The Benchmark

A few years ago the Canadian Real Estate Association decided that it was tired of the variability in average and median prices. When average prices shot up the regulators got antsy and starting talking about how they could cool the market. When prices dropped, they desperately tried to explain it away by talking about changes in sales mix and seasonality.

The alternative is a repeat sales index like the long standing Teranet HPI which tracks how the prices of homes are changing by tracking homes that sell twice (a sales pair) and taking the difference in price (and doing a bunch of statistical magic to try to remove outliers like heavily renovated flips). This works well, but Teranet only tracked the market as a whole rather than individual property types or regions.

So the CREA came out with their own repeat sales index, the MLS HPI. Unlike the Teranet, you can slice and dice this index into arbitrarily small sub markets. They do this by coming up with a benchmark or typical home in each region and property type. So they will have a set of characteristics of the typical 1 storey single family home in Gordon Head, and in Oak Bay, and in the westshore, or the core. Same for a typical condo in downtown and so on. Once they have defined the typical home, they try to track the price of that home over time.

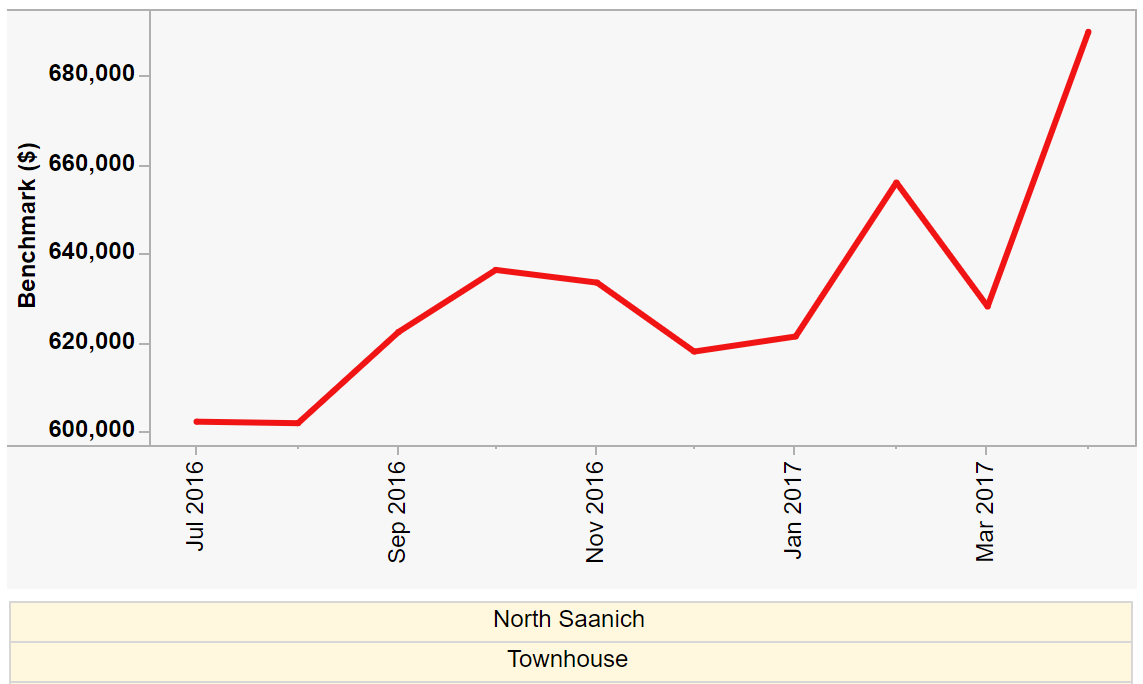

For example, do you want to know how much the price of the benchmark townhouse in North Saanich increased between July 2016 and April 2017? No problem. Click some buttons in the handy dandy MLS Dashboard (you plebes only get the national one but I get the detailed one for Victoria) and you can pull up a chart to show exactly that.

And there you have it. The typical townhouse in North Saanich increased from a value of $602,300 to $690,000 in that span of 9 months. Pay no attention to the fact that there was not a single sale of any townhouse in North Saanich in that entire period. None at all. So maybe it’s a stretch to call it a repeat sale index and you should take that graph with one of these.

However I don’t want to be too harsh on the MLS HPI since I really don’t mind it overall. I’m sure that when there are no sales in a certain region of a certain property type they use sales in neighbouring regions where there were some, or in different property types and then adjust them based on historical relationships between the two. In the end you get a number that is about as good a guess as to market value for the benchmark house as you’re going to get. I do wish that the VREB would indicate when the data quality goes down the tubes for a region in their monthly reports but in the end it’s a minor sin.

Couple weeks ago they updated their definitions of what constitutes a typical home in each region so I thought I’d pull out a few municipalities and fields to see what this magical benchmark home is.

