Dark sales

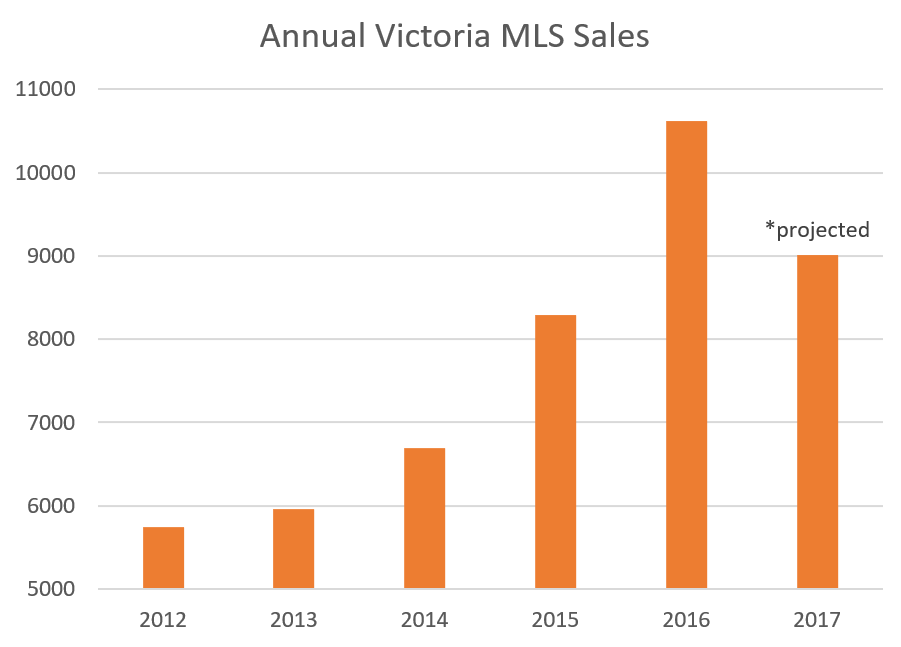

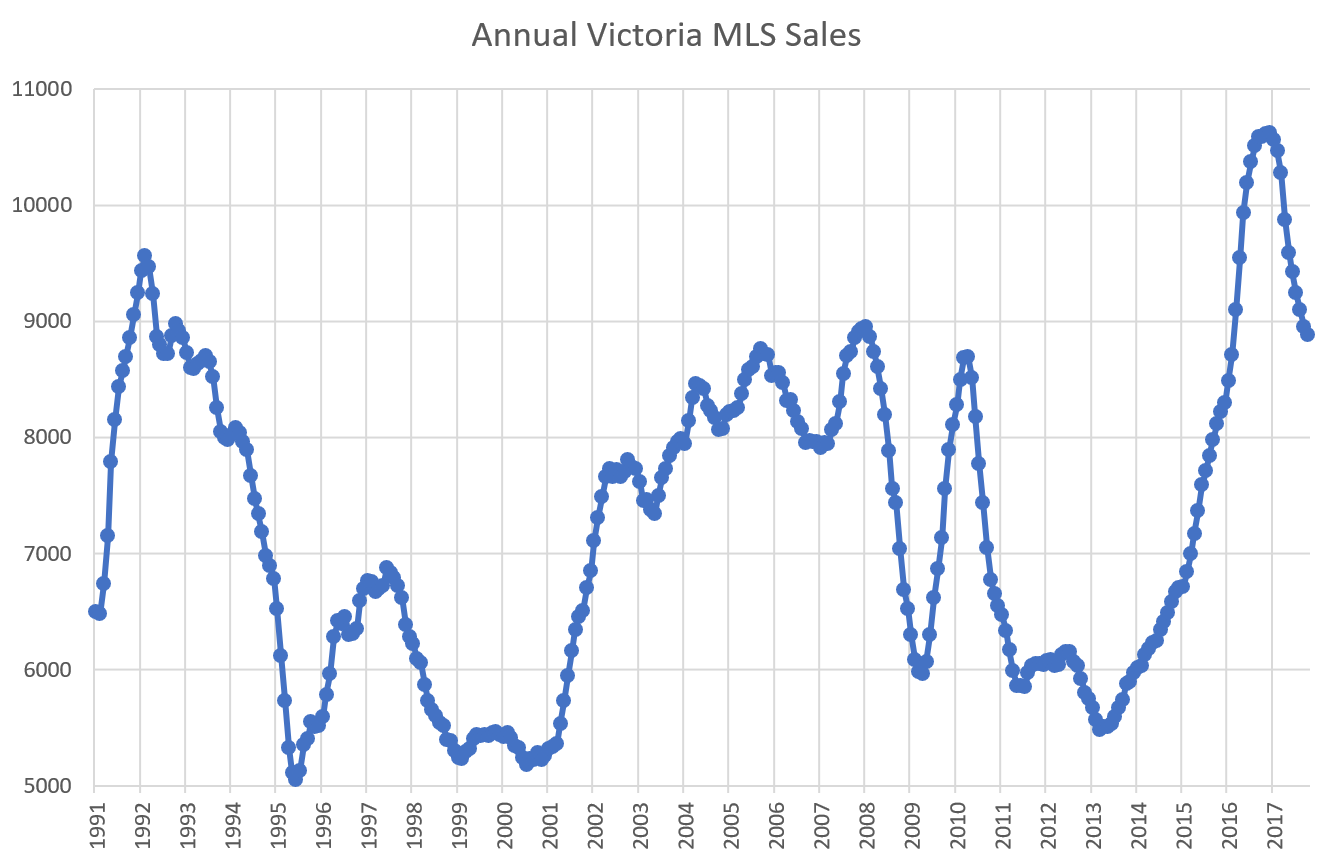

All the data on this site are based on the sales and listings in the MLS database. There are just under 6000 of those sales in a slow year, and over 10,000 in an insane one.

Thing is, while most sales happen on MLS, there are quite a few that are not captured there. For new builds, only a small fraction are ever listed on MLS, and none of the private sales would show up there either.

