Mar 25 Market Update

It’s the middle of reading break for the kiddos out there and so I along with many of the house buying selling public out there are taking a little break from the market to rest up for the main part of the spring selling market in April and May.

Sales and new listings usually decline a bit in this period, but last week was a bit of an exception with an active week of sales especially on the single family side. That means we have closed half of the gap to last year and are now trailing the sales pace of last March to date by only 6%.

With 5 business days left in the month, we will likely hit between 620 and 650 sales for the month depending on whether the buyers go to Mexico or to open houses.

Weekly sales courtesy of the VREB:

| March 2019 |

Mar

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 176 | 317 | 481 | 688 | |

| New Listings | 390 | 684 | 988 | 1188 | |

| Active Listings | 2204 | 2272 | 2354 | 1766 | |

| Sales to New Listings | 45% | 46% | 49% | 58% | |

| Sales Projection | 598 | 595 | 640 | ||

| Months of Inventory | 2.6 | ||||

Commenter Patrick mentioned that these numbers don’t include new build sales and presales which is mostly correct. The MLS data that the VREB reports only includes sales that were reported in the MLS database. That includes some presales but not most of them. Some developers list many of their sales in MLS and others only list one unit and sell all the others directly through their own websites.

The good thing about writing this blog for so long is that I’ve covered most everything, including this topic of what I called “dark sales” that aren’t reported in MLS. Presales form the bulk of these, but they also include private sales and assignments. Back in 2017 when I wrote about this, about 81% of sales were captured in MLS (the numbers I mostly use) and 19% of sales happened outside of this.

Two years ago I also theorized that the higher level of construction could mean that these dark sales would represent a greater proportion of the market going forward. Patrick raised the same point and implied that since I am not measuring all the sales, we cannot actually make the claim that sales are slowing down compared to last year. After all, dark sales could have increased to make up the slack.

There’s a few reasons I don’t believe this is the case, and continue to be confident that sales are in fact slowing down.

- The resale market is very strongly linked to the pre-sale market. When resales are strong, pre-sales are strong too, and vice versa. In other words, the MLS sales data is a very good proxy for overall sales.

- When we’re talking large declines in MLS sales which represent ~80% of all sales, it would be very difficult for dark sales that normally make up only 20% to increase enough to cancel out the decline. To counteract a 10% decline in resales, dark sales would have to increase by 40%.

- Total land title transactions are decreasing at roughly similar rates to residential MLS sales.

For the last point, I use the provincial land title transfer data from the Ministry of Finance and charted the year over year change in title transfers compared to the year over year change in residential sales. Title transfer data starts in June 2016 and is up to date as of Dec 2018.

It is clear to me that although individual months have different percentage declines, the title transfer data is telling the exact same story as residential MLS sales data. That’s not to say big sales declines will continue forever. I suspect we are about petered out of the big year over year declines and we will see gentler declines or equal sales further along the year.

Aligning the data (remember title transfers happen usually a couple months after sales go unconditional), about 78% of all sales in 2018 were captured in MLS. As I predicted two years ago, that is down slightly from the 81% for 2016/17, very likely because of the increase in construction (and thus presales). However the shift is not enough to impact any of the conclusions I would come to from the MLS data.

Back from the interior… New post: https://househuntvictoria.ca/2019/03/31/has-it-ever-been-a-bad-time-to-buy-victoria-real-estate/

Well, what does “flat” mean to you? Unchanging sales volumes? Unchanging prices? Unchanging affordability? I mean affordability, which is why I said affordability trends up, then down. I didn’t say prices. People sometimes get caught up in “prices” when that’s one measure among several. Alone, it’s not going to tell you the whole story especially using nominal values.

If nominal house prices never moved and every other metric like wages and inflation went on its present course, that’s not a flat market. That’s a declining one. In Marko’s examples, 2010 to 2015 was not a flat market at all – affordability improved very significantly during that time due to both price drops as well as declining rates. The 1995 to 2000 period was similar, except the decline was actually modestly larger. It was also the tail-end lead out from the national bust in 1990, when, as I said, you do tend to see a relatively flat market as it finds the bottom.

You’re right. Would it be helpful to see Leo’s RE affordability chart for Victoria again? What would you presume? That the line goes flat at 0° from here? Sure, there’s nothing in the laws of physics preventing it, but then it’s kind of a question of what’s a reasonable inference based on the available data we have. It’s nothing to do with a crystal ball. And of course, it all presumes we’re thinking “flat” means the same thing, which I’m not sure we do.

Note to readers – this man ^ does not own a crystal ball.

Naturally we should acknowledge that a flat market would bring steadily improving affordability as incomes climb.

Flattening occurs for relatively brief periods at market peaks and troughs;

Median SFH Price 1993 – $225,000

Median SFH Price 2001 – $233,500

Median SFH Price 2010 – $562,000

Median SFH Price 2015 – $567,500

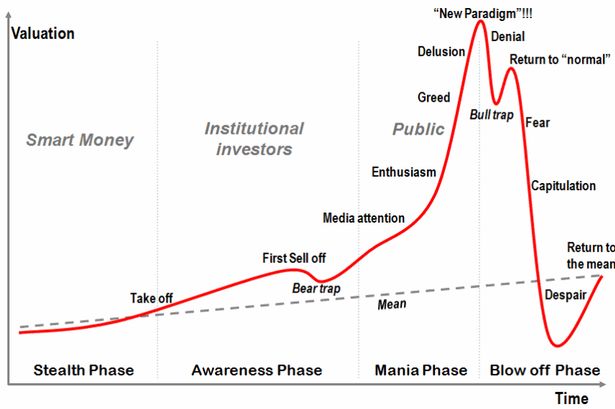

Yes. The issue is there are too many vultures over there trying to find a “deal” and sellers aren’t that desperate yet. It’s actually a bad time to vultch, IMO because most of the VanRE market isn’t at a point of capitulation.

This is probably why REBGV is reporting increased OH traffic, but little of it is translating into sales. Wait a few months, when the reality that Vancouver is facing a potentially historic retrenchment becomes absolutely inescapable. There are still plenty of folks there who think prices aren’t really going to change.

Here in Victoria, people won’t behave any differently than they are in Vancouver. Many people will think we won’t really be touched here regardless of what happens there.

And this comment would be one early example of this. Whatever scenario happens, a flat market for years on end isn’t going to be one of them, especially if VanRE goes to blazes. Affordability will trend up, then trend down just like it always has. Flattening occurs for relatively brief periods at market peaks and troughs; it’s not a state of perpetual being.

from a good realtor friend in Vancouver….

“It’s pretty shit out here man. Buyers are not even countering the sellers counter. They’re moving on to the next property trying to find the desperate sellers”

I’d agree, no major build up yet. One thing I have noticed is the return of the sub $1,000,000 Fairfield SFH. For a while these were virtually extinct except for poorly located bulldozer bait.

Wrote offers for four different clients this weekend and all ended up in multiples. 3 places had 3 offers, one had four offers including an unconditional.

March will finish with around 650 sales. My personal gut feel prediction is we see a strong April, May, and June with 5-year fixed rates dropping substantially and then we have a super slow summer like 2010 as things transition into years of a flat market.

I am not seeing a real build up of inventory in Oak Bay; James Bay; Rockland and Fairfield.

LeoM: I guess we will know the numbers tomorrow or the next day but does it look like sales will be down from last March?

Trump Fed pick was held in contempt for failing to pay ex-wife over $300,000

Looks like he’s well versed on life not being fair – to someone else.

You bears are amazing. Keep up the good work. Trip to Disney land is warranted to keep the fantasy going that is in your mind. Should be fun to see those plunging numbers tomorrow. Funny how real numbers from actual sales to assessment are not negative like the -10 posted below.

yup .. some places are just over priced .. I remember I mentioned that there was a house on Cadillac Ave being over priced and some people go on a typing spree of how Bears are just mad that price wont come down.. now,, that place was repriced for the 4 time and lots of time wasted … sellers have a price they want to get .. buyers have a price they want to have .. in the end, time is the only metric used to gauge the desirability of the property

Either my PCS account is broken, or the Spring real estate rush is a total bust so far this year.

