of the shortage of trades. So I would say in general a lagging indicator.

Yep. You couldn’t pay me enough to spend my weekends hosting open houses and my evenings chasing deals. I prefer to hang out with my family, and chat about data and turning horses into glue when I feel like it.

After having watched 2009 I am very cautious about projecting weakness into the future. Early 2009 we had a horrible market and everyone was predicting further price declines. Instead the whole thing came roaring back and within months the price declines were erased and we were at a new peak.

It’s different this time because the weakness is not caused by a black swan event like the great financial crisis, but still, I am wary about predicting anything too dramatic. That said I too am suprised by how many price cuts there are now. A few weeks ago we were at a ratio of 3 new listings, 2 new sales, and 1 price change. Now we have 3 new listings, 1 sale, and 1 price price change. Big weakening.

Until when ? 2 months ? 6 months? Contracts get cancelled in a heartbeat when things change. Forget 2008 already?

Just like when new developments on prime Peninsula land gets slashed $100K over night for shacks under $950 K. Builders must be getting squeezed by creditors . Savy builders I know of are long gone.

I have also had to provide 2 years NOA for my last three mortgages…

Grant, Andy,

Thanks. Last time i went through this process was over 13 years ago so my memory is fading. Pre-approval was simple and only required pay statements but I’m assuming they will step it up for actual approval???

Per Steve Saretsky, June 7, Vancouver detached for sale inventory hits highest total since October 2012:

http://vancitycondoguide.com/vancouver-detached-sales-may/

@Grant, @Cynic

I had to provide CRA NOA’s for a 2 year period, and that was a couple years ago.

About a month ago. Last 2 years assessments.

Grant,

We thank you for the service you provide to the blog. /s

Did i use it right? (Insert smiley face here)

In all seriousness, when did you have to provide a CRA NOA? All I’ve been asked for is a pay statement to prove my income… mind you that was for pre-approval.

“A flat rate tax system would, among other things, launch income and wealth inequality to the moon. And it’s already so bad now.”

It depends. Under the present tax regime, if I accumulate billions in capital gains I pay no tax until such time as those gains are realized, so I can enjoy a prolonged tax deferral, an even when the capital gain is realized I pay only half the regular income tax rate.

A flat tax applicable in full on capital gains calculated annually would reduce wealth inequality. A capital tax with an exemption on the first million would accomplish the same end and provide a further disincentive to foreign investors in Canadian RE.

Nope, just tired of people speaking out their ass. If it was a sarcastic statement then add a sarcasm tag “/s” – that’s how it works these days on the internet.

I’ll continue to call out BS when I see it. When you don’t call out BS people start to believe it – just look at Trump and Fox News.

Surely I can’t be the only one who had to provide CRA assessments to my mortgage broker in order to justify I can afford my mortgage?

Was. The great majority of Canadian homeowners have seen only declining interest rates.

Often doubly and triply true in desirable places such as ours.

A flat rate tax system would, among other things, launch income and wealth inequality to the moon. And it’s already so bad now.

I don’t consider it either. If people are buying homes in serious need of reno’s to live in then the countertop, flooring, home renovation companies will do well. If people need to sell their outdated or otherwise neglected home in a slowing/slow market then the counter, flooring, home renovation companies will do well.

The WSJ article confirms what we, if you are honest, have known for some time now. The inflow of foreign capital [and a lot of it is ill-gotten, just read Sam Cooper’s investigative reports] is to “park” money. A parking stall is temporary, not long term and certainly not in order to devote time, money and talent to the area.

Our tax system: faulty. We should have a flat rate tax system. Example: 10%. It would encourage innovation and make us competitive. With the current “Morneau the moron” and “Trudeau the groper” corporate tax structure – we can’t compete with the US.

Here is an interesting article [I know it is from Breitbart, so consider the source] – question period may be entertaining tonight, not that the Liberals ever answer any questions:

[see: http://www.breitbart.com/big-government/2018/06/07/justin-trudeau-grope-reporter-2000/

Trump and Trudeau have things in common.

Introvert has a mortgage? Surprising to see him as a renter and not a land baron.

Hey Hawk,

Where do you go to discover the price slashes? I’d like access to this info as well. Thanks!