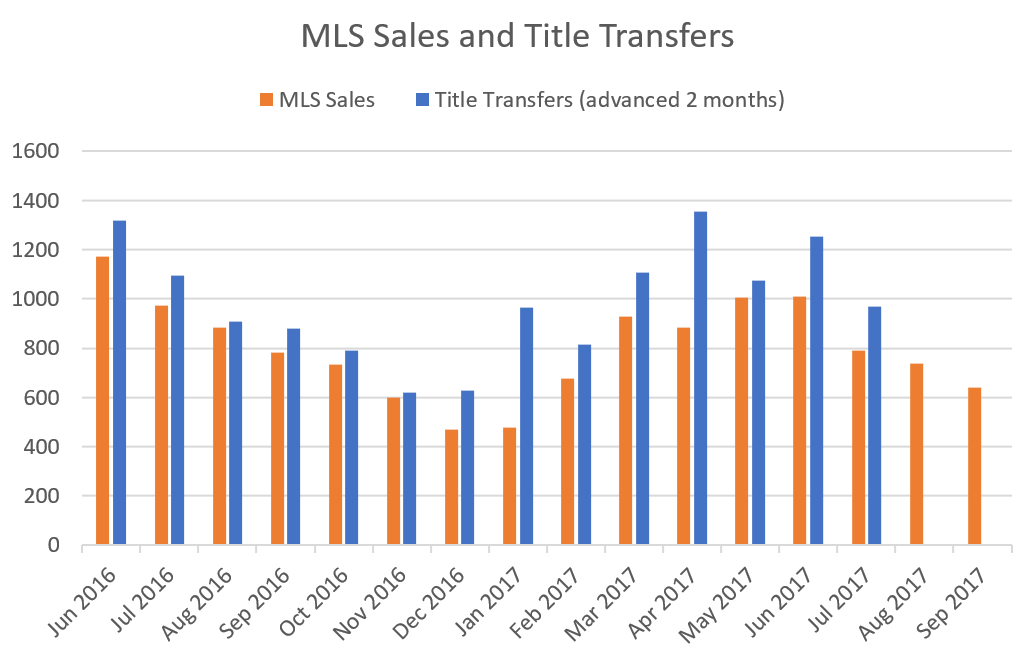

How many sales are happening outside the MLS system? Well one side effect of the province publishing foreign buyer data is that they are also publishing the total number of land title transfers every month. Now that we have a full year’s worth of that data we can get a sense of the number of these dark sales. Because sales are recorded when the contract goes unconditional, and title transfers happen on closing which is usually a couple months later, I’ve advanced the title transfer data to best fit the seasonal pattern.

In the 12 month period from August 2016 to July 2017, there were 9240 MLS sales, and 11358 title transfers. In other words, around 2100 sales or about 19% of all sales happened outside the MLS system.

Most of those sales would have been condo and other new construction pre-sales. With the strong pace of construction in the area those sales are likely quite a bit higher than usual.

The rest would be private sales and inheritances. Impossible to tell how many transactions are conducted privately every year without access to the land title data and cross referencing that with MLS data, but that would be an interesting area to explore in the future. Would it be 1% of sales? 5%?

We bought our house without a REALTOR® back in 2013, but that was only on the buyer’s side so it was still registered in MLS. Anyone here sold their house privately before? How did it go? How did you market it? Any advice on how to make it go smoothly?

Wanted to add we had our wonderful lawyer go over the contract before we finalized it. A must!

New post: https://househuntvictoria.ca/2017/11/14/nov-14-market-update

Always nice to hear stories of adults handling a transaction like, well, adults. Real estate doesn’t need to have the reputation that it does.

52% of the sales of both houses and condos in the core were condominiums this year. Last year it was 46%, the year before it was 42%, 5 years ago it was 43% and ten years ago it was 44%

So as Entomologist alluded to, condos are now outselling houses in the core.

2016 had the highest number of condo sales in the core on the real estate board data service at 2,322. Before that the record condo sales was way back in 2007 at 1,945. So far we are at 1,862 and it looks like we are on track to beat the record set in 2007 but fall short of last years.

JD- condo prices are sticky because of all the new construction. Unlike houses, the supply of condos in the core is going up, up, up.

Just make sure you have a good real estate lawyer look over your offer of purchase or sale BEFORE you sign it.

We bought our house upisland after I put an ad up on Craigslist when there was nothing on the market we wanted. I got 3 replies and one was perfect. The guy was a mortgage broker, we had bought and sold privately before and it went very well. Amazing how people can work together if you give it a shot.

Felt so damn good to bypass huge realtor fees.

You have nothing to lose with ads online.

The median price for a house in the core this month is around $830,000 and a condominium is $380,000.

At around half the price of a house, why have condo prices not increased for the last nine months? The MOI is way down to under 2. Only 1.4 new listings are being added for every condo sold. The only odd thing is that, unlike houses, the DOM is now 30 days to find a buyer.

Relative to houses, condos are cheap so why haven’t their prices increased?

Years back in 2015 I prophesied that house and condo prices were under pressure to increase and all we needed was some form of stimulus. That came with the black swan event of a crash in oil prices as many transient Alberta workers came back to BC to buy rental properties. But that flow of unemployed workers with their severance checks in hand has ended and prices have now plateaued and sale volumes have plummeted.

We are now in a market that is mostly the reverse of 2015 with declining sale volumes. Prices are sticky but as the volume of sales decline the possibility of a correction increases. It wouldn’t take much for the wheels to fall off the cart in this market as we could easily double the number of listings this spring and yet the high prices would deter a corresponding increase in sales.

As always, I look to the outer lying markets such as Sooke, the Malahat and the Gulf Islands as I expect these areas to correct first. So far I’m not seeing an indication of a market correction. For all of you land bankers (hoarders) this means that you can fly off to Aspen this winter with little to worry about.

As I said: >We would still need an increase of 20 to 75 percent more active listings, given our rate of absorption,

“given our rate of absorption”

The number of sales can increase as people get raises and/or put down bigger down payments. In the last year or two that bigger down payment has likely come from the baby boomers dipping into their home equity to gift their children a down payment.

But, I think that is slowing down as the down payment for a house in the city may be $200,000 or more today which costs the parents about $800 a month in financing.

So, can you put a dollar value on how much you love your child?

F-king rights I can! I think around 200K is enough.

Bean counter:

Very interesting article and thank you for noting it. I would have found it rather chilling reading if I had not already moved our assets out of Canada.

Education alert: Debt crises and free money solutions – Canada gets a special nod.

http://www.dw.com/en/can-we-avoid-another-financial-crisis/a-41111841

Penguin: I already told this story a long time ago on the blog but you could also try this – After attempting to buy a house the ‘normal’ way with a realtor, and then loosing three houses to multiple offers in late 2015/early 2016 – almost in a state of desperation, I placed a ‘house wanted’ ad on ‘Used Victoria’. You could also try ‘kijiji’ or even craigslist (though personally I’d stay away from craigslist). It stated requirements, price range, neighbourhood wanted, and no swimming pools (state whatever your requirements or wants are). Even in the red hot market that it was then, I received a number of replies and viewed several homes with owners willing to sell at a good price without a realtor and best of all: no competition! Many homeowners out there detest the exorbitant realtor’s fees that we all too often seem beholden to, you would be surprised. You’ll also find many homeowners don’t want numerous realtors and people tramping through their homes. Working directly with you, they’ll also get to work on their terms or time scale that works for them.

None of the houses were quite right, though most of them were quite nice, until I placed the ad yet again (at that point having almost given up): A builder contacted me – He was about to list his home on the market. The house was perfect! The builder signed on the dotted line and we did the paperwork properly with a lawyer for what we felt was then a very fair price in that market. Having done everything to the house in extreme well built quality, it was also a very rare find in the Victoria market. I had not seen anything like it anywhere else, except new builds, and it is actually over a century old but you would never know it.

