Mitigate risk by: holding

A few years ago I came across an article that showed the return of the stock market by holding period. As you might expect, for any given year the market can be up or down wildly, but as you hold for longer and longer time periods, the average annual returns even out, and down markets get smoothed over.

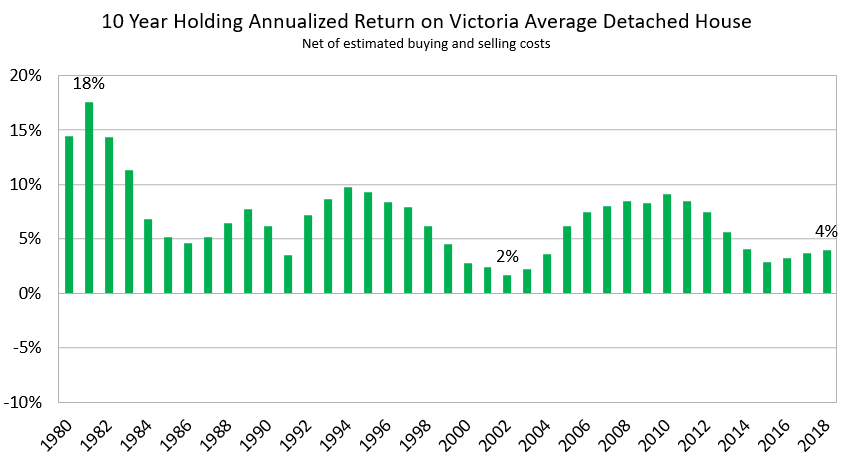

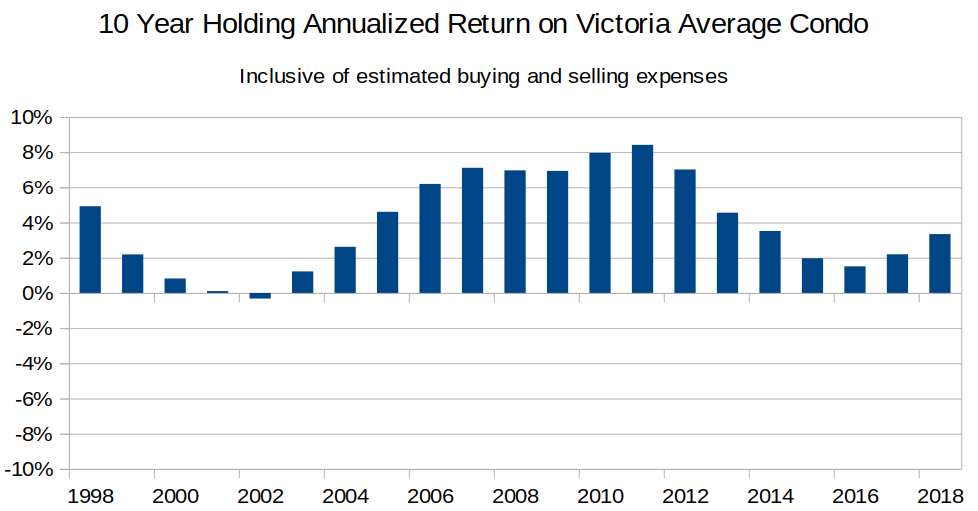

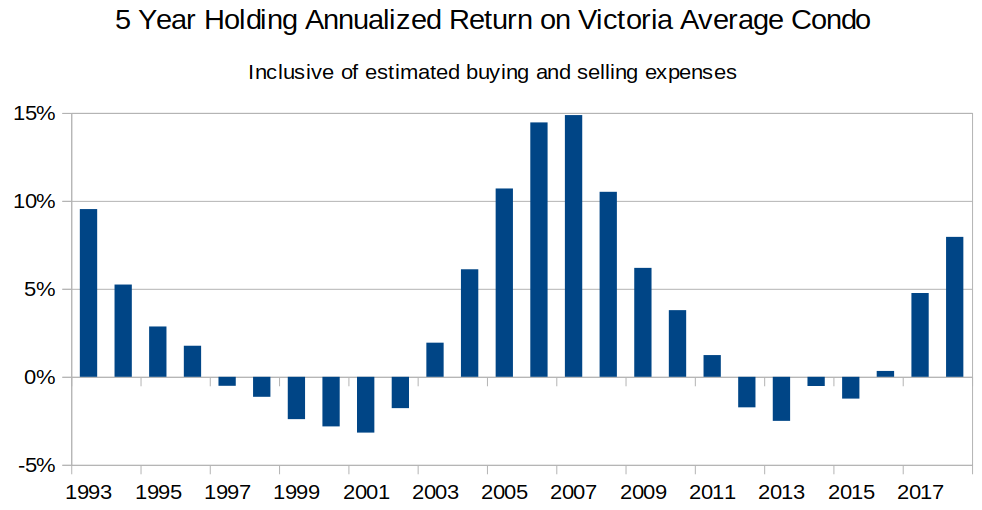

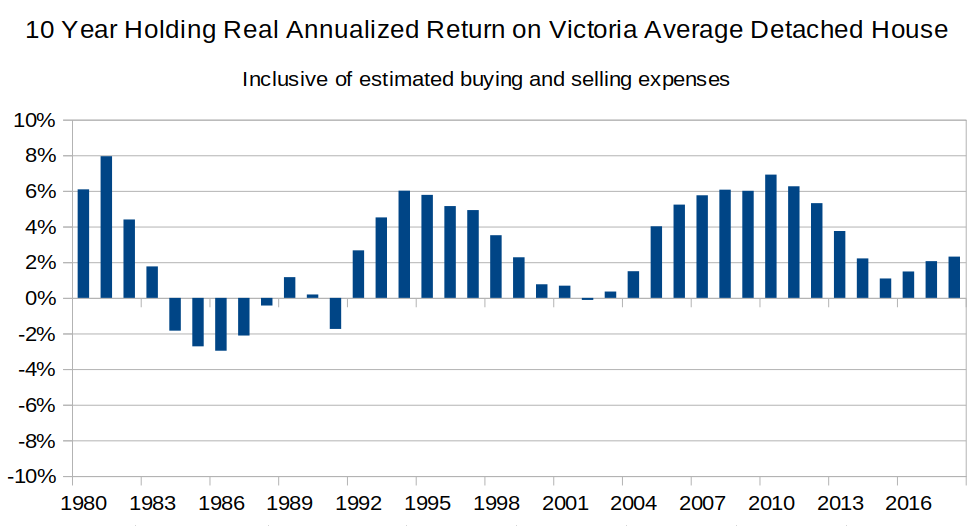

Well the same thing is true in the housing market in Victoria. Although it isn’t nearly as volatile as the stock market, the extremely high transaction and tax costs in real estate put a large penalty on to short holding periods. Below, I’ve charted the return on the average detached house since 1980, looking at various holding periods. These are all nominal average single family house prices in Victoria, and the data includes the typical costs of selling (primarily commissions) and buying (primarily property transfer tax but also legal, inspections, etc) but does not include any costs for maintenance or financing.

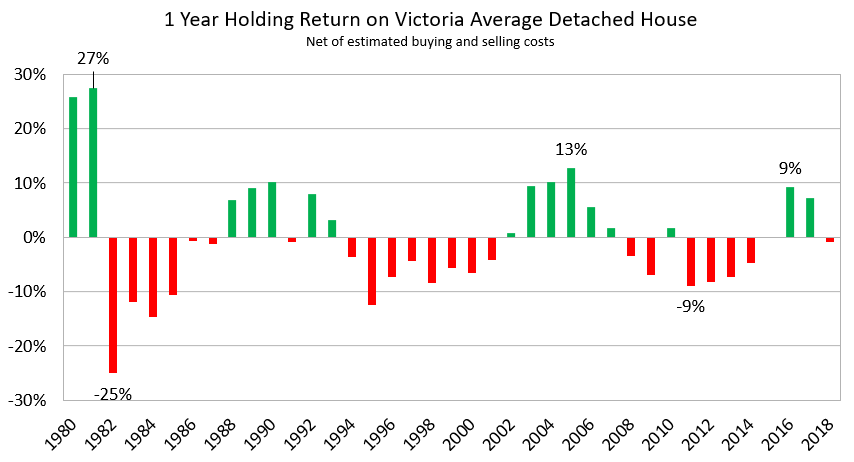

Each data point is your annual return during the holding period if you had sold your house in that year after holding it for X years. Let’s start with a holding period of one year:

As you can see, it’s quite insane to hold a house for only one year. Even though the average house price was up in 2018, transaction costs would have eaten up more than all of the profit. And even though price declines have mostly been mild, if you bought in the wrong year you would have faced steep losses. In short: If you’re going to flip a house after one year, you better have put some serious sweat equity into the place.

