May Market Wrapup

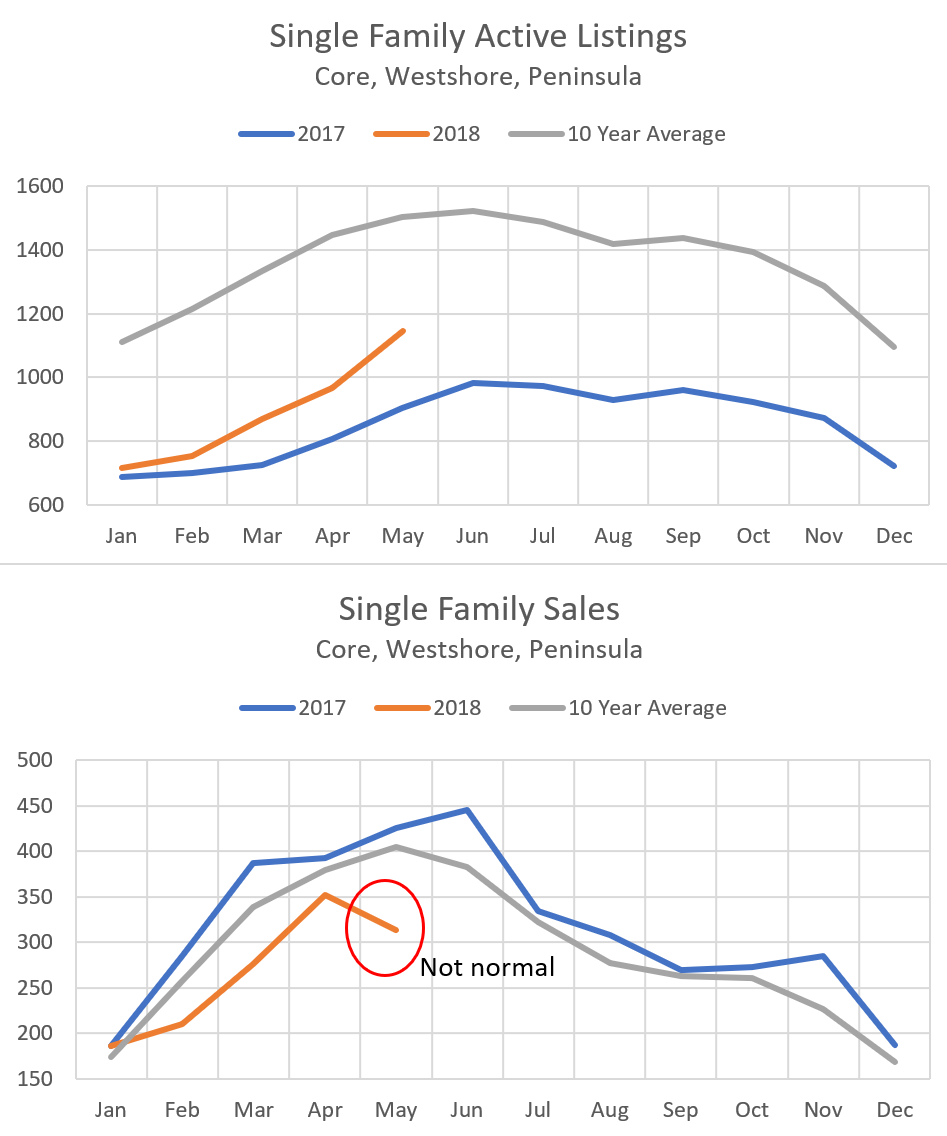

End of another month, and it’s been slow throughout. Before the official stats come out let’s take an early look at how it turned out. Here is the picture for single family active listings and sales.

A few takeaways from the single family home situation :

- Sales dropped substantially in May from April. This is quite unusual as you can see from the 10 year average and happens in times when the market is slowing quickly enough that it overpowers the normal seasonal increase from April to May.

- Sales are down substantially from last year, but also below the 10 year average. Not a record low, but a surprisingly large dip from earlier in the year.

- Inventory is still very low. It is increasing more quickly in recent months but will still take quite a while to get even to the 10 year average, let alone to the highs of 5 years ago when there were nearly twice as many detached homes on the market.

- The low inventory means the market continues to move and about 20% of single family homes are selling over asking price. It’s like a pot that you’ve turned down from a roiling boil to a simmer. Still not a great idea to stick your hand in there but at least the soup isn’t splattering all over the place.

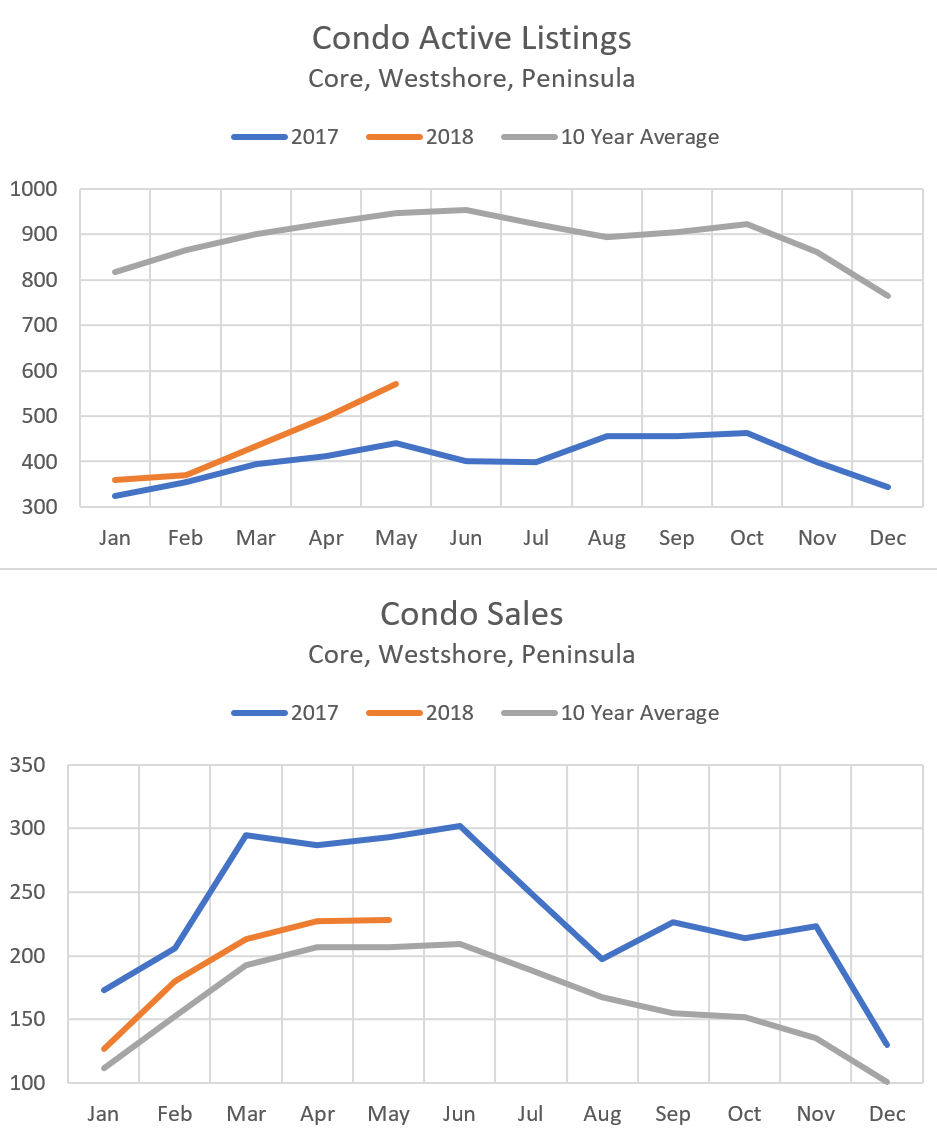

Situation for condos looks somewhat different. While fewer properties are selling over ask, sales are still above the 10 year trend and the seasonal pattern does not exhibit any kind of abnormality. Despite this theoretically stronger situation, a few months ago I predicted that condos will likely be hit harder than single family by both the stress test and the coming down cycle in housing. There is some early evidence this is happening with continuously declining bidding wars but I believe this will be caused primarily from increased supply that is coming down the pipe.