Try it, you never know what someone is planning. Now, and over the winter is a good time as people are making plans for next spring. The winter is also the best time to view a house as you will see the most faults then. You will find that you may hit it off with the seller and become friends, and the seller could help you out with this and that details that you may need to learn about the house. Often, the seller will like to see his/her home go to a person that truly values it and they’ll extend that pride of ownership over to you. You will score a great house without all that pesky competition to contend with. More people should do it this way I feel. Also, yes – the market does appear to be cooling down from ‘red hot’ status it was then, so that’s even better for you – but – if a rare desirable property comes up you can bet there is still loads of people poking around since as we all know, the core of Victoria does not have much inventory. This way you’d avoid that. Good luck!

LeoS:

Have fun in Vancouver and thanks for the quick numbers. Safe trip home.

“Hawk: If you regularly fart golf balls off coffee tables then I am not inviting you to the Christmas party.”

Well you’re no fun Barrister. I take it you don’t serve chili at your Christmas parties ? 😉

https://www.youtube.com/watch?v=R6dm9rN6oTs

In vancouver will update later tonight. 241 sales and 387 newlistings this month to date. Pretty good sales clip now same as last year. New listings pace a bit faster than a year ago. 1916 active listings

More on “there are complicated tax rules when you sell”, basically you pay US income tax based on the gain of the house, not your world income. The same as in Canada (for a foreigner).

Scrooge.

3Richard Haysom,

The correct regulation is called: Foreign Investment in Real Property Tax Act (FIRPTA). You can see all the details in Wikipedia. To be deemed as US tax payer is a different matter that related more with time length stayed in US than just house ownership there.

If you just own a property in US as foreigner (no green card or working permit), you can do maintenance work on it yourself as long as you don’t rent it out. If you rent it out, you must report rental (not world) income to IRS (there is also a flat withhold %). You must hire US personal to manage rental and do maintenance work. If you do any work yourself and are caught and reported, you could be banned to enter US for some years (due to working without permit). And there are complicated tax rules when you sell. I know these as we owned a condo in AZ until recently.

Note Canada does have very similar regulations in place, too. And we have foreign buyer tax in Vancouver and Toronto that US cities don’t have now.

Hawk: If you regularly fart golf balls off coffee tables then I am not inviting you to the Christmas party.

… Or maybe sales numbers will increase, right? Hawk and JD – surely you didn’t miss the months on months of wannabe buyers frustrated by poor quality listings and a lack of options. All this talk of ‘dregs’, etc.

IMO, late November through end of December doesn’t tend to dictate seasonal patterns in Victoria. Mid-January through end of February, on the other hand, is much more influential. Last winter (early 2017) it was all about January. This year, what will it be?

1277 Walnut St slashed $50K to $849K.

252 Superior St on slash #2 for a $50K total to $729K.

Only one sale on the so called hot 2 bed 2 bath (under $500K) condo market over the weekend and it went $19K under ask. The other 6 in the past week were all under except one that had it’s price slashed $25K.

JD, but if listings keep increasing just a small amount and buyers are tapped out by HELOC’s or by the new stress tests, or just basic affordability limits, then it won’t take nearly as much to tip the scales to buyers market. We have never seen this type of market before with so much high risk involved. It’s like balancing a golf ball on a glass coffee table. If someone farts it will keep on rolling right off the edge.

No doubt now that Christy Clark sold BC off to foreigners to keep political power and keep the bubble pumping while telling us the opposite. The bigger they are, the harder they fall as they say.

Clark, Wat met Hong Kong developers, while foreign investor debate roiled B.C.

“Some of the investors that Clark and Wat met with in 2015 have courted controversy with regulators in Hong Kong and China, according to media reports in Asia, or have avoided property taxes through loopholes, or have been linked to offshore banking databases. And some of the Chinese development corporations have been linked to fraud and corruption allegations.”

http://vancouversun.com/news/local-news/clark-wat-met-hong-kong-developers-while-foreign-investor-debate-roiled-b-c

Active listings for houses in the core are at a three year high so far this month. And that’s different from what typically happens in the fall market. Active listing have historically declined in November not increased.

Too early to see if this is a trend towards a buyers market but still an interesting twist. We would still need an increase of 20 to 75 percent more active listings, given our rate of absorption, before this would be the start of a buyers’ market. But that can happen very quickly as it did in 2012 when active listings for houses in the core increased from 625 to almost 1,000 in under six months.

“The bigger they are, the harder they fall”

Is this op-ed in today’s Times Colonist penned by our very own Deryk Houston?

http://www.timescolonist.com/opinion/op-ed/comment-we-re-not-getting-ready-for-the-electric-car-era-1.23093081

Thanks Numbers, good advice!

Correction FATCA not FACTA.

@Penguin

We have been long time residents close to Willows Beach and want to inform you that there are deals to be had in your price range of $700K to $800K. You just have to know where to look. Within a 5 block radius of where we live, we know of 3 private opportunities that have come up within your price range +/-5% in the last 12 months. Here are some tips.

1/ Walk around the neighbourhood you want to buy in

2/ Strike up a conversation with one of the old timers, we are generally in the garden doing something stupid

3/ Tell them that you are looking in the neighbourhood

4/ You’ll be surprised at how much you learn or which one of the seniors are thinking/planning to move on.

5/ Set a fair price and be flexible in your move in date (sometimes as far out as 1 year)

6/ you save realtor fees and most importantly…

7/ the long time resident doesn’t feel pressured and doing it on their terms!

With that said, there is one private house within 2 blocks of the beach that is on 5500 sq ft lot that is likely to go in the 750K to 775K range. Good luck. You just need some brains and some elbow grease to find these opportunities.

“Chinese continue to flood south. Regular 4 hour ferry delays don’t help sell the island.

Seattle is drawing Chinese homebuyers because it has something Vancouver doesn’t”

When the Chinese buyers heading South garner sufficient understanding of US tax laws for foreign ownership in the US they will hurriedly reconsider.

Recent law changes for any foreigner owning RE in the States in their name runs a huge risk of being “deemed” a US citizen for tax purposes only. If a foreign owner falls for one of the simplest missteps of renting out their property or personally caught performing any maintenance work on their property and are reported they will be deemed US taxable, which means all their net worth on worldwide assets is now US taxable and the IRS has the power and no hesitation in reaching all the corners of the globe. It boggles me why anyone would personally buy RE in the States as it comes with huge risks. Google FACTA to read the details for yourselves.

As per your original question, we sold privately. We sold to the tenants who rented off us while we lived in Rotterdam. They told me that if we wanted to sell let them know. They really loved the house, and my garden so it felt good to pass the house on to them. I set the price I wanted based on evalue sold and accessed prices of area properties. My own property assessment was useless since it was still grossly under valued. The greater weight on my price was having enough after all the BS to buy our lot we had an offer on with some to spare. They had a contract of sale their lawyer made with no conditions and I had my lawyer review. There counter offer met my requirements and we settled quickly at the kitchen table. The timing was good since we had a day between receiving the proceeds from the sale to lifting our financing clause on our lot!

