March: Sales settling down

March numbers are in and this month I thought I’d give it a couple days before writing the monthly summary until all the pending sales were recorded so we can get a more accurate picture of what actually sold rather than what happened to have been reported as sold last month.

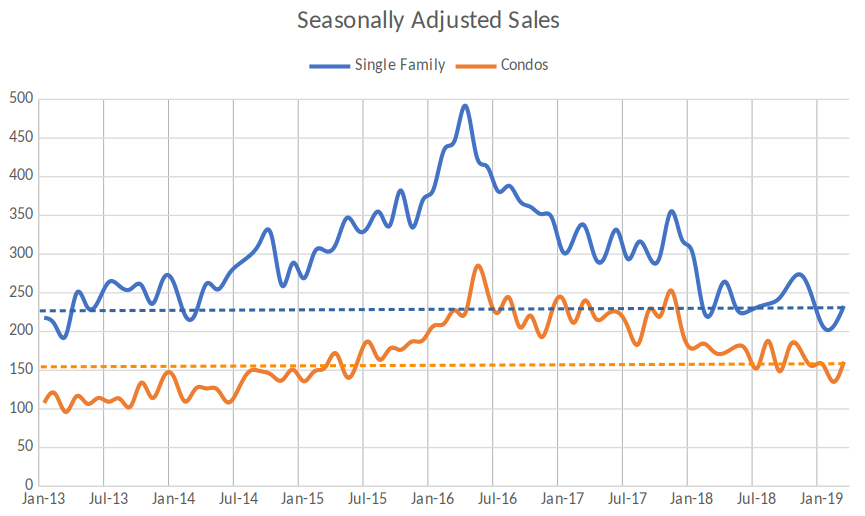

Last month’s sales were very nearly back to the very slowest pace of 2013, partially due to the week of poor weather. Some of those sales ended up in March, and the sales pace was back to approximately the same level as we’ve seen for most of the last year.

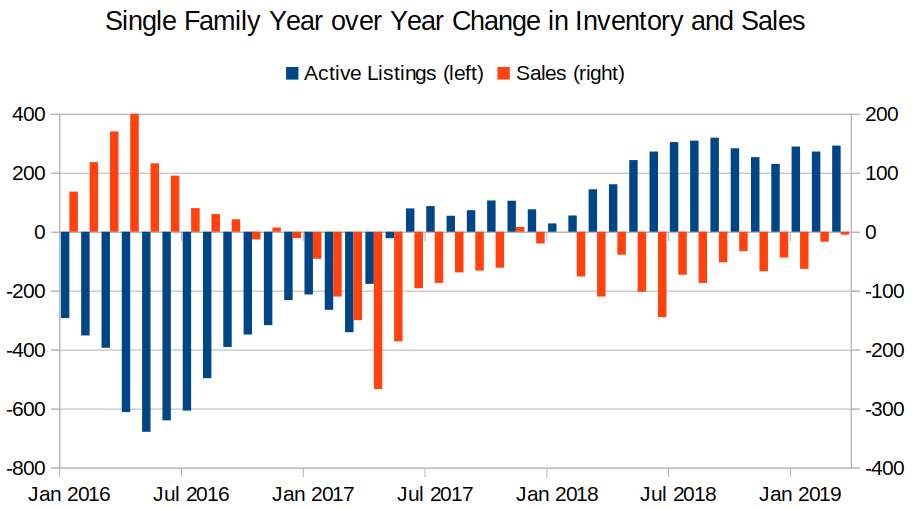

Condo sales continue to be somewhat more active than the single family side, with levels down substantially from the highs of 2016 but closer to the long term average for this time of year. After a couple years of solid year over year sales drops, I suspect the sales declines are nearing their end. The number of detached sales were essentially unchanged from last March, while condo sales declined by 8%. Sales of single family properties will probably bounce around this low level for a while while condos might drift down some more. However last year was already pretty weak so don’t expect the big double digit declines going forward.