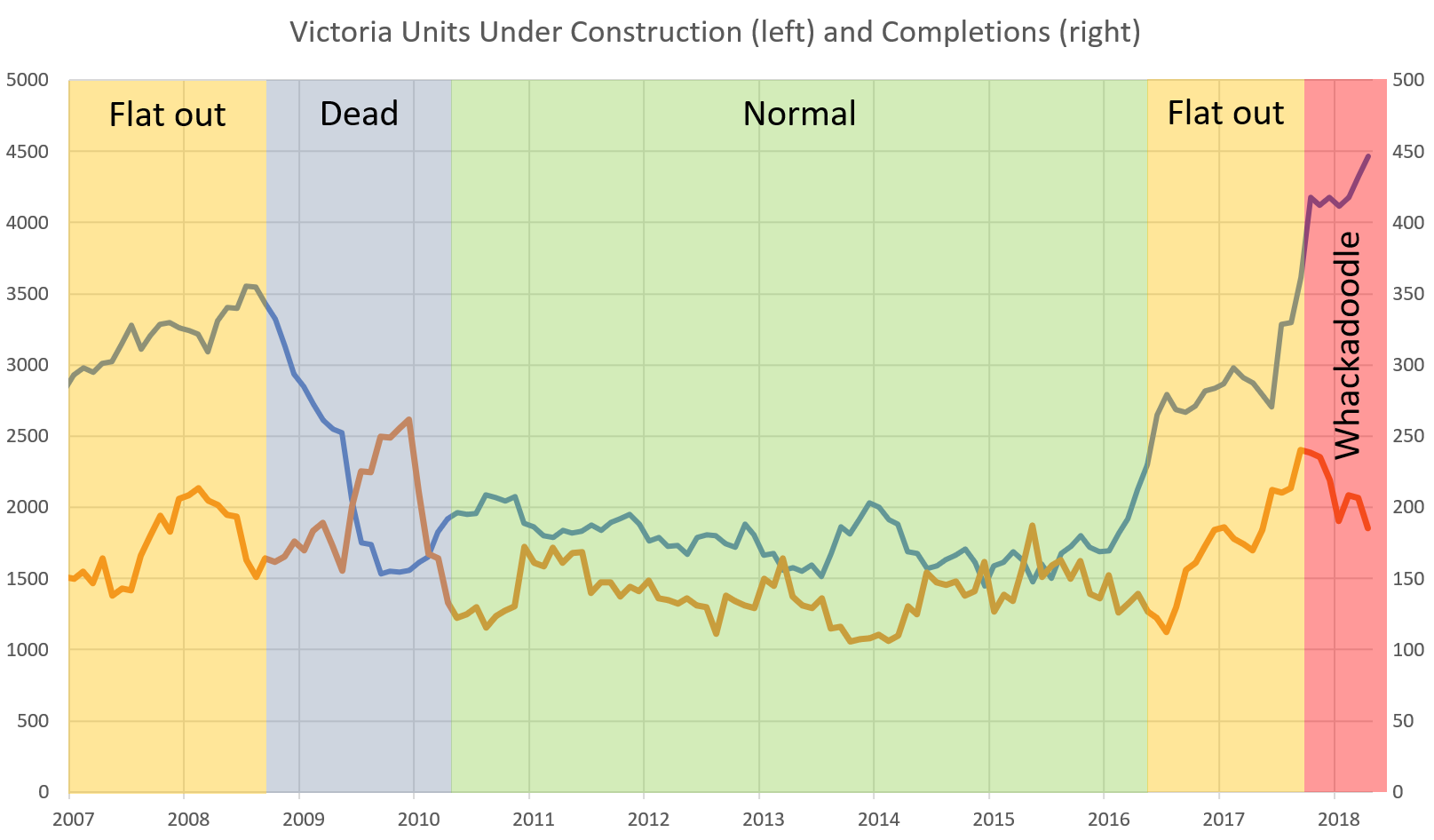

Notice that monthly completions took a step up after the increase in construction in early 2016, however we should soon see another jump up as projects are completed from the even higher level of construction mid 2017 onwards. With the recent investments in affordable housing by all levels of government, it’s unlikely that construction boom is going to slow down for another couple years.

On prices, not much is happening with the single family median hovering around $800,000 so far this year while a median condo goes for half that price. No substantial movement in the price in May in either segment.

Sales to new listings ratio continues to fall. May’s level of 50% is pretty low for this time of year. In May 2016 it peaked at 91% and we are now down to 2013/14 levels. The lowest values we tend to see in May are about 40% though so we are not at the levels of the weakest markets we have seen (2011/2012).

Update: VREB press release is out and I believe it is somewhat misleading. They say that “we’re seeing pressure from increased competition on a smaller number of homes, which is really pushing the under million dollar market.” This is not true. Active listings of single family homes under $1M are up from last year (868 from 802) while sales are way down (298 from 428). That means there is less competition in the under $1M single family home market than last year, not more.

They are also making the argument that listings are up in the over $1.5M market due to the spec tax, foreign buyers tax, and school tax. However the majority of properties over $1.5M are not subject to the school tax as it only kicks in over $3M so it cannot be a factor. Their argument is that the decline there is not helping affordable housing so the taxes are not having the desired effect. However, the truth is that no market segment can decline in a vacuum. If the top end of the market declines, it drags down the middle and low end as well due to the theory of substitution.

https://www.searchvancouverhomelistings.com/homes/bc/vancouver/vancouvresdr2247329262268956/2826-e-broadway-vancouver-bc-v5m%201z1

@Grace

Hi Grace, yes, up island went a bit nuts!

Interestingly, for SFH all up island areas have dropped drastically in sales volume in May 2018 except the Comox Valley and Campbell River.

Qualicum/Parksville SFH sales dropped 37% May 2018 compared to May 2017.

The CV and CR are still trucking along at almost the same rate as last year with a drop in inventory as well, at least in the CV. But those two lagged behind on the upward trend, so I imagine they’ll fall in line with the rest in the next few months…

Can view sales stats on page 13 here:

http://www.vireb.com/assets/uploads/05may_18_vireb_stats_package_64515.pdf

Leo, if you want more data to support your premise then you could look at the Historical Sale Price Trend preset in the stats mode and plot median list price to median sale price.

Agents anticipated a rise in house prices in the spring but that didn’t happen and fewer properties sold over asking price. Interestingly the spread between list and sale is getting wider again as we head into the summer market. So are we going to see more lawn signs with reduced stickers plastered on them this summer? As that visual stimulus may send a psychological message to home buyers, that not only are asking prices coming down but so are sale prices.

The value of your home is mostly psychological. We say things like the property is mostly land value assuming that land has an essential value that never falters. But land is only worth what a buyer and seller can come to an agreement on. Both buyer and sellers’ motivation plays an important role in setting that price. If there is no economic demand or motivation to buy then the property has no value.

I would say that investors are more knowledgeable than home owners when it comes to the marketplace. And what I have noticed this year is that revenue properties with four or more suites, that are purchased solely for their income producing qualities, have had rising capitalization and declining gross multiplier rates. The buyers for these properties have already anticipated a decline in market prices for this year and have been buying

accordingly.

So what’s next for the detached housing market in the core…?

-steadily increasing days to find a buyer in the range of 30 to 60 days. Along with more active listings and more selection for home buyers. The return of creative financing schemes such as assuming a mortgage, vendor financing, vendor rent backs.

The Parksville Qualicum market is pretty hot right now. Many homes going over ask. Our house has gone up about 100,000 in one year ( judging by the sales of very similar houses in the neighbourhood) Will it last? Probably not but I don’t think the drops will be as dramatic as in Victoria.

It may not be cheap upisland but is more affordable in comparison..

Caveat:

Sadly Rockland, being under serviced by the city, actually does not have a neighbourhood park, playground or tennis courts. Perhaps the parking lot of the art gallery might work for a tent city.

New post: https://househuntvictoria.ca/2018/06/05/of-price-changes-and-gains

I also hear there is a real groundswell of support for hosting a new tent city in Rockland. Very selfless of the residents there.

What’s the top 5% of household income in Victoria right now?

Wolf: You got it wrong, the secret is to get the women to pay for your gambling and drinking.

1883 Monteith, in Oak Bay just dropped its price by 190k which is a pretty significant drop. It is jst one listing but at a quick glance it seemed to be mostly in line with other simliar sales. But this one made me stop to wonder if people might be a bit worried now that we coming to the end of the spring market.

“typical high quality case: 750-900k SFH (or perhaps he said this was the mortgage amount), 200-300k down, dual income household.”

$750K-$900K would likely be the mortgage amount not including the down payment. My anecdotal evidence suggests that if you’re in the market for a $1M home you must have a household income in the top ~5% of Victoria with a 20% down payment or a lower household income with a down payment well above 20%. That’s why sales in this price range have decreased considerably; people either don’t have the household income or the down payment required. To me it seems like it’s a matter of time before the market runs out of people buying with large down payments from previous equity.

“However it’s more about the trend than the absolute value.”

Thanks Leo. I’d be interested to see sale price to original asking price as I can only recall seeing a handful of homes sell over ask since January in my (somewhat wide) SFH search criteria. If that 20% is lower it would suggest a stronger downward trend and, in my opinion, a shifting mentality to offers at or under ask (or even at or under assessed). In 2016 most offered over ask because it was what you had to do so I’d bet most will offer under ask now if it’s all you have to do; nobody wants to be the winning bid by $50K. Personally, I’d rather spend half that money on gambling, liquor, and women- and then waste the rest.

Anecdote Alert: I spoke with a friend who is a mortgage broker and asked him what he is seeing at the moment. He said it’s basically frozen right now – with the addition of the stress test the highest quality applicants are simply not being approved. In his words a typical high quality case: 750-900k SFH (or perhaps he said this was the mortgage amount), 200-300k down, dual income household.

Boosi:

Having survived a declining market in the past (not here), I found that many realtors really don’t know how to price a property when the dynamics of the market change. Get several agents to give you a market analysis and fair estimate of value.

Boosi:

Impossible question to answer. The devil is in the details. Suggest you get a few good real estate agents to price it for you.

Josh:

You are right about Songhees and the need for Commercial and community support structures is important to integrate. But James Bay is the ideal location for not just much higher density but also an opportunity to provide more assisted housing and supportive housing and temporary shelters. In exchange for high density the developers would pay for the costs of housing the homeless and providing supportive house for low income families. It would be a step towards solving many of the housing needs that Victoria faces.

