A March of Records

Remember when the VREB was the real estate cheerleader? In the market doldrums of 2011 and 2012 they jumped on any positive glimmer in the stats and held it up as examples of the market not being quite so bad. Eventually even they could not keep up the positive spin, and market summaries were filled with somber warnings about sellers needing to “price appropriately” in this market in order to make the move.

Well it seems like their spirit has been permanently broken, because the March numbers were decidedly undersold as “Another busy month in the Victoria Real Estate Market”. Let’s take a look at just how busy this month was.

Monthly sales, at 1121 are both the highest we’ve ever seen in March, and the highest we’ve ever seen in any month in history. Only when we adjust for population does March 1991 outdo us by a smidge. Inventory is not as low as it was in 2004 and 2005 but you can see March inventory levels have fallen off a cliff in the last two years so we are not far off.

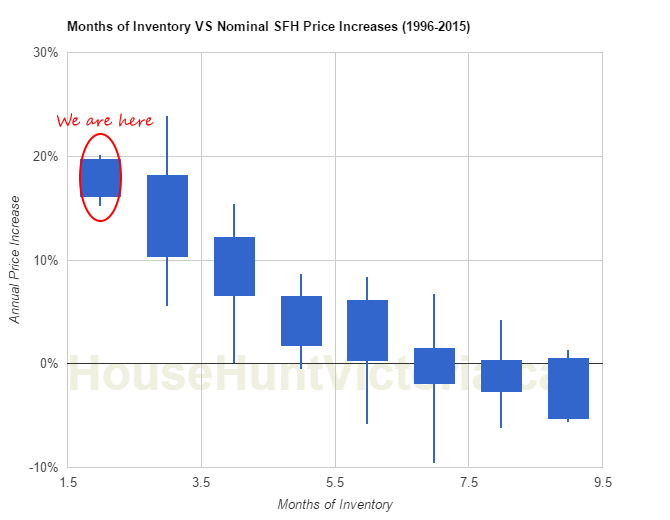

Looking at months of inventory, one of the better gauges of the market, we are now squarely in the same category as 2004 and 2005.

At that kind of market activity level, here is what we could expect based on past performance.

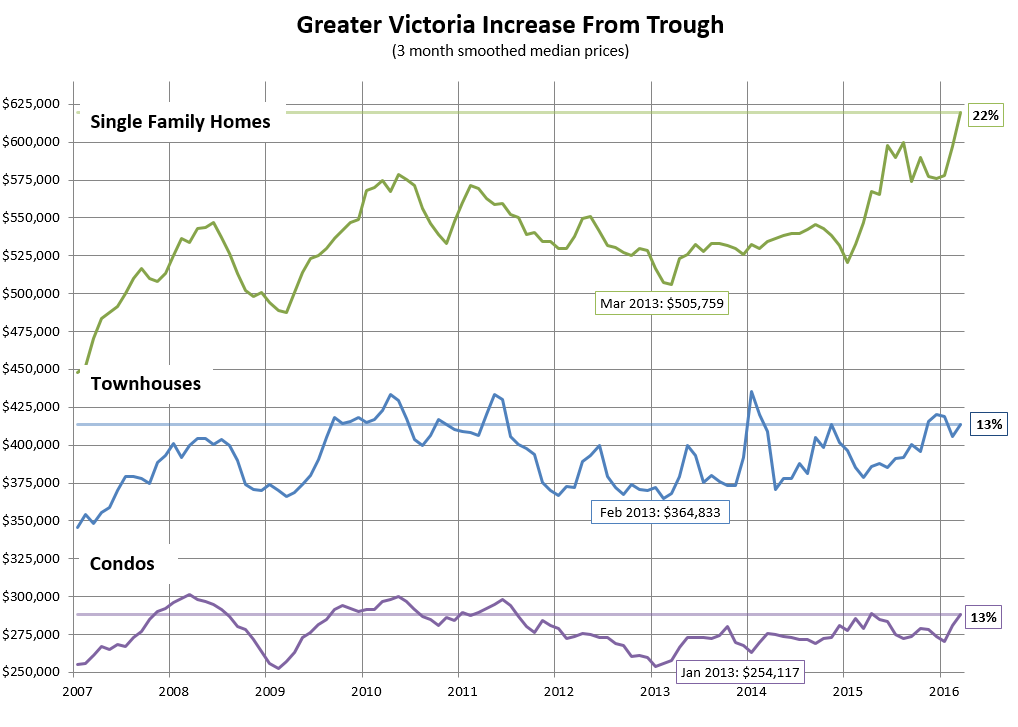

Sure enough, single family house prices have taken a huge jump, with the average sitting at $748,000 which is a massive jump over the previous record of $704,000. Of course that should be taken with a grain of salt given the average can be easily influenced by high end sales. However the median of $651,000 is also a record and a huge jump over the previous high of $606,000 just a month ago.

Condos continue to lag, up about 13% from the bottom in early 2013.

What’s causing the market insanity? The president of the VREB, Mike Nugent, gives a reasonable theory:

“Pent up demand from the slower years of 2008 to 2013, lower than historic mortgage rates, strong interest from out of town buyers, a buoyant economy that’s attracting job seekers and the lifestyle and beauty that Victoria and area offers all contribute to the activity we’ve seen this year.”

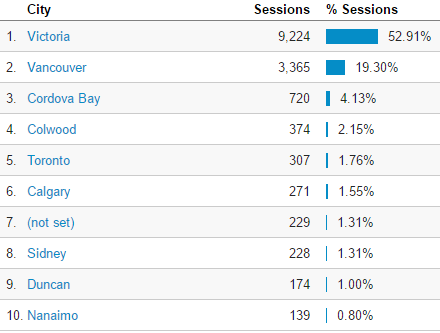

I was pretty skeptical about the foreign buyer theory a couple months ago, but given that out of town buyers have a proportionately greater effect on demand, and the increasing number of anecdotes on the street, I think they are a big part of the picture. Interestingly, we’ve had a large increase in visitors from Vancouver to the blog lately. In March:

In February, only 15% of visitors were from Vancouver. In January it was 9%. So if you’re reading this and you live in Vancouver, leave a comment and let us know what your interest is in the Victoria market. Have you come to invade our sleepy little hamlet with your fistfuls of cash? Or do you just come to appreciate the various squiggly lines I post?

One thing that surprises me is the stories of people being frustrated by the multiple offers issue. Some mention coming over to Victoria several times and not being able to successfully win a bid on a house. Why don’t they buy from a private seller? Our daughter and my son just did and there was no bidding war. It was relatively easy using our own lawyer. We thought about selling our own house in Rockland and listed it on craigslist and used Victoria and we only got one person who enquired. (We also only got one agent who called which was surprising). Our house has five fireplaces, two small offices, 1912 character home, four full bedrooms, beamed ceilings in the living room, large entrance hallway with beamed ceiling, very large sunny dining room with beamed ceiling, new electrical panel and completely rewired, New heat pump, newer roof, chimney’s all repointed, one bedroom suite in basement with private entrance, large,very private sundeck, exterior painted a few short years ago. No buried oil tank. The kitchen is modest and would need updated. The house is within walking distance to downtown and oak bay village and it sits among lovely oak trees on a quiet dead end street. And yet we only got one call. No one seems interested in buying privately. The price we were asking was about two hundred thousand over what it should have been. We have decided to stay in this house. As for buyers, it would seem buying privately should be worth considering if people are having trouble buying a home in Victoria.

Yes, thanks Introvert for showing us new readers the history of Just Jack, very revealing and gives new readers some perspective about the poster rather then listening to him, they can ignore.

Posters who post strong real data then layer over it their own strong negative opinion about the market might mislead new buyers or sellers, not sure if that is his/her intention. That’s a long time to be posting on this blog.

Introvert, to respond to you is a waste of time. I would like to say that JustJack is the most important contributor (of course the admin too) and justbrilliant would be the right name for you!

I don’t know any of you but I think it was beneficial for introvert to post those old comments to give perspective to lurkers like myself. Very illuminating.

Introvert, what you’re doing is not normal. You are stalking me and only me on this blog. You’re a sick person that needs help. Normal people don’t do what you’re doing.

How many hours did you spend going through all those years and years of comments to find bits here and there that show nothing other than you have an unhealthy fixation about me.

Better wrap your mind around Canadian fixed and variable rates moving up. BMO predicting higher growth than BOC. Rates go up across board, bubble goes “pop”.

New post up. Tax rates in GV municipalities. https://househuntvictoria.ca/2016/04/05/municipal-tax-rates/

Better wrap your mind around Canadian fixed and variable rates moving up. BMO predicting higher growth than BOC. Rates go up across board, bubble goes “pop”. It’s early 80’s all over again.

