July 17 Market Update – Gordon Head drops off a cliff

Weekly numbers courtesy of the VREB.

| July 2017 |

July

2016

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Unconditional Sales | 187 | 384 |

972

|

||

| New Listings | 315 | 582 |

1127

|

||

| Active Listings | 1972 | 1961 |

2161

|

||

| Sales to New Listings | 59% | 66% |

86%

|

||

| Sales Projection | — | 778 | |||

| Months of Inventory | 2.2 | ||||

On the surface of it, seems like much the same as last year. Tight market conditions, maybe a very slight easing but nothing major (graph below the fold).

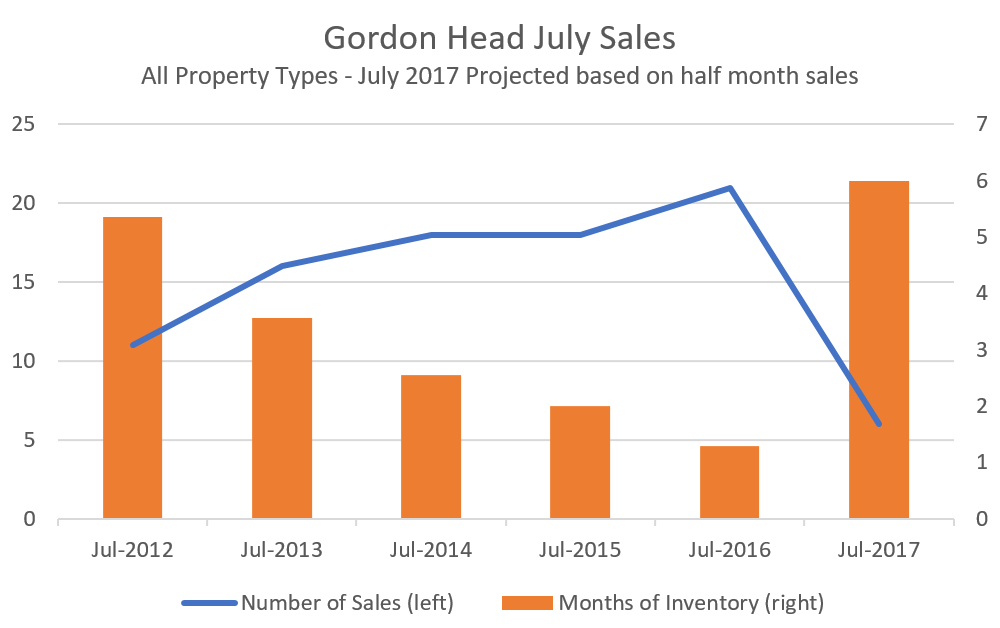

But I happened to take a look at sales in Gordon Head since I haven’t noticed much selling lately. Once one of the hottest neighbourhoods for detached houses, there were a grand total of 3 sales in the first half of July. And don’t think it’s because there’s no inventory. There are 36 28 properties on the market, and if this sales rate continues we’ll have 6 sales in July, or 6 months of inventory (There were 36 active listings as defined by VREB to mean any property that was for sale in the month).

Maybe just a fluke? The rest of the sales coming in the second half of July? As Marko pointed out, a number of other properties have accepted offers in place with conditions scheduled to be removed in the next few days so if those offers hold this could very well increase. I haven’t seen other neighbourhoods where sales have just fallen off a cliff like that. Oak Bay sales are at 19 so July will handily outsell last July (24 sales). The Uplands has just one sale so far, but there are so few sales there normally that it isn’t wildly unusual. Downtown Victoria looks like we’ll about match 2015 sales levels. Maybe that million dollar listing for a 70s box with a coat of paint in Gordon Head woke people up to the nuttyness of price levels.

So far other areas have taken up the slack in some neighborhoods to keep the overall market very active, but some cracks are appearing.

Someone has to say it… that’s gold Jerry, gold.

New post: https://househuntvictoria.ca/2017/07/20/the-benchmark/

I apologize for being annoying. It’s not my intent. Nonetheless the Victoria market has (so far) confounded bearish predictions including my own for a long time. That is a fact.

I don’t extrapolate that bullish view into the future. It feels like the market must turn at some point. I personally hope it does.

For me personally it wasn’t super risky when I bought despite my bearish view. We had a decent down payment, two solid jobs, and a plan to stick for the long term. I would never advocate taking big risks to get into the market, least of all right now.

With thoughtfulness like yours I don’t think it’s likely you’re going to make a careless decision. The issue is really, how important is it for you to buy, to buy now, and to buy here.

While I think we’re in for an unwind, it’s possible that it may take years and as they say, life happens while you’re busy making other plans. I’d say if you really want a place, ask yourself if you could afford it at 6% (and I really mean afford, not whether it’s mathematically possible).

If you cannot, then the risk is probably too great right now – that 500k mortgage will really sting then, and you will come to hate your house and your debt-prisoned-life in general. And if you have a partner, the resulting money strain will give you plenty of fuel to keep at each other’s throats. Excessive debt can destroy relationships and even lives, in a hurry.

You know these things run in cycles, and right now legions of people think they cannot lose, most especially here on the west coast. Victoria is little more than a small, spillover market of a pretty classic asset bubble and you’re quite sensible, in my opinion, in being fearful.

I like reading the bears posts and find they understand the market and financial situation in Canada. This comes out clearly in their posts and I feel like they add a lot of value to this blog. Obviously it doesn’t mean they will be right in market predictions but it is helpful to understand from people more tuned in than I am. Bulls seem to have only a few arguments and most of them are that Victoria is amazing, low rental vacancies, nowhere to build houses etc. They don’t seem to delve into the financial side of it and most of their posts have less educational value IMO.

I like Hawks price slashes because it highlights what’s going on out there without me having to do the work. Biased he may be but it’s still worth reading. I wouldn’t mind seeing the other end of the spectrum as well.

Caveat by saying the bears have been wrong for 10 years is annoying. It’s great for you that you got lucky in real estate but it may not have ended up that way had the govt not stepped in as oops mentioned.

As a renter and wannabe home buyer it’s a tricky situation. Everyone tells you that you can’t lose in real estate and that’s obviously false but so tough to argue at this point in time. One thing is true is that it’s best not to put all your eggs in one basket and I have a feeling there are many people doing that in BC right now in real estate. Good for them if they take that huge risk (just like you did) and it pays off but I’m not willing to take the risk right now.

I’ll never kiss and till.

You mean bearkilla’s? If so, no, although about 20% of his posts are not trolling unlike others I have banned that were just here to antagonize. But if we start debating about what is constructive or not we will end up with lots of posts on the chopping block. No youtube links, no price slashes, no over asks, no rants, no politics, etc 🙂

It isn’t. Although now we have 7. 7/20*31 = just under 11 sales at this rate for July. That is about 50% less than last year, and the same as 2011/12 when the market was dead. To find fewer sales you have to go back to 2010 when there were only 4 all month (July 2010 was just after the market topped out and started declining last time, although I’m not implying that is where we are now).

Funny you say that Jerry, because that’s what first struck me about the name.

Suitor vs Suiter 🙂 Either way it’s a good name – keeps you guessing!

@Garden Suitor

Could you let us know the general location of the garden you hope to marry? Even for these enlightened times this is a bold move on your part.

Vancouver opening up SFH neighbourhoods to duplexes and laneway houses. Good start

http://vancouversun.com/news/local-news/vancouver-looks-at-new-housing-options-in-single-family-neighbourhoods

I don’t recall making that statement, perhaps you just misread what I wrote. Anyway, it certainly wouldn’t be my theory. More likely Adam Smith’s theory of Substitution which has been shown over and over again as correct.

I agree with you Hawk on condo sales this month. I wouldn’t say that sales have hit a wall but certainly they hit a speed bump. While active condo listings are up this month, sales are down 20 percent down in all areas. It’s worse in the core with sales down 27% from June so far this month.

It’s incredible how fast a market can cool off.

We have heard from people on the blog that delayed buying in hopes of a price fall and regretted it. Of course they didn’t just listen to posters on this blog. Bearish housing sentiment is widely available. Of course on balance I suppose many more people fall prey to the pervasive buy buy buy mentality.

You were much more bearish at the outset (when prices were lower). Your theory on Langford weakness affecting the core never really happened in any substantial way. However I recall you did make recent good calls on condos and also on the strength in the core spreading outward. You also provide a lot of great data which I and many others appreciate.