The kind of illogical and incorrect belief that keeps you poor all your life. Grew up poor and only heard this type of statement from those who never made a go of it. Wise up. A mortgage is the best financial thing that ever happens to most Canadians.

Depends if you believe the reno market is a lagging or leading indicator of the overall housing market.

I agree with Josh that this is not much of an indicator at this point in time. The first thing that happens in a slow down is that buyers get picky. Haven’t fixed up the place? More likely to get passed over. These last 4 years I have seen a plethora of dumps – properties in severe need of simple fixing – broken/missing appliances, falling apart cabinetry, failing roofs, mold on walls, holes in walls – and they sold over asking in insane bidding wars. Now that there is a slowdown, you can bet that there will be more care in fixing the obvious cosmetic items like countertops and flooring.

Don’t know what the heck is going on with 5-118 Michigan St. Saw it at an open house, it’s a postage stamp of a townhouse. Listing said it dropped from $620k to $600k within the first week, but others at the open house said it was previously listed for $650k. Now it’s been relisted again for $650k. If they’re panic selling, they’re doing it wrong.

I think that’s a pretty bad indicator. Public sentiment lags behind the market (hence overcorrection), and the contracts a countertop place has would have to clear before it would be apparent that things had changed. Good indicators are all the ones that LeoS has been writing about.

Impossible. You’d have to implement foreign exchange controls worthy of North Korea to track money inflows – which are huge – like that. You’re not considering money inflows which arise from trade, for starters.

The way to stop foreign money going into RE is to change the tax laws to make it a lousy investment for those not simply using it for shelter. The provincial government is about 1% there. And yes you would have to do it for locals too.

The WSJ story has cast a light on the egregious lack of policy and framework in this country to properly embrace globalization. Unfortunately the free market is not being allowed to work because central banks are intent on engineering economies. They simply cannot live with the idea that capitalism is inherently boom and bust. That leaves it to governments to deal with the issue, namely policy/laws/taxes/etc, to which people naturally have a distaste for.

I firmly believe that foreign capital/wealth has upended our societal apple cart. Nothing else can explain the metaphysical detachment of housing costs relative to income in the Lower Mainland. Yes, domestic credit has played a role, but this has been a secondary effect.

In our society, the income tax is extremely progressive. It has kept a lid on inequality for a long time. The foreign capital phenomenon has successfully subverted this system, and a multiplier effect that has allowed citizens to subvert the system as well (that capital has to go into someone’s hands). Yes, there have always been expensive places to live in this country, but prices have never been so out of touch with incomes. The question now is what to do about it.

I think fundamentally the goal should be to level the playing field with any money coming into this country that is not used for commercial investment (i.e., not to purchase residential real estate) should be taxed as income according to our income tax scheme. The measures introduced thus far are not getting the job done, and are inadvertently affecting hard-working citizens. How this is accomplished is up for discussion. I think this is where the government is falling short.

Would it not be a pretty easy move to make those the same thing for domestic buyers? Want to qualify for a mortgage – give us your CRA reported income.

you really want to know when this market is done. Make friends with a countertop company like colonial. When sales slow than the end is near. Talk to them yesterday. booked solid.

goody we have the grammar police out today.

If I’m just “renting” then it’s a cool kind of renting where, after a few years, my landlord (the bank) gifts me a million-dollar house—but the whole time I’ve been paying rent equivalent to a $500K house.

“How can you be on this forum and make a statement like that?”

The same way you got on this forum… clicked on a link and voila!

Tongue in cheek Grant. Feeling a little elitist are we today? Maybe woke up on the wrong side of the bed?

Perhaps all newcomers to the blog should have to pass the “Grant test” first?

Btw, it should be a legal² mechanism not a “legal legal” mechanism. How can you be on this forum and make a statement like that?

For anyone that does not have a WSJ account:

https://www.msn.com/en-us/money/realestate/western-cities-want-to-slow-flood-of-chinese-home-buying-nothing-works/ar-AAyirSd?ocid=ob-fb-enus-894

That is flat out wrong

Hawk I said pray and anything is possible. If you really believe 1981 prices are possible.

Those slashes are coming quickly. Its like a furniture store now.

gwac, it’s actually 6 more slashes since earlier, not 5. That’s 35 in past 24 hours. Funny dude, posts all the debt news and how it’s all bad then says house prices can’t go back beyond January. Closet pumper. 😉

Grant it just makes some people feel better.