Which he never does.

JJ’s wave direction seems to only go one way: historically, he’s pointed to weakness in the West Shore, including Sooke (why not Port Renfrew, too?), and then wondered when the reverberation of that weakness will reach Oak Bay.

Another problem with “real estate wave theory”: correlation doesn’t necessarily mean causation.

@Bizznitch: careful about predicting rates. Even economists get it very wrong. A few years ago 60/60 economists failed to forecast rates in the USA.

July 30, 2014, at 8:42 AM, Just Jack wrote:

I don’t think any neighborhood will be immune to a fall. Fernwood prices have just continued to inflate while others like Happy Vally stopped.

The saying goes…..

The bigger they are – the harder they fall.

Fernwood has a lot farther to fall.

The market just corrected…. It will probably do a similar correction later after this price gain period. My prediction is it will run up faster but shorter than the last run. It will then correct by a smaller amount than it went up equating to a net gain….

The wave theory is true and pretty easy to observe as long as you get the direction of the wave right.. in the declining market weakness started in the outlying areas and moved in. In a strong market like now the strength started in the core and moved out.

February 18, 2011, at 3:23 PM, Just Jack wrote:

… I believe we are in the first weeks of a serious meltdown in real estate prices.

Here is an example JJ’s oft-repeated and quite stupid “wave theory” that I’ve pointed out before:

February 9, 2012, at 3:53 PM, Just Jack wrote:

… What happens to prices in one neighborhood has an affect on other neighborhoods.

So, Victoria is not different. Falling prices in the outlying neighborhoods will lead to lower prices in the urban core.

By watching the outlying districts of the market area, you can foretell where prices are going in the inner city.

Introvert: The market’s always correct. It’s difficult to predict when, but they always do.

Something to think about:

http://www.theglobeandmail.com/real-estate/mortgages-and-rates/many-canadians-would-struggle-if-mortgage-payments-grew-slightly-poll/article24976435/

It looks like the US will raise rates. That will bring up our fixed rates. Wouldn’t surprise me if they go up 50 basis points by the end of the year, and continue to go up in the following year.

http://www.marketpulse.com/20160405/fomc-minutes-to-validate-fed-and-markets-on-us-rate-hikes/

Would just suck to be someone just getting by.

September 7, 2010, at 1:43 PM, Just Jack wrote:

… Fear is a double edged sword, it drove the market up and it will drive the market down. The only thing worse than fear is boredom. And if people become bored with real estate, its teats up for prices because no one can tell where the bottom lays.

The MSM has turned on Real Estate and buying a property is now becoming part of a comedy routine. So, how do you own a million dollar home in Vancouver. Buy a two million dollar home – and wait.

People do not buy things that people make jokes about.

Ouch!

December 8, 2011, at 3:52 PM, Just Jack wrote:

… If the marketplace continues to contract into the city (which is what happens) at the rate it is in the outlying areas (and it will) that would mean a drop in the city from the current median price of $578,000

to

$387,750

or 33% off current urban home prices.

And that will $%#@ up most people’s lives who bought in the last three years.

June 7, 2011, at 8:57 AM, Just Jack wrote:

… I do expect prices to fall to the level where a starter home can be purchased by a single parent.

Or a double income family will be able to afford a Gordon Head box without the need of a suite.

Its getting near closing time in the housing casino. Time to cash in the chips.

No opinion, just old news about a fire there:

http://www.timescolonist.com/news/local/fire-damages-oak-bay-home-that-had-massive-model-railway-1.1590106

Like Aristo-crat, several years ago, before the craziness – we just had to act quickly to beat out the flippers, developers, and investors. Waiting for >14 days would have been nice, but even then, we found that the best properties were sold within a day or two.

“Best” to us just meant an acceptable floor plan (without weird renos), solid construction & insulation, nice bit of land, and convenience to stores, schools, and parks without being too busy.

We lowered our expectations with “street appeal” and opted to fix that later. We also waited till the fall season, because spring is notorious for being pricey. Our realtor mentioned that Victoria has always had a low inventory of the most desirable houses because of geography.

If you don’t jump in on new listings, you’ll end up with a dumpy house in this market.

I just bought last month – I had been thinking of buying for the last two years or so, but I backed off because I was hesitant. Well, now I got what I wanted in a house, but I had to pay about $100k more than I would’ve 2 years ago. The only reason I’m not complaining is because my house has very good cashflow with the suites in it. But if you actually want to own a house, and you try to wait it out right now, you’re gonna get slaughtered when you finally pull up your boots and buy. That has been my experience.

We jumped in on the listing for our house, and because of it, got it for list price instead of waiting for a price war after the open house. Time will tell if issues are revealed as we didn’t get an inspection done, but we did a very thorough inspection ourselves, more than once.

I agree with JJ on not diving in on the latest listings in this market. Not unless you are a foreign investor with piles of cash trying to drive to overall market up….

Another thing to watch is the Days-On-Market. As the market heats up that indicator drops.

Here are the DOMS for January, February and March respectively by area

Victoria 21-8-7

Oak Bay 22-7-7

Saanich East 15-8-8

Half the homes in these areas are now selling in less than 8 days. In January it was 2 to 3 weeks. Before we see any easing on rising prices in these areas the DOM is going to have to increase. Normally, a reasonable exposure on the market is between 30 to 90 days. More than 90 days and prices would be declining.

Again, no need to panic if you’re planning on selling.

But you can see how fast that median exposure can change. As I said in an earlier post, bidding on anything that has been listed less than 14 days could mean you’re going to be bidding against some irrational people. If you wait two weeks for the listing to cool then you’re more likely to get a better deal including having clauses accepted such as a building inspection and financing. If a property has been listed for 3 weeks with little action, the agent is going to be pushing the vendor for a price reduction.

If you’re in the car waiting for the next new listing emailed to you – you’re just road kill.

“No one can predict the future 100% accurately 100% of the time”

No even me!

Shadow Protection

But how do you protect yourself from falling victim to shadow lending and shadow flipping (if in fact you can fall victim to them at all)? Actually quite easily. First of all, don’t buy the media hype!

After that, if you don’t understand the terms of a mortgage, ask questions. Then, if you still don’t understand, ask more questions. At that point, if you still don’t understand, seek legal counsel. And if you don’t like the terms of the mortgage presented to you, simply don’t sign.

Ultimately, no one is forcing you to sign mortgage documents.

If you are worried about being taken advantage of on a real estate contract, and the idea of someone flipping your house in the shadows upsets you, simply don’t accept any offer that includes an assignment clause. It’s just that easy!

At the end of the day, you should always seek professional advice and make informed decisions. It’s your money and your property, you have every right to spend it, or not, sell it, or not, how you see fit.

You tried that comment once before Introvert and I had to school you on how wrong you were. You want another whoop ass kicking?

No one can predict the future 100% accurately 100% of the time, but some people are better at it than others. Just Jack has one of the lowest prognostication scores of any commenter to ever put finger to keyboard on this blog. When I need a few laughs I just dig into the old HHV blog site (http://househuntvictoria.blogspot.ca/) and compare his old predictions to what we now know — it’s a hoot.

Re: the Oliver house. I had a look into the open house and the listing broker seemed to be more interested in chatting to his mates than talking to prospective buyers!

It’s written right in the listing. The home is assessed at $706,000 in an area where the typical house in South Oak Bay has been selling at 30 percent over assessed value.

So what do you think was the purpose of listing at 3% over assessed value?

And that leads into the problem of shadow flipping. Since this home was not given enough exposure to the market it may have sold under fair market value allowing the new purchaser to flip the property for a small profit.

Would it not be easier for BC to have a fair pricing policy for residential real estate that protects both buyer and seller. Where auctions are prohibited under the real estate act unless scrutinized by an unbiased third party for fairness.

I suppose there are a few on this blog who think that things will never change because Greater Victoria is too important of a city.

Greater Victoria covers a lot of area and we do have some wide differences in the new listings to sales ratio. But our differences are not as great as comparing our city to say Vancouver or Toronto. Victoria City has more in common geographically, economically, politically and socially with Sooke than it does with Vancouver.

And last months the new listings to sales ratio for Sooke was 1.9 new listings for every house that sold. Langford and Colwood had a ratio of 1.4:1

And it is happening in the core too. Victoria and Oak Bay both had ratios of 1.6:1 last month.