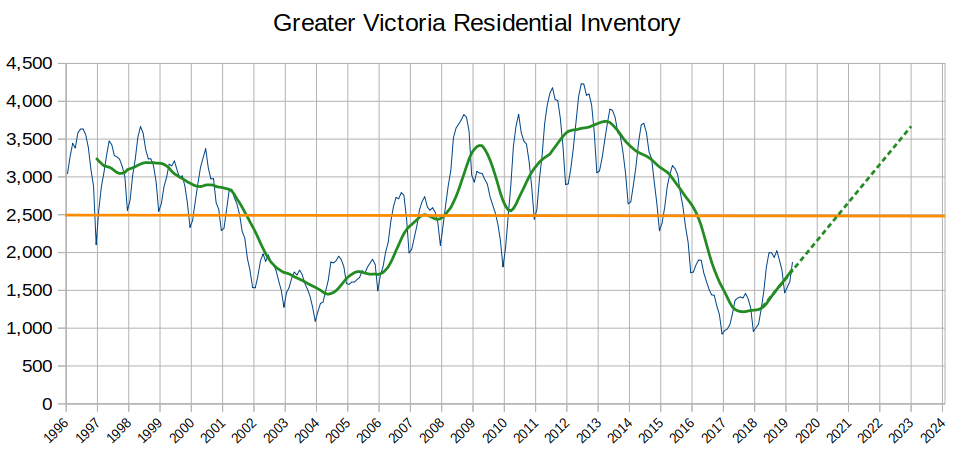

Inventory is up nearly 40% from last year, but let’s not forget that we are recovering from extremely low inventory levels, so 40% is not as significant as it sounds. If we actually dig into what most people are looking for (Greater Victoria houses or condos), we see that it translates to about an extra 300 houses and 200 more condos on the market compared to this time last year.

A bit over a year ago I predicted that inventory wouldn’t recover to normal levels until 2020 to 2022 based on historical market behaviour. A year later, we are right on track, with inventory building at a fairly constant rate, but still a year off from regaining average levels. What’s more, at this rate of inventory growth (which is already relatively steep), we won’t regain our recent inventory peak until 2023!

Have I mentioned that real estate markets move at a glacial pace? Real estate markets move at a glacial pace.

Given that this week’s poll indicated that 80% of you are planning to buy within 3 years, it also moves slower than almost everyone’s buying window. Because unless you’re weird like me, you probably won’t be wanting to look at these charts for 5 years. The good news is that we are in an upswing for inventory and that means you have more selection now than you did last year, and I’ll bet my right foot you’ll have more selection again a year from now. That is across all market segments, no matter how many times the industry tries to insist that only the high end cooled down. Condos remain more active than the more expensive detached segment, but everything is moving in the same direction. Gradually.

What does it mean for prices? Not much yet. As a reminder, just because the market is cooling doesn’t mean it is cold. If we look at months of inventory, the entire market is just scraping the bottom end of balanced market territory. While single family prices have come off their peaks by a bit, I wouldn’t normally expect any sustained price declines until months of inventory rises into the top end of the balanced market range (around 6). Sales are low, but inventory has not built up enough to really put a lot of pressure on sellers.

