April: Lower sales, stable prices

It’s springtime, which means that coverage seeking to spin the market numbers in a positive way will talk about sales going up compared to last month (+9%). That’s a figure that’s about as meaningful as observing that the grass is taller this month and concluding that this year’s farm crop will be better than last. As you well know, month to month changes in sales figures are primarily dominated by seasonal effects, so to get a useful picture you need to look year over year (sales down 10%) or seasonally adjust the data.

I’ve grown increasingly fond of seasonal adjustment, given it is an effective way to see changes in the trend without the lag built in to year over year comparisons. Looking at sales, we can see that not much changed in April relative to March, with single family sales flat while condo sales took a small dip. Single family sales are bouncing around near their multi-year lows, while condos are doing somewhat better, in the lower third of historically normal activity levels.

New listings, although the series has been a bit noisy lately, seem to be roughly unchanged, and averaging about 800 new properties coming online every month for the last 5 years. That’s still down some 20% from the levels we saw in the previous 5 years (2008-2013) but doesn’t show any immediate sign of changing.

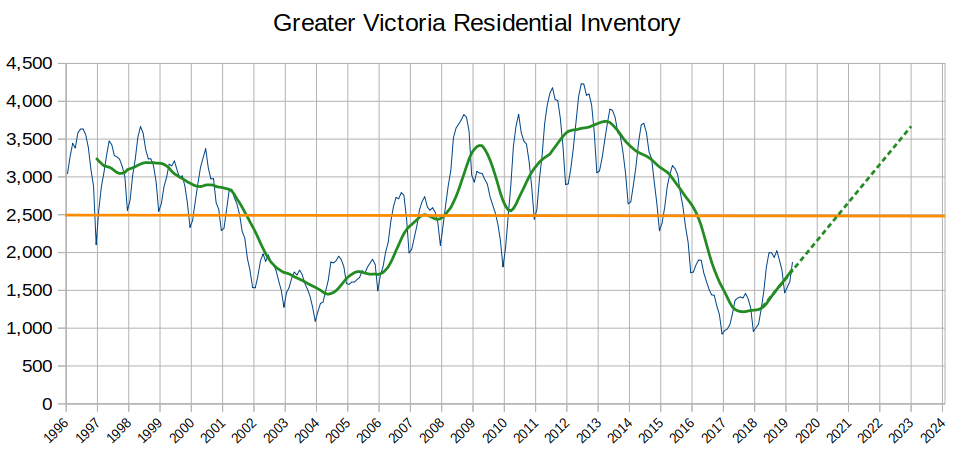

As you can see, despite sales being near multi-year lows, inventory is still nearly 40% lower than the last peak. That’s the reason that prices have remained relatively stable so far after a small pullback from the overshoot caused by the overheated market of 2017/18.

This can be seen more clearly on the months of inventory chart. Normally one wouldn’t expect price declines to occur until months of inventory was higher than 6 or 7. I believe the fact that we have seen some pullback in single family pricing already is more due to the shock to the market changing and over-market sales in the superheated market than something that is as of yet sustainable. The market will very likely keep cooling down, but don’t be surprised if prices stay stable until that months of inventory climbs further.

Sure enough, prices in April were more or less flat again. The single family median price rose to $816,000, substantially above the low of $750,000 that we saw in January. What does that mean? Just as much as when the median price declined from $830,000 in October to $750,000 in January: essentially nothing. Changes in month to month sales numbers are determined primarily by seasonality, and month to month price changes are determined primarily by noise.

I still find the steadyness of the trend remarkable if you look at the 12 month months of inventory (green line above) the line’s slope has been nearly constant for the last 18 months. The same is evident in sales/list ratios.

I know it’s ironic that as the owner of a blog where I wrote 51,893 words on the minutiae of the market last year I am telling you that the day to day, week to week, and month to month numbers aren’t really that important, but that is the reality of real estate markets which move very slowly. What’s important in order to make well informed decisions in real estate are knowing which few key metrics are actually significant, and how to match the level of risk in the market with your own risk tolerance and life situation.

Right now, if you want to pay less than the going rate for a house, you have two options:

- Wait and see if the cooling trend continues until broad based price reductions take hold. I do expect this to happen but of course no one knows the future and in the end it’s your house, not mine.

- Pay very close attention to the market and find the motivated sellers and overlooked properties. Those generally appear once market activity dies down substantially (October-December) but could be at any time.

Yeah I saw the smoke from up in Saanich. Crazy.

Monday numbers: https://househuntvictoria.ca/latest

Big fire downtown.

Yes, I’m also getting a little tired of those runny-nosed, high-pitched losers that can no longer afford to put a roof over their kids heads because, back in 2013-2014, they did not have the presence of mind to see how foreign millionaires, criminal gang members and greedy speculators in Vancouver were going to run up house prices all throughout the west coast of Canada, way out of proportion to the wages that people earn, and faster than any RE market anywhere on Earth, except for maybe Hong Kong. They remind me of those sad-sack lepers in Ben Hur who came begging on the street for food and money. Oh, the filth. Why don’t these jealous, unwashed smidgeons leave us lucky winners alone. Geez, I wish they would just pay our monthly OAS and CPP benefits and the shut the %$#!?* up.

That feeling of being envied is a mirage caused by an abundance of smugness.

To be honest, your opinion doesn’t really sound too humble.

@guest_59167

So basically a place that had been on the market “a while” all of a sudden had two offers in place. They went for the best deal but who knows if it will hold up. You did the right thing Josh, there will be other places and you will find the home you are looking for if you wait it out.

That was our first offer. We had been interested in that place since they first listed. The selling realtor contacted ours to say they had an offer and so we prepped our own. We went with a blank offer which had an addendum which invited the seller to fill in $5k higher than their next bonafide offer, and we would have 15 minutes to accept or reject their price. They way I saw it, that’s basically the same as a normal offer but theoretically, the risk of overpaying is smaller (they’re not legally obligated to stay under $5k over the next offer), and I get more information from their response. The sellers were a bit sketched out by that and just wanted us to fill in an amount. So we did, they wanted to work with us over their other offer, but they countered and there was still a pretty big divide between our numbers. It was very easy to decline (while laughing).

We’ve been to see 6 or 7 other places, all of which had some kind of deal breaker, but it was good to better understand what exactly we were looking for. I thought I had a pretty good grip on that but it needed refinement.

Depending on the upgrades done by current sellers of 208 Govt, they may have taken quite a beating. BC Assessment lists it as a 2 bed, 4 bath – suggests that they put the suite in it recently.

I’d be very interested in hearing about your experiences in the market if/as you put in other offers.

In this scenario, if you had 20% down on a 3% mortgage, you’ll have paid $203,270.77 in interest. Which means you paid $3360 a month in just mortgage interest plus losses. You’d be way better off renting for $3360 a month.

It seems the FI has taken a cue from its role models south of the border and now finds it unnecessary to get even basic facts straight. Hint: I don’t mean the taxes.

Man you guys type a lot. But you all know the stuff I would reply with if I kept up anyways 🙂

Made an offer on a place today. They countered with 98% of ask and we declined. This place has been the market quite a while and they (should) know for sure that it’s plainly not worth their ask. Shrug, we’re definitely not heartbroken.

I’m under the impression that our demands and budget are reasonable, but it’s surprising seeing what’s problematic. I didn’t think that a master bedroom which can fit a queen bed and a dresser, and a kitchen with that can reasonably cook a turkey dinner would be asking for the moon, but it seems to be. In the time that I’ve been paying hyper-attention to our kind of product, anything reasonable is still selling pretty quick. The annoying thing is that while I qualify for something in the semi-detached range, I’m just not comfortable with that kind of leverage, which means I’m competing against everyone for the bottom of the market which still pretty warm.

And now I brace for everyone telling me 1 of 2 things:

1. “what are you doing, you should be waiting, make the sellers SUFFER!”

2. “You had the chance to buy and didn’t take it!? You idiot!”.

Not a good analogy. A realtor is not an financial advisor in any sense (in fact I think they are required to disclaim being one) but simply a commissioned salesperson. Of course they can and should supply you with any material facts on hand but their job is not to advise you whether any particular property is a good investment.

Yes I have been watching this one since last year, it is very much what I am in the market for. Not on that street though, so it was just out of general interest that I followed it.

It was sold to flippers in March 2017 and has been on and off the market since then. Rented out for 6 months over Christmas and then back on early this year. The buyers in March 2017 paid $820,000 so I guess with a sale price of $865,000 and the costs of buying and selling their profit was not great but they may have made a few dollars.

Thanks!

So the 6000 units under construction currently should have an even more outsized effect on actual inventory. Where do you find the number that are commericial?

Only if you sell that paper loss would realized. However, most people that don’t have to sell would live in it or hold on till better market condition as history shown that most owners held on to their houses through the 80s.

IMHO, many first time home buyers have too high of expectations and are whining/hopping for a market crash so they can jump in. They are envious of homeowners as they felt that they missed out the recent housing lottery/run up.

Do you know I’ve paraphrased you a few times on this line you once said, something to the effect of,

“Markets remain irrational longer than anyone thinks, including the people who say that.”

So perfect…

$998,000

Most people would only see it on their assessments. Wouldn’t be surprised if we see assessments decline this year. But that is a very laggy measure indeed.

Will people feel particularly bad about it? Well maybe recent purchasers. I definitely see the opposite case where people get renovation or upgrade fever when they see how much their assessment jumped. Seeing it drop will likely put a damper on reno spending.

Really not a big deal. The cube closed because it wasn’t attracting new business. AR companies are now all over at Launch Academy.

There is a certain privilege that comes with making good money. One is being able to swallow losses and see a $200k loss as a mild inconvenience.

The flip side is that because you stretched for the mortgage you’ve had to work a high stress job to make ends meet and couldn’t take that promotion in Vancouver because you couldn’t afford to sell.

That’s why it’s an individual thing and everyone needs to weigh the risks and rewards themselves. Not everyone has the privilege of being able to regard 6 figures as essentially a rounding error.

Yes, I think my point is that once something becomes a speculative bubble it becomes impossible to predict when it might pop because there’s nothing to go on. The best anyone can do is point at it and say that it no longer reflects fundamentals.

While true, this is essentially useless as a prediction. Ben Rabidoux made many of the same and very well reasoned arguments 10 years ago for Vancouver. Falls under the problem of markets remaining irrational for much longer than anyone expects.

Sorry the chart wasn’t up to date to April.

Res inventory: 2171

Total inventory: 2751

What pay raises? BCGEU pay raises have been less than inflation going back a decade now. There were 0% years in there.

Deb

Sorry, no secret squirrel info, I only have PCS access. Interesting to see 208 Govt went well under assessed @ $1,038,000

That is the crux of the matter. If you buy a house for the long term as a home and factor in rate increases and your cash flow is still solid then there should be no problem.

We shot for keeping housing at max ~25% of our net income and are fine if our mortgage payments go up by 50% (not ideal but wouldn’t change quality of life). We would have gone with a condo or kept renting if we couldn’t meet those conditions.

We could comfortably afford to stop renting our basement suite, but we’re happy making do with the 1,000 sqft 2br upper that we have. It’s plenty of space for 2 adults and a kid, and we’re happy to help Victoria have another rental unit.

@guest_59224

Thank you for the selling price. Any chance you can tell me what the original asking price was in 2018?

CNBC is reporting that despite what the Trump administration has been saying, tariffs on $200B of goods goes up to 25% on Friday. They are also reporting that 25% tariffs on an additional $325B worth of goods will come into effect soon after.

https://www.cnbc.com/2019/05/05/trump-says-tariffs-on-200-billion-of-chinese-goods-will-increase-to-25percent-on-friday.html

That’s a fair point Patrick and Caveat. My friends and I are certainly more financially inclined then the average person so maybe I projected my own feelings. Perhaps a lot less people would be concerned with a 10% drop after purchase then me or people I know because many wouldn’t even really know. It’s hard to say. But I do know how I would feel.

We can get cheaper housing by either increasing supply or decreasing demand in Victoria.

DECREASING DEMAND: If BC’s economy goes awry, and government revenues fall; than the public sector should feel the pain. Assuming 50% of economic activity in Victoria is attributable to one form of government or another, that would be PERFECT for HHs. Imagine if the government would decrease their headcount/pay raises pari passu to revenues, HHs would have much less competition for homes!

https://www.fraserinstitute.org/blogs/bc-budget-2019-a-missed-opportunity

The province now has the ninth highest combined federal and provincial personal income tax rate out of 61 American states and Canadian provinces.

And over the next three years, net debt is expected to grow almost 25 per cent, not including program increases

https://www.theglobeandmail.com/canada/british-columbia/article-cut-adrift-bcs-tech-sector-sees-government-support-dry-up/

“The consequences were clear. Everyone was aware in the absence of government funding, we’d have to close the Cube, to let people go and tell all these thriving companies that they are going to be disrupted,” BC Tech Association president Jill Tipping said in an interview.

https://www.fraserinstitute.org/studies/comparing-government-and-private-sector-compensation-in-british-columbia-2017

British Columbia’s government sector workers (from the federal, provincial, and local governments) were found to enjoy a 7.4 percent wage premium

I don’t care what it’s “worth” X years from now, over-leveraging and excess indebtedness affects a family today and through the entire amortization period and beyond. In fact, excess debt and resulting financial pressures have long been known to be one of the most powerful and destructive forces in families and relationships.

Because a mortgage takes priority in the family finances above almost everything else, you can’t trivialize its impact on your family’s ability to flourish in ways that disposable income allows you to. If I was a child, I don’t think I’d even know enough to care whether my parents owned or rented.

I’d definitely care if them owning meant they had little or no money available to send me to soccer camp, go to Disneyland, help me get a car, or go to university. I wouldn’t be thinking, “Yes, my parents are downstairs fighting nonstop about their strained finances and might even get a divorce, but thankfully I live in a decent place in a decent neighbourhood.”

It’s a mess in BC. The only thing our parents seem to have been doing is pulling HELOCs so their kids can go buy more houses, and/or, the kids stay with them till they’re in their 30’s. The rapid indebtedness and vulnerability of consumer finances is very visible in the data and the BoC has repeatedly sounded the alarm on the effects of all of this newfound debt on families, as well as our abysmal savings rates. This unwinding isn’t going to be pretty, but unfortunately, the alternative is much worse.

I don’t think that would help at this point, but I’m only guessing. The downward trend is already getting too firm and the buyer in BC is too tapped out at this point. FB’s would have to utterly dominate the marketplace on a scale much larger than ever before, and that’s not happening any time soon. Incidentally, China has apparently just squeezed its capital controls a little tighter, by lowering the amount of US dollars their citizens are able to withdrawal. This does have relevance to Canada as a lot of Chinese capital flight starts as USD…

https://www.scmp.com/business/banking-finance/article/3008795/chinese-banks-quietly-lower-daily-limit-foreign-currency

There’s been a few people observing that when the market activity and subsequent price explosion occurred in Vancouver, it travelled over to Victoria, and sort of worked its way up the Island. The unravelling of it all seems to be working a similar way.

I’ve posted several tables from the VIRB showing the precipitous drop in sales volumes, but prices have been more mixed. Some places have had to cut to sell but most have still seen pretty notable YOY gains. That growth isn’t going to persist in the face of consistent volume declines, however.

I tend to agree. But:

1) Most people don’t even track their house value that carefully, so if the loss is not that big a lot of people won’t even be aware that they have something to feel bad about.

2) No matter when you buy, you have to accept some risk that the house will decline in value right off the bat. Now way be riskier than many times, but that risk ALWAYS exists

Ford prefect

I’m watching the Cumberland market quite closely and am seeing lots of reductions -some places cutting prices by $50k and still not selling.

The houses that are selling are often bought as investments and show up for rental not long after.

I think the right sized house with renos will still sell fast there. Anything else less so. Seems like the sellers need to come to terms with the reality of the market right now.

The message that British Columbia real estate is dropping in price does not appear to be getting through in the Comox Valley.

Case in point, 3 bed, 3 bath home, built in 2014 in Cumberland.

2593 Kendal Avenue

Assessed $563

Sold: Jan 2017, $491

July 2017, 518

Mar 2019, 611

Freedom_2008, that was an interesting anecdote regarding the Abbotsford couple. I live in Vancouver and there has been a lot of hype about the Fraser Valley market going strong.

I have an anecdote to share from this morning. My wife’s friend decided to sell a 2 bedroom 1 bath condo in Vancouver in a nice area. The realtor suggested a listing price and my wife’s friend pushed the realtor to list it $50k lower than that (sub $700k), hoping for a quick sale.

The place has been on the market for a couple months, and they have had 25 showings. They have not had a single offer. Apparently the buyers are saying they are waiting as they anticipate lower prices (potential self-fulfilling prophecy). Two years ago, apparently everything in the building sold within a week at a higher price per square foot than he is asking.

The narrative about this decline continues to shift. First the pumpers said Vancouver prices would never decline. Then they said only the luxury market would decline. Now people are seeing East Van SFHs go way under assessed and under $1 million. And some condos are down over 10% with big supply coming on stream. The pumpers are looking progressively less credible in the public’s eyes.

Here’s what I think – in the next 12-18 months the prices in the Vancouver suburbs are going way lower, the condo prices are going way lower, the Fraser Valley prices are going way lower, the Okanagan prices are going way lower, and Victoria prices are going way lower. Even today the prices all around BC are largely insane (if you are actually a tax-paying Canadian). The foreign money is no longer chasing Vancouver property (for now) and the ripple effect is of this change is moving outwards throughout the whole province. I think the only thing that could save the market would be a return of foreign buyers in a big way.

For those of us hoping to buy, keep in mind what it really means to save $50k, $75k or $150k. For most of us those amounts will be debt at a mortgage rate of 3%+. Then, to pay off the debt, we need to get our income through the gauntlet of the Canadian tax system and all of our ordinary living expenses. It’s no exaggeration to say that getting a $100k discount could mean retiring 5 years earlier, less stress and better health. Why do people minimize these consequences?

Deb,

208 Government sold for $865,000

“there’s way more to owning a house than making money on it”

You’ve finally written something worth reading. Congratulations, Patrick.

Fair enough. It’s interesting to read other people’s opinions on these things.

Patrick, the whole point was to say someone who loses value in a home in a quick fashion is going to feel bad about it. Thats it. It doesn’t matter if they are healthy, have a family or whatever, losing money – or asset value – feels terrible. Of course you can look at people with worse lives, or the fact that you are still healthy or whatever but guess what – you presumably had those things a year ago when you bought the house so who cares? Thats like saying anytime something bad happens in your life you shouldn’t feel bad because you have good things too. Thats not how people work. So yes, if i look into a crystal ball and see a bunch of things are are NEW to me the house price might not matter. But guess what – if tomorrow i buy a house in Victoria and a year from now its worth 100k less i’m gonna think ” darn, probably should have waited a bit longer” – regardless of the fact that i have a wife and kid and job i’m happy with.

Anyway – you’re throwing all these extra points in when it comes down to the fact that losing money (or the perception of lost money) even if temporary, doesn’t feel good. Forget about dragging kids to rentals, or gypsies, or family – losing money on investments, assets, or just out of your wallet sucks. Can you compare a million different scenarios where you would be worse off? Sure – but you’re only living in one. Thats all i was saying.

Can anyone tell me what 208 Government St sold for. Thank you for your help

Rush4life,

If you looked into a crystal ball today, shown to you by a gypsy lady at Fisherman’s Wharf, and saw yourself in ten years.

And the crystal ball shows in 2029……you have bought a $1m home in Fairfield in 2019, but that house is only worth $800k in 2029. And you see that you and your wife have 2 more kids in 2029, and the family have all grown up happy and healthy in that house in Fairfield, and your kids are going to elementary school there.

Do you look at that gypsy lady and say “oh no, that’s terrible! ”

Or do you say! “two kids, everyone is healthy, we’re all living in Fairfield ..that’s my dream…awesome!

… the point being there’s way more to owning a house than making money on it.

Ok, so you’d feel terrible about your paper house money loss. And if it’s the only thing going on in your life, you’d likely feel overall terrible. But what in the meantime your family has grown and you have 3 healthy new kids, and a stable family life in a nice neighborhood. Do you think you’ll overall feel terrible?

What do you say to your kids if you dont buy, and instead you’re dragging them around to new rentals as they grow up, because “daddy doesn’t want to feel terrible about potential paper losses, so he won’t buy a house”.

Sounds healthy.

In other news, I’ve doubled my weight in the last 10 years. #healthKick

I guess you’re just not a numbers guy.

There appears to be a common driveway at the back of the building. Is the driveway strata-titled?

Patrick I disagree with your assumption that they wouldn’t care about buying for hundreds of thousands more than their home is currently worth. I think most people would care in fact. People brag on the way up when their home gains equity like crazy – which if people were purely logical like u r implying they wouldnt care as prices can fall just as fast – – and on the way down when your losing it’s hurts even more because people feel losses harder. Neither of them is real but if you have ever bought a stock to watch it drop the next day it’s fine to SAY ‘oh well I’m holding for a while who cares’ but deep down it still feels like shit. Magnify to 10s or 100s of thousands lost and it feels even more terrible.

I think that’s more reflective of how people actually feel in my experience.

Had dinner at friends place last night. They mentioned a sad story of one couple they knew in Abbotsford.

This Abbotsford couple bought (at the peak) and moved to a condo last year, they wanted but didn’t sell their SFH (with large lot) then as their son just got married and needed a place to stay temperately. Recently they put the house on the market, asking for $800Kish as that would be the price if they sold last year and would have been sold fast. After a few months without any buyer, they dropped the price to $600Kish, still no taker.

Now they put their condo on the market, too, hoping that one of them would sell soon, as they have mortgages on both properties and can’t afford to wait and see …

It was the early 90s and paid just under $300k (out east). Bought within a few hours of the peak :). I recall prices fell about 20% over the next five years. As mentioned, It didn’t bother me as I didn’t think about prices much after buying. At the bottom, you needed to beg a RE to take a listing to sell it, as they has so many unsold listings already. I can see multimillion $ losses in Vancouver (esp. high-end), but for the the people here in Vic looking for starter homes (<$1m), I don’t see them facing those level of losses. There’s risk in everything in life though.

@ Local Fool

Sounds like perhaps the defendants ‘bought’ to assign the units and were unable to, hence the inability to close?

@ Patrick

If you don’t mind sharing, how much did you pay though? Because if it was for example, 350 k to buy at the peak back east, that’s a heck of a lot different than paying 1-2M+ to buy at the peak here in the West and risk losing a large chunk of that as the overheated market corrects.

Good news from Toronto RE market in April. A healthy TO market bodes well for economic and mortgage credit growth in Canada. Most metrics improved or stable (at 10 year averages), sales up, only 2 months of inventory as they also absorb 50k new units per year.

Here are the details… http://creastats.crea.ca/treb/

“Upward movement for April real estate numbers. When compared to March 2019, unit sales across most categories increased, with single family home unit sales increasing 43.68%, condo sales increasing 38.31% and duplex/rowhouse sales increasing 34.06%. Year over year sales are up in all major categories, with single family homes sales increasing 1.91%, condo sales increasing 2.77% and duplex/rowhouse sales increasing 3.93%. “

TO Prices up 100% in 10 years http://creastats.crea.ca/treb/images/treb_chart05_xhi-res.png

Pretty big loss incurred by some folks locally due to collapsed financing. The details are available below at the BCSC link.

The defendants, operating for luxury property broker Engel & Volkers, put down a $50,000 deposit for two adjacent units in the downtown Songhees complex. The list price for both was 1.85M, which they put in an accepted offer for 1.75M.

They had requested an extension on the closing date which was granted, but when the new closing date came and went with no funds being transferred, the sellers (Plaintiffs) hired counsel and declared the $50,000 deposit as forfeited. They also put the property back to market.

Unfortunately with the market having cooled somewhat, the units ended up selling for a total of 1.56M, over $190,000 less than the original contract closed for. In court, counsel for the defendants cited some case law to argue getting their deposit back, as well as not being liable for the plaintiff’s loss between the original contract price and the final price to the new buyers.

The judge rejected those arguments on some other precedents, and declared that not only would the $50,000 be fortified, but the defendants were also liable for the $190,000 selling price differential.

Owning to that and some other legal fees, the defendants were held responsible for nearly $248,000.

Don’t know how often this is occurring, but ouch. Definitely a cautionary tale to make sure you have your financing in order before extending an offer, especially with that much at stake.

https://www.courts.gov.bc.ca/jdb-txt/sc/19/06/2019BCSC0679.htm

Which is 41%. I said 1/3, which is 33% and that’s close enough for me. Is your point that I should have said 2/5 or 41%, and wanted to make a point about that? The point is that Langford is much smaller than Victoria, and has more new construction, the exact % is not material. Anyway, good night.

From 2016 Census

Langford: 35,342

Victoria: 85,792

Go on…

I guess you’re not a numbers guy, or we’re speaking a different language. Anyway, that stat isn’t important/relevant to anything, so let’s end this topic. Nice talking to you.

How do those numbers add up?

Article has just over 2600 starts in the same 9 months in 2017, but only 765 were in Langford. Guess that means that… 700 were Victoria, 700 Saanich, and 500 were in the Saanich Peninsula? I call bullshit.

Langford isn’t a 1/3 the size of Victoria.

Yes, though in 2017 new starts were still highest in Langford , but Victoria was closer behind and Saanich still way back. The surge to Langford construction started in 2018 ( as the article title says:Capital housing starts sizzle, especially in Langford) where it is 4X rate of Victoria city. This despite Langford being is 1/3the population of either city.

Don’t know if you noticed, but there’s an extra 7000 people trying to sell that can’t. If they aren’t selling, it’s because no one’s buying.

If they’re not selling, they likely don’t care. I bought at the peak out east and didn’t care.

Gotcha!

Tell that to the people in Vancouver who bought last year. At least some of them are smart enough to realize that a $500,000 loss is better than a cool million.

Patrick is the Tim Russert of the blog. (If anyone gets this reference, kudos to you.)

How many times you gonna cherry pick that quote?

Should I go back to when you couldn’t manage to spell my name right?

Doesn’t this part right here:

imply that in 2017 that the vast majority of the starts weren’t in Langford?

Also, it doesn’t actually say that data is from CMHC, just quotes a guy from CMHC, prior to giving some data.

I didn’t find the Reno at 1749 Davie to be great. The rooms are still pokey, the outside is not impressive and the rental suite is generic and small. I know that house and when I saw the price I was expecting much more of a wow factor. A million dollars has got to mean something a little special and that house has nothing special to offer.

I will be very curious to see what it finally goes for!

From his previous posts, it appears he expects to see more than that to happen to those most in debt …

https://househuntvictoria.ca/2018/11/19/nov-19-market-update/#comment-52254

“Pay attention to what you’re doing with your life, don’t expect others to compensate you for making a poorly informed or impulsive choice. The hubris must be wiped clean, and that inevitably involves some really tough lessons for those that chose to get in over their head. I don’t want you or anyone else to pay gratuitously for their mistakes.”

James,

Here’s another article, data from CMHC and quotes from President of home builders Victoria. Not for one month, for first 9 months of 2018.

https://www.timescolonist.com/real-estate/greater-victoria-builders-struggle-to-keep-up-with-demand-1.23457905

“Langford leads the way with 1,439 starts through the first nine months of the year, almost double the 765 started over the same period last year. Saanich has seen 369 new homes started so far this year, down from 423 last year, and Victoria has seen its pace cut in half with 319 starts so far this year compared to 665 at the same time in 2017. Edge said while builders are starting more than the average of 2,000 homes a year, they are still not keeping up with demand.”

If you look at these 3 cities mentioned in the article, the main core of population: Victoria, Saanich , and Langford… and the biggest sources of construction, here are the results for the first 9 months of 2018

From the article….

Langford 1439 starts (68%)

Victoria City 319 (15%)

Saanich 369 (17%)

As you can see, Langford has 4X more units started than Victoria city or Saanich in 2018 (first 9 months) . I don’t know how you could possibly think that you could click around citified.ca for a few minutes and be counting up builds that you find and come up with better data than CMHC.

Here’s my take on how they’re doing it.

If you look at LeoS affordability graph, it would be reasonable to look at where we are now (56) with the upper limit of affordability being 58, and ask… how are people affording homes? I think people are misinterpreting this graph to think that the house would be continue to be as unaffordable years after they bought it.

IMO, this is because the graph doesn’t make clear that it is just a “first year” affordability measurement. Because if you look at a cohort who buys in certain year, and follow them for the 25 years of a mortgage , you’ll see that there the affordability for them improves each year due to their rising income. Incomes rise with inflation and age (older people make more through better experience/seniority/promotions)

For example, look at 1994 in the affordability graph – affordability was terrible at 50% which is the upper limit of range (the youngest boomers were 31 then, buying their first SFH). So in 1994 you may have also asked “how will this young boomer pay for it?” when they needed to use 50% of their boomer income to buy the $256K median SFH Vic home?

IMO, the answer is easy ….. each year their incomes rose, about 2% with inflation and 2% through getting older (better paying jobs) , so it got easier to pay their mortgages. And here we are 25 years later, and how hard is it for them to pay their final year of mortgage payments before they own their house outright and burn their mortgage this year. That 31 year old boomer rookie fireman who bought in 1994 making $30k per year is now a dept. chief making $90k and his $1,250 per month mortgage is easy to pay now, even though it was very hard to pay in 1994.

Perhaps Leo could add a decaying line for each year of the affordability graph so you could trace how affordability will look for you in future years and finally drops to zero in 25 years when mortgage ends,

I think the young people who are buying now are smart enough to realize that it will be hard to pay in the first few years but gets easier each year with rising income. So they aren’t scared off by the first year affordability graph, unlike some bears here expecting it to be easily affordable at all times.

It’s pretty hard to believe that it got there all by itself, but it’s possible. Intuition sucks, though and that’s all it really is in the absence of data. Perhaps the upcoming registry might help…then again perhaps not.

Prices are divorced from fundamentals there, and people played a wicked game of greater fool. That’s not quite the same thing as arbitrary, it just means that for a time, the prices were not about the house anymore – it could just as well be tulips. If you mean they are arbitrary in terms of “we don’t know where all the money is coming from”…then sure, I’d agree.

No, I was basically agreeing with you, I just worded it poorly. You said it best:

“I expect we can sustain substantial compression of the differential before it becomes a real issue.”

So I’m saying we’re still seeing the lag effects we usually do – but given the large differential we’ve grown, they could continue to experience carnage for a while before and if, we do. However, regardless of how long it takes for that differential to narrow, you can bet no one is going to be jubilant on RE in Victoria, with VanRE crashing. With prices here already on their tippy-tippy toes of fundamentals…

That is so funny. Tourism Victoria and related agencies been saying that since the 1980’s, possibly longer. Every year you read that somewhere, with all kinds of data and anecdotes to go with it. It’s just like the “Techtoria” claim, which has been going on at least as long. Victoria’s always been doing what a city tends to do…grow. It’s still a relatively sleepy city, IMO. One of the reasons I like it.

I’m keen to get back to a market grounded in reality, which is what I’m sure a lot of others would like too. People gain and lose opportunity at all points of the cycle, while many are not affected either way.

Can you explain that chart there Leo?

Since it seems like it says we’ve got about 1750 in residential inventory, but actual numbers for April were 2700ish. Are you saying that about 1000 of that is commercial inventory?

So for one month it was 60%, that means that they’re all out there?

Look at the links. Vast majority(10 times more!) of under construction (you can check a box to see only under construction) condos are in Dt/Urban Core, and there are more rentals going up in the Urban Code than Westshore.

Don’t know how people quote the TC when they’ve been shown (in this thread even!) to be crap.

Because one year it goes up 2000 and the next it goes up 5000?

Doesn’t really matter so much the doubling, just a ton of inventory coming. Which he was saying it would take for price to drop by 10% in a year.

My question was, based on what’s coming, Do you really think it’s only going to drop 2% per year for 3 years?

Joking aside, you’re right. The value of a realtor is not their (in)ability to predict the future of house prices just like you don’t hire a financial advisor to predict the stock market, but rather to hopefully help you make a well-informed decision about the investment.

As Marko said, inventory building takes a while. I wrote about that here: https://househuntvictoria.ca/2018/01/04/the-journey-back-to-normal/

Inventory is building quickly now, but it will go down again in the fall so it takes several years to complete the cycle.

and updated chart with projection:

Not really super hot, but more active than higher end for sure.

Income isn’t everything, but it is the underlying factor for most things. The new buyers have to have the income (and access to credit) to get into the market and allow the move up buyers to move up. That income-driven demand has to be there to push prices up and create the equity for move-up buyers. The retiree in a million dollar house has to have had the income to buy that house at some point, and until they buy or sell are immaterial to the market anyway.

Out of town rich retirees certainly influence the market and won’t show up in income stats, but as we grow I actually think this will be less of an impact than in the past. Victoria is no sleepy retirement village anymore. I believe more and more of the demand will come from local factors.

I think it speaks to the slow nature of housing markets and the strong recent performance. Just because prices are at a certain level doesn’t mean they are supportable there. We won’t know if they are supportable until they stay at the level for several years. The second is consumer sentiment. As you say, people are willing to rent out rooms, share houses, carry cash flow negative rentals because they expect prices to go up. If prices don’t go up for several years that kind of hopeful behaviour tends to get reduced.

Very high debt tolerance?

Very impressive. I would like to do more, but am not great at it. Limited to small things like the backsplash which we did ourselves, but don’t think I’m cut out for big renos.

Yes it is not factored in. Those affordability charts are simply average house price financed to 80% at the average mortgage rate, compared to average monthly household income.

I actually don’t think it makes a huge difference. Even though the stress test was a bigger change than most, we have seen a lot of changes to credit availability in the past 2 decades. We went from 25 year mortgages requiring I believe 10% down to 40 year zero down back to 25 year with about 5-7.5% down requirements. None of it was really enough to derail the underlying driving factor which is that mortgages need to eventually get paid back with income.

It’s a cycle, remember. It never ends.

Are you just keen to get into the part of the “cycle” where people lose money?

Catching up on some comments

First, I am going to doubt the accuracy of the data, then I would observe that the outflows can go anywhere in the world, into any asset class. So not entirely unconnected, but I bet the correlation to VanRE is extremely poor.

VanRE prices have been pretty arbitrary. If he’s discovered a model behind it I have yet to read about it on his blog. I don’t watch the youtube videos.

It’s not a black and white issue. Single family becomes progressively less affordable in a growing city, but it happens slowly.

Not sure what you mean by this. Vancouver appears to be crashing due to prices having gotten away from ours, is that what you mean?

That’s why I said prices too. But in the same region, yes we can conclude that population is a pretty good proxy for desirability. Calcutta is more desirable than a rural village nearby.

My wife says he has nothing on me.

Added chart to article.

Too far out to be of concern to most so it gets discounted. Also earthquake safety is a luxury most buyers cannot afford to care about when they are struggling to get any kind of house, let alone one built to withstand a major earthquake.

Doesn’t that just support Marko’s view that it would take about 2 years for inventory to double?

Lots of sources.

https://www.timescolonist.com/business/capital-housing-starts-sizzle-especially-in-langford-1.23363963

e. g Capital housing starts sizzle, especially in Langford

“Greater Victoria housing starts for the first six months of this year ran ahead of the same months in 2017 as the number of multi-family units in Langford surged. In June (2018) alone, 307 multi-family (condominiums or rental apartments) units got underway in Langford, along with 32 single-family houses, Canada Mortgage and Housing Corp. said in its monthly report released Tuesday. Langford’s total starts of 339 represented the bulk of the 512 homes started in June.”

Note: 339/512 = 66%

Tiny bit of overlap (3?)

But here’s the condos going up:

https://victoria.citified.ca/condos/

DT/Urban Core: 30

Saanich Peninsula : 6

Westshore: 3

Again, way more stories going up in the DT/Urban core buildings.

Where are you getting that stat?

https://victoria.citified.ca/rentals/

Certainly looks like there are more rental buildings going up in the Urban Core/Downtown Victoria than Westshore.

22 – Dt/Urban Core

2 – Saanich Peninsula

13 – Westshore.

Obviously the biggest ones are going up in the urban core & downtown.

11% of the 6,035 units now under construction in GV are SFH (and even less given the SFH teardowns ). The other 89% are mainly apartments, and other multi unit types. Most of the construction (60%) is Langford, and intended for rentals.

The numbers are gross, not reduced by torn-down units. SFH net construction in GV is way below demand, and likely to stay that way IMO.

Majority are condos/appt.

Just over 10% detached, another 7% either semi-detached or row unit.

Not net, but whatever has been knocked down has already been knocked down.

Saw the opposite on a house in Tsawassen recently. Bought in 2018 for 1.55M, just sold for 1.01M. A lifetime of debt for less than 12 months of rent.

What percentage of these are condos/townhouses/sfh? Are the numbers net? (ie. If 10 units get knocked down to build 40, does that count 30 toward the number of starts?)

Gawd I can’t wait for this nonsense to end…

Fast flip to market, 1749 Davie St. Not sure if anyone posted.

MLS#:410087

Bought Oct 2018, $800k, selling now $1.2M.

Nice job on the reno, I doubt 400k worth 😉

Marko, here’s Vancouver inventory since 2017 for April:

2017: 7,813

2018: 9,822

2019:14,357

It can snowball pretty quickly.

I don’t see Vancouver slowing down either, since they’re right up there with Victoria, by far the highest number of units being built per capita.

Well, if anyone has their finger on the pulse of the market any may be able to pull it off, it’d be you Leo.

For me to buy an investment property, it would have to make sense from a rental income perspective. I don’t think I could convince myself to buy something just because I thought it was the bottom of the market and appreciation might be strong.

For the bottom of the market I will be looking at primarily:

That’s really it.

I have no idea.

It would be interesting to see how assessments in different neighbourhoods vary year to year. I assumed GH assessments were up only because the average for Saanich East was up 4% (or something like that).

Yes, mine went down 2%. I thought mine was an anomaly, but maybe it wasn’t.

Based on last time Leo bought (well timed whether by skill or luck) there will be lots of folks on the blog telling him he is wrong if he buys again. In the 2008-2013 timeframe anybody that admitted to buying a house was pitied or mocked here.

Starts in

2014: 1315

2015: 2008

2016: 2930

2017: 3862

2018: 4273

Total completions in:

2015: 1765

2016: 1787

2017: 2526

2018: 2668

There will be more than a full years worth of completions happening in the next 6 months, and it’s not going to really slow down after that.

Which is what I’ve been saying – the quality of what is coming online now is superior to what I saw just a couple years ago. Lots of properties also have the big work done now – new roof, new mechanicals, etc. There is a value add to not having to go in after closing and spend $$$ to get a place to a reasonable condition.

On a different note – remember when I asked about vendor financing? Here’s one for you that showed up today: MLS 410152, 1970 Fairfield Pl. Owners clearly want a number and are sweetening the pot by offering flexible vendor financing.

Based on Introvert’s list of “Un-cherry-picked recent sales in Gordon Head” the takeaway is that the only houses selling in Gordon Head are those with extra special features, such as:

All the other Gordon Head houses seem to be languishing on the market.

Google shows the house interior pictures when you search by the addresses Introvert listed. Each house he listed has something special that accounts for its sale above assessed value. Introvert’s list obviously excludes the houses that sold under assessed or didn’t sell at all before the listing expired.

I’m curious if you could provide your own take on what you’re going to be looking for, that will make you comfortable in saying, “okay, I think this is it”.

Bad choice of words on my part.

All my spare dollars are in VGRO so fully invested.

I suppose the “driest” I could keep my powder is to pay down the mortgage (guaranteed 3% after tax return) and then refinance later to get the money back out.

Nice, Thanks Marko. Too bad it is in Sidney (I meant not in “core”) …

Maybe that sly old Hawk was smarter than we thought.

Great write-up^ by the way.

Interesting market out there. Thanks Leo for the insight and Marko for the crystal ball prediction. One friend relisted this week after not selling last year, while two friends with deep pockets just bought in Victoria one on Dallas Road, and one a few blocks from the water in Fairfield. One is a move up mini development move and the other is a Vancouver investor who is going to reno and build a garden suite (doubling the housing potential of the lot in 2-3 years).

Our new to us house in Sannich we bought December 1 is almost done. The reno suite for my in-laws started December 3’rd and due to countertop delays is going to be done next week. Always twice as long and 30% more expensive but super happy with how it turned out. The houses on Cadillac where we sold, all seem to be sitting, we got out at the right time and the right price.

Almost miss checking in on the market and this blog daily, but nice to be occupied with mowing the lawn, fishing and gardening. Hope everyone is healthy and happy.

Introvert, in your GH sales report, how many of those houses that sold for above assessment had renos?

Also, as far as GH assessment this year being the highest, pretty sure they actually declined this year, that’s my experience, also the experience of my parents and some other owners I know, and wait i think you even admitted to that too.

Inventory is going to double in the next 6 months. Then what Marko?

You do realize it has taken 24 months for inventory to climb from 1,690 to 2,751? I can’t see it taking less than 12 to 18 months to get to 4,500ish (2011-2014 levels). Doubling would take 2 years assuming it was actually going to happen.

In Victoria, all the townhouses are strata units with monthly fees, there is no “no monthly fee freehold” townhouse like in ONT or other provinces.

There is, but they are just rare. Example -> https://www.realtor.ca/real-estate/20609163/2-bedroom-single-family-row-townhouse-9706-fifth-st-sidney-sidney-south-east

Leo S – Just keeping my powder dry.

I’m curious when you mentioned this. Can I ask how you can keep it bone dry these days? Are you worried about a deflating CDN dollar having an affect on your future buying power?

No great worked out plan. Just keeping my powder dry. Once I see a condo or small rancher that has a solid investment case I’ll get more serious about it. Would like to see if the next bottom can be timed.

There’s definitely some. I can think of 5 on San Juan alone in Gordon head over the last 2 years. There’s also 2 developments that are going to be coming on Feltham that’ll have multiple houses. So it’s not like it doesn’t happen.

Anyway, people will move, others won’t buy in the core, and there will be places that open up. Just because their not all net new in the core, doesn’t mean that it won’t open up other places in the core.

Yes, numbers are ramping up like that. Will be good to see some choice available.

James, how many of those are freehold SFH in the core? What about within a 4km radius of downtown?

It’s tough for me to imagine many net new freehold SFH within Victoria City, Esquimalt, and closer parts of Saanich/Oak Bay

viola: yes the Belmont st house is pending at a great price. Perhaps a hair too small for us (looking for 1100 sq feet or so). Can’t be sure but have reason to believe a few homes that would be great for me may come up for sale in the next year or so. Am kind of hanging in there in case but also keeping my eyes peeled.

I lived in a strata as a renter and was quite impressed with how things were managed. It did seem much less work than owning. Pros and cons as far as I can make it.

“Introvert: Yes I see your point. It had occurred to me that not paying strata gives one more autonomy and flexibility. As it is, it’s a forced saving device with limited say in what happens with the funds. Still, in my particular position, I have come around to thinking it may work better for me though that would probably depend on the individual strata. I have heard echoes of nightmare scenarios involving strata squabbles…”

I wasn’t looking forward to living in a strata after owning a house. But now i think it’s kind of nice because owning in a strata means so much less work. I only have to worry about what’s in between my walls. I don’t have to worry about yard work. If there’s a major issue, the cost is shared with everyone else. And, mine is run reasonably prudently with no expected major repairs (it has all been kept up). It is a lot less work than the house was.

That being said I miss having a house sometimes. But I don’t miss some of the headaches that go with it (high heating bills, yard work, etc…)

In Fernwood, 2333 Belmont pending at 610k, assessed at 656,300. Whoever got that did quite well. The kitchen looks like it could really use an update, but it’s small so can be done quite cheap. Same with bathroom.

Should be 2900 new units completed between now and October. Even more coming in a huge group at the beginning of next year.

I bike down it every day. People just walk the street.

Only problem I’d have with backing onto the mountain is that I’d be a bit more nervous leaving my kids in the backyard by themselves w/ all the cougar sightings we’ve had lately.

Saanich really needs to do something about the deer. Just relocate them, same as the cougars.

Yes.

Ultimately, I personally can’t get comfortable with the concept of strata fees. Unlike a mortgage, it just doesn’t feel like money well spent.

I love Parkside Crescent, especially the side with the houses backing onto the forest of Mt. Doug Park. It’s a neat area. Not very walkable, though. But good for biking and taking the bus, I suspect.

Fair enough.

It’s looking like garden suites will soon be legal in Saanich:

Saanich residents have say on garden suites

https://www.timescolonist.com/news/local/saanich-residents-have-say-on-garden-suites-1.23809087

“Even if you take your version where BC had a 4.1% increase (which was shown to be misleading at best in the last post by localfool), it’s still not 2% above bc’s inflation rate of 2.4%.”

Wages have frozen in BC the past year and inflation is now eating away at pay. Another reason to support home price drops ahead

A caveat of the employment story has been a ramp-up in part-time work, which rose nearly 10% year-over-year, while full-time gains increased by a relatively modest 1.5%. This unequal split has contributed to relatively slow growth in total hours worked, suggesting top-line employment growth overstates economic growth. Meanwhile, average hourly earnings growth has eased to 0.5% year-over-year from more than 4% in the first half of 2018.

https://biv.com/article/2019/04/employment-real-estate-down

To be honest, this one surprised me. Was wondering what it went for.

New HHV sport: Competitive cherry picking

I know exactly what you mean. I had a look yesterday at recent Owen Bigland videos. Had not looked at his youtube for over 9 months (am not a tremendous fan of his). And, lo and behold, 2-3 videos basically telling sellers to lower their price.

Quite a contrast from his previous work if memory serves…

We do it making well under 6 figures, but we rent.

You need vastly more income to own in this city at the moment, even if you are saving a considerable amount of money.

Nice. Since assessments were done at the market peak (July 2018) these sales above assessments are also above peak prices.

James,

My post 59188 isn’t referring to any future part of the graph, so the strong wage growth part of it isnt relevant. The post just refers to the past affordability chart, and applied actual improved affordability factors that happened in 2018 (house price fall, cheaper mortgages , and wage growth). Leo plans to let us know what the current affordability numbers are for 2019 in a future post. I think affordability is better, just not sure how much.

Introvert

I generally agree but it really depends on the building. The condo we lived in strata fees were low (too low imho). We were paying $120/month on a 1100 sqft place. Yes, over a decade ago now, but still ridiculously low by that era’s standards. I was on council (self managed) and tenants definitely had a say in where money went (basically nothing other than necessities).

One huge difference is with a house you can defer maintenance to a much higher degree than you can with a condo.

Introvert: Yes I see your point. It had occurred to me that not paying strata gives one more autonomy and flexibility. As it is, it’s a forced saving device with limited say in what happens with the funds. Still, in my particular position, I have come around to thinking it may work better for me though that would probably depend on the individual strata. I have heard echoes of nightmare scenarios involving strata squabbles…

Un-cherry-picked recent sales in Gordon Head:

4272 Gordon Head Rd

Sold: $1,085,000 ($190K above assessment)

3928 Lexington Ave

Sold: $834,000 ($47K above assessment)

4270 Parkside Cres

Sold: $930,000 ($35K above assessment)

1832 Teakwood Rd

Sold: $858,000 ($106K above assessment)

4524 Vantreight Dr

Sold: $939,000 ($75K below assessment)

My take:

Unless I’m mistaken, not a lot of sales since my last reporting.

My gut feeling is that, although sellers were probably getting slightly higher prices back when the market was red hot, sellers aren’t crying a river about the deals they’re inking this spring. Prices seem strong to me.

Sales seem to be coming in above assessment more often than not, which is saying something since 2019 assessments are considered by everyone to be historically high.

