Has it ever been a bad time to buy Victoria real estate?

Sometimes I get feedback saying this site focuses too much on the current market movements (market slowing down) versus the bigger picture that’s required for real estate. While I do cover long term term cycles and price trends, those of course only move very slowly so current market conditions dominate the article count.

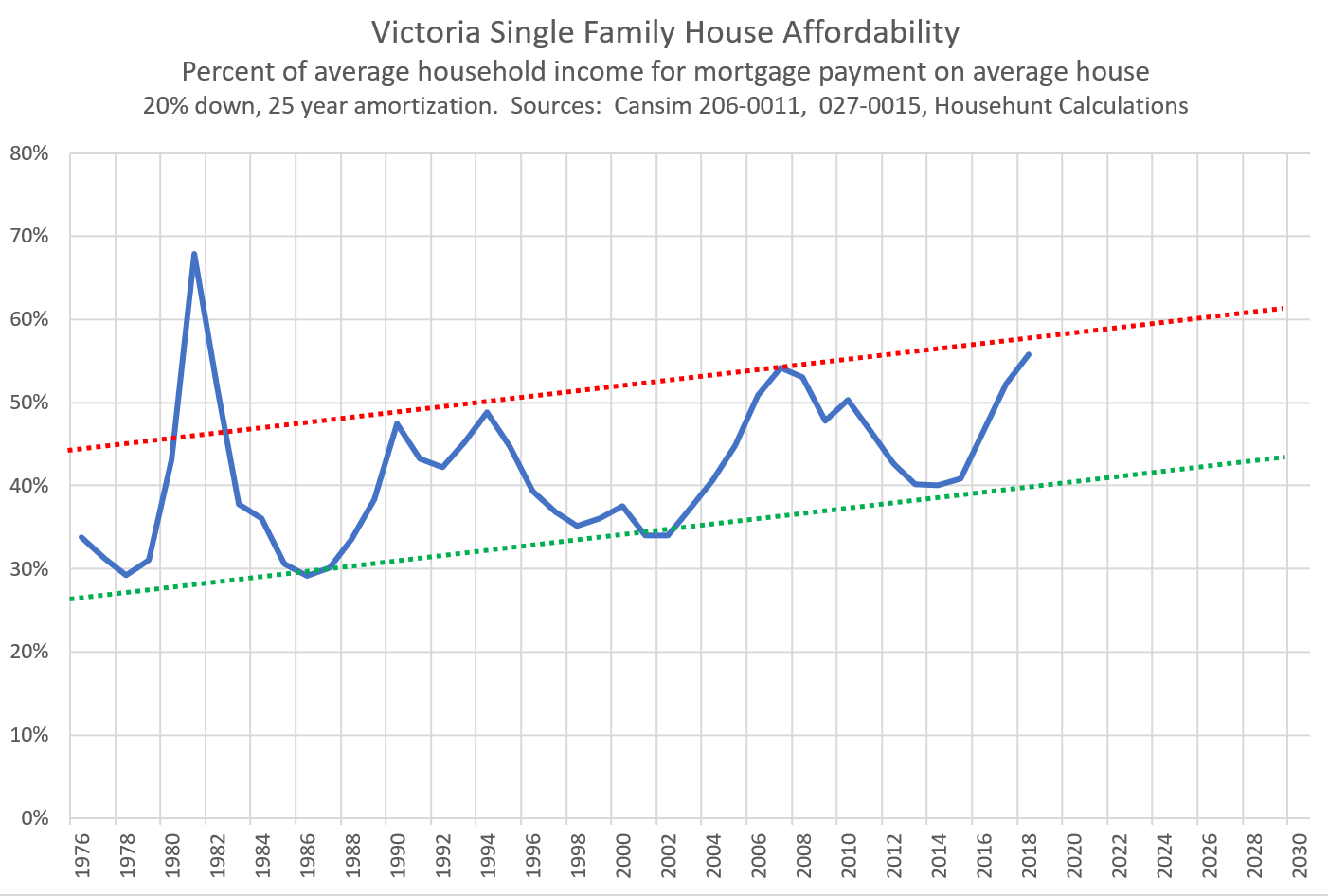

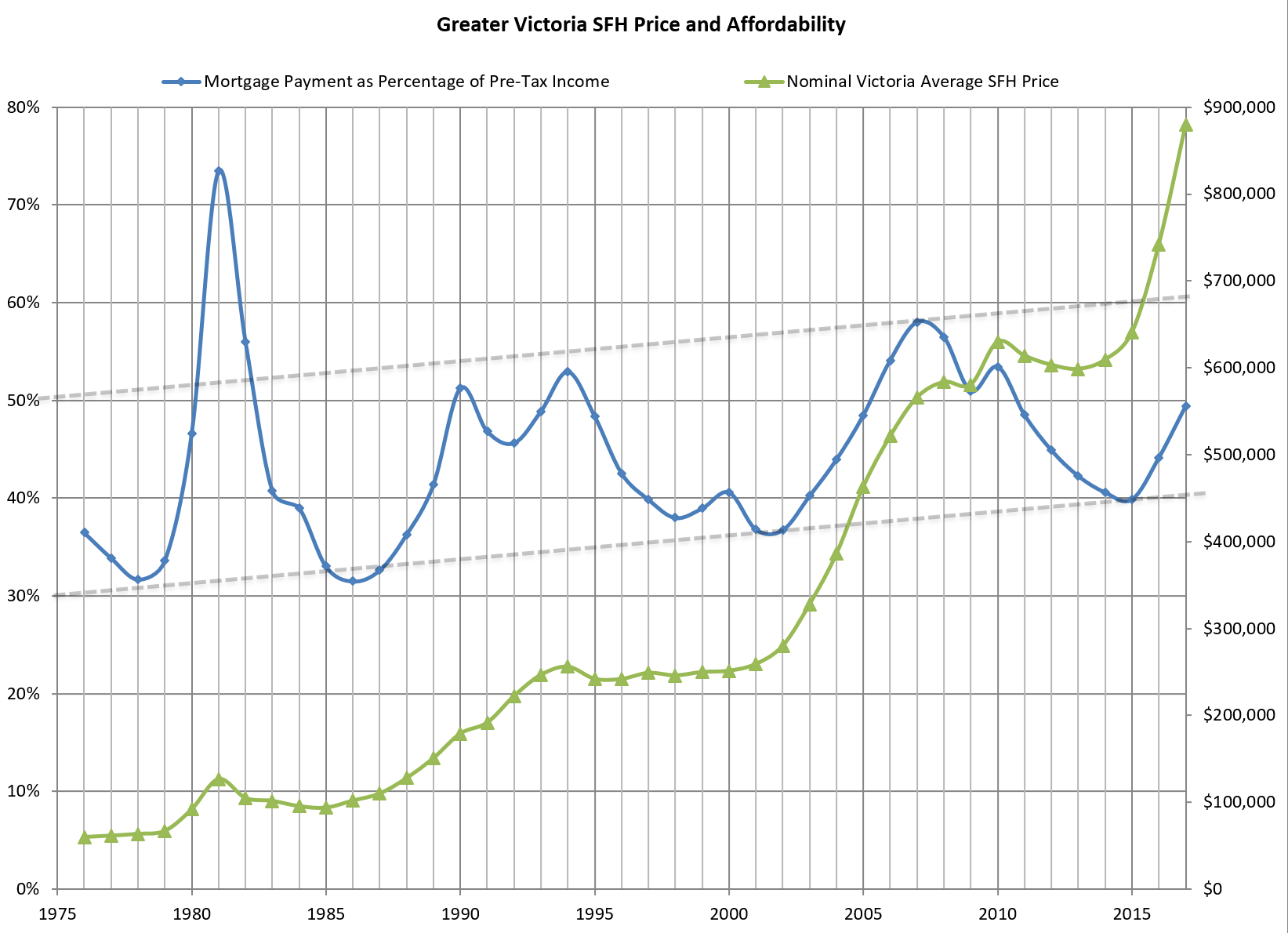

If you’ve been reading this site, you know that we are at a historical high point for affordability which means mortgage payments are very high in relation to incomes and affordability is poor.