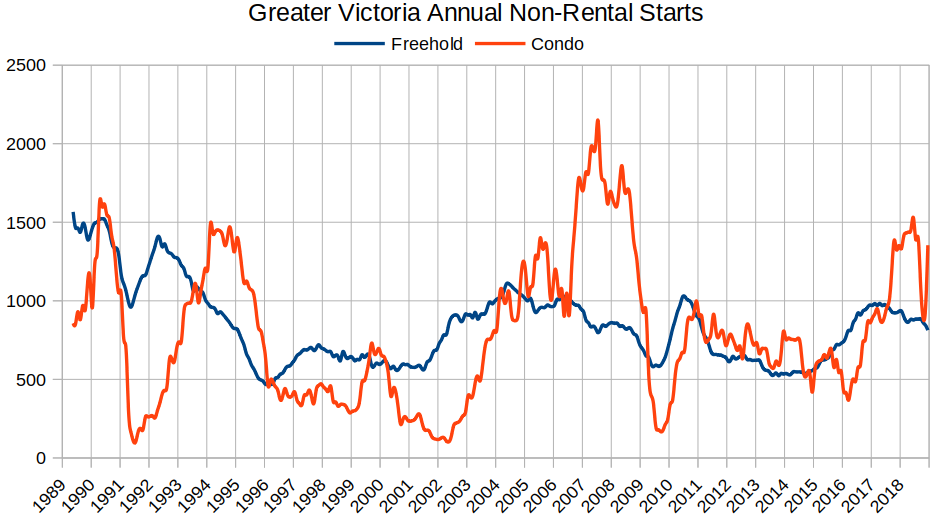

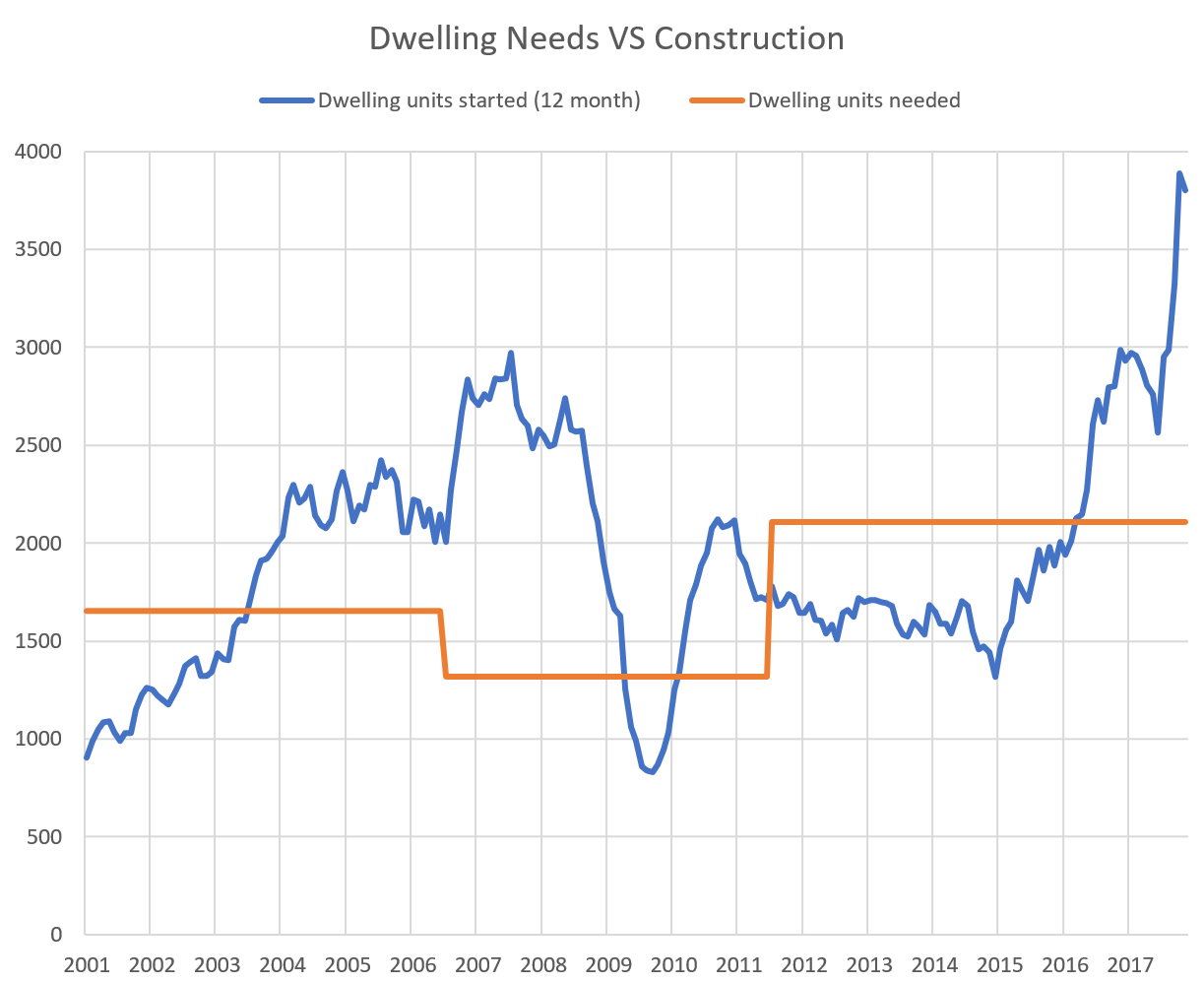

With recent annual population growth in the area at about 5000 people, we need just under 2500 new housing units to be built to keep up with the demand from new residents. Despite calls for an impending slowdown, our construction rate has continued to ramp up and we currently have almost 6000 units under construction.