I know that this concept is strongly supported by a few of the city council already.

I think you made a really good point about the fact that James Bay is not and has not been an area of single family homes for a long time. In that sense it is the perfect area to provide desperately need housing not only right downtown but also adjacent to the ocean so that every income level can enjoy the benefits of all this area has to offer. I would guess that this type of redevelopment would get pretty broad support in James Bay since it a very progressively minded community.

Well, I have to agree with Hawk today about recent “slashes” (I prefer to call them “price changes”). Of the first 15 listings with my selection criteria (selected core + Central & North Saanich up to $950K), 7 are recent price changes ranging from $20 – 50K.

How much do commenters think a top-to-bottom , modern, energy efficient reno on a SFH near carey and tillicum would go for (it’s a quiet side street north of tillicum). The home is 2500 sq ft, 5 bedrooms, 2.5 baths. No garage. Nice big, private fenced yard. We want to sell and upgrade to a larger property further out but are worried that this area may not be able to support the price we are hoping for. In that case we would just delay and live there longer.

That, I hope doesn’t happen. James Bay feels like a real community and the Songhees developments really don’t. So many of those units are timeshares and the whole area seems so sterile. Locals seem to just park in their underground garages and disappear up to their unit. No walking interaction, no sense of community. The rail path there really needs to be walking and bike lanes and the old train yard needs to be developed. The northwest end of James Bay is already snooty rich folk developments and hotels that no one in the community interacts with. The wharves in James Bay and Songhees are a good reflection of their neighbourhood. Fishermans wharf is bustling with local businesses and real homes and the Songhees marina is just where wealthy Seattle folk park their yachts.

You make some good points about James Bay. Might be a good place to put in some medium size condos, fifteen to twenty stories, which would provide access to both downtown and the waterfront. The right configuration of shops and pedestrian malls with bicycle lanes on the ground floors would provide an interesting community. The city could

expropriate a lot of the land under an urban redevelopment plan and then rezone the area to match the Songhees developments.

Josh:

Was not suggesting Stradford was local theater and since I was a Toronto boy most of my life we generally considered Stradford as an extension of the Toronto theater scene. I remember the special trains that were run out from Union Station which was a delightful way to go to the theater. Not sure what the point of your meth comment is aimed at other than you are being cranky (pun intended).

josh – Don’t think it’s the same 2 houses. The ones I am referring to are on Rithet.

It’s not the same two houses I referenced earlier in my post, is it?

Coming from Ontario, I find that a bizarre thing to say. Stradford has a thriving theatre scene because it’s called “Stradford”. As in the city in which Shakespear made his name. Theatre groups all across Ontario have their festival there because of the name. Their arts scene can’t really be considered local. They’re also the meth capital of Canada.

Josh – happen to know a little about the Rithet situation. Frankly, the homeowners there piss me off no end. A low rise building is planned to take the place of 2 SFHs that are pretty run-down. Basically increasing density. Homeowners are claiming that it will ruin the character of the street (even though there are similar buildings on that street that is only one block long). They then argue that they would be ok with the new construction if it were affordable housing. (a claim I have a hard time believing especially as many of the stratas there don’t allow rentals.) They seem to be just throwing out every and any objection possible even when they contradict themselves.

I’m far from a community spokesperson, so I’m not sure. In the few places where there are SFHs that aren’t apartments, there are a few anti-density signs up. One is bright red and reads “STOP OVER-DEVELOPMENT” and another is complaining about a particular building going up, saying it’s too close to the road and will worsen parking. It’s only a few neighbors on a few streets that put up these signs. Both are full of it if you ask me.

Walk around James Bay (or any downtown-ish neighbourhood) and count the mailboxes. SFHs are not single family anymore and they haven’t been for a long time. They’re apartments with anywhere between 4 – 8 units. There are some poorly designed apartment complexes here for sure, but my problem with them isn’t their height or the fact that they exist. My problem is too much of their land is un-used, and the complex that they build around them cuts the community into un-walkable segments. With fenced-off parking lots and stupid half-walls, they ruin the walkability of the neighbourhood. The only thing they’re guarding with these half walls is a big empty grassy field. When a complex takes up the width of an entire block, having people walk around the whole block just to do groceries is stupid. Put one little path through the complex and it saves everyone a ton of time and helps the people in the building the most.

I get that tearing down old homes is sad, but there’s a lot of homes here that should be low or high-rises instead. James Bay needs higher density.

Exhibit A and B: https://goo.gl/maps/UdWzchVhTdR2

I knew someone that used to live there. Those homes are run by slumlords. They’re literally falling over. I’d love it if they both torn down and had a lowrise put in their place.

Oh, and ironically, one of the signs that are complaining about a new building worsening parking is talking about Rithet, the widest street in the neighbourhood. They could paint some lines and allow parking front or end toward the curb and it would solve all their problems. Seriously, look how wide this street is: https://goo.gl/maps/7nWLdXhhaU82

Reverse prospecting inquiry: Sellers are motivated.

Haven’t seen that in a while.

A good proportion of the singles are widows or widowers. It is a function of the demographics. There is also a growing phenomenon of “grey divorces”.

Actually we watched quite a few Shakespeare’s plays around the world, including stratford upon avon. The plays in Victoria have smaller crews, but the quality is very good in comparison.

Looking for love? Plenty of singles live in these Victoria neighbourhoods

http://www.timescolonist.com/news/local/looking-for-love-plenty-of-singles-live-in-these-victoria-neighbourhoods-1.23324833

Two more slashes in Golden Head in the $800K range, another on St Charles for $900K in prime Fairfield, all nice places and reno’d. Many more all in prime hoods. Market has to be rolling over here when these places would have gone over ask just a couple months ago.

@Leo S

Do you have that number available to share? I’m curious about how often this happens. Same with the number of houses that get de- and then re-listed at a lower price within a reasonable timeframe (couple weeks?).

Agreed, but it would be great to factor this in to get a higher confidence in the veracity of the analysis of the trend.

Freedom:

If time permits, nip out to Stradford Ontario and take in a couple of plays and performances just for the sake of comparison. Victoria is a small city and one cannot and should not expect it to compete with New York, London or Toronto for that matter. One of its charms is that it has lots of active community groups. It is like having a cute pony and then having people try to tell you it is a racehorse.

Victoria’s great strength is precisely that it is not Toronto or New York or particularly Vancouver. It is easy to get around but not as easy as it was even five years ago. I have addressed this often enough that it is not worth repeating. I am going to go mow the lawn and then play in the garden.

Grant, congratulations on your new home again. I suspect that, with the passage of time,

it will turn out to be a far better choice than you imagined.

When I have posted the charts, they have been percent sold over last listed price. So yes there will be some that have been listed as you describe. It’s generally not a huge number. However I believe there is a field I can pull for original asking price which would factor out most of these (still doesn’t catch the listings that are cancelled and re-listed at a lower price).

However it’s more about the trend than the absolute value.

Former realtor linked to B.C. gangs facing money laundering charges in U.S.

http://www.timescolonist.com/news/b-c/former-realtor-linked-to-b-c-gangs-facing-money-laundering-charges-in-u-s-1.23323517

Are you serious? How could you believe that housing affordability is a problem and yet be anti innovative solutions for bringing down the cost of housing. The idea that we can retain the traditional predominance of SFH while improving affordability substantially is pure fantasy. Not going to happen. Densification will be required.

The problem with the malahat isn’t driving it, it’s that it’s so narrow that any crash will close it. Coquihalla has a lot of accidents but it’s wide enough that only a big pileup will shut it down.

I guess it will be up to them to judge. I certainly don’t think Victoria is perfect but I sincerely fell that it is just as good or possibly better than when I moved here 10 years ago.

Growth brings changes and so does the mere passage of time. I don’t love all the changes, but some have been good.

We also have “Victoria Shakespeare’ Festival” each summer on Camosun lansdowne campus ground, very high quality plays. Canada Day party with lots artists display their work on Gorge waterway. Victoria Art Gallery moss street paint in (on July 21st this year), ….

There are lots cultural events around us in Victoria if you pay attention, and much easier to attend than in big cities (note we are in TO now vacationing).

Best theatre deal in town: season tickets to the Phoenix Theatre at UVIC. If you subscribe, you can see 3 or 4 plays for under $14 a show. From my experience, most plays have been good; some have been outstanding. The odd play has been a dud, but the students always have a lot of enthusiasm.

The nice thing about Victoria is that it’s pretty easy to get around if you do want to see something. If you didn’t live downtown in a big city, would you really drive in that often to attend events?

Josh:

I am the last person to ask for investment advice. Frankly, I a moved the last of my investment assets out of Canada when we were still par with the US dollar.

By the way, since you are in James Bay, I understand from a number of the present city council that they are planning to massively increase the density in James bay in the coming years. How is this sitting with the community there?

Penguin:

Not in the least bit bitter but saddened by the fact that the best qualities of Victoria are overlooked and increasingly diminished while at the same time being replaced by pretensions and illusions. Frankly I feel that we have failed the next generation.

Wow Barrister you are putting down the place we all live. You are sounding very bitter these days. Maybe look on the bright side? It’s not so bad here but I guess it is no NYC…

Grant welcome to the island! Sorry I didn’t know you bought when I said that. What I meant was that in my opinion it is not the best time to buy a house on the island not that one shouldn’t. And also that if you are going to buy one don’t buy one that you can’t resell easily (like the house you described).

