April 29 Market Update

Well, we had one more week to jump out of the sales slump and perhaps pull off at least a match to last year’s already middling sales total, but it didn’t happen. At this point I’m ready to call this year’s spring market as more or less over. A few weeks this year we pulled off some solid numbers and I thought we might see a small bounce back from the big stress test hit we took last year, but it didn’t happen. Just more slow melt in activity every month. Yes we will see more sales in May than April like every year, but the bounce back that many in the industry were hoping for is not happening this year. Neither are significant price declines, but you shouldn’t expect those in the spring market until market conditions get significantly worse. In the spring you will see opportunistic sellers list and the well-priced properties will sell while the overpriced ones get de-listed. The serious sellers will hang on into the fall and that’s where we see price declines usually happen. Remember this is not yet a real buyers market, so the most motivated sellers are still only found in the slower seasons.

2 more business days means we’ll probably see about another 60 sales or so. If we’re really lucky we might hit 700 but I doubt it.

| April 2019 |

Apr

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 136 | 310 | 479 | 622 | 774 |

| New Listings | 346 | 681 | 980 | 1302 | 1291 |

| Active Listings | 2517 | 2598 | 2649 | 2749 | 2002 |

| Sales to New Listings | 40% | 46% | 49% | 48% | 60% |

| Sales Projection | — | 735 | 715 | 685 | |

| Months of Inventory | 2.6 | ||||

Agents are increasingly motivated to facilitate sales out there because the times where anyone could sell anything are at an end. Even though prices are substantially higher than in 2016, sales volume is down by nearly 30% from that recent peak. That separates the wheat from the chaff, and as usual in a downturn, the number of registered agents will start dropping slowly.

On the rates side, the Bank of Canada decided not to raise last week which was to be expected. As I’ve been saying since they started tightening, the economy is too dependent on easy credit and cannot tolerate big increases in interest rates. With the stress test in place that becomes even more true, with every increase in the benchmark rate disqualifying more borrowers. At best we will see a very slow grind upwards in rates over years, but with signs of the artificially boosted economy down south losing some momentum, I wouldn’t be surprised if rates even dropped at some point late this year or next.

Moved to new forum

Preliminary look at the month’s numbers: https://househuntvictoria.ca/2019/05/01/april-lower-sales-stable-prices

Since this is related to housing in BC…

https://globalnews.ca/news/5215614/money-laundering-canada-bc-casinos-whistleblower-journal/

I’ve actually said similar things multiple times, albeit I don’t try to put it in those insulting terms. My aim is not to belittle those who are calling for declines currently**. But it is a fact. If at any point in time there is some person calling for a decline in RE prices mostly that person will be wrong (upward trend to prices) but occasionally the person will be right. When someone is finally right it is genuinely hard to say if that person had genuine predictive skill or merely dumb luck.

For another example: There is always an economist somewhere calling an imminent recession. Mostly they are wrong. Occasionally through luck or skill an economist gets a recession call right. When they do they start raking in the big bucks and basking in fame. (See Roubini, Nouriel for ex.)

** Especially since I too believe some price declines are likely.

There’s been people, even a few months back, saying that Victoria had amble room to get more expensive because it’s so much cheaper than Victoria. Don’t know how you missed those.

Well put, LF. We’re all subject to confirmation bias, but I think individual risk tolerance also plays a role in our leaning towards either the bear or bull camp. I’m certainly no property bear; I’ve owned real estate since my early 20’s and have, to date, made out like a bandit. From the vantage point of my 50’s, I cringe at the amount of risk that I, without recognizing it, accepted. There is nothing normal or organic about the performance of real estate in Van or Vic over the last decade or so; I don’t think any of us currently have the tools to envision where the market goes from here. That kind of uncertainty makes me throw up in my mouth a little bit, and I don’t even have a mortgage.

I found it interesting watching the Twitter thread #VanRE. I remember it in 2016 and 2017 – constant flaming between opposing modes of thought. One side was accusing the other of being blind and ignorant, and the other of wealth envy and desperation.

I remember when the market shifted, the latter group said similar things that one or two posters on HHV say now. The shift was small, it was nothing, prices haven’t moved, it’s your only chance to get in before 1.5M turns into 3M, etc (they also added the “it’s still cheaper than X city in another country”, a comment that is rare on HHV). Then the market picked up again, and I remember one post showing a month worth of data exclaiming, “We’re back, baby!” Of course, we know what happened shortly thereafter.

I didn’t check the thread again until recently. You should see it now. All of that is gone. It’s essentially a lurid display platform for people losing huge sums of money, political activism relating to fraud, updating laws or enforcement of existing ones, Airbnb and the odd posting from a realtor or developer. Not one cheerleader to be seen.

Curious to see what happens here. The cheerleading has definitely died down and is becoming more cautious and conditional. Still haven’t heard the sarcastic, “wow, you’re so smart, being wrong for ______ years and now by chance, you (just might) be correct.” Someone will post it, eventually.

https://twitter.com/hashtag/vanre

I enjoyed reading all the well reasoned arguments as to why house prices should be declining in Victoria. I am not yet seeing much in the way of price movements in the core or at least in the few areas that I am keeping an eye on. That could easily change.

There are a couple of points that I do question including the repeated statement that house prices have to reflect local incomes. Things might well change in future years but Victoria seems to still attract a lot of out of town purchasers. Best numbers I have seen is that over half the purchases of SFH in Oak Bay are out of town retirees. I agree that the numbers will probably decrease in the next few years but I am not sure that there is going to be enough inventory of SFH on the market that will induce major price drops.