| Muni | Storeys | Lot Size | Living Area | Beds | Baths | Built |

|---|---|---|---|---|---|---|

| Colwood | 1 | 8405 | 1430 | 3 | 2 | 1979 |

| Colwood | 2 | 8058 | 1841 | 3 | 2 | 1991 |

| Esquimalt | 1 | 6221 | 1276 | 3 | 2 | 1958 |

| Esquimalt | 2 | 6098 | 1547 | 3 | 2 | 1953 |

| Langford | 1 | 7500 | 1377 | 3 | 2 | 1992 |

| Langford | 2 | 5227 | 1660 | 3 | 2.5 | 2006 |

| North Saanich | 1 | 22215 | 1897 | 3 | 2 | 1981 |

| North Saanich | 2 | 22215 | 2464 | 3 | 2.5 | 1989 |

| Saanich East | 1 | 8373 | 1484 | 3 | 2 | 1967 |

| Saanich East | 2 | 9147 | 2099 | 3 | 2 | 1980 |

| Saanich West | 1 | 7405 | 1323 | 3 | 2 | 1958 |

| Saanich West | 2 | 7173 | 1784 | 3 | 2 | 1980 |

| Victoria | 1 | 5662 | 1216 | 2 | 2 | 1949 |

| Victoria | 2 | 5662 | 1771 | 3 | 2 | 1920 |

| Vic West | 1 | 4791 | 1243 | 3 | 2 | 1967 |

| Vic West | 2 | 5227 | 1500 | 3 | 2 | 1912 |

The “living area” is only above ground, so not very accurate given how many places have finished basements. Still, kind of neat to see the differences in character reflected in the data, from the cramped lots in Vic West, to the estates in North Saanich, to the character homes downtown, and 70s boxes in Saanich. In the downtown we see the 2 storey buildings are the older character homes, while in the westshore they tend to be the newer builds.

From looking at some areas with largely homogeneous housing stock like Gordon Head, I believe the benchmark is more of an average rather than the most common property, but still you can see the broad differences in what is common by region.

True if you are speaking only of the City of Victoria itself or Esquimalt which have a higher transient population and more purpose-built rental and subsidized apartment buildings. Not true overall for Greater Victoria.

First column is owned home, second column is in rented home. Overall 66% of folks in the CRD live in a home they own. In OB it is 76%.

Victoria 41% 59%

Esquimalt 49% 51%

Oak Bay 76% 24%

Saanich 73% 27%

View Royal 72% 28%

CRD 66% 34%

You’d have to know mortgage stats, asset stats and how much of this group is purpose built rental apartment buildings.

Monday Numbers: https://househuntvictoria.ca/2017/07/24/july-24-market-update

@ Barrister:

“I read somewhere that over half of the city of Victoria population rents. ”

Which means that the largest number of homes are owned by rentiers. To understand the future of the market, one would need to know, therefore, how this huge owner group will behave in the face of (a) rising interest rates, and (b) flat or declining prices. Will most of them hold for the long-term, or will a large number aim to cash out while still near the top?

Growing up, a friend’s family had a classic 80s station wagon with a 3rd rear facing row. We used to get into wrestling matches over who got to sit backwards.

Yeah, would also make the Transcanada less bunged up if there were bigger economic centres in the Westshore and fewer people had to commute into Victoria.

I can’t get away from more condo supply in the core being a good thing though. If we add more stock, concentrate more jobs in Victoria, and the prices stay the same as today, that just points to a growing economy for our city. If we don’t add that stock, and prices stay the same, it seems like stagnation.

edit: we do have to curb speculation though

I do think in 5 years electric car charging in strata corporations will become like in-suite or shared laundry is right now 🙂 People avoid shared like the plauge.

“The rear facing seats are $5,700 alone…”

What are the for? When using autopilot?

Sunday nights car nights on HHV. Back to the usual program 🙂

The quickest way to get car sickness is to sit in rear facing seats! No wonder such depreciation!

We seemed to have turned into a car blog again.

Checked in to trading my July 2014 Vin #38,xxx build P85+ (that has everything available at the time even rear facing seats) for a

The rear facing seats are $5,700 alone and something no one would want on re-sale.

Experience of depreciation of electric cars seems to be variable. Here’s a quote from forums.tesla.com:

The Model S 75 starts at $94,300 brand new…..if you option it out to $223,500 yes you will take a hit.

You can’t really find may used ones for under $75,000 unless they have the 60 battery.

Also when they came out with dual drive and autopilot the RWD non-autopilot became a lot less desirable.

We’ll trade in isn’t depreciation. He could likely sell it for significantly more. That said I suspect depreciation on any $100k is pretty eye watering

Experience of depreciation of electric cars seems to be variable. Here’s a quote from forums.tesla.com:

So the maintenance may be low, but the depreciation could be what kills ya.

Was talking with my Toronto real estate buddy again today. He’s already having problems qualifying buyers because of the stricter lending rules. The banks are lowering the loan to value on new purchases which makes him feel there is going to be a nasty cross country correction.

The sudden shift has really caught him off guard but he could also see people were going way past their means, just like many are here.

If I was to give any advice would be to wait a few more months and see how fast this picks up steam. Look at the GTA dropping from $920K to $800K average price in only 3 months. That’s serious bucks.

My agent buddy was also a multi-owner who got caught in the 81 crash so he has a good sense of when the shit is hitting the fan.

Tesla owners have lucked out so far in BC in that you use to get a $5,000 rebate in BC (I was one of the last people in BC to get it) but then that got killed, the MSRP was quite a bit cheaper 1-4 years ago due to exchange rate, and the depreciation is slow.

That will all change when the Model 3 rolls out in mass. Model S will likely take a huge beating.

As far as the battery I am charging up to 99.5% of brand new at 60,000 km; the car will fall apart just like any 200,000 – 300,000 km car way before the battery becomes an issue.

It seems like not the best time to buy. But I have felt that about Victoria for 10 years. Seems like it may be a good time for YOU to buy. If kids are finishing school you may be able to do with less space than you would have needed a few years ago. If rural-ish living appeals it seems like there is some relative value in some acreages (compared to the core). You have to be OK with the commute though.

I’d agree with the 10 year timeframe. In the long term inflation plus Victoria’s desirability means you’ll probably do OK.

