Condos hit harder as single family sales gain

We’re two months into the real impact of the virus on our market, and so far it has more or less played out as expected. Sales increased in May as we knew they would once some restrictions were lifted and people became more comfortable with going out and resuming their normal activities of daily living.

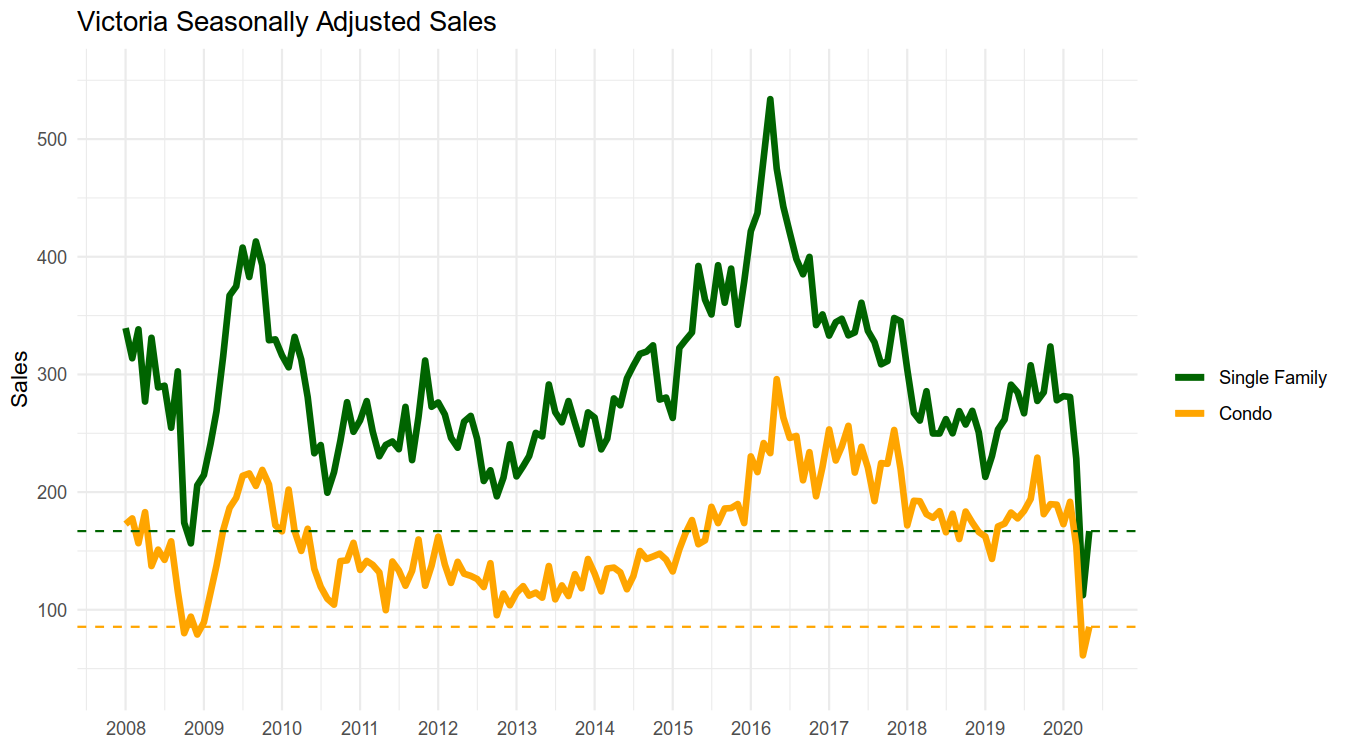

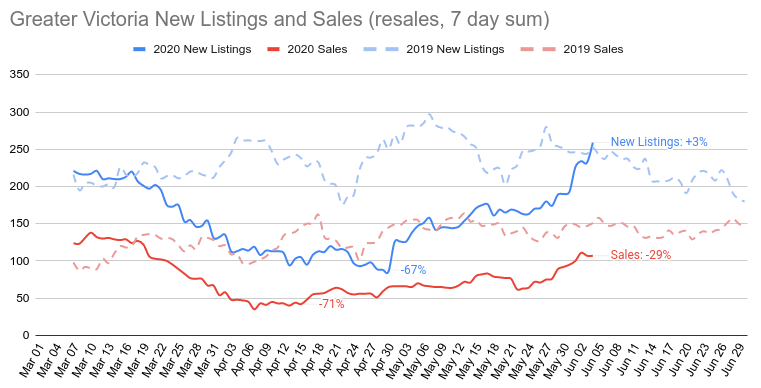

In general the recovery in sales has come a bit slower than I thought it might. The end of the month brought a bit of a surge though, bringing the weekly sales rate to more than double the lows we saw in early April. The CMHC expected BC sales not to bottom until Q4 of 2020, but I can’t imagine how they came up with that projection. It should be clear that sales during the acute period of the lockdown will be much lower than when restrictions are eased. That’s not to say we are anywhere near normal of course, with the final tally of May sales down 46% from last May, while new listings dropped 32%. I expect the year over year data to continue to improve in June and July. On a seasonally adjusted basis, sales for both single family homes and condos are at about the same level as during the worst of the financial crisis. It wasn’t the worst may on record though, that honour is held by May 1990 with 441 sales compared to the current 459.

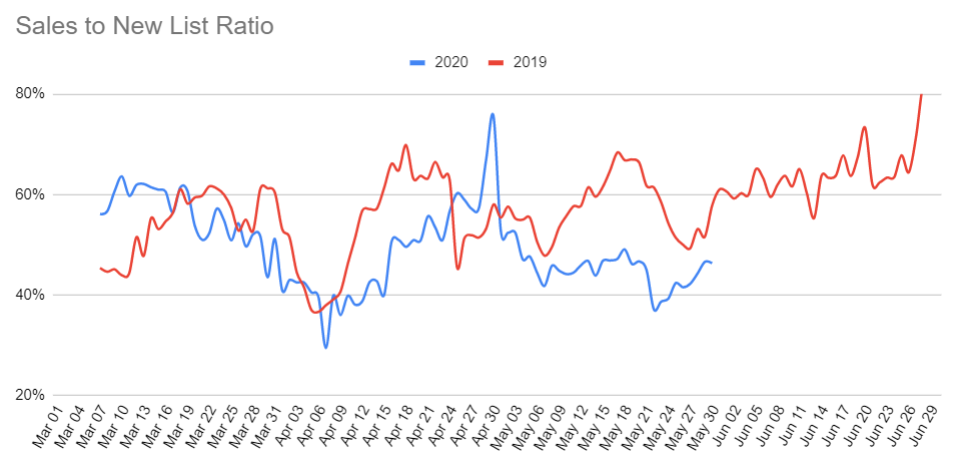

Although both sales and new listings dropped sharply, market balance is definitely more in favour of buyers than it was at this time last year.

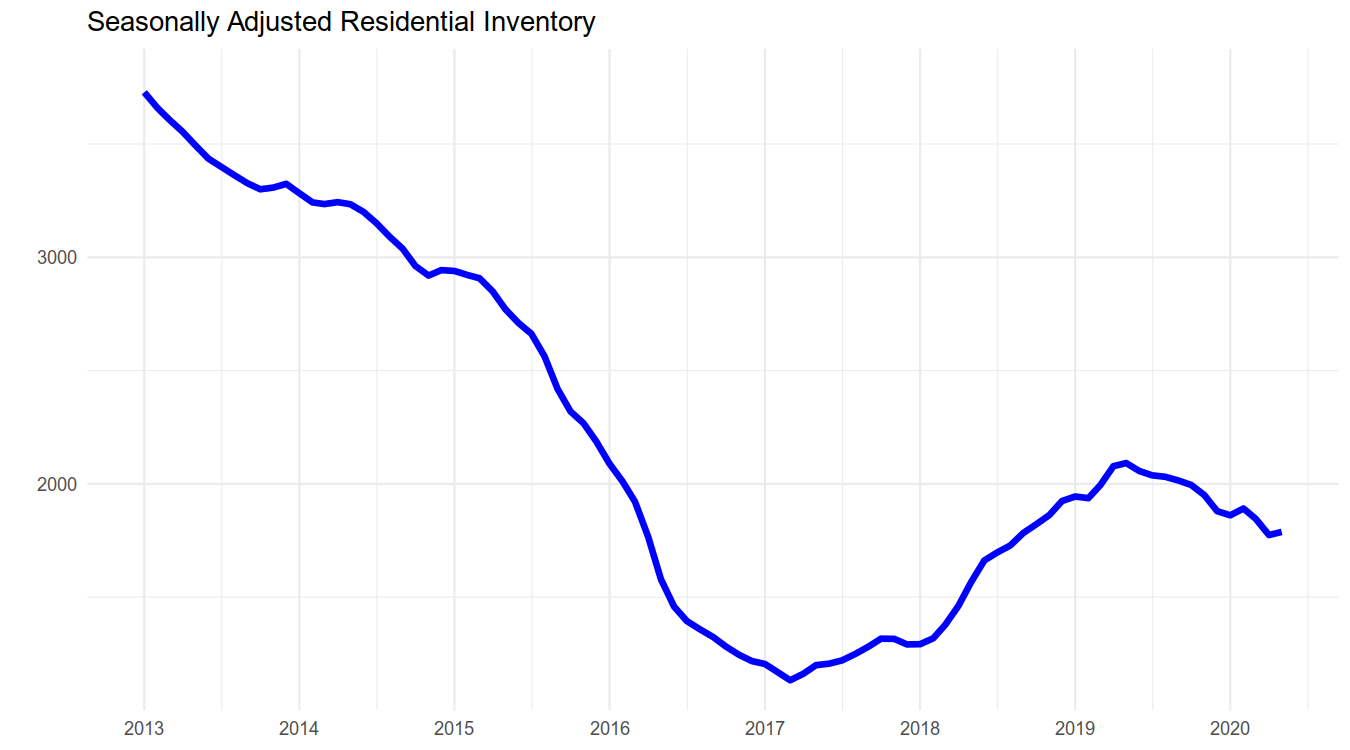

It seems that sellers are coming back to the market a bit sooner than buyers, and that’s a good thing because inventory is still very constrained in many segments. There was a very small uptick in seasonally adjusted inventory in May, but nothing that would convince me that the downward trend that has been in place for a year now has reversed.