You forgot to stick a fork in it, Mr. Sunshine.

How can you be on this forum and make a statement like that?

A mortgage is a lien, full stop.

A lien is a form of security against a property to secure the repayment of the debt.

It is a legal legal mechanism which allows the lender to take possession and sell the secured property (“foreclosure” or “repossession”) to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms.

Notice nowhere in there does it say the lender owns the house.

With all these slashes. We might be back to Jan 2018 prices soon. Takes a 1000`s more slashes to get to 2013 prices. Anything is possible if you wish and pray hard enough.

The bank owns the mortgage and you’re paying rent on that. All of the costs and benefits of owning the property go to you.

Just a simple click of a mouse, just like your daily TC tourism pumper articles.

I like to stay up to date on the market panic. Looks like it’s ramping up as expected. 5 more slashes since my earlier post in Oak Bay, Fairfield and Golden Head. Pity. 😉

Well said Victoria Born. The gloating homeowners won’t know what hit them as the months off a very long, and very overdue bloated bubble begins to release it’s noxious fumes over the next couple of years just as The Big Short did in the USA.

Will be another one for the history books. NAFTA, tarriffs and international discord at Trumplandia is going to blow this thing up as he does everything to stay in power while the White House implodes and Congress does nothing until the bitter end. A global trade disaster will have huge ramifications on our local economy. This is just the warning shots.

Agreed Cynic. Intorovert has no investments other than his aging shack with no renos and will be crying like a baby and gone from this blog by the time this craters.

“Music to my homeowning ears.”

You don’t own your home. The bank owns it.

You effectively pay the bank rent.

Introvert is a renter.

That should really be “they are not willing to try anything that works”. Because they don’t want to slow down the capital inflows (because they need the money), nor are they willing to face the ire of local owners if prices go down.

Probably so that HHV doesn’t cultivate a monoculture of bears sporting uniformly bland and uncontroversial opinions.

What a life! Mind you, he works his ass off. I personally wouldn’t want to work that hard.

Quite a hobby you’ve got there, Hawk.

“Nothing works.” Music to my homeowning ears.

Thank you, Leo S – this confirms what our eyes have been witnessing.

Poloz changed his tune, as Hawk correctly points out, and is telegraphing rate hikes.

Poloz says that the housing policies are working to reduce excesses. However, we are far away from equilibrium.

The price / asking cuts are far more pronounced that I had expected, particularly at the height of peak selling season. I did not expect this until the Fall. However, this is a ominous leading indicator for what we might expect this Fall. That said, 2019 [when the full-blown speculation tax kicks in] will be the true blood-letting. The time to pay the proverbial piper is coming, but what we are seeing now is the introductory mood music.

I read a report that in the USA [note the latest job creations exceeded expectation and the latest jobless claims were under the target] has more jobs needing to be filled than unemployed workers [lack the skills to fill the jobs], combine that with the ant-immigrant theme of the current administration, spells wage-push inflation. The steel and aluminum tariffs should help that situation by adding 40,000 to their unemployed pool. The import of this: rising interest rates in the US and you can see that in the bond market today as yields rise.

VB

WSJ Headline: Western Cities Want to Slow Flood of Chinese Home Buying. Nothing Works

We’re selling real estate to foreigners to pay for the manufactured goods we no longer make for ourselves, while making life Hell for young families that want to buy a home.

And the province is taking a cut, through foreign investor taxes and spec. taxes, making it official — we’re gonna pay our way by selling the country.

So that must have been whatTrudeau had in mind when he declared Canada “the first post-national state.”

@guest_44572

“BOC sending out signals they think debt levels are easing and incomes are rising really means further rate hikes are coming.”

That was exactly what I was tjimikg reading his speech last week.

GWAC:

We have decided not to decide until the end of the summer. Most likely we will be. Certainly will spend part of the winter there.

Barrister

There a few good people around who don’t want something….LOL

Are you still moving???

BOC sending out signals they think debt levels are easing and incomes are rising really means further rate hikes are coming.

GWAC:

I know that it is gloomy outside but there are a lot of nice people around and the good news is that you get to select who you spend time with. Of coarse, not too many people can really compete with a golden retriever. Nor am I sure that swimming with a Great White is all that much better than spending time with a lawyer.