Keep in mind however that those will not be all built in one year. A better measure is the pace of completions, which for the last 12 months was 2600 units, and should be taking a step up within the next few months. So we are currently building enough plus some to house new Victorians, but it’s not a huge mismatch yet.

On the regulatory side, the diversion that the federal government caused by pretending to throw a bone to first time buyers seems to have worked. The new buyer assistance program will make absolutely no difference to high priced markets like Victoria (as designed) while moderately propping up some of the cheaper markets that have been unnecessarily negatively impacted from the stress test. Most importantly the feds give the impression they are helping first time buyers/voters while not actually compromising their mission of de-risking the housing market by lowering prices. The province also introduced a bill to reveal the ownership of properties in BC through the previously promised registry which should go live early next year. Given the extent of anonymized ownership of especially high end properties in Vancouver, I suspect the thought of that registry being pored over by journalists and CRA auditors will liberate quite some additional inventory in those regions.

What will be the impact on Victoria? Hard to say but I would guess it will be mostly secondary. I don’t have any reason to believe the problems with money laundering are present here to nearly the extent as in Vancouver, however if prices in Vancouver are brought under control it will reduce the spillover into Victoria which was a major factor in the urgency of our last price runup. Also I believe that much of the anger at high prices is caused by the perception (and very likely reality) that the playing field has been uneven. A greater degree of transparency and effort to root out real estate related crime will not suddenly make housing cheap, but it will go a long way to bringing fairness back.

By and large the greater fools have been those taking Garth’s RE advice.

Good discussion, Leo.

Read the Victoria paper discussing our debt to income ratio as being the largest now in the English speaking world [fascinating]:

https://www.youtube.com/watch?v=P0q1nw_FDxQ

I am of the view that the Registry for home ownership will cause inventory to rise substantially, particularly on the mainland. I also believe that money laundering is an issue in Victoria RE, but not to the degree we have in Vancouver. If so, there will be a direct impact on supply here and an indirect impact as Leo mentions. I like this common sense discussion:

https://www.youtube.com/watch?v=vJjY73gtegs

The Registry goes live in early 2020. It will be interesting. But note: March and April RE is historically characterized by falling inventory – year after year after year – not now – note, inventory is rising – why? Good discussion [ignore the 30 second introduction]:

https://www.youtube.com/watch?v=r0jgajtPYro

The Fed Liberals have to go – Trudeau improperly tried to pressure JWR and his taxing and spending is killing us. US adds 200,000 jobs in March, we lose 7200.

Keep your head in the sand, if you wish. Thanks, for the good summary, Leo.

Garth’s strategy is beyond idiotic….was it a joke?

So many problems with it one being that your average completion/possession in Victoria is around 7 weeks +/-. If you are asking for 6 months, for example, on average you will sell for a lower price as you will have a much smaller market pool of buyers willing to do a completion date that long.

Etc., etc.

LeoS – yes, Garth’s strategy: during a strong sellers market (bidding wars, etc) sell and ask for a significant non-refundable deposit with a long closing date. If buyers realize they got caught up in the insanity and walk the seller makes off with a sizeable deposit. If buyers go through with it then the sellers take their “peak” earnings and should be able to sit for a while (ie. rent) until the market regains sanity.

Like any short strategy this one can backfire if the asset value climbs continuously over a long time period, which is exactly what happened in Toronto for the 8 years after Garth made his post.

https://www.greaterfool.ca/2009/08/14/by-the-shorts/

Might not have been a bad strategy for a higher-end property here 2-3 years ago. But hindsight…

LeoS How are sales of over two million doing compared to last year? Is the luxury end still moving?