This means that unless the affordability cycle changes this time around, we should be in for a few years of improving affordability through some combination of price drops, income gains, or interest rate cuts.

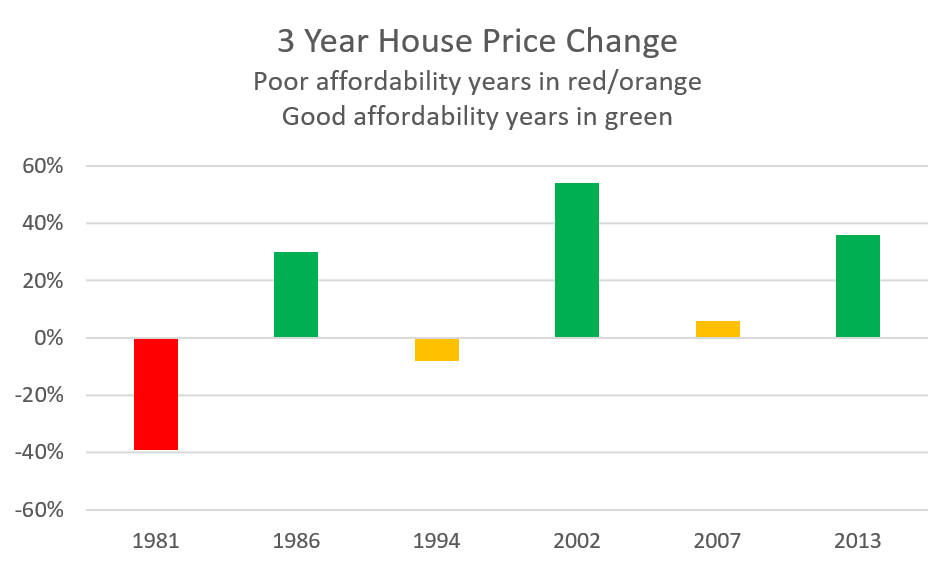

We also know that in the past, buying in poor affordability years has resulted in much poorer near term returns than buying in good affordability years.

However does that mean it has been a bad idea to buy in a poor affordability year? Not really. During the last two cycles, price drops were quite limited, with nominal prices staying roughly flat and the mild declines coming mostly from inflation while affordability was restored through interest rates drops and income growth.

Personally, we started casually looking at buying a place in 2008 or so. Back then it was mostly condos we had our eye on, but we could have swung the house we ended up buying 5 years later if we were more risk and debt tolerant. I don’t regret waiting to buy because we lived very cheaply during that time (renting apartments) and weren’t yet sure we would stay in Victoria so we didn’t want to make a big commitment yet. For me 2008 felt like a high risk time to buy, and we waited until the risk had drained from the market before we bought but it would have turned out fine if we hadn’t waited.

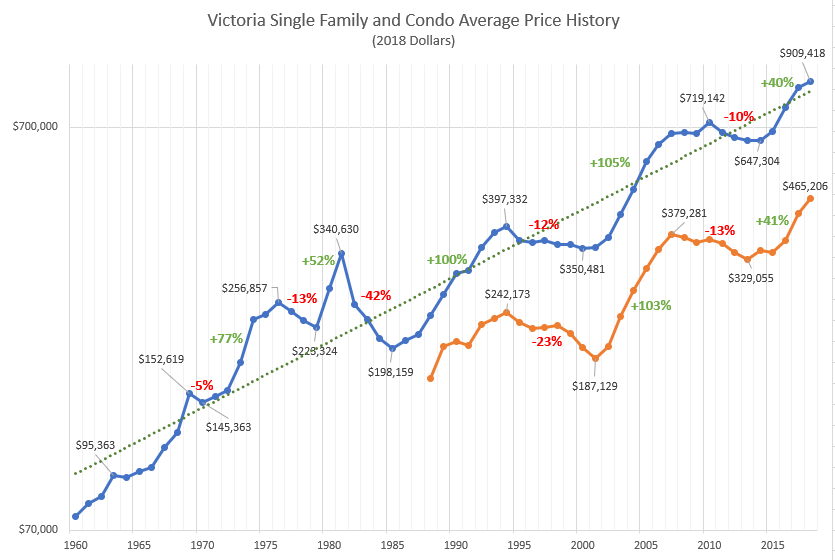

Given a long run real annual return of about 3.75% for single family properties in Victoria (over the last 7 decades), most times have been decent times to buy if you are holding.

However are there any situations when it wasn’t a good time to buy?

- 1981 – The early 80s were the only real crash in Victoria real estate that we have on record and it was preceded by a level of price appreciation we haven’t seen since. With real prices collapsing 42% in 4 years, buying at the height of the mania was certainly a bad idea. It’s not that prices didn’t recover eventually, it’s that you would have been much better off waiting a bit.

- Condos in poor affordability years – This is for two reasons: condos tend to correct more than single family, and people tend to keep them for shorter periods. So if you bought a condo in in a poor affordability year like 1994 or 2008 and wanted to upgrade to a house 5 years later, you probably lost money on the sale and paid thousands more than if you had rented during that time instead.

- Short holding periods – Typical transaction fees (PTT, legal, commissions) in real estate are insane which means you want to maximize holding period in order to minimize the negative impact of fees on your return. Strong markets can mask these fees, but I would recommend planning not to sell for at least 10 years.

- Overheated markets – Not a rule, but overheated markets like we saw in 2003/04 and 2016/17 lead to quite a few above market value sales due to emotional or uninformed buyers. The rapidly appreciating market during those times will likely overtake those bad purchases but in the end many people still paid more than they should have due insufficient inventory and the associated bidding wars.

Of course this all applies to the past and doesn’t necessarily hold for the future. Victoria’s track record is pretty good, but like in 2008 I feel we remain in a higher risk period for the market. That means being extra vigilant and putting more consideration into what and where to buy and accepting the likely low performance in the market or waiting for some of the risk to leave the market.

When do you think the market will be in a state that you will be comfortable buying?

When do you expect to buy in Victoria?

- 1 to 2 years (30%, 76 Votes)

- 3+ years (20%, 51 Votes)

- 2 to 3 years (19%, 48 Votes)

- 6 months to 1 year (18%, 46 Votes)

- This spring (14%, 36 Votes)

Total Voters: 257

@ Ford Prefect

Thanks 🙂 Please post that final number when you get it, always interesting to see what’s going on!

Not sure if its just my Zolo app but have we gotten pretty much 0 listings in the last 72 hours? (actually 3 listings but still!) I know its only a few days in but it seems like there is nothing coming to market in April – unless of course Zolo sucks and just doesn’t have everything – can anyone confirm? Cheers.

It should also be mentioned that WAC Bennett was re-elected in a landslide win in 1969, and was finally defeated in 1972 by Dave Barrett in his first try as NDP leader.

What are you basing this on Barrister?

2018 # of Households is: 106587

(based on https://www.bcstats.gov.bc.ca/apps/Households.aspx)

Based on a 2018 population of 390,613, that’s 3.66 per household (which actually seems high to me), but even at 3 per, that’s only 1666 units per year.

points finger at gwac

A thank you to Andy7 from a Comox Valley resident. The information you provide is not readily available, at least from my experience.