This market is looking like an old grey mare who ain’t what she used to be. 29 new slashes the last 24 hours all in prime areas and only 4 are over $1 million. The stress tests and flipper tax must be kicking in bigtime.

LeoM: The 18k per horse is closer to the mark. More or less, about a quarter million per horse. To avoid the remote possibility that one of the horses might get injured in an accident and need to be put down the proposed solution is, in reality, to kill all of them right away. This is a view shared by a number of our city Councillors.

https://www.bnnbloomberg.ca/bank-of-canada-says-household-debt-vulnerabilities-are-easing-1.1089338

Household debt — mortgages and consumer debt such as credit cards — has swollen to $2.1 trillion, and as a share of income tops the Group of Seven. Two-thirds of that is mortgages.

I am guessing here 36m/3 people per household 12m households 6m have debt (assuming 50% do not have debt may be high)

2.1 trillion/ 6m households is 350k average debt. Well that is a lot.

Except these ones don’t.

There is a horse meat market. Not sure really how it is different than cows or pigs. Pigs are smarter than horses. Seems kind of crazy to raise a kerfuffle about slaughtering horses if you eat pigs or cows. And to raise animal cruelty concerns about horse-drawn carriages while turning a blind eye to factory farming seems a bit hypocritical.

LeoM: Thank you for the precise quote.

The last couple of weeks have seen a few sales here in Rockland at prices that still strike me as very high. The house on Terrace being a case in point.

‘Room and board’ and medical bills for a young healthy horse costs at least $35 per day and an older horse costs at least $50 per day. That’s $12,000 to $18,000 per year. If the working horses aren’t earning their keep, they get slaughtered in 99% of cases.

I see another happy day on the site. So much positivity and thankfulness.

Rather spend time with an animal than most people….

I think George Carlin said this: “ Think about this, the average person is stupid, and that means 50% of the people are even stupider than the average person!”

Okay children, being a poor sole with two retired horses, do any of you have the slightest idea how much it costs to keep a retired horse. Bear in mind horses can live up to 28 years. And you dont want to know how many horses get seriously injured when in a paddock with other horses. And before you think the owners are cruel think about the fact, that after taking away their lively, you are expecting them to come up with hundreds of thousands of dollars to retire these horses for their natural life.

George Carlin was right when he said that the average person is stupid and that you should then think about what the word average means.

On a lighter note, I like this idea of a commuter ferry from Patricia Bay:

https://www.cheknews.ca/local-company-aims-for-pat-bay-to-cowichan-bay-ferry-service-by-spring-2020-457989/

I don’t know the other end well enough, if it can handle the traffic. Seems like a better first step than a $2B bridge.

While it is true that this is happening, it does not mean we cannot make intelligent choices about the animals we casually destroy or abuse. Just because there are casualties in modern civilization doesn’t mean that we can’t make the world a better place. Hence, women’s rights, anti-slavery, etc.

Doing less is for cowards.

Yup. Having been involved in the slaughter of animals when I was younger made me think pretty carefully about my choices.

I have also had to put down sick horses, bury dead horses, and watch horses shipped off to the meat plant. And to be clear, yes, some times animals die or have to be put down. This doesn’t mean we can’t work toward being more humane.

(end of off-topic horse conversation, from my end at least)

What is this, horsehuntvictoria.ca?

https://youtu.be/sRM-j1-AZdU?t=4m35s

Did someone post this?

“Are Canadian homebuyers overstating their income on mortgage loan applications? A study of CMHC-insured mortgages seems to suggest the answer is yes.

The study revealed that incomes reported on mortgage loan applications were systematically higher than those reported to the Canada Revenue Agency (CRA).

The study reached two interesting conclusions. First, FTHB are more likely to misstate income in real estate markets with affordability challenges. Second, they found a correlation between higher default rates and the incidence of income misstatement.”

http://business.financialpost.com/real-estate/mortgages/homebuyers-inflating-income-on-mortgage-applications-study-says-but-dont-blame-the-brokers

THey point to the low arrears rate as evidence that everything is OK, but arrears rate is a lagging indicator. It doesn’t spike until after price declines, not before.