The only places that seem to sell are those houses in nice neighbourhoods with recent renovations to the kitchen and bathroom and houses that are selling for 10+% under the BC Assesment valuation.

I’d hate to be a house owner who relies on basement suite income to pay the mortgage because those 10,000 new apartments/condos coming onto the market later this year and early next year will make renting out a basement suite difficult at best, and impossible for the dingy dark suites with low ceiling that I see at many open houses. Maybe that’s another reason why first time buyers are not buying now, perhaps they are waiting for those nice bright modern downtown condos, there might be deals when that many new units come onto the market in one season.

I’m still predicting a sudden increase in vacancies and a jump in unemployment when the 10,000 new units are completed; the trades people will be out of work and the building supply/services industries will be laying off hundreds of workers.

Good news!

Anyone interested in mortgage and consumer credit trends in Vancouver and Victoria should read the latest CMHC report, publish March 2019. Its a good idea to see the actual report, rather than just read headlines or my summary.

https://eppdscrmssa01.blob.core.windows.net/cmhcprodcontainer/sf/project/cmhc/pubsandreports/mortgage-consumer-credit-trends/2019/q1-2019/mortgage-consumer-credit-trends-bc-69327-2019-q01-en.pdf?sv=2017-07-29&ss=b&srt=sco&sp=r&se=2019-05-09T06:10:51Z&st=2018-03-11T22:10:51Z&spr=https,http&sig=0Ketq0sPGtnokWOe66BpqguDljVgBRH9wLOCg8HfE3w%3D

It’s full of good news about the health of mortgages and other debts in BC as of Q3-2018. The report above has all the details you need, but here are some highlights.

And with interest rates falling from the levels in Q3-2018, I’d expect even better numbers now. To me, this shatters any narrative of the Van or Vic mortgage holders being struggling to stay solvent paying their mortgages and other debts.

Life’s not fair Stephen.

Great video this morning from Steve Saretsky, in talking about BC RE both in terms of sales numbers but also the evolution of mortgage credit in Canada (to reiterate – they’re linked).

“Everyone’s talking about how gloomy this outlook is, and the reality is, if you want the sales volumes to pick up, if you want your commissions to pick up, if you want the market to get going again, you better drop your price – that’s the only way to increase the sales volumes at this point.”

“This is very, very typical of a housing cycle. You cannot draw this out to be any more textbook. I find it completely fascinating to watch. None of this has been a surprise, other than maybe the data, in my opinion, was worse than I actually anticipated. For my belief, as I said, I felt the market was going to slow, I felt the prices were going to come down, I felt that we did have a household credit bubble that was really the main issue in the housing market…just to see how things are developing is truly fascinating because it’s actually falling into place as if it’s perfectly written into an old history textbook…”

Indeed. I know exactly what he means as do many of you. Data and history are awesome, aren’t they?

March VanRE numbers are looking to be yet another 35 year low in sales.

https://www.youtube.com/watch?v=b3fxgS-7A3w

….

….

Do you want to know more?

Do you want to read the book that some of our regulators reference when they talk about the finances of the Canadian consumer today? Do you want to know how the “new” shared equity program is not a new idea at all? Do you want to know how we can look to consumer credit trends to determine the most likely path for real estate? Do you want to know how we’ve actually seen all this before, over and over and over?

“House of Debt” by Atif Mian & Amir Sufi (2014)

__

https://www.amazon.ca/House-Debt-Recession-Prevent-Happening/dp/022608194X/

They’re considering to do this capital gains change in the US – to only tax capital gains that exceed inflation. So far only you are concerned about a financial engineering risk, but let me know if you find any articles that mention someone agreeing with you on that regarding the US plan. They already financially engineer share prices up/down via dividends and other measures, this would be nothing new. Dividends are fully taxed in and out of the corporations. If there is a big risk of financial engineering, best to leave the inclusion rate where it is at 50%, where the inflation factor is considered.

https://www.npr.org/2018/07/31/634396871/trump-administration-eyes-capital-gains-tax-cut

“It is not fair for the government to tax someone on a gain that really is just due to inflation,” said Stephen Moore, an economist at the Heritage Foundation and a former adviser to the Trump campaign.”

This would result in financial engineering by both corporations and investors to avoid realizing a gain in share price above the inflation rate.

A lot of the capital gains people realize are just inflation. Those inflation gains shouldn’t be taxed at all. Then, gains above inflation could be taxed at 100% inclusion rate. Until then, an inclusion rate of 50% seems right to me.

Average person in Canada saved just over $800 last year. I don’t believe what your saying applies to the middle class.

Increasing the general inclusion rate to 75% while leaving the rate for principal residences at 0% will encourage well off people to put more money into their principal residences.

I don’t really think we’re talking about the “middle class” as I understand the great majority of people don’t make maximum RRSP and TSFA contributions and don’t have investments subject to capital gains taxation.

“In an interview with the Star on Thursday, Singh said he wants to increase the proportion of capital gains profits that are taxed by the federal government. This “inclusion rate” is currently set at 50 per cent — meaning only half the profits people make by selling property or securities investments is subject to income tax. The NDP wants to increase that rate to 75 per cent, which Singh said party researchers predict would bring an additional $2.7 billion in tax revenue to the federal government each year.”

Right. Government needs to tread very carefully. While the intent can be viewed as a means to pay for looming massive shortfalls in Health care, choosing seemingly easy targets will likely mean a large exodus of investment for both non-residents and citizens.

Slogans of Tax the Rich are of the same thread.

The truely wealthy have the means and access and network to out-manoeuvre policies aimed at them. It’s the middle class that this will penalize, those in their 50’s that have their RRSP’s maxed, TSFA maxed, and are looking for additional investments. And naturally, we are required to claim foreign property on our tax returns. So where does the couple make further investments,?

https://www.thestar.com/amp/politics/federal/2019/03/29/ndp-leader-jagmeet-singh-targets-rich-with-proposal-to-raise-rate-for-capital-gains-tax.html?__twitter_impression=true

So like… 10%?

Ks112, let’s get something straight. I’ve never denied that prices today are lower than at the peak. So if you think I’m in denial, feel free to post evidence in support.

My general point is that prices are far from collapsing, and decent places in GH seem to be selling quite quickly so far this spring.

I do disagree with your $80-120K estimate. Based on my personal observations of GH, I think prices are generally down $50-75K from the peak. Current assessments (which are as of July 1, 2018) reflect near historically high prices and sale prices this spring generally aren’t wildly below assessment.

Enjoyed reading that Matthew! Was a charming and entertaining way to share your perspective.

Hope uncle Jimmy got a prenup for when things went sour. 🙂

Good report LF. But I have another way of explaining it, as follows:

Supposin you’re Tim Pattison (name changed for privacy reasons), the richest man in all of B.C. He’s worth an estimated $5.7 Billion dollars (that’s $5,700,000,000). I counted. Simple interest at 4% per annum would garner Tim $228 million in profits per year. In short, Tim could blow $624,657 each and every day for the rest of his life, and he would never touch his principal savings of $5.7 Billion. Tim is married to a fine woman (Sally) from Moose Jaw, Saskatchewan. He often jokes “the secret to a good marriage is – marry a girl from Saskatchewan”.

Now supposin Sally comes to you and wants some money to go shopping. You say: Yes dear, absolutely, how much would you like”? Sally says: “Well, I don’t know exactly. I’m just going to go to the Mall and see what they have. May I have your VISA card?”. You say: “OK dear, have fun”. Then, to your utter amazement, Sally comes home that evening with six diamond necklaces, three tiaras, a Rolls Royce Sweptail, and tickets to see the Trooper concert at BC Place. Pricetag: $15 million. “Wow Sally. That’s pretty opulent. I certainly hope the Mall’s closed tomorrow” you say.

