The journey back to normal

Right now we are at near-record low inventory levels. Not the lowest we’ve seen, but damn close with residential inventory only a few percent higher than this time last year. There were 958 residential properties for sale at the end of December, while the ten year average is 2213.

So when do we get out of this buyer’s hell?

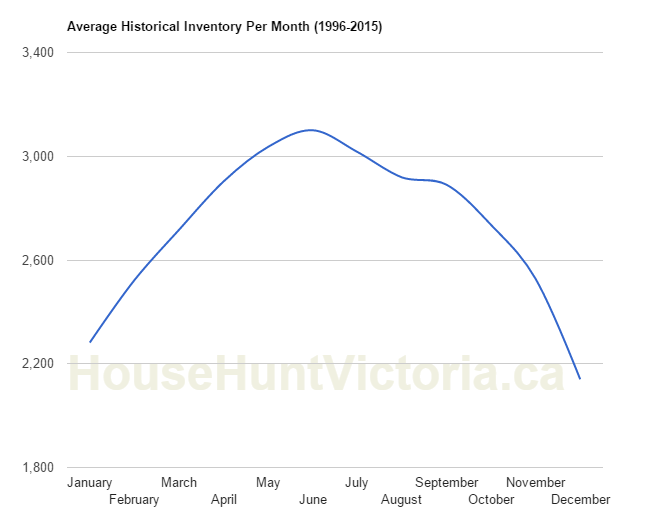

Well there’s widespread agreement that the market will cool off further this year, so we are almost certainly on the upswing as far as selection goes. But how long will it take? For that we should look at how fast the market has swung in previous years. Now, first of all, inventory is always lowest around Dec/Jan and highest between May and July. Hot market or cold, this pattern holds every year.

We know that inventory will be increasing for the next few months, but will it get back to normal (i.e. average) levels? Here is the history of residential inventory for the last 20 years.

There’s two ways to look at it. One is the fastest growth in inventory we’ve seen, which was in 2010 when inventory from January to June piled on at a rate of over 330 per month. At that pace it would only take us 5 months to get back to average levels of inventory.

Problem is that inventory always drops again in the fall, no matter how badly the market is imploding. Better to look at the year over year changes and see how fast they can shift. In a slowly cooling market like 2005 to 2007 we were adding only an average of 25 listings per month. In a complete meltdown that can go as high as 100, however the strongest sustained rise in inventory was around 50 per month in 2010. Given that, we can estimate at what point we are likely to return to average inventory levels.

In conclusion, it’s going to take a while. While prices declined rapidly during the great financial crisis, at that point the market had already been cooling for over 4 years and was sitting at above average inventory levels. The panic in the markets brought it from a mild buyers market into an extreme one very quickly. From where we are now, it would take a much longer period of cooling to achieve the same effect.

I agree. See this one too

New post: https://househuntvictoria.ca/2018/01/08/jan-8-market-update

Such a stupid argument.

Sure they do! I’ve met IT workers living in Port Renfrew.

The difference is that those 200 renters could be owners of those 200 units.

Let me try to make my point once more. I don’t disagree that investors or even speculators are bad for the economy or for society.

But we don’t have a normal market today. Rapid build up of equity, low interest rates and easy access to credit has permitted more people to buy multiple properties. And that has been driving prices and rents up.

For the BC Government this is a cheap fix to stimulate the RE-SALE market. And the government make a few bucks in Capital Gains tax too. They don’t have to spend hundreds of millions on new construction which will end up being little shit boxes at high rental rates or what the Americans call “The Projects”

A little alarmist don’t you think? The guy working 70 hours a week can still invest in tons of things.

The thing with real estate is the hard working average Joe can add some value to the investment instead of investing in a company where she or he can’t add any value and the CEO makes 200x the average employee.

No kidding. I’m always amused at the argument that Canada is running out of room for people.

Problem is people don’t want to live in Port Renfrew.

I’m not sure it is a problem per se. After all that is rental housing. However I do think that discouraging rental investment by individual owners will lead to better, more stable rental situations in the long term. By forcing industry and governments to act to supply better rental housing that is stable and well managed, people will be better off.

Management aside what’s the difference between one very rich person owning a 200 unit apartment building or 200 individual owners owning 200 units in a condo building that are rented out?

I agree that a 200 unit apartment is a much better way to go due to management and stability of rental but people don’t seem to take issue with the top 1% owning such a building; however, they will take issue with Joe who owns a house in the core that buys one condo unit to supplement retirement income. Sure, the investment is probably bad but option should be there.

“It isn’t enough for them to just fill the void, that would just be stabilizing the market.

There is a lot of problems with your argument in that the numbers don’t work.

The population of Oak Bay has not grown, yet prices increased by 15% between 2016 to 2017.

And in Langford where almost all of the population growth has occurred prices rose 13% in that same time.

Wheres the correlation between population growth and price?

But if you wanted to speculate on house prices where would you buy?

An older couple in Oak Bay moves on. The house comes up for sale and a dozen Dodge Ram trucks with lansccaper and drywaller names on the doors descend on the two bedroom cottage. Flush with the equity in their homes, these speculators buy the cottage and rent it out.