If it’s your intent to just post some interesting slashes for their own sake, then great! But posting a few slashes and concluding that those few slashes are evidence for a slowdown/correction as you seem to allude with most of the slashes posts of your that I’ve seen, isn’t that convincing. In aggregate yes, but each message of yours seems to go “3 more slashes, gotta be the market tanking!”. Maybe I’m misreading those messages though.

Anyway, I feel like we’ve hashed this slashes posts issue out enough. You do you, Hawk. 🙂

Sure, but the presence of increased price reductions doesn’t necessarily imply a correction 😉

Garden, a few trees? There’s been hundreds of price slashes the last few months not a few. I’ve only posted the notable ones in the core that would interest the blog.

Interpret it all you want but with the SFH’s flat to declining it’s evidence something is afoot. All bubbles come to an end and they start with increased price reductions, that’s a fact.

In a low inventory market with new mortgage lending rules i would say your odds of a crash is increasing by the day but that’s my opinion and what the blog is all about.

Condo sales are down 50% this month. No slowdown eh ?

That a silly statement to make. Wouldn’t it be more likely that an individual would weigh all comments and make the best choice for themselves. You give the bears too much credit if you think they can sway any persons decisions. The average Canadian may be far from a genius but your assumption that they would blindly follow an anonymous blogger is absurd.

If such a person did exist they would have bigger problems in life than buying a house. They would be so easily swayed that they would be preyed on by anyone trying to sell them anything. They would have bought more home than they could afford and would be bankrupt today.

Of course if they had listened to others, like myself, about condos being ready to increase in price they would have made a small fortune by now. And yet some on this blog still insist I’m a bear.

Since when is 3 sales in gordon head, half way through july, normal?

All this “bears are wrong for a decade” crap. It’s definitely the same people that have been posting here for a decade? Why don’t you go on and on about the halibuts being wrong for a decade as well (since it actually IS some of the same people)?

Do you really find those posts constructive Leo S? Because it’s just the same baiting post after post.

No bets by anyone on 1848 San Juan Ave ?

868K ask, comparables have sold at 900K (didn’t dig into the details on those, but both had suites and were the same road).

How about 3 tiers?

below ask

above ask but below 900K

above 900K

I agreed with it. What I continue to disagree with is that a handful of slashes in and of themselves indicates a market slow down. You post a few slashes and then make comments that speak to the overall market like “I’m sure Toronto started this way too”. It doesn’t follow. You’re looking at a few trees from the ground and trying to use them to tell us about the shape of the forest.

“the SFH median core prices are on a 3 month decline and the median has done little since January

See, that’s a good substantive comment on the core market.”

Exactly what I said in my first reply to you way back but you chose to ignore it. Troll habit to circle around.

Another Golden Head slash to add to LeoS thread post. Just a minor slash of $26K at 4175 Longview Dr but shows the increase slash activity for that area and under the $1 million mark.

4039 Magdelin St in the same hood slashed just $10K but shows they can’t get a nibble even under $600K.

I’m sure Toronto started out this way 3 months ago too. A slash here, a slash there, now everywhere a slash slash. 😉

Fewer buyers going to open houses as Toronto housing market cools, agents say

Agents also report fewer bidding wars, lower offers and more conditions being added to purchase agreements

http://www.cbc.ca/news/canada/toronto/real-estate-market-buyers-market-open-houses-1.4210501

Absolutely correct.

Unfortunately the historical stats the VREB has here are 100% unreliable. Seems like as soon as you look for price reductions more than a few weeks in the past the system starts returning complete nonsense. Makes it difficult to compare over time.

Perhaps. I can think of a few cases where it was good to wait:

However I agree that in most cases the savings to be had by waiting haven’t been massive and required fortuitous timing.

See, that’s a good substantive comment on the core market.

But only in aggregate and put in context of the larger market. As Leo said:

And if someone used those every day slashes last year to conclude that the market was slowing down, they would have been very wrong.

hawk

1607 San Juan Ave wasn’t even close to in the ballpark of its hood. The person paid 650K Jan 2017. Nicer places sold for 900K, and yet you think them dropping from >1.1million to 1.039 is somehow significant and indicative of a falling market?

What about the rancher out in Brentwood near Jedora that was price for more than any of the 2 stories had sold for in that area? A rancher priced higher than bigger homes (some with suites) that recently sold is somehow “in the ballpark”? It’s not. They had to drop their price so they were “in the ballpark”.

The entire point of any of my counters to your “slashes” is they aren’t in the ballpark.

End of the day it’s sale price compared to recent sales that counts, no matter how they get to that sale price.

It is unknown whether the sun, when it becomes a red giant, will have its outer parameter grow to the circumference of our orbit. It may not get so large or, the reduced gravitational influence of the Sun’s lower mass may allow the Earth’s orbit to expand outwards – avoiding the interaction.

Ergo, a correction in Victoria’s RE market is more certain than the sun swallowing the Earth, and will happen sooner too. 😀

” But it seems to me like you’re trying to make the argument that increased slashes indicate a slowdown. ”

Once again Garden, the SFH median core prices are on a 3 month decline and the median has done little since January. Seeing price slashes increase in even a slightly declining market shows something is afoot and some of the slashes are multiple slashes and very healthy cuts at that. That is meaningful info wether you like it or not. If I’m a buyer I want to know it now, not later.

$100K slash is a $100K is nothing to sneeze about losing out on wether you think you priced it right or not, which most of my slash posts have shown have been in the ballpark of their respective hoods.

As oops says, if you want to read about it months after the fact then follow the local media or VREB.

For someone who says they don’t care if the market tanks back and they lose a lot of money, you sure care a lot about my “meaningless” posts. You could just skip them and be done with it but like Bearkilla losing is tough to swallow.

Caveat: “When I moved here in 2008 I was convinced prices would fall, so I was wrong too FWIW. Fortunately I bought a place anyhow.”

The funny thing is that you would have been right if it hadn’t been for measures enacted to counteract the GFC. Monopoly money was the worst of them but that was an unfortunate casualty of saving the economy. From 2004 – 2007 the Prime rate went from 4.25 to 6.25. Did anyone hear anything in the news on those increases even remotely similar to the headlines surrounding our most recent .25% increase. Anyone, Anyone?

How about our super conservative CMHC. Let’s see, since 2006 we’ve had 40 yr, amortizations,interest only mortgages, zero down mortgages, a program for self-employed Canadians who have difficulty documenting their earnings to obtain mortgage insurance by “stating” their income, as well as the wonderful mortgage sales by our beloved banking institutions.

Yes, those CMHC programs were eventually eliminated and tighter controls have been brought in over the last several years but the point is the rise in housing prices was fairly easy to predict given the environment. No, they were, when you give Joe Millennial who can’t afford a home, monopoly money what did you really think was going to happen?

So, is it easy to predict a crash? Inevitability, yes. Timeline not so much so apparently. However, if you look at all of the factors that are coming together to affect this market negatively you should be able to see the same thing happening as a lot of the bears do.

It probably would have been soon if there weren’t all of the shenanigans going on behind the scenes.

Anyone who makes this prediction:

“Sometime in the indefinite future, Victoria home prices will fall significantly” is bound to be correct. It is also a totally useless prediction.

If you read the early days of the precursor blog you will see that there were a lot of predictions of housing doom and gloom. Those folks in 2007 weren’t talking about a correction “sometime before 2020”. They were talking soon. You can also look at the annual housing predictions – we have generally all been wrong by quite a bit.

Bottom line anyone who listened to the bears on this blog between 2007 and 2015 and postponed a housing purchase that was desired and affordable to them probably made a mistake.

Yeah, I get the feeling that there’s an implicit “soon” to those predictions. Otherwise with no time bounds the statement “the Victoria RE market will face a correction” is a certainty when the sun expands and swallows the Earth.

oops: We bought last July, and tbh we tried to shut out most of the indicators out there, especially the mainstream media. Timing the stock market is foolish, and (IMO) same with the housing market.

From what we experienced though, it was a hectic time to get into the market. We went to about 6-8 OHs each weekend for months on end, all packed, put in over a dozen offers, all beat by unconditionals.

But we were getting kicked out of our rental because the owner was going to move back in, and 2 years previous the same thing happened. So we wanted long-term stability. Our hope was that we didn’t buy at the very peak before a large correction, and that in 25+ years we will at least keep pace with inflation.