Translation of what Patrick said below is that you can bet on the direction that certain RE indexes will go. That might be a way to monetize this site Leo! You can take a 10% rake on the betting pool!

Caveat,

They have that in the USA. There are CME S&P Case Shiller futures contracts for US house prices indexes, for a composite or a specific city. Based on case Shiller index for cities (that’s like our Teranet index) They’ve been around for a long time, since 2006. The idea is that if you’ve invested in RE, you might want to hedge the risk, just as you would hedge currency.

Currently it looks like RE futures prices in most US cities are trading with various cities expecting a 1-3% gain (in the Case Shiller index) over the next year. The futures bounce around, in 2009 I think the futures were trading expecting a 20% 2-year drop (which of course did happen, and more).

The 1-year futures are mildly bullish now, they were a little bearish in Dec 2018 (when rates were higher).

https://www.homepricefutures.com

Barrister,

I was also surprised that numbers for builds in Victoria (city) and Saanich dropped YOY (msg 58341) from 2017 to 2018.

Using the numbers in the TC article, the construction totals for Victoria+Saanich have dropped 37% in 2018 (vs 2017) while Langford builds have doubled (2018 vs 2017). The ratio of Victoria+saanich to Langford builds was 60:40 in 2017 and is now 30:70. More than twice as many builds in Langford than Victoria+Saanich combined. A big change in a year.

So majority of the 5000 under construction are rentals.

I think it was Garth that proposed some hare brained scheme to short the market. Something to do with selling with a long completion date? Can’t recall.

Except unlike shorting they don’t make more money if the market falls. In fact they make less because often they have other units they did not pre-sell.

This is more like a futures contract where you are selling in advance the obligation to buy at a specified price.

That was me but I was joking/mocking the idea. Shorting REITs broadly would have been damaging to your wealth other than during the global financial crisis when they went down a roughly similar amount to everything else.

The bottom line is that there is no good way to short Canadian housing and that is probably a good thing. Do we really want houses to become MORE like poker chips.

CMHC doesn’t track the split after they start construction but they do have the data for starts.

Here are the non rental starts.

https://househuntvictoria.ca/2019/01/24/a-deeper-dive-into-construction/

The only parties who are actually shorting RE are the developers who sell pre-sales. That transfers the risk of falling prices from them to the buyer.

Someone talked about shorting REIT’s. They do not invest in houses or condos. The market dynamics of commercial RE and purpose built rentals are a lot different from those of personal residences. Also their holdings are diversified across markets.

Patrick Not really surprising that they are building in Langford since that is where the vacant land still exists. My guess is that in future years more and more jobs will be based

in the west shore. While the West Shore is not everyone’s preference one has to admit that it has really developed over the past few years and added some nice facilities.

Article quotes a builder as saying they have a “tsunami” of Victoria new house demand. One surprise (to me) in the 2018 numbers is the ever increasing shift to Langford. Among the three cities mentioned, 70% of 2018 builds are Langford, the other 30% are Victoria & Saanich

https://www.timescolonist.com/real-estate/greater-victoria-builders-struggle-to-keep-up-with-demand-1.23457905 (oct 2018)

“Langford leads the way with 1,439 starts through the first nine months of the year, almost double the 765 started over the same period last year. Saanich has seen 369 new homes started so far this year, down from 423 last year, and Victoria has seen its pace cut in half with 319 starts so far this year compared to 665 at the same time in 2017.

Edge said while builders are starting more than the average of 2,000 homes a year, they are still not keeping up with demand.

“We have seniors, baby boomers, Generation X and millennials all in the housing market at the same time, so the usual [building average] just won’t cut it anymore,” said Edge. “We have a tsunami of Canadians in the market and that’s why we have an affordability crisis despite us building above our average.”