Result: Population growth near zero, price increase 15%”

I’m confused. Obviously prices in Oak Bay increase because of its desirability. And obviously Oak Bay would be a better investment because if/when prices stall/retreat/collapse they will stall there far later then in Langford which is significantly less desirable. That you believe that the appreciation of land in Oak Bay is due to renovation and improved landscaping shows a deep lack of understanding in how property and markets work.

To your other argument: obviously there’s population growth. Just because people die doesn’t mean that the population is dropping. The population of Greater Victoria grew by 23,190 between 2011-2016. Again, the fact that people die doesn’t change that.

Pre-qualify for kids now before they introduce the parenting stress test.

Our daycare costs ~50% more than our mortgage does every month… Where’s the stress test there?

A little alarmist don’t you think? The guy working 70 hours a week can still invest in tons of things.

Good. Isn’t that exactly what we’re looking for?

No kidding. I’m always amused at the argument that Canada is running out of room for people.

I’m not sure it is a problem per se. After all that is rental housing. However I do think that discouraging rental investment by individual owners will lead to better, more stable rental situations in the long term. By forcing industry and governments to act to supply better rental housing that is stable and well managed, people will be better off.

I think the solution to that problem is to create more dedicated rental housing suitable for a wide variety of people and families rather than trying to make it so that everyone owns. That just leads to bad programs like BC’s Home Parnership plan.

Well, rental yields are undoubtedly extremely low after our recent price runup. I’m sure there are still the odd places that make sense as rentals but those are few and far between. Rents will have to increase or prices decrease to make rental investments sensible again.

Dasmo your house is amazing! I am also in love with the stump porch. Maybe a tour when it’s all done? I always see new houses around greater victoria and wonder what some people are thinking. Like if I had their money I would not build 99% of the new houses I see. It’s nice to see you being so creative and it is going to be fantastic! I’d settle for a trailer on that property 🙂

Also true about the baby comment except that once number 2 comes around you realize it’s more hassle to own with little ones. You know that an owned house doesn’t make a happy family. And with >2 kids in daycare more money too. Better make those budget spreadsheets before you jump in! I have a friend who just bought and wants a family and has no idea the cost of raising a kid and taking a year off. Probably should have thought of that before taking max mortgage… but it will all work out I’m sure…

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2172rank.html

This factbook measures GINI index – that is the measure of inequality. Canada doesn’t appear to fare too badly on this measure – coming in #112 out of 150 countries measured. (#1 is the worst country for inequality, #150 is the best) As I expected – most European countries and especially the Scandinavian countries – fared well on this list, and often Scandi countries are said to be among the happiest in the world. So, does more equality mean more happiness for more people, even the wealthy?

The problem is, we can measure equality or inequality all we want in Canada – but if we remain wide open for plundering of our best residential RE by the world’s uber wealthy – then this measure doesn’t mean much for those of us who want to continue to live in the best cities.

https://www.youtube.com/watch?v=zBkBiv5ZD7s

This 4 min. video is very telling re. inequality in Canada. It’s telling, that there is actually a much wider gap between rich and poor in Canada than what most of us collectively think there is. We think we have less inequality than in the US, and we do, but actually it’s not that much different here than there. I’d bet that domestic speculation, coming from the top 10%, and esp. the top 1% who own most of the wealth, could be partly responsible for manipulating the markets in both Van & Vic – arguably among the countries most desirable cities.

Truth is, inequality is increasing in the globalized era, and it continues – the rich are getting much richer, and poor and middle class are barely keeping up. On the flip side, extreme poverty in the world (living under $2/day) is also decreasing, while this is a good thing, this has little direct meaning for those of us in most western countries.

My take is, that currently in most western countries, Canada included, the increasing inequality (esp. if it continues to worsen) is a bad thing. In the near future, we could end up w/ a society filled with too many hopeless, and perhaps also jobless in the upcoming era of robotics and AI/automation. If the top 10% end up owning most of the property and wealth, they could almost become virtual slave-owners of the other 90% if things go too far. Esp. if Government protections for the 90% ‘underclass’ start to break down in the not too distant future.

Right now, we have low unemployment and yet – most employed people in relatively well paying jobs in Van & Vic can’t afford what was once considered a modest or basic house/home (unless they bought in years ago or have come into money somehow). This is not a good situation, but how to resolve it? Even conservatives think if our society was more equal we’d all be better off…

So, while it’s good to encourage people to ‘hustle’, I think house hoarding or home hoarding, esp. in overpriced metro area’s like Van & Vic – should be strongly discouraged either through regulation or ultra high taxation on speculation. Hopefully the NDP does something in this direction come Feb. If people end up w/ no hope for a better life and can’t even get a basic roof over their heads, which is simply a basic human need, then what encourages them to ‘hustle’?

Langford’s gonna give it a shot.

Anywhere? This is one of the least dense countries on earth.

Why just foreigners?

Wheres the correlation between population growth and price?

I am saying throw out the ownership and renter concepts. Throw out prices. Where you do physically accommodate 1.7 million people?

Haven’t heard from Hawk in a while. Maybe he bought a house.

The millennials are filling the void before the boomers are dying…. And babies do make households. Nothing like a baby to make a lady want to own….

Next time ask them how I can get the pop up adds on my Android phone to disappear.

I’d like to find the IT person that invented that!