We have the Mcpherson, The Royal, The Metro, Langham Court (also a great costume rental resource come Halloween), Theatre inconnu, The Roxy, (Not a dedicated “proper theater” but hosts Blue Bridge), The Belfry (eating at Stage before hand is a must) and The Victoria Event Center. If you have never seen Atomic Vaudeville there I highly recommend it. It’s our very own comedy troupe of Kids in the hall caliber, maybe better. https://victoriaeventcentre.ca/tag/atomic-vaudeville/

I didn’t watch the video at all. I just skimmed the article.

I’ve been half-considering moving all my assets to fixed income for the next year or so.

This is actually pretty much the ONLY thing Victoria proper supports. How many Theaters do we have in Victoria? 5? 6? How many hockey rinks? 1 and that is half filled with shows. How many rugby fields? 1 in James Bay? There’s 1 baseball diamond that I can think of, and one soccer field at Topaz park. Theater is far and away over the top supported by the city of Victoria.

Bearkilla doesn’t read the posts. His hood the Peninsula housing development slashed $100K on under $900K shacks. No one is buying. Bed to couch makes Bearkilla a dull boy.

Patriotz ,

The fact that corporate donations are banned from municipal elections is meaningless due to loopholes, as reported in this CBC article. Plus the local developers will still be donating huge amounts to Lisa but not with corporate cheques.

http://www.cbc.ca/news/canada/british-columbia/municipal-elections-donations-reform-npa-vision-1.4622553

What will bears do when the crash fails ONCE AGAIN to materialize this fall? Will you finally give up and move away or try and improve your life situation? Probably not right bear?

It’s the bear life for you. A literal forenter.

I don’t know about that. We will be first to legalize and weed stocks are doing great. Too bad I sold mine to pay for my money pit….

There are a number of seriously distressing cracks in the Canadian economy. I certainly would not consider investing here at the moment.

Highest end squatter house in town goes up in flames. Arson would not surprise me. Some very smelly ownership transactions.

Firefighter treated for smoke inhalation after Oak Bay blaze

The property has changed hands three times since the fire in 2013.

http://www.timescolonist.com/news/local/firefighter-treated-for-smoke-inhalation-after-oak-bay-blaze-1.23324033

Leo, how is the percent of sales over-asking determined? For example: if a home is listed at $900K and doesn’t sell, is relisted at $850K and still doesn’t sell, and then is relisted for $800K and sells for $810K, is this sale reported as sold over-asking? I’ve noticed this with a handful of homes lately and, if this is true, would lead me to be cautious with using percent of sales over-asking as a barometer of strength in a declining market and instead reference to assessed value.

I didn’t realize it had grown even higher. That leads to rather unsettling implications on how that debt is concentrated. 30% of us have no debt, meaning there must be some pretty extreme leverage out there.

The NDP government has banned corporate donations at the municipal level. There’s been a lot written about the effect of this on Vancouver civic politics, but I guess not as much in the city where that government is.

Introvert – that is not what Poloz said in his interview. Don’t rely on the headline – watch the whole video and listen carefully. He is talking still about the credit vulnerability of households. Look at what the IMF said today too. Canada’s housing market is vulnerable to a sizable correction.

I think unhappy is the wrong word. More like incredulous that the head of the BOC would use the phrase “Mother Nature” to describe the driving force of the housing market. Human Nature drives housing markets (along with artificially suppressed interest rates), not Nature. Nonsensical, ridiculous, and idiotic are the first three adjectives that come to mind considering that the phrase “Mother Nature” is commonly used in context to describe natural phenomena that involve sublime, god-like scales of destruction or influence.

I find it only fitting that in the same article is mentioned that the average Canadian owes $1.73 for every dollar they earn. It is both sad and incredible that fellow Canadians are in that much debt. Just crazy.

That’s funny Introvert, really funny. It reminds me of Alan Greenspan’s many comments in the months just before the great American housing crash. For example:

“That said, there can be little doubt that exceptionally low interest rates on ten-year Treasury notes, and hence on home mortgages, have been a major factor in the recent surge of homebuilding and home turnover, and especially in the steep climb in home prices. Although a ‘bubble’ in home prices for the nation as a whole does not appear likely, there do appear to be, at a minimum, signs of froth in some local markets where home prices seem to have risen to unsustainable levels.”

Greenspan on June 9, 2005

Doomsayers’ favourite realtor isn’t happy that Poloz thinks Vancouver and Toronto still have “very, very strong fundamentals.”

https://www.bnnbloomberg.ca/mother-nature-driving-vancouver-toronto-housing-poloz-1.1087254#_gus&_gucid=&_gup=twitter&_gsc=0GuVirc

Lisa Helps… who does she help?

She helps developers and she helps advocates of intense densification.

She is proposing to allow up to 12 units in a SFH that is currently zoned for a Single Family Home

Her recent opinion piece in the VICTORIA NEWS should be mandatory reading for every homeowner in Victoria. And, because she is advocating for amalgamation, everyone in Greater Victoria should read her article.

She is saying that a regular house could be rezoned to allow FOUR dwelling units per floor; TWELVE dwelling units per current residential lot of 5000 square feet (40% lot coverage of building footprint).

Lisa has a clear mission to destroy single family homes in Victoria and turn Victoria into a mini-Vancouver.

Lisa is also attempting to be a master of spin; her words attempt to hide facts of her true intent. For example, she talks about a 2000 square foot house, but what she is actually advocating is a three story building totalling 6000 square foot, with 2000 square feet per floor; in other words, a building with a 2000 square foot footprint. Each floor can have four units of 500 square feet each; total of 12 units at 500 square feet each equals 6,000 square feet per building.

Lisa also tries to dispel that her financial supporters are corporate developers by referring to the 51% that were corporate donations during the election four years ago. The last election is history and her corporate donations from four years ago are irrelevant; I’m more interested in her being forthright about her current percentage of corporate donations; I suspect it is much higher after her pandering to the wishes of developers for the past four years.

https://www.vicnews.com/opinion/mayors-message-neighbourhoods-are-for-everyone/

Yeah, for anyone who has driven on winter mountain roads, it really shouldn’t be a big deal. However, starting in Victoria with such a mild climate, it deceives a lot of people into a false sense of security. Combined with a strange psychology for a lot of the drivers, it ends up being way more dangerous than it should be.

If you drive carefully in bad weather, it isn’t a major problem most of the time. It is the weird behaviour of everyone else that gets you. People bringing Vancouver driving aggression meet sudden snow after leaving balmy downtown, but don’t want to slow down.

To be clear, Hawk, I agree that the market is changing. I just don’t think that individual price changes give much information. As they say, the plural of “anecdote” is not “data.” That is why I appreciate LeoS so much, he does the number crunching to see what is going on behind the individual moves.

Lived in Alberta for 10 years. Sorry but I didn’t rate that in my top 5 rough driving spots and that’s with having to travel all winter long for kids sports. And yeah – done the Kootenays as well.

Haven’t done the Sea to Sky. Maybe some day.

I find the Malahat odd and have driven it maybe a dozen times. It could just have been that the crazies were out when I was on the road.

If you haven’t driven in Alberta or the Kootenays you won’t get how relatively easy the Malahat is. All highways are not fun in rain, snow, darkness.

True it is how others drive and yes the crazies on the Malahat are dangerous. That also goes with any highway.

I have driven tough mountain passes ( the Salmo Creston for example) many times.

To me the most dangerous highway in BC is the Sea to Sky to Whistler. By far.

Look forward to what you think of the Malahat after a year or so Grant!

Maybe … maybe not. When I participated in the naysaying of the Malahat it was not a reflection on Grant’s driving ability. 40 years driving and in some extremely tough conditions (metro-D.C., Chicago, L.A., San Francisco, etc. etc.) only had 2 times in my life white-knuckled while driving and both in B.C. Once when the Coq was closed and all summer traffic rerouted with dusk coming. The second was on the Malahat. It’s not so much one’s driving as what others are doing.

@Grant – Victoria is a wonderful place to land. Welcome!

Funny how a home with no one in it can suddenly be on fire.

http://victoriabuzz.com/2018/06/late-night-fire-in-oak-bay-shuts-down-major-streets/

Portland’s metro population is the same as Vancouver’s, but is cheaper than Victoria. Eugene’s metro population is the same as Victoria’s, but it is much cheaper.

And both are among the most desirable metro areas in the US.

Victoria is much more similar to Portland if you want to compare it to a US city.

I will never understand the beef about downtown parking. Never have a problem..first hour free is amazing. Yes it can be tough on a long weekend or when a special event is on but you can’t plan parking for those occasional conditions.

90% of the time parking is not an issue.

I really enjoy downtown Victoria..it is not perfect but is a great place to walk and browse.

I love your excitement about moving to the island Grant. I lived in the Kootenays for years and know the feeling.

You will love it here…and will find the naysayers about the Malahat etc. are really exaggerating.

Ice cream and slashes. Reasons to get up in the morning.

Good question.