Don’t panic though, If you want to cash in at the top there is still time to do so. It is still a sellers market and we would have to see the ratio in the core approach 2:1 before hitting the panic button.

https://youtu.be/WB8XDk3sQBc

@Just Jack

Not sure what you’re getting at.. The Oliver house was listed on Friday and had an OH on Saturday. Then I guess it sold without conditions on Saturday evening.

Am I missing something?

AG, why would an agent list a property for one day at $724,000 when they already had an accepted offer at $825,000 and were not showing the property to other potential buyers?

1050 Oliver sold for 100k over asking. Nice location but needs a LOT of work inside

I suppose someone who is a bull wouldn’t be selling their property instead they would be buying properties at these higher prices. Not many would be rubbing their hands together for just paying $750,000 that they could have bought for $100,000 less two months ago.

Then there are those that might be rubbing their hands together because their equity has increased. But if they are not buying or selling then they are neither bull nor bear. They would be either a cow or a castrated bull. It’s like saying you’re a stock investor because you bought one stock ten years ago but have never bought any since.

My neighbor has heard of all of these over asking prices and is going to take this new equity out of his home to buy more mutual funds. In this case I think it’s the banks that are rubbing their hands together.

Another neighbor has a paid off house. And he’s worried that his home might be worth less sometime in the future. He’s 75 years old. How much future does he have?

Thanks for the details on 5099 Del Monte, Just Jack. Listed 15 times! I’m amazed that it lasted 199 days on the market, but I suppose after a certain point people assume it’s haunted, broken, or otherwise undesirable. I would have done the old trick of cancelling/relisting once the spring market heated up.

Anyway, congratulations to both the buyers and sellers if you happen to see this post when Googling your address.

I really hope people don’t need an online calculator to figure out how to calculate a percentage.

I was amused to see that the chart appears to end at $600,000. If you enter a current Saanich house price or god help you a Vancouver price — the bars go right off the chart and get clipped.

(Maybe it’s just a glitch with my browser.)

Sheesh, I don’t think the bulls are losing any sleep, they are rubbing their hands together and rejoicing….

The Del Monte home has been listed 15 times since it was built in 1989. I haven’t seen the property but I think it backs onto a ravine and has very little useable yards. That has a negative impact on the property value. Although the listing shows almost half an acre it would have less value than say the level 7,000 square foot lots that surround it. It’s all about how much land is useable rather than the amount of land.

But still it’s a good deal for someone at $710,000. The property was bought previously for $640,000 in December 2010 and has had some updating since then.

So why hasn’t this property appreciated like others?

Maybe the better way to explain things is see that this sale falls more in line with the definition of market value than what is going on in some other neighborhoods closer into the city. Part of that definition of market value is that the property has to be reasonably exposed to the market so that a prospective purchaser may make an informed decision in their own best interest and not under duress.

A property that is listed and sold in under 10 days in an auction may not meet the accepted definition of fair market value. It’s an auction value that may or may not be a fair market value and if you as a prospective purchaser are not made aware of the difference then you could sue for damages. I’m not saying that you’re going to win but if you feel that you were mislead in that vital information was withheld from you.

I understand that some of you pure capitalist would say that no one is holding a gun to the buyers’ heads. But I have never seen someone actually do this in any department store either. Yet we have laws that protect people from being baited and fair advertising laws for products and services.

All’s fair in love, war and real estate.

Average prices are now at close to 9 times average family income. When the market tanked in 81, incomes were only around 5 times. This market is clearly on a death watch. When the bidding wars stop, look out below.

Jack, can you tone it down abit please. The bulls must not be sleeping well. 😉

Interesting house worth calculator from the Globe and Mail, up or down, what will your home be worth: http://www.theglobeandmail.com/globe-investor/personal-finance/housing-price-calcualtor-how-would-a-correction-affect-your-selling-price/article18079370/

My pet listing of 5099 Del Monte Ave appears to have finally sold after 199 days on the market. Asking $775,000, sold for $710,000 — that’s $80,000 under assessed value. I wish I knew the story with this one! The interior looks lovely.

Where’s the money coming from?

The first place to look is CMHC. CMHC is a secretive Crown Corporation where straight forward answers don’t come often. I understand that they have been reducing their exposure to the real estate market, but how they are doing this might shed some light on why prices in so many places in Canada have gone nutty. Obviously the government wants Genworth Financial and Canada Guarantee Mortgage to take on more high ratio mortgages. What are the incentives the government is giving out to these companies to make more mortgages?

@Just Jack: please stop prophesying the market. You can’t predict the future & neither can I. One could easily counter that because many homes have had multiple offers (some over 10), there are still tons of buyers swimming in the market.

Is buyer demand outstripping supply in Victoria?

In order to understand if this is an accurate statement you have to look at the ratio of New listing to Sales.

Since some people list a home too high or cancel the listing because they change their minds, there has to be more new listings than sales. A ratio of 1 new listing to every property that sells would not be enough. A ratio of 1.5 New Listings for every one that sells has historically been enough to provide good selection and stable prices.

More than 2.5 new listings for every home that sells would indicate a glut of housing coming on to the market and prices would moderate lower. A replenishment rate of less than 1.5 to 1 for a prolonged period would lead to rising prices. And as we have experienced in the last couple of months if there is less than 1 new listing to 1 sale you have irrational buyers over bidding to acquire a home at any cost.

For March in the City core these were the New listings to sales ratios for detached houses.

Victoria City proper 1.6:1

Oak Bay 1.6:1

Vic West/ Esquimalt/View Royal 1:1

Saanich East 1:1

Saanich West 1.2:1

Those ratios show how the market favors sellers. But they have been changing as higher prices reduce demand and increase supply.

April and May are significant months as these are the months that a lot of people put their homes on the market. But with high prices I don’t expect demand will increase at the same rate as more selection comes to the market. I expect these ratios to lay in the 1.5:1 to 2.5:1 range in the next 90 days and bidding wars will be a thing to tell your grand children.

And if you were unfortunate enough to get caught up in a bidding war and over paid for a property then it will be a life lesson than you can ponder over the next 25 years.

@Numbers hack: your # regarding high net worth individuals with >2.5 million usd is way off by 100x. It’s more like 1 million people at most.

@Numbers hack: thanks for sharing your viewpoints. I’m originally from Vancouver but now live in Victoria. I recently bought a detached house in Vic & will be selling my condo. Do you think Vancouver prices will escalate further if no government interventions are implemented? And, why the sudden surge in Vancovuer prices in the last 12 months? Are we attributing this to the low loonie + Chinese capital flight in the last little while?

From a market fundamentals perspective, Vancouver RE is massively overpriced. However, the foreign $$$ has distorted everything beyond belief.

Fuel to the Fire

1/ 3x Canada’s population: 100 million people with a net worth + $2.5MM USD in China

2/ 2.5/5.0 people in the world live in China, SE Asia, and India, these regions are generating the most absolute millionaires on an annual basis

3/ they have no social security safety nets, what is better than having an asset such as RE paying you a monthly payment to perpetuity as a safety net?

If I only had the time and inclination to share more…my only wish is that there are some government policy types that read this blog and make some effective policy changes to enhance the lives of its citizens.

The only silver lining is that because Victoria is an island, it will discourage many people from coming. However the displaced old stock from Vancouver and Toronto, where they sold out for a song…now that’s another story 🙂

BTW Leo, you took out my bad driver references haha. But check http://www.youku.com and look for selves.

Hawk – you do realize Asia is a big non-homogenous place composed of a number of different countries and cultures each with their own set of laws, government structures and infrastructure right? Nothing in Asia can be generalized imo except perhaps some attitudes towards elders, family obligations and food.

But dasmo, totoro said she had zero problems driving there. One of you isn’t telling the truth. 😉

I’m with you on this numbers hack. My IP address has registered Asia for part of this year too. It is lack of appropriate government response is the issue here imo. Make some rules that require investment other than sending kids to school here and impose appropriate restrictions on housing purchases that only impact economically advantaged immigrants or foreign purchasers who are competing with Canadians who have to live and earn in Canadian dollars. Many counties – including Hong Kong – have these rules already in place.

The craziest driving I ever experienced was in China! Honk Kong was insanely aggressive but Shenshen was a form of ordered chaos since all the infrastructure was in place with lights turning red and green but totally being ignored and extremely busy. Both were environments where you need to be an excellent driver simply to survive!

[removed off topic driving discussion. Let’s keep it on topic – admin]

Travelled and have lived in China for over 2 decades. Still travel there on a monthly basis; so definitely speaking from experience.