It isn’t enough for them to just fill the void, that would just be stabilizing the market.

There is a lot of problems with your argument in that the numbers don’t work.

The population of Oak Bay has not grown, yet prices increased by 15% between 2016 to 2017.

And in Langford where almost all of the population growth has occurred prices rose 13% in that same time.

Wheres the correlation between population growth and price?

But if you wanted to speculate on house prices where would you buy?

An older couple in Oak Bay moves on. The house comes up for sale and a dozen Dodge Ram trucks with lansccaper and drywaller names on the doors descend on the two bedroom cottage. Flush with the equity in their homes, these speculators buy the cottage and rent it out.

Result: Population growth near zero, price increase 15%

There seems to be a lot of wealthy immigrants. Is there any system in place that allows our country to take in equal portions of immagranfs accross the spectrum of wealth. My guess is no, and wonder if this too is contributing to our massive dichotomy between local incomes and house prices.

Problem is you need a certain amount of points to apply and be accepted for landed immigrant status and you accumulate points through level of English, education, work experience, and for a family of three you need $17,000 in cash in a bank account in your country of origin. The 17k probably eliminates 99% of the world population considering emmigration.

Before Christmas I had dinner with four new Croatian families in Victoria. All couples between 28 and 39 yrs of age. All family incomes over 100k/year. One couple has already bought a home on the Westshore and one bought a townhome in the core.

Two are computer programmers recruited directly from Croatia by local IT companies.

I don’t know enough about immigration and economics to say this is good or bad but reality is highly educated immigrants are flooding the country.

Babies don’t form new households

So your argument is as 300,000 die each year there aren’t 1st time buyers filling the void?

All the immigration is doing is keeping the population from declining here and in most of the Western World.

Population increased by 1.7 million 2011 to 2016 and immigration is ramping up.

Babies don’t form new households.

The death rate in Canada alone is almost 300000 a year. There is no shortage of homes being built here but simply an overabundance of speculators

If we ignore the 400,000 births the argument almost most makes sense.

There seems to be a lot of wealthy immigrants. Is there any system in place that allows our country to take in equal portions of immagranfs accross the spectrum of wealth. My guess is no, and wonder if this too is contributing to our massive dichotomy between local incomes and house prices.

“Back to the question I’ve been asking for the last three years. If we completely ignore the ownership vs renter concepts where do you physically accommodate 300,000 immigrants? + organic population growth.”

The death rate in Canada alone is almost 300000 a year. There is no shortage of homes being built here but simply an overabundance of speculators

Have you not heard that the reason we need immigration is to replace the baby boomers? A lot of boomers are leaving there homes for care facilities and other places. All the immigration is doing is keeping the population from declining here and in most of the Western World.

So now you have your answer Marko. One day immigrants will live in your parent’s house. Which is really nothing new for Canada for the last 50 years.

@marko- I know you know this but there is a thing called “business” one can invest in. Speculating on housing with negative returns isn’t even investing- again I know you know this.

I have no idea whether a “hustler” is necessary in society but no matter- they can save and invest in business and buy commercial properties, even buy bitcoin if they’re feeling saucy. There are no shortage of investment opportunities out there that one can use to accumulate capital that can be passed on to next gen that don’t require ruining the lives of those in society that see housing as a home and just want a safe place to live and raise kids without “do I don’t I” decisions about taking on short term financing for long term debts for crappy houses that can either ruin you or make you a millionaire.

If this is based on current housing market price (not what owners paid), then most long term renters of downtown condos are probably also enjoying subsidised housing.

We don’t need to build more housing which stimulates the economy and increases demand for more housing. We’ve been trying that solution for over a decade and it has only exacerbated the problem.

Back to the question I’ve been asking for the last three years. If we completely ignore the ownership vs renter concepts where do you physically accommodate 300,000 immigrants? + organic population growth.

This would imply to me that restrictions on multiple ownership make sense. Everyone wants to feel that they have a home and renting doesn’t deliver the emotional safety and piece of mind or capital growth that owning does.

In theory, it makes 100% sense.

However, at that point what is the point of hustling whatsoever? 90-110k middle management government job, buy a SFH, spend flex Friday weekends on Mt. Washington skiing, etc.

For society to be productive you need to accommodate the individual that works 60-70s hours a week, has a suite in their basement instead of a rec room for kids, buys a second property and spends the remaining 20 free hours fixing it up to flip or rent out. Saves his or her pennies, buys a third property, etc., and leaves 3 houses to his or her 3 kids.

Good point re subsidizing. I only had a couple of clients buy SFH investment properties in the last year, but the last one paid $600kish for a SFH they rented out for $1,600 per month.

I would love to hear Leo’s take on this.

As the National Post reports, “Real estate-related taxes are now the government’s single largest revenue generator”—more than gambling revenue, and more than the combined tax revenue from “forestry, mining, natural gas and all other resource industries.”

http://nationalpost.com/news/canada/huge-tax-windfall-highlights-b-c-economys-dangerous-dependence-on-real-estate

At current prices ALL renters of SFHs in Victoria are enjoying subsidised housing. There are no exceptions.

This topic has been around for a while but I’ve never asked this question: What do the folks on here think is the better alternative for a well functioning society & overall happiness? Few owners and many renters or more distributed ownership? Why? Is there an optimal split that is observable somewhere else in the world?