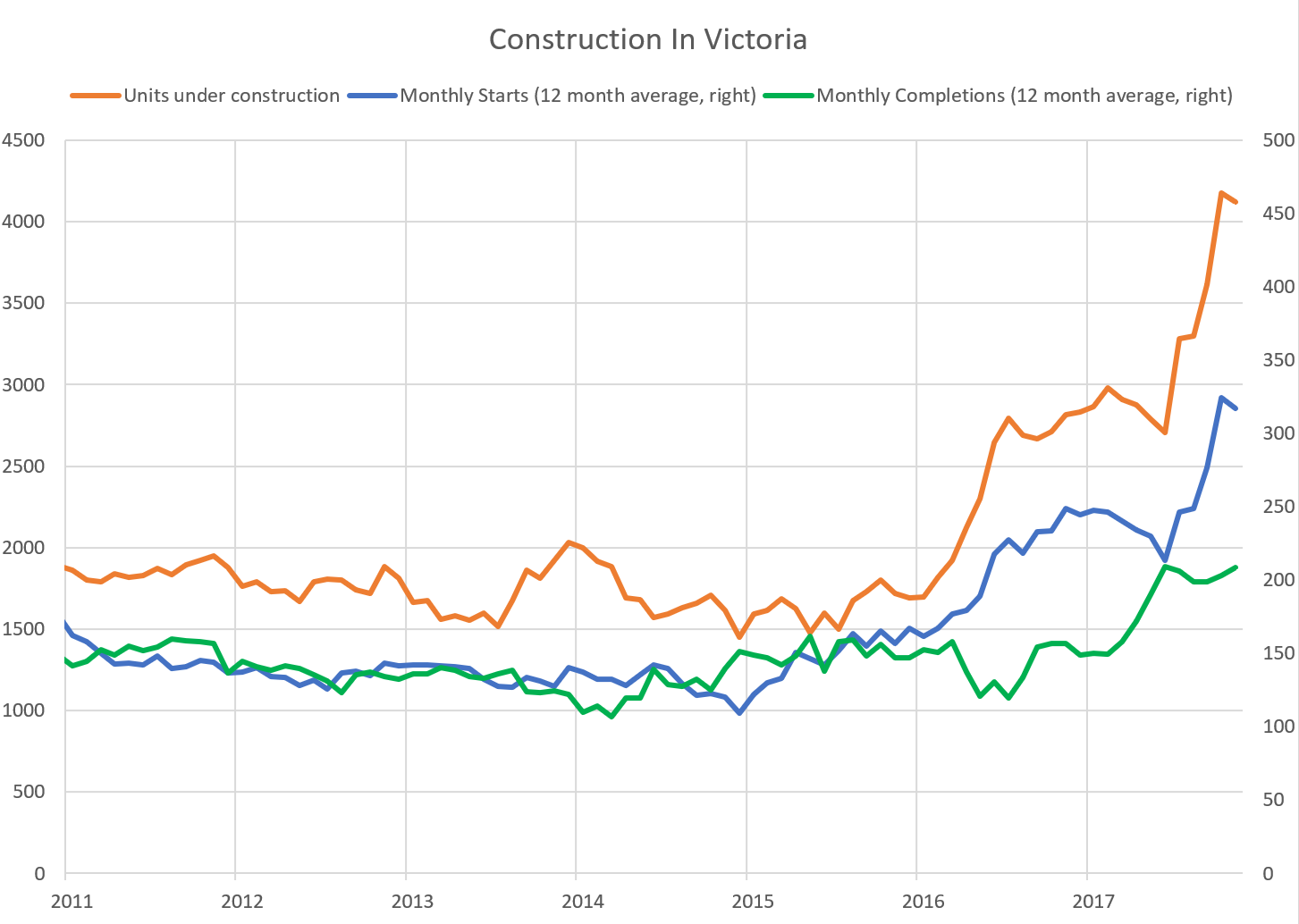

Looks like about 1800 units started between July and October 2017. (+ an additional 2100 between Feb and August 2018). So lots of completions coming this summer.

Interesting, so Apartments actually includes all condo builds as well, wonder how many of the 5000 currently under construction are actually rentals then.

Thanks Leo!

An older chart but it relates housing need vs construction

Might update this using the annual data from BC stats instead of census data.

Patrick: This shows the completions and lag between starts and completions. We should be seeing an upturn in the completions this year from the jump in starts late 2017:

Given the chart of construction data above, and the additional point that there were 2600 units completed in 2018, it looks like it takes about 1.3 years to build on average, and if that’s correct there should be about 4300 units completed this 2019 year.