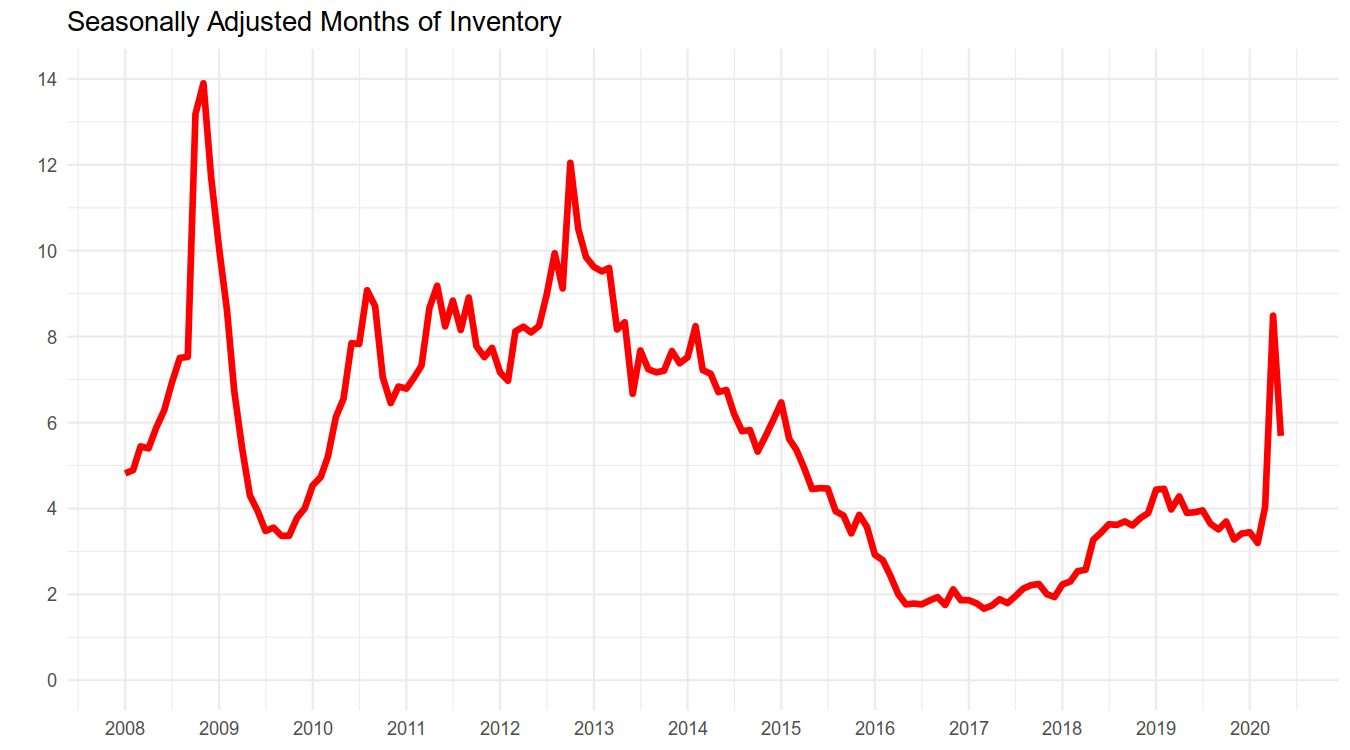

As expected, the increase in sales combined with the relatively steady inventory means that months of inventory bounced back partway from the shock of last month, moving from a buyers market level of over 8 to a more balanced indicator of just under 6. Realistically though, the market is swinging too quickly to put much importance on the exact reading month to month. Going forward we should be done with the wild gyrations and get a better read of where this market will end up after the acute shock is past.

It’s useful to think of the virus impact on the market in two parts: on buyers and on sellers. The maximum impact on buyers came in April during peak lockdown. In May and future months that impact should ease as economic activity and buyers return. The maximum impact on listings is likely still in the future as a weak tourism sector and rental market hurts investors and the longer term job losses start to weigh. Will there be substantial forced selling in September as the “deferral cliff” approaches? There is some indication that BC will be hit less badly than the rest of Canada, but at this point no one knows.

Single family market outperforms condos

The overall months of inventory also hides what is becoming an increasingly bifurcated market, with single family detached under a million recovering better while condos and the high end flounders. Sales of houses under a million are down 47% from last year, while both condos and houses over a million are down about 57%. However new listings for single family properties are down 39% while condo new listings are down only 23%. Opportunistic sellers (those that didn’t need to sell) have disappeared in equal measure from both markets, so why the disparity? It could be a few reasons:

- The collapse of the short term rental market has caused some condos to hit the market

- A weakening rental market or financial distress has motivated some investors to liquidate units.

- Disproportionate job losses in lower income industries and among younger ages has caused more condo than detached home owners to need to sell.

- Insurance and associated strata increases may have motivated some new listings.

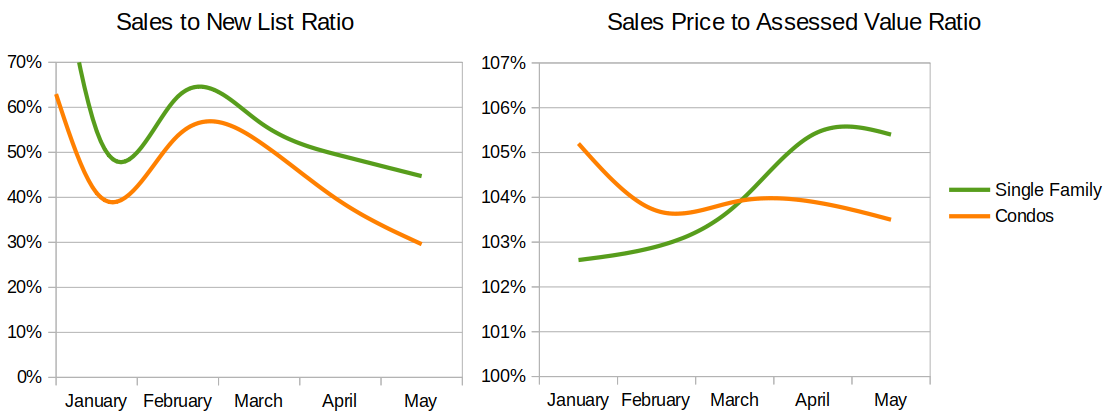

In any case, the net result is that condo market conditions are substantially weaker than those in the single family market, which is evident in both the sales to new list ratio, and in average selling prices compared to assessed value. In fact in May the single family segment showed substantial heat, with 15% of single family properties sold for over ask, a similar rate as in February and March before the virus hit.

Prices overall didn’t move much in May in either segment.

Construction Update

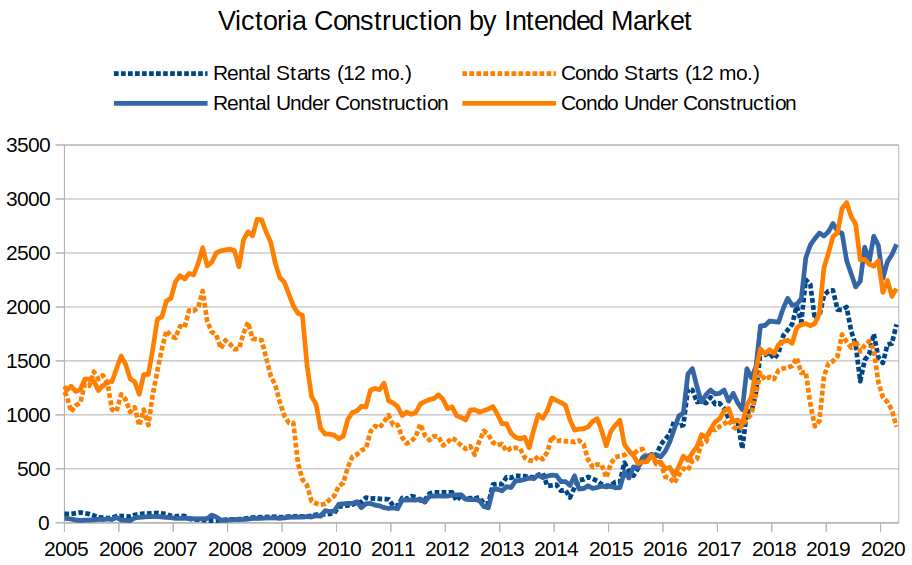

Looking at construction levels, it is still very active in Victoria. Although down somewhat from the peak of 6000 units under construction, the current level is still almost three times the level of 7 years ago.

Back in the Great Financial Crisis, multi-unit housing starts went to zero for a year as financing dried up, future demand was in doubt, and projects were put on hold. While we don’t have data for May yet, I don’t expect this to happen this time, mainly because many of the units under construction as well as projects in the pipeline are rental projects that are substantially supported with government dollars that are already allocated.

COVID has increased construction costs and slowed schedules in the short term, but productivity has recovered substantially from March and April. There is some indication that the global recession and slack in the labour market will decrease construction costs in the medium term (1-2 years) or at least stop the rapid appreciation of costs we’ve seen in the past few years both for labour and materials. That should help public projects that can take advantage of the lull to get more done for the dollar.