I have been tracking new tract houses in some of the many subdivisions thrown up in the past decade. It seems that prices peaked late here – either fall or winter of 2018. However one house (I know very small sample size but the market here is relatively miniscule) sold in February this year (purchased July 2018) for a minimum $40,0000 loss. I suspect, once the final sales figure is available from BC Assessment, that the loss will top $100,000.

@RenterInParadise

Thanks for that.

IMO it should read:

Ask(original): $1038k Pending:$927k DOM: 140(ish)

That growth rate of 5000 people means we have to build about 2500 units every year to keep up. This year is an exemption with about 5000 units being added. But it is going to be a challenge but it also means that the prices in the inner core are less likely to see major declines.

Another decent listen – Steve Saretsky talking on Bloomberg.

https://www.bnnbloomberg.ca/vancouver-home-sales-sink-31-4-in-march-amid-cooling-measures-1.1238409

@guest_58279

Perhaps you should check your facts prior to posting: https://en.wikipedia.org/wiki/List_of_premiers_of_British_Columbia

The list of countries in that money laundering report isn’t a “short list” – it’s about 70 countries, including Canada, U.K. and most European countries. Most countries with signifcant GDP are on the list and Canada’s proximity to US makes it an attractive place for money laundering. https://www.state.gov/documents/organization/290502.pdf

If you read up on money laundering, you’ll find that it has been going on for decades, all over Canada, and much of the world. It’s worth a try to continue to fight it of course.

Matthew, I don’t even know what to say given that you are being serious. Your suggesting someone liquidate their asset in real estate and purchase an asset that consists of penny stocks being a wise idea. The risk adjusted return for that strategy is probably -99.9%. Well I hope that person is worth at least $50 million, but given the context of your advice that is doubtful.

I been working in finance for over 10 years (albeit not as an investment advisor), and your idea is probably the ridiculous I have ever heard. Thanks for the tip and good luck!

That’s the fakest history I have read for a while. Everyone know that BC in that period was ruled by a triumvirate consisting of Jimmy Pattison, Margaret Thatcher, and Milton Friedman.

Really shouldn’t blame the whole country for the doings of one province.

New population estimates show the population of the Greater Victoria grew by about 1.3 per cent from 2017 to 2018.

According to new population estimates, 395,523 people lived in the Greater Victoria area in 2018, up from 390,613 in 2017.

This growth rate was below average for Canada as a whole, which grew by 1.4 per cent during the same period. Compared to other Census Metropolitan Areas (CMAs), Victoria ranked ninth from the bottom among Canada’s 35 CMAs.

Peterborough led all CMAs with a growth rate of 3.1 per cent as communities from Ontario occupied the first five spots.

Kelowna’s CMA was the fastest growing region in British Columbia with an increase of 1.9 per cent, hitting 212,311.

Vancouver grew by 1.5 per cent, while Abbotsford–Mission grew by 1.4 per cent.

https://www.vicnews.com/news/victorias-population-grew-by-1-3-per-cent-from-2017-to-2018/

Wow. I’ve heard of revisionist history before, but this is something.

Dave Barrett was voted out in 1975 when Bill Bennett of the Social Credit party won the 1975 election. He was the premier until 1986.

You’d rather hang out in the Gremlin than check out the model train store? (Assuming it was there at that time). I remember buying a pair of roller blades at the Sport Mart. 🙂

I also remember that house where the Lazy Boy store is now. Always thought it was out of place – lone house with a huge yard in the middle of a major arterial corridor. No more.

Noobie: I hear that you are still driving that Gremlin . I dated a girl who had one of those and it is hard to describe it.

LF:

If you look real close at the parking lot, you’ll see me in my mom’s Gremlin cranking Led Zeppelin on the radio as I wait for her to finish shopping….

My personal opinion is that we should keep the spec tax and introduce measures at the federal level to ban foreign ownership. If locals want to buy and sell real estate because that’s how they make money and they live and spend here, that’s fine. If people are buying houses and renting them out and they reside in Canada (PR or citizen), also fine. But some millionaire drinking GnT in his/her mansion in Australia or wherever flipping houses or buying and selling like it’s a stock – not fine, not ok at all.

Watching Vancouver is incredible. 7.7% yoy decrease – a surprise for many.

Just a little distraction for anyone interested. This is a southwest facing overhead of the old Town and Country Shopping Centre in 1979. Note at the bottom right, Saanich Plaza (Save-On-Foods, Uncle Willy’s, Tim Hortons, TD Bank etc) was mostly greenspace, with single family homes along Saanich Road and the Vernon Ave corridor. The Emily Carr Library is visible, but the adjacent Munro centre is not yet there.

1981 – The early 80s were the only real crash in Victoria real estate that we have on record and it was preceded by a level of price appreciation we haven’t seen since. With real prices collapsing 42% in 4 years,

It would have been interesting if the period had been linked to the government of the time. It of course was the NDP under Premier Barrett from 1969 to 1984. That government bled the province white making it an economic cripple which took years to recover from. With the present NDP Horgan Government, BC may well be back on the downhill road to economic chaos.

There’s a tsunami developing 100 kilometres north by north east of Victoria. Better go buy a rain coat

https://www.bnnbloomberg.ca/vancouver-home-sales-sink-31-4-in-march-amid-cooling-measures-1.1238409?fbclid=IwAR1p1UnjtVNRLFoE8kikWVf87yrmE_Pb3EqpVcgUfFGo8nJ69aX7gZGQb2M

Viola: Sorry if I misinterpreted your post.

Ks112: I said “just for fun” when referring to the purchase of cannabis stocks. I wouldn’t do it myself, however, I know a person who purportedly made $20 Mil on Aurora stocks. So I wouldn’t be so quick to laugh the idea off. The secret is twofold: first you have to buy into it when they are penny stocks (if you are trying to make a killing). Second, you have to be kinda wealthy to begin with and you have to be willing to risk losing your entire investment. But Tim M. from Alberta purportedly bought about $100,000 worth of Aurora stocks when they were about 7 cents per share back in 2014. When they escalated to $14 per share in Jan 2018 he sold out and made an absolute killing. You still might be able to do this today with “Liht Cannabis” out of Kelowna. Their stock is currently worth 22 cents and some say that this company is going to go viral. There you have it. My stock tip for the day. Read it and weep.

Marko: Correct, no one has a magic ball. But we can still apply intelligence, statistics and logic to the current market conditions to try to figure out where it’s going, right? You kinda remind me of the school teacher who is asked “Is the world flat or round”? He responds: “It doesn’t matter to me. I can teach it either way”.

Wasn’t someone on here saying something about this whole money laundering thing not being a big deal and that it would be forgotten about soon enough. Or something like that.

Not so much.

https://globalnews.ca/news/5102137/us-canada-major-money-laundering-country/

“The March 2019 report, which places Canada on a short list of countries vulnerable to significant drug money laundering transactions — such as Afghanistan, the British Virgin Islands, China, Colombia and Macau — ”

Always good to be on the same list as Afghanistan and Columbia. Wow do we suck as a country for allowing this to happen.

Did someone really suggest selling a house for $1m and use all the proceeds to purchase pot stocks? Matthew please tell me you were joking.

Who cares if a seller is not willing to drop their price or negotiate? Some sellers are just not that motivated and take the approach “if it sells it sells otherwise, I am staying put.” It’s their house they can do whatever they want and no one is forcing you to buy it.

And if they end up selling for less in the end because they chase the market down, again who cares. I’ve seen lots of sellers hold out and luck out too. I’ve had sellers cancel a listing, rent it out, and sell a few years later for 200k more. I’ve also had sellers sell for 30k less than the first offer we had that they rejected. No one has a magic ball.

Thanks Matthew, though I was responding to Josh. I have been meaning to change the pic for some time, just haven’t had the energy to look into it. Perhaps I should 🙂

Matthew, I really think you misunderstood your friend below! They actually appeared to be agreeing with Josh and expanding on that point. Don’t you think so?