I did a very quick, inaccurate count of SFHs in Oak Bay and there seems to be only 80 houses on the market including a dozen in the Uplands, That does not seem to be enough to move the market considering that they are still selling at top dollar. But that could change and it should be interesting to watch.

I suspect the market crash is simply waiting for us to put the house on the market.

There was occasionally been some good info on VREAA. But I have to admire them keeping their previous predictions online.

A cautionary tale, not about the bear case, since real estate markets do decline, but about being overconfident in predictions about the future

https://vreaa.wordpress.com/2012/05/31/premature-calls-of-bottom-awesome-deal-bears-might-just-be-missing-yet-another-correction/

https://vreaa.wordpress.com/2009/12/27/prediction-for-the-coming-decade-a-real-estate-bear-market-will-be-vancouvers-defining-social-and-economic-event/

Patrick is a logical bull. He backs up his position with facts and stats and is a good balance to have in the comments section IMO. It took me a bit to get use to him but that’s because i want house prices to drop and i didn’t like the fact that he makes some reasonable points as to why they may not and i don’t like that haha. This site would be boring if everyone was saying the sky was falling on house prices. i like the discord.

I learned something important from Patrick on this site. If you find that someone rubs you the wrong way, then you are free to pass by their comments without reading them.

😛 haha.

Time will tell. In a year we will all look back and ?????????

Is Hawk’s Revenge the same person as Hawk? Awesome name.

Isn’t that adorable? The bears are having a pep rally!

Funny how, a few years ago, when basic Vancouver properties were selling for nutso figures in no time flat, nobody here ever bothered to mention how close in proximity Victoria is to Vancouver. But now that Vancouver is busting, oh the geography lessons don’t stop!

I don’t think that’s your typical Calgary-to-Victoria retiree. I know a handful of people who made the move, and almost all of them brought a lot more than $400K to the table.

Can I get an ascii data table while we’re at it?

i thumbs up and chuckled when i saw the name

Bear trifecta complete. 😀

No bubble ever has a soft landing, has never happened in history. Bubbles like this blow up huge because buyers stop buying as the long awaited disaster is finally upon them. You permabulls are totally clueless and are in for a world of hurt.

Toss in social media exposure and this pig will implode in the ugliest of all hard landings. FOGB = Fear Of Going Bust.

Matthew, my thoughts exactly.

Cheers.

https://www.bnnbloomberg.ca/vancouver-s-openly-hostile-housing-market-closer-to-significant-declines-warns-pimco-s-devlin-1.1251528

I think that the Victoria benchmark price for a single family house will drop about $7,000 per month for the next year. Maybe not this exact figure each month but, by this time next year, it will have to dropped by about $84,000. So, if you want to get a good deal on real estate, all you have to do is WAIT. Every indication is that prices will drop:

By all accounts, big sister Vancouver (less than 100 kms away) is in trouble. Sales have dropped off a cliff there, so money cannot get out of Vancouver to buy Victoria RE with. So that will affect Victoria prices moving forward, it has too.

Chinese money has also dried up big time. And for those that can sneak investment money out of that country, they are no longer looking to the west coast because of the implementation of several new BC tax laws. Instead, they are looking east to places like Montreal and Toronto, so says the news reports.

The BC Gov’t is already starting to take a more detailed look into the money laundering issue which will not help Vancouver prices. And Victoria prices are inextricably intertwined with Vancouver prices, IMO.

The Stress Test continues to make it hard for people to get big money loans. So if you curtail money lending, that has to have a deleterious affect on prices, eventually.

Builders and Developers are slowing down on their building projects. That will affect construction jobs, realtor incomes, lawyer incomes, mortgage broker incomes, furniture store profits, and many other related incomes. In short, the BC economy is probably going to take a downturn which will further affect RE prices.

People from Alberta and Saskatchewan (BC’s Number 1 retirement customers) don’t have very much money anymore to move out to the west coast and retire with. This is due to the ongoing slowdown in the oil patch. Plus, there is just too much disparity between west coast RE prices and prairie RE prices. By the time a Calgary couple has completed their careers, and sold their house for $400K, they are only left with a deposit for a west coast home. So it’s just not feasible anymore. Maybe an Alberta couple could retire in a smaller town in the Okanagan where RE prices are more affordable, but the west coast seems out of reach now.

Prices are starting to come down in many big cities across the world (London UK, Sidney Australia, Manhattan USA, So Cal, etc) and Victoria is not immune to a global real estate slow down.

Regarding the argument that “they are not creating any more land on the west coast”, so this is one reason why prices are so high, I don’t really buy this argument. You could fit a city the size of Los Angeles (with over 10 million people) just above Sooke. Looking at a map, you can see Victoria and Sidney are located in a small peninsula area, with an huge attached island (half the size of England) just above it. So there’s plenty of room for expansion on Vancouver Island, if there was a will for this kind of thing.

I believe that it’s true that many Canadians would love to move out to the island where the weather is much better than the rest of Canada, but that’s not going to happen if prices remain out of reach for 95% of the population. But maybe that’s what islanders want: a nice quiet community.

Anyway, those are my thoughts …….

The numbers don’t lie:

-Listings soared and now sitting at 37.3% higher than same time last year

-Sales tumbling week after week, month after month: down 20% from same time last year.