While condo starts and units under construction continue to decline from the peak in early 2019, rental starts have stayed high. There are now 2500 rental units under construction, which is over 9% of the existing purpose built rental universe in Victoria. Many of those units will complete this year and pile on to the weakened demand in the rental market from the lack of students and tourists.

In general the increased rental construction is sorely needed to catch up from decades of underbuilding, but if you’re a rental investor, factor in some serious slack in the market for a year or so into your calculations.

New post: https://househuntvictoria.ca/2020/06/08/cmhc-sheds-risk-in-the-condo-market/

To get most recent Canadian Covid numbers (the current death number is 7830):

https://www.ctvnews.ca/health/coronavirus/tracking-every-case-of-covid-19-in-canada-1.4852102

Where’d you get that number?

7800 have died in Canada from covid.

Those numbers were current as of May 09th; the ratio would look much worse now that those CoVid death #s have tripled.

Wow, that’s surprising and puts a wrench in my article I was about to publish.

For who? People with not great credit scores who can barely get into the market? I’d say it would be better for those people if prices drop because less people can afford to get into the market and they pick up their place 10% cheaper than today. Or you mean for you because this will reduce the impacts of the possible drop in prices?

That’s good news.

looks like the 75% pay for bc ferries is for people who got laid off, so essentially sitting at home and collecting 75% pay.

The govt should and will continue to help people in need beyond the end of CERB. But they should come up with a better program that targets those in greatest need. There are lots of people getting it that don’t need it, and in some cases are choosing CERB over working.

Just saw on Twitter that Genworth has no plans to follow CMHCs lead on stricter mortgage requirements. It won’t change underwriting policy related to debt servicing ratio limits, minimum credit scores, etc. Which means basically the CMHC rules will have no overall impact on consumers in Canada and will only have an impact on their own book of mortgages.

There has been debate here comparing deaths from CoVid to influenza.

Here are the current numbers …. So far 2,537 have died in Canada from CoVid. And there have been only 111 deaths in Canada from influenza this season. That’s 23X more for CoVid and getting worse as influenza season is over.

Canada keeps track of cough/fever via a FluWatch surveillance survey. The lockdown measures have lowered Coughs/fever from all causes so that “ The percentage of participants reporting cough and fever are at the lowest levels ever observed. This may be due to social distancing measures implemented in March and April.”

https://www.canada.ca/en/public-health/services/publications/diseases-conditions/fluwatch/2019-2020/weeks-15-19-april-5-may-9-2020.html

Yes I believe mid July for anyone that has gotten it continuously since it opened

LeoS : Fair to guess that most people will use up their benefits by end of July?

CERB ends on October 3, but any one person can only access 16 weeks of benefits

When are the last of the government payment for covid going out?

Do you mean reducing the hours to 75% or the hourly rate to 75% for the same number of hours. The latter would clearly be a violation of the collective agreement, indeed even in a non-union workplace it would be likely regarded as a constructive dismissal.

so 3 in 4 sold under ask and

11 in 12 sold under ask ..

looks like good numbers to me

So… have we made it through the pent up demand yet?

heard that bc ferries has given some employees a choice of working for 75% pay or get laid off.

Yep for sure. The more you cut off the bottom the less demand will filter up . Hard to discern anything but the biggest shocks in the data though.

We have heard in the past that the first time buyers are the ones that drive the rest of the market. They come in at the lower end buying low cost properties such as condos and those folks who sell move onto single family detached and so on. I guess we will find out really how much of the market is dependent on that 1st timer cohort pushing the sales volume from the bottom upward.

SARS has a much higher case fatality rate if infected, but Covid has had a much higher transmission rate so I agree that Covid has caused way more deaths.

Epidemiology upgrade. 😉

Sars, 774 deaths total.

Covid-19, 400 thousand deaths and counting.

Which one’s more deadly?

Well, I got my head screwed on straight by early March!

Not taking sides here but isn’t that true? I thought the mortality rate for SARS was 3.5-20x Covid depending on certain factors?

This is from February.

The interesting thing will be to see what happens with lending and interest rates this fall and if the the rates offered by lenders depart from the BoC rate. If there is a wave of defaults, why would investors buy debt at record low rates of return? So, if rates stay low, it might lead to a liquidity crisis for lending in the not too distant future. Key thing to remember, someone has to want to buy some else’s debt. It’s not just the bank lending money. That’s why CMHC bought 150 billion in mortgages from they banks to encourage them to keep lending because the banks could not sell them to other investors. Eventually, government and it’s agencies can’t keep pumping liquidity into markets from the tax payer. I believe the 2008 or 2009 number was only in the 80 to 90 billion range purchased by CMHC.

An interesting quote from the article about insurance premiums going up.

I wonder if there is any truth to the quality of buildings decreasing. Would this be more to do with poor quality of new construction or poor maintenance of existing buildings.

As for having a law to limit how much insurance companies can increase rates (as somebody suggested in the article). That would completely backfire and result in even less (or no) insurance companies wanting to offer insurance. The only way that would work is if the government backstops it and that would mean tax payers would be subsidizing them.

I think the US has something like this where they subsidize insurance for houses in flood prone areas. This encourages people to build in this areas, which causes much more damage due to flooding than there would otherwise be.

I don’t think I said what’s between those quotation marks, nor anything like it.

In fact, in early March, I was pushing back against Local Fool’s minimizing of the situation:

Local Fool:

Me:

https://househuntvictoria.ca/2020/03/02/february-market-report/#comment-66451

BoC says the 5 year rate was over 6% as recently as 2008. Of course I’m talking about mortgage rates, not some rate irrelevant to the housing market.

https://www.bankofcanada.ca/wp-content/uploads/2010/09/selected_historical_v122497.pdf

Thought it was a nothing burger Marko?

One could even argue that the current epoch began even earlier, around 1995 — the last time we saw 6%.

Yeah, you shut up about it after March when it turned out not to be “just another Swine Flu”.

back to being an armchair economist I see.

Good thing 6% hasn’t happened for the last 25 years, and is looking like it might not for at least another 5-10, or more.

I agree. But I don’t see “high” interest rates returning for a long time.

Not me. I’m pretty sure I’ve pointed out that households are so indebted now that double digit rates would be highly deflationary. I have also pointed out that a return to just 6% would be disastrous for the RE market.

I do think that in the near future rather than a jump in interest rates market pressure is likely to come from tightening lending standards. In fact that’s what’s happening right now. Oh and even higher consumer debt, which is also happening right now.

Ah, the new epoch. The new epochs have all been different in their own way, but one thing that does repeat is that they all eventually come to an end.

“Metro Vancouver condo buildings are being forced to spend an average of 65 per cent more on insurance premiums in 2020, new data suggests, providing the first statistical glimpse into the extent of the financial crisis hitting owners in multi-unit buildings.”

https://vancouversun.com/business/exclusive-new-data-shows-extent-of-condo-insurance-crisis/wcm/56c3fb65-9d00-4e5f-932f-00e505ead6da/

FYI: At least 5 incidents involving vehicles with Alberta license plates have grabbed (BC) people’s attention

https://www.cbc.ca/news/canada/british-columbia/pandemic-bc-alberta-tourism-tensions-1.5599998

That is not kind. We have so many vehicles with Alberta plates in our neighborhoods and on streets here (you can always see one every time you look) that they become part of Victoria composition.

Below is a heartwarming note left on our car windshield from a fellow Canadian when we drove (from ON) to DC in 2008, which I keep as a treasure until the end of my days …

Haven’t heard a lot from the armchair epidemiologists here lately. 🙂

Seems very unlikely given the current data on those with antibodies (7.3% in the epicenter of stockholm – unknown but less elsewhere). Norway has stated it believes it is unlikely to experience a significant second wave due to their effective control measures.

https://www.wired.co.uk/article/sweden-coronavirus-herd-immunity

https://www.thelocal.no/20200520/interview-my-belief-is-that-we-wont-have-a-big-second-wave

Sure, rates will probably be higher in five years, but they’ll still be historically dirt cheap, I bet.

Bears are always hoping/expecting that interest rates will eventually return to 1990s-era (or before) levels. They won’t anytime soon. More than a decade after the ’08 financial crisis, interest rates still weren’t very high and now a pandemic has dropped them back to the floor.

Since the financial crisis, we’ve been in a new economic epoch characterized by, among other things, very low interest rates. The unique conditions that precipitated the high interest rates of the ’80s/’90s won’t reappear. History does not always repeat itself. And, in many cases, history doesn’t even rhyme.

Reason for the soil at Arbutus though is because they got rid of the trees for a better view. It was all large old trees there a decade ago.

Sweden might have higher COVID rates during the first wave but when the second wave arrives they might have the lowest rates. No one knows how this mystery ‘novel’ will end, but Dr Tam is getting worried about the coming “Explosive” second wave.

https://youtu.be/ngCUZ_tO92s

“CMHC warns COVID-19 could lead to huge losses in real estate market

The head of the Canada Mortgage and Housing Corporation is warning that not only will Canadians’ debt levels climb to an all-time high, but the coronavirus crisis is also going to have a huge, negative impact on housing prices.”

https://globalnews.ca/video/6967139/cmhc-warns-covid-19-could-lead-to-huge-losses-in-real-estate-market/

CMHC tightening really doesn’t affect single family much because stress test basically forces 20%+ down. Impact almost entirely on condos.

New listings keep climbing (pent up supply?).

Problem is single family is only 45% of new listings but represents 55% of sales.

Put another way, condos are 35% of new listings, but only 25% of sales.

Wait till they go to renew in 5 years… better hope rates are still as cheap then cause if they are not watch out.

I retract my comments about Lakehill being underrated.

It’s not just 970k that’s important but the fact that it was UNCONDITIONAL. I am guessing they had offers (there were a lot) over 970k but went with the sure thing.