Except she was responding to a completely different post if you look at the text quoted and her response is reasonable. I’d say an apology is in order.

Most of the time when I see the letters NDP either “amateur hour” or the second coming Elmer Fudd comes to mind, but they have a heck of a lot more heart and good intent than the despicably corrupt, shameful group that was previously in power. Thank god they are finally doing something about the toxic undercurrent underpinning this province for so long.

VIOLA: you start every one of your posts by giving the finger to the reader. I’d say you’re being a little dramatic yourself, bub.

All I was saying is that sometimes it’s not wise to refuse to lower your asking price over the course of a full year. Then I cited an example as to why. So I ask: why would you be “confused” about about a simple concept like this?

Instead of criticizing, why don’t you offer a logical, rational rebuttal to the point I was making which is: a smart seller needs to be flexible, not rigid. He needs to react to the market realities, in real time, and not just sit like a bump on a log, in an unwavering fashion, for a year straight, sticking to a price that no one will pay.

The seller I was referring to (on Plymouth Road) has had his property up for sale for almost a full year now, and STILL he has no buyer. And, all during this time (I’ve been following this particular house), he did not once lower the asking price. Now, for the first time ever, he has lowered it. Why do you think he did that? Maybe it’s because he can finally see that he has been delusional thinking that he can get $1,149,000 for this very basic property with an old house on it. Maybe he has finally realized that out of 6 billion people on the planet, not even one of them (over the course of a full year) has been foolish enough to give him the money he thinks his home is worth. Or maybe he was just having fun wasting everyone’s time.

I simply opined that this seller might have gotten $1,099,000 last Sept 2018 had he been willing to get reasonable at that time and reduce his asking price. But he wasn’t. But this is a concept that you are “confused” about, hey? It’s called “chasing the market to the bottom”. It’s a well known principle that you can read about in Real Estate Bubble Books and on several websites.

Now, who knows what a loss this seller may have to take with nearby Vancouver real estate sales collapsing to 30 year lows (and with prices now starting to react to that reality). This Plymouth Road seller might not even get $995K for his very basic property now. And, if you don’t think that plummeting sales and prices in the Vancouver area is going to make it’s way over to good-old Victoria (which is less than 100 kilometers away) in the not-too-distant future, then I’ve got some swamp land in Florida you may be interested in.

“A place that was listed early last year, didn’t sell, then reposted this year got an offer for 95% of asking recently. The seller rejected it and relisted for $10k higher. Blows my damn mind.”

Some people really need the drama. Confuses me too but by now I just accept that some people need drama (by which I mean to make everything more difficult than it needs to be).

This one’s worth a listen – Steve Saretsky mentions Victoria & Van Island near the 9 minute mark:

https://omny.fm/shows/the-simi-sara-show/worst-march-for-greater-vancouver-home-sales-since

A place that was listed early last year, didn’t sell, then reposted this year got an offer for 95% of asking recently. The seller rejected it and relisted for $10k higher. Blows my damn mind.

Wages in BC have been steadily declining in both nominal and real terms since October 2018 (the former has been technically positive, but is less than inflation). Unemployment has also risen this year, but only slightly and is still very good by BC’s historical standards. My guess is that as this correction intensifies, these metrics will deteriorate…but we’ll find out for sure one way or another.

http://www.bcstats.gov.bc.ca/Files/9bf727e9-f34c-407c-b0a4-07720ddfbb1a/EarningsandEmploymentTrendsData.pdf

Ask: $948k Pending: $927k DOM: 11

I believe it is only owners of 10% or more of the company

last year .. what happened to this year ?

love this quote .. sugar coats affordability … i am not talking about those typical 200k house hold income .. i am talking about the 1st, 2nd, and 3rd quintile people

Local Fool: I am assuming that publicly traded corporations are excluded from identifying beneficial ownership. ( sort of pointless trying to figure out all the owners of TD shares since the bank does own a number of individual condos that are used for executive stay).

“Sometimes it pays to relist in the spring”

Yes, and sometimes it pays to list a home for a reasonable price in the first place.

Because the owners had to carry that empty home for months and months and months until it finally sold. They probably lost $30K or more for property taxes, insurance, mortgage payments, and property upkeep/management, not to mention worrying about it for so long.

Also (and this is just for fun but it’s true), if they sold last Aug 2018 for $1.13M, they could have taken the profits and purchased Aurora Cannabis stocks for $5.34 a share. Today, they are worth $12.09 a share. So their little pot investment would be worth $2.5 Mil today. So, you see, there can be a downside to holding out for top dollar in real estate, sometimes.

And I’m not even really chastising the above mentioned sellers that much. They at least lowered their asking price over the fall months trying to find a buyer, which (in my opinion) is the correct thing to do.

What gets me is sellers refusing to lower their asking price at all, even though the property has been up for sale for almost a year. For example, I see that this seller has FINALLY dropped the asking price from $1.149 M to $1.099 M. Took em long enough. If he just sold last Sept 2018 for $1 Mil, and simply purchased pot stocks, he’d be living the high-life on the Costa Brava, sipping planters punch, and kicking the fresh oysters off the rocks on the beach. Oh well ……

https://www.realtor.ca/real-estate/20177490/3-bedroom-single-family-house-3466-plymouth-rd-victoria-henderson

Does anyone know what 4358 Elnido Cres sold for?

Also why is victoriamls.ca so horrible? It never remembers all my “favorite” houses so I often miss the sold price.

One wonders why this wasn’t done before. I don’t know, I just find the concept of opaque ownership of residential RE to be a little uncomfortable, especially when it occurs on a substantial scale. I definitely think this is an almost common sense idea.

There are some people here that seem to only believe something if it is said by the NDP govt. So here is some good news for you, directly from the NDP govt (see below). This helps explain why BC homeowners are overwhelmingly able to pay their mortgages, which also explains why some people here hoping for lower house prices (caused by imminent recession, mortgage defaults, slowing credit growth, unemployment, bankruptcies and general misery) are so disappointed.

Of course 4.1% wage growth like this, above inflation, with stable interest rates, bodes well for house price increases.

https://www.bcbudget.gov.bc.ca/2019/pdf/2019_Highlights.pdf

“B.C. has the strongest economy in the country with the highest projected real GDP growth, lowest unemployment rate, and biggest wage gains nation-wide. Last year, wages in British Columbia increased by 4.1%, leading all of Canada. This is the strongest wage growth in B.C. in a decade.”

“Last month’s sales were 46.3 per cent below the 10-year March sales average and was the lowest total for the month since 1986.”

If adjusted for population increases the numbers would look even much worse

Metro Vancouver population 1986- 1,442,778

2018- 2,654,227

Sometimes it pays to relist in the spring.

1509 San Juan sold for $1.13M after spending much of last year on the market starting at $1.25M and ending at $1.15M.

Also potentially a hint to the value of staging an empty (new in this case) home.

“100,000 owners missed the spec tax deadline…”

Maybe some of them have something to hide. We already know through the CRA real estate audits in BC that tax evasion is a big problem here. In just 1400 real estate audits the agency collected 140 million dollars or an average of 100k per audit during 2018. “Complex audits are bound to follow the submission of speculation tax declaration forms, policy and tax experts suggest. The $642 million estimated new tax revenue is payment of the speculation tax only. The B.C. government says it has not assessed the amount of tax from unreported worldwide income or capital gains could be recovered from the data it collects for the speculation tax. The government said it does expect the speculation tax auditing process to help identify overseas tax evasion and thus the ministry is expected to flag audit leads for the CRA.

https://www.burnabynow.com/b-c-real-estate-audits-reveal-widespread-tax-evasion-1.23643194

Renter

I guess a lot of shocked people…Who will than have to go through some process to reverse it.