The “hot” spring selling season was, as predicted, a total dud, disaster, failure, devastation, …………….you get the picture.

But, on the bright side, Vancouver was worse. Here is my fav of the day:

https://www.bnnbloomberg.ca/vancouver-s-hostile-housing-market-nears-significant-declines-warns-pimco-s-devlin-1.1251528

It’s not nail biting time, it is time for capitulation. The regulations [stress test, foreign buyer’s tax, vacant house wealth tax, …..] will not be softened. The Fed Budget [CMHC aiding with down payment] will do nothing to slow this or reverse it.

Anyone interested in catching this falling knife? Sellers remain out of touch. Local incomes set local prices. Devlin speaks of the risk [which is a certainty, not a risk] of the foreign owner selling. It is not a question of “if” – and the “when” is happening now and will escalate because these folks looking to launder or hide the cash from their own governments are at risk of just that, plus prosecutions. They now know they have to sell to locals who don’t have $2M sitting around and banks won’t or can’t lend. Next: the home ownership registry will be live and there will be nowhere to hide. Victoria will be struck twice: (a) lower volume of Vancouver sellers migrating here and (b) local foreign buyers looking to sell and get out.

Buyers: do NOT be in a hurry. FOMO is dead and gone. The recent history of the luxury market will play out in the upper-middle and middle. Cool your heels; another bus will be by soon. We will not see more sales in May than April, contrary to popular view. Don’t put the cart before the horse: sales drops and increased listings MUST come before price declines [not the other way around and not contemporaneously]. February GDP was negative – we are primed for a recession. Cutting rates a quarter point, or more, will not prevent it. We need the Liberals out of Ottawa and we need to tax real estate speculation to the hilt.

Thanks, Leo. I expect you to be a full convert by mid-summer or fall.

Tell you what. If you nail this, I’ll let Barrister take me out for lunch.

May 22

Just noticed the inventory – 2749

Creeping up there. When do you think we hit 3000? End of May?

Edit:

Last May inventory increased by just over 200, so might make it.

2017 May inventory is kind of shocking: 1896

Looks like a drop of 2% from June last year so far in wages. Number of people employed has gone up, but hours worked per person has dropped 4.5%.

It’s not the case for BC either. Wages in BC did see strong growth lagging the upward explosion of the housing market, but they are trending negative at this point and have been since the fall of last year. This is true whether we measure in current or constant dollars.

http://www.bcstats.gov.bc.ca/Files/9bf727e9-f34c-407c-b0a4-07720ddfbb1a/EarningsandEmploymentTrendsData.pdf

Considering the vast majority of the province lives outside Victoria, and the major employer in Victoria is government (which hasn’t given anything close to 4.1% in a decade), I don’t think this tells us as much as you think about Victoria.

Doesn’t seem to be the case in the US right now which has had low unemployment for at least half a decade, and under 4% for the last year with low wage growth.

*Anglicized, “cat sank”.

If it weren’t for ^ explanation I wouldn’t have got it and would have had to ask my partner for help :/

Low prices in Phoenix and Vegas didn’t stop those markets from being the worst in the country in 2009.

Trois, Quatre

Um, because basic properties in good areas became worth $3.5M in Vancouver, and nothing of the sort happened here.

Cadborosaurus,

I understand what you are saying, and you are not one of those to whom my earlier response was about (see my post wrt Leo’s comment).

About lifestyle I had in my early 30s? I was a grad student in UVic, alone without family here, no car, rented in a basement suite with my young son, rode bike to send him to daycare in rain and walked with him to stores carrying a little chair (so he could sit on it on side of road whenever he was tired of walking). Bought an old Plymouth for $800 when I started working, and lived in the 1st floor suite for a while after bought my first house. I knew it was a privilege (not a right) to own a home and I knew that I had to make lots sacrifices to make that happen, in addition to hard working, so I did.

Agreed that things have changed lots and the housing market is much harder to get in now. So to buy outside the core and have a rental suite or to co-buy with others as suggested on this bog all become necessary options, I would do so if I was a millennial with limited resources but really want the privilege of home ownership rather than renting …

Good one.

*saves in dad joke bank for when the kids start French *

Beat this:

There were two cats – one was named, “One Two Three” and the other, “Un Deux Trios”. They decided to go to the pool to see who could swim the fastest. They both jumped in, and swam like mad. At first it was close, damn near a tie.

Turns out, One Two Three ended up winning. How come?

…Because the Un Deux Trios Quarte Cinq*.

*Anglicized, “cat sank”.

Biking from thetis would definitely be less daunting. Our workplaces have showers and bike racks and with the crawl right now, I wonder if it’s even faster to bike?

Thanks Viola I have friends who’s youngest started kindergarten this year too and they are also over the moon excited about not paying for childcare. Nice to know it’s a temporary cost in our lives. The fact that we have full day kindergarten in BC is wonderful too. Au pair is a great idea if you can swing it. We really lucked out getting the childcare space we have that works with our schedule, and quality for some subsidy under the new govn’t fee reduction programs which im super happy about.

2018, wage growth 4.1% in B.C. as reported by the NDP in their 2019 budget. https://www.bcbudget.gov.bc.ca/2019/economy.htm

With Victoria unemployment @ 2.8% 2nd lowest of any city in Canada, and 1st lowest of any coastal city in mainland USA/Canada, I’d expect that to continue this year too, at least in Victoria. Low unemployment is a strong driver and predictor of wage growth.