Personally, I think more people would be happy if they owned. Just my 2 cents but people like to own and when there are few owners and many renters, I think overall societal happiness is lower because people don’t feel stable when they rent, especially in BC where the laws are terrible for this.

People buy multiple properties to extract rents from renters for their own benefit and deprive the consumers of those properties of any capital gain that might yield therefrom. If they weren’t allowed to buy, property prices and quality would decrease to where the renters could then afford the properties.

This would imply to me that restrictions on multiple ownership make sense. Everyone wants to feel that they have a home and renting doesn’t deliver the emotional safety and piece of mind or capital growth that owning does.

Also, I think most renters would prefer owning a more basic place they could afford than renting a fancy one they can’t owned by someone who can afford to own it.

Again just my 2 cents.

Careful what you wish for. A lot of renters are subsidized by owners of second properties.

Barrister, I think Marko meant no CG tax (on principle residence).

Under normal conditions I would agree with your premise. But low interest rates and ease of financing has made many, many more people owning multiple properties. Individually it isn’t a problem but collectively it is a problem.

One solution is to get people to put their existing homes up for sale. We don’t need to build more housing which stimulates the economy and increases demand for more housing. We’ve been trying that solution for over a decade and it has only exacerbated the problem.

And the BC government can do this by introducing its own Capital Gains tax on investment properties. And this could take many forms including a graduated tax where the more investment properties under your control the more you are taxed. The refinements of a BC Captial Gains tax can be worked out and fine tuned but the intent of this legislation is to bring existing homes on to the market without stimulating an already over stimulated construction market.

Marko:

Can you point out a house in the Uplands that is not paying a “dime in taxes”. Is there one with no property tax? If there is I would love to buy it. It is early Sunday morning but as a real estate agent you know better.

This means ending speculation by limiting it almost completely.

Maybe cap a limit on what people can own to two properties in Metro areas?

I don’t know….I have no issues with individuals owning beyond two properties as long as they are NOT sitting vacant. For example, let’s say you had three SFHs in the core. You live in one and you rent out the other two to families. The three lots are an average of 5,000 sq/ft and the houses are average 2,000 sq/ft. How is this worse for soceity compared to someone living on a 22,000 sq/ft lot in the Uplands in a 6,000 sq/ft home not paying a dime in tax with massive appreciation?

If you bought a new Mercedes and there was a big patch on the outside of the body would you accept delivery and pay full price? Why is this bridge any different?

@Barrister

I sent the article to a friend of mine who is a retired senior civil engineer. His take is that this is a problem that could effect the life span of the bridge. Also it is an ugly fix to an engineering project that is supposed to be aesthetically attractive.

I notice that the new houses on Pendray seem to keep coming back on the market. Are these flips?

I forget where I read the article but wasn’t there a measure in China where, for second and third homes, the downpayment requirement went up and the max mortgage length went down?

If a lot of speculation is people drawing on their phantom home equity to buy investment condos, then that might reduce it without impacting people who only own one place, and actually live in it.

The devil is in the details, though, and it may be hard to actually enforce?

http://business.financialpost.com/personal-finance/mortgages-real-estate/foreigners-are-banned-from-buying-property-in-new-zealand-canada-should-do-the-same

This is what I just alluded to – imo foreigners need to be completely banned in all forms from using our residential RE as a commodity. If this ever happened here it could very likely effect people’s equity and prices could go down as a result. But, it would be for the greater good of all society.

Right now, our country is among the most incompetent and inept at dealing with this problem in the entire Western world. Australia, Britain, and Europe are also all moving forward in dealing with this problem. Meanwhile, it’s easier to set up a numbered company here than it is to get a library card… we are the sheep of the world and if it doesn’t change we will continue to get fleeced.

https://www.economist.com/news/business/21734034-identity-checks-obtain-library-card-are-more-onerous-those-form-private

I sent the bridge article to a friend of mine in Ontario who is a senior engineer with one of Ontario’s top companies involved in steel fabrication. I will let you know what his response is when I get it. If the article is accurate, in spite of being written by a person who is not an engineer, I find it very troubling.

You are quite right to question this, as I do. What Horgan really should do imo, is make housing about housing again – you know – a place to live in and not a commodity to be traded by wealthy overseas or domestic people. This meanings banning foreign buyers – in all forms (i.e. no more numbered Canadian companies that could simply be owned by foreigners either) – from purchasing any residential RE. This means ending speculation by limiting it almost completely. “We’ve had 10 years of where we have built tons of new supply and it hasn’t made any dent in the rise of real estate prices. … Is the problem supply or is the problem that these units are being sold to people who are not occupying them?”

Virtually eliminating speculation, and not just taxing it as Horgan may do, sounds draconian to some I bet, and the speculation part should only apply to larger towns and cities (that way you can still buy that cottage or ski chalet if you want to). Maybe cap a limit on what people can own to two properties in Metro areas?

Question I have also is what percentage of land in the core here is SFH? – I would bet that it is a high number here as well as it is in Van. I think density increase needs to be done here as well moving forward as it says in that Vancouver sun article: “Vancouver’s plan includes opening up parts of the city zoned for single-family houses — almost 80 per cent of residential land — to other housing options, such as townhouses”.