But tomorrow arrives and Sally asks for “your VISA card” again. This time she wants to fly to Los Angeles to pick up a few things at a Sotheby’s Auction. “OK, Sally but be careful please”, you say. Guess what? Sally comes home late that night with $15 million worth of Picasso paintings, Liberace’s grand piano and candelabra, and a life-sized bust of lead singer Ramon McGuire from Trooper. Now you really start to get concerned.

The next day Sally wants to fly to Rome to have an audience with the Pope. Then, it’s off to the Kremlin to have lunch with Vladimir Putin. Then, a Trooper Reunion Dinner at London’s Albert Hall to finish off the night. Price tag: $15 mil.

OK. I think you can see where this is going …….

The point of this little story is that people are the same everywhere in the world, no matter how rich or poor they may be. They will spend as much money as you give them. Give them $5 and they will spend it. Give them $15 million dollars, and they will spend it. There is no limit to what they will spend. They are like cattle, they will eat and drink until there stomachs burst, if you let them.

This is what’s been going on in real estate in the western world for the last five years. In places like Sydney, Australia, and San Francisco USA and London UK, and Toronto and Vancouver and Victoria as well. People are borrowing as much money as the banks will give them. They don’t care. They appear to be absolutely oblivious to the idea (and responsibility) of paying the money back. Maybe it’s just human nature. And the clear beneficiaries are the homeowners (and realtors). They are happy to continue jacking up their home prices ever higher while the Sally Pattison’s of the world continue to offer them more and more money. And there are plenty of people in the background that will lend their support to the utter craziness of the game. And they will do this even though house prices are 11 times the average person’s annual income, whereas the acceptable standard for the last 40 years has been 4 times income.

But there comes a day of reckoning when the bank gets a tinge of concern, when they realize that they might not get their money back. They have expanded the credit game too far. They are “in” too deep. So they freak out and start the process of contraction. They start lowering the amount of money they are prepared to lend.

Meantime, Tim Pattison tells his wife:

“No, no, no. No more diamond necklaces”.

“No more gold earrings”.

“No more Trooper concerts”

“No more wasteful things”

“The sun’s not shining”

“In this rain city”.

“I’m not lending you anymore money”

“Isn’t it a pity”.

“Were here for a long time”

“Not a good time”

“So have a bad time”

“The sun can’t shine everyday”.

In the end, everyone becomes very upset. Sellers can’t sell. Buyers can’t buy. Realtors can’t make money. Construction workers can’t make money. Lawyers can’t make money. Governments can’t collect big taxes. A recession starts to creep in. Then, house prices start to really contract because the market has collapsed under its own weight of greed. And so, it’s back to the beginning ……..

The title of my story? It’s called a “Real Estate Cycle”. I’ll leave it to you to decide which part of the cycle we are in right now.

A well presented argument LF. It amazes me the amount of debt people are willing to take on.

Ah, novella time.

It’s Friday night and I’m staying in, so I’ll bore all you folks to death with this. Once again, there’s not much new in here, but newer readers might be interested. Everyone else, scroll up.

A few points of discussion, from my own perspective. Most of it is probably wrong.

“House prices are unpredictable, so anyone who says they can predict prices is full of nonsense.”

Agreed. Predicting pricing with any accuracy at any point of time is impossible. Period. If you try to sell at the very peak or buy at the very bottom, only luck will permit you to do that.

However, it is important to understand influencers versus drivers. Influencers are local aspects of a market. Every market has them and all of them are unique. They can be long term, or transient. They can include demographics, incomes, climate, foreign buyers, the employment market, infrastructure and accessibility to other urban centers etc. But underpinning all of these markets is the driver. That driver is credit.

“Drivers? Give me a break. What does that have to do with anything?”

Home prices are a complex expression of both long term and transient local influencers but in Canada, they are driven by regional and national credit trends. Ergo, if you want to have a sense on the upcoming trends in the Victoria market, Vancouver, Kamloops (it doesn’t generally matter which market it is)…the local, monthly data is not the primary source you want to look at. Why? Because, local data provides a window into the effects of those drivers and influencers, not the drivers themselves.

“Ok, so what’s happening with our market vis-à-vis credit?”

Our market is increasingly experiencing the effects of a credit driven downturn in the household sector. It’s demonstrated by the changing availability of credit, and how Canadians are managing existing debt loads with the only way most people have available to them – their incomes. If you have declining credit trends in a national or regional area, a consumer spending paring back on durable goods, a debt saturated consumer, mortgage delinquency rates rising, and a bank of Canada that is too scared to move up or down due to a shaky economy, any one of these are contraindicative of house price gains. If it’s happening all at the same time…well, you get the picture.

“So what does that mean for Victoria RE?”

The more consumer credit a region extracts to divert to an unproductive asset, the greater the knock on effect upon the wider economy is and the greater the retrenchment in that asset is likely to be. A poster recently provided some data indicating that debt-to-income (DTI) ratios in Victoria are around 240%. When we juxtapose that with the amount of consumer credit shrinkage in Canada, it is therefore no surprise that the cities with the greatest expansions in RE credit landing are now experiencing the sharpest drops in that credit:

Victoria is one of the most overvalued markets in North America and you can expect a significant correction before prices inevitably begin rising again. And no, 10% is not a significant correction. 🙂

“But growth in residential mortgage credit is still positive!”

Yes. It is, but that might not mean what you think it means. Mortgage growth should actually never go negative. If it does, we have very big, bad, deflationary problems. The only time it’s gone negative was very briefly in the early 1980’s, and even then, it was barely below zero and for a very short time. In the middle of the last major national housing downturn in the 90’s, mortgage credit growth was actually notably higher than it is today (6% nominal in March 1995, versus less than 2% today). In fact, we haven’t seen mortgage growth this slow in decades – and, like magic, look what’s happening to the market!

“This is still just academic. I know what I saw at that last open house – it was crazy. This downturn is just a blip.”

Ya, it is academic. But it’s also real life, it’s happening and it’s already self-evident this is no blip. The Bank of Canada has responded in its monetary policy. Our regulators have aggressively moved to curtail credit growth and the resultant march to ever more dangerous house prices. The lending industry is crying out for relief. Mortgage lending is falling to levels not seen in decades. Provincial policy is throwing in its own repressive influences. This downturn is likely to be substantial and potentially years in duration; in fact by some measures and regions in BC, it already is.

“So you’re saying it’s impossible for home prices to do anything but go down from here.”

No. I’m not. What I’m saying is that the drivers in the RE market are not conducive to rising prices – in fact, it’s sharply the opposite. Among other factors, wage growth cannot make up the gap within an intracyclical time frame. Interest rates can no longer fall far enough to make a serious impact on affordability like a decade ago.

The only way we’ll see a market turnaround now is a very large, unprecedented expansion of credit, and have a population that is willing to use that credit to put even more of it into real estate. Aside from the fact that this scenario completely abrogates everything we know about the credit cycle and associated economics, other less tangible factors such as consumer fear and debt revulsion begin to set in amongst the population. Housing just won’t be sexy anymore (or more accurately, for the remainder of this cycle). But is it possible that CB’s have something up their sleeve that no one could predict? Sure. They did it before, they may try again.

“But homeowners have a high net worth – that’ll mitigate or even prevent any problems.”

Pick up a history book and a perhaps a book in elementary logic.

Wishful thinking and price drop mean a big fat zero.

Real numbers on sales are what is important. Let see the price crash numbers on April 1st.

Good afternoon – I believe that this summary tells us all we need to know about the future direction of real estate prices in BC [yes, that includes Victoria]:

https://www.youtube.com/watch?v=aL_mxVwMsvA

Simple and to the point. Look at the price drops week after week. Look at the rise in For Sale signage on every street. Contrary to Leo’s guess, this is just the beginning.

Intrigued to see a few Fall favorites starting to show up again in the listings. A very few up in price from the Fall and most down from Fall pricing. Will be an interesting Spring for sure.

These statements can both be true of course.