+100

School age does make it cheaper. After school care is a bargain compared to full time day care. Hopefully one parent can start work late enough that before school care is not needed. Of course there are the inevitable days where the kids are sick and someone needs to stay home and the calls from school that your kids have injured themselves on the monkey bars.

Of course people pull this off as single parents too, which must be damn hard.

I feel ultra lucky that school, work and home are all within 10-15 minute bike ride for me. Adding a big commute to the mix would not be fun.

Sorry LF. It was meant to be absurd. A possibly lame attempt at humour. And yes I realize that none of the “bears” are saying that Victoria RE will decline to match the prices in Rouleau, SK.

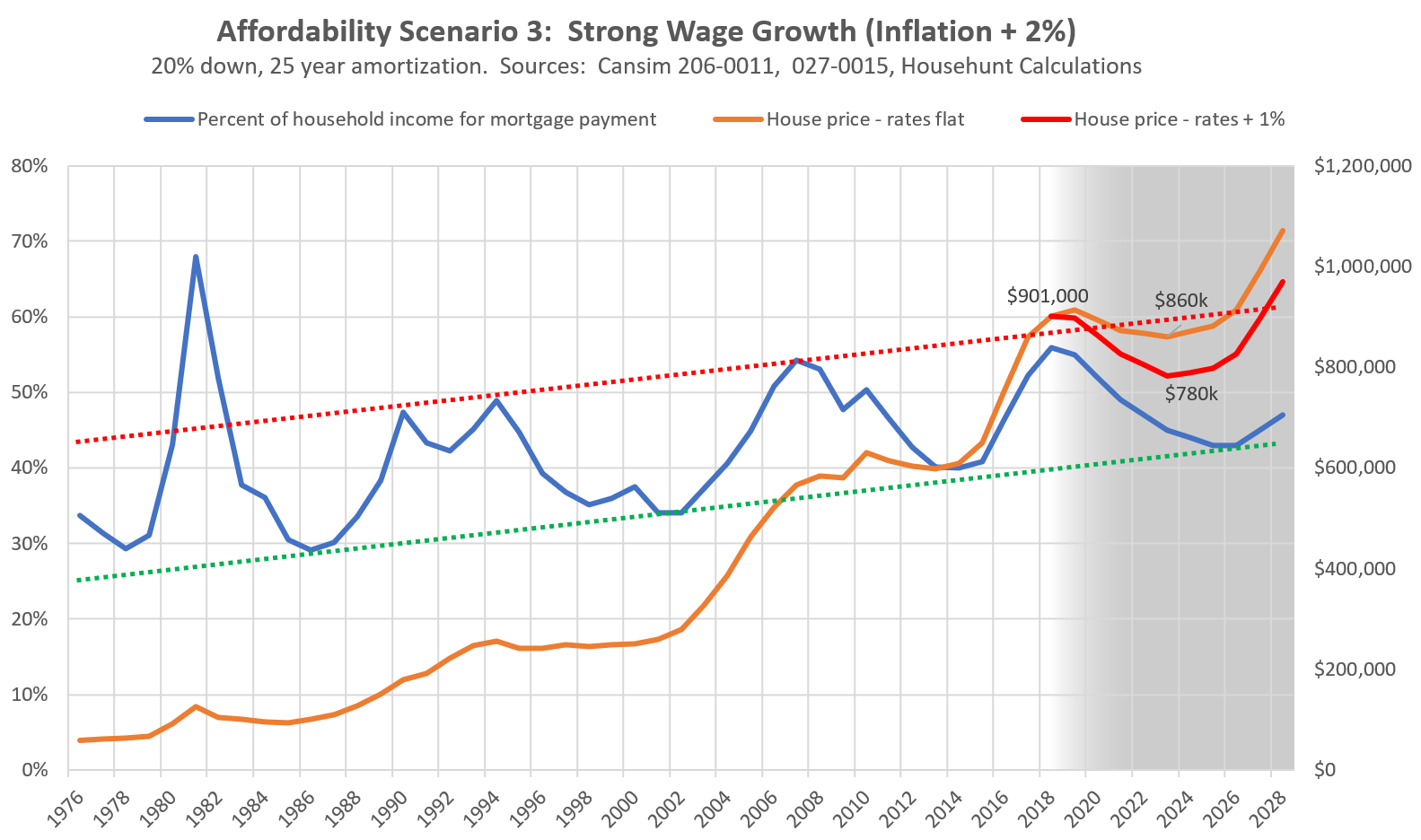

That’s the strong wage growth graph.

When was the last time that happened here?

I work with a couple people who drive to thetis and then bike from there. It’s faster for them than dealing with the highway.

Two parents working f/t with 2+ young kids and no family nearby is very challenging. To anyone out there doing it, let me tell you what no one told me: it gets easier when they go to school. Our youngest is starting kindergarten in September, which I’m looking forward to. We are cuspers – the oldest Milennials or the youngest Xers. If you do move to the Westshore, with kids, try to get an extra bedroom because I know one thing that has worked for some families, and is affordable, is an au pair.

Why not?

University Heights redevelopment on hold as owner crunches costs

https://www.timescolonist.com/business/university-heights-redevelopment-on-hold-as-owner-crunches-costs-1.23804291

Also, I wonder when Hillside Mall will find a new tenant for Sears. Seems to be taking a while.