Luke : Who knows? Maybe she’ll actually do more about the issue than I think they will?

I have a feeling Selina Robinson will do a lot less. She sounds clueless. And our hero Eby has gone completely silent since election time. Sounds like some things regarding speculation and money laundering will be announced in February’s budget and won’t get implemented for much longer than that. Fail.

https://omny.fm/shows/the-jon-mccomb-show/what-is-the-ndps-housing-plan

It’s not out of the question, but the article doesn’t go into much detail about why Victoria would continue to experience a real estate boom. I think the strongest argument is that the current boom has been quite short, compared to previous ones. We are about 2 years into our hot market, and the last one lasted twice as long.

However we are also pushing affordability limits now, so 2 more years of this would put us into completely unprecedented levels.

In the bigger picture yes. There was definitely a short term crunch when construction levels were low after 2008 and suddenly the market picked up. Construction exploded in response and now we are seeing that inventory starting to come online so we should have an easing of the supply problem.

One of the big reasons for the bump up in prices was definitely an influx of Vancouver buyers that came at the exact moment that the market was entering a natural sellers market based on local demand. That drove it into extreme sellers conditions.

CS:

I agree that we have reached some price stability but a much higher level than local incomes would support.

As I mentioned in another post the numbers coming from Vancouver have declined but enough to have a steady stream to maintain the higher prices.

Chinese continue to flood south. Regular 4 hour ferry delays don’t help sell the island.

Seattle is drawing Chinese homebuyers because it has something Vancouver doesn’t

https://globalnews.ca/news/3857541/seattle-chinese-homebuyers-vancouver/

@ Barrister

“I would point out that it is not simply an issue of foreign buyers but rather out of town buyers. ”

But according to Leo S, construction is keeping pace with population, so why would out-of-towners (who have always been a factor in the market) make so much difference? However deep their pockets, out-of-towners will certainly pay no more than they have to and in the current market one would not, therefore, expect them to drive prices up. And indeed, as JD has indicated, in the core, prices this year have not been driven up. The market, in other words, is balanced.

Thanks for the sales info Leo!

“Prices are not really declining—even in the dead of fall”

ICYMI Intorotroll, average and median prices dropped $40K for SFH’s and $40K for condos averages . It’s in one of those VREB news release internet articles you so despise.

If we are talking just about the Victoria market, rather than all of Canada, I would point out that it is not simply an issue of foreign buyers but rather out of town buyers. Last time I looked about 25% or more of sales in Victoria are to non-local buyers. Since Victoria is a retirement destination a lot of these buyers have fairly deep pockets.

I’m not really sure what you’re reading into there. That a RE market must reflect its fundamentals is demonstrably false. Vancouver does not behave this way, and neither does Victoria. Fundamentals are easy to break away from; you use debt to do it. This is especially true when credit is cheap and abundant. That’s what we’re doing. It’s what we’ve been doing. It’s when the credit runs out that there’s a problem – as debt repayment capacity is always limited by incomes. So can it break away? Of course it can. Perpetually? No.

On foreign buyers, and a large inflow of cash. No one said it doesn’t do anything, except maybe Garth. Sure it does. How much is difficult to say. But there’s a difference between say, the luxury class of a RE market, and a non-luxury class. The former often sees money from elsewhere – this is the segment of the market that is less attached to local incomes and generally isn’t much of a concern to a local population writ large.

But when all types of housing are unaffordable and even entry level dwellings are going parabolic, we have a problem. Our exploding consumer debt levels provide a very strong case that it’s Canadians who think that they either buy now or never, and others who are using equity in existing homes to buy condos to “strike it rich”. There’s a reason why our regulators are freaking out and throwing as many policy wrenches into the mania that they can. They know exactly where this leads, sooner or later.

If you believe that the Chinese or some other group are going to keep the entire RE market going independent of all local buyers, all I can say is you’re not alone.

Poor Intorovert, stuck in his pathetic bubble where growing bankruptcies and foreclosures are just “internet stories” while he plays troll, the lowest level of poster.

Looks like the real stories are flooding out now of the massive debt bomb about to blow. You can’t “extend and pretend” forever.

How Canadian homes became debt traps

“Scott Terrio, an insolvency estate administrator and president of Debt Savvy in Toronto, calls this phenomenon “extend and pretend.” Canadians can extend their debt repayment terms and pretend to live a lifestyle they can’t otherwise obtain. He sees it all the time—couples with decent jobs carrying large mortgages, and putting daycare, cars and vacations on credit.”

“Some reach a trigger moment when they can no longer pretend—a job loss, say, or divorce or illness. But lately Terrio has noticed a change in his business. More clients are coming in because they’re simply tapped out. As with Ann in Vancouver, there is no trigger. “It’s a gradual realization for some people,” Terrio says. “They can’t do it anymore.” Lana Gilbertson, an insolvency trustee in Vancouver, has seen the same change. “Nowadays, they have jobs, they’re making money, they’re plugging along, but they’re just in over their heads,” she says.”

http://www.moneysense.ca/save/debt/how-canadian-homes-became-debt-traps/

It just keeps getting worse for Hawk. Prices are not really declining—even in the dead of fall—and many still regard Victoria’s current prices as a relative “deal.”

Cook, we already debunked that scam newsletter group.

“We are in recovery mode and real estate expected to boom”. Not sure if any reads the Gold-stream Gazette http://www.goldstreamgazette.com/news/greater-victoria-region-about-to-experience-real-estate-boom/

Not sure what to think about this. Thoughts?

Looking out the window, for some unknown reason I thought of Winnie the Pooh and the blustery day. A moment of nostalgic comfort.

I hope that everyone here takes a moment to actually enjoy the day.

I already predicted that LF wouldn’t like that last comment, he hopes it isn’t different now. In the 1980’s and even during the 1990’s still, China was still stuck in the dark ages so it is different now. There were not as large amounts of foreign money floating around the globe before 2000 like there is now – esp. to what was then considered a backwater (Vancouver). Japan may have had some influence on things in the late 1980’s, but it’s nothing like what we see today coming mostly from China. In Van in the 1990’s, we did see an influx of Hong Kong people who were afraid of the 1997 handover to China which did exert an influence there. However, some of these went back home after it was apparent the handover was going to go smoothly, partly causing a dip after 1997 that resumed around 2002 once mainland Chinese started to take notice of Van. The amounts of foreign money we see today have recently accelerated, and are the likes of which have never been seen before.

You are right I’m at a catch 22, being a home owner and like many others who bought in before the large price rises, having benefited from that foreign money flowing here, as I first bought in at age 23 in 2001. Back then, the average home price in Coquitlam was $250,000 – and driven mainly by local fundamentals at the time. Today, the same home fetches close to $1.4m. Here’s an example of a home similar to my first home that cost just $205,000 in 2001: https://www.realtor.ca/Residential/Single-Family/18680720/927-SMITH-AVENUE-Coquitlam-British-Columbia-V3J2X4

Back then I never imagined remotely things would be like they are today.