Calling a spade a spade; Canada should like at the best way of integrating these new immigrants into Canadian society. Here is what they bring:

1/ Tons of Cash

2/ Tons of business Acumen

3/ a can-do attitude

4/ little English proficiency

5/ without intervention, if they arrive on the island in big numbers, RE prices will be in the stratosphere. Let me repeat stratosphere. Shenzhen real estate plots have gone up 1000%, yes 1000% in 3 years. Yes 10x in 3 years. And with the average liveable flat approaching $2MM USD in big cities, the AVERAGE middle class or upper middle class family will be able to outgun and outspend any local if the same focus is a RE asset.

So if our lazy government would do something smart like:

1/ create 5 Canadian jobs, we will let you buy $2MM worth of RE, that might be helpful

– if they create a good business, everyone wins!

– it is amazing how entrepreneurs get integrated into the community!

2/ have a “STAMP” Tax like Hong Kong, Singapore etc…

– remember HK, Sing are all Chinese, but they have been exposed to Western Culture for over 100 years!

3/ have a 2 year hold period before ALL new immigrants can purchase

The rules of engagement are much different than say Syrian refugees, who are not as empowered economically. So instead of making the problem larger, we need to harness the best of these entrants and make them into contributors to our society socially and economically.

Leo, you can check my IP, I am in China right now, but raised on the Island.

For the posters with negative connotations of these newcomers: you are correct, given the amount of change in Vancouver. Note I went to university there! This is a definitely the fault of IMCOMPETENT local and provincial governments.

But the bright side is, I personally know of a handful of really cool, worldly, and accomplished Chinese families in Vancouver who have settled in the last 5 years. They have been either stone walled or ripped off in Vancouver, and they wanted to start up local North American offices of their companies IN VANCOUVER. These guys would make the Canadian Business List of who’s who and richest, but they WANT a reason to CREATE something meaningful in Vancouver.

Now how our government does that…well that’s another story 🙂

Maybe I would feel differently if I lived in the lower mainland ( I did 20 years ago but don’t remember). But for the past 10 years in Vic and Calgary ( 5 yrs in each) whenever I see an a-hole driver, it’s always, and I mean always, a young white guy driving a pickup.

John Chan – 欢迎来到加拿大。加拿大的人都好;我们欢迎中国人。

@john in HK: welcome to the board! Great to get your perspective! (interesting to know that this site came up #1 as well)

If you buy 2609 please keep the trains running! We used to live near there and the kids loved watching them. I briefly considered it (it does need a lot of renovating) just for the nostalgia… and the proximity to the bakery…

On the negative side that intersection is pretty busy – Cadboro Bay also has some road noise issues.

Nan, read the study before you deem it “useless” – it is adjusted for both shorter commuting time and greater use of transit. http://www.sciencedirect.com/science/article/pii/S0001457511001655

While you are at it you might want to take a look at the 2010 study that found Asian-born Australians were far safer drivers than Australian-born drivers. http://www.tandfonline.com/doi/abs/10.1080/15389581003614888?journalCode=gcpi20

Reminds me of hearing about “women drivers”. Socially accepted stereotype in a certain generation – the stats told a different story. http://www.statisticbrain.com/male-and-female-driving-statistics/

Come to think of it, I did see a white guy driving the wrong way on Yates a few months ago.

Also, I lived in Asia for a number of years. We owned a car there. I had zero problems with other drivers. It took me an hour to switch to driving on the opposite side of the road and a week to stop turning the windshield wipers on instead of the turn signal – which I did when I came back to Canada too.

Asia is way too big and diverse of a place to make sweeping statements. The stats on foreign ownership of BC real estate are anecdotes mostly now. In Australia at the peak of their housing run up they instituted an Asian buyer hot-line – yep, to report Asian buyers bidding on properties. Unfortunately the buyers turned out to be mostly Australians of Asian heritage. Canada’s immigrant investor program resulted in a lot of Chinese permanent residents and these people are Canadians now.

If there is a problem with Asian money invested in the BC market by people not paying tax here (and I’m not sure what the bottom line is) imo the government is to blame for not enforcing existing rules and creating new ones that work to manage the situation. Other countries collect stats and charge foreign buyers a 15% tax or restrict them from buying waterfront – many examples out there.

Many reasons. Family easier to visit, some friends in Vancouver, Safe, and Canadian Dollar. Friendly Canadians.

“We could look at previous cycles, same thing.

Late 70s, mtg rates went from 10% to 21% while Vic prices +70%.

Late 80s, mtg rates went from 10.2% to 14.2% while Vic prices jumped ~70%.”

Personal and household debt levels were half of what they are now and they still had a crash in early 80’s. Most of the interest increases were in the last 2 years before it crashed.

History will show that this is the opposite where lower and lower interest rates caused this to tank. Not the” same thing” in the slightest.

This is same mantra as you heard from the dot com crowd, it’s a “new world”. This puppy is going to explode in a sea of pain.

Best check out Garth’s blow off top chart, it won’t be long now.

http://www.greaterfool.ca

@ John Chan

What makes Victoria appealing when compared to Seattle or other places on the West Coast?

@john Chan. Welcome to the site and welcome to Victoria!

(in case anyone is wondering, John Chan’s IP address does in fact resolve to Hong Kong).

It’s not about race, it’s about culture. This article is in my local paper today and it is NOT an April fools exercise:

http://www.thenational.ae/uae/transport/uae-drivers-say-using-indicators-is-a-sign-of-weakness

A friend recently took his driver’s test and was failed for indicating lane changes. The examiner said this would only encourage other driver’s to speed up and close the gap.

Does anyone have an opinion or thoughts on 2609 Cadboro Bay Rd?

I Chinese buyer from Hong Kong. Victoria is my favourite place in the world. I look for nice home in Gordon Head in one month. This website comes up number 1 when I search for house in Victoria BC Canada.

Just want say not all us are bad drivers, only mainland small town with new money.

Chinese value house over all other investments, it’s very very safe, protect family money.

LeoM another disgruntled highly leveraged homeowner who desperately needs wealthy HAM for his retirement plan or he is hooped.

With the word “bubble” back in the headlines and the biggest leak of corruption documents ever, I would be sweating bullets. Justin is in charge now,not Harper, and changes to old deals will change overnight.

@ LeoM

Is that why ‘child poverty’ rates are so high in West Vancouver and West Point Grey? I don’t think you really know what you’re talking about. Those ‘wealthy immigrants’ you speak of actually report lower incomes to the CRA after 10 years than the poorest immigrants.

A 16 year old crashed into a house in Gordon Head. Just another sign of the influx of teenage buyers causing problems here. http://www.timescolonist.com/news/local/girl-16-gets-two-tickets-after-driving-car-into-saanich-house-1.2125969

Speaking of stereotypes, I imagine Hawk foaming at the mouth as he types his stereotypical rants about Asians. From my perspective, watch out for those old guys driving with Veteran licence plates… Was that you that cut me off yesterday Hawk?

Just for perspective, Canadian immigration under Harper was focused on wealthy immigrants with advanced university degrees who are typically high earners who easily afford to buy nice houses in Victoria or Vancouver. Guess who tops the list of desirable Canadian immigrants annually for the past decade? Chinese!! And I say, welcome to Canada.

http://www.cic.gc.ca/english/resources/statistics/facts2013/permanent/10.asp

Anyone who has lived and driven in Asia understands that there really is no following of rules of the road. Traffic lights, intersections, road markings of any sort, and pedestrian cross-walks etc are all ignored 90% of the time and it’s okay, sooner or later you get used to it and start driving the same way the locals do. There is a definite attitude of the bigger and more expensive the car the more rights you have. The problem is they come to Canada and think that they should be able to continue driving the same way. I have driven and lived all over Asia, its a wonderful part of the world in many ways but even my Chinese daughter in law admits most of her family, herself include are terrible drivers. She once called me from the middle of the Port Mann bridge in the middle of a snow storm and asked me how to drive in the snow. Amusing for me but I can imagine what the rest of the drivers around her must have thought when she came to a stop, mid bridge, to call me.

Well said Nan and Vicbot. Totoro you are full of it. Life isn’t all about stats. Pretending my comment about the increase in brutal drivers that just happen to be more Asian is racist is pathetic. As well as any media articles I posted.

Just over a month ago I was almost forced into a head on at a major intersection by you guessed it…who cut me off in slow motion and I missed by an inch having my life severely in physical danger. They then proceeded to come to a complete stop for 2 minutes for who knows why holding up major traffic.

Dangerous drivers come in all shapes and sizes but the many and most serious I have seen or had to avoid lately were on the Shelbourne Hillside area where there is an Asian population increase.All you have to do is look to see the anecdotal increase. It’s not a “stat” to disect like some nerd with a calculator.It’s real life.