Finally since you have kids you are already familiar with the concept that a lousy investment can nonetheless bring you great joy 🙂

Depends. For the Leaf the depreciation has been astonishing because:

Meanwhile Tesla depreciation has been less than comparable luxury vehicles. Either way the way to avoid it is to buy a used one.

One could argue that the majority of the last 60 years in Victoria could have been defined as that as prices were at previously unseen highs.

But obviously prices are somewhat nauseating at the moment. Why is it not the worst time? Well rates are still historically extremely low so at least the mountain of debt won’t cost as much as it has in the past.

I would try to go low based on what you can afford though. You say the kids are done school so they might be out of the house soon?

I wouldn’t counsel anyone to buy or not buy. It’s just too unpredictable and we have seen many people smarter than me be wrong in both directions. You can only evaluate the risk level for yourself.

Yes. If the defect is a material latent defect it must be disclosed.

Material – would involve great expense to remedy, or makes the house unsafe to live in, or involves unauthorized modifications made to the house (major work done without permits)

Latent – not discoverable through reasonable inspection by the buyer. Or to be safe, not obvious. So a big hole in they roof would be a patent defect since it is obvious

My big question for electric cars is how the market is going to be for 3-5yo used ones, esp with battery replacement costs. I’m too frugal to ignore the first couple years of depreciation for new cars.

I must admit while I am in favour of densification you have a point. I don’t really see how we can get away from requiring more supply but maybe a bunch of those condos are just landing in the hands of speculators.

Seems to be. Vancouver buyers down 50% from last year.

Nice. Drove to the ferry the other day, saw about 5 Teslas and about 15 Leafs. Adoption picking up.

The advice is pretty much spot on…..I would lean towards a minimum of 10 years and with such a massive run up who knows if we will be above water (from current prices).

@Bitterbear

No offence bitterbear but data is not in any way going to help you decide on buying right now.

Vicbot is 100% correct in saying

“You have to buy when it’s right for you, independent of the direction of the market”

I have made this exact statement before and it is what I council all my buyers. This means you have to be

1) absolutely confident in job security or income stream

2)be prepared to live in your home a minimum of 5 years (Vicbot says 10)

3)determine how much you are prepared to pay monthly as a maximum for mortgage/insurance/utilities/condo fees/municipal taxes and then reverse calculate the maximum amount for a mortgage payment that you are comfortable with which determines what you buy.

When you are satisfied with the above 3 criteria you are ready to buy. Good luck with it.

I think you got good advise from Garden and Vicbot both. Do a lot of research on the neighborhood including proposed developments and think about traffic and sound. I seriously looked at a house only to discover that the firehall was hidden around a small hill lock. They are required by law to put on their siren as they pull out and the fireman at the station said that they pulled out with at least one vehicle about six to eight times during the night shift.

I guess I’m a long time bull as I believe in the value of owning RE. That said I also believe there will be a short term correction and we are at the end of the current run-up, for many of the reasons cited on here.

There are lots of great reasons to buy your family home, most are not financial. If I wanted to buy a house in this market I might look to subareas or property types for value. Sooke may still be within grasp of affordability, maybe (although it will drop faster than other areas when the ball starts rolling), and I believe there is good value in some acreages.

Hopefully you’ve been getting out of debt and investing over the past 10 years to prepare for the purchase. If so, and you come into this market with substantial equity, you may still be able to benefit if / when the market drops.

Bitterbear

A house is a place to live and enjoy. It should not be an investment. Nobody knows what is going to happen. If you can afford it and are not stretching yourself and have room if something were to happen to one of your incomes. Life is short and waiting for something that may not happen is time lost.

That was a strong motivating factor for us too (bought last summer). Buying because you want a long-term home makes the market timing less important. However, I’d think long and hard about your purchase price and whether you can financially handle a potential increase in mortgage rates to 5% or 6%, and psychologically handle a potential drop in home value of 25% or more. Long term, housing tends to keep pace with inflation, but it sure can fluctuate up or down in the short term.

Sounds like you already made the decision.

Bitterbear, I’m not a bull or bear but I’ve bought at both market tops and bottoms.

You have to buy when it’s right for you, independent of the direction of the market. But at a market top you have to be prepared to stay for >10 years.

I saw what happened in the 80s and it was devastating to the economy – people had to sell homes at losses to find work. Renters disappeared, so investors lost properties. It doesn’t sound like you’re in that position. (Anyone who thinks it can’t happen again was probably born after 1970.)

My own experience is that buying based on season is more important. Summer, fall, and winter are better times to buy than spring. (Victoria’s spring frenzy may be different this year due to lack of inventory). But inventory is rising now.

Wherever you buy, you can create your own personal paradise in your home, and not worry so much about being an extra 10 or 15 minutes from town – it’s all relative. Vancouverites think a 1/2 hour drive is nothing.

Advice needed.

So, after 10 years of putting my kids through school, I am now at the point where I have no more excuses. My husband is pressuring me to buy and frankly, I’m tired of sitting on the side-lines and would like to have a garden and a wall I can put a nail into.

I know this is the worst time in the history of the universe to buy a house but I’ve been saying that for 10 years and it got me nowhere.

I would like to hear a rational argument from a bull about why now would be a good time to buy. I will accept any reasonable argument but data is preferred.

You guys poke fun all you want. I’m going to be rich.

All I need to figure out is…E-type or 62s landaulet? They appeal to different facets of my psyche. Only one. Both together would be ostentatious. I still won’t be buying a house here, though.

Barrister, I may charge up a couple of Samoyed pups. Good temperament.