However comparing to a hypothetical sale price is tough. For most long time homeowners they won’t think the value has gone down until falling prices are widely in the news or they see the decline in their assessment. And of course for most longtime home owners they key fact is that their house will still be worth multiples of what they paid for it

“I posted some recent sales in GH mostly to show that sale prices are by no means in the dumps and that many places are selling fast this spring.”

Introvert, you can deny if you want but the truth is your house is most likely worth 80k-120k less than what someone would have paid at the peak. I am saying this and I am in the same boat as you!

Did you see his other one today on household credit growth? “Quick, spot the cycle”.

https://twitter.com/SteveSaretsky/status/1111721971597766656

I don’t like it. Either he or his source constrained the series to depict something that wasn’t quite as sinusoidal as he was implying. Yes, it’s nonetheless bad news for residental RE, but still…

Kind of find that photo offensive in 2 manners. Very stupid.

Steve Saretsky’s twitter post on March’s Van numbers:

https://twitter.com/SteveSaretsky/status/1111727412964806656

New advertisement from the Legal Services Society. Hmm.

Can you imagine seeing something like this 2 or 3 years ago?

It’s fine, they all have plenty of assets. Likely exactly 1.06 million on average and median.

Given some recent discussion on household wealth and home prices, here’s a decent article from Australia chronicling the growing loss of household wealth due to falling home prices.

Households wealth drops $260b in just three months as debt hits a record 200pc of income

According to Australian Bureau of Statistics data, household wealth fell $257.6 billion in the fourth quarter as the housing and equity markets tanked.

The 2.1 per cent fall in household wealth is the largest since 2011 and follows a 0.1 per cent decline in the previous quarter.

In real terms, taking into account inflation, the news was even glummer, with wealth down more than $310 billion — made of $170 billion in real holding losses on land and dwellings and $140 billion on financial assets.

While eye-watering in size, the losses were not surprising given housing market retreat was accelerating (the fourth quarter house price index dropped 2.4 per cent) and the ASX tumbled around 10 per cent over the quarter.

“Household wealth per capita decreased $10,198.10 to $404,319.80, following a $2,263.70 fall in household wealth in the previous quarter,” the ABS said.

https://www.abc.net.au/news/2019-03-28/australian-household-wealth-down-260-billion-in-december-quarter/10950242?

Sorry – breaking the quiet here. I have a Q – did 1656 Stanhope Pl (MLS: 405535) sell? If so, for how much? I see it’s up as an “ideal UVic student” rental.

Since they could file Canadian tax return, with low income reported, they would get all the social benefits: no MSP fee, free public recreation pass, child benefits, …. to name a few. I am fine with my tax money go to help the poor and disadvantaged, but I do mind and don’t want to pay for these people.

ˢʰʰʰʰʰ

ʸᵒᵘ ʷᵃˢᶜᵃˡˡʸ ʷᵃᵇᵇᶦᵗˢ ⁿᵉᵉᵈ ᵗᵒ ᵏᵉᵉᵖ ᵛᵉʷʸ ᵛᵉʷʸ ᵏʷᶦᵉᵗ

Sssssssssssssh!

Try realtor.ca?

I also seek real property! But don’t give a shit about the current argument. Sorry don’t ban me…. just please stop talking…. please!

It’s not ridiculous at all to suppose someone living in PG might own a vacation property in Greater Victoria. However I do find it ridiculous that I am supposed to feel sorry for people who can afford to own and leave vacant a vacation property in one of Canada’s most expensive housing markets.

In considering the plight of the hypothetical PG folks I consider it relevant that there is still over 99.5% of the province where they can own a vacation home, leave it vacant and pay no speculation and vacancy tax.

People raised a lot of valid concerns about the NDP’s first policy proposal. I give the government credit for listening to and addressing many of those concerns.

Many of the concerns raised since have been a bit ridiculous. Either ridiculous by their unlikeliness or ridiculous in the premise that we are supposed to feel great pain that people who can afford to keep a vacant pied a terre in Kitsilano or a vacant 1.3 million waterfront property in Belcarra will have to pay a few dollars more in taxes.

Patrick whack-a-mole.

The concern starts out as:

“What about a family two non residents on work permits working in BC and owning a home in one of the spec tax areas?”

When pressed on the validity of that example we see that the group Patrick is actually concerned about is the:

“Family of two non residents on work permits, working in BC, but not really making any money, but nevertheless owning an expensive property in a spec tax area thanks to a mortgage co-signed by rich Canadian uncle”

We get it – you hate the spec tax. But your examples are really lame.

I guess the answer is yes….like Plato and the Allegory of the Cave. Unless you want to debate shadows.

I keep thinking that I should say something, but then I think again… and decide I should say nothing…is that what his has become?

I actually think that is exactly what it is!

The scenario doesn’t say anything about how they bought the house, so you can’t assume they own it outright or paid with “non taxed money”. They may have put 5% down and have a huge mortgage (co signed by a Canadian Uncle). Or inherited the house from a Canadian relative who paid tax on it, and have modest incomes.

If you’re in favour of taxing the rich just because they’re rich, just say so, and that’s a reasonable position. And apply your capital tax to all the rich in BC.

What doesn’t seem reasonable to me is arbitrarily picking on foreigners or this case people on a valid work permit and pretend they owe made up taxes on the value of the house.

Valid point… Credits may partially offset but on a $800k Vancouver condo they’d owe 2%, that’s $16k for 2019, and BC credits on median $100k income would be $6k, leaving them a $10k spec tax bill which I assume you’re also fine with. Strange that a NDP supporter would support a “REGRESSIVE” tax credit like this, where the rich satellite families may get off scot free and poorer people get none or less of a credit.

Anyway. hopefully the Greens or Libs get in next time and fulfill their promise to kill the spec tax.

“If you’re not a B.C. resident, or if you’re a member of a satellite family or a foreign owner, your credit amount is based on the B.C. income reported, if you meet the qualifications.”

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/tax-credits/non-bc-residents

In other words, a non-citizen, non-PR owner will get a credit against the spec tax commensurate with their reported income. If that income is sufficient to buy the house, they won’t pay anything. If it isn’t, that means they bought the house with untaxed money and they will and should pay.

I don’t think anyone has argued that short-term flips are going to succeed in the present market.

I posted some recent sales in GH mostly to show that sale prices are by no means in the dumps and that many places are selling fast this spring.

No mention of gravity on a house investment site would be complete without mentioning Isaac Newton – the scientist who described (in Principia) the laws of gravity that we use today. Some call Newton the greatest genius of all-time.

The “Newton” relevance to this site is a cautionary tale. Isaac Newton was obviously a genius, but also fell victim to one of the biggest financial bubbles of all time, and lost his fortune investing in the South Sea Company. His saying became that he “could calculate the motions of the heavenly bodies, but not the madness of the people,”. (Perhaps one of the first victims of the Hawk graph http://www.thebubblebubble.com/wp-content/uploads/2012/05/South-Sea-Company.png

A cautionary tale for anyone, bull or bear, who thinks “it isn’t rocket science” and they know for sure where Victoria house prices are heading. https://www.smithsonianmag.com/smart-news/market-crash-cost-newton-fortune-180961655/

Spec tax is already only for uncommon situations. 49/50 people here can forget about it, doesn’t apply to them.

About 2% of homeowners are targeted by it. In the early days of spec tax I would describe the most common scenario I could think of such as a person owning a home in Prince George and a vacation property in Sidney BC. I was told don’t be ridiculous, what a silly example that somebody could afford to own two properties.

And so every example presented of spec tax from then on is responded to in the same way, what a ridiculous example that wouldn’t commonly occurr.

Anyway life is complicated, and for about 2% of people it is complicated enough for them to find themselves in the crosshairs of this absurdly designed spec tax.

The people affected don’t need to defend themselves by explaining why their situation isn’t more common. Instead you should be able to defend the governments implementation of this tax and how it applies to everyone fairly. It is by applying this process that the people who objected to the initial spec tax pointed out the absurdities of it that force the government to change it (lower rates, non gulf islands etc) . So yes that’s why we point out examples and ask people to explain why the tax would apply to people in this or that situation.