Penguin we are renting in town so a little different than the situation you’re asking about but the plan is to be purchasing in Langford at some point. We make it work right now (trying to save more) by sharing childcare. I work a flex schedule so 4 days @ 10hr days, 1 day off. On my day off I watch my child and my friends child and they do the same for me on a different day. So we are only paying for 3 days of childcare vs. 5, saving thousands a year. We will try to keep up this schedule when we move. I have a feeling it’ll get messy with more kids, school etc but it works very well right now. One of us takes the bus to work the other drives or bikes, but commuting from the boonies and dealing with daycare / school pickups will throw this out of whack. I really hope they finish that overpass soon and add rail and a seabus. I have friends in the Westshore who have kids in daycare for extended hours, who have grandparents watch them, or who work flex or p/t while the kids are young and not yet in school. We don’t have family here and working p/t would not allow us to buy a house so I’m not actually sure what our plan will be once we get out there, hope i can still afford cheese.

With the “rising interest rate environment” peg recently chopped off, bears are hanging all their hope on the “Vancouver is collapsing; therefore, Victoria will too” peg, which is not that solid of a peg, IMO.

Freedom:

No one has said boomers didn’t work hard. But you really need to get your head out of the sand (especially with a renting millenial child) if you think it’s just a matter of ‘working harder’ nowto attain the same lifestyle you had in your 30s or that your situation even remotely compares to what millenials are faced with in today’s housing market (and job market, post secondary, childcare, pensions, etc). To sum it up, it’s a hell of alot worse now. https://www.gensqueeze.ca/its_harder_now

I ‘complain’ about my ‘entitlement’ because it is actually working to adjust the playing field. Government interventions have stopped prices from climbing even further out of reach and in some areas those prices are decreasing. We wouldn’t have policy changes like foreign buyers tax, the stress test, PTT exemptions for 1st time buyers etc. Without people raising issue with our current market conditions and voting for progressive policy makers at all levels of government.

2 working adults with post secondary, stable good jobs and kids should have an expectation of being able to buy a home within a reasonable commute to their work after saving up a downpayment. If you want to call that “entitlement” so be it but please have some self reflection on what’s changed in the past 30 years.

Vancouver has it’s own unique level of insanity. It’s a given there will be a significant correction there since it is already well underway.

One of the points I have tried to stress is that the arguments on both sides never change. I’ve posted stuff from 100 years ago demonstrating this. Heck I could probably go back and find stuff from ancient Rome if I was inclined. I only started speaking out when I felt like we were seriously overdoing the leverage thing. I deserve no credit for it as IMO, it wasn’t hard to see.

Don’t appeal to reductio ad absurdum to make your argument. I doubt there’s a single poster or lurker here that expects this market to be “cheap” unless they’re blind or completely misunderstand this market. What it actually means to “bears” (or basically, people paying attention) is that affordability in the market is likely to improve, and people can once again purchase homes in an environment that is fiscally sustainable. That is not the state of the market now, and you’re well aware of it.

There are some places in Vancouver right now that are being sold for 2011 prices.

And even other people who were bearish couldn’t stand it.

It means:

Clever bears think they gonna buy houses real cheap in a couple of years.

It is possible that you are smarter than the other bears who have been saying those things since 2007. Since now they actually appear to be happening.

It is also possible that you are just lucky. You showed up saying a lot of the same things bears have been saying forever just around the time they finally started happening.

I’d guess a bit of lucky timing with when you showed up and a bit of smarts and market understanding. Certainly you are the most articulate “bear” we have had here. Reading Hawk or Info you could practically feel the flecks of saliva hitting their screens.

It did drop for a couple of years there 2011-2014. Hard to take into account money laundering on a massive scale though.

But was there a bloated pig involved?

True, but of the people raiding their equity, a great deal of them decided to dump that into Vancouver condo presales, not homes in another city. It’s one of the reasons among a few that I believe that market is in so much trouble. So many people not only never intended to close on the units – they actually can’t afford to. That didn’t occur nearly as much here, thankfully.

Victoria only briefly served as a pressure relief valve, as well as an “oh look, another future Vancouver so let’s buy everything” market.

If you look at LeoS “scenario 3” graph (see post below), you can see how 10 years from now, in 2028, Victoria can have both…

– nominal prices are up 20% (orange line),

– and affordability has improved to the cheapest part of the range (blue line)

If that happens, someone buying a house today for $1m (with $1m mortgage), in 10 years would own a house worth $1.2m (orange line) and owe $700k (30%. mortgage paid off) , so would have $500k equity. And be in a market with better than average affordability (blue line). Seems like a win-win!

Take the same teacher who simply paid down his/her mortgage on schedule; s/he would be mortgage-free (or nearly so), with enough equity to purchase three homes in Victoria for a $1M each.

Using Warren Buffett’s metaphor, that teacher would look like this when the tide goes out:

Yes, that was a great post LeoS. I especially like this graph, which nicely combines the affordability chart (left side), with nominal house prices. That graph is one-stop-shopping for 40 years of history and 10 years of the future of Victoria house prices. You could make coffee mugs of it! Also interesting to see the various price scenarios based on rates (as of June 2018). So far it looks like we are on the orange line “rates flat”, which would mean some flat(ish) nominal prices and then a rise. That orange line would be a nice soft landing to get us “back on the rails”. As seen on yer graph…

For a young family I think that there is some real value to be found both in Esquimalt and also the area around the Gorge road both of which offer a better commute than the west shore. A lot can be done with a small two bedroom house particularly down the road if you add a small addition.