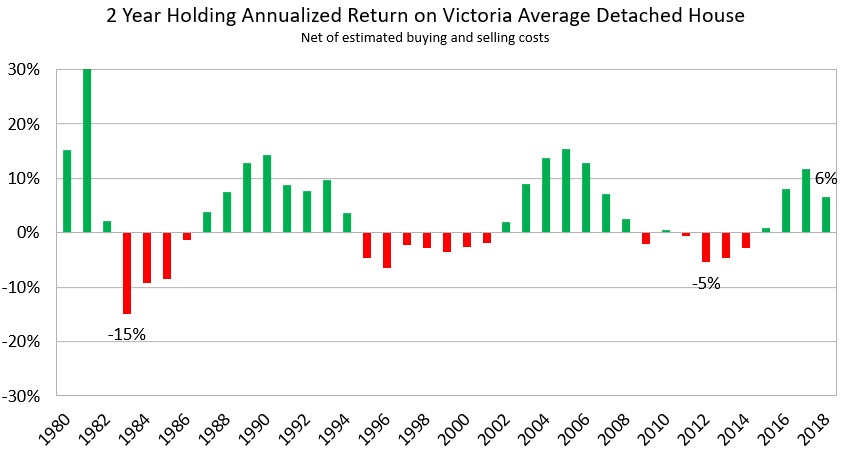

What about 2 years?

Not much better. There are still substantial periods of negative returns. Is 3 years enough?

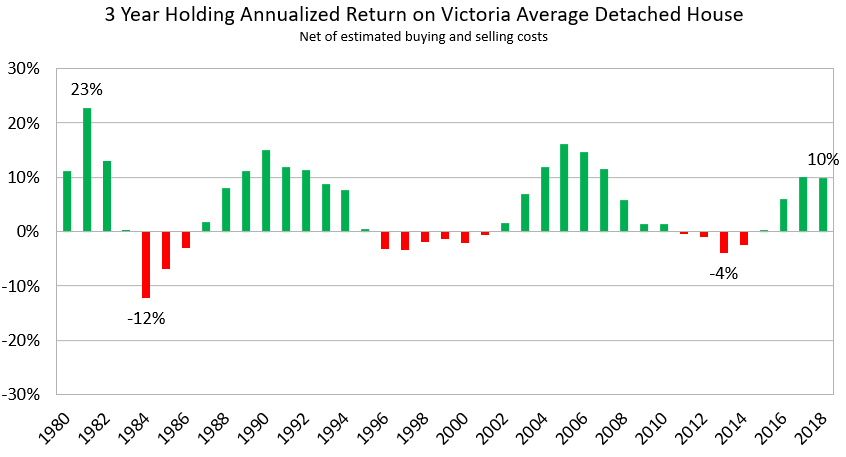

Not yet, although losses are getting smaller again. Remember that when the chart indicates a return of -4%, that is per year compounded, so over the 3 year period it would be -12.4% and same vice versa. How about 5 years?

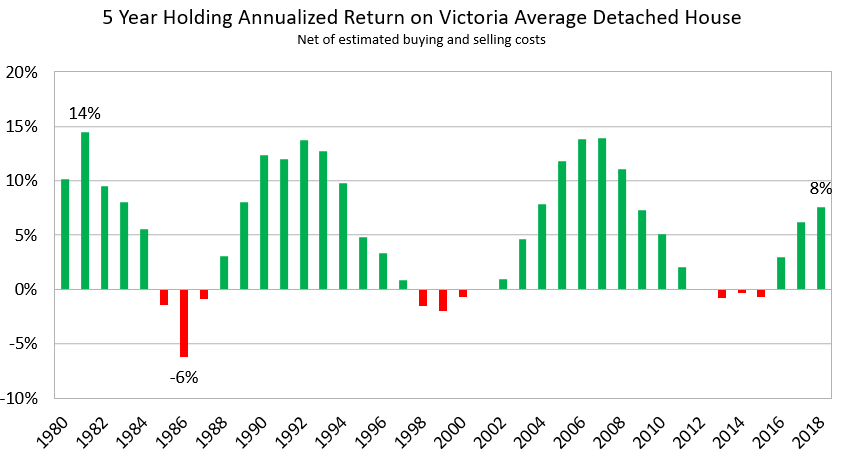

This is where it starts to look safer. Only if you bought in 1981 and sold in 1986 was it really a bad time to buy, with the rest being at worst about break even, and at best annualized returns of over 10%. However for a single family house I normally recommend a timeline of 10 years, so let’s double it to that.

Now we have erased all negative returns from our near 40 year history of detached house prices in Victoria. The worst period was 1992 to 2002 with 2% annual price appreciation (flat in real terms) and the best was 1971 to 1981 (remember, high inflation in that period though).

A few thoughts from this data:

- You can mitigate the downside of poor purchase timing by holding for longer.

- The best returns are clearly when you buy in years with good affordability and sell in years with bad affordability. If you buy in a year with poor affordability, you should be prepared to hold for longer.

- Even after our recent 40% price runup, the annualized return from 2008 to 2018 is only 4%. A far cry from the previous peaks of nearly 10%, or the insane numbers in the early 80s. Surprising right?

- Returns are getting less and less over time. If our current peak is at an annualized return rate of 4%, returns going forward will almost certainly be less. We may even get a 10 year period where house prices fail to match inflation. I believe the days of big returns in single family house prices are behind us. That doesn’t mean they won’t be decent investments, but be prepared to accept substantially lower returns.

- This is not a rent vs buy analysis, it is only comparing price appreciation over time. The re-built rent vs buy analyzer is coming later this year.

Just in case you’re curious, here’s the chart for 20 years.

Went through some more of that development data. Per capita, Victoria has the most development going on in Canada. Over double some of the bigger cities like Edmonton, Calgary and Montreal. Only cities that are close is Vancouver, which is nearly the same, and Toronto which is 25% less, and oddly, Halifax, with 11% less.

https://www.bloomberg.com/news/articles/2019-04-25/millennials-are-becoming-a-bulwark-against-canada-housing-bust?srnd=premium-canada

Yes, and we thank the Millennials and their love/need of core-big-city living for helping to prevent the bust.

According to RBC, the rate of Millennials pouring into the biggest cities (Toronto, Vancouver, Montreal) has exploded from 20K per year (in 2015) to 90k per year (in 2018). And still rising. This rise is so big that RBC concludes that “Housing demand isn’t at risk of falling anytime soon”.

—====—-===

Millennials Emerge as a Bulwark Against Canada Housing Bust

Apr 25, 2019 https://www.bloomberg.com/news/articles/2019-04-25/millennials-are-becoming-a-bulwark-against-canada-housing-bust?srnd=premium-canada

“Toronto, Montreal and Vancouver have seen the biggest net inflow of millennials in 12 years, a key reason demand for housing is expected to remain strong, despite spiraling costs, according to Royal Bank of Canada.

“Housing demand isn’t at risk of falling anytime soon,” Hogue said. “What could fall, however, is the rate of young households who own a home. High housing prices set an impossibly high bar to clear for many millennials to become homeowners in a big city. Expect a greater proportion of them to rent in the future.”

As we all wait for the Monday numbers to arrive. Then all the usual tea readings.

Yes, prices could fall significantly in the future for many reasons.

Let’s assume you are correct, and it’s a bubble. You still need to decide if you’re going to buy a house or not, because making money isn’t the only reason to own a house. But let’s stick on topic with the money part.

If you buy a house, and get a 25 year mortgage, after 10 years you’re going to owe 70% of the original mortgage balance. If you borrowed $500K (@ 3.1% 5 year http://www.mortgagearchitects.ca) , you still owe $350k after 10 years. So if you buy now, and there’s a big crash and in ten years time prices are down 25%, this means that $500k house is worth $375k. If you sell it then you’ll break even. Is this the scenario you’re afraid of, and you’ve named yourself “let’s protest” for? That you might only break even after ten years?

If you’re afraid of that “break even after ten years” scenario happening, the solution is simple…. don’t buy a house. Wait for the “bubble” you’ve spotted to burst, and then buy in at the bottom years later and make a killing. Only 60% of households in Victoria own, the other 40% rent.

#59027

https://youtu.be/Ei9BijlUv3E

The Boomer generation will actually have the most to lose in a housing bust, by far.

This is a bubble, Patrick. What you’re saying makes no sense, there lots of millennials moving to Van and lots of boomers leaving as well. Construction is at all time high and we are not competing just like the boomers were; do you prefer higher interest rates and lower prices or the opposite? For every 5k extra that the boomers could throw at their mortgage per year would reduce their monthly payments significantly and help to pay the mortgage faster, for us, millennials, 5k would reduce our payments by a dollar and the total mortgage by a month and we are talking about a shoe box, not a house. Now tell me again that this is not a bubble and that the boomers faced the same situation.

If you’re referring to only SFH in the city of Vancouver, well no, I don’t think that Millennials are the cause of those high-end multi-million dollar prices, and I didn’t say that.

I am referring to the median prices in general of housing in Victoria and Vancouver, and specifically the entry level prices. It is in the lower end of the housing market where rising numbers of city-core-loving Millennials are causing the prices to rise

Millennials are the largest group of first-time buyers. If a city has a large population increase, and 50% of the increase is Millennial age (as in greater Vancouver), this puts pressure on the lower end of the market, as more young families are in the house market. The number of available SFH is not keeping up with the number of Millennial families that want SFH homes. This causes prices to rise IMO.