This is a good thing for sure. If a new government comes in and reverses everything that the NDP has done, I am pretty sure that this is one thing they will keep.

“B.C. government introduces legislation to ban the practice of hiding home ownership

The B.C. government is closing a major loophole used to hide wealth, evade taxes and launder money in the province’s housing market.

Finance Minister Carole James introduced legislation on Tuesday that, if passed, will establish a public registry of beneficial owners of property in B.C.

The law will require corporations, trusts and partnerships that currently own or buy land, to disclose their beneficial owners in the registry. This is the first registry of its kind in Canada.

“For years, the previous government did not act while people used numbered companies, trusts and partnerships to hide who really owns property in B.C.,” James said.”

Read more…

https://globalnews.ca/news/5122302/home-ownership-hidden-beneficial-owners/?fbclid=IwAR2VQiZUjR9zDn89JPfem7bv2kEQ5dYl-40YgOJMoWfML8Do1qGH33bSXeM

Damn, I like this new government. Some of their policies may not be popular, but things are getting done. Nice job.

@ RenterInParadise

From what I heard, they’ll get a reminder notice in April, and if the declaration is not submitted by June ish, then they get billed. As it’s a new tax and some people may not be aware of the deadline, that seems more than fair.

What are the implications of this?

I’m just telling you my experience with a balanced/flat market as we purchased in one. At that time, homes in good condition in great areas were attracting multiple offers even if priced at or above market. Less desirable homes, one of which we purchased, were not moving if the initial price was above market.

The market is not suddenly filled with less desirable homes, less desirable homes don’t attract the interest they do in a seller’s market, while desirable homes remain so. In a falling or buyer’s market even desirable homes will lose value and interest as consumer confidence declines with prices. This is my recollection from 20 years of following the market locally, but it is only my opinion.

100,000 owners missed the spec tax deadline…

“.(oga sraey 2 evah dluow yeht tahw naht rewol tib a .e.i) thgir ti ecirp ot deen yeht tsaf ylevitaler evom ot ecalp rieht tnaw srelles fi taht snaem osla ti sseug I .won yub ot erusserp on s’ereht ecnis gnitiaw dnim t’nod ohw sreyub rof taerg s’tI .sraey wef txen eht rof talf ssel ro erom yats lliw secirp kniht I”

I have to admit, that is pretty convincing evidence that the Victoria market is going to crater.

+1. Probably both, with flattening out occurring after whatever the retrenchment ends up being. This could be a few years to play out.

A balanced market is where the SAL ratio doesn’t put pressure on pricing in either direction. But I don’t think it means a “desirable” house inherently attracts multiple offers. Unless the ground is spewing out U-235, most homes in almost any market will sell quickly when priced aggressively compared to other similar homes in that market. It’s the shifting expectations between the parties that makes the DOM go up, not that the market is suddenly filled with less desirable homes.

Hey Leo –

Would it be possible to add another line in the first graph starting in Oct 2016 showing a “stress tested mortgage payment” as a percentage of household income? This may add some context between ‘actual’ affordability vs ‘created’ affordability.

“Ok, now read these sentences in reverse order. Do you still think prices will be flat? Sellers needing to price to sell to move anything is why prices come down.”

Good point. I have no idea, except that i’m pretty sure they won’t be shooting up.

No-one knows exactly what will happen next, but the market conditions and historical graphs show there likely will be either a drop or flat market for a period of time, or both, to compensate for the atypical run up in prices.

A flat market is one which doesn’t favour buyers or sellers, otherwise known as balanced I think? This means that if you have a desirable house it will still probably attract multiple offers. Less desirable homes need to be priced favourably at the start or they may sit. So I guess you might see a bit of a divide in the market demand based on condition/location. At least that is what my recollection has been of past flat markets.

For buyers, a flat market is a way better time to buy than a market like last year, especially if you are willing to put some work in on a home.

Ok, now read these sentences in reverse order. Do you still think prices will be flat? Sellers needing to price to sell to move anything is why prices come down.

I can’t tell if the Greater VanREB takes themselves seriously anymore. It’s all just absurdist comedy at this point.

I think prices will stay more or less flat for the next few years. It’s great for buyers who don’t mind waiting since there’s no pressure to buy now. I guess it also means that if sellers want their place to move relatively fast they need to price it right (I.e. a bit lower than what they would have 2years ago). And, for those who want to flip, there is probably still money to be made buying places in the right location for the right price that don’t need major repairs. I guess the returns on the flips will be slightly lower and it will take more work to find the good opportunities.

The article says to plan to hold for 10 years. Maybe that’s right in terms of dollars and cents, but I haven’t lived anywhere for 10 years in my entire life, even as a child. We are happy if we can hold for 5.

Greater Vancouver RE Board Press release for March 2019.

What ails the VanRE market, you say? Why…the government of course.

………………………….

Prospective home buyers remain on the sidelines in March

Metro Vancouver home sales dipped to the lowest levels seen in March in more than three decades. The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,727 in March 2019, a 31.4 per cent decrease from the 2,517 sales recorded in March 2018, and a 16.4 per cent increase from the 1,484 homes sold in February 2019.

Last month’s sales were 46.3 per cent below the 10-year March sales average and was the lowest total for the month since 1986. “Housing demand today isn’t aligning with our growing economy and low unemployment rates. The market trends we’re seeing are largely policy induced,” Ashley Smith, REBGV president said. “For three years, governments at all levels have imposed new taxes and borrowing requirements on to the housing market.”

“What policymakers are failing to recognize is that demand-side measures don’t eliminate demand, they sideline potential home buyers in the short term. That demand is ultimately satisfied down the line because shelter needs don’t go away. Using public policy to delay local demand in the housing market just feeds disruptive cycles that have been so well-documented in our region.”

Do you see what they did in the bolded text? Slick work, Ashley. 🙂

http://members.rebgv.org/news/REBGV-Stats-Pkg-March-2019.pdf

Ministry of finance news release

“Two reports on money laundering in British Columbia were delivered to government, following a two-pronged review aimed at shutting down avenues for money laundering in real estate, luxury cars and horse racing.

The reports were commissioned in September 2018 following widespread concern about British Columbia’s reputation as a haven for money laundering.

The first report is to the Minister of Finance from the Expert Panel on Money Laundering, and recommends rule changes that will shut loopholes in the real estate market and increase transparency on who owns property in B.C. The other report is Peter German’s second review into money laundering, focusing on real estate, luxury cars and horse racing. ”

Thanks, now I know prices will drop.

Sounds like the recipe for a flat market.

For anyone interested in up island, here’s a peak at the Comox Valley for March 2019:

SFH sales: Down 46%

– You have to go back to 2009 to see lower sales.

– 6 months inventory so just on the cusp of a buyer’s market — maybe by end of next month it’ll enter a buyer’s market, who knows.

SFH active listings/inventory is still really low, at about 1/2 of what it was in 2014. My guess is low inventory is pretty much the only thing keeping that market (and prices) from free falling.

Condo sales: Down 24% (4.5 months inventory)

Townhomes: Down 47% (4.4 months inventory)

Lots: Down 25% (8 months inventory)

Yes, that is fair comment. But before seeing 90 day mortgage delinquencies, there would be earlier signs of delinquency in other credit types. And credit cards, auto, LOC delinquencies are also at/near all time lows for Van and Vic mortgage holders (0.20%). That’s not to say it can’t happen in the future, of course it can, it’s just saying there’s no sign of it yet.