Who knows what the future holds, but I’m betting that Victoria will keep being a desirable place to live, and supply+demand points to land becoming more valuable over the long term. We’re increasingly becoming an information society, so telecommuting to jobs in larger centres is going to be more prevalent. So even if we’re at a local maximum, I’m betting that over the long term that we’ll be okay. Will that bet pay off? Who knows.

It sure is fun to try and spot patterns and argue about them on the internet though 🙂

hawk

So it should be trivial to find a comparable to 3439 Cook St that sold for over 999K.

Too trollish?

I like the price slashes. I’m hoping for one that surprises me though. Like a GH box with neighbours that sold for 800s that has to drop their price into the 700s to get any traction (that isn’t obviously worth less than the neighbours.. so equal amounts of shag and wood panelling).

Speaking of which 1607 San Juan Ave still hasn’t dropped their price any further. Strange.

1848 San Juan Ave looks a lot more desirable at 868K. I wouldn’t pay that much for it, but I’m sure someone with more money or less sense will bite.

1811 San Juan went for 900K.

1864 San Juan went for 900K.

Any bets on what 1848 will go for?

Will it be pending by Tuesday or will there be conditions causing it to take longer to hit pending? (I’m assuming it’s not subject to probate)

Fair enough Leo S. It’s your blog and you get to decide what stays and what goes.

caveat emptor

July 20, 2017 at 1:35 pm

“Yep any day now bears you might be right after being wrong for a decade. Boy you sure are geniuses.

The tone was uber-trollish but the point stands. People expecting a major correction for Victoria RE have been wrong for more than a decade.”

They’ve only been wrong if they gave a date or date range for a correction to happen. A major correction for Victoria RE could still happen and then they would be right.

Garden: “I don’t want mushy or feel good. I want statistically meaningful analysis on the Victoria RE market.”

I can certainly appreciate that point of view, Garden, however the only somewhat meaningful analysis that you are going to get regarding Victoria RE is going to be after the fact. Now, that is fine if you are in a home, have lots of money and have no plans of selling in the next 5 yrs but when the tide turns, it can be very challenging and you have to look for indicators.

Case in point, when you bought your home, what indicators did you look at? Zolo has been mentioned, myrealtycheck has been mentioned, market affecting legislation has been mentioned, Leo S. has a commentary on the current market each week, as well as the posting of numerous price drops. That has all been on this blog. When did you start reading this blog??

Now, CHEK TV and the Times Colonist also report on Victoria real estate and apparently mainstream reporting is what most people watch. The only problem is that it will not make the news unless it is an extreme. The market has either taken off with bidding wars or it has crashed. There is no news in a balanced market. The impact of the .25% prime rate increase is a case in point regarding the mainstream reporting.

If I’m a new buyer with 5% down, the last thing I want to hear on the news 3 months after I purchased is that the housing market in Victoria has fallen off the rails with average price drops of 10 to 15%. Never mind the fear of renewal, who the hell wants to pay $800,000 when 3 months later the same home is $680,000.

Note to reader: This price drop is not indicative of the market in Victoria. Price changes may vary based on municipality. Lol

First I am not an expert on this and I might be wrong but I would expect that a greater percentage of price slashes are to be expected normally mid summer and into September. Basically the houses that were put up for the spring market and that have not sold would typically start to lower prices about now.

Having historical stats would be good so that one could compare to see if the number of slashes was higher (or lower) than typical for the season. This was over three years ago, when I started to look in January I noticed that by late September that many of the houses had dropped their price.

I really hope that people dont start attacking me because my comment is vague and I will be the first to admit that I have no stats. Rather I am asking whether anyone actually knows whether price decreases tend to be seasonal? I do know that they were in Toronto for many years.

The tone was uber-trollish but the point stands. People expecting a major correction for Victoria RE have been wrong for more than a decade. Along the way we had a minor correction (late 08-early 09) and an extended period of softness (roughly 12-13). Nothing approaching a crash or even a major correction. This blog started early 2007 and was heavily populated by housing bears.

In retrospect anyone wanting to buy a home in Victoria in 2007 and able to afford one would have done well to buy. Perhaps prices will drop to 2007 levels some time, but even if they do that hypothetical person wanting a home will have waited well over a decade for the opportunity.

When I moved here in 2008 I was convinced prices would fall, so I was wrong too FWIW. Fortunately I bought a place anyhow.

I doubt the next 10 years of Vic real estate will look at all like the last 10 years but as Bearkilla’s post reminds us we aren’t that good at predicting the future.

I am not a bigwig here nor do I follow RE that closely but just read the average rent for aome bedroom apartment in Vancouver is 2,000.00

I grew up,there and would never go back,for a variety of reasons but this madness is hurting a lot of good, decent, hardworking people.

I feel like my beloved Victoria is heading in the same direction. A city where only the very rich or students who will settle for basement suites can live is a hollow shell of the city it should be.

No real point to this post except it all pisses me off and also scares me. I am solidly middle class. Will I ever be able to return to Victoria as a renter ? I have no desire to buy a condo. Won’t need or be able to afford a house.

Personally I found the crazy over asks and over assessments more “newsworthy” than sellers dropping their asking prices. The “norm” in real estate markets that I have experienced is sellers price on the high side, see if they get any offers. If not, drop the asking price. So the period of crazy over asks was basically a freak show and thus interesting.

If cuts to the asking price are becoming more prevalent that is indeed interesting to me. It would suggest we are gradually cooling from crazy to normal (consistent with some other data)

Individual price slashes, especially if devoid of any context (previous sale prices, assessment, what similar properties have sold for) aren’t that useful or informative to me. But they aren’t really trolly. Plus I get the feeling that posting the price slashes is therapeutic for Hawk.

They should remain. They add much-needed spiciness to the blog. This blog would suck if it were completely sanitized and devoid of anyone ever poking anyone else.

Put me down as in favour of auto-deleting YouTube links.

That’s very sensible, Leo. In my opinion, HHV strikes a good balance: it doesn’t tolerate egregious, constant trolling, but it does allow the occasional borderline outburst to stand, which keeps things interesting without turning the blog into a flaming dumpster.

In short, I think Leo has been doing a decent job.

Fair point for Garden Suitor to make. Price reductions in an of themselves are not a strong indicator of anything. I agree with Hawk that an increase in price reductions shows a slowdown, but some reductions happen in every market so even this time last year you could have posted a couple reductions every day. I hope that myrealtycheck introduces a trending feature where they graph the number of price reductions over time. Then it would be a good early indicator of market changes because price reductions should come even before the DOM starts trending up.

Kalvin, for 2020 Wenman, you might get a good deal because some people don’t like T intersections – they tend to take longer to sell. Also if it doesn’t have a basement, check to see if there’s a crawl space or slab.

@Garden Suitor

We had months of commentary on over asks and line ups to get into open houses. This is no different than that, and yet people are complaining about it. I can see why Hawk would be defensive about it since no one cared on the way up.

I don’t want mushy or feel good. I want statistically meaningful analysis on the Victoria RE market. If that’s not your aim, then fine. But it seems to me like you’re trying to make the argument that increased slashes indicate a slowdown. That’s a fine argument to make, but posting individual slashes isn’t a very convincing way to do that.

May I ask about the home on 2020 wenman? I’m not familiar with the area. Looks very well kept and tidy.

” I like seeing indicators of where the market is going, whether good or bad.”

Exactly my last point Garden, you’re now a hypocrite. Last time I looked this a blog to debate the market good or bad. You also said you want it to be all mushy feel good/neutral, so what is it? My posts point to what’s happening in Vancouver and Toronto, increased price slashes.

Again, you’re not making sense and beginning to look like the previous trolls who have come on here then disappeared once exposed.

Quantifying the increase of slashes over time in context of the whole market would have some value. That speaks to overall market conditions and could be an indicator of market movements. Posting individual points of data doesn’t.

New homeowner, I am new to posting here, but I don’t work in the industry. I don’t need to put my head in the sand and feel good. I like seeing indicators of where the market is going, whether good or bad. But I don’t find the scattershot slashes posts speak to that at all. It’s a handful of data points from which no meaningful conclusions can be drawn.

Again, I would find the same thing to be meaningless noise if it was someone repeatedly posting a bunch of overs in a similar style to try to support their argument that the market is heating up.

“Hawk’s price slashing posts aren’t trolling per se, but I find them pretty mindless and repetitive. Not sure if they count as antagonism, but definitely low value IMO.”

Garden,

Your posts make zero sense. Since you’re a new homeowner by the sounds of it and new to the board(and maybe work in the industry), where can you say that an increase in price reductions after more than a year of way over asking sales is “low value” ? It’s the facts of change.