Victoria is not a cultural backwater…. It has plenty of culture. If you can’t observe it or you don’t like it it isn’t it’s fault. It’s small but it has many scenes that define it. Google the movie “Somewhere to Go” to see but one. Sure it’s not your culture but it’s culture. I have been around the globe and know what a cultural backwater is like. Kuwait comes to mind. Lubbock Texas is another. If you don’t like the vibe why live here? Life is short, especially at your age…

This happened a few weeks ago, but can anyone list the selling price for 101-1190 View St?

per Saretsky

Makes sense as we are at the same halfway point of up cycle.

Grant:

I suspect that you are right about Victoria being culturally closer to Seattle. On the other hand, you dont want to know how much dirty coal we ship out of BC every year.I do worry what happens to a government town if the economy in BC really goes into the dumpster.

Gosh if Victoria is a cultural backwater, then what the heck does that make Calgary and its 1.3 Million? The city and the province in general has a disproportionate amount of red necks driving their jacked up Ford/Chevy/Dodge trucks with “Truck Nuts” hanging off the back of their hitch – folk who are shockingly socially intolerant, and who refuse to listen to the science on climate change. Don’t get me wrong Calgary also has tons of fabulous people too, but the stereotype of Texas North exists for a reason. And economically only now is the provincial government seriously trying to diversify the economy away from O&G – well, at least they are now until the UCP likely wins the next election.

IMO Victoria is a mini Seattle (culturally and socially) the difference of course is size and economically Seattle has a heavy-duty tech base whereas Victoria has been a government town. But having government as an anchor for an economy is really beneficial because it is so stable. Now it’s a matter of attracting and fostering growth of those companies and industries that build on the future.

Great comment, and highlights the notion that everyone’s situation and needs are different – a potential or pending correction (or worse) is not the final be-all-and-end-all for many. So long as you can afford a hike in rates, it sounds like you’ve made a great choice for you and your family. Very exciting. Congratulations and enjoy your new digs!

This equates to an 8.5% annual appreciation.

Grant:

To me at least it sounds like you have made a very sensible decision and managed to avoid most of the trendy pitfalls while putting your family’s real priorities at the forefront.

Plant a rose garden and hope to end your days sitting in that garden.

Refreshing to hear a sane voice out here.

LeoS: You are a really smart guy and you know that throwing in a few bike lanes does not suddenly transform the architectural character of the city. Since you are in the RE industry , you can be forgiven since your job is essentially to put spin on reality but it strikes me that most of the real estate industry’s function is to make used car salesman more respectable.

I am sympathetic to a point to real estate agents at the moment because there is a strong possibility that the volume of sales is about to mirror Vancouver. A good percentage of agents will not be able to put food on their tables. A culling of the herd may not be a bad thing.

At the end of the day I am old enough that it matters little to me one way or the other. Maybe the old adage needs to be rewritten to read:-

You can fool all of the people some of the time.

But you can fool most of the people all of the time.

Market to the second group.

I was being more critical of how buying a million dollar house that is 10 metres from the highway is really questionable; I was not critical of buying in general.

I recently bought in Mill Bay, my deal closes in mid July. I paid over list too (thankfully barely over list, the competition in Mill Bay is stiff.)

Would I have preferred to not pay over-list? You bet.

Do I have some concern I might be buying at or near a peak? You betcha I do.

Am I still happy with the house as a long term investment? Yes

Do we get a house that my wife is ecstatic about? Yes

Do we finally get to move our family to the island? Damn right!

I’m not going to put my life on hold on the hope that the market is going to correct. I don’t expect to be moving again for a while, so I should be able to ride out any dips. And even if I don’t, I’ve done quite well on 2 previous house sales so c’est la vie.

Because as we all know, American cities are filled with bike lanes. 🙂

Caveat:

I have no problem with Victoria being a cultural backwater but I find it annoying when people want to pretend otherwise. Victoria has a lot of good qualities that are both unique and attractive. Building a forest of high rise condos downtown does not enhance those attributes.

Just for those who hate price cuts and news of changing markets. A look at what’s to come here.

Via @SteveSaretsky

Vancouver Detached Home Sales fall 39% year over year in May. Fewest sales on record dating back to 1991. #VanRE

Vancouver condo sales dropped 28% year over year in the month of May. A five year low for sales volumes. We appear to have definitely turned a corner.

https://twitter.com/SteveSaretsky/status/1002651263895388160?mc_cid=c2345947c7&mc_eid=1c71249e28

Metro NY = 20 million

Greater Toronto = 6.4 million

Vancouver Island = 0.75 million

Hopefully not too many folks moving to Victoria are shocked to learn that we are a cultural backwater, especially if NY is their point of reference.

RE: the book “I Flipping Love You”

I Googled the book description because I was curious what the plot would be. The puns abound:

“A new kind of love story about flipping houses, taking risks, and landing that special someone who’s move-in ready…”

“SHE’S GOT CURB APPEAL”

“HE’S A FIXER UPPER”

Penguin:

Different strokes for different folks. Personally I dont find downtown particularly appealing. Leaving aside the growing number of pot shops and coffee house usually occupied by the marching morons with their eyes glued to some electronic device, most of the restaurants, with a handful of exceptions seem to manage to be both overpriced and mediocre at the same time. Nor does Victoria have a thriving theater sector like New York or even Toronto. Frankly, we have shifted most of our shopping and dining to Oak Bay. The new bridge though perhaps for me does symbolize the direction were Victoria is heading, namely, boring , mediocre and over priced. The bike lanes dont personally impact upon me but they are representative of the bad planning and worse execution that is becoming the hall mark of the city. The city is being Americanized. But it is what a lot of people want and the silver lining is that it has made a couple of my developer friends very rich.

@once and future

I do not get why you don’t like when people post about price drops? I love when others do this because it is an indicator of the market and I don’t have to do it myself. Especially Vancouver as I’m so out of touch with the Vancouver market. The more info and viewpoints the better IMO. So thanks Andy7!

@Grant

I don’t think some people have got the memo not to buy right now…

@josh

I agree. To me going downtown is an outing and I’m happy to pay the 3 bucks. I think the future may be a bit different and shopping downtown will be a luxury as people will more and more be bogged down with big bills to pay. In my opinion if things get much worse (unaffordable housing) there won’t be many people to work a those retail stores downtown and if things get better (affordable and abundant housing) the homeowners won’t be able to afford to buy anything.

Haters of bike lanes, lovers of ample parking I present to thee………….downtown Prince George. Like a ghost town on Sunday night. Could probably park on the sidewalk. No bike lanes except a few licks of paint that sure as heck ain’t slowing down your F350. Paradise.

Jesus. Anybody have the pictures from 2011?

Sold 2011 for $737,500. $600k in 2005 and $365k in 2001.

Assuming it sells for $1.4M that would be a roughly quadrupling in 17 years.

2744 Avebury Ave, heritage house in Oaklands, is asking 1.4M. I think this one was for sale maybe 5-7 years ago – anyone know what it last sold for?

Looks like it’s been reasonably well kept and in a great spot, but I would have thought maybe 1.2 for this one.

Love the bike lanes, keep em coming. Can’t say I’ve had too much trouble parking the odd time I’ve had to take the car in. First hour free at view st parkade, what’s to complain about?

I say all this with a little tongue and cheek. I live close to town so I’ve paid for the luxury of being able to bike in. Contrast to my friend who bought new in the Westshore and has to drive in, he thinks the lanes are the devils work, with the whole 8 parking spots lost on Fort. Was it Barrister that liked to say “where you stand on an issue depends on where you sit down to eat”?

Can’t say I’ve had any issue going downtown and parking. Generally pretty easy. When is it bad?

@Once and Future

There were a lot of people that knew Vic was going to take off before it did, based on Van’s behavior. Personally, I think it’s wise to watch what Van’s up to, if we want to know what Vic’s about to do as well. But each to their own.

P.S. I love Hawk’s posts, this blog just wouldn’t be the same without him on it.

Perhaps I’m a minority bicyclist/motorist here. I belong to the group that no longer go downtown because traffics and lack of parking.

1046 Mathers Ave, building is assessed at $102,000 suggests that it could have been purchased for the lot and the developer pulled out at the last minute hence there is a drop in price.

4778 Meadfeild Crt. If they get anywhere near $2 million still a great gain of 38% over 3 years.

Andy7, while it is interesting to know what Vancouver’s housing market is doing in a broad sense, if you post all the price changes here we are going to be drowned in irrelevant information. It is bad enough that Hawk goes nuts every time someone over prices a house and has to correct it.

Yes, we are nearing the tail of the credit and housing cycle. Obsessing over individual cuts in Vancouver does very little for the conversation here.

I think this will be one to watch what it sells for to see what the market in Van is doing at this time for decent homes — it’s a decent house, updated, nice views, nice area.