Where did I say any where I hate them ? ?..but I believe many of the new ones to Canada who have a license (or not)have never driven in their life. I live in a building with many nice Asians and personally know a few. Your perception of life and my comments is seriously warped.

Totoro, the stats you posted are for drivers of all economic classes.

If you take affluent car owners, the story is much different.

Luxury cars have higher accident rates, eg.,

“Smart cars only registered 78.6 at fault claims per 1,000 drivers. By comparison, Lexus owners proved to be the worst offenders, with 111 at fault claims per 1,000 drivers.”

http://www.telegraph.co.uk/finance/personalfinance/insurance/motorinsurance/11993627/Its-official-drivers-of-luxury-cars-cause-more-accidents-insurers-say.html

This discussion was about affluent investors, who tend to buy their families expensive SUVs & sports cars, which are used in road races, or for unlicensed driving.

The “affluence” was an essential part of the discussion, because it was related to how affluent buyers are pushing out Vancouver families who need to find affordable homes..

(for immigrants like my parents, they treasured every mile they drove in their car, so even though my dad was a bad driver, they were careful because their daily survival depended on getting him to and from work. That might explain the discrepancies between the general stats and the more specific Richmond cases )

BTW in a previous post I spelled Salman Rushdie wrong 🙂

@Ben, that area is another world though. Its a choice not unlike living in another province. so IMO a brutal commute if work, friends etc are in greater Vic. I considered it wanting to live in nature since it is rare to find this side of the Malahat. That said The advantage to living that side of the malahat is you are closer to the wonderful nature playground of the island! If your moving from elsewhere and starting from scratch anyway I would look north too….

@ Totoro – the conclusions being drawn from that data are unsubstantiated. The American data set is 12-17 years old and the Canadian data isn’t mileage adjusted, so all more or less useless.

I have seen many bad drivers of all races and then there’s this:

http://www.richmond-news.com/news/thousands-of-illegal-chinese-motorists-could-be-driving-in-richmond-1.947451

“almost everyone we stop in Richmond” They aren’t even bothering to get licenses anymore.

I also remember a few years back a guy being busted in Richmond for selling what at the time was thousands of unearned drivers licenses to Chinese.

You can hide behind your half baked studies until the cows come home but Chinese drivers driving terribly in BC are a rapidly growing problem whether you admit it or not.

It difficult to get someone to understand something when their income depends on them not understanding it…

Duncan is a nice community if you don’t mind the mind numbing odour of the pulp mill. It is not there every day. But most of the time I drive up there I find my eyes literally watering and my throat clenching. People who live there say that they don;t notice it. But I certainly do and the stats show that cancer rates are higher near pulp mills. They say they cut emissions by a large amount with updates but they also increased production which means that while the pollution percentage is lower per ton……….. it still adds up to the high levels of the past. I would never buy a home anywhere near Duncan because of this factor. Everyone to his own I guess.

I’ve been following this blog for five or six years, and I really appreciate all the information posted on here. Recently, we finally found the property we have been looking for, an acreage just south of Duncan, in Cowichan Station. After looking in the area for three years, I feel fortunate to have closed the deal this past Friday, just as things are starting to heat up. Duncan is a hidden gem. It really is changing from the kind of town it used to be, and I would recommend the area to anyone who has a young family is looking for a fresh start at a still reasonable price.

@huevos 2684 Eastdowne: Listed March 30 @$725K, went to pending on April 2 @ $855K

What did 2684 Eastdowne go for?

Exactly – you need facts. The tendency to want to compartmentalize information is strong, as is confirmation bias.

I drive and see unsafe driving and it is not limited to one ethnic groupn. There may be more unsafe Asian drivers in Richmond because there are way more Asians overall. If anything my experience is that some young males drive badly – and the stats back this up.

The question remains whether there are ethnic differences in driving stats on accidents and safety – those are the facts. And the fact is that Asians are safer drivers than Caucasians and new immigrant Drivers are safer than long-term resident Canadians. I posted the links to the stats.

There is a big difference between facts and stereotypes. If you make up negative race-based information that is not supported by facts and falsely brand an entire race as inferior on those grounds.

I think you are confused about what racism is and is not – seems like Canada needed to add a few more words into the curriculum.

@Michael – Tsawwassen saw a massive spike after the new Bridge was announced (the one that will replace the Massey Tunnel.) After years of stagnation, it’s also seeing a ton of development right now: new mega mall on the native reserve, Tsawwassen Springs (backed by Michael Buble and other local celebs), Tsawwassen Shores (also on the reserve), the contentious Southlands project and a rumoured development/rapid transit somewhere farther into the future pushed by Aquilini Brothers.

It also became quite popular with Mainland Chinese buyers, though they will only buy on “high ground,” so tend to compete on houses on the Bluff. I have heard, but don’t know enough to know, that the reported Mainland Chinese interest in the Gordon Head area is becoming a similar phenomenon.

Ladner has also seen a huge surge. Perhaps even more so. Where Tsawwassen had a reputation for being a bit more white collar and Ladner a bit more blue collar, the prices have mostly equalized, aside from the fact that Tsawwassen still offers multi-million dollar ocean-front cliffside homes, while Ladner simply doesn’t have these. A similar house is almost priced higher in Ladner nowadays. I have heard that realtors are actually selling Ladner as “Richmond South” to Asians that have been priced out of Richmond. I also have Chinese friends that bought in Ladner ($1.1M for a 2010 build but pretty standard SFD home!!) due to its proximity to Richmond, where they have family.

Well said bolides & nan. Agree with how you described the “Truth”, as I have also experienced it in my own car .

Also agree with nan’s descriptions of Victorians sometimes so afraid of discussing anything that touches on anything related to foreign buyers for fear of it being “racist”.

I’ve lived in both Victoria and Vancouver, and Vancouverites (and frankly a lot of multi-cultural cities) have a totally different approach – everyone lives and works every day with people from dozens of countries around the world – and we joked every day about differences and similarities.

We also learned a helluva lot from each other, eg., benefits & disadvantages of all sorts of topics from communism to arranged marriage. I was incredibly lucky to spend time with (and laugh with) people from everywhere in the world. They seriously had some of the best senses of humour when it they described their relatives’ experiences when first arriving in Canada, including their driving habits.

It’s definitely not about your “descent” – it’s about the reality of arriving in a new country where road rules are different. Also money plays a huge factor. We saw the influx of extremely rich folks buying their kids the most expensive SUVs and sports cars, but they didn’t know the rules of the road.

When my dad came to Canada, yes he was a bad driver and admitted it! because the roads, vehicles, rules, everything was just so different. And he liked that he was being included in joke, and laughing WITH people.

As Salmon Rushdie said, “the moment you declare a set of ideas to be immune from criticism, satire, derision, or contempt, freedom of thought becomes impossible.”

Did you say bubble ? Pop goes the weasel.

March home sales smash through record in Greater Vancouver as bubble fears grow

“It was the first time the Real Estate Board of Greater Vancouver has seen 5,000 sales for the month and comes as the market faces increasing focus from people worried about a bubble and the impact foreign buyers are having on property activity and values.”

http://www.theprovince.com/business/march+home+sales+smash+through+record+greater+vancouver/11829038/story.html

I find the differences in view on what is and what isn’t racism incredibly divisive. I was raised in Victoria not to be racist. The interesting thing though, was that I was taught not to be racist without ever experiencing any racism. I never had anyone in any of my classes that was more foreign looking than “slightly dark skinned” until high school. Maybe they were Greek…or just tanned. No Chinese, Indian, Japanese, Black folks, etc.

By the end of high school, all I knew is that pretty much everything you could say about a non-white group of people was racist. I even felt uncomfortable using the word “Chinese” to describe Chinese people!

In my early twenties, I moved to Vancouver and couldn’t believe what I saw & and heard. What I thought was for sure blatant racism was just part of a normal discourse, as folks who had grown up with different cultures actually understood more about non-white cultures than what they read in the pamphlet at school.

This in my view is where Victoria has the same cultural disadvantage Vancouver had in the 80’s. Unchecked acceptance.

Victoria is still +90% white, if I’m not mistaken. Raised like I was and with limited exposure to other races and cultures, many Victorians are so afraid of being labelled racist, they either keep their mouths shut when faced with racially charged issues or if they can’t, will call racism at every opportunity to avoid being labelled racists themselves. Out of touch closed mindedness takes many forms. “Racist!” has become the new “Witch!

I agree with a lot of what is written in the “Many Chinese are bad drivers” posts on here. Because they are not meant to be racist. They are not meant to mean “you look different therefore I don’t like you” or “you look different therefore you need your own rules”. They attempt to call out systemic bad behavior caused by cultural incompatibilities that make good drivers feel unsafe and are for the most part supported with facts.