That 4,300 should be 1,800 in excess of the 2500 units estimated for the 5,000 population. Of course lots are rentals, but a dwelling is a household regardless if it’s rented or owned. Either people overall reduce household size or the vacancy rate climbs by excess houses/total dwellings = 1800/160000 =+ 1.1% vacancy. Added to our current rate of 1.2% that would be a 2.3% vacancy rate in 2020. Those are just a bunch of estimates of course, but the overall idea is that we’re building more than needed so vacancy rate should rise.

But if we do have a 2.3% vacancy rate in a year from now, that should be good news for renters and house buyers. Would also make a good argument for removing Victoria out of the spec tax region, since areas got in it for having a low vacancy rate, and there’s plenty of BC areas with lower vacancy rates than 2.3% that are not subject to the spec tax. The spec tax is supposed to free up houses for rent, and what’s the point if/when the vacancy rate becomes high?

A longitudinal examination of HHV comments/predictions in terms of retrospective accuracy indicates far more crap coming out of the bears’ butts.

We shall see whether that trend continues going forward.

Too bad. It would be interesting to see the period from about ’87 to ’92.

Yeah, data only goes back to 1996

It would be interesting to see the residential inventory back to the 70’s or even 50’s.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3410015401

Hey Leo, where do you get the units under construction data?

I meant prior to now – those houses are just being completed based on a 1.5-2 year build.

No but I would like to. The standard static charts are made in Excel or Openoffice, the dynamic ones are custom Javascript programming with the Google charts API.

Once I have a few spare hours I’ll go through the R training and switch to that for a lot of things. It’s especially useful for analyzing statscan data which is currently extremely tedious to retrieve.

Yeah for sure elevated construction will lead to more supply of course, the growth rate for inventory was more based on historical growth rates.

Keep in mind though that construction is also quite reactive to current conditions. If there was a sudden supply shock, many construction projects would immediately be paused to wait and see what happens, so over a longer time period like several years into the future I figure it about evens out.

The bigger risk of supply shock comes from resale listings. If investors decide to bail en-masse that can come online much faster than new construction. We’ve definitely seen that happen in other markets.

Yeah I wouldn’t underestimate the ability of the banks to influence policy. One criticism of the stress test is that it reduces competition and locks people into their lender on renewal. That allows banks to extract more profit via less competitive rate offers.

Also banks have increased their spread as rates rose. Pie might be getting smaller, but they are good at protecting their share. Much of the risk if foreclosures ramp up is off their balance sheets anyway.

Short Canadian banks and REITS? I’ll let the bears tell me how that one works. 🙂

Or maybe you can sell naked call options for a Westhills SFH

In Canada you can’t, at least not directly. You could technically short the banks and in fact, a lot of people are doing that. Too rich for my blood though.

Good question. To be honest I didn’t independently verify it, however it is in line with growth from 2011 to 2016 so it seemed plausible. Compound annual growth rate between those periods was 1.31%.

BC stats has different numbers than the census for some reason, but most recent growth rates also at 1.3%

https://www.bcstats.gov.bc.ca/Files/0364dc42-bf99-4293-adc0-6d76b111c923_39384/BCCensusMetropolitanAreaandCensusAgglomerationPopulationEstimates2011-2018.xlsx

According to their numbers, Greater Victoria grew by 4923 people in 2018.

Census says avg household size is 2.2 so that would necessitate 2237 new housing units. Rough estimate of course I have no stats on avg household size of new arrivals.

Good approach. The poll is just for fun. Best to keep a look out for individual deals.

I’m vaguely watching the “Vancouver house price collapse” Facebook group. Very curious to see how many members there end up buying once the bottom is in in Vancouver, and how many end up missing it. Vancouver market is extremely bad right now but I get the feeling the echo chamber will continue even once it isn’t. We’ll see.

Such as?

@guest_58309

Or the last time over 750 houses were built was August 2017 @ 751 or July 2018 @795

Got to think, I wouldn’t want to buy anything made in the last few years. Just so many places going up – where do they find enough skill or people? You’d think corners would have to be cut somewhere.