Local Fool: Don’ t wait go out tonight and run up those charge cards. Although I am still waiting for my Bernaise Mountain Dog Puppy to be Fed Exed to me from Nigeria. So be patient.

Now hang on there Local Fool…..the Reverend is sending me the money. I just got his confirmation email thanks to my $10000 processing fee. I think you’ve been duped. He’s even coming to stay with me Sept 1st, cant wait. I’ll see that you get your deposit back then☺ You were a little hasty in being upitty to Barrister, but I’m sure he graciously won’t hold it against you.

Reverend Nicholas Okorie from Nigeria will be depositing $35,000,000 US into my account tomorrow. I know he will – I just paid him my life savings of 5k towards his processing fees, and he even calls me his “dearly beloved”.

Can’t believe my luck – out of countless possibilities, he emailed me! By this time tomorrow, I will surely be referring to all of you as peasants! That includes you, Barrister. 😀

I predict a partial obscuring of the sun on Aug 21.

Also Trump will tweet something stupid shortly.

It’s amusing to see many of you predicting geopolitical events with such conviction. None of you can forecast the future. Please stop trying. Humility is a noble trait.

Or life for treason?

Rook,

I think we’re in uncharted waters and there will be many out of the blue political events that create major market uncertainty. Rates could drop back as well but in the end it’s the credit market that will be effected.

Trump and the GOP are so corrupt that they’re going to take the whole party down and create massive disarray as the indictments start rolling in soon.

Bearkilla proves once again that alcohol kills brain cells.

@gwac. Thank you

Kalvin

https://www.google.ca/amp/s/www.thestar.com/amp/business/personal_finance/2014/05/26/disclose_problems_if_youre_selling_a_house_weisleder.html

Does look like you could be on the hook later if it can be proven you knew.

Sorry this is off topic. I would like to know if a seller becomes aware of a deficiency through a home inspection, do they need to disclose the deficiency to prospective buyers from a legal standpoint.

Trump will serve the full 8 years. Screencap this.

“My main point is that the Canadian government has limited control over interest rates ”

Agreed. And far too many variables to make a compelling prediction about what will happen. But suppose the Fed keeps raising in tiny steps, while Japan and China keep unloading their hoard of US$, then the US$ may weaken despite the rise in rates, thus boosting the price of oil and Canada’s oil and gas export revenue. Then the C$ could hold or improve on its relationship with the US$ without much of a rate increase by the BoC.

Hawk – I’m curious how Trump being tossed out would shake the financial system. Couldn’t it also strengthen it?

“My main point is that the Canadian government has limited control over interest rates something most Canadians dont seem to fully appreciate.”

Correct Barrister, and when the QE gets withdrawn from the market over the next two years in the US to the tune of a $1 trillion as well as in Europe and Canada, the possibility exists for a massive liquidity drought.

The signs of easy money ending are evident now but few want to acknowledge it via the denial mode. The higher risk countries like Canada will have their interest rates forced up much further than expected due to the enormous debt loads.

Toss in Trump about to be impeached/jailed/resign etc in the next 6 months and you have a very unstable world financial/economic system.

Yes apparently the highest % of Canadian buyers was in Florida, followed by Arizona, especially people in Ontario & Quebec (even though Florida can have freezing temps in winter, it beats snow)

Also as Barrister mentioned, RE in Florida & Arizona is cheap.

I think the only things people might under-estimate are the complications related to someone’s estate (eg., US estate taxes), maintenance costs (especially with Cdn $ changes), hurricane & other insurance risks. Also, those areas often have bigger price fluctuations, so you may have to sell for health or family reasons when it’s the worst time for the US $ or RE in that area.

(The reason I’m familiar is because some friends bought & sold in places like Florida and Palm Springs. Interestingly they liked their home in Florida but they didn’t always gel with their ultra-right-wing neighbours so that became a nagging factor)

CS:

The main factor that would definitely push interest rates up is if one of the G-7 countries, particularly the U.S. started to push up their rates. The Canadian government has limited control over interest rates The government simply cannot afford to have capital drain south of the border or to Europe.

The other thing that could force interest rates up is a declining Canadian dollar. If the free trade talks go badly the dollar could be hurt particularly if the price of oil declines at the same time. I am not talking massive interest rate increases but two or three points over five years could really shake the market.

My main point is that the Canadian government has limited control over interest rates something most Canadians dont seem to fully appreciate.

Leo S:

Not a real surprise, the baby boomers are starting to retire. While Victoria has the best weather in Canada winters are still wet and gloomy here compared to the US. Even with the weak loonie house prices are often still much more affordable in the US.

@ Barrister

Yes, the points you raise indicate that a correct interpretation of the data cannot be a simple matter.

We can assume that with so many renters, most first time buyers or younger people seeking to move up-market will be in the above-median household income bracket. However, with prices as high as they are now, purchases by this group will mainly be credit-dependent. Thus, the behavior of this group will be interest rate sensitive.

However, at the top end of the market, many buyers will be either rich foreign investors, inheritors, or people moving from even pricier markets than our own, all of them with cash to invest. Does that mean that this sector of the market is relatively interest rate insensitive? Perhaps not, because some of these people are likely investing in RE because they believe it offers a better store of value than bonds, one of the main traditional repositories for savings. However, if that is the case, there is unlikely to be a rush back to bonds, since until bond rates stabilize or return to a downward trend, bonds will be a losing proposition.