Leo, none taken. And I understand housing difficulty young people facing today completely (my son is in his early 30s, working and renting in Victoria. But I don’t think he would stop eating out and buying clothing for 4 years to save for his first house/condo ;-).

My response was more towards some comments during discussion of your last post, e.g. “I only complain to piss off all the entitled boomers on this site. That’s the change I want to see in the world” and “often times the boomer wealth wasn’t just created from their own hard work. Often times,they themselves inherited. …The idea that the boomers earned it fair and square misses something… What I am saying is that the boomers weren’t especially hard working or smart, they were jut especially lucky,…”.

Another way to elucidate this principle is to quote Warren Buffet, “Only when the tide goes out do you discover who’s been swimming naked.”

Its specifics vary in context, but it generally refers to the process by which an investment environment degrades to an extent that bad investment decisions are forcibly corrected in some way.

In RE, this is starting to occur in Vancouver. For instance, take a teacher who bought a Vancouver home in 2001 for $350,000. Now, their home is “worth” 3M. During the last few years, they pulled out multiple mortgages from Banks and alt lenders to finance a lifestyle they could never afford otherwise. Now, they owe almost as much as the value of the house. It worked, so long as the house value increased each time they went to renew their financing. As soon as the house value stops rising though, or worse, falls – it’s over.

That’s a really bad scenario. Many more people will simply have to allocate far too much of their income to the mortgage for years or even decades, but because they are underwater on it – they literally cannot afford to sell it. Bankruptcy may be the only option to get out at that point. This is also why the BoC is concerned about the long term prospects of too much consumer debt: it weighs down the economy since consumers can’t spend as much.

He was also calling the top in Victoria 4 years ago

Highly recommend this setup. Depending on the personalities involved of course, but it works great for us.

There are two patterns actually: House prices and affordability.

https://househuntvictoria.ca/2018/06/21/the-battling-trends/

The good thing is, both trends cannot continue. So in the next few years we will see which one of the two breaks down. I will bet it’s not the affordability one but we’ll see.

Didn’t I cover this just a few weeks ago?

You look at land title transfers and compare to MLS sales. The difference is private sales + new construction that happens off MLS.

https://househuntvictoria.ca/2019/03/25/mar-25-market-update/

@LF what does this mean “Eventually, the deleveraging clears the excesses from the system”? Tx

This is what almost no one can accept and why there is a lot of conflict between generations. You can be successful both by working extremely hard and having an easier time. Pointing out that some things (like buying a house) are objectively harder now should not be taken as somehow degrading your own accomplishments.

Yes, they do that, but it’s not truly random unless you’re only listening to RE board press releases. RE is one of the most cyclical asset classes there is and there’s some pretty good reasons that’s the case.

It’s true that you cannot say it’s something so regular that you can predict tops and bottoms in advance, but that doesn’t render the observer helpless. I had no idea Victoria’s peak was in when it was – but I did know that once that peak could be visualized retrospectively, there were going to be various themes emerging in the economy.

Superficially speaking, we’d see sales volumes would start to slow, SAL ratios would drop, and price escalation would start to level off. But the better indicators are under the hood, which is what actually makes RE a cycle to begin with. Credit growth begins to slow. Consumers start to pull back. Retail sales become affected, a little at first, then more over time. Sales on bigger ticket items other than houses that depend on credit start dropping off. Mortgage originations fall. Central banks become dovish (haha this time, they’re just confused). Housing starts begin to decline. Consumer confidence falls.

Right now, I think this is where we’re at, and it’s something that has been borne out repeatedly including right here in this city. And broadly speaking, where housing goes, so does the economy.

Eventually consumers go into debt repayment mode – most of it is paid off gradually, but some is written off quickly. Insolvencies rise, unemployment goes up. Some people feel it’s hopeless. Eventually, the deleveraging clears the excesses from the system, and we do it all over again. It’s not random, CE, and we’ve been here so many times before. Perhaps you’re thinking about cyclicalty to mean pinpoint accuracy. It doesn’t. Ever.

Then I am not making my messaging clear, despite my telling you directly in the past that peaks and troughs can only be viewed retrospectively. If I could do it as you seem to think I suggest, I’d be living in Palm Springs, not sitting here in Canada debating about a RE market most people have never even heard of.

You’re right. All we can make is educated and/or intuitive guesses that best align with our cognition at the time. I’m pretty confident I’m making the right choice for me right now, but that’s not saying anything, really. 🙂

I believe Hawk was saying stick a fork in this pig because she’s about to blow w/r to the Vancouver market in 2016.

Oops… thanks James!

A couple of things about waiting for these “cycles”:

1) Maybe LF can reliably spot the peaks and troughs in real time but most people can’t and don’t.

2) Based on a lot of postings here we have literally been either at the peak, or already plummeting ever since 2007.

3) The cycle might go on a lot longer than you expect

4) There are no guarantees that the wait will be worth it in savings

5) Whenever you buy there will be a risk your timing is less than ideal. However holding for the long term will skate you back onside.

All that said at this moment in time the market appears EXTREMELY unlikely to accelerate away from you in the short term so there is no harm in waiting a bit for selection to improve. I personally think prices are going to fall a bit over the next few years. The question is do they fall enough to make waiting 2-3 years worthwhile?