We are now in the situation where we simply don’t have enough space for any more SFH in the core and not enough to go around – hence ever increasing land prices. More density in the core isn’t the only answer – actually building rapid transit to Westshore and creating a new city over there is another option possibly to put on the plate of our leaders who are trying to think about what things could look like in 2050.

It’s an aesthetic bridge so the patch is a big deal. Engineered right or not it’s an ugly patch on an apparently poorly engineered bridge. The simply should have at least did a better job on the patch. It’s brutalist and it’s not appropriate on a 120 million dollar bridge.

This is why I question the depths of any measures that BCGOV will take in February. You can see yet again they are speaking from both sides of their mouth. And I get it, I get why, but it doesn’t make it any better.

Here is an excerpt from a end-of-year interview with the Premier, on tackling the demand side for housing:

“But on the demand side, on driving up costs, it’s all about speculation and we have to wrestle that to the ground,” he said.

Okay, but then:

“We have to stop the speculation, and you have to do it with a deft hand. You don’t want to impact people’s equity who are already in the market place and you want to make sure that at the same time you are bringing on more supply,” he said.

This is mutually contradictory. The point is to stop speculation because the activity is driving up prices and people can’t afford anything. At the same time, it’s very important that prices don’t fall.

Right. Makes sense. Up is down, down is up, Trump is a stable genius and I’m gorgeous.

http://vancouversun.com/business/real-estate/so-many-housing-promises-we-inspect-city-provincial-and-federal-plans-to-figure-out-what-will-be-built-when-and-where

For some perspective on this, see the reddit thread (top comments). The problem is that the author of this article is not an engineer and is trying to guess at the reasons for engineering decisions. Would be better not to have this fix for sure, but it’s likely not more than an aesthetic problem.

https://www.reddit.com/r/VictoriaBC/comments/7o6whq/bridge_design_flaw_hidden_for_a_year_then_given/

Could be. But we have no way of knowing. The people that are carrying forward quite a lot of equity should be putting down the minimum to maximize their return. How common is this? Probably not all that common. Most people probably don’t optimize their return. Still I don’t think that you can equate the two. https://househuntvictoria.ca/optimal-down-payment-calculator/

New bridge woes, how bad this is and what impact it will have on the life of the bridge is yet to be seen.http://www.focusonvictoria.ca/janfeb2018/bridge-design-flaw-hidden-for-a-year-then-given-quick-and-dirty-repair-r15/

Leo S. “No one really knows what percentage of people that put the minimum down are also borrowing the max they were approved for.”

<<<<<<<<<<<<<<<<<<<<

I’m not quite sure whether you’re debating this issue from a practical or a pragmatic position, Leo.

Yes, a certain amount of people with a minimum down payment did not max out their mortgage, but let’s be realistic. If one third (possibly conservative) of Canadians are mortgage free and move up buyers carry forward a reasonable amount of equity then a considerable amount of people with minimum down payments are contributing to the extreme LTI levels.

http://www.businessinsider.com/canadians-now-have-more-than-2-trillion-in-debt-2017-5

Canadian Mortgage Debt Is Now $1.454 Trillion

Having another chat room where the poster has to use their real name would be helpful as it will keep the trolls out.

I disagree it means a great deal. Comparing our current market to one from 1975 wouldn’t make sense so why would comparing this market to one that was 5 years ago make any better sense.

It is how our current market is changing that is important. What levels inventory or sale prices where half a dozen years ago isn’t relative to today’s economy or house prices.

I’ve taken a few stabs at the comments features but no clear advantage so far and several downsides. I like the idea of not forcing people to sign up to comment. Very few systems allow that. Adding a forum could allow that. I’ll see if there are any that can use the existing users.

It’s difficult to find info on the toronto market suprisingly enough. Best data site I’ve seen is this one

https://zammit.com/charts

There was definitely a large and rapid jump in inventory due to a massive jump in new listings in May. We’ll see how that holds after the shock of the regulations fades a bit.

Summary: City of Toronto condo apartment sales down 9.1%, active listings up 31.0%

Summary: City of Toronto detached home sales down 13.7%, active listings up 200.6%

Sales in Victoria dropped 15.8% and prices were still up substaintially.

Inventory going up 31% means nothing if it was at record lows. Even if inventory in Victoria went up 200% we aren’t close to 2012/2013 territory inventory.

Need to look at 10 year averages.

Leo,

What would you think about this site having some kind of PM feature? Would that be easy to do? Would other users like to have that? I don’t know if that’s been raised before or not.

Like I said, make it an HPI like system and remove the individual dollar value and simply make it a relative thing.

Nothing new under the sun.

A homeowner in North Cowichan, B.C., disputes his property assessment. Hundreds of people flooded city hall in 1959 when property values increased in the small Vancouver Island community. (CBC)

Outrage over property evaluations from B.C. Assessment is no new matter in the province

http://www.cbc.ca/news/canada/british-columbia/fighting-for-fairness-43-years-of-b-c-real-estate-assessments-1.4474091

Sure, not saying people aren’t borrowing more. But the assertion that the group of people putting down the minimum is the same group as the people borrowing to the max is just not true. It’s a faulty assumption. No one really knows what percentage of people that put the minimum down are also borrowing the max they were approved for.