I had two clients today end up in multiple offers on two different $1.1-1.2 millon properties.

Dirt cheap money is driving this imo. I had clients that were planning on putting down 75% decrease to 50% after their mortgage broker informed of the rate they could get.

CMHC tigthening is just lipstick. Funtamental problems driving up housing remain in place imo (massive immigration, dirt cheap money, anti-development mentality/beaurcracy, etc.)

Well there you have it. 928 Lucas Ave, discussed in the comments below, sold a whopping $70,000 above ask for $970,000, a cool $100,000 above the price it sold for just under a year ago

As others have said definitely something to look for in waterfront properties along that stretch between Mnt Doug Park and Finnerty Cove. Go for a walk at Arbutus Cove Park or East along the beach at Mnt Doug and you will see the slopes that are steep and mostly soil. I’ve been in a couple of those places and some owners have done substantial work to stop erosion while others haven’t.

Then again for relatively unique property like waterfront I wouldn’t put a whole lot of stock in assessed values

I feel like the jackasses that took out all the trees in the area are more responsible for that.

In 2016, a small section of bluff in Gordon Head near Locarno Lane slid down, taking a staircase with it (see 2nd photo in article):

https://www.timescolonist.com/news/local/landslide-on-gorge-limited-house-stable-esquimalt-official-says-1.2176785

Erosion and continuously rising sea levels will eventually claim many waterfront properties in Victoria, but it’s probably not an immediate concern unless your back yard features a cliff.

That area is known for shore landslides for a long time. I remembered seeing an open house there about 5 or 6 years ago, the realtor then talked about using some engineering methods to control the slides, and some neighbors did just that (with lots mesh and lots little trees).

If you take a beach walk down from Balmacarra Rd and go along the shore, then turn around the end of the tip on the other side, you will see how bad it can be. The houses may be far inland and safe, but the backyards can getting shorter and shorter over the years.

So being on ocean front might not be a good idea sometimes, unless the lot is high on rock and the house is well built and well insulated.

I’ve been stalking this site for awhile as my husband and I plan to retire soon and move up from California (we’re dual citizens). I’m finally commenting because I’ve noticed some unusual things about sales prices in one area. I’m using the following comment as a pretext to join the conversation:

4315 Gordon Head also sold under assessment (300k under 2018 assessment although that seems to have been an anomaly)

I just checked out bcassessment and realtor.ca and saw that 4600 Bonnieview place is asking 300K+ below assessment. Then I clicked on the ‘sample sold properties’ button (on bcassesment) and noticed that many houses along the waterfront have been selling for 100K’s below their assessed value since last October if not before. ie 4585 Leyns road, 2270 arbutus road and 2 properties along shore way. These properties and 4315 Gordon head are all in the same general area. So what’s up? Are landslides/ slumping occurring along the coast? Anyone know?

Reversal of trend of rising rates and 18 months for people to earn, beg, borrow or steal the additional down payment to pass the stress test.

My question to Leo and everyone is how did the market adapt to the stress test if prices were beginning to rise again? Obviously people were adjusting to it, but by what means was that done, can’t only have been the rate coming down slightly.

The seller hopes so I would think. It’s only assessed for $815,000 which is a bit odd considering the closing date was Jun 25, 2019. Seller had better hope BC Assessment got it wrong not him. But the standard question remains – why bail after just a year?

https://www.bcassessment.ca//Property/Info/QTAwMDBIUEJHUw==

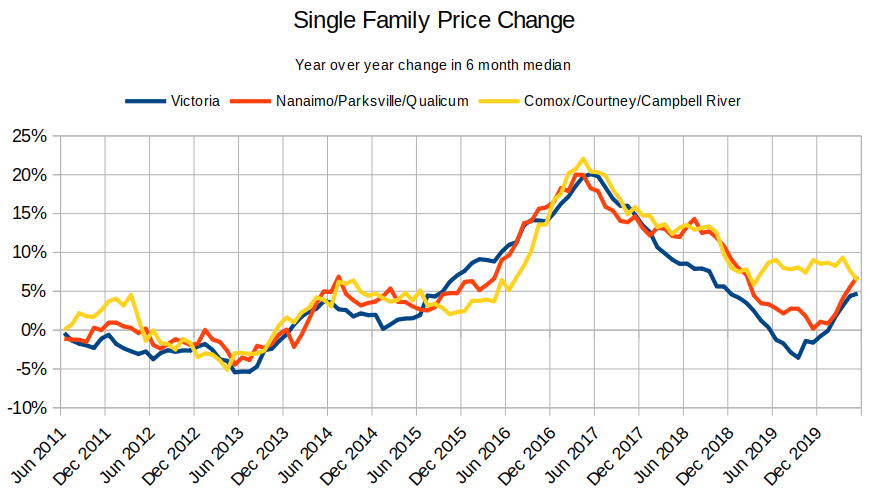

Interesting to see how Victoria was hit harder than the up island communities by the stress test.

More retirees up there perhaps and lower prices meant it had less impact?

I’m not sure where the figure came from in the article but Sweden’s death rate per capita is 38/100,000 residents. The US death rate is 27, Canada’s death rate is 17, and Denmark’s death rate is 9.

Sweden’s death rate is among the highest in the world. Approximately 12% of people officially given a COVID-19 diagnosis in the country have died. Canada’s death rate is 7.5%.

Over the last seven days Sweden had the highest death rate per capita in Europe.

I think it is fair to say that not being as strict with lock downs hasn’t served Sweden all that well and it is probably not a good model to follow.

https://www.businessinsider.com/sweden-most-coronavirus-deaths-europe-per-capita-report-2020-5

https://nationalpost.com/news/world/danes-actually-listened-a-return-to-normal-for-denmark-as-it-exits-lockdown

I guess 10x is a bit like 20x in that both mean “a lot bigger”. But the article could have said “more than 10x” and stayed 100% factual.

That listing price is set for “multiple offers bidding over asking ” for sure, otherwise seller would lose money if they just bought it last year for $870K.

Another topic: went MEC this afternoon and took a downtown walk afterwards. When walking on government street from MEC towards inner harbour, noticed at least 3 recently closed stores (with sign gone and windows all papered up), and all gift shops are 50% off everything. No tourists of course and not many people in stores, except MEC (30 to 45 min lineup waiting outside). Restaurants have clients, but not busy (guess 3pm on a Friday doesn’t help either). Saw no homeless people except one on store street.

It’s an exaggeration, but not a hyperbole.

Deaths per million:

Sweden: 460

Finland: 58

Norway: 44

Denmark: 101

I mean, it’ s the worst May in 30 years in terms of total sales.

Only part that’s nuts is that there are multiple offers.

The death rate in Sweden is nowhere near 20 times Norway Denmark or Finland

This sounds like fun.

Leo, what neighbourhoods fall into your underrated category and why? And then do overrated.

I just read the most Victoria sentence ever in the TC.

Regarding the concrete barrier being replaced along Dallas rd near Ogden pt:

“ Constructed in 1957, the 500-metre-long concrete barrier is crumbling and rusted. However, many Victorians have a fondness for the barrier, which for decades has been the backdrop of many photos along the waterfront.”

Wow, I guess we have to see what happens on the sale and MOI side in coming days and weeks. Thanks for the chart!

Yes, see chart below and recent surge

Sold for $869,900 in June of last year now listed for $899,900… What’s the margin after taxes and realtor fees on that?

Separately, did it seem like a lot listings popping on Thursday and Friday this week?

In the last ~2 weeks in the core:

1 in 4 single family homes under $1M sold for over ask.

1 in 12 condos under $1M sold over ask

1220 Reynolds has been up for a while previously listed around $939K I think. Reduced to $898K a while ago. Suite potential, big yard etc. Was still for sale last I drove by.

Suite potential, big, updated, in the core. Looking at the rest of the listings at that price it definitely seems like the best of the bunch. Always thought Lakehill was an underrated neighbourhood.

https://www.realtor.ca/real-estate/21921444/928-lucas-ave-victoria-lake-hill

Marko – is it a decent house, w/some upgrades? Or very average in need of some work? See lots in the core sub 1 mill that aren’t moving.

@Marko Juras

When you say the sub 1 million SFH being hot is that with suite or does it matter?

As with everyone here surprised at the resilience of the market. Not sure why I should be anymore…

Weekly new listings exceeded last year’s rate for the first time since mid March.

Sales still down 29%.

Just showed a 900k home in the core with offer deadline tomorrow at 6 pm and three buyers have already pre-inspected it (usually indicates unconditional offer)….that sub million SFH core market is still nuts.

She has done a great job:

https://www.nytimes.com/2020/06/05/world/canada/bonnie-henry-british-columbia-coronavirus.html?fbclid=IwAR0x84dVHL-HMNuLKGH7hoIp5qtmySNEdAlO05BmyZPUnMtMCGPN67WE03s

Did you read the article?

None of us know how this will play out in the end but if you lock down early the best evidence shows your mortality rate will be better than if you lock down late (Britain) or not as much (Sweden).

Former Landlord – they increased the HBP to $35,000

Good point, I forgot about that.

The HBP is a max of 25k, so spread out over 15 years, it would only raise your taxable income by just over $1,600 a year if you did not repay it. Even at a high marginal tax rate of 40% that is only a tax liability of $600 a year or $50 a month. I doubt that would be much of a concern to the Bank or CMHC.

Vancouver Island (Health Authority population 785K) active CoVid cases now zero.

0 active cases, 0 in hospital, 0 in ICU

130 cases total = 125 resolved + 5 death

Interior and Northern regions also at zeros for all of the above.

Leaving Fraser and VancouverCoastal as the only two regions with active cases.

Bccdc.ca http://www.bccdc.ca/Health-Info-Site/Documents/BC_Surveillance_Summary_June_4_2020.pdf

We’ve all heard of those special amplifiers that can go to 11.