If you mean something regular that can be counted on to happen at regular intervals with regular predictable outcomes then no I don’t believe there is cyclicality in the Victoria housing market.

On the other hand if you mean that the market sometimes gets ahead of itself and then pauses or pulls back then yes I’d agree. The data show that is what happens.

Condos are included in apartments for what it’s worth, not all of those are rentals.

???

All good things must come to an end.

What are us Gen Xers too meek to speak?

My retired mother-in-law wants to move into our yet to be realized and entirely fictitious suite. Weather channel and Live PD marathon here we come!

Thanks Leo and interesting data.

I don’t know how anyone can deny price drops from peak as we have seen it in some areas already (Gordon head). I have continued to notice that in the areas (saanich east to peninsula) and price range (7-850k) I have been looking places sitting there. Definitely still active but it seems like maybe instead of bidding wars there is one buyer for a house and they pay close to asking for the house. They should really be playing hard ball but it’s tough to lose out on a house time after time. I know we aren’t in a buyer’s market quite yet but I think it is very close. I am surprised by some of the houses sitting there. Places like sidney and Dean park which were pretty hot a year ago have perfectly nice houses just sitting there. Drop the price!

I’m at the point of wanting to buy and get on with it but there is still limited inventory.

I pretty funny that a Boomer is offended by a millennial saying you had it easy. Obviously each situation is different and you can’t lump millions of people’s situations in with each other. Each generation has its perks. Millennials do not have affordable housing in our location. How could you deny that? Do you think a millennial with currently youngish parents have had the responsibility of caring for their aging parents yet? No but when they do they probably won’t have room for them in their basement suite pantry. Maybe the inheritance from massive house sale will go to assisted living?

I also struggle to understand why some people are so offended by a young person not wanting to live in Langford. If someone values their time more than a big house or would rather rent who cares? Personally I would never move there because of the commute. Two parents working full time and 3 kids is tough to manage. And it is still unaffordable with one parent working so if I were to stop working I’d move communities entirely out of Victoria as Jamal said.

Those who did/do have two full time parents and >2 kids each with >1.5h commutes round trip to work and no family in town please speak up about your experience. I would love to hear how you made that work 🙂 I’m sure us millennials would love to hear your wisdom. I think you also have to factor in before/after school care, gas and time into your affordability calculations.

I guess most of these new builds are rentals, so they shouldn’t count. So its not that big an issue.

fwiw, of the 6,035 units under construction now in GV, 11% are SFH, 82% apartment, and the other 7% are semi-detached/row. When you consider that many of the SFH new builds are after a SFH teardown, that doesn’t make for many net new SFH.

The only pattern I’m seeing over the last 33 years is prices going up, then flatlining, then going up, and so on:

Could the pattern break this time?

LeoS,

Great post, as usual!

I have a question about non-MLS sales (“dark sales”). My understanding is that your numbers above are MLS sales only, so don’t include non-MLS sales such as many new units sold. You’ve told us that it is estimated to be about 80% MLS and 20% non-MLS, but IMO this number must be changing with the increased new home construction, where units are sold outside MLS.

What I don’t know is if there is a way to estimate non MLS sales by looking at housing unit completions.

For example, it looks like Greater Victoria is completing about 220 housing units per month, and this is up from 120 units per month in 2013.

Any idea of what % of these newly constructed units are non MLS sales vs MLS sales, and is this ramp-up in new construction relevant to the total number of sales (MLS sales + non-MLS sales). For example, if all of the newly sold units were dark sales, that would mean there are about 1,000 more total sales per year starting in 2017 compared to 2013-2016, which is about 80 per month additional sales. What is the estimated % of new-construction sales that are non-MLS?

Total housing units completed in Greater Victoria for 12 month period

2013 1,465

2014 1,813

2015 1,765

2016 1,787

2017 2,526

2018 2,668

2019 2,596 (last 12 months from Apr 2018 to March 2019)

source: https://www150.statcan.gc.ca/t1/tbl1/en/cv.action?pid=3410015401 (thanks patriotz!)

Yeah, and this blog’s founder thought the same thing 12 years ago:

https://househuntvictoria.blogspot.com/2007/06/much-ado-about-nadda.html

Cadborosaurus,

Thanks for the info, I’m glad to hear that some people are considering Langford. Something like 60% of the new builds are there, so hopefully you’ll have some good places to choose from.

Eh, I think it would be a shame if you didn’t at least try to. I already told you, it isn’t difficult and I’m far from perfect. I appreciate your rebuttals and this place would be pretty pointless if everyone saw it my way.

So then – do you not think there is cyclicality at work? Is it just a lucky guess that I’ve been repeatedly saying the population is overleveraging and the market was unsustainable…and now things are somehow going into reverse? Is it unreasonable to say that this reversal will continue until liquidity in the market begins to grow again? Should we expect a recovery while mortgage credit growth continues to decline to levels not seen in almost 4 decades, with consumer spending and confidence falling?

Once again, over-exuberance in RE is among the easiest kind of financial imbalance to spot, due to housing’s core function and the type of connection it has within an economy. Any people unfortunate enough to read my posts knows that most of what I point out is extremely simple, and obvious. And sure, sometimes I’ll throw a guess in there. It’s fun. Don’t take it so serious.

Cadboro: We might see some price drops but my gut feel is that the lower end of the market will not drop all that much.(10% at a wild guess).