Listed: 2M

Last sold Aug 2015: $1,445,000

2017 Assessed: $2,303,000

*And what’s been said over and over, what happens in Van, eventually happens in Vic, just a matter of time (so I like to watch both).

https://www.realtor.ca/Residential/Single-Family/19189268/4778-MEADFEILD-COURT-West-Vancouver-British-Columbia-V7W2Y3

Flip flop

West Van

Listed: $1,700,000 (500k BELOW last sale price)

Last sold: June 2016: $2,200,000

2017 Assessed: $1,990,000

https://www.realtor.ca/Residential/Single-Family/19518464/1046-MATHERS-AVENUE-West-Vancouver-British-Columbia-V7T2G2

It always intrigues me as to why someone who owns a home in an area where they plan to live out their days would want the value to escalate to 7-figures plus. As Hawk quoted below – their kids would never be able to afford to live close by. What? The desire to pay rising property taxes is so great that they cheer the drug-money-laundering. It is your home – not a game of monopoly. It may make you feel rich but when June rolls around and the municipality looks for their “rent”, that smile may be a little tarnished for good reason. Truth be told generation X and the millennial generation will be the first generations in history who will not financially do better than their parents – really sad and hard for a parent to watch their kids struggle. Those Caribbean vacations must be hard to take while leaving your kids behind in their apartments raising the grand-kids. Is that why we worked so hard to keep our families close – all so this madness creates distance and class consciousness? For me, I agree with those wanting a sizable correction so the next generations have a chance for the Canadian dream of owning a home, building memories, contributing to the community and raising their families in a safe environment. Just sad.

Just another sale. Some people value the new house more than the location. That’s ok.

It is likely to be a fraudulent transaction, mortgage fraudsters thrive at the end of booms like this. They will be out in full force.

@Barrister re: “I just don’t see the makings of a major crash…where do you think the inventory is going to come from to drop prices that much.”

This is bigger than a local supply-demand curve. We face resumption of the DEBT CRISIS that was interrupted 10 years ago. All the markets rose on a tide of cheap debt-flation. Loss of confidence has been postponed for a few extra years, but now we face the central banker’s nightmare: real deflation.

On a related note, the breakdown of NAFTA talks with the Americans should bode well for construction of the Trans Mountain Pipeline Expansion, since it underlines (more than the perverse NAFTA arrangement to sell Canadian oil at a ridiculous discount to the USA for ~$30/bbl) the need for Canada to expand oil and gas trade (at REAL market prices) with new and solvent partners. Our own economic sustainability, including that of the Port of Vancouver and its environs, is at stake. (Heck knows, you can’t reach this island without boarding a petroleum-fueled ferry.) It will be an important sign from Ottawa of awareness and appreciation for the shifting macroeconomics of energy, and a gesture of confidence in the future of Canada, when that project goes forward. (The fact that Victoria is the seat of local government might help, if only local politicians weren’t so muddled.)

I wonder how many homeowners here think the same ? I’d say almost zero. The greed is so over the top the thought of losing $10K paper profits keeps them awake at night.

In Vancouver, a Housing Frenzy That Even Owners Want to End

“I would like to see a correction to sober up this whole place,” said Rob Welsh, a retired airplane mechanic who lives in a Vancouver suburb. Mr. Welsh bought his house in 2000 and has become a paper millionaire based on its appreciation. It makes him more anxious than happy.

“If I got to lose 200 or 300 grand to keep the kids and the future of this place, so be it,” he said.”

https://www.nytimes.com/2018/06/02/business/economy/vancouver-housing.html

Look what I found on the ferry. Should we start a HHV book club?

“Flipping houses and hearts”

On the topic of bike lanes, I have a car and use my bike around town and think the backlash has been unjustified. Being able to find parking and the affordability of parking in Vic is really good. I don’t doubt that it used to be easier, but when suburbanites say it’s “killing downtown”, I don’t see it. You’re going to box malls because of the stores that are there, not because you can’t find parking downtown.

That said, I do wonder when the council will stop approving new bike lanes. We should have a network of connected separated bike lanes, but now we’re getting several east/west corridors just a few blocks apart. The existing lanes do get used though. A lot.

Holy Cow. For all the talk of slashes in prices and the start of RE Armageddon that property is an excellent indicator that the market is continuing to defy expectations of normal. 390460 is a beautiful new modern home with fantastic ocean views, and it was built by a reputable builder but it is, no exaggeration, 10 metres from the #1 Highway in Mill Bay. (Google 84WRJFM2+GF for map view)

The builder put up a sound wall but when I stood outside the front door it didn’t make any difference, the traffic noise was incredible. I don’t understand who can drop a cool million on a place like that – unless they’re literally deaf and even then their resale value is always going to have a great big anchor hanging around its neck. AND there are 3 other houses in the same spot, all sold at or above list price.

More great planning by the city. Lets build bike lanes, increase density, but narrow the traffic lanes to slow the existing traffic to a standstill and still allow bikers to ride in the car lanes. Brilliant ! Imagine 10 years down the road with population increases.

Fort Street a squeeze for buses after opening of new bike lanes: transit union

http://www.timescolonist.com/news/local/fort-street-a-squeeze-for-buses-after-opening-of-new-bike-lanes-transit-union-1.23323338

Thank you, Leo S on the 383100 listing. It is an example of a whacky listing price [initially listed for $4.3M over a year ago and had dropped 3 times before now being removed. A house across the street was also on the market for over a year or so with multiple drops – sold for $2.2M – $200K above assessed. I agree with you that thees “luxury” listings have unrealistically high asking prices. Common to see 3 or 4 price drops over a period of a year before they sell. The well-healed can wait, I guess.

LeoM,

The homeowners are too busy with their ice cream and walking their Chihuahuas to worry about something that could cause a reverberating reaction globally. Just don’t talk about it and it won’t happen. 😉

Almost as many price drops as sales. Problem is the vast majority are just completely whacky prices dropping to slightly less whacky ones.

@Grant

Sold $940k.

@Victoria Born

Expired

Sort of a gloomy day out there at the moment. This might be an interesting summer in terms of real estate. Will house sales remain low and will there actually be any meaningful price decreases over the summer.

In spite of a real glut in the luxury home segment I have not seen a lot of price drops yet.

On the bright side. Ice cream cone season (hawks favourite) is back.

In economics and particularly in consumer choice theory, the substitution effect is one component of the effect of a change in the price of a good upon the amount of that good demanded by a consumer, the other being the income effect. Here is a video explaining it:

https://www.youtube.com/watch?v=YZxImVH5gKM

It may be dry but this is the torture we went through in University to get that degree. Further simple discussion:

https://dqydj.com/substitution-effect-income-effect-implications/

Think in terms of 2 price segments: (1) mid-prices home and (2) luxury home. What happens when the luxury home price falls. Or, if some one’s income goes up.

Interested in this “substitution effect’. Can anyone point me to an article that talks about this, specifically in the context of higher end real estate falling in prices translating in lower prices across the board?

Lots of comments on this blog recently suggesting that any decline in SFH prices will be slow due to inventory, MOI, days on market, etc

Those reasons are important, but maybe not the only important set of conditions that might affect SFH prices.

Did anyone else read the Wall Street Journal article in their May 30th edition about the sudden panic sell off in the markets when Italy’s latest government had issues? The Italian president refused the appointment of the governments chosen Finance Minister, and that caused markets to panic.

http://online.wsj.com/public/resources/documents/print/WSJ_-A001-20180530.pdf

My point is that our current economic system has vulnerabilities that are usually hidden, but sometimes exposed by seemingly trivial matters.

I don’t doubt you. After I talk to a REALTOR® about a house, I might as well go to Galaxy Motors and talk to one of their SALESPEOPLE® about a car too. Then again, I like my car. Maybe I’ll just go for a coffee, taking care to thank the SERVER®.

That probably depends how much commission you’re willing to pay. 😉 At the bottom rung there’s “Layla”:

https://www.theglobeandmail.com/news/british-columbia/bc-realtor-accused-of-making-threats/article30024457/

Anyways, enough degeneracy for the afternoon. Got us this Jackie Chan flick we’re going to watch tonight. He’s looking old now, but he could still kick my ***.

Also, out of curiosity, did MLS listing 383100 (a) sell or (b) was it taken off the market [listing expire]? I would be indebted for any guidance on this and thank you in advance.

VB

“If the top end of the market declines, it drags down the middle and low end as well due to the theory of substitution”.

The VREB press release is very misleading. The substitution effect that you speak of [in economics it is called the “income and substitution effect”] is a known a and proven phenomenon [not a theory].

The local news ran with the article saying that the average price of a SFH was now $935,000.

I wonder how that compares in Europe, where people can be in small towns that are much higher density. Personally I think it has more to do with lack of commute, and less Joneses to keep up with.

“nuts, sluts and perverts”

Which category do the REALTORS(symbol to denote unwarranted importance) fall into?

$100K slash on a major development in a prime area of the Peninsula is very telling where this market is going. Everything starts from the outside and the highest priced in the core. Tells me the developers are getting very very scared of a crash.

With all the Euro/Deutsche Bank black swan potential in the air, those late to the game or blinders on will get crushed.

This is what we read before 2008 crash but everyone ignored it. Goldilocks stole the goods.

Deutsche Bank’s U.S. Operations Deemed Troubled by Fed

https://www.wsj.com/articles/deutsche-banks-u-s-operations-deemed-troubled-by-fed-1527768310

If the TC wanted to do an intelligent report on RE in Victoria they could start by talking to Leo since Victoria happens to be blessed with one of the best RE blogs around. But No apparently it is better to regurgitate the press release and quote a shill making questionable claims

That’s classic LF. Goes to show how so many like myself see through the TC self preservation motions of keeping the industry happy as their largest income of advertising dollars and their lack of articles on crash/investment risk. Can’t bite the hand that feeds you.

Out of curiosity, did MLS 390460 sell or was the listing canceled?

The Real Estate Board, which licenses the trademark, makes them write it that way to protect their trademark rights. Just like Tim Hortons requires it.