Something like this is coming here…It’s no different. Every boom ends with a bust.

Summary: City of Toronto condo apartment sales down 9.1%, active listings up 31.0%

Summary: City of Toronto detached home sales down 13.7%, active listings up 200.6%

Hmm. Looks like my prediction is going to be wrong right off the bat. Good. Could make the year more interesting than expected.

I like betterdwelling. One of the few sites that actually tries to use data to get at the truth behind the housing markets. Doesn’t mean I buy every argument but they are doing interesting work there.

https://www.economist.com/news/business/21734034-identity-checks-obtain-library-card-are-more-onerous-those-form-private

@ James Soper: “Didn’t realize burning a bunch of gas while circling around meant that you went into multiple stores and the mall.”

Geez, I didn’t realize this blog was so micro-managing. Well, to be clear, I peeked in two stores while the family was peeing. I sure hope you find that acceptable. To the other blogger who suggested that tastes change, yeah, you’re probably right. Upscale apparel in particular just doesn’t seem to be a priority these days.

Apologies to those on this blog who have more important things to discuss.

I think at this point if I were a bear I’d be looking at moving away. I mean seriously this is all adding up to absolute tragedy for a bear. Even condos are booming. CONDOS. A rat box in the sky. Now even a condo is out of reach for a bear. Imagine.

It makes sense, as people who booked pre-OFSI mortgages before end of 2017 have to purchase and close before their locked-in loan expire date (to avoid going through OFSI), don’t they?

Any guess as to why SFH have slowed at a time when condo sales are booming?

Seasonal for the most part in terms of SFHs….kind of interesting to walk into a condo on January 4th and there are 12 business cards day one on market. In 2013 you would list the same condo for 100k less and be lucky if you had three showings by end of January.

Just as a point for Marko to ponder. There have been 87 new listings in the last three days compared to 22 sales.

Sellers re-listing properties that expired end of December and not many offers are made between Christmas and the New Year. There is activity right now but it takes 6-7 days for the conditional period so you’ll see the sales picking up heading into mid-late January.

@ oops, it wasn’t my response, it was from one of the BD authors.

Leo: “Sorry but this is bullshit. Given low mortgage rates, the optimal choice is to put the minimum down even if you have more money. Yes we don’t know how many people are putting down the minimum because that’s all they have vs how many are choosing to do so, but generalizing every borrower with the minimum down as “leveraged to the max or stupid” is categorically wrong.”

<<<<<<<<<<<<<<<<<<>>

Actually Leo, I believe that Local Fool is on the right track, albeit there are undoubtedly astute and well heeled borrowers that prefer the minimal down payment.

https://www.bankofcanada.ca/wp-content/uploads/2017/11/fsr-november2017-bilyk.pdf

Analysis of Household

Vulnerabilities using loan-level

mortgage data

“Loan-to-income ratio and amortization period over time

Mortgages with high LTIs became more prevalent between 2014 and 2016 across almost all demographic characteristics and market segments

(Table 4). Households with LTIs above 450 per cent account for 22 per cent of low-ratio mortgages in 2016, up from 16 per cent in 2014. The mortgages of these more vulnerable households are larger than the average mortgage, making up 32 per cent of the value of all low-ratio mortgages in 2016, up

9 percentage points from 2014.15 The fact that the share of high-LTI mort- gages increased to almost one-third of the low-ratio mortgage originations suggests stronger household sector vulnerabilities.”

Lore

I’m not super bully on the future of retail in Victoria given high commercial rents and the broader state of brick+mortar retail, but tastes change over decades. Could just be those two stores are no longer in.

Yeah well your mother’s from Metchosin.

I thought you reneged and went to Sidney?

Didn’t realize burning a bunch of gas while circling around meant that you went into multiple stores and the mall.

<Nanaimo is the mildest climate in which one is likely to suffer a violent break-and-enter.

reminds me of a classic joke we used to tell growing up:

What’s in a Nanaimo Bar?

…

Hell’s Angels and hookers.

Time for the semiregular reminder that Lisa Helps was a councillor when the Blue Bridge contract was approved, and she voted against it.

Greater Fool describes its readers.

Jobs created under an NDP government? My redneck uncle said that’s impossible.

Leaving the Island doesn’t make one better; being better does.

Nanaimo is the mildest climate in which one is likely to suffer a violent break-and-enter.

@ James Soper re: “They won’t attribute your absence to the bike lanes since you haven’t actually supported anyone down there in a long time.”

I merely expressed my negative opinion. Downtown looks sick generally; the seeming obsession with bike lanes is just one symptom. Another that stands out for me is the perceived ill health of local retail. We visited two specialty stores that used to bustle back in the glory days of the 90s and early 2000s: inventory was scant and very stale. The contrast was stark and depressing. And we went into the Bay so the kids could use the washroom. You could shoot a cannon in there. How long before it closes?

I want to avoid downtown not only because it’s a pain, but because it’s downright depressing!

All but one of the Big Six banks now say Canadians will see a rate hike this month

All but one of Canada’s six biggest commercial lenders now say the central bank will raise interest rates this month after the jobless rate dropped to its lowest in modern records.