So while the BoC probably wishes to see an end to the crazy upward spiral of house prices it will surely want to avoid an RE crash, and so will raise rates cautiously, if at all, hoping thereby to achieve that “permanent high plateau” in RE prices. Question is, then, what might prevent them from succeeding? What could be the catalyst, nationally or internationally that could force a rapid increase in interest rates?

Other than war, a meteor strike or some such thing, no such factor likely to emerge in the immediate future is apparent to me. Rather, it seems that the danger is we will slip back into recession prompting the Federal Government to do more to stimulate the economy, i.e., borrow or print on a large scale.

Currently, the Feds are spending a couple of billion a month more than their revenue. That’s about $2400 a year per family of four. But that’s chicken feed compared with the deficit racked up by the elder Trudeau, which reached 8.2% of GDP in 1984. Today that would be equivalent to $10 billion a month or about $14,000 a year per family of four, which remind me of Tim Hawkins’ “The Government Can” (If U-Tube Video links have not been banned).

Despite a weak loonie and recovered US housing prices, a record number of Canadians buying in the US last year

http://www.cbc.ca/beta/news/business/canadians-real-estate-1.4216906

Home owners that don’t claim their rental income from legal or illegal suites are just playing with fire. Firstly most of the income can be written off against a % of mortgage interest, utilities, municipal taxes, home insurance and any maintenance upkeep costs. Secondly if you ever had a vindictive ex tenant or even neighbour and one phone call later you’d have CRA all over you… I simply don’t see the point in not declaring.

CS:

The income chart is great but it would also be more informative if there was an age breakdown. Victoria has a disproportionately high percentage of people that have retired here. Many of them dont have a large income stream but do have a high net worth. I have meet a number of people here who are around 55, sold their house in Vancouver or Toronto for around three or four million, bought here for 1.3 million and are living well off the rest. The income from their investments is not large but they are principally living off capital.

I read somewhere that over half of the city of Victoria population rents. If you then look your chart of

income distribution it does sort of reflect the price of houses in the city especially when you take into account that about 25% of purchasers are from out of town.

“Condo market still appears to be nuts….couldn’t even get a showing booked today for a client; “ALL APPOINTMENTS HAVE BEEN FILLED FOR FRIDAY APPTS. WILL BE RECEIVED FOR SATURDAY.”

You have a habit of picking all the agent promoted places for your clients. No wonder they always get outbid. I see over 200 other condos out there plus many with price slashes.

I guess inheritance is another important factor that explains some of the huge expenditures we are seeing in the housing market.

If my wife and I were on a plane that crashed, and our daughter’s widowed mother-in-law were on the same plane, our daughter would be in a position not only to buy a titanium bike and an iPhone X, but also carpet her back yard.

I suspect money laundering plays an important roll in a few of these unique developments.

For the most part I would say the agents in Victoria distance themselves from dirty money. But for some developments it’s the only way they are going to get built.

Number one tip off is that the properties are not being sold by a licensed real estate agent. Number two they are very over priced and not on the listing service. Great brochures of what the development will have like a 5 star hotel, spas, tennis courts, and other grandiose ideas to be finished in two, five or ten years.

It’s all about the sizzle when marketing to this group of buyers. Without the money launderers these developments could never be built.

I suspect Croatia has a larger underground economy than Canada.

https://youtu.be/X_ssq7op00U

@ JD: “These people aren’t buying homes to live in. They are speculating that in a year or two they will be able to flip it.”

It’s what a neighbor did around 1986. He later committed suicide, which was sad. A nice guy, but rash.

Being macho in the markets don’t always pay, as I learnt to my cost when I was short a couple of million C$ and Mark Lalonde announced that the Government would not allow speculators to sell the dollar short. Unfortunately, I was out of my office when my broker called to warn me. Fortunately, I was stopped out before being annihilated.

😐

@ Barrister:

“but it is three times what you would have paid in 2013 (really)”

Yeah, makes you think that it has to be either severe inflation or a market crash in the pretty near future.

As for condos. Banks like RBC and CIBC are doing 2 year rate guarantees. So anything new or to be built is crazy. These people aren’t buying homes to live in. They are speculating that in a year or two they will be able to flip it.

The July listing to sales ratio for this month in Victoria City proper for condos built in 2015 or before is 79:52 or 1.5:1

But for 2016 and pre-construction the ratio is 1:1 and lower. Most of the condos are not even listed and will not be completed for a year.

This splurge is due to those rate guarantees.

The government wants to slow down appreciation but they don’t want to slow down construction. Slower construction means fewer jobs. The answer is to raise the interest rate but grease the construction market.

@ Marko

“In the capital of Zagreb, Croatia the average salary is 800 Euros per month and you see more luxury cars than here. …”

Victoria’s median family income of ca. $80 K makes it sound like we’re doing OK. But if you look at the distribution you see that the average of the lower half is less than half the median, so there’s a lot of people not getting by so easily. Then there’s about five percent of households with twice the median income, which adds up to a lot of households. Presumably they are the folks building envelope homes and carpeting their yards. Just wish they wouldn’t do it around my humble abode:

http://www12.statcan.gc.ca/nhs-enm/2011/ref/guides/99-014-x/c-g/c-g02-eng.gif

@ Caveat emptor:

“For me carpeted back yard would be after the house reno when you haven’t yet disposed of the old shag carpet you dragged outside.”

YeahRight’s lower picture give a good idea of what it looks like, although they have incorporated a small putting green. I guess the neighbors will have to put up with the sound of an outdoor vacuum cleaner, though I suppose that’s not much worse than a gas mower.