As to your question about how common for the situation in scenario 2 in msg 58118. I think it could be common among the 2% paying spec tax. Apparently 10% of properties in Vancouver are legally owned by foreigners so I don’t find it unreasonable that there could could be two foreigners owning a single property and both legally working on a work permit in Vancouver, living in BC and paying BC taxes in a single house that they own. I don’t think they should pay spec tax because the NDP aren’t smart enough to design a fair tax.

Hypothetical example that is. Does not seem to be describing an actual case. I wonder how common this is – families with work permits but no residency owning property in the spec tax areas?

Here’s the most bizarre example I’ve seen about an example of someone owing spec tax. It comes directly from a big 4 accounting web site.

I have no idea why spec tax would be payable in this example, or if it’s a mistake or what. In the past we’ve had sob stories presented, but this one is different and just baffles and annoys me.. how about you?

Anyway here it is…. (note that there is just one property here, not two)

https://www.pwc.com/ca/en/services/tax/publications/tax-insights/british-columbia-implements-new-speculation-vacancy-tax.html

“Scenario 2

Person A and Person B are spouses. Both are resident in British Columbia by virtue of a work permit and earn employment income in the province. The spouses are considered residents for Canadian income tax purposes and file Canadian personal income tax returns accordingly. They jointly own a residential property located in Metro Vancouver.

Despite being considered resident for Canadian income tax purposes, Person A and Person B do not qualify for the principal residence exemption, because they are not Canadian citizens or permanent residents of Canada. Therefore SVT should apply to the residential property in Vancouver, at the rate of 0.5% in 2018 and 2% thereafter.”

For the past 40 years, we have had the unfortunate combination of wage stagnation and asset inflation. If you believe the stats, many people are maxed out on credit beyond belief. Incredibly sad for the younger generation. It’s so bad that just returning to a normal, long-term historical average interest rate would be the equivalent of an economic supernova. 5%? We were there not too long ago. Now? That would bring a nuclear winter. How have we gotten here? Credit for some time has been shifting away from investment in things that produce good, lasting returns for productivity and job-wage growth. Apparently real estate is not one of them. The great sucking sound. Not a recipe for a sustainable future in my opinion.

https://www.forbes.com/sites/johnwake/2019/03/15/the-debt-shift-theory-of-the-great-financial-crisis-and-the-great-real-estate-bubble/#21129ab719d0

What months are all these new condo/rental inventory supposed to be available this year Leo S? Also has any landlords or renters experienced a slack in the market recently?

Do you know that despite its complete pervasiveness in our lives, scientists actually don’t know either? We can measure it with extreme precision, predict it and observe it…but actually explaining its origin as a fundamental force has been elusive. M-Theory, Branes etc all make attempts but the issue is observation and measurement at the Planck length. Too small, too energetic. So I say gravity as a concept – the inhibiting forces that prevent prices from reaching arbitrary levels.

Heh never mind.

Anyways I’ll leave it there, thanks for the debate

I wasn’t confusing cause with effect.

Just stating.

Probably. Could be a drop or failure to rise for a period of time. The run up we’ve seen is above historical norms, so it would make sense.

I have no idea what gravity is. It is not a RE force.

Of course the market is influenced by all those factors and more and will continue to be, along with new ones that are not common now, like co-housing and fractional ownership and those we cannot predict. The market could also turn for a while if there is, ex. a big earthquake. Just my opinion mind you.

Like what? I think the past is likely the best predictor of the future. I believe appreciation can outpace inflation in our market during my lifetime and it has so far.

There are and should be some limits on an excessive rate of appreciation if the market doesn’t slow after a jump, including government intervention to control it such as through a capital gains tax. In addition, shelter is a need and our tax dollars should be put into basic affordable government-funded housing options as well imo.

Okay, thanks.

So then I ask you, do you believe that chart you linked to represents a market escaping gravity? Do you think interest rates have anything to do with it? What about the rise of dual income families? The declining aversion to consumer debt? The greater willingness to devote more of the monthly household income to housing? Do you believe that these drivers will continue to persist, or that other factors such as land constraints will somehow overcome the fundamental economic limitations of real price inflation?

Couldn’t I just pull up Leo’s price affordability chart which would show gravity as a potent and consistent force in this market? Would it also not suggest that this market is heading for a downward leg, and then eventually it will pick back up again and achieve new heights?

This chart:

https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

Personal insults on an anonymous board say way more about the person making them imo.

I didn’t say they did. I’m more thinking readers might appreciate viewing the debate and be given something to think about. Hence, we aren’t having this chat in isolation any more than a buyer is affecting the market in isolation.

Sorry, which one do you mean? The affordability one? Nominal? He posts a lot of charts.

This truly is a great thing. There are many sources of opinion out there and many interpretations of the facts. In the end the responsibility for your decision rests entirely with you.

I find this a useful tool to gauge how I feel about a decision. Ask yourself “what if I’m wrong and prices drop/rise by 10%, how would I feel?”

I’ve told you what my opinion is. There are no future facts in RE so time will tell as to whether I’m in/correct.

The great thing is you get to make your own decisions based on your opinions and views as to the market, mine don’t matter if you don’t agree with them. If you think there will be a great crash in the market and return to income-based affordability for a sfh in the core you can just wait to buy.

Also, why reference forever? All you have to work with is your potential buying window, which is likely a maximum of approx 40 years from start to finish. My money is on appreciation in this window, which has been correct to date, but we’ll see. Credit is a national factor, but not all markets have behaved the same up or down in Canada when rates fluctuate (for example) because there are many local factors. This is why benchmark house prices will be different everywhere.

As far as more people becoming renters, it is not the worst thing if there is purpose-built government-owned or coop housing at affordable rates as there is in many areas of Europe where owning is unaffordable. Hopefully this will be addressed in high demand areas by the provincial/federal governments over the coming years.

Did you look at the 60-year house price graph linked from Leo’s post on this? This is past factual information and does not support this statement.

You’re flogging exactly the same premise of isolation. Buying activity in Langford does not exist in isolation from the rest of the Victoria market. In terms of market segment, exactly the same thing applies. A condo still forms part of the sales chain. Vancouver is yet again a great example – it started at the top segment in one geographic area and is working its way down throughout. Buyer characteristics in each segment are different for sure, but I don’t think that’s material to the inherent connectivity and interdependence of each of the market segments.

I see what you did there. 🙂

Meaning what? That you believe that this market will outpace inflation forever? High demand locations tend to have more volatility, but they don’t escape gravity. While local dynamics dictate how severe the up or downside is, all RE markets are credit driven and that credit is dealt out nationally, especially in Canada. Ben Bernanke made an argument a decade ago that all markets are local ergo, a national housing downturn was not likely. We can see that wasn’t the case…heck even in Canada in the last few downturns it was national. In other words, markets are local but they are ultimately fed from the same credit trough.

A greater proportion of renters does allow for some greater home price elasticity. Rent prices however, are not very elastic. So I don’t know what your point is? That entire cities will be bought up by wealthy land barons driving prices to obscene levels, only to rent them out to serfdom at a loss? Then the only thing left is capital appreciation from more and more wealthy land barons forevermore? We have 125 years of history in this market showing that is unsustainable and for all the reasons I alluded to earlier, and is the principle reason why RE is grinding to a halt in British Columbia.

I read the ad. It said nothing about not living in the home.

The law requires that

(a) the tenant has permission from one of the owners of the residential property to occupy the residence, and

(b) the residence is the place in which the tenant resides for a longer period in the month than any other place.

So a scheme in which the house-sitter does not comply with this section and reside in the home would result in tax payable. No need to resort to the anti-avoidance rules.

Or buy in Langford or a condo in the core to start. This is what is happening, along with increasing parental help from home equity. Entry level houses can get smaller and further out from the core to compensate for the increasing gap in income-based affordability.