We are told here that the cause for high house prices is “money laundering” (msg 58992) or “people with two homes”. When a millennial family looks to buy a $800k house in Gordon Head, they aren’t competing against money launderers. They are competing against a rising number of mainly young families also looking to buy.

Millennials should get used to it. You’re soon to be the largest cohort in Canada, bigger than the boomers, so expect to be faced with lots of competition from fellow Millennials at every stage of life, just like the boomers were.

Yup.. Because our honourable boomers said so.. they don’t understand why majority of the population is in City center.. places where jobs are located.. jobs are longer in farm ville or lumber towns … jobs are located in City centers … Millennials have to work unlike mordern day boomers.. leeching of next generations pension fund

« Excluding the core, what are people’s preferred areas? Are there any overlooked or underappreciated areas?«

Esquimalt. It’s so close. We might end up there ourselves one day! I’ve lived in many cities and they all have areas like this. Eventually, as the city grows, i think Esquimalt will become very desirable.

Maybe not millenial driven but certainly home-grown Canadian moron driven – no matter what their age.

This from the Bank of Canada via Saint Garth shows that the same daft herd that drove the prices up will drive it down…

‘“Overall,” says the bank’s report, “the evidence presented in this section suggests that the unexplained strength in resales reflects extrapolative expectations, which drove up speculative demand and caused some households to pull forward purchases in fear of later being priced out of the market. Importantly, the provincial housing measures appear to have played the dominant role in eliminating these sources of demand. This is mainly because the measures, while directly targeted at the relatively small portion of home purchases by non-residents, altered the expectations of residents and generated an outsized response in the housing market.”

“The largest impact of the policies,” it concludes, “came through shocks to expectations of domestic homebuyers.”’

If that’s all a bit too reasoned for your tastes, you may consult Pogo:

“We have met the enemy, and he is us”

For starters, I believe a check of your reading comprehension skills are in order. Correct me if I’m mistaken, but Vancouver is a city in British Columbia. Greater Vancouver is not, and that name is nowhere mentioned in my previous post.

As far as the number I gave, I came across it in an article some time ago and it stuck in my head, shocking as it was. But you seem to be at the ready with real-estate related numbers, more adept than me I’m sure, perhaps you can share with the board the average price of a detached home in the city of Vancouver? I bet you will find that my estimate is not far off, if at all. I believe the numbers were something like 3.5 million for the west part of the city and 1.6 million for the east side. Millennial driven? Ridiculous. I feel like I am wasting my breath (or keystrokes in this instance).

And then let’s return to the original question – and, just for giggles, pick your number or mine, both equally absurd in my opinion. Please tell us how this young generation is responsible for these numbers? I’m all ears, and all about reason – willing to believe if it makes sense to me. Please don’t just say they are moving to the city. There seem to be smart people on this board that would probably want more detail, especially for a generation that is characterized as living in their parents basement while saddled with immense school debt.

As far as the moniker, read into it what you will. For all anyone knows I could be a rug salesman in Bishkek, you, a spice merchant in Ulaanbaatar. Well, based on your outlandish claims, perhaps you are a sand salesman somewhere in the Middle East.

For anyone interested, here is the report from MacBeth MacLeod Wealth Management on the Vancouver Housing Conference. It references the sale of the residence on Eyremount Drive. Also, it looks as though the chasedown on that house was over a period of a few months, starting at 12.8, then a huge drop to 9.5, then the final sale price. Someone must have seen that and smelled blood, and I guess they were right. I wonder how the current buyer will fare? Was still purchased for quite a large sum.

https://web.richardsongmp.com/documents/136777/590856/Vancouver+housing+conference.pdf/0cd5e85c-5422-43f9-b17f-95574e07cab8

Excluding the core, what are people’s preferred areas? Are there any overlooked or underappreciated areas?

QT:

Central/North Saanich. Never liked the core, which seems to make me the minority. I avoid it as much as possible. I do have an upper limit to what I am willing to pay, but it would depend on the property itself. The “right place” has a funny way of making people feel a little more flexible. 🙂

Shameful post. Why make stuff up like “he attempted to flip it” and “decided to chase the market down”. You’re just making that part up, right? For all you know, the reasons and timing to sell may have been from a divorce, death or illness, making it shameful for you to be doing a “happy dance” in public about it, including posting the person’s address.

Pathetic.

@Local Fool

What is your prefer area and price range?

Not interested in that area or price range, QT. Thanks anyways!

3195 Humber Rd. is going to take that lost in Victoria and is waiting for your pocket change of 6-7 mil Local.

Ks112,

This transaction and sale price was reported at the recent Vancouver Housing conference. It hasn’t been posted to Insights yet, and I don’t believe the last listing was on MLS. I don’t know if it was court ordered or not – for that degree of loss it could be. Definitely an outlier atm.

It’s the correct address. BCA figures often take months to show up. Insights can be better, but it’s not instant either.

Hey LF, BC Assessment data indicated that the 2008 sale was probably a tear down, with the 2016 sale reflecting the new build. 2016 sale is no longer available on the site.

Local Fool, where does it say it sold for $5.5 million?

Look at the graph of the population rise in Vancouver (see link from theStar below) , and you will see that Millennials (age 18-40) account for 50% of the of population growth in Vancouver, larger than any other group (boomers are about zero % of the population growth). Millennials love big cities, and move to them, even if they can’t afford to buy the housing. Nothing wrong with that, it just causes house prices to rise. If Milllennials loved living in the countryside, house prices in big cities would fall, because population growth would fall. Boomers didn’t flock to big cities to the same extent (boomers led a flood out of cities and to suburbs in the 70s-90s) , and certainly aren’t flocking to the big cities now. Greater Vancouver has 40K new population per year, and half of those (20K) are Millennials, many of them looking to buy housing. That’s a big part of the cause of the rise in house prices IMO. We hope to free up maybe 2K homes as a one-time gain in Vancouver via the spec tax, and there are 20K Millennials arriving each year to Vancouver needing housing. That puts pressure on house prices and rents.

https://www.thestar.com/vancouver/2018/07/02/millennials-are-flocking-to-vancouver-despite-the-housing-crisis-says-ubc-demographer.html

“Millennials are flocking to Vancouver despite the housing crisis, says UBC demographer. There are so many young people making the move to Vancouver that newcomer-millennials make up a significant percentage of population growth, according to a demographer from the University of British Columbia. “

Highest loss I have seen to date in Vancouver.

1153 Eyremount Drive

http://www.vopenhouse.ca/vid/23540_Eyremount/

(no MLS)

Bought in January 2016 for $11,280,000 (Previously sold for $2,400,000 in February 2008).

Attempted to flip it for as high as $12.8 million, no takers. Decided to chase the market down for a while, then…

Just reportedly sold for $5,500,000, for a ~$5.8 million loss, not including transaction or carrying costs. Put another way, this owner lost an appalling ~$150,000 per month of ownership.

Another reminder to folks – a housing correction is never an equity problem. It’s always a liquidity problem. No liquidity? Buh-bye to equity, as this seller will certainly be able to attest to.

More to come, folks. A lot more…

Comparing Vancouver to Greater Vancouver = comparing apples to oranges

For starters, how about explaining your claim of $2.4m for the average price of a detached home in Vancouver? With a name like beancounter, you should be accountable to the accuracy of numbers you post.

http://creastats.crea.ca/vanc/

“Sales of [Greater Vancouver] detached homes in March 2019 reached 529, a 26.7 per cent decrease from the 722 sales in March 2018. The benchmark price for a detached home is $1,437,100. This represents a 10.5 per cent decrease from March 2018, and a 0.4 per cent decrease compared to February 2019. “

In what bizarre universe do you live in which millennials have driven the average price of a detached home in Vancouver to 2.4 million dollars? I suppose it’s possible you might actually be experiencing an alternate universe depending on which side of the bed you roll out of in the morning.

Calgary

Did they?

They had to move to other cities, buy houses in the suburbs, and commute 2-3 hours a day to corporate jobs — things millennials hate.

Should millennials feel sorry for boomers? No, but boomers shouldn’t feel sorry for millennials either.

Personally, I only complain to piss off all the entitled boomers on this site. That’s the change I want to see in the world.

Beautiful comment, BeanCounter!

What you guys are forgetting is the fact that the median house price is equal to the median loan that banks are giving to the median worker.

With ultra low interest rates and on the top of a credit cycle you would expect an affordability crisis.

The only thing ppl talk about in BC is real estate, Im on the ferry right now and ppl beside me are talking about the condo they bought to rent, and I hear the same thing over and over again everywhere.

If RE never goes down and is the best investment ever I don’t know why ppl buy stocks or bonds… You can leverage RE like nothing else, isn’t it great?

Viola: Cant say i disagree with you about the two hour cummute. But you are making Patrick’s point for him. Almost everybody prefers to be in the inner core. And that includes me as well. Like always it comes down to the highest bidder. The problem is that you are talking about an ever increasing population in a city that is still a premier retirement destination.Simplistically you and I are competing for the same real estate.More than twenty per cent of sales are to out of towners (much higher in the premium areas) and I suspect that most can outbid you. The good news is that there are a lot of alternatives by way of condos.