Maybe go the VV board where you will find it much more feel good as I’m not changing my posts.

This will test the condo market

http://victoria.citified.ca/news/record-breaking-condo-prices-expected-at-ultra-luxury-customs-house-development/

Can someone explain this?

516-21 Dallas Road, Victoria, BC, V8V 4Z9

$2,095,000 2017-02-07

$1,948,000 2017-06-07

$2,250,000 2017-07-16

Overall Change= $ 155,000.00

Percent: 7.40

Leo what are the pros/cons of Vreb Benchmark is it accurate or lagging?

See, that is a useful commentary on the market as a whole. Not just a scattershot of posts with slashes or overs.

In the words of Justice Potter Stewart: “I shall not today attempt further to define the kinds of material I understand to be embraced within that shorthand description [“hard-core trolling”], and perhaps I could never succeed in intelligibly doing so. But I’ll know it when I see it“

Vicbot

I’ve been watching among other things, the myrealtycheck site. It’s lousy at showing longer term trends per se, but it can give you an idea of what the market is doing at any given moment. I’ve been watching it for a while and Vancouver of late is just consistently overwhelmed by a sea of red.

As some people have said, the drops on average are not a lot, but when you think about it in the context of the run up, it signifies quite a change in the market when you see the same thing week after week. For me, it begs the question of how long the prices can stay up at 8 to 20 multiples of income. Equity supported buying will hold it for a time, but then…

Victoria is also a sea of red, but it doesn’t look like a lot of data. Not sure what to make of that. Anyways, it’s interesting to watch, and next three months have real potential to see some significant changes beyond the ones we’re already seeing.

Yeah there is a whole lot of pumping the RE market out there. I just prefer each board/etc to be as neutral as reasonably possible.

Posting individual slashes or overs can be interesting for those properties if something is said towards that (ex “Can’t believe that one went 100k over for an 80s shitbox in a bad neighbourhood”, “150k slash on this one seems appropriate because the yard is a swamp”). But Hawk’s slash posts seem to be just a list of slashes in order to try and support their position that the market is tanking.

If someone was repeatedly posting just over asks with pithy comments like “that’s an extra $100k that could help to go to the pension, etc”, I’d be annoyed by that too. Kind of like an anti-Hawk. But I don’t see anyone doing that.

I’m fine with my housing choices and have a plan. It’s a home, not an investment and I don’t care that much if it drops a bunch in the next few years 🙂

I find the price slashings interesting – it provides a good balance with mindless marketing hype of RE boards, which need closer scrutiny.

I follow lots of stats, but those specifics give me a way to delve deeper into a specific property if I want to. (I’m sure it’s invaluable to buyers looking for a property!)

Why be annoyed about price slashing posts, but not about over-askings? Is it because you feel worried about your purchase? Everybody does.

But to make yourself immune to negative news, try to protect your investment with a long-term plan – then there’s no need to feel annoyed.

Hawk’s price slashing posts aren’t trolling per se, but I find them pretty mindless and repetitive. Not sure if they count as antagonism, but definitely low value IMO.

Not to say that they don’t have other good points, but the price slash posts I could do without 🙂

I have been reading this board on and off, given that I am interested in retiring in Vancouver island. I have a comment on one item that I have seen many posters have commented on and that is regarding short term rentals:

One has to be reminded that the big businesses and hotels are trying to block short term rentals and hence they are lobbying for their own profit just like taxi companies did so to block Uber although taxi company owners would take all the profits and the taxi drivers would live on minimum wage and typically they are unable to acquire self ownership of their taxis in many cities.

It is also valid to say that those that gaining income from the any type of business have to pay the required taxes and that applies to short term, long term rental, basement apartment, etc…

Also the war on short term rentals is not always designed to accommodate the worker class access to rental properties either because many of the properties are used part time by the owners and they would not be in a market for long term rentals .

I personally do not have a stake in short term rentals but I have rented few of them while on vacation because hotels do not take my dog.

In my opinion, the attack on short term rentals should be limited to properties that are rented for that purpose alone. It should be noted that major hotel chains are also operating such accommodations.

That’s the problem. How many comments do they have to post and how often? What counts as too “trolly” to allow, versus “almost bad enough”?

This isn’t rocket science. If someone continues to post in a manner that, to a reasonable person, has no real purpose other than mindless, repetitive antagonism, they should go.

Leo S “Seems like 5 to 5 split on deleting trollish posts. For now I’ll toss the deciding vote to not deleting until it gets out of hand. I’d rather not delete anything if I don’t have to.”

What is your criteria for “gets out of hand”?

Another failed Oak Bay auction at 2016 Frederick Norris Rd. Let’s jack it up $350K and see how many suckers are left who wouldn’t bid it up $350K.

A Fairfield second slashing for a total of $100K at 620 Normanton Crt. Amazing how $100K down the tubes is “ridiculous”. That’s lost money that was hoped for to help with the pension, old folks home etc etc.

Sam Cooper has done a lot of excellent reporting on the scams in BC real estate that could affect demand & prices as well (spillover effect from Van), not sure if you’ve seen these ones:

http://vancouversun.com/news/local-news/vancouver-real-estate-in-the-red?cn=bWVudGlvbg%3D%3D&cn=cmV0d2VldA%3D%3D

“Postmedia’s review of over 30 regulatory or civil court cases shows a trend of allegations that home buyers and real estate professionals are involved in deceptive mortgage applications that include exaggerating the incomes of borrowers, forged documents of home ownership used by multiple borrowers to obtain mortgages, phoney claims of offshore assets used to back home loans, falsely inflated collateral accepted by subprime lenders to fund real estate development loans, and falsified CRA tax return documents.”

http://vancouversun.com/news/local-news/clark-and-b-c-liberals-got-donations-in-funds-with-money-from-allegedly-defrauded-chinese-investors-hearing-told

Liberals got donations in funds with money from allegedly defrauded Chinese investors

“B.C. Election records show that from November 2011 to November 2015, Paul Oei donated $55,787 to the B.C. Liberals … Oei, who is accused of bilking investors of $6.9M in an immigration-investment scam surrounding Cascade, a proposed Port Coquitlam recycling plant.”

“‘he knows people, in the Liberal party, so I guess it’s party’s promotions,’ Sun said. ‘(Oei) said this project received strong support from the provincial government, and he showed us a lot of photos with the lady premier,’ Chinese investor Wei Chen told the hearing. ‘He said the B.C. government would use this project to go to China to attract immigrants.'”

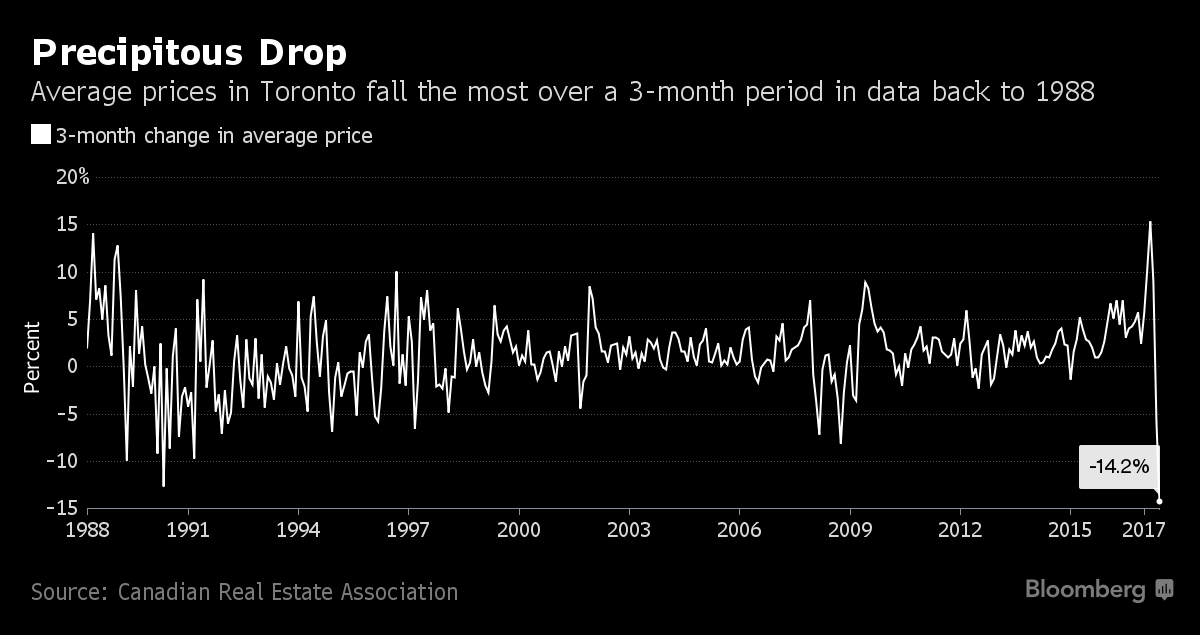

Was talking to my Toronto real estate buddy yesterday and he said things are looking very grim. Richmond Hill/Markham is a ghost town and Toronto/Mississauga has slowed down bigtime. Lots of panicky sellers.