VREB press release excerpt for March 2019…

There were 2,435 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of March 2019, an increase of 14.3 per cent compared to the month of February and a 37.9 per cent increase from the 1,766 active listings for sale at the end of March 2018.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in March 2018 was $867,900. The benchmark value for the same home in March 2019 decreased by 2.8 per cent to $843,600, lower than February’s value of $845,900. The MLS® HPI benchmark value for a condominium in the Victoria Core area in March 2018 was $501,500, while the benchmark value for the same condominium in March 2019 increased by 1.0 per cent to $506,500, slightly higher than February’s value of $502,800.

To add to the convo, via VREB stats pkg:

SFH – Residential March sales:

2019: 278 —– (Active Listings (AL): 836, which is up 52% from last year)

2018: 287 —– (AL: 549)

2017: 396 —– (AL: 418)

2016: 537 —– (AL: 766)

2015: 365 —– (AL: 1087)

2014: 249 —– (AL: 1222)

https://www.vreb.org/pdf/VREBNewsReleaseFull.pdf

https://www.vreb.org/media/attachments/view/doc/statsrelease2017_03/pdf/March

https://www.vreb.org/media/attachments/view/doc/statsrelease2015_03/pdf/March

I would question that. Liquidity is defined as how easy it is to establish a market price and thus get a sale. It’s not significantly harder to establish a market price for a house today. Sellers just aren’t willing to accept that it’s gone down.

Ya, figured. Look forward to your next press release!

Yep depends on the criteria you want to pull gives you slightly different results but the year over year change is somewhat down for sales and prices on the single family side.

Someone posted this chart. I have no idea what their source was or if it’s accurate?

What no love for the SFH average? Down 5%? 🙂 For real though, the monthly numbers are +- 10%. Doesn’t mean much of anything up or down until you see a trend.

Bet ya a beer that January will not be the bottom though.

They will rise. Delinquency rates are substantially lagging since a mortgagee needs to be 90 days behind before they are considered delinquent, and after a big runup it requires some time for falling prices to lead to delinquencies. The two are very strongly correlated.

https://househuntvictoria.ca/2017/05/25/paying-the-vig/

Vancouver liquidity has dried up over a year ago (you’ve told us so!), and delinquency rates have just fallen further. It’s because people are able to afford to pay their mortgages. And their Equifax credit scores are improving. The mortgage holders are not only paying their mortgages, they’re also paying all of their other debts too (0.20% default rate). The rate of delinquency among non mortgage holders is 5-10x higher for credit card and auto debt than mortgage holders. Likely due to the difficulties as a tenant paying rents that rise each year, unlike mortgage payments that typically stay constant.

Anyway, sounds like your plan is more waiting and more watching your YouTube RE heroes, instead of a spring/summer enjoying and tinkering with your own house that you’ve told us you can afford. I hope that plan makes sense to you and your family. If not, check out some open houses, it’s still a good time to buy in Victoria if you can afford it.

@guest_58216

1566 Craigiewood Crt has already had a price drop of 20k and a DOM of 15. Don’t see a bidding war there.

Somebody bought all the houses that have been built and is paying for them. For that group, the houses are affordable. There can’t be any more houses sold than that. There are 40% of people that aren’t house owners. For many of them, houses aren’t affordable. The solution for them is to build more low-cost houses, not wait in vain for the 60% people that own the houses to default on their mortgages because an inflection point on LeoS affordability graph has been hit. Until that new construction happens, there are enough people that can afford the housing stock that is available, indicated by the low mortgage delinquency rates and people that do pass the stress test.

In case nobody’s posted March numbers yet:

SFH median price up 0.6%

Condo median up 6.7%

I suspect January’ish will be looked back on as the bottom.

There were 84% spec tax declarations as of March 19. The final number returned by the deadline is 91%. That leaves 9% or 114K people who weren’t “deadline driven” , and are about to get a bill, which is 3.5X as much as the 32K estimated people that will owe the tax.

Hopefully the govt isn’t stupid enough to now send out bills to 114K people. That will just keep the train wreck going. They will need to hire people to resend them the declaration forms, keep the phone lines open etc etc.

All because the govt wasn’t smart enough to figure out how to cooperate with municipalities to add a single line to the property tax form to say

[X] if this is a second home (as defined on the back), check here and add 25% to this property tax bill

That would do it, and treat everyone (including foreigners) fairly.

https://vancouversun.com/news/politics/rob-shaw-b-c-government-offers-leniency-as-speculation-tax-deadline-passes

Voted for “2-3 years” before reading the post -:( After reading it, it seems a good time to buy would be between 2024-2026, if the history holds.

They’re not. Delinquency rates for RE are broadly speaking, a function of liquidity. Southwestern BC had one of the most liquid RE markets in North America a little while ago – it’s not a surprise that delinquency correspondingly dropped to among the lowest levels in history. Any bankruptcy trustee will tell you, there’s is a cyclical business; you don’t typically see delinquencies en masse on the upside. Even less if it’s a bubble.

If delinquency rates were an indication of affordability, VanRE would be implied to be one of the most affordable markets on the continent. Well, if the liquidity continues to dry up…watch what happens.

I don’t see how mtg delinquency rates are linked to “affordability”. Do you know how hard it is to get qualified for a mortgage? Banks and CMHC don’t make it easy. You need to have good credit, a downpayment, and strong income. At scotiabank you needed a minimum 6.5% in liquid investments – (5% of downpayment and 1.5% of closing costs). So on 500K you need to prove you had $32,500.00 in cash from savings. Thats just to get in the door. People with good savings habits, good jobs, and good credit aren’t goin delinquent on their mortgages. Especially since rates haven’t gone up all that much AND the fact that we live in a government town where people aren’t losing their jobs due to oil price drops etc. I would say, at least for the Victoria market, mtg delinquincies aren’t a good measure of affordability. ESPECIALLY now with the stress test in place – now you’re definitely not getting approved for a mortgage you can’t afford – and remember the stress test was in place for CMHC mortgages at least a year or two before the most recent one came into place (cant’ remember when exactly).

To me its pretty simple logic to say that 5 years ago incomes weren’t that much lower but house prices were 40% lower. Clearly today a home is a lot less affordable then it was 5 years ago. Seems a lot more logical then looking at mortgage delinquincies which are more likely to be impacted by external forces like divorce and job loss rather than what is actually affordable for the average family. Don’t you think?

Is this house priced for a bidding war?

https://www.realtor.ca/real-estate/20440001/3-bedroom-condo-1566-craigiewood-crt-victoria-mt-doug

Leo,

“Affordability” is a market factor for sure. But you aren’t directly measuring “affordability” on that graph You are just labelling a chart of “mortgage payments as % of income for first year buyers of average house”, and calling that “affordability”. You could equally call it “year 1 mortgage stress level”. It’s like measuring a few things about mental health and charting it and labelling it “happiness” level. Says who?

Problem is , there are lots of different ways to assess affordability and the market participants use whatever method makes sense for them.

Mortgage delinquency rates could equally be a factor to determine affordability. Because it answers the question whether the houses bought have indeed been affordable. If we saw delinquency amongst recent purchasers or purchasers in general, that could indicate affordability issues. But we don’t, and 999/1000 Vancouver and Victoria house owners are affording to pay their mortgages on time (and their other debts like credit cards). These are amongst the best levels in North America. And virtually all the newest buyers are passing the mortgage stress test and paying their mortgages on time. To me, those are equally important indicators of affordability not captured in your affordability chart.

Increasing affordability is a factor that supports the general desire to own.

I just don’t know.

I think underlying my view that the past is the long-term best predictor is the idea that the desire to own a home is part of our culture and has worked out well for many generations and if you don’t own you rent and there are generally not great rental alternatives in Victoria.

Even if affordability declines, I suspect demand will remain strong in desirable areas despite boomer demographics as we also have fairly strong immigration – both extra and intra. Homes can get smaller and further out and there can still be move up demand for in core areas that are already fully built.

Also a total guess.