Then why would millennials constantly belly aching for making that intelligent choice of renting in the perfect core dwellings?

https://www.nytimes.com/interactive/2019/04/27/upshot/diversity-housing-maps-raleigh-gentrification.html?action=click&module=Top%20Stories&pgtype=Homepage

« The middle class of the past wouldn’t have even dreamed of preparing avocado-on-toast on a granite countertop. »

Whose countertops? Or is this just jealously of exotic fruits we are talking about.

« In the year or so I’ve been reading the forum I don’t recall even one Millennial here looking or even considering to buy in “affordable” Langford. All are looking for the same thing – a SFH in “unaffordable” Core Victoria«

Smart millennials. Who wants to spend 2-3 hours per day spewing out fumes in the Colwood crawl. I’d sacrifice almost anything to avoid that.

I think immigrant parents could be different when it comes to money. Nonetheless I agree that people who built up wealth over their working lives aren’t suddenly going to become big spenders and drain their savings

Except we are not talking about the top third. If I read the stats right, 92% of households in Greater Victoria (not just the core) cannot afford to buy a SFH without move-up equity or other family help – even at today’s low interest rates.

Things have changed. Affordability based on income is likely only relevant for the % of the 30% of first-time homebuyers who do not have family help. Of these buyers more than 10% will have more than 100k of family help and, on average, they are getting more than 60k of help.

Not to say income is not relevant, but it is not the mover of the market beyond a minority of first-time buyers.

https://www.thestar.com/news/gta/2019/04/23/1-in-10-first-time-homebuyers-in-canada-expect-a-100000-gift-from-family-or-friends-study-finds.html

https://newsroom.bmo.com/2019-04-23-Lean-on-Me-Majority-of-Canadians-Will-Look-to-Friends-and-Family-for-Assistance-When-Buying-a-Home-Finds-BMOs-First-Time-Homebuyers-Report

There might not be a direct connection to money laundering and Victoria but it certainly impacted Vancouver which indirectly impacted Victoria. Check out Leo’s post on Vancouver buyers.

In the year or so I’ve been reading the forum I don’t recall even one Millennial here looking or even considering to buy in “affordable” Langford. All are looking for the same thing – a SFH in “unaffordable” Core Victoria. I’ve also not seen any articles or data pointing to money laundering being a significant factor in the Victoria market.

200 years ago,,… people were expected to farm .. technology kicked in … 50 years from now grand kids living in coffin size pods will complain about the same thing … we robbed them .. get off your high horse boomers .. you had it good

Montreal, Ottawa, Edmonton and Calgary are perfectly fine w/r to affordability.

The cause is quite clearly laundered money, and people thinking they can rich off of real estate. The problem is in the process of ending. It’s why you see million dollar drops happening in Vancouver, or places that were accessed at 1.3 million in december sell for $800k. And it’s just starting.

whoops… sp. Millenials … that should be Millennials

The worst affordability in Canada is the big cities. Millenials aren’t the victims of this, they are the cause. This is because Millenials have started a “back-to-the-city” movement since 2010, and this has created higher demand and higher house prices in the biggest cities in Canada. Boomers had lower prices in the 70s-90s because they didn’t all want to live near the center of a big city. If Millenials would spread out and live more in suburbs and small towns, they could help solve the unaffordability issue themselves.

https://www.citylab.com/life/2018/06/millennials-are-happiest-in-cities/563999/

“When it comes to place, Millennials are different from the generations that came before them. Unlike older Americans, they tend to be happier in larger, more urban environments. As the charts below show, for most of the period since 1970, people have been much happier in smaller, less urban places. But that started to change recently—around the year 2010—as the back-to-the-city movement accelerated. Millennials are the only generation that is happier in places with a population of more than 250,000.”

Note to millennials: despite everyone telling you how hard your life is, you actually have it good.

With the possible exception of some early boomers, millennials have it better than any generation before.

The middle class of the past wouldn’t have even dreamed of preparing avocado-on-toast on a granite countertop. They would be considered poor by modern standards.

Roughly 25-45% of the cost in new residential housing is related to sales and trasfer taxes, permits, development costs, revisions to the building code, donated green space / public land, revisions to drawings, approval process, wcb standards and fees, etc. Some of these costs are beneficial to society, however the local and provincial government need to realize that they are a significant part of the problem.

Thanks QT, very helpful to know.

Oversize the system is a common practice among many HVAC contractors because they can up sale to a larger unit that cost more money, and it minimizes the first year service calls that under warranty. However, with more diligent work and fine tunning a correctly sized or slightly undersized system will prolong the service lifespan of the heat pump (compressor and blower) and save the home owner more electricity over that of oversized.

Air source heat pumps can run well into the negative, however you are not going to get any efficiency out of it, and can damage or greatly shorten the lifespan of the unit. Most air source heat pumps are design to effectively work down to -3C to -5C, but you are not going to get much efficiency out of it therefore it would be wise to set the cut off temperature above -2C and run backup heat to save energy and prolong the lifespan of the unit.

That’s exactly it Barrister. 45 year old can’t buy his 1.1 million dollar house if he can’t sell his 800k paid off house in Fairfield. And buyer from Esquimalt can’t afford to buy his 800k house in Fairfield if he can’t sell his starter home there for 550k, because first time buyers can’t or won’t buy a shack for over half a million dollars.

Also for anyone who played M.A.S.H as a kid who wondered how he became a millionaire but lived in a shack…

As a seller it will help your sale, and as a buyer it will pay for itself quickly.

You can now get $3000 off for converting oil, propane, or nat gas to a heat pump. Total no-brainer.

https://efficiencybc.ca/incentives/central-system-air-source-heat-pump/

Good idea, but I wouldn’t rip it out and put in a central system with out pricing out all of the alternative heating, as central AC/heat pump costs more to implement than ductless split system. Electrical panel and service upgrade would be around 5K +/-1K, and if you want built in electric heat that could easily add another 1.5-2K. And, NG is cheaper than electric as I mentioned below.

Personally, I would seriously look at central AC/heat pump system or NG if the return air duct is easily accessible and /or adequately sized. However, I would still keep the electric baseboard heating and LPG fireplace as backup heat if I go with heat pump (new 100 lbs propane tank is less than $200 at Costco).

@guest_58813

« My wife and I are going to build a home for ourselves and I just found out I have to take this exam.«

Are they themselves physically taking part in the building? If so I can maybe see why there’d be some standards. If not why the heck is there an exam?!

Is it like that to do additions? Or conversions, like changing an attic to livable space?

Not trying to attack you but it sounds like you are very focused on problems rather than solutions

That is the problem I see right now. Everyone is just complaining about the high cost of real estate but there are so so many problems that can easily be solved but people are focused on complaining rather than solutions.

Three more owner-builder emails this morning….this is one of hundreds of problems that can EASILY be solved to make housing more affordable. The average Joe complaining about the high cost of real estate has no idea how much bureaucracy has been thrown at housing. What you hear on TV about “affordable housing,” it complete non-sense, every single leve lof government is trying everything they can (whether intentional or not) to making house unaffordable.

My dad and I are working on a few houses in Colwood we hope to bring to market at $699,900 and even since the last house we built in Colwood in 2017 they’ve piled on so much more crap. You need a degree to make it through all the paperwork. Problem is end-product doesn’t change whatsoever. I really want to build a house in the City of Victoria so I can do another YouTube series and break down all BS bureaucracy and costs involved.

10+ emails like this per week.

My wife and I are going to build a home for ourselves and I just found out I have to take this exam.

The lot is ready, the plans are ready, but I can’t even get the permit process started without taking and passing the exam.

I only want to write it once and I hear there are trick questions and no real way to study for it.

Would appreciate any help you can offer.

Will also happily take part in any movement underway to get this abolished!!!

Im from the prairies where it gets to -40 but somehow the heat bills in the winter a much less than they are here. When I say expensive I mean $300-$400 a month for all hydro, including heat pump/electric and all electricity, for a 3 bedroom house with a 1 bedroom suite. I don’t know, maybe that’s not expensive here. Seems ridiculous to me considering my dads heat bill never reaches $200, even when it’s -40 for the month. I am genuinely confused about the cost of heating here…

Aren’t you still required to have a backup heating system in addition to the heat pump?

If you oversize the system a bit you should be able to run off the heat pump year round. Ours seems a little undersized but heat pumps should be capable of running well into the negative temps. QT, any insight there?

« Back to the oil heat topic, I would do the same as a buyer and a seller: rip it out and put in a heat pump.«

We did this – no regrets. The system uses electric when it gets too cold for the heat pump, so we have 2-3 months a year where it’s quite expensive. But the rest of the year it gives very affordable heating and cooling in the summer.

Back to the oil heat topic, I would do the same as a buyer and a seller: rip it out and put in a heat pump.

As a seller it will help your sale, and as a buyer it will pay for itself quickly.