Here comes the Blame Game!

Who opened up the flood gates?

Price slashes are trolly but over asks have your seal of approval Bearkilla ? Your posts are useless blaming a changing market reality on your lack of ability to accept it. It’s your exaggeration of “every hour” posts that give you zero credibility.

I wouldn’t write trolly posts if Hawk didn’t post his ridiculous “price slashes” every hour and Just Jack’s posts are pretty trolly too. I don’t really care if you delete my posts but you should probably delete Hawk’s if you delete mine. Introvert’s posts by and large should be deleted too I’d say.

http://www.vicrealestate.ca/listing/380859-4525-rithetwood-dr-saanich-east-bc-v8x-4j5/

A lot of talk about Broadmead lately.

I look at this as a test to where we are in this market. Good quiet street. assessment 850k 1980s original. Asking 1050k. Just came on the market.

“My existing mortgage is with TD and they would not offer any discount off posted or drop the penalty at all. I actually had a face-to-face meeting and was told the penalty is the same whether I renew with them or not, so I said ‘see ya’. I was quite surprised they would not ‘fight’ for my business.”

I don’t know what it is with big banks, they will spend all kinds of money in promotions and offer special deals to get you business but do NOTHING to keep it. Seems ridiculous to me.

So here’s a hint, offer to BRING them money, such as RRSP, TFSA, or simple savings account. Banks respond to money, that’s how they make money. For every $1 you deposit with them they in turn can lend that $1 out a minimum of 20 times at once. So a $100 deposit to them is worth $2,000 in lending power. Yup they pay you 1.5% on your $100 or $1:50 interest in a year and they in turn lend out your $100 X 20 at 2.5% in mortgage money for a total earning of $50 over a year. Pretty nice return on your $100. Take them a stash of cash and they will happily give you a break on their mortgage rate.. you’ve got to talk their language, money talks!

Mortgage: we bought last summer and are a year into a 2y fixed at 2.24. Not sure what we’ll do next year. Variable better historically, but if fixed rates are still low probably do a 5y fixed.

Ah yeah we would have loved to have a 3rd up, but everyone seemed to want that and it added quite the premium.

I back up my computer data, so the same with a second kid seems prudent. Now how to upload a baby to Backblaze…

Don’t know. This was back in the fall so I don’t think all the changes had come through yet? We took them up on it and got a lower variable rate with RBC.

Interesting. With the big banks increasingly regulated perhaps they are drowning in mortgage applications.

I actually had a credit union offer to waive the penalty if I wanted to transfer my mortgage. They were reducing their mortgage portfolio. Not sure exactly why but maybe they can get better returns outside of low rate mortgages.

Very good points. Have him focused on the bigger loopholes and tricks and have Selina focus on the housing specific issues like encouraging more affordable supply.

Renewal in exactly a year. Not concerned, Rates might be up a bit but I doubt it will make a difference. Expect to renew at about the same rate as what we have (2.79%)

Seems like 5 to 5 split on deleting trollish posts. For now I’ll toss the deciding vote to not deleting until it gets out of hand. I’d rather not delete anything if I don’t have to.

Same, with 2 kids the upper is good enough for us, although we have 3BR in about the same space which helps. Also you’re gonna have to have another kid just for redundancy purposes

James:

Thank you for the recommendation on the program for languages. I will give it a try and see if my grey cells can absorb anything anymore.

I think Whistler has made the right move. Victoria should follow their lead.

@YeahRight

I did try ratehub and the person who called me back from mortgagepal said to take the deal I’m currently working on. They couldn’t come close even though they advertise 2.49. Their best was 2.84 with no extras. They said to call back if the current deal fell through.

@gwac

My existing mortgage is with TD and they would not offer any discount off posted or drop the penalty at all. I actually had a face-to-face meeting and was told the penalty is the same whether I renew with them or not, so I said ‘see ya’. I was quite surprised they would not ‘fight’ for my business.

I know mathematically that variable is likely better, but I would obsess over a variable too much. I like not worrying about it for 5 years and historically speaking, 2.69 is an amazing rate. I have been the sole income provider for 15 years, but now my wife is back to work as of last month after being a stay at home mom and then a college program. Time to start knocking down the mortgage. Yay! It was nice that only my income was needed to qualify for the renewal – a bit of breathing room is great.

There was talk of sharing bedrooms; our 7 y/o and 12 y/o girls share a room and they love it. That might change, but so far they have only expressed interest in not being split up (I ask regularly). They have always been best of friends and have the most polite fights you have ever seen, no yelling or slamming of doors. Our 14 y/o son has his own room.

Whistler just helped their rental market by moving ahead with regulating short term rentals. Nice to see a community put the people that live and work there first. Because at the end of the day, local people make Whistler tick along, and without them, the town would fall apart. So in the end, a wise social and economic decision.

“Properties without proper zoning for nightly rentals won’t be able to obtain a business licence, and without a business licence a property owner may be fined up to $1,000 per day for either marketing or providing illegal tourist accommodation.”

https://www.whistler.ca/media/news/business-licences-now-required-all-whistler-vacation-rental-properties

Not saying I ever paid for Rosetta Stone (they actually had a free promotion a while back which is how they got my email address). So technically I was judging them equally since neither cost money, I found Duolingo to be better (at least for French & German.)

@James Soper

“Rosetta Stone costs an arm & a leg, and they will incessantly email you if you give them your email address.

Duolingo is equally good and free. (www.duolingo.com).

— i’ve actually used both programs. I actually find duolingo better, and not because of cost.”

But we live in Canada, where on the internet “Sharing is Caring”. As long as it’s a direct download (no Uploading), It’s a gray area aloud.

Not that I’m promoting this or telling you how.

😉

Just read your post from the last thread. I probably come across as more negative than I am, mostly because I’m a reader, and not a writer and so generally comment more often when something aggravates me. For the most part I find what people post on here great, and people are friendly, so sorry if I’m contributing negatively. Although I doubt the sentiment will result in more positive posts, but just less posts in general.

I’ll second that.

I wouldn’t write a trolly post if those types of posts didn’t exist here. Definitely get rid of them.

Rosetta Stone costs an arm & a leg, and they will incessantly email you if you give them your email address.

Duolingo is equally good and free. (www.duolingo.com).

— i’ve actually used both programs. I actually find duolingo better, and not because of cost.

If the NDP Greens accomplish nothing else other than campaign finance reform and a crackdown on fraud and speculation in housing before government changes hands I’ll consider them a success.

Variable prime minus 0.55 2013- Oct 2018.

I am not doing anything as I don’t anticipate much increase in the prime especially now seeing how the CAD went nuts with one increase.

The last two years I have actually been paying down the mortgage pretty aggressively. Not such a great return on investment (equivalent to about 3% pretax) but I haven’t seen a ton of value in the stock markets the last few years (so much for my crystal ball). I have been doing RRSPs and TFSAs but everything else is going into mortgage.

The renewal in late 2018 will be for a small balance so I probably won’t get the best rate. Banks want an 800K mortgage not a 80K mortgage.

Don’t bother unless it gets much worse. I agree that some posts don’t add much value, but the pure trolling is a tiny proportion of posts.

Lots of the regulars here, myself included, occasionally write slightly trolly posts, but overall the tone here is cordial and informative by blog standards.

@islandscott

I presume you mean fixed.

If I wasn’t almost done with my mortgage completely by Oct. of this year (Right now 2.19%), I’d take that.

(Yes folks, if you remember my story from the archives, I will be done this year!)

But maybe you can try for cheaper rates using others as an example:

2.49%

https://www.ratehub.ca/best-mortgage-rates

Even if you have no intent on using others, try to scare them into to giving it. They want your money after all.

I don’t know where you are at. But this tool helps me decide the hard decisions.

http://cgi.scotiabank.com/mortgage/payment/en/payment.html

Island have you tried going to your bank to see if they will beat and not charge you a break fee? They become very negotiable when you threaten to leave?