If by “corrections”, you mean short-term downturns, equity is only one factor, albeit the most significant one in some market areas. Others include mortgage rates, incomes, inflation, employment rates, market confidence, lending rules, inter-provincial migration, immigration, annual rate of appreciation… Too many really which is why, short-term, it is impossible to predict the market accurately imo.

I find long-term rates of appreciation in our market the most likely predictor of future movement. For the last 60 years house prices in Victoria have increased an average of 3.74% after adjustment for inflation. If we have a big drop or a big run up (like we’ve had) that puts us below or above this benchmark it seems more likely that not there will be a market adjustment. This rate of appreciation far exceeds wage gains.

https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

If by “corrections” you mean a permanent return to income-based affordability for SFHs in the core, you are battling a long-term trend with lots of supporting factors for continued appreciation long-term.

No, real estate markets are local and don’t act in the same manner as each other. Some markets outpace inflation, and others lag it, and still others collapse when an industry collapses. If you head over to Cape Breton you’ll find house prices have depreciated. House prices can outpace inflation and adjustments to lot size and living space and location can compensate for this somewhat. And more people can become renters. All of these trends exist in high demand locations.

That’s not accurate, mortgage credit is not shrinking, it’s growing. it just isn’t growing as fast (slower growth is what we’ve called a “slowing” here). Your graph is showing mortgage growth and it doesn’t fall below zero, so is growing not shrinking. If this is now your latest flavour “primary cause” narrative for price changes in Victoria, you should at least get that straight.

Especially when you are trying to present yourself as superior to others …. “LF: This isn’t rocket science, and the evidence of the problem is getting so glaring I’m not sure how you miss it. ”

Maybe. But I’d be far more inclined to think that shrinking amounts of mortgage credit is the primary cause:

In regions of sharply overvalued housing, this curtailing of credit growth would be felt proportionally stronger than in other regions closer to historical averages. And in fact, that’s exactly what we’re starting to see.

Totoro it is very understandable that for someone with no real job asset appreciation is crucial. Not only needs to make you rich but as you have stated numerous times your four kids too. Not a good thing that all this intelligence you demonstrate is not serving humanity, only promoting greediness on the backs of young people.

Along with the prices in Victoria.

Sure. The problem is you’re continuing to imply that any RE transaction is occurring in isolation. At some point, there’s a FTB that needs to access a lot of leverage to get started. A parent can’t just gift them that money ad infinitum either as that eventually runs into the same constraints presented by the sales chain. Monetizing a house requires a buyer at every level below that tier.

This isn’t rocket science, and the evidence of the problem is getting so glaring I’m not sure how you miss it. If your logic model was sustainable, we wouldn’t have nationally unprecedented consumer debt in both real and nominal terms, central banks unable to hike rates despite them functionally being negative, or consumers pulling back on spending and delinquency rates rising. If it wasn’t for completely unaffordable housing, we might not even be having the economic slowdown we’re having. In your scenario, corrections wouldn’t really ever happen (certainly not significant ones) because the higher the house prices got, the more the high prices support the high prices. And that appears to be, despite anything, the essence of your argument.

Given nearly all of your previous posts, I’m going to presume you mean we can predict that home prices will continue galloping ahead of inflation and wages. What’s funny, is I agree this is possible, depending on the time scales you’re looking at. When rates are low for a long time, people go further out on the risk curve to find yield. People dump cash into housing, which inflates them dramatically until they crash spectacularly. But if rates stay low, it may happen again, until it crashes again. In other words, this goes back to what I was saying about CB’s lately becoming serial asset bubble blowers. But over the long term (say a century) you’ll notice something interesting – house prices will actually follow the rate of inflation.

The last 35 years here have been aided by declining rates, shifting demographic and workforce trends and greater acceptance of high debt levels. I’d argue those changes have been priced in and then some. Good luck sustaining that direction and pace of change from this point, for the next 35 years.

The reason foreign buyers would not have turned up that article is that it is about non-resident ownership. FWIW, a non-resident includes Canadians living abroad who does not have a primary residence here.

If you are looking at foreign buyers you might want to look at Leo’s post on this: https://househuntvictoria.ca/2018/07/29/foreign-buyers-drop-by-89-in-victoria

Seems like the number is 4.24% and dropping?

From the article.

So where are you getting this:

The implication is that the person advertising a way to avoid spec tax is trying to run a scheme where he pretends to live in multiple houses. If the intent was to actually rent the ad would have read “I am a renter and will rent your house full time”

I did read that report when it came out but I don’t think this is correct. What they looked at was percentage of 2016/17 built condos that were purchased by foreign buyers. That is very different than 11.6% of purchases to foreign buyers.

Don’t know if you missed my post Leo, but 5% of Victoria homes are foreign owned. 11.6% of sales in 2016/17 were to foreign buyers. It was in the Vic news. Stats came from CMHC. They didn’t include numbered companies with owners being foreign buyers.

edit: found the article – https://www.vicnews.com/news/cmhc-reports-non-residents-own-5-2-per-cent-of-greater-victoria-homes/

Oddly looking up foreign buyers on the vic news website produced nothing, but looking up 11.6 produced the article right away.

Less so here. Certainly an increase in Vancouver buyers in 2016 which one could argue is spillover from foreign buyers. But no huge direct foreign buyer presence in Victoria

LeoM: Not getting stuck by spec tax at all. It is fluke because of how we had to arrange things before the spec tax was even a wet dream for Carole James. We are living off capital and a modest amount of interest on that capital which is all in Canada. Our corporations and trusts do not distribute income and simply reinvest. The fact that we are both frugal means that we are good for about thirty years, The structure was set up for inheritance planning since we have had to deal with multiply jurisdictions.

I may have misread the spec tax but I believe that it may not apply as long as all your world wide income is declared in Canada and Canada is your principal residence. I thought it only applied if one spouse, not resident in Canada (and not declaring Canadian income), was funneling income to the other spouse. I suggest your friends consult a good tax lawyer.

Hope your friends dont have to leave B.C, since that would be a net loss to the provincial economy. We should be out of here soon before they mess us up with something new.

Cheers to all, back to the garden.

As I posted here several times when it was proposed, I am not in favour of the tax. That said, it is here.

Where is the data or logical analysis to back this theory up? When I look at the market it appears to me that net worth (whether the buyer’s or their parents who are helping) is now a primary driver in, for example, sales of SFHs in the core which was not the case even 10 years ago.

You can look at this as densification impacts, but however you want to put it, first time buyers are probably driving the entry level market in Langford, but not in the core – this is fueled by equity plus income.

As far as income-based affordability goes – you can check it yourself here: https://www.ratehub.ca/mortgage-affordability-calculator

“the government is going to (sic) far in controlling to lives of people”

This your reaction now? What did you think when they first introduced a program which actively penalizes materially successful, law-abiding citizens and will NOT encounter a single “speculator”?

I like Carole James, but that is silly. The stated purpose of the tax is: “because people who live and work in B.C. deserve an affordable place to call home”. House-sitting does not defraud anyone and provides a very affordable place for a local to live, a care taking service to the owner that they would otherwise pay for, and the owner will still need to make sure it is occupied at least six months.

There are hosts of people who move around house-sitting, we use a lovely couple ourselves when we travel – a retired UBC prof and his wife who don’t even own a house and just move around from house-sit to house-sit and country to country. Under the legislation a tenant does not need to pay rent and the government is going to far in controlling to lives of people by stating you cannot use a house-sitter imo.

To accurately assess the impact you, again, need the stats. What is the actual % – if it doubled from 2-4% you need to think about the other 96% of sales as this is the biggest impact.

Ok, let’s call it poor affordability – as long as you are comparing apples to apples ie. the repurchase of the same property later point in time by the first time buyer.

At times of high appreciation and poor affordability it is existing home owners that will have equity to move up the ladder if they wish, or cash out and move from Vancouver to Victoria or Victoria to Comox.

I think if you take the same SFH in Gordon Head that you purchased and tried to do it now with your down payment and incomes you’d find there is a big difference in affordability.