You might not believe it, but I do feel empathy for others as I picture myself today, if at age 23, and see how it would be impossible to do the same thing as back then. I’d be looking at tiny condos if in the same situation today. I feel like the situation is unfair for others not able to buy into the market – it is not a feign of empathy. But – life isn’t fair and it never was. Some get lucky, others aren’t so lucky. However, I already had the OB haters, etc to deal with, so I ‘get’ how you might think that.

Penguin is right – myself and others who bought in before the large price rises got ‘lucky’. Some of us acknowledge that. The baby boomers who bought in before 2000 are even more fortunate.

Do I think it would be great if the Gov’t did something about the foreign money even if it negatively affected house prices? Yes, as it would be good for society as a whole.

Do I think foreign buyers are the only factor? No – you are quite right locals have taken on more debt to compete, and so are part of the story driving up prices. Also, lack of supply as population grows is another factor. Robust economy, yet another factor. But, if foreign money was cut off or heavily taxed we would at least not have that factor to blame anymore. I don’t think it will happen though.

@ Local Fool

You can’t be serious that RE prices must reflect local fundamentals. I agree that prices are very stretched and extreme by local metrics. However, there is massive amounts of foreign capital in the market. Can do be denied.

Translated: Home prices in Canada will not meaningfully fall because globalization and foreign money will prop up our real estate market. Ergo, both are new market fundamentals, and it’s different this time.

In the macro sense, globalization and the resulting depression of wages is a net bearish signal for housing, not the reverse. This concept us Canadians have recently developed that foreign cash will now hold up these insane valuations is cute, naive, and a bit humorous.

Foreign money is not a new RE market fundamental in Canada. It never was, and never will be. Foreign money in Canada has always been there; its presence has ebbed and flowed with other countries in the past having mass run ups in credit (late 80s and early 90’s, Japan was doing the same thing China is now, with buying RE left and right). Today, China must keep control of it if they want to have money to run their country.

No matter what anyone posts, a RE market ultimately depends on locals to drive it. If the market exceeds that which locals can pay, locals bridge the gap with debt. This can go on for years. But when debt grows larger than the economy’s ability to pay it, the market deleverages without exception. This scenario has been played countless times throughout history in all kinds of asset classes, and each time legions of very smart folks were convinced that that time was different. People complain that only the rich can afford the asset, and everyone else can’t. This isn’t new. We’ve seen this all before; all you have to do is have a quick look at history.

And to the poster directly: You can probably stop trying to feign discontent and empathy that RE is getting too expensive, as the bulk of your postings to date are almost contradictory to that premise.

@Bean Counter

Re your link:

http://vancouversun.com/opinion/op-ed/opinion-surtax-needed-to-bring-fairness-to-vancouver-real-estate

An excellent proposal by UBC Prof. Gordon.

Urban real estate is expensive because it provides access to valued services, amenities and economic opportunities. Many of those benefits depend on taxpayer funded infrastructure and services. Thus every property owner should contribute to the cost of providing those benefits.

Non-taxpaying foreign owners of urban real estate are free-loading. The solution, as Josh Gordon indicates, is a heavy property tax, say five to ten percent of the property’s assessed value, on foreign-owned real estate.

The effect of thus preventing foreign investors exploiting Canadian taxpayers would be to free up a substantial proportion of real estate in both Vancouver and Victoria for purchase by Canadian citizens and landed immigrants.

Everybody is happy to have others pay right until they discover that inflation has pushed them into the higher tax bracket.

The Staggering Value of Urban Land

https://www.citylab.com/equity/2017/11/the-staggering-value-of-urban-land/544706/?utm_source=nl__link3_110317&silverid=Mzk3NDcyODEyNjExS0

@luke I think the NDP has a chance if they pin it all on the Liberals and really push hard on the fraud and organized crime angle. Shouldn’t be too difficult, with the gambling stories that have come out recently. If they can clamp down on foreign money with the primary argument that it is enforcing our laws, I think a house price decline won’t be disastrous for them. I suspect they can’t pull it off though, and any housing action will be weak.

Here’s a story that is likely pretty common. Acquaintances out in Vancouver, bought into the housing market early but upgraded into more expensive places over time so likely always with a big mortgage. Long commute to drop off the kids, then a longer way to work, and do it all again 8 hours later. No choices because the mortgage needs to be paid.

Now divorced, dad kicked out.

Who knows if the money stress or the time stress were the primary causes, but they can’t help. Take care of yourself first folks.

Penguin, I think you have a very sensible approach. Doesn’t mean it will work out, but like you said, there are things in life more important than housing and it’s not worth sacrificing your mental health for it.

$1.455M and $1.999M

And just for fun, in 1995 988 Victoria sold after 3 years of being in the market off and on, for $312,000.

Quite possible. Unfortunately the VREB stopped publishing their quarterly report on that, so we’ll have to wait on the end of the year to confirm.

http://vancouversun.com/news/local-news/new-housing-minister-selina-robinson-to-tackle-b-c-s-runaway-home-prices

Someone posted in another thread that BC’s new housing minister is Selina Robinson – here is her contact info:

https://www.leg.bc.ca/learn-about-us/members/41st-Parliament/Robinson-Selina

Who knows? Maybe she’ll actually do more about the issue than I think they will?

Excellent article Beancounter – thanks for posting that.

Here’s the problem currently facing the NDP – 70% of British Columbians are homeowners. The minute they introduce much needed legislation, like a surtax talked about in that article, they would cause more problems for themselves. With Globalization continuing to benefit the worlds uber wealthy more and more, Vancouver has now essentially become another playground for these global elites – with Victoria feeling effects from that. However, there are still many established homeowner’s left in Metro Van and Vic, who bought before the really large prices rises started this century, and there are those who have bought relatively recently, possibly stretched to the max. If the Gov’t makes dramatic moves to deal with the foreign money flowing in, then they could cause ensuing damage to these housing prices that could be dramatic, esp. in Van but also here in Vic, and it would mean they would likely cause themselves to suffer dramatic losses in popularity and in the next election. All those people who had been counting on that equity will not reward them in the polls.

If they make a move to act that is too onerous on the foreign money flowing into BC, they also face huge risks to disrupting the existing economy here – Hawk would see his dreams come true as all those construction sites around town fell silent. The Global Elites have other playgrounds in the West that they would move on to from Vancouver and BC.

What’s more likely to happen for BC is the Gov’t will announce something in the next budget, in an attempt to soothe or appease the base that request’s some sort of action – like those priced out or not in the property market already. But, it will be far too little, and we all know it’s already too late. They are stuck between a rock and a hard place.

So, my prediction is the foreign money will continue to flow in to the most desirable RE here from jurisdictions where it is far easier to earn than it is here. This money could be proceeds of criminal activity (money laundering). It could be proceeds from what essentially amounts to slave labour compared to our standards. Or, it could be more or less ‘honestly’ earned – but in jurisdictions that have far less onerous income tax systems than Canada. This is what globalization has brought us, it is not a level playing field for Canadians, who are now and esp. in the future will be unable to compete on their own soil for the best RE in the best cities, instead being left the scraps or forced to move to cheaper cities. It is unfair to hard working and well paid Canadians not yet in the market. Globalization ensures an unequal playing field. This environment did not exist in the 20th century, and this is why it’s different now than it ever was before.