What are people doing with their mortgages right now? I’m in the process of locking in for 5 years for 2.69% with $500 cash back and free lawyer/appraisal fees (switching banks). I’ll actually have to pay a bit to break existing mortgage, but I think it’s worth it. If I renewed instead in a year at 2.9% it’s a break even with paying the penalty now, but I think rates will be higher in a year. Thoughts?

“She forced their hands by making inaction politically unconscionable. ”

Agree. (and it’s high time they make coffee coloured shirts)

I even got an email from the Libs saying “Horgan has a chance to use an inherited, $2.8 billion surplus to reward NDP friends and insiders ” … never mind that the Liberals rewarded their insiders for years by letting them run amok with condo developments sold to their friends & Bob Rennie being their chief fundraiser. Pot calling kettle black 🙂

IMO, one of the most outrageous dynamics of recent times is the degree that Kathy Tomlinson has affected the housing policy frameworks in this Province. She did, with little resources and no privileged access to information, what our leadership refused to do. Actually look at the problem – and expose it. She forced their hands by making inaction politically unconscionable. I’m very glad she did, don’t get me wrong, but that just seems like a reflection of a very dysfunctional state of affairs.

Ugh. All I can do is hope. F(&()* and I just spilled coffee all over my shirt…

Eby is going to be a star and put the boots to the criminals that have been raping this province the last 16 years with no fear of Liberal intervention. Selina will do well in housing and knows what the game plan is.

I’m very optimistic of what’s to come and the corruption will be cleaned up, and those getting payoffs will be revealed. I bet Eby has strong leads already from the excellent investigative reporting the past year exposing the cons and thieves.

Remember folks, always put things into a written contract, even (especially) with family: http://vancouversun.com/news/local-news/maple-ridge-man-sues-stepdaughter-over-alleged-breach-in-agreement-involving-real-estate-flip

@Barrister

“On a different note has anyone here had any success or can recommend language programs, I am thinking of learning both German and Italian.”

Rosetta Stone® – Best computer program “ever” for language learning!

“Can someone kindly direct us the best post/rant ever on HHV from earlier this year or last year? ”

By rant, do you mean put-downs? Can you give us an idea as to what is “best”?

For me the blog is addictive because of the debate, not the rants.

Added: I just saw what Leo posted. Yup, a list of put-downs of other people’s opinions.

Someone the other day remarked that the Internet has been too fueled by putting other people down – I agree.

@Numbers hack

Good post is debatable, but the best rant for sure

https://househuntvictoria.ca/2017/04/03/march-update/#comment-23886

Nan:

I think you have made an excellent point about suites in houses. Maybe I should point out that the government has not changed the law as to rental income or capital gains on a property; all they have done is to start enforcing it better.It limits my sympathy.

Reading this blog is starting to feel like East Germany’s vision of the future. On a different note has anyone here had any success or can recommend language programs, I am thinking of learning both German and Italian.

@ 3Richard Haysom yes – that is certainly a factor.

The main point of that post was to point out that the way the add back was done before they changed the rules created much more incentive to bid higher for houses with suites. Now, combined with the changes to capital gains enforcement on suite portions of houses and enforcement, suites look much less attractive than they once did.

A source of tax free earnings and capital gains that allowed you to get a nicer house has now turned into a boat anchor that may cost you a ton of money in taxes without being able to sell at the premium you once were. Bummer.

Can someone kindly direct us the best post/rant ever on HHV from earlier this year or last year? Or repost it? Thanks in advance.

Bearkilla and others who only add constant, trollish comments should go. And grammar nazis also, please.

Income splitting is going to be thing of the past!

1/ Bill Morneau will be affected

http://www.ctvnews.ca/politics/morneau-expects-to-be-hit-personally-by-closing-tax-loopholes-1.3507642

2/ but who is counting when you got a stock portfolio worth over $32 million, not including your other assets?

http://ottawacitizen.com/news/politics/morneaus-corporate-holdings-hold-potential-conflicts-for-cabinet-post

Feel sorry for doctors/dentists/entrepreneurs

Our plan if we have a second is for the kids to share a room at least until puberty. We’ll see how well that works though as it’s still early days and from what I’ve seen, kids can throw a thousand wrenches into ones plans.

That I can get behind. A reasonable allotment of space for each human.

I have to confess that I feel sorry for young people buying a house today. The tax burden on every level is so much higher than in my day. The thought hit me, when I was looking at the increased levels of debt for Canadians, that if you added in government debts that the debt load would be huge. I really do hope that I am wrong but this might not end well.

An imputed rent tax would be a huge disincentive to speculative investment (foreign or otherwise) in empty houses.

I’ve seen a bit of bewilderment on here with respect to David Eby’s appointment as AG Minister, rather than Housing.

While I think him being placed as Housing Minister would be consistent with the subject matter he appears most passionate about, I think him running the AG’s office does make sense.

One of the most repeated arguments Eby has made is the degree of toxic demand in the housing market, in particular, those who are laundering cash and/or buying homes without revealing who the beneficial owner iss. Further to that, the lax or non-existent enforcement of laws that we have, that are designed to protect and maintain confidence in our regulatory system and market.

There’s an argument to be made that as AG, he would be better positioned to actually work on addressing these issues and adding some transparency to our housing market and better enforcement of the laws and policies we do have (and perhaps new ones). So I would say that this position for Eby is actually ideal, and I’m hopeful that Selina Robinson will prove to be a competent Minister as well.

@Nan on

Banks only apply 50% of rental income towards mortgage qualification, not 100% as your examples showed.

“I do like the idea of people living with less space. We live in a 2br, 1000 sqft suite with an infant, and don’t anticipate expanding into the suite downstairs for 10+ years, even if we do have a second kid.”

We got fed up in about six months with our second kid sleeping in the living room of our 1000 sf 2 bed bung, which is why we expanded to about 2500 square feet.

But today, that’s kind of small, it seems, as more and more people in North Oak Bay make a statement by tearing down a livable old housae and building five to 10 thosand square feet.

I personally think it would enhance their statement if there were paying a coupla dollars per square foot in tax on the imputed rental value. And with Liberals in Ottawa, the “need” for more cash will likely prove insatiable.

Maybe an imputed rent tax would have an exemption of, say, 500 square feet per person. Then they could call it, not an imputed rent tax, but a green tax on conspicuous consumption.

It is baffling how David Eby was not appointed housing minister. I think a reason why the NDP won in some ridings in Vancouver was because of how vocal Eby was on housing reform. I wonder if Horgan thought Eby might be a little too enthusiastic on massive reform

That would be a simple model. But ideally it should be the actual market value as a rental. I imagine there’s a lot of discrepancies between assessed and rental value. Just my gut, but features like a large lot size would have a lower rent:assessed ratio than location or updated/modern interiors would.

I do like the idea of people living with less space. We live in a 2br, 1000 sqft suite with an infant, and don’t anticipate expanding into the suite downstairs for 10+ years, even if we do have a second kid.

” just because you got lucky with low interest rates and tax breaks doesn’t make you a genius.”

Agreed, crap shoot luck that rates went to near zero and are only going up from here on in and house prices going down as credit lending tightens.

Bearkilla needs to be turfed, he offers zero.

Islandscott

I think Ottawa is desperate for cash to continue its expansion of social programs. I think they will be heading deeper into the well going after smaller and smaller tax payer omissions especially if technology can make it cheaper for them. landlords forgetting to include rent is a fairly easy one that can recoup a descent return from the expense.

When we bought 4 years ago we made a choice to buy a smaller rancher over a house with a suite. We were in a townhouse and the main factor was not wanting to share a wall again. At just over 1600 square feet our house is smaller overall, but larger than the main floor of most houses with suites (at least in our price range). I also look at it that we won’t need to downsize when we get old, so there is a savings there that offsets the gains of the more expensive purchase of a house with a suite. And we get to live more stress free lives without the hassle of renters.

gwac: Great point on the subsidy being used to track renters’ addresses. Hadn’t thought of that.

Poll question: most of the trollish comments are pretty childish and 1 comment per thread is probably easily ignored. I agree with Garden Suitor, 1 comment per thread.

The only thing I’d add is that it gets tiring when a poster ONLY posts when they’re critical of another person’s comment – even if those critiques are informative. If they only post to criticize others, and can’t go out on a limb and post an unsoliciated opinion, news article, or share a new thought/idea, then it’s pretty cowardly. Other readers DO notice those patterns.