So where am I going with all this? If you see a bad driver, they are a bad driver. If they drive the wrong way down the street in a 3 ton Lexus and you say and do nothing other than mumble to yourself and shake your head because the driver is Chinese and you don’t want to be labelled a racist by doing something more responsible (like calling the cops), that incompetent driver could run your kid over next week.

The same applies to real estate. Don’t weaken the position of disenfranchised Canadians trying to afford reasonable housing for their Canadian families by calling them “racist”. This is what happened in Vancouver. Support them as fellow Canadians and help them get what they as Canadians, deserve – a fair real estate market (and while we’re at it, safe roads).

On their way to The Best Place in Heaven (or Hell) maybe ? 🙂

But why would 7000 leave The Best Place on Earth ? Third quarter numbers were atrocious with immigration at 15 year lows. Evan Cam Muir the biggest pumper was speechless.

Silly Hawk, the net was +3762…did you purposely ignore the 10,910 In-Flow line? So unlike you.

Btw, the blow off top part will be around 2023 when you finally buy 🙂

“I forgive you. It’s really only a tale of TWO cities – GVA & GTA (Vic & Windsor inclusive in the ‘A’). Same classic Dickens tale as it was 30 years ago :)”

But Windsor you can drive over a bridge to the US. Here you have to open your wallet and waste 4 hours plus.

Funny, I thought only Victoria was “catching up”. Seems like everyone else in Canada wants to lay claim to that marketing BS.

It’s called a blow off top and there will be a sea of regret in the near future when the tide goes out.

“This is Windsor’s growth period,” Campbell said. “We’re catching up to the rest of the world.”

http://windsorstar.com/business/local-business/windsor-area-real-estate-market-feeding-frenzy

Van #s are out. Interesting how Tsawwassen saw the largest yearly jump at 39.6%. Maybe people are on their way to buy Vic, miss the ferry and say “screw it, let’s check out Tsawwassen” 🙂

Otherwise metro Van houses combined increased 27.4%, apts 19%.

If you want to impress your friends with year-out Vic predictions, replace the word ‘Van’ with ‘Vic’ and you’ll be pretty darn close.

“It’s more of an economic/demographic migration. Same thing happened in the late 80s. It’s all very predictable.”

I wonder where the 7000 plus folks who left BC last quarter went to Mike ? Net international immigration was negative as well. I wonder why the trend to leave ?

Vancouver peep here – it’s nuts over here right now, anyone following the van housing blogs?

You think Vic is nuts w a few % over asking, that ain’t nothin on Van!

I forgive you. It’s really only a tale of TWO cities – GVA & GTA (Vic & Windsor inclusive in the ‘A’). Same classic Dickens tale as it was 30 years ago 🙂

“How would you know this?”

Because I’ve seen it happen. The value is all in the lot, not the house, so they don’t even want to see the inside of the house.

[ADMIN EDIT: This poster has previously commented with names: Trapper, RonP, and Vantoria.]

Ok I’m 42, have family + dog, live in Vancouver, and have been looking to move to Victoria since late last year.

What a few posters below have said is true. Our neighbourhood has been completely gutted by mainland Chinese buyers. Completely.

We are looking at our 1950s little house in Van we bought for 950k in 2011 being sold for 2.85m.

The funds from our house sale will buy us a very very nice house in the 900-1.2m range, in one of the best areas, within a few min drive from everything. No Highways! No Traffic!

The approximately 1.6-1.8 million tax free gives us a guaranteed early early retirement, and also gives us a couple years to move, reno, settle in, and then look for work and or buy/start a business.

We are NOT the only ones in this situation, there are literally tens and tens of thousands in this situation.

Why did we chose Victoria? Because it is the most similar to Vancouver! It is a city, it is by the water, parks, community, nature, easy access to airports, sailing, culture (this is a big deal, nowhere else in BC has operas, plays, musical shows, educated populace, high end universities for our kids, great public schools).

Also a bonus as we are finding out is SUN.

Victoria is exactly like Vancouver was in the 80s – 2002. It has that exact same high end educated crime free feel. We have met a lot of great people here, and we also know long time family friends moving here.

It’s also a 20min scenic flight to downtown Van if we want to pop over for activities.

Make no mistake, Vancouver doctors and cultured art scene people are not moving to Duncan or Nanaimo or Kelowna when they can have it all on the water front or near it in Vic.

The other thing that shocked us was that prices here are 10 years behind Vancouver, we literally couldn’t believe it!

Oh and the USA is a pleasant ferry ride away, unlike the 3-5 hours (dep on peace arch waits) drive through Surrey and I5.

We can drive 20 min and park 1 min walk from our check in at the airport and go to Hawaii direct, or San Fran in 2 hours!

As much as I appreciate the real data on this blog, I think there is a few sad lost souls beating on the fear and doom drum. I think they haven’t left the island or really have any clue as to how lucky they are here. This is a gem, a polished gem in the world, and the mainland Chinese know this, that is why they buy sight unseen, to them it is not even a question that their money is safe here, that they will make a very lucrative return, and their culture is “buy and hold”.

Prices here are frankly unbelievably cheap. 750-900k gets you a 10k-12k lot w a decent 3-5 bed house a few blocks from water and world class schools and Uvic!

We haven’t found our home yet, and as the weeks continue we are slowly upping our budget, from the lower end to the upper 1.2. But If the right place came up we would go much higher, we are confident it would be a safe investment that would appreciate nicely.

Good luck out there other Vamcouver buyers, see you at the farmers markets!

“For the older houses, many Chinese buyers don’t even bother looking inside. They walk around the yard, drive along the street a couple of times, then buy it!”

How would you know this?

“can’t speak English, show up with a clipboard, park in the driveway, badger the realtor about when offers will be taken, how many offers there are so far, how much they’re for, etc.”

^^^^^

This.

We lived in Vancouver until fairly recently and went to a few open houses. For the older houses, many Chinese buyers don’t even bother looking inside. They walk around the yard, drive along the street a couple of times, then buy it!

Chiming in as someone who left the Lower Mainland in the last month…

Regarding the rampant stereotypes at play right now, there’s a fine line between racism and truth.

Truth: In Richmond and other areas of the lower mainland, it’s commonly known that some immigrants are trained to drive by parents who up in a country were it wasn’t common practice to drive (therefore, they wouldn’t be as well trained as those of us who are trained by second or third generation drivers- this also isn’t necessarily their fault). Some go to very dodgy training schools. Some drive without a license because they don’t give a f***. The stereotype doesn’t apply to all Asians, but some fall into the above categories. Many are concentrated in Richmond. If you don’t believe this is a legitimate thing, look up “Richmond Learns to Park” on Facebook. Driving on the wrong side of the road, as Hawk describes, is child’s play for Richmond. If the same demographic comes to Gordon Head, don’t be surprised if you see more of this. Then again, they would have to actually LIVE there, not just buy and abandon or rent out.

Truth: There are a lot of home buyers out there, and all of them are responsible for driving up the prices. However, when we were shopping in the lower mainland, easily 80% of the “competition” (aka other buyers) that showed up at open houses were “Asian.” I say “Asian” because I don’t actually mean “of Asian descent,” I mean “can’t speak English, show up with a clipboard, park in the driveway, badger the realtor about when offers will be taken, how many offers there are so far, how much they’re for, etc.” These are the people that will never actually live in houses. We officially started to question things when vacant houses started showing up in Tsawwassen, North Delta and then…Langley (wtf?!) Ok, time to move!

I don’t regard the above comments as disparaging in any way, and they’re not meant to be offensive. They’re based on observations. They’re also not indicative of the Asian population as a whole, though I don’t think anyone here ACTUALLY means “Asians” as a whole, but rather seeks to describe the specific group of Chinese “Mainlanders” who may be Canadian Residents or even Citizens, but certainly, in their own hearts, never deign to consider themselves such, despite the fact that we all believe it to be a great privilege and honour.

Ooops, sorry Michael to make you think I meant EVERY city in Canada. I should have been more clear. The point, as you know, was to illustrate that this is not a Victoria only phenomenon. Other cities in Canada are having the same style of bidding wars occurring as we are too.

Windsor, Mississauga, Surrey, Langley, Toronto, Nanaimo, Vancouver, etc. So what do these cities have in common? Is it as simple as migration? Then they are leaving some place to go to these cities and that means listings should be increasing in the cities they are leaving.

If it is an exodus from Vancouver then there are many cities that they can choose to live in other than Victoria. That would mean the drain of prospective purchasers from Vancouver or Toronto would be enormous. Not happening.