The consensus of economists polled by Bloomberg last month was for an increase in April, with National Bank Financial already calling for a January move in that survey. Poloz increased the central bank’s benchmark overnight rate to 1 per cent at consecutive decisions in July and September, but ended the year stressing that policy makers would be “cautious” with future moves.

As of noon Friday, swaps trading suggested the implied odds of a rate hike this month are now over 80 per cent — up from 40 per cent Thursday, before the blockbuster jobs data.

http://business.financialpost.com/news/economy/most-big-canadian-banks-expect-jobs-data-to-force-polozs-hand#comments-area

Marko:

Any guess as to why SFH have slowed at a time when condo sales are booming? I always find your reports from the trenches interesting by the way.

It could be faster. For a couple months in 2008 we were adding inventory at an average rate of 100/month. At that pace it would only take until early 2019 to get back to average levels. But that was a global meltdown so seems like the extreme end of the scale.

Yup, good point, things can change. Although it was pretty clear this was due to the large regulatory intervention. I haven’t yet seen a market react that quickly without that external stimulus.

Which forum?

Sorry but this is bullshit. Given low mortgage rates, the optimal choice is to put the minimum down even if you have more money. Yes we don’t know how many people are putting down the minimum because that’s all they have vs how many are choosing to do so, but generalizing every borrower with the minimum down as “leveraged to the max or stupid” is categorically wrong.

Exactly freedom. I’m surprised there’s no one piping up about their experiences with the stress test. Are there any readers out there who know or are in this situation?

Also I have so many friends bragging about how much “money” they have made on their house because of the assessments. Of course it’s not real money but I’m still a bit peeved that I’m not one of those smug and brilliant homeowners.

Besides the low inventory level, if the lenders do honour their 120 days pre-approved mortgage (done around end of 2017), the OFSI stress test may not have that much impact for the first 3 or 4 months of this year. If anything (without other major events), these pre-approved loans might continue to push the market, especially the condo, higher for the first 90-120 days.

They have an engaging and accessible style of writing which I appreciate, and I like that they usually try not to be too one sided – I feel like it’s generally just data and their extrapolation. I look at their articles most days.

There’s a few that catch my attention though, like this latest one. It’s frustrating when you’re left wondering if you have the whole picture. Nothing’s worse than using correct numbers to make incorrect or illogical conclusions, most especially if the reader isn’t educated enough to be able to evaluate it properly.

Just as a point for Marko to ponder. There have been 87 new listings in the last three days compared to 22 sales.

A ratio of close to 4 new listings for every home that sold. I don’t recall seeing that kind of ratio before.

I noticed this as well.

I like Better Dwelling and their attempt at being “edgy”. I appreciate anyone who takes a proper statistical approach to things. However, there are a lot of little things they get wrong, or don’t understand, and it makes me worry about the other parts of their analysis.

They also state a lot of things with serious overconfidence, which bugs me. Anyone dealing with predictions should show a bit of humility. The future will make fools of us all.

I’m like a Jew making Jewish jokes. I grew up in Langford…. Well the bush of Langford. It deserves its ribbing a lot more than VicWest does. Back in the day there were a lot of rusted cars in front yards….

Anyway it’s good. For those that love to drive and park there is something for you. That’s the beauty of this place. Something fore everyone. It’s why amalgamation will never happen. I don’t want Victoria to turn into Langford anymore than Langford wants to turn into Victoria.

Leo,

I had copied your rebuttal to another forum and Stephen Punwasi (one of the writers/analysts at BD) had this to say in response.

You’re right. Technically they’re making the “minimum” down payments.

Although I guess the argument can be made if they’re only making the minimum downpayment, they’re either leveraged to the max or stupid. Doesn’t look good for the borrower either way.

Re: less impact. Low ratio borrowers were already substantially less risk for lenders. That is, the probability of home prices dropping faster than the equity being built with a 20% cushion is pretty low. I wonder if low ratio borrowers are distributed in cheaper regions.

It’s looking more and more like another rate hike this month…

It’s the most ridiculous part of Victoria, the people who are just better than everyone else, even though they’ve barely been off the island. You should see what they think of Nanaimo. Big fish in a small pond.

But haven’t in years clearly. They won’t attribute your absence to the bike lanes since you haven’t actually supported anyone down there in a long time.

Thanks for your thoughts, guys.

People were saying the same thing about Toronto, and it went from historic lows to pretty normal range in a matter of months.

I think the stress test will be countered by the bank of mom and dad seeing they have an extra $200k in equity after opening their mail. This wealth effect will also stimulate speculation and second home aspirations.

Observations from showings in the first few days of the New Year…..condos are still insane. Walked into one yesterday afternoon (listed in the am) and already had 12 business cards and reviewing multiple offers today. It will be a record setting price for the building.

Houses aren’t flying of the shelf. I get this impression that the spread between condos and starter SFHs is getting tighter, much like 2007, and either we see condos pull back or a bit more appreciation on the SFH front.

Leo, thanks for this awesome analysis; exactly what I was interested in….I suspected it would take a long time for a market to return to “normal” inventory levels but 2-3 years! Once again, we need an external shock or interest rates to go up.

https://ca.finance.yahoo.com/news/newsalert-statistics-canada-says-78-133453857.html

Alberta down to 6.9% unemployment? Was hovering around 9% last year.