Who cares if someone’s been wrong in the past – just because you got lucky with low interest rates and tax breaks doesn’t make you a genius. It also doesn’t make you “ahead of the game” or a good predictor. It just means you’re one of the masses that benefited.

A good forecaster analyzes new trends not just past data.

@Garden

“Taxing imputed rent would be a pretty huge change, and seems like it would be problematic to enforce.”

it would be a change, that’s for sure. But no more revolutionary than, say, the GST.

it would be easy to assess. It could just be a percentage of the assessed property value.

Collection could be done in collaboration with the municipalities or by a Provincial Revenue Agency (there’d be big money at stake, so well worth the cost of a new bureaucracy).

“Also would it incentivise people to make their places worse?”

No more than do municipal property taxes. It would, however, incentivise a move to smaller houses, and create pressure for rezoning to allow smaller lots, which would drive down lot prices and make urban housing more affordable.

Nan: I was not aware that the banks have changed how they treat income from a suite. Good information to have and thank you.

John Dollar: I have not done the math but I have often wondered if you might be financially ahead these days by not paying extra for a house with a suite. This might be particularly true if your goal is to have the mortgage paid off early. There is also a large intangible factor since I know a number of couples that have almost come to blows over tenants. (I am not including the couple where one spouse was having sex with the tenant which might raise the question of whether one can raise the rent under the landlord and tenant act for extra services provided).

Poll: Generally I am not in favour of deleting posts, Bearkilla is short and not really offensive.

CS

Taxing imputed rent would be a pretty huge change, and seems like it would be problematic to enforce. Also would it incentivise people to make their places worse? “No way this place is worth $2k in rent, I’ve been soaking cougar urine into the subfloors for months”

Broadmead should have included more retail in its original development. Like cook street or Oakbay. Other than that it is a nice family planned community.

Once the NDP gives the $500 renter subsidy. Landlords better look out. Revenue Canada has a computer program that spits out multiple families living at the same address now also.

Let Bearkilla have 1 troll per comment thread. Any more, delete.

I feel sorry for Bearkilla. Obviously has some issues that needs an outlet that isn’t that harmful because we pretty much ignore him/her.

Talking of taxing income from suites, what about nanny suites? Do those live-in Philippina nannys who work all hours for what one understands are modest wages pay rent? And if not, should not the employer pay tax on the imputed rent of the accommodation provided? (Perhaps it is to accommodate a nanny or other live-in servant that so many Uplands homes have a fully equipped suite.)

I should probably keep my mouth shut, but the new provincial government might even think about taxing owner occupiers on the imputed rent, as does the government of the Netherlands. That actually makes some sense, since a tenant must pay the landlord rent that not only covers the landlord’s expenses and a return on investment but also the landlord’s tax on the rental income. So why should owner occupiers be exempt?

Reply to Poll:

Leave the trolls’ posts, it’s entertainment, plus trollish posts reveal more about the trollor than the trollee.

Within reason of course; if someone posts nothing but troll comments, then ban their IP

“Spot poll: Posts like the trolling below from Bearkilla, should they remain or should I delete those type of comments going forward?”

A certain sourness in acknowledging that one is on the wrong side of the trend is understandable. I think Bearkilla’s public capitulation is worthy of note and should stand.

Time for Bearkilla to go.

It comes down to the intent of his/her repetitive message that doesn’t encourage discussion but is only meant to incite anger.

https://youtu.be/6Zxy_dScjsM

I would suggest deleting them, and then putting the user’s posts in moderation moving forward. If they don’t stop, get rid of them. Most of us post troll-like stuff from time to time, which can make it fun to read…but occasionally you get some people that don’t seem to do anything else.

For a long time, suites were a massive driver behind price increases. For mortgage affordability calculations, the suite income was a deduction from the mortgage payment whereas now it is an addition to the applicants income. This change had a pervasive impact on the ability of people to bid up units with secondary suites, or support larger mortgages if they had the intent of building one.

e.g. under the old rules and today’s interest rates, a 500k mortgage has about a $2200 mortgage payment. Lets say that is what the bank would approve based on a $100k income. If the mortgage you wanted was $750k, the payment would be $3,300, which is too high based on your employment income. If the suite had an income of at least $1,100, you could buy this house since the net mortgage was only 3,300 – 1,100 = $2,200.

Under the current rules, that $1,100 would be annualized and added to the applicants income. So if they have 100,000 in annual income, their income for the mortgage would only be 113,200. The mortgage amount would maybe increase from $500k to $550k or something, not the $750 as under the old calculations.

My numbers aren’t very precise here but at the end of the day, the old suite income calc’s allowed folks to borrow more to buy houses with suites in them, so they did.

I have always thought so too. But Broadmead does not allow suites. And that has kept their price appreciation down.

Spot poll: Posts like the trolling below from Bearkilla, should they remain or should I delete those type of comments going forward?

A speculation tax? Wasn’t the PPT touted as just that. Doesn’t Toronto have both a provincial and a city property purchase tax?

Neither have ever slowed speculation or hoarding. Time to remove the profit incentive to those that own more than three residential properties. Residential is for people to own and live in. If you want rental properties – go buy an apartment building.

Why Eby is not housing minister is beyond me. Sure AG is perhaps more prominent but the guy has been focused on housing for so long.

Yep any day now bears you might be right after being wrong for a decade. Boy you sure are geniuses.

New housing minister Selina Robinson to tackle B.C.’s runaway home prices

Coquitlam MLA Selina Robinson has been named B.C.’s new Minister of Municipal Affairs and Housing. Robinson, re-elected in Coquitlam-Maillairdville and formerly critic for mental health and addictions, is seen as a strong advocate for housing affordability and a rising star in Premier John Horgan’s party.

On the campaign trail, Robinson said imposing a speculation tax to slow runaway home prices in Metro Vancouver and Victoria, and building 114,000 new rental units, were at the top of the party’s to-do list.

The NDP also promised to close loopholes that allow for flipping of presale condos and to establish a multi-agency task force to fight tax fraud and money laundering in the real-estate market.

Robinson is filling the shoes of B.C.’s new Attorney-General David Eby. As NDP housing critic, Eby promised the party would change land-holding rules that allow true owners to hide behind shell company and legal trust arrangements.

“I think the most important thing they can do is to make sure people who buy homes in B.C. are paying taxes here, and I’m pretty optimistic the NDP will move in that direction,” Davidoff said. “And I think they will clamp down on speculation and money laundering.”

“The NDP will be more aggressive in regulating capital in-flow and demand that is not local serving demand,” Somerville said.

Somerville and Davidoff both said they believed one of Robinson’s early actions could be reforms to the B.C. Rental Tenancy Act, to tackle so-called “renovictions” that allow landlords to raise rent prices through dubious means.

http://vancouversun.com/news/local-news/new-housing-minister-selina-robinson-to-tackle-b-c-s-runaway-home-prices

The Golden Head glow continues to wane at 4367 Torquay Dr where the student special is slashed for a second time for an $80K beating.

1668 Earle St in Fairfield couldn’t get the million dollar bid so down she goes $30K.

Another overpriced bungalow at 1716 Albert Ave slashed only $20K. Going to need more than that at $734 per sq ft.

3446 Plymouth Rd getting a bit serious with a $100K slasher in the Henderson hood.

A couple more in the prime Glanford area in the $800K ranges slashed $30K a piece.

Lots more to out there in condos on Beach Drive to South OB but will need much more slashing to get the traffic.

Price slashes are hot and heavy like no other day in all areas. I guess the Horgan government has hit home and they all want out.

I always thought that Broadmead is one of the better areas to buy. better value for your dollar than a number of other areas in Victoria.

Yes, I am personally aware of a number of Uplands homes (not for sale) that have suites occupied by renters. Further, at least two empty Uplands houses for sale that I viewed had secondary accommodation complete with kitchens ready to go.

If suites were the reason for price increases, then Broadmead would be the most expensive neighbourhood in Victoria as their association is fanatical about rooting out secondary suites. The rule against suites is enforced hard in that area and I believe there are even legal covenants on each individual property.

Yet, Broadmead, a very good upper middle class neighbourhood, (correct me if I am wrong) has never been the most expensive or even in the top three or four areas for high average property prices (absolute or per square foot of land or building size). And Broadmead has some of the largest and best homes in Victoria.

Yes, I am personally aware of a number of Uplands homes (not for sale) that have suites occupied by renters. Further, at least two empty Uplands houses for sale that I viewed had secondary accommodation complete with kitchens ready to go.