No but really – why do people freak out that two horses fell over? Is there serious talk about banning cars when we see a squashed raccoon or squirrel? Thousands of birds a day (in Canada) die from glass windows, and no one considers that a travesty. The socio-biology of pet ownership in North America (different in many other countries, e.g. eastern Europe) considers forcibly sterilizing and then imprisoning mammals (cats, dogs) at a very young age to equate to love and companionship.

People have a serious lack of perspective when it comes to animal-human relationships. For us to live, masses of animals have to die on earth. It has always been so for top predators (yes, even if you’re vegan, though somewhat less so). Nature is naturally cruel, and has efficiently evolved this way. It’s ok. Don’t fool yourself with the horses.

Comps will be generally far more valuable for a few reasons:

Certainly not. Some people will have more realistic strategies as you say. But overall we can see from the price changes (103 price changes vs 83 sales last 3 days) that overall sellers and their agents are very bad at pricing for a changing market.

Bringing this back to housing Hawk will shortly explain to us that after the epic housing crash we ‘ll replace the horses with teams of unemployed, impoverished former homeowners willing to pull tourists around for tips and the odd lump of sugar.

Killing animals for meat ain’t a pretty business. If more folks had to dirty their hands with that end of the food chain there’d be a hell of a lot more vegetarians. I grew up on a farm and never liked that part of the business. At least I am pretty sure everything we killed was as humanely as possible (unlike some of the stories you hear).

Re horses. Let’s recognize that it is pure custom that makes it perfectly OK to kill and eat cows, pigs, deer, moose, lamb, goat, chickens, ducks, geese, buffalo, etc. but cruel and unusual to kill and eat horse ( or make it into pet food).

Personally I’d like to see the horse carriages continue. The occasional unfortunate episode aside do those horses have such a rough life?

You could ask but he’s on vacation racing Teslas 🙂

2 properties for sale on Craigslist, listed by realtors it appears, leading with “reduced/price drop”…

https://victoria.craigslist.ca/reb/d/price-reduced-income-property/6605501568.html

https://victoria.craigslist.ca/reb/d/price-reduced-20-income-or/6610076354.html

Pakistan’s version of Realtor.ca. https://www.zameen.com/

Reprehensible and disgusting. Why Leo continues to let you on here is beyond me.

I wish I was making $900 an hour. Unfortunately I’m tapped out at just over $200. I fully admit I should have paid more attention in school. As for bears and their outlook it’s not good. What happens when the market softens is they dig in to their belief that we’ll FINALLY see that 80% decline not gonna happen ever. So keep forenting bears.

Also, who cares about the horses? Make them into glue or not who cares. Just don’t pretend that if you shut down the horse rides they’ll live. That’s 100% not going to happen.

The Truth Hurting in Liars Paradise

Food for thought. Didn’t see it in any of the recent posts so I thought I would share.

Leo, the Sale Price to Assessment Ratio was very interesting to see. How much weight will an agent/seller assign to this value and its trend when pricing a unit vis a vis nearby comps? Is it out of this realm for an agent/seller to consider the downward momentum and price below comps in hopes of attracting buyers who may otherwise be looking at another unit?

We are looking at homes in James Bay, Fairfield and Fernwood. I’m seeing price reductions on homes we’ve been watching for some time. As more homes sell for less and less over assessment, I’m curious to know how pricing strategy plays out in these situations.

Thanks for a great post. Very interesting indeed.

Culling horses is standard practice in the industry. No one wants to think about that part of it. They prefer to think about old horses being retired in a rich grassy field with a babbling brook and a big willow tree. The reality is few people can afford to maintain an old horse.

What usually happens is they get wedged onto a transport and delivered to the door of a slaughter house. They panic as they move down the chute towards the killing floor because they can smell the blood and hear the cries of other horses. Some of them break their legs trying to crawl over the side. Once inside they are they are stunned with a bolt gun to the head hopefully the first time, strung up by the back legs and their throats are cut.

I wish people would keep that in mind when the buy that perfect little yearling from a breeder for their 12-year-old’s birthday.

Thanks, Leo.

Just headed over to our pal Marko’s website. Looks like 100 sales puts you in the 1%. Interesting.

I wonder how much of that 2.65% goes into Marko’s pocket.