Perhaps we’ll find out if there’s a 12 for the taking. I wonder if that 1.99% has some stinky conditions attached to it…

HSBC is now advertising a 1.99% 5 year fixed mortgage rate (for insured mortgages).

In 2014 Jim Flaherty lectured BMO for bringing in the irresponsibly low 2.99% 5 year mortgage.

With debt cranked up to 11 we are going to see low rates for longer.

Falling sales and rising debt do not bode well for the V-shaped recovery theory propelling the rally

He’s talking about corporations and the stock market, but the same argument applies to the consumer sector.

It’s only your money net of tax. The rest is the government’s money. Do note that there is a withholding tax on RRSP withdrawls, to avoid a big tax liability next year. We already have an appropriate vehicle for saving down payments and that’s the TFSA. It’s all your money.

Any program which makes it easier to buy supports higher prices. The cynic might say that’s the ultimate purpose of such programs.

Okay, you could pull all your money out of RRSPs, not using the HBP for your downpayment and have a huge bill the next year instead of spreading it out over 15 years. Either way the RRSPs are your money not borrowed money.

The whole purpose of the HBP is to make it easier to use your RRSPs for the down payment for first time buyers.

Disagree with ‘certainly in mortality’. Sweden flattened the curve to the point where their medical system was not overwhelmed. It is likely that they have allowed the virus to spread through their population quicker. Integrating the area under the curve may yield the same death rate as other countries once this has all played out. Their death rate is lower than some countries that did have a complete shutdown. And regarding their economy, we shall see. Intuitively it doesn’t make sense that avoiding a complete shutdown of the economy yields the same result as countries that did, but since they and we rely heavily on exports, GDP is heavily governed by what other countries did.

You’re quite right, but such buyers would be less likely to be hitting the DSR limits IMHO. Stock holding outside registered accounts is not common and is skewed toward higher incomes. As well, you’re assuming a specific buy/sell scenario for the portfolio which makes it even less likely.

The tax liability situation for HBP applies to everybody who uses it.

Stress test was huge impact. Pushed the market from a pretty hot sellers market with appreciating prices to flat prices pretty much instantly.

This tweak, hard to tell at this point. Depends on whether Genworth follows suit and then if the uninsured lenders start tightening to match. Right now it will likely just further reduce CMHCs insurance volume. Seems they are keen to reduce their exposure

If you pulled out money from stocks to use for a down payment that had risen by a large amount over 10+ years, you would have to pay capital gains on that and it is all due the next year.

There is also a future tax liability on RRSPs used for HBP, but you can spread that out over 15 years.

Huh? The feds have tightened mortgage rules for the last few years, including some more just this week.

We’ve had so many of these “big impact” things the last 13 years the blog has been running and give or taken nothing has happened unless you consider keeping appreciation in check at 40-100% in various markets across Canada in the last 13 years.

Interest rates need to go up and downpayment needs to go up to 10%-15% to have any sort of real impact, but neither will happen anytime soon.

I’ve seen so many ways around qualification criteria it’s not even funny. As long as money is close to free people will find a way to get into the market imo. For example, you have a house at $1,015,000 but you only have 10% down. Just write up the contract at $999,000 + $16k for appliances, put down 7% and pay for appliances with remainder….one of the many many creative ways around qualification criteria I’ve seen at various pricepoints.

I had three listings on Johnson Street 30 days ago. One condo sold, one condo my seller rented out (1.75% mortgage), one seller moved back in and we lost 3 worth of inventory.

Everything revolves around cheap money. If interest was 4-5% buyer wouldn’t have bought the one listing and seller that rented her unit out would be majorily cash flow negative and would be looking to dump versus rent….etc. Inventory would pile up and there would be downward price pressure. When 5-year money is around 2.29% panic selling and inventory piling up is just not going to happen.

I invested in the stock market in March and April and fully expected further declines. What is this madness? Doesn’t seem logical. We’ll see what happens in the fall during the second wave if we don’t have better treatment by then. We’ve learned a fair bit about the virus since March so we know more what to do to keep it in check but this doesn’t help a huge part of the economy function.

I also expected house prices to fall. It seems like there has been some variable impact on the high end and condos, but so far not so much for the under a million SFH. The new CMHC rules will affect many first-time buyers though. Seems like there should be some sort of cumulative negative effect on the housing market overall at some point unless we continue to have few listings along with a lot of demand from those that have secure jobs.

I forget, did the people who said to sell everything in February time the bottom and buy back in in March?

‘

‘

‘

I can almost guarantee they didn’t and here’s what will happen next. They will say market is too high and due for a fall, then when it does fall a few percent for some reason they will say that they wont invest now as things are getting worse, then the market will recover and keep going up and they will sit on the sidelines looking for bear’s theories that support their thinking, years will go by and stress will mount until they eventually give in or by gics, seen this time and again, kinda sounds like the housing market. Moral of the story, don’t try and time the markets.

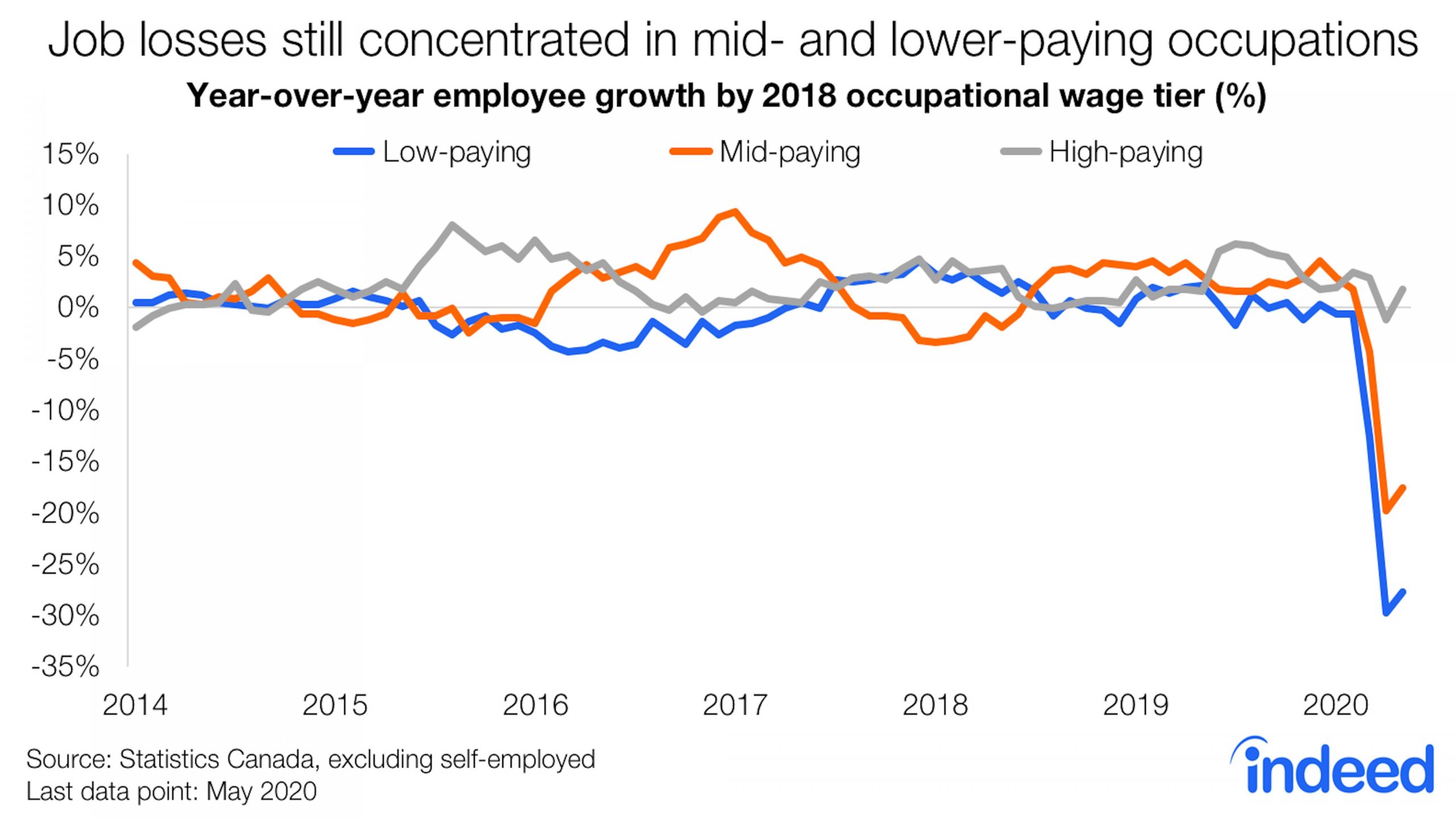

High wage jobs fully recovered in April. UP from last year.

United States: Support the stock market at all costs.

Canada: Support the housing market at all costs.

If we can’t drive real wealth, we’ll just inflate assets ad infinitum instead…

Valuations are off the charts. I think we are in for a pretty big pullback sooner rather than later but what do I know. Just keep investing slowly.

I forget, did the people who said to sell everything in February time the bottom and buy back in in March?

Stock market…..wholy crap.

KS all government positions are paid based on 35 hours – including executive level. Whether you work 35 or not depends on the position and your time management.

HBP lets you use before-tax income in your RRSP to buy a property. There is a future obligation either to put it back or add it to your taxable income. I would say that’s effectively debt in the context of debt servicing ability.

No. HBP does not cause additional debt (I guess you could argue that you are borrowing from yourself, but you can easily not pay yourself back which in fact most people do when they withdraw from the HBP).