I thought there is a “bad tenants” list here in BC? If you are a member of BC landlord association (called LandloardBC now), they can help you check the list when they help you run credit checking on new tenants. We were members when we helped friends to manage their rental house a few years ago, the $150 membership fee was the best money any landlord can spend, as the association was very very helpful.

I’m looking for a house that I could live in for forever if I had to because it seems a bit less risky. And barrister I only look at houses that have been on the market for a while because I’m not willing to get in a bidding war or pay over what I think it’s worth. I totally agree with everything you did, seems smart. I want a bit of a fixer upper with a good size lot with a suite or options to add one in (at first to afford kids in daycare and after for extra space for family) and be in one of the many areas I’d be willing to live in. I don’t care about the house being perfect or updated or open floor plan or garage etc. But has to have a good yard and be big enough for a growing family. I am not super picky about the actual house but just have not seen too much out there for my budget and am not willing to live in West shore. Doesn’t seem unreasonable for 700-800k budget but there’s just nothing good out there and if there is it seems to get snapped up. To me it’s not worth it to jump into buying a house that isn’t what I want for so much money. I think I would regret it if I settled and then the inventory shot up or prices decreased in the next year or two. I would not regret it if I slightly overpaid for a house that I thought had potential or I could see myself living in forever. That means more of a wait for the right house scenario for me but it is so easy to second guess it.

I wish I had been in a position to buy a house a few years earlier and it feels really crummy to be in a situation where we are in the top tiers of incomes Victoria (as Leo’s stats suggest) and can barely afford to buy (or rent) a SFH within a 20 min commute of work. Especially with everyone around us gloating about how much they have made in RE and sacrifices and how we have to get into the market asap. These people just got lucky and we didn’t. No one will ever tell you that though and they think it was their hard work and smart financial decisions.

They say:

Just load on the debt, buy multiple houses, don’t worry about saving or investing or risk and what do you know we got lucky and made tons of money! 800k is nothing, I thought 300k was a lot back in 2007 and now look my house is worth 1 million! Kids nowadays just want their smartphones and lattes, those 500 dollars a year is why they can’t afford a house! No work ethic those millennials!

I went to University and have a great job and a great life. I’ve paid my loans and saved and invested lots of money. I don’t think it is my right to buy a house and don’t complain about it. It is what it is but I’m not willing to throw it all away just to own a really crappy house. I also just can’t stand those smug homeowners who think they are so smart when most of them really just had good luck.

Anyway I could go on literally forever but I’ve waited this long so I’m not willing to settle on a shitty house that I’m going to hate living in more than my current house. Just not worth the extra costs of owning (because it is more expensive right now to own). I just have to be willing to bite that bullet if prices of SFH rise out of my reach but I guess it’s a risk I’m willing to take. I’ll probably be whining to you all in a year because I have to move to Sooke to afford a house.

Get the word out. There should be a groundswell of highly vocal support for this. Time to hold the NDP’s feet to the fire. Unless of course you actually enjoy paying the taxes of the elites.

http://vancouversun.com/opinion/op-ed/opinion-surtax-needed-to-bring-fairness-to-vancouver-real-estate

This is why I sold my last rental property a few years ago and why I’m done being a landlord forever. It happens here in Victoria more often than you’d think because it’s not often reported in the news.

http://www.cbc.ca/news/canada/hamilton/go-public-landlords-tenants-rent-1.4392947

For police officers and teachers, they normally have good pensions which allow them to retire at age 55, and they can live comfortably but not rich, even without selling houses. Selling Vancouver houses and moving to here would bring increased living standards than when they were working.

John Drake:

Actually a number of people that i meet in Oak Bay are middle class people around age 55 who had jobs such as police officers or teachers. They sold in Vancouver at about 3 million and bought an equivalent house here for 1.5 million. The million and a half they put in the bank let them retire ten years early. The island works because you can still see friends and family but have enough money to take a month down south and not have to ever go to work again. it leaves then comfortable but not rich.

I think a lot more of those Vancouver/Lower Mainland purchasers are just ordinary folk. They may have made some money on their sale of their homes in Surrey or the West Side but still needed a mortgage.

They came here because they were out priced in their mainland cities and were young enough to relocate their families and find work here. They are just as hampered by the high prices now as the locals. As they most likely had to take a cut in their incomes to live here. And those may be a reason for the stagnation in house prices in the core.

Sure there may be a few extremely wealthy that have moved here but if they are that wealthy why would they move from a city they were very comfortable living in? With that much wealth, they could winter in any city in the world.

And besides our prices are being driven by the demand for middle class housing not upper income.

I suspect that the number of people selling out in Vancouver and retiring to Victoria has finally started to slow. The sudden massive spike in house prices in Vancouver allowed a lot of people, in a very short period of time, to sell out and retire to the island. But there are only so many people that want, or are able to retire here so it is not surprising that the flood has turned into a much smaller although perhaps steady stream.

It would be interesting to know what percentage of buyers above the 1.5 million price point where not local.

Does anyone know what 988 Victoria Ave and 830 Transit sold for? Both appeared to be overpriced vs. comparable listings in the area, I’m surprised they sold.

With MOI and sales to listing ratio and day-on-market so low – prices should be rising!

From 2013 to 2014 house prices in the core rose 2%

From 2014 to 2015 -8.2%

From 2015 to 2016 -19.2%

From 2016 to 2017 – 14.9%

And this year there has been zero increase in prices during the last 10 months and the number of house sales in the core has dropped substantially from last year.

Who knows what next year has in store for Victoria. But my opinion would be that Victoria would have to pull a rabbit out of a hat for prices and sale volumes to magically increase other than for seasonality.

Are we at an apex in the market?

Prices could be rising.

We made a list of “must haves” and “must not haves” and then everything else was a nice to have. I think my wife’s only criteria on the must not list was “be a shithole”. I think it’s a good idea to keep criteria fairly open then you have more options. Most things end up feeling less important after except for location as Barrister said.

Penguin:

What are your criteria for a house at this point? More importantly, are you thinking in terms of five years or twenty five years.

Definitely seeing more delayed offers failing. Seems like buyers and sellers are a little sick of the tactic.

Only 14 new bankruptcies in the last 3 days of the week. Yikes ! We even beat out Vancouver by one. Nothing to see here folks, just keep the line moving please. 😉

https://justice.gov.bc.ca/cso/viewNewCaseReport.do

Penguin:

Sometimes you are better off looking at houses that have been on the market for a month or more and then low balling it. Worst that happens is that they say no. it still has to be the right house.