I wouldn’t be publishing names. However I might do a brief article on this in the future. Basically the 80-20 rules applies.

It’s not hard to find the top producers though. Most will advertise the fact that they have won MLS Gold, Silver, or Bronze awards (top 10%, 20%, 30% by sales volume)

If you are taking on a mortgage of 800k you need to be forcibly committed to the Institute of Financial Stupidity.

Hey, Leo. Is it against realtor rules to ever publish realtor sales data (as in, who sells the most—and the fewest—properties each year)? God I’d love to see that info.

Based on the income chart provided my earlier comment should be changed to top 10%; I was referring to what I presume is older data. Either way, if your household income is $150K/year and you have a 20% down payment you’re probably not buying a $1M home with a mortgage at a big bank given the stress test, but I’d love to be proven wrong if there’s anyone out there who is.

Pfft $50 gift card. Lots of emails these days offering thousands of dollars in special realtor bonuses for people to bring a buyer.

Maybe bearkilla. Wasn’t he making $900/hr?

@ once and future

Did you read the article? It is not my opinion, it is a fact that unwanted horses are butchered for pet food etc.

Personally, I love seeing horses in the city but not on city streets. I think it would be far more appropriate to have them in the Beacon Hill Park area still I don’t think this would be as popular. I agree with you that a slow removal of the horses could work but I am sure the business owner would disagree.

I don’t agree with you, but for now we will say you are right. The solution is just to licence the existing individual working horses in the city and ban any replacements or additions. As they retire/die, the industry will naturally fade out within 10 years.

I still think it is a red herring, though.

So basically… stick a fork in it, this goose is cooked?

That’s quite a shift in your narrative. One of your principle arguments undermining the concept of local affordability is the influx of “wealth”.

And indeed, due largely to the housing market, Canadians’ net wealth has never been higher (I think). Clearly many people cashing out of other markets can come here and spend some of that money.

So then, let’s assume prices go down in the near term, regardless of the amount. Why do you think that would be happening?

@Leif “Looks like some realtors are pulling out some goodies to get there customers place sold after 3 weeks on the market.”

That should be: their customers.

@once and future, re: carriage horse ban.

Realistically most of the horses will be put down. Few can afford the upkeep of large horses that are not bringing in any money to support the costs of their care. You can not just turn a working horse out to pasture they have to be vetted, wormed and have regular hoof care and supplementary feeding. In a perfect world they would be in a large lush meadow without a care in the world, in fact they will face a far darker future. https://www.care2.com/causes/will-horses-be-slaughtered-if-horse-drawn-carriages-are-banned.html

We are not in the top 5%. But I bet Leo S might be.

“Open Thursday June 7th 12:00-2:00-realtor draw for two $50 GLO restaurant gift cards.”

Looks like some realtors are pulling out some goodies to get there customers place sold after 3 weeks on the market.