I just do not get where all the money comes from. Expensive housing, expensive cars, all the restaurants are full. I do not get it with an average family income in Van/Vic/Toronto of 80k.

In the capital of Zagreb, Croatia the average salary is 800 Euros per month and you see more luxury cars than here. I’ve noticed in quite a few countries what you see doesn’t seem to add up. It probably has to do with the fact that you don’t notice 100 corollas and civics passing you but you notice the 101st car which is a Tesla….which isn’t totally outrageous 🙂 60,000 km no servicing, no gas, I just bought new tires and that has literally been the only maintenance cost. Plus saving at least a couple of hours a month with real traffic nagivation.

Condo market still appears to be nuts….couldn’t even get a showing booked today for a client; “ALL APPOINTMENTS HAVE BEEN FILLED FOR FRIDAY APPTS. WILL BE RECEIVED FOR SATURDAY.”

hawk

OMG, we agree on something!

Yeah, I don’t think the whole set up bidding war / delayed bid thing is working anymore (except in very specific circumstances). You can’t under price any junker and expect 6 unconditional offers anymore.

This is a good thing. I wouldn’t say we’re any where near balanced yet (still heavily in favour of the seller) but it’s good to see the slimy sales tactics are failing.

CS:

You are right but it is three times what you would have paid in 2013 (really).

” they have carpeted the back yard ”

Close to this?

http://uglyhousephotos.com/wordpress/wp-content/uploads/2016/07/160730a.jpg

Or are we talking about like this?

http://www.artificialgrass-houston.com/images/art/fake-grass-carpet-bastrop-texas.jpg

like Astroturf? or actual carpet? I’m ignorant on this one. Is it for looks or low maintenance or what?

My redneck past must be showing through. For me carpeted back yard would be after the house reno when you haven’t yet disposed of the old shag carpet you dragged outside.

Here’s something for you guys to consider. Below are some quotes taken from Torontonians who attended the “Real Estate Wealth Expo” in March, which was hosted by Tony Robbins and a few other people. Here is what some of the participants said back then. As you know, some of these people are now in the process of a very rude awakening.

When asked about the future of Toronto real estate:

“Don’t take advice from non-doers and keep only positive people around you. I’m going to look into getting a spiritual mediator.”

“I think it’s going to go even more sky-high.”

“This is actually my second expo. I was at an expo two years ago when Tony Robbins hosted. What I learned is to believe in yourself. It’s difficult because—and I think Pitbull was saying it best—99 per cent of people don’t understand what’s going on when someone else is doing something right. They want to criticize it and bash it.”

“…I learned that every opportunity that you don’t take is an opportunity missed. It’s all about turning opportunities into possibilities. I think it’s positive that there are many foreign investors with a lot of capital, so I think the market will continue to exponentially increase.”

“…Keep at it. I invested about a year and a half ago in my first property, and it works—so, just keep doing it.”

“…I personally don’t think there’s going to be any kind of crash. It’ll just level out. I don’t know what the magic number is, but at some point people will just say, ‘Alright, that’s it, that’s all we’re paying.’ Whether it’s $2 million for a house in Toronto, or $2.5 million, it’ll level off and maybe correct a little bit, but I don’t think we’re going to see this big burst. Governments can’t let it happen.”

“…investing in real estate and starting your own ventures is really crucial. Just from the way it’s going, I think it’s going to rise. I think a lot of people are interested in coming here, especially people from outside Canada, and the market will continue to boom.”

“…I really think a lot of Torontonians will be moving outside of the Toronto area, and I think anyone buying into the Toronto market is going to be more adventurous and be more involved with family. Toronto housing is a big-ticket item now, and people can’t do it alone. They’re going to have to get family and friends to be involved in it.”

“…Seems like it’s going to be doubling, or tripling, hopefully. I don’t think it’s going to be as accessible to people as it was, but there are different avenues you can take to get the funding you need.”

“…It’s growing, and it will continue to grow for a while.”

“…I don’t really know much about Toronto’s real estate, but I think it’s growing.”

“…In my opinion, it is going to keep going up, but possibly not as quickly as we’ve seen.”

http://torontolife.com/real-estate/think-going-go-even-sky-high-wealth-expo-attendees-talk-torontos-housing-market/

LF, you don’t have wealth envy, just good taste 🙂 I’d put that back yard in the “more money than brains” category. The carpeted back yard made me shake my head!

IMF: Canada Has The Most Overvalued Homes In The G7, Fourth Globally

Global home prices are on the rise, and Canada is leading the pack. Numbers from the International Monetary Fund (IMF), the monetary policy arm of the UN, show that Canada ranks amongst the top ten of all of their housing indicators. While that sounds like a good thing, the IMF generally warns that too much growth means overvaluation. Overvaluation requires a correction, and if it goes too high, even a crash.

House Price-To-Rent Ratio:

This is the primary measure the IMF uses to determine if a market is “overvalued.” They use the ratio of home prices to the cost of renting, then measure the deviation from the normal. On the global index, Turkey (149.70%), New Zealand (139.75%), and Israel (132.94%) take the top spots. Canada is in fourth globally, and is the highest of any G7 country at 132.94%. Generally speaking, it’s a smarter idea to rent in these countries if all you can afford is the median house price (or less).

https://betterdwelling.com/imf-canada-overvalued-homes-g7-fourth-globally/

Maybe I have some kind of unconscious wealth envy, but really I just find that so distasteful and shallow. Ugh…

@ Barrister:

“Noticed a new listing in Uplands today that was actually under two million. The lot was 14,000 which is smaller than most which may account for the price.”