And just like you don’t have to be a Tim Hortons to sell doughnuts, you don’t have to be a REALTOR to sell real estate. They just want you to think so.

Blue: units under construction, left axis

Orange: monthly units completed, right axis

Sorry should have added a legend there

The under construction graph… What do the orange and blue line represent?

REALTORS® are doing the same thing that REALTORS® have been doing since they were just realtors. I think the idea behind calling a house salesman a REALTOR® in caps with a silly symbol is to make REALTORS® collectively sound more professional, consistently trained to a high standard, and somehow infused with irrevocable integrity. And some are – but they were like that before, and despite, the rather amusing REALTOR® moniker they’ve mandated upon themselves. I actually laugh each time I see someone on here write “REALTOR®” and mean it. Hilarious.

I remember taking a course in undergrad that had a sectional focus on media integrity. Let’s just say the professor used the TC for much of his source material. And when you subject their journalism to critical scrutiny vis-à-vis the facts, you won’t likely want to read their publications henceforth. I remember he would say media focus is always, “nuts, sluts, and perverts”.

Yes I added that to the article

Yup, interesting how the super pro development mods at VV are absolutely against a mayor that has presided over the biggest development boom in Victoria’s history

Once again, the Gray Lady has noticed the goings-on in our part of the world:

In Vancouver, a Housing Frenzy That Even Owners Want to End

In 2016, the nonprofit Angus Reid Institute in Vancouver found that roughly two-thirds of residents in the metropolitan area wanted home prices to fall, including half of homeowners. More startling was that one in five homeowners in the survey expressed a desire to see home prices fall by 30 percent or more.

No doubt, many voters would think twice about that opinion if home prices actually crashed. Still, respondents “were clearly reacting from a place of deep anxiety, even desperation, about their own or their loved ones’ ability to access the housing market,” said Shachi Kurl, executive director of Angus Reid.

https://www.nytimes.com/2018/06/02/business/economy/vancouver-housing.html

doesn’t the “profession” of REALTORs (special symbol, whatever it is) have any accountability to the public? Their propaganda has been misleading at best and the TC ought to be ashamed for their blatant lack of journalistic integrity. Who calls these people to account? Makes me sick.

Leo, “misquote” is very generous. Is there a way to compare YOY listings priced below $1M? Or to compare median asking prices of YOY listings?

I cannot reconcile that statement with the data. I would suspect either a misquote or he was talking about listings under $750k, a number they seem to have cherry picked to make this point

“very confusing…” “…one-third fewer single family houses for sale…”

Active listings single family – residential:

May 2018 = 803

May 2017 = 593.

I’d say “blatant lying” instead of “very confusing”.

@guest_44378

But the graph! the graph!

I just like the headline:

Benchmark single-family home price hits record $878,100 in capital’s core

this article is very confusing: http://www.timescolonist.com/real-estate/benchmark-single-family-home-price-hits-record-878-100-in-capital-s-core-1.23322934

“Selling prices for single-family houses in the region’s core continue to march up”

“The new benchmark for a single-family house in the core was $878,100 last month, up from $820,800 a year earlier”

“The total number of real-estate sales in Greater Victoria slid by 25 per cent in May”

“The capital region’s housing market has one-third fewer single family houses for sale compared with a year ago”

“The total number of properties for sale was listed at 2,394, up by 26.3 per cent from May 2017.”

Before voting in our civic elections, please take a look at voting records on redevelopment. I hate the bike lanes as much as anyone as I regularly go downtown for business and they drive me crazy, but at least Lisa is trying to effect affordability by getting higher density and getting more supply on the market. 1/2 the council votes no on every redevelopment proposal and this does nothing but drive prices higher.

Barrister,

In 2016, it was about 2 billion dollars.

I am asking here to see if anyone knows because I dont have a clue. So my question is whether the Land Transfer Tax is actually an important source of income for the province.

If the dollar volume of sales continues to drop to half or less is this going to leave a hole in the provincial budget or is it just a minor source of revenue?

Interesting article in the Washington post that found that people who live in small towns are much happier than in high density communities. What struck me is that it was a Canadian study based on hundreds of Canadian cities and communities. The more I think about it the less surprising it feels.

SFH sales numbers for May

Saanich East

Year-Sales-Total

2018-67-65.1M

2017-101-100.1M

2016-125-106.0M

That is quite the drop in both sales and total money spent.

Ya, that’s why houses are over $2m in Vancouver… a strong economy…

I guess they did not like the place?

3-4630 Lochside Drive

Purchased April 2017 for 755K, assessed in July 2017 at 655K

On the market today for 779K

It will be interesting to see how much this place sells for. I think it sells for ask and the seller gets their money back if just barely.

VREB president: “Arguably, many of these properties may be listed due to new and incoming taxes from the provincial government. The Foreign Buyer Property Transfer Tax, the Speculation Tax, and the increased School Tax are putting pressure on those high value home owners. Unfortunately, these taxes are not resulting in what the government said it intends – to increase the availability of affordable housing.”

Another poorly thought out and biased VREB narrative. Do you really think that if these taxes are leading to more listings that, once the listings have been on the market for awhile and aren’t selling, that they won’t drop in price? Owners will want to sell these properties and they’ll find out that there isn’t a buyer unless they drop their price. So yes, there will be an increase to affordability.

“Anecdote…new housing development starting to go up on East Saanich Road. Homes were starting at 975k and had been so for a while now. This afternoon I drove by and they’re now starting at 869k. That’s quite a drop, especially that most of the homes haven’t even been built yet.”

LF,

$100K is a major hit. Friend was telling me about that development a few weeks ago and could see what a gouge they were. The biggest red flags are when new developments slash big like that.

As I said before the older experienced builders from 70’s and 80’s have sold a few months back saying 30 to 50% tanking coming.

Gwac, is that a self portrait? Bummer the biking stopped working.

Swch, yes Intorovert does walk cats. He has many talents besides being the self proclaimed asshole of the blog. 😉

It doesn’t look like the BCREA agrees with you.

Greater Vancouver home prices predicted to keep climbing – at slower rate

“The housing market continues to be supported by a strong economy,” said Cameron Muir, BCREA chief economist. “However, slower economic growth is expected over the next two years as the economy is nearing full employment and consumers have stepped back from their 2017 spending spree.”

http://www.vancourier.com/real-estate/greater-vancouver-home-prices-predicted-to-keep-climbing-at-slower-rate-1.23322169

And you’ll note in their chart they are predicting a largely flat market, yet their own chart simultaneously demonstrates it’s never flat – it’s always trending in one direction or another. Got to love realtors.

Oh, my apologies: REALTORS®.

What, you mean your average working-class Vancouverite can’t afford the $2.4 million for a run-of-the-mill SFH in the city limits?

Ponder that number for a moment. It’s an AVERAGE. If the phrase “comically insane” doesn’t reach out and take you by the throat, then keep pondering. Eventually it will.

Anybody care to venture how that kind of astronomical price floor has been set given your average household income is only about 80-90k? Talk about precarious ground. If anyone has any illusions whatsoever that there are strong fundamentals holding up Metro Van RE you need your head examined.

If we compare Saretzky’s information below with Leo’s analysis, the relationship between our markets bears some interest.

I don’t think that these slowdowns occurring in the month of May, is indicative of a normal deceleration – especially their apparent magnitude. Something else is occurring here. Who knows, but I’m pretty confident in one thing: the longer it goes on, the more momentum it’s liable to get. House, anyone?

Via Steve Saretzky:

Via Steve Saretzky:

James – I’d call (d) likely a subset of (a), although folks moving here definitely bring a different perspective than the lifetime Victorian.

Anecdote…new housing development starting to go up on East Saanich Road. Homes were starting at 975k and had been so for a while now. This afternoon I drove by and they’re now starting at 869k. That’s quite a drop, especially that most of the homes haven’t even been built yet.

You forgot d) Isn’t from here and wants to buy a house here

Each poster on here either:

a) has never owned a house in Victoria

b) currently owns a house in Victoria

c) once owned a house in Victoria but doesn’t anymore.

I don’t have time or interest to wade through five years of unrequited bearishness. However based on his postings I predict that Hawk is most likely (a) or (c).

Lisa will likely walk all over the three clowns (one literally a clown) that have thrown their hats in the ring so far. Still plenty of time for some serious competition to enter the race though. Stephen Andrew perhaps? One of the incumbent councillors?

That’ll make on street parking awkward

Says in the Colonist today that Lisa Helps is being challenged by three individuals. I didn’t even know opposition was permitted on the Left Coast. These are exciting times.

I do hope that at least one of these brave souls will campaign on the “shoot all deer on sight, dismantle the bikelanes, impound all vehicles travelling less than 50 km/h” platform.

Guaranteed landslide victory in my oblast.

swch

that surprise you

hawk this morning

https://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcT9AJAA6KGhQVmW3UQTjBvB-oPc5W5DiMyI-L1Sk7SVki1130IifQ

< Sounds like you really need a dog or cat to take for walks

you walk your cat?

Wonder how they decided to rank Victoria as #1 given it doesn’t have the lowest vacancy rate and quite poor cap rates.