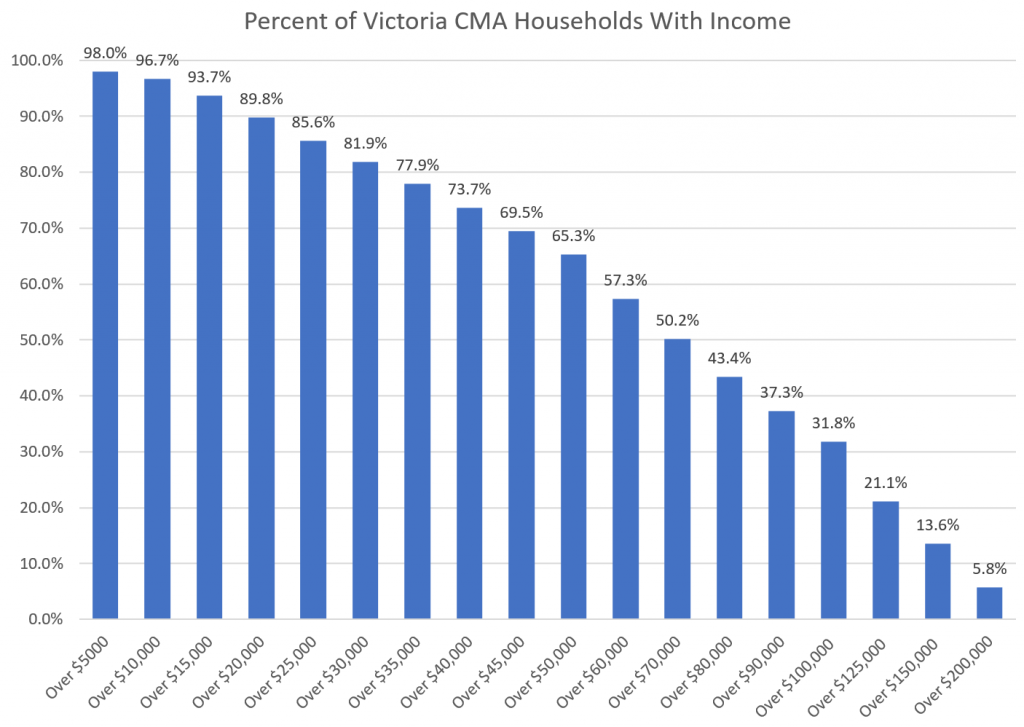

LeoS thanks for the income chart. I found it very interesting.

Hot take: Victoria real estate has entered a period (who knows how long?) of cooling during which prices will probably go down (who knows how much?). Bears will of course not buy, assuming prices will continue declining to, say, 2009 (or earlier) levels. No one will see it coming but, one spring, the market will get hot and in a very short time prices will not only storm back to today’s levels but exceed them, and bears will be sad they missed out—again.

Over $200k

Sold $1.705M

I find it funny what sometimes qualifies as “BREAKING NEWS” in Victoria.

I was wondering about Terrace as well.

I’m sure Mary’s Farm would take some…

http://marysfarm.ca

The SPCA has been given the responsibility of animal protection, but given almost no enforcement power. They have to be really careful with anything that gets political since they are bringing a pen to a gun fight. I don’t know many people who deal with animal welfare that think urban horse-drawn carriages are a good thing, but it takes a pretty visible screwup to get them to make a statement like this.

There are plenty of other places for horses to go, unless the owners are bastards. If the owners care so little for their horses that this is the first solution, then that says a lot about the companies and their operating attitude. I would hope that the operators are more humane that that.

There are a lot of “heritage” horse activities that would be nice to keep in the modern world, but urban carriage rides don’t give enough value to the city to be worth the cost to the animals. (Source: Several years horse-logging.)

Does anyone know the sale price of 915 TERRACE AVE? It was sold for $870k in 2014 and was listed for $1.8 this time!

Great post Leo!

The SPCA has a series of recommendations. The headlines are a bit misleading. Yes the SPCA would like to ban from city streets and that’s due to a recent incident. Some of the recommendations make sense:

The incident that cause the SPCA to speak up is where 2 horses were harnessed together and one slipped & fell causing the second to go down. These horses should not have been harnessed together and the carriage operators should be better trained.

One hopes that common sense actions are taken that still allow for these businesses to operate but in a safe manner. This city needs it’s tourism and the horse-drawn carriage rides are a part of that business.

What happens to all those working horses if the city of Victoria bans horse carriages? They will get sold then slaughtered for sashimi and dog food.

https://thetyee.ca/News/2017/11/06/Canada-Horse-Meat/

Most price slashes are on places that are reasonably priced to latest sales. Price declines will eventually kick in after a few months of this trend since previous prices were based on the extreme over asks being the norm and pushing up prices. Law of averages says down we go like Toronto, Van westside/condos and every other bubble city.

I’ll let the reader decide what this says about Victoria, but yesterday’s hours-long “BREAKING NEWS” on CFAX 1070 and CTV was the SPCA’s recommendation to ban horse-drawn carriages.

Upload picture at https://imgur.com/upload

Then right-click the image and select “Open image in new tab.”

Then copy and paste that newly created URL ending in “.jpg” into your text box on HHV. It will show as a picture when you post the comment.

Anyway, this is how I do it on my PC.

Just paste the link. If it ends in jpg/png/gif/etc it will auto-expand (note, only if the image is hosted on an https server, otherwise it will remain as a link)

Has anyone looked at Anderson Hill estates at 644 Beach Drive? The lot was bought for $2.1m back in 2015. Now, it’s been subdivided into 4 lots and selling for $2.1m EACH.