The first house I bought the main criteria was the lot. The house was tiny and really old but by putting on a two story addition on the back a few years latter as well as doing all the trim and molding work myself I managed to get a fine home for a lot less. The only thing that cant be changed is the lot and location. So start with that.

Won’t be long til the fence sitters who are waiting for more money wake up and realize it’s not going to happen. When an economy is based on easy credit and the noose is tightening, then you have one massive ticking time bomb.

B.C. Now More Dependent On Real Estate Than Alberta Is On Oil

http://www.huffingtonpost.ca/2017/11/10/b-c-now-more-dependent-on-real-estate-than-alberta-is-on-oil_a_23273530/

John,

The DOM is so low! It is one of the reasons I’m waiting to buy. I can’t make a decision in that time and get in a bidding war. When I buy a house I want it to be a thoughtful decision and not be in a situation where I know I have to jump on it asap or it’s gone. And the other problem is there might not be a house with all your criteria again for…who knows…another year. I find myself making too many compromises in my head about what I’m willing to settle for but really the best option is to wait if there’s no hurry. It is just hard to tell yourself that when it’s been crazy like this for so long. We are quick to forget what it was like 4 years ago. I don’t think it can get much worse for buyers…

House prices in the core have been very stable over the last 10 months with the median at $863,000 +/- 3 percent. That certainly underscores how stable prices and the market has been this year at this price point. House prices in the core are at an equilibrium point and that makes supply and demand in balance.

Active listings averaged 408 per month . And sales averaged 170 per month. The average months of inventory being what has been historically called low at an average 2.4 ( +/- 30%) MOI. NOTE: In past markets a balanced market with stable prices exhibited 5 to 7 Months of Inventory but at lower prices when more people could afford to buy and more people were likely to list their homes to move up the property ladder.

Personally, I’ve seen more people choose to renovate their homes in the last year or two, than sell and move up to a better property. Simply because they could not find very much in the price range that they liked and could afford, and chose to spend their money on their current home instead.

Another indicator of the health of the marketplace is the New Listings to Sales Ratio which is sometimes expressed as the reverse in a percentage form.

The average NLS for 2017 is 2,605 new listings for 1,697 sales or 1.53 new listings for every sale (or 65%) Historically a ratio between 1.5 to 2.5 new listings for every sale or (40 to 60%) has been considered to indicate a balanced market. In historic terms the market for houses in the core has been in balance but right at the margin of a balanced and a sellers market.

The last indicator is the much maligned days-on-market (DOM). This is the one key indicator that denotes a “hot” market to buyers and sellers. It’s the one most proffered as showing the health of the market. And this year it is 12 days. WOW! This is really low. A historical balance is between 30 to 90 days and all lenders without exception have chosen this to define a balanced market as such. Mostly out of ignorance as this is what they’ve been told by their mentors and have never had the DOM indicator explained to them. At 12 DOM the house market in the core is on fire so much so that you’re roasting wieners along side the Devil by this one isolated indicator. If you’re a prospective purchaser for a house in the core that means you are getting regular updates on new listings from your agent, the car is gassed, the baby is tossed in the back seat, and you’re off to the next showing in minutes. Hopefully the agent hasn’t intentionally under priced this one so that there isn’t a 6 baby stroller pile up in the driveway.

Went through 137 Olives open house yesterday and it actually a really well built house with a lot of nice features and well done trim work. I am not sure that this street supports this house price. But i dont know what things are selling for in that corner of Fairfield. But it struck me as one of the higher quality houses that I have seen recently.

Has anyone else been through it and what did you think?

PS

I am really trying to override my instincts that 2 Million should be a mansion.

@freedom_2008 – Great summary and a good process to follow.

I’m not sure what you are looking for. You mean averages for each calendar month over several years?

Leif asked for a longer time period chart of annual sales. That is what this is. Except instead of just counting all sales in a calendar year, it counts annual sales every month. In other words, every data point is the sum of the previous 12 months of sales. It gives the range sales totals that Victoria sees in various market conditions.

I helped a family member sell a condo in Vancouver 1.5 years ago. I approached two realtors and got their view on value and marketing. Then we paid $400 for an appraiser to have a look. After that we polled people in the building and found someone that wanted the unit. It was one of only two units in a 16 unit building that had a proper ocean and mountain view which is why I figured this approach might work. The price agreed on was towards the top of the range identified by the realtors and appraisers. The realtors and appraisers were quite consistent in their views on value.

Total selling costs pretty low. Notary for conveyancing plus appraisal plus my time to make a trip to Vancouver. Of course if they had held on till now they would have made more. That was unknowable of course and in any case it was the right time for them to sell (plus it still tripled in price over the 24 years they owned it).

I suspect that the EV conversion costs for larger condos will make for some interesting condo meeting battles. If the whole electrical system has to be up graded to handle the extra amps I would suspect that it would be a pretty big ticket item. I have no idea what sort of costs might be involved; does anyone here know? Also would one want the individual charging stations to be metered to the owner?

We have sold three houses privately (and 2 with realtors) in past 30 years. It is not rocket science, but does need hard work and good knowledge of market condition, the selling process and the regulations.

Our most recent private sale (a SFH with multiple offers) was in Oct 2009. We bought a new and bigger SFH nearby in Feb that year, and rented out the old house as market was bad then. But by Oct 1st, the tenants wanted to break out the lease due to family reason. With no reply to our rent ad posted immediately, we decided to sale. Lucky for us, the market was much better by then, and we had a couple evaluations done not long before (we did tell realtors that we would try to sell privately first), so we set a price that was good for us and reasonable for the market.

We posted for sale ad on UsedV, Craigslist, Kijiji, and got more than 30 inquires in the next two days. I talked with all 30 plus people over the phone and selected just 12 families that we felt could fit for the house (1000 sqft with partially finished basement) and the neighbourhood, to come and have a look the house (each had 30 minutes private viewing, and was told about the offer day and time)

The showing was on Monday and we got 6 offers by 6pm Wed. Since most of the offers were above our asking price, We decided that we will not do any counter-offer, and told all of them about the process we would follow.

We accepted the highest offer first, but it fell through the next day due to financing issue. We had two back-up offers, one of them with buyer realtor, and the price the realtor offered would cover the commission we pay, so the two offers were really the same price to us. We chose the family without agent and we knew wouldn’t have financial issue and asked if they want to continue, they did. We supplied PDS and survey to them and the house passed inspection and mortgage approval. But they had to find and use their own lawyer, as in BC law society and the notary society prohibit their members from acting for both buyer and seller.

At the end, the family who bought the house was happy and they did finish the basement with a suite afterwards. We were happy as we got a good price that was over asking and beat the price realtors would list for, without price negotiation and paying commission. The other families who didn’t get the house were also fine, as we were very open to them on the process.

So the key points of a private house sale are very much the same as other sales, know the process, know the market, know the rules, be honest and be fair.

The only thing that has changed dramatically and will continue to change, I think, is how to market your home for a private sale. Back in 1991, we put ad on TC, sold conditionally to the neighbour from next street but he couldn’t sell their own house, so my co-worker bought it. In 1999, we sold (in ON) via Grapevine to a stranger. But now, in a good or balanced market, one doesn’t need to spend any ad money at all, if you and your house are prepared and presented well.