If suites were the reason for price increases, then Broadmead would be the most expensive neighbourhood in Victoria as their association is fanatical about rooting out secondary suites. The rule against suites is enforced hard in that area and I believe there are even legal covenants on each individual property.

Yet, Broadmead, a very good upper middle class neighbourhood, (correct me if I am wrong) has never been the most expensive or even in the top three or four areas for high average property prices (absolute or per square foot of land or building size).

Totoro:

I was not suggesting that the lack of rental suites was the only factor but rather it is an additional factor to the ones you have mentioned.

I don’t think a lack of suites is what caused the Uplands values to go up. Many of the homes do have separate accommodation for caregivers or guests. People who can afford to buy in the Uplands may not want to rent out the suites on the market because they don’t need to do so to pay the mortgage. Lot sizes, house quality and location support higher valuations.

Penguin:

Actually you do have a bit of a point in that most of the City of Victoria’s housing stock is pretty horrible. All the basement suites really dont add value to the neighbourhoods. Someone pointed out that one of the reasons the Uplands has increased so much in value is that it is one of the few areas in the core that are not flooded with basement suites. I am sure that I am about to be beat up for being politically incorrect but that does not necessarily make me factually wrong.

It doesn’t matter to me if prices go up because I don’t want into the market as it is now. If there was a bit more selection I’d be ok with today’s prices but not where it’s at now. Just not worth it to me and I’d rather rent forever and save more money than spend all my time and money on a crappy house that will leave me house poor.

Yeah I don’t see a lot of value out there. But I also didn’t see a lot of value in many places when they were 25% cheaper so that’s not saying much!

I think we have some more price gains in most sub markets ahead of us, but I doubt we will have nearly as long of a hot market this time around as in the mid 2000s when it lasted about 5-6 years. We are going into our second year here and I can’t see it lasting more than another 9-12 months.

Leo I definitely ask my friends and am surprised that of all the people that have told me (about 7) that none of them declare. They don’t see anything wrong with it because they say no one declares. I’ve been looking into buying a house with a suite and would not feel comfortable not declaring. Taxes aside I’m definitely going to wait to buy a house. Who knows if that is a good or bad idea but just doesn’t feel like the right time to me. Nothing out there I’m willing to spend my hard earned cash on yet.

I don’t know anyone like that. Or rather, I wouldn’t ask if they did or didn’t.

We don’t declare the income but that is because we are only charging a nominal amount far below market rent to a family member so it qualifies as a cost sharing arrangement and does not have to be declared (also can’t claim expenses related to the rental).

From the areas in looking at and with no data to support my argument it looks like the market is cooling. I think the next two years will be very interesting at least!

Nan:

“If I could split income with my wife I’d have saved 10’s of thousands of dollars over the last 5 years. But I can’t so I paid my taxes and those folks who hid behind corporate structures realized more money after tax while benefitting as much from the taxes I paid as I did.”

I feel ya. As a high-middle class earner I feel everything is rigged against me. Pay more taxes, get less money for kids and social assistance goes to low income earners. But 160k salary in Victoria is like earning a quarter of that in most other bc towns and yet those people get much more assistance and pay less taxes. I’m very privileged and not complaining but it is totally the high and low income earners who seem to get the benefits.

What also grinds my gears are that almost everyone I know who owns a sfh rents a suite and doesn’t declare the income. As a taxpayer this infuriates me as it should be declared. I hope they are all caught and face fines to be honest. I’m curious and have a question for those who rent out houses/suites: do you declare the correct income?

I think if anyone fudges taxes they should not complain about overseas bank accounts because you are just as bad as they are!

@Barrister

Just remember to learn about their strange sports and customshttps://www.theguardian.com/world/2017/jul/18/switzerland-puzzles-over-citizenship-test-after-lifelong-resident-fails

“Duolingo does Italian too, but yeah, not as close to English as German is.”

The main differences is that in Italian you have to use your hands a lot.

“Personally I have not found people in Victoria to be very friendly.”

I also found it was easier to get to know people in Vancouver because in a group of say 10 people, 70% would be outgoing enough to suggest some activities outside of what you were doing. Maybe because Vancouver is a mix of people from many places, and perhaps the work world is more competitive so you have to be outgoing and try new things to survive there? Here, so far I’ve discovered that perhaps 30% of people you meet are like that.

But maybe we just need to get out more, since our renos have taken up a lot of time 🙂

Lugano is still relatively small and certainly less packed than Victoria is becoming. It is more expensive but not to the point were it makes much difference to us at this point in our life. If we had to buy a house there then it would be prohibative. Personelly I have not found people in Victoria to be very friendly. I am sure that many would disagree but it has simply not been my experience.

Launching soon. http://cacciaallacasalugano.ch

Well no wonder you are ambivalent about Victoria 🙂 Ticino is beautiful!

I just got back from a visit with extended family in Switzerland. Lots of things I admire about the country. Amazing infrastructure. Culture of physical activity instead of our culture of sloth. A real effort made to preserve and enhance their historic cities. Actually found people to be very friendly counter to stereotype about Swiss being very reserved. The only downsides for me are (1) EXPENSIVE!!, (2) Eight million people packed into the area of less than 1.5 x Vancouver Island means it is hard to get away from it all.

I get that retiring in a foreign country when you don’t speak the language might not be ideal. English is very widely spoken but it would still be isolating not to speak much of the local language.

Learning another language is great but you will always bee seen as a foreigner. Still we will make a decision towards the end of the summer.

Duolingo does Italian too, but yeah, not as close to English as German is.

Certainly better than Italian administration, German Fashion and French fries.

James:

Actually the main language is Italian in that part of the country. You are sorta stuck with Italian food, French fashion and German administration. )n reflection it could be worse.

There is an element of just being in your home country.

nan, have to agree. It’s been legal but undeserved, and not the original intent. Sure people took advantage of it because they saw others using it, but it doesn’t really help Canada’s tax system (or anything that’s paid by our taxes like medical, social services, etc) to allow this to keep happening.

Also agree that it doesn’t even matter the level of income (not necessarily wealthy), it seems everyone from tradespeople to accountants have used it.

Now that you’re retired, you could take up a new hobby. German is pretty close to English. I used Duolingo (a free app for you phone, or online) and can now read German kids books to my kids. It’s like 10 minutes a day.

Caveat Emptor:

My wife has a rather large home in Lugano that she inherited. She also is a Swiss citizen as well as American. The drawback for me is that I am unilingual. It was the other alternative before we finally settled on Victoria. At the moment her cousin lives in the gatehouse and looks after having the property maintained but there would be a few years work and disruption by contractors to totally upgrade the property. But a very pretty part of the world.

This is pretty big. I don’t agree with the headline since wealth =/= high income and the proposal has nothing to do with taxing wealth and all to do with taxing income.

http://www.cbc.ca/news/politics/morneau-tax-changes-wealthy-consultations-tuesday-1.4210201

Either way, it’s about time. I earn income as an employee and I’m tired of living in a society that has a 2 tier taxation system. I’ve said it before but it makes no sense that folks who have the opportunity to structure their affairs behind a corporation can earn a similar net business income and pay a lower average tax rate on that income because his/her spouse is the “accountant” or the kids are shareholders or other such nonsense.

If I could split income with my wife I’d have saved 10’s of thousands of dollars over the last 5 years. But I can’t so I paid my taxes and those folks who hid behind corporate structures realized more money after tax while benefitting as much from the taxes I paid as I did.

Barrister. Just curious – where would you consider moving? If the goal is to get away from a city that feels American then presumably not to the US. What sizeable cities in Canada feel less typically American than Victoria? Perhaps Quebec City or St John’s? Or are you thinking further afield? Europe? Latin America?

Barrister is like any monopoly profession. It is works for them no incentive to change unless the government forces it. DOM are just not a big deal in the scheme of it all.

What bugs me is paying 40k or whatever to sell a 1m home.

“That is not a triplex.”

They are calling it a “non-conforming Triplex “. Get over it.

” It is a SFH on a busy road”

A busy road ? Heaven forbid. I recall some ridiculous sales the last year on busy roads.

“with two illegal suites ”

Better call the bylaw cops. Oh right, it’s none of your business like with Helps AirBnb fiasco.

“You’d have to be under 5’6′ to live there. ”

Short people have to live somewhere.

It is assessed at 749k. Good luck getting 999k.”

I’ve lost track how much trash has sold for $900K with a $600K assessment and in need of major renos.

GWAC: