What condo prices did in 2017

The big question in January is how much of an effect the OSFI stress test will have on the market, and when. We could see it immediately as lenders apply the stress test, or we could see a delay of up to 3 months as anyone even remotely considering a purchase may have gotten a pre-approval with a lender that is not applying the stress test on them.

There are two theories on the OSFI effect on condo prices. On the one hand one might argue that condos are more likely to be bought by first time buyers and people with less means that will rely more on mortgage financing. Those people that aren’t bringing in equity from a previous purchase could be sidelined by the stress test. On the other hand some argue that the stress test will push people into lower priced properties, and some people will move their sights down to a condo instead of a detached house, accelerating that market.

It’s too early to tell the effect either way, so let’s take a quick look at what happened to condo prices in the last year. In general, it was a pretty solid year for condos in the core with a continuation of the trend from 2016 causing the median condo in the core to increase by about 15% in 2017.

If we look at per square feet values, we can see a similar trend, with the median 1 bedroom or bachelor units cracking $500/sqft while increases in larger units were more muted.

On the activity side, we saw a similar frenzy in the spring followed by a normal seasonal slowdown towards the fall. However at the end of the year when the stress test was announced we saw the market pick up again and return to nearly a third of properties going for over original asking price.

I’d be pretty surprised if the condo market can digest the stress test without significant cooling. At the same time we should see Victoria’s AirBnB restrictions come into effect this year which will further pull demand out of the market for smaller units. Personally I’d be surprised if a lot of people that were planning to purchase a detached house prior to the stress test will move to a condo. I would bet that more will delay their purchase, beg/borrow/steal a larger down payment, or find a creative financier instead.

Yep, also gotta fix the chart on that page. Not sure why it only goes back to 1988.

Neeeeeeeeeeeeeeeeeeeeeeeeeew post: https://househuntvictoria.ca/2018/01/04/the-journey-back-to-normal/

Parking downtown has rarely been an issue for me. I really enjoy downtown Victoria.

Once I figured out a strategy for Uptown I am okay going there but wow the first time there is pretty intimidating. It looks like a fortress meant to keep people out not welcome them in.

Wonder what parking will be like when Mayfair is completed.

Perfect. I’ll through the couch in the back of the truck and pickup a case of Lucky! Meet y’all in the parking lot! Wooohoooo!

Park on the fringes and walk 5-10 minutes and there is nearly always some free parking. I go downtown all the time and never find it much of an issue. Frankly I find parking at Uptown more annoying.

Indeed. And nothing like having no parking at all to make me want to go downtown.

Nothing like more parking lots to make me want to go to Langford!!!

“Hun, go get yourself dolled up—we’re goin’ downtown tonight!”

“Downtown? But there’s no parking.”

“No, silly! Downtown Langford!”

https://vancouverisland.ctvnews.ca/langford-mayor-promises-more-parking-to-lure-disgruntled-drivers-1.3746518#_gus&_gucid=&_gup=twitter&_gsc=WHemjVm

Leo, future post idea: an update to A Brief History of Prices post from March 2016.

I wonder whether the 3.74% historical real annual appreciation has changed much with the last few years’ big price increases.

https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

Aspiring home buyers, your dreams are about to get even further out of reach

I guess Rob Carrick isn’t on the crash-is-coming bandwagon.

https://www.theglobeandmail.com/globe-investor/personal-finance/household-finances/the-door-to-home-ownership-will-close-for-some-in-2018/article37507483/

Go Qualicum!!!!

Seems like the property wave spread outward. 2016 we had a bigger jump, now the bigger jump is in smaller communities

Didn’t we already cover this? There is zero risk and private lenders are happy to take that zero risk.

Odds are very high you’d survive the quake. Christchurch has a population of just under 400,000 (similar to Victoria), and only 185 people died.

In terms of earthquake insurance, I think you’re damned if you do, and damned if you don’t.

Just rent it out to yourself.

I have phoned around to see if I could get a renters insurance policy that would just cover liability

and contents since that is all I really need. In the event of a major fire or earthquake I would just sell the land which is worth a lot more than the land with the house. I will let you know if anyone will sell me renters insurance in spite of being an owner.

That may happen. After an earthquake conditions are assessed and if there seems to be some damage then your house may be marked as uninhabitable until it can be inspected.

I see uninhabitable suites every week that people are renting, and nothing is being done to inspect them. Highly doubt authorities will escort me off my own property in the event of an earthquake.

I guess something could be put into place where it makes the home difficult to resell, but I’ll wait until I have to face such a problem, if I survive the quake in the first place.

This means I’m paying very high insurance premiums. Is there any way to accept a lower rebuild cost in order to reduce your monthly premiums?

When I purchase insurance I play around with the numbers and the biggest factor on both car insurance and SFH insurance is the deductible which I always make very large. Rebuild cost didn’t move the premium too much when I looked into it.

I am saving a couple of hundred on my home insurance with large deductibles and there is no way I would want to deal with adjusters/insurance, etc., on water damage of $5,000 for example. Rather just take care of it myself in a timely manner. Over 50 years I save a ton of money and when I do have a problem it will be dealt with on my own terms.

If you live paycheque to paycheque large deductible could cause a problem.

You have to read your insurance policy to see if they are speaking about replacement cost or reproduction costs.

For example if you have a 1930’s character home you could never reproduce that home again. The materials, the labor skills no longer exist. Instead you replace plaster with gyproc; plaster cove ceilings with crown mouldings. 1 inch hardwood with engineered hardwood, etc.

But before you replace that building. You have to take the old one away. That’s a cost. And you have to live somewhere for six moths or more. That’s another cost. Then there is the fixtures that have to be cleaned and reconditioned – that’s another cost.

Then there is your contents which is an extra.

In the end you could easily add 50% if not double the cost of what it would cost to build the same house on a virgin piece of land.

Your insurer most likely will want their own contractor to build the new home. If you want your own contractor or change the building plans then anything over their contractor’s quote is your cost.

There is no question that insurance is a rip off. But everyone has to play the game.

Why not just ask them. The replacement cost is flexible. They use a costing program by Marshal and Swift but many of the items that make up the value is open to interpretation. I think they want to sell you more insurance because the premium is tied to the amount. But if you said I only want $200,000 insurance and you understand that will not rebuild your house – why not.

BUT before you do so, check with your bank because they may not let you do that as you are affecting the security of the loan by being partially insured. That damn small print thing again.

Interesting discussions on here re. earthquake insurance. One does wonder if the city is ruined how many insurance companies would pay out, and how long it would take to build. Even with that insurance to cover living in hotels/motels for a certain amount of time one wonders that all the motels would either be full, or ruined themselves.

The last major earthquake in this region was the Cascadia quake on Jan. 26, 1700. This was around magnitude 9. I believe They pinpointed the date pretty accurately from Japanese records from the tsunami it generated for them, and based on local First Nations lore, etc.

https://en.wikipedia.org/wiki/1700_Cascadia_earthquake

These types of quakes occur every 500 years or so, so we could be waiting perhaps hundreds of years until another one – Kim Jong Un might try to use his little button before that…

On the other hand, before I finish my Costco trip this afternoon, the bridges back home may be out, as we are overdue for it, as you just never know when it’s going to happen. Then again, a truck could squish me on the way to/from Costco – or maybe that lottery ticket I bought last week is a winner…or I might decide to join a cult. If you never see me on here again you know what happened – one of those three 😉

Yes, With BCAA insurance – I was able to accept $200/sq ft. though- $250/sq ft. might be more accurate for actual ‘replacement’ cost, I’d be content with just getting another house that doesn’t have to be as fancy as what exists. I just hate the thought of dealing w/ contractors/red tape. Can you imagine all the red tape that would have to be reduced if they had to rebuild the city after a major quake?

Regarding house insurance, my 1930’s house replacement value has been estimated @ 1.3 million. Obviously, the current structure is not worth this much, it that’s the so-called ‘rebuild’ cost. This means I’m paying very high insurance premiums. Is there any way to accept a lower rebuild cost in order to reduce your monthly premiums? For example, If my house was completely destroyed, I’m probably going to build a 3500 sqft new house @ 250/sqft = $875,000.

Don’t ever get rid of your liability insurance otherwise you could be sued and lose your house, wages can be garnished, and you will be paying all your legal bills.

A homeowner needs to be somewhat negligent for a liability claim to succeed, but you’re negligent if the postman/woman trips on a bucket you left on your walkway, you’re negligent if you dug a hole in your backyard to plant a shrub and that night a police officer trips on your hole while chasing a thief. The point is, negligence is a daily occurrence for most homeowners but luckily no one is usually injured. Regardless of your guilt or innocence, your legal bills will bankrupt most people without liability insurance.

“2018 forecast: Will the housing market crash by year’s end?”

James Loewen believes the government has catalyzed the very thing it is trying to prevent with the recent B-20 changes, and the irony isn’t lost on him.

“…the government purports that they’re trying to prevent an economic crash, people walking away from their houses, but if you can’t qualify under these guidelines, which, definitively more people can’t, there will be more people walking away and selling their house,” said Loewen, broker and owner of Loewen Group Mortgages.

“They will be inciting the very thing they’re trying to avoid, which is a collapse,” said Loewen. “If I couldn’t qualify at TD or Scotia, I’d go to Home Trust or Equitable for a slightly higher rate than the best rate, but now I probably won’t qualify for that mortgage, so I‘ll have to go private. The risk private lenders are taking is much lower than even six months ago, and we can’t bundle up to 85% loan-to-value inside these government guidelines, so there might not be a solution at all for the client and they might be forced to sell.”

https://www.mortgagebrokernews.ca/people/2018-forecast-will-the-housing-market-crash-by-years-end-235750.aspx

Deb,

That seems like an attempt to avoid the Occupier’s Liability Act. I don’t think a blanket disclaimer of liability is possible, although I’m not very familiar with that Act.

Bad wording I know but I am unable to edit comments. The drift of my comment is clear anyway.

@caveat emptor

What would happen if a sign was posted in front of the property with wording such as: “Anyone entering this property does so at their own risk. The owner carries no liability insurance and will not be held responsible for any accidental injury to property or person on the premises.”? Could make for some fun legal work.

Barrister – question for you. Don’t most/all home insurance packages include some liability insurance? Isn’t this important, particularly if you have significant assets? Can one buy that separately?

That actually makes good sense. Why pay insurance on the improvements if they only contribute marginally to the price of the property

My opinion of house insurance is that it’s to safeguard the lender from loss and for poor people.

Or in the case of severe destruction of your home from an earthquake, just toss some gas and a match into the house on your way out the door.

That may happen. After an earthquake conditions are assessed and if there seems to be some damage then your house may be marked as uninhabitable until it can be inspected.

As I’ve said before, 7 years later people in Christchurch are still fighting for insurance money. https://www.stuff.co.nz/business/money/89610941/christchurch-earthquake-insurance-wrangles-endure-six-years-on

If the big one hits here don’t expect a payout anytime within a generation.

Thing is it makes perfect sense if your fundamental belief is that real estate always goes up. A house can’t go down in value, therefore lending against it is foolproof.

No earthquake insurance here and would not consider it. New house built on rock. If it suffers 10% damage than the rest of Victoria has been flattened and we have other things to worry about. Not sure what the federal government would do but given the lack of skilled labour would probably take years to rebuild.

I am just not a fan of insurance/extended warranties, etc., in general. All my ICBC deductibles I’ve always had at $1,000+ since I was 20……it lowers the premiums substantially and who is really wants to deal with them over a $600 claim, for example?

the only way a structural engineer can ‘clear’ it is to expose some of the critical components and visually inspect them.

You make it sound complicated. Having down the owner builder on my place it is a bunch of 2x6s, some joists, a few LVLs, and brackets. It’s not like a SFH has serious components like elevator shafts, etc. If my plumbing if holding pressure and the house appears to be fine there is no way I am cutting open drywall to inspect unless forced by a level of government.

Plumwine. Maybe you should be fair and wait until the bridge is actually up and working before we decide how long it took to build.

If earthquake happened, your house (and thousands of houses in our region) damage are over $100,000, do you think rebuilding will be as easy as 1) call up the insurance co. 2) got the check in mail 3) hire a GC, P.Eng and some trades and start hammering??

Japanese may able to rebuild their towns in weeks after tsunami, but it take us 9 years to build 1 bridge.

I could not find cheaper insurance than TD but they make you take the earthquake. I am considering getting rid of the insurance altogether. With a major loss the land is worth more without the house. I should if one can get just contents insurance.

Ours is 5%, to a limit of insurer’s liability of $646,000.

Leo, what’s your specific premium for earthquake? I think we’re both with Meloche Monnex, if I recall correctly.

Our deductible is 8% which is apparently the highest they offer. Other companies will do more.

47K sounds low to me. I have been told that the deductible is typically a percentage (10?) of the total replacement value of your house/contents. In this regard, it does not benefit you to have an overly high valuation for replacement costs. For example, if you have a replacement cost of 1M on a house that would only cost 600K to rebuild, your deductible is 100K regardless of the actual cost of rebuilding.

Likely that 1:3 ratio won’t hold for the month, but if it does it will be a typical January pre 2016. January is often the lowest sales to list of the year. Based on Leo’s chart in the nine years 2007-2015, Jan sales to list varied between .38 and .23

Could you quantify a “high” deductible? Mine is $47,000.

Same. With a high deductible.

Although I only have about a 10% confidence that if the big one happened I would see a payout sooner than a decade after

Hopefully that assertion is never tested.

I also find calculus a piece of cake.

I have it.

Earthquake insurance is like any other insurance. If the loss is going to be catastrophic, insure for it. If it isn’t, don’t.

Mathematically speaking you are more likely to be ahead by not insuring however for large value items of course if the loss does occur you will never live long enough to cover it through saved premiums.

Just don’t do what a lot of people do and set the deductible really low and then make a claim when your flatscreen falls off the wall

I personally would do it – even on new construction. Chatting with my structural engineer for my new build I was surprised by a few comments:

Wind loads in Victoria are generally larger than seismic.

Houses built to the 2012 code (which is new construction up to now) are engineered to stay standing, but not necessarily be without significant structural damage.

In the event of a significant earthquake, even if a house appears to be undamaged, the only way a structural engineer can ‘clear’ it is to expose some of the critical components and visually inspect them.

In the case of ‘the big one’, most new construction will need to be torn down and replaced.

No matter how you slice it, it ends up being expensive. The real question is whether or not the typical large deductible nullifies any payout.

Thanks for the opinions, all. I suppose what we’re trying to do is create a garage out of a carport. So it’ll need a garage door and then the other, currently open side will be closed in. The floor is concrete — not sure if we’ll change that. We don’t plan to park a car in there but instead use it for storing all of the things that are currently taking over our tiny front entryway.

I don’t know anything about anything when it comes to building stuff, so I think I’ll need to hire someone. The rest of the house has been nicely renovated inside and out and I’d rather not mess it up…

Thread drift: What is the prevailing opinion on the need for earthquake insurance on the house? The coverage costs are 40% of the total premium.

45 New Listings against 15 sales since January 1.

That’s 3 new listings for every sale. 3:1

Let’s hope it isn’t a trend.

It’s the same with the Canadian Army. We have a lot of Brigadier Generals because that is the last rank that you can be appointed to by the military. A Major-General or Lieutenant-General are political appointments.

So if they have been a respected Colonel over the years and did everything they were asked to do, the military will bump them up to a Brigadier the year or so before they retire. That gives them a bigger pension.

“I suspect that you need a permit to enclose a carport if you are converting it from a garage to an enclosed part of the house.”

Probably correct. How many people actually get permits though? I assume most people don’t bother, and get away with it. Maybe if your neighbours are nosy jerks with a vendetta you get busted.

And later, when Dasmo asks them how it’s “zero risk” they retort with,

They’ve got to be under 30. It’s one thing to be bullish and another to be out-and-out reckless. I can’t even apprehend that mentality or the ignorance of history or markets that this represents. And there’s so many more like them.

Good lord. This mess can’t end soon enough…

I suspect that the magazine company changes the city depending on where the magazine is being distributed.

It’s a fluff piece that is used to sell magazines. If your city is in the magazine you’re going to buy it.

How to bypass the stress test:

https://vibrantvictoria.ca/forum/index.php?/topic/5061-investment-ideas/?p=418108

Zero risk folks. OSFI is out to lunch.

Luke it can be a lot more complicated that being a legal or not legal suite.

How would you determine if a house on a site was a tear down or not? Agents make this mistake all the time and are quick to call everything land value if it ain’t pretty and small. But most of those houses don’t get torn down. Instead it is painted and sold again a few years later with the agent again calling it a tear down. And this is related to Highest & Best Use. One of the many tests that are made in determining H & B Use is if it is economically viable to tear down the house, rebuild with a new one and sell with a reasonable profit in a reasonable period.

As for custom construction costs in Oak Bay being $300. Sure why not if the builders can get you to pay $300 then they will. But most of the difference between identical homes in Langford and Oak Bay is that builders know they can get their Oak Bay client’s to pay more.

I suspect that you need a permit to enclose a carport if you are converting it from a garage to an enclosed part of the house.

I come back to the BC Assessment placing such high values on realestate as problematic to the “affordability crisis”. I guess they aren’t so independent so a mechanism to NOT goose the market would be to implement an HPI like system to the assessments. Everyone says it’s not real and it just gets the tax roll relative to others, so remove the actual “value” and make it a simple relativity number. It would remove a whole bunch of effort too.

“Question: Does anyone know what kind of tradesperson to talk to about closing in a carport? And any guesses as to how much this would cost? It’s a single-car carport that’s open on 2 sides.”

I agree with Garden Suitor. Why not do it yourself and save a bunch of money? You might even have trouble getting someone to do a small job like that in this market.

Framing is pretty easy and so is laying floor. Adding an outlet/light/light switch to an existing circuit is pretty damned simple too. Most challenging part would be drywalling/mudding if that’s how you intend to finish the new room.

As to the point about credit unions taking up all the slack from the stress test, it is possible but I think unlikely. You have to remember that the big banks are too big to fail but the credit unions are not. They can’t count on a bailout if they take on too many marginal loans and things go sideways.

I noticed Gordon Head wasn’t on the list of 10 reason to visit “walkable haven” Victoria.

Sort of. BC assessment is an estimate of your home’s value. They are not necessarily accurate since they don’t enter homes and are at least 6 months and up to 18 months out of date. So it is no substitute for an estimate of current market value. However it is the only published value out there so people glom onto it. And unless market value is changing quickly it can be a reasonable starting point

The assessment is not supposed to reflect building costs so it doesn’t.

Common misconception. The absolute value of property assessments is irrelevant. Only the relative value of your assessment to others.

Victoria lands a spot on USA Today’s 10 of the most beautiful places we visited in 2017:

http://www.10best.com/interests/vacation-ideas/10-of-the-most-beautiful-places-we-visited-in-2017/

Don’t think you’d need trades to just knock up a couple walls, frame in a door/windows, and put a floor in. If you want to run or modify electrical/plumbing/etc, then you’d have to get trades.

Question: Does anyone know what kind of tradesperson to talk to about closing in a carport? And any guesses as to how much this would cost? It’s a single-car carport that’s open on 2 sides. We want to enclose it so that it can be a mud room / entryway. It doesn’t need to be heated. Thanks! And happy new year!

Introvert. – You are quite right we pay taxes for services. Unfortunately there is a lot of waste out there – especially in municipalities ( I know this because l worked for two different municipalities in the past). I also think the Feds and some elements of Provincial are good at waste but that’s a subjective opinion.

Anna – you’re right but it’s also a psychological thing with buyers as I think swtch pointed out earlier.

James – The way I’m aware of it is only the person that has an assessment increase above the average for their municipality would pay more in tax. Anyone with an assessment in line with the average in their municipality pays the same unless, say the municipal government and possibly other components of property taxes raised taxes that year. If someone has an assessment decrease, but their municipality average assessment increased – then they will pay less.

Barrister – don’t feel too sorry for my generation ( Gen X). Maybe feel sorry for those born a bit later, like after 1982 (millennials).

No Luke, that’s not how that works.

Just that person would be paying more taxes, and everyone else would pay less. Same amount of taxes would be taken in.

We must live in different countries, because taxes aren’t goring me.

@Introvert:

No magical thinking required, we have far too much bureaucracy already in this country. We have more admirals than ships (and yes I am including the subs). Ask Marko how many bureaucrats are involved in housing.

But, you are right that Canadians keep demanding more services so why be surprised when taxes start to gore you.

I’m a neophyte with Assessments but I thought that Assessments had to do with value for tax purposes and not value for selling purposes so how come the the news say things like this title from Victoria Buzz “How much is your Vancouver Island home worth this year.” Are they being misleading?

Wealth flow.

I hope you’re not one of those magical thinkers who wants taxes lowered but services to remain the same (or increase).

Luke”

You are right about the secondary suites in Oak Bay. Taxes on houses with secondary suites should be a lot higher and those houses are not paying their fair share. The portion of the house with a secondary suite should be taxed on a commercial basis just like any other apartment building.

You are not taxed to the max yet. Give the government a few more years and you will see taxes increase more than you think. There are days when I feel sorry for your generation.

One acquaintance who lives in Rockland said that they once successfully convinced the bank to wave house insurance requirement (for mortgage) using the exact reasoning.

So number 6. I guess the difference between OB and Victoria is that technically OB doesn’t permit suites ( even though more than 1/2 the homes there have them anyway ) while Victoria does permit suites. This is why we get the same age home in Victoria increasing approx 50% while the exact same home in OB decreased approx 50%? But what is confusing is that didn’t change this year, and they changed the description of the building for no apparent reason.

I’m comparing Fairfield to OB and there is no rezoning in that part of Fairfield. As we all know, OB is less friendly to any changes, so maybe that’s part of it ( though that’s what is appealing about OB for some). If In the future OB finally came on board with secondary suites legal, then that could change. After all, we are right next to a growing metropolis.

But the home I have here, while originally built over 100 years ago, is anything but old in its present condition. It was completely renewed from 2010-2015. Everything, and I mean everything, was completely redone by a professional live in builder with permits. There is virtually nothing old left. But, since Assessment is looking at the age maybe they simply don’t know what the real condition is, and that’s why they now called it ‘basic’. I’ll enjoy the lower taxes and when it comes time to sell, perhaps many years down the road, the real condition of the property will trump anything Assessment thinks. Though I may run into problems with someone’s psyche all I’d need to say is look at replacement cost…

Fact is, sometimes Assessments are totally inaccurate, but why would a person want to increase taxes? This is why you often only have people trying to lower their assessments.

Interesting thoughts also Freedom_2008. Maybe someone in the area was trying to lower all of our taxes? In that case I should thank them. Here in Canadistan we are already taxed to the max…

It’s a hypothetical guesstimate on my part to illustrate a question I was making- if a market correction can be localized? Of course not all of construction workers and those in the FIRE industries would lose their jobs but there would be a sharp increase in unemployment in those jobs related directly and indirectly related to those industries.

So do you think a market correction can be localized and not be BC wide or Canada Wide?

@Marko: Which SFH sold for 9 million?

@Number 6: You are right that my house would be worth a lot more if the actual house burned down.

Luke said: >In OB – older homes around the same age as mine are experiencing sharp drops in the ‘building’ value – at times of more than 50%, while some of the homes I know of in the City of Victoria – exactly the same age – have shown dramatic jumps in value – at levels approaching a 50% jump in ‘building’ value. So, it has nothing to do with the age of the building

You’re right Luke it has very little to due with the age or remaining physical life of the building. It has to do with the Highest and Best Use of the property and the building’s remaining ECONOMIC life.

Say you built a home five years ago on a quarter acre lot for $500,000. But last year land in your neighborhood was rezoned to multi-family hi-rise. The house that you built just five years ago at great cost to you would contribute nothing to the value of the property as a developer would demolish or remove it to build a hi-rise. That’s an example that I chose to show an extreme case so that the concept is easier for most people to understand. In reality it can be more subtle say with a an older house on a large lot. The rents obtained from the house are not sufficient relative to the value of the property. That happens most often in Oak Bay when the difference between the cost of land and the relative rental income is marginal. In fact the small, old home on the lot can be detrimental to the value of the property as the site would sell for more it it were vacant.

The Concept of Highest & Best Use is a lot more complicated than what I just described. You got the ‘in under 100 words” description.

I wonder where you are receiving your stats No. 6. The BC government stats have the province FIRE industries employing 5.6% of the population. And I would imagine it should be a touch smaller in Victoria then the province as a whole because of the mess that is Vancouver. If Victoria really had 30% employment in FIRE industries that would mean Victoria would count for more then half of all people in BC that worked in those industries.

The unemployment rate in Victoria is currently at about 3%. There is absolutely no slack in the current labour market. It is literally as low as it has ever been.

1030 St Charles was listed as a 7 unit multiplex in 2007. It has since been spiffed back into a single family mansion (with detached cottage). Oh, and it was bought by a couple of retired Vancouver real estate industry baby boomers.

It is weird. I have never heard any property assessment decrease (in a hot housing market) that was not initiated by an owner with specific reason. Could someone complained to BCA that all these North Oak Bay houses had wrong description before?

It may be possible to ask BCA as a general inquiry, without giving them personal info?

If so, it also explains why OB only has 12% (=lowest) increase.

Here’s what the wizards at BC Assessment have to say about what I just brought up…

” Ala kazam – Ala kazoo! … We’ll assign this number to them and then that one to you ”

“Don’t say boo… or maybe – you do! It’s up to you…since we have no clue!”

Perusing through other homes I know on BC Assessment… these are all older homes… I’m finding something odd and curious…

In OB – older homes around the same age as mine are experiencing sharp drops in the ‘building’ value – at times of more than 50%, while some of the homes I know of in the City of Victoria – exactly the same age – have shown dramatic jumps in value – at levels approaching a 50% jump in ‘building’ value. So, it has nothing to do with the age of the building. Why are they increasing the value of these older homes in Victoria so dramatically and decreasing OB homes? I’ve found numerous examples and I know for a fact that there are no new renovations to speak of. So far it makes no sense…

So wait a minute, sometimes when you find an older home and you think Assessment will decrease it’s value you better think twice… Abra ca dabra! – it’s either up by 50% or down by 50% for no apparent reason….

Ask why – did you ask why? Are you going to ask why? I know why I’m not asking why… but that doesn’t mean I’m not curious… I’d still like to know… why…

…Since OB went up an average of 12% overall, a decrease of 1% or 2% now equates to a decrease of 13% or 14% over the average in the municipality. This means your property tax will drop from last years amount probably quite substantially. I’m in the same boat almost exactly – also in North OB – and scratching my head as to why they think the building suddenly dropped so much in one year.

Their assessment on many buildings seems out of whack from the reality of current building costs.

Never mind all that red tape and waiting for contractors you’d have to do. Imagine If the actual cost of building a new comparable structure to what currently exists was factored in on Assessment! Say, at todays costs of around $300/ sq ft. for custom build – the Assessment would be sharply higher… meaning many thousands more in tax each year. Am I right on the cost per sq. ft? Does anyone with more experience with current building costs/ climate want to chime in?

This makes me think you are better off to buy an older home all fixed up instead of a newer home, at least as far as whatever Assessment thinks its worth, and subsequent savings on property tax is concerned.

I take it you disagree that plumbers can be re-trained as web designers. So if the FIRE industry was hit hard then the plumbers would just hang out around doing nothing.

Looks like we might have a bloated SFH average for January….1st business day back and already $2.9 and $9.0 SFH home sales reported.

That could result in a lot of unemployable landscapers and plumbers re-training to become web page designers.

You couldn’t get a reliable reasonably affordable plumber in 2012/2013. Problem with trades is an absolute shortage. Instead of having to wait months you’ll have to wait weeks when the market and construction cool off.

I wonder if any market correction could be localized. Obviously loss in jobs in the FIRE industries will be heavily felt in cities with a lot of construction. Similar to what happened in the USA in retirement cities in Florida. While other cities that were far less dependent on FIRE jobs did not correct very much such as San Francisco.

I think some 25 to 30 percent of all jobs in Greater Victoria are in the FIRE industry now. That could result in a lot of unemployable landscapers and plumbers re-training to become web page designers.

Governments in western countries generally loathe to interfere in the housing market unless it’s politically impossible to do otherwise. It’s one of the reasons I am not holding my breath that the NDP will do anything particularly substantive in February, then again the level of voter anger is extremely high. Policies like tracking beneficial ownership, taxing pre-sales or making buyers hold them for a period of time etc can have an indirect effect rather than say, a 75% speculation tax. I’d chuckle if they actually do this 2% spec tax thing they were talking about.

As far as inflating debt away, there’s too much consumer debt relative to wage growth and inflation. I recall there was a calculation done by Better Dwelling demonstrating this point and how far incomes would have to rise in order to catch up to home prices over 25 years presuming stagnant housing prices from now until then. It was quite a lot, to the point if it being almost comical.

I did a keyword search for it and didn’t find it. Will post if I do.

Sidekick:”If affordability tanks and the economy starts heading south, why wouldn’t the government jump in and start messing around again?”

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

The government is actually less interested in over leveraged home owners than you think. However, yes the portion of GDP that the FIRE industry forms is large enough to push us into a recession during a “correction”. The challenge:

Well, the prime rate could very well be dropped but there isn’t nearly the room to do that today as opposed to 2009. The prime rate in 2008 was dropped by 3.75%. That drop is higher than our current prime rate.

The government may very well do that but bond yields will dictate mortgage rates and OSFI will be untouchable because quite frankly it protects the financial system. That, unfortunately, is more important than the people. The B20 legislation was brought in to protect the financial system not to protect the people.

The Canadian dollar would also drop and inflation would be pushed higher. Does the government close their eyes to rising inflation or ….

Haven’t we already had that preview a la 2009? If affordability tanks and the economy starts heading south, why wouldn’t the government jump in and start messing around again? The governments must be praying that inflation kicks in and inflates away the debt.

Introvert

January 2, 2018 at 1:54 pm

We will see, Local Fool.

I remember folks on the blog betting the elimination of the 35-year mortgage would be the turning point for the market. Then they said that about the 30-year. There were probably other tweaks along the way that I’m forgetting.

<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<

… and during that entire time mortgage rates continued to drop to offset those pesky changes. Perhaps the big drop in the prime rate might have helped. lol.

https://www.superbrokers.ca/tools/mortgage-rate-history/

Highest Prime Rate observed: 6.00% on Wednesday, January 9th 2008.

Lowest Prime Rate observed: 2.25% on Wednesday, April 22nd 2009.

Highest 1-Year Rate observed: 7.35% on Wednesday, January 9th 2008.

Lowest 1-Year Rate observed: 2.89% on Wednesday, March 4th 2015.

Highest 3-Year Rate observed: 7.55% on Wednesday, January 9th 2008.

Lowest 3-Year Rate observed: 3.39% on Wednesday, March 4th 2015.

Highest 5-Year Rate observed: 7.54% on Wednesday, January 9th 2008.

Lowest 5-Year Rate observed: 4.64% on Wednesday, April 8th 2015.

Now, Introvert you just have to figure out what kind of changes are going to offset increasing rates.

Our overall assessment in North Oak Bay decreased by 1%. The “Buildings” portion decreased by 57% and the “Land” portion increased by 11%.

True, but almost everything has doubled since 2014.

Few properties have close to doubled….the Rockland property went from $1.5 to $2.9 that is almost a legit double.

We don’t even know how big the mortgages are that people are taking out. We have no specific data.

My inkling has always been that Victoria’s price increases stem more from wealth flowing in than from ever-increasing debt being taken on.

For example, I don’t think the buyer of a $900,000 Gordon Head home is doing that with an $800,000 mortgage.

But no one really knows.

@Marko:

True, but almost everything has doubled since 2014. I suspect that it will be converted in either condos or multi-family rentals. Very few of the old Rockland homes are still single family.

Thank you Marko, that was a fair bit under ask price.

and near double 2007 sale price.

Thank you Marko, that was a fair bit under ask price.

I remember folks on the blog betting the elimination of the 35-year mortgage would be the turning point for the market. Then they said that about the 30-year. There were probably other tweaks along the way that I’m forgetting.

Now it’s the stress-test that many are betting will do the trick.

Well, good luck with that.

There was been a lot of changes over the years…..the 20% min over $1 million did absolutely nothing to prevent SFHs in the core from pushing through that barrier in larger numbers.

Etc., etc.

The actual payment per month needs to change (i.e. interest rates) for there to be a serious impact on the market. Too many ways to work around max affordability regulations.

1030 St. Charles St. Victoria sold for

$2.9 million

I don’t agree with this assessment. While it is debatable how much they “care” about the risk to the borrower, they most definitely care about the risks they bear loaning it out. There’s various iterations of the following saying that appears online all the time:

If you owe the bank $100 that’s your problem. If you owe the bank $1 million, that’s the bank’s problem.

IMO , the only way the banks will continue to underwrite jumbo or mega-jumbo mortgages would be they were confident they could get their money back from the open market if the buyer defaults. So if we extend that logic and say, they don’t care about the risk to the buyer – then wouldn’t it presume that they perceive the value of the asset itself to be stable, growing or very likely to grow? I don’t know how bullish their lenders are behind closed doors these days, but I do wonder if they question how much gas is left in this growth cycle. Which lends to another point.

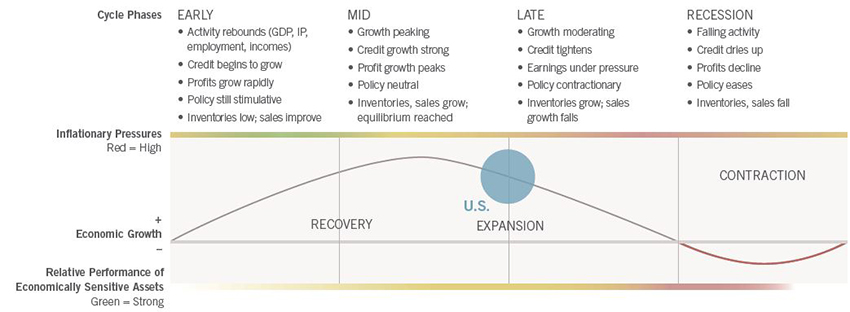

If one accepts the notion of a credit cycle, and what happens in each stage of that cycle, where would the banks think we are? In a period of growing credit expansion? Or a more mature credit market? Having said that, I do note that CIBC compared to others, has shown more willingness to underwrite than others – so they also have more to lose in any downturn.

Sure but it’s questionable whether the credit unions have the capacity to take up all the slack created by the stress test.

At the very least credit unions will be able to do the math to know who fails the stress test and therefore has fewer competitive options. These folks won’t be offered the best rates.

Does anyone know what 1030 St. Charles St. Victoria sold for? Thanks.

Banks and credit unions only care about risk to the extent they are legally forced to by the federal and provincial governments.

In general, their goal is to make as much money as possible, and they don’t give a lick about the perceived “greater good” of Canada.

CIBC was on it getting my mortgage renewed early before January. I was happy they did the approach. One less thing to worry about in this juggling act. I was worried I would not pass the stress test since I have a crazy construction loan right now. What I found interesting is that they were trying to lock everyone in before the rules. The could give a crap about the “risk” they want their money pipes and know they will just go to the credit unions otherwise.

Ahhh, so this is the soft landing that they keep talking about.

We will see, Local Fool.

I remember folks on the blog betting the elimination of the 35-year mortgage would be the turning point for the market. Then they said that about the 30-year. There were probably other tweaks along the way that I’m forgetting.

Now it’s the stress-test that many are betting will do the trick.

Well, good luck with that.

I believe this fall is their intention.

That made me laugh, but I don’t know why. Imagery I guess. Almost like they’re addicts looking for their next fix. Maybe they’re as bullish as you, but mortgages that would fail a 200BPS test when we’re (probably) moving into a rising interest rate environment might give them a bit more caution. I honestly don’t think they’d have the funds to support that anyways, but I’d defer to someone who can confirm or correct.

No it won’t.

Vancity has always seemed to me to be the less-greedy, more ethical of BC’s two largest credit unions.

Makes sense.

Are you now on your sixth identity, Just Jack?

Leo,

Would it be possible to make some sort of projection on how much sales would need to drop for us to reach a 10 year average in terms of active inventory by September 1st, 2018? (assuming “new listings” were at a 10 year average from now to Sept 1st, 2018).

Yes, I was aware of that. However, CCS is not under federal regulation yet.

I don’t know, but one of the primary goals of banks and credit unions is to increase assets, of which mortgages are an important kind. So I think credit unions may be more enthusiastic than you suspect/hope.

Sounds like a reason for credit unions to pile these mortgages on quick, while the gettin’ is good.

Another example of how the stats published by the board can be confusing.

Inventory at the end of December was 1384, or down 7% from last year. So less selection right?

Not really, that includes commercial inventory. Factoring that out, residential inventory is 958, up 4% from last year.

Any way you spin it, ridiciolously low.

By comparison, 2012 – 3,896 with 3055 residential inventory.

Leo – as per your windows question on the last post:

You shouldn’t need a permit for a straight up window replacement but just in the unlikely event Saanich becomes involved I would suggest a local company like PlyGem or Van Isle or similar. Having to rip out two brand new Mildgard (massive window company in business for over 50 years) windows in Colwood right now as inspector is not happy with their “testing sticker” which was done in the US or something.

I honestly think it will never ever be possible to build an affordable home for a middle class income family going forward. The amount of bureaucracy and complexity that has piled up in terms of building a SFH is outrageous.

Just had friends in the Oaklands area wait 5 months for a RENOVATION permit from the City of Victoria….thankfully they are in a position to afford a contractor with HPO otherwise the owner builder exam would have taken them another 5 months. (Renovation but pouring new footings/foundation so you need HPO letter).

Everything is so ridiculous that I don’t see how people don’t see it as a major factor in what is driving up costs. Everyone is distracted by foreign buyers and other crap.

Another example of how the stats published by the board can be confusing.

Inventory at the end of December was 1384, or down 7% from last year. So less selection right?

Not really, that includes commercial inventory. Factoring that out, residential inventory is 958, up 4% from last year.

It will be interesting to see what the number of listings are at the end of this month.

“I am not a number!”

Anecdotally, friend of mine is on the BoG of Van City and when I visited with them a few days ago, I posed the question about mortgage qualification, and it was said they will be applying the same standards required of the big banks.

Number 6:

I heard you’re afraid of the number 7. Makes sense, as seven ate nine.

What normally happens when demand for an item goes up?

My take – the credit unions can’t and won’t want to take up all the newly rejected lenders from the stress test. More likely they will expand their business modestly by picking off the best risks among the lenders rejected by the stress test.

Those prospective buyers willing to substitute a house for a condo would almost entirely have been those looking to purchase a small two-bedroom starter home.

Middle income families of three or more will opt for a less expensive house further from the core rather than a condo in the city.

Leo – this older article gives short shrift to overnight index swaps but has some interesting info nonetheless on interest rate expectations

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.202.955&rep=rep1&type=pdf

Introvert,

Whether or not Credit Unions will pick up the slack is a topic previously discussed at length on here.

On that REW article, Joannah Connolly’s writings have generally been about as neutral as Garth Turner, Benjamin Tal or David Madani. Anything she says needs to be carefully scrutinized and this case is no exception.

If you plan to “evade” the stress test by going to Coast Capital, you better hurry up: At the end of 2016, Coast Capital’s membership voted to leave the provincial regulatory regime and move under the federal Bank Act. Ergo, B-20 will then apply for loans originating at that institution.

So the question, “How is the OSFI stress test going to take a big bite out of the market when prospective buyers can just walk over to Coast Capital Savings or Vancity and get a non-stress-tested mortgage there?” itself begs a question:

Do the few remaining Credit Unions (also other alt lenders) have the capitalization and corporate will to offset the legions of rejected borrowers desperate to jump into the Van and Vic RE market?

In the case of Coast Capital: if your regulatory regime was about to change in this manner, would you be willing to pile on all of these higher risk mortgages which in a short time, you won’t be able to do (assuming they even had the cash to pull it off)?

Here is a link to Coast Capital’s page re their application to be regulated federally:

https://www.coastcapitalsavings.com/lang/en/host/.coast.com/PressRoom/NewsReleases/2017/20170814/

IMHO, anyone buying via an alt lender because they’d fail the stress test is setting themselves up. You can’t afford it, and you’re not actually “beating” anything; you’re just putting your own self at risk.

Well, drove my friend back to the airport this morning; delightful visit. Time now to put away all the Christmas stuff. Always makes the house feel a bit emptier.

Thank you Leo for all the hard work over the last year.

From today’s Times Colonist article freedom_2008 was referencing:

http://www.timescolonist.com/business/real-estate-assessments-on-island-skyrocket-1.23133602

How is the OSFI stress test going to take a big bite out of the market when prospective buyers can just walk over to Coast Capital Savings or Vancity and get a non-stress-tested mortgage there?

Further:

When asked … whether FICOM BC intends to follow OSFI’s lead in implementing a “stress test,” Frank Chong, acting superintendent of financial institutions at FICOM, confirmed that there were no plans to do so.

“We will continue to assess the situation, but no changes are contemplated in provincial requirements at this time.”

http://www.rew.ca/news/how-to-avoid-the-new-mortgage-stress-test-1.23096448

Leo – as per your windows question on the last post:

We went with PlyGem Windows’ top efficiency product: TG LoE2 (triple glazed, with double layers of argon between panes), and solar shield film on interior panes. It seemed pretty good value for a high efficiency window. Haven’t received them yet, so can’t comment on performance.

Thanks for the read in 2018! Still waiting for watching to see what market will be like in 2018.

Do you think the bchousing down payment program will keep the purchase going for under 750,000? Besides finance changes there is also some boomers that will start to downsize but more likely to high end condos or something.

Thanks for the analysis Leo, small homes will be something to watch..

https://www.bchousing.org/housing-assistance/bc-home-partnership/program-overview-applicant-information

Good condo data and analysis Leo, thanks.

FYI: TC has news today about the new BCA (but not part of Saanich in school district 61 somehow):

“Within the capital region, three municipalities are seeing increases of 20 per cent or more — Metchosin came in at 25 per cent, followed by Langford at 21 per cent and Sidney at 20 per cent.

The highest average single-family assessment in Greater Victoria was again in Oak Bay, at $1.156 million this year up from $1.036 million.

The portion of Saanich that falls within School District 63 follows with an average single-family assessment of $940,000, up from $836,000, and the District of North Saanich is at $876,000, a 14 per cent increase from $767,000.

For all of the Vancouver Island, Gulf Islands, and Powell River region, the highest percentage increases were at 26 per cent, seen in Ucluelet and Powell River.

Only one municipality on the Island experienced a drop — the Village of Zeballos, with an average assessment of $85,000, down by four per cent and $89,000 in the previous assessment.

The lowest average assessment for a single-family house on the Island is in the Village of Tahsis at $81,000, which is up by 19 per cent from $68,000 previously.

When it comes to where the most valuable properties are located, many have been on these lists for multiple years. They are often small Islands, and spacious waterfront homes filled with amenities in Oak Bay, Saanich and North Saanich, many on acreages.”

Often when discussing interest rates, articles talk about investors betting on future interest rates and say things like: “According to trading activity in overnight index swaps, investors now think there’s about a 56 per cent chance of a rate hike in January. On Wednesday, that likelihood was lower, at around 46 per cent.” From: http://www.cbc.ca/news/business/inflation-1.4460013

Can anyone explain to me how this works? I found this article: https://www.canadianmortgagetrends.com/2010/08/overnight-index-swap-ois/ which helps, but where would you look up current OIS and translate that to what traders are betting interest rates will do?

December final numbers:

462 sales (down 2% from last year)

441 new listings (13% higher than last year)

1384 active listings (7% lower than last year, due to a much larger drop at the end of the month this year compared to last).