Bingo. Your buyer will likely need equity, usually from a prior home sale, unless they are well beyond the median income level.

I’d strongly disagree. It has been true during my lifetime and, based on the stats, beyond as well as far as I can tell.

Home equity may be a stronger factor in our market than income-based affordability – not sure as I haven’t seen the data but someone like Marko would know how many buyers have all-cash or significant down-payments from prior home equity.

What I do know is that the median mortgage in BC is 230k and the benchmark house price in the core is 840k. If you fit this stat you’ll have a down payment of approx 600k from selling your benchmark house you are going to be able to afford a home worth about 1.2 million if you have a median income.

Housing markets have short-term significant gains and losses and those who have to sell are vulnerable to this – or profit from it – but it is the long-term rate of appreciation that is the most reliable and what you need to focus on imo if you are interested in accurately assessing what has happened and making a guess as to what might happen.

Long term, equity builds and can be used to buy a second home or move to a more expensive or suitable home well beyond income-based affordability.

Totoro, the household income is being brought up because it is a more relevant driver to home prices than net worth. Can some do a calculation on how much house ($) two people with incomes of $45k each (done for maximum tax efficiency) can afford assuming they have the 20% down payment?

Barrister, are you getting stuck with paying SpecTax because you moved all your investments outside of Canada? It’s happened to two of my neighbours who are in a very similar situation to yours.

It will include some, but it will also include a bunch of retired people with low incomes and high net worth, those who live alone, single parent families… but by far the largest component of economic families are couples, both married and common-law. If you take the median it is going to cut out the less common arrangements so it is going to be a more representative measure.

Also, as far as income goes, not sure why there is all this debate. Again, it is just a stat that you can access, no need for all the debate. The median household income here is $89,640/year.

If you want to look at specific segments you can. https://www2.gov.bc.ca/gov/content/data/statistics/people-population-community/income

You’re talking about the sales chain. Home prices are made and sustained on the sales chain and when that falters, the result is a retrenchment.

This is why the “home equity/net worth holding up a market” argument is inherently circular and bogus. As we’ve seen countless times, home equity and resultant “net worth” are precisely what gets curtailed in a housing correction. Vancouver is a current, right-in-front-of-your-face example of this process in action. The more severe the correction, the more deleterious that effect on equity and net worth is.

Home equity is a theoretical construct anyway. As you alluded to, it’s always predicated on whatever a buyer is willing to give you for it at that moment in time, regardless of whether you owe 95% of your mortgage, or you’ve paid it all off. Do you think the West Vancouver buyer who bought that 10 million dollar home outright in 2016, now has 10 million in “equity”? Not even close…

totoro, in order to monetize an existing homeowner’s net worth to upgrade into a new home one needs to sell their existing home first, which is where income comes into play for a first time buyer. Unless your saying that a big portion of household net worth for existing home owners isn’t in their home but in some other asset.

I am in that exact situation, I want someone to pay me as much as they possibly can for my existing house so I can buy something better. And the home i currently have isn’t even considered a home for first time buyers now. What I do know is that if i sold my house now (70’s, 2200 sqft, none reno’d gordon head house west of gordon head road on a 6000 sqft lot) i would likely get somewhere between $80k to maybe $120k less than what it would have went for during the peak.

And yet the biggest appreciation corresponded with a doubling of foreign buyers.

I don’t think it is. Affordability is not out of range of the historical pattern. It is just at a high (poor affordability) point. As if on cue, the market started slowing once it got close to that point.

Vancouver affordability is well outside of any historical norms.

I think this is probably true for first-time buyers. For most other buyers it is net worth in the form of home equity that becomes more important. It is not rich foreigners that drive market appreciation here imo, it is those with significant home equity, along with consistent first-time buyer demand.

If you think about it, if housing affordability is diverging from income-based affordability then net worth is likely the missing link.

Leo,

I agree with your assessment. The comments about the ad from the NDP weren’t as accepting though (see below). I fear that this govt will keep meddling and changing the spec tax every time they see an ad like this. The tax is confusing enough without more amendments. As long as the arrangements people find are legit, I see no problem in easy to find and use services, like a service that finds house-sitter for 6 months. Likely becomes a cheap rent situation for a student, and a good solution for an owner that wants to use it too.

These are quotes from the same article…

https://globalnews.ca/news/5104477/vancouver-empty-homes-tax-loophole/

“British Columbia’s Finance Minister Carole James didn’t mince words after seeing the ad, calling the practice illegal and a violation of the province’s speculation and vacancy tax.

“If there are people who want to defraud a system they’ll try and find ways to do that. But we have clear anti-avoidance laws in place,” said James.

“We’re very concerned about any kind of scheme people may be putting together and we’ll certainly be looking into it.””

Don’t see a problem per se as long as they are following rules of the spec tax regarding occupancy length.

I know one person lives 10 months in a place in shawnigan and just camps for 2 months during the summer. Seems like people should be able to find arrangements like that.

Not just assets James, it’s net worth so u need to subtract the debt from the assets also 😉

Patrick, before you go correcting me or James by saying it’s home owner net worth you were referring to, please be aware of the sarcasm contained in the post.

Ohhh, the whole everyone in Victoria has assets worth a million bucks was a joke.

Well it’s clear now.

As an unmudied lake. As clear as an azure sky of deepest summer.

Looks to be spec-tax buster “house sitter for hire ” services running in Vancouver. This one seems silly, but indicates that people are getting around the tax, though most of them will need to be smarter than this about it.

https://globalnews.ca/news/5104477/vancouver-empty-homes-tax-loophole/

“The couple, who identify themselves only as “J + S,” says they have house sat for homes in West Vancouver, Whistler, North Vancouver and Vancouver’s Dunbar neighbourhood.

Jamal, that job is not a senior management job. Folks in finance/accounting and probably engineering would know that job is one up from entry level (entry level being straight out of university and in the process of getting a professional designation). You know how I know? Because I had pretty much the exact same job albeit in a different function at a different employer ( I was 28 at the time).

That role (professional) would typically report to a manager ~$120k (middle management) whom reports to a director $~150k (upper middle management) whom reports to a VP ~$200k or above (senior/executive management).

Patrick we knew it was a joke since we all know that you dont actually have a friend. My wife says I am too subtle. Also too short.

just want to poke fun of your professional salary .. guess every one who is not senior position is just a Joe Blow in the system … good thing we have a lot of senior position to manage that one rookie

Well to be clear, that was a joke, indicated by the smiley face. 🙂 Meant to poke fun at posts that list the source of data presented as “my friend says”.

Probably lots of city stats have issues like that. If someone isn’t, for example, including Sooke in their Greater Victoria stats, they’re wrong, and I guess we all have to live with it and move on. 🙂

the things with house hold net worth/income is that it includes a lot of 30 year old children unable to move out .. multi family homes … seen a lot of chinese and indians have giant families all living under the same roof .. but that is their culture …

That’s not my argument. My argument is that those who aren’t in trouble aren’t going to come to the aid of those who are.

I am pretty sure most people can agree that household income has a much higher correlation with home prices than household net worth. But that is rarely mentioned by the bulls or bears.

Oh ya, on my previous post about $90k/year being a professional salary in Victoria, lots of people were saying I am too high. There was someone who said their wife/husband is a CPA with experience and is only getting $70K at the provincial government. Here’s a new job that person may want to apply to: https://www.civicinfo.bc.ca/careers?jobid=48833

Patrick: I am not questioning which areas you are including in :Greater Victoria ( I agree with your list as generally right) but rather the fact that not everyone uses the same list for Greater Victoria when they report stats.

RE: Post 58060

“My friend says your friend is wrong”. Now you are stretching your credibility totally.

Household net worth is not academic, it underpins credit and hedges risk. It is a big market influence.

There is no “accurate prediction of the future” in RE short-term. Too many variables that don’t appear in the same constellation. Longer term there is enough historical data to state that the most likely thing is that prices will rise.

Oh yeah! But my anecdote can beat up your anecdote with just its little pinky finger.