It’s small, especially for an Uplands home. And despite the seemingly modest price, it’s 21% over the 2016 assessment, so it’s not cheap exactly.

It’s being promoted as a tear-down, so the price is about twice what you’d have paid a couple of years ago for a tear-down on a full half acre lot on Lansdowne Road.

@ LF

“One of the things I noticed last year is I began to get the impression that the natural thing one did when buying a house – was to tear it down and build a new one. Was everyone but me swimming in multi-millions? ”

As I may have mentioned before, of the last seven houses to sell on the two blocks of Lincoln Rd between Estevan and Dorset, six were torn down and replaced by a larger home (two still under construction) and the 7th was stripped to the studs inside and out and rebuilt.

So, yes, quite a few people are spending large amounts on accomodation (a million plus for a 50 foot or greater lot, plus one to two million for the house). Some may even be swimming in money. Saw one new house where they have carpeted the back yard and installed a kitchen, plus the mandatory hot tub, trampoline, store-bought tree house (two actually) and a Tesla, among other vehicles, in the driveway.

Two more Golden Head slashes today, albeit small ones for $20K at 3981 Oakwood St and $25K at 1860 Ventura Way. They’ll need way more than that.

That’s like half the places listed in Golden Head have been pushed to that point of having to drop the price in the last month or so. If that doesn’t smell like a slowdown, not sure what is which coincides with Leo’s post.

Also another failed auction at 3156 Quadra St who now jacked it up $53K. I think the owner went in the wrong direction with that shack.

BTW, what happened to all those obnoxious agents in the packed open houses screaming out “the Vancouver people are here ! ” Gone by the wayside by the looks of it. 😉

Grace that act alone probably not.

Other scenarios could. Their records indicate 2 families in the same address. An audit where they go through banking records and see check deposits. Someone informs them.

If you have a suite and did not declare the income for years and then decide to start would you be risking having to pay back taxes?

Interesting, Leo. Thanks for that. Turns out I live in a nearly exactly average 1-storey Victoria house. (It still blows my mind that at this point high income earners like myself and my partner are the ones buying such houses rather than your average resident, but there it is.)

Re: rental suite question from the last thread: We have a suite that we’re testing out renting for the year and we will declare the income on our taxes. I know several people who don’t, though. I didn’t ask them about it but they volunteered the information when we bought the house. (“You know you can totally get away with not declaring your suite income, right? We’ve been doing it for years!) One friend actually believes that you only need to pay tax if you have a legal suite. Seriously.

Noted. And thx!

Garden:

Generally people avoid the f word on here. It is not a matter of offensiveness as much as respectful comment.

I really did enjoy your pun.

Gwac:

As I mentioned in a earlier post when you combine private and public debt the total indebtedness of Canadians is rather scary.

I’ve never bought into the over-weighting people have for CDN equities in broad-market index portfolios. Our eq markets are what, like 3-4% of the world? Some people recommend 1/3 each CDN, US, rest-of-world.

Yeah same. Would I like some more space and updated wiring/amenities? Sure. Am I willing to spend $400k and countless months getting there? Fuck no.

GWAC:

But you miss the point that it is actually much more virtuous to raise a family in a small 700 sq ft box and bike to work. The fact that the sprawling estates and horse farms outside Toronto are often owned by the developers building those boxes seems to escape notice.

Local Fool:

Obviously, if you are swimming in money you need a pool to put it in.

Barrister

The unpleasantness is not only individuals but Governments having to rollover their debt.

I just do not get paying a million or more dollars for a box in the sky. I like knowing my land is mine. Just me I guess.

Gwac:

I suspect that the problem is to were the money comes from is the method of calculating average family income and what does it actually reflect. Take any two income family where one of the spouses is in their thirties and has a job as a policeman, teacher or fireman. They would all be well over the average 80K. It might be more useful to look at stats that break incomes by various tranches according to age and whether they are single or married ( I am including common law in that group). I suspect that if you parse out students and retired or semi-retired people in Victoria your stats change rather dramatically.

The other factor that immediately comes to mind is outrageously cheap money combined with the escalating levels of debt. Somebody is borrowing all those billions and they are all being spent on something. Am I worried, only moderately since I have long ago removed an investments from Canada. Am I making predictions? definitely not but rather I am suggesting that we do have a serious potential for a major economic crash. As a close friend of mine who is the chief economist for one the banks pointed out to me all you have to do is run any model where interest rates climb to 6% over the next five years and the picture becomes seriously unpleasant. I have a very low risk tolerance so the numbers make me more worried than many people that I know.

Tourism, wealth effect, HELOCs, debt debt, debt would be my guess. But I wonder that sometimes too. One of the things I noticed last year is I began to get the impression that the natural thing one did when buying a house – was to tear it down and build a new one. Was everyone but me swimming in multi-millions? Seemed so bizarre and wasteful. Probably an inaccurate perception on my part, but what can I say.

Barrister

I just do not get where all the money comes from. Expensive housing, expensive cars, all the restaurants are full. I do not get it with an average family income in Van/Vic/Toronto of 80k.

I agree with your view on density. Does not seem to solve the cost issue.

GWAC:

I am not totally surprised about the Vancouver condo market, it is following the same pattern that I saw in Toronto. It is what happens when one concentrates all the jobs in one place. Simplistic minds always like the idea that if we just increase density than affordability goes up. The fact that real world examples run contrary to that result does not seem to faze anyone. Frankly I get suspicious when I listen to very rich development companies foisting that vision of cities.

Barrister not too bad inside. Love the uplands.