Looks like the last time we were building over 750 detached houses at once was in December 1980.

Uhhh, yeah Patrick.

Try hovering over it.

January 2015, 385

January 2019, 729

Doesn’t look unchanged to me.

Have a look at LeoS graph again. The blue part -“detached” represents SFH construction which looks unchanged. Also remember that many SFH. builds are after a SFH tear down, ending up with a more expensive SFH and no net gain

LeoS,

Really great post. Your graphics wizardy improves with every post, and is the best I’ve seen anywhere. Out of curiosity, for your charts, do you use some type of graphics package or some data programming like “R”or ?

James,

I think LeoS and Barrister’s estimate of 2 people per household is right on. The Victoria 2016 census figures are 368k people and 173k dwellings, which is 2.13 people per household.

Then there are other factors, like some of those dwellings might be vacant (although people only fill out the census once, so that shouldn’t be a factor). But the units being constructed are mainly apartments which would be lower occupancy. Using an overall value of 2 seems about right to me for the units being built.

https://www12.statcan.gc.ca/census-recensement/2016/dp-pd/prof/details/page.cfm?Lang=E&Geo1=CMACA&Code1=935&Geo2=PR&Code2=59&Data=Count&SearchText=victoria&SearchType=Begins&SearchPR=01&B1=All&TABID=1

Random data point from the stats can data. 39% of Victorians currently live in a SFH. I read elsewhere that 78% of young house buyers would prefer a SFH. With construction of about 800 SFH/year minus the tear downs of SFH, it seems to me demand for SFH is outstripping supply, but there are lots of factors there.

Shouldn’t this be dramatically affected by:

We’ve had double the number of single family housing, nearly double the semi detached, and over two and half times more row unit construction compared to 2015, plus at minimum 3 times the number of apartments since the middle of 2017. How wouldn’t this change the amount of inventory coming online in the later half of this year?

Who’s admin?

Thanks. Introvert has been sleeping on the job as chief spell checker

“summery” in the first paragraph?

Are suites in houses counted in housing units? What about all these new homes with purpose built suites – does that count as 1 or 2 units? I’m curious as I see lots of requests for rentals in basement / rooms/ suites on UsedVic and other places from people moving to the area. Just makes one wonder about how numbers are counted.

Asked about this at the end of the last thread, because Barrister said the same thing.

What is this based on?

2018 # of Households is: 106587

(based on https://www.bcstats.gov.bc.ca/apps/Households.aspx)

Based on a 2018 population of 390,613, that’s 3.66 per household (which actually seems high to me), but even at 3 per, that’s only 1666 units per year.

Sales numbers go back to 1990.

I have read some of the threads over the past months and noticed a few of the commenters getting a bit testy with each other.

From what I can glean from most of those threads, there are no “real Bulls” or “real Bears” commenting here, just a group of people giving their opinions, some more assertively than others. A “real Bull” would own as many houses as he possibly can in Victoria and a ”real Bear” would be finding a way to short the housing market. I haven’t noticed that any of the commenters here actually have…………“skin in the game”.

So, no reason to get upset at other peoples comments, and hey, in the run up to 2007 quite a few very smart people (including Nobel Prize winners) were saying…..”It’s different this time.”

I find Leo’s commentary and posts quite informative, as for some of the more bias comments in the threads……….it’s just Bull and Bear crap.

As a respondent within that category, I’d say that my timeframe could easily go further out depending on what the market looks like in say 6 months time. I’d be intrigued to see this poll pop up every 6-9 months to get a feel for what people are thinking. Now I might buy even sooner than indicated in the poll if the right property comes along at terms I’m comfortable with. It all just depends.

Thanks Leo!

Just wondering, how far back do you have data for sales volumes?

Too bad no one in Victoria is this organized.

Incredible info on the Vancouver purge.

https://twitter.com/mortimer_1

“A greater degree of transparency and effort to root out real estate related crime will not suddenly make housing cheap, but it will go a long way to bringing fairness back.”

Totally agree!

Great post Leo.

Great Summary and a pretty balanced analysis.