If you can afford to buy or rent a two bedroom apartment then you can have two kids. That isn’t some crazy third world idea, that is reality for a significant number of middle class Canadians. I personally know multiple families in Victoria and Vancouver who are raising or began to raise families of 2 (and in one case 3) kids while living in two bedroom apartments. Several of these families have eventually upgraded to small SFHs but some are still in the 2BR apartments with kids well into grade school.

Would most of these families prefer a SFH if they could afford it? Probably. Do any of them regret starting a family while living in an apartment? No.

Vancouver cherry picking:

Who was complaining?

i love this millennial driven boom … wonder how many are there that can fork out a small chunk of change to support this growth .. .. there will always be some ;how ever, what jobs can keep them here .. its great if you have rich retirees here .. but who is going to service these rich people .. unlike big cities .. Victoria lacks the meat bags for our viable labor force .. unlike the gov’t .. this city can’t be top heavy … Gov’t jobs are filled with boomers that come back for casual jobs after retirement .. millennial can’t even get in the door without a boomer dropping dead … most of these boomers are locked in and can’t move – rooted with too many years of life … maybe in a decade or two, Victoria city core will be like Nanaimo downtown, people holding onto regrets or people moving out with technology advancement – automated cars will closed the gap for job related travels and work will become more remote .

If you look at Vancouver single family housing areas – kids are disappearing from those mill$ neighbor hoods… not that people dont procreate .. people just cant afford to have kids and live in expensive areas .. my folks neighbourhood in van is filled with empty nesters .. in another 20 years the inheritance will benefits my kids .. but a generation of people moving away will leave an expensive void to fill.

Victoria is the same – unlike Vancouver, there is no surrey to move to .. once people moves out .. they’re gone ..

it is fun to look at unemployment rates here in Victoria .. either we have a booming economy or people are no longer looking for jobs here .. one thing for sure .. your kids in school will likely move out of the island to find a job…

One could go on – 2010 – 756, 2009 – 747, etc

But it would be a shame to tarnish LF’s narrative of the inevitable market cycle that is written in the stars and foretold by the wise.

I do feel sympathetic to millennials (including my own son who is working and renting in Victoria). But complaining about the Boomers doesn’t get anyone anywhere closer to their wishes.

Yes, we boomer lucked out on the housing market, and some of your parents or relatives might have access to old wealth or easy funds. But for most of us, boy we have worked very hard all our lives.

I didn’t eat out once or buy any cloth for 4 years before bought my first house (a SFH with one bed suite) in View Royal area in 1990; We paid/earned our own education; We paid for our own housing without any help; We paid/helped our children’s education; We took time off from work to take care our aging parents; We paid/helped our parent’s debt/monthly bills and for their funerals.

Yes we do live a good life now with a nice house and no debt (and no pension btw), but please don’t tell me this is because we had easier time. Just a few years back, lots (young?) people on this blog were so dead set against buying a SFH with a suite or outside the core area, as that would drop their “living standard” (note that lots of our boomers growing up sharing bedroom/bed with our siblings and grand parents).

So please stop complaining about your entitlement and be back to reality, appreciate what you have and be happy, work hard and sacrifice are the only ways to get what you want.

Thank you.

Patrick you said that none of us millenials are looking at Langford houses; I don’t think I’m alone in the group. We’ve been pretty much exclusively looking out in the boonies, at first because it was more affordable than Vic and now with the stress test because it’s literally all we can afford for a SFH. And the very few ones we can ‘afford’ (at 500k, with a mortgage of $2300/m) are dumps that will require construction mortgages I can’t access or having 2 less kids than planned, and I only planned for 2. I have rented in the core for the past decade and have been mentally preparing for the awful commute since we started house hunting, not really a choice. It’s frustrating because even the mediocre housing out there is still in the 600-700k range which most first time buyers like us couldn’t even buy without substantial incomes or downpayment help. The whole region is due for some price drops.

2015 – 840

2016 – 1286

2017 – 885

2018 – 774

2019 – 680?

2011 – 574

2012 – 586

2013 – 615

2014 – 664

On nearly double the inventory and prices went no where.

“Why Arrogance is Killing your Sale – Vancouver Real Estate”

https://www.youtube.com/watch?v=0pbspnOKcZ0&

Victoria isn’t quite here yet, but sellers will need to increasingly take heed as the downturn proceeds forward…

Puts it into context, doesn’t it? It’s like what Leo was saying how when you step back and compare these longer time periods, the change becomes unmistakable.

On an academic level, it will be interesting to watch Victoria’s ride down, compared to Vancouver. I wonder if the new Maserati dealership will be here in a few years? With a housing led recession looming ever closer, I’m not so sure…

April Sales (per HHV):

2015 – 840

2016 – 1286

2017 – 885

2018 – 774

2019 – 680?

We’re down nearly 50% from 2016. Wow.

Single family sales down about 18% vs about 12% for condos

Great stats. How are condo sales doing compared to SFH?

Leo,

Your blog has become an integral part of my weekly reads.

Thank you for all the effort you put in.

Great post Leo!

As always an excellent post. I had been mentally wagering on 680-ish for the totals for April just based on the limited view I have of properties and what’s selling. It is nearly dead here in my area for SFH sales and it looks like there are a number of properties primed to go on the market soon. One of the homes in this area, instead of dropping the asking has changed realtors to go with a discount realty. I get the saving money on the sellers end on commissions but that’s only IF they get an acceptable offer. Will be an interesting May and into Summer for sure.