You can now get $3000 off for converting oil, propane, or nat gas to a heat pump. Total no-brainer.

https://efficiencybc.ca/incentives/central-system-air-source-heat-pump/

Yes, but you have to compare apples to apples. You can’t pick the top third of properties and say they should be affordable to the entire population. You have to look at all properties for sale, as you said.

The top third (or whatever the ratio is of single family in the core to all dwellings in the region, I haven’t looked it up) of properties has never been affordable to the average household. Not now, not 60 years ago. Was the average household in 1960 able to buy a mansion in the uplands or an estate in Rockland? No.

That doesn’t mean that incomes don’t matter, that means that higher end houses get purchases by those with higher end incomes (or wealth, but those tend to correlate pretty well).

It isn’t a smooth process for sure. There are always quick runups in price and then stagnation/decline. When was the last time a median income in Victoria could afford the median house in the core (not any house, the median house)? Maybe mid 2000s? If we look at the ratio of single family houses in the core to all properties, we might find that that was the last time we were approaching 50/50. (I haven’t looked up the numbers, but will).

I see it very simply. There are expensive homes and cheap ones. There are high earning families, middle income earners, and those earning less. Families in general buy the homes they can afford, and that means high priced homes are primarily bought by high income families as they always have been. Sometimes the price of homes is higher than what can be matched to the income distribution (like now) which stresses families’ ability to afford the level of house they would have bought previously and generally leads to a price stagnation/decline until the situation corrects.

Nice. Should be a quiet one so might actually get your questions answered.

I am finding this whole affordability discussion at best misleading and at worst illogical.

When it comes to affordability measures what a lot of people seem to be measuring is the first time buyer without specifically saying so. That is a key point. The 45 year old buyer who has a family income of 80k but has a 800k paid off house in Fairfield (that he bought at age 28) can afford to buy a 1,1 million dollar house in Oak Bay.

Two other factors are equally obvious. First the city has grown and most of the core is now premium real estate (sorry, Fairfield is no longer a blue collar area nor is Oak Bay).

Secondly at least 20 % of buyers or more are from off island and most of them are older and coming with a lot of cash. Their income more often than not has nothing to do with their purchasing power. In premium areas like Oak Bay I would guess that well over half the sales of SFH are to the off island crowd and often for cash.

So if what we are actually talking about is first time buyers then the real metric is whether it is affordable to buy something in the West shore and not necessarily a SFH. So unless the government starts to create the infrastructure for new cities on the island this is not a situation that will suddenly open up Oak Bay to first time buyers who work here.

Local Fool’s book learnin’ is going to collide head-on with reality in the next few years, and he’s going to be mighty disappointed.

Attorney General David Eby to do a Reddit AMA on Friday May 3rd.

Should be an interesting read…

https://www.citynews1130.com/2019/04/26/b-c-s-attorney-general-wants-you-to-ask-him-anything-on-reddit/

I dare say zero detached SFHs are added to the core per year, specifically Oak Bay, Fairfield, James Bay. Hence, no wonder only the top 1% family income in Victoria can afford to buy in now.

I think the point is that affordability in Victoria is a result of many factors, not just mortgage payment as % of income required to buy a house. Since only 1/1500 mortgages in Victoria is delinquent, the people who have bought all the houses here are clearly able to afford them. You can’t predict/assess that with a simple graph looking at one metric only.

Sorry Leo, my response presumed you meant the previous government. I read it too fast and see what you were meaning now.

I think the point is just the same, though. The market was already turning before any of those changes were made. Like I said, government has basically stepped in and acted as an amplifier by kicking a dying dog. Sure, it’ll die faster, but the trend was becoming established just the same. On a broader level, we can also see that the degradation of BC’s RE market is far from an isolated case and the commonality in all of it, is declining liquidity. When liquidity declines, something else tends to happen…

boomers prime year of entering housing market around mid 70 to late 80 .. affordability relative low .. millennial years of entering housing market late 2000 to now .. hmm … must be hard for boomers .

hmm boomers had it hard .. .. too bad millennial doctors can’t afford much in Victoria .. good thing boomer janitors can buy their house around age 30

Also, in order to buy a benchmark SFH in Greater Victoria you’d need a family income of 110k or more if you don’t have equity exceeding the down payment, inheritance or family help. This type of housing makes up over 50% of all housing that is sold, but the number of households making this much is about 8% as far as I can tell.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=PR&Code2=59&Data=Count&SearchText=victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1

If you’re referring to affordability, well… yes you did define it with nothing but income having relevance. Because you defined to us here what you mean by “affordable” and used a specific definition that only had gross income relevant to the formula. Here is your definition….

There we have it …a simple range of 30-45% of gross income and there’s affordability defined by LF. No mention of anything of anything other than gross income in the affordability equation there LF. So you can see why the poster assumes that you don’t think anything else has relevance to you in determining affordability.

Anyway, it’s good to hear that you admit that other factors are at play, such “influencers” as “equity, inheritances and sympathetic parents.” Hopefully this means an end to your repetitive posting of that affordability graph, with claims of its cyclical nature, that doesn’t include or mention any of those factors, yet is supposed to show us that prices are unaffordable and headed down.

Okay, but even if we look at SFHs in Greater Victoria the benchmark HPI is 741k which is not affordable on the median income. I don’t think it is about percentage of available housing being SFHs as much as it is about rise in land prices and the fact that it has happened at a rate exceeding income increases.

In other words, I think you have it a bit backwards maybe. It is lack of affordability due to rising land prices, which has separated prices from income-based affordability for SFHs throughout Greater Victoria that is causing more condos to be built to meet the need for affordable housing.

Bottom line, we don’t have to go back 50 years to when the housing mix was different. Affordability for a SFH has deteriorated since I first purchased in 2003 when there was a similar mix of housing available and affordability based on income is not a hard check on appreciation over time in desirable areas imo.

Remember others said here or elsewhere: “owning a home is a privilege, not a right (or an entitlement)”.

I am more referring to policy actions, as opposed to omissions. I’m not sure I could say an omission is a contribution, but I do see your point.

I don’t recall saying nothing else has any relevance, especially since this wouldn’t be true. I was responding to the notion that RE markets can be supported on metrics such as equity, inheritances and sympathetic parents. These can be influencers, but they aren’t drivers.

Depends. A big contribution that the government has made is changing the environment that was allowing unlimited money to flow into the real estate market.

Remember, Vancouver is definitely one example of a market that had clearly detached from income-based affordability constraints and I am convinced that it is because of this lack of attention paid to where the money was coming from.

I do not have your faith in a real estate cycle that makes everything else irrelevant. I believe in the importance of affordability and that forms a sort of cycle, but it does not have a regular period. And various policy positions and market sentiment can definitely shift the market around even if not remove its fundamentals.

50 years ago, the core was completely different. Cordova Bay was where people had their cabins, and Gordon head still mostly farm land. In 50 more years Sooke could be part of the core just like White Rock is part of Vancouver.

I’m not sure if I’m disagreeing with you as much as trying to understand what you mean by affordability. To me, income-based affordability means that a median income is used and with this income a home needs to be affordable without equity, family help or inheritance.

What you seem to be saying is that affordability of all housing in the greater victoria area, including condos is the measure? What is the median price of all housing that is for sale?

It would be good to clarify terms because the goal post has changed over time. The median household used to be able to afford a benchmark house in the core, despite there being condos and townhouses and houses in Langford going for much less. Now they can’t.

I guess this might be linked to your theory on densification? It is hard when densification and affordability are used without clarifying because affordability is linked to income so we are adding in another factor without explanation.

Crucially, the relative housing mix also changes over time.

50 years ago, a single family house in the core represented probably 80%+ of the available dwellings in the city. So you would expect that roughly the top 80% of potential owners would be able to afford one.

Today, the same group of houses (single family in the core) represent a much smaller percentage of houses in the whole city. Let’s say 40% but whatever the percentage it is much lower than in the past. So it does not make sense to expect the same percentage of the population to be able to afford one.

Yep that’s our primary disagreement on definitions. I would not expect a median income household to afford a median house in the core. In fact it is fundamentally impossible for that to happen in a healthy city given there are many more lower cost options for housing.

Same as my comment below, we should not expect a median income of the entire population to be able to afford a house that is in the top ~30% of dwellings by desirability (aka price).

I don’t expect Oak Bay, Fairfield, Gordon Head, and a handful of others, to ever be affordable to the bottom 70% of income earners.

That said, I still think wealth plays a role in all these discussions, because if you have a chunk of money you don’t need a massive income to afford a massive price.

I think we are talking at cross-purposes. What I’m saying is that prices over time in certain areas have appreciated well beyond income-based affordability so even if they “stall” they are beyond income-based affordability already so the link is not as direct.

I should probably be more specific in that I use the median income as the test. On the median income in Victoria of 80k per year the maximum mortgage you will qualify for currently is $488,266. The benchmark house price is 840k?

Are you using a different measure?