Non-traditional down payments are basically loans. “Qualified home buyers may use non-traditional sources of down payment including borrowed sources that are arm’s length to the purchase or sale transaction such as personal loans, lines of credit or credit cards, gifts from non-immediate family member(s) (an immediate family member is defined as a father, mother, child, brother, sister, grandparent, legal guardian, or legal dependent).

Repayment of borrowed funds must be included in the TDS calculation.” https://genworth.ca/en/products/borrowed-down-payment-program.aspx

I think 35 hours a week only exist if u work in the union in core government.

Get a job in govt then.

Comes with the concomitant pay cut.

I didn’t realize you want a government job 😉

Lol I wish I had a 35 hour work week….

Well, now we know what it would have likely looked like here with less strict measures. A mistake and no savings to the economy – probably a higher cost economically and certainly in mortality.

https://nationalpost.com/news/world/top-epidemiologist-admits-he-got-swedens-covid-19-strategy-wrong

Keynes Predicted We Would Be Working 15-Hour Weeks. Why Was He So Wrong?

http://npr.org/2015/08/13/432122637/keynes-predicted-we-would-be-working-15-hour-weeks-why-was-he-so-wrong

Patrick I was meaning for bc gov – stick my 35 hours into 4 days instead of 5.

I am not sure they are measuring productivity properly in their numbers. My understanding is that productivity has slowed since the 70s but their graph shows almost a straight line up.

Also, a damper on wages in the US has been increased Employer Paid Healthcare benefits, which is less of a burden in Canada for Employers.

Still there is definitely a productivity pay gap, since more of the economic gains have been going to company profits and higher income earners, than to wages for a typical worker. Just not as big of a gap as the factor of 6 calculated by EPI.

I was referring to the HBP, since it requires the repayment or it reverts to the tax penalty. Would this be considered non-traditional and a liability to factor with the new rules?

So for example… lawyers, plumbers, electricians hourly fees would rise by 25% per hour? And others like RE agents would raise their commissions by 25%?

The revolving door:

Former Bank of Canada governor Stephen Poloz appointed to Enbridge board

https://www.theglobeandmail.com/business/article-former-bank-of-canada-governor-stephen-poloz-appointed-to-enbridge/

Do you mean straight withdrawls (doubt it, it’s income) or HBP (could be, it has to be paid back).

I think the problem is that the pandemic is mostly hurting small businesses. Most companies listed on the stock exchange will have a better chance of surviving this storm. They may even come out stronger on the other side, since some of their competition may have gone under.

I mentioned a few postings ago that my impression is that the market is strong- we listed our home in Shawnigan ( priced at 1.359MM) and accepted an offer for 97% in less than two weeks. The folks that are buying our home are selling their place in Fairfield for 1.45MM and it is going into multiple offers. We are both astounded by the strength in the market.

In the United States, productivity has grown 6x more than pay since 1979.

If the situation is similar in Canada, we’re long overdue for a 4-day work week that pays out like a 5.

https://www.epi.org/productivity-pay-gap/

I wonder if this include RRSP withdrawals as well?

If you are looking for sense, don’t look at the markets. What you are witnessing has nothing to do with fundamentals or looking into the future, and everything to do with the central bank levitation. There is no precedent for the amount of liquidity that has been unleashed in the last two months, and according them there is no limit (which makes me wonder why I or anyone else is asked to write cheques to the government every year when money can simply be printed ad infinitum). Without it we would no doubt be witnessing the worst financial collapse in history.

No idea. I was just saying how the govt flex days worked (although they work 7 hour days + unpaid lunch) so 8.75, which gets pushed up to 8.84 because of stat holidays or some bullshit.

Oh, so work 4 days x 10 hours instead of 5 days x 8. That option has been around for a long time for many people. Why the excitement now? I thought the idea would be to change to a legislated 32 hour work week (with 32 hours pay, and overtime for >32 hours), to get the 25% unemployed working again, not just rearranging the 40 hours to 4 days.

So that, for example, a restaurant with 8 employees x 40 hours per week would be better off with 10 employees x 32 hours per week, because they wouldn’t have to pay overtime.

The flex day thing is that you work 5 days in 4 days. So still doing the same amount of hours and get the same pay. Or 10 in 9 if you just do the flex once every two weeks.

I had no idea the previous ratios were that high. I thought it was 32/44.

35/42 is still pretty intense IMO.

Is the “game changer” idea that you work 4 and get paid for 4, or get paid for 5?

So the CMHC changes are:

Could be a pretty big impact.

4 day work week would be a game changer – i used to get flex days in government and it was amazing.

‘Nothing is off the table’: B.C. premier on a 4-day workweek following coronavirus pandemic

https://globalnews.ca/news/7025926/bc-four-day-work-week-pandemic/

Wouldn’t that be so nice!

That’s why it’ll never happen. We can’t have nice things.

Right, so markets expect unemployment and other indicators to be swell in the near future?

I don’t.

The future is unknown. Markets are anticipating a future that looks very much like the past few years.

I now have access to all the data from the island. Will write a post on it for Monday to see what’s going on in various communities.

“Introvert, markets don’t care what’s happening today, markets look to the future, that’s the mistake most non professionals make.”

Did we witness the shortest bear market in history, or a classic bear market rally? Time will tell.

Introvert, markets don’t care what’s happening today, markets look to the future, that’s the mistake most non professionals make.

From Ratespy on Twitter:

“DEVELOPING STORY: According to sources:

CMHC will announce lower debt ratio limits and higher credit score minimums for its insured mortgages, and ban borrowed down payments. If our sources are correct, this news could drop soon. The Spy will give you the scoop once it does.”

If this is true, CMHC really trying water down the flames.

Yesterday the stock market hit a three-month high.

Unemployment is at 13%.

Interesting times…

Unfortunately not. Seems to be collected by a prominent insolvency trustee firm. Don’t know of anyone doing that in BC.

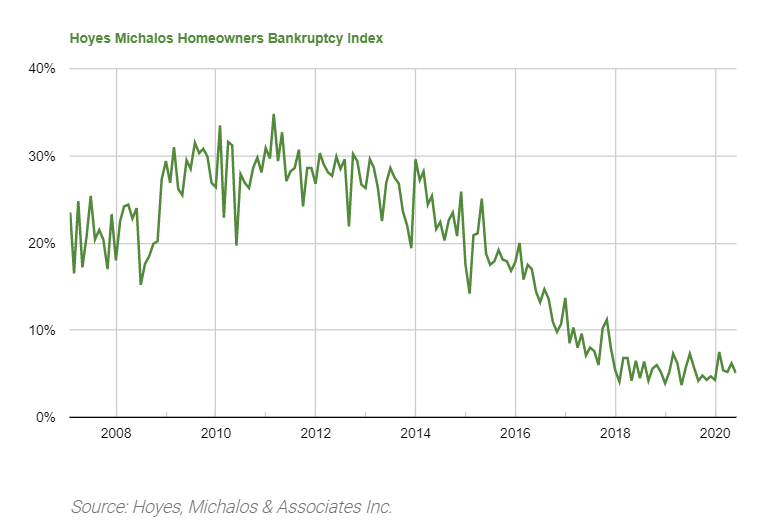

Interesting to see homeowner insolvencies go way down after prices go up. No point going bankrupt if you can liquidate your house first.

Now that is an interesting stat Leo S. Do we have this info for BC as well?

Ontario data but will be interesting to watch this year

Percent of consumer proposals or bankruptcies that are from home owners.

https://www.hoyes.com/press/homeowner-bankruptcy-index/

Somehow ended up on my Twitter. Connected to Trevor Tombe I think

@introvert, you should be proud of your former city.

Interesting analysis on the industries most exposed to the second wave of job losses. They look more like the home owner types.

I believe trump said it best https://twitter.com/sarahcpr/status/1261085326887604224?s=21

Got ours today too. Last year, our property tax bill dropped by $30 a month, and this year it’s stayed the same. So that’s nice.

In terms of Covid, the number to watch right now is hospitalizations. If those start to seriously increase towards the end of June then we may have a problem.

Hard to tell because there are so few sales. The place on King George was originally listed at $2M, so they just had to let go of $500k to sell it.

4315 Gordon Head also sold under assessment (300k under 2018 assessment although that seems to have been an anomaly)

Just got Saanich property tax bill, 6% lower than last year (due to more than average % house assessment value drop which we don’t care). Woo-hoo!

Mine actually went down by a couple percent. However, what is covered for a home insurance may not include the same types of risks covered in strata insurance plans.

House insurance up 2%. Guess the increases haven’t filtered down to detached properties if they’re going to.

With the mayhem down in the states, most people from Hong Kong will be coming to Canada. I’m sure they’ll want to get their money out as soon as possible, before China takes control for good. It seems that every day the governments around the world want to control their own people, taking away their rights and freedom.

I stand corrected – I read and interpreted your initial comment as “falsified” (disproven by objective measurement) rather than “falsifiable” (able to be disproven). With that said, I’m still not convinced that falsifiability of a hypothesis and the matter of belief are mutually exclusive. It must be a belief until disproven (based on available evidence, one must “believe” something to be possible to warrant further investigation), and even then the event of being “disproven” is itself not infallible. Seems like we’re left with nothing but belief. In religion and science. In science, you must have a “belief” in the “truth” of your measurements and your methodology. Godel’s theorem comes to mind. At some point, whether religion or science, because, as you said, nothing can be proven, belief must come into play. A large number of people believe that COVID is not very lethal. Scientific studies may eventually come out and validate the belief that this is more lethal than the flu. Even then many people will not believe them. And then more studies may come out refuting the earlier studies. Saying a theory cannot be proven in science and that all scientific theories are nothing more than beliefs seem to me something of a tautology.

In any case, this is sounding more like a conversation over coffee while social distancing (for the belief that this virus is both contagious and lethal). I ‘believe’ I’ve rambled enough that we’re at risk of being shooed off the blog!