I have never found the number of foreclosures to be significantly different from one area over the next area. It isn’t the property that defaults on the mortgage it is the home owner.

@Local Fool:

My own suspicion is that the Victoria real estate market is a bit atypical because of the amount of outside money flooding in. If I remember one of LeoS’ great charts (correct me if I am wrong, which I might well be) about 25% of purchases where all cash. My guess is that the higher up the property market you go the more likely it is that you are looking at all cash purchases. I suspect that most if not all the purchases in the Uplands are cash.

On the other hand, most first time buyers are heavily mortgaged. I am expecting a far greater impact on the West Shore than in Oak Bay. The classical real estate model is one were people move up the property ladder. While we have some self reported stats on out of town buyers, I have not seen any breakdown of buyers by price ranges.

Like many things in life time will tell. But if i was a west shore builder I would be getting a little concerned at this point.

We used to have business meetings in downtown restaurants but in the last few years have had a low turn out of members. Now we have them in places out of the downtown area, and the number of members at the meetings has gone back up. Our last meeting was at the Fireside Grill in Royal Oak. Great place, great food, easy to get to, easy to park at, and less costly than downtown.

The data that indicates the effect from the last stress test is the increase in 20% down payments from 20 to 23%. That extra 3% are probably the people that couldn’t pass the stress test and begged/borrowed/stole enough down payment to get to 20% and avoid it.

@LocalFool.

Interesting data, but I don’t think they are analyzing it correctly.

They say that based on the 2016 stress test (for high ratio buyers) “The BoC estimates the new rules led to a $21 billion dollar reduction in buying activity.”

Then they say for the new stress test “BoC estimates this will lead to a reduction of $15 billion in mortgage lending activity.”

Sounds like BoC anticipates the new stress test to have less impact than the previous one. Not sure how they came to that conclusion but it contradicts what Better Dwelling is saying that the impact will be higher than anticipated.

Also the data is only showing down payments. It says nothing about whether those borrowers are maxing out their borrowing room. That connection they make is completely unfounded.

First time for ages.

I was mistakenly looking for an intelligent opinion on housing. Instead I got a rant about how awful minimum wage is because it is inconveniencing some Tim Horton heirs.

Interesting article on Better Dwelling, regarding the stress test.

They argue the new rules are perhaps more significant than some thought, by challenging the contention that buyers don’t borrow the maximum allowable:

“Over that past few months we’ve heard lenders and agents say the new stress tests won’t be an issue because most people don’t borrow the maximum. However, those lenders and agents didn’t have access to the BoC’s data to analyze the whole mortgage market. Now that we have access, we can see people do borrow the maximum…”

They seem to think that the higher end of the market will be more effected than the lower.

Thoughts?

https://betterdwelling.com/new-mortgage-distribution-data-from-the-boc-shows-stress-testing-is-a-huge-deal/

But you go anyways. Secretly, you love the dog pics. It’s okay, I do too. 😛

From the previous post, and Introvert’s digging up of the ‘history of prices’ post from 2016:

To convert that to a percentage yearly increase, we just take the equation for compound interest (P = C e^{r t} ) and solve for the rate. I’m ashamed to admit I had to look up how to solve for r in this case, but it’s been a while since high school.

The answer, of course, is logarithms! Vindication for the most maligned of math functions. Stay in school, kids.

Lore: I guess you missed the fact that ta lot of the streets are posted at 30 kph. That is to ensure that the maximum amount of exhaust can be spewed out.

We had lunch today at Brentwood Bay; these days we simply avoid downtown Victoria. It is a shame because there are a number of restaurants we used to go to regularly.

I also wonder at times about all the derogatory comments about Langford. Victoria is a pleasant but very provincial little city but it is anything but the height of cosmopolitan culture.

Turning to inventory, at least for SFH in the core, I believe that the numbers are likely to remain low until the point where the baby boomers start to die out faster than they are retiring.

Re: “I think they should really make [Langford] more car friendly.”

Are we talking about the same Langford, or is this sarcasm? I gather that Langford is working actively to make the community traffic-friendly. The real state of emergency in this regard lies in Victoria. What a shocker. We read about the War Against Cars in the local newspaper, but I hadn’t experienced it personally until this past weekend, when I took my family downtown to revisit favorite old haunts after long absence. Fort Street in particular is like a weird sitcom joke that isn’t funny. Holy cow, what a mess. And what’s with the 40 kph speed limit? After waiting in line and circling around and burning a bunch of gas, we reneged and went to Sidney instead. “Let the market speak.” I used to spend thousands of dollars on Government Street in particular, shopping and dining, but to hell with it. And now I hear that Mayor Helps is going to run for re-election on a platform of “changing the climate.” Well, Victorians, I hope you enjoy all your bike lanes, shoebox condos, debt and taxes and gold plated bridge, because if you re-elect her, that’s all you’ll have left. I always knew Victorians were weird, but visiting last weekend, I truly felt like a visitor to an alien planet. Ba-bye.

Wow just visited greater fool. Feel like I need a shower.

Garth is such a blowhard and the comments are a cesspool.

Thank god for Leo and HHV

Every single time I go to Langford I think they should really make that place more car friendly.