Maybe. Although history points to other historical and geographic factors as being far more significant: https://www.vox.com/2015/5/20/8615345/america-global-power-maps

As far as individualism and self-sufficiency goes, that works well to a point, and thankfully you can work harder and longer when you don’t have a functioning nuclear or extended family to create security in our society, but it is not nearly as powerful as a related social network working together if you want to build inter generational wealth. Plus the value of healthy family connections and support goes both ways, it is likely to increase your happiness and lifespan as well.

https://www.webmd.com/balance/news/20080619/for-happiness-seek-family-not-fortune#1

And Bingo Bingo. That is exactly what income based affordability means. It doesn’t somehow mean all homes in all segments cost the same.

This is why I don’t accept the notion that huge portions of the city will remain unaffordable forever. Notwithstanding the fact that there’s no historical convention for it, there simply aren’t enough “rich people” to cause that to happen. A precursory glance at the income distribution here in Victoria should be enough to clue people in.

Bingo. Lots of confusion about this concept but it is very simple: if the housing set is in the top say 30% of available housing, then we should expect it to be affordable to the top 30% of income earners, not 100% of society

I would have hoped that this rather basic premise would be more obvious to people. No folks, homes in Uplands are not going to be costing 350k.

Genuine income-based affordability does not mean that a household with a metro-wide median income should be able to buy in a premium neighbourhood.

Blah, blah, blah… although I should have said individuals. I don’t believe that everyone feels entitled to a lifestyle in any generation and I don’t respect the feeling of entitlement in general beyond the basic level of human rights which includes affordable shelter but not in the form of a SFH in an area that has appreciated beyond income-based affordability.

And yet if you could trouble yourself to scroll down on this very page, my actual words referencing that the situation is a result of both a desirable location AND government policies, specifically tax and financing policies:

An interesting area of discussion and something I will read more about, however I do believe that this focus on individualism and self-sufficiency is important. Part of the reason north america has historically done well on the world stage.

What does Buffet say, “give them enough to do something but not enough to do nothing”? Of course there are lots of gradations on what “enough” and “something” means to each family, but it seems to be a well-supported approach in general.

So, Local Fool, you think that Oak Bay, Fairfield, Gordon Head, and so on, will someday return to genuine income-based affordability, such that a family earning median income ($80K) will be able to reasonably afford to purchase a SFH there?

You are dreaming so hard.

In 2008/10, parts of the core stalled but never returned to broad income-based affordability.

I bet that happens again this time round.

Except the data doesn’t support this. Core house prices stalled out when affordability got bad in 81, 94, 2008/10, and now 2018. No different than houses in the westshore, townhouses, condos.

The current slowdown is a good example. It was only 8 years from the last peak, and a mere 40% increase in the runup. Nothing like the 100% runups in the past or the multi-year hot markets. And yet, the marked stalled out, including in the core.

You can retire on this in a fairly short timespan. I recommend reading through MrMoneyMustache if that is your goal.

TOTORO – “If you have trouble owning a home and living on 200k a year in Victoria there are other issues at play.”

You are right, the other issue is: retirement.

I guess that means you have zero respect for anyone, since preceding generations have not only expected as much as their parents but more, and got it. Particularly the boomers, whose parents had to live through the Great Depression and WWII.

Also you don’t seem to get (or admit) that the housing crisis is not the result of some unstoppable trends, but is the result of government policies that inflate the price of housing. Change those policies and prices will go down. But people who have bet their futures on RE appreciation – we know who they are – won’t stand for it.

Yeah peak for vancouver looks to be 2016/17, before NDP got into power. Since over half the province lives there, that basically tells the tale.

“There is no reason co-ownership can’t work if you split a house up, and if does not work you have an agreement that sets out what happens in this case. Do a little research first before dismissing it as a potential nightmare. Sometimes you need to just focus on the benefits while covering all the risks ahead of times – if it is not for you because you don’t like living in a duplex arrangement that is different. http://spacing.ca/vancouver/2018/04/16/check-fostering-community-co-ownership/”

I have a friend that bought with another friend and it turned into a total disaster. The thing that killed it is that they didn’t have an agreement in place to deal with what would happen if it didn’t work out. They didn’t see a lawyer first, so when it went bad, it went really bad. Luckily my friend was – eventually – able to buy out the other one.

It could work, theoretically. Probably best not to do it with a friend tho, and instead make it a purely business relationship.

https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=3410015401

It’s been posted before, it’s where Leo gets his data.

How about a link to this data rather than announcing it piecemeal.

You’d swear some people have never seen a market cycle or opened a history book.

“Government elicits substantive control over the housing market, and RE cycles may….in some sense – perhaps…have an impact. Or, maybe not? Perhaps it’s actually random? We just don’t know.”

This is almost entirely about the RE cycle, and it always is. Similarly, government is a similar force as it is every cycle – either a dead hand or an amplifier, coming in with some idea either too little and/or too late.

BC RE was turning long before any substantive policy changes were made. If Christy Clark and her friends came back tomorrow morning, the housing market trajectory would not materially change. If it were that simple, elections could be held at any housing downturn and poof…all good again. We’re not here because of edge-nibbling social policy changes, we’re here because we preposterously overbid on housing.

Your favourite thesis, and it continues to be impossible. For any new readers contemplating this notion, understand that equity never supports a housing market – never has, and it never will. If equity supported high housing prices, then, the higher the housing prices, the more supported they would be. It’s circular logic in its most simplest of forms. In effect, there wouldn’t be an upper limit on prices, and housing busts would never occur.

What supports housing prices in a RE market isn’t equity, inheritances, and your sympathetic family members. What supports housing prices is liquidity – essentially, cash flow within an economy. And that is what dries up in a downturn, and that’s why equity (and resultant net worth) gets decimated during a correction. Anyone who doesn’t think so has their head deep in the sand, considering what we’re seeing spreading across this province as I type.

Only 1150 completions in the last 6 months says you’re wrong about that. Units under construction over the last 6 months has jumped by 800 too, that doesn’t exactly say above average number of completions to me.

edit: even if you add up the best 6 months over the last 2 years you can’t get to 2000 completions. So they’re definitely still on their way.

Not often I agree with you, but yeah, me saying people are gonna die is what it is. I’m gonna die too, hopefully not right away, but I know enough people who’ve died at my age in the last few years to know that it’ll happen whether I want it to or not (mid 30s, fentanyl, cancer, suicide).

The topic of inheritance and wealth transfer sometimes elicits strong emotion, I think, because we can see the ways in which this particular movement of money may serve to solidify inequalities of wealth, income, and opportunity.

LETS PROTEST – Not trying to attack you but it sounds like you are very focused on problems rather than solutions – and something is definitely wrong with your spreadsheets or you have a lot of unusual expenses.

If you have a family income of 200k and a 20% down payment you can buy a house up to 1.2 million. Buy one with a suite if you are worried about rates. Stay in place and prices will rise and your mortgage will go down. You will be fine if this is your scenario.

There is no reason co-ownership can’t work if you split a house up, and if does not work you have an agreement that sets out what happens in this case. Do a little research first before dismissing it as a potential nightmare. Sometimes you need to just focus on the benefits while covering all the risks ahead of times – if it is not for you because you don’t like living in a duplex arrangement that is different. http://spacing.ca/vancouver/2018/04/16/check-fostering-community-co-ownership/

Now imagine you buy a $1,000,000 home with another person that is divided or dividable into private spaces. Each of you only has a mortgage of $400,000. Your total costs of ownership is likely 2500-3000 a month. On a family income of 17,000 per month before tax you are going to be able to retire early if you stay in place. But again, with that family income you don’t need co-ownership, you can buy a house with a suite for 850k and pay your mortgage just fine.

If you have trouble owning a home and living on 200k a year in Victoria there are other issues at play.

Average time to build is more like 1.5 years. If that’s the case those units would have already been absorbed. Remember that most of the new unit sales are not even counted in the housing sales statistics on this site, as just MLS sales get reported. So a huge bump in non MLS sales might cause a drop in MLS sales even though we have an increase in total sales. It’s too bad we don’t see official monthly stats of the non MLS sales. Because maybe we are seeing more total sales than last year because of all the new house sales, and it’s just MLS sales that are down.

Totoro, moving to another city is only an option if you’re not in the tech industry, co-ownership is a solution that can turn into a nightmare and sometimes it is not even a solution, house prices are so high that even splitting a house in 2 it might not work for the average middle-class worker.

Even if you have a big down payment if you do so and commit yourself for the next 25 years you most likely will not retire.

I did a lot of math and even having a family income of 200k and a huge downpayment, buying a house and planning for retirement does not look very attractive, imagine for the average Victorian family that is making 77K.

This video is very interesting and scarily similar to what is happening in Canada:

It will take you only 7 minutes of your life:

https://www.youtube.com/watch?v=PSGp2Hh1jQ4&list=PLCDC316F0E2265D8D

This other one explains Credit cycles: (30 min)

https://www.youtube.com/watch?v=PHe0bXAIuk0

The real head-shaker is that at least two people here have read an incredible amount into what have uniformly been neutral statements of fact regarding inheritance.

And I will point out that precisely no one here confessed to a reliance on parental inheritance, early or otherwise.

And it isn’t in many families.

Whether a gift/inheritance of any size is ultimately a “good” depends to a large degree on the particular relationships, family dynamics, and personalities (of giver and receiver) involved. There are no absolutes as far as I can see.