This has been the GH Report, brought to you by your friend, who doesn’t want to be your friend, Introvert.

Media is really starting to ramp up on VanRE.

TheStar, The Strait, Vancouver Sun, Huffington Post, CTV, Financial Times and a few smaller outlets are all running slide-greasing articles at once.

Media is an important influencer of cyclical market behavior. Remember all the cheerleading articles that showed up a few years ago on how unstoppable everything was? People read that and it plays an important role in collectively galvanizing the population to buy. People panic to get in, and others accuse the media of being “in on it”.

Slide-greasing refers to the same thing, but the other way around. People see the media’s scary, doom and gloom articles and it has that same role in shaping public opinion over whether RE is a good thing to buy. Unfortunately, it’s a lot easier to get people to become afraid, than it is to make them throw all caution and common sense to the wind.

Realtors® ironically, are instrumental in this process as well – as they will eventually become more motivated to have a sale at any price, as opposed to have a sale at a high price. They eventually push their clients, advising them to “get ahead” of the market (price lower). As you have seen by some of the examples posted here, in the cusp of a downturn, time can be big money.

Who’s looking for that in a realtor?

Is s/he sexy? Is s/he a pseudoeconomist? You should be asking yourself those questions.

I think it’s different. In a SFH, you save for maintenance. If there happens not to be much maintenance required over a given period of time, you still have that saved money in your pocket, and you could theoretically use it for something else, if the need arose.

Whereas, with a strata fee, that money is coming out of your pocket no matter what, and you have little control over what, when, why, and how it’s used. So, to me, it’s kinda like chucking money into a black hole—same as people who pay for cable TV 🙂

Okay then. Guess they need to dissolve it, since B-20 appears to be eroding consumer purchasing power in RE markets across the world.

Canada. China. Hong Kong. Great Britain. Australia. United States. Israel. India. Even perpetually sloshed Ireland is coming off their bubbly 2.0 crest. Damn B-20.

Sound thinking:

(1) Wait and see if the cooling trend continues until broad based price reductions take hold. I do expect this to happen but of course no one knows the future and in the end it’s your house, not mine.

(2) Pay very close attention to the market and find the motivated sellers and overlooked properties. Those generally appear once market activity dies down substantially (October-December) but could be at any time.

I think it important to keep a eye across the pond – that is a source of buyers and they are not having fun at this point in the cycle. The latest Casino money laundering news places it at the feet of the NDP – where it belongs. B20 should and will stay in place. Hopefully, the pipeline is built and Trudeau’s socialism is gutted in the fall.

Here is the local real estate board’s spin:

May 1, 2019 A total of 696 properties sold in the Victoria Real Estate Board region this April, 10 per cent fewer than the 774 properties sold in April 2018 but an 8.8 per cent increase from March 2019. Sales of condominiums were down 9.8 per cent from April 2018 with 203 units sold but were up from March 2019 by 3.6 per cent. Sales of single family homes were down 12 per cent from April 2018 with 369 sold.

“Spring has been a non-traditional real estate market thus far,” says Victoria Real Estate Board President Cheryl Woolley. “Consumer purchasing power continues to be negatively impacted by the B20 mortgage stress test, causing many buyers to step back while they save more money for a down payment.”

There were 2,751 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of April 2019, an increase of 13 per cent compared to the month of March and a 37.4 per cent increase from the 2,002 active listings for sale at the end of April 2018.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in April 2018 was $874,800. The benchmark value for the same home in April 2019 decreased by 3.4 per cent to $845,100, higher than March’s value of $843,600. The MLS® HPI benchmark value for a condominium in the Victoria Core area in April 2018 was $506,900, while the benchmark value for the same condominium in April 2019 increased by 1 per cent to $511,700, higher than March’s value of $506,500.

“Prices have remained reasonably flat across the region and are expected to stay that way,” adds President Woolley. “Presently, REALTORS® are busy showing homes and bringing new listings to the market, but with few new options to view, we are still seeing multiple offer situations when that right property does become available. Given the current dynamic and evolving market conditions, it’s a good time to chat with your Realtor about a personal plan for buying or selling a property.”

CMHC HAS IDENTIFIED 2 AREAS IN BC THAT ARE AT HIGH RISK – VANCOUVER AND VICTORIA. VANCOUVER’S APRIL 2019 NUMBERS ARE DISMAL, WITH SALES FALLING OFF A CLIFF AND THE BENCHMARK PRICE DOWN 8.5% YOY.

Again, this is the strong wage growth graph.

Even if you take your version where BC had a 4.1% increase (which was shown to be misleading at best in the last post by localfool), it’s still not 2% above bc’s inflation rate of 2.4%.

You’d also somehow have to maintain that growth rate over a decade, which BC hasn’t been even close to over the last decade.

For reference, only 5 of the last ten years have we even got over 2.0% wage growth, let alone 2% above inflation. As far as I can Government workers haven’t even received a 2% increase in the last decade until this April, and they are the major employer in Victoria.

https://www.bnnbloomberg.ca/vancouver-home-sales-sink-29-1-in-april-as-slowdown-deepens-1.1252807

Victoria and Vancouver remain at high risk – we have farther to fall; this is just beginning.

sold out: from what I can tell, my agent is pretty much on top of that. He spent a weekend poring over strata documents and other docs before letting my family member buy a condo. Generally speaking, I trust him. I would also absolutely get an inspection. Can’t fathom a situation where I would buy without one. It is good to know that I should access all common areas for the inspection. Hopefully the inspector would know this but it had not occurred to me.

Thanks for the link!

Koalas

Ask for a depreciation report, along with any strata meeting minutes going back a minimum of 2 years. If it’s a small strata, 4 units or less, there likely won’t be a depreciation report available. Have an inspection done which includes ALL common areas, including attics and crawlspaces attached to other units. Ask for, or access through Land Titles Office, a site plan which shows the property designations for every square inch, and request access to all common property for inspection. You are buying all the common property, not just your strata entitlement, so access should be granted. Don’t use an inspector suggested by your realtor, but check out reviews on several different inspectors. If you want to get the dirt on the strata plan or inspector, check out:

https://www.canlii.org/en/bc/#search/jId=bc&text=Limited%20common%20property%20HVAC&origJId=bc

You can search for litigation involving the inspector or strata corporation.

Koalas,

You’ve received great advice here from several posts, and I can’t add much to that. Those are great neighbourhoods. And if you plan on holding for at least ten years, and can pay your mortgage, just go for it and don’t look at house prices. At the end of ten years, your mortgage balance will be down 30%, your income up about 25%, and your mortgage payments likely the same. House value likely up in ten years, I think so, but who knows?

FWIW, I bought my first house at the peak of the market (back east) a long time ago. Ignorance was bliss, I didn’t even realize that until a few years ago when I looked at charts. Once you buy a house, you forget about the market. I just enjoyed owning the house with my family. Once you buy, you’re likely an owner for life, so even if the market drops, your next house is cheaper.

Koalas,

My understanding is that the monthly strata fee is only for regular maintenance and small repairs, major work like changing roof would normally need each unit to pay extra “special assessment” to cover. High monthly fee is normally due to building age and amenities (e.g. swimming pool, 24hr concierge, a special gardener 😉 ) that just cost more to maintain, but not to cover coming major work.

Even in a “small” town like Victoria, for same job, cost can vary greatly among different contractors. With a SFH, not only you can budget and plan for coming work, you can decide to do the work yourself or choose reasonable priced good contractor. With a strata, it is decision of the board.

Gosh I so wish you are correct James, about the inventory doubling I mean. Even if that did not translate in lower prices, I would be happy to have more choices. It is still pretty much ‘slim pickings’ right now. Especially in Fernwood.

Victoria Born

6-figures isn’t what it used to be. Median family is making high 90s as of 2016. I have friends with little education (e.g. couple with HS only and 2 year diploma) who are making over 100K combined. Making 50K each in this town doesn’t take a ton of education.

You need 6-figures as an individual if you want a stay at home parent. I don’t think a stay at home parent has been realistic in Victoria for a long time (at least for the middle class).

Inventory is going to double in the next 6 months. Then what Marko?