Today’s hot sheet

17 new listings

6 price reductions

10 sales with 4 selling over asking price

Best deals for buyers in the last 30 days include

A two-bedroom condo in Duncan at $43,000

A 1000 square foot rancher on an acre in Cobble Hill at $175,000

A one-bedroom condo along Glasgow at $135,000

An 1,100 square foot home on 5 acres in Prospect Lake. This was a foreclosure with only one bidder.

A small rancher on a 9,000 square foot lot in the Tillicum area at $355,000 (estate sale that was listed for 32 days)

A 1,700 square foot rancher on 1.3 water front acres in Deep Cove at $1,300,000

A 4,600 square foot Rattenbury designed home on a half acre lot in Rockland at $1,350,000.

There were also some really bad deals made too. But I’m not going to show these – I think the buyers have suffered enough without being humiliated. Although, there does seem to be a general theme to the style of home, age and being recently renovated.

I love the smell of fresh paint in the morning – it smells like …

a bidding war.

Not even remotely – Winnipeg, Regina, Calgary, Atlantic provinces, Quebec, Ottawa… – deadsville.

It’s more of an economic/demographic migration. Same thing happened in the late 80s. It’s all very predictable.

Similar deal in the States as seen by latest Case-Shiller.

Portland 11.8% (currently the leader)

Seattle 10.7%

San Fran 10.5%

Chicago 2.1% (think CME commodities exchange)

If I take my tinfoil hat of for a minute I could almost buy the idea that a Chinese conglomerate is forcing prices higher by overbidding on properties. It only takes a few after all and it raises the value of all. Ok tinfoil hat back on…. Nah it’s just herd mentality at work….

These price wars are not just a Victoria thing. Through out cities in Canada the same thing is happening at the same time. Even Windsor is having panic buying.

If it was just people selling their homes in one city and moving to another then you would see a relationship between the two cities. Increasing listings in Vancouver as people leave the city for Victoria which would raise Victoria’s prices. And that isn’t happening.

There must be a common denominator to this madness. In the past it has been financing through CMHC and Genworth. The key is to follow where the money is coming from.

https://youtu.be/HvSAfKKswdg

When the elite can do it, any of them can. Money laundering in Vancouver and potentially Victoria is a reality, not some “blame the government because it’s just a few elite”. Arrogance breeds ignorance.

China’s elite—including Xi Jinping—are linked to offshore deals that hid millions of dollars

“At least eight top Chinese officials are linked to offshore deals through associates, an investigation into 11 million leaked documents from one of the world’s largest offshore law firms shows. ”

http://qz.com/653836/chinas-elite-including-xi-jinping-are-linked-to-offshore-deals-that-hid-millions-of-dollars/

Mon Apr 4, 2016 8:30am:

Apr Apr

2016 2015

Net Unconditional Sales: 85 840

New Listings: 136 1,413

Active Listings: 2,584 3,945

Please Note

Left Column: stats so far this month

Right Column: stats for the entire month from last year

@JD I also find the city zoning BS. Everything is spot zoned now. Most of Fairfield is not SFH. Most large houses are mini condos. All new houses have basement suites. Any house that has been renovated in the last 15 years has a suite. Yet the zoning is R1B. Shit Gordon Head is the same! Most houses have suites. This you can blame the university for not building housing…. I’ve seen some very nice neighbourhoods in Rotterdam that are extremely dense because of the row house style of building. Family friendly and attractive. The Netherlands is one of the most densly populated countries and there aren’t a lot of high rises. I would prefer this evolution rather than dark basement suites, backyard sheds as homes, and even small lot subdivisions. Most certainly rather this then more micro loft condo towers for AirBnB investors!!!!

“It’s baffling that someone from Vancouver would move here and not find the westshore appealing.”

Good enough to invest in, and rent out, profit from but a shithole(as per previous Langhole comment) to live in and drive to. Sounds slummy to me.

7 years ago sounds like you bought at the top. Bummer.

“I like comedy but Hawk is no comedian here.”

Totorro,

You lack the least amount of sense of humor on here (nor substance), as in none. As Jack as pointed out time and again, one can’t post an anecdotal experience without you cutting the shit out of it due to your personal attack angle on anything that effects the value of your real estate holdings, just like a few others on here.

My anecdotal experiences seem to coincide with thousands of others and they may not show up in some “stat” but Stats Can doesn’t show how many hundreds of near misses in this town in what could have been disastrous accidents causing great harm to others.

Turning it into racism is disgusting, and is another cheap shot attack who are scared shitless this might just blow up in short order. If they were foreigners moving into your hood and caused prices went down $300K then you would be leading the pack to get them out of there.

You know what they say, if you can’t take a joke, then…..

It’s baffling that someone from Vancouver would move here and not find the westshore appealing. If you have been driving Vancouver traffic for years you would look at the so called “colwood crawl” as a pathetic joke. You face that going to the mall on Saturdays.

As for being a “slumlord” I guess if you call a 7 year old unit that’s well maintained a slum then guilty as charged.

Regarding the current affordability, this has happened in the last 6 months. I bought under $600k in a slow market in 2011 for a house in South Jubilee, and still people said we got a pretty good deal then. Now? I’d guess ~$900k. A lot of people are in my situation. I don’t want this. I’d rather have young families moving in and my house price remaining unchanged. I’d like it if my kids could afford more than a 2br condo someday.

A lot of people I know are moving here from the mainland, or have already. My wife is on the board for our preschool as the admissions chair, and gets many calls from people who just moved from ‘Vancouver’, when really it’s all over the lower mainland. These people are selling townhouses in East Van/Burnaby and buying SFH in Oak Bay. A lot of them can work remotely or are commuting, or, increasingly as I suspect, moving their businesses here too.

Just recently I was reading an article in the TC that had an Oak Bay councilor regretting the houses being moved to Washington State, stating that ‘our heritage is being stolen’ or something similar and that they should maybe consider moving them to ‘open space’. Insanity. Matchstick boxes the market doesn’t want and instead of addressing the affordability problem right in front of you, it’s the junk piece of nostalgia that you’re focusing on. This is the base of the Asian blame game, and it’s the simple denial of what’s happening right now. There is no leadership. People scream foreign money, but we ignore the massive lack of affordable, appealing density. Nobody is building rowhouse/townhouse in the core that I can see, at least in any volume. Instead, we get 2br and den, or ‘garden suite’ policies. Oh that’s great, yeah I’ll sterilize my property with a $100k untitled anchor in the backyard, removing the point of having a SFH and forever relying on having some rotating, sad medical resident living in a 400 sq. ft. box in your backyard. They’re popping up like hotcakes!

Not.

This is an interesting way to look at it. With increases at this rate I think many people will find themselves in that situation. If not outright not being able to afford it, then at least being driven so high that it would be too uncomfortable financially to buy.

Let’s just leave out the speculation on people’s driving ability. I volunteer I run the 4 way at Kenmore every time I can manage it.

Thanks totoro for adding some facts to the noise.

Well, before we get into how cool Victoria is, my understanding is that racism is based on the belief that members of each race possess characteristics or abilities specific to that race, especially so as to distinguish it as inferior or superior to another race or races. Stereotyping is based on an impression formed by a group of people for another group or individual irrespective of their origin. So it appears that we are dealing with racism.

My understanding is that:

Hawk feels entitled to malign an entire race based on anecdotal evidence that he has gathered and categorized for himself as a race-based driving deficiency.

Hawk has apparently done no research at all before setting out his racist beliefs.

Instead Hawk has had several Chinese buds over the years (classic – how can he be racist when he is friends with the group he is putting down?) who agree with him – so it must be okay to make this statement.

Let’s take a step back and look at the actual stats.

Overall immigrant drivers (mostly from China and India in the study) are safer than long-term residents of Canada. There is a 40-50% lower risk of a crash. http://www.cbc.ca/news/health/immigrant-drivers-safer-than-long-term-residents-1.1036868

Asians in particular have a far lower rate of being involved in a fatal crash than other ethnicities (1/4 that of Caucasians): http://www-nrd.nhtsa.dot.gov/Pubs/809956.PDF

I like comedy but Hawk is no comedian here.

I too find all the “HAM” and criminal Chinese assertions references vis a vis the Vancouver and Victoria market pretty racist too. There may in fact be an issue with Canada’s policies on foreign ownership in relation to some wealthy Chinese immigrants (a very small subset of “Asians”), but, imo, if there is a problem it lies in the failure of Canada to close loopholes or enforce existing tax laws. Focus on that. Other countries have dealt with it already.