Not sure if this is helpful but if I was just starting out now these are the things I would consider doing:

If I wanted to have kids/pets sooner than later I’d do one or two. The best value is likely co-ownership if you are able to navigate the paperwork.

Bingo. And the last part echoes what I said earlier:

For reference Oshawa (which is similar size and growth rate as Victoria) is currently building half as many housing units. London which is also similar size, but smaller growth rate, is building under half as many. Kitchener–Cambridge–Waterloo which is 30% bigger than Victoria, and growing at a similar rate is building half as many as Victoria.

None of these cities have ever had as many units going up as Victoria does right now.

Winnipeg is close at 5100 units under construction (15% less than Victoria), but they have over double the population of Victoria and are growing at the same rate.

There’s just the major cities in Canada that are building more housing currently than Victoria (Calgary, Edmonton, Ottawa, Toronto, and Montreal)

I get the sense that we’re over building…

No, Deb, you need a reality check. You seem to be confusing “expecting” with “deserving.”

I don’t deserve an inheritance from my parents. It’s their money to do with as they please, including upon death. And I’m fortunate not to be in need of money.

However, because of my deep powers of observation, I have good reason to expect to inherit some money in the future.

I don’t believe I ever said, let alone implied, any such thing.

My parents are both in retirement, seem to be having a ball, and have told me that they intend to leave something for me and my sibling—so, yes, I would be surprised if we inherited nothing.

Yes, although to be a little contrary, helping adult children get an education and a home early creates early security they benefit from significantly, as do grandchildren. As someone who did everything without parental assistance I can say that there were more drawbacks than benefits.

If you don’t have the means to do this that is completely understandable. If you do have the means and choose not to because you think you’ve done enough in paying for university and it is “your time” to blow the money this really doesn’t make sense to me in terms of family systems and the leverage and the support working together as an extended family can create. I mean, what is the best use of the money really?

We draw a line between future financial security assistance, health needs, and wants. We don’t pay for cars, phones, entertainment, eating out or gap years. They work and save for these things. We pay for reasonable local educational costs provided they apply for scholarships and apply themselves, gym memberships and second-hand bikes. They can stay at home as long as they want, for free, as long as they are helping out and working on a goal that this benefits, like saving up a down payment.

We’ve planned to help them with their first home already and they know the terms so they can plan around it. They can buy into our property and we’ll hold the mortgage, or we’ll match their down payment and cosign. If they have children we’ve offered to help with some of the financial costs and childcare already if we are healthy. It works to create a sense of security rather than entitlement imo. We have also planned to protect the assistance we provide for a home in the event of a future marriage breakdown.

Checked it out. We have over double the number of housing units under construction right now than we did 2 years ago. Between April 2017 and October 2017, 2932 housing units were started. So between now and the end of October, we’re looking at over doubling our current inventory.

“I have progeny. I guess it depends on what you define as ensuring their success. I define it as not handing them everything.”

I agree. My kids are very young and I already teach them about the value of work. I also try to teach them about privilege, luck, and fairness.

At the same time, with the way things are going, I am, right now, planning on setting my kids up for the future. I hope to leave them property and liquid wealth. They’re going to need it.

On the other hand, maybe I should just spend it all on a one way ticket to Mars…

I have progeny. I guess it depends on what you define as ensuring their success. I define it as not handing them everything.

What is the point in having progeny if you don’t want to ensure their success? Doesn’t make a lick of sense to me…

Good point in terms of social policy changes. The market has slowed partly because of these changes and maybe partly because of market cycles. My view is that what you actually have control over is yourself and there are always lots of opportunities and choices to create financial security for your family in Canada, and a stable place to live, provided you have your mental and physical health and you are willing to consider all reasonable options.

Sacrifice is a weird word (in general) when used in the context of giving up ex. a vacation to help pay for a child’s education or assist them in other practical ways. You’re right that it is not really a situation in which I’m giving up something I value for this, more like it seems like the logical choice.

Agree that non-monetary support is super important. Not sure about your much more monetary support being counter productive. That is an idea you were likely raised with and may have seen negative examples of “spoiled” children, but it doesn’t have to be that way and isn’t in many other cultures. Cultural norms in North America and the odd focus on individualism and self-sufficiency doesn’t seem the best way imo if you are an otherwise mentally healthy bunch facing, ex., an extremely expensive housing market.

Things are different for each generation. My parents also left school early and found jobs. They had a nice home in their 20’s and we were all secure and happy. However paying for further education of any sort was not budgeted for. If we wanted it we paid for it.

My children’s generation expect to continue to college or university. The possibility of apprenticeships still exist but working manually for a living is not so popular now. So it is 4-6 years of uni after graduating school, oh and let’s not forget the gap year usually funded by Mum and Dad too.

So after paying for 12 years of university, nope I don’t feel any obligation to pass on wealth (I wish). If there are pennies in the pot when I kick the bucket my children are more than welcome to it but I don’t plan on pushing up a daisies any time soon.

And that is all I am trying to say. Some inherit, some don’t, but no one should rely on their parents early demise for their future security.

Yeah but let’s not pretend we aren’t radically privileged here. You don’t have to sacrifice a lot because I imagine that blowing money on expensive things and vacation isn’t what you (or I) would do even without kids.

I got 20k for university and 25k for the house from my parents. I expect to pay more for my kids, but much bigger support you give is non-monetary, and much more monetary support is counterproductive anyway.

lol exactly! Was thinking the same thing as I read along. Beancounter for the win 🙂

I talk to my co-workers with houses who say they couldn’t afford the house they’re currently living in if they had to buy it now instead of 10 years ago. Doesn’t seem like a sustainable situation, especially considering many of them make way more now than they did 10 years ago.

Sort of. Complaining about it yourself is not going to change it. But a society “complaining” about it is the reason our current provincial government has a radically different approach to housing policy than the last one. And arguably their policies are quite effective at changing the market so far, although of course there are lots of other factors

Which is exactly what is occurring in Vancouver right now.

We’re also months away from the start of the of the biggest completion rate of inventory in the history of Victoria that will likely go on for a couple of years.

Our low inventory issue should disappear shortly.

Except for some types of housing prices don’t stall out when they exceed income-based affordability.

I think the market is divided between housing that is linked to income-based affordability, and housing that is now supported by equity, inheritance, and family assistance as almost no-one could afford it based on incomes alone. Much of the core SFHs are in the latter category now and have been for some time.

The two are linked through the use of equity from an income-based purchase to move up the property ladder to a home in which you could not afford based on income only. If interest rates rise all types of housing gets affected because when you move up with equity and still need a mortgage qualifying at a higher rate limits you just as it does when you are a first time buyer. In addition, even if you have equity, when prices stall or decline you are more likely to stay put due to the impact of consumer confidence.

In other words, striving to provide your children an opportunity to enjoy a similar standard of living that you have enjoyed?

You seem to be equating the idea of providing the younger generation a similar or greater opportunity that you have presumably enjoyed with something that is owed (a “lifestyle”) other than the opportunity itself and the potential that it could provide given an input of hard work. Those opportunities are shrinking along with their potential. Debt and wage trends are very telling. Yes that is life, and this generation will need to deal with it and adapt. At the same time they should not take it lying down. If the current trajectory continues, history says they will not.

“A little reality check for the millennials. Your parents worked hard for their cash and you should not expect anything from them when they die. They looked after you, fed you, loved you and if you were lucky they paid for your education. If they have nothing left when they go, too bad.”

Except that often times the boomer wealth wasn’t just created from their own hard work. Often times, they themselves inherited. So, what about that wealth? Do you think there’s some kind of moral obligation to pass that on?

Also, I don’t think many people would deny that things are harder for today’s young than they were for the boomers. My dad dropped out of school in grade 8 and my mom had a high school education, yet they managed to buy a SFH near the core in a desirable neighborhood by the time they were 21. That simply can’t happen now, unless there is a lot of help from parents. Just watch any movie from the 80s with Chevy Chase to see the difference between the middle class in the 80s and the middle class now.

The idea that the boomers earned it “fair and square” misses something. They were born at a time of unprecedented wealth and opportunity. What I’m saying is that the boomers weren’t especially hard working or smart, they were just especially lucky, in some ways at least. That being said, in the history of human efforts, I suspect that where we are now, the struggle, is what is normal. Things have never been easy for humans, we struggle, isn’t that what defines us? We have returned to normalcy.

In my opinion some of the younger people have too high of expectations with regards to their first properties. IF you are in a position to buy, buy what you can live with for 5 years, and expect to move up. There are a few people that seem to want their first house to be their forever house, and keep waiting and waiting, and prices keep going up, and it gets further and further away, especially over the long term. When we moved to Victoria I was prepared to buy a 3 bedroom apartment condo in Esquimalt, wait to build some equity, and then, maybe in 5 years move up. We got lucky with our purchase, which many others our age overlooked. Anyway, sometimes you have to settle. And of course this does nothing to help the genuine and legitimate concerns of those who are so bogged down by student loans and rent that buying a modest condo is out of reach.