B.C. health officials announce 22 new COVID-19 cases, 1 more death

Largest single-day increase in nearly a month.

https://vancouverisland.ctvnews.ca/b-c-health-officials-announce-22-new-covid-19-cases-1-more-death-1.4967518

1) Because it is at least temporarily at bay here (BC)

2) Because less total people are dying in North America and Europe which is mainly what our media reports on

3) Because government and public health officials here are relaxing some restrictions here, reflecting their assessment that the immediate danger is less than it was some weeks ago.

Maybe things are starting to turn around and the higher end market has some life!

‘

‘

‘

Those home are in the 1.3MM to 1.4MM range, I would hardly call that higher end.

Although with the stock market roaring back maybe that is helping confidence, balanced portfolio up almost 2% YTD and only about 3% of all time highs!

No. Falsifiable doesn’t inherently mean a hypothesis is false, it means the hypotheses is contained to a degree in which measurements can be taken. You can never “prove” something to be true, at least in the scientific sense. Most people don’t get that. Relativity for instance has never been “proven” – it has simply withstood all experimental attempts to debunk (ie, falsify) it. So, we fail to reject relativity as a hypothesis for that particular branch of physics.

This is why questions of faith aren’t matters of science. You cannot use empirical methods to falsify the existence of god, heaven or hell – even extraterrestrial life at this point falls in that category.

Sorry, I made such a silly tangent on a RE blog. It just caught my eye…

James IMO the number of cases isn’t all that relevant assuming the number of tests has increased as well. We know that there are way more cases out there then what is reported. The number of deaths is likely more accurate (although still probably way off especially in third world countries) but they have been reducing consistently from their peak of around 7K a day. The last few days have been between 3 and 4 (Though today is already at 4300). If these start increasing i’ll be more concerned than the case numbers.

Any hypothesis that is falsifiable through objective measurement would be considered incorrect, no? Although in the case of lethality, in this context, is not yet known because we do not have a firm handle on how many asymptomatic carriers are out there. I happen to believe it is pretty darn lethal when compared to the flu or other viruses floating around.

FYI, this is flying way off topic, but I agree with you: the theory of gravity absolutely is a belief, as is everything else concerning science and anything that humans can say about the world or universe. Newton and Einstein have very different views as to the “cause” of the phenomenon: One looks at mass as exerting a “force”, and the other as mass warping space so as to alter the path of objects. Nonetheless, falling towards the ground is a phenomena that Nature cares not one iota what you or I think of it or how you choose to label it. It just happens. I think Bohr said it best: “It is wrong to think that the task of physics is to find out how Nature is. Physics concerns what we say about Nature.”

Can we get back to housing and not deal with the protests.

Any hypothesis which is falsifiable though objective, retestable measurement is never a matter of belief. You might as well say, “If you believe in gravity, you will fall towards the ground”.

Barrister

4315 Gordon Head Road

1179 Old Esquimalt Road

I don’t know why people think the virus is letting up. Globally the last 7 days have been the worst 7 days in terms of # of cases. All have been over 100 thousand. Also includes the worst day on record at 125 thousand.

Patriotz, your quoted text more or less confirms my point. Their choice of words I find vastly different than the message being driven home this entire pandemic, which has been: Stay at Home. You are endangering people’s lives by violating the rules. No exceptions.

I think it has been a good message and has saved lives, but now is not the time to waver, no matter how good the cause. If you believe in the lethality of this virus, then letting off the pedal will just end in more deaths.

Mayfair Man: What other two water view properties sold?

Found these pretty easily. The mayor of Atlanta is a black woman by the way.

https://globalnews.ca/news/7008473/george-floyd-protests-coronavirus-outbreak/

https://www.thestar.com/news/canada/2020/06/01/coronavirus-updates-the-latest-canada-covid-19-testing-june-1.html

299 King George Terrace

We are following water view properties in the $1.2M – $2.2M range. 3 went pending today after 1 sale the previous 30 days. Maybe things are starting to turn around and the higher end market has some life!

Now that the police brutality protests have spread to major cities across the globe, has anyone noticed that the public “shaming” by health authorities, political figures, etc., for anyone violating the lockdown rules seems to have fallen silent all of the sudden? They are really risking the legitimacy of the message and therefore their authority. It cannot be selective, unless they find that the virus is aware of what you happen to be gathering for so that you are no longer endangering the healthcare system that we have been so concerned about overwhelming.

Agree. Terrible home but great views and location. I thought it could be fixed up too though.

https://www.timescolonist.com/news/local/downtown-victoria-library-gearing-up-to-reopen-for-pickups-1.24143915

another 989 one bed room unit just hits the market- 2nd FL, 379k c/w parking.

You would think that opening all the branches at the same time would be more pragmatic in that it would spread out the crowds.

Introvert, do you know when/where/how the library is accepting returns?

Not really any worse than anywhere else along the outer waterfront between South Oak Bay and the naval base. You can check the statistics for the Victoria Gonzales weather station which is literally a stone’s throw from King George Terrace.

The southern waterfront of Greater Victoria is on average a bit warmer than inland and up peninsula during the winter months and quite a lot cooler during the summer months. The effect is very noticeable on sunny summer days with strong SW winds. Then you have 25 degrees at Uptown, 21 degrees downtown, and 17 degrees at Clover Point.

Definitely if you like hot summer weather avoid buying anywhere on or near the southernmost coast of Greater Victoria. On the other hand if you are like me and find anything above 25 degrees intolerably hot, then the climate close to the strait is near perfect.

299 King George Terrace must be one of the coldest places to be in Victoria, no thanks

Pretty disappointed in the GVPL’s crappy reopening plan…

We can all pick up our holds at one super convenient location—the Central library, downtown—”by the end of June.”

Then three branches will open in July, and three more in August.

The library big wigs who make these decisions (not to be confused with the unionized workers and librarians who don’t) had months to come up with a decent reopening plan, and this is the best they could come up with?

BTW, this criticism comes from a devoted and frequent library patron.

My understanding is that the second waves of pandemics are often worse than the first.

If that’s the case with COVID, I expect another full K-12 shutdown and the reinstatement of all previous lockdown measures (and possibly more, if circumstances dictate).

I don’t get the sense that the federal government or the provinces will choose to put the interests of the economy above preventing as many infections and deaths as possible.

You caught me red-handed.

But now I’m curious how you know they’re from Alberta.

299 King George Terrace

Price Sold:$1,500,000

Assessed Value:$2,631,000

Tax Year:2019

Somebody got a deal. House is crap but 500k can fix that.

My thoughts exactly Patrick. If the new cases remain very low and are stomped on immediately you can keep them there. So far so good and promising for BC to come out of this with less damage than other provinces.

Barrister, I think Public Health have a good chance to keep our numbers low without another lockdown.

This doesn’t require perfection, with no transmission of the virus. All it means is that each new person that gets infected, on average passes it on to less than 1.0 new persons. An “R-naught” of less than 1.0 will eventually reduce the numbers to near zero (exponential decay). We’ve seen that in many of the successful countries (Asia, Oceania).

Getting the R to less than 1.0 can hopefully be accomplished without another lockdown, by:

– the public social distancing, wearing masks, washing hands etc.

– public health tracing cases and quarantining

– govt maintaining bans on high-risk “super-spreading” events like concerts and large gatherings

– govt selectively re-closing or restricting activities that are shown to be spreading the virus. For example, this may mean extra restrictions for bed n breakfasts etc.

– All this staying in place until a vaccine or treatment.

So yes, people may get infected at a salon, hotel, airplane, restaurant or workplace etc. Elderly/vulnerable should continue to avoid those locations. But this doesn’t necessarily mean that our numbers will rise to high levels.

And we are doing this. Western Canada (west of Ontario) has a population of 11 million, and had a total of only 20 cases yesterday. Those have been falling for weeks, indicating R value <1. We just need Ontario and Quebec to experience the same thing.

Haha, snooping on your fellow Alberta refugees Introvert?

Sold $795,000

Can someone please tell me what 560 Baxter Ave sold for?

Freedom: That is a really great drawing. You have captured her soft and gentle personality.

I am a bit surprised that non-essential travelers are allowed now. There is actually no new Covid case on the island since May 7, the one case reported on May 14 (or 13?) was a missed case happened before May 7.

For ourselves, we still stay in phase one, but did buy two e-bikes (from local bike shop) in lieu of plane travel. It might be a good idea to do a bit Costco and art shopping now to refill the supplies, before the next Covid wave …

One drawing I did last Month, just before the brush (likely) with Covid:

Patrick, while I agree with you that the numbers for the first two weeks look promising (and I really hope that they hold) I also think that we are in early days. The bed and breakfasts in my area are just opening up. The good news is that there are guests coming. The bad news is that they are from Calgary, Toronto and one set from Montreal. So the potential for another outbreak seems to be there.

I dont pretend to be an expert on viruses so for me it is a matter of lets wait and see. I suspect that it is inevitable that we will see a lot more cases but I also dont believe that the government will close down the economy again. The sad fact of the matter is that if you are over sixty or have a pre-existing condition (both of which apply to me) then you need to figure out how best to protect yourself and what degree of risk is acceptable.

I pay more attention to the daily BC public health briefings from Dr. Bonnie Henry and the comprehensive followup data posted on bccdc.ca. At the briefing three days ago, Dr. Henry was asked about the opening two weeks ago, and pointed to the 5-6 day median incubation period. She pointed out that they hadn’t seen a rise in community acquired cases and described this as an encouraging sign, which is what I did when I said it “bodes well.” Note that with the BC numbers this low they are tracking every case, and categorizing them with community acquired/unknown source being the important one. Of course this is early days in the opening, so nothing definitive yet. Just encouraging early numbers.