Several reasons I expect long run (like next several decades) returns to be lower than the past few decades:

I still expect decent returns but not the near 4% real rate of return. Perhaps half that but obviously a total guess.

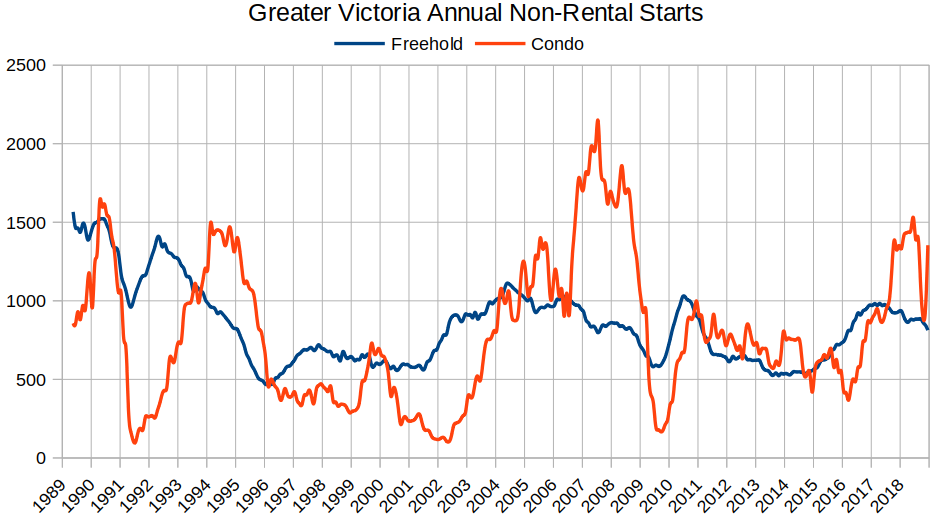

From the chart….

2016 new condos for sale start builds = 400

2018 = 1300

Condo for sale construction Up 3X

MLS sales are way down (up to 50% down from 2016), so the assumption is that sales of new condos are also down because of the assumption that their dark sales always track MLS sales. I think dark sales of new condos must be up (not down), given those construction numbers. Why would we be selling way less condos now than 2016 just because MLS sales are down, when we are building 3X as many new condos for sale?

It would be good if those numbers were actually measured.

Josh if the liberals came in and did a slash and burn to the budget and jobs here of course that would have an impact. I think the NDP spending ways have definitely supported Victoria housing.

Largely yes. Condo boom not as big as 2008, but still sizable.

That’s a constant though. Whether the starting affordability is good or bad, it improves over time. Not a factor for the market.

The other thing that the affordability chart misses, is that is only a snapshot of the first year affordability for a new buyer. In year two of owning a house, mortgage payment is the same, but income is up, so affordability improves by about 3% per year for the next 25 years. People who bought 25 years (1994) ago paid about $200k for a house, and have been paying about $1k per month mortgage. That year (1994) shows up as unaffordable on the graph, and it may have been barely affordable in year one, but got easier each year.

People passing a mortgage stress test in year 1 will be in much better affordability shape in 10 years when their income is up 35% and mortgage payment is the same.

Thanks for the update Leo. Look forward to it every week. There really are too many variables at play in the Victoria market for any reasonably accurate predictions for the near term..IMHO. The Spec tax and the Stress test have thrown the market into disarray…and not in a good way. Victoria is transitioning from being a Gov’t town to a retirement town as the bulk of the Baby Boomer bell curve drives Canadians from every region to pass from working life to retired life. Many had bought homes in the region in anticipation of retirement and are now being driven away by the politics of division. Others are being drawn in even more so in order to cash out of much higher markets like Vancouver, thereby pocketing the win-fall difference. Add to this an uncertain political future for the governing party and its policies, a wounded construction industry unwilling to risk capital, and a heavy handed bureaucracy stifling development of high density housing supply… you get a very foggy crystal ball. Thanks for the read and the great discussion. Cheers.

But isn’t the construction boom mostly rentals?

I also hate the use of “real” prices. But that is mostly when talking about specifics and in name since for the long term big picture analysis we don’t have much else to go with to paint reasonable comparative picture. I wish the names were “real” for nominal and “adjusted” for real…. It’s much more representative of what is actually going on. Now don’t get me started on the CPI that is used to adjust prices!

If Victoria has a huge RE crash, the returns over the next few decades could be quite decent. If it bleeds out slowly…perhaps not so much?

Oh I’m agreeable all right. And have you seen Deryk’s Peace Garden project at Woodwyn? Amazing. I wonder if he did that project in tandem with the residents.

http://www.derykhouston.com/

It’s a valid observation. I maintain that all markets undergo affordability changes, but the extent of those changes depend on the local market. Don’t use the little graphs on page 8 – the series is too short.

Take Halifax, which visually appears to be the flattest one for the longer series:

Even there, you can see the affordability cycle moving. St John’s. Moncton, Winnipeg and virtually all other markets in Canada show this behavior. But for the “lesser tier” (or whatever the elitist term is) markets, local factors render the affordability cycles much less meaningful; it probably will never make a difference when you buy. Other markets it makes a much larger difference – Toronto is probably the best national example, but Victoria is good too.

Heh, until you get to Vancouver, that is. Vancouver’s cycle is perfectly visible, but in the last 10 years it’s been completely usurped. I don’t think that negates my thesis though. I believe that phenomenon is due to a housing bubble caused by a confluence of factors that are now starting to unwind. Victoria’s is still very visible, but for about the last 8 to 10 years has probably been tugged upwards by Vancouver.

I guess that doesn’t apply to Vancouver?

People’s mortgage payments for 25 years are not inflation adjusted, they stay at one nominal level (other than changes up/down from interest rate fluctuations on renewal). To me, inflation adjusted prices hide the benefits that home owners see as their nominal price rises and the mortgage payment stays the same. To show the “complete” picture, you could show both nominal and inflation adjusted, you don’t need to hide the nominal prices.

“Problem is many don’t have the buffer to weather a downturn like that. And I do think that the return in Victoria real estate will decrease significantly in the next decades compared to the previous ones.”

I agree on the “buffer” comment and am intrigued about your thoughts on future returns for the Victoria RE market…can you expand?

So your beloved liberals are the only thing that can hurt your clearly cherished bull perspective. Got it.

Only true if the number of new condo (ie dark sales not part of MLS numbers) is also down 7% from last year.

So I’m clear on this, this total of 640 is MLS sales only, and that represents about 78% of all the sales that happened. The other 22% are “dark sales” of new condos that happened outside of MLS. That would mean about 180 dark sales and a total of 820 sales for the month. We don’t know or count the number of dark sales, we just assume from past trends that dark sales of these new condos are also down 7% YOY, so we can just not worry about how many dark sales there were and use the MLS number and call it sales. So just confirming that this is what you’re saying (in your March 25 post).

I thought we are in a construction boom that would imply more dark sales from more sold new condos and houses, so I’d be surprised if they (dark sales) too are down 7% YOY.

Yes, it’s like going all in to the stock market in spring 2008. An objectively bad time to buy, and your return would be way better if you had waited a year, but if you can weather the downturn it ends up fine (World’s worst market timer: https://awealthofcommonsense.com/2014/02/worlds-worst-market-timer/). Problem is many don’t have the buffer to weather a downturn like that. And I do think that the return in Victoria real estate will decrease significantly in the next decades compared to the previous ones.

Nope I am one side of the market. I am a 100% land bull.

I’ll take “unlikely”. That is a more credible prediction than your previous “won’t happen”.

I was curious about this statement so I looked at the RBC affordability report – http://www.rbc.com/newsroom/_assets-custom/pdf/house-mar2019.pdf .