Noticed a new listing in Uplands today that was actually under two million. The lot was 14,000 which is smaller than most which may account for the price. It is 3395 Weald Road which is actually in the heart of the Uplands. The lot is small only in the context of the Uplands but a lot of people might actually view a more manageable lot as an advantage. Be interesting to see what it sells for in this market.

Vancouver Condo market seems out of control again. Steve has been pretty negative over the past year in his blog. So surprised about this one.

https://www.youtube.com/watch?v=AAqt6gA5caU

Barrister

Agreed. It was the best response possible. Quite witty.

I probably shouldn’t have said ‘bad’ pun. Banning puns was a joke. Maybe we should ban all humour. ONLY SERIOUS TALK ABOUT REAL ESTATE. All comments must be well researched and have supporting data!

There’s a fine line between keeping things civil and having fun. I trust Leo’s judgement in that regard. He seems quite impartial (allows both sides of an argument to occur). Trollish posts don’t bug me much (I find bearkiller’s stuff funny.. but my tastes lean towards sarcasm). So I can see why he’d want feedback. Some may not find any humour in it. I take more issue with ad hominem.

“Interesting article on California housing problem Nurse makes 180k but has to commute 2 hours. Make the Langford crawl not so bad.”

Sounds like the nurse needs to take a pay cut and work in her own area. If you choose to live in Nanaimo and commute that’s your choice. If you’re that good a nurse you can find something closer. The heart of San Francisco has always been expensive.

YeahRight: Of coarse the whole system is rigged. Why does that come as a surprise. Your role is to be quiet while being robbed.

By the way I thought it was an excellent pun that put a real smile on my face.

Somewhere there is a threshold between something being a rough indicator and actually being either meaningless or misleading. I am not going to ignore the HPI totally but but that grain of salt pictured is a pretty good idea to have around.

@john Dollar

“You’ll find yourself confused quickly on what means what as do most agents when they are imputing the raw data.”

No doubt, when we tried to fight our assessment a few years ago, the agent lumped in a house that we considered 2 story, based off the info I got from their official website.

The agent was so adamant, that I had to show them my wife’s picture of the house, as she walks by it to go to work, to prove that it’s a two story that they are comparing to our 1 level cement slab of a property!

In conclusion: the judges were in our favour. But the agent wouldn’t budge on the land. However they would, with hesitation, budge on the house. We one $25k off the house.

…Next year, it shot back up 20K+ on the house and of course the land went up as well.

?!? —Not improving anything on the house. How is it that the value goes up on the house? Yes the land, but the house? Stay the same or cost less. But go up 20K+ with nothing done to it!

The whole system is rigged!

Can we ban bad puns?

Where are the benchmark numbers that go with the new definitions?

OK got it. I still think that the divisions between 1 and 2 storey homes for “benchmark” is a gray area – and they could have simply divided it into 2 or 3 or 4 bedr homes. They’ve made some assumptions which aren’t clear. eg., it’s very common in older Victoria houses to have very cramped 2 storey 3 bedroom homes (eg., 2 sloped ceiling bedrooms on 2nd floor), and then others that are 1 level with much larger rooms and 3 bedrooms (with or without basements).

The HPI is all about the benchmark dwelling in each category. It is not a method for valuing a dwelling that does match that benchmark. (Although of course a slightly different home in the same market will be related)

Doesn’t the HPI assign “scores” to each bedroom, bathroom, living room, etc.?

So when you’re slicing and dicing, you’re actually slicing and dicing parts of houses, not whole houses? Sort of like Lego.

The way VREB is defining their benchmark homes is more confusing to me, because they’re arbitrarily defining a 1-storey or 2-storey house, instead of taking a Lego approach.

eg., there are a lot of 1 storey houses with 3 bedrooms in Victoria, eg., 50s houses built outside of “city of Vic” with or without basements (OB, Uplands, Saaniches), 70s split entrances, and 60s side splits.

The Lego approach also explains why you can get a benchmark townhouse even when there are no townhouses sold. Unless I’m missing something here.

https://www.nytimes.com/2017/07/17/us/california-housing-crisis.html?ref=todayspaper

Interesting article on California housing problem Nurse makes 180k but has to commute 2 hours. Make the Langford crawl not so bad.

Government is working on forcing local government to allow construction of what is needed and not what neighbours and communities want.

I wonder how the board determines if a house is either one of the only two choices being a one or a two storey?

Because houses don’t fit into these two simplistic categories. If there were to be only two categories, I would have chosen one based on quality. Standard or Custom as does BC Assessment when you look up your assessment on e-value BC.

Here’s a list of types of houses and their layouts

One level on a slab

One level on a crawl

Ground level entry with main level up

Main level entry with lower level (s)

Main level entry with upper level(s)

Main level entry with lower/upper levels

Bi-Level entry

Three level split

Four level split

Five level split

As you go through the list try to imagine what the house would look like and if it would be a one or a two storey. You’ll find yourself confused quickly on what means what as do most agents when they are imputing the raw data.

Then there is the question why did they choose to use a one or two storey division in the first place. A one storey home on a poured slab costs very much the same to build as a 1.5 storey on a poured slab. Yet they would be in two different categories. Yet a one storey- standard construction costs less than a one storey -custom and they are in the same category.

Just to add my two cents worth and exercise my right to vote..! I don’t have any objection to bearkiller’s comments just as I don’t have any objection to Hawk’s. Without either two the blog would succumb to a certain dullness at times. In other words keep the format as it is, you are doing a great job!

Thanks good explanation of what it is and how it came about.