As for you expecting me to have learned from your “many discussions here” about CoVid. Sorry, I don’t pay much attention to you on this. I think I tuned out with a ridiculous conspiracy theory post from yours like this one ( https://househuntvictoria.ca/2020/03/16/what-could-covid-19-do-to-real-estate/#comment-67243 ) , where you said “vaping lung illnesses in the USA in 2019 might have been caused by the coronavirus escaping from an American military research centre”. Let’s hope that you’ve learned something since then and don’t still believe that.

Patrick, did you forget so soon the many discussions on this blog about exponential growth? It would be virtually impossible to see a big increase in less than two weeks as you suggest. The end of June will be about six weeks since restrictions were relaxed, and that will be the earliest we will see a definitive new trend of exponential growth.

Big announcement today, Aryze and Telus are partnered up on the https://telusocean.com/. The Jawls got the bounced out of the deal and rumor has it a new construction company is also being setup to run the Starlight Development while Campbell and Farmer continue their slow demise.

Well given all the provincial campsites booked up maybe that’s where I can take the kids then. Prime ocean view camping

We moved here in 2001 and I remember downtown was dead after 6pm with very few people living downtown and lots of panhandlers. Fast forward leaving out the current pandemic issues , downtown is in my opinion safer due to more people at all hours and more interesting, I think people always look back at the past more fondly then it actually was

This is one reason why camping in Beacon Hill Park might increase!

https://www.tripadvisor.ca/ShowUserReviews-g154945-d186967-r126257670-Beacon_Hill_Park-Victoria_Victoria_Capital_Regional_District_Vancouver_Island_Bri.html

https://vancouverisland.ctvnews.ca/victoria-hotel-housing-homeless-evacuated-after-second-fire-1.4965619

Some solutions seem to develop into problems almost immediately!

I contacted the city about the campers in Beacon Hill Park and was told “Bylaw Services will allow people in Beacon Hill and other parks to shelter-in-place during this health emergency” so there is no enforcement of the bylaws stopping camping in the park at the moment and I would expect it to increase once word gets around.

Yes, it’s great to see the tents gone from Pandora and (mostly gone from) Beacon Hill Park. Just need a solid week or two of sun and everyone’s spirits should pick up.

Back in the ’90s, Alberta premier Ralph Klein once bought welfare recipients one-way bus tickets to B.C.

Maybe Victoria should return the favour.

We would have seen a bump in cases at 5-6 days after opening, which is the median of the incubation period . Since we opened up two weeks ago, this bodes well, as there wasn’t a bump in BC cases, and no new cases at all from Vancouver island in last two weeks. Let’s hope the numbers stay low as we continue to open.

James. I haven’t been in Victoria at all since early April, so you are correct that my dreary impression of Victoria may be dated. I sure didn’t feel the usual love for Victoria when I returned from abroad. My bad impression started in Langford, worsened in Saanich and peaked on Pandora. It was only when I got back to my regular Fairfield bubble that I remembered why I love Victoria so much.

If the situation downtown has greatly improved in the last seven or so weeks I am super happy to hear that as I am shortly returning to Victoria to stay.

I haven’t looked over the market writ large, but in the segment that I watch (SFHs on the Saanich peninsula) I have definitely noticed price changes.

Six months ago, there was virtually nothing sub 800k in Central or North Saanich. The few that were were bulldozer bait, and in one case, a former grow-op house. A year ago you’d get even less.

Fast forward to today and I can easily find rather nice homes for 700k, and there’s lots to choose from too. Heck there’s a few at 650k in Sidney that are worth looking at. You would not have seen that previously – like I implied, the difference I’m perceiving in what you get for the dollar now is actually quite striking.

Infrequent: My neighbour built a garden suite and Markos video is dead on about the costs and challenges. Actually his ended up being a bit more than Marko was suggesting.

I believe he said he was getting 875 from the tenant but he has gotten nothing since covid. Also check with your insurance company for extra costs for the garden suite. He says it goes into the stupid column of things to have done.

I never asked him but I wonder if they bump up your property taxes?

Government action postponing (and exacerbating) the eventual pain. I don’t think they can do it indefinitely but maybe I’m wrong.

Riddle me this

How with 20% employment and our economy in shambles are SFH prices not falling. Even I Mr bull cannot explain this.

Telus announces new downtown Victoria headquarters

The proposed office and retail building will become the company’s regional headquarters for approximately 250 employees, according to the city.

https://vancouverisland.ctvnews.ca/telus-announces-new-downtown-victoria-headquarters-1.4965721

https://www.youtube.com/watch?v=D_VuAb3uPgU&t=26s

If you have a significant mortgage you’re not likely to have much or any taxable income after expenses. The bad news is you’re likely to be liable for capital gains on a proportional amount of the property. Then again, the good news may be that there aren’t any gains. 🙂

Yes, for my lot the max size is 400ft2. Thanks for linking to that post, I had not seen it. I have looked into prefab and I’m not very impressed with the prices I’ve seen. This unit, for example: http://modulinepenticton.com/project/baker-14726/ 364ft2 I was quoted $62,000 delivered, plus PST and GST and installation costs separate (sewer, water, hydro, etc.). So, easily over$200 per square foot installed. That’s probably like a 5-6 year break even if you netted $1000 a month rent (after tax). So yeah, wondering what it might cost non-prefab.

We are approaching two weeks since the COVID restrictions were relaxed. The exact weekend the restrictions were relaxed I noticed an immediate change in attitude by many people who started ignoring social distancing, people congregating outside pubs, cafes, restaurants, and restaurant patios.

If COVID is as contagious as claimed, albeit less outside, then we will start seeing the daily numbers increasing again.

Remember in early March when daily numbers starting averaging over 40 per day the authorities shutdown everything. Will it happen again? I’m guessing the daily numbers will be over 40 per day by the end of June if the lackadaisical attitudes spread.

Over the last 30 years I have watched the character of Victoria change from one of old world charm and quaintness to a place where heritage/character buildings mean little when standing in the way of development. I often wonder why tourists come here at all. Apart from it being in a beautiful location it has little else going for it now. The out with the old and in with the new is making this just another coastal town with the usual problems. There seems to be little real effort put into solving those problems.

It is my town, I love it but covid has reminded me how peaceful it used to be without the huge tourist influx and the constant traffic speeding around our neighbourhoods. I am not saying bring back the old times, just let’s be a little more conscious of how we develop our city and let’s consider the permanent residents a little more instead of always going for the mighty dollar.

Max size depends on the lot. Lots over ~6000sqft or lot with 2 road accesses (laneway, 2 frontages, or corner) fall into the plus lot category and can support a garden suite of up to 600sqft.

https://househuntvictoria.ca/2019/10/23/garden-suites/

Working on a piece about prefab as it relates to building and garden suites. Something to look into. I think there is huge potential in garden suites, just waiting for the right player to take advantage with a sensible option to build them.

Hi gang, I’m considering building a garden suite, I see Victoria’s max size is 400 ft2. Has anyone here built one around that size recently-ish? Wondering about an approximate cost for building one, and also what an expected rent would be (and therefor how long it would take to break even etc.). Thanks!

None of these people have been downtown lately, clearly.

There are no homeless people on Pandora anymore, they’ve all been housed.

There are a few people in Beacon Hill park, which I don’t quite understand since now that they have space for everyone not camping in Beacon Hill should be back to being enforceable .

I have to agree with Caveat, but while Covid has highlighted the problem, downtown has actually been deteriorating for a few years. Interesting to see if condo prices start reflecting a diminished desirability for the city core.

I’ve always been a big Victoria booster, but I must say after recently returning to Victoria from 9 months abroad I was shocked by how bad downtown has gotten. It was especially noticeable when you have a fraction of the normal traffic the homeless population was the main thing you noticed.

I some time post invitations on reddit for homeless to come here.. after all.. it’s a nice city to retire for homeless too ,

Downtown is rather sketchy with all the druggies and it looks tawdry and rather dirty. Neither cosmopolitan or quaint.

The good value is the ultimate qualifier in that statement. The question is during instability and turmoil, how is that value now measured? But if people merely decide on it’s their dream as a reason, oh well, there are people that buy extended warranties, credit card insurance, time shares, multiple lotto tickets, and Amway too. In the end it’s still morally wrong to let a sucker keep their money.

Yes it is, I have been in Harris Green for the last decade and it has gotten worse year by year. I will be departing the area because of it. It’s not just the numbers, it’s also the increasing aggressive nature of some or many the displaced folks. As it turns out, if a city decides to bring in certain policies, it actually draws that population from other areas instead of decreasing or addressing the problem.

Is it really substantially worse? Seems like fairly promising developments with housing lately. Then again I really don’t go downtown ever

I really wonder what COVID would have had done to the market if it had hit 6 months earlier….

Leo mentioned 15% of properties went over ask. So some owners are obviously pricing their properties competitively. Also if it the place is your dream home and is priced @ good value, somebody else might also think so and purchase it, leaving you to keep searching.

Great article Leo. Covered a lot of ground.. thanks!

My client bought a unit with parking at 295k+GST on launch. Had a friend buy another unit for 310k+GST. There were definitively units around 300k+GST.

MLS#:425817 – this one just shaved $100,000 off their asking today… Separately, why would a buyer make any offer on a property right now before the seller has reduced the asking price? What would be the point of negotiating from off the sellers initial asking? A buyer might as well wait and only make an offer after the seller has taken off tens or hundreds of thousands off the asking before making any kind of offer.

not worry, housing in Victoria only goes up…

right?

Paid attention to 989 at its launching time, don’t remember there was anything that low ($299K with GST included)?

It should be, … It will be …, and finally It comes, about time 😉

Been tracking 989 Johnson for a while now, one unit /listing dropped from 400k to 368k, and ended with 369k. they owner pocketed 70k in about 3 years?( excluding agents fee/income tax etc)…. anyone know what happened there?