Budget 2019: Impact on Victoria Housing

The federal budget was released today and as expected, it has some housing measures in it. There are some small tweaks (cap for the RRSP Home Buyers Plan was increased to $35,000), a continuation of rental housing construction incentives, some additional measures to crack down on real estate related crime, and the most interesting piece: the new CMHC shared equity mortgage.

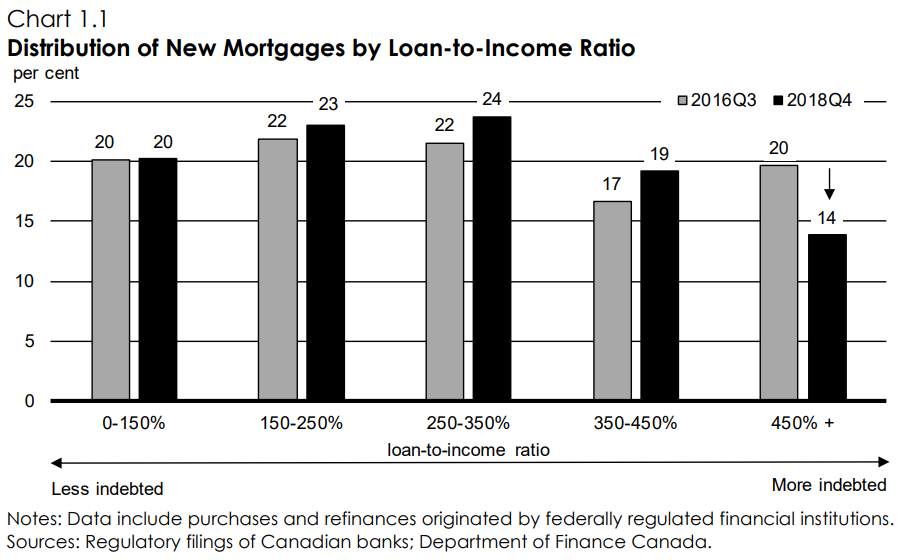

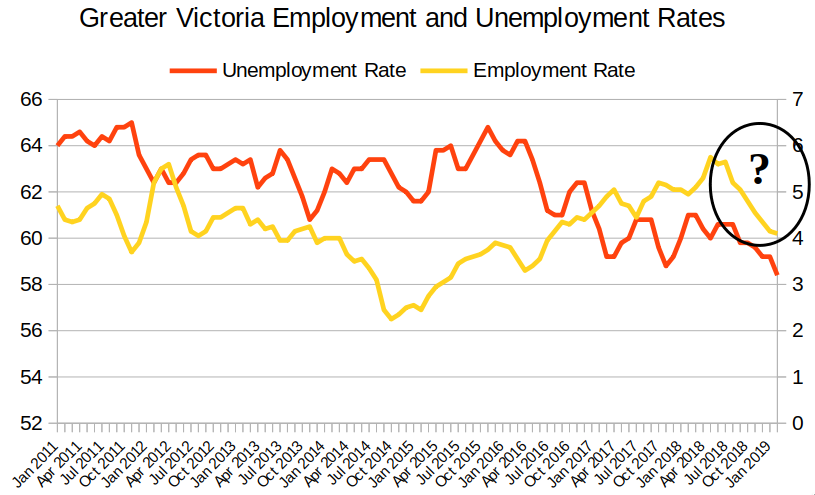

Most notably absent from the budget is any backing down on the most impactful policy change in the last decade: the mortgage stress test. I didn’t expect them to back down on the mortgage stress test and they didn’t despite intense lobbying from the real estate and mortgage industry. In fact they made a point to double down on the message that the stress test was working as expected in reducing highly indebted borrowing (see figure below). Whether the goal was to control debt levels and stabilize the housing market or reduce prices, it seems like it is working and the feds are not about to reverse course on what they still consider a wholly effective policy. However, they have given themselves a little wiggle room in this budget by saying that the government will adjust the stress test “if economic conditions warrant”. In other words in case of recession we may have to grab onto the real estate life preserver again to try to stay afloat.

Rental Incentives and Real Estate Crackdown

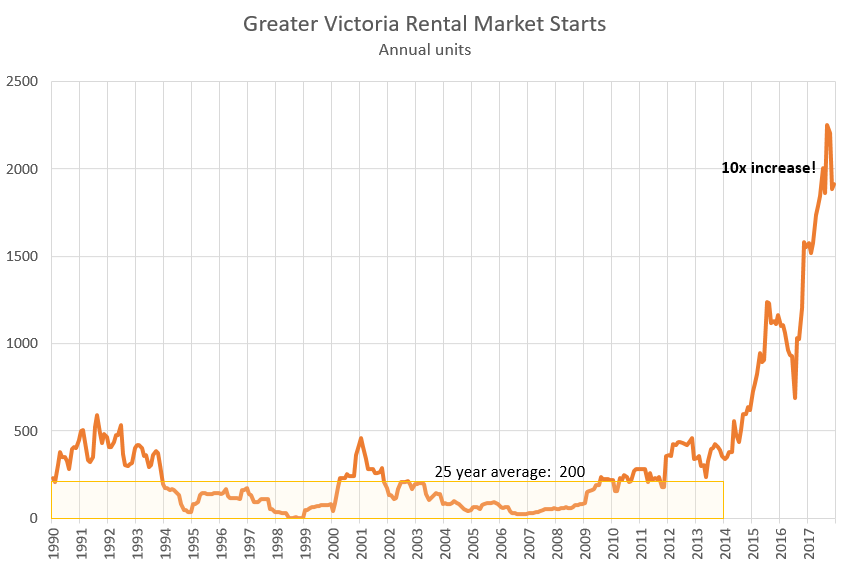

The budget also extended funding for their 2017 Rental Construction Financing Initiative by providing another $10B to carry it to 2027 and support building 42,500 new rental units through low coast loans. Aside from the fact that the program seems to have been spectacularly unsuccessful so far (only 500 units announced nationwide!), proportional to our population the grand total would mean a paltry 425 units for Victoria. However that money combines with provincial money which is now flowing for affordable housing projects and increasing municipal support to getting these things built. While not the driving factor, it’s a (small) part of the reason why our rental unit construction starts are currently ten times the long run average.

The government is also investing more into ferreting out tax cheats and other real estate related crime. Recent efforts by the CRA lead to the assessment of $100 million in additional taxes on real estate transactions that previously went under the radar so they are stepping up that initiative with particular focus on “high risk” areas like BC and Ontario. The good news is that it won’t even cost us anything since expected revenues from additional taxes exceed the $50M investment.

It seems the feds are also starting to listen to our Attorney General David Eby about the seriousness of the problem of money laundering in BC, because they are also stepping up their efforts on that front and starting a working group with BC to tackle the problem. It also looks like new initiatives for better sharing of data between the provinces (BC and our speculation and foreign buyer tax are specifically mentioned) and the CRA are coming. How effective will all this be? Who knows, but again it adds up to reducing the impact on the market from buyers not motivated by living in a home, or from money that falls outside traditional income sources. It should reduce upward price pressure, especially in markets where these kind of shenanigans were a bigger factor (Vancouver).

CMHC Shared Equity Mortgages (First Time Home Buyer Incentive)

This is the final and most interesting new initiative in the budget. In short, CMHC is launching a program that would allow a first time buyer to partner with them and share in the equity stake of the house. In other words, instead of buying the whole house, you buy 90-95% of it and CMHC buys the rest.

It’s in some ways similar to the now defunct BC HOME Partnership program, in that both programs aimed to provide about 5% of the price of a home to first time buyers and both programs come with a big set of restrictions that will limit the situations where they will be useful. At first I was surprised that they came out with this program, given CMHC President Evan Siddall’s scathing criticism of that failed BC program just two years ago. But there are some key differences that might explain why:

- CMHC is not giving out free money. They are taking a stake in the equity of the property, so it should (barring a major price decline) be more or less break even for them or a money maker in the long term.

- Borrowers still need to meet minimum down payment requirements. CMHC’s equity stake does not reduce the required down payment.

- CMHC is giving out 10% for a new home, and only 5% for a resale. That means unlike the HOME Partnership, the program will increase demand for new construction and incentivize more supply rather than just adding demand.

All the details aren’t out yet, but fundamentally this will be like those co-ownership ideas (buy a house with a friend!) that get trotted out in the newspaper periodically as a way to address housing affordability. The difference is that CMHC won’t throw a party when you’re trying to study or move to Iqualuit on a whim. CMHC also won’t take out the trash and pay their share of the utilities though.

So first time buyers get to use 100% of the house for 90% of the money now and don’t pay until later when they sell. Sounds like a recipe for success. However there are some restrictions that will make this of limited use in high priced markets like Victoria.

- Maximum family income of $120,000. That encompasses about three quarters of the families in Victoria but not all.

- Mortgage and incentive cannot exceed 4 times household income. For the median household income in Victoria (~$90k) and a 5% down payment, that means a maximum “house” price of $380,000. In other words: a condo.

- CMHC retains 5 or 10% ownership. If you need their help that’s great. But if you’re bullish on Victoria real estate it would probably be a bad idea to take the offer. As I understand it, if they kick in $40,000 on purchase and house prices double they collect $80,000 when you sell the place.

- Morneau expects an increase of 40,000 first time home buyers per year which seems optimistic. If so that would be about a 5% increase in overall buyers for Victoria.

Not all the details are out yet so stay tuned, but I suspect this will have a very modest positive impact almost entirely on the lower end of the condo market and will be almost impossible to spot in the sales data. It seems like the feds were under pressure to throw a bone to the market and this one sounds good without disrupting their overall plan to keep real estate markets under control.

What do you think? Anyone thinking of using this shared equity plan to buy?

More money laundering linked to Canada going back to 2008. Very interesting read on the money laundering going through Canada that apparently the RCMP didn’t care about until years later. Allowing hezbollah to setup all kinds of networks here.

What a shit shown.

On the other hand Australia pulled in half a billion dollars in a single year tracking down a money laundering and drug scam.

Sam Cooper does some great work!

When they initially said a few million dollars in BC I’m sure when they really figure out how much fentanyl and laundered money has poured into real estate it will be I large enough amount to impact house prices for the general public.

https://globalnews.ca/news/5084587/hezbollahs-canadian-money-laundering-ops/

Thanks Dasmo, this webpage is a good summary of multi-family construction projects; now I just need to find the data in spreadsheet format.

https://victoria.citified.ca/data/

Monday numbers: https://househuntvictoria.ca/2019/03/25/mar-25-market-update/

Awesome post Cynic! Just bang on to what is happening right now!

LocalFool,

About a month ago, you lectured us about not using anecdotes. https://househuntvictoria.ca/2019/01/28/demographia-were-number-2/#comment-55565

We were told by LocalFool…”No data? Then it’s conjecture and nothing more.”

And now we get this long anecdotal tale about your friend’s friend supposedly with asbestos all over his purchase house, costing him “tens of thousands”. Some people like to see at least one fact included in these stories.

For example, you could throw in the fact that sellers are potentially still liable for undisclosed asbestos, regardless if there was an inspection or not. https://www.haz-mat.ca/2017/02/28/buying-home-with-asbestos/ By omitting that fact, your anecdote can be misleading. Although including it kills your “what a waste” narrative. You should let your “good friend” know the good news, and “you’re welcome!”. And yes, of course it is still important to get an inspection. And my friend’s friend agrees with everything I’ve said in this post.

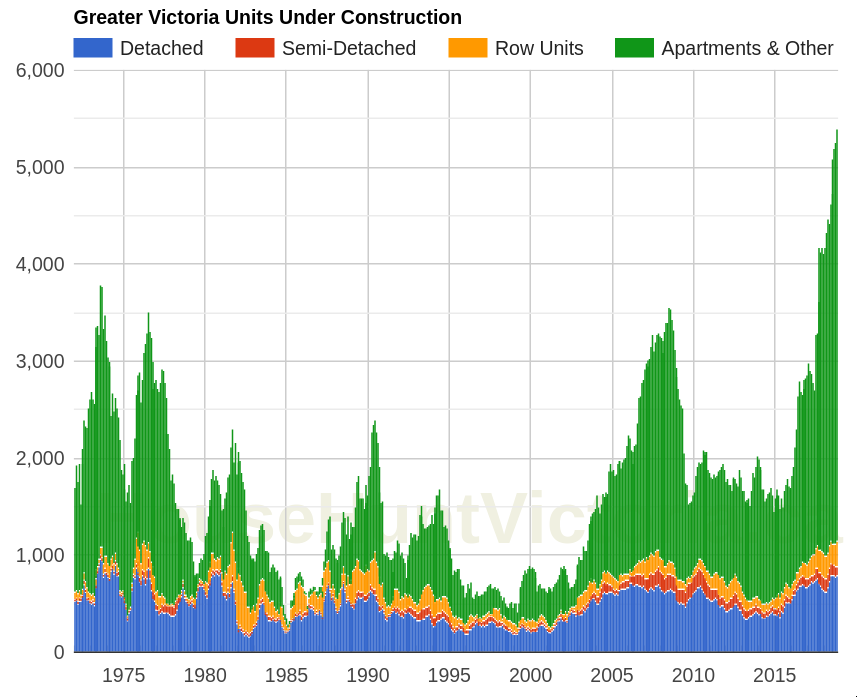

More sales may be not included in monthly MLS® stats this year because of the big increase in newly constructed units. As you can see in the graph, this number has been increasing dramatically since 2015, and many of these units must be completing this year. The projection on this site for this month “market report” sales is 93 units less than last year, but maybe there’s more sales than that not included in the stats because they are new sales, which if included would change the narrative from falling YOY sales to rising sales.

“Like i said folks, buy now or be priced out forever.

Never mind the crappy sales data and increasing DOM. This market has turned up the heat again!”

Cynic, I completely disagree.

1. Inventory has been very low.

2. Weather was miserable late Jan/Feb (typically when Victoria market picks up)

3. Spring Break, more visitors and out of town buyers.

4. Economy hanging on by a thread

However in the short term I would mention:

1. 5 year bond is crashing. Look for more interest cuts

2. 5 year cycle picking up. I believe that people look to move at the end of their term. Sure can move and port the mortgage but I think people tend to move in 5 year cycles. Since 2014 was the start of this upwave, folks are likely going to start looking. Just a theory…

Why would it be a bigger & major source of sales this year Patrick?

This was literally the same rhetoric in Vancouver last year

I was having a birthday celebration with a good friend of mine today. We chatted briefly about RE and he was saying one of his work colleagues just bought a house and did so without an inspection.

As it turns out, there was a plumbing problem and when the tradesperson came over, one thing led to another and the entire house was found to be full of asbestos. He’s now looking at tens of thousands in remediation and that presumes they don’t find anything else. What a waste. I have no idea if the seller would somehow be on the hook, and I didn’t ask.

Some studies have said people spend more time deciding on a pair of jeans than a home. I don’t really believe it, but stories like this make me wonder. Buyers – get an inspection when you buy a home. If the seller won’t have any of it, neither should you.

Deryk,

That is completely indicative of what I’ve been seeing too. Nothing but a madhouse out there. Every place i’ve looked at has swarms of people there and the offers are coming in left, right, and center. All over ask and over assessed. Accepting back up offers as well. Bidding wars happening everywhere.

Its pretty much just like 2016 again.

I’m actually now looking at throwing in unconditional offers, sight unseen, or else i’m never going to get that investment house where I can subsidize my tenants rent. Negative cap rate doesnt matter when you have capital appreciation

Like i said folks, buy now or be priced out forever.

Never mind the crappy sales data and increasing DOM. This market has turned up the heat again!

Small house at 1423 Bay street apparently had five offers on Friday night….only hours after being listed. (asking price was $674,000.000 It is assessed at $652,000.00

It was also absolutely crawling with people today (sunday) at an open house. (I guess they are accepting back up offers.)

Looks like a nice tidy house.

Marko,

Thanks, that’s important information. So the numbers reported here may be missing significant number of new property sales, and I would expect in a construction boom like this year, that this is a bigger factor.

Hopefully a clear disclaimer (“these number don’t include newly constructed properties sold outside the MLS® system) can be added to the Market Update that gets posted here weekly, to point out that it doesn’t necessarily include the sales occurring from new units – which may be a bigger and major source of sales this year.

I say that, because the data presented also comes with analysis and conclusions about the “sales pace” is and what it means for the market. For example, maybe there was a significant numbers of new condo sales not reported, so the “steady as she goes” comment wasn’t appropriate.

Maybe it turns out that total sales (including newly constructed condos) was higher than last year? Who knows if it isn’t reported or even mentioned as an issue? Why are people confidently drawing conclusions about sales slowdowns etc. based on data that doesn’t include all sales?

If a brand new condo building is completed with 100 units, when do those show up in the monthly sales stats? When they are pre-sold, or all at once when occupancy starts?

All over the place. Sometimes you have developments with 100+ units and only a handful are reported in the MLS® system. The sales would count when reported as pending so if a sale is reported in 2017 as pending it would have been counted then not when construction is complete in 2019.

If not reported on MLS® then it doesn’t show up in the monthly stats.

Good point. It seems the data here focuses on monthly sales from RE boards. But if they are missing certain types of sales, this might skew the data. In a year like this with huge amounts of construction it would be interesting to know if a lot of the sales occurring are not being reported in the monthly data that we see here

The question can be broadened to do they show up. It’s my understanding that the real estate boards report only sales that go through them, and most pre-sales and assignments are done by the developers themselves, not through RE agents.

If a brand new condo building is completed with 100 units, when do those show up in the monthly sales stats? When they are pre-sold, or all at once when occupancy starts?

That’s a good question. I’ve seen people point to the citified site, but I couldn’t see the summary data that you were looking for there . I’m assuming you’re interested in things like

– how many units completed so far in 2019

– how many units expected to be completed in 2019

Also, if a rental building is completed, I assume that it never shows up as sold units, yet it adds to the housing stock. It would be interesting for a monthly index that shows total housing stock, as that is the “supply” part of the supply/demand for housing.

https://victoria.citified.ca/

Question:

Can anyone point me to a website that lists all condo/apartment projects currently under construction in greater Victoria, address, projected completion date, number of units at each building, and whether the units are rentals or condos for sale?

I think you would need to pull up numbers of investment properties bought in the last few years to really see the risk profile. Rents have gone up so much that anyone that bought before 2016 probably has very little pressure to sell.

Anecdotally we might blame the slow market post the Great Recession. Friends couldn’t sell then but were “allowed” to buy another house and simply rent their first. Now there is zero incentive to sell that house.

Many investors will sell if they think prices are going to go down, above all those who are cash flow negative. That matters, a lot, because unlike owner-occupiers there are no lifestyle issues getting in the way of selling. It’s only about the money.

Inventory in Vancouver is actually not very high by historical standards, but it’s rising. It started slowly, but has been increasing speed. So people are indeed trying to dumping houses, but many more sellers are withdrawing and refusing to sell. The reason inventory in Vancouver is rising despite seller pullback is because the sheer volume of the sales decline is overwhelming it.

In a quirk of psychology, most home sellers don’t just rush to the exits before they “lose even more equity”; they will actually take a monthly carrying loss of a few hundred or even thousand, for sometimes years as opposing to locking in a loss of hundreds of thousands today, all at once. This behaviour is classic loss aversion you see in virtually every downturn and is one of the principal reasons home prices don’t fall at the same speed as an equity market.

So what about Victoria?

The low inventory is certainly in part cyclical, but also may have other reasons that are harder to verify – sellers can’t afford to move, sellers afraid of being buyers, sellers afraid they cannot find a better property, or aversion to taking on more debt by doing a trade up buy. Who knows? What’s important is it doesn’t last forever, any more than rising prices.

Inventory will inevitably rise here, and you can look to Vancouver as a proxy for what you can expect to see. As the mood here shifts decidedly to the downside (that hasn’t really happened yet) and all that new supply comes online, the “problem” will essentially go away like it always does. Having said that, I believe Victoria’s experience will be more muted than Vancouver’s, given we didn’t experience the same level of craziness. That’s a good thing, IMO.

@Marko; I would be interested in your opinion (and any else too) about “why” Victoria inventory is so low these days. In nearby Vancouver, inventory is very high. Same with Calgary and Edmonton and other places in Canada, but Victoria remains low. Why is this?

No idea really…..I thought interest rates trending higher would bring more properties to market, but obviously that hasn’t come to fruition. I also thought we would see more spec tax selling but I’ve only seen a handful of examples of that.

Solid economy and low vacancy rate don’t help inventory in my opinion. I just lost a condo listing after two price drops. Seller rented it out (easily) and will re-assess in 2 or 3 years. If she had not been able to rent it easily maybe she does a third price drop to try and move it?

And as I opined before, when sales are declining during a spring market (presumably the busiest time of the season) I don’t think it bodes well for prices.

Sales aren’t declining thought…they are increasing like they do every spring for the last 30 years of data we have.

January 2019 – 135

February – 204

March – 275ish?

I thought maybe you were referring to YOY decreases but the gap will drop on those this month as well compared to January and February so it is narrowing not widening.

I think you reference YOY? but I don’t see how a YOY drop in the spring market bodes worse for the market than a YOY drop in any other season of the year? We’ve also had YOY drops in sales for the last 25 out of 26 months.

I might as well throw in my opinion on why Victoria has such low inventory when compared to Vancouver. I would say that there are generally two reasons.

One: Victoria is pretty well at the end of the line.

Two: In Vancouver, people are watching their homes drop by five hundred thousand dollars and want to sell before they lose even more equity. This is not even close to happening here in Victoria because house prices haven’t gone up anything close to the prices in Vancouver. My friend was offered $3 million for her war time bungalow on 14th and McDonald a year and a half ago. It is now worth “only” $2,4 million! They bought it for Fourteen thousand dollars in the sixties. The same house here in Victoria in a comparable neighbourhood would be around $800,000.00.

So anyway…..it makes sense to me that there is hardly any inventory here in Victoria.

When we moved to Victoria 30 years ago, we had the same problem. Lack of inventory.

So we went around the neighbourhoods we liked and handed out letters asking people if they wanted to sell their house.

People in Victoria will only sell if they have to or if they want to downsize. It’s easy to hang tight and demand the price you want if you don’t need to sell. People in Vancouver on the other hand are watching their much over inflated houses drop hard and are eager to get the hell out.

The suite meant we could afford to buy in a better location than we otherwise could have. And, when we choose to take back the suite, our living space will double without the need to sell and buy a bigger home. For us, those were big advantages.

A suite gives you options.

@Andy7: yes, your figures also show a meaningful decline in sales this year. And as I opined before, when sales are declining during a spring market (presumably the busiest time of the season) I don’t think it bodes well for prices.

But as Marko pointed out, inventory still remains relatively low in Victoria, and that plays a big role in price appreciation or declines too.

Also, I think when house prices are declining basically everywhere in Canada (Vancouver, Edmonton, Calgary, Regina, Winnipeg, and many other places back east except apparently Montreal and PEI) and in the USA, and Australia, and other places worldwide, it’s bound to happen in Victoria as well, no matter how unique we think the market is here. And there’s recent news both in Canada and the USA about a possible recession. So that’s not gonna help price appreciation.

@Marko; I would be interested in your opinion (and any else too) about “why” Victoria inventory is so low these days. In nearby Vancouver, inventory is very high. Same with Calgary and Edmonton and other places in Canada, but Victoria remains low. Why is this?

4 . ????????

@ Marko & @Matthew

I’m going to throw some different numbers out. Let’s look at VREB’s Single Family – Residential sales patterns for Feb & March over the years:

Feb 2013: 177

Feb 2014: 197

Feb 2015: 266

Feb 2016: 378

Feb 2017: 283

Feb 2018: 226

Feb 2019: 191 * Sales down 15% from 2018, and back to 2013-2014 levels.

March 2013: 238

March 2014: 249

March 2015: 365

March 2016: 537

March 2017: 396

March 2018: 287

March 2019: ?? * If sales drop 15% from 2018, we’ll be at 2013- 2014 levels. If sales drop 20% from last year, we’ll be at the lowest sales since before March 2013, coming in around 230 sales.

@ Josh

Yep. I noticed in concrete buildings, unless there’s carpet in the unit above you, you’re still going to get significant sound transfer. Best bet is always to live on the top floor.

I was about to say, I’ve lived in concrete buildings for years and you can hear everything your upstairs neighbours do.

Chasing a cat…..lol. Why just not have a cat and use the saved $ to rent in a concrete building? Not to mention there would be less noise from the kid chasing the cat. Not to mention that it would be way easier to rent with a 3 yr old verus 3 yr old+pet. Too many other obvious solutions like rent a ground floor unit which are typically less desirable anyway.

Developers build what the market wants and the market wants woodframed. If you give a family the option of 1,000 sqft concrete or 1,100 sqft woodframed 9/10 will go woodframed and then they will complain about noise transfer.

Btw having lived in concrete buildings you can still hear people dropping things above you. It isn’t perfect either.

We are also talking about brand new 12 story wood framed buildings….a used concrete building would be cheaper but guess what people want brand new stainless appliances.

“Just buy a smaller unit in a concrete building? No one is forcing you to live in a wood frame. I feel bad for people in countries without clean water not some Vancouver yuppie in a brand-new wood-framed taking Yoga classes 5 days a week so they can relieve all the stress associated with the “noisier units.”

In cities with low vacancy rates you don’t get to pick and choose and if developers start throwing up more wood buildings now you’ll have even less choice. You seem to think that only single yuppies live in condos or apartments. Families with kids live in these places too. You can’t just tell a kid to keep quiet. Tell the dad in this story who was evicted from his rental in a wood frame building because his kid was walking around and dropping things that “no one is forcing you to live in a wood frame”

https://bc.ctvnews.ca/family-evicted-from-rental-over-noise-from-toddler-dad-says-1.4264894

Marko, note taken. Reading my post again I notice my total disdain for the vast majority of realtors shows through slightly…

Marko Juras

If you don’t want to live downtown, you are already forced to live in a noisy wood frame. Now there will be even less incentive to build concrete.

Questioning a transaction would look along the lines of “anyone know why MLS#401343 sold 51k over asking price after 128 days on market?”

Bitter? Maybe the question should be “why are realtors so sensitive when transactions are questioned”? Sorry, not all of us are realtors with the inside scoop on why a transaction would take place at a price higher than any time during the 131 days of listing/re-listing and price drops. But yeah I guess Schedule A sale explains it, I should have known…

2013 = 483 sales (SFH average value = $583K)

2014 = 575 sales (SFH average value = $632K)

2015 = 734 sales (SFH average value = $624K)

2016 = 1121 sales (SFH average value = $748K)

2017 = 929 sales (SFH average value = $846K)

2018 = 668 sales (SFH average value = $903K)

2019 = 595 sales projected by Leo (SFH average value = $885K Feb 2019

If it wasn’t for 2016/17 the current sales numbers would be a non-story. Also keep in mind in 2013 inventory was 4,072 and currently we are at 2,131. The lowest number on new listings on record in February didn’t do anything to help inventory levels. If we are going to see substantially price pressure it will have to wait until next year imo. Three months into this year inventory has not moved meaningfully and looks like interest rates have stabilized.

Victoria current prices (Teranet) are up 4% from jan2017 (now at 2.5% below all time high)

Sounds about right from what I can see when evaluating individual sales. Core SFHs in particular have not budget much at all. The biggest issue I see is lack of quality inventory.

What realtor convinced their (dopey) clients bidding $51k over on a house listed since November 2018 (131 days) was a good idea? Or did the listing realtor tell them they had “another offer”? 355 Robertson St, MLS#:401343

Why does everyone come across as so bitter on here?

Simple explanation, schedule A sale.

BC building code adjusted to allow the height limit for wood buildings to rise from 6 storeys to 12 storeys. Sounds good for the lumber and development industry but bad for the people who have to live in these noisier units

Just buy a smaller unit in a concrete building? No one is forcing you to live in a wood frame. I feel bad for people in countries without clean water not some Vancouver yuppie in a brand-new wood-framed taking Yoga classes 5 days a week so they can relieve all the stress associated with the “noisier units.”

I would dump the condo in a heartbeat. There are too many worries like either a special assessment or a bad tenant that can quickly turn this into a negative cash flow situation.

Do you really need the headaches.

I found that dealing with people at work is annoying enough without having to deal with strangers in my house.

So, you are advocating for a low stress lifestyle and risk avoidance and then you bash “greedy” and “rich” developers. Classic Victoria mentality.

Reality is if you want a middle management government job for the rest of your life and god forbid you have a suite and might have to say hi to the tenant twice a month then you can afford a house in Happy Valley or Sooke.

No need to hate on those that hustle a bit and have a suite that helps to propel them forward financially. Unless I had millions in cash sitting in my accounts, I just wouldn’t feel comfortable owning a home without a suite. Crap happens, you lose your job, or your business suffers, you or a family member get sick and you need to take time off work, etc. Suite is such a nice financial buffer to have.

When new construction methods are introduced, there are often lessons to be learned the hard way.

I would be reluctant to buy in a tall wood building.

BC building code adjusted to allow the height limit for wood buildings to rise from 6 storeys to 12 storeys. Sounds good for the lumber and development industry but bad for the people who have to live in these noisier units

https://www.ctvnews.ca/canada/b-c-building-code-adjusted-upwards-to-allow-12-storey-wood-buildings-1.4334801

What realtor convinced their (dopey) clients bidding $51k over on a house listed since November 2018 (131 days) was a good idea? Or did the listing realtor tell them they had “another offer”? 355 Robertson St, MLS#:401343

Heading to the interior for a week. Another place where the real estate wave swept through. The non-spec tax regions should benefit a bit from shifting demand but I suspect minor just like we haven’t seen massive liquidation here from spec tax

Insane, given we are at like 40% of that rate with an eight of the population.

Well if you are talking about fundamentals that isn’t technical analysis.

And what does that mean “it’s not hard to predict a trend”.

That is my impression as well but I very rarely look up island. But we definitely saw the price wave go from Vancouver to Victoria to up island on the way up. Makes sense that they will be connected on the way down but what no one knows is to what extent.

Yeah and I haven’t looked at enough data to get an accurate number, but it would be interesting to see how a typical condo performs as it ages. There is more renewal in that space so just looking at growth of median prices isn’t really showing how existing units have appreciated.

Leo do you ever look at the data from up island? Are things slowing down there as well? Anecdotally I hear from friends that things seem to have slowed a bit in the Comox Valley but that wasn’t based on any data.

Seems like Comox Valley and Campbell River only started going up a few years after Victoria so it seems like the downward leg might be a bit delayed there as well.

The growing Vancouver carnage is getting ever more apparent across all market sectors. March VanRE numbers are almost certainly going to be scary-bad. The projected differential between 2019 and 2016 sales volumes is just astonishing:

Right now March sales are averaging less than 78 a day in a region of nearly 2.5 million people. Without some type of major influx of capital or other bizarro monetary intervention, this is looking increasingly like a major RE event is in the process of unfolding on the LM.

Below is REBGV president Phil Moore’s response tonight to the data…

Talk about a nuclear winter…

It’s been demonstrated empirically that where the Vancouver trend goes, Victoria eventually follows.

No, apparently we’re not. If you want to get a general sense of the upcoming trends you can expect to see in the Victoria market, the monthly Victoria sales data is somewhat paradoxically about the last place you want to look. I can tell you, metrics for RE pricing aren’t currently looking up – at all. It’s not really a mysterious, roll-of-the-dice proposition.

There is no tool I am aware of to predict future prices of a tradable asset with precise temporal or numerical accuracy. But, technical analysis is a fantastic tool to highlight market psychology in action. Depending on what the analysis is specifically, it can also be a corollary to other data in predicting the general trends you can expect to see. Real estate is about the most cyclical, emotionally driven type of asset class there is, and also the slowest. It’s not hard to predict a trend Leo, especially when the valuations of something irrevocably constrained by incomes are so completely out to lunch.

Yeah – I was guesstimating. I don’t have access to the data. Be a interesting graph to compare with the sfh one.

I agree peace of mind is great. If you can afford a home plus a comfortable retirement without rental income you have peace of mind. Of course most younger folks in Victoria are not in this position. For them, a rental suite is peace of mind.

here is a funny Vancouver tweet i saw earlier …

just want to share

Yes, it does seem silly. And costly.

http://www.victoriabuzz.com/2019/03/victoria-is-building-138-new-affordable-housing-units-at-two-development-locations/

Does this seem stupid to anyone else? There aren’t 138 new units here, there’s 57 if you consider that they’re demolishing 81 units. They’re not old or remotely condemnable buildings either. Surely there are better redevelopment options than these.

Good Post Barrister. I cannot imagine having to deal with tenants at my primary residents. I have tenants in my rental house but thankfully I transferred that responsibility to my retired father, in exchange he gets to keep all the positive cash-flow.

Barrister,

Great post, and I heartily agree!

Yeah, I’m not sure what the problem with buying in a declining market is either. We bought in early 2012, and prices were going down. Not fast, but they were declining from the 2010 peak.

It meant that there wasn’t much pressure to buy and we could take our time. It was great!

Yes, we got one or two assessments (in 2013 and 2014) that suggested that the place we bought was worth slightly less than the 2012 value, but ultimately we weren’t flipping the property so it didn’t matter at all. Plus assessments are BS anyway.

Compare that with the rush that happened once everyone figured out in 2015 that the bottom had passed and prices were climbing again – bidding wars, unconditional offers, high stress, prices going up 1-2% MoM. Ugh.

NE14T: I will reluctantly give you an old man’s perspective here which will not be popular with all the real estate moguls that reside on this site. From my perspective what everyone glosses over is the value of peace of mind.

I would dump the condo in a heartbeat. There are too many worries like either a special assessment or a bad tenant that can quickly turn this into a negative cash flow situation.

Do you really need the headaches. On top of that the equity in your condo will reduce your mortgage payments on your house by about $500 a month.

I also would not bother with tenants in your basement. Paying an extra 100k for a house with a suite in your basement in my mind means putting up with people for eight years or more just to get the extra principle paid off. Plus capital gain and loss of a potion of your principle residence exemption. Marko will set out all of the advantages but no one mentions that intangible loss of privacy cost. Also everyone assumes that you will be lucky enough to get a series of wonderful people as tenants. I found that dealing with people at work is annoying enough without having to deal with strangers in my house.

But that is my two cents worth and lots of people will disagree but give some thought to keeping things simple.

Nope not at all. Just calling out bullshit when I see it.

gwac you sound angry

Dec 2015

Hawk

#3992

I think they are called “the greater fools”. Paying that much to live in Oaklands area is ridiculous. If you can afford to overpay for a new house then you can suck up the new extra costs. Goes with the territory

Wonder who the greater fool is?? That Oaklands buyer is sitting pretty.

2013 = 483 sales (SFH average value = $583K)

2014 = 575 sales (SFH average value = $632K)

2015 = 734 sales (SFH average value = $624K)

2016 = 1121 sales (SFH average value = $748K)

2017 = 929 sales (SFH average value = $846K)

2018 = 668 sales (SFH average value = $903K)

2019 = 595 sales projected by Leo (SFH average value = $885K Feb 2019

been since aprox 2015 that Hawk has called for a crash. How can anyone possible say that he is right in 2019. He`s been wrong about rates and prices big time. Hope no one actually listened to him…:{

Or you know, not. Are we reading the same data Leo is posting? Or listening to Marko’s anecdotal yet important “on the ground” feedback? It seems there is some quantum entanglement going on whereby some are reading a HHV from a parallel universe.

If that were true, wouldn’t it be ironic that his timing is off again? But don’t lose focus, because his predictions are not coming true. Here are Hawk’s predictions for 2019:

Hawk 9020 $525,000 $275,000 3.50%

We’re just coming up on the end of Q1 but those predictions sure don’t look good. The interest rate prediction is down right laughable.

Gee James how do you really feel. 🙂

US 10 year curve inverted not a good sign for the US economy. May see rate cuts in Canada and US a lot sooner than anyone imagined a few months ago.

Honestly, I think you’re a bit delusional if you think whatever you bought for $175,000 in 2016 is worth $350,000 now.

Victoria current prices (Teranet) are up 4% from jan2017 (now at 2.5% below all time high)

Vancouver current prices (Teranet) are up 15% from Jan 2017 (now only 4% below all time high)

So every dog has a price point – 2557 Wentwich is pending at 462,500. Which is not far off what the land itself assess for at $421k

All the predictions are coming true for people who bought after 2016; if they sell now they are losing a lot of money; not just in Vancouver but here in Victoria too.

Every week when I look at my PCS account I see houses that are listed for sale now that were purchased within the last 30 months. If these places sell the owner will be taking a significant financial loss. I’ve also noticed some new spec builds that are languishing with monthly price reductions to the point where the builder will suffer a financial loss when they eventually sell.

This is probably just the beginning of a prolonged deep decline; it’s spring but the RE market feels like the winter market… humdrum…

What happened to Hawk? Now that his predictions are coming true, he has disappeared.

Matthew…..my advice would be for you, or anyone else, to be careful if you plan to sit out and wait and see if house prices drop here in Victoria. Keep in mind that if the higher priced homes are simply not selling, then that changes how the “average” prices “appear”.

We have been looking at the modest home purchase range of SFH and also in the higher range for a purchase and the lack of product is startling. When we see one that is in good shape, we find it has an offer on it. Several times now we have witnessed back up offers. My point? The lower range priced SFH are not going down. (we see asking prices going down but not the actual price) We have missed out on five “good” houses now because of our dithering.

Waiting to buy is a mugs game…..because no one can predict what will happen. Talk to those who have been left out because they thought paying $200,000.00 for a house in Rockland was “way to much” and felt if they wait a few years they will get a better deal.

That would be true with no immigration and no population growth, but immigrants average age is 27, so if immigration trends continue, 30 year olds won’t decline. Based on current pop. Growth (1.4% Canada), overall population will be up 32% in 20 years. That could mean, in 20 years, 32% more people in Victoria and (based on current trends) likely the same or less SFH available, increasing demand for SFH.

https://www.statista.com/statistics/443305/international-migrants-in-canada-2014/

Don’t forget the unlimited supply of condos. Also there wouldn’t be much incentive to downside in the first place if the price gap narrows.

@NE14T:

1/ if the condo represents less than 20% of your assets

– keep it

2/ if it is more, then sell it, you’ll be too leveraged. Regardless of any returns and opportunity costs.

I believe so. Basically you can’t STVR a self contained suite unless it is grandfathered. So for the 4 months you would have to rent it at least a month at a time.

Shouldn’t be a problem though, tons of co-op students looking for that kind of period.

Not sure if I’m ready for 100% equities. However 20% is between the assertive and aggressive models here.

https://cdn.canadiancouchpotato.com/wp-content/uploads/2018/01/CCP-Model-Portfolios-ETFs-2018.pdf

Wondering if anyone can confirm my understanding of City of Victoria rules on short term rentals in relation to my self contained basement suite in my principal residence:

Is it that simple?

I ask because I might be renting it to a student who only needs it for 8 months, so trying to determine my options for the other 4 months.

Leo did you consider VEQT which has 100% equity allocation vs. VGRO which is 20% bonds? Do you expect a 7% return even with the bond allocation?

Victoria March Sales figures & Average Single Family House values for last six years:

MARCH

2013 = 483 sales (SFH average value = $583K)

2014 = 575 sales (SFH average value = $632K)

2015 = 734 sales (SFH average value = $624K)

2016 = 1121 sales (SFH average value = $748K)

2017 = 929 sales (SFH average value = $846K)

2018 = 668 sales (SFH average value = $903K)

2019 = 595 sales projected by Leo (SFH average value = $885K Feb 2019)

2019 March sales will be about 1/2 of what they were in March 2016.

To date, the SFH average peak value was in Aug 2018 = $937K. That was the highest average ever recorded, and it’s been going down ever since.

It’s anybody’s guess as to what will happen with Victoria market in the next few months (April, May & June), but I wouldn’t be surprised if the SFH average drops to about $850K by July 2019. I don’t think its a good sign when a spring market shows deteriorating sales numbers like what we are seeing in this market. The spring is typically the busiest time of the year for transactions, but sales figures haven’t been this low since March 2014, when the average price of a SFH was $632K.

But, as you can see in the Chart above, prices went up from 2016 to 2018, while sales dropped off each year. But (IMO) that was another time with different factors at play. FOMO (fear of missing out) was significant during those years, especially in neighbouring Vancouver. And the banks were willing to lend huge sums of money to just about anybody who asked. And the Chinese Gov’t was not actively preventing money from exiting their country, like they are now. And most (or all) of those Provincial taxes (foreign buyer, spec, education, vacancy) were not in place in Victoria in 2016-2017. And the Fed Liberal Gov’t (in the recent Budget) made no mention about relaxing the Stress Test anytime soon.

In any event, I don’t think there is any FOMO buying going on in the Victoria market today. Judging by the present sales numbers, potential purchasers appear to be in no rush to buy. And I think it might be easier to try and rob a bank today, as opposed to applying for a loan there. It’s been almost 7 months since Aug 2018 when SFH prices were at the highest. Seven straight months of price declines is no laughing matter. Could it be that Aug 2018 was the start of a true blue Victoria price correction? I don’t know, but I don’t want to be a buyer with his hand out trying to catch a falling knife. So I’m gonna sit the spring market out and see where prices are at this summer.

Finally, I would think that Realtors would want prices to come down so they can get some sales on their books.

Rent or sell condo when upgrading. Seems like a good idea for a new calculator…

@guest_57806

If we keep the condo and rent it out we’ll be positive cash flow but not by much (maybe $100 per month). Is your advice to sell mostly based off the possibility of special assessments for older buildings?

The 1 bedroom at the Yates on Yates within the link you posted would provide potentially worse cash flow ($340K with 20% dp is still over $1500 per month with strata.) So if you rent it for $1400 it’s negative cash flow.

I appreciate all the feedback as deciding to keep this condo or not is a tough decision.

Yeah. Still debating whether it’s better to pick up a small condo or another SFH when the market bottoms out. SFH probably better appreciation but the absolute value is likely more than I’d be comfortable with at that point.

Valuations still make no sense for investment at this point to me, but I think we’ll get back there.

I think the biggest deciding factor here has to be skillset. If I was a carpenter, or similar, I would go SFH and add value via improvements. Maybe buy an older bungalow in the Oaklands area then add a garden suite and then after that pop a suite into the basement and you have a three-unit property.

But as a REALTOR® condos make way more sense for me. I don’t have time to deal with maintenance. If I want, I go onto the strata council and pick up a lot of re-sales in that building. I’ve helped a few of my tenants buy places, etc.

Yes, totally, the 2% wage growth is going to definitely make up for the 50% growth in house prices.

Would the 2% wage growth in the past 2 years even take care of the interest rate increases?

Market was flat give or take since 2010 so affordability had improved substantially before the 40-50% run up.

Population has grown, but inventory of core SFHs has remained fix.

I have all variable mortgages, but the rental income has gone up in excess of the interest portion of the mortgage. I just rented out my parents basement suite in the Oaklands area for $1,300; up from $1,000 previously. For someone who has a mortgage $300 does cover a decent clip of the interest.

Obviously SFHs in the core have had a huge run up and are unaffordable but you have a lot of factors working together to offset ridiculous prices. All I am saying is it buffers the downsize.

In my opinion for a substantial correction we need an economic shock.

Right now we are running at a 2014 sales pace with nearly half the inventory. Average SFH price in 2014 increased 1.79%. If anything plays out it will play out next year but as noted the longer it takes the more downsize support there is. What are the odds we see a few years of flat and then market dips in 2021?

Yeah. Still debating whether it’s better to pick up a small condo or another SFH when the market bottoms out. SFH probably better appreciation but the absolute value is likely more than I’d be comfortable with at that point.

Valuations still make no sense for investment at this point to me, but I think we’ll get back there.

$350,000 or more

Personally, I would cash out and just go for a larger SFH with a suite. I rent my suite out for what a $500,000 condo would rent out for; however, it maybe cost me an additional 50k to build? If that. Same applies to purchasing a home. Maybe you’ll pay an extra $100,000 but you’ll bet pulling out of the suite an equivalent of what a $300,000 condo would.

If you really wanted to stay in the condo game despite huge transaction fees, I would make a trade to something like this -> https://www.realtor.ca/real-estate/20452775/1-bedroom-single-family-apartment-1101-848-yates-st-victoria-downtown?

You would get $1,400 or so in rent, but your strata fees would be close to $200 lower and pretty much safe to say no special assessments for 15 or so years.

These are price/income ratios which is what the BD article talks about. You’re correct that absolute price declines are different.

They specifically mentioned monitoring principal residence sales as one of the areas so I think this was a significant chunk of it.

I enjoyed reading that, thanks a lot for writing.

My data has different values? Off the top of my head I think ’81 was -40.9% and I think 2010 was -9.9%? That was peak to trough, real prices. Were you using a different methodology/reference point?

Keep in mind that demographics should lean towards condos for a while now.

Yep. As interested as I am in real estate, I am 100% disinterested in my other investments. As soon as the money leaves my savings account and goes into my investment account (100% in VGRO) I completely forget about it. Research shows that has worked out just fine in the past with about 7% annual returns.

Yes, many things.

Well it depends on what you have for incomes and prices, but my data shows for Victoria corrections the following percentage declines in price/income:

1976: -12%

1981: -35%

1994: -17%

2010: -15%

Doesn’t look like a standard -30% to me.

Here’s the thing. I agree with the overall point that it would be difficult for prices to stay totally flat and have affordability ratios cycle back as I have written about several times. My disagreement is just that the article they wrote is not convincing at all, and the numbers they estimate in years of flatness to reach “support” are wrong.

Where I think BD goes sideways is applying these technical analysis tools from the stock market to houses. Technical analysis has dubious value in stock trading, and I suspect even less in real estate.

Not so sure about that. Looking at 60s condos that sold in the last 12 months and their long run annualized returns, it seems only those with substantial renovations can hit that rate. The more original condition places seem to be more like 2-3%. Depends quite a bit on the period though. One place went from $108,000 in 1993 to $106,000 in 2001, then to $210,000 in 2018.

wow .. seeing the ebs and flows of alberta and bc migration was kinda entertaining .. all correlated to oil prices 10k ish people migrated from alberta .. but in the early 2000’s .. 10k-ish emigrated to alberta

I wonder how much of this additional tax revenue was from tax cheats with undeclared basement suite rental income and capital gains from the sale of a house with a basement suite.

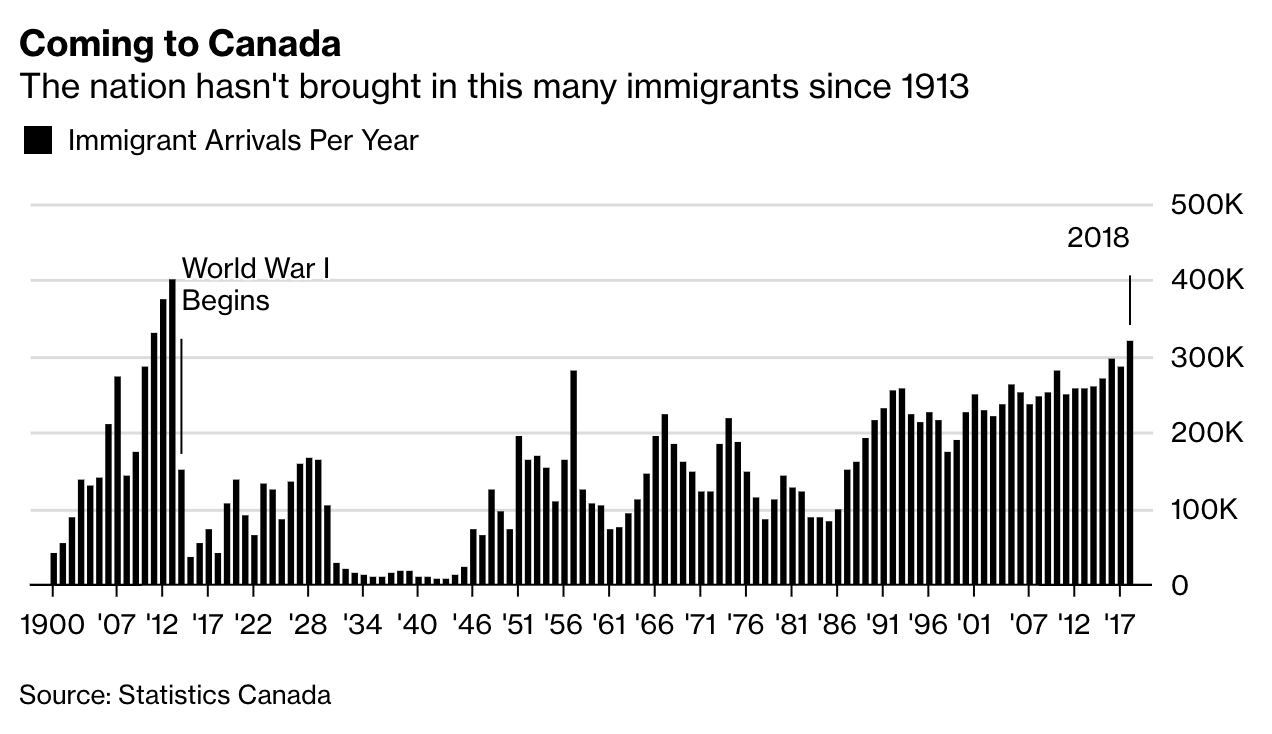

… also the RE crashes of 1912, 1929 matching immigration drops.

Here’s immigration to Canada going back to 1900. Showing us at a highest level since 1913! Note the dismal 80s for Immigration and RE. ?itok=0vlYkPh-

?itok=0vlYkPh-

Grant,

Ref October and stocks. Its called dollar cost averaging and it was a great time to buy. Those w/ DRIPs got some great deals, especially when you look at what happened in Jan, Feb, and Mar (so far).

You, yourself say we are nearing the end of a credit cycle. I would argue that real estate is more dependant on credit that the stock market is. (Dont have any stats to back that statement up though 🙂

Stocks have little to no maintenance (ETFs have low MERs) and the dividend tax credit makes it pretty sweet as well. I think anyone is a fool to only invest in one asset. That is simple diversification of ones total portfolio.

However, to each their own i guess.

Well yes, I take issue with the substance of the post. It is posting huge number of years like 30 that it would take to return to normal price/income ratios.

You could pick any graph to take “issue”, so let’s just pick the first one. They say it will take 32 years to lower the house price/income rate 42% from 7.1 to 5.0. And of course that’s graphed with a straight line, so apparently no need for compound interest here. Obviously a red flag, as compound interest is a big deal.

Issue is that

– at 3% income growth per year that would take 12 years to grow 42%, not 32.

– And at 2% income growth per year, that would take 18 years, not 32.

– and 5% income growth per year, that’s 6 years to grow 42% and get back to typical price/income. You might think it absurd that average income growth is 5% per year, but remember, the owner is getting older, and income rises with age/seniority. Ask yourself if your income has grown 5% per year?

I’m surprised to see some posters advocating diverting money from RE into this current stock market. Yes traditionally the stock market outperforms RE, but if we’re discussing assets that are long in the tooth, in my book the risks are far, far higher right now with equities. We’re nearing the end of the current debt cycle and the market can be ruthless and turn on a dime in a matter of days or weeks. This last October, oh boy! Do you have the fortitude to not sell those stocks when you see it going down hour by hour or day after day? The data shows many do not.

Stocks are not tangible, physical assets. They are liquid which may be important for some but serve no utility. Some speculate with real estate but commercial and residential real estate serve tangible functions and have value in and of itself.

If each of these assets are overvalued, I’d still stick with the real estate, especially if the location, location, location is right.

Depends how far back you go.

If you did it in the late 70s and the interest rate then goes through the roof, and you can no longer afford the house, you’re probably telling a different story.

Big house may mean more money and time spent on maintenance of the grounds and the structure.

Some people love doing that stuff.

Other people view it as a distraction from more important stuff like narrowly avoiding injury bombing down local mountain bike trails (as just one example).

Yes, that’s a great chart, and a longer time series would be good. Also provides a little BC connected history lesson, for example seeing BC immigration bumps for Vietnamese (boat people, 1975) and Hungary (revolution, 1956-57).

This is where I differ. If I could go back in time I would have bought the best house I could afford and moved up the property ladder as quickly as possible.

Looking at the stats, as long as you can afford it, 20% down on the house with the most potential that you can afford in the nicest area probably is going to have the highest ROI. I’ve been slow to act and analyze and I can look back and calculate the difference now had I made those decisions more quickly. It is significant.

Of course, once you have enough money, ROI is just another factor. And most homeowners don’t get that detailed about it all or focus on ROI and do just fine anyway. But you’re asking so there you go 🙂

Yeah I’ll see if I can find the source of the data. Not my chart.

LeoS

Is there enough data to extend that immigration series say…to the 70’s or 80’s and overlay that with the provincial housing market? Not sure if that would reveal anything, but I’d sure be interested in seeing what came out of it.

Aside from the “we’re so smart” part, do you take issue with the substance of the article itself?

Anytime someone says they have algorithms to predict real estate prices my bs detector immediately goes berserk. Better dwelling plays this card sometimes (we are super smart and important) but Ross Kay is probably the worst offender.

Best you can do is assess level of risk or estimate probability of direction of price movements. Even that is questionable.

We can provide a better finish for part of the better dwelling quote.

they don’t actually work.

@NE14T

We found ourselves in a similar situation. Renting the condo is tempting once you see that tenants will pay it all down for you. But as Totoro said, don’t forget you’ve got 150K tied up in the mortgage – i.e. opportunity cost. In 20 years that should double twice in an equity fund.

But more importantly, there’s a third option to consider: sell the condo and buy the cheaper house that meets your needs. Then invest the 150K…just because you can buy the big house, doesn’t mean you should.

Local time for you to just go buy a house. Deep down you know you are wrong and time to just bit the bullet. All the top bears eventually do and just disappear into home ownership fixer upper projects.

This article speaks to exactly your point. Quite eye opening, IMO…

Victoria Would Take 31 Years to achieve support at current valuations

“Victoria’s market has been running very quickly since locals convinced themselves they’re the next Vancouver (they’re not). To the point where the home price to income ratios rose a massive 32% in under 2 years. If home prices now stalled and waited for incomes to catch up, they would hit support in 2048 – 31 years from today…”

“…Yes, we have residential real estate forecasting algorithms at Better Dwelling. No, this was not based on any of them. It was simply meant to highlight that the probability of home prices staying flat, while incomes catch up has little to no logic to it. In no way does anything I’ve said explain what would happen, we’re just ruling out one possibility. Now that this has been ruled out, time to look at other more likely scenarios. Those are home prices drop, we ramp up the use of land banking, we become a nation of high priced landlords, or incomes make stratospheric climbs soon.”

Pretty sure Vancouver is looking increasingly instructive, but I digress.

https://betterdwelling.com/flat-canadian-real-estate-prices-incomes-catch-nope/

Most likely. The 1960s condos have more than doubled in the last 20 years. All he needs is an average (non-inflation adjusted) rate of 3.88% per year in appreciation to double the value in 20 years. The actual long-term average for condos is probably more like 5-6% not adjusted and 7% for SFHs.

The real question is whether this is the best place to put the money given that houses have outperformed condos consistently and the tax advantages offered by a primary residence with fee simple ownership. Probably not unless there is another compelling reason like he wants to hold it for a child’s use in future.

@guest_57783

Good point on the additional rentals coming onto the market soon.

The condo has nearly doubled in value in the past 3 years so doubling again in the next 20 years doesn’t seem too crazy but it’s hard to tell for sure.

@NE14T you gotta take into account that there are a boat load of rentals coming on the market this year. 10 times more than normal.

Also, you think a $350,000 condo from the 80s is going to double in the next 20 years?

Yes, totally, the 2% wage growth is going to definitely make up for the 50% growth in house prices.

Would the 2% wage growth in the past 2 years even take care of the interest rate increases?

This data is likely skewed by the students making less than $12,000 a year buying mansions in west van.

Which is why my first choice for investment purposes would be a duplex or triplex unless you hate sharing a wall, which you seem ok with as you are planning on a suite.

If you have a condo and a less expensive house you are paying two sets of maintenance costs/strata fees/transaction costs in a market where the only reason you are breaking even, if you are, is because you have 150k invested on the condo already.

150k conservatively invested will bring you 6k a year in and of itself so long-term appreciation and net rental income must meet or exceed this net of all costs to even consider keeping the condo – and you don’t have to actively manage stocks.

With a SFH and suite or multifamily you live in everything is close at hand and ownership costs are not doubled, plus owner occupied gets better rates for lending and you can claim the capital gains tax exemption on the % used by you.

Marko is the right guy to ask about condos. I’d listen to him.

I’m probably one of the right people with local experience you could ask questions about multi-family if you have any. Make sure you understand ROI and all that goes into it (maintenance, income taxation, property taxation, financing, market, landlord issues…)

If I were you I’d consider selling the condo, putting 20% down on the best multifamily you can afford, and invest the rest in the market. That way your mortgage interest will be partially tax deductible and all your money won’t be in one asset class. In particular, maximize your TFSA and RRSP if you have not already.

$1600 for a 2 bedroom condo in the current market indicates to me that it is an older building and most likely outside of downtown. I would just cash out, the probability of you getting hit with a huge strata bill for repair is probably higher than the condo appreciating further.

@guest_57806

“What do you figure the condo might be worth?”

$350,000 or more

The mortgage remaining is 180k. The two-bedroom condo could be rented for $1600 per month from what I’ve seen with comparable condos. Possibly higher…? With these numbers I am wondering if it’s worthwhile to keep or sell for the equity?

Amount on the mortgage is kind of irrelevant. What do you figure the condo might be worth?

@guest_57806

You’re correct in that the elevators will need repair/replacement eventually. The depreciation report has these events covered however they always seem to come sooner than expected.

The mortgage remaining is 180k. The two-bedroom condo could be rented for $1600 per month from what I’ve seen with comparable condos. Possibly higher…? With these numbers I am wondering if it’s worthwhile to keep or sell for the equity?

Recent studies have found that immigrants to Canada value and are more determined to own housing than native Canadians. In Toronto and Vancouver for example, recent Chinese immigrants already have 73% home ownership rates in Canada, higher than Canadians (67%) and much higher than Millennials (even though recent immigrants are also young). They don’t arrive in Canada, and then start waiting for a housing crash before buying.

https://vancouversun.com/opinion/columnists/douglas-todd-canadas-immigration-targets-a-form-of-housing-policy-says-study

“Most immigrants show greater determination than Canadian-born citizens to buy housing in Canada’s three major cities, said Hiebert, who also studied buying and renting patterns along ethnic lines.

The elevated home-ownership rate among ethnic Chinese immigrants in the expensive cities of Vancouver and Toronto is “striking,” Hiebert said.

The discovery that most new Chinese immigrants can afford to buy housing within a few years of arriving in Canada — at a rate higher than the overall Vancouver average of 69 per cent — supports numerous reports that have indicated many new immigrants from East Asia are making their purchases with large amounts of capital earned in their homelands.

Recent Chinese immigrants to Toronto and Vancouver have a home-ownership rate of nearly 73 per cent “and a propensity to dedicate a very high portion of their income to housing.”

I mean, the sales data totally illustrates how we are being bombarded with wealthy people right now buying up all our dwellings. Sales are at all time highs.

The thing is immigration, all the government/VIHA/UVIC/military/etc., jobs in Victoria plus their 2% annual wage increases help the market stabilize without a huge drop. Sales have been dropping for 3 years now, but in that time a lot of people have seen a 6% increase in their wages. Heck even a few 100k+ jobs have appeared out of thin air -> https://www.timescolonist.com/news/local/helps-gets-ok-to-hire-adviser-for-mayor-s-office-130-000-salary-challenged-1.23522968

You have the market decling ever so slowly (in terms of prices) and if you have population/wage growth every so slowly as well the two slowly work their way towards improved affordability….kind of like the 2010-2015 flat market we saw. It never tanked depsite poor sales and massive amount of inventory. Right now we just have slow sales. If it takes another year for inventory to build that is another year 2% wage growth/inflation eating into the affordability issues we are seeing.

It’s a two bed in an 80’s building near Rutledge park. Large square footage. Well kept building.

No matter how well kept doubt your elevators are new, etc.

For the numbers to make sense it has to be super small -> http://victoria.citified.ca/news/stay-small-a-guide-to-buying-an-investment-condo-in-victoria/

and my video from 4 weeks ago -> https://www.youtube.com/watch?v=DAz_1KGS-hY&t=1s

Oh crap. Tons of wealthy immigrants are coming here and buying all our real estate. I fear i might miss out on a great opportunity and therefore should totally run out and buy another right now. Hell, it is such a great investment i might just pick up two.

I mean, the sales data totally illustrates how we are being bombarded with wealthy people right now buying up all our dwellings. Sales are at all time highs.

Buy now or be priced out forever folks by those immigrating here who have tons of cash. You’ve been warned.

@guest_57808

I’m general, deploying equity into a single family home will be superior to a a condo because it is the land that appreciates over time, whereas the building depreciates. In a SFH the land is a larger component of total value.

Also you are talking about an 80s condo and an investment timeline of nearly 20 years. Look at 60s condos now and think about whether you would like to own one, and what special assessments you might be paying for over the next 20 years (read your depreciation reports).

@guest_57806

It’s a two bed in an 80’s building near Rutledge park. Large square footage. Well kept building.

@Leo S @guest_57775

The main driver for wanting to keep the condo is that when the mortgage is paid off in 18 years it will be worth a pretty penny (maybe 500 – 700K). The idea of someone else paying this mortgage is the compelling piece as it is the only investment that someone else will buy (pay mortgage) for me.

The downside of buying a more expensive house is that a ton of our capital would then be tied up in a single asset.

I appreciate the thoughts and welcome more.

1) Keep the condo and rent it out (rental income would be positive or break-even cash flow) and buy a house.

Can you describe the condo? For example if two bed in a 1990s building I would unload for sure but if a studio or one bed downtown in a concrete building I might keep that.

Would need a ton more info to evaluate.

Indeed. The data is pretty clear on this. The Canadian census data on immigrant vs non immigrant incomes consistently shows immigrants to Canada as a whole continue to earn less, often notably less, on average than their non-immigrant counterparts…

Leo is right that it is hard to know without a projected cap rate.

If this is currently your primary residence you may wish to sell in order to have tax free gains. If you are considering a house with a suite you may just want to put the money into a purpose-built legal duplex or triplex instead. That is what made the most sense for us given the ROI on condos vs. freehold.

If you have additional funds left after this I’d personally invest in stocks rather than a condo in Victoria.

Trudeau policies putting this country at risk. Rating agencies chiming in.

Productivity in this country in brutal. It is a tax and spend and the end will be ugly if it continues. For those of you who lived through the other Trudeau mess you will remember how ugly it can get.

https://www.bnnbloomberg.ca/fitch-issues-warning-on-canada-s-debt-1.1232456

Hard to say without knowing if the “better” house is just a luxury or a better location that is likely to retain value and appreciate more.

However I would always go for 2 unless the cap rate on the condo is compelling. Break even is not an investment in my books

If this is the case on a large scale then we will see it in the income data. Definitely one way to correct affordability is for incomes to rise

Looking for opinions.

Currently own a condo with about 150k equity and would like to purchase a house. We can afford to buy a house (with a suite or build a suite) if we keep the condo. However, because Victoria real estate prices are stupid high if we sell our condo we could buy a more expensive house (bigger, better neighbourhood etc). The condo will be fully paid off in about 18 years.

Options are:

1) Keep the condo and rent it out (rental income would be positive or break-even cash flow) and buy a house.

2) Sell condo for more money towards a “better” house.

Wondering if anyone else is in or has been in the same situation…

International migration has underpinned growth in recent quarters, offsetting weakness in net flows from other provinces.

Net interprovincial migration has trended lower since peaking in early 2016, but the third quarter of 2018 was the first time since early 2013 that B.C. lost more people than it gained (down 1,217 persons). This trimmed the latest four-quarter period gain to 5,474 persons, compared with the increase of 15,186 persons observed in the third quarter of 2017. B.C. has seen a downward trend in people moving into the province – particularly from Alberta and Ontario – and an upward trend in people leaving the province. Improved economic conditions in other provinces and affordability factors may have played a role in this trend.

International migration trends have been much brighter. Since bottoming in late 2016, the flow of international immigrants moving permanently to Canada has risen strongly and the number of non-permanent residents has surged. The latter includes those on work permits, students and, to a lesser extent, refugees.

Four-quarter net international migration reached 59,466 persons compared with 42,787 persons in the third quarter of 2017.

https://biv.com/article/2019/01/bc-population-rises-above-five-million

Booming numbers for net immigration, this year both to Canada and BC.

Defintively seeing it on the ground. This week two accepted offers with young couples that have been in Canada for less than 24 months. Both have >20% down. One couple is buying with 50% down (worked on cruise ships for 10 yrs and banked their earnings).

It’s not just immigration but the way the system works. The younger you are and the more education you have and the better your English is the better your chances of your application being approved. Then you also have to prove you have 10-20k CND in a bank account in your country of origin depending on size of your family so what you end up is with immigrants showing up that are quite capable with some money. If you are able to save 10-20k in a country with a poor economy your saving rate in Canada is likely to be solid.

Booming numbers for net immigration, this year both to Canada and BC. About 50k to BC in last year. Canada’s population rise of 518K is like adding a new city. Very kind of our bears here to hold off house buying, allowing the new immigrants first dibs.

https://www150.statcan.gc.ca/n1/pub/91-215-x/91-215-x2018002-eng.htm

* On July 1, 2018, Canada’s population was estimated at 37,058,856, up 518,588 in the past year (2017/2018).

* An increase of this magnitude has not been seen since 1956/1957 (+529,200), a period characterized by the height of the baby boom and an influx of several thousand Hungarian immigrants.

* Canada’s population growth rate of 1.4% last year was the highest since the early 1990s.

* In 2017/2018, Canada’s population growth remained the highest among all G7 countries.

* Last year, Canada’s international migratory increase was the highest ever recorded (+412,747), surpassing the peak of 320,750 set in 2016/2017.

https://galleries.data.gov.bc.ca/56610cfc-02ba-41a7-92ef-d9609ef507f1/

Provincial level migration data if you’re interested. Net interprovincial migration seems to have turned negative in Q3

awesome .. found it .. … was interesting to see female participation in part time is doubled from men part time… ..

might be a winter thing … but construction employment dropped a few %… we should keep an eye on that for the next few months ..

.. weird to see employment goes down while unemployment goes down ..

possible explanations: emigration out of province, or more % of people got older so they get excluded from participation rate therefore unemployment calculation goes down … while young people does not come to the island (15-24).. evidence seen from every fast food restaurant looking to hire people ..

Labour force survey. Various tables on Cansim. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410029402

Local Fool: not actually sure where the inter municipal migration data is, if such a thing even exists

hey leo, where do you find the source of employment rate? i am just interested .

Is there any recent migration data?

This is what I was talking about last thread. Big drop in employment rate recently, even though no corresponding increase in unemployment rate.

People are deadline driven. Let’s see what comes in end of the month.

As of March 19, with 12 days left, only 84% have declared so far for the spec tax. To me, it looks like a slow motion train wreck, seeing that only about 2% are expected to be subject to the spec tax. But the govt declares that number as “encouraging”. Time will tell. Reportedly people declaring by phone are on hold for up to two hours (likely more “encouraging” news, and I’m sure offline people will be happy to be on hold for two hours every year ).

https://www.google.ca/amp/s/globalnews.ca/news/5072947/speculation-tax-forms-not-filled-out/amp/

“According to the B.C. Ministry of Finance, 84 per cent of the around 1.6 million homeowners in areas covered by the tax have filled out the declaration.

“I’m encouraged to see that over 80 per cent of property owners have already declared their exemptions. That’s great progress,” B.C. Finance Minister Carole James said.”

I think the March results for sales of detached homes in Vancouver will officially move the LM into bloodbath teritory. Victoria, delayed as usual, will have its bloodbath next spring.

Property tax rate in Austin is about 1.8%. That’s over 3x the rate in Victoria. Texas has no state income tax and some of the highest property taxes in the US.

Not that I’m knocking it, I think BC should have lower income taxes and higher property taxes. As I’ve said before, the present tax regime encourages speculation and underutilization.

Why bring Trump into the discussion?

There seems to be quite a bit of “hyperbole” out there today, holy and otherwise. The figure of 700 billion is being bandied about which Josh and his cohort will be on the hook for. That’s a lot of avocado toast.

https://nationalpost.com/opinion/kelly-mcparland-trudeaus-next-apology-should-be-to-heavily-indebted-future-canadians?video_autoplay=true

Been interesting to watch that, as the banks to date haven’t exactly tracked those movements down in their rates 1:1. Could be a balance between building in a risk premium versus grabbing more share of a dwindling number of buyers.

You tell me, is the market pricing in a recession good or bad for the housing market?

More bad news for housing. 5 year Canadian bond rates have gone from 2.5 to 1.6. At least I think its bad according to the bears.

Great news for my mortgage renewal.

LeoS: There is a lot fundamentally wrong with that; principally that house prices will bump up to absorb most of that lost equity. Still you are right that there is nothing fundamental wrong in terms of RE commissions.

US Fed just capitulated, anticipates no more hikes in 2019…

Josh: Don’t worry Josh, we will think of even more ways for you and your wife to pay for other peoples’ housing. Don’t even think of moving to somewhere like Austin Texas like my friend who moved his whole tech company there. (Take a look at Zillow for 500k houses in Austin and you might get an idea why he has some happy employees)

Holy hyperbole Batman. The plan does no such thing. It may be of limited use, but it isn’t some predatory evil scheme. You’re just giving up some ownership to buy in earlier than you perhaps could have. Nothing fundamentally wrong with that.

Suppose you encounter a relative today who proudly announces they have found a financial product which will finally enable them to buy the long-desired home. It is a mortgage which requires no downpayment and the only payments required are a token amount towards the interest. At such time as death comes the principal will be more than double what it was initially but he is not concerned – his children can deal with the fallout.

I think you would have words concerning the new plan.

Yet…. have a band of gurning frauds in Ottawa announce the same plan for the entire nation, kicking the interest grenade down the long corridor of your children’s working lives and future tax bills and what do we get? Sage forum posts about the relative merits of the candy in the debt piñata.

Did the nation with the most grotesquely unqualified leader become so-encumbered because it is the nation with the most grotesquely unqualified electorate?

Borat voice High five!

The federal government’s message to the RE industry yesterday:

Question: Will most time shares be subject to the spec tax (assuming that they divided in such a way that nobody has a six month tenancy in them)?

The govt example of the shared equity being a good thing is for a $400k house with a $20k downpayment needing a $380k mortgage , or a $340k mortgage with the $40k shared equity. Problem is that example assumes that prices don’t rise because of this govt equity idea,

The thing I don’t like, is that it’s just as likely that the FTB is going to end up paying more than $400k BECAUSE of the shared equity being available, and the worst case is he pays $440K, and ends up owing $420k ($380k mortgage +$40k equity) instead of $380k total he would owe in the good old days before shared equity.

In other words, for buyers there is good and bad (perhaps higher prices) in this shared equity thing, and I think the bad is worse than the good.