LeoS; I differ to the chart expert but do you have the actual monthly averages? Sorry, that is probably too much work for little purpose.

My problem, not being familiar with reading this type of cumulative chart is what information is it actually giving us?

Normally they would have approached you first and asked you to provide a commission if they brought their buyer. Only as a last resort would they get the buyers to pay. A bit odd they didn’t ask.

I’m not 100% sure about how it works when seller is private and buyer has realtor and whether those show up in MLS

LeoS, thank you for your excellent work, once again. Your data analysis is exactly the kind of thing missing in most discussion of the market.

This is a good point. Things will really start to change when EVs are the same price as ICE cars. We will look back with some regret that we didn’t plan ahead for enough charging stations. It is fine if no-one uses them right now. In 5 years they may all be full.

Yes, well each data point is the sum of the previous 12 months.

Barrister-

I think the chart shows annual sales. So it’s a 12-month average, which is why the line is so smooth. There is indeed a huge seasonal effect in the month-to-month numbers.

4173 Bracken Ave slashed $50K to $799K. Nice place in nice hood by St Marg’s.

1339 Carnsew St in Fairfield slashed $60K.

116 South Turner St in James Bay slashed $100K.

3651 Craigmillar Ave in Maplewood slashed $50K.

3661 Craigmillar Ave, slashed $40k.

What struck me on you chart is that sales for single family homes seem to be very uniform from month to month. Maybe I am misreading the chart but there does not seem to be a flood of spring sales and a slowdown in the fall to any great extant.

rush4life, they tried the cheap auction pump and were too naive to realize that game ended months ago and are now waking up. If it failed then, it usually fails after they jack it up, especially on a busy street.

We sold a home in Calgary privately only using a lawyer for the usual things. He went over the contract and sorted out transfer of title etc. The home sold in two weeks for the asking price. The buyers were using a realtor who was quite happy to deal with us. It was only later we discovered the buyers had covered her fees, we were never involved. I guess as they used a realtor the sale would still have appeared in the MLS numbers.

It was honestly so easy I have never been sure why anyone uses realtors unless they don’t like meeting buyers face to face.

Would you be able to isolate the ones that were left over from the spring, and remove them from your calculations? I just think it would be an interesting topic to tackle, and I realize your analysis wouldn’t be scientific.

I get listings sent from a Realtor and have been following the price slashes (hoping to buy spring of 2018). I noticed 2901 Quadra St went UP about 40K from 618K to 658K. This is the first time i’ve seen a detached home price change upwards in the last few months – any ideas on why this would happen in this environment?

The so called hot market for 2 bed 2 bath condos under $500K that someone was touting as flying off the shelves has fallen off a cliff. Only 6 sales since Monday in the core and 5 went for under asking and the 6th was $5K above after a $25K slash. I sense there’s a change in the wind in the condo mania market.

Most of my data is just what I’ve manually scraped together over the years from public VREB releases. I do have access to the internal system of course but it is not an API so very cumbersome to do advanced queries, or listing-level stats.

However, I did recently license the API from the VREB and I’m building front and backend to enable private portals so people can get market stats for the area of the market they are interested in, not just the overall market. Stay tuned on that one, it’s coming together pretty nicely.

Too lazy to put it into that format, but yes I have the data.

@Deryk. I believe there is a townhouse development that put Ev chargers in. I think none of the buyers had EVs though.

Odd. I get about 40.

You’re right about the EV issue but builders won’t care until they see the impact on sale prices and we’re not there quite there yet.

I don’t think we are going to retrofit all the condo buildings downtown to have a charger for everyone though. Too expensive. Autonomous vehicles will reduce car ownership especially downtown, and with longer range EVs and faster charging it is possible that people could drive and just stop at a charger half an hour every week or two so they won’t need one at home.

By the way Deryk you keep getting stuck in moderation because you have a user account but are posting not logged in. The system flags that. You can either log in to post or I can delete your account and you can post not logged in.

I find it interesting that, to my knowledge, there isn’t “ONE” new construction building in Victoria that is able to provide electric vehicle charging stations for every person who might own an electric car in the near future. (Even though electric vehicles ownership is growing exceptionally fast.) The buildings are being built without the capacity to handle the electrical load. This will mean that more power would have to be brought in from the street and a new electrical panel installed, plus all the wiring to each parking spot and meters for the same.

It is like building a building and saying …well…. if you get in early, then we can give you power for a stove in your kitchen, but we don;t have enough power coming into the building to give everyone power for their stove.

When you own an electric vehicle, plugging in overnight is as important as having a stove.

Some buildings are saying….”well…we are installing a couple of charging stations for those with electric cars in the parking lot”. But to an EV owner, that is next to useless. Who wants to have to check every half hour to see if the charger is available? One needs to plug in and retire for the evening.

Some people think that no one will own their own cars in the future. But the thinking on that has changed as technology for electric cars has become cheaper than a regular gas car. (Cheaper because it has several hundred fewer moving parts and very little maintenance. Cheap milage. $1.75 to drive all the way out to Sooke and back to Victoria which is cheaper and faster than the bus.)

People who are buying these places have no idea that their next car will likely be an electric and yet they are not aware that they could very well be stuck with an expensive upgrade to their buidlings as strata councils vote to spend the money for the upgrades. Builders in the meantime, just keep building them as is because they know the issue is not on peoples radar and it will not be them that are stuck paying the upgrades. Something to think about when you buy into a new building or even an old one for that matter. I’ve tried to get the Times Colonist to write a story on this but no one seems to grasp the idea because, unless you are an EV owner, it’s hard to grasp the importance of plugging in. Contrary to people’s understanding….people who drive an electric vehicle, don;t get their biggest charge from stations around town. They plug in at home. People generally don’t plug in at the mall, other than to top up and general convenience. (If I’m at the mall and there is a charger, then I top up…why not…it’s free. But I only get about 10kilomoeters of driving after an hour plugged in at the mall.) It takes several hours to charge your car and so it makes sense to do it overnight which gives you a full days range.

Anyway….. big changes are coming. Apparently some dealerships are having trouble keeping electric vehicles in stock. The shift is on. And new condos etc have no where to plug in for everyone.

We sold our home privately earlier this year in May. It had been previously listed on MLS for 6 months with one offer we didn’t accept.

I spent quite a bit of time writing the ad, no long story just point form with good information and decent photos. I ran the ad on Craigslist and sold it within a week. Pricing was the hardest thing to figure out, but we decided to price it close to what we thought was fair value and we sold for very close to it.

We are still looking for an acreage to purchase though!

In your first chart, do you have a longer time period? Can you do 10 or 20 years out?

Hey Leo,

How do you get your stats? Is there a API (computer interface https://en.wikipedia.org/wiki/Application_programming_interface) into VREB’s database as a real estate agent or brokerage firm or how do you gather your data?