Looking at all the graphs in that report I’d say that many Canadian markets have experienced multiyear periods with little change in affordability – what most people would call flat affordability. True – none of them meet your definition for perfect mathematical flatness.

Affordability in Victoria has gone up and down more than most markets, but even here there have been stretches with very modest changes in affordability. So given that nearly flat affordability has occurred elsewhere – is it impossible here? Are you agreeing with GWAC and Deryk that Victoria really is different? 🙂

Nope it was about Victoria and the poster said everything he saw sold was 10% off assessment.

HHV conspiracy theory: Hawk is gwac. Having fun trolling from from either end of the bull/bear spectrum.

BC and Canadian Government spending and job cuts need to happen for the Victoria Housing market to see any large decline. Directly and indirectly this is a government town.

That statement was about Vancouver if I remember correctly. I was out of town last week so I haven’t read all the comments though.

Thank you for all the historical data. Things could be different this time, but it is not a bet I’d be willing to make.

Waiting for a price drop has not been a good idea during my buying window, however, now seems to be a better time to buy than last year this time given the lower level of competition for some properties and approx. 2.5% price declines.

Even buying in the 80s had excellent ROI if you were able to hold. Unfortunately, with interest rates at the level they were following a period of high returns, when prices dropped I can recall that it had a devastating impact on some of my friends’ parents who had invested in rental properties and lost them when they couldn’t pay the mortgages.

I’ve never forgotten that lesson, and have probably been more conservative than I otherwise would have been. Those that took greater risk have experienced greater returns in the Victoria market.

What I do think is clearly different now is affordability. Even though affordability may improve over the next several years, the overall long-term trend looking at the chart is for decreasing affordability for a SFH. Probably a greater decrease than the chart reflects if we narrowed it down by areas in the core.

I assume median and average plunged since sales are at 90% of assessment according to our bears hear. Leo/Marko?

640 sales for March. That is down 7% from last March.

Marko: This is me calling you out as requested for sales not being within 5%, although it ended pretty close.

Inventory up by 38% from this time last year.

New listings at 1284 are up from last year’s 1188, but down from the 10 year average of 1365.

Fair enough! New listings very low when you considering we had the lowest on record in February due to weather.

The reason I don’t use nominal prices for long run charts is because they don’t represent what the money is actually worth to people during the time. Of course 4 decades later, the losses in 1981 seem puny (drop of $30,000 is hardly a rounding error at today’s prices). However I guarantee you it absolutely was scary for a lot of people back then.

You also have to consider your alternate return. When you can get 15% in a GIC, it becomes much more beneficial to hold out. That is all discarded if you just look at nominal prices, but inflation adjustment strips some of that out for a more complete picture.

1734 in Vancouver. By contrast, that’s apparently the worst March since 1986. That really is amazing, considering the comparative size of the two markets.

640 sales for March. That is down 7% from last March.

Marko: This is me calling you out as requested for sales not being within 5%, although it ended pretty close.

Inventory up by 38% from this time last year.

New listings at 1284 are up from last year’s 1188, but down from the 10 year average of 1365.

I will be writing a full article on March’s numbers on Wednesday. Just giving it a couple days for all the pending sales to come in so that the numbers are more accurate than VREB’s reporting-date based method.

Last two corrections condo median prices dropped more than single family, but n=2 isn’t a lot to go on, I agree. If you look into a segment of the market like luxury, you may be right that single family drops more but I have no data on that.

Just from a logical point of view, I expect condo prices to do worse just because market booms usually come with construction booms and then there is a glut of inventory during the slow period that keeps the condo market weaker for longer than the single family side.

This will be something to watch for sure. I’ve got a close eye on local construction activity and so far I’ve heard some increased caution about upcoming projects but nothing too concerning yet. It is slowly backing off from the record levels of construction to a more manageable level.

@guest_58178 How far do you think are current condo construction costs below resale prices?

Some good early 2019 news for mortgage credit growth …. The 5 big Canadian banks forecast a healthy year for mortgage growth, at the January 2019 conference they had. TD expects 4-6% which would be a return to normal. These are the CEOs of the 5 big banks saying this, though I’m not sure that you think they know more than your Youtube gurus.

https://www.cbc.ca/news/business/bank-conference-mortgage-growth-1.4970630

“Toronto-Dominion Bank chief executive Bharat Masrani told the conference on Tuesday that he expects mortgage growth in the mid-single digits for 2019.

The Bank of Nova Scotia’s chief executive Brian Porter said “early indications” have been positive, but performance during the key spring real estate period are more important.

“Mortgage activity for the first couple months of this year has been really quite strong … We’ll see what happens in the spring season.”

To the question, is it ever a bad time to buy a house in Victoria?… A chart of nominal house prices vs affordability paints a different picture for me than inflation adjusted. Here I see mostly flat or rising periods of prices, so there are no bad periods to buy. Early 80s was the worst time I suppose. Overall no scary time to buy. The formula for affordability has price in it, so it’s not surprising to me that they are inversely co-related. Buying a ticket on that “green line” train at any time looks good to me.

Source of chart : https://househuntvictoria.ca/2017/07/12/rate-reversal/

It’s not really math and no, I’m not literally that inflexible. But if you’re just talking about nominal prices, it’s unlikely they’ll be maintained. It would take many years for wages to catch up and inflation to eat away at the prices. Both will have an effect for sure, but in the interim there’s not really enough room for rates to take up much of the slack. It’s not a “bear thesis” as much as it is a simple observation. If credit growth starts to trend upwards for several months or more, then my little keyboard commando assessment will change as well.

I said unchanging affordability isn’t going to happen. In response you’re telling me that I cannot rule out flat prices. Apples to apples please. Affordability is already changing. The only point of debate is how much it will continue to change – then you get into actual numbers (including prices), and like I recently said no one can pin that down. Once again, if you want a better sense of what trends you’re going to see in the RE market here, watch the consumer credit market. No crystal ball required. 🙂

Removing the builder/flipper should substantially increase market stock. It’s not just Oak Bay buys for $899k tear down rebuilds and relisted at $1.8-2.2M because I started seeing that everywhere even in Sidney although Duplex’s or Multi’s are becoming more common there now it looks like.

With interest rates lowering however I think that could change and reintroduce buyers that were on the bubble, and lower the carrying costs for builders in general. I can see Marko’s point, that a big plateau is coming up, but I think were already in as many have discussed in the last year.

March numbers are out soon and we we can see if the spring market is starting out hot or not. Stopped by an open house on Sunday and it was empty which incidentally is a measure of absolutely nothing. Well, I have a full day of messing in the garden trying to tackle the dreaded list.

I didn’t think that was the case. A long while back I looked at previous corrections for SFH vs condo prices and remember noticing that SFHs dropped by a larger %, especially luxury places. Logically it would make sense to me that lower-priced properties would have the rental market for support.

Great article, per usual.

The upcoming local recession in about 2-3 years should be a real good one! New projects in the pipeline are getting spooked by the new building code and increased construction costs.

For the record I am not actually predicting flat prices. Just find it funny that someone thinks they can definitely rule out a flattish market.

Bears on here have been predicting that dramatic things were going to happen to Victoria home prices since 2008. The market continuously confounded them by not really doing all that much from 2009 to 2015. Not flat but flattish.

Finally in 2016 the bears were right – a dramatic move in price happened!

Total Vindication!

Except, oops the dramatic move was in the opposite direction from what was predicted.

Flat – would be minimal movement in prices up and down. Are you really going to go all math nerd on me and say that a “flat market” must mean a perfect zero percent slope and no deviation above or below that?

Funny that!

Affordability is definitely a useful lens but it is not the be all and end all. Not as important as price for the 25% of cash buyers I assume. Also to those folks that have to save up nearly double the down payment of 10 years ago is that really the same “affordability”?