The below is the kind of debate/information I find useful from the bulls and the bears regarding to where the local real estate market is. All that stuff about asset bubbles and household net worth are academic at best and does not reflect reality and likely won’t be an accurate prediction of the future.

Introvert wrote:

“1605 Mileva Lane

List: $925,000

Sold: $930,000 ($24K below assessment)

DOM: 6”

AZ wrote:

“Purchased 29-08-2017 for $900,000. Then did a significant reno & added a suite.

Big $$$ loss on that one and it was purchased in 2017. More importantly though is Teranet says prices are down 2.5% from peak…”

Victoria might, but the cuts to the RE sector in Vancouver would have much larger and more immediate effects.

It’s impossible to convey the sheer volume of capital that would have to have been dumped into VanRE to get it to its current valuations. A retrench to even barely sustainable pricing would be of such a magnitude that it would, IMO, completely dwarf the economic effects of even the most dire cuts to public sector jobs in Victoria.

My friend says your friend is wrong 🙂

Can’t tell if parody or real.

https://mobile.twitter.com/stephenpunwasi/status/1110704801837285376

*the statistics are not accurate and not meant to be taken seriously

Never know, NDP didn’t even win this election, if the economy falters here before the next election, I could see the Liberals getting back into power, and with way less money coming in from home sales I could see the public service getting chopped. Victoria will suffer those cuts more than anyone.

So saw the stats for greater victoria in a Victoria News article. Just over 5% of places in Greater Victoria are owned by foreign buyers, and 11.6% of the buyers in 2016 & 2017 were foreign buyers. Some how some way, I think that might have affected prices here.

Ya. Unlikely Victoria would see the retrench Vancouver would, as suggested by that decoupling of the last few years. We’re lucky that way IMO, but the trajectory of VanRE affects the whole province proportionally much more than ‘lil old Victoria.

No question Vancouver and Victoria are strongly linked.

I think the only question is to what extent Vancouver got away from Victoria recently and how much of that can compress again without affecting us too much.

Vancouver definitely outpaced us after about 2011 so there is room for them to come down without getting too far out of line with historical ratios.

Well if we accept Leo’s quantification of the two markets’ correlation, I wouldn’t think it’s terribly debatable. The Victoria market is not going to hold pretty while Vancouver tanks and liquidity dries up.

Dasmo,

Good points and perspective. Many of us do the same and continue to track other area’s we were interested in.

As for sales… I got some info from a friend in Vancouver on recents sales in the past week.

Almost every property selling for more than 10% below assess with the majority in the 20-30% range.

Debatable the effect here to some. But I think the answer will be coming swiftly. If I knew someone buying I would tell them to hold off until June when supply will be far higher and MOI inevitably tracks higher.

@guest_57961

Purchased 29-08-2017 for $900,000. Then did a significant reno & added a suite.

Big $$$ loss on that one and it was purchased in 2017. More importantly though is Teranet says prices are down 2.5% from peak…

Introvert, how come you left out all the ones that sold for the mid 700’s? Also, the assessment for gordon head has generally declined around 2% YoY for those who aren’t up to speed.

Greater Victoria would typically be the census area, population 367,770 in the 2016 census. (Sidney and Sooke are “in”)

It is described in detail here…

https://en.m.wikipedia.org/wiki/Greater_Victoria

@LF, I am not advocating such behaviour, I am simply admitting it. Part of it is also simple interest. (It’s not like a frantic daily checking with sweat forming on my brow) Me being a long time equities investor has given me the ability to observe my mistakes in real time constantly. So far in the Real Estate sense I have not had any PTSD because my decisions have thus far turned out to be sound. (I did have major stress during my build and before selling however)

As a RE nerd you will not ignore the market after you buy I guarantee you. Just ask Leo….

Ugh. No. What are you going to do about it if it turns out you did? You can’t do anything except enjoy your home, so you might as well do that.

Not preaching. After I buy, not “verifying” the soundness of my choice will be my challenge too, given I am expecting the market weakness to be going on for possibly years to come.

I’ll probably just ignore the heck out of the market afterwards and eventually lose interest entirely. To do otherwise after you’ve committed is just anxiety inducing.

Patrick: And which greater Victoria are we talking about. Sidney and Sooke are in or out. I am not attacking you nor commenting on your opinion but rather over the years I have seen stats that are all over the place when they reference “Greater Victoria”. Also whether one includes or excludes students at University as family units can impact the results.

Stats can be fun but not worth having a serious argument over. Might as well watch the washing machine during the spin cycle. Perfect day out and the weeds are winning.

@ Introvert, If we are cherry picking anecdotally….

I have focused on a very small area of Victoria since 2011 and have somewhat consistently checked listings in this zone over this 8 year period. We were looking to buy in a specific area of Fairfield so my sample is very small (and thus statistically irrelevant). Why have I observed this tiny zone for so long? After you buy you continue to look to see if you messed up. When we changed plans and decided we would sell I continued to keep my eye on this zone. Of course after we sold you continue to look to see if you messed up. My observations are that the listings for SFHs in this zone are up considerably in the last year. Asking prices are still high but they are not climbing like they were and properties are stagnant. I also see like properties with listing prices lower than they were last year that are sitting for months on end still. for a brief time there was nothing listed under 1million in this zone. This is not the case anymore. The mania is over that is for sure. IMO this spring will test the stickiness of Victoria’s prices. I think inventory is the key here. If it starts to rise across the board that is the only thing that will tip the scales. With low sales and low listings eventually the industry starts to drive prices down since they need sales more than price increases. Thus the “sales” you are starting to see in some developments. Another factor is that the rental developments buoy the development industry but not the sales side….

Most Gordon Head recent sales generally below assessment but still fetching strong prices, with many selling quite quickly:

1605 Mileva Lane

List: $925,000

Sold: $930,000 ($24K below assessment)

DOM: 6

4025 Haro Rd

List: $1,125,000

Sold: $1,125,000 ($29K below assessment)

DOM: 9

4002 Dawnview Cres

List: $799,900

Sold: $799,900 ($48K below assessment)

DOM: 10

1880 San Luis Pl

List: $929,000

Sold: $965,000 ($27K below assessment)

DOM: 11

4006 Providence Pl

List: $1,095,000

Sold: $1,050,000 ($66K above assessment)

DOM: 9

Totoro,

Thanks. I appreciate the thoughtful reply.

You can check out the survey of financial security (2016) to get data for BC: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110001601&pickMembers%5B0%5D=1.20&pickMembers%5B1%5D=3.1&pickMembers%5B2%5D=5.5&pickMembers%5B3%5D=4.1

The median net worth of all economic families in BC was $434,400 in 2016. Victoria is likely a little higher because of RE values, and homeowners will be higher than renters.

Stating that median net worth of the homeowners is the median of quintiles 3,4,5 is possible, but it is not a reliable stat. Also, if you are trying to gauge where you are on the net worth scale relative to others in your situation there is not just a difference between renters and owners, there is also a big difference between age groups and size of economic families. You need to get the stats for your age group and family status.

I believe we are in the return to normal stage?

This one?

I tried posting Hawk’s graph a few times for Gwac, but he’s still too raw from the loss. It just hurts him. So I don’t post it anymore. Now Ks112 hates it too, for shame. 🙁

I miss Gwac vs Hawk. It was much more visceral and entertaining….

All references were to Greater Victoria.

So even without the numbered companies taken into account, 10% of all Vancouver real estate owned by foreign buyers, and over 20% of new builds.

Patrick, your stats are just as annoying and meaningless as that asset bubble graph the bears post. Just leave that stuff alone going forward.

Go find some unrenoed homes that sold for much higher than assessment and post those.

Thanks for all the dueling statistics here. It has motivated me to go garden this morning.

One of my problems about “Victoria” statistics is that sometimes they reference city of Victoria and sometimes Greater Victoria and sometimes the CRD. With Greater Victoria they dont always couver the same area.

At the end of the day this does not tell you much about the housing market.