Six top landlord cities for 2018

http://www.westerninvestor.com/how-to-invest/six-top-landlord-cities-for-2018-1.23288886

Greater Victoria to get pro soccer team next year

The new pro soccer Canadian Premier League is set to announce today that a team based in Greater Victoria will be playing in the inaugural league season, which begins in April 2019.

http://www.timescolonist.com/sports/greater-victoria-to-get-pro-soccer-team-next-year-1.23321490

It’s actually “CDO”. That way, the letters are arranged in precise, alphabetical order…as they should be.

“But what reading through too many old posts by Hawk did underscore was how he hasn’t been right about anything. But it wasn’t for lack of trying.”

As I was saying, one sick puppy who spends his mornings reading up old posts of mine. Sounds like you really need a dog or cat to take for walks, or maybe coffee with James. Something is seriously lacking in your miserable life. OCD on roids.

Still going up with sales down

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in May 2017 was $820,800, while the benchmark value for the same home in May 2018 increased by 7 per cent to $878,100, higher than April’s value of $866,700

“Update: VREB press release is out and I believe it is somewhat misleading. They say that “we’re seeing pressure from increased competition on a smaller number of homes, which is really pushing the under million dollar market.” This is not true. Active listings of single family homes under $1M are up from last year (868 from 802) while sales are way down (298 from 428). That means there is less competition in the under $1M single family home market than last year, not more.”

Good digging LeoS. The pumpers here hang on every word from a real estate industry that is not independently checked and is nothing but a massive bag of salespeople trying to get you to keep buying or they starve. In other words “Fake News”. Trumpian style heads north.

Per condos, the listings are the highest I have ever seen it and expect a nice tanking beginning over summer into fall. Who wants to own down in the cesspool called “downtown” is beyond me.

There we go….Hawk

Who said I was a professional. I collect pop cans on my bike along the goose

“Hawk never denied he sold in hopes of crash. It has been brought up dozens up times and it just lead to more posts and attacks on those who brought it up.”

gwac,

You, like Intorotroll, waste more time of your life making false claims on me based on nothing but a vivid and warped imagination. The fact you’re a so called professional is even scarier.

Maybe get out for some more bike rides in the vehicle exhaust, the CO is definitely having an effect on your posts as they go downhill.

@josh

Sounds like they’re going to be behind the ball regardless; maybe they’ll figure it out when it finally hits the news or friends start talking about it around the dinner table, dunno.

Regardless, whatever happens in Van, will eventually happen in Vic as we know, and considering Van’s not doing great, it’s only time before Vic is hit with the same.

Another West Van property, listed today, 2017 assessed at approx 2.5M, listed a hair under 2M. Meh house, but good location. Listed approx 500k under assessed.

https://www.realtor.ca/Residential/Single-Family/19512353/1507-JEFFERSON-AVENUE-West-Vancouver-British-Columbia-V7V2A2

Another one, 2017 assessed: $3,094,000, 2016 assessed: $3,310,000, listed today for $2,600,000 on 1/2 acre. So listed 500k under 2017 assessed and 700k under 2016 assessed.

https://www.realtor.ca/Residential/Single-Family/19512347/1850-29TH-STREET-West-Vancouver-British-Columbia-V7V4M8

Updated the article above to address some blatant spin in the VREB press release. Now, how many media outlets will blindly parrot the press release without questioning it?

Thank you, Leo S – very good data. Sales are markedly off the pace leading up to 2018, particularly April and May. The “front-loading” sales are through the system and now we get a pure picture of the happenings [or non-happenings] in the Victoria market. Sales to listings are poor, at best, which is indicative of a decelerating market. However, to this reader, this is more than a “tap” on the brakes. Frankly, I did not foresee such a precipitous drop coming – I expected a slow down, but nothing as sizable as this early in the selling season. My PCS site shows multiple price drops [many below the inflated tax assessment values] and new listings. The Spring selling season has demonstrated an impotence that we have not seen in 5 years. History tells us that May tends to be the “peak” of selling season. June will be intriguing. Buyers are taking a wait and see approach, I presume, and the foreign money is off to Montreal. Tariffs add risk and fear. The Trans-Mountain boondoggle also adds risk and fear. US jobs data looks solid as the unemployment rate drops and the Fed turns decidedly hawkish – Read “rates rising”.

Fascinating times, to say the least.

I’ve been keeping my eye on Latoria rise off Latoria Road in the Westshore. Houses are going for a million there. Am I crazy to think they’ll come down. There’re quite a few brand new houses just sitting there with for sale signs. How can anyone afford them? I’m hoping they come down to $750-$800 levels like they were when they started a few years ago.

Removed off topic - adminAlso Toronto in the late 80s… no recession until after the housing market crashed yeah?

Hawk never denied he sold in hopes of crash. It has been brought up dozens up times and it just lead to more posts and attacks on those who brought it up.

He does mention he has done really well with his housing money invested in stocks.

Rising unemployment can be before or after a housing fall.

The US housing crash started in early 2006 when unemployment was under 5%, The rate declined to 4.4% in May 2007 and remained under 5% until December 2007. The unemployment rate then started rising rapidly. The rise in unemployment was a result of the crash, not its cause.

https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

A 45 day suspension so she can relax in a pile of money for 6 weeks. I’m sure she’s very sad.

I don’t disagree. Real estate will likely be a drag on the economy. Just saying that we need to see that recession in the economic data before we can go from a slowdown to a crash.

Yes.

A little more complex than that because a lot of those units are also rentals so will have an indirect effect only. Also because of presales many under construction units are already sold. On the other hand many speculators will have bought them with intention to resell when complete or close to it. Hard to estimate exactly the impact other than new supply will increase.

I think this might have been asked before, but what is the accounting difference for under construction vs completions? A building can be under construction for years (a year or 2 of data points) before being counted for completions in one data point. Does that account for the order of magnitude difference between the scales?

There’re 4,500 units currently under construction and the 10 year average for condo sales is just under 2,000. Does that mean some time over the next year or two, we’ll be injecting ~2.5 years worth of new supply in?

Okay, but I’ll bite on this one, because I see its sister statement here somewhat regularly:

“You need a recession for home prices to drop”, implying that A is causal to B and so long as there’s no recession, the housing market is fine. The question there is does real estate go where the economy goes, or does the economy go where real estate goes?

IMHO, it’s the latter, most especially here where such a huge portion of the economy is suddenly based on real estate. If prices are rising rapidly, you can have the wealth effect and industrial/commercial spin-off effects, regardless if the price increases are beyond the economy’s ability to support them.

But if there’s a lot of leverage in the system and people are over extended, all you actually need for a broader economic recession is prices to stop rising. Greater leverage and falling prices simply makes it worse, and the more they fall the worse the recession has the potential to be. People focus their incomes on debt repayment rather than consumption, all the spin-off activities to RE slows, and “investment” dollars go elsewhere. It also erodes a person’s ability to liquidate their RE assets in the event they run into trouble, and if they have to sell for less, the risk for bankruptcies rises higher.

I think this unfolding slowdown has greater risks associated with it, than some of the previous ones. We don’t need to wait for a slowdown in tourism, tech, sushi or weed before we find ourselves in payback mode.

Speaking of realtors, the hard hammer of justice has finally come down on shady practices within the real estate industry ending the ‘wild west’ business of preying on citizens trust that realtors hold clients best interest at heart. (eye roll)

From Kathy Tomlinson on twitter:

New Coast realtor Sandra Li has been given a 45 day suspension for multiple #VanRE infractions – two years after she was featured in this story:

https://www.theglobeandmail.com/news/investigations/inside-a-fast-growing-bc-firm-that-has-home-sellers-crying-foul/article29578417/?utm_medium=Referrer:+Social+Network+/+Media&utm_campaign=Shared+Web+Article+Links

*I do believe that honest realtors still exist. We just need some sweeping of chaff.

I do like the comic, but I wonder what the unintended consequences will be. Like how all the recycling and getting off paper in the 80s has led to a world full of plastic and electronic junk, which is definitely worse.

Josh

I would agree that talking to most people who aren’t actively researching and simply going by anecdotal or realtor advice still show the ‘now or never’ outlook. I think once mainstream media starts actively reporting declining sales, and if/when price declines, people will start talking, and the FOMO off offloading may begin.

You’re the one that created that impression, with your repeated assertions. Just like how you tried to imply that he was the Oak Bay father that killed both his children at Christmas time.

(From the previous thread:)

Yeah, I came up empty. It’s possible it doesn’t exist.

But what reading through too many old posts by Hawk did underscore was how he hasn’t been right about anything. But it wasn’t for lack of trying.

REPORT CARD

Student name: Hawk

Effort: A+

Performance: F

I hate it when my housing market soup splatters all over the place.

My wife has chatted with a few coworkers at the hospital who are considering buying or selling. Not a single one of them is convinced the market could ever go down or that it will do anything but continue to climb. But how many of them know what a cycle is or have looked at any trends longer than 3 years?

What does it take for their sentiment to change? A barrage of news reports, or does it have to be anecdotal evidence?

Leo S…..A crash requires much higher unemployment.

Considering the amount of jobs connected to the housing industry I would think that higher unemployment is just around the corner.

“Global Real Estate Prices Are Synchronizing & Creating A Real Estate Supercycle… That’s Bad”

Economic shock to a real estate market in one part of the world, can now lead to a domino effect across the globe. Now we’re starting to see global hypersupply appear. Pop quiz, does anyone remember what comes after hypersupply?