Ugh. I think being a parent is a privilege and the responsibility does not end when your child turns 19. I would never “have a ball” spending it all on myself. Having a ball for me is helping my family in any way I can.

Too few restrictions on capitalism paired with the lack of critical thinking by voters who elect politicians who have incentives to remove restrictions on capitalism… lather rinse repeat.

That’s how we’ve ended up with executives making an average of 361 times more than their average worker, up from ~20 times in the 1950s (https://www.forbes.com/sites/dianahembree/2018/05/22/ceo-pay-skyrockets-to-361-times-that-of-the-average-worker/#7cb9f8fa776d).

Give me a break. Your parents will be providing you with the same opportunity? Social factors and the actions of the larger economy, including its links to the global economy, are not within their locus of control friend.

What is within your locus of control is planning for and assisting your children even when they are adults, especially if you have benefited from the run up in housing prices yourself. If you want them to be able to stay in Victoria and own a home start thinking about how you can help now. They likely will need help with a cosigner or down payment.

I have zero respect for a culture that makes bumper stickers about “spending my child’s inheritance”. I also have zero respect for a generation that believes that they are owed the same lifestyle as their parents. If you choose to have children and housing in your area has become unaffordable, again, stop complaining and start planning to address this economic barrier and think about using some of your wealth at the age and stage when your kids need the leg up.

If you are someone without parental help or inheritance, which was our situation, maybe the core of Victoria is just not the place that works best for now. Complaining about it is not going to change it. Maybe Langford/Colwood or other less expensive locations are where it is going to work to start. There is no right a single family house and affordable SFHs in the core for a first time buyer don’t exist as far as I can tell.

What has happened in our housing market is not the result of unchecked greed imo. It is the result of a desirable location and tax policies and financing that favours the purchase of primary residences and makes it a logical choice for people in desirable locations. This has led to appreciation as demand increases and appreciation has built consumer confidence in this type of investment. Hard to topple that without radical changes in tax/financing policy and/or a big drop in the market that decreases confidence.

As you should be frustrated, and yes your generation should be protesting en masse. Marko asked what you expect in terms of opportunities for accommodation. That’s an easy one: At least the same opportunities that your parents had. With every generation in this country there is an inherent expectation that your parents will provide such that your opportunities and potential will exceed theirs (or remain equal). I know that is my hope for my children. Your generation is the first in modern history whose standard of living will be less than the previous generation:

https://www.theguardian.com/business/2016/feb/14/economics-viewpoint-baby-boomers-generation-x-generation-rent-gig-economy

A tough pill to swallow. Some here believe that the future will hold only more of the same, but I can’t see that happening. The incredible wealth inequality is not, by and large, being fuelled by economic prosperity. A great read on this topic is The Great Leveler by Walter Scheidel.

I may be in the minority, but I did not find your previous comment intentionally racist. There is extreme frustration out there, and there should be. Unfortunately it is not always channeled toward the rational or positive. This same frustration is why our southern neighbours have an orange-headed buffoon leading the free world. Take the backlash with a grain a salt and consider the source. I find it amusing that the blog’s resident living, breathing Remax sandwich board will not hesitate to exhale rainbows if there are attacks made against his sacred cash cow, while at the same time championing a state of affairs that is so detrimental to our communities. Financial insecurity is a terrible burden for any young family to bear, but you will hear no sympathy from his side of the fence on this issue. There’s no profit in it. Greed is an ugly thing and has little bound. As an example of leaving their mandate unchecked, look no further than Vancouver – the city has been effectively eviscerated by materialism and astronomical inequality.

On another note, as Local Fool has already commented, the conversation here has taken a turn for the pathetic. Hand-rubbing over the financial consequences of old folks’ deaths – just a head-shaker. Just a sign of the extreme environment I suppose.

A little reality check for the millennials. Your parents worked hard for their cash and you should not expect anything from them when they die. They looked after you, fed you, loved you and if you were lucky they paid for your education. If they have nothing left when they go, too bad.

I don’t expect anything, and I have more than enough for myself but I literally can’t get my parents to spend. I’ve been trying to get my dad to retire for 5 yrs as financially he doesn’t have to work anymore and building houses (I have to do the administrative stuff as he is not computer literate) stresses the **** out of me, but if his health holds up, I can’t seem him retiring before 80 or so. He is used to working 6 days a week and not spending anything. Happier on a construction site than sitting at home. Still can’t get him to sell his Bobcat, dump truck, or any equipment.

If you parents are 60 and they’ve used their house as an ATM for the last 30 years, then they are probably living you with nothing. I’ve seen that scenario too but that will be the difference between those buying a house in Fairfield/Oak Bay in 25 years and those that are not.

I agree with you Deb but it’s not how a lot of people work. People who have lived frugally all their lives don’t tend to suddenly start spending money in retirement even if they could. My parents are the same as Marko’s. They could be spending more money, and I always encourage them to, but they don’t.

A little reality check for the millennials. Your parents worked hard for their cash and you should not expect anything from them when they die. They looked after you, fed you, loved you and if you were lucky they paid for your education. If they have nothing left when they go, too bad.

You have your kick at the can now, so if you really think parents should scrimp when they get old so they can leave you some cash I suggest you work at doing the same for your children. However, don’t be surprised if your own parents have a ball after retirement and leave you nothing.

You might not be in the right boomerhoods 😉 Marko.

Check this web site where the boomers go: https://www.financialwisdomforum.org/forum/

Sorry about my comments here, I’m just super frustrated with the situation, things are so expensive that my generation is delaying their lives and losing hope.

It is unbelievable that it got to this point, I’m seeing 700K 800sqft condos in Victoria and the math does not add up.

Something is crushing the middle class and turning us into slaves. If we don’t start protesting things will get really ugly in a few years.

In your opinion what should a middle class family be able to purchase in terms of accommodation?

ya … not every one tends to spend … many parents main goal is to pass wealth onto the next generation …. especially true in Asian cultures

love how people talk about boomers and millennial..who cares about YEAR branding … the next group of people who is going to pass on wealth is AGED 70 to 85.. and there is quite a lot of those sticking around…

If wealth was the primary factor we would expect to see prices continue to appreciate and not have such a strong relationship with income-based affordability.

Fixed inventory will be the biggest factor imo. In 25 yrs it will require huge incomes + inheritance in order to be lucky enough to secure a limited inventory of core SFHs.

think outside of the box .. now people can die faster due to lack of physicians, doctors, health professionals

Don’t be cheap, get her a Tesla. Or an eTron. 🙂

It all sounds very logical. And of course those people are buying single family homes. But still, when income-based affordability gets bad, the housing market stalls out. If wealth was the primary factor we would expect to see prices continue to appreciate and not have such a strong relationship with income-based affordability.

Yep, that is why the long term super-trend for single family affordability is that it gets steadily worse over the multi-decade time frame. So right now we will likely see improving affordability, but it will not likely get quite to the point where it was in the last bottom (2013).

The hard thing about wealth stats is that we get about half of the articles about wealth talking about how boomers are carrying more and more debt and are increasingly having to work longer, and the other half are about how they have record wealth. Both are correct depending on which end of the curve you want to focus on.

To really figure out impact on Victoria would require more specific data about existing elderly owners in Victoria and millennials in Victoria. Do the older owners have kids here or will they move here when they inherit? Do the millenials who live here have wealthy boomer parents from here or are they from lower priced markets?

In the end I suspect this won’t be a big impact either way. More wealth floating around, but also a more elderly population that increases turnover. Will probably roughly cancel out compared to larger cycles.

SFH owning baby boomers are not moving into condos, now or in 10 years. My parents (60) and their peers have been in the same house for 30 years, and as kids move out they just fill rooms with more stuff. I only know 1 couple in their 60s moving to a condo, and it’s purely because of mobility issues that have hit them early. I know of many more who are staying put or just moving elsewhere to other large houses with stairs to be closer to grandkids or to snowbird to the states. The belief that boomers are going to vacate their SFH properties and make room for new families is a myth. Boomers want their square footage whether its utilized or not.

+1

I’ll host an open house a 1,200 sq/ft condo and single boomers will come in complaining about lack of space….people have so much crap. Boomers downsizing to condos is overplayed in the media in my opinion. Some are, but most aren’t.

We are the younger boomers (around 60), what we heard and read from friends with similar age or older and financial blogs full of boomers are “how to die broke” and “what is the best withdrawal methods to use up all the money before the end”. blah, blah, blah …

Not the boomers I know. When I go to Croatia, I stay in my luxury condo and rent a Tesla for transport. My parents on the other hand (61 & 60 yrs old) take the bus around and work on their house in Croatia because they are too cheap to pay for a rental car and too cheap to pay for workers. They have a net worth of a few million but getting them to spend anything is very difficult. They still rent their basement suite and they paid the house off 15 years ago. Last year they wanted to fix their 2001 Civic, I had to step in and get my mom a new car.

I just can’t see too many boomers going out and getting reverse mortgages, etc., to milk their net worth down to zero before death. There will be a lot of people out there with some massive inheritances as you have a lot of single or only two children situations with boomers.