As an aside, the US and Australia (which are favoured more than Canada by the mainland Chinese according to the article) unlike Canada, do keep stats on who is buying property. China is the biggest group overall, but guess which country is right behind them? Yep, Canada – bidding up prices for locals. All that hot Canadian money looking for a home. Probably a bunch of money launderers behind it. http://www.huffingtonpost.ca/2014/08/27/foreign-real-estate-ownership-canada_n_5718705.html

The last 6 sales reported in the last couple of hours….

Ask/sold.

4032 Zinnia Rd SW Strawberry Vale$625,000 $701,000

1700 Sprucewood Pl SE Lambrick Park $749,000 $800,000

1040 Gosper Cres Es Kinsmen Park $599,900 $630,500

2360 Rosario St OB South Oak Bay $949,000 $975,000

2450 Camelot Rd SE Cadboro Bay $749,500 $881,000

2650 Dean Ave SE Camosun $700,000 $780,000

For all of the insanity in the “core” that I read about, it seems to me that the high end market still has value in it.

For instance, I looked at realtor.ca and see an Uplands waterfront property of half an acre (stable rock low bank not less desirable unstable high bank) or so going for $3,200,000.

There’s a Ten Mile Point waterfront listing going for just under $2,000,000 – again real waterfront, not unstable high bank.

There’s a high bank place but rocky/stable with a largish house on Ten Mile Point going for $2,500,000. It has been sitting on the market for a long time with one price reduction.

All of those places are on big half acre or larger lots and real waterfront in prestige areas in the “core”. That’s about what they would have gone for in 2007 or 2011, don’t you think? And certainly, bargains from the perspective of what you can get in Vancouver for those prices.

For all of the cost of that “Salty Towers” property, it’s really a land assembly for a waterfront subdivision and viewed in that light wasn’t outrageously priced.

My objective view from Vancouver here (former Victoria resident) is that it’s the middle/upper middle priced homes that are going for outrageous sums and subject to the bidding wars. It also tells me that it’s mainly locals who are bidding on those mid range homes in the core. I would think Vancouverites selling their little cottage in the west side and now even East Vancouver would be buying more expensive houses than the $800,000 mid range homes that are so sought after in Victoria.

Insane weekend on the ground….I am predicting 1200+ sales for the month.

Increasingly more so the only chance at an attractive in home in the core seems to be unconditional offer and over asking.

The unattractive stuff you might have a chance with a conditional at asking.

Hey everybody, calm down – we’re cool now!

http://www.thestar.com/life/travel/2016/04/03/cool-victoria-is-no-longer-just-for-the-newlywed-and-nearly-dead.html

If the real estate market crashes it won’t be due to the ‘foreign money’ that Hawk now suddenly refers to, rather than his usual derogatory HAM references; but instead a crash would be more like this excellent BBC show about how the Great Depression emerged; lots of parallels to what is happening globally in the RE market.

http://youtu.be/FXNziew6C9A

Agreed AG, just scream racism when your whole financial future you rolled the dice on depends purely on foreign money. It’s all about greed to them not racism. Trio of phonies.

There are stereotypes of EVERY ethnicity and profession. To each his own, but if people didn’t find stereotypes funny, then Russell Peters (who makes $20M per year with sold-out crowds), Margaret Cho, Nia Vardalos (My Big Fat Greek Wedding), Banana Boys, and Jon Stewart (his impressions of Italian New Yawkers & politicians) wouldn’t be as popular as they are.

I don’t think 1609 Amphion St has sold yet, no. I live very close. There’s been interest, but interestingly it went from an owner-sale to Marko Juras’ listing, going from $959k to $1.13m as a result. I walked over to an open house on Chaucer a month or so ago, listed at $650k. It was a teardown, same as the one next to it that I looked at in 2011 before buying on the other side of Foul Bay. Sold for $802k as I understand. So that’s $850k for a bare lot not far from 1609 Amphion. I think 1609 is over-priced when you consider that it’s basically not custom at a custom tear-down-and-build price. Still, 1.1 to 1.2 has proven to be the bottom for a new build in Oak Bay.

Asians, Vancouver, pent-up demand, whatever – I think it’s a simple supply issue combined with a veritable ocean of cash out there, both foreign and domestic. More people, same number of lots east of downtown. We have had almost a decade of rock-bottom interest rates. People inheriting their parents’ places, awash in cash. Vancouver cash, you name it, it’s a pretty perfect storm. The tipping point is that two professional first-time buyers can’t do it south/east of Fort St with just 10% anymore. I certainly couldn’t afford my house if it was listed today. No chance. Time for municipal governments to start rezoning for higher density that’s still palatable to families. Barring foreign ownership will do little. I was in Seattle a few weeks ago and got talking to someone as we were watching the truly lavish custom steel framework of the Amazon headquarters’ ‘biosphere’ going up. ‘Oh, you’re from Victoria! The new tech capital. The Bay Area is moving here, we’re moving to you.’

Get ready kids, this is just the start. It’s not good, but it is what it is.

Looks like Victoria’s red-hot real estate market has caused Hawk to finally go berserk (like it did Just Jack, not that long ago). Must be rough to be proved so wrong, so resoundingly wrong.

Hawk, unlike you, I don’t find racism humorous.

Exactly Vicbot. I have talked to several Chinese buds over the years who tell me similar stories and even worse but would offend LeoM’s and bearkilla’s sensitive ears. Zero lack of humour in those two and need to get out of the house more.

Shouting ‘racism’ is just a cheap way of brushing some serious problems under the carpet. If you don’t want Victoria to go the same way as Vancouver, pay attention.

Mainstream media can report on foreigners but I can’t LeoM? Blow it out your ass. How many windows did you peak in tonite ?

Bearkilla; a large percentage of Hawk’s posts have racist undertones and his constant derogatory references with innuendo, speculation, hearsay, and outright accusations to our Chinese community are intolerable in any setting except an anonymous blog like this. He frequently takes any scrap of news about Chinese immigrants and restates it in exaggerated negative terms as a factual description of illegal actions by the majority of Asians. If he was referring to Blacks instead of Asians, he would have been banned from this blog months ago; but it seems Asians are fair game on this blog.

Hawk’s post was pretty funny, as depicted in this Judgmental Map of Vancouver (see the label in the lower right corner of Richmond):

http://www.vancitybuzz.com/wp-content/uploads/2016/03/tL9mX5O.jpg

Yes it’s a stereotype but they joke about it a lot themselves. Two Chinese engineers told me a lot of stories. One said his mom has gotten into 5 car accidents, kept easily paying the ICBC increases, but then finally lost her license after the 6th accident.

Then there are all the 17-year-old students driving Mercedes & Porsche’s, eg.,

http://www.cbc.ca/news/canada/british-columbia/teen-driver-charged-after-allegedly-going-5-times-speed-limit-1.3512770

Sometimes I think it’s like driving on the left side of the road for us – it’s a new experience with new rules.

Do you ever leave Sidney bearkilla ? You hate on the city folk but this is reality of driving in the city. I saw a group of 5 seniors locked in a battle to get in and out of a parking lot the other day. It was comical but highly dangerous at the same time as they were blocking all one way of Fort St. Not racist against seniors nor Asians, just reality of how bad it’s getting. So you’re a slumlord now in Langford ?

Pretty sure it’s racist to even read Hawks post about Asian drivers no matter how true it is.

@Leo S

“1572 San Juan Ave for $686,000 positioned for a bidding war, but they said offers to be reviewed March 30 and it’s still listed.”

I don’t know about this particular listing, but just want to remind people that listings can stay up on realtor.ca for many days after an accepted offer is in place, so don’t use that as an estimate of how many days it takes to sell.

If there are conditions, such as getting an inspection or granting of probate, it can take awhile for them to be removed. In my experience of several houses I have inquired about, the house usually stays up on realtor.ca during this time but is not really available. Sometimes the listing agent adds a note to the description, which is helpful.

Maybe the provincial government should hire the homeless to go around and check out the houses? Might get a better study done?

These people would know who has re-cycling and who doesn’t?

Next garbage day check out your neighborhood and see what houses don’t have their garbage cans rolled out by the city workers? Because I know on my street, if the cans are empty they don’t roll them to the curb.

I would agree that homes with electricity turned off but waiting for demolition or those that are new build but not yet occupied should not be included in the results. Doesn’t seem particularly relevant. I also don’t have an issue with partial-year use of a home. I don’t know how you’d measure those with caretakers.

The premise of the study was to determine whether there was a substantial vacancy rate in the Vancouver housing market. I understand that this was to support the proposition that there are homes being bought by individuals from China purely as an investment and left vacant. This, I presume, takes housing out of the rental market and could drive up prices.