Benchmark Vancouver house has dropped over 1% ($16000) since that chart was made.

freedom, Sorry, i did not express myself well. I know that all townhouses have strata monthly fees. I was asking what those fees pay for compared to a unit, say a SFH, that does not have fees. Assuming that all of the Strata fees go to maintenance or big repair work, is not safe to say I would face the same with a non strata fee unit? Just that I would have to budget for it myself.

ex. Say i buy a strata that is collecting higher monthly fees knowing the roof needs to be replaced. How different is that from buying a non strata SFH where I realize the roof will need to be replaced soonish. In both cases, I have to put money aside each month to plan for a known imminent repair.

My sister pays around $300 a month in Strata fees which is about the same as I put aside each month when I was a SFH owner for maintenance and repairs.

I was originally quite shocked at the strata fees thing as this more or less did not exist out East where I come from. I have since come to think it could be a positive in that the strata plans and executes most maintenance and repairs. Given that I am not handy, that is a plus.

However, I am quite willing to believe that my understanding of Stratas and their associated fees is incomplete at best.

Thanks Freedon2008 for posting the Zoocasa income to home price chart. You need to make 6-figures a year [assuming you have 20% down] to afford a “shack” in this town. The “bench-mark” home is NOT a dream home.

freedom_2008

Cool infographic. Looks like they are using the “High income tax filers in Canada, specific geographic area thresholds” to determine income group. That’s individual incomes I think. Not sure how many individuals are buying a SFH in Victoria. Also the individual income is somewhere above 10% but below 5% (can’t get any more acurate from that table). At least it uses Victoria CMA, not Victoria proper.

According to “Distribution of total income by census family type and age of older partner, parent or individual” the median income of couple families (2016, so same year as they are using) is $97,580. So not far off from that 106K needed. Does Stats Can have a table for income group or quintile by family rather than indvidual?

Koalas,

In Victoria, all the townhouses are strata units with monthly fees, there is no “no monthly fee freehold” townhouse like in ONT or other provinces.

In addition to monthly strata fees, there can also be “special assessment” fee whenever any major work needs to be done (say add a new parking lot, changing roof/windows, etc …) which can be required time by time, and not part of the monthly fee.

In this sense, duplex is better, it is strata but normally no or very low strata fee, with two neighbours work out things between themselves. But it is hard now to find good quality new or near new duplex which is reasonably less expensive than a SFH in the same area.

Yes they added that in. Not only did they extract the 250 figure from the monthlies instead of YTD, they mixed up the rows too (2018 vs 2019). So they solved one issue and added a new one. Not paying any attention at all.

I sent them another email. We’ll see if they fix that too.

freedom

a

Yes I am aware that townhouses have strata fees. My understanding is that, whatever you pay in Strata, you would probably have to pay out in maintenance if you are not in a strata. I know it can get more complicated. If a strata is in bad shape and has not collected enough fees, a new purchaser could be in for a nasty surprise. Conversely, strata fees can be ridiculously high (saw one on the westshore with $797 monthly strata fees). When that is the case, I assume that a big expense is coming and the strata had to increase its monthly fee. Either way, is this significantly different from budgeting for maintenance for a non-strata unit? Genuine question.

FYI, from Zoocasa yesterday “REPORT: The Income Group You Need to Be in to Buy a Home Across Canada”:

Looks like they took out the incorrect sales numbers but further down it still says “despite the fact there have been 250 more sales this year.”

Leo S

Oh agreed. But it appears that somehow many new buyers can afford the 700Ks, at least to support current inventory in that price range (and a bit more with a suite). The stress test hasn’t appeared to affect that price range in Victoria (SFH in 700-900 range is super hot, right? You’ve stated that many times).

So at current inventory levels the new buyer input is still working to support the equity of people sitting on property.

My point was income isn’t everything. There are more sources of money than income alone, and LFs claim was that:

I simply countered that people making median family income can in fact afford a 1M home given enough cash (equity as an example, or gift money or WHY.. just money from another source other than income). Yes equity needs a buyer, seems we still have those. There are other sources of money that don’t require a buyer lower in the chain. My example was also supposed to be someone on the younger end of the spectrum (of course some boomer with a paid off house and a pension can afford a 1M house despite low income).

Another scenario: extended family living in a SFH. E.g. parents and kids sharing a house with a suite. Anecdotally that seems more common, or more acceptable to a wider group of people. House was not affordable for one family, so now it has 2.

I’ve said something similar before, but if people bought what they could afford (rather than borrowing money, renting out every room in a house etc etc) we wouldn’t be seeing these prices. Yes, wages alone don’t support these prices (800K let alone 1M), but people are making it work with what they earn somehow. This raises the bar for people that limit themselves to what they can afford without stretching their finances.

For us to buy our own house now, despite making above family median, we’d need over 20% down. Run of the mill middle income hood with plenty of mediocre 60s and 70s houses (recent sales 750K-high 800s, 700s having no suite, 800s having suite). When we moved up from our condo to a sfh we refused help from our parents and took the hit of CMHC insurance. Put our young selves in current day (adjusting wages to inflation) and we’d need help to get into a SFH in this area. Help or no house. I don’t think we would have taken money, so it would have been condo/town or move out to the Westshore. I think we would have chosen Westshore.

So how are people doing it? :shrug: no clue, but it’s not like there are a bunch of rich people moving into my hood. Gifted money, cosigning parents?

Koalas, I guess you are aware of the monthly strata fee associated with townhouses? Sometimes, these fees could be even higher than condos (and of course increase every year) , due to smaller unit number to share the cost.

We are thinking of possible downsize to a condo/townhouse/duplex, but decided to forgo townhouse due to high strata fee (condo or duplex options don’t look that attractive either now).

“Viola: I have thought about that – buying a home that needs significant updating. My concern is how hard it would be to hire people to do the work. I am no handy person so I would have to hire and it seems as though all construction workers are busy busy. I don’t mind waiting 6-8 months and like the idea of having things the way I would like them but would not like to have to wait for a year or more.”

It really isn’t for everyone. With our first place we had almost no money so it dragged on and took 3 years to get it nice. I ended up doing the entire kitchen by myself over a summer. That took two months alone because I had no experience with physical work (including even painting).

With this current place we had more money so it was a lot easier. We did the flooring before we moved in with End of the Roll. This saved money because we didn’t have to pay to have furniture moved. We also did the painting for the same reason. For the kitchen we hired IKAN and they installed our kitchen for under 10k in one week it was amazing. I had slowly purchased the appliances over the 6 prior months when they went on sale. My partner and his dad laid the flooring and painted the kitchen, so that saved money.

I have an excellent plumber and a good electrician here now. The tough one to find is the general contractor type person who can do things like drywall repair and lay flooring. I found one of those guys who is reliable but he is way overpriced. He quoted us $1100 plus materials to do a small backsplash in our kitchen, we got it done for under $500 with materials because I asked around and a friend of a friend knows a tiler. Anyway, it does all take time and a fair bit of patience. But, it is very satisfying when it’s done. Except then you get bored.

They’ve corrected the TC article, or at least the most glaring issue re the numbers.

https://www.timescolonist.com/business/region-s-real-estate-sales-prices-slipping-in-slow-start-to-spring-1.23809096

Koalas – As others have said your real estate agent can’t see the future. And of course real estate agents are biased optimistic. it’s pretty hard to build a career selling RE if you think it is a terrible investment.

That said I think there is some merit to what your agent says. I expect core areas to go down somewhat less than outlying areas if and when there is a significant overall market decline. There is a genuine scarcity value to SFHs (and to an extent townhomes and duplexes) in the core that is just not true for the outlying areas like Sooke, Colwood, and Langford where they are building new SFHs as fast as they can. Add to that the growing popularity of living in or near the core vs the desire a generation ago to live in the burbs. Also add in the growing cost of commuting in time and money.

No area is immune from declines in value. I live in Fairfield watch RE here a bit. It went down in the financial crisis (late 08, early 09), it went down again in the 2012-2013 timeframe and it is down a bit now from 2018. But I think there are sound reasons to believe that desirable (but still middle class) core areas may not fall as much. As well as the reasons I listed above there is